03 October 2018

By Maynard Paton

Happy Wednesday! I hope you continue to find my Blog useful… and that your shares served you well during the summer.

Unfortunately, my portfolio has not exactly sizzled during the last three months.

In particular, notable price advances from Andrews Sykes and Mincon were offset by further declines at System1 and Tasty. Elsewhere, highly rated holdings FW Thorpe and Tristel have come off the boil, while stagnant positions Mountview Estates and Oleeo remain, well, stagnant.

It has all meant that, nine months into the year, I am up 4.4% versus a 1.0% total return produced by the FTSE 100*. No doubt about it, my gains this year have been far from stellar. But following two years of lagging the index, I will happily take my current outperformance for 2018.

Recent RNSs from my shares have been broadly positive. Once again there was a mix of satisfactory to lacklustre statements, and I am glad no major horror stories emerged.

And I did venture to one AGM, which helped prompt my portfolio’s only Q3 trading.

How my portfolio has performed

I publish quarterly updates to explain what has happened within my portfolio, and this Blog post outlines my July/August/September activity. You can click here to read all of my previous round-ups.

The table below lists all of my shares. Alongside each holding is my portfolio’s weighting at the start of the year and at the end of the third quarter.

This table also shows the total return (that is, the capital gain/loss plus dividends received) each holding has produced for me so far during 2018. Each holding’s contribution towards my overall 4.4% gain is disclosed, too:

| Holding | Weighting 01 Jan 2018 (%) | Weighting 28 Sep 2018 (%) | Holding Return (%) | Portfolio Return (%) |

| Andrews Sykes | 3.9 | 4.3 | 19.0 | 0.7 |

| Bioventix | 8.8 | 10.9 | 30.1 | 2.6 |

| Castings | 6.4 | 5.5 | (7.3) | (0.5) |

| City of London Inv | 7.0 | 6.7 | 1.7 | 0.1 |

| Daejan | 6.3 | 5.8 | (2.6) | (0.2) |

| Getech | 2.9 | 4.2 | 47.8 | 1.4 |

| Mincon | 4.3 | 6.4 | 56.9 | 2.4 |

| Mountview Estates | 8.1 | 7.1 | (5.0) | (0.4) |

| Oleeo | 4.4 | 4.3 | 0.0 | 0.0 |

| Record | 6.2 | - | (4.8) | (0.3) |

| S & U | 4.4 | 4.9 | 19.4 | 0.9 |

| System1 | 1.5 | 2.5 | (26.9) | (1.0) |

| Tasty | 6.1 | 5.0 | (39.7) | (3.4) |

| FW Thorpe | 9.1 | 7.1 | (17.9) | (1.6) |

| Tristel | 9.0 | 10.4 | 20.7 | 1.9 |

| M Winkworth | 5.9 | 6.5 | 29.5 | 1.7 |

| Cash | 5.7 | 8.4 | - | - |

| TOTAL | 100.0 | 100.0 | 4.4 |

I have become convinced it makes a difference to marketing

My only Q3 activity involved buying more System1 (SYS1). I increased my holding by 201% at 238p including all costs during August.

This purchase is a ‘contrarian’ investment. Annual results issued during June were described by the chief exec as “miserable” as profit collapsed by 72%. Less than 18 months ago, the share price had briefly topped £10. These days the price hovers above 200p — the lowest for more than five years.

Why buy more? Well, I remain convinced there is a decent business here. SYS1 effectively pioneered its method of market research and advert testing, and — at the risk of being deceived by some ace salesmen! — I have become more and more convinced the firm’s ‘System1’ approach does make a difference to marketing.

(You can download SYS1’s book — Unlocking Profitable Growth (free pdf) — to judge my conclusion for yourself).

One or two investors have told me SYS1’s future is bleak. You see, everyone is watching less television and more content online, and nobody watches Youtube ads anyway. Meanwhile, vloggers can apparently produce advertorials that are far more effective than traditional advertising.

All that may be true, but companies will continue to advertise in some way, and will always want to know which of their adverts — whether it is a six-second ‘pre-roll’ for Youtube or a vlogger’s affiliate video — resonate with viewers and are therefore more likely to drive sales.

I attended SYS1’s AGM during July and did not leave thinking management had given up and the business was doomed. The board’s answers were informative — plenty of numbers were revealed about a new service — and even the non-execs showed their worth by chipping in with certain insights.

I had thought buying at 238p would equate to paying 11x my 17p per share earnings guess adjusted for a £6m/46p per share cash position.

However, a trading statement during September indicated a new service could absorb £3.6m/28p per share before producing any meaningful revenue. After I bought at 238p, that 28p per share of expenditure has been knocked off the share price…

Anyway, I first bought SYS1 during March 2016 and, combined with my latest purchase, my average buy price is now 266p. At less than 3%, the position is the smallest within my portfolio.

Statements from 12 of my 15 holdings

As usual I have kept watch on all of my existing holdings — trying to seek out buying opportunities just in case.

Here is a summary of the statements issued during Q3:

* Satisfactory updates from Andrews Sykes, Daejan, M Winkworth, Mincon, S & U and Tristel;

* Acceptable progress at Castings, City of London Investment and FW Thorpe;

* Adequate-in-the-circumstances results from Getech (full write-up coming soon);

* Mixed news from System1;

* Dismal-but-not-disastrous developments at Tasty, and;

* Nothing of major significance from Bioventix, Mountview Estates and Oleeo.

My new SharePad side-income

You may have noticed I recently started writing articles for SharePad. My first piece covered Ramsdens and my second covered CMC Markets. A third piece should be published next week.

My decision to become a SharePad contributor was not difficult. I have used the investment software since 2015 and consider it to be an exceptional service for private investors. I also rate the educational and analytical articles that SharePad has become renowned for.

My SharePad articles will include my own stock-screening efforts — where I attempt to track down respectable companies that offer attractive financials, capable managers, reasonable prospects and modest valuations. I hope you find what I write for SharePad helpful.

I would like to think my return to ‘proper’ writing and deadlines will increase my content output, which in turn can help me find decent buying opportunities — and perhaps reignite my stock-picking!

I hope the payments I receive from SharePad can assist my returns, too.

You see, for almost four years now I have been a pure full-time investor. During that time I have received no freelance or employment payments whatsoever.

As such, my new SharePad side-income should mean I have a bit more money to invest — and not have to think too much about withdrawing capital and dividends to fund my living expenses.

Best of all, I don’t really see the SharePad articles as ‘work’ :-)

I had been using about 20% of the features

My SharePad articles may prompt a few changes to this Blog.

For one thing, the articles will replace my Watch List reviews, which I admit have been somewhat infrequent of late. That said, any new share that ends up in my portfolio will most likely be covered first in a SharePad write-up.

Another likely change will be my Blog showcasing SharePad charts.

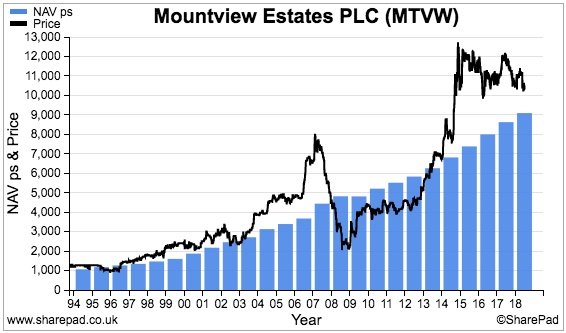

I have to confess, I had been using about 20% of all the features of the SharePad service — but now I know how to produce charts such as this…

…I can easily create them for my articles on this site. I think such charts can often tell a story more effectively than the tables I use.

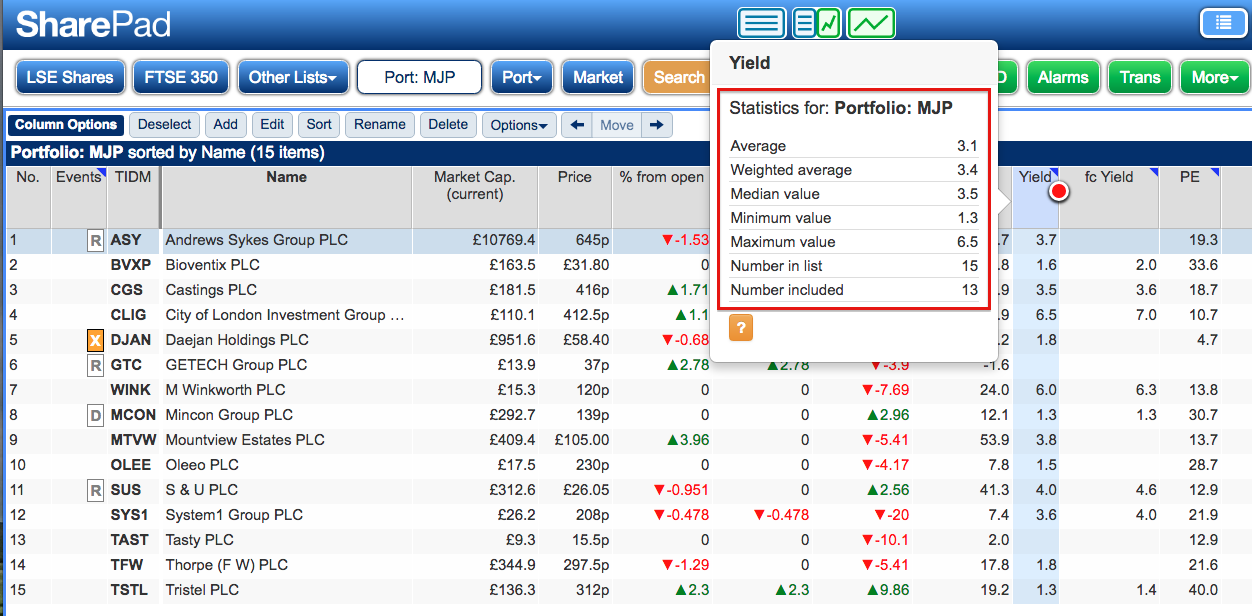

Something I will have get to grips with is SharePad’s portfolio-tracking feature. My aim is to transfer my buy and sell transactions from MS Money to SharePad, and then be able to produce portfolio-performance snapshots such as this:

In the meantime, I can now determine certain ratios of my portfolio. For example, the average dividend yield of my holdings is 3.1%:

How shares helped me quit the day job

Finally, a friendly reader sends an email:

“I admire your decision and ability to generate from your own capital enough income to cover your living expenses. I find it unconventional and extremely inspirational.”

I have never considered what I have done to be “extremely inspirational” — I just decided to change my life and do something more enjoyable.

Still, I guess some of you may also wish to give up the 9-to-5 in order to sit at home and look at shares all day. I have therefore repurposed an old Motley Fool article of mine — How Shares Helped Me Quit The Day Job — to get you started.

I made the leap aged 43 back at the start of 2015, and I am convinced anyone with a passion for shares and the determination to give up the 9-to-5 can take the same path. Trust me, nothing I have done was rocket science.

Until next time, I wish you happy and profitable investing!

Maynard Paton

PS: You can now receive my Blog posts through an occasional e-mail newsletter. Click here for details.

(*I compare my portfolio against the FTSE 100 total return index as it is the main UK benchmark and I would invest in the FTSE 100 were I to give up stock-picking and become a passive investor.)

Disclosure: Maynard owns shares in Andrews Sykes, Bioventix, Castings, City of London Investment, Daejan, Getech, Mincon, Mountview Estates, Oleeo, S&U, System1, Tasty, FW Thorpe, Tristel and M Winkworth.

Maynard,

Thanks for the update and yes your blog is very useful to me. One thing I have learned in recent years is to limit my buys and sells and my activity these days is pretty low, I haven’t made any transactions YTD. My portfolio is holding up and YTD I’m up 7.5%, TAST being my worst offender also but these days its just 3% of my portfolio.

I admire your independence to live off your Portfolio at such a young age. Have you a goal with your investments and does it include some extravagant purchase(s) at some stage after so many years of careful spending ?

I have 3 years to go to age 60 when I intend hanging up my boots but I keep thinking what am I waiting for ? I have money tied up in Pensions which my Financial Advisor says don’t cash in but with a moderate return of say 5% I could be living very well now with this.

Keep up the blog

best regards

David

Hello David,

Thanks for the comment. I have no set investment goal, other than hopefully make enough to live on, and I have never been one for extravagant purchases. Pricey cars and luxury holidays just don’t do anything for me (or my wife). Sad, but there you go. I stopped full-time employment because I became fed up with the work and the commuting, and would always regret not trying something different. My decision is not for everyone, but if your personal sums look good, you’re a confident investor and you are fed up with your work, then the decision to change could be worth considering.

Maynard

Hi Maynard,

Wishing you and your family a Happy New Year and all the best for a healthy and prosperous 2019.

I have just analysed my portfolio performance for 2018 and I’m down 10.8%. My Whiskey investment is up 8% and other pension pots are down around 10%. Not a great year!

Best regards

David

Hello David

Well, thank you. Likewise I wish you and your family the best for next year, too.

My early sums suggest I am down c7% with my market benchmark down c8%. I hope the 4.5 hours of trading on Monday can keep me ahead of the market, otherwise 2018 will be another year of under-performance :(

Regards

Maynard

PS I always knew Whiskey would be a great investment :-)