***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

16 August 2024

By Maynard Paton

Could now be the time to back Nick Train?

The buy-and-hold fund manager was for years feted for selecting blue-chip multi-baggers such as Diageo, RELX and London Stock Exchange.

But recent times have witnessed a stark change to market conditions…

…and Mr Train admitting to a “mortifying” underperformance that even necessitated a public apology.

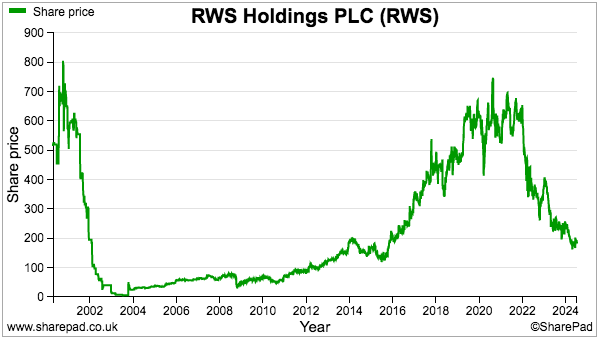

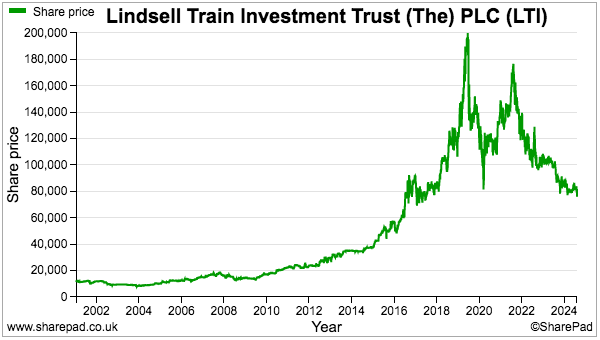

The shares of Lindsell Train Investment Trust, an investment trust managed by Mr Train, have for example lost 60% from their 2019 peak and are now back to a level first achieved eight years ago:

Yet Mr Train’s supporters may now want to consider this £154 million trust as a way of profiting from his potential comeback.

Importantly, this trust owns 24% of Mr Train’s fund-management firm, which last year paid a £39 million dividend split between Mr Train, his colleagues and this trust…

…and yet this 24% stake appears valued by the stock market at less than 2x earnings.

Let’s take a closer look.

Read my full LINDSELL TRAIN INVESTMENT TRUST article for SharePad >>Maynard Paton