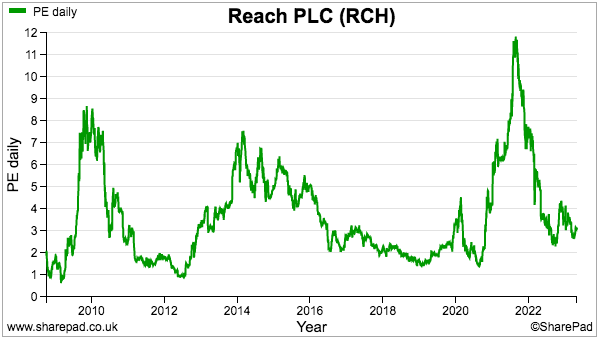

Newspaper publisher Reach trades on a P/E of 3. Maynard Paton believes the rock-bottom rating reflects a pension scheme ‘black hole’.

Let me start by confessing this article covers pension deficits.

What follows is therefore not thrilling and does require some concentration. But please stick with me, especially if you have ever fallen victim to a ‘value trap’.

You see, an onerous pension scheme is a common reason why companies trade on permanently low ratings. The market essentially believes too much of their future profits will have to plug a retirement ‘black hole’ instead of being paid out as dividends.

A good example is Reach, the newspaper publisher that used to be known as Trinity Mirror.

An update the other week confirmed a £95m profit was expected for 2023:

“Profit expectations for FY23 remain in-line with market consensus.(1)

…

(1) Market expectations compiled by the company are an average of analyst published forecasts – consensus adjusted operating profit for FY23 is £95.3m (range from £93.7m to £96.5m)”

…and yet the market cap is £265 million and the 83p shares currently trade on a P/E of approximately 3:

Studying the group’s pension situation goes some way to explain the rock-bottom rating.

Let’s take a closer look.

A recap of pension deficits

Pension deficits arise only at companies that maintain ‘defined-benefit’ or ‘final-salary’ schemes — that is, schemes that have promised employees a certain level of pension benefits at retirement.

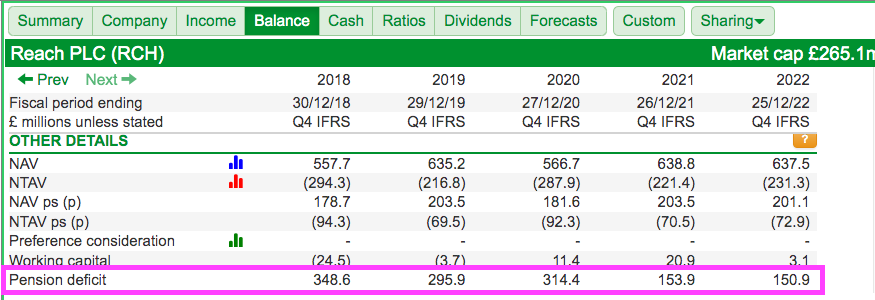

The Balance tab within SharePad tells us whether a company operates such pension schemes and carries these promised obligations:

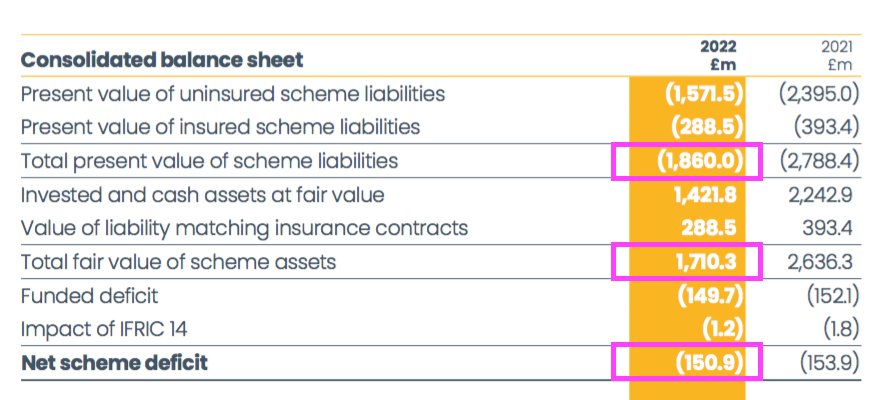

SharePad shows Reach suffering a pension deficit of £151 million for 2022, and the group’s annual report reveals how that £151 million was derived:

The pension scheme has assets of £1,710 million and liabilities of £1,860 million, which alongside a £1 million technical adjustment gives the £151 million deficit.

In theory, at least, the £151 million deficit means the scheme requires extra assets totalling £151 million to ensure all the future payments to the pensioners are met.

I say “in theory” because the scheme’s liabilities are calculated by actuaries using educated guesswork.

Predictions about longevity, inflation, salary increases and a lot more besides are all fed into a spreadsheet…

…and tweaks to the data can make the liability calculation fluctuate significantly. Such fluctuations can then leave investors very confused as to how serious the deficit really is.

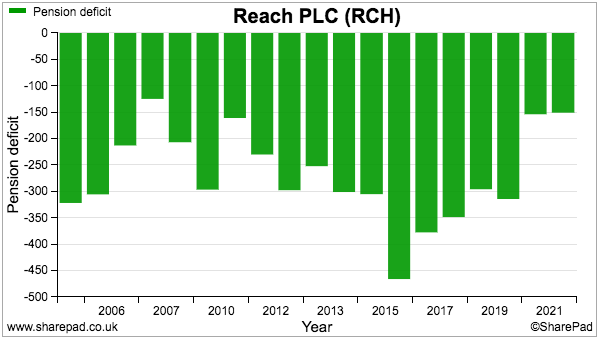

Case in point: SharePad shows the pension deficit at Reach being anywhere between £80 million and £466 million since 2005:

A better way to identify a problematic pension is to focus on the scheme’s assets.

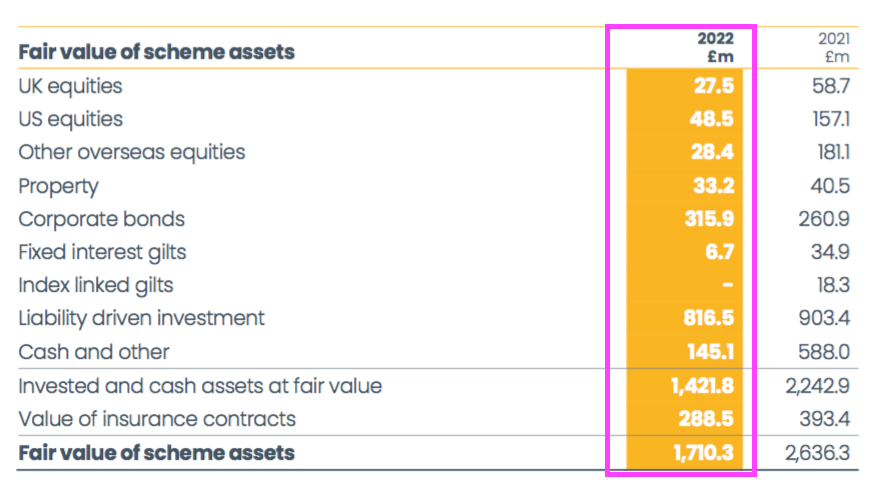

Scheme assets are valued in the here and now, and therefore no real guesswork is involved. The assets held by Reach’s scheme are invested within various classes:

Scheme assets should be studied because they generate the returns that pay the pension benefits to the scheme’s members.

If the assets are not generating suitable returns — and worse, having their value eroded as well — then the scheme could require extra funding to ensure the scheme’s members are paid what they are due.

Such extra funding will be effectively shouldered by shareholders, as cash that could have been reinvested into the business or distributed as dividends is instead absorbed by the scheme.

The possibility of cash being redirected into a pension scheme may therefore explain a ‘value trap’ P/E — the market struggles to believe future earnings will flow entirely to shareholders.

Pension asset movements

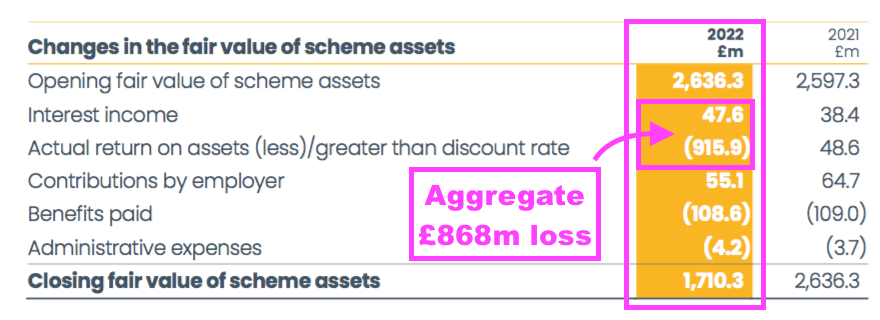

Back to Reach’s annual report. This note explains how the scheme’s assets changed during 2022:

We can see:

- The assets were valued at £2,636 million at the start of the year;

- Investment losses totalled £868 million;

- Reach paid contributions of £55 million;

- Pensions paid to members totalled £109 million, and;

- Admin costs were £4 million.

Those movements left assets sporting a £1,710 million valuation at the year-end.

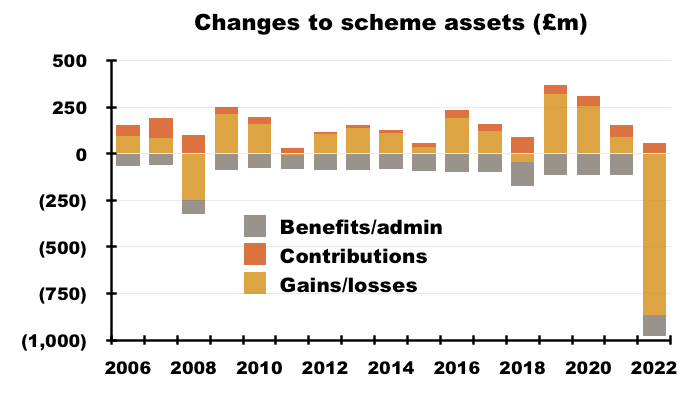

The year was clearly bad for Reach’s scheme, with assets reduced by £926 million. But 2022 was an awful year for financial markets generally, and my chart below puts last year’s movements into greater perspective:

We can see Reach’s scheme generally recording positive investment returns, with the last major setback occurring during 2008.

Probably the fairest period to assess the long-term progress of Reach’s scheme are the 14 years from 2009 to 2022, given both the start point and the end point were at market lows.

During those 14 years to 2022:

- The scheme’s investments gained an overall £822 million;

- Reach paid contributions of £561 million, and;

- Pensions paid to members and admin charges totalled £1,363m.

The net effect of these 14 years of pension investing, contributions and payments? Scheme assets advanced by just £20 million (£822 million plus £561 million less £1,363 million).

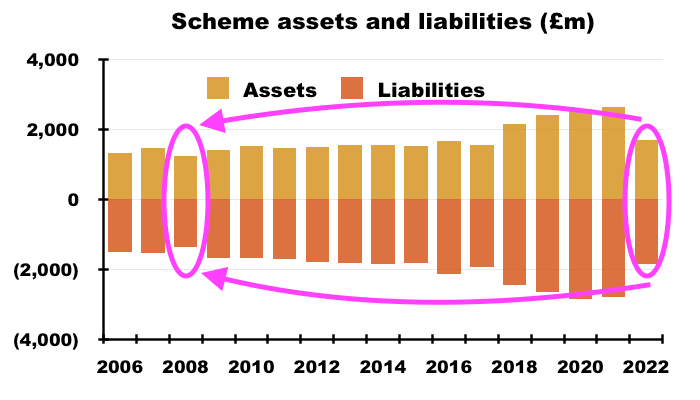

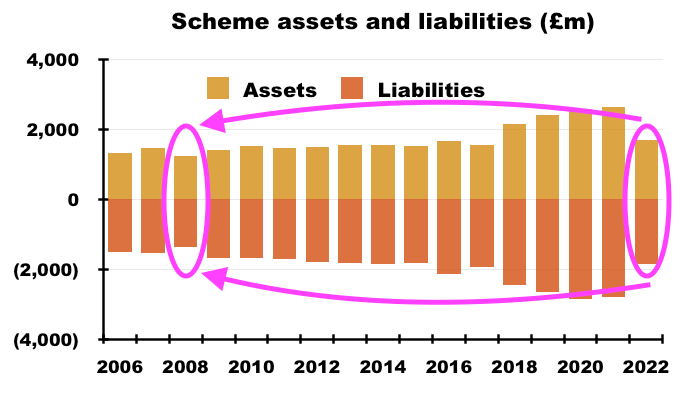

My chart below shows the scheme’s assets (and liabilities) of 2022 remaining similar to those of 14 years ago:

The sobering thought for Reach shareholders, therefore, is the £561 million paid into the scheme by the company during those 14 years has resulted in no substantial improvement to the fund’s assets (nor any material reduction to the scheme’s liabilities).

I would venture the £561 million has been simply absorbed by a retirement ‘black hole’, with Reach’s scheme no better off now than it was 14 years ago.

And making matters worse for investors, that £561 million has not been charged to Reach’s earnings…

Pension costs bypassing the income statement

I won’t bore you with the in-depth accounting here, but will just say defined-benefit pension contributions effectively bypass the income statement.

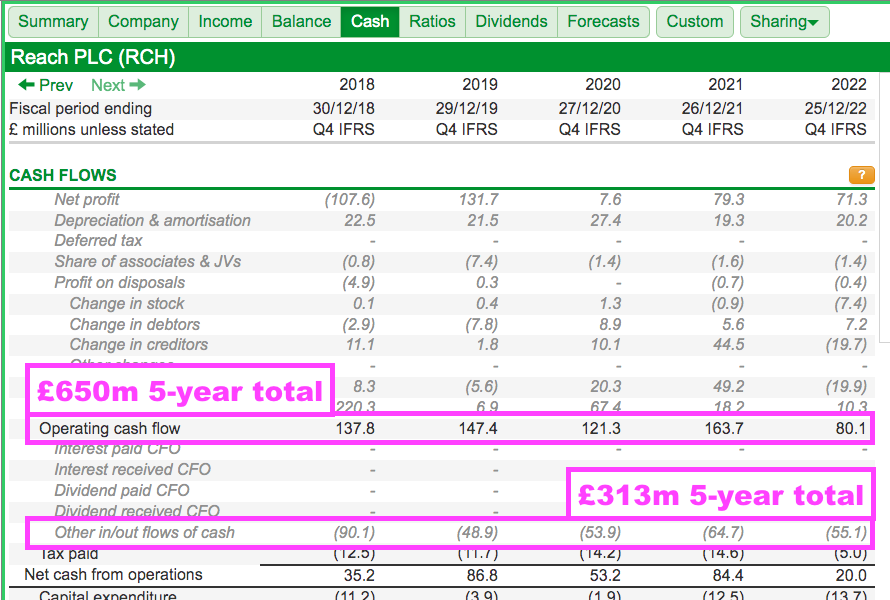

SharePad shows these contributions on the Cash tab as ‘Other in/outflows of cash’:

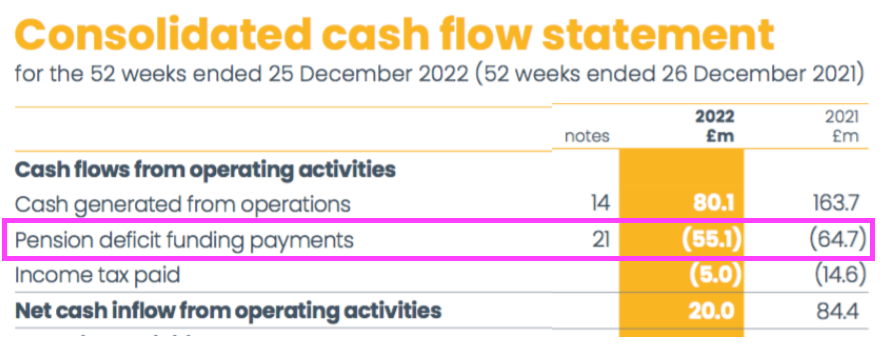

Reach’s annual report confirms SharePad’s data as ‘pension deficit funding payments’:

The last five years have seen £313 million paid into the pension scheme — absorbing an enormous 48% of the £650 million SharePad shows as aggregate operating cash flow.

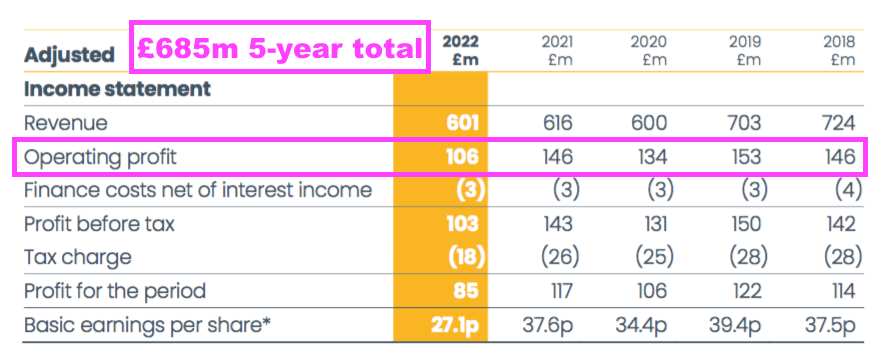

Reach’s version of adjusted operating profit reported during the last five years totals £685 million:

Given the aforementioned ‘black hole’ features of the scheme, I would suggest adjusted profits ought to be reduced by 45% for valuation purposes to satisfactorily reflect the contributions made in the past…

…and to be made in the future.

Future contributions

The bad news for Reach shareholders is the elevated £55 million level of contributions paid during 2022 will be maintained for the next few years. From the 2022 annual report:

“Contributions per the current schedule of contributions are £55.8m pa in 2023 to 2025, £56.7m pa in 2026, £54.7m pa in 2027 and £8.6m pa in 2028 and 2029.“

Remember Reach saying adjusted operating profit is on track to be £95 million for 2023? Paying another £55 million into the scheme therefore effectively reduces that adjusted forecast profit by almost 60%.

The annual report also says the deficits ought to be cleared by 2029:

“At the reporting date, the funding deficits in all schemes are expected to be removed before or around 2029 by a combination of the contributions and asset returns.“

But I am not convinced. For instance, the 2017 annual report claimed:

“As part of the agreement of the valuations, deficit funding contributions were agreed at £43.8 million for 2018 to 2027 after which contributions are due to cease. The deficits are expected to be eradicated by 2027 by a combination of the contributions and asset returns.“

Five years on, and:

- The agreed £44 million contributions have been raised to £55 million;

- The 2027 deficit “eradication” has been extended to 2029, and;

- Reach no longer talks about contributions potentially ceasing.

Go back as well to the 2012 annual report, and Reach even talked of “normalised levels of contributions” from 2015:

“Following a period of consultation with the trustees of the Past Service Scheme, the MGN Scheme, the Trinity Scheme, the MIN Scheme and the Trinity Mirror Retirement Plan (the ‘TMRP Plan’), in conjunction with the refinancing completed on 14 March 2012, these schemes agreed to extend their recovery plans with reduced deficit funding payments for 2012, 2013 and 2014. Normalised levels of contributions will recommence from 2015.“

Annual contributions were £11 million for 2012, but we now know had climbed to £20 million by 2015, to £40 million by 2016 and to beyond £50 million by 2020.

These days Reach admits certain payments to scheme members will increase by 42% between now and 2034:

“Uninsured pension payments in 2022, excluding lump sums and transfer value payments, were £73m and these are projected to rise to an annual peak in 2034 of £104m and reducing thereafter.”

Going on the scheme’s past history, I cannot see Reach’s contributions decreasing anytime soon when benefit payments to scheme members are likely to increase for the next 11 years.

Regulator negotiations

Underlining the difficulties Reach has with its pension is a protracted negotiation with the Pensions Regulator. The discussions concern the funding requirements of the group’s largest scheme:

“In 2023 we will continue to engage with the Pensions Regulator to seek to agree the funding of the remaining scheme and in the meantime continue to make payments per the existing schedule of contributions.

Discussions in relation to the funding valuations of the MGN Scheme at 31 December 2019 are ongoing. The funding valuation of the MGN scheme: at 31 December 2016 showed a deficit of £476.0m. The Group paid contributions of £40.9m to the MGN Scheme in 2022 and the current schedule of contributions includes payments of £40.9m pa from 2023 to 2027. “

I presume the regulator (and scheme trustees) would like Reach to increase its contributions, while Reach would rather not increase the contributions.

Revised scheme calculations and discussions between trustees and companies about pension funding take place every three years. But these particular negotiations have taken so long, the calculations for the next triennial funding review have already commenced.

Management did not want to discuss this funding matter during March’s results Q&A:

“Jim Mullen (CEO): With regard to the triennial review, obviously we still have to complete 2019. We’re at the process now of gathering the data for the next triennial review, which we are working with the regulator and the pension schemes. So, there’s nothing really more to update on that. Darren, do you want to add anything to that?

Darren Fisher (CFO): No.“

The terse response implies this matter is a touchy subject for management, which does not bode well for shareholders.

Summary

Well done for getting this far. I hope I have explained how significant Reach’s pension situation is for the company’s shareholders.

Many investors believe pension-funding problems will become more manageable over time as higher interest rates reduce the net present value of scheme obligations.

But I am not convinced Reach’s pension will become more manageable.

For a start, Reach says its payments to pensioners will increase until 2034. And maybe one day the Pension Regulator could ensure those increases are greater than Reach currently expects.

What’s more, rising interest rates have hit financial markets and reduced the market value of the scheme’s assets. Those assets therefore now require higher returns to underpin the scheme’s payments to the pensioners.

Just look again at that earlier chart:

Reach has pumped £561 million into its pension fund since the start of 2009 — hardly any of which was charged to earnings — and yet the scheme is no better off now than it was 14 years ago. A textbook pension ‘black hole’…

…and a very good reason why that P/E of 3 offers ‘value trap’ characteristics.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own shares in Reach.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.