18 August 2022

By Maynard Paton

Results summary for Andrews Sykes (ASY):

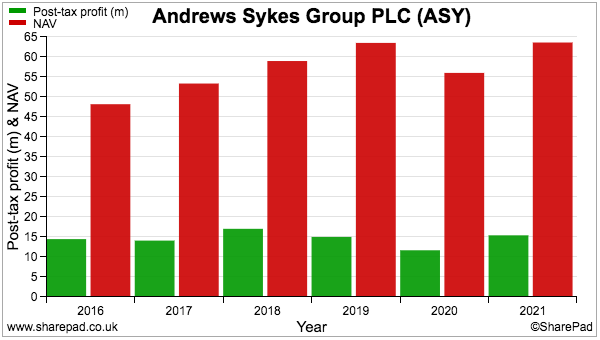

- An encouraging performance, with profit recovering 35% following the pandemic to almost match the record set during FY 2018.

- Additional reporting disclosures revealed ASY’s main UK Hire division enjoyed sales rebounding 17% and a wonderful 34% margin.

- European operations expanded to 27% of group revenue following very strong progress, although Middle Eastern woes included an extra £1m provision.

- The books remain in good shape, with useful cash generation lifting net funds to £29m and perhaps increasing the possibility of another special dividend.

- An estimated 13-14x P/E and near-5% yield hardly seem expensive given the appealing financials, potential for an FY 2022 heatwave bonanza and scope for further European expansion. I continue to hold.

Contents

- News link, share data and disclosure

- Why I own ASY

- Results summary

- Revenue, profit and dividend

- UK

- Europe

- Middle East and non-hire

- Financials: margin and return on equity

- Financials: cash flow and working capital

- Financials: pension scheme

- Going concern

- Valuation

News link, share data and disclosure

News: Annual results for the twelve months to 31 December 2021 published 04 May 2022.

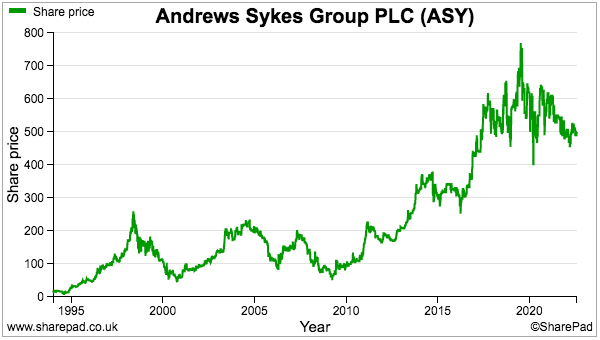

Share price: 520p

Share count: 42,174,359

Market capitalisation: £219m

Disclosure: Maynard owns shares in Andrews Sykes. This blog post contains SharePad affiliate links.

Why I own ASY

- Supplies air conditioners, portable heaters and industrial pumps for hire, with success based on a prompt 24/7/365 service, high-quality rental fleet and commercial-only customer base.

- Accounts regularly showcase high margins, generous cash flow, net cash and satisfactory returns on equity.

- Chairman and family are 90%/£198m shareholders and ensure management focuses on “long-term shareholder value creation” (point 10).

Further reading: My ASY Buy report | All my ASY posts | ASY website

Results summary

Revenue, profit and dividend

- A better-than-expected H1 that signalled improved H2 progress…

“Management remains optimistic that the business will continue to improve as the economy recovers fully but are mindful that we live in uncertain times and circumstances can change very quickly.“.“

- …had already suggested these FY 2021 results would reveal an encouraging performance.

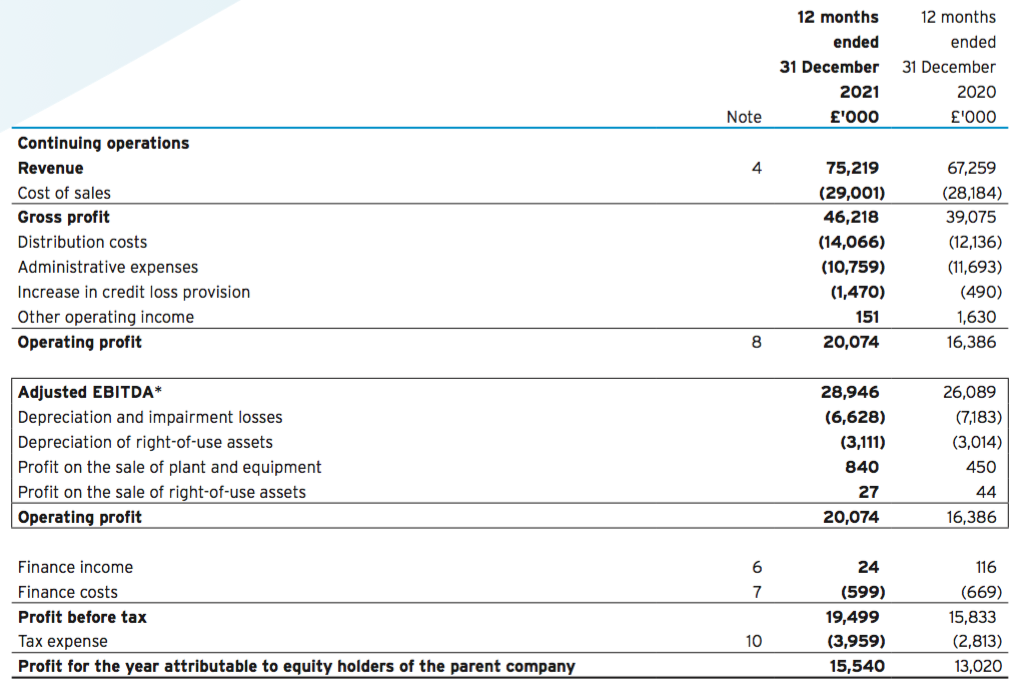

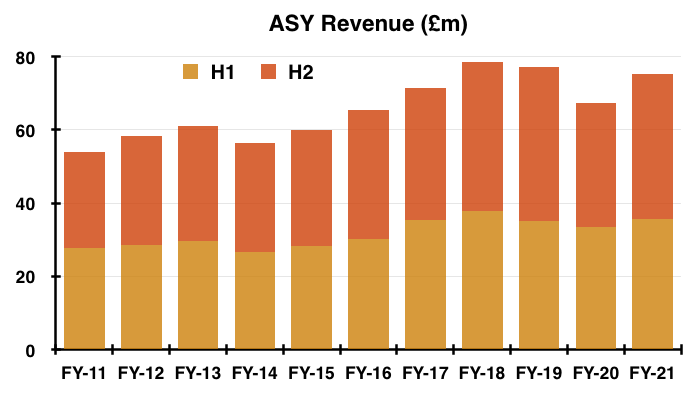

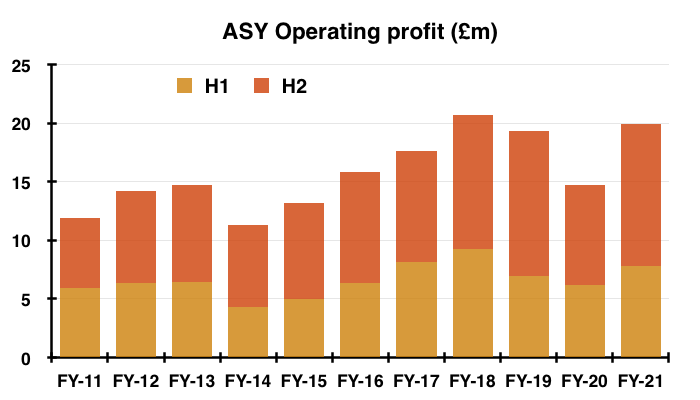

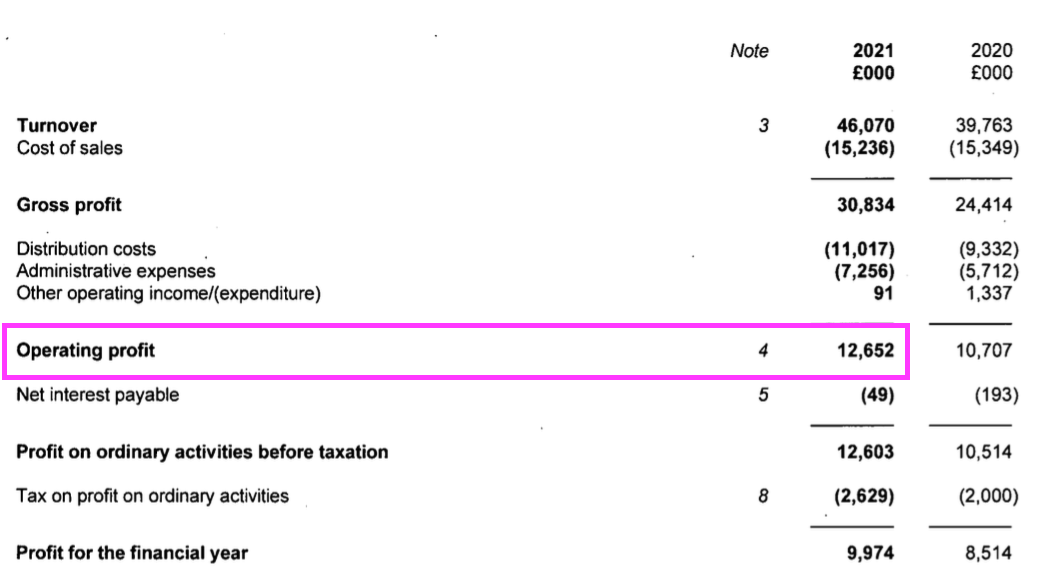

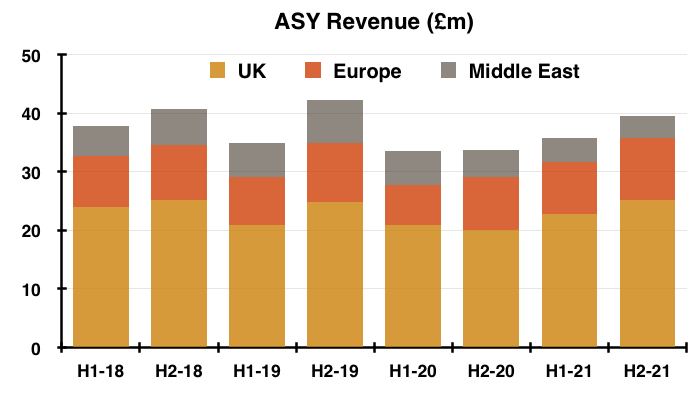

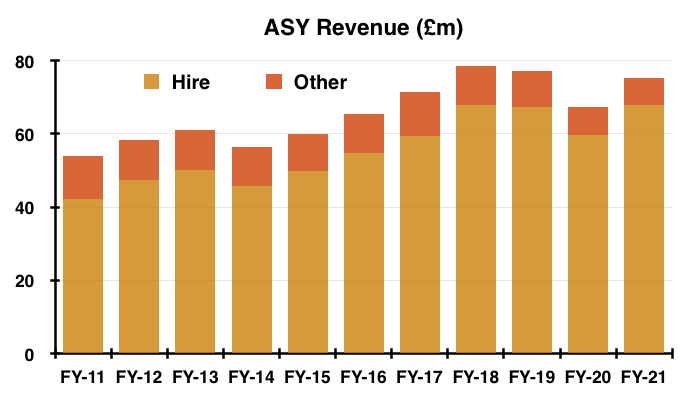

- Annual revenue gained 12% to £75m while annual operating profit surged 35% to £20m to almost match the bumper FYs of 2018 and 2019:

- ASY’s progress did indeed improve during H2, with H2 revenue up 17% to £40m and operating profit up 41% to £12m.

- Extreme weather — particularly cold snaps, heatwaves and extensive rain — typically prompt sudden demand for the group’s hire equipment (primarily heaters, air conditioners and water pumps).

- Progress from one year to the next can therefore fluctuate due to different climatic conditions.

- The FY 2021 performance incurred some pandemic restrictions throughout the group’s UK, European and Middle Eastern operations…

“The group has also achieved a rebound in revenues from our core traditional markets of ‘comfort’ cooling and heating despite various lockdowns and ‘stay at home’ guidance being in effect at multiple different times throughout the year.”

- …but progress was probably helped by fewer restrictions within the UK and Europe versus FY 2020.

- Supplying pumps within the UK warranted a special mention for yet another record effort:

“This year was once again supported by another strong year for our UK pump hire business, which finished the year 16% up on the previous year’s revenue and continues the recent history of setting record levels of revenue yearly.”

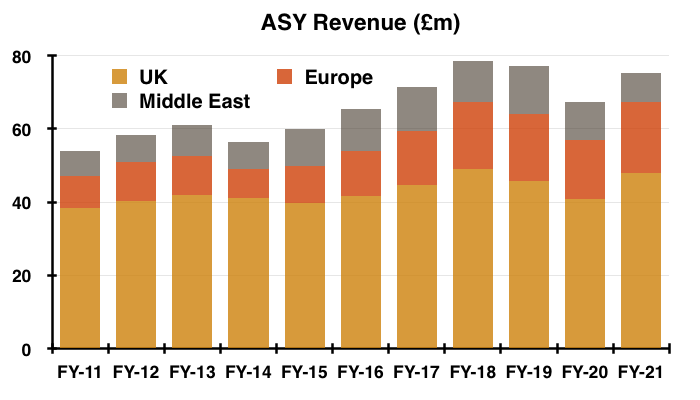

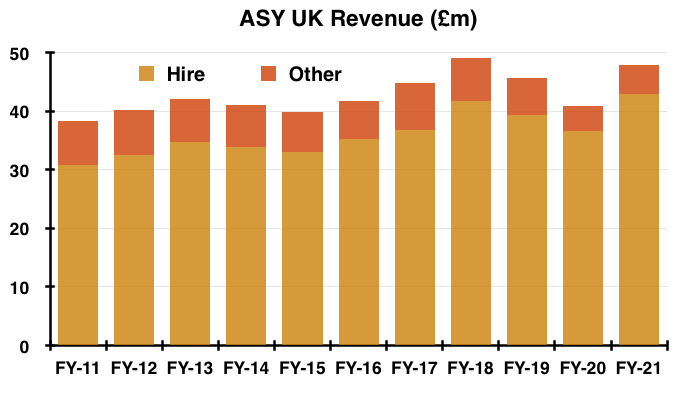

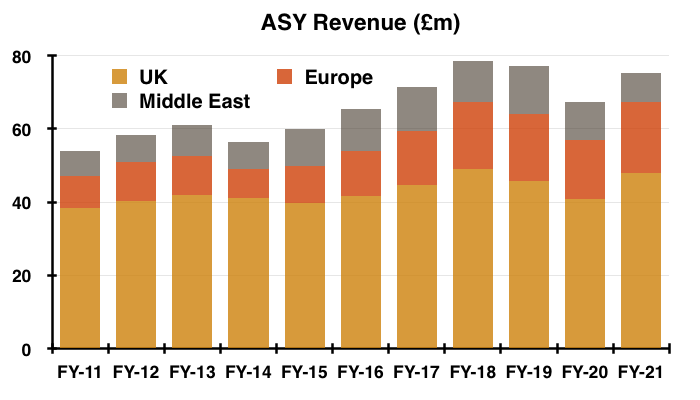

- The UK performance meant ASY’s domestic market represented 64% of group revenue, the highest since FY 2016:

- Europe meanwhile contributed 26% of group revenue, the region’s highest-ever proportion.

- Pandemic restrictions and a “lack of significant infrastructure projects” meant the Middle Eastern division suffered a difficult year.

- ASY’s excellent blog continues to showcase the company’s activities. H2 customers included:

- “Distinguished London hospital seeks heater hire for covid testing and vaccination centres“;

- “Eleventh-hour chiller hire ensures the show goes on at London’s Lyceum Theatre“;

- “Independent festival in Hampshire seeks help from Sykes Pumps“;

- “British kitchen manufacturer seeks ventilation for new warehouse fit-out“;

- “Event organisers hire air conditioning for technology exhibition in London“;

- “Yorkshire university hires temporary heating and air-quality control systems“;

- “Air-conditioning system averts television blackout in the north east“;

- “High-performance air-conditioning system keeps aerostructures company operational“;

- “Thames Water seeks emergency pump hire following burst water main“;

- “NHS Trust turns to Andrews Ventilation ahead of mortuary upgrades“, and;

- “Tour of Britain organisers turn to Andrews for comfort heating“.

- ASY’s reported profit was bolstered by government furlough benefits of £151k, hindered by a credit loss provision of £1.5m (see Middle East and non-hire) and excluded additional pension contributions of £1.2m (see Financials: pension scheme).

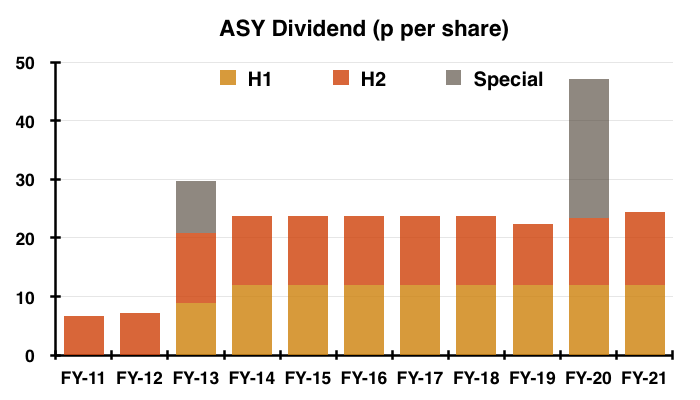

- After being reduced slightly for FYs 2019 and 2020 following the pandemic, the final dividend was higher than I had anticipated at 12.5p per share:

- The 24.4p full-year payout was ASY’s highest since FY 2008 (33.6p per share).

UK

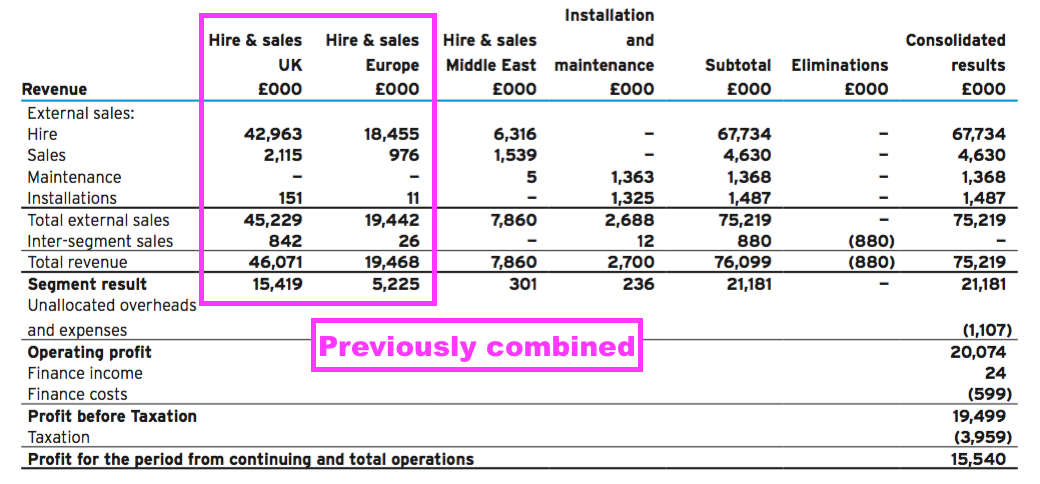

- These FY results were the first to split both UK and European revenue and Hire and Sales revenue:

- ASY previously lumped UK and European revenue together for Hire and Sales, and judging the progress of the group’s main division — UK Hire — had required subsidiary accounts from Companies House.

- The new disclosure confirmed annual UK Hire revenue gaining 17% to £43m, which helped total UK revenue set a new £48m record:

“The UK… business [including inter-segmental sales] experienced a 16% turnover increase when compared to last year, supported by an exceptional overall year for our pump hire business in the UK. We are pleased to report company turnover surpassed the previous record set in 2018.

- ASY outlined how particular hire products fared within the UK:

“Our core markets of heating and air conditioning (in the traditional markets of “comfort” cooling and heating) recovered strongly from 2020 being 33% and 36%higher respectively in 2021. Chiller and boiler revenue was the only part of the business not to improve on 2020 revenues, being 7% down on 2020.“

- Presumably chiller and boiler revenue (down 7%) represents a significant proportion of UK income, given total UK revenue gained 16% after UK heating and air conditioning revenue jumped 30%-plus.

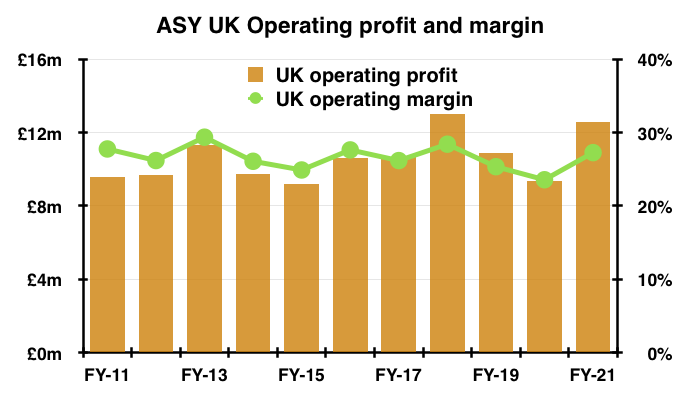

- The additional reporting disclosure showed the UK Hire and Sales margin at a super 34% (£15.4m / £45.2m).

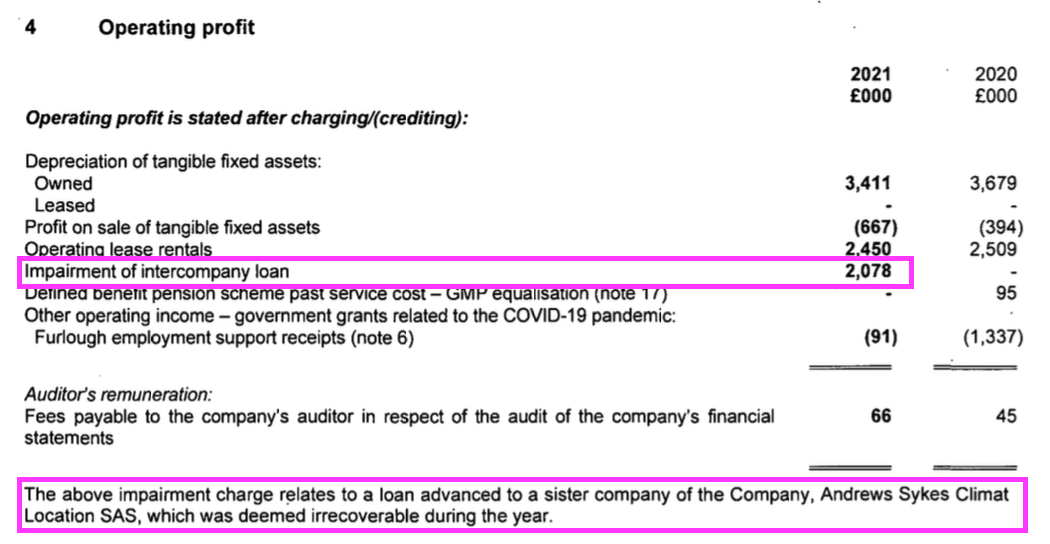

- Note that ASY’s UK subsidiary accounts show a £12m operating profit versus £15m within the full annual report:

- The difference appears due to an impairment of a loan made to ASY’s French subsidiary:

- I guess the loan impairment within the UK accounts and presumably the corresponding impairment reversal within the French accounts cancelled each other out within the group accounts.

- But writing down a French loan is not ideal, and this FY statement did admit France was ASY’s only loss-making market:

“Whilst France remains the only loss-making geographic location, that operating loss was reduced in 2021. Management continue to focus on revenue growth opportunities and are investing in human resource across the country in order to grow the business further and improve the operating profit performance.”

- Even with the loan impairment and including very low margin UK installation and maintenance income (see Middle East and non-hire), UK profit represented a healthy 27% of UK revenue:

- The UK subsidiary margin has topped 20% since at least FY 2004.

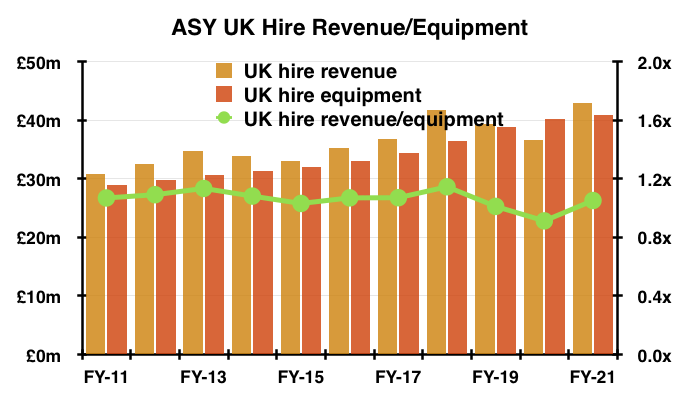

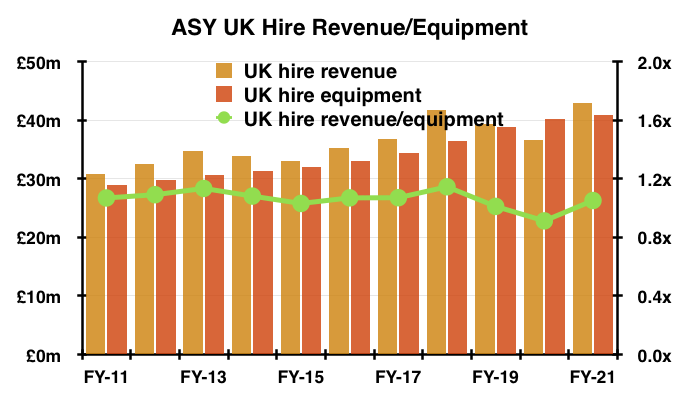

- The UK subsidiary accounts also show the division improving its equipment efficiency following the pandemic.

- Hire revenue (£43m) versus the original cost of the hire equipment (£41m) came to 1.05x — just a fraction below the 1.08x average seen prior to the pandemic:

- UK hire revenue at 1.05 times the value of UK hire equipment alongside a subsidiary margin of 27% means the UK division takes less than four years to recoup the original cost of its equipment (before tax).

- Although ASY’s website lists 32 UK depots, the 2021 annual report says the UK division operates from 26 locations:

“Our main UK trading subsidiary, Andrews Sykes Hire, has 26 locations covering the UK and employing around 300 members of staff.”

- I am not sure why the website and annual report do not agree on depot locations.

- Revenue per UK depot for FY 2021 was therefore £1.4m or £1.8m depending on which depot/location denominator is chosen.

- The number of UK depots looks to have reduced over time. The 2013 annual report said the main UK subsidiary operated from 30 locations, but the 2014 report said 28 locations and the 2018 report then said 26 locations.

Europe

- Europe remains ASY’s main opportunity for growth.

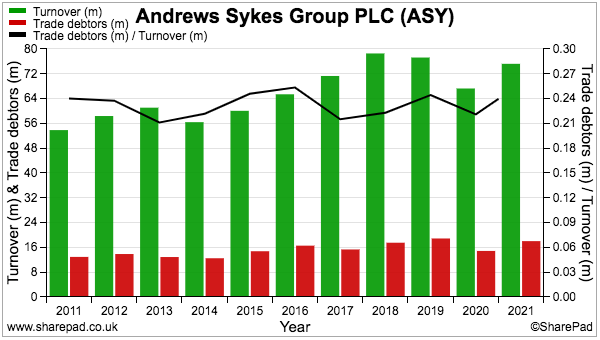

- Between FYs 2011 and 2021, European revenue expanded from £9m to £19m to represent 26% of total group sales:

- H2 witnessed European revenue reach 27% of the group’s top line:

- ASY’s European operations consist of:

- Netherlands:

- Opened FY 1971

- 4 depots (Amsterdam, Bleiswijk, Hoogeveen, Oirschot)

- Belgium:

- Opened FY 2007

- 2 depots (Antwerp, Brussels)

- Italy:

- Opened FY 2011

- 3 depots (Bologna, Milan, Verona)

- France:

- Opened FY 2012

- 6 depots (Lille, Lyon, Marseille, Nantes, Paris, Toulouse)

- Switzerland:

- Opened FY 2013

- 2 depots (Geneva, Zurich)

- Luxembourg:

- Opened FY 2014

- 1 depot (Luxembourg)

- Netherlands:

- Twelve European depots have opened since FY 2011 to take the region’s total to 18.

- Revenue per European depot looks to have decreased during the last decade:

- European revenue of £9m from six depots gave revenue per European depot of £1.5m for FY 2011.

- But European revenue of £19m from 18 depots gave revenue per European depot of £1.1m for FY 2021.

- Reduced revenue per European depot most likely reflects the extended time required to build a notable presence within new markets. ASY has opened depots with Italy, Luxembourg, France and Switzerland during the last ten years.

- Further European depots alongside revenue per European depot one day matching the £1.4m (or even £1.8m) UK equivalent should see Europe become a much more significant contributor to overall group progress.

- Mind you, opening twelve depots during the last decade could mean future European growth will be slow going.

- European progress during FY 2021 nonetheless appeared very satisfactory:

- Netherlands: “This subsidiary performed exceptionally well with total revenue 26% above that of the previous year.”

- Belgium: “Turnover increased 26% as compared to prior year.”

- Luxembourg: “This subsidiary produced 41% growth during the year…”

- Italy: “…this business provided another record result in 2021 with turnover up 20% as compared to 2020″.

- France: “Turnover for 2021 finished the year 13% favourable to the comparable number for 2020.“

- Switzerland: “Following a small operating loss in 2020, our Swiss operation returned to profitability in 2021 with turnover increasing 94% to that achieved in 2020.“

- European operations enjoyed a robust 27% margin during FY 2021.

Middle East and non-hire

- ASY’s Middle Eastern operations suffered from ongoing pandemic restrictions and fewer construction projects.

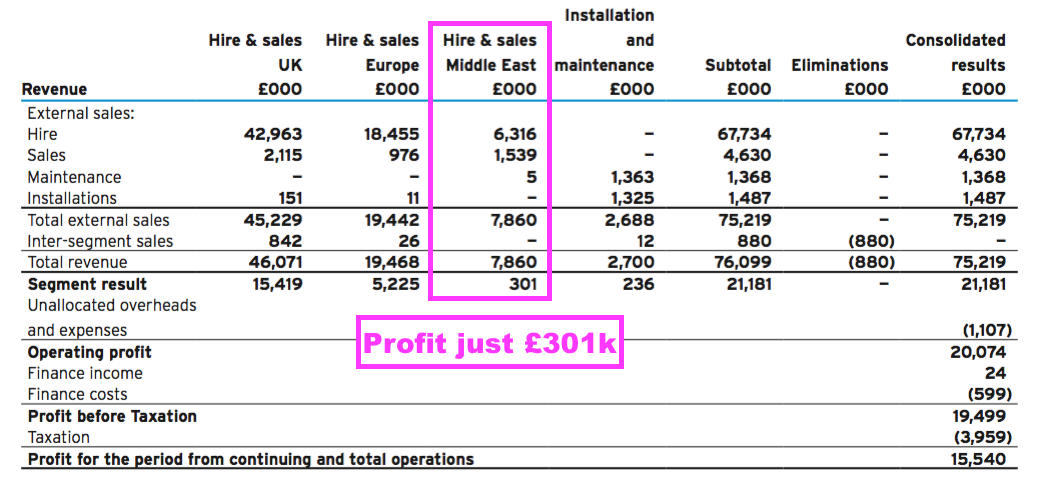

- Middle Eastern revenue dived 24% while divisional profit — which since FY 2015 had been running at between £2-£3m a year — collapsed to just £301k:

- The paltry Middle Eastern profit was due to the estimate of future unpaid debtors increasing by £1m:

“In 2021, debts written off against the expected credit loss provision were £449,000 compared with £477,000 last year, and there was a net charge of £1,470,000 (2020: £490,000) to the income statement from the expected credit loss provision, which was calculated on a consistent basis each year.

Of these figures, £306,000 (2020: £456,000) of the debts written off and £1,204,000 (2020: £441,000) of the expected credit loss charge related to external debtors of our subsidiary in the Middle East.“

- Group operating profit would have been 5% higher — and set a new record at £21m — were it not for the extra Middle Eastern provision.

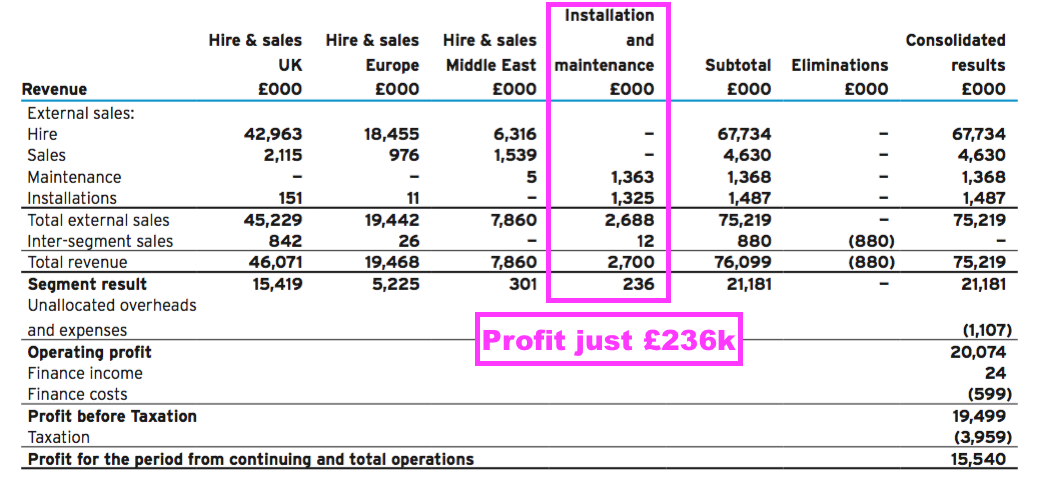

- The prospects for ASY’s ‘Other’ operations — which sell, install and maintain equipment — do not appear favourable:

- ‘Other’ revenue had been running at a regular £11m until FY 2016, since when such revenue has dropped to £7m.

- Installation and maintenance services do not generate much profit:

- And equipment sales may not generate much — or any — profit either.

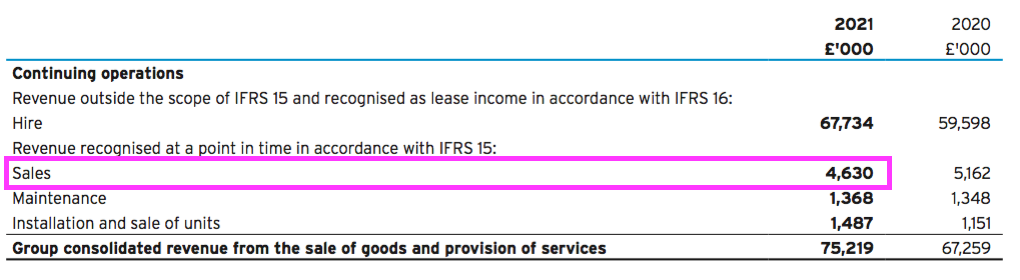

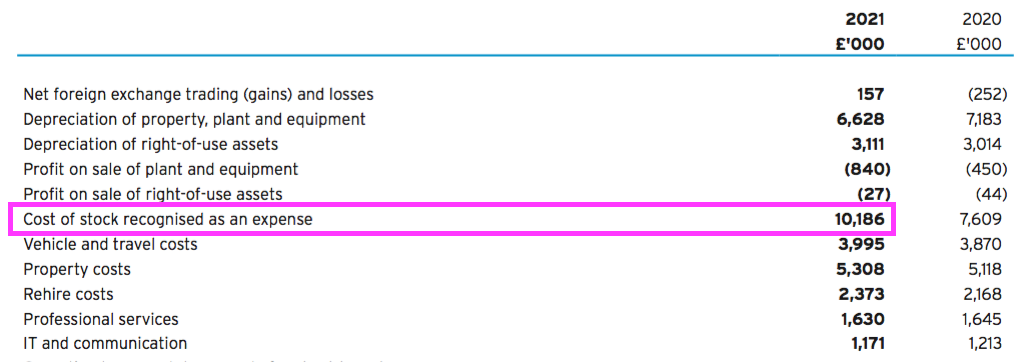

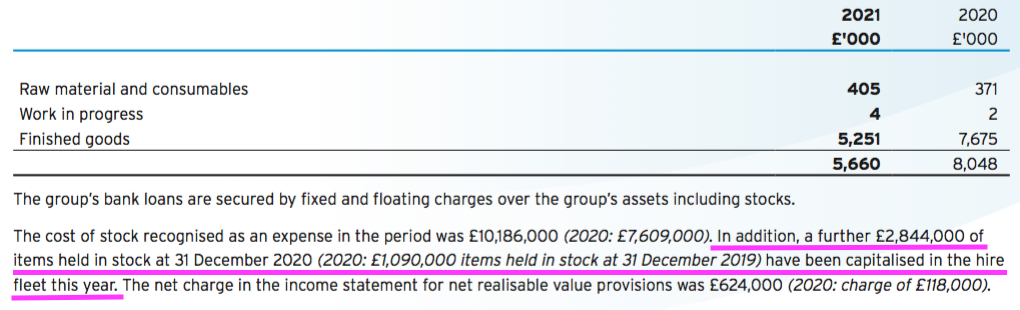

- Such sales came to £4.6m during FY 2021…

- …but the cost of stock (which presumably represents the equipment sold) was £10.2m:

- The cost-of-stock-sold figure may be inflated by ASY reclassifying certain stock as fixed-asset hire equipment (see Financials: cash flow and working capital).

Financials: margin and return on equity

- ASY’s accounts remain in very good shape.

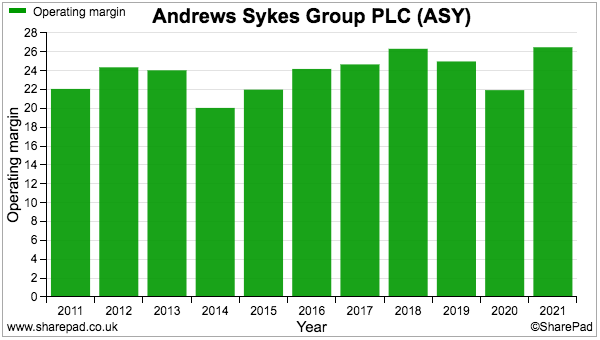

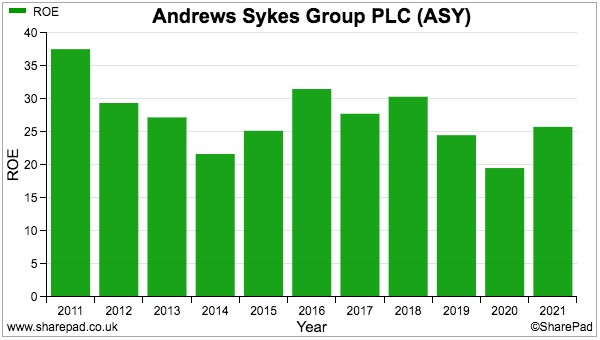

- The aforementioned high margins within the UK and European divisions ensured another year when group revenue converted into more than 20% of profit:

- Return on equity (ROE) also remains at appealing levels:

- Note that the pandemic has limited ASY’s returns on retained profit.

- During the five years to FY 2021, earnings increased by just £1m while net asset value (or shareholder equity) advanced by £15m:

- Reinvesting £15m over five years for an additional £1m is not ideal.

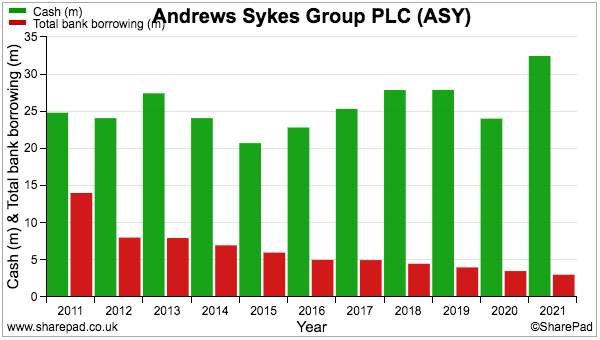

- That said, the largest balance sheet entry for FY 2021 — and for the ten years before that — was cash:

- Cash yielding very close to zero does not enhance ROE calculations.

- Indeed, net cash has increased by £12m to £29m during the five years to FY 2021 — which eases concerns about ASY reinvesting profits at low rates of return.

- Exclude the higher net cash, and ASY has arguably reinvested £3m for extra profit of £1m.

- The concern perhaps is ASY retaining too much cash.

- ASY paid a £10m special dividend during FY 2020 when net cash was £30m:

“As at 22 July 2020, the Company had net cash reserves* of approximately £29.9 million. The Board has assessed the Company’s ongoing cash requirements under a range of forecast scenarios and has concluded that, as a result of the Company’s expected robust cash generation, a portion of these cash reserves is surplus to the Company’s requirements.“

- Wishful thinking perhaps, but net cash now at £29m could mean shareholders will not have to wait too long for another supplementary payment.

Financials: cash flow and working capital

- ASY’s rising cash position reflects controlled capital expenditure and consistent working-capital management.

- Cash flow for FY 2021 was enhanced by spending only a net £1m on tangible assets:

| Year to 31 December | 2017 | 2018 | 2019 | 2020 | 2021 |

| Operating profit (£k) | 17,589 | 20,681 | 19,298 | 14,756 | 19,923 |

| Depreciation* (£k) | 5,917 | 6,666 | 7,203 | 7,183 | 6,628 |

| Net capital expenditure (£k) | (4,929) | (6,198) | (5,522) | (3,538) | (1,357) |

| Working-capital movement (£k) | (1,155) | (4,292) | (5,592) | 647 | (966) |

| Net cash (£k) | 20,293 | 23,381 | 23,897 | 20,521 | 29,443 |

(*excludes IFRS16 depreciation)

- ASY’s capital expenditure is complicated by the company acquiring equipment for resale but then capitalising a proportion of that stock into the hire fleet:

- Such stock-to-fixed-asset transfers are unusual, but presumably reflect ASY offering for hire any equipment that could not be sold direct.

- Between FYs 2017 and 2021, stock with an aggregate £10m value was reclassified into the hire fleet.

- This £10m is arguably capital expenditure rather than working-capital investment.

- The table below adjusts the working-capital movements and capital expenditure for the £10m:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Operating profit (£k) | 15,815 | 17,589 | 20,681 | 19,298 | 14,756 |

| Depreciation* (£k) | 5,310 | 5,917 | 6,666 | 7,203 | 7,183 |

| Working-capital movement (£K) | (2,157) | (1,155) | (4,292) | (5,592) | 647 |

| Stock transferred (£k) | 2,156 | 1,460 | 2,407 | 1,090 | 2,844 |

| Adjusted work-cap movement (£k) | (1) | 305 | (1,885) | (4,502) | 3,491 |

| Net capital expenditure (£k) | (4,719) | (4,929) | (6,198) | (5,522) | (3,538) |

| Stock transferred (£k) | (2,156) | (1,460) | (2,407) | (1,090) | (2,844) |

| Adjusted net capex (£k) | (6,875) | (6,389) | (8,605) | (6,612) | (6,382) |

(*excludes IFRS16 depreciation)

- ‘Adjusted’ working capital absorbed aggregate cash of just £3m (and not £13m) during those five years.

- ‘Adjusted’ capital expenditure meanwhile came to £35m — just £2m more than the associated five-year depreciation charge.

- That £2m difference is very acceptable given aggregate operating profit was £88m during the same five years.

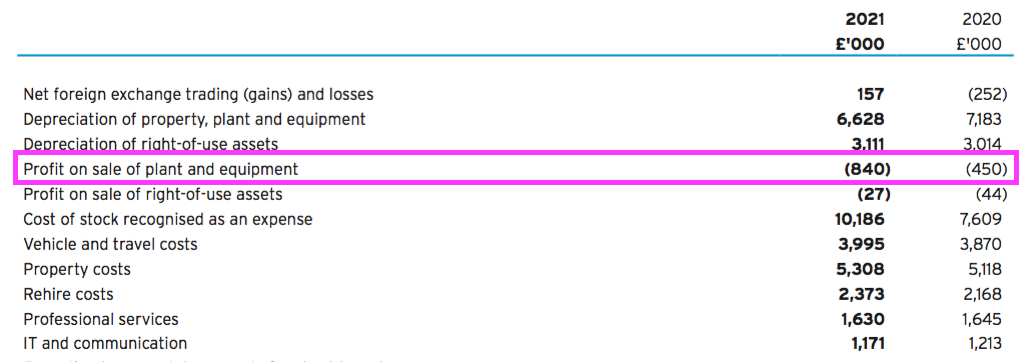

- Emphasising a conservative depreciation policy, ASY has recorded a small profit over the book value of sold equipment every year since at least FY 2005:

- Despite the aforementioned problems with Middle Eastern invoices, net trade receivables at £18m remain close to ASY’s typical 23% of revenue:

- ASY revealed a £3m loan was cleared after the year-end to leave the balance sheet free of conventional debt:

“On 30 April 2017, the group took out a new five-year bank loan of £5 million. This loan was repayable in four annual instalments of £0.5 million commencing 30 April 2018, followed by a balloon payment of £3 million on 30 April 2022.“

Financials: pension scheme

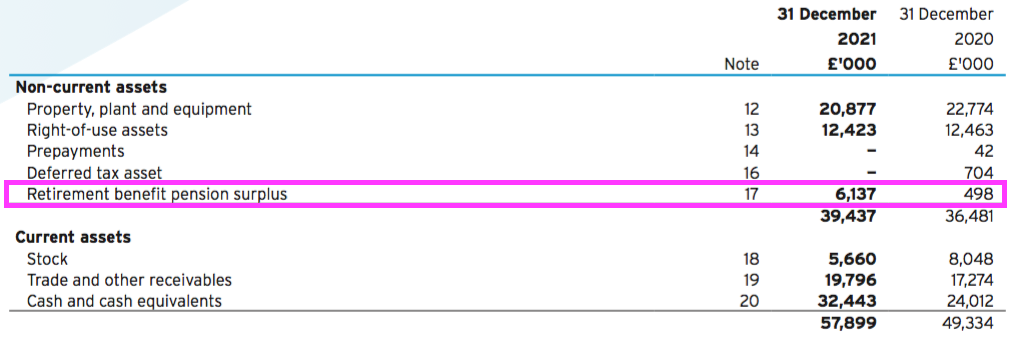

- ASY’s defined-benefit pension fund demonstrates how long-term pension accounting does not always reflect the near-term cash reality of a pension scheme.

- Although ASY’s balance sheet continues to show a scheme surplus…

- …these FY 2021 results reiterated the need for additional scheme funding.

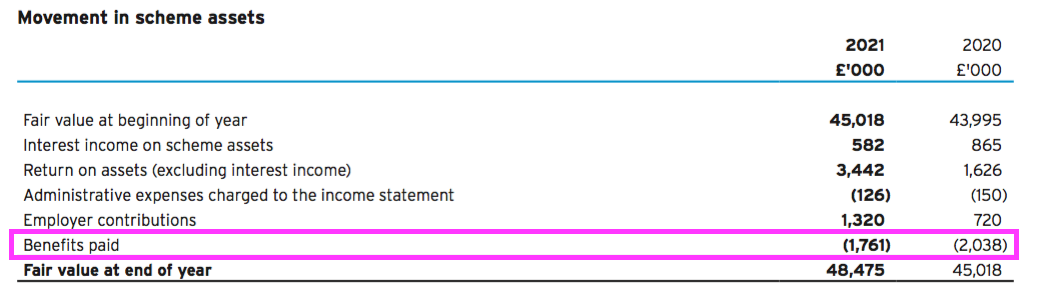

- A one-off £600k was paid into the pension during FY 2020…

“The last triennial funding valuation was as at 31 December 2019. A draft funding valuation was presented to the Board of directors in early summer 2020, and the group made a one-off contribution of £600,000 in late May 2020 to largely eliminate the funding deficit as at 31 December 2019 as indicated by that draft valuation.

- …while £1.3m will be paid into the scheme during FY 2022 versus the standard £120k for FYs 2023, 2024 and 2025.

“In accordance with this schedule of contributions and recovery plan,the group will be making regular contributions of £110,000 per month for the period 1 January 2021 to 31 December 2022, and £10,000 per month for the period 1 January 2023 to 31 December 2025, or until a revised schedule of contributions is agreed, if earlier. Consequently, the group expects to make total contributions to the pension scheme of £1,320,000 during 2022.“

- Although paid benefits from the scheme dropped to £1.8m during FY 2021 following three years of paying at least £2m…

- …scheme assets of £48m do not seem enough to sustain annual benefits of £2m (and scheme admin charges of £100k-plus) when contributions drop to £120k a year from FY 2023.

- Unless paid benefits reduce significantly, the scheme may well need much more than £120k a year through employer contributions to limit the chance of the scheme’s assets being eroded.

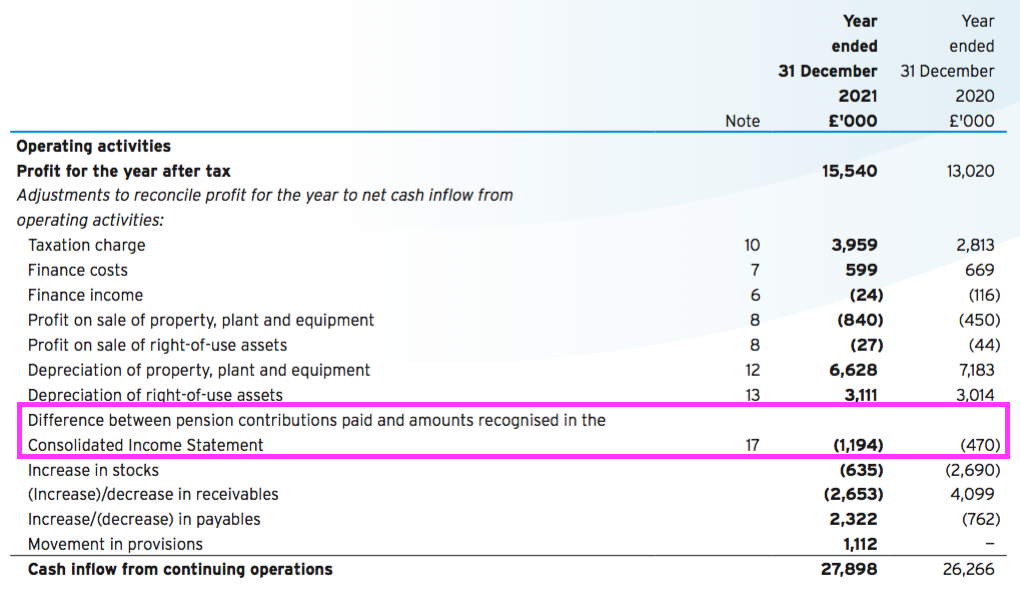

- Note that extra pension contributions bypass the income statement, with the cash flow statement highlighting the expense that is not charged to earnings:

Going concern

- ASY provided very detailed and very welcome ‘going concern’ text within its 2019, 2020 and 2021 annual reports.

- ASY’s “reasonable worst-case trading scenario” for FY 2022 included the following assumptions:

- “Normal level of dividends will be maintained during the 12 months subsequent to the date of approving the accounts;

- No new external funding sought;

- Hire turnover and product sales reduced by 12% versus budget—a similar variance when comparing 2021 actual results to 2021 budgets;

- All overheads continue at the base forecast level apart from overtime and commission and repairs and marketing, which are reduced by 5% and travel costs reduced by 2.5%;

- All current vacancies are filled immediately; and

- Capital expenditure is reduced by 5%.“

- “Normal” dividends being maintained during a “reasonable worst-case trading scenario” sounds encouraging.

- Hire turnover and product sales being 12% below budget for FY 2021 suggest actual hire and sales revenue of £72m could have been more like £82m in a pandemic-free year.

- ASY confirmed revenue would have to drop below £50m before any financial concerns arose:

“Given these assumptions, and for modelling purposes only, assuming dividends are maintained at normal levels, group turnover could fall to below £50 million on an annualised basis without any liquidity concerns. Due to the level of confidence the Board has in the future trading performance of the group, this scenario is considered highly unlikely to occur.”

- The £50m level was an improvement on the £55m cited within the 2020 annual report.

- The going concern text did not sound too encouraging about post-year trading:

“Whilst profitability and cash flow performance to the end of February 2022 has been close to expectation…“

- But the 2020 annual report said the exact same thing the previous year…

“Whilst profitability and cash flow performance to the end of February 2021 has been close to expectation…”

- …only for ASY to deliver a better-than-expected H1 and this satisfactory FY 2021 performance.

Valuation

- ASY did not provide any detail on FY 2022 trading, and limited its outlook comments to the following sentence:

“The group is confident in its core markets, its revenues and its profits.

- But ASY did express “optimism” for the year ahead (by using the same wording contained within the 2020 annual report):

“The Andrews Sykes business remains strong: the experience of our senior management team, coupled with our development plans, provide optimism for further progress in 2022 as we navigate out of the pandemic and adapt to the new environment accordingly. The group continues to develop new sales channels and propositions, which will enable the business to take advantage of favourable market conditions and opportunities as they arise.”

- ASY and its blog were kept busy during H1 2022:

- “Andrews warms guests in Six Nations corporate hospitality“;

- “Swift pump hire ensures sewage treatment maintenance project is completed months ahead of schedule“;

- “Divine intervention from Andrews Sykes keeps soul church warm“;

- “Manufacturing plant maintains output thanks to ventilation hire“, and;

- “Andrews delivers eye-catching performance at this year’s Glastonbury“.

- And H2 2022 may be even busier judging by this “Unprecedented heat prompts us to pull out all the stops!” update:

“It’s fair to say that last week’s record-breaking temperatures put quite a strain on our resources. Staying on top of the online enquiries and inbound telephone calls was challenging enough, without the small matter of having to ensure each air conditioning hire was agreed, coordinated and delivered in as timely a fashion as possible… our teams around the country adopted a siege mentality in a bid to combat the seemingly never-ending flow of requests.“

- Whether this year’s long scorching summer — and the “seemingly never-ending flow of requests” for air conditioners — is just a freak occurrence or becomes the norm within the UK and Europe remains to be seen.

- But extreme weather conditions do seem to be occurring with greater frequency, which ought to be favourable for ASY’s hire services.

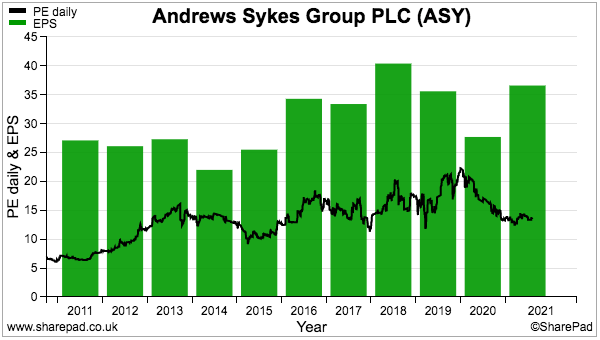

- FY 2021 operating profit excluding furlough payments but including IFRS 16 lease financing was £19.4m. Taxed at the upcoming 25% UK standard rate gives earnings of £14.5m or 34.5p per share.

- But…

- going-concern text alluding to budgeted revenue of £82m;

- enormous summer demand for air conditioners, and;

- an improved Middle Eastern performance…

- …could easily see FY 2022 register new highs for revenue and profit.

- Revenue of, say £85m, leading to operating profit of say, £23m, could then lead to earnings of approximately 39p per share after 25% tax.

- Subtract the £29m net cash position from the £219m market cap, and the underlying business is arguably valued presently at £190m or 450p per share.

- Whether the entire net cash position is truly ‘surplus to requirements’ is debatable, given ASY has operated with net funds of at least £15m since FY 2012.

- Depending on your view of earnings (trailing 34p per share or possibly 39p per share) and the cash position (truly surplus or not), ASY’s P/E could be 11.5x, 13.1x, 13.3x or 15.1x. The average of 13.3x feels about right.

- A possible 13.3x multiple hardly seems expensive for a high-margin and cash-rich business that proved reasonably resilient during the pandemic, could well be enjoying an FY 2022 heatwave bonanza and may have further expansion opportunities within Europe.

- Bear in mind ASY’s P/E has rarely climbed to a premium rating:

- Keeping a lid on the P/E may be:

- The very limited free float (the chairman and his family control 90% of the shares);

- The profit ups and downs due to the weather, and/or;

- A possible lack of economies of scale.

- ASY’s economies of scale may not be fantastic.

- That earlier chart of UK hire revenue versus UK hire-equipment cost…

- …shows a consistent limit between the cost of the hire equipment and the revenue then generated from that equipment.

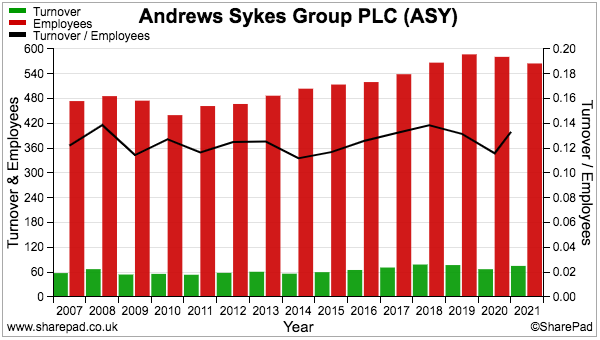

- Revenue per employee bobbing within the £100k-£130k range could be further evidence of extra revenue requiring a commensurate level of extra (employee) expense:

- A sustained P/E re-rating may therefore require ASY to discover how to generate more revenue from its existing hire equipment and workforce, rather than relying solely on opening more depots.

- The 24.4p per share full-year dividend meanwhile supplies a 4.7% income at 520p.

Maynard Paton

Andrews Sykes (ASY)

Publication of 2021 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

1) STRATEGIC REPORT

a) Principal objectives and strategy

A reminder that customer service supports the group’s competitive advantage:

“By providing a premium level of service 24 hours per day, 365 days per year, we have become the preferred suppliers to many major businesses and operations spanning a huge range of industries and geographic locations. Our reputation for providing high levels of training to our staff whilst maintaining a strict health and safety workplace, within an environmentally conscious culture, makes us an employer of choice for our industry.”

b) Future development of the business

A reminder that supplying up-to-date products is important to group progress:

“Our success has been centred on providing technically advanced climate rental and pumping products to numerous geographic locations and market sectors. We plan to continue to develop new products and services within our specialist portfolio whilst continuing to expand our geographic coverage both within existing territories and new markets. During 2021, we continued to develop new products and have a number of new developments ready for launching in 2022, which will extend our product offering to both new and existing customers.”

c) Key performance indicators

ASY introduced two new non-financial KPIs for 2021: staff absenteeism and energy consumption:

I like absenteeism as a KPI. Too much of it occurring following the pandemic, and I trust nobody is coasting at ASY.

The 2020 report said asset utilisation was a non-financial KPI monitored by the board, but was not disclosed due to giving a “business advantage to our competitors“.

ASY claimed its 2021 EPS performance was “exceptional“:

“Achieving an EPS of 36.85p is regarded as an exceptional performance bettered only in 2018.”

d) Adjusted Ebitda

New for 2022 is a detailed calculation to derive adjusted Ebitda:

e) Cash flow from operations

Useful commentary on debtors and the Middle Eastern influence on unpaid invoices:

“Total outstanding debtor days at the year-end increased from 74 days at the end of 2020 to 78 days at the end of the current year. Although still high in UK terms, the debtor day statistic in both years includes our subsidiary in the Middle East, whose debtor days were 220 days (2020: 225 days). The local economy remains badly affected by the coronavirus pandemic and slow-down in major construction projects. Consequently, debtor days have increased dramatically in this region compared to historic levels as payment terms were extended. The group’s average debtor days for current unimpaired debts increased slightly to 42 days from last year’s level of 35 days.”

f) Strategic risks

Lots of Covid and Brexit text has been removed for 2021. The only text change concerns a new IT system:

“The group has recently approved the upgrade of its existing IT systems and a group wide ERP system will be rolled out over the next few years.

As before, the main risks are:

“Competition, product innovations and industry changes are regarded as the main strategic risks.

And the same comment about weather risks:

“The potential impact of the weather has been reduced over the past few years by the expansion of our non-weather-related business. The group also has a diverse product range of pumps, heaters and air conditioning and environmental control equipment, which enables it to take maximum advantage of the opportunities presented by any extremes in weather conditions whenever they arise. This, combined with our policy of reducing fixed costs and linking them to a sustainable level of turnover, enables the group to achieve a satisfactory level of profits even in non-extreme weather conditions.”

g) Financial risks

No changes here, with the risks remaining as:

“* Interest rate risk;

* Market risk;

* Credit risk; and

* Funding and liquidity risk”

h) Share buybacks

No changes here for 2021, but the text has become more relevant given ASY has started repurchasing shares (albeit spending just £60k during 2023 to date):

“No shares were purchased for cancellation in 2021 and, to date, the company has not purchased any of its own shares for cancellation during 2022. In prior years, the company has purchased its own ordinary shares for cancellation and these purchases enhanced earnings per share and were for the benefit of all shareholders.

At the forthcoming 2022 Annual General Meeting, shareholders will be asked to vote in favour of a resolution to renew the general authority to make market purchases of up to 12.5% of the ordinary share capital in issue. Any purchases will only be made on the London Stock Exchange and they will only be bought back for cancellation provided they enhance earnings per share. If this resolution is passed, it should not be taken to imply that shares will be purchased but the Board believes that it is in the best interests of shareholders if it has this authority in order that market purchases may be made in the right circumstances if the necessary funds are available.”

i) Directors’ duties

No changes here for 2021. The text reiterates the group’s strategy and competitive advantage:

“We aim to provide dependable high-quality services to our business partners in the UK, Northern Europe and Middle East. We often provide business critical solutions to key businesses and are instrumental in helping our customers achieve their goals.

The company is committed to being a responsible employer. Our behaviour is aligned with the expectations of our employees and together we provide a first-class service to our clients, 24 hours per day, all year round.

Our business strategy prioritises organic growth. We regard customer relationships as being of the utmost importance and our key account customers, that account for approximately 50% of our business, are visited by a customer relationship manager on a quarterly basis to ensure we are meeting their expectations. The next largest 25% of customers are actively managed by desktop reviews supported by contact by telephone, and the remaining customers’ accounts are subject to periodic internal reviews to ensure no issues are apparent.

We pride ourselves in providing our staff with a good working environment within a strong ethical culture. The group’s HR policies are regularly reviewed by the senior operations team, are provided to all staff both on commencement of employment and are available at all times via a company intranet site. The group has a large number of long-serving staff members, many with 30-plus years’ service, which is a testament to our working culture.

Our business strategy is to differentiate our services from those of our competitors by providing our customers with a first-class level of service 24 hours per day, all year round. Our reputation is among the best in the industry and means we are the employer and service provider of choice for many individuals and businesses alike.”

Also a note to reassure shareholders the business should not become a ‘fiefdom’ (and hopefully not delist without a suitable payout to minority shareholders!):

“The company is committed to openly engaging with our shareholders. The company has a controlling shareholder that owns 86.25% of the shares in issue and this shareholder has a number of representatives on the Board. A relationship agreement has been entered into with this shareholder (originally dated 10 December 1999 and updated on 21 September 2018), which confirms that the company’s business and affairs will be managed for the benefit of shareholders as a whole. ”

Here is the relationship agreement.

2) DIRECTORS’ REPORT

a) Directors’ interests

Among the directors, only members of the Murray family own ASY shares with the group MD and the four other non-execs owning none:

The 86% shareholding represents the Murray family’s interests.

b) SECR disclosures

ASY’s UK Andrews Sykes Hire Limited division encouragingly decreased its ratio between revenue and emissions for 2021:

Gross emissions per revenue of 44.38 compared to 55.40 for 2020 (and 57.31 for 2019).

Transport fuel appears to be the largest emission contributor, with ASY taking commendable steps to reduce travel costs:

“We continue to invest in hybrid vehicles with our transport fleet where possible. Fuel consumption is constantly monitored by our internal transport department to measure performance throughout the businesses. Awareness training is given to all staff on driving behaviours whilst vehicles are fitted with tracking software that enables the management of vehicle routes, idling times, and efficient driving style and behaviour in order to optimise fuel consumption.

In our business we saw a reduction in travel during 2020 with the impact of the pandemic on minimising travel. This has been a feature of all businesses but we have seen an increase in meetings carried via on-line conferences — thus mitigating the need for travel and reducing fuel consumption accordingly. We have maintained this change into 2021. ”

ASY could be a customer of portfolio member TFW:

“In our depots, we continue to fit LED lighting with PIR sensor technology as depots are refurbished and maintained to reduce energy consumption.”

c) Corporate governance

ASY is very much a Murray family business. Corp-gov details are deferred to the website:

“The company’s corporate governance disclosures are included on the company’s website, http://www.andrews-sykes.com.”

Some useful website quotes:

“I would highlight that membership of the Board, both executive and non-executive, has been very stable over recent years and this, along with the presence of a longstanding, substantive majority shareholder has, I believe, provided the stable base and established management methodology from which Andrews Sykes has been able to deliver an excellent track record of financial performance and shareholder returns and to be focussed on the medium to long term.”

Shareholder value in the medium term to long term is intended to be delivered by driving operational excellence across the Group and growing within selected markets and geographies.

The presence and requirements of a longstanding majority shareholder has resulted in a strategy with the key aim of creating long–term shareholder value.

The Group has a long-established heritage and reputation based on sound ethical values and the Board considers this to be of great ongoing value. Many companies within our market sector envy our reputation and we frequently optimise this commercially and by attracting new staff.”

Full board meetings could be sporadic and there is no nomination committee:

“The Board meets on at least three occasions each year. Due to the consistent nature and strategy of the Group, this is considered sufficient. All Board appointments are considered by the Board as a whole and, as such, it has not been considered necessary to establish a Nomination Committee.”

Note ASY does not publish reports from the audit committee and the remuneration committee, which is bad form — but one of the ‘quirks’ of investing in family-run firms.

3) DIRECTORS AND ADVISORS

a) Chairman

Surely the oldest director at a UK quoted company:

The FD is not a board member.

4) INDEPENDENT AUDITOR’S REPORT

a) Materiality and scope

Materiality is the standard 5% of pre-tax profit at £975k.

Audit scope improved for 2021 — full-scope audits on the Netherlands as well as the UK and UAE, plus specific-scope audits on Italy and Belgium instead of ‘analytical procedures’.

The full-scope percentages in the table…

…did not correspond exactly to the percentages in the text:

“Our full-scope audit procedures provided coverage of 78% of the group’s consolidated equipment for hire, 83% of the group’s consolidated revenues and 90% of the group’s consolidated profit before taxation. ”

Auditor mixed things up a bit:

“To add unpredictability to our group scoping and risk assessment, the group engagement team also carried our procedures in respect of Noloclimat S.R.L relating to management override of controls and confirming the existence of cash, as well as procedures to confirm the existence of cash in respect of Andrews Sykes BVBA.”

b) Key audit matters

Slight refinement to the revenue key audit matter:

“Accuracy and completeness of revenue related deductions (new in the year, but refines the prior year key audit matter being occurrence of hire revenue generated from continuous hire invoices raised in the final quarter of the year);”

The other key audit matter remains the assumptions that derive the pension liability.

The audit-risk chart for 2021 now includes ‘going concern’:

Lots of extra text from the auditor to testing the revenue key audit matter, including:

“* Testing a sample of customer deductions recorded during the year and rebate provisions at the year end by agreeing to supporting documentation including contractual agreements as well as subsequent cash payment or a credit note issued to the customer;

* Testing a sample of new customers and related rebate agreements entered into within the year and challenging as to whether a rebate provision was in place for these items at the year end. We inspected credit notes or cash payments after the year end to determine if post year-end activity was indicative of an unrecorded arrangement;

* Testing a sample of items from the off-hire records in close proximity to the year end. For the off-hire transactions we obtained a copy of the respective off-hire invoice to ensure that the revenue had been recognised in the correct period.

c) Other audit matters

Details of the auditor discovering one of its overseas divisions had collected £3k from ASY during 2020, which contravened FRC rules:

“Other matters which we are required to address:

As we reported to the Audit Committee, we identified that accounting services, of which the firm was not aware, were provided by Grant Thornton International Limited network firms in the Netherlands and Belgium to controlled undertakings of Andrews Sykes Group Plc, in respect of the year ended 31 December 2020, for which non-audit fees totalled £3,000. These services are not permitted to be provided to a controlled undertaking of an ‘other entity of public interest’ under the FRC Ethical Standard (2019). We have subsequently considered the impact on our independence and concluded that these accounting services do not impair our independence as the accounting services were of a routine and mechanical nature, and the work undertaken for purposes of the group audit was performed on the underlying financial information, which did not rely on the presentation of local statutory financial statements. The non-audit fee of £3,000 is also considered to be trivial. The Audit Committee was in agreement with this conclusion.”

5) GROUP ACCOUNTING POLICIES

Nothing obviously alarming here.

a) Revenue recognition

All new text for 2021:

“Revenue is recognised to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur. Therefore, the amount of revenue recognised is adjusted for any negotiated rebates which are estimated based on historical data. Rebates are recognised as a separate liability to reflect the method of settlement and included as a component of accruals (see note 21). The Group reviews its estimate at each reporting date and updates the liability accordingly.”

b) Provisions

All new text for 2021:

“Dilapidation costs expected to be settled at the end of the lease term for rectification of wear and tear damage of the Group’s leasehold premises are provided for as an expense over the tenancy period as the wear and tear occurs. The cost of the remedial work required on the group’s properties is based upon the group’s previous dilapidation experience and quotes received from professional surveyors. ”

c) Expected credit losses

All new text for 2021:

“Management consider the main factors in assessing the appropriate allowance for doubtful debt and credit losses are the age of the balances held relative to the due date and the profile of the customers; past default experience; external indicators and forward-looking information. Specific trade receivables may be written off when there is considered to be little likelihood of recovering the debt.

If the credit loss percentage for the gross debtors greater than 12 months old was increased by 10%, the expected credit loss provision would increase by approximately £0.3m. Similarly, if the credit loss percentage for the gross debtors greater than 12 months old was decreased by 10%, the expected credit loss provision would decrease by approximately £0.3m.”

6) NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

a) Segmental analysis

I note capex in Europe is equivalent to 11% of sales versus 6% in the UK:

A similar difference was reported for 2020, implying European operations are not as mature as UK operations as less revenue is generated from new equipment.

b) Costs

This is brilliant:

ASY lists all of its costs. Mind you, some of the stated costs from 2020 (e.g. “Customer compensation receipts credited to revenue for lost or damaged plant and equipment“) are no longer disclosed and are now mixed in with other entries.

c) Employees

The aforementioned revenue per employee KPI and absenteeism KPI suggest ASY likes to manage its workforce well (point 1c above):

Revenue per employee at £133k compared to £116k for the pandemic-disrupted 2020, and was the best ever aside from 2008 (£135k) and 2018 (£137k). Revenue per employee has not made major strides over time (see blog post above) and I dare say the level of staff productivity is not really commensurate with ASY’s “first-class service to…clients, 24 hours per day, all year round“.

Mind you, the average staff wage for 2021 was only £32k, which has been kept under good control especially given the 24/7 service. ASY’s average wage has bobbed between £30k and £31k since 2016.

I note redundancy costs have appeared every year since 2006.

Total employee costs represented 28% of revenue during 2021, within the 27% to 31% range experienced since 2013.

d) Director pay

The chairman and two of the non-execs do not collect fees:

The newish MD looks to be on similar emoluments to the previous MD. Director bonuses have in the past been lumped together with basic pay, which is poor disclosure. At the moment the executive pay arrangement/disclosure are very much ‘if it is not broke, do not fix it’ — so let’s hope group progress continues to be positive.

e) Property, plant and equipment

My blog post above noted ASY’s regular transfer of equipment held as stock (i.e. for sale) to equipment held as fixed assets (i.e. for hire).

The £5,374k capital additions for 2021 comprised of £2,530k spent on capex in the cash flow statement, and £2,844k of equipment transferred from stock originally purchased for sale:

No longer sure my sums adjusting for the stock transfer in the blog post are entirely correct. The stock involved could have been purchased many years before it was transferred to fixed assets. My table of adjustments assume the stock was purchased during the year before the transfer.

f) Pension scheme assets

Quick addition to my notes about the pension scheme:

The scheme’s assets are mostly bonds and gilts, which tend to have lower long-term returns than equities and which underlines my theory that notable scheme contributions will be required over time. I note the investments are entirely UK equities.

g) Stock

Still not sure about stock expensed being £10.2m:

As noted in the blog post above, sales of equipment were £4.6m, or £6m if installation and sales are included. Perhaps the stock is sold at a loss. Or maybe there is an element of stock sales in the hire revenue (fuel for boilers etc?), but that should be split out as per IFRS 15.

At least the stock provisions are not huge.

h) Trade receivables

Some mixed numbers here:

Total trade receivables of £18.0m are equivalent to 24% of revenue, which is higher than the 22% for 2020 but within the 21%-26% range witnessed since 2006.

Trade receivables not past due at £12.8m represent 71% of total trade receivables, and favourably compares to c50% since 2013. But I note the P&L included a doubtful debt charge of £1.5m, or 2% of revenue, which compares to less than 1% since 2011. So the lower rate of ‘past due’ invoices may be simply due to ASY writing off a greater number of unpaid bills.

i) Trade and other payables

Nothing too untoward here:

Trade and other payables of £13.6m were equivalent to 18% of revenue for 2021, and within the 16%-20% range witnessed since 2010.

j) Bank loans

This small-print has become academic as the £3m loan was paid after the year-end during April 2022:

k) Right-of-use obligations

Nothing untoward here:

Right-of-use assets are mainly rental properties and a £3m payment within one year versus a total £15m suggests a 5-year obligation. Profit at £20m for 2021 does not indicate obvious problems paying the leases.

l) Provisions

New for 2021, a separate provision entry to reflect the cost of returning rental properties to their original state when the lease expires:

Hence the new accounting policy text (point 5b above).

m) Share capital

No options!

Options were in fact last seen during 2010.

Maynard