13 September 2018

By Maynard Paton

Update on M Winkworth (WINK).

Event: Interim results for the six months to 30 June 2018 published 12 September 2018.

Summary: These results were quite satisfactory and actually revealed record first-half revenue — despite the estate-agency group remaining dependent on London’s difficult property market. In fact, the confident management narrative said sales commission rates had increased and also described online rivals as “digital experiments”. Meanwhile, the accounts seem in decent shape, the outlook appears relatively encouraging and the valuation is hardly extended. I continue to hold.

Price: 125p

Shares in issue: 12,733,238

Market capitalisation: £15.9m

Click here to read all my WINK posts.

Results:

My thoughts:

* Earned proportion of gross network income increases to 13%

Once again I was not exactly sure what to expect from WINK’s interim results.

True, March’s annual statement had revealed a relatively chipper second half, while a 9p per share return of capital during the summer suggested some confidence about current trading.

Still, you never can tell with this estate-agency franchising outfit. Some 80% of revenue is dependent on London-based franchisees, and the persistent gloomy headlines about the capital’s housing market have been difficult to ignore.

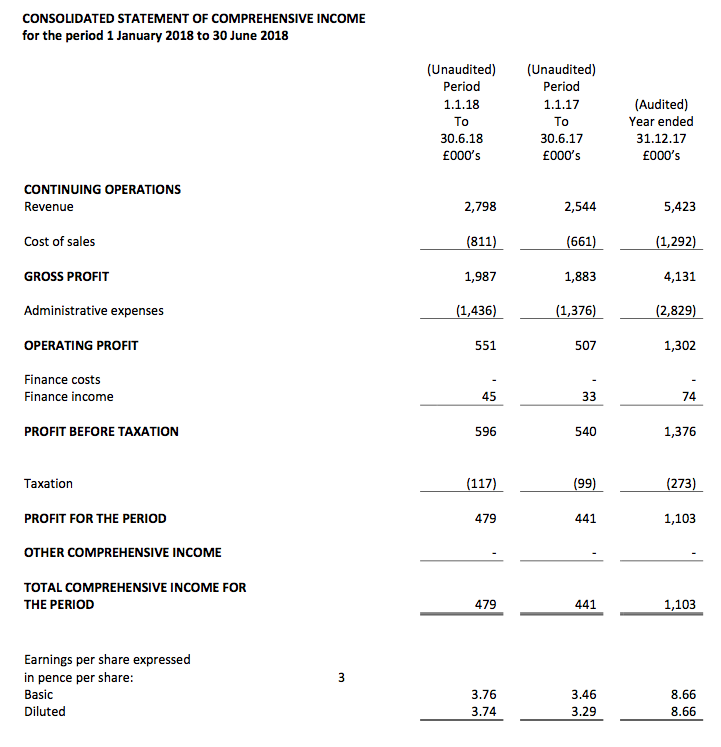

In the event, revenue and operating profit both advanced 10%. WINK said the effort was “driven by the central service initiatives and the continued strong performance of the lettings and management business”.

Revenue of £2.8m was actually a new first-half record. However, the £551k profit was below the £600k-plus reported during 2014, 2015 and 2016.

WINK’s revenue performance was achieved by taking a greater share of the total income from its franchisee office network.

The table below shows WINK’s take at a new high:

| Year to 31 December | 2014 | 2015 | 2016 | 2017 | H1 2018 |

| Gross Franchise Sales & Lettings (£k) | 50,100 | 49,010 | 46,120 | 46,200 | 21,300 |

| Revenue (£k) | 5,496 | 5,865 | 5,566 | 5,423 | 2,798 |

| Revenue/Gross Franchise Sales & Lettings (%) | 11.0 | 12.0 | 12.1 | 11.7 | 13.1 |

I am not sure whether this higher percentage is sustainable. Four new franchise offices were opened during the six months, and I wonder if the associated initial fees bumped up WINK’s cut.

Anyway, gross revenue from the franchised office network fell by £0.1m to £21.3m during the half. Extending the differing trends seen during the last few years, total franchisee income from sales commissions fell 8% (to £10.8m), and from lettings and property management climbed 6% (to £10.3m).

* Another Foxtons-thumping performance as commission rates increase

WINK claimed “the local knowledge and experience of our franchisees has enabled them to adapt quickly to testing times and, as a result, we are pleased to see our metrics outperform peers of a similar geography.”

For some time now I have been comparing WINK’s progress to that of London rival Foxtons (FOXT).

The comparison is not strictly like-for-like — WINK generates 80% of its revenue from its London-based franchisees, while FOXT’s income is almost entirely derived within the capital. However, I feel the overall trend is quite telling.

Here are my stats:

| Year to 31 December | 2014 | 2015 | 2016 | 2017 | H1 2018 |

| Winkworth | |||||

| Gross Franchise Sales Revenue (£m) | 32.6 | 30.1 | 26.0 | 24.8 | 10.8 |

| Gross Franchise Lettings Revenue (£m) | 17.5 | 18.8 | 20.1 | 21.3 | 10.3 |

| Total Gross Franchise Revenue (£m) | 50.1 | 49.0 | 46.1 | 46.2 | 21.3 |

| Foxtons | |||||

| Sales Revenue (£m) | 69.8 | 72.5 | 55.5 | 42.6 | 17.2 |

| Lettings Revenue (£m) | 67.4 | 69.0 | 68.3 | 66.3 | 31.7 |

| Total Revenue (£m) | 137.2 | 141.5 | 123.8 | 108.9 | 48.9 |

| Winkworth / Foxtons | |||||

| Sales Revenue (%) | 46.7 | 41.5 | 46.8 | 58.2 | 62.8 |

| Lettings Revenue (%) | 26.0 | 27.2 | 29.4 | 32.1 | 32.5 |

| Total Revenue (%) | 36.5 | 34.6 | 37.3 | 42.3 | 43.6 |

Back in 2014, WINK’s franchisees earned almost 37% of FOXT’s annual sales and lettings revenue. Last year they earned 42%, and for this first half they earned nearly 44%.

FOXT’s results covering the first six months of 2018 showed total revenue down 9%, a small operating loss and a cancelled dividend.

Clearly WINK’s franchise system has coped better of late than FOXT’s conventional employee set-up.

Note, too, that WINK revealed “sales commission rates increased” as “clients showed their willingness to pay for trusted expert advice to help them achieve their goals in uncertain markets”.

March’s annual results gave a similar assessment. I guess the pricing threat from online rivals — or as WINK now calls them, “digital experiments” — may not have occurred just yet.

* The launch of new franchises may have necessitated further handouts

WINK’s finances look just about in order.

In particular, the 20% operating margin remains very respectable while cash in the bank topped £3m prior to the aforementioned 9p per share/£1.1m return of capital.

Expenditure on capital items — at just £16k for this H1 — was remarkably low, too.

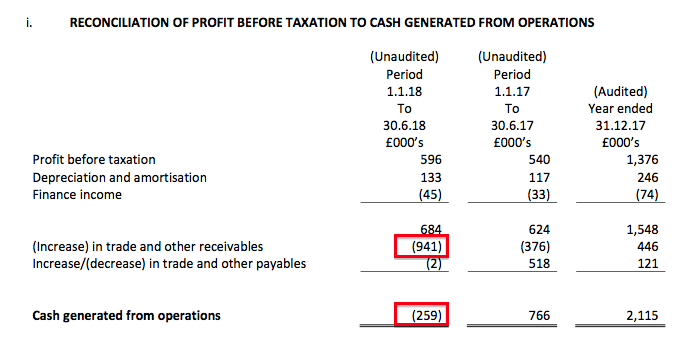

However, WINK’s cash generation from operations was poor:

The period’s entire cash flow was absorbed into trade and other receivables.

WINK stated: “Trade receivables at £2.56m, whilst up from their level at the end of 2017 (£1.62m), were broadly in line with the equivalent period in 2017 (£2.44m) reflecting the seasonal nature of the billings and collections.”

I am not sure I fully accept that explanation.

You see, the largest component of trade and other receivables are not “billings and collections” — but start-up loans owed to WINK by franchisees.

At the 2017 year end, such loans came to £981k — and I dare say the launch of new franchises during this first half necessitated further handouts.

WINK hardly ever mentions these start-up loans, but they do provide a useful financial income. This half enjoyed interest income of £45k — equivalent to 8% of operating profit — which I am sure came almost entirely from these loans.

I should add the balance sheet remains free of debt and pension complications.

Valuation

WINK’s outlook sounded relatively promising:

“We expect the second half of the year to show an improvement on the first as further new franchises open and sales agreed in the Spring market complete. The rentals and management business is expected to benefit from the important lettings months of August and September. Based on our first half performance and recent trading, we expect full year results to be in line with management expectations.”

WINK added that it did not expect transaction volumes to fall further.

Assuming the second half of 2018 matches the second half of 2017, then full-year revenue would be £5.7m and operating profit would be £1.3m. Applying tax at 19% then gives earnings of 8.6p per share.

Adjusting the £3.2m cash balance for the £1.1m return of capital, and then adding on that £981k of franchisee loans, my guess of effective net cash comes to almost £3.0m — equivalent to 23p per share.

Subtracting that 23p from the 125p share price gives an enterprise value of 102p per share, which is 11.9 times my earnings guess. That multiple does not appear extravagant to me, although the shares have rarely traded on an extended rating in the past.

Still, I am hopeful WINK can enjoy a P/E re-rating should further steady progress emerge. Certainly WINK’s financial performance has diverged from that of FOXT, and perhaps investors may one day recognise some estate agents are not suffering as much as others within London’s difficult property market.

In the meantime, the 1.85p per share quarterly dividend continues to deliver a 7.4p per share full-year payout and a 5.9% yield.

Maynard Paton

PS: You can now receive my Blog posts through an occasional e-mail newsletter. Click here for details.

Disclosure: Maynard owns shares in M Winkworth.

Hi Maynard, Follow you because of your interest in Tristel. Decided to buy one of your buys back in March 2017. bought WINK at 101p. Needless to say I am a happy camper – thanks for all your good work.

Thanks Steve. I am glad you like the blog.

Maynard

M Winkworth (WINK)

Trading Update and Dividend Declaration

Not a bad update in the circumstances, with an encouraging slight lift to the dividend.

Here is the full text:

——————————————————————————————————————-

M Winkworth plc (“Winkworth” or the “Company”), the leading franchisor of real estate agencies, is pleased to announce the following trading update for the financial year ending 31 December 2018.

The UK residential sales market continued to be challenging in 2018, characterised by low availability of stock. Prime central London prices stabilised some 15-20% below the peak levels seen in 2014, while prices in greater London slipped by up to 10%. Although the number of transactions in London remained weak, we are pleased to report that, according to data collated by TwentyCI, in 2018 Winkworth ranked second by number of exchanges and third by number of new listings.

Despite rental prices being broadly flat for the year, the Company achieved a further increase in revenue from lettings and management and this business line now accounts for half of group turnover.

Total revenues rose on 2017 and are expected to be within 5% of market expectations while, subject to audit, profits before tax are expected to be higher than in 2017 and slightly ahead of expectations of £1.4m. The Company expects to announce its final results for the year ended 31 December 2018 on or around 3 April 2019.

Over the course of the year the Company opened six new offices, merged four with others in neighbouring vicinities and closed one, raising the total number of franchised outlets at year end to 100 (versus 99 in 2017). The number of new franchise applicants rose by almost 80% in 2018 and this year we expect to see further opportunities to grow new franchises.

After returning 9p per share of surplus funds to shareholders in July, Winkworth ended the year with a strong net cash position and the directors are pleased to announce that the Company will pay an increased dividend of 1.9p (2017: 1.85p) per share for the fourth quarter of 2018, bringing total dividend payments declared for the year to 7.45p (2017: 7.25p).

Dominic Agace, Chief Executive Officer of Winkworth, commented:

“We are proud of what the Group was able to achieve in 2018 in a market still suffering from uncertainty, and this is further testimony to the hard work and dedication of our franchisees. While the outlook remains hard to forecast, the market fundamentals remain sound with interest rates low, real wage growth and record levels of employment. We are encouraged by the sharp increase in applicants on our site for both property purchases and rentals seen in December.”

——————————————————————————————————————-

The following snippet attracted my attention:

“according to data collated by TwentyCI, in 2018 Winkworth ranked second by number of exchanges and third by number of new listings.”

My ongoing comparison between WINK and Foxtons (see Blog post above) has been showing WINK gaining market share over FOXT for some time now. To my knowledge, WINK has not referred to market share within an RNS before, so I presume being ranked second and third are new ‘highs’ for the group. If so, I am pleased with the progress.

Elsewhere, I presume 2018 revenue being “within 5% of market expectations” means “within 5% below market expectations”. At least profit will be “slightly ahead of expectations of £1.4m“.

This time last year, WINK said profit would be “slightly ahead of expectations of £1.3m” and the figure came in at £1,376k. So I guess we may see something like £1,476k.

The quarterly dividend lift to 1.9p per share is encouraging. WINK has never cut its annual payout and the implication from this higher dividend is a 2019 payout of 1.9p*4 = 7.6p per share.

Assuming a £1.45m profit, a 7.6p per share dividend and the £3m cash pile (as per the Bloig post above), I arrive at a cash-adjusted P/E of 10 and a yield of 6.7% at 115p.

One point I would note is the proportion of franchise applications being converted (or not) into actual franchisees. WINK has been bullish about levels of franchise interest for a while now, and yet last year saw the estate grow by a net one outlet to 100. Many franchising applications would seem to be unsuitable.

Maynard

M Winkworth (WINK)

Proactive Investors video

A useful 6m30s interview.

——————————————————————————————————————

Dominic Agace, chief executive of estate agent M Winkworth Plc (LON:WINK), spoke to Proactive London following the release of its 2018 trading update.

”We’ve got a fantastically defensive model – we’ll continue to trade well and progress despite it being a low transaction market with a significant potential for upside as transactions increase … and a chance in this period to grow our footprint so we benefit to a greater extent when those transactions drop through the business”.

M Winkworth (WINK)

Property Industry Eye

Recent news stories that suggest the traditional estate agent (at least in London) may not be dead just yet:

https://www.propertyindustryeye.com/most-agents-charging-between-1-and-1-4-says-latest-poll/

““In my view, for those who charge more than 1.5%, this has nothing to do with location or competition. It’s about skills, attitude, confidence and the deliberate commitment to charge a decent amount of commission in order to secure their future.””

https://www.propertyindustryeye.com/online-agents-see-market-share-stabilise-at-7-2-of-exchanges-but-big-regional-variations/

“Online estate agents achieved 7.2% of all exchanges in the final quarter of 2018 – but while their market share climbed in northern regions, it fell in London and the south.”

https://www.propertyindustryeye.com/low-fees-less-important-than-transparency-to-sellers-when-they-are-choosing-agents/

“Consumers look for transparency as to what estate agents will charge – rather than low fees.”

https://www.propertyindustryeye.com/online-agents-new-listings-achieve-just-4-of-market-share-in-the-two-weeks-until-yesterday/

“New data covering the fortnight until yesterday evening is showing just how decisively Purplebricks is conquering the online estate agency sector. However, the sector’s market share as a whole, in terms of new listings in the last two weeks, is just 4%.”

Maynard