29 October 2021

By Maynard Paton

Results summary for Tristel (TSTL):

- A disappointing pandemic-disrupted performance, with H2 revenue and profit down 15% and 36% respectively on the preceding H1.

- Progress was curtailed as NHS outpatient clinics closed and orders “dried up“, which left certain UK product sales running at a six-year low.

- Overseas revenue up 3%, a resilient 16% H2 margin, net cash of £10m and a 2% final-dividend lift suggest the business is not broken just yet.

- A re-introduced timetable for product launches in the United States provides hope of the seven-year FDA process concluding during 2023.

- The £236m market cap remains elevated, and is supported by a sector rival implying the US market for ultrasound-probe disinfection is worth up to $180m. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own TSTL

- Results summary

- Revenue, profit and dividend

- Product revenue, non-core and MobileODT

- UK

- International

- United States: FDA submission

- United States: market potential

- United States: Nanosonics

- Share options

- Financials

- Valuation

Event links, share data and disclosure

Event: Final results, presentation and webinar for the twelve months to 30 June 2021 published/hosted 18 October 2021

Price: 500p

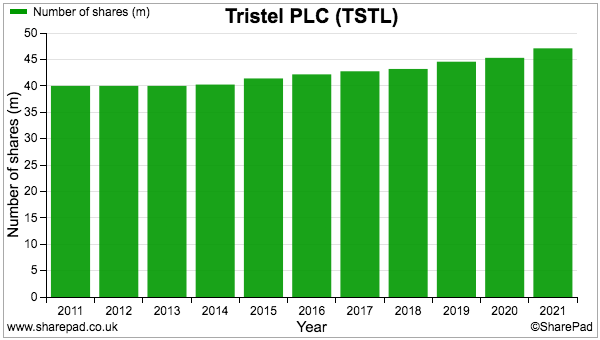

Shares in issue: 47,185,043

Market capitalisation: £236m

Disclosure: Maynard owns shares in Tristel. This blog post contains SharePad affiliate links.

Why I own TSTL

- Develops medical-device disinfectants that are repeat-purchase and face limited direct competition due to multiple patents, instrument-manufacturer approvals, scientific testimonies, secret ingredients and regulatory hurdles.

- Enjoys a sizeable and resilient UK market position alongside significant expansion opportunities abroad — most notably within the United States.

- Boasts financials that, pandemic-disruption aside, showcase high margins, robust returns on equity, decent cash conversion and no debt.

Further reading: My TSTL Buy report | All my TSTL posts | TSTL website

Results summary

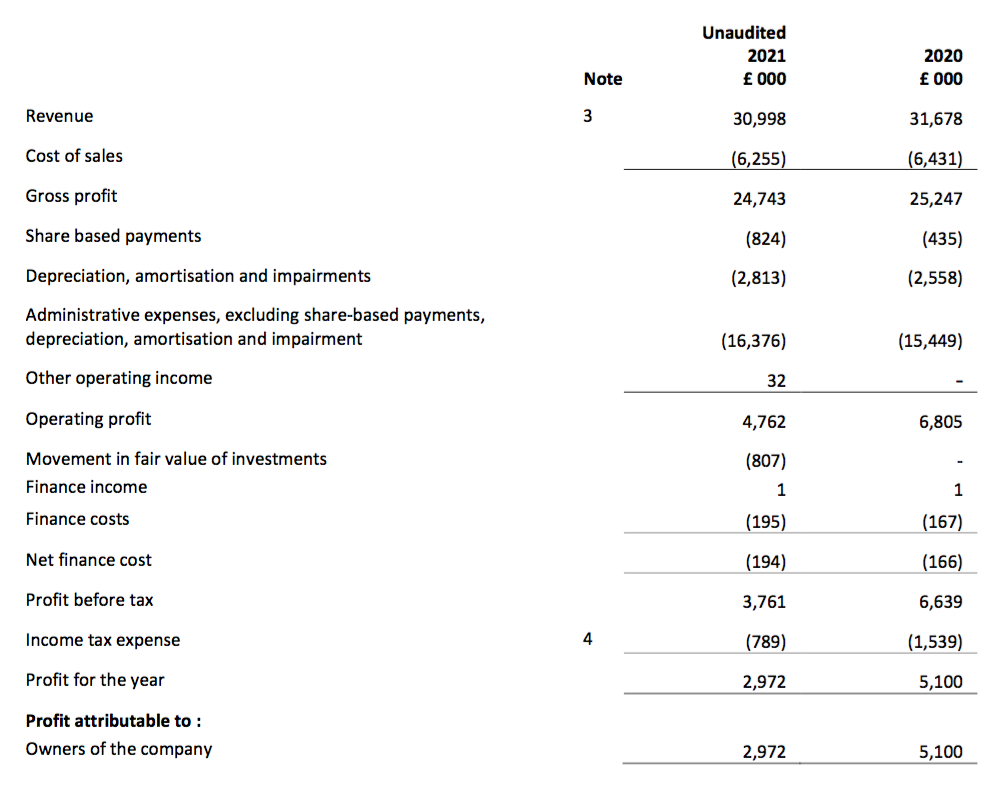

Revenue, profit and dividend

- Uncertain outlook remarks within February’s H1 statement…

“Sales of our medical device disinfectants during the first seven weeks of 2021 are lower than budget due to the impact of COVID-19 on patient examinations”

“The release of this [Brexit stock-piling] inventory will have some negative impact on second half sales of medical device disinfectant products in the UK.”

- …followed by a sales warning during April…

“Second half sales in all markets started very slowly because of the impact of COVID-19 on patient examinations. In the UK, this trend has continued through our third quarter to 31 March and shows little sign of reversing meaningfully before year-end.”

- …had already signalled these FY 2021 results would not be spectacular.

- The headline numbers presented did not quite match some of TSTL’s earlier predictions.

- April’s update said revenue should “exceed £31m”, although a July update then said the figure would be just £31m. Revenue was indeed just £31m.

- April’s update said pre-tax profit before share-based payments should be “not less than £5m“, and the July update then said the figure would be £5.5m. But pre-tax profit before share-based payments (and an impairment) was actually a tad lower at £5.4m.

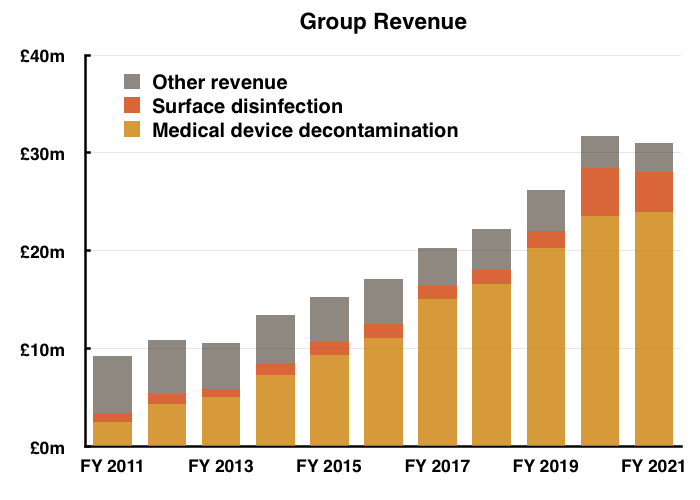

- The performance curtailed a run of seven straight years of revenue growth…

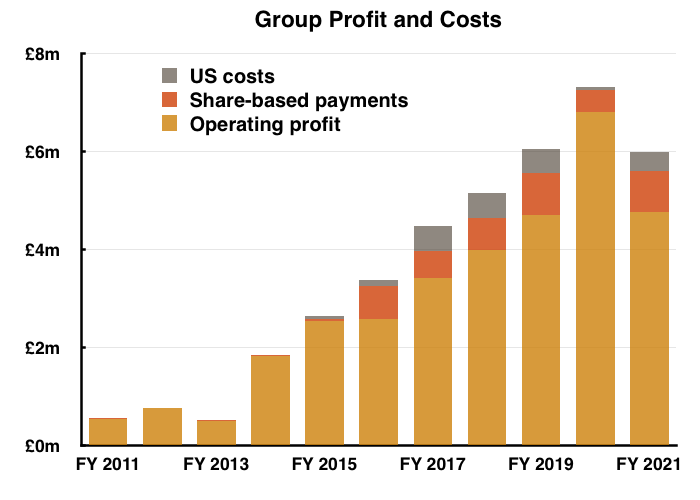

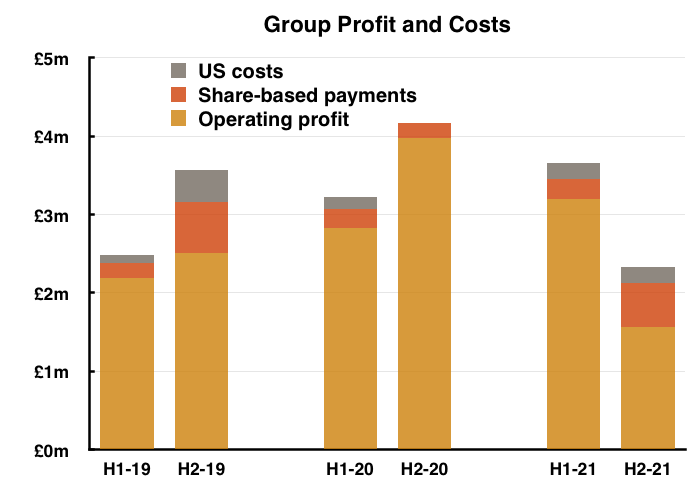

- …while operating profit returned to FY 2019 levels:

- Interpreting TSTL’s progress remains awkward.

- The comparable FY 2020 was bolstered by what management described during the webinar as “an element of [pandemic] panic buying“, while this FY was blighted by the pandemic curtailing orders.

- Confusing matters also was the NHS stock-piling for Brexit.

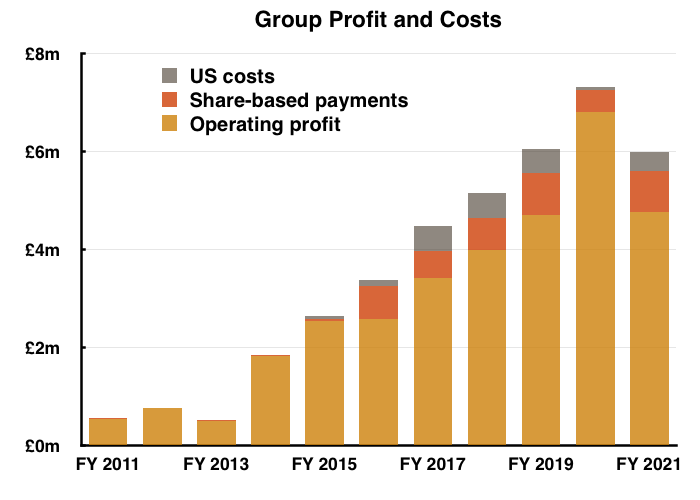

- TSTL’s reported profit was as usual distorted by:

- Notable share-based payments (see Share options below), and;

- Costs associated with the US regulatory project (see United States: FDA submission below).

- For the full year, operating profit before share-based payments and US costs fell 18% while operating profit after share-based payments and US costs fell 30%.

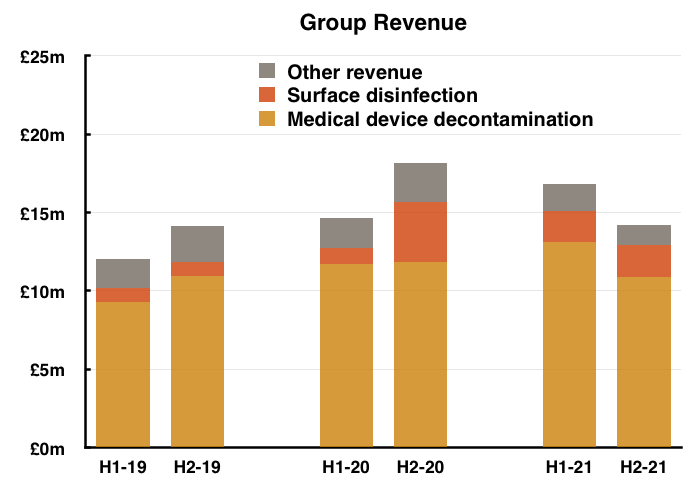

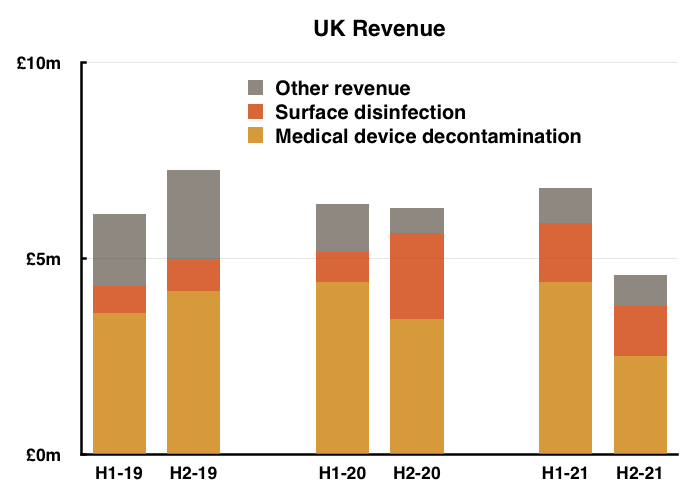

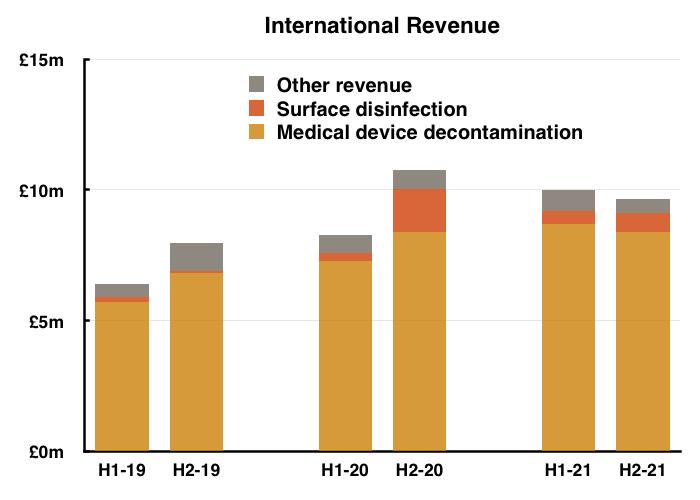

- H2 was weaker than the preceding H1 due to a disappointing UK performance.

- H2 group revenue was 15% lower than H1…

- …and H2 group operating profit before share-based payments and US costs was an estimated 36% lower than H1:

- The lacklustre UK performance meant overseas revenue represented a record 68% of group revenue during H2.

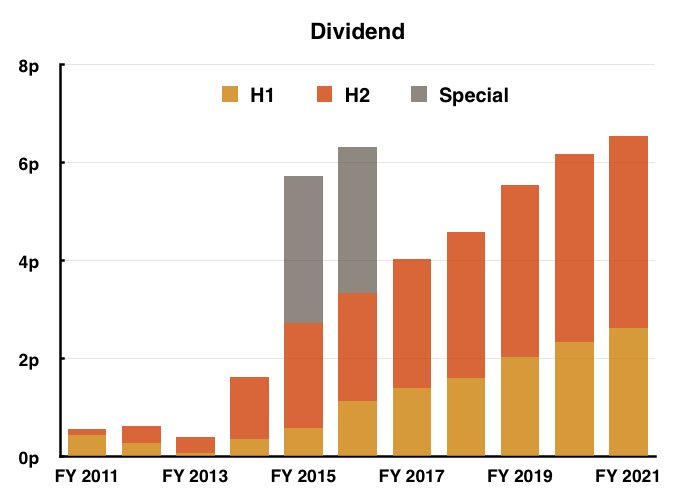

- The sole headline number moving in the right direction was the dividend, with the final payout up 2% versus up 12% for the H1 payout:

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Product revenue, non-core and MobileODT

- The FY 2020 reporting re-jig allocated revenue into three categories:

- The various wipes and foams used to decontaminate medical devices within hospital outpatient departments (e.g. nasendoscopes, cardio echo probes and tonometer prisms);

- The disinfectants used to clean hospital surfaces (e.g. bedside tables, mattresses and floors), and;

- Other products, including ‘non-core’ disinfectants for pharmaceutical cleanrooms and veterinary practices.

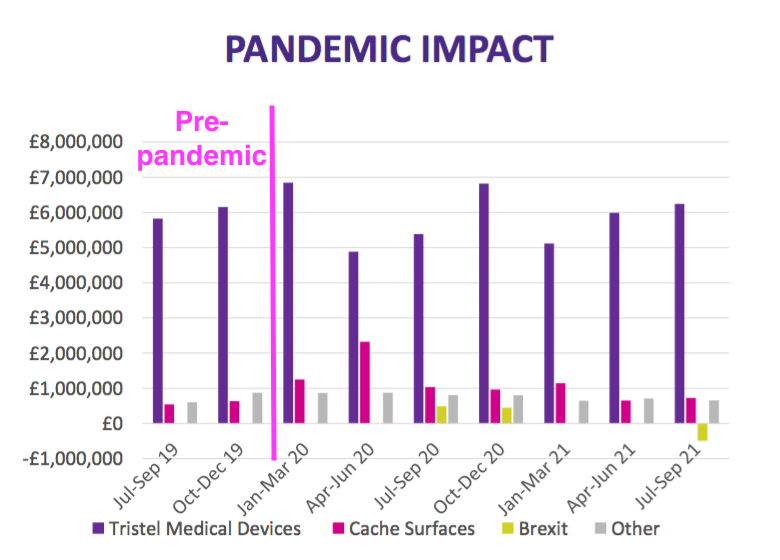

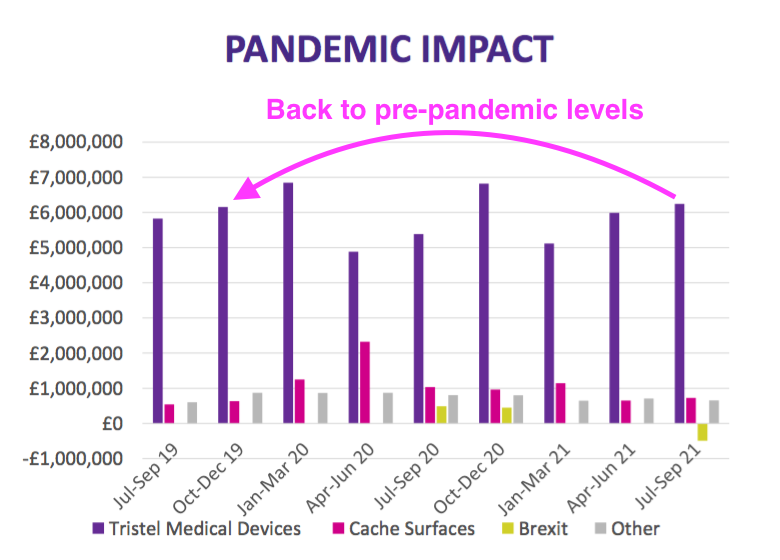

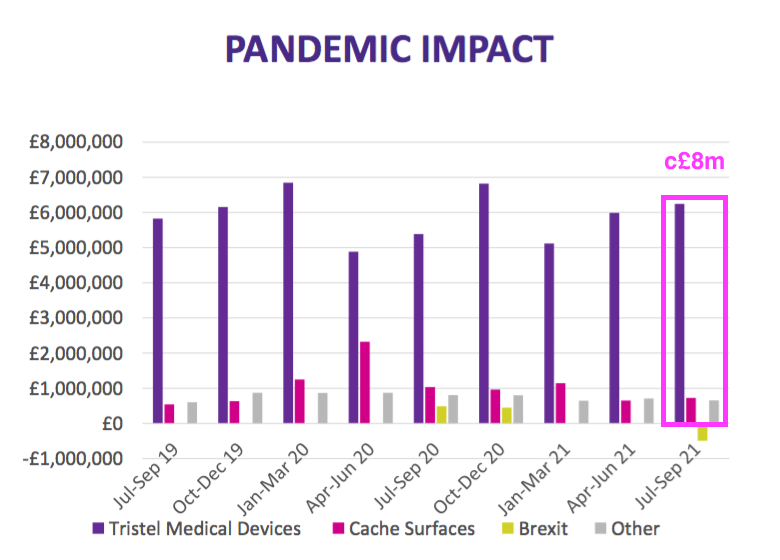

- TSTL commendably included an updated Pandemic Impact slide to highlight the ups and downs of each product category during FY 2020, FY 2021 and Q1 2022:

- Demand for TSTL’s medical-device wipes and foams is correlated to the number of hospital outpatient examinations, which reduced during the pandemic as resources were diverted away from outpatient departments.

- But TSTL noted a recovery may be occurring:

“During the first quarter of the current financial year, we can see that patient examinations in most of our markets are increasing“

- The Pandemic Impact slide suggested revenue from the medical-device wipes and foams had actually recovered to pre-pandemic levels:

- Revenue from surface disinfectants appears to have stabilised around the £0.7m per quarter level — less than the £1m per quarter level I had anticipated previously.

- Management said during the webinar that a new capsule range of surface cleaners called Shot had been launched after the year end and had enjoyed a “great response“.

- Hospitals before the pandemic had mostly used low-grade disinfectants to clean mattresses and tables, but TSTL now expects “the legacy of Covid-19 to be that hospitals will be more rigorous in their selection of the best performing and most scientifically validated disinfectant products“.

- Management implied during the webinar that surface-disinfectant revenue could effectively grow six-fold to catch up with the medical-device wipes and foams:

“Over time we anticipate that our surface-disinfection range will come to equal that of medical-device sales“

- Although management also said during the webinar that the medical-device wipes and foams would be the group’s “growth driver“.

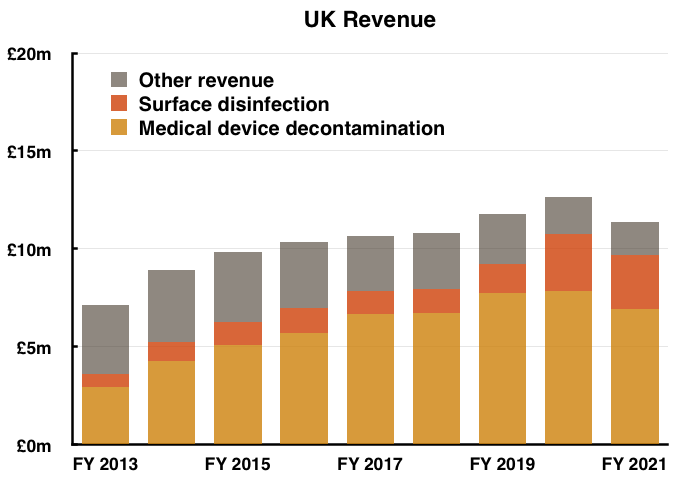

- The FY powerpoint re-introduced the disclosure of UK revenue for each product:

- Monitoring UK progress is important because the UK is by far TSTL’s most mature market and therefore serves as a guide for the sales potential of other countries.

- TSTL announced the welcome cessation of certain ‘non-core’ products:

“The remainder of our revenues derived from other chemistries and sectors outside of the hospital which we consider to be non-core, and it is our intention to discontinue many of these products in the current financial year because they are lower margin than our chlorine dioxide products and draw upon our resources disproportionately to the contribution they make to our financial and strategic objectives.“

- Non-core activities represented 8% of group gross profit during the year and management said during the webinar that “fairly significant cost savings” would be made.

- Discontinuing many non-core products ought to eventually make clear the true profitability of TSTL’s ‘core’ disinfectants.

- Mind you, the profitability of the core disinfectants may be hindered by a “substantial investment” to resolve some operational shortcomings:

“We identified that substantial investment must be made in our people and systems if we are to be capable of achieving our strategic objectives and be ready for our entry into the USA market. “

- An audit by the British Standards Institution revealed “certain weaknesses” within TSTL’s product administrative processes. The group’s response was:

“…to bolster our quality assurance and regulatory functions with new recruits, to bring in specialist consultants, and to direct all the resources of the Company to redress the weaknesses identified.“

- Management said during the webinar the remedies had cost £100k-150k during Q4 and, while the initial consultant expenditure has since reduced, new quality-assurance employees would have to be appointed.

- One product experiencing problems is MobileODT, a mobile colposcope in which TSTL invested £589k during FY 2017 and a further £120k during FY 2018.

- July’s update admitted the MobileODT developer had put itself up for sale but had attracted no buyers.

- These results showed the MobileODT investment written down to zero and an associated exceptional impairment charge of £807k.

- The ‘exceptional’ accounting contrasted to that of FY 2019, when the MobileODT investment was revalued upwards and the £98k gain was included within operating profit.

UK

- The re-introduction of UK-only revenue figures provided greater clarity as to how orders from TSTL’s largest buyer — the NHS supply chain — fluctuated during the pandemic.

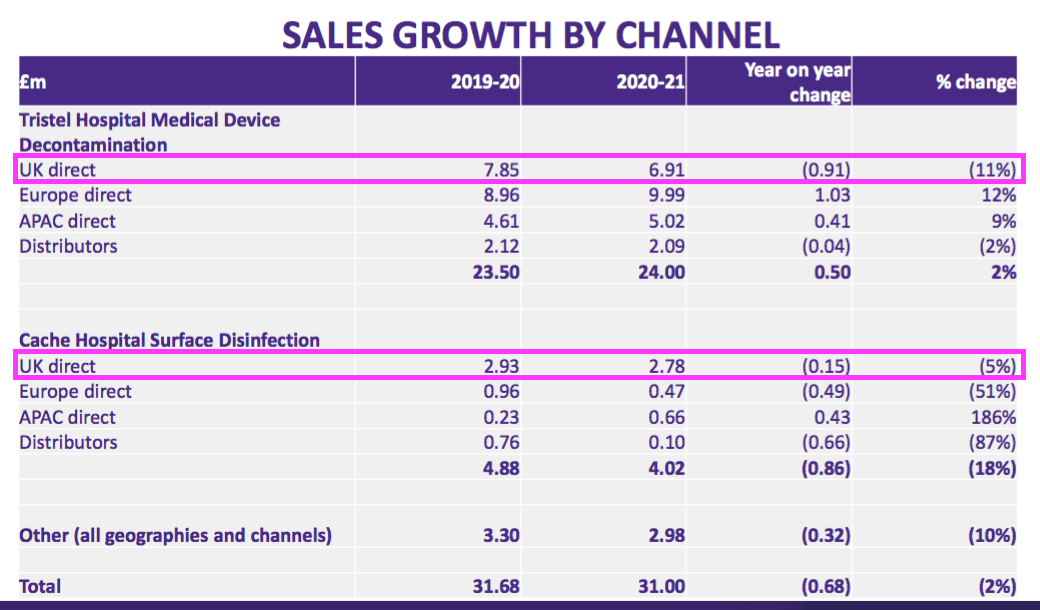

- Between FY 2019 (i.e. pre-pandemic) and FY 2021, UK revenue from medical-device wipes and foams fell 11% while revenue from surface disinfectants jumped 87%:

- February’s results had already stated the H1 performance was bolstered by NHS Brexit stock-piling…

“In preparation for [the Brexit] transition, last September the NHS purchased approximately £0.9m of Tristel medical device disinfectant products and has held them in a dedicated storage facility.”

- …and so H2 was always going to appear very weak:

- UK H2 sales of medical-device wipes and foams, at £2.5m, were in fact the lowest for either H1 or H2 for six years.

- Management said during the webinar that orders from the NHS supply chain, which apparently are normally between £100k to £200k a week, “dried up for ten consecutive weeks” at the start of H2.

- While orders from the NHS supply chain remain as unpredictable as ever, purchases from other UK customers appear to be growing.

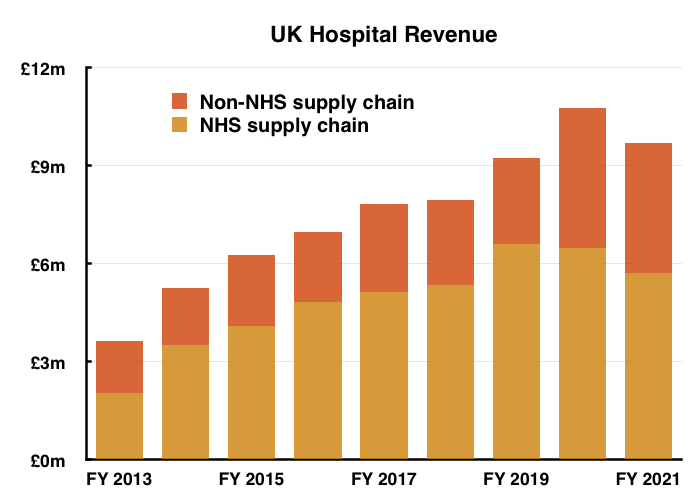

- TSTL discloses revenue from the NHS supply chain within its annual reports (point 7), and subtracting that revenue from total UK hospital-related revenue shows non-NHS supply chain income at £4.0m versus £2.7m for (pre-pandemic) FY 2019:

- I would welcome TSTL becoming less dependent on the NHS supply chain and enjoying greater sales direct from UK hospitals and/or through other (less powerful, more predictable) purchasers.

- Pandemic disruption, recent Brexit stock-piling, earlier Brexit stock-piling, other NHS bulk purchases and endoscopy reclassifications have made assessing underlying UK progress difficult over time.

“Slowing growth in the United Kingdom is due to the very high levels of market penetration”

- UK hospital-related sales have nonetheless since compounded at almost 7% annually.

- I will take anything close to a 7% CAGR for UK revenue during the next five years.

International

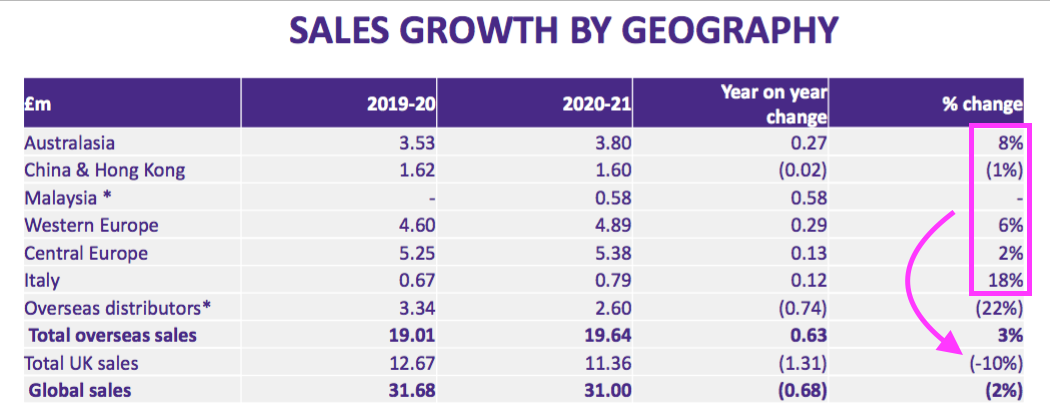

- The powerpoint showed every overseas market in which TSTL has a direct presence outperforming the UK:

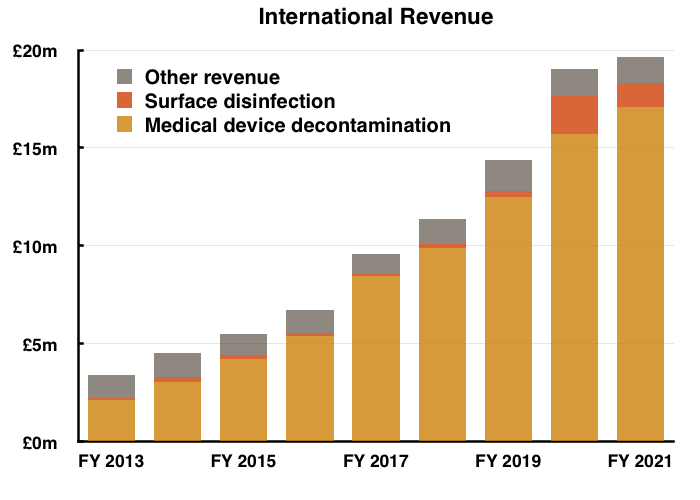

- Total FY overseas revenue gained 3%, with overseas hospital-related revenue advancing 4%:

- Unlike the UK, overseas H2 sales of medical-device wipes and foams broadly matched those of H1 and those of H2 2020:

- Management remarked during the webinar upon how the UK handled the pandemic differently to other countries:

“[Australia] managed Covid by closing down the country, and very different to how the UK managed Covid, which was not to close down the country and suffer the level of infections [the UK] did“

“[The overseas] markets took a different approach to Covid than we did in the UK. In the UK the outpatient departments were closed down, no sales teams were allowed to access hospitals. But internationally, in Europe and the [Asia Pacific] region, we did not have the same experience. We were still able to grow and take on new customers.”

- Among TSTL’s overseas subsidiaries, only TSTL’s central European division (mostly Germany) suffered a notably weaker H2:

| Overseas revenue (£k) | H1 2020 | H2 2020 | FY 2020 | H1 2021 | H2 2021 | FY 2021 | |

| Australasia | 1,700 | 1,830 | 3,530 | 1,900 | 1,900 | 3,800 | |

| China/Hong Kong | 620 | 1,000 | 1,620 | 800 | 800 | 1,600 | |

| Central Europe | 2,490 | 2,760 | 5,250 | 2,800 | 2,580 | 5,380 | |

| Western Europe | 1,750 | 2,850 | 4,600 | 2,400 | 2,490 | 4,890 | |

| Italy | 300 | 370 | 670 | 400 | 390 | 790 | |

| Malaysia | - | - | - | 200 | 380 | 580 | |

| Total in-house | 6,860 | 8,810 | 15,670 | 8,500 | 8,540 | 17,040 | |

| Distributors | 1,390 | 1,950 | 3,340 | 1,500 | 1,100 | 2,600 | |

| Total | 8,250 | 10,760 | 19,010 | 10,000 | 9,640 | 19,640 |

- TSTL’s overseas revenue has almost tripled from £6.7m to £19.6m during the last five years — a CAGR of 24%.

- International growth has been assisted by the acquisition of overseas distributors, the performances of which post-purchase have been impressive.

- Australasian sales (i.e. Australia and New Zealand) have since climbed 76% from approximately AU$3.9m to approximately AU$6.9m (five-year CAGR: 12%).

- Western Europe sales (i.e. Benelux and France) have since climbed approximately 80% from €3.1m to approximately €5.5m (three-year CAGR: 22%).

- Italian sales have since climbed 27% from €700k to approximately €892k (two-year CAGR: 13%).

- Management said in a previous presentation that TSTL supplies 35 overseas distributors, with the largest ten accounting for 80% of distributor sales.

- Total distributor revenue was £2.6m for this FY, which implies the largest distributors pay TSTL approximately £200k annually for stock and perhaps earn themselves revenue from hospitals of £400k.

- The remaining distributors therefore appear small and further significant distributor acquisitions would in turn seem unlikely.

- More likely would be distributors following the lead of the Malaysian operation, which joined TSTL of its own accord at the start of FY 2021 and delivered annual revenue of £580k.

- Various product approvals were obtained during the year for India, South Korea and Canada, although TSTL admitted the pandemic had made subsequent progress “slow“.

- Pandemic disruption aside, I would like to think the international division can sustain a double-digit growth rate during the years ahead.

Quality UK investment discussion at Quidisq. Visit forum.

United States: FDA submission

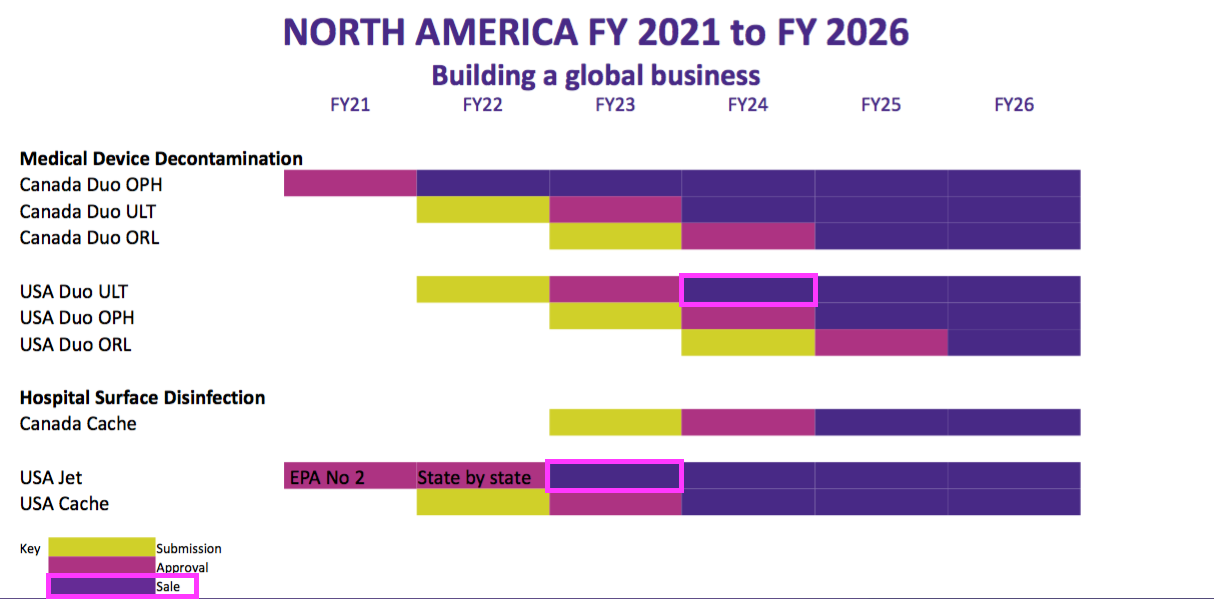

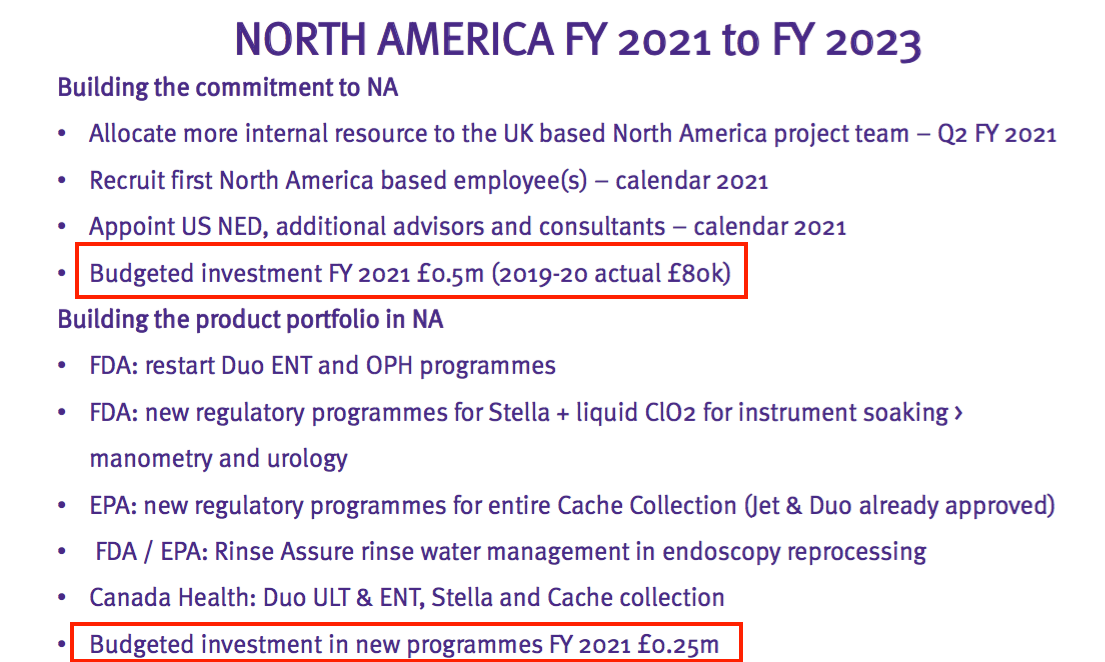

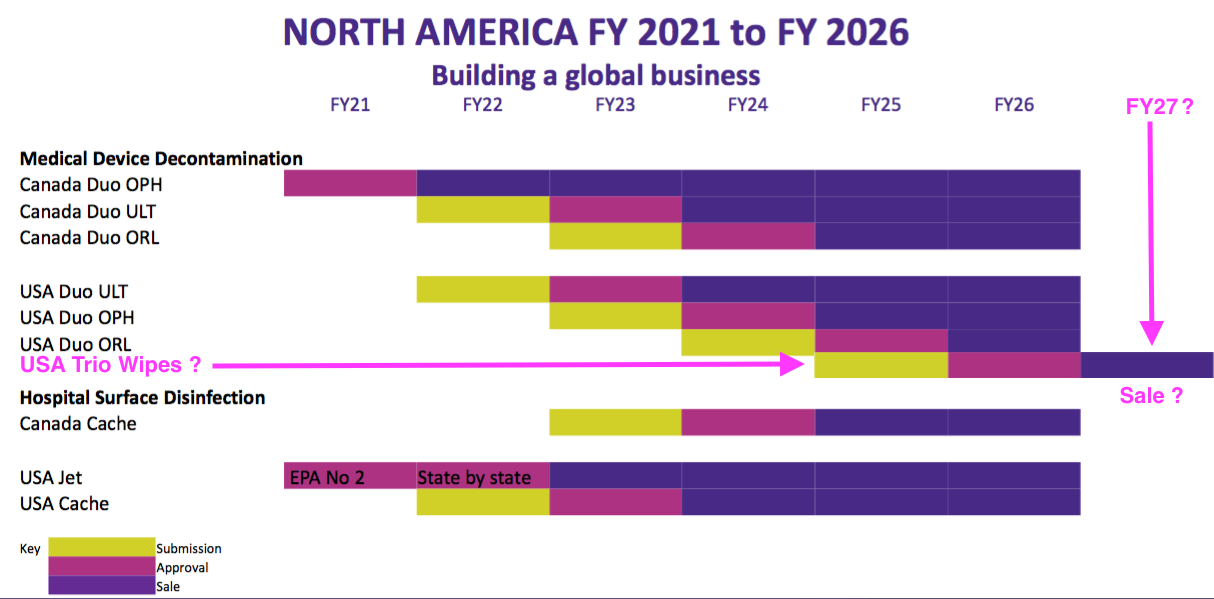

- These results were the first to include a timetable for product launches in the United States since TSTL withdrew all guidance on the subject more than two years ago.

- To recap, TSTL started its US regulatory approval process back in 2014 and bungled an FDA pre-application during 2018. A formal product application for FDA approval is still to be submitted.

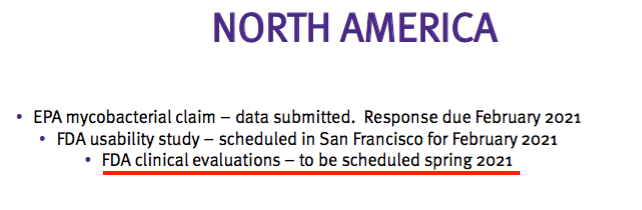

- TSTL said the only task left before making an FDA submission by 30 June 2022 was to undertake “short patient-side evaluations”:

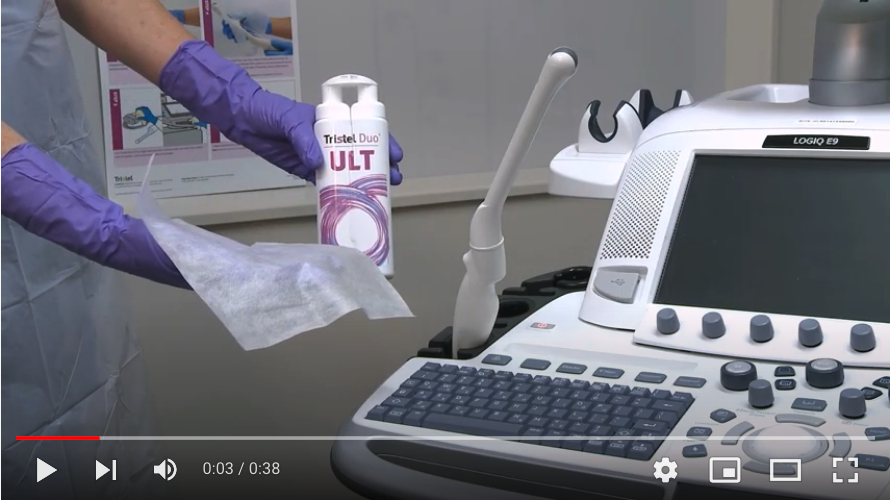

“We are confident that we will make our submission to the FDA for Duo for Ultrasound by 30 June 2022. The only caveat is that we can recruit two to three clinics in the USA to carry out short patient-side evaluations of the product. Only COVID-19 can complicate this. With a submission in this financial year, we can expect a decision from the FDA before 30 June 2023.“

- The slides showed US revenue from selling Duo for Ultrasound (ULT) could commence during FY 2024:

- US revenue from the lower-regulated surface disinfectants could meanwhile begin during FY 2023.

- The latest slides indicated the US plan had changed during the summer.

- February’s H1 presentation suggested US costs would be £750k this year:

- But costs were only £400k.

- The lower US cost probably related to the aforementioned “short patient-side evaluations“, which this time last year looked set for Spring 2021…

- …but will now be undertaken in the coming months.

- Management explained during the webinar the evaluations were required to prove the Duo ULT foam “works just as effectively in the clinical setting as it does in the laboratory“.

- Management also claimed to have successfully performed “two [clinical evaluation] dry runs” in the past and that the “only difficulty” was to “get access to clinics and hospitals” in the present Covid environment.

- Management confirmed during the webinar that the FDA submissions for the follow-up Duo OPH and ORL foams would each take only a year.

- Management said the follow-up submissions would take less time because the “great majority” of data generated for the current Duo ULT application could be re-used.

- Management gave the following insight into the US marketplace during the webinar:

“The science we have to generate for the FDA is to a level we have never had to present to a regulator anywhere else in the world. It will be one reason that in the United States there will be something like 20 disinfectants that are approved for use.

The majority of those disinfectants use a chemistry that has been largely stopped being used elsewhere in the world, and certainly throughout Europe, and so we might think some of the disinfection for medical-instrument practices that are still commonplace in the United States are rather arcane and that would suggest to us, with an approval, we will have an exciting opportunity ahead of us.“

- Total US project expenditure to date is now £2.2m.

- Adjusting for US costs allows shareholders to better judge the group’s underlying profitability. US costs are of course presently accompanied by no US revenue.

United States: market potential

- The re-introduction of a United States timetable prompts the following speculation about the country’s revenue potential.

- TSTL has only once issued a formal estimate of the possible size of the US market. From the FY 2016 results:

“Our estimate of the potential value of the North American ophthalmology market is approximately £8m and the North American ultrasound market approximately £10m. We have made no assessment of how much of this potential market we can penetrate, or of the timeframe. We have not yet attempted to value the potential market opportunity in surface disinfection and rinse water management.“

- The total £18m projection compared to then total sales of £11m for the group’s wipes, foams and surface disinfectants.

- Among TSTL’s high-level disinfectants, only the Duo foams — and not the Trio wipes system — feature within the current US plan.

- A June update said worldwide Duo sales were £4.3m during this FY, and perhaps one day replicating that £4.3m within the States is not a completely outrageous assumption.

- Management said during the webinar the scale of the US opportunity should be viewed against worldwide sales of Duo foams and Trio wipes, which together amounted to £24m during this FY.

- The US timetable slide implied the earliest the wipes could be submitted for FDA approval was FY 2025, with approval perhaps occurring during FY 2026 and initial revenue perhaps occurring during FY 2027:

- UK wipes and foams revenue was nearly £8m pre-pandemic, so perhaps US revenues could one day reach almost £40m.

- Management said during the webinar that TSTL typically views the US marketplace as between 10-12 times larger than the UK, which implies eventual US revenue of at least £80m.

- Management also confirmed during the webinar that the initial Duo product would be sold in the US at a price similar to that in the UK.

- If UK-US product pricing is similar, then the 10-12x US-to-UK market multiple is presumably based upon US hospitals undertaking twice as many patient procedures as UK hospitals.

- Perhaps the best guide to the US market is Nanosonics (NAN), the quoted Australian developer of the trophon machine…

United States: Nanosonics

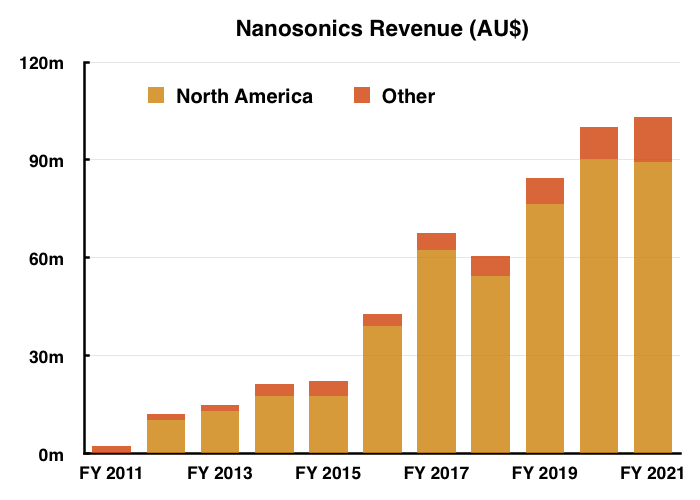

- NAN was established during 2001 and launched its trophon high-level disinfection machine in Australia during 2009:

- The trophon machine disinfects only ultrasound probes and its primary advantage over TSTL’s products is the seven-minute automated process that eliminates the potential for human error via manual cleaning.

- Sales of trophon in North America began during 2011 and the region now dominates NAN’s revenue:

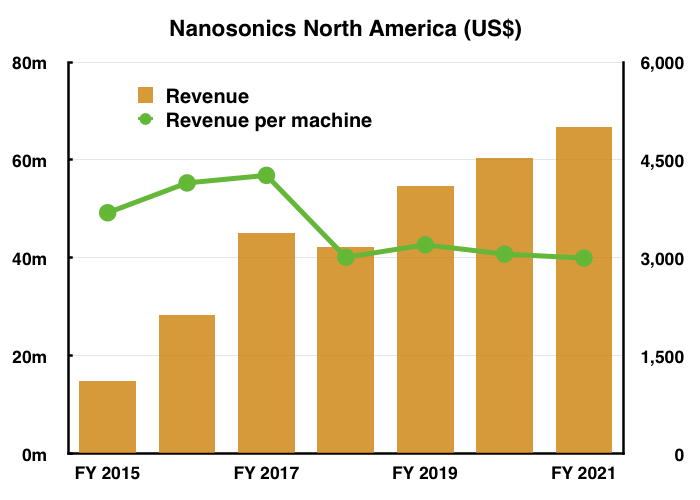

- More than 23,000 trophon machines are used presently in the States, with each generating NAN average revenue of US$3,000 a year (green line, right axis):

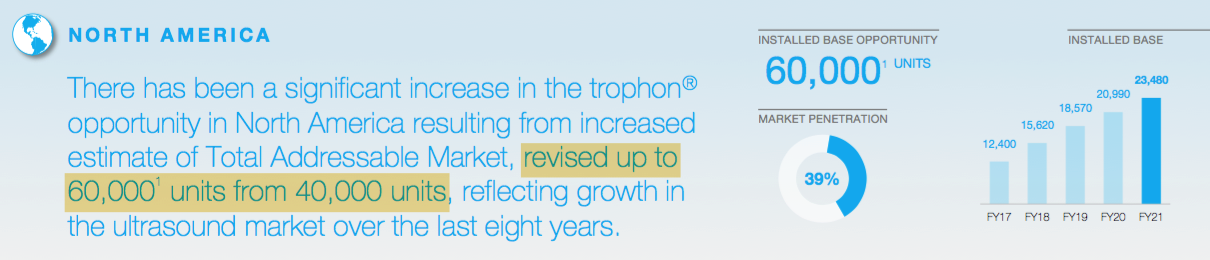

- NAN’s FY 2021 presentation claimed a “detailed analysis of the US ultrasound market” had revealed a 50% increase to the total market opportunity for trophon:

- The larger, 60,000 trophon-machine opportunity means NAN could earn further revenue of up to $108m a year from the States (i.e. the extra 36,000 or so machines multiplied by the average $3,000 revenue per machine).

- $108m is a significant sum for TSTL to target with its Duo ULT alternative to trophon:

- NAN’s 60,000 trophon-machine estimate implies the total US market for high-level ultrasound probe disinfection could be worth up to $180m.

- These $108m and $180m market estimates of course assume US hospitals will spend the same $3,000 a year on TSTL’s Duo ULT foam as they do currently on a trophon machine, which is probably unrealistic.

- Mind you, the US opportunity for TSTL should extend beyond ultrasound probes as the follow-up Duo OPH and Duo ORL products will decontaminate other medical devices.

- And beyond the Duo foams there’s also the Trio wipes system, which currently generates a multiple of Duo revenue worldwide.

- These US market-value estimates will remain academic until TSTL actually commences selling in the US, scheduled for FY 2023 with a surface disinfectant.

- Management was confident during the webinar of Duo ULT co-existing with trophon:

“[Nanosonics has] created an understanding that semi-critical ultrasound devices used for intra-cavity procedures do need to be high-level disinfected. Those clinics that have not bought a trophon will not be high-level disinfecting those instruments.

We are a completely different proposition, a completely different cost, we are portable, we are mobile, they are not, they are a fixed-installation machine.

I think there is plenty of space in the North American marketplace for I hope Nanosonics’ continued success and I hope for ours, too.”

Share options

- Significant share-based payments have featured regularly within TSTL’s accounts.

- Between 2016 and 2021, share-based payments reduced the aggregate reported operating profit by £3.6m, or 12%:

- This FY witnessed share-based payments reduce operating profit by £824k, or 15%.

- IFRS 2 requires all companies to calculate a share-based payment charge even if the options turn out to be worthless (i.e. the performance targets are not achieved).

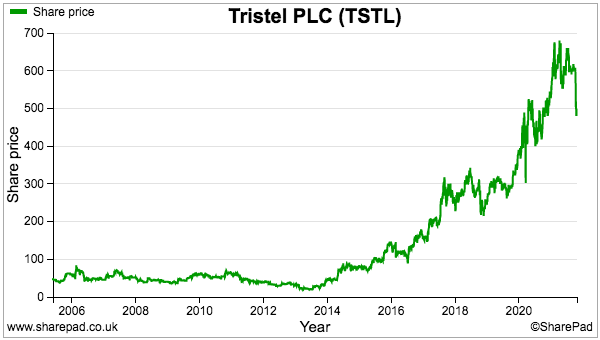

- TSTL’s (somewhat controversial) 2015 senior management options were granted when the shares were 96p and would vest if the price topped 134p.

- TSTL’s (less controversial) 2018 management options were granted when the shares were 275p and would vest if the price reached 350p, 425p and 500p.

- All the 2015 and 2018 options vested as the share price climbed from 96p to 500p.

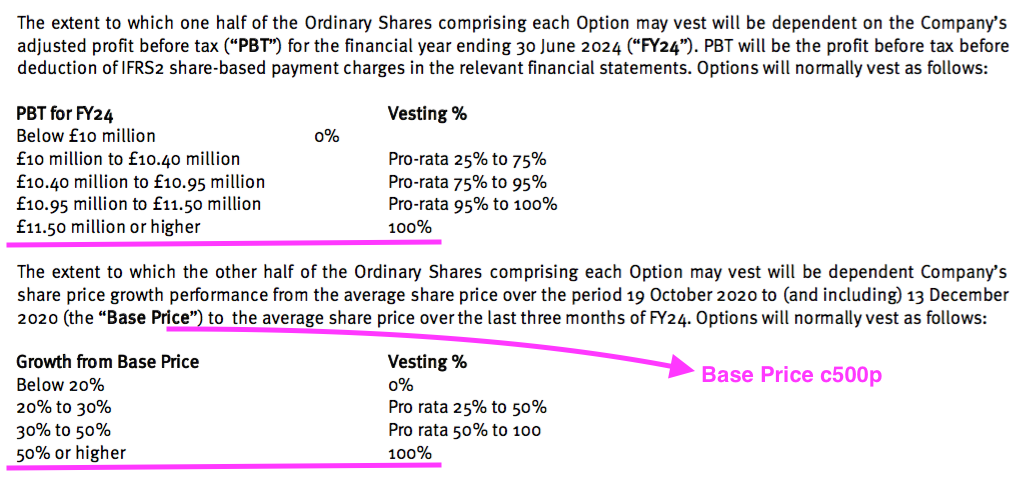

- These 800k options will vest in full if profit before tax (and share-based payments!) surpasses £11.5m and the share price tops c750p during FY 2024:

- Management expressed pessimism about the 2021 scheme during the webinar:

“The scheme [was] presented to shareholders with challenging targets and at the moment we’re not on track to hit those targets. So… there’s no prospect of that scheme delivering shares to us. It’s an incentive to push ourselves towards that position.“

- For any of the 2021 options to pay out, profit before tax and share-based payments has to reach £10m during FY 2024 (versus £5.4m for FY 2021) or the share price has to trade at a c600p average during Q4 2024.

- In brief, rather than view (potentially misleading) share-based payment figures as a cost, I instead alter earnings per share to use the fully diluted (48,535k) share count.

- Using the fully diluted share count negates adverse valuation surprises when options are excised and the share count increases.

- Last year option exercises lifted TSTL’s share count by 4%:

- Since 2013, the share count has increased by an average 1.9% annually due to exercised options.

- The value of the options can also be compared to the extra market-cap shareholders will enjoy if the options come good.

- For example, TSTL’s 2021 scheme requires a c750p share price to pay out in full. The scheme’s 800k options have a 1p exercise price and therefore will provide the directors with effectively free shares worth £6m (800k*750p) if the options all vest.

- TSTL’s market cap at 750p with the 800k options converted into shares would be £355m.

- Shareholders foregoing £6m while retaining a market-cap gain of £124m (£360m less £236m) does not seem completely outrageous.

Financials

- TSTL’s accounts remain in satisfactory shape despite the pandemic disruption.

- Cash conversion in particular was respectable:

| Year to 30 June | 2017 | 2018 | 2019 | 2020 | 2021 |

| Operating profit* (£k) | 4,023 | 4,645 | 5,549 | 7,240 | 5,586 |

| Depreciation and amortisation (£k) | 1,243 | 1,498 | 1,470 | 1,799 | 1,974 |

| Net capital expenditure (£k) | (959) | (1,450) | (1,347) | (2,380) | (1,767) |

| Working-capital movement (£k) | (530) | (520) | (780) | (1,453) | 324 |

| Net cash (£k) | 5,088 | 6,661 | 4,170 | 6,212 | 8,094 |

(*before share-based payments)

- For this FY and on aggregate during the last five years, net expenditure on tangible and intangible assets has been matched by the combined depreciation and amortisation expensed against earnings.

- A reversal of FY 2020’s stock building ensured a favourable working-capital movement.

- The year ended with cash at £8.1m, up £1.9m, after £3.9m was generated by the business, £1.0m was raised through options and £3.0m was paid as dividends.

- Management said during the webinar that cash had since advanced from £8.1m to £10m.

- Lifting the cash balance by £1.9m between July and October seems remarkable given the business produced free cash flow of £3.9m during the preceding twelve months.

- TSTL carries no bank debt and no final-salary pension obligations.

- The pandemic disruption understandably caused TSTL’s financial ratios to decline:

| Year to 30 June | 2017 | 2018 | 2019 | 2020 | 2021 |

| Operating margin* (%) | 22.3 | 23.2 | 23.1 | 23.1 | 19.3 |

| Return on average equity** (%) | 22.0 | 19.0 | 19.3 | 19.7 | 12.7 |

(*before for share-based payments and US costs ** adjusted for MobileODT impairment)

- The operating margin before share-based payments and US costs was 22% during H1 but was 16% during H2 — the lowest level since the 15% recorded during H1 2015.

- That said, the 16% H2 margin does not seem that awful given H2 suffered the full cost of the 16% workforce expansion TSTL announced during H1:

“During the period we increased global headcount by 31, from 164 at 30 June, to 195 at 31 December. We have bolstered our marketing, product management, product development, quality management and regulatory teams to prepare for the growth that we anticipate once hospital patient examinations return to their pre-pandemic levels in all countries, and the Cache product range is marketed globally.”

- The 16% margin was also achieved despite the aforementioned lowest UK sales of wipes and foams for six years and the aforementioned £100k-150k BSI-audit remedies.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Valuation

- TSTL did not adjust the financial guidance given for FYs 2020, 2021 and 2022.

- TSTL expected revenue to grow at an annual average compound rate of between 10% and 15% during those three years.

- Meeting the bottom-of-the-range 10% level requires FY 2022 revenue of £34.8m — £3.8m or 12% greater than revenue for this FY.

- Ignoring the Brexit stock piling, the earlier Pandemic Impact slide indicated quarterly sales are running close to £8m…

- …which suggests achieving £34.8m for the current (FY 2022) year may be a tall order.

- Government actions to alleviate NHS waiting lists — including opening clinics within shopping centres — may help the number of UK outpatient examinations to rebound and in turn revive demand for TSTL’s wipes and foams.

- Mind you, TSTL’s 500p share price appears to be looking well beyond what happens in the current year.

- The maximum £11.5m pre-tax profit target for FY 2024 within the 2021 option plan provides an optimistic medium-term benchmark.

- £11.5m after (then) 25% standard UK tax gives FY 2024 earnings of £8.6m or 17.7p per share on the fully diluted 48,635k share count.

- The 500p share price is 27 times my 17.7p per share FY 2024 calculation.

- The valuation sums could be fine-tuned further, but a 27x multiple for an optimistic FY 2024 outcome already tells a story.

- A premium share-price rating may well be justified if:

- TSTL’s collection of product patents, scientific papers, manufacturer agreements and regulatory approvals continue to underpin a worthwhile competitive ‘moat’;

- Covid-19 has created an irreversible trend of hospitals enhancing their cleaning and disinfection regimes;

- TSTL enjoys further meaningful growth within its established overseas markets, and;

- FDA approvals are eventually received, US sales take off trophon-style and the country’s ultrasound disinfection market really is worth up to $180m a year.

- Remember, too, that the latest option grant requires c750p to pay out in full.

- For now at least, I am hopeful my ten-bagger TSTL investment can continue to compound over the (very) long term as the company succeeds in the US in particular.

- But I recognise the share-price downside will be substantial were the ‘moat’ to evaporate and/or the US project fail completely.

- The 6.55p per share full-year dividend meanwhile supports a lowly 1.3% income.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Tristel (TSTL)

AGM statement published 13 December 2021

An update that raises questions that February’s H1 results will have to answer. Here is the full text:

——————————————————————————————————————

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, will hold its Annual General Meeting at 11am today at Lynx Business Park, Fordham Road, Newmarket, Cambridgeshire CB8 7NY.

Paul Swinney, Chief Executive Officer, will address the meeting with the following update:

“As the half progressed, in all our geographical markets sales have picked-up well as hospitals have gradually returned to normal service levels for diagnostic procedures.

We expect revenue to exceed £15m compared to £16.8m in the first half last year, noting revenue last year included a one-off sale of £0.9m to the NHS for Brexit-related inventory. This stock was released back to UK hospitals during this first half, creating a £1.8m period-on-period distortion.

Overseas revenues are expected to account for 64% of worldwide sales during the half compared to 60% in the comparable period last year. Reducing our exposure to the UK NHS by growing our existing overseas businesses and entering new geographical markets is a key objective for the Company.

Cash after the full-year dividend sits above £8m. Based on continued normalisation of hospital procedure numbers in the UK and elsewhere, which is clearly dependent on Covid-related updates, we are on track at this stage to be in line with market expectations for the year.”

——————————————————————————————————————

This statement was not as informative as last year’s AGM update, which gave an indication of H1 profit (alongside revenue) and also referred to the FDA programme. None of that for this year.

Why TSTL sometimes gives both sales and profit figures within AGM updates, but then sometimes gives just one or the other figure, has never been made clear. The inconsistency is not ideal and suggests the missing figure may not be too encouraging.

Anyway, H1 2022 revenue of the predicted £15m compares with £14.2m for the preceding pandemic-blighted H2 2021, so at least that is positive. The predicted £15m also compares to £14.6m for H1 2020, which was the final six months before the pandemic, which is also positive.

UK H1 2022 revenue appears on course for £5.4m, versus £6.8m for H1 2021 and £4.6m for H2 2021.

Adjust for the £0.9m Brexit stock-piling and I guess UK H1 2022 revenue would have been on course for £6.3m versus a Brexit-adjusted £6.1m for H1 2021.

Overseas revenue appears set for £9.6m, which is below the £10.0m for H1 2021 and equal to the £9.6m for H2 2021. So overseas sales may have stagnated, which is not great when “growing our existing overseas businesses” is a key company objective. But the standstill overseas performance could be explained by the pandemic and currency movements.

Post-final-dividend cash at more than £8m after half-year cash was £8.1m means cash generation during H1 is set to be approximately £1.7m. That does not feel spectacular, but could be due to FDA costs and/or general cash fluctuations (TSTL did say cash was £10m during the October presentation).

All told, I get the feeling “we are on track at this stage to be in line with market expectations for the year is management code for ‘expect a stronger H2’.

Maynard

Tristel (TSTL)

Publication of 2021 annual report

Here are the points of interest

1) CHIEF EXEC REVIEW

A few extra paragraphs included in the annual report that were omitted from the original RNS:

The extra text contained no great revelations.

2) STRATEGIC REPORT

A few snippets of useful text.

a) Confirmation of the financial impact of Covid-19 and Brexit:

My blog post above does not refer to the £2m of medical-device disinfectant sales that were lost due to Covid-19. But the £2m was mentioned in the 2021 slides. My blog post did mention the Brexit impact.

b) Administration expenses:

Useful text explaining reduced costs that total £0.6m:

c) KPIs

The seven KPIs used are unchanged from 2020:

d) British Standards Institution audit

Confirmation of the BSI-audit non-conformances as mentioned in the blog post above:

e) Covid-19 Risk

The text below incorrectly refers to surface-disinfectant sales for 2020:

Sales of surface disinfectants for 2021 fell from £4.9m to £4.0m.

f) Supply chain

For 2020, TSTL mentioned stock-piling extra components and raw materials for up to 4-6 months. But nothing similar for 2021:

3) DIRECTOR BIOGRAPHIES

A couple of snippets:

a) Finance director:

The FD now holds the role of UK Managing Director:

b) New non-exec

New NED offers useful experience at Johnson & Johnson:

Unlike many AIM shares, TSTL does have useful and diverse non-execs. The five NEDs have backgrounds in healthcare, packaging, accountancy, intellectual property law and marketing.

4) DIRECTOR REMUNERATION

More snippets:

a) New LTIP

Bit sad TSTL does not disclose the full LTIP terms in the annual report. Shareholders have to visit the website for the full details:

b) Pay

Executive salaries unchanged from 2020 and no bonuses:

Pensions a hefty 15% of salaries though. Total remuneration (excluding options) not out of the ordinary for an AIM company given reported operating profit reached almost £7m for 2020. I would like to think profit will first show a meaningful recovery before the directors enjoy meaningful pay rises and bonuses.

c) Options

800k options from the latest LTIP are now outstanding after all the other options were exercised:

Text says the directors exercised all of their options during July 2021, which contradicts this RNS confirming option exercises during March:

Expiry dates of the options exercised within the table above are 7 January 2021 and 30 June 2021. As such, all of the options should have been exercised before the stated July 2021. TSTL’s option reporting requires further investigation.

Options for the non-execs (a corporate governance no-no) have now all disappeared.

5) CORPORATE GOVERNANCE

Various snippets here:

a) Strategic goals

Retrospectively added “deemed equivalent to any automated process” to one of the original September 2020 goals:

b) Environmental and social issues

Lots of new text for the ES part of ESG:

Installation of LED lights could be helpful for fellow portfolio member FW Thorpe.

But no SECR information!

c) Succession planning

A new paragraph for 2021:

Succession planning was first mentioned (I think) in the 2020 report, so progress has been made for when the time comes.

d) KPIs

A new paragraph for 2021; confirmation the board does look at the KPIs:

e) Meeting attendance

The chairman missed two meetings and the new non-exec missed one:

f) Audit committee

Perhaps not the greatest omission, but TSTL’s reports continue to lack a proper audit-committee report:

g) 2021 strategic goals

One goal from 2020 was omitted for 2021:

The 2020 annual report disclosed the following as the fourth goal:

“To replicate the market penetration achieved in targeted clinical areas in the UK in all overseas markets. Whilst this is difficult to measure, the Company has achieved overseas sales growth of 32% which is clear evidence that good progress is being made towards this goal.

Perhaps this goal was dropped because it is “difficult to measure“.

h) Board functioning review

All new text for the 2021 report, which includes a snippet on succession planning:

6) AUDIT

Nothing too concerning with the auditors.

a) Overview

Materiality at the standard 5% of profit and the same key audit matters as 2020:

b) Key audit matter: revenue recognition

Minor change to the text for 2021; this time no mention of LTIPs perhaps influencing a misstatement:

c) Subsidiary audit

One subsidiary underwent an intriguing audit due to “specific individual risks“:

Table in d) below shows this particular subsidiary generated nil revenue, so could be India or USA?

d) Scope

Audit scope covered an acceptable 80%-plus of the group:

One subsidiary not subject to a full scope audit represented up to 8% of revenue/profit/assets, which seems a lot.

e) Going concern

This line was new for 2021 — the auditor offers its “most likely” adverse risk:

f) Detection of fraud

All new boilerplate audit text for 2021 covering fraud:

7) ACCOUNTS

a) New accounting regulations

A few new regulations on the horizon, but nothing expected to impact TSTL:

b) Largest customer

Confirmation of the largest customer, the NHS supply chain, reducing its purchases from £6.5m to £5.7m during the year:

c) Missing segment tables

Unfortunate that TSTL omitted the asset/liability segment tables for medical-device decontamination and surface disinfectants, which were included for 2020:

d) Operating costs

Cost of inventories recognised as an expense of £5.7m:

The £5.7m represents 18% of revenue and is the lowest ever proportion. The figure was 19%-21% between 2017-2020 and 25%-plus before that. The 18% goes a long way to explain why TSTL should fundamentally be a high-margin business (it can buy goods for 18p and sell them for 100p). Plus, any inflationary input costs may not have a dramatic effect on TSTL’s profitability.

The £5.7m also compares to year-end stock of £4.3m, which implies stock turn is 4.3/5.7 = c270 days or 8-9 months, which I guess reflects some Brexit stockpiling. Stock-turn was c200 days or less between 2014 and 2019.

Research expenses rebounded to £727k to almost match the £739k for 2019. TSTL has spent £3.6m on research during the last five years.

e) Employees

Stagnant sales and an increased workforce meant employee productivity ratios went backwards:

Sales per employee at £164k compared to £193k for 2020 and were the lowest since 2015 (£152k). Total staff costs less director pay absorbed 29% of revenue, versus 28% for 2020 and extending the rising trend seen since at least 2015 (24%).

The proportion of staff in marketing remains at c38%, but the proportion of administration staff has increased from 26% to 30% since 2017 while production staff has reduced from 37% to 32%. Production efficiency on the factory floor has therefore sadly been counterbalanced by extra admin.

f) Audit remuneration

The auditor enjoyed a nice 25% basic fee increase to £190k:

g) China losses

Small-print on tax losses suggests the Chinese operation lost money last year:

h) Lease liabilities

Discounted lease liabilities of £5.9m compare to the associated right-of-use asset of £5.4m, which suggests TSTL is not obviously on the hook for onerous lease payments for assets that could now be leased a lot cheaper.

Total lease payments of £992k versus total non-discounted lease liabilities of £7m imply lease terms averaging just 7 years.

i) Goodwill headroom

The discount rate applied to test the value of acquired goodwill has reduced from 21% to 14%:

The reduction reflects TSTL’s lower cost of capital, and increases the net present value of the discounted cash flow sums used to determine whether the goodwill retains its carrying value.

Upshot: impairments are less likely with a lower discount rate.

According to the small print, the Australian subsidiary may be worth £1.2m + £4.5m = £5.7m:

The French, Dutch and Belgian subsidiaries may now be worth £6.2m + £14.8m = £21m:

And the Italian subsidiary may now be worth £1.0m + £2.3m = £3.2m:

j) MobileODT

The small-print revealed MobileODT is struggling:

k) Stock provision

A £116k stock provision is equivalent to only 3% of the total stock held and does not indicate a great risk of product obsolescence:

l) Trade and other receivables

Trade receivables of £3.8m after a provision of just £24k and equivalent to 12% of revenue provide no immediate concerns:

The 12% proportion revenue contrasts with 15%-19% between 2013 and 2020, and implies customers have settled invoices faster than usual. I suspect the proportion will increase as sales rebound, but for now customer payment collections look fine.

The trade receivables of £1.5m that are past due are equivalent to 4.6% of revenue and in line with the 4%-5% seen during 2017-2019. The £2.6m/8% figure for 2020 seems an aberration, and did not translate into notable write-offs for 2021:

m) Trade and other payables

Offsetting customers paying their invoices faster is TSTL paying its suppliers faster:

Trade payables of £1.4m is equivalent to 4.6% of revenue and the lowest proportion since at least 2010 and compares to a usual 6-8%. I suspect the proportion will increase as sales rebound, but paying suppliers early to maintain sufficient stock levels and preserve good customer service rarely does much harm.

Maynard