30 June 2022

By Maynard Paton

Happy Thursday! I trust your shares continue to perform better than mine during 2022.

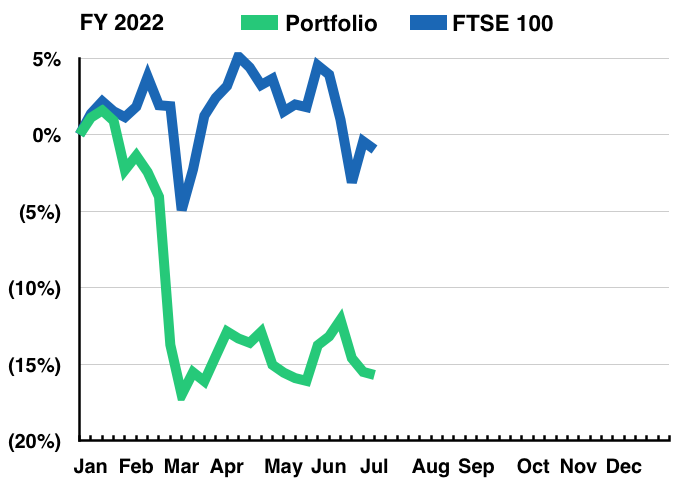

A summary of my portfolio’s progress:

- Q2 return: -2.9%*.

- Q2 trades: None.

- YTD return: -15.7%* (FTSE 100: -1.0%)

- YTD winners/losers: 2 winners vs 9 losers.

(*Performance calculated using quoted bid prices and includes all dealing costs, withholding taxes, broker-account fees and paid dividends)

My portfolio’s 2.9% Q2 drop leaves my shares 15.7% lower this year and nursing their worst half-year decline since I commenced this blog at the start of 2015. I think I have to go right back to the second half of 2011 to find a similarly underwhelming six-month performance.

At least Q2 did not reveal any major RNS disappointments. Andrews Sykes, Mountview Estates and M Winkworth in fact lifted their ordinary dividends while S & U and Tasty disclosed promising progress despite the uncertain economy.

But the market’s disillusionment towards smaller companies is leaving many of my shares marooned at best.

For now I trust an investment mix of respectable competitive positions, capable directors and asset-rich balance sheets can herald a better second half.

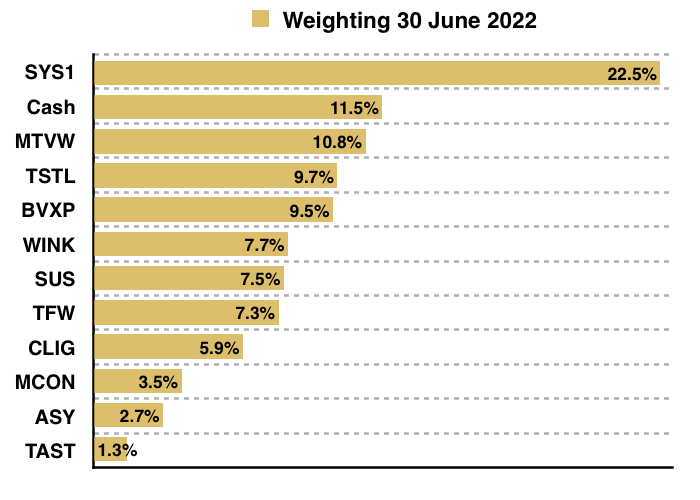

I also feel opportunities are starting to emerge for anyone prepared to delve beyond the gloomy headlines. My portfolio is 11.5% in cash and I am hoping for bargain buys.

I have summarised below what happened within my portfolio during April, May and June. (Please click here to read all of my previous quarterly round-ups). I will then outline how my portfolio has enjoyed eight consecutive years of special dividends.

Contents

Disclosure

Maynard owns shares in Andrews Sykes, Bioventix, City of London Investment, Mincon, Mountview Estates, S & U, System1, Tasty, FW Thorpe, Tristel and M Winkworth. This blog post contains SharePad affiliate links.

Q2 share trades

None.

Q2 portfolio news

As usual I have kept watch on all of my shareholdings. The Q2 developments are listed below:

- Annual earnings rebounding 19% at Andrews Sykes.

- Funds under management falling 8% and director changes at City of London Investment.

- A Q1 update outlining higher revenue and higher costs at Mincon.

- A final dividend up 11% at Mountview Estates.

- Current-year profit running “above budget” at S & U.

- A mixed update and plans for a tender offer at System1.

- Promising director changes and bank-facility repayments at Tasty.

- Confirmation of the long-awaited FDA regulatory submission at Tristel.

- Annual profits more than doubling to a new record at M Winkworth.

- Nothing of significance from Bioventix and FW Thorpe.

Q2 portfolio returns

The chart below compares my portfolio’s weekly 2022 progress to that of the FTSE 100 total return index:

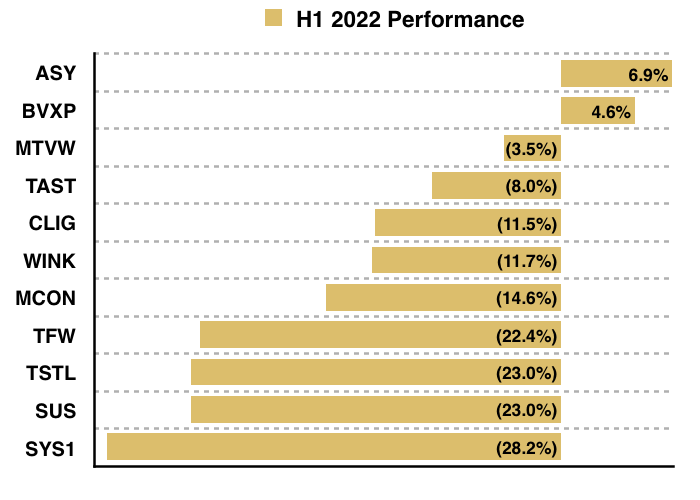

The next chart shows the total return (that is, the capital gain/loss plus dividends received) each holding has produced for me year to date:

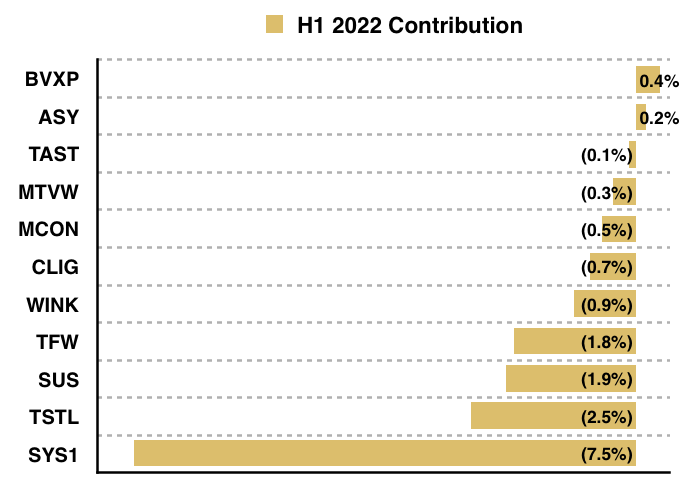

This chart shows each holding’s contribution towards my overall 15.7% loss:

And this chart shows my portfolio weightings at the end of Q2:

8 years of special dividends

Amid my portfolio’s dismal performance during 2022 is a very encouraging collection of special dividends.

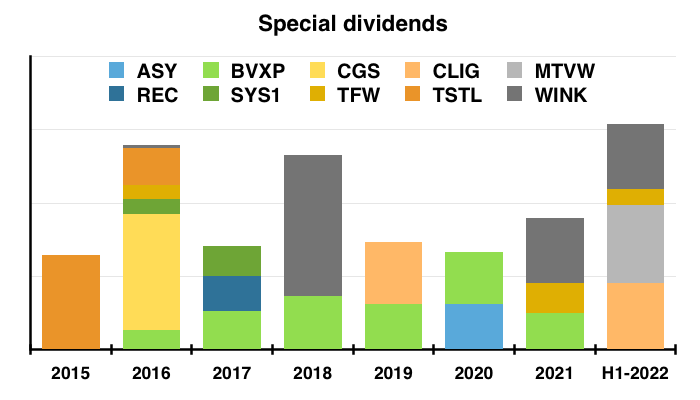

Of my eleven holdings, City of London Investment, Mountview Estates, FW Thorpe and M Winkworth distributed an extra payout during H1. And if past form is any guide, Bioventix is likely to declare a special during H2 as well.

This year is already my best-ever for special dividends, and marks the eighth consecutive year of my portfolio receiving at least one additional payout.

Specials may not always be so special

Special dividends are generally positive for shareholders. They typically signal companies that i) generate surplus cash, and; ii) employ executives sensible enough to hand that cash back to investors.

But special dividends do not always guarantee investment success. Extra payments could in particular weaken the balance sheet by removing useful funds and/or by increasing debt.

Some companies have declared bumper specials in the past… only then to experience weaker profits and wish perhaps they had kept the money.

System1 is a good example. Five years ago I wrote:

“Still, the group’s executives remain confident about the long term and underlined their confidence by declaring a super 26.1p per share special dividend.”

Back then the shares were 760p. Various difficulties resulting in a scrapped ordinary dividend have since seen the mid-price slide to 300p.

Special payments may also indicate companies with lower reinvestment opportunities, and therefore lower growth prospects. Or maybe they point to a management team completely bereft of expansion ideas.

Or maybe they are declared because a dominant shareholder requires extra cash due to their own particular circumstances. The (very surprising) mid-2020 special from Andrews Sykes may have been prompted by the controlling investor running short of funds during the pandemic.

Boosting my ordinary income by 22%

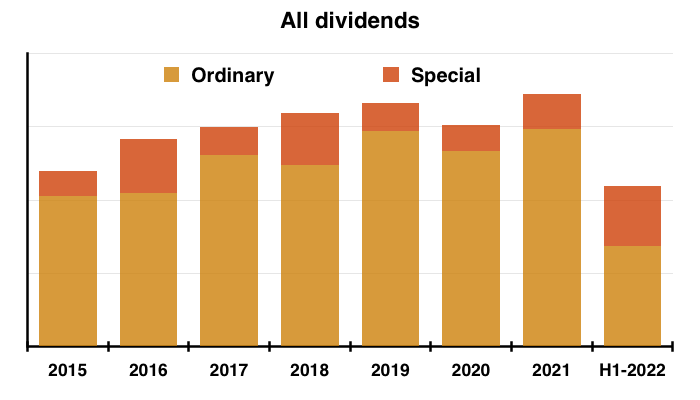

Special dividends have added a sizeable 22% to my ordinary payouts since I commenced this blog at the start of 2015:

Special payments have been declared by ten holdings during those eight years:

Eight of those ten holdings — Andrews Sykes, Bioventix, City of London Investment, Mountview Estates, System1, FW Thorpe, Tristel and M Winkworth — remain in my portfolio today.

I note that after my disposals, Castings has declared a further two specials while Record has declared a further three. Those businesses still seem to be generating surplus cash and perhaps I was wrong to let their shares go.

Bioventix has been a regular special payer after joining my portfolio during 2016. Developing a handful of antibodies in a small laboratory with a dozen or so employees means revenue far exceeds costs to leave plenty of cash for shareholders. I expect the company to announce another special later this year.

Estate agent M Winkworth has developed a welcome habit of returning surplus cash, paying two specials last year and one (so far) this year following buoyant activity within the housing market.

Mountview Estates meanwhile joined the ranks of special payers this year after it too enjoyed a strong housing market but discovered few property-buying opportunities for its cash flow.

The past few years have seen City of London Investment and FW Thorpe trim their substantial cash positions through specials, which in turn have aided the retirement incomes of former executives with substantial shareholdings.

As noted earlier, shareholder demands may have prompted Andrews Sykes to declare its 2020 special payment — which awkwardly coincided with the group receiving government pandemic benefits.

System1 and Tristel both paid specials some years ago, but such payments ceased after the companies embarked on costly projects for which the eventual returns remain unknown (data services for System1 and US expansion for Tristel).

Will 2023 be as special?

Perhaps I should not be too surprised by this eight-year run of special dividends.

My stock-picking strategy has after all focused on companies blessed with owner-friendly managers, respectable track records, conservative balance sheets and decent cash generation.

Indeed, a prevalent characteristic among the ten special payers is high net cash compared to earnings. Another common factor is sizeable director shareholdings:

| Company | Year to | Net cash (£m) | Earnings (£m) | Board ownership (%) |

| Andrews Sykes | Dec 2021 | 29.4 | 15.5 | 90 |

| Bioventix | Jun 2021 | 6.5 | 6.7 | 8 |

| Castings | Mar 2022 | 35.7 | 8.5 | 5 |

| City of London Inv | Jun 2021 | 25.5 | 20.7 | 39 |

| Mountview Estates | Mar 2021 | (18.6) | 26.9 | 53 |

| Record | Mar 2022 | 17.3 | 8.6 | 42 |

| System1 | Jun 2021 | 6.5 | 1.7 | 29 |

| Tristel | Jun 2021 | 8.1 | 3.8 | 4 |

| M Winkworth | Dec 2021 | 5.0 | 2.6 | 47 |

| FW Thorpe | Jun 2021 | 75.9 | 14.2 | 46 |

I like to think my approach ought to enjoy a greater chance of receiving extra payouts versus owning a random collection of shares.

But whether the eight-year run can extend to nine years remains to be seen. Signs of an “adverse economic environment” are not ideal, although the four specials I have collected this year suggest not every business is facing doom and gloom.

Mind you, the pandemic did emphasise how companies retaining excess cash ‘just in case’ can often sidestep financial trouble. This year has been special for my specials… but right now my intuition says 2023 may not be as special!

Until next time, I wish you safe and healthy investing.

Maynard Paton