02 December 2019

By Maynard Paton

Results summary for Getech (GTC):

- Revenue fell 15% to its lowest first-half level since 2010. At least the H1 operating loss did not increase from H1 2018.

- GTC continues to be dependent on oil and gas operators purchasing its “market leading” data — the income from which remains “lumpy”.

- The level of recurring revenue implies a lot of work is needed before GTC can sustain positive earnings.

- The accounts are still rather fragile, with cash flow shored up by tax credits and capitalised development costs becoming more significant.

- Delays to both a Sierra Leone project and a property sale have not helped support the £9m market cap. I have sold out entirely.

Contents

- Event links and share data

- Why I sold GTC

- Why I had owned GTC

- Results summary

- Revenue and loss

- Gravity & Magnetic Solutions

- Information Products and Software

- Geoscience Services

- Financials

- Valuation

- Portfolio Sale

Event links and share data

Event: Interim results and presentation for the six months to 30 June 2019 published 24 September 2019

Price: 24p

Shares in issue: 37,563,615

Market capitalisation: £9.0m

Why I sold GTC

- I am slowly trimming lower-conviction holdings from my portfolio, and GTC’s latest statement re-emphasised some drawbacks that I can no longer tolerate.

- In particular, GTC appears very dependent on a rising oil price and “lumpy”/one-off data sales to achieve near-term profits.

- The current chief executive was appointed three years ago, and an emerging question now is how much longer will he give his turnaround strategy? I note the optimistic tone of the director commentary has reduced.

Why I had owned GTC

- Developed “market-leading” geoscience/oil-exploration software that enjoyed multi-year contracts, a blue-chip client base and a recent track record of recovery.

- Chief executive recruited during 2016 had implemented a greater commercial focus and his high-flying CV had underpinned the prospect of significant turnaround potential.

- A £9m market cap could have offered notable upside if a rising oil price stimulated customer orders and led to much improved earnings due to a mostly fixed cost-base.

Further reading: My GTC Buy report | All my GTC posts | GTC website

Results summary

Revenue and loss

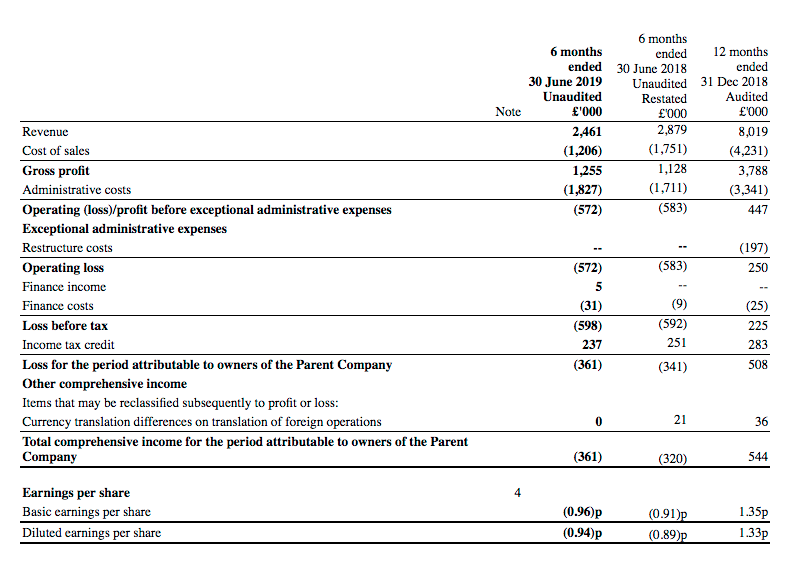

- The gist of these first-half results was revealed within August’s trading update.

- Revenue was indeed £2.5m, the ‘cost base’ was indeed £3.2m and the “net impact of the reduction in cost base and revenue” did indeed have a “neutral impact on the Group’s profitability position when compared to H1 2018”.

- The “profitability position” was in fact an operating loss of £572k — versus a (restated) loss of £583k for H1 2018.

- Revenue fell 15% to set the lowest first-half level since 2010:

| H1 2017 | H2 2017 | H1 2018 | H2 2018 | H1 2019 | |||

| Revenue (£k) | 3,055 | 4,160 | 2,879 | 5,140 | 2,461 | ||

| Operating profit (£k) | (399) | 544 | (583) | 1,030 | (572) |

- The revenue reduction was due largely to restructuring the group’s geosciences consultancy division.

- Given the group’s operating loss remained the same, the consultancy revenue lost was seemingly not profitable.

- GTC notably disclosed two new sales measures:

- The orderbook, which gained £1.0m from H1 2018 to £3.0m, and;

- Annualised recurring revenue, which gained £0.8m from H1 2018 to £2.3m.

- The introduction of these new sales measures perhaps means GTC’s revenue has become more predictable.

- The £3.0m orderbook represents 39% of the revenue generated during this H1 and the preceding H2.

- Recurring revenue of £2.3m represents 30% of revenue generated during this H1 and the preceding H2.

- For (full-year) 2019 revenue to match that of 2018 (£8.0m), the current second half will require revenue of £5.6m.

- During 2018, revenue was bolstered by a last-gasp $3.2m (£2.5m) data sale.

- Since the publication of these results, GTC has announced one data sale that will generate revenue of $1m (c£775k).

- Repeating the H2 2018 revenue performance may therefore be touch and go.

- GTC recognised some work was required to deliver an acceptable H2:

“Our H2 2019 sales and marketing campaigns for products are well underway, with active trials taking place for Globe and Software in SE Asia, Europe and North America… In data, a number of high-value opportunities are maturing as our customers present the business case to extend their gravity and magnetic data library…”

“Our focus remains on delivering a strong sales performance to 31 December 2019… H2 is busy with face-to-face customer meetings in many regions of the world.”

- Future prosperity still rests on the group’s oil and gas customers.

- GTC said (my bold): “Global economic uncertainty and geopolitical tensions continue to drive crude price volatility, and Getech’s oil and gas customers remain careful in the release of their investment budgets.”

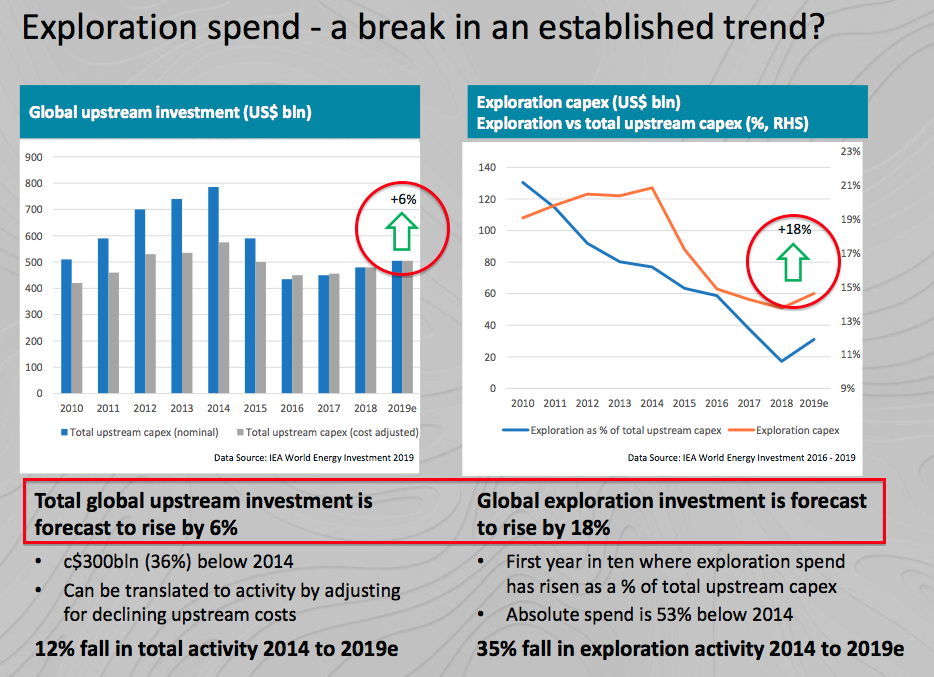

- However, the presentation slides suggested capital expenditure within the oil and gas sector could soon recover:

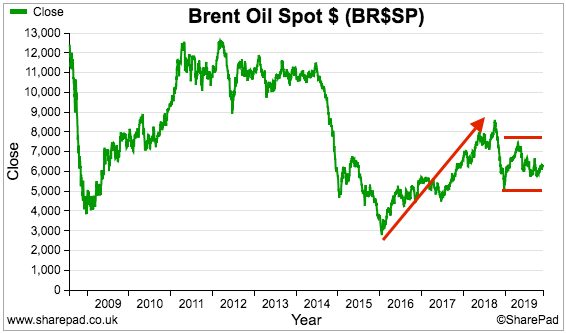

- The oil price rallied from $30 to beyond $80 between 2016 and 2018, driving an improved performance at GTC:

- However, the oil price has traded between $50 and $75 during 2019.

Gravity & Magnetic Solutions

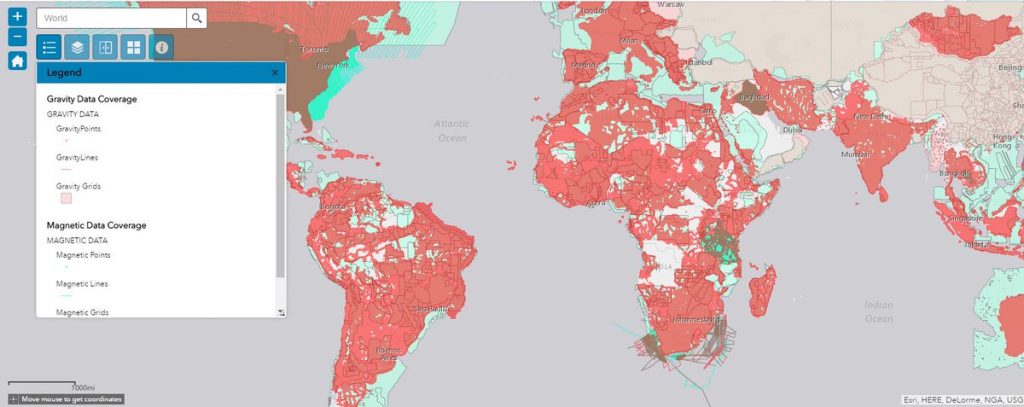

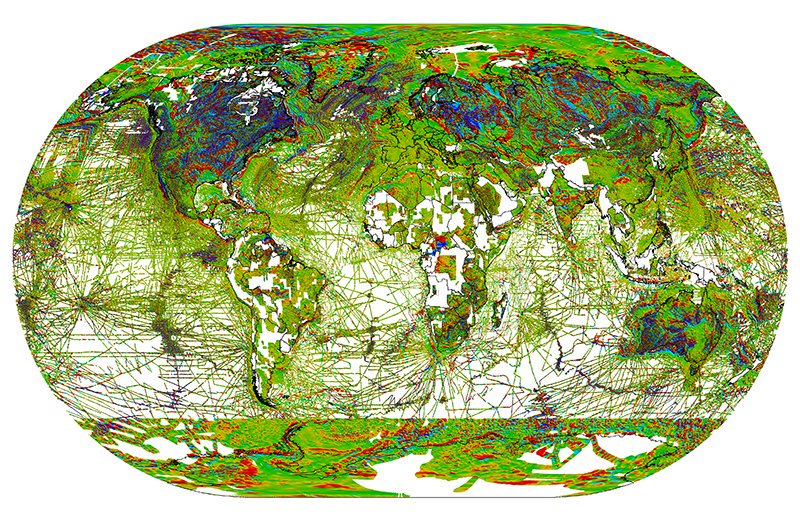

- GTC continues to describe its gravity and magnetic data as “market leading”:

“At the heart of our product suite is our portfolio of market-leading Gravity & Magnetic (G&M) data. These data are used by our oil & gas and mining customers to model variations in the Earth’s crust, which in turn helps them to visualise the Earth’s structures and understand the evolution of natural resources.”

- Income from such data sales remains “lumpy”:

“G&M data sales are typically high-value, high-margin and lumpy, and demand for G&M data in H1 2019 has continued despite oil price uncertainty.”

- Valuing such “lumpy” income is difficult — especially as a single data sale can represent up to 30% of revenue in any one year (e.g. 2018).

- Applying a conventional P/E to unpredictable data-sale income may be a tad ambitious.

- Management claimed during a 2017 company presentation that selling off-the-shelf data was a “100% profit activity” and that the data “does not go stale”.

- Such comments sound great, although once such data is purchased the customer seems unlikely to purchase the same data ever again.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Information Products and Software

- This division develops the Globe product, which serves “a broad group of super-majors and large independent oil & gas companies” and allows them to “model the Earth’s geological evolution and predict the location of oil & gas.”

- Globe is upgraded every year and the majority of customers have “signed-up to multi-year contracts.”

- Globe and other software products presumably represent the bulk of GTC’s recurring revenue.

- Recurring revenue of £2.3m compares with a reported ‘cost base’ of £3.2m for these six months — or £6.4m for a full year. Staff costs alone last year came to £4.5m (point 14).

- This Globe/software part of the business therefore needs to expand significantly for GTC to reach a more predictable level of profit.

- Until recurring revenue can cover group costs, profitability will be dictated mostly by (“lumpy”/one-off) data sales.

Geoscience Services

- The 2018 results revealed this division had been restructured at an ‘exceptional’ cost of £197k and that the associated savings would amount to £500k a year.

- The associated savings were not obvious in these results given the group’s £572k operating loss was similar to that of H1 2018.

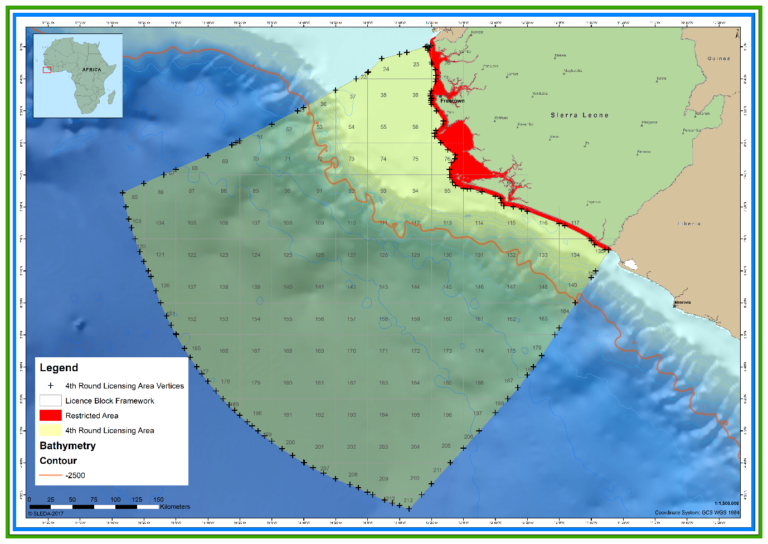

- This division’s involvement in the Sierra Leone licensing round has become very protracted.

- The Sierra Leone work started during October 2017, and the deadline for licence applications was originally June 2018.

- Various delays have since occurred, and these results revealed the application deadline had been delayed (again) until February 2020.

- GTC claims the Sierra Leone work will enable the firm to “broker a high value portfolio of seismic and well data to prospective investors”.

- GTC has not revealed how much revenue has been — or will be — earned from this Sierra Leone project.

- The 2018 annual report (point 12) hinted that a write-off could occur were a “successful licensing round” not to complete during 2019.

- Perhaps the Sierra Leone work has been delayed because the interested oil companies are not entirely convinced about the area’s exploration prospects.

Financials

- GTC’s accounts remain underwhelming due to the absence of H1 earnings.

- At least GTC received payment for the $3.2m data sale recorded at the very end of 2018.

- A favourable £2.5m working-capital movement meant free cash flow for this H1 was £1.6m, which took the cash position to £3.0m

- Borrowings of £0.9m left net cash at £2.1m.

- The borrowings are secured on GTC’s Leeds office, which includes “a grand neo-Jacobean style carved wooden staircase” and “a superb glazed ‘peacock cupola’ dome”, and is in the books at £2.4m.

- GTC placed the office on the market during the first half of 2018, and twelve months ago the group claimed: “A number of parties have expressed interest…”

- However, a buyer for the office has yet to come forward due to “Brexit-related uncertainties”. Reducing the asking price could always counter such “uncertainties”.

- GTC really could do with selling the office. Cash in the bank is useful to have when current earnings are so hit and miss.

- The Leeds building was purchased during 2006 for £2.5m.

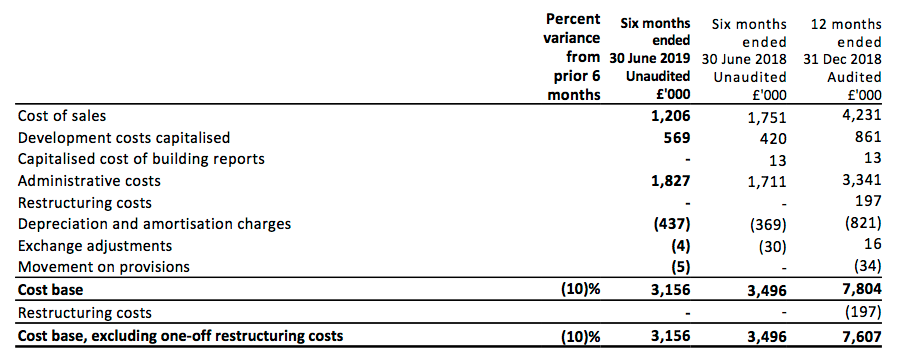

- GTC continues to capitalise certain software development costs.

- For this H1, development costs of £569k were capitalised on the balance sheet rather than expensed immediately against earnings.

- The associated depreciation and amortisation charge was £437k.

- Account for tangible asset expenditure of £25k as well, and the ‘excess’ capitalised expenditure during this H1 was a notable £157k.

- For full year 2018, such ‘excess’ capitalised expenditure came to £119k (point 12).

- The divergence between capitalised development costs and the associated depreciation and amortisation charge arguably flatters GTC’s reported earnings (and losses).

- The 2018 annual report (point 12) disclosed capitalised development costs have a useful life of between five and ten years:

- Five to ten years is a long time. My research suggests most software companies that capitalise development costs (and many do not capitalise any development costs) apply a useful life of no more than five years to such expenditure.

- The longer the useful life of an intangible asset, the lower the annual amortisation charge against earnings.

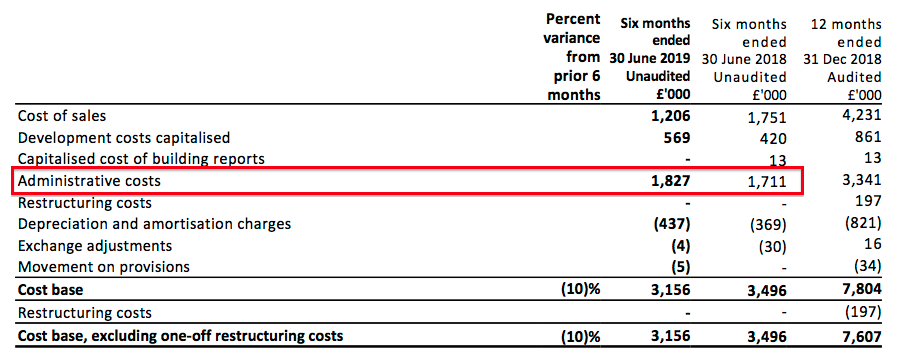

- GTC provided an updated ‘cost base’ for this H1:

- As the cost base calculation includes depreciation, tangible capital expenditure really should be included as well.

- That said, the small amounts of tangible capital expenditure (£25k for this H1, £78k for 2018) do not make a great difference.

- The cost base for this H1 was 10% lower than for H1 2018.

- The smaller cost base reflects the reduced cost of sales associated with the lower level of consulting revenue.

- But administrative costs did climb 7%:

- Unlike previous statements, these results did not refer to the group’s “85% fixed” cost base. Past results have implied future revenue improvements could lead to significant profit advances.

- GTC continues to enjoy R&D tax credits. Tax of £39k was refunded during this H1, and a further £140k is expected during H2.

- The balance sheet carries no pension complications.

Valuation

- A 24p mid-price supports a £9.0m market cap.

- The £2.4m Leeds office is surplus to requirements and might suggest the underlying business is valued at closer to £7m.

- Book value — which includes goodwill and other intangibles of £7.7m — is above the market cap at £12.3m.

- Near-term earnings remain at the mercy of “lumpy” data sales, the timing and value of which are unpredictable.

- As noted earlier, applying a conventional P/E to data-sale income may be a tad ambitious.

- For GTC to really succeed, recurring revenue from Globe and the other software products has to grow to cover the cost base.

- However, covering staff costs of £4.5m — let alone the full cost base — seems a tall order at present with recurring revenue at only £2.3m.

- A more radical business approach would be to ditch Globe and sell only data. Employee overheads could then be vastly reduced and the group might then operate at a reasonable profit — assuming a few data sales each year.

- However, such an approach would probably have no need for the high-flying chief exec, who has instigated the shift to recurring revenue and is on a useful £250k a year.

- An emerging question now is just how long the chief exec will give his turnaround strategy.

- The boss was appointed in mid-2016 and deserves credit for cutting costs, righting the balance sheet and trying to expand the recurring revenue side of the business.

- But three years on, GTC’s earnings remain shaky while notable progress continues to be dependent on greater spending from oil and gas customers.

Portfolio sale

- I sold my entire GTC position following these results.

- I am slowly extricating lower-conviction holdings from my portfolio (c.f. Castings), and this latest statement re-emphasised some drawbacks that I can no longer tolerate.

- In particular, GTC has struggled to sustain an acceptable level of profit.

- Immediate earnings remain dictated by “lumpy“/one-off data sales, the timing and value of which appear unpredictable.

- Meanwhile, recurring revenue seems a long way off from covering the cost base — let alone helping to generate a decent profit and funding a dividend resumption.

- In addition, GTC appears very dependent on a rising oil price — to prompt greater oil exploration and follow-up demand for GTC’s exploration software — for future progress.

- The level of capitalised development costs is not encouraging. Nor is the protracted Sierra Leone work.

- Some of the director commentary has been rather optimistic, too. For example, the 2018 results mentioned “acquisitional growth” and “potential to reinstate the dividend”.

- The director commentary no longer mentions GTC’s “fixed” cost base and the potential for amplified profit growth should revenue recover.

- A lot depends on the high-flying chief exec to implement his turnaround plan.

- Appointed in 2016, the chief exec could jump ship if GTC continues to struggle and/or a lucrative job offer appears elsewhere. The chief exec was the finance director of Salamander Energy before its £314m takeover.

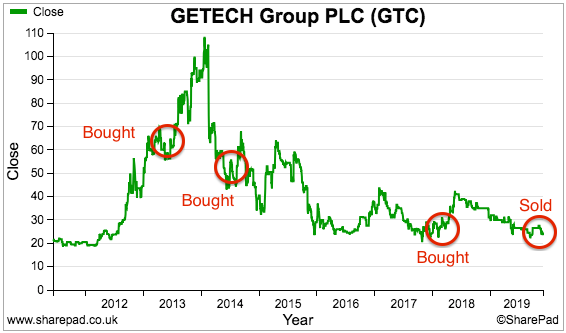

- I first purchased GTC at 62p during 2013 and then at 59p during 2014.

- I bought more at 25p during 2017 following this company presentation.

- All told, I paid an average of 51p, collected dividends equivalent to 4p along the way and ended up selling at 23p to register a thumping 47% loss.

- The chart above (annoyingly) shows I could have exited each purchase for a quick profit.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Disclosure: Maynard no longer owns shares in Getech.

Maynard, thanks so much for taking the time to share your Getech write ups. Looks like you cut your loses at the right time, double the number of shares in issue now but rock bottom market cap. Looks like the previous CEO ended up taking Getech on a crazy transformation into the capital intensive world of building out green hydrogen infrastructure. Wonder if it could be a case of back to the future…

Hi Rob

Thanks for the comment — glad to know people read my old stuff! At the time I thought I had sold far too late as the company had not really performed during the few years prior and I should have sold earlier. But quite happy to be out. Not really followed it since, bit I see the shares are 2-3p (£2m mkt cap!) and the company is seemingly getting back to Globe etc.

Maynard

Hi Maynard, I read your old stuff too.

I’m still learning about investing, particularly getting out of loss makers quicker.

Full disclosure, here’s the problem, we still have quite a lot of Getech shares and I am wondering about adding to them in the current retail fund raise. I think their core business now they’re concentrating on it again has some potential.

Castings is now our third biggest holding. I must read why you sold them.

I’ve been pleased and impressed by the success this year of your portfolio, we bought a few shares yesterday in Mountview Estates after I’d read about your own additions recently in three companies you hold shares in.

Vic

Hi Vic, hope you are keeping well.

Always get a little nervous when people read my old stuff — never quite know whether it has aged well or not!

Did see the GTC fund raise the other day; I recall revenue now running at £4.4m and costs at £5.5m, so the funds are to be used to support the £1m losses until sales reach £5.5m I think. Company talks about ARR, but a lot of revenue I think is lumpy contract stuff. Always recall GTC saying it had unique data, but external macro events frequently seemed to curtail customers exploring for oil and needing the data. But the business model may now have changed since my day.

Mountview is for very patient investors only and is extremely unlikely ever to drive my portfolio in a SYS1-type manner. But on the flip side, major operational trouble is highly unlikely and the dividends should be useful.

Maynard

Hi Maynard,

I read the old stuff too! Sometimes it’s good to go back and review the old winners and losers and the lessons learnt. It’s all good stuff! Andrew

Thanks Andrew, glad you also enjoy the archives!

Maynard