01 January 2022

By Maynard Paton

Happy 2022! I hope you profited from last year’s strong market and you continue to find my blog useful.

A summary of my portfolio’s 2021:

- Total return of +24.5% (Q4: +4.6%)*;

- 8 holdings recorded a gain while 3 holdings recorded a loss;

- Returns ranged from up 104%, for System1, to down 20%, for Bioventix;

- Two shares were topped-up: System1 and M Winkworth, and;

- No new shares were purchased and no shares were sold.

(*Performance calculated using quoted bid prices and includes all dealing costs, withholding taxes, broker-account fees and paid dividends)

I publish a portfolio review after every quarter (Q1, Q2 and Q3), and this post recaps my October/November/December activity and my 2021 performance.

Contents

Disclosure: Maynard owns shares in Andrews Sykes, Bioventix, City of London Investment, Mincon, Mountview Estates, S&U, System1, Tasty, FW Thorpe, Tristel and M Winkworth.

Q4 share trades

None.

Q4 portfolio news

As usual I have kept watch on all of my holdings. The Q4 developments are summarised below:

- Acceptable full-year progress and another special dividend from Bioventix.

- Clients withdrawing money for the fifth consecutive quarter at City of London Investment.

- A mixed update from Mincon.

- NAV up a fraction and a welcome special dividend at Mountview Estates.

- A reassuring trading update from S & U.

- Confirmation of significant data-revenue growth at System1.

- The 19th consecutive annual dividend lift at FW Thorpe.

- H2 pandemic disruption and a re-introduced FDA timetable at Tristel.

- A positive trading update from M Winkworth.

- Nothing from Andrews Sykes and Tasty.

I have written a full review of all the shares I held during 2021 — simply click here for the complete run-down.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Full-year review

I always study my portfolio’s performance at the start of every year.

I am keen to discover where my gains and losses occurred during the previous twelve months, and check whether my portfolio decisions have become consistently good, bad or indifferent.

2021 performance

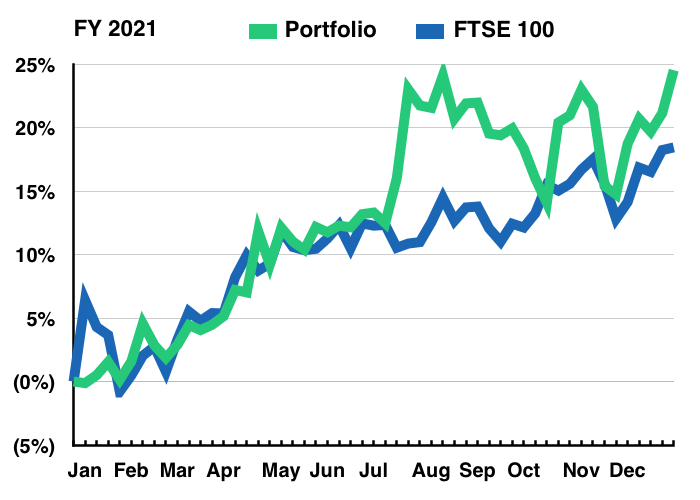

The chart below compares my portfolio’s weekly 2021 progress (in green) to that of the FTSE 100 total return index (in blue):

I finished up 24.5% versus an 18.4% gain for my benchmark. My 2021 performance was due mostly to:

- My best idea of 2020 doing well: System1 rallied 100%-plus after I tripled my holding before the start of the year.

- Better-than-expected company performances: Newsflow from FW Thorpe, S & U, Tasty and M Winkworth improved during 2021 as pandemic restrictions were lifted.

- Avoiding major calamities: My portfolio (amazingly) did not suffer a catastrophic profit warning.

2015-2021 performance

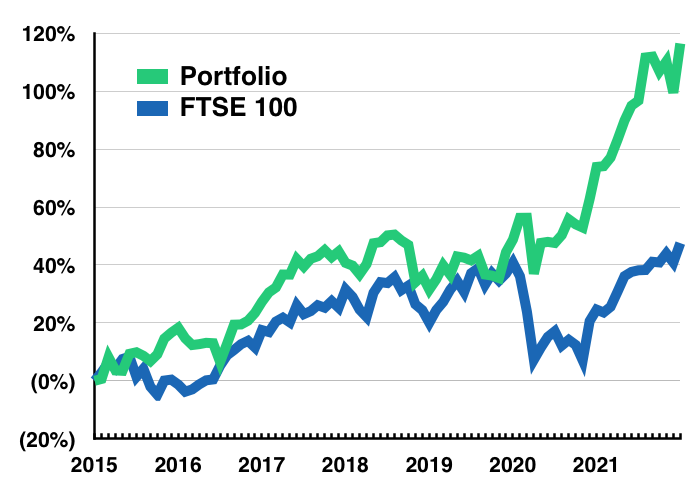

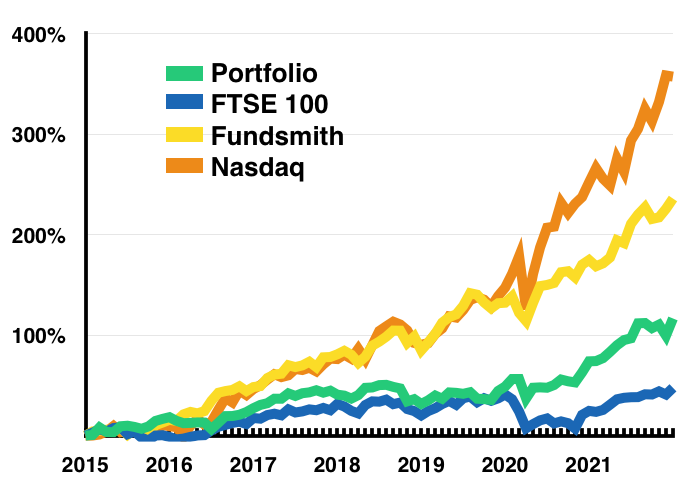

The next chart compares my portfolio’s monthly progress to that of the FTSE 100 total return index. The chart commences at 2015, which coincides with me becoming a full-time-ish investor:

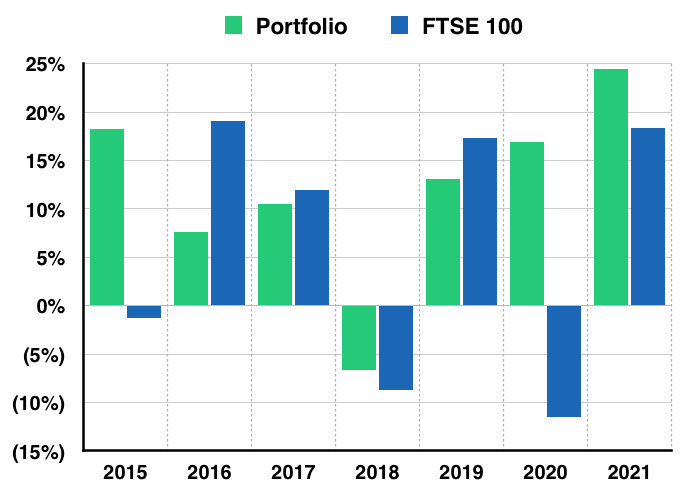

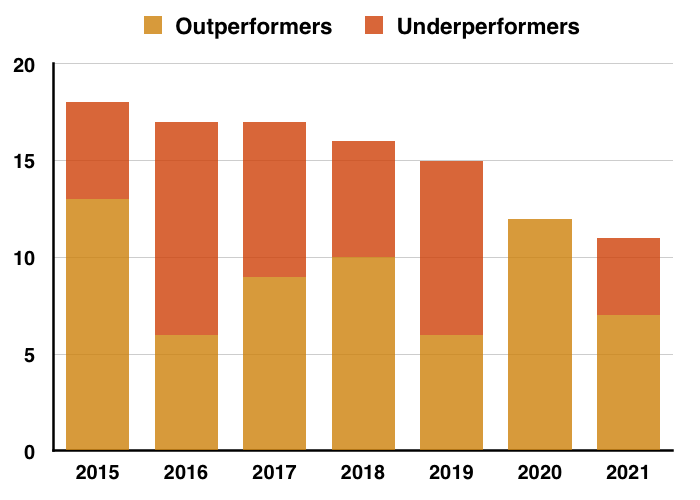

I am pleased I am ahead of the FTSE 100 on this seven-year view — up 116% versus up 48%. But I have underperformed the FTSE 100 during three of those seven years (2016, 2017 and 2019):

My positive 2021 was perhaps a follow-on from the ups and downs of 2020, which emphasised the importance of backing companies with owner-managements and cash-rich accounts during uncertain economic conditions.

So you have UNDER-PERFORMED during 2021? What now? Read more.

Investment returns and portfolio contributions

Just to confirm, during 2021:

- I did not buy any new holdings;

- I did not top-slice or sell any holdings, and;

- I left nine holdings untouched (Andrews Sykes, Bioventix, City of London Investment, Mountview Estates, Mincon, S & U, FW Thorpe, Tasty and Tristel).

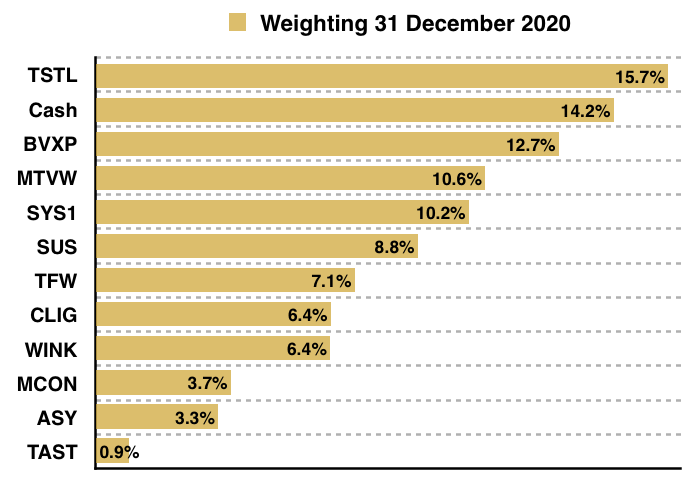

My portfolio started 2021 like this…

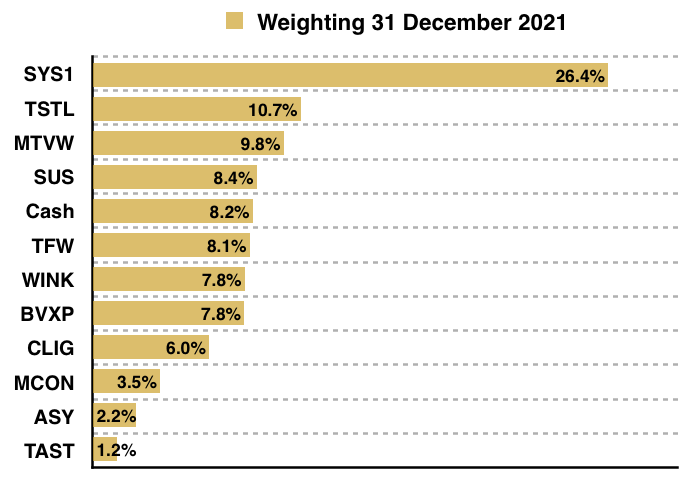

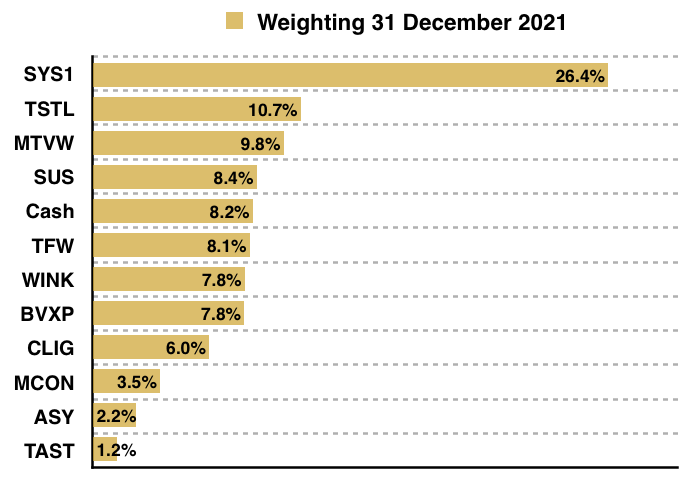

…and finished 2021 like this:

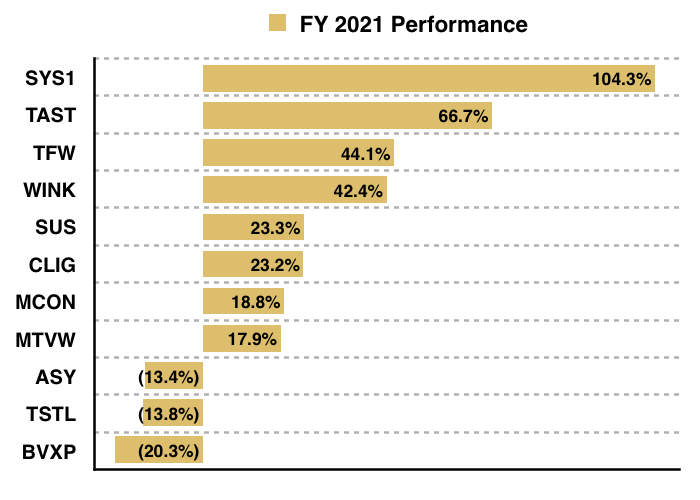

This next chart shows the total return (that is, the capital gain/loss plus dividends received) each holding produced for me during the year:

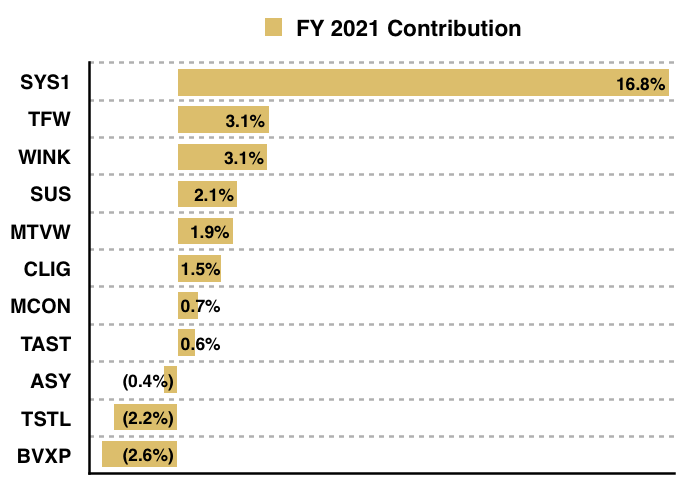

And this chart shows each holding’s contribution towards my overall 24.5% gain:

System1 surging higher had a significant influence on my performance. My portfolio would have advanced 20.9% had I not bought more of the shares during Q2.

My portfolio was hindered by Bioventix and Tristel. Both suffered from Covid-19 hospital disruption, which scuppered my earlier notion that healthcare-related companies might withstand the pandemic.

A more concentrated portfolio combined with some sizeable share-price moves left only Andrews Sykes, Mincon and Tasty making minor contributions of between -1% and +1% to the overall result.

My return was not helped by the 9.5% average cash position held throughout the twelve months.

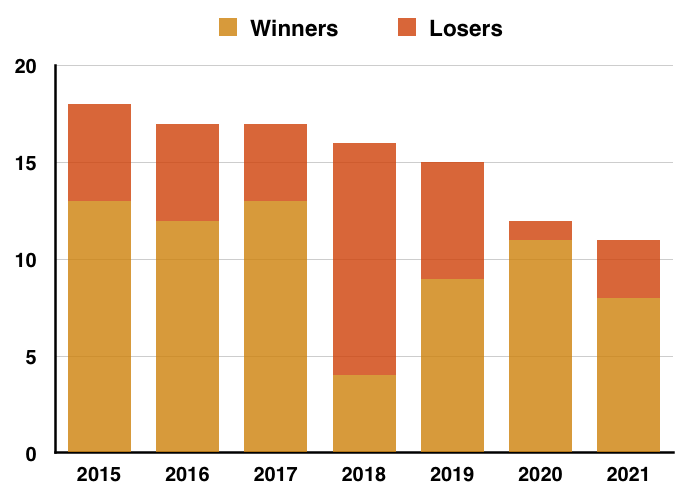

I am pleased 8 my 11 holdings recorded positive total returns:

I am also pleased 7 of my 11 shares outperformed the FTSE 100 during what was a strong year for the index:

Dividends received, portfolio turnover and trading costs

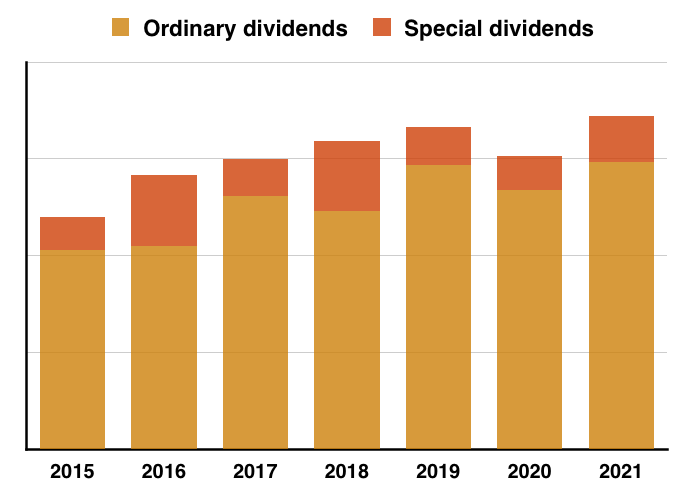

My dividend total rebounded 14% during 2021 and the payouts collectively added 2.9% to my performance:

(Note: Compared to (pre-pandemic) 2019, my ordinary dividends improved by 1% and total income gained 3%)

Once again I collected a batch of special payouts (Bioventix, FW Thorpe and M Winkworth), which last year enhanced my ordinary dividends by 16%. Specials have in fact bolstered my ordinaries by 19% since 2015.

Portfolio turnover remained relatively low. I bought shares equivalent to 6.8% of my portfolio’s year-start value, and did not sell any shares.

Trading costs were kept modest. Dealing commissions, stamp duty and account-management fees net of interest received represented an aggregate 0.06% of my portfolio’s year-start value.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Summary

So here we go into 2022, with my current investments confirmed below:

My top eight shares each represent at least 6% of my portfolio, and all therefore stand a good chance of impacting my 2022 result. Of course I recognise System1 at a 26% position will probably dictate proceedings.

As usual I have no idea how the market will behave during the next twelve months. But I remain convinced that pinpointing smaller businesses that offer decent accounts, capable managers, respectable prospects and modest valuations remains a sensible long-term approach.

Whether that approach is in fact the most lucrative way to invest is debatable. Terry Smith’s Fundsmith and the Nasdaq index for example have trounced my portfolio, the FTSE 100 and I am sure most other stock-pickers during the last few years:

The challenge I face during 2022 and beyond is not just to ensure my chosen shares do well, but to keep up with those top-performing alternatives.

Until next time, I wish you safe and healthy investing.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.