21 February 2023

By Maynard Paton

Results summary for Mincon (MCON):

- A very satisfactory performance buoyed by healthy post-pandemic orders, showing revenue up 27% and profit up 18% to set new H1 records.

- Positive progress was reported throughout the group, with construction-related sales up 55% helped by greater demand for specialist drilling.

- The long-awaited Greenhammer system has won its first commercial contract and now offers “transformational potential” to MCON and the mining industry.

- Greenhammer and other new developments may hopefully improve MCON’s financials, given the group’s modest margin, significant stock level, net debt and poor cash conversion.

- The shares do not appear outrageously expensive on a possible 16x P/E, although the group’s expansion led by the dominant family owners has yet to deliver superior returns to outsiders. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own MCON

- Results summary

- Revenue, profit and dividend

- Sector divisions

- Customer case studies

- Greenhammer

- Large-diameter hammer prototype and subsea drilling

- Financials: Margin

- Financials: Stock

- Financials: Cash flow and net debt

- Financials: Return on equity and revenue per employee

- Valuation

News links, share data and disclosure

News: Interim results and presentation for the six months to 30 June 2022 published 08 August 2022, Greenhammer commercial contract published 05 September 2022 and Q3 trading update published 01 November 2022.

Share price: 90p

Share count: 212,472,413

Market capitalisation: £191m

Disclosure: Maynard owns shares in Mincon. This blog post contains SharePad affiliate links.

Why I own MCON

- Designs and manufactures industrial drills, with sales supported by established reputation, engineering excellence, technical innovation and tip-top service.

- Boasts veteran family management with 46-year tenure, 56%/£108m shareholding and very long-term perspective.

- Offers higher earnings potential through supplying a buoyant mining sector, greater direct sales, prospects of larger construction contracts plus “transformational” new products.

Further reading: My MCON Buy report | All my MCON posts | MCON website

Results summary

Revenue, profit and dividend

- Optimistic outlook commentary within the preceding FY 2021 statement…

“Our order books for 2022 remain healthy as the markets remain strong. We are passing on inflationary manufacturing cost, such as increases in energy cost, through price increases to customers. The Group continues with the momentum from H2 2021 into 2022.“

- …that was reiterated within May’s Q1 trading update…

“We have carried the positive revenue momentum from H2 2021 into the first quarter of 2022, while continuing to build on our order books during this quarter, driven by the strong underlying demand for our products across the Construction, Mining and Waterwell/Geothermal sectors.“

- …had already indicated these H1 2022 figures would deliver positive progress.

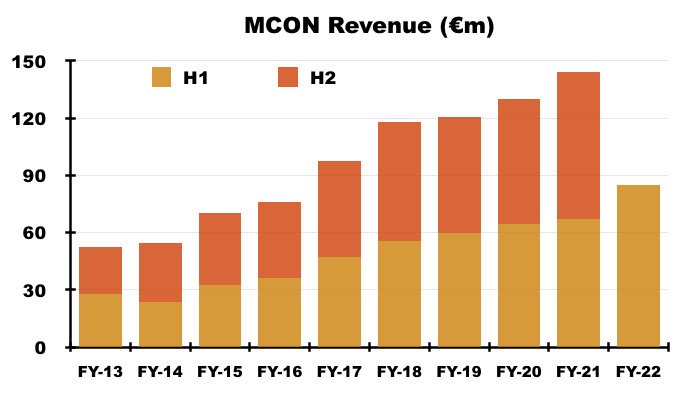

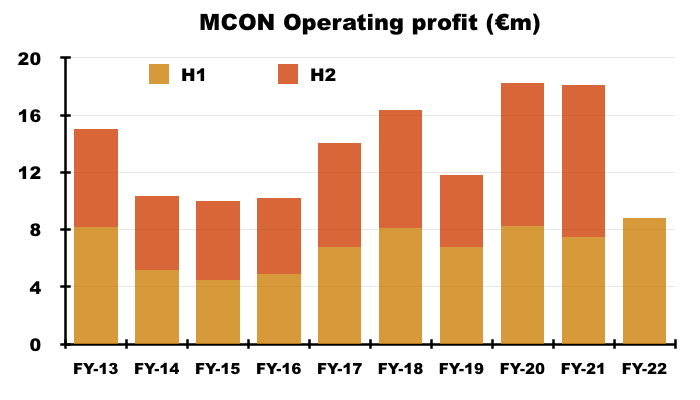

- Both revenue and profit in fact registered new H1 records.

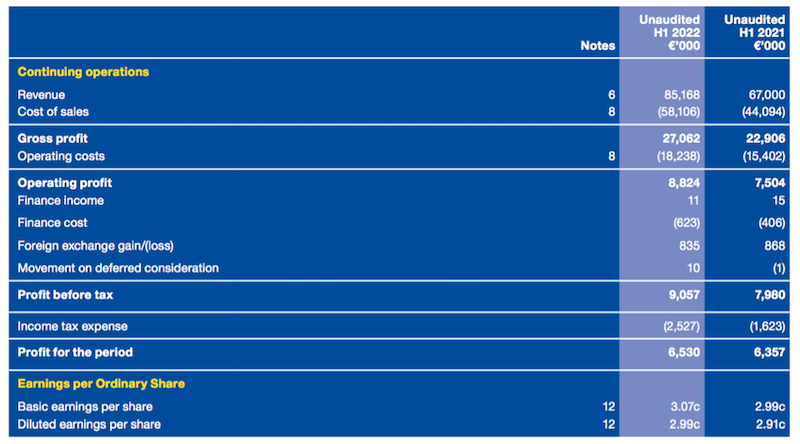

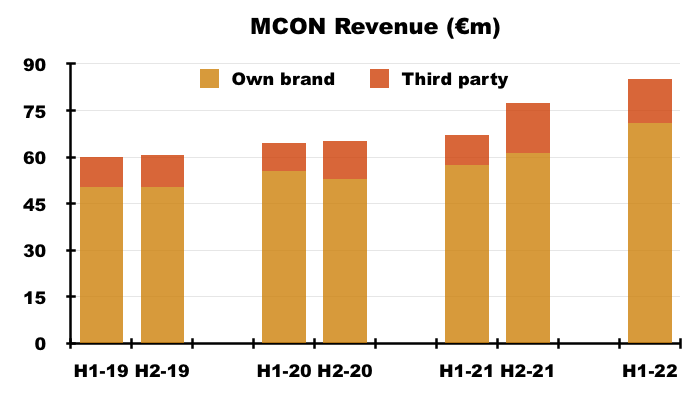

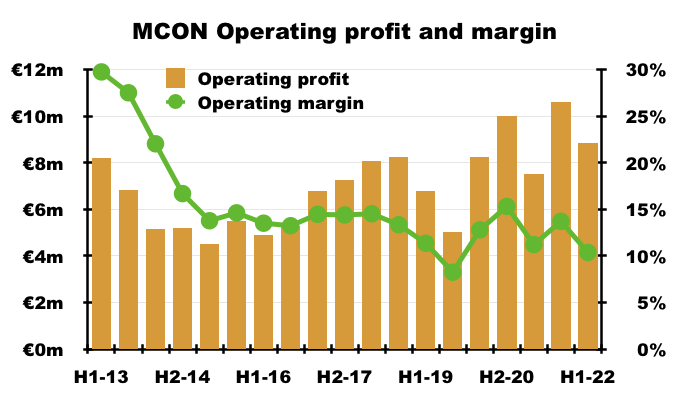

- H1 revenue gained 27% to surpass €85m while H1 operating profit advanced 18% to reach almost €9 million:

- MCON said the “vast majority” of growth had been organic, with favourable currency movements and small acquisitions last year and this year complementing the performance.

- MCON confirmed the sales uplift was driven by “increased output from our factories“, although price increases for customers had yet to filter entirely into the accounts:

“The price increases we have introduced have been rolled out gradually across the regions, with the majority of planned increases being fully introduced towards the end of the period.“

- Profit growth therefore lagged revenue growth as MCON absorbed higher costs before passing them on to customers:

“We have experienced inflation on all fronts; in manufacturing, procurement of non-Mincon manufactured product, employee costs and operational costs in the regions in which we operate.”

“…there is a lag between cost increases and price increases, and therefore we have absorbed some of the increased costs during the period.”

- Costlier air freight and external manufacturing were among the additional expenses required to keep customers happy:

“To ensure timely delivery to our customers, we continued to transport high volumes of our own product by air. We also outsourced some manufacturing to ease the pressure within the factories.“

- The logistical headaches prompted greater levels of stock…

“Sea freight conditions remain challenging, with no improvement in sight, so we will continue our current policy of holding high levels of finished goods inventory so that we can give our customers the excellent service that they expect from Mincon.”

- …and the elevated stock position continues to raise doubts about MCON’s inherent economics and the reinvestment requirements to deliver higher earnings.

- Note the bumper growth rates were magnified by the comparable H1 having suffered Covid-related interruptions such as this:

“At the beginning of the year [2021], including all of January and most of February, we experienced interruption in our manufacturing in some of our plants due to the pandemic. The largest impact was at our hammer factory in Shannon. Our capacity in the Shannon plant was severely disrupted, with a 35% reduced manufacturing workforce during those initial months of this year.”

- The only mention of the pandemic during this H1 concerned greater travel expenses after Covid restrictions eased.

- Sales of MCON’s own-brand equipment gained 24% versus the comparable H1 and were up an impressive 15% on the preceding H2:

- Due mostly to an acquisition, sales of third-party equipment jumped 48% versus the comparable H1.

- Selling third-party equipment helps MCON satisfy a wider range of customer orders, but derives much lower margins then selling own-brand products.

- The profit performance was distorted slightly by government grants, the nature of which MCON did not make clear:

“The Group recognised €194,000 in Government Grants during H1 2022 (H1 2021: €307,000). These grants differ in structure from country to country, they primarily relate to personnel costs.“

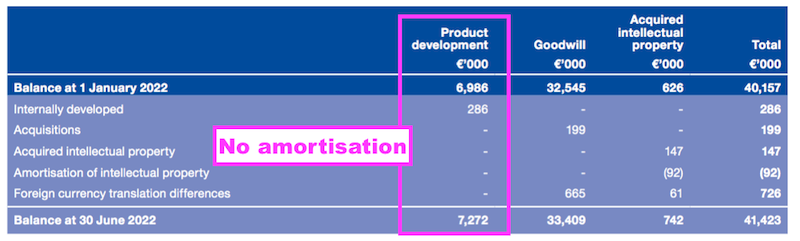

- Reported profit could also be fine-tuned for capitalised R&D spend without an associated amortisation charge (see Greenhammer).

- All told, MCON’s financials did not showcase obvious ‘moat’-like qualities despite the group’s dedication to “innovative engineering and industry-leading quality” and an “overall strategic objective… to develop [a] long-term sustainable competitive advantage with our products and services” (point 4a).

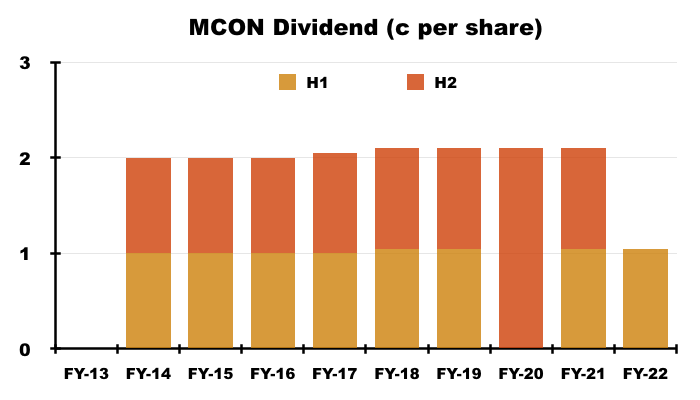

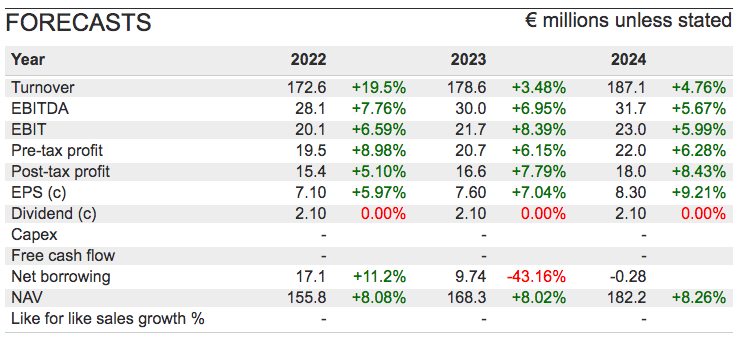

- The H1 dividend was set at 1.05 eurocents a share and puts the annual payout on course for 2.10 eurocents for the fifth consecutive year:

Sector divisions

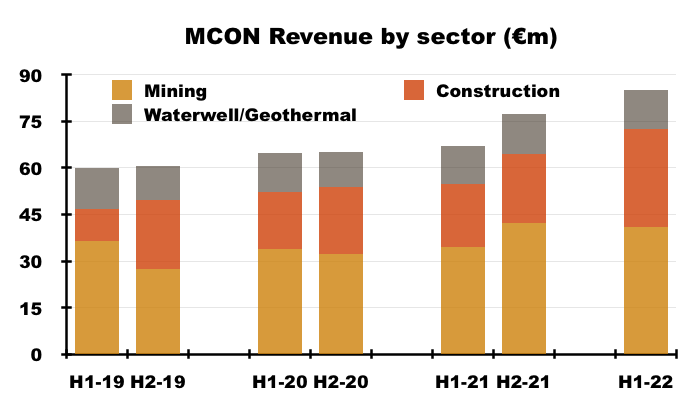

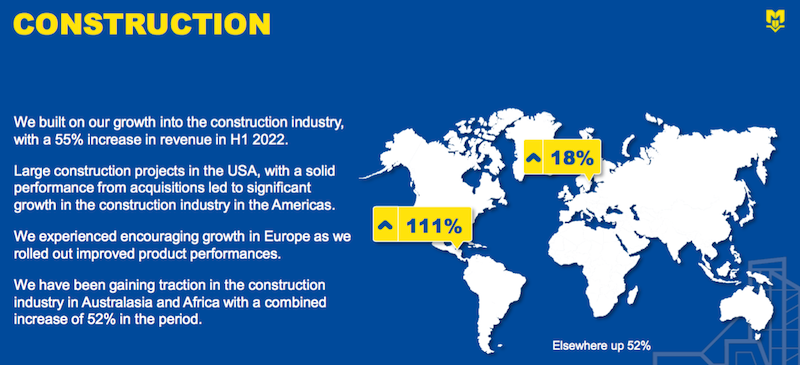

- MCON’s three sector divisions each enjoyed a positive H1:

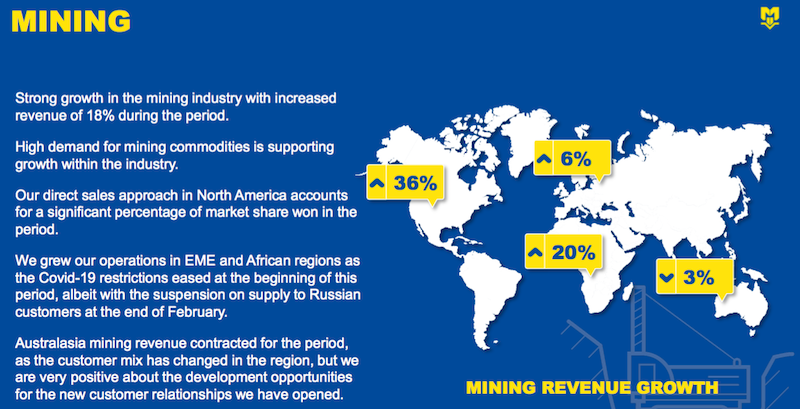

- MCON said “high demand for mining commodities” helped sales of mining drills gain 18% to €41m:

- “The return of large construction projects in North America” propelled construction-related sales up 55%:

- The construction division has shown superb progress during recent years, with revenue of approximately €31m during this H1 exceeding the division’s FY 2019 revenue of €30m.

- MCON’s construction division was effectively formed during FY 2017 following the purchase of Finnish operator PPV.

- Since then further acquisitions and new products such as the Spiral Flush have helped construction revenue grow to represent 37% of group sales:

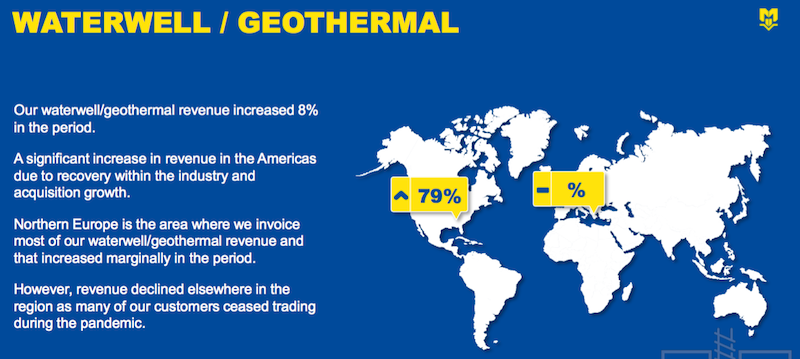

- A post-pandemic recovery helped revenue from waterwell/geothermal drilling advance 8%:

- MCON’s 2021 annual report (point 3b) claimed the group enjoyed a “dominant” market position within the European geothermal industry.

- Helping matters generally is MCON’s strategy to sell equipment direct to its end customers rather than through intermediaries. The group said three years ago:

“We are differentiating ourselves from the less developed businesses in low margin activities in the sector, and we are positioning ourselves to deal directly with end customers and to win large contracts.”

“Going forward we plan to… seek long-term partnerships and multi-year contracts with end customers incorporating direct delivery to their sites.”

Customer case studies

- MCON’s website showcases informative case studies that underline the advantages of the group’s equipment.

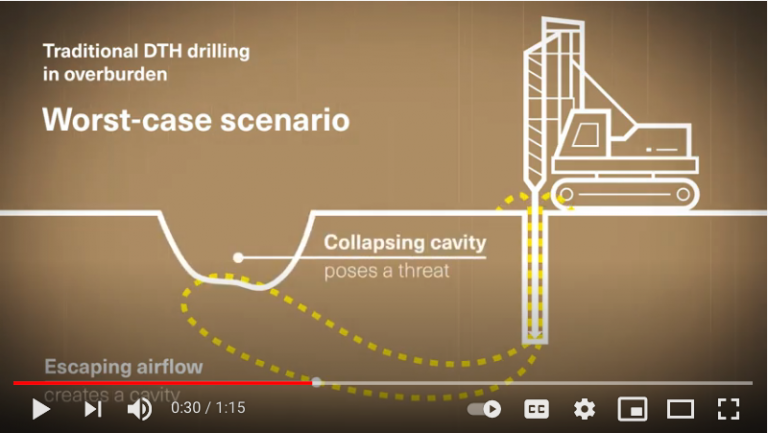

- Reinforcing the Melo dam in Finland for example required specialist drilling:

“The most obvious challenge during the project planning was to avoid disturbing the soil masses of the dam during the renovation: conventional drilling would risk discharging high-pressure air into the surrounding ground and possibly weaken the dam.“

- MCON offered a solution…

“The team at our Geotechnical Centre was asked to offer an interlocked retaining wall solution that would ensure the safety of the dam while still being cost-effective and quick to deploy. The solution chosen by engineers at KFS and PVO turned out to be Mincon’s integrated M-Wall ring bit casing system, which is purposely designed for building pipe-pile walls safely and quickly – even in technically demanding ground conditions like those in Melo.“

- … and work progressed very well:

“All of this has resulted in exceptional progress at the Melo hydroelectric site and work being completed much earlier than initially anticipated as drilling operations are estimated to finish several months ahead of schedule.“

- This 6m11s video provides a wonderful overview of the drilling involved:

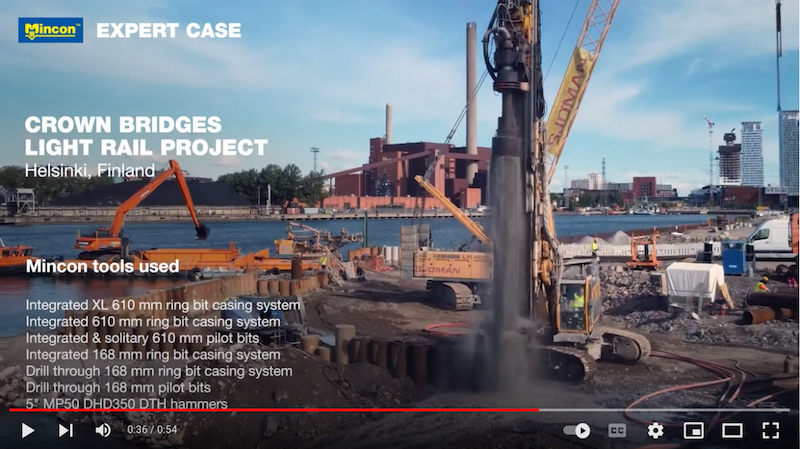

- Another Finnish project involving MCON’s equipment is the Crown Bridges Light Rail system:

“The Crown Bridges Light Rail (Kruunusillat) project is one of the biggest infrastructure projects in Finland in recent years…

“Construction started in 2021 and Mincon’s drilling expertise has played a significant role. With the foundations of the bridges drilled right at the shore banks using the DTH method, it is important that air flow is controlled. Our patented Spiral Flush technology prevents the air from escaping into the soil, thus making the drilling safer in complex ground conditions, like seashores in this case. This was well observed by the constructor company, YIT, which compared Mincon’s Spiral Flush ring bit system with a competing wing bit alternative without air control.“

- The Crown Bridges site manager reports:

“Based on what we’ve seen, the difference in durability of the current pilots and the previous systems is substantial. With Mincon’s products, we gain efficiency and cost savings, even though the point price of one pile is higher.”

- MCON’s MP40-MQ hammer has meanwhile been put to good use by BAM Ritchies, the UK’s largest drill and blast contractor:

“A drill rig operator at a Bam Ritchies limestone quarry in the north of England has managed to achieve a total depth of more than 28,000 metres without incurring stoppages for maintenance or breakdowns – a record depth for a single hammer at this site.“

- MCON implied the MP40-MQ lasted four times as long as BAM’s previous set-up:

“On average, operators at the quarry in expect to achieve approximately a quarter of that service life from their drill string before stopping for rebuild maintenance or replacement.”

- MCON emphasised the MP40-MQ’s financial and environmental benefits:

“In this instance, the benefits of a more reliable DTH hammer allowed drillers at Bam Ritchies to increase drilling productivity by an extra 600 metres per week; finishing jobs faster, servicing more sites, and increasing revenue – which translates into reduced costs and lower CO2 emissions.

With this single hammer, Mincon has proven that investing in high-quality, premium drilling equipment is easily offset by longer-term savings through lower maintenance and running costs.“

Greenhammer

- This H1 revealed good progress with MCON’s most exciting new product.

- After the preceding FY 2021 statement revealed the Greenhammer system had delivered “outstanding” test results, this H1 confirmed discussions were underway with a potential customer:

“We have made some good progress on the Greenhammer, and I am very pleased to report that we are in discussions with a major mining contractor in Western Australia on commercialising the system and we hope to have a further update on this shortly.”

- MCON also talked of Greenhammer making a “significant impact” on the wider industry:

“This is the culmination of many years of development work, and we are confident that it can have a significant impact on both Mincon and hard rock surface mining more generally. This Greenhammer development has not gone unnoticed by the mining industry in Western Australia, who are keen to monitor the performance of this new system.”

- Less than a month after this H1 statement, MCON announced Greenhammer’s first contract and reiterated the system’s “transformation potential“:

“Mincon is pleased to announce the signing of the first commercial contract for the Greenhammer system.

This milestone is the culmination of many years of development work and is the first step toward revenue generation with a unique drilling system that has a transformational potential for Mincon and the hard rock surface mining industry. The Greenhammer contract is with a blue-chip mining contractor operating on a major gold mine in Western Australia.“

- MCON said this first contract had the potential to become a “multi-million-euro” deal, with initial revenue expected to have been recognised during H2 2022:

“The contract provides for the mobilisation of the Greenhammer system to be run on a Mincon-owned test rig as well as a full Mincon team to support drilling blastholes on an agreed price per metre drilled. The Greenhammer system is expected to be onsite at the mine and generating revenue early in Q4 2022.“

- The Greenhammer system had been under development for some time. It was first mentioned within the FY 2016 results while the FY 2018 results said development had started seven years prior.

- The FY 2018 statement described the new drilling system as…

“[A] disruptive technology, offering tremendous savings in fuel, with an ambitious planned partnership programme in our customer base”.

- …and suggested the design could enjoy a strong competitive advantage:

“This is not a small system or easily replicable, and we have placed patents around the system to protect it. The system is more than just the hydraulic hammer; it includes all the drill string and the supporting on-rig infrastructure and handling.”

- Further information about Greenhammer and its first paying customer is frustratingly hard to find online.

- MCON has published limited pictures of Greenhammer, too:

- MCON will presumably promote Greenhammer’s “transformational potential” to the wider mining industry (and shareholders) once the system is proven to work on a commercial basis.

- Google Patents does not shed obvious light as to which patents Greenhammer employs.

- MCON capitalised Greenhammer development costs of €0.3m during this H1, taking total capitalised development expenditure since FY 2016 to €7.3m:

- Not a eurocent of that €7.3m expenditure has to date been charged against earnings. But amortisation ought now to commence given the system has entered commercial use.

- The associated useful life is a reasonable 3-5 years (point 16).

- The €7.3m expense represents 7% of the €98m aggregate operating profit before exceptional items reported since the capitalisation began during FY 2016.

Large-diameter hammer prototype and subsea drilling

- MCON remained upbeat about its large-diameter hammer prototype:

“Once Malaysia re-opened for travel, we made a trip to see how our large hammer and bit prototype had coped with the drilling conditions. We were pleased to see that they were in excellent condition which augurs well for the future of this product for large diameter drilling.“

- The preceding FY 2021 statement had claimed the prototype had drilled the “largest holes ever… with a single hammer“…

“Another testing success was the drilling that was carried out in Malaysia with our new large diameter hammer system to drill 1750mm diameter rock socket friction piles. We believe that these are the largest holes ever drilled with a single hammer.“

- …while the 2021 annual report said the prototype could be “transformational” for the wider industry (point 1b):

“One of our most recent innovations has been the large diameter, down the hole hammer. This was recently successfully tested on a pile-boring project in Malaysia. With a drilled hole diameter of 1,750mm, we believe they are the largest diameter holes ever drilled with a single down the hole hammer system. It has achieved penetration rates that are a multiple of times faster than those achieved with existing methods. With sustained productivity rates at these levels, this system can be transformational for the large diameter piling industry, especially in areas of high building density, such as Hong Kong.”

- The trial customer appeared pleased with the results to date:

“The customer is waiting to inform us of the next project to use the system and we will get Mincon personnel onsite to oversee operations. There remains a lot of interest in this system from the large-diameter piling industry.”

- MCON’s seabed drilling venture remains at a very early stage:

“Our Subsea project progresses well, and we have successfully developed a small-scale prototype water-powered hammer and bit. This is an important early step, as this design will be the cornerstone of our offering, once we can develop a commercial solution on successful completion of the Disruptive Technologies Innovation Fund (DTIF) project on which we are working with our consortium partners.“

- MCON’s robotic drill aims to overcome the disadvantages of current subsea drilling, namely: slow installations, complex hammers, dependence on large support vessels and limitations with certain seabed geologies.

- MCON added that it had also made “good progress on an overall commercial solution with our Subsea partners” and was “on track for offshore testing“.

- The subsea drilling ought to help install offshore wind farms, and the wider renewable-energy industry is on MCON’s radar. The 2021 annual report disclosed the search for a relevant non-exec (point 9a):

“They should also have experience and knowledge of the renewable energy sector as the Committee agreed that this sector was one which was likely to be a significant growth market for the Group in coming years.”

- This 1m50s video has more on the subsea project:

Financials: Margin

- I bought MCON shares during 2015 partly because of the group’s then attractive 19% operating margin:

“[H]igh margins underpin the notion that MCON has a respectable competitive advantage. The group converted 19% of revenues into profit during 2014 and above 20% during 2011, 2012 and 2013.”

- But the margin has since bobbed between 10% and 15%, with this H1 showing revenue converting into profit at the lower end of that range:

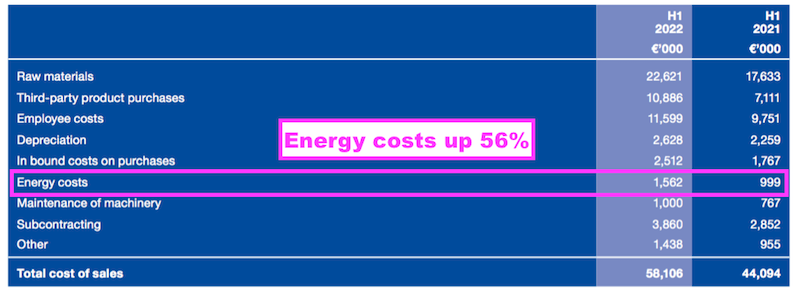

- As well as costlier air freight and additional external manufacturing, MCON noted energy costs (indirect as well as direct) also hurt its margin:

“The increase in our raw material costs has had the most significant impact on our manufacturing margin for the period. The cost increase is mostly due to our raw material suppliers passing on their increased production energy costs to their customers.“

“Our own manufacturing energy costs also significantly increased in H1 2022, particularly in our European manufacturing plants, as these costs soared across the region.“

- MCON commendably lists its major operating costs:

- Energy costs adding an extra €562k did not seem that dramatic given MCON’s frequent reference to that particular expense within the results commentary.

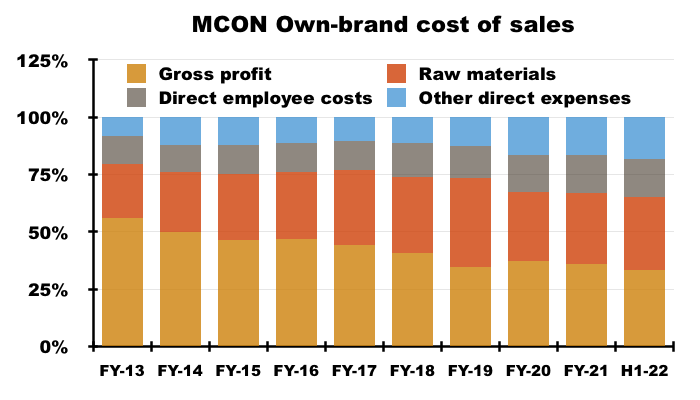

- MCON’s long-term margin decline has been caused by the greater cost of sales for its own-brand equipment:

- Since FY 2014, the gross margin on own-brand equipment has dropped from 50% to 33% due to:

- Raw materials increasing from 26% to 32%;

- Direct employee costs increasing from 12% to 16%, and;

- Other expenses increasing from 12% to 18%…

- …of own-brand revenue.

- My question to management about MCON’s operating margin at the (online) 2021 AGM elicited the following (paraphrased) response:

“The 20% margin of the past was achieved on much lower revenue when the company was manufacturing only part of the drill string and the more profitable DTH [down-the-hole] drills represented a greater part of the business.

Today the company manufacturers the full drill string, and as such has been able to win large direct contracts and therefore increase profit. That said, 14% is not our level of ambition.”

- Following the 2013 flotation, MCON has acquired at least 15 businesses to broaden its product range in order to serve customers direct….

- …and in doing so has evolved from operating as a niche, high-margin drill manufacturer with perhaps modest growth prospects into a wider, middle-margin drill supplier with possibly larger growth prospects.

- MCON was hopeful of a margin improvement during H2:

“Through the anticipated impact of passing on price increases to customers, raw material supply pressures unwinding and a normalisation of product mix with the sale of more Mincon-produced product, the Group is confident of improving this margin performance in the second half of the year.“

- But November’s Q3 update hinted H2 margins may not improve as much as previously expected:

“We introduced price increases in H1 2022 across all markets and regions of the Group. While the effect of these in the past quarter has improved margins compared to the first half of 2022, they have been offset to some extent by higher energy prices in our factories and energy related surcharges on raw materials. Nevertheless, we remain positive about achieving an improved margin percentage for the second half of this year.“

- Although skewed by sales of third-party equipment, a sub-15% operating margin since FY 2015 is not really commensurate with MCON’s focus on tip-top engineering and the annual report citing:

- Highest design specifications;

- Best manufacturing methods and processes, and;

- Delivery of superior products to our customers.

- MCON’s aforementioned Greenhammer comments include an interesting reference that may have a bearing on past and future margins:

“The contract provides for the mobilisation of the Greenhammer system to be run on a Mincon-owned test rig as well as a full Mincon team to support drilling blastholes on an agreed price per metre drilled.”

- I now wonder if MCON’s lower margin reflects the changing nature of the services supplied and the way customers are billed.

- MCON had previously sold its equipment mostly to intermediaries, but the group’s direct-sales approach may now involve providing equipment, manpower and other services…

- …with customers paying on a performance basis that leaves MCON with all the financial risks that can arise from under-priced contracts incurring operational difficulties.

Financials: Stock

- The aforementioned logistical headaches prompted even greater levels of stock:

“Sea freight conditions remain challenging, with no improvement in sight, so we will continue our current policy of holding high levels of finished goods inventory so that we can give our customers the excellent service that they expect from Mincon.”

- Significant levels of stock have long been an unfortunate feature of MCON’s balance sheet.

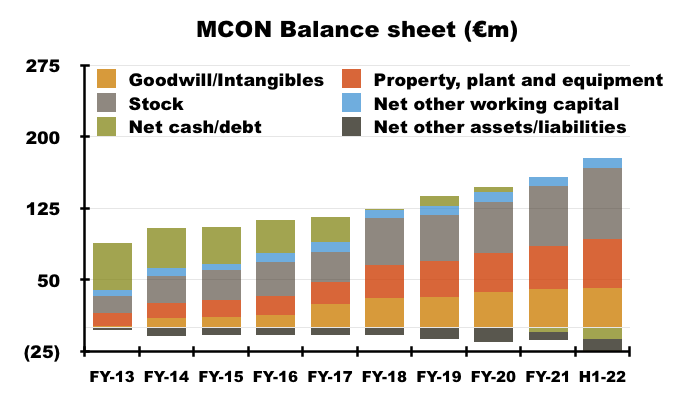

- Stock has grown from 21% (€18m) to represent 49% (€74m) of the group’s net asset value between FY 2013 and this H1:

- This H1 witnessed stock increase by more than €11m to €74m, equivalent to 46% of trailing twelve-month revenue.

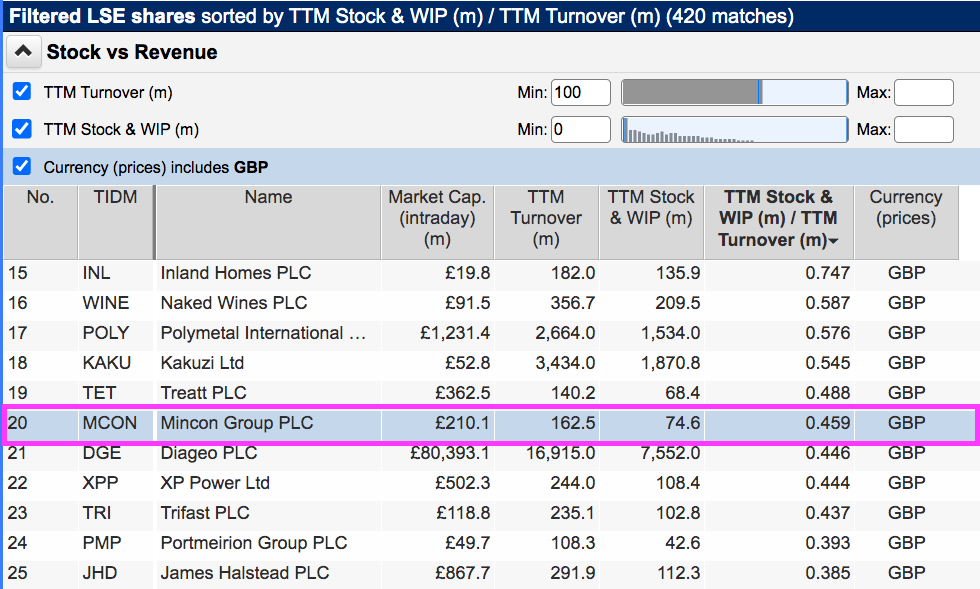

- For some perspective, SharePad shows MCON ranked 20th out of 420 companies with revenue of £100m or more on a stock-to-revenue basis:

- The majority of shares ranked higher within that SharePad list are house builders, which are inherently asset-dominated businesses.

- But notable stock levels can feature at ‘quality’ companies, with Diageo on the list ranked 21st and James Halstead ranked 25th.

- Carrying large amounts of stock can nonetheless mean a company:

- Manufacturers slow-moving items that carry a greater risk of obsolescence;

- Applies inefficient working practices, and/or;

- Will require greater cash investment into extra stock to support future growth.

- At least MCON’s stock is not perishable and write-downs during this H1 were small:

“The Group recorded an impairment of €87,000 against inventory to take account of net realisable value during the period ended 30 June 2022 (30 June 2021: €NIL).“

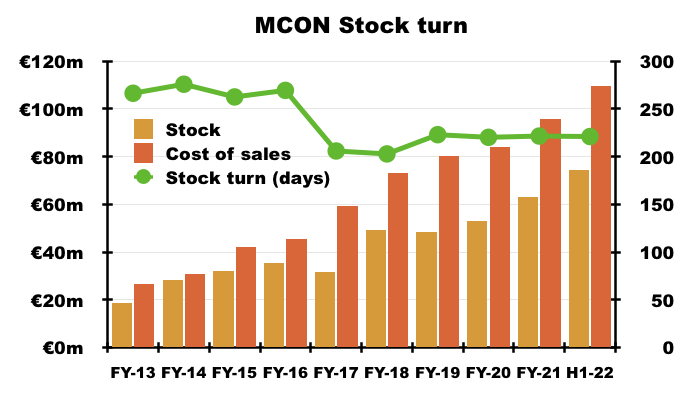

- Stock turn has improved over time but remains lengthy. Average stock employed during the last twelve months divided by cost of sales incurred during the last twelve months gives 220 days (7-8 months):

Financials: Cash flow and net debt

- The extra stock investment extended MCON’s record of poor cash conversion.

- Between FYs 2017 and 2021, aggregate operating profit of €79m translated into operating free cash of only €23m.

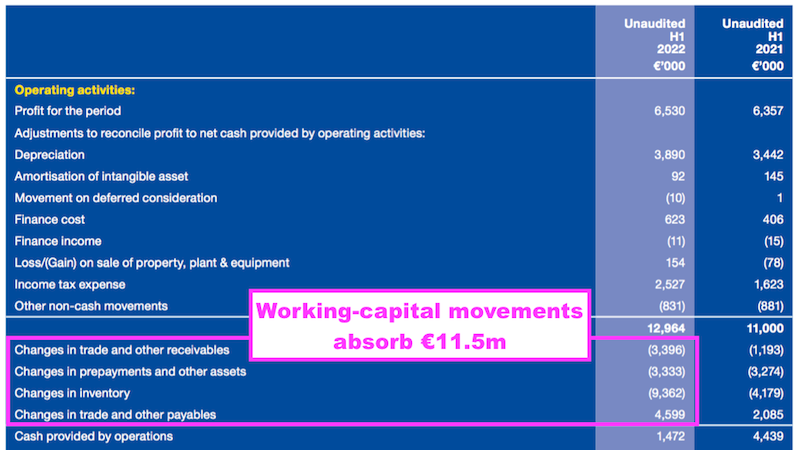

- Operating cash flow for this H1 was €12.9m, of which an enormous €11.5m was absorbed by working capital:

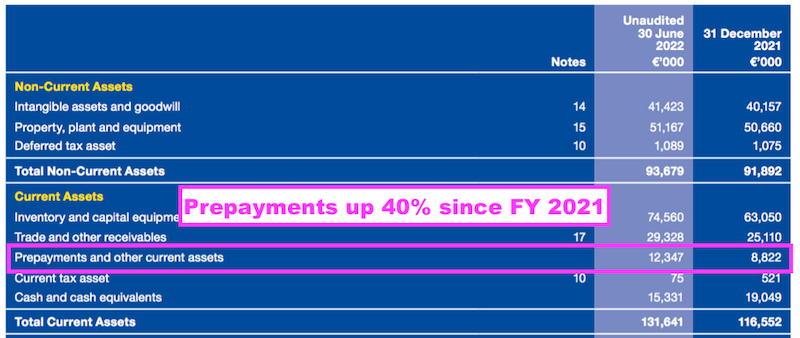

- Note that €3.3m of that €11.5m was used to fund prepayments for factory equipment and similar.

- Such prepayments now stand at a not insignificant €12.3m, which does not suggest MCON has fantastic purchasing power with certain equipment suppliers:

- At least trade and other receivables at €29.3m do not appear overly large at approximately 18% of trailing twelve-month revenue.

- The working-capital investment alongside interest of €0.6m, tax of €1.8m, net capex of €2.0m and acquisition spend of €1.4m left free cash flow at a negative €4.3m.

- Dividends of €2.2m were therefore effectively funded via extra debt, and helped leave net borrowings (excluding finance leases) €7.6m heavier at €12.0m.

- Total gross bank loans stood at €27.3m versus cash of €15.3m, which is not perfect but not truly alarming either.

- The 2021 annual report disclosed interest on bank debt was payable at a reasonable 3.4% (point 21).

- But operating with net debt is never ideal, and how far MCON will increase its borrowings remains to be seen.

- The H1 commentary tried to reassure shareholders:

“We remain prudent in our approach to borrowing, particularly during inflationary periods. However, we have borrowed further across the Group in the period and have used this additional lending to finance the commissioning of plant and equipment in our factories, and to support our working capital requirements in the regions where we have experienced a surge in demand for our products.“

- But demands on cash flow are not expected to alleviate during the near term.

- Indeed, commitments for future capital expenditure stand at €4.7m, while €4.1m remains payable to clear earn-outs from previous acquisitions.

- Expenditure on further acquisitions cannot be ruled out either.

- At least MCON’s accounts are not complicated by defined-benefit pension obligations.

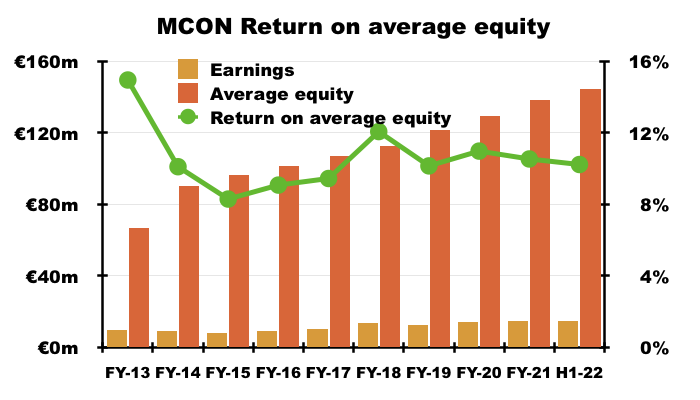

Financials: Return on equity and revenue per employee

- MCON’s modest margins and hefty asset expenditure continue to translate into approximately 10% returns on equity:

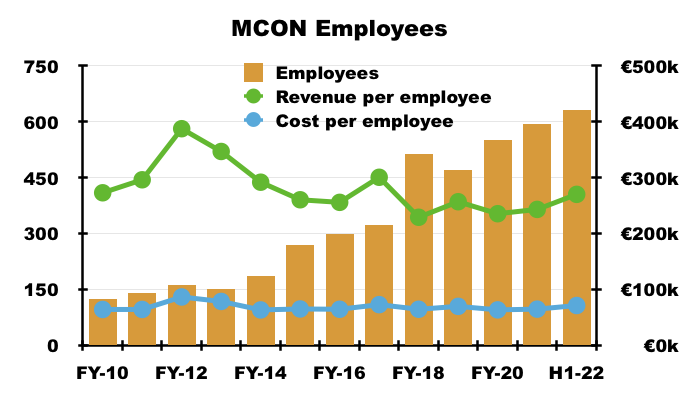

- Only revenue per employee provides some hope that MCON is an above-average business.

- During the eight years following the flotation, revenue per employee has averaged a useful €259k and improved during this H1 to €270k per head, the highest level since FY 2017 (€300k):

- My rule of thumb with revenue per employee is anything beyond £200k might indicate the employees develop higher-value products that could sustain a competitive ‘moat’.

- I trust MCON’s revenue per employee can continue to improve over time to reflect higher selling prices, greater contracts and new product launches.

Valuation

- November’s Q3 update did not read too badly. Revenue looks to have held up in all three divisions following this record H1:

“The very strong revenue growth reported in the Group’s half-year results to 30 June 2022 has continued in the past quarter, and revenues for the first nine months are 25% ahead of 2021. Our revenue growth has been mostly organic, supported by currency tailwinds, price increases and some contribution from acquisitions.

The construction industry has experienced the highest level of growth, though it is pleasing to see double digit growth in mining revenue, the Group’s largest industry, and this is when we exclude the positive currency tailwinds. We also experienced positive growth in waterwell/geothermal industry revenues during the first nine months of the year.“

- Comments about Greenhammer suggested the system’s “superior capabilities” could be confirmed during March’s FY 2022 statement:

“The first commercial drilling with our Greenhammer system with a customer in Australia marks another significant milestone, and I look forward to the system demonstrating its superior capabilities in the months ahead. We are confident that the Greenhammer system will be a step change in terms of technology and efficiency in the hard rock mining environment.”

- MCON’s shares may not be outrageously valued on a reported profit basis.

- Trailing twelve-month operating profit is €19.4m, which after the 25% tax MCON anticipated within this H1 gives earnings of €12.9m or 6.1p per share with GBP:EUR at 1.13.

- Adjusting the £191m market cap for cash of €15m, borrowings of €27m and the deferred consideration of €4m gives an enterprise value of £205m, or 97p per share.

- Dividing that 97p per share by my 6.1p per share earnings guess then gives a possible P/E of 16.

- While the sums could be fine-tuned for lease financing, Greenhammer expenditure and minor other items, my rudimental rating does not appear bargain cheap nor bonkers expensive.

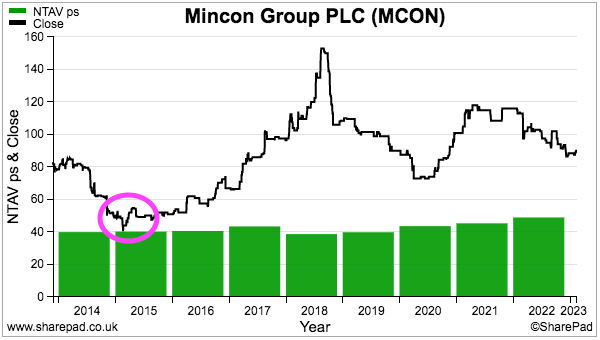

- Given MCON’s ballooning stock level, an alternative valuation yardstick is the balance sheet.

- This H1 showed net tangible assets at €108m or 45p per share, which represent 50% of the 90p share price:

- The shares looked much better value on a net tangible asset basis back in early 2015, when I invested at 45p.

- For now I am hopeful a mix of:

- An easing of cost pressures leading to improved margins;

- Further robust demand from the mining and construction sectors;

- Greater direct sales of equipment, and;

- Greenhammer and other development projects bearing fruit…

- …can lead to respectable financial progress during the next few years.

- Longer-term investment success will depend upon management’s commitment to product quality eventually translating into financial evidence of a competitive ‘moat’.

- For now at least, MCON’s financials sadly do not indicate an obvious competitive advantage.

- Cash conversion in particular needs to improve after the dividends paid during this H1 and the preceding FY 2021 (total €8.9m) were arguably funded entirely by extra borrowings (of €12.5m).

- Shareholder patience will be required before superior returns are enjoyed.

- After all, MCON was established during 1977 and very much remains a family-run business with a corresponding long-term perspective.

- MCON’s founder still works as a board non-exec in his mid-80s while his two sons are the lead executives. The family members own a collective 56%/£108m shareholding.

- No family member sold a share at the 2013 flotation and none has sold a share thereafter.

- The lack of family share-dealing indicates MCON’s stewards are in for the long haul, and great change is unlikely to happen overnight.

- Mind you, an emerging danger to outside investors is the dominant family shareholders becoming too focused on expansion at the expense of logical capital-allocation decisions.

- MCON’s shares floated at 73p during 2013 and, almost ten years later, the 90p price is not really indicative of the business having demonstrated superior economics.

- As clear signs of a moat are awaited, the trailing 2.1 eurocents, or 1.9p, per share dividend supports a modest 2.1% income (before Irish withholding taxes for UK-resident investors).

Maynard Paton