15 July 2021

By Maynard Paton

Results summary for Mountview Estates (MTVW):

- A respectable performance supported by a remarkable H2 comeback, with full-year profit up 5% after declining 18% during a pandemic-disrupted H1.

- Property sales realising a welcome 1.55x premium to their 2014 valuation alongside the first dividend lift for three years suggest favourable near-term trading.

- A small text change to AGM-related statements imply some unhappy shareholders have started to engage with management.

- Debt of £22m stands at a 21-year low and represents just 5% of the £398m property estate.

- Book value inched to a record £101 per share, although my calculations still point to a balance sheet inherently worth beyond £200 per share. I continue to hold.

Contents

- Event link, share data and disclosure

- Why I own MTVW

- Results summary

- Revenue, profit, dividend and net asset value

- Gross margins

- Allsop valuation

- Financials

- Corporate governance and protest votes

- Valuation

Event link, share data and disclosure

Event: Annual report for the twelve months to 31 March 2021 published 09 July 2021

Price: £130

Shares in issue: 3,899,014

Market capitalisation: £507m

Disclosure: Maynard owns shares in Mountview Estates. This blog post contains SharePad affiliate links.

Why I own MTVW

- Buys, holds and sells regulated-tenancy (and similar) properties and boasts an illustrious, 40-year-plus history of net asset value and dividend advances.

- Board led by veteran family management that continues to boast an aggregate 50%/£254m shareholding.

- Simple accounts carry properties at cost, which if sold at their current ‘reversionary’ values may be worth significantly in excess of the recent market cap.

Further reading: My MTVW Buy report | All my MTVW posts | MTVW website

Results summary

Revenue, profit, dividend and net asset value

- Interim results published during November had already confirmed MTVW had suffered no major pandemic upheavals.

- The chief executive said at the time:

“I am happy that I can repeat that we have not had to furlough any staff or reduce staff numbers in any other way and that I remain confident that our years of financial prudence will enable us to continue to conduct the business successfully and to maintain our dividend payments.”

- The interim performance nonetheless did incur lockdown-related delays:

“The first lockdown started shortly before the beginning of our financial year and had the effect of delaying the procedures that are necessary to bring a vacant property to market. This delay was about a month or six weeks and is commensurate with our fall in turnover.“

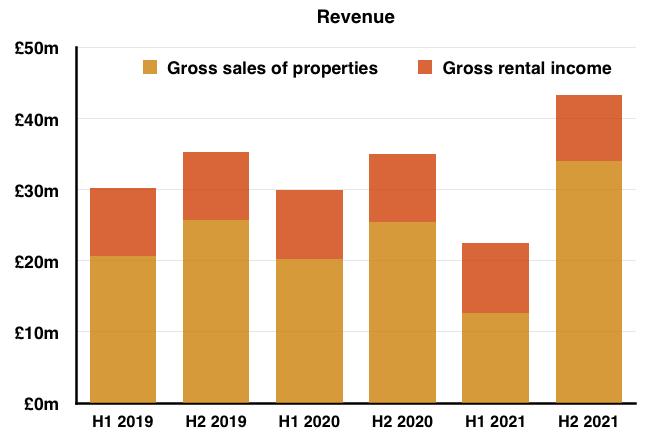

- During the first half, revenue fell 25% while operating profit fell 18%.

- However, these full-year figures unveiled a remarkable comeback after “much of [the H1] backlog” was recouped during H2.

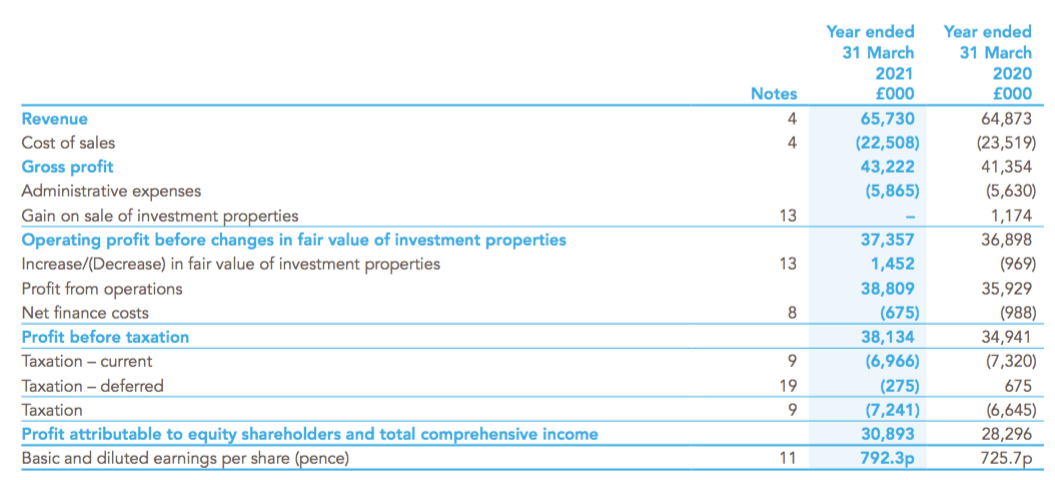

- Annual revenue in fact climbed 1% on FY 2020, leading to operating profit gaining 5%:

| Year to 31 March | 2017 | 2018 | 2019 | 2020 | 2021 |

| Net asset value (£k) | 336,279 | 354,462 | 366,874 | 379,574 | 394,871 |

| Net asset value per share (p) | 8,625 | 9,091 | 9,409 | 9,735 | 10,127 |

| Revenue (£k) | 78,232 | 70,272 | 65,428 | 64,873 | 65,730 |

| Gross profit (£k) | 52,056 | 43,357 | 40,801 | 41,354 | 43,222 |

| Operating profit (£k) | 46,825 | 37,850 | 35,359 | 35,724 | 37,357 |

| Net valuation gain (£k) | (1,020) | (376) | 287 | (969) | 1,452 |

| Finance income (£k) | (819) | (714) | (1,079) | (988) | (675) |

| Other items (£k) | - | 145 | - | 1,174 | - |

| Pre-tax profit (£k) | 44,986 | 36,905 | 34,576 | 34,941 | 38,134 |

| Earnings per share (p) | 929 | 766 | 718 | 726 | 792 |

| Dividend per share (p) | 300 | 400 | 400 | 400 | 425 |

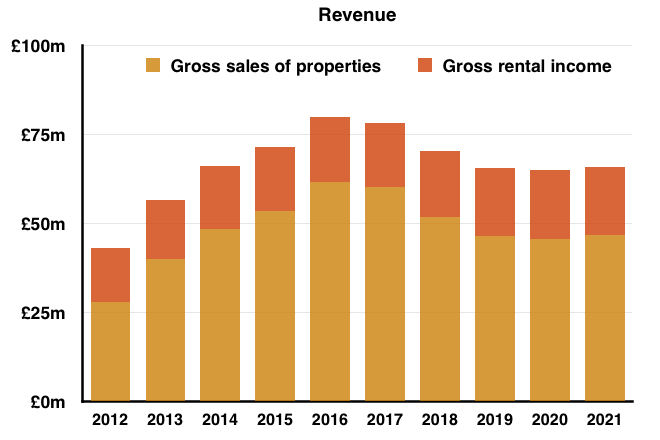

- This FY 2021 performance broadly matched the achievements of FYs 2018 and 2019, too, but was approximately 15-20% below the record revenue/profit levels witnessed during FYs 2016 and 2017.

- Revenue was split 71%/29% between property sales and rental income — to match MTVW’s ten-year average:

- Note that MTVW sells its regulated-tenancy (and similar) properties only when the tenancy ends — which typically occurs when the tenant has died.

- As such, the number of properties becoming available for sale — and the total proceeds MTVW earns — from one set of results to the next can be unpredictable.

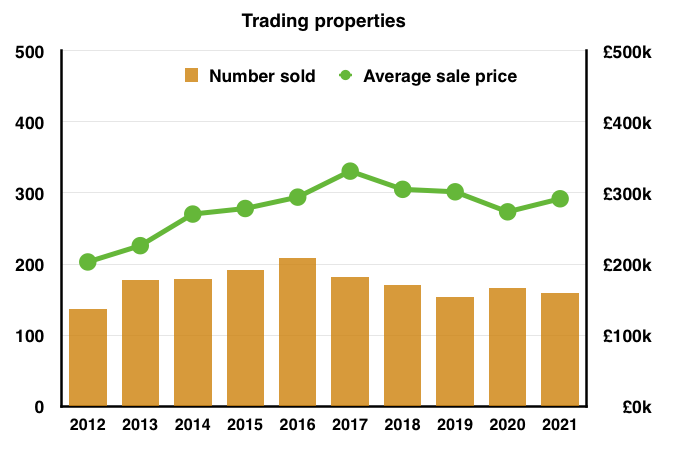

- The 160 properties sold during FY 2021 compares to an average of 173 per annum during the last ten years, with a low of 137 sold in FY 2012 and a high of 209 sold in FY 2016:

- The £292k average sale price was below the £300k-plus reported for FYs 2017, 2018 and 2019 due to the lower number of properties sold for £500k-plus:

| Year to 31 March | 2017 | 2018 | 2019 | 2020 | 2021 |

| Sales price range | |||||

| Below £500k | 152 | 145 | 132 | 151 | 144 |

| Between £500k and £1m | 28 | 22 | 19 | 15 | 15 |

| Above £1m | 2 | 3 | 3 | 1 | 1 |

| Total | 182 | 170 | 154 | 167 | 160 |

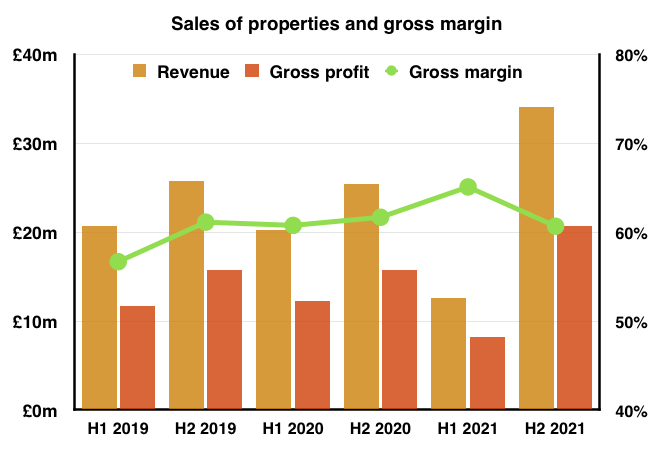

- Recouping the H1 “backlog” meant H2 was MTVW’s most lucrative ever save for H2 2017:

- Reflecting the aforementioned pandemic-related delays and subsequent backlog recouping, 110 properties were sold during H2 (average price: £310k) versus only 50 for H1 (average price: £252k).

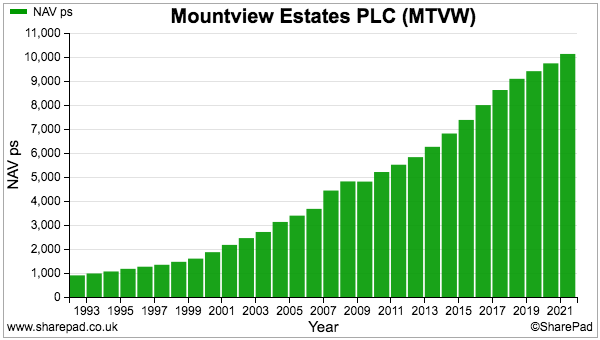

- Net asset value (NAV) improved by £15m to £395m — equivalent to £101.27 per share and a fresh NAV record:

- The 4.0% NAV increase was a little better than the 3.5% advances seen during FYs 2019 and 2020.

- But NAV per share growth has slowed over time.

- NAV per share has compounded at a 5% average during the last five years, 6% during the last ten years, 7% during the last 20 years and 10% during the last 30 years.

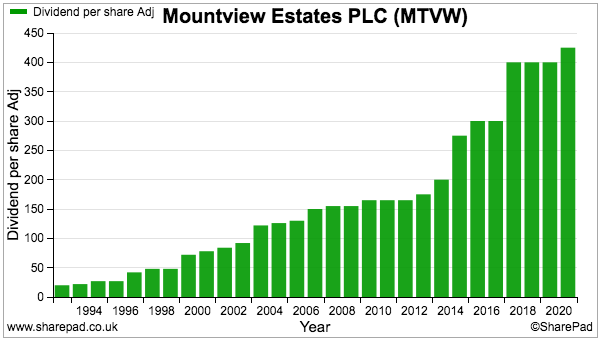

- The headline indicator improving the most was the dividend. The full-year payout was raised 6% to 425p per share after the final dividend was lifted 12.5% to 225p per share.

- MTVW said:

“We only increase the dividend when we are confident of maintaining that increase and, indeed, we look forward to being able to increase the dividend further.”

- The dividend had sat at 400p per share for the previous three years.

- The archives at Companies House show the dividend has never been cut since at least 1979 — after which the payout has risen 283-fold:

Enjoy my blog posts through an occasional email newsletter. Click here for details.

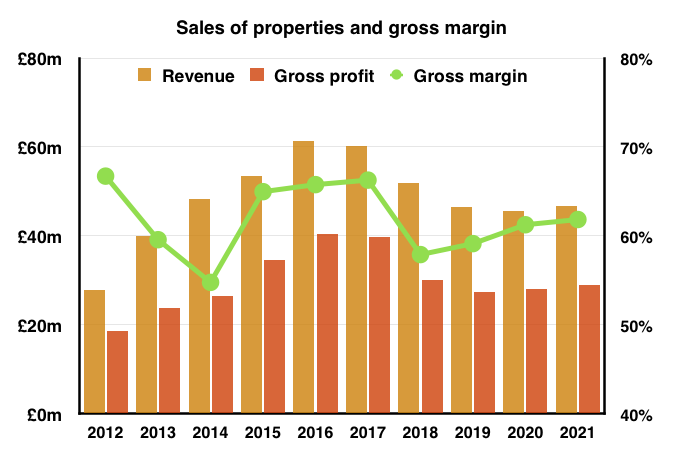

Gross margins

- The gross margin generated through property sales is calculated using the initial cost of the properties.

- The percentage gain on each property sold is correlated in part to the duration of MTVW’s ownership, which can range from a few years to a few decades.

- The overall gross margin achieved from property sales within any set of results is dictated by the mix of properties that were sold during that period.

- During FYs 2018, 2019 and 2020, the gross margin achieved from selling properties averaged 59%.

- But the gross margin achieved from selling properties improved to 65% during H1:

- A 65% gross margin is equivalent to buying a property for £100k and selling it for £286k.

- MTVW selling properties at 65% gross margins is not unheard of but not common either.

- MTVW has recorded property sale gross margins of 65% or more during seven of the last 20 years — most recently during FYs 2015, 2016 and 2017:

- I had speculated that the higher, 65% H1 gross margin might have signalled a step-change in MTVW’s performance.

- Sadly the 65% H1 margin looks to have been caused by an unusual collection of properties becoming available for sale during those six months…

- …because the property sale gross margin reverted back to 61% during H2.

- MTVW’s rental income gross margin has reverted to normal levels, too.

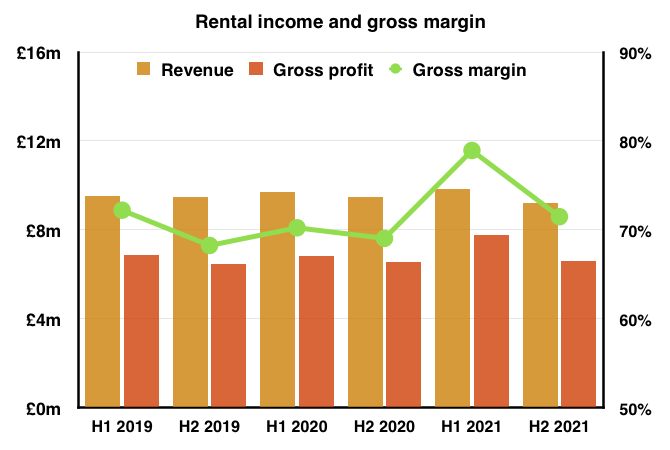

- The chart below shows the gross margin achieved from rental income improving to 79% during H1 and falling back to 71% for H2:

- The annual-report small-print revealed some property expenses had been deferred due to the pandemic, which may have supported that 79% margin:

“We have, therefore, deferred non urgent works while dealing with emergencies and essential remedial work in agreement with the tenant.”

- The annual-report small-print also noted:

“We are working with tenants, on a case by case basis, to advise on the help and assistance available to them as a result of loss of income through Covid-19.”

- Rent of £9.2m collected during H2 was the lowest since £9.0m was collected during H1 2018. Rent for the full year fell 1% to £19.1m.

Allsop valuation

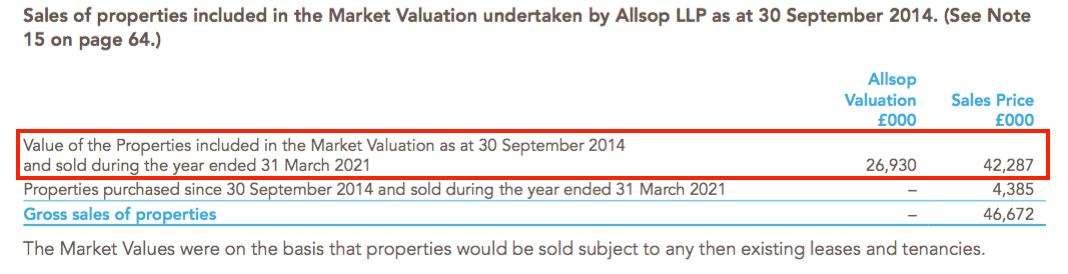

- The most promising aspect of these full-year figures concerned the proceeds from sold properties compared to a past valuation.

- To recap, MTVW commissioned property agent Allsop during September 2014 to assess the group’s estate.

- Allsop returned a £666m valuation — some 2.1x the £318m book value of the properties carried at the time.

- The Allsop calculation was based on MTVW’s properties remaining in their regulated-tenancy state and therefore excluded any ‘reversion’ premium (i.e. the value uplift that occurs when a regulated tenancy finishes, the rent reverts to a proper market level and the property can then be sold).

- The Allsop valuation was not applied to the audited accounts. MTVW’s properties instead remain on the balance sheet at their cost price.

- Following the Allsop valuation, MTVW reveals the proceeds from sold properties versus their stated Allsop value:

| FY 2017 | FY 2018 | FY 2019 | FY 2020 | H1 2021 | H2 2021 | ||

| Property sales revenue (£k) | 57,174 | 45,156 | 41,273 | 41,819 | 11,290 | 30,997 | |

| Allsop valuation (£k) | 38,505 | 30,594 | 28,727 | 29,221 | 6,995 | 19,935 | |

| Sold-premium-to-Allsop (x) | 1.48 | 1.48 | 1.44 | 1.43 | 1.61 | 1.55 |

- Sale proceeds between FYs 2016 and 2020 averaged 1.45x the associated Allsop valuation.

- However, November’s H1 results showed the ‘sold-premium-to-Allsop’ multiple at 1.61x and these full-year figures indicated the H2 ratio was 1.55x.

- The notable improvement to the ‘sold-premium-to-Allsop’ multiple during this FY 2021 was not explained by management.

- The higher multiple may of course be due to the random mix of properties involved.

- But I am minded to believe the higher multiple has been supported by higher sale prices being achieved in a very active property market.

- A higher ‘sold-premium-to-Allsop’ multiple has favourable implications for assessing MTVW’s property estate and share price (see Valuation below).

- MTVW has disposed of properties with a book value of £127m during the 6.5 years following the Allsop review.

- Assuming the same rate of sales, MTVW could take a further ten years to sell the remaining properties that were valued by Allsop.

- My sums suggest MTVW’s property stock is presently split approximately 50:50 between property valued by Allsop and properties acquired since the Allsop valuation.

- As more Allsop-valued properties are sold and other properties are purchased, the less relevant the Allsop valuation becomes to the share price.

- MTVW is not keen to undertake another valuation. The 2020 AGM Q&A statement declared:

“The cost of carrying out a valuation is such that your Board are reluctant to inflict such an expense on the shareholders when the information so acquired is not a useful management tool.

The uncertainties created by Brexit and Covid are such that any current valuation is unlikely to have any long-term reliability. Nevertheless your Board always review any representations made by shareholders in respect of a potential valuation.”

- The aforementioned dividend uplift suggests neither Brexit nor Covid have been a problem of late, and therefore a repeat Allsop valuation might now possess greater “long-term reliability“.

- I dare say the topic of a repeat formal valuation will arise during the 2021 AGM, which will be held on 11 August and is set to permit shareholders to attend in person (I hope to be there).

- I maintain MTVW ought to implement regular valuations to provide greater insight into the inherent value of the group’s property estate.

- Further valuations could also judge the astuteness of MTVW’s more recent purchases.

- MTVW continues to buy and sell properties, which implies their fair value can still be judged by the executives.

- And if MTVW’s executives can still judge the fair value of a property, Allsop can as well through another valuation!

Quality UK investment discussion at Quidisq. Visit forum.

Financials

- MTVW’s accounts remain very straightforward.

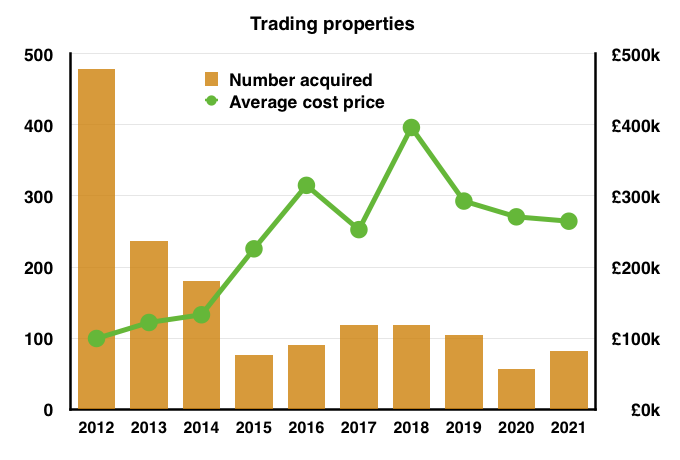

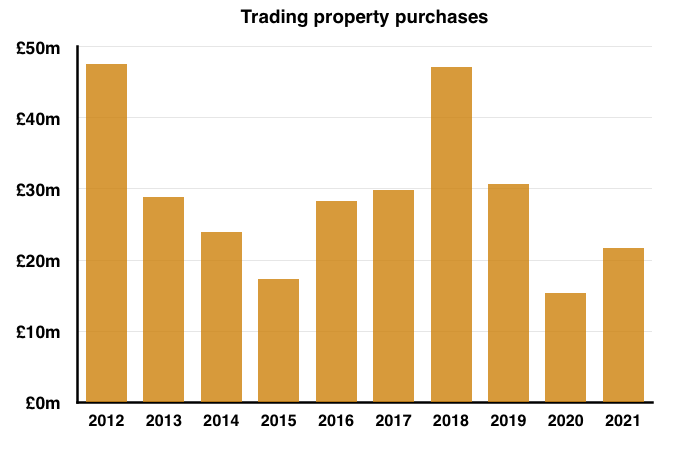

- Some £22m was spent during the year acquiring 82 additional properties at an average of cost of £264k:

- Note that the bulk of the expenditure, £20m, occurred during H1 with only £2m invested during H2.

- MTVW suggested the market for buying regulated tenancies (and similar) had not dried up just yet:

“We made good purchases during the year ended 31 March 2021 and have continued to do so since, and I am confident that we will continue to source good opportunities.”

“The results from early auctions in the current year are promising and, thus, we are hopeful that we will be able to continue to acquire new stock to sustain the business going forward.“

- But the market for regulated tenancies continues to shrink. Such tenancies have not been created since 1989 and Allsop estimates fewer than 75,000 currently exist.

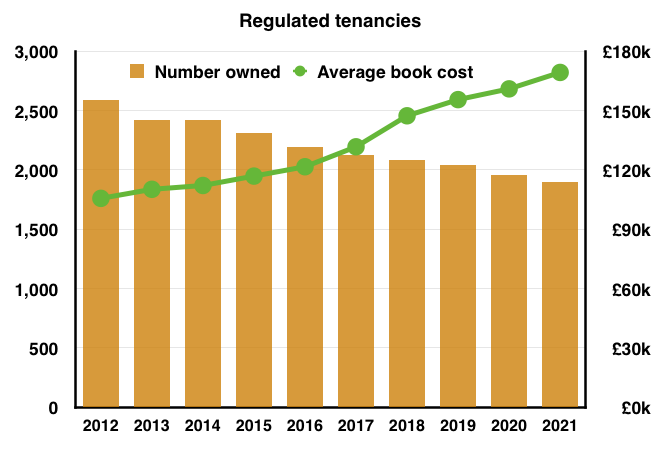

- The number of regulated tenancies owned by MTVW topped 3,000 20 years ago, topped 2,500 ten years ago but today is less than 2,000.

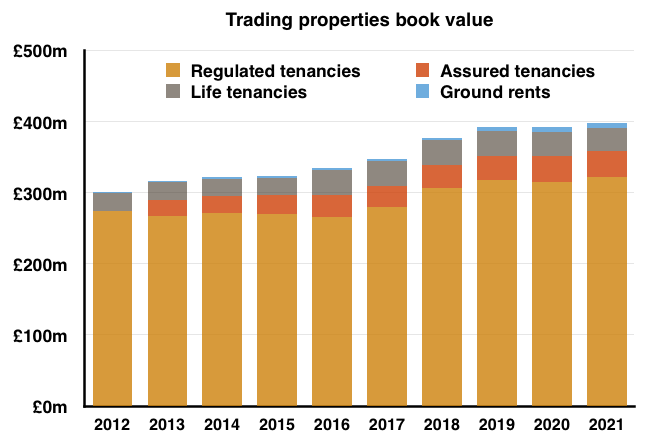

- MTVW’s property estate has a £398m book value, of which regulated tenancies represent £321m or 81%:

- This FY 2021 statement revealed MTVW’s portfolio of conventional investment properties had enjoyed a £1.5m valuation gain.

- The gain counterbalanced the £1m write-down from FY 2020, and the portfolio is presently in the books at £26m.

- Earnings of £31m funded dividends of £16m, debt repayments of £10m and net additional property purchases of £6m, which combined left the cash position almost £2m lighter at less than £1m.

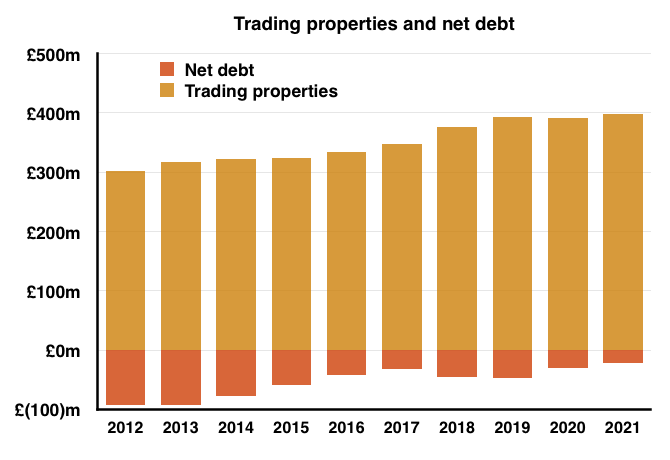

- Borrowings finished the year at £22m with net borrowings at £21m — the lowest year-end levels since FY 2000.

- Net debt of £21m is equivalent to 5% of the group’s £398m property estate — the lowest percentage since at least FY 1997:

- MTVW’s gearing has been much higher. During FYs 2012 and 2013 for example, net debt represented 30% of the property stock.

- MTVW implied the low debt was a result of always ensuring “at least one accountant [is] at the helm of this business“, which has in turn led to “years of financial prudence“.

- The annual-report small-print disclosed banking facilities of up to £90m — equivalent to 23% of the property estate.

- The current low level of gearing alongside the debt headroom suggests the group would have no problem buying future property bargains.

- Finance costs of just £675k for this year imply a manageable 2.5% interest rate on the period’s £28m average net debt.

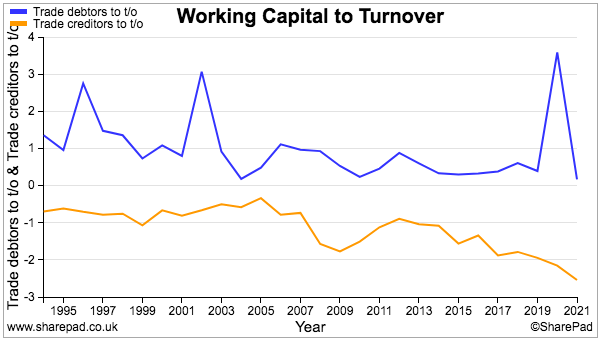

- Both trade debtors and trade creditors continue to represent a trivial 3% or less of revenue:

- MTVW’s accounts are free of pension obligations.

Corporate governance and protest votes

- Despite MTVW’s illustrious history of NAV and dividend advances, not every shareholder is content with the way the company is managed.

- The last four AGMs have witnessed c30% protest votes against re-electing independent non-execs, approving the board’s pay and re-appointing the auditors.

- MTVW shareholders can be divided into three camps:

- The Sinclair family concert party, which is led by chief executive Duncan Sinclair and represents just over 50% of the share count;

- The Murphy family and connected parties, who claim to own 24% of the share count and whose leading shareholder is the chief executive’s sister, and;

- Everybody else, who own 25% of the share count.

- The protest votes come from the second camp.

- From what I can tell, the Murphy family is broadly happy with how the business is run, but:

- Is aggrieved about the board’s pay;

- Has lost the trust of the non-execs to act on the views of shareholders, and;

- Is frustrated about a general lack of influence at board level.

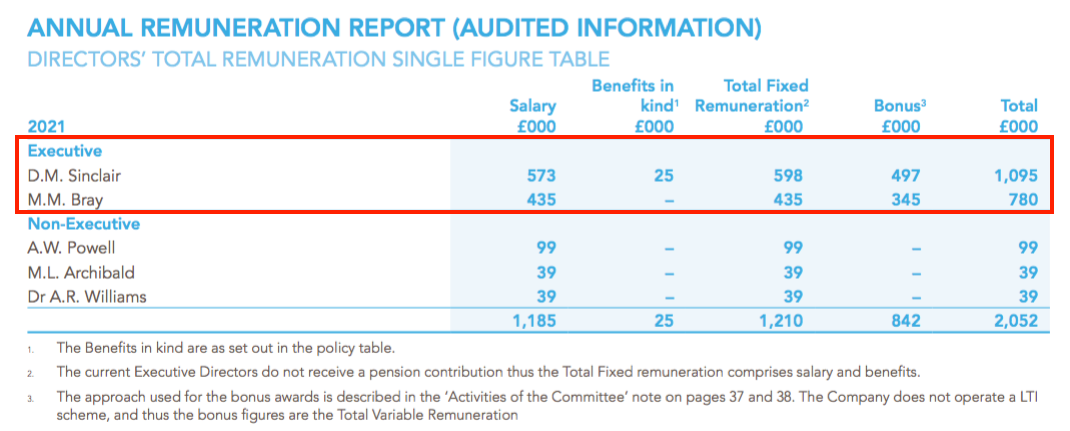

- Last year the chief executive took home a total £1,095k while the finance director received £780k:

- Some could argue those payments are extremely generous for simply collecting rent and putting properties into auction.

- Some could argue part of those payments could instead be used to fund another Allsop valuation.

- Total board pay for FY 2021 represented 46% of all employee pay (£2.1m/£4.4m) and 35% of all administrative costs (£2.1m/£5.9m).

- The Murphy family and other dissident shareholders have prevented the re-election of certain non-execs at the 2017, 2018, 2019 and 2020 AGMs.

- Following those AGMs, MTVW held general meetings to reinstate the non-execs. The non-execs were all re-appointed because the Sinclair concert party then gets to vote on the non-exec re-elections (unlike at the AGMs, where the concert party is prohibited from voting on certain resolutions):

| 2017 | 2018 | 2019 | 2020 | |

| AGM | ||||

| Votes FOR | 126k (13%) | 223k (19%) | 180k (16%) | 236k (20%) |

| Votes AGAINST | 827k (87%) | 927k (81%) | 938k (84%) | 971k (80%) |

| Subsequent GM | ||||

| Votes FOR | 2,361k (74%) | 1,504k (62%) | 2,095k (69%) | 2,048k (68%) |

| Votes AGAINST | 826k (26%) | 941k (38%) | 939k (31%) | 971k (32%) |

- Stock market rules dictate any company incurring a sizeable protest vote has to contact the dissenting shareholders and publish an update within six months.

- Up until this year, the six-month follow-ups had yielded nothing but confirmation the dissenters had “declined to meet or engage“.

- However, the follow-up published during February stated:

“Some shareholders did not wish to engage.“

- So maybe some members of the Murphy camp have broken ranks to engage with the board, and/or other objectors have come forward with grievances.

- Only the Talisman Dynamic Master Fund — essentially controlled by the Pears family — owns a disclosable MTVW stake (5.7%) beyond the wider Sinclair/Murphy factions.

- The Talisman fund first appeared with a disclosable holding (4.1%) during December 2016.

- Sadly MTVW’s six-month updates do not divulge the nature of the discussions with the protesting shareholders.

- An update during May repeated the spiel given in February:

“Following the meeting, the Company identified, as far as possible, those shareholders who did not support the resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage. The Company remains committed to shareholder engagement and will continue to offer to have discussions with shareholders and will take into account their concerns and considerations in the future.”

- Next month’s AGM may shed further light on the dissident discussions. The annual report invites questions in advance, with the answers to be commendably published online a few days before the meeting.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Valuation

- MTVW’s shares could be worth £214, assuming all of the group’s regulated tenancies (and similar) end immediately and the properties then fetch a fair market value.

- The following table outlines the sums:

| Property stock Sept 2014 (£k) | 317,651 |

| Less property stock sold since Sept 2014 (£k) | (126,663) |

| 190,988 | |

| Allsop-premium-to-book | 2.10x |

| Sold-premium-to-Allsop | 1.55x |

| 620,547 | |

| Stock purchased since Sept 2014 | 207,178 |

| Sold-premium-to-Allsop | 1.55x |

| 321,126 | |

| Possible property stock value (£k) | 941,673 |

- I have taken the original September 2014 portfolio value of £318m and subtracted the £127m book value of properties sold since that date.

- I have then multiplied the £191m remainder by the 2.1x ‘Allsop-premium-to-book’ multiple and then by the 1.55x ‘sold-premium-to-Allsop’ multiple witnessed during this H2.

- I arrived at a £621m estimate for all of MTVW’s properties that were owned at September 2014 but have yet to be sold.

- Since September 2014, MTVW has acquired additional properties with a net £207m book value.

- I have assumed these additional properties can be sold for £321m based on my 1.55x ‘sold-premium-to-Allsop’ multiple.

- Adding the £621m and the £321m together gives £942m.

- This next table adjusts that £942m for 19% taxation, the £26m conventional property portfolio, net debt and other liabilities to give a possible book value of £835m or £214 per share:

| Possible property stock value (£k) | 941,673 |

| Less tax at 19% (£k) | (103,266) |

| Plus other investments (£k) | 25,574 |

| Less net debt (£k) | (21,283) |

| Less other liabilities (£k) | (7,586) |

| Possible NAV (£k) | 835,111 |

| Possible NAV per share (£) | 214.19 |

- Bear in mind my estimated value of MTVW’s property estate has not really improved during the last few years. Previous estimates were:

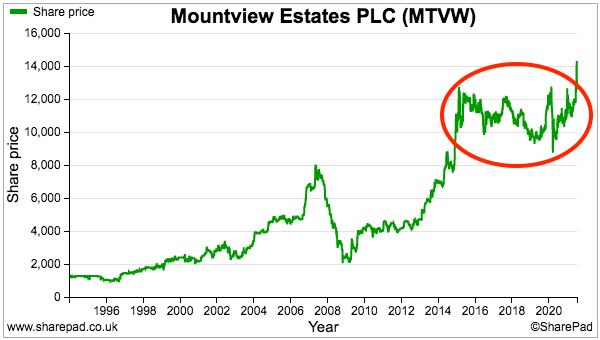

- The £200-£214 range-bound estimates might explain why the share price stagnated during the same time:

- The range-bound estimates might also suggest MTVW exhibits ‘value trap’ characteristics, whereby all the property buying and selling is not really creating much additional benefit for shareholders.

- My estimated NAV sums are not perfect, and these questions remain unanswered:

- How long will MTVW take to sell all of its properties?

- Will future house-price gains compensate for being unable to sell all the properties immediately?

- How reliable is the 2014 Allsop valuation today?

- What impact could annual admin costs of £6m have on the calculations (I have ignored such costs)?

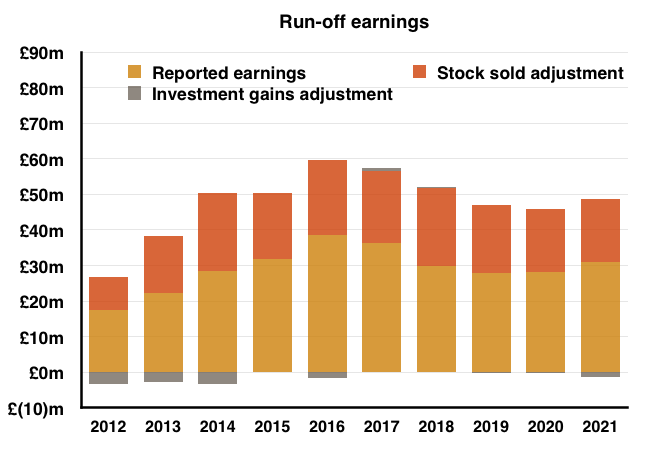

- An alternative valuation is based on a ‘run-off’ scenario, whereby MTVW continues to sell its properties as normal but no longer buys any replacements.

- ‘Run-off earnings’ can be calculated by adding back stock sold during the year to reported earnings. A further adjustment can be made for investment gains relating to the conventional property portfolio.

- Run-off earnings have bobbed around the £47m mark for the last three years:

- At the start of FY 2021, MTVW’s property estate had a £392m book value and during the year properties with a £18m book value were sold.

- With the year-end property estate carrying a £398m valuation and, assuming stock of £18m is sold every year, MTVW would take another 22 years to dispose of its entire estate.

- 22 years of run-off earnings of £47m give an aggregate £1,034m or £267 per share valuation.

- Discount all 22 payments of £47m at 7.5% per annum, and their total net present value would equal the recent £507m market cap and £130 share price.

- In theory at least, those calculations imply shareholders might enjoy 7.5% annual returns should MTVW never buy another property.

- These run-off sums are not perfect either, as they do not account for lower rental income as the property estate shrinks.

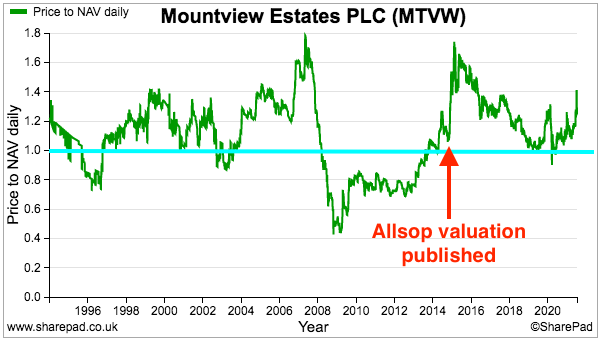

- Turning to more traditional valuation measures, MTVW’s shares have generally traded ahead of NAV (blue line below) following the Allsop valuation:

- The premium to NAV with a £130 share price is 28%, which is not the smallest surplus the shares have ever traded at post-Allsop.

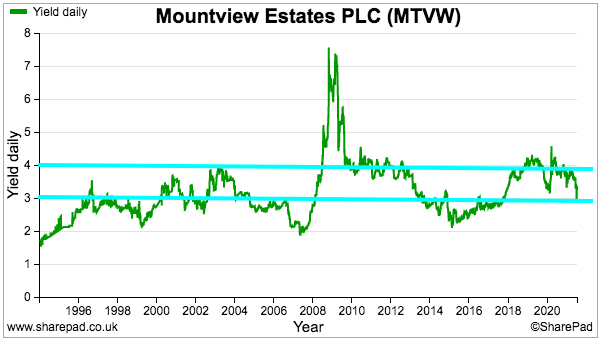

- The 425p per share dividend meanwhile supplies a 3.3% income that is at the lower end of the 3%-4% band the shares have typically offered:

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Mountview Estates (MTVW)

Publication of 2021 annual report

Here are the points of interest:

1) Extra management narrative

MTVW’s annual reports always contain extra management text not included within the preliminary RNS. The chairman’s remarks were not that notable, but the chief exec’s comments carried a few interesting lines.

The term “other people’s debts” was used to describe the government’s efforts to prop up the economy during the pandemic, and justify pay rises:

MTVW has indirectly benefitted from the government’s pandemic actions (e.g. the stamp duty holiday), so management seems rather mean by implying the cost ought to be repaid by those businesses that suffered the most.

2) Our purpose and how we operate

This section was given far more prominence in this annual report than previous editions. The section included some minor additional text:

The “long-term view, underpinned by family values” missed the words “and ownership” from the year before. I note the listed responses to Covid-19 prompted a “re-think” of how the staff worked.

ESG now being mentioned, too:

3) Review of Operations

Lots of interesting snippets in this section.

a) This Vacant Properties table is new for 2021:

Not sure why MTVW has included the table (I doubt the information has become a disclosure requirement) and I can only surmise — given the similar totals — that the number of properties top be sold in the current year may be similar to last year.

b) MTVW’s revenue includes lease extensions, which really ought to be excluded from my calculations of sales proceeds per property:

c) MTVW often buys portfolios of properties:

Last year 53 were purchased for £16m. During 2018, 50 units were acquired for £26m and during 2017, 51 were acquired for £10m. The risk perhaps is these sizeable portfolios are not always available to buy and perhaps MTVW suffers a few lean years of purchases.

d) The outlook text below seems promising, but has been repeated word for word every year since 2012:

e) I have missed the text below from earlier annual reports:

Looks as if MTVW’s standard investment properties are not in tip-top shape if they require some refurbishment:

f) A reminder that MTVW’s progress from one year to the next is dependent on properties becoming vacant, the timing of which is unpredictable:

g) Confirmation that MTVW did not carry out as much maintenance work (and therefore saved on expenses) due to Covid-19:

h) Showing some confidence, MTVW has removed Covid-19 commentary from its formal risk review:

i) New for 2021 is a ‘Climate’ risk and MTVW looking ahead for “emerging” risks:

j) This snippet might be of interest within the Viability Statement:

Last year the same text included “is ongoing“, so a proper succession plan (even perhaps for the chief exec?!) is seemingly now in place.

4) Section 172

a) No major text changes here, although new for 2021 is confirmation that emails from (disgruntled?) shareholders are passed onto the board:

b) Although removed from the formal Risk section, the report did include lots of text about Covid-19 (albeit mostly identical to the associated 2020 text).

c) Confirmation that MTVW’s tenants remain “elderly“:

The chairman at the 2019 AGM said he did not know how old the tenants were (their age is useful to know because death is often the reason why a MTVW property becomes vacant and available for sale). But if MTVW knows the tenants are “elderly“, the boards should have a rough idea of their age!

5) Directors Report

a) New text for 2021 includes usage of sustainable electricity and hybrid cars:

‘Eco-lamps’ could also mean extra business for portfolio holding FW Thorpe!

b) Average employee tenure now 11 years, and everyone apparently speaks to the executives:

c) The long staff tenure means recruitment is infrequent:

d) Confirmation that the Sinclair concert party still own over 50% of the stock:

The percentage was “approximately 51%” in the 2019 report, so “over 50%” does in fact mean ‘just over 50%’. I am not sure what happens if the proportion goes below 50% — in theory the dissident investors referred to in the blog post above could then garner more votes than the concert party and disrupt the board.

6) Corporate governance

A fair bit of extra corporate governance text this year. Most of it was boilerplate stuff, but a few interesting snippets:

a) Not surprisingly given the dissident voting, the board has been busy discussing matters with shareholders:

b) The following text may not go down well with the Murphy family; they have been arguing for a board seat for years:

MTVW presumably does not believe the Murphys would add the necessary “capacity or skills“.

c) Mind you, MTVW has included some new text about the possibility of one day appointing a senior independent non-exec:

d) New text for 2021 reveals there is no formal board evaluation:

e) More new text suggests the board actively seeks shareholder feedback:

I am unsure whether the board’s desire for feedback truly comes across at the AGM.

f) Further confirmation of shareholder contact being forwarded to the board:

g) Remuneration committee meetings went from 3 during 2020 to 6 for 2021:

Never great to see boards undertake more meetings about pay than auditing (i.e. whether the accounts are correct).

7) Audit committee

MTVW was chosen by the FRC for an annual report review:

Reassuring that no major concerns were raised.

8) Remuneration committee

a) Staff bonuses up by a third and their wages enjoyed double the usual increase:

b) MTVW remains vague (“non-financial factors”) on how the executive bonuses are calculated. But the sums remain hefty:

As before, the board reckon bonuses should not be linked directly to profit, because profit in any year can vary due to the number of properties becoming available for sale:

c) The chief exec’s and finance director’s pay climbed 3% during 2021:

The chief exec’s basic pay is up 52% over the last 5 years, while the dividend is up 42% and NAV is up 27%. Not ideal.

The chief exec has averaged take-home pay of £1m since 2016:

3% wages/fees increases to the directors for 2022:

d) As noted in the blog post above, not everyone is happy with the way MTVW is run and how the directors are remunerated. Confirmation that the 2020 AGM witnessed a sizeable protest vote on pay:

9) Employees

Total employee costs advanced 8% to £4.4m on an unchanged headcount:

This 8% advance implies bonuses represent a small part of an employee’s pay, given employee bonuses were said to have increased by a third (point 8a).

The total cost per employee was £153k, the highest ever, versus £141k for 2020 and £100k ten years ago. Total employee costs represented 6.7% of revenue, versus 6.3% for 2020 and the highest proportion for at least 20 years.

Exclude the executive directors and the total cost per employee was £88k, up from £80k for 2020 and £50k ten years ago.

MTVW conducted 160 property sales and 82 property purchases during the year, leading to 242 transactions, or 8.34 per employee. Perhaps transactions now take greater manpower, as transactions per employee ranged between 10 and 25 between 2005 and 2018.

I suppose some could argue the employees are taking a greater share of the sales proceeds for doing less work.

10) Investment properties

Some bullish commentary on house prices within central London:

11) Inventories

The usual confirmation of the £666m Allsop valuation from 2014 and management’s view of its usefulness and the likelihood of a repeat:

I do wonder why MTVW arranged the valuation in the first place, as management was questioned at length during the 2019 AGM about a new valuation and I dare say the topic will be raised at the 2021 meeting.

12) Trade receivables and payables

Amazingly tiny numbers for trade receivables and payables given revenue was £66m:

13) Borrowings

I calculated interest on debt was 2.5% within the blog post above, but MTVW says the rates were lower:

Either way, the rates are modest and does not suggest MTVW has any lending difficulties. The stated rates for bank overdrafts and loans were less than those for 2020, too.

Confirmation of total borrowing facilities of £90m:

The note also includes a reminder that the chief exec and friends have lent money to MTVW and receive interest at 0.5%.

I am not clear why this relatively small loan exists, or why it has increased by nearly £0.4k. The directors could invest their £1m instead in MTVW shares and receive a better dividend yield (albeit not guaranteed of course).

14) Audit report

Nothing of concern here.

A full scope audit was performed:

The key audit matters did not change, although all the Covid-19 text was removed to imply the auditor no longer sees Covid-19 as a threat to MTVW:

Materiality remains at a conventional 1% of gross assets, with a new performance materiality figure introduced for 2021 (I think):

Maynard

Mountview Estates (MTVW)

AGM attendance 11 August 2021

Below are my notes from MTVW’s AGM — my first ‘physical’ company meeting/presentation since February 2020. Credit to MTVW for hosting the meeting rather than using Zoom or hiding behind closed doors (as some quoted companies continue to do). All five directors were present, alongside 15-20 attendees. Questions were asked by Craig Murphy, me and three other investors.

The whole meeting was recorded on audio — certain major shareholders do not get on and disagree about the group’s corporate governance, board membership and other matters. A tape recording could therefore be useful as to who said what. My notes are paraphrased/summarised.

It was a pleasure to meet Giles, who reads my blog and approached me after the meeting to say hello. The chairman also said during the meeting that he reads my blog and finds it “very interesting“. The executives did not make any prepared remarks, so the meeting went straight to the Q&A that lasted almost an hour.

The discussion confirmed the Murphy family (representing c24% of the shares) is no longer in direct communication with the board. The chief executive also mentioned the vague possibility of one day selling the whole business.

(CM: Craig Murphy; DS: Duncan Sinclair (chief executive); MP: Maynard Paton; Q: Another questioner; MTVW: Another director (mostly the chairman)).

——————————————————————————————————————

CM: Received email on 8th March 2020 from the board about the new remuneration policy, to which I replied “please do not forward it to us, to be clear we do not consent at this time to receive any inside information”.

Reply acknowledged. But on 5th June, the board sent the new remuneration policy. This was well before the publication of the annual accounts and was inside information.

MTVW: Remuneration committee talked about consultation and the code, which says to consult shareholders on a number of matters, including remuneration. “That is why we continued to persist.” We work together as a small committee, were aware of the emails, and all consented to the emails being sent.

(MP note: A discussion between CM and the board then followed about ‘inside information’. CM’s complaint was based upon receiving details about proposed remuneration changes — despite explicitly saying he did not want to receive them — and these details being ‘inside information’. I guess any share-dealings (planned or executed) by the Murphy family could then be called into question by receiving anything that might be considered ‘inside information’. I think the issue boils down to a) whether proposed changes to director remuneration are actually ‘inside information’, and; b) whether the board will continue to send the Murphy family further unsolicited documents that could also be deemed to be ‘inside information’.)

CM: My family and I will never engage with you outside of a public forum, because the risk is simply too great.

MTVW: Disappointed that is how you feel. Door remains open and happy to talk. Needs to be two way.

Q: Details on the £975k lease extension?

MTVW: Not a common occurrence. Property is near Kensington Palace. Arose due to very unusual circumstances.

Q: Acquiring new properties seems difficult. Plans for the future development of the business?

MTVW: Contact major concert-party shareholders each year. They are content. They recognise the situation. Tell us to continue our strategy and not diversify. May be a time when options need to be explored. Will look at them at that time.

DS: We are still in the marketplace. Some companies bring opportunities to us, some are diversifying, and some want to dispose of regulated tenancies. Confident can keep acquiring regulated tenancies. Will be a time when there are no more regulated tenancies. Confident a number of years ahead of acquiring regulated tenancies.

Q: Number of tenancies keeps going down, the number of vacancies keeps going down. Not a healthy situation.

MTVW: Comment noted. Check with major shareholders, but for now maintain the current strategy and business model.

MP: If you keep on repaying debt as you have done, the company will soon be debt free. So the obvious option is to then raise the dividend if you can’t find enough properties to buy.

MTVW: Capital allocation considered at each board meeting. One option is the dividend. Increased the dividend this year. But will still take up good buying opportunities, assuming the price is right. Still have strict due-diligence process.

DS: Regulated tenancies will run out one day. But expertise is in this part of the property market. May one day find few opportunities and portfolio becomes vacant. As properties become vacant and sold on, may “get to the day when someone comes along and says I will take the whole portfolio”.

MP: Once the debt has been paid off, would you be happy with a cash-positive balance sheet? Surely that surplus cash should be repaid as dividends.

DS: Can increase the dividend. But could get to where we cannot justify paying enormous dividends. Probably before then will consider buybacks and making capital rather than revenue distributions.

(MP note: MTVW repaid debt of £10m last year. Borrowings at c£20m are very modest versus the near-£400m property portfolio, while interest rates remain low. Perhaps MTVW should consider special dividends instead of repaying further debt. Another £10m debt repayment would be equivalent to a c£2.50 per share payout).

Q: Are there a lot of people who would want to buy you?

DS: Not something being investigated. “Would not say there are a lot of people. Although there is more than one.”

CM: Over the last six years, profit is down a bit, executive remuneration is up 42% and the dividend up 55%. Intend to maintain a link between the dividend and executive remuneration?

MTVW: Profit figures outside of our control because they are dependent on getting vacant possession. Pay and dividend not linked. Separate decisions, taken by the remuneration committee for pay and the whole of the board for the dividend. Dealt separately on their merits each year.

CM: A recurring theme is various mistakes in the annual report. e.g. remuneration committee chairman says she has no notice period, but actually has a one-month notice period.

MTVW: Will bear those points in mind for next year’s annual report.

Q: Plans for another valuation? Seven years seems a sensible interval for another valuation.

MTVW: Accounting standards and regulations do not require a regular valuation. Has no useful management purpose. Property could be +/- 15% of the valuation. 15% could be conservative estimate. Has very little value and limited lifespan.

“Reluctant to inflict shareholders the cost”. Last time was £600k. Will be more now. Substantial amount for something of very little use.

Q: Information should be provided about the assets the company has.

MTVW: All working with the same information. Not required to do the valuation. But overwhelming demand from majority of shareholders would be different question. Not the situation now.

Q) If the valuation is done at intervals, £600k equates to £100k a year. Not significant money for the company.

MTVW: Comments are noted.

Q) Cost of valuation was £600k, or £200 a property. But online companies can give figures, plus using local estate agents, so no need for Savills. Could cost under £100 per property, or £250k.

MTVW: Comments are noted.

MP: Why did you have the valuation in the first place if it is of no use to running the business on a day to day basis.

DS: “There was a certain pressure from within the family shareholdings, which was more than satisfied by the figure that virtually ended up as an apology for putting us to the trouble.”

MP: Property fraud can be quite common within regulated tenancies. How do you ensure the residents of the your properties are the genuine tenants?

DS: Properties are visited regularly. Aware of attempts to pass on tenancies without informing MTVW. Has happened. But fraud is exposed sooner or later, e.g. a new bank account.

MP: What are the “other non-financial achievements” used to determine board bonuses?

MTVW: Contributions to the stability of the business. Purchasing activities, but also stable staff. Staff tenure is 11 years on average. How executives work with staff, keeping them motivated. This year, how the business was run almost as normal. No furlough etc. Cost comes with replacing staff. Executives have managed that cost well.

(MP note: Not quite sure about this. Board could lift staff pay to persuade them not to leave, and bosses then receive a bonus. Staff costs excluding the two executives averaged £88k for FY 2021, up 10%. Executive bonus paid to DS every year since at least 2001. If a bonus is paid every year, is it really a bonus?)

MP: Last three AGMs have seen protest votes of about 30% on pay. Can you explain how you see the director pay as fair and reasonable because clearly some people disagree.

MTVW: Protest votes on a number of resolutions, not just pay. Wanted to engage with shareholders who voted against, but they declined to engage. Board therefore could not discuss any actions.

Q: Proportion of property expenses that relate to refurbishment prior to sale?

DS: Generally higher value properties more likely to be enhanced prior to sale. Anything £1m+ may well have involved refurbishing. Between £0.5 and £1m may have involved some refurbishing. Not company policy to refurbish property for selling. Hold a lot of higher value property, but some buyers prefer such property not to be redeveloped.

——————————————————————————————————————

There was also a discussion about the accuracy of the map on page 5 of the annual report, the contents of which I did not note.

Maynard