***SharePad New Subscriber Special Offer***

Readers of my blog can claim one month of free data. Click here for details.

15 April 2023

By Maynard Paton

I have embarked on further ‘back to basics’ filtering to unearth a potential long-term winner for my portfolio.

This new screen identifies companies that offer a rising dividend, low valuation, robust balance sheet and decent director ownership.

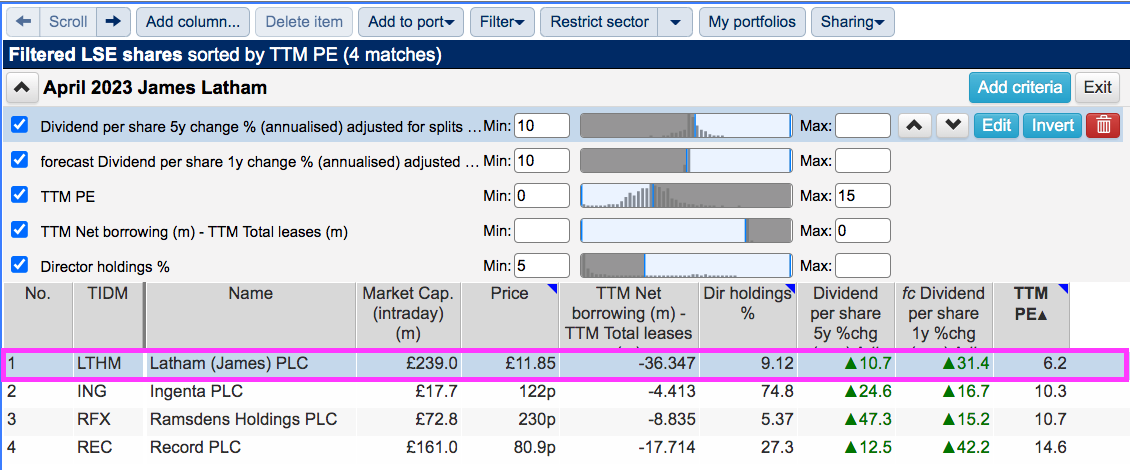

The exact filter criteria I applied for this search were:

- A 5-year annualised dividend growth rate of 10%;

- A forecast 10% dividend increase;

- A trailing 12-month P/E of 15 or less;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A minimum 5% total director shareholding.

I ran the screen the other day and SharePad returned only four matches:

I selected James Latham because it traded on a remarkably low trailing P/E of 6.

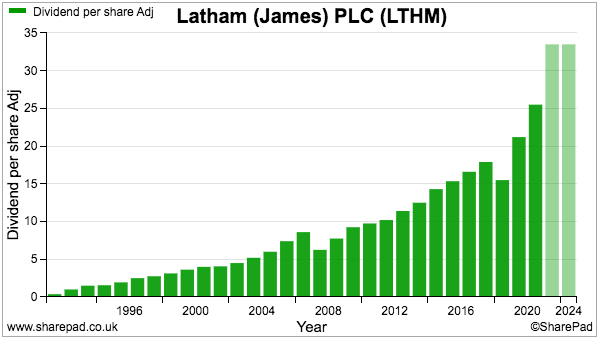

SharePad shows Latham’s dividend rising nicely over time with only a couple of setbacks:

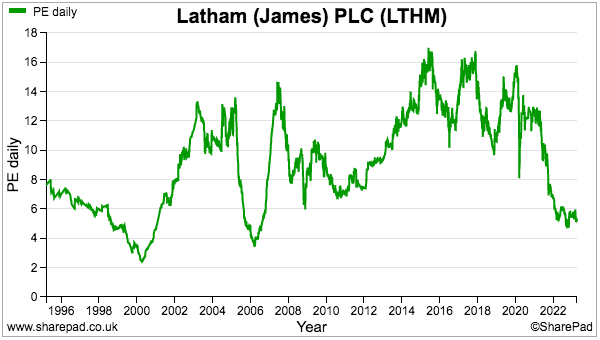

SharePad also shows the trailing P/E at its lowest since 2007:

Let’s take a closer look.

Read my full James Latham article for SharePad.

Maynard Paton