25 May 2021

By Maynard Paton

Results summary for Andrews Sykes (ASY):

- H2 revenue down 20% and H2 profit down 37% disappointingly confirmed a lower level of pandemic resilience than H1.

- However, the main UK equipment-hire subsidiary apparently delivered a FY 2020 profit only “marginally below” that of FY 2019.

- Commendable ‘going concern’ text revealed a “cautiously realistic” assumption of a “comparable” performance for FY 2021.

- The books remain healthy with robust margins, effective working-capital management and sizeable net cash, although the pension scheme is absorbing extra contributions.

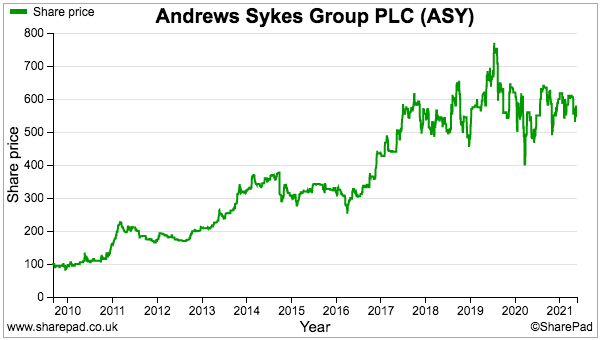

- A possible P/E of 16-17 and yield of 4% do not appear completely outrageous given the appealing financials and potential for further European expansion. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own ASY

- Results summary

- Revenue, profit and dividend

- Furloughed employees

- H1 versus H2

- Financials: Hire revenue versus hire equipment

- Financials: Operating margin and return on equity

- Financials: Cash flow and working capital

- Financials: Pension scheme

- Financials: Going concern

- Valuation

Event links, share data and disclosure

Event: Preliminary results (and annual report) for the twelve months to 31 December 2020 published 05 May 2021.

Price: 550p

Shares in issue: 42,174,359

Market capitalisation: £232m

Disclosure: Maynard owns shares in Andrews Sykes. This blog post contains SharePad affiliate links.

Why I own ASY

- Supplies air conditioners, portable heaters and industrial pumps for hire, with success based on a prompt 24/7 service, high-quality rental fleet and commercial-only customer base.

- Accounts regularly showcase high margins, generous cash flow, net cash and attractive returns on equity.

- Chairman and family are 90%/£209m shareholders and ensure management focuses on “long-term shareholder value creation” (point 10).

Further reading: My ASY Buy report | All my ASY posts | ASY website

Results summary

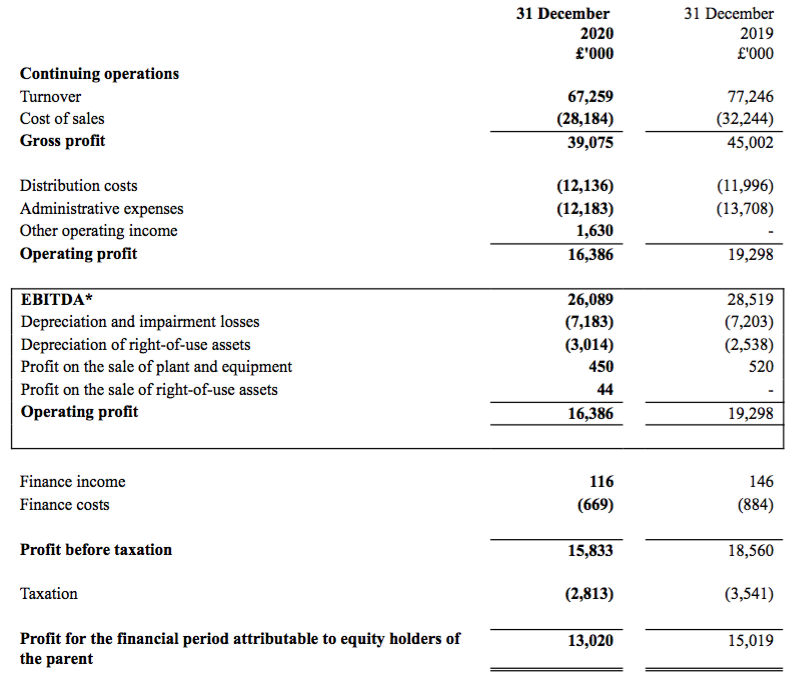

Revenue, profit and dividend

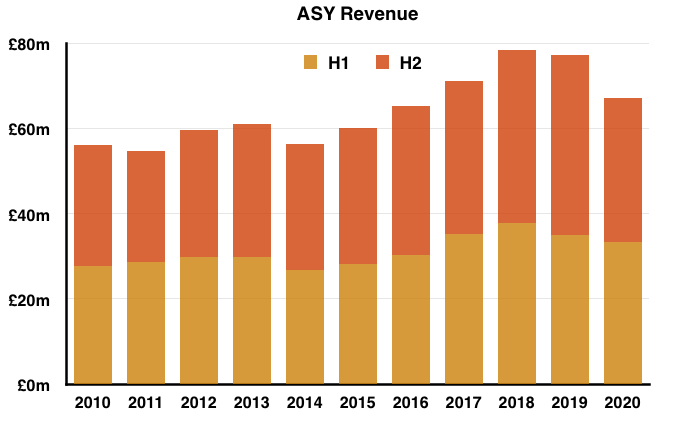

- These FY 2020 results disappointingly showed a lower level of pandemic resilience during H2 than H1.

- After September’s interims revealed revenue and profit broadly flat, this statement admitted annual revenue had dropped 13% and profit (before government grants) had dropped 24%.

- The yearly performance was the weakest since 2016:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Revenue (£k) | 65,389 | 71,300 | 78,563 | 77,246 | 67,259 |

| Operating profit (£k) | 15,816 | 17,589 | 20,681 | 19,268 | 14,756 |

| Other items (£k) | - | - | - | - | 1,630 |

| Finance income (£k) | 1,725 | (304) | 364 | (738) | (553) |

| Pre-tax profit (£k) | 17,541 | 17,285 | 21,045 | 18,560 | 15,883 |

| Earnings per share (p) | 34.3 | 33.4 | 40.4 | 35.6 | 30.9 |

| Dividend per share (p) | 23.8 | 23.8 | 23.8 | 22.0 | 23.4 |

| Special dividend per share (p) | - | - | - | - | 23.7 |

- ASY admitted the pandemic had “greatly impacted” demand for air conditioners and heaters for offices and outside events.

- ASY also explained:

“The fourth quarter of 2020 was particularly challenging due to the combination of severe Covid-19 restrictions being imposed by the governments in the UK and Europe and a relatively mild winter in the UK.“

- Mind you, the lockdowns did not restrict demand for pumps, with such equipment witnessing revenue gain 3% for the year.

- ASY’s blog (“Vaccination HQ at Ashton Gate stadium now operational thanks to Andrews“) had already indicated examples of a Covid silver lining:

“The company’s extensive involvement with many Covid-related projects ensured consistent boiler and chiller revenue throughout the year.“

- The general lack of extreme weather also influenced ASY’s progress. Cold snaps, heat waves and extensive rain typically prompt sudden demand for the group’s equipment.

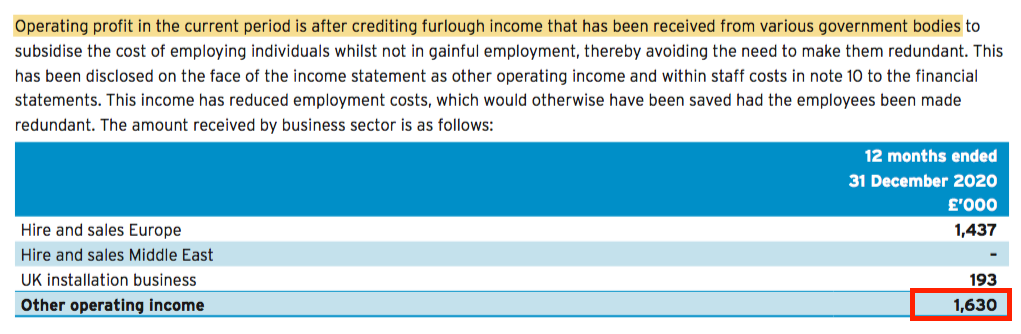

- The annual report small-print described the year’s performance as “exceptional“:

- ASY’s reported profit was bolstered by government furlough grants of £1.6m (see Furloughed employees) and hindered a fraction by a one-off pension charge (see Financials: Pension scheme).

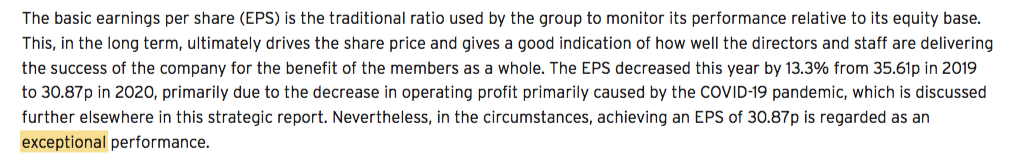

- Between H2 2014 and H1 2019, ASY paid 12 interim/final dividends of 11.9p per share:

- The final dividend for FY 2019 was trimmed to 10.5p per share due to the pandemic, but the interim payout for H1 2020 was restored back to 11.9p per share.

- This FY 2020 statement then declared an 11.5p per share final dividend, 0.4p per share less than the 11.9p H1 distribution — suggesting the H2 performance came in a tad below ASY’s expectations.

- The dividend highlight of course was the bumper 23.7p per share special payment declared during July 2020.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

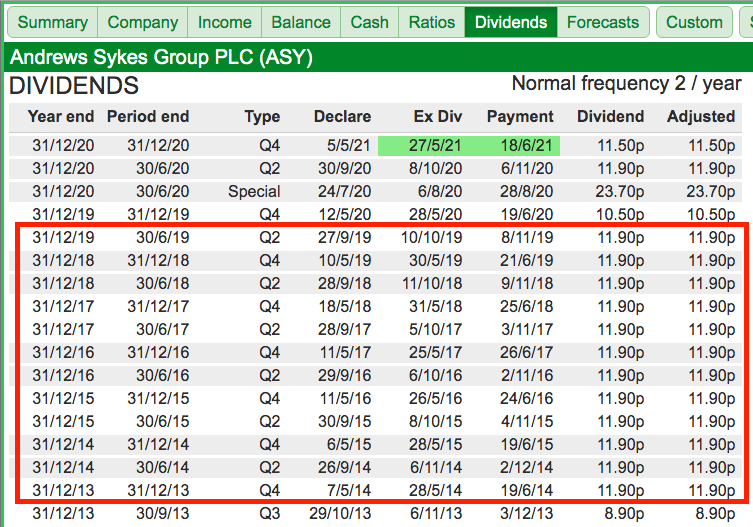

Furloughed employees

- These FY 2020 results revealed ASY collecting furlough grants of £1.6m:

- The narrative implied employees were furloughed mostly during H1 (April 2020):

“The group’s UK trading entities continue to make use of the Coronavirus Job Retention Scheme but on a vastly reduced level as compared to April 2020 and the level of monthly receipts are not significant.“

- But the H1 results did not disclose any furlough benefits, indicating the £1.6m was received entirely during H2.

- Why the furlough grants were accounted for during H2 when the associated costs seemed biased towards H1 was not explained.

- Another mystery is ASY’s H1 performance given the furlough process.

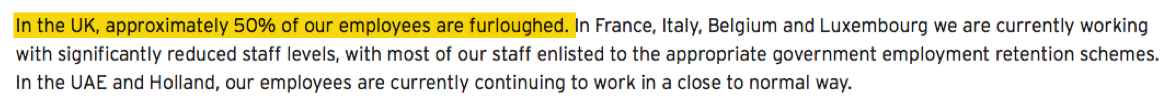

- The small-print within the FY 2019 annual report (point 2) claimed 50% of UK employees were furloughed at the time of the report’s publication (May 2020):

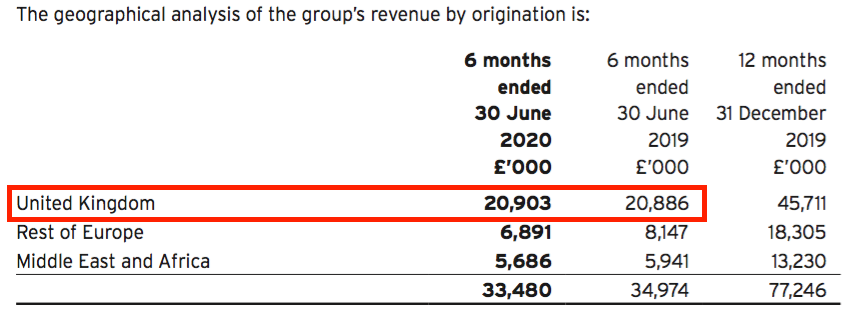

- And yet the subsequent H1 statement showed UK revenue flat at £20.9m:

- How the UK business could sustain its H1 revenue with 50% of the workforce at some point sat at home was unclear then and remains unclear now.

- ASY paying regular and special dividends while at the same time furloughing staff does not feel entirely right.

- But there are mitigating factors.

- Mitigating factor 1: The special payout was funded from cash reserves constructed before the pandemic. The H1 statement said:

“This [special] dividend was paid out of the group’s substantial brought forward cash reserves accumulated from previous years trading, a proportion of which were surplus to the group’s requirements and were therefore returned to shareholders.”

- Mitigating factor 2: The H1 dividend related to January-June 2020, a period during which — at least according to the accounts — no furlough grants were received.

- Mitigating factor 3: ASY claims employees would have been let go had the furlough payments not been received, and the net effect on profit would have been similar:

“Operating profit in the current period is after crediting furlough income that has been received from various government bodies to subsidise the cost of employing individuals whilst not in gainful employment, thereby avoiding the need to make them redundant… This income has reduced employment costs, which would otherwise have been saved had the employees been made redundant.”

- Let’s just say ASY’s furlough actions are not quite as clear as those of follow portfolio member FW Thorpe, which declared:

“The Board decided not to apply for any government support for furloughed employees during lockdown; this impacted operating costs by £0.6m, as the Group paid all employees normal salary whilst they were not working. This decision was duly considered and leaves the Group free of debt to external supporters, protects its reputation, and gives management ongoing freedom to make choices for the good of the business and its shareholders.”

- Note that the aforementioned 0.4p per share difference from the H1 dividend to the final dividend equates to £168k, versus furlough receipts of £1.6m.

H1 versus H2

- Group revenue fell 20% during H2:

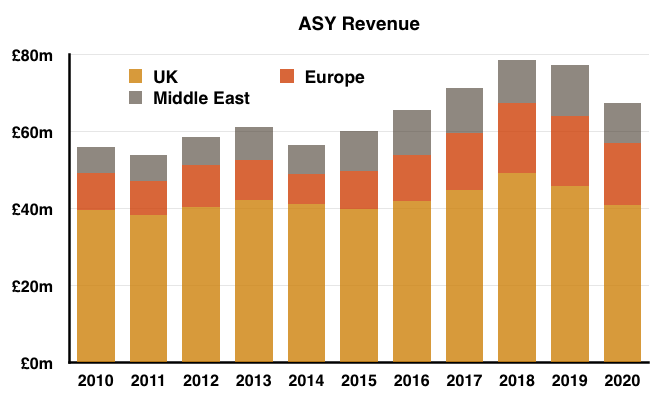

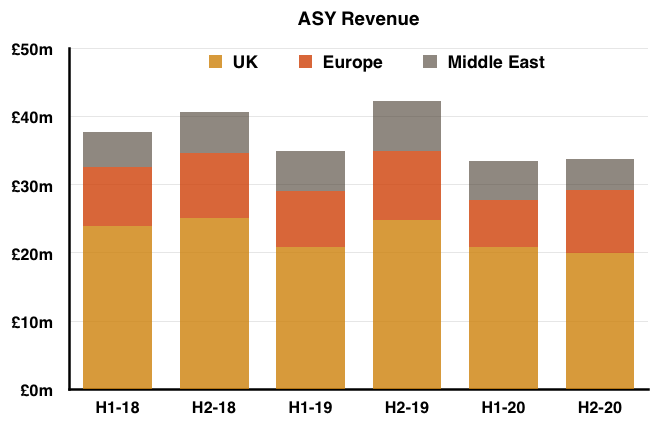

- UK revenue fell 20% during H2, with European revenue down 10% and Middle Eastern revenue down 37%:

| H1 2019 | H2 2019 | FY 2019 | H1 2020 | H2 2020 | FY 2020 | ||

| Revenue | |||||||

| UK (£k) | 20,886 | 24,825 | 45,711 | 20,903 | 19,979 | 40,882 | |

| Europe (£k) | 8,147 | 10,158 | 18,305 | 6,891 | 9,186 | 16,077 | |

| Middle East (£k) | 5,941 | 7,289 | 13,230 | 5,686 | 4,614 | 10,300 | |

| Total (£k) | 34,974 | 42,272 | 77,246 | 33,480 | 33,779 | 67,259 | |

| Operating profit (£k) | 6,918 | 12,380 | 19,298 | 7,000 | 7,756 | 14,756 | |

| Other income -- grants (£k) | - | - | - | - | 1,630 | 1,630 |

- H2 operating profit dived 37% before furlough payments, with £7.8m the lowest H2 profit since H2 2014.

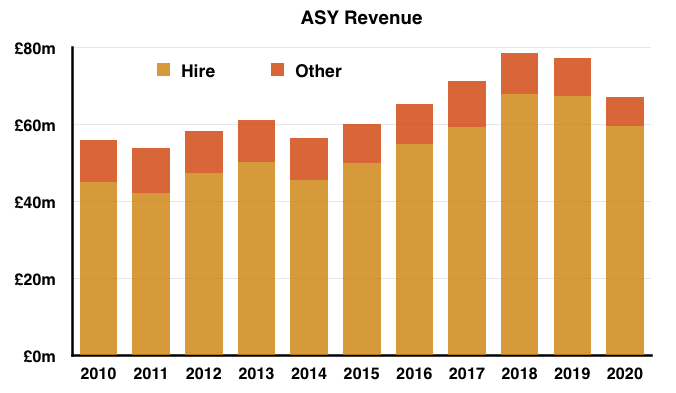

- The geographic full-year revenue split was 61% UK, 24% Europe and 15% Middle East:

- H2 witnessed Europe’s revenue grow to its largest ever group proportion of 27%:

- Ten years ago European sales were 17% of the group’s total.

- The annual report revealed certain European subsidiaries delivering encouraging performances, with new depots helping to counterbalance the pandemic disruption:

- Luxembourg: “…produced growth during the year…“

- Italy: “…comparable business levels in 2020.”

- France: “Turnover for 2020 finished the year within 2% of the comparable number for 2019.”

- Switzerland: “…another stable performance…“

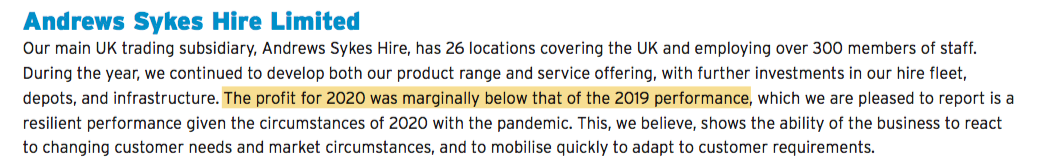

- The annual report small-print claimed ASY’s main UK hire division, Andrews Sykes Hire Limited, put in a respectable performance:

- Companies House shows Andrews Sykes Hire Limited delivering a near-£11m profit for FY 2019…

- …so a near-£11m profit may have been recorded for FY 2020 as well.

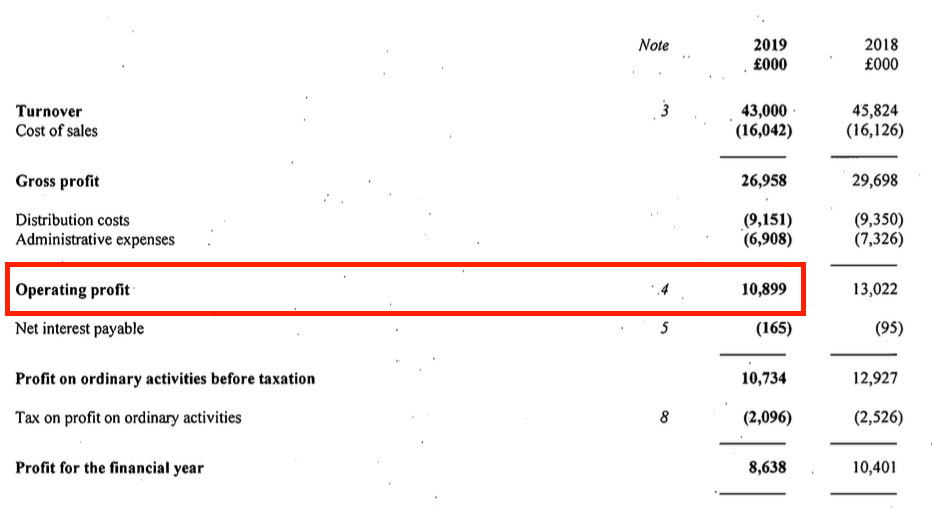

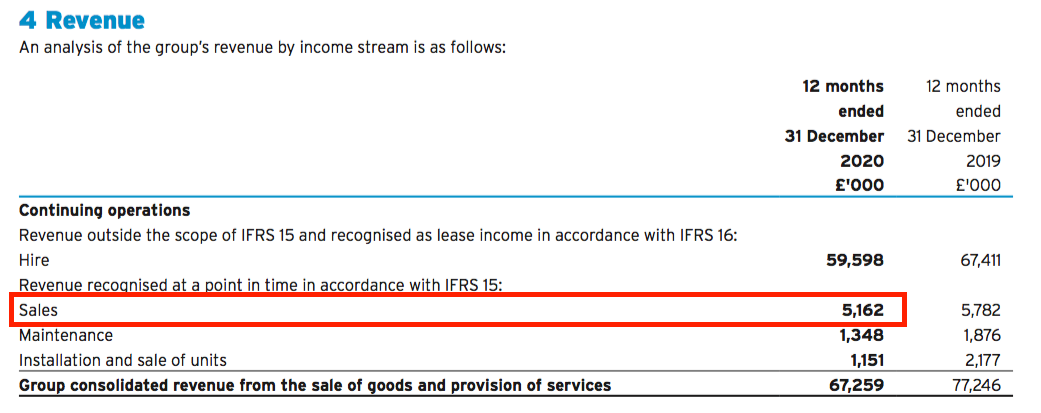

- ASY’s all-round performance was influenced by lower equipment sales alongside reduced installation and maintenance activity.

- Such ‘Other’ revenue dropped 22% during FY 2020 — and 31% during H2 — and now represents 11% of the top line:

- Revenue from the core equipment-hire operations did not decline as much as ‘Other’ revenue, falling 12% for the year and down 19% during H2.

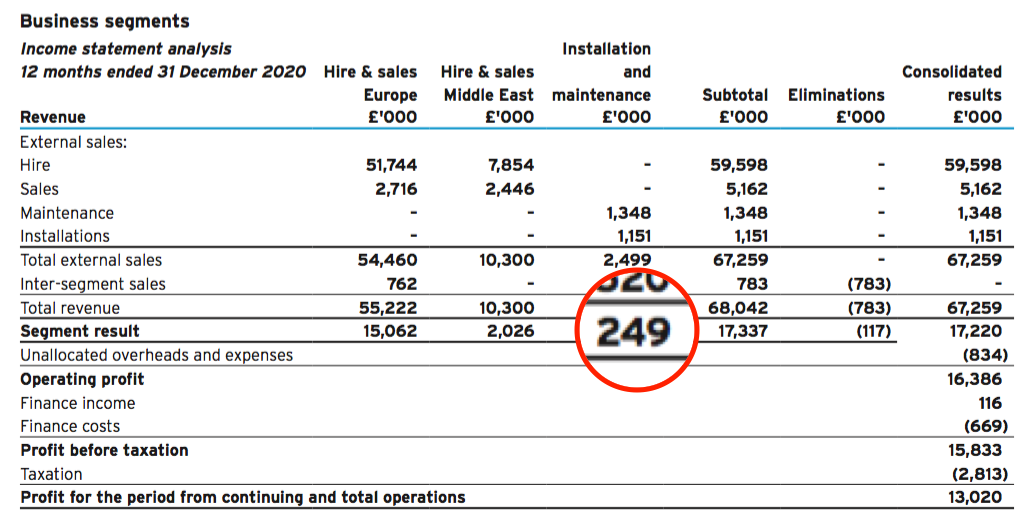

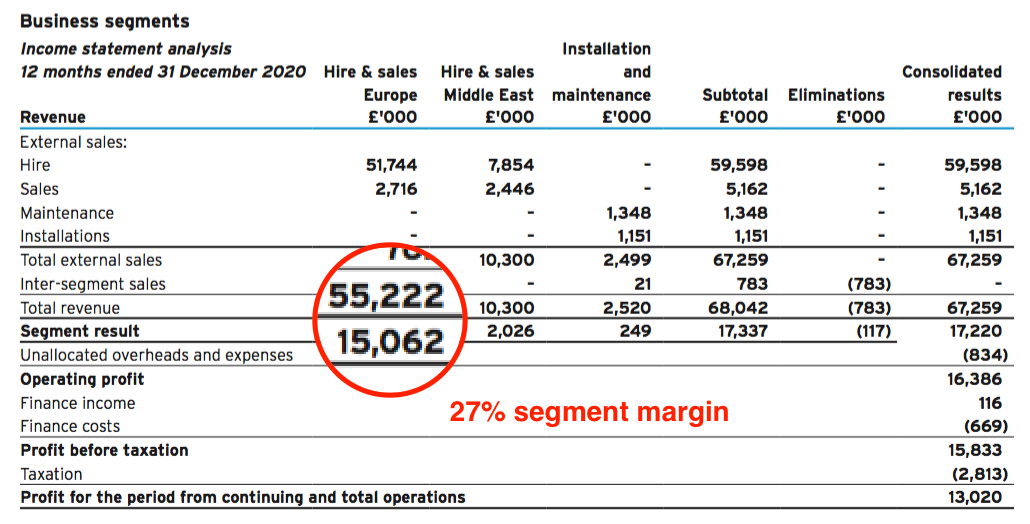

- Installation and maintenance services do not generate much profit:

- Equipment sales may not generate much — or any — profit either.

- Such sales came to £5.2m during FY 2020…

- …but the cost of stock (most of which presumably represents the equipment sold) was £7.6m:

- ‘Other’ revenue generated 11% of group revenue during FY 2020, with the proportion dwindling steadily lower from more than 30% since the early 2000s and 19% from 2010:

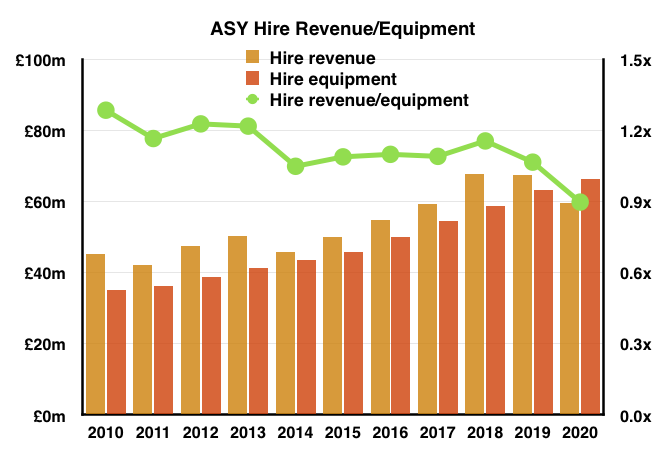

Financials: Hire revenue versus hire equipment

- The productivity of ASY’s hire equipment continued its downward trend during FY 2020.

- The chart below divides revenue derived from hired equipment by the equipment’s historical cost (green line, right axis):

- Ten years ago ASY’s hire fleet had cost approximately £35m to assemble and generated revenue nearly 1.3 times as great at £45m.

- Last year the hire fleet had a £66m historical cost but produced revenue of £60m.

- True, the pandemic disrupted operations last year, but the underlying direction from prior years is clear.

- The cause appears to be ASY’s operations abroad.

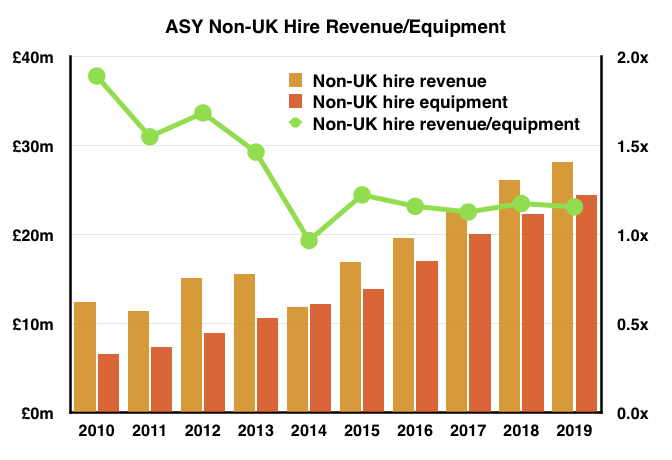

- The chart below displays the same hire-revenue-versus-hire-equipment for ASY excluding the main UK Andrews Sykes Hire Limited subsidiary:

- The downward trend is much more pronounced and is heading towards the UK level, where hire revenue just about exceeds the historical cost of the equipment.

- I presume as ASY’s overseas divisions mature, so the equipment range is broadened to include products that are used less frequently.

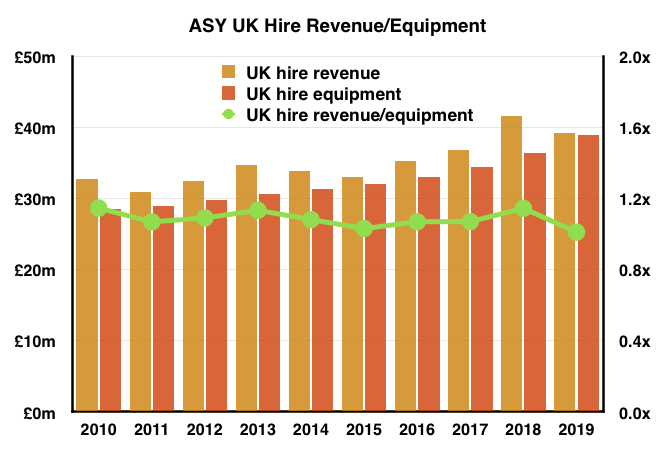

- The same chart for the main UK Andrews Sykes Hire Limited subsidiary shows a much more consistent income from the equipment hired out:

Quality UK investment discussion at Quidisq. Visit forum.

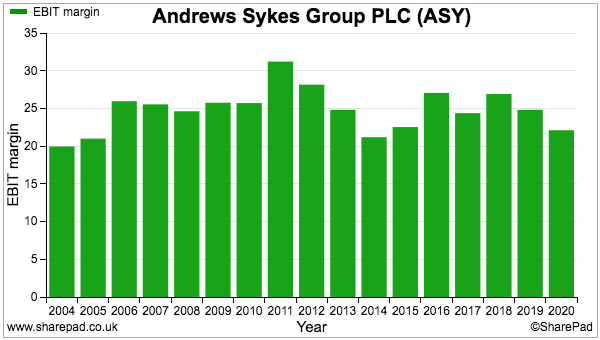

Financials: Operating margin and return on equity

- ASY continues to exhibit attractive 20%-plus margins:

- Despite the pandemic, the Hire & Sales UK and Europe segment enjoyed a super 27% margin before central costs:

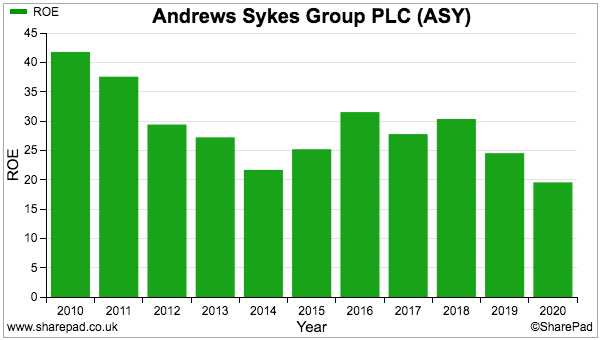

- Return on equity (ROE) also remains at appealing levels:

- Note that the largest balance sheet entry for FY 2020 — and for the ten years before that — was cash.

- Cash yielding very close to zero does not enhance ROE calculations.

- Prior to the pandemic, ASY had boasted useful returns on retained profit:

- During the five years to FY 2019, earnings increased by £5.7m while net asset value (or shareholder equity) advanced by £21.4m.

- Investing a further £21.4m over five years to boost earnings by £5.7m arguably equals a welcome 27% return.

Financials: Cash flow and working capital

- Cash flow was enhanced by lower spending on new equipment:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Operating profit (£k) | 15,816 | 17,589 | 20,681 | 19,298 | 14,756 |

| Depreciation and amortisation (£k) | 5,310 | 5,917 | 6,666 | 7,203 | 7,183 |

| Net capital expenditure (£k) | (4,719) | (4,929) | (6,198) | (5,522) | (3,538) |

| Working-capital movement (£k) | (2,157) | (1,155) | (4,292) | (5,592) | 647 |

| Net cash (£k) | 17,673 | 20,293 | 23,381 | 23,897 | 20,521 |

- A £7.2m depreciation charge versus net capital expenditure of £3.5m allowed reported earnings of £13.0m to convert into free cash of £16.0m.

- Working-capital movements produced an unusual inflow during FY 2020:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Operating profit (£k) | 15,816 | 17,589 | 20,681 | 19,298 | 14,756 |

| Working-capital movements | |||||

| Stocks (£k) | (2,251) | (1,022) | (2,682) | (3,834) | (2,690) |

| Trade and other receivables (£k) | (1,876) | 563 | (2,139) | (1,818) | 4,099 |

| Trade and other payables (£k) | 1,970 | (696) | 529 | 60 | (762) |

| Total (£k) | (2,157) | (1,155) | (4,292) | (5,592) | 647 |

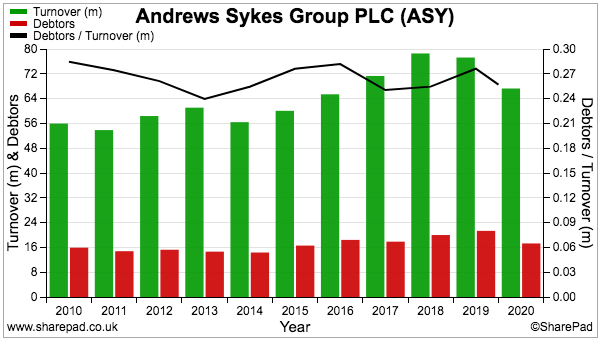

- Debtors were reduced by £4.1m, and remain close to ASY’s typical 25% of revenue (black line, right axis):

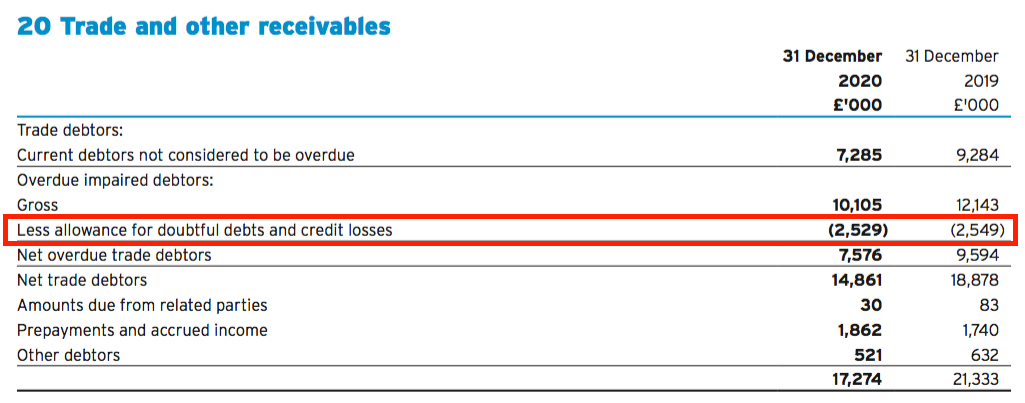

- Note that ASY’s doubtful-debt allowance was maintained at £2.5m despite overdue invoices declining from £12.1m to £10.1m:

- ASY admitted customers in the Middle East were given extended payment terms during the year, and revealed debtor days for the region had increased 42% to a very protracted 225.

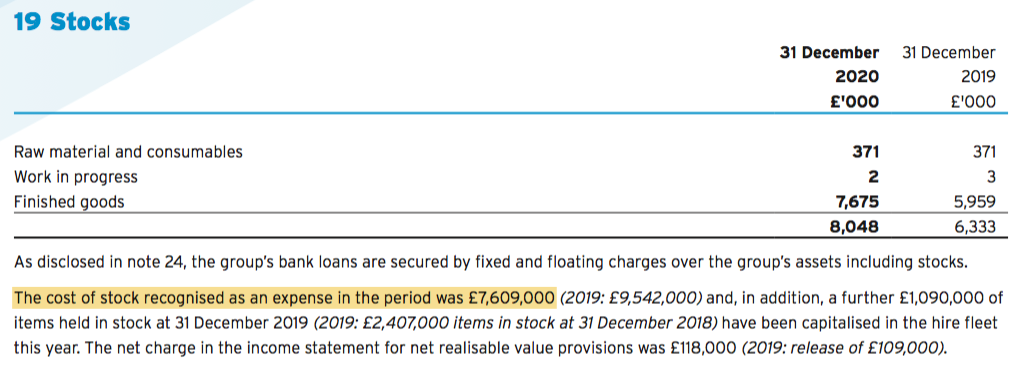

- Stock levels increased to £8.0m and represented a record 12% of revenue (black line, right axis):

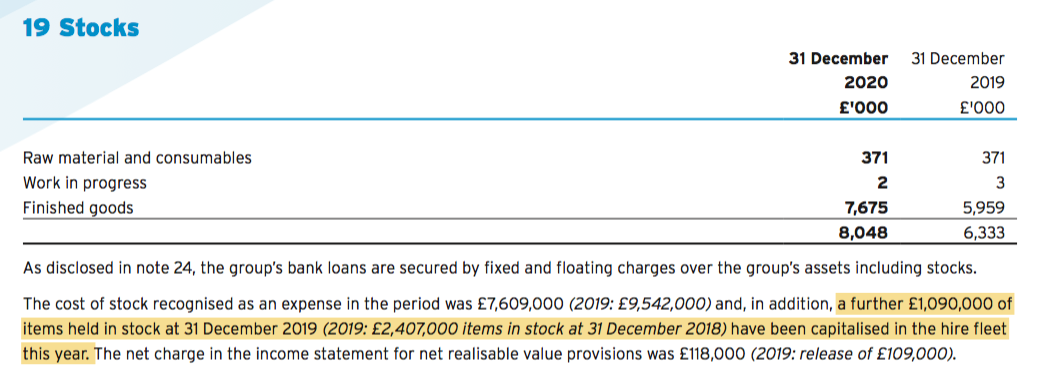

- ASY’s stock is complicated by the company acquiring equipment for resale but then capitalising a proportion of that stock into the hire fleet:

- Such stock-to-fixed-asset transfers are unusual, but presumably reflect ASY offering for hire any equipment that could not be sold direct.

- During FYs 2017, 2018, 2019 and 2020, stock with an aggregate £7.1m value was re-classified into the hire fleet.

- This £7.1m is arguably capital expenditure rather than working-capital investment.

- The table below adjusts the working-capital movements and capital expenditure for the £7.1m:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | Total |

| Operating profit (£k) | 15,815 | 17,589 | 20,681 | 19,298 | 73,384 |

| Depreciation (£k) | 5,310 | 5,917 | 6,666 | 7,203 | 25,096 |

| Working-capital movement (£K) | (2,157) | (1,155) | (4,292) | (5,592) | (13,196) |

| Stock transferred (£k) | 2,156 | 1,460 | 2,407 | 1,090 | 7,113 |

| Adjusted work-cap movement (£k) | (1) | 305 | (1,885) | (4,502) | (6,083) |

| Net capital expenditure (£k) | (4,719) | (4,929) | (6,198) | (5,522) | (21,368) |

| Stock transferred (£k) | (2,156) | (1,460) | (2,407) | (1,090) | (7,113) |

| Adjusted net capex (£k) | (6,875) | (6,389) | (8,605) | (6,612) | (28,481) |

- ‘Underlying’ working capital absorbed aggregate cash of £6.1m (and not £13.2m) during those four years.

- ‘Underlying’ capital expenditure meanwhile came to £28.5m — just £3.4m more than the associated depreciation charge.

- That £3.4m difference is very acceptable given aggregate operating profit was £73m during the same four years.

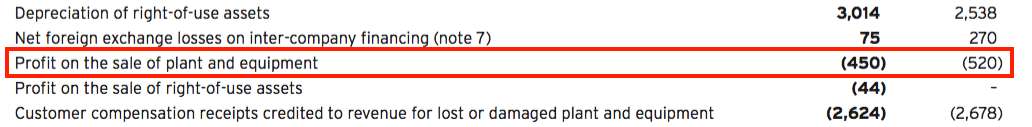

- Underlining the notion of a conservative depreciation policy, ASY has recorded a small profit over the book value of sold equipment every year since at least 2005:

- Free cash flow of £16.0m funded dividends of £19.4m and reduced debt by £0.5m to leave the bank balance £4.0m lighter.

- Cash finished the year at £24.0m while bank debt was £3.5m.

Financials: Pension scheme

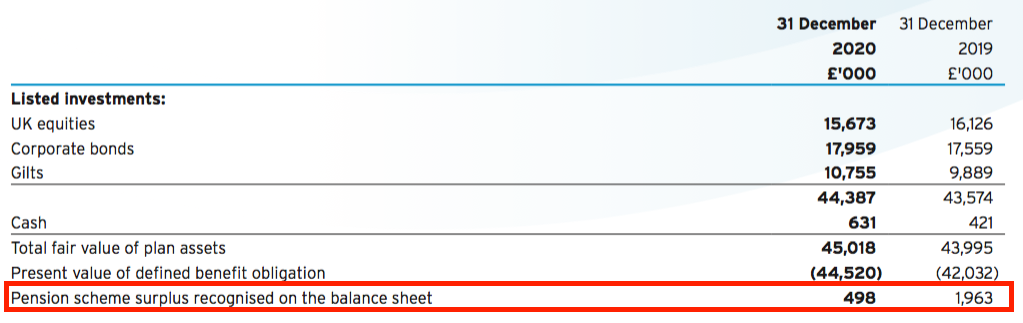

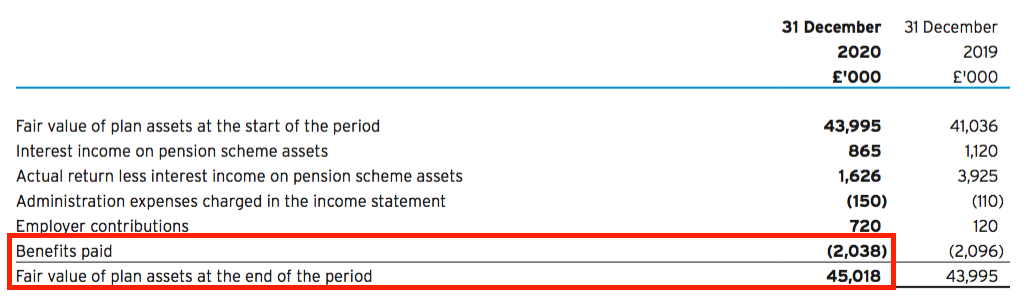

- ASY’s defined-benefit pension fund demonstrates how long-term pension accounting does not always reflect the near-term cash reality of a pension scheme.

- Although ASY’s balance sheet continues to show a small scheme surplus…

- …the company’s pension fund requires higher contributions.

- “Paying benefits of £2.1m from scheme assets of £44.0m requires an annual investment return of 4.8%.

- I am not convinced employer contributions of £120k a year are enough to sustain benefits of £2.1m while preventing the erosion of the £44.0m scheme assets.

- A formal pension funding review is underway and may prompt additional company contributions.“

- Sure enough the funding review has asked for additional contributions:

“A formal funding valuation as of 31 December 2019, together with a revised schedule of contributions and recovery plan, was agreed by the Board with the pension scheme trustees in March 2021. In accordance with this agreement, the group will be paying £1.3 million per annum into the pension scheme in both 2021 and 2022.“

- ASY paid an extra £600k to the scheme during FY 2020, and will inject an extra £1.2m a year for FY 2021 and FY 2022.

- Total contributions of £1.3m seem enough to sustain annual benefits of £2.0m while preventing the erosion of the £45m scheme assets:

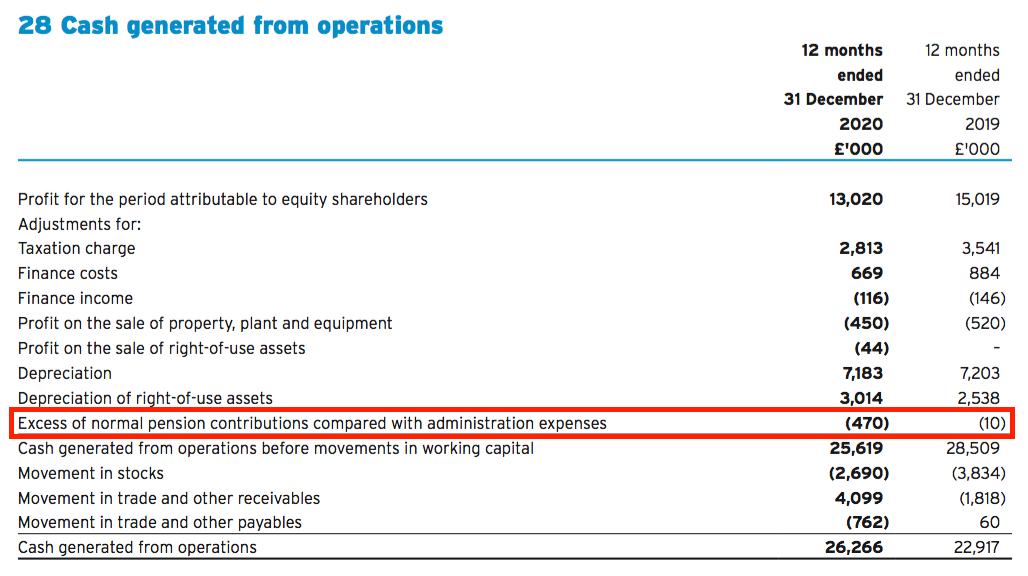

- Note that extra pension contributions bypass the income statement — with the cash flow statement highlighting the expense that is not charged to earnings:

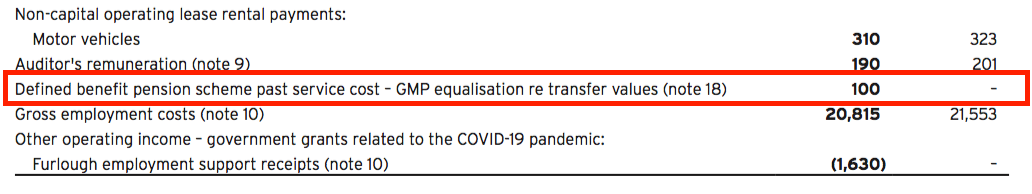

- ASY suffered a one-off £100k pension charge during the year:

Which is best for stock-screening: Stockopedia or SharePad? See my verdict.

Financials: Going concern

- The FY 2020 report contained further ‘going concern’ small print that commendably outlined ASY’s own projections:

“Management has prepared a detailed “bottom-up” budget including profit and loss and cash flow for the financial year ending 31 December 2021 and has extrapolated this forward into 2022 in order to form a view of an expected trading and cash position for the required period.

This base level forecast fully incorporates management’s expectations around the continued impact of coronavirus on the group and was prepared on a cautiously realistic basis.“

- Projection highlights include:

- A “cautiously realistic” assumption that turnover and profit for FY 2021 will be “comparable” to FY 2020;

- A “reasonable worst-case scenario” leading to revenue reducing by 15% between March 2021 and May 2022, and;

- Revenue could fall below £40m (i.e. fall more than 40%) before “any liquidity concerns” arise.

- The FY 2019 ‘going concern’ text proved to be too cautious. In particular, a forecast of a nine-month cash outflow of £10m…

“[T]he group’s net cash outflow in the nine months ending 31 December 2020 is forecast to be approximately £10 million.”

- … was thankfully overly pessimistic.

Valuation

- The ‘going concern’ text did not provide an ultra-bullish hint of current trading:

“Whilst profitability and cash flow performance to the end of February 2021 has been close to expectation…“

- But the main results narrative did refer to “improving” trade:

“The Board is confident that once conditions ease and external market conditions improve, customer demand and trading will return to normal levels. Conditions are improving in the UK with positive signs for the months ahead.”

- Operating profit excluding furlough payments but including IFRS 16 lease costs for FY 2020 was £14.2m.

- Assuming the pandemic eventually subsides, ASY’s profit ought to rebound from that level.

- For perspective, operating profit for FY 2019 including IFRS 16 lease costs was £18.8m.

- Applying tax at the standard 19% UK rate to those FY 2020 and FY 2019 profit figures gives earnings of 27.3p and 36.0p per share respectively.

- ASY remains a tightly held share with a minimal free float and vast bid-offer spread.

- The 101-year-old chairman and his family control almost 90% of ASY, leaving approximately 10% for everybody else.

- A 550p mid-price values ASY at £232m and the free float at £23m.

- Subtract the £21m net cash position from the market cap and the underlying business could be valued at approximately £211m or 501p per share.

- Whether the entire net cash position is truly ‘surplus to requirements’ is debatable, given ASY has operated with net funds of at least £15m since 2012.

- Depending on your view of near-term earnings (27.3p or 36.0p) and the cash position (truly surplus or not), ASY’s P/E could be 13.9x, 15.0x, 18.3x or 20.0x. The middle-ground at 16.8x feels about right.

- A 16.8x multiple does not seem completely outrageous for a high-margin, decent-ROE, cash-rich and dividend-orientated business that may have handy expansion prospects in Europe.

- The valuation sums could be fine-tuned further to reflect ASY’s pension situation.

- The trailing 23.3p per share dividend meanwhile supplies a useful 4.2% income at 550p.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Andrews Sykes (ASY)

Publication of 2020 annual report

Here are the points of interest:

1) Strategy

A reminder that the group’s competitive advantage is based upon a 24/7/365 “premium level of service” plus “technically advanced” equipment:

Also includes a reminder that the business benefits from extreme weather.

2) Operational performance

The results RNS did not include the following operational text, which outlined how each of the group’s divisions performed:

3) KPIs

No change to the KPIs used:

ASY is one of the few quoted companies to use revenue per employee as a KPI. More companies should really use it, as increasingly employee talent can be a more lucrative resource than traditional tangible assets.

Good to see ASY continues to monitor net funds as an indication of the group’s “long-term financial stability”

4) Debtor days

Here is the Middle East 225-debtor-day text that I referred to in the blog post above:

5) Interest charged

Interest at 1.38% suggests the banks view ASY as a good credit risk:

6) Capitalised stock

Further text on the transfer of stock of £1.1m to fixed assets…

…which explains why additions to tangible assets were £5.2m…

…but capital expenditure was £4.2m:

7) Going concern

Here is the going-concern text that includes the near-term projections as mentioned in the blog post above:

8) Strategic risks

No major changes, with “competition, product innovations and industry changes” still the main risks. No Brexit issues, plus a restructured IT department:

9) Pension

Confirmation of the increased pension contributions, from £10k/month to £110k/month:

10) Corporate governance

The shareholder agreement referred to in this text…

… can be downloaded here.

ASY’s corporate-governance statement is published only on its website.

Lots of reader comments on ASY have concerned the board’s dominant shareholding, but the board reckons the shareholding ought to benefit all shareholders:

“The Board believes that the presence and requirements of a longstanding controlling shareholder helps focus the Company’s strategy on long-term shareholder value creation.”

The website text also confirms the chairman delegates his board duties to the vice-chairman (his son):

“The Board consists of 8 members, led by Jean-Jacques Murray, the Non-Executive Vice Chairman who on behalf of the Chairman, manages and provides leadership to the Board to ensure that it is effective in its task of setting and implementing the Company’s direction and strategy.”

The chairman can be excused his duties as he is 101:

Do note that ASY’s annual reports do not include reports from the audit and remuneration committees, which is bad form.

11) Director changes

The former MD died of Covid and his replacement is, encouragingly, an old ASY hand:

12) SECR disclosure

New for this year is a Streamlined Energy and Carbon Reporting disclosure:

Not sure if fellow portfolio member FW Thorpe could help with the LED lighting:

Useful talk of the business saving time/money by conducting meetings online.

13) AGM special business

New for this year is the proposed disapplication of shareholder pre-emption rights:

I would like to think this proposal is a formality ‘just in case’, rather than ASY actually preparing to launch a rights issue.

14) Key audit matters

This year’s audit matters chart was sparse…

…compared to last year’s effort:

The “occurrence of revenue generated from continuous hire invoices raised in the final quarter of the year” matter replaces the “uncollected hire revenue” matter from 2019 (which in turn replaced the “revenue recognition” matter from 2018):

The basis still concerns the potential for fudging the figures to earn bonuses.

The second audit matter now refers to pension-liability assumptions rather than the actual liabilities:

Perhaps easier for the auditor to check whether the assumptions are valid rather than the overall liability calculations.

15) Audit report

Materiality a standard 5% of pre-tax profit:

The auditor (Grant Thornton of Patisserie Holdings fame) also reckons profit for 2020 would have been higher were it not for the pandemic.

Greater scope information was provided this year:

Full-scope audits were performed in the UK and Middle East, and these divisions accounted for 80% of hire equipment and 87% of revenue. These numbers underline the theory in the blog post above that hire equipment in Europe is not as productive (yet!) as the equipment employed elsewhere in the group.

16) Revenue recognition

A snippet about “trade discounts and volume rebates” for frequent customers:

Payment terms also confirmed as 30-60 days.

17) Useful life

A helpful note for judging the suitability of ASY’s depreciation charge:

Equipment-hire depreciation was £6.4m, and the £1.6m/£1.1m one-year variations suggest an equipment useful life of approximately 4.75 years. That ties in with the stated straight-line depreciation rate of 20% for most hire equipment and 10%-33% for the balance.

18) Employees

Employee productivity unsurprisingly declined, with staff headcount just 2% lower at 581 as revenue dropped 13%:

Revenue per employee was therefore £116k, down from £130k for 2019 and £137k for 2018 and back to a level last seen during 2015.

Employee costs as a proportion of revenue was 31%, the highest since at least 2005 and beyond the typical 25%-29% band.

The average employee cost was kept at £35-36k, a level witnessed since 2016.

19) Director pay

Minimal remuneration disclosure as per point 10 above. The chairman and two other non-execs do not collect any fees:

20) Stocks

Year-end stock of £8.0m and stocks recognised as an expense of £7.6m…

…suggest the stock sits in the warehouse for almost a year. No wonder some of it is transferred into hire equipment. I suspect ASY will always encounter long stock lead times, as, for example, the best time to buy heaters is in the summer — well before you want to sell them in the winter.

21) Trade receivables

Nothing too alarming here.

Net trade debtors represented 22% of revenue, within the 21%-25% range seen since at least 2006:

Overdue trade debtors (£7.6m) represented 51% of all trade debtors (£14.9m), within the 48%-51% range seen since 2013:

The debtors written off represented 0.7% of revenue, within the 0.6%-0.9% range seen since 2015.

22) Trade creditors

Owing a bit less to suppliers and a bit more to the taxman (VAT deferrals etc) seems reasonable following the pandemic:

23) Leases

No concerns here. ASY has total lease obligations of £15m, mostly for renting depots, which is not a huge sum when profit before furlough payments was almost £15m:

70% of the leases are due for payment within five years.

24) Options

Confirmation ASY continues to operate without an option scheme:

Maynard

This is quite off-topic. But because I just got this from the shed (and I believe it is fathers from about 1980) I thought I’d add here. An ASY relic.