26 April 2024

By Maynard Paton

H1 2023 results summary for Andrews Sykes (ASY):

- A bumper £25m special dividend was the clear highlight of this record H1, which reported net cash reaching £39m after revenue increased 2% and profit gained 14%.

- Progress was underpinned mostly by ASY’s European depots, where revenue climbed 17% and earlier restructuring led to “significantly reduced” losses in France.

- The “de-risking” of the pension scheme was a welcome surprise and, alongside a very intriguing executive appointment, could be interpreted as preparing the company for a potential bidder.

- The accounts remain very respectable, with the H1 margin at a super 25%, cash generation helped by tight stock management and bank debt kept at zero.

- A possible 13-14x P/E does not appear outrageously expensive, although the limited free float, weather-sensitive operations and mixed H2 outlook might restrict any re-rating. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own ASY

- Results summary

- Revenue, profit and dividend

- UK

- Europe

- Middle East

- Financials: margin and cash flow

- Financials: pension scheme

- Boardroom

- Valuation

News links, share data and disclosure

- Interim results for the six months to 30 June 2023 published 25 September 2023;

- Jacques-Gaston Murray published 07 June 2023, and;

- Board Changes published 12 February 2024.

- Share price: 560p

- Share count: 41,858,744

- Market capitalisation: £234m

- Disclosure: Maynard owns shares in Andrews Sykes. This blog post contains SharePad affiliate links.

Why I own ASY

- Supplies air conditioners, portable heaters and industrial pumps for hire, with success based on a prompt 24/7/365 service, high-quality rental fleet and commercial-only customer base.

- Straightforward accounts regularly showcase high margins, generous cash flow, net cash and satisfactory returns on equity.

- Chairman and family are 91%/£213m shareholders and their “presence and requirements… helps focus the company’s strategy on long-term shareholder value creation” (point 10a).

Further reading: My ASY Buy report | All my ASY posts | ASY website

Results summary

Revenue, profit and dividend

- An encouraging outlook from the preceding FY…

“Trading momentum has continued into the current year, with overall performance in the year to date in line with the Board’s expectations. The group is confident in its core markets, its revenues and its profits.”

- …alongside busy company-blog activity…

- “Andrews Boilers helps leading university with bioscience medicine research“;

- “Andrews Heat for Hire stops cast stone manufacturers from becoming stone cold!“;

- “Thirty-unit boiler hire package maintains district heating system output“;

- “Andrews Boilers helps Bath hospital get out of hot water“;

- “Andrews Heat for Hire provides heating solution for students“;

- “Adapted submersible pump arrangement gets client out of deep water!“;

- “World-famous brewery avoids hangover thanks to bespoke chiller replacement“;

- “Draining the obstacles: Sykes Pumps clears the way following underpass flood“;

- “Andrews Sykes: powering development at Hinkley Point C“, and;

- “Andrews Sykes provides cooling solutions for critical medical amenities“.

…had already suggested this H1 2023 would deliver satisfactory progress.

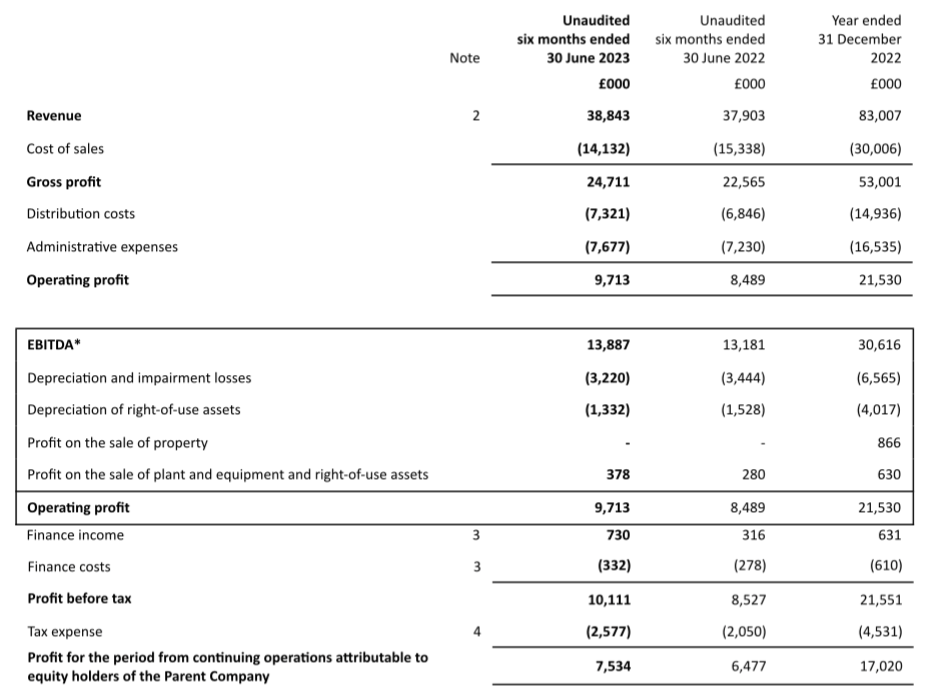

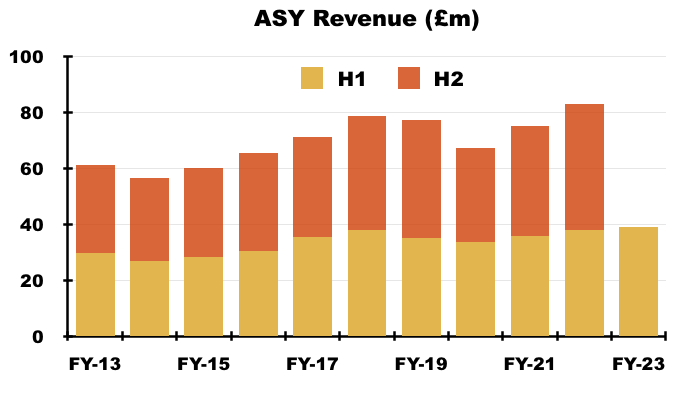

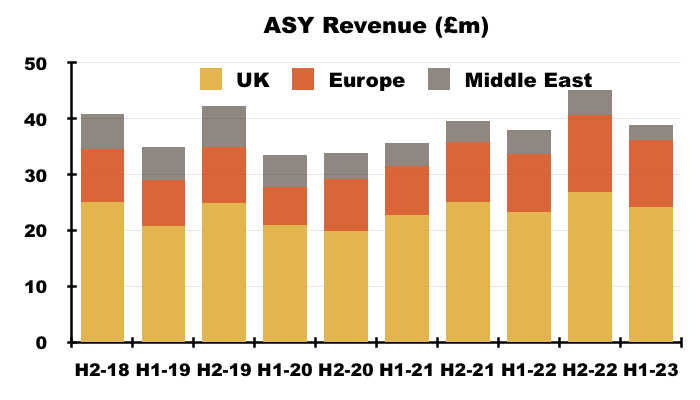

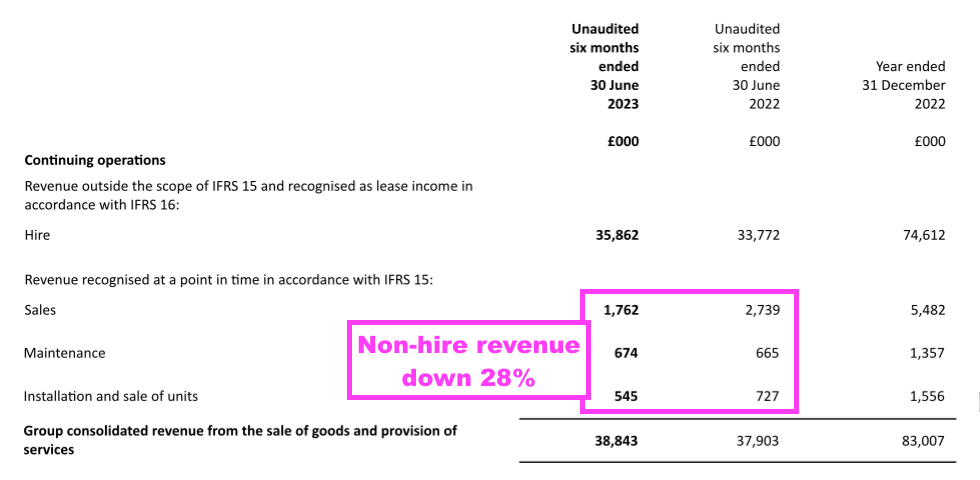

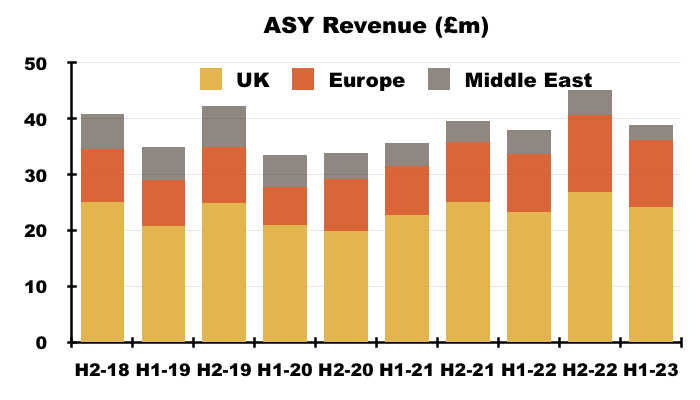

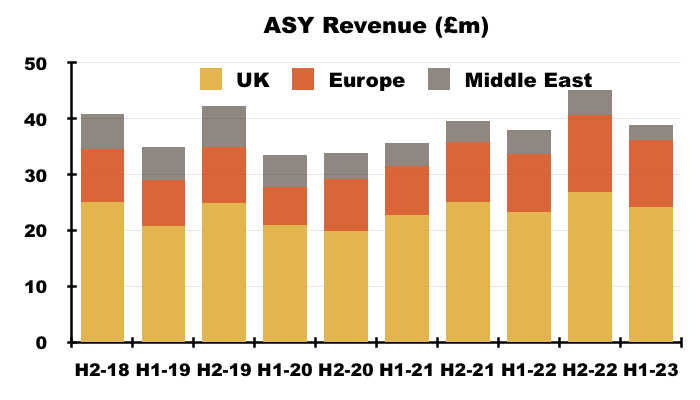

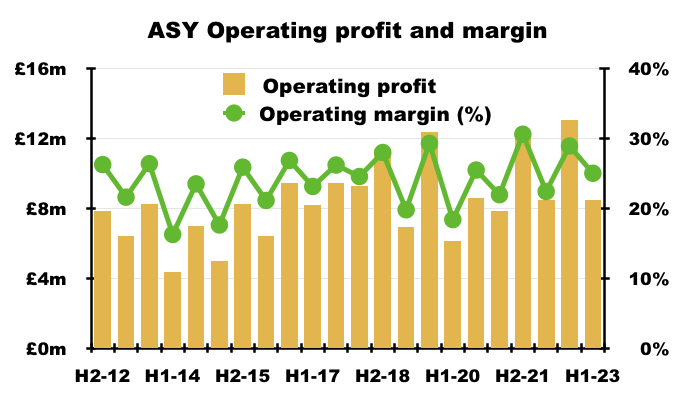

- New H1 highs were set for revenue, which gained 2% to £38.8m…

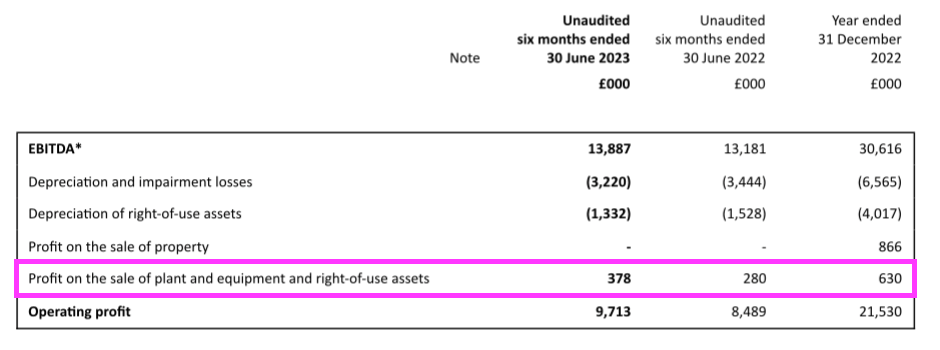

- …and operating profit, which advanced 14% to £9.7m:

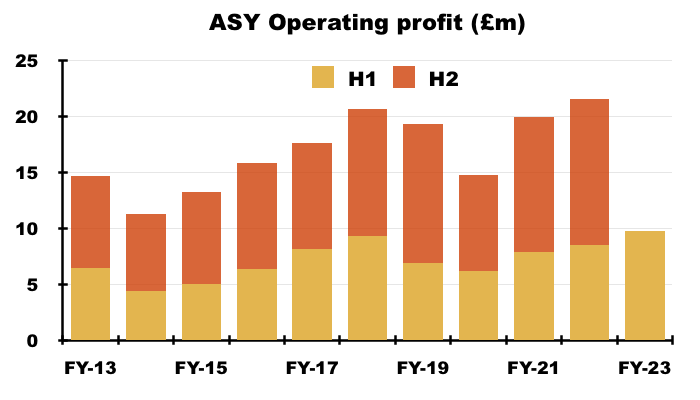

- H1 revenue was driven by core Hire revenue gaining 6% that counterbalanced a significant 28% reduction to the group’s Other income:

- H1 revenue progress was also curtailed by the closure of depots in France (see Europe) and difficult trading in the UAE (see Middle East).

- The H1 profit improvement was amplified by the comparable H1 incurring restructuring costs of £0.5m in France (see Europe).

- Extreme weather — particularly cold snaps, heatwaves and extensive rain — typically prompt sudden demand for the group’s hire equipment (primarily temporary boilers, air conditioners and water pumps).

- Progress from year to year can therefore fluctuate due to different climatic conditions.

- This H1 referred to both hot and cold weather:

“[A] cold winter and the high early summer temperatures in June driving increasing demand in our heating and cooling products“

- The preceding FY indicated the group’s largest earners were water pumps, hire for which is often prompted by heavy rainfall.

- Reflecting the bias towards water pumps, the latest three updates on ASY’s blog (at the time of writing) referred to pump hire:

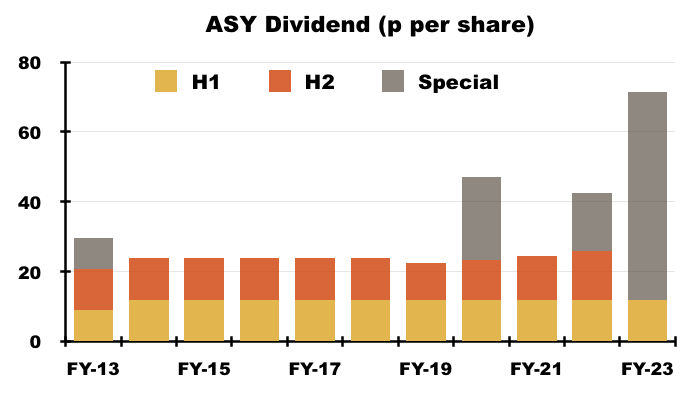

- The H1 dividend was set at 11.9p per share for the tenth consecutive H1:

- The H1 highlight was without doubt the 59.4p per share special payout. ASY said:

“In addition to the interim dividend, the board has assessed the company’s ongoing cash requirements and has concluded that, as a result of the company’s robust cash generation and de-risking of the defined benefit pension scheme, a portion of the current cash reserves are surplus to the company’s requirements. The board has therefore decided to return this surplus capital to Andrews Sykes shareholders by way of a special dividend of 59.40 pence per ordinary share which in total amounts to £25.0 million.“

- I had speculated within my FY 2022 write-up that ASY might consider another special payout:

- With net cash at £37m, could yet another special dividend be forthcoming? ASY has twice declared extra payouts when net cash has reached £30m:

- During the preceding H1, which reported net cash at £31m and announced the payment of a 16.6p per share/£7m special dividend, and;

- During FY 2020, when a 23.7p per share/ £10m special dividend was declared when net cash reached £30m.

- I bought my ASY shares 11 years ago at an average 233p and the latest dividends take my total ASY income to 356p per share, of which 109p per share has been funded by special payouts.

UK

- ASY can trace its UK Sykes history back to the 1850s and its UK Andrews history back to the 1960s:

- The combined group today offers a trade-only nationwide rental service supplying pumping equipment, air conditioners, air purifiers, chillers, heaters, boilers, dehumidifiers and ventilation units:

- ASY’s competitive edge is based upon depots providing first-class customer service (point 1)…

[AR 2022] “By providing a premium level of service 24 hours per day, 365 days per year, we have become the preferred suppliers to many major businesses and operations spanning a huge range of industries and geographic locations. Our reputation for providing high levels of training to our staff, whilst maintaining a strict health and safety workplace, within an environmentally conscious culture, makes us an employer of choice for our industry.”

- ..and stocking the best and most relevant equipment for different clients (point 1):

[AR 2022] “We constantly review and refresh our fleet of rental equipment to ensure that we set the standards within the rental industry throughout the UK, Europe and the Middle East.”

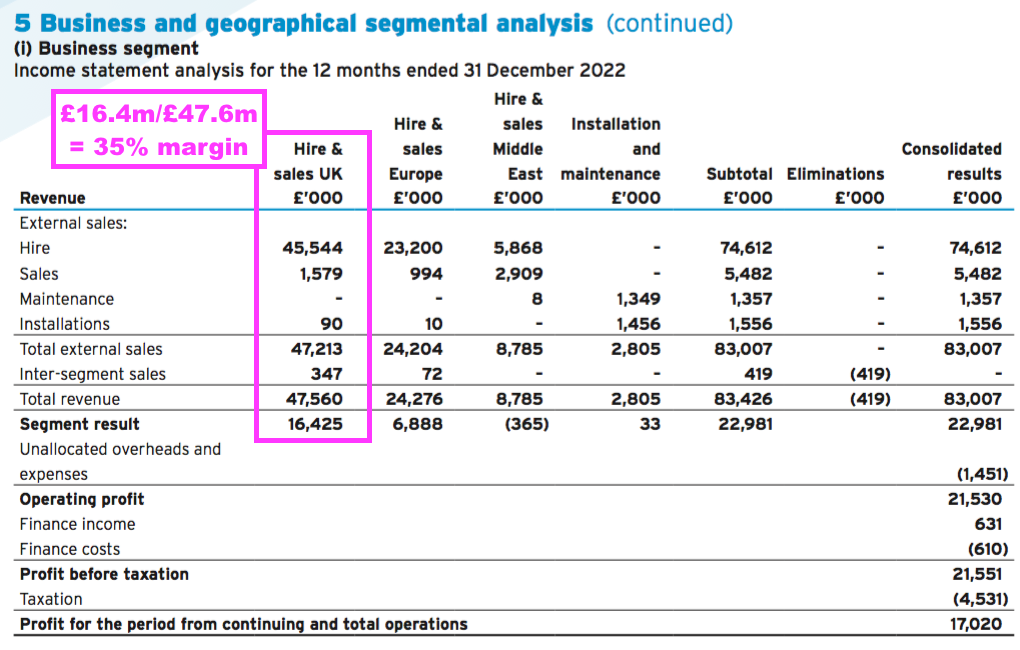

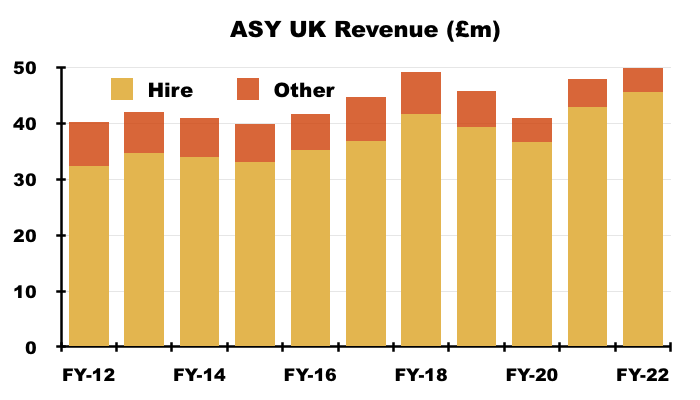

- The UK Hire and Sales subsidiary remains ASY’s dominant division.

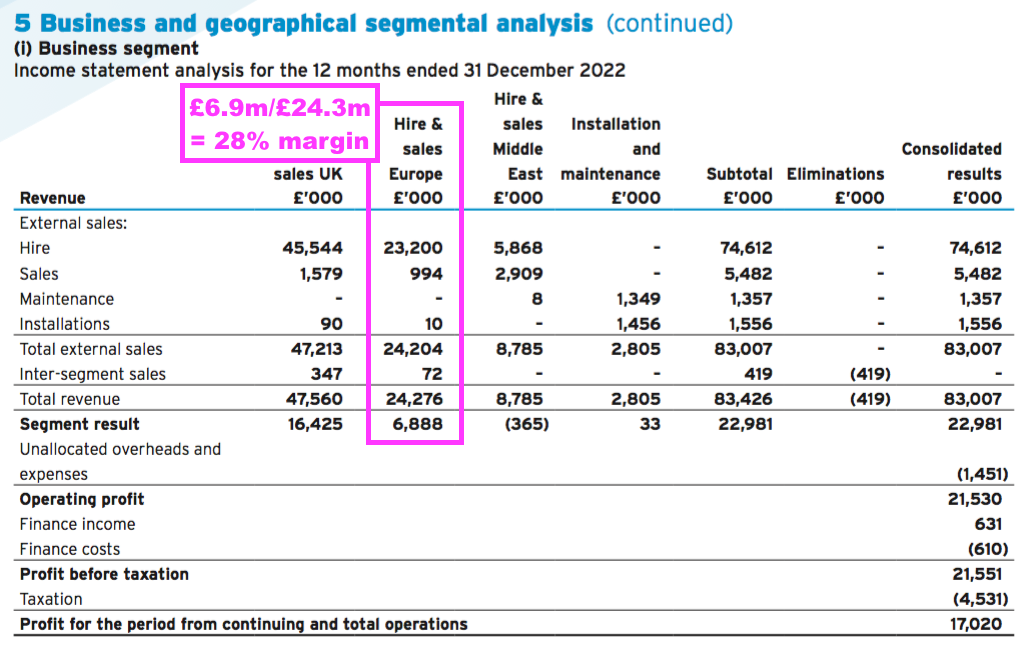

- For the preceding FY, UK Hire and Sales represented 57% of group revenue and 71% of group profit, which led to a super divisional margin of 35%:

- ASY sadly does not disclose its segmental analysis within its H1 statements.

- This H1’s (limited) commentary indicated UK Hire revenue gained 5.6%:

“Revenue at Andrews Sykes Hire in the UK continues to grow and improved by 5.6% compared with the same period in 2022.”

- A 5.6% UK Hire advance appears respectable. The accounts of ASY’s main UK subsidiary show UK Hire revenue increasing from £32m to £46m during the ten years to the preceding FY — equivalent to a 3.5% compound average:

- Total H1 UK revenue gained 2% to represent 62% of group turnover:

- ASY’s UK operations include notable revenue from product sales, equipment maintenance and installation, which declined 28% during this H1:

- The 2022 annual report disclosed the UK operations incurred restructuring costs during the preceding FY:

[AR 2022]: “[T]he UK business has undertaken a restructuring exercise during the year resulting in the relocation of four locations into one larger consolidated site. The exit from these four locations has lead to onerous leases, and in turn, the impairment of the associated right-of-use asset, which now have no economic value to the group.“

…

“Restructuring provision relates to the relocation from four locations in the UK to one large consolidated site and the associated costs involved including expected move costs and redundancy.“

- The “the relocation from four locations in the UK to one large consolidated site” involved a £289k right-of-use asset write-down (point 20) as well as a £672k restructuring provision (point 27).

- Total UK restructuring costs for the preceding FY were therefore £961k, which is not insignificant when the reported FY operating profit was £21.5m.

- These restructuring costs were not identified as exceptional (or similar) in the main income statement for the preceding FY.

Europe

- Europe remains ASY’s main opportunity for growth.

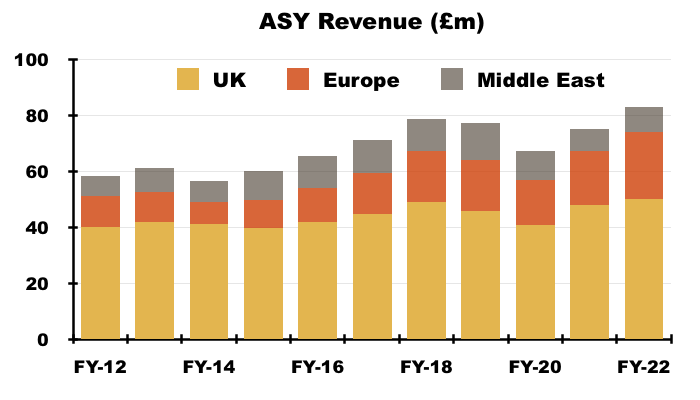

- Between FYs 2012 and 2022, European revenue expanded from £10.9m to £24.2m to represent 29% of group turnover:

- This H1 witnessed European revenue advance 17% to £12.1m to support a record 31% of group turnover:

- ASY noted an “exceptional” performance from the depots in Luxembourg and the Netherlands:

“This [European] result was driven by an exceptional performance from our Luxembourg and Dutch subsidiaries, with revenues up 64.8% and 24.1% respectively on the same period in 2022“

- ASY’s website shows the European operations consisting of:

- Netherlands:

- Started FY 1971

- 4 depots (Amsterdam, Bleiswijk, Hoogeveen, Oirschot)

- Belgium:

- Started FY 2007

- 3 depots (Antwerp, Brussels, Kortrijk)

- Italy:

- Started FY 2011

- 4 depots (Bologna, Milan, Toscana, Verona)

- France:

- Started FY 2012

- 1 depot (Paris)

- Switzerland:

- Started FY 2013

- 2 depots (Geneva, Zurich)

- Luxembourg:

- Started FY 2014

- 1 depot (Luxembourg)

- Germany:

- Started FY 2023

- 1 depot (Frechen)

- Netherlands:

- The German depot appeared to be opened after this H1, and marks ASY’s entry in what could be a “promising” market.

- Mind you, European expansion does not always go to plan. ASY presumably believed France was a “promising” market by opening six depots… only to close five of those depots during the preceding FY.

- ASY said the French subsidiary recorded a “significantly reduced” H1 loss:

“The previously announced restructure and depot closures in Climat Location, our France subsidiary, has contributed to a significantly reduced operating loss in France, with a loss of £0.1m being recognised in 2023. In addition, the group has further benefitted by not incurring any further restructure costs in the period whereas the same period in 2022 included £0.5m of restructure costs.“

- The 2022 annual report (point 20) revealed the French restructure costs were greater than the £0.5m cited by ASY:

“[D]uring the year our French subsidiary, Climate Location SAS, ceased trading from three depot locations. Property right-of-use assets associated with these three depots of £531,000 have been impaired as a result of this exit due to no future economic benefit expecting to be generated by these assets. In addition, due to the continued operating losses generated by Andrews Sykes Climat Location SAS, the group has decided to impair £147,000 of motor vehicle right-of-use assets and £29,000 of plant and machinery assets.“

- I calculate the French restructure during the preceding FY cost £531k + £147k + £29k = £707k.

- The European subsidiaries enjoyed a lovely 28% margin during the preceding FY:

- I am hopeful a smaller-but-improved French business could soon help that 28% margin catch up with the 35% enjoyed by the UK division.

- The French retrenchment means European depots have increased from six to only 16 since FY 2011.

- Opening a net ten depots since FY 2011 could mean future European growth will be slow going.

Middle East

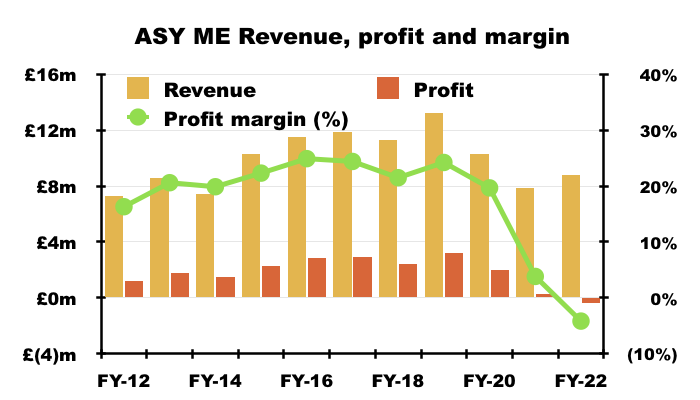

- ASY’s Middle Eastern ventures continue to underperform.

- The preceding FY had appeared to draw a line under the problems, with a £1.9m provision taken against various unpaid customer bills.

- ASY had also claimed this division would return to profit for FY 2023:

[FY 2022] “Management [is] confident all historic credit losses are captured in the expected credit loss provision and that 2023 will see a significantly reduced credit loss and thus a return to profitability in the Middle East.“

- However, this H1 admitted Middle Eastern revenue had plunged 40% and the division’s profit would be £0.4m below that recorded for the comparable H1:

“Khansaheb Sykes, our business based in the UAE, continues to experience a difficult trading environment with revenue down 40.3% versus the first half of 2022… The reduced turnover in the UAE has resulted in operating profit being £0.4m lower to the first half of 2022.“

- The preceding FY had already indicated the Middle Eastern ventures had incurred a £0.4m loss:

[FY 2022] “The turnover of our hire and sales business in the Middle East has pleasingly increased from £7.9 million last year to £8.8 million; however operating profit decreased from £0.3 million to a loss of £0.4 million in the year under review. The operating climate continues to be tough in the Middle East with a lack of significant infrastructure projects still depressing turnover in the pumps division to below what was being generated a few years previous.”

- The upshot therefore is the Middle East division continues to lose money, which is contrary to what ASY expected at the preceding FY.

- Perhaps ASY’s tighter credit control — that is, ensuring Middle Eastern customers actually pay their bills! — has persuaded some customers to hire equipment elsewhere.

- This H1 said the UAE business had been rejigged:

“A restructure undertaken during the period has further reduced headcount in the UAE and rationalised our depots to one main trading depot in Sharjah. New senior management [has] recently been recruited and are having a positive impact.”

- H1 Middle Eastern revenue of £2.6m represented just 7% of total H1 turnover:

- For perspective, Middle Eastern revenue during H1s 2015, 2016, 2017, 2018 2019 and 2020 exceeded £5m and at times represented 17-18% of total turnover.

- ASY’s Middle Eastern operations have in the past enjoyed FY profits of £2m-plus and margins beyond 20%…

- …which presumably explains why ASY is persisting with the region.

- Maybe the Middle East is an inherently difficult market. I recall a £164k trade investment in Saudi Arabia was written off during FY 2017.

- I note ASY’s Middle Eastern blog has been dormant for more than a year.

Financials: margin and cash flow

- ASY’s accounts remain very respectable.

- Despite the Middle Eastern woes, the H1 operating margin was a super 25.0% and was the highest for an H1 since H1 2008 (26.0%):

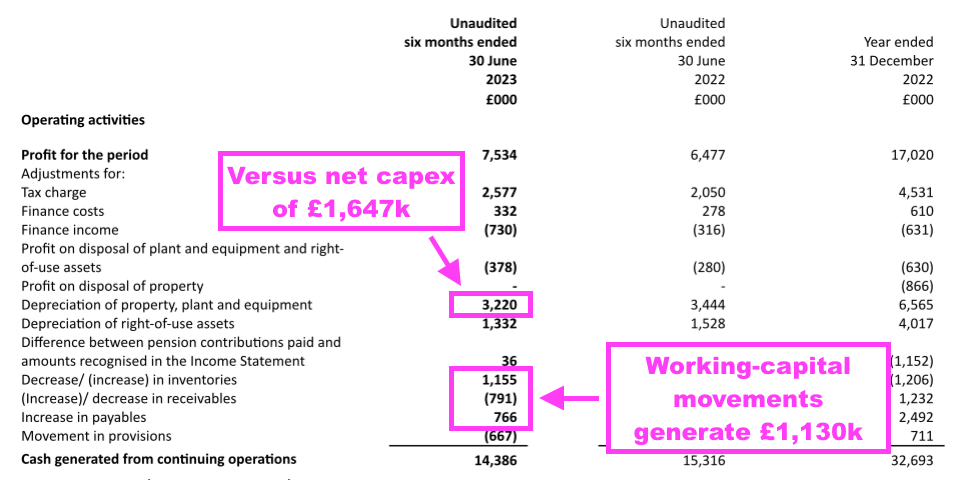

- Cash conversion was good. Earnings of £7.5m were exceeded by free cash flow of £8.3m, support for which included:

- A positive working-capital movement of £1.1m, and;

- Depreciation of £3.2m covering cash capex of just £1.6m:

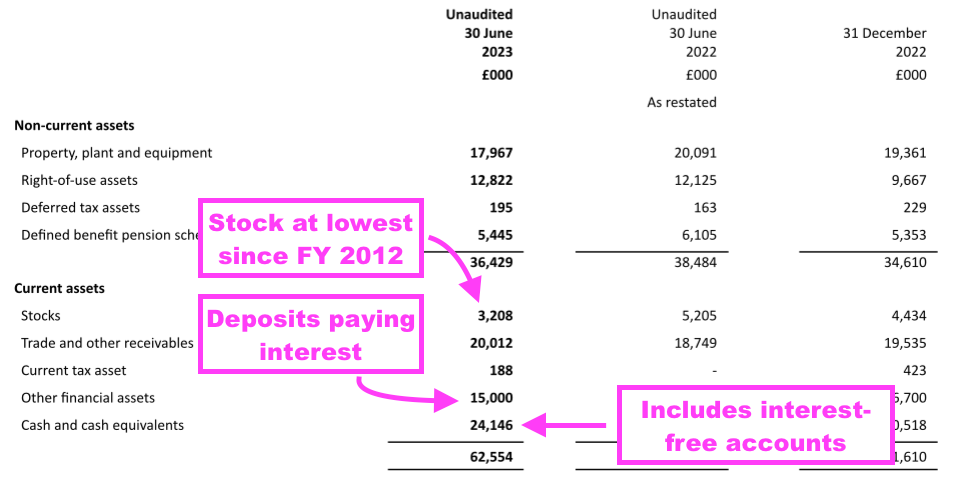

- Working-capital management was assisted by stock reducing by £1.2m to £3.2m — ASY’s lowest level of stock since FY 2012.

- Free cash flow of £8.3m funded the preceding FY’s final dividend of £5.9m and buybacks of £0.5m (see Valuation), which left the cash balance £2.0m stronger at £39m.

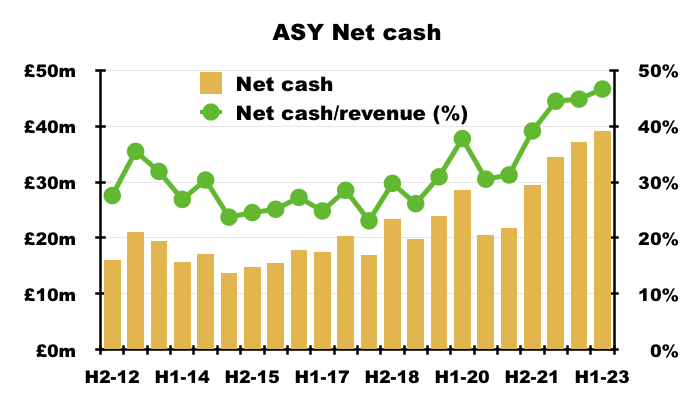

- Bank debt remaining at zero meant the cash of £39m set a fresh high for net cash:

- Net cash at £39m is equivalent to 47% of trailing twelve-month revenue of £84m, and is the highest percentage for at least ten years.

- No wonder ASY decided to declare that £25m special dividend.

- Net cash of £39m less the £25m special dividend leaves net cash at £14m — equivalent to nearly 17% of trailing twelve-month revenue and the lowest percentage for at least ten years.

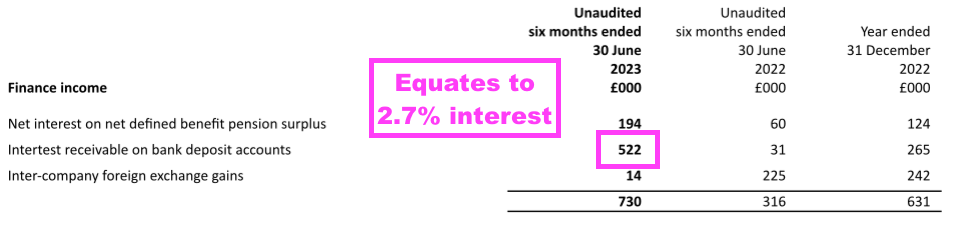

- ASY’s cash position averaged £38m during this H1, and bank interest of £522k gave an effective 2.7% interest rate:

- The H1 balance showed £15m held within interest-bearing deposits accounts of more than three months…

- …although up to £24m was held within standard accounts the 2022 annual report admitted paid no interest whatsoever (point 25).

- ASY has traditionally exhibited very tight cash control, and may well have valid reasons for employing interest-free accounts (I suppose the board may have been preoccupied with discussing the £25m special dividend to consider additional interest-earning accounts).

- Nonetheless, excuses for significant cash balances earning no interest have to be very convincing with the base rate now at 5.25% and mainstream instant-access business accounts currently paying 1.46-1.92% AER variable.

- This H1 recorded a profit over the book value of old equipment and right-of-use assets — extending the run of such gains since at least FY 2005:

- The 2022 annual report explained why old equipment is sold and refuted any speculation about ‘hidden asset value’ from the regular profits generated (points 12a and 15):

[AR 2022] “The profits on the disposal of hire assets represent occasional requests to sell hire assets, often to an existing customer, and are not considered by management to indicate that there is positive residual value in the entire hire assets portfolio. The group also considers market-based evidence from other comparable industry competitors when assessing the useful economic life of its assets.”

- The 2022 annual report also revealed ASY’s rental fleet contains equipment with zero book values that continue to generate revenue (points 12a and 15):

[AR 2022] “The group incurs maintenance spend in order to keep its fleet to a high level of repair, which often extends an individual assets life beyond its useful economic life. During the year, the group incurred £2.2 million of repair costs. More substantial parts, such as replacement parts, are capitalised, with the asset also removed from the fixed asset register. To provide sufficient asset availability for periods of extreme weather, the group routinely keeps nil net book value items rather than scrap them.”

Financials: pension scheme

- A welcome surprise from this H1 was ASY announcing its pension obligations had been “fully de-risked” through a scheme buy-in:

“Since the period end, the company has worked with the pension scheme Trustees and pension advisors, Hymans Robertson, to successfully de-risk its defined benefit scheme by completing a buy-in deal with Canada Life.

This transaction, whilst significantly reducing the defined benefit pension scheme surplus recorded on the balance sheet, means that future liabilities are fully de-risked and the company will not be required to contribute significant cash payments into the pension scheme to fund adverse liability movements. During 2021 and 2022 the company contributed £2.6m of cash into the defined benefit pension scheme.“

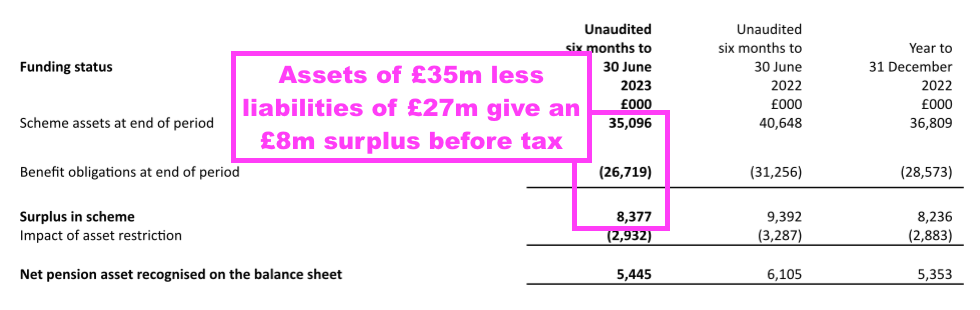

- “[S]ignificantly reducing the defined benefit pension scheme surplus recorded on the balance sheet” suggests Canada Life calculated the scheme’s liabilities to be much greater than the £27m declared within this H1:

- I also wonder whether Canada Life believed the scheme’s assets of £35m were insufficient to cover the greater obligations…

- …and ASY has had to contribute a sizeable sum to the pension scheme to complete the deal.

- The terms of the buy-in were not disclosed, but the forthcoming 2023 annual report will reveal all the details.

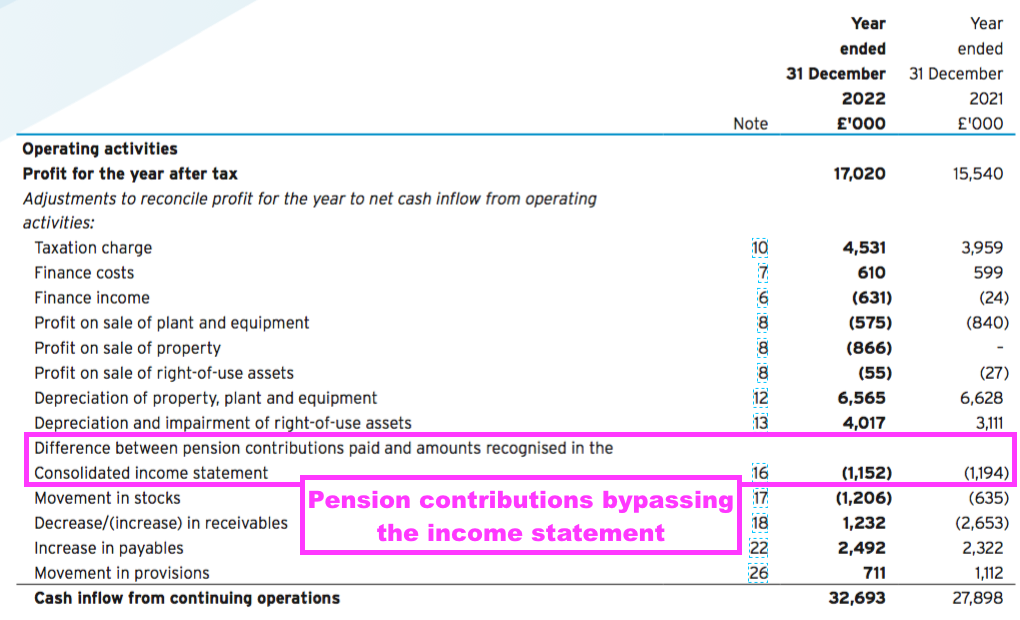

- At least the buy-in should now eliminate significant distortions between ASY’s profit and cash flow.

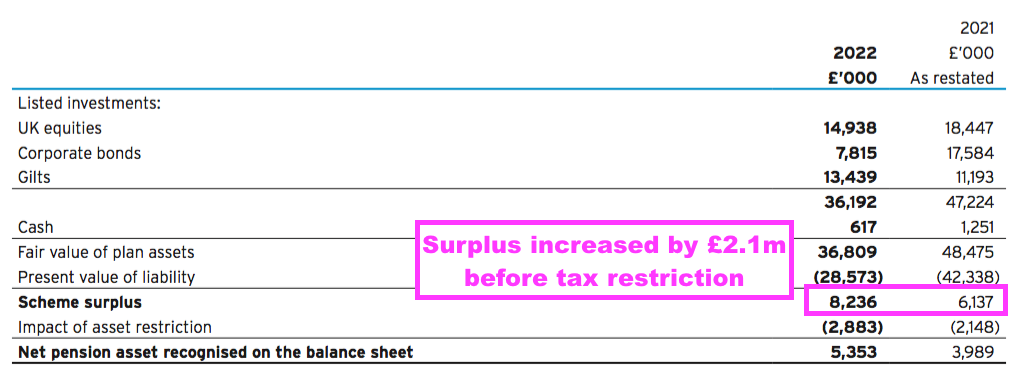

- For example, despite a pre-tax pension surplus of £8m at the preceding FY…

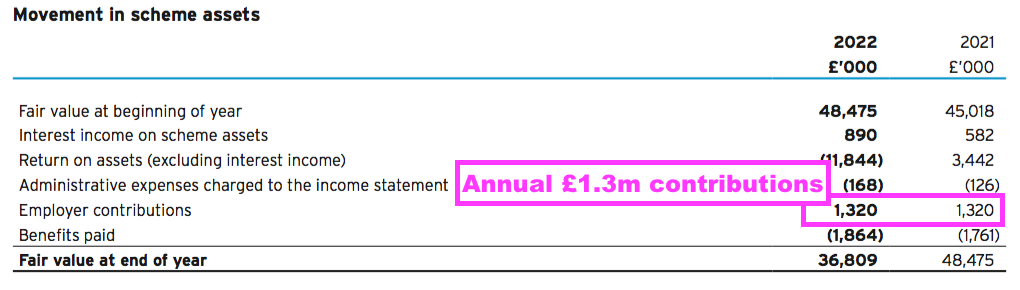

- …ASY has been paying £1.3m annual contributions…

- …most of which bypassed the income statement and were therefore not charged to earnings:

Boardroom

- ASY announced last June that its chairman, Jacques-Gaston Murray, had died:

[RNS 2023] “The Board of Andrews Sykes (the “Board”) is deeply saddened to announce the death of its long-serving Chairman of the Board, Jacques-Gaston Murray, aged 103 years old, who has passed away.

The Board sends its heartfelt condolences to Mr Murray’s family at this difficult time and would like to place on record its immense appreciation for the many years of service that Mr Murray has dedicated to the Company.

Mr Murray was appointed to the Board in May 1994, following his acquisition of a controlling interest in the Company, and he has had a prominent role in guiding the Company’s successful performance and strategy since that time.”

- Mr Murray maintained his controlling interest in ASY until 2008, at which point he transferred the shareholding to his sons:

[RNS 2008] “The Company has been notified today that on 26 October 2008, the Chairman, Mr Jacques-Gaston Murray, transferred his controlling interest in the Tristar Corporation in equal proportion to two trusts; the Jean-Jacques Murray Trust and the Jean-Pierre Murray Trust. Accordingly these two trusts are now the ultimate controlling parties of the Tristar Corporation and subsequently the ultimate controlling parties of the Company.

“The Tristar Corporation continues to control EOI Sykes Sarl which in turn has a beneficial interest in 36,377,213 ordinary shares of one pence each in the Company (‘Ordinary Shares’) representing approximately 82.17% of the Company’s issued share capital. As a result of this transaction, the beneficial interest of Mr Jacques-Gaston Murray has decreased from 37,687,369 to 1,310,156 Ordinary Shares representing approximately 2.96% of the issued share capital of the Company.”

- ASY also announced during June the appointment of one of Mr Murray’s sons, Jean-Jacques Murray, as ASY’s new chairman:

[RNS 2023] “The Board also announces that Jean-Jacques Murray, the son of Mr Murray, will assume the role of Chairman of the Board with effect from 7 June 2023. Jean-Jacques Murray has been Vice-Chairman of the Board since February 2007 and has been very influential in the progress and development of the Company since that time. The Board remains extremely confident in the ongoing strategy and prospects of the Company.“

- ASY then announced this year Jean-Jacques Murray had taken on executive responsibilities:

[RNS 2024] “The Company announces the following changes to the Board of Andrews Sykes (the “Board”) with effect from 12 February 2024:

· Jean-Jacques Murray, will become Executive Chairman. Jean-Jacques Murray has been Non-Executive Chairman since June 2023 and prior to that was Non-Executive Vice-Chairman since February 2007.

· Jean-Pierre Murray will assume the role of Non-Executive Vice-Chairman. Jean-Pierre Murray has been a Non-Executive Director since August 2008.

The Board remains extremely confident in the ongoing strategy and prospects of the Company.“

- Jean-Jacques Murray becoming executive chairman is very intriguing.

- After all:

- ASY has coped well employing just one board executive (ASY’s managing director) since 2011, and;

- The Murray family had previously never undertaken an executive ASY role since taking the aforementioned controlling interest during 1994.

- My notes from ASY’s 2016 AGM recounted the Murray family were ‘hands off’ shareholders:

“The controlling family, who are not involved in the operation of the business, like the higher levels of management governance a stock-market listing can provide“

- Jean-Jacques Murray now appears to be ‘hands on’, although I doubt he will be managing water pumps and temporary boilers.

- I speculate Jean-Jacques Murray might instead be contemplating corporate activity.

- Wishful thinking perhaps, but that £25m special dividend alongside “de-risking” the pension scheme could be interpreted as optimising the balance sheet for a potential bidder (corporate suitors never like to pay a premium for surplus cash and guess whether pension obligations will turn into ‘black holes‘).

- The Murray family were cited by the Sunday Times Rich List 2023 as being worth £2.7b, and maybe the death of Jacques-Gaston Murray will prompt a review of the family’s portfolio.

- The family’s 91% ASY shareholding carries a £213m market value and therefore represents less than 10% of their estimated wider investments.

- The Murray family’s other London-quoted investment — a 99% shareholding in London Security (LSC) — has a market value of approximately £370m. The Murray’s business empire also includes Miami beach-front hotels.

Valuation

- This satisfactory H1 performance did not entirely continue into H2:

“Following the Company’s strong first half performance, trading in the second half of the year to date has been more mixed. Whilst extreme summer temperatures in Southern Europe positively impacted demand for the Group’s chillers in Italy, a more subdued summer season in the UK has limited the overall positive impact for the Group. Overall, Management remains confident of delivering full year results in line with the Board’s expectations.”

- ‘Climate’ references were made about the economy as well as the weather:

“In the longer term, management remains optimistic that the business will continue to improve but are mindful of the current economic climate and the impact that volatile energy prices and inflationary cost pressures can pose to the business and customer demand.”

- ASY’s blog has nonetheless reported plenty of H2 activity:

- “Warming hearts and facilities following school boiler breakdown“;

- “FD40s to the rescue! Read how we rapidly responded to a flood emergency in under three hours…“;

- “Preserving history: Dehumidification for household cultural institutions“;

- “Andrews Sykes goes the extra mile for prestigious motorsport event“;

- “Tackling temperature trouble at Twickenham Stadium“;

- “Comedic delights and comfortable nights! Adaptable cooling solutions for Edinburgh Fringe Festival“;

- “Filtration Sensation: Kent hospital benefits from AC/HEPA combo solution“;

- “Andrews comes up with golden ticket for Charlie and the Chocolate Factory stage show“;

- “We put the icing on the cake for Glaswegian cake manufacturer“, and;

- “Crisis averted: Andrews Sykes tackles bitumen emergency“.

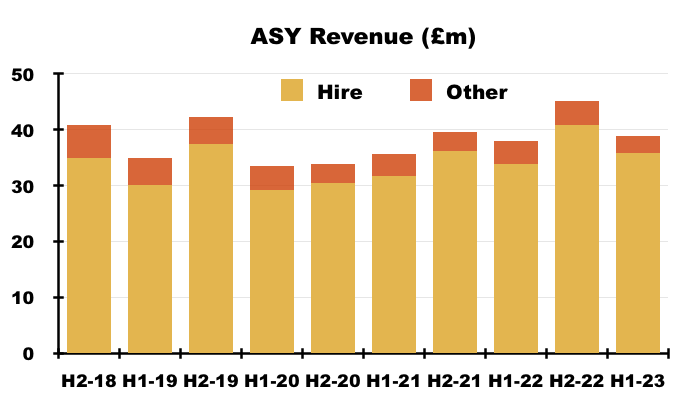

- Assuming H2 2023 matches H2 2022, the forthcoming FY 2023 will report revenue of £84m and an operating profit approaching £23m.

- The valuation sums could be fine-tuned for:

- UK restructure costs of close to £1m incurred during H2 2022 (see UK);

- Losses one day returning to profit in France and the Middle East, and;

- Annual IFRS 16 lease costs of more than £0.6m.

- But the valuation sums may not have to be fine-tuned for:

- The £39m cash position (mostly repaid through the £25m special dividend), and;

- The pension scheme (now “de-risked“).

- Operating profit approaching £23m less 25% standard UK tax gives earnings of £17m or nearly 41p per share.

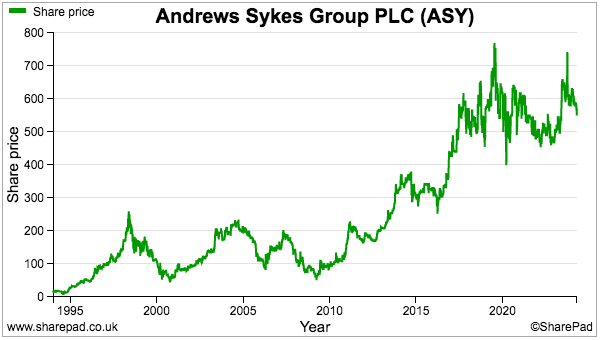

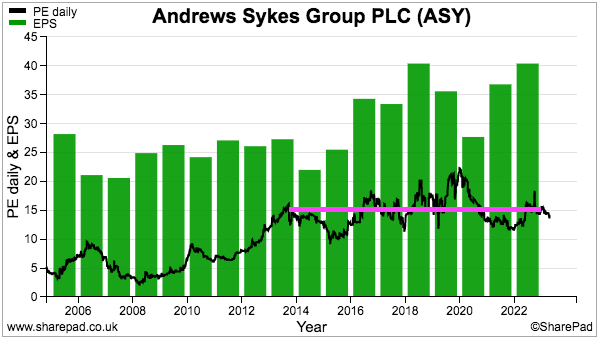

- The 560p shares are valued at 13-14x my 41p per share estimate, which does not appear outrageously expensive for a high-margin and cash-generative business that:

- Seems likely to deliver record annual figures for FY 2023;

- Offers further expansion opportunities within Europe, and;

- May possess vague bid hopes should the Murray family want to exit (see Boardroom).

- Bear in mind ASY’s P/E has tended to bob around the 15x mark during the last ten years and has rarely climbed to a 20x rating:

- Keeping a lid on the P/E may be:

- The Murray family’s 91% ownership (see Boardroom) and risk of delisting;

- A lack of reinvestment opportunities for growth, underlined by that £25m special dividend, and/or;

- The profit ups and downs due to the weather.

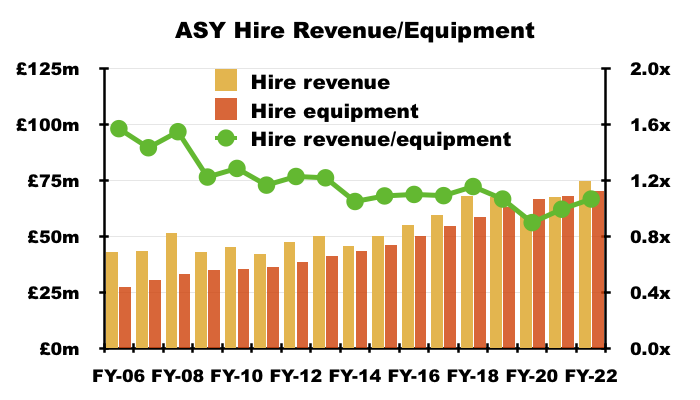

- Plus ASY’s economies of scale may not be fantastic. In particular, previous results have shown a consistent 1.2x limit between revenue generated from the group’s hire equipment and the original cost of that hire equipment:

- A sustained P/E re-rating may therefore require ASY to earn more revenue from its existing hire equipment, rather than consolidating its UK locations and/or opening more depots within Europe.

- A positive omen perhaps are ASY’s buybacks, which occurred during this H1 and the subsequent H2 that cost £1.9m at an average 643p.

- The last time ASY undertook significant buybacks occurred during FYs 2010, 2011 and 2012, when an aggregate £3.1m was spent cancelling shares at a 155p average.

- For now the 25.9p per share trailing twelve-month ordinary dividend supplies a 4.6% income at 560p.

Maynard Paton

Hello Maynard, first of all, many thanks for this highly instructive post. I have to admit I’m confused by it, however. I’ve looked on the company website and the 2023 interim report, from which you draw in your article, was already released at the end of September last year. Accordingly, the special dividend was already paid to shareholders November last year.

Or do you generally only write about results with a certain lag-time after the reporting to allow time to put matters into perspective?

Hi Simon

‘Putting matters into perspective’ is a kind interpretation, but I am simply way behind with my blog write-ups! I am trying to catch-up this year to reduce the time between results publication and blog write-up, which is currently almost 6 months. Next up is MTVW’s interims (published Nov) and then SYS1’s interims (published Dec). Stay tuned!

Maynard

Hi Maynard,

Good stuff as always and interesting speculation regards a potential sale. I’d not picked that up despite knowing the company pretty well having held continuously since initially buying in 2007 and 2008. (Pretty sure that’s a record for me JDG’s bought in 2009 a close 2nd). It’s certainly been a wonderful sleep at night share over the last 16 to 17 years.

Patrick

Thanks Patrick. My speculation could be completely wrong of course, but just seems a possibility given the bumper special dividend, the pension de-risking and a Murray becoming an executive all happening in relatively quick succession. I think the main worry to this share has always been the de-listing risk and the Murrays going private with a low-ball offer — but over the last 16 to 17 years (well done btw!) that has not materialised and I would like to think the Murrays are more likely to be sellers than buyers. All told, a really good case study of a low-profile owner-orientated business delivering good progress over time with minimum fuss.

Maynard