Devoted company bosses do not always create great returns for outside shareholders. Maynard Paton studies chocolate retailer Hotel Chocolat and the board’s decisions and composition.

I love ‘owner managers’ — company bosses with significant shareholdings who live and breathe their business and want to build wealth for the long haul.

Typically, entrepreneurs, and owner-managers who lead quoted companies do seem to think and act differently to standard chief executives.

A hefty investment complemented perhaps by substantial dividends should certainly focus the mind on fundamental business matters…

…versus more common executive considerations such as bonuses, LTIPs, adjusted earnings and career progression.

But seeking owner-managers is not a foolproof way to identify your next great multi-bagger. Hotel Chocolat provides a useful example of what can go wrong even with devoted founders in charge.

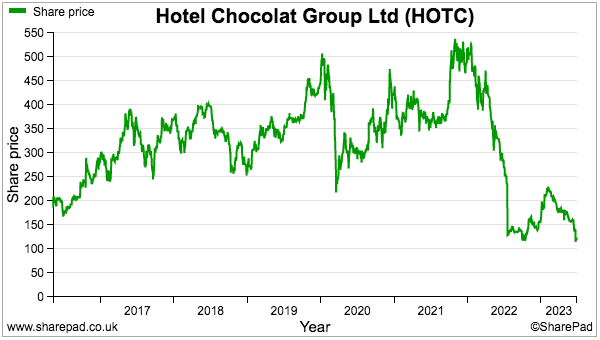

The upmarket chocolate retailer floated at 148p during 2016 and its shares reached 530p the other year…

…but a series of mishaps has since dragged the price down to 120p and raised questions about the board’s decisions and composition.

Let’s take a closer look.

‘To make chocolate exciting again’

Angus Thirlwell and Peter Harris ought to be textbook owner-managers for small-cap investors.

They started what became Hotel Chocolat during the 1990s, initially selling chocolates online and then opening their first Hotel Chocolat shop during 2004 in Watford.

Mr Thirlwell recounted the company’s early days during this interview:

“In 1993 we became one of the UK’s first e-tailers, selling our chocolates exclusively online. But we wanted our chocolates to deliver amazing escapism, to take you to that special place in your mind. So we decided to build a physical place that you could run away to, to eat chocolate, interact with experts and hear fascinating stories.

Having spent some time living in France, I knew I wanted to have the word ‘chocolat’ in there. There’s something so luxurious and quite romantic about its pronunciation and it has an almost onomatopoeic quality. ‘Hotel’ came from being a place of refuge; a hotel’s a sanctuary, somewhere you can escape to. And so ‘Hotel Chocolat’ was born.”

Hotel’s website talks of a compelling ‘disruptive’ story of Messrs Thirlwell and Harris “on a mission to make chocolate exciting again… guided by three basic values“:

- Originality: “We’ve never played by the rules of what people said a chocolate company should be.“

- Authenticity: “Our mantra has always been ‘More Cocoa, Less Sugar’. Cocoa will always be our number-one ingredient.“

- Ethics: “We have a deep sense of fairness that extends to our farmers, our customers and future generations. ”

The devotion to high-quality chocolate ensured the business only ever reported a loss just once as a private company, and the co-founders (very commendably) still owned 100% of the company just before the 2016 flotation.

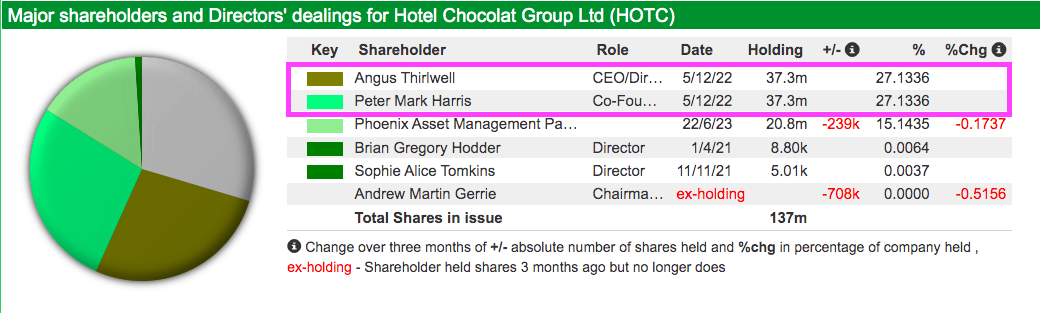

Messrs Thirlwell and Harris sold 25% of their shares at the flotation and today still retain overall control with a combined 54%/£90m holding:

So what went wrong?

Overseas expansion. Quoted UK retailers have rarely fared well abroad and a Japanese joint venture in particular proved far too ambitious.

At the 2016 flotation, Hotel operated 80 UK shops and had limited its foreign activities to just three outlets in Copenhagen.

That UK focus had pushed revenue beyond £80 million, and the group’s minimal domestic market share suggested plenty of scope for further UK expansion:

But greater international efforts began in 2018, with that year’s annual report referring to further stores in Denmark, a pilot store in New York and the joint venture in Japan.

Hotel took an initial 20% stake in the Japanese venture and reassuringly adopted a “cautious ‘test, learn, grow’ approach” with the first Tokyo outlet.

An early warning sign perhaps was the 20% stake costing only £7,200, which meant the Japanese partners were not risking much of their own money (less than £60,000) for the remaining 80%.

Hotel also loaned the Japanese joint venture £2.5m to fund the start-up costs and fitting-out that first Tokyo store.

By 2020 the Japanese venture had eight stores open and Hotel’s loan had increased to nearly £6m.

And by 2021, the Japanese venture operated 22 stores and Hotel’s loan had increased to £12m. An ominous sign was the 2021 report small-print admitting the loan term had been extended by five years:

“The loan facility has been extended to Hotel Chocolat KK from December 2023 until December 2028. The credit risk of the loan was assessed in line with IFRS 9 and the Directors believe there is no change to the risk of default and the probability of default has been determined as nil. Whilst the date of repayment has been pushed out, the directors do not deem the loan to be impaired and therefore no expected credit loss is recognised. “

Other 2021 small-print confirmed Hotel was on the hook for further Japanese loans of approximately £4 million:

“The group guarantees the external bank loans of the joint venture in Japan, Hotel Chocolat KK, totalling 600m Japanese YEN.”

Hotel then dropped a bombshell during 2022, announcing it had adopted a “de-risked approach to international growth opportunities” and would limit further funding to the Japanese joint venture.

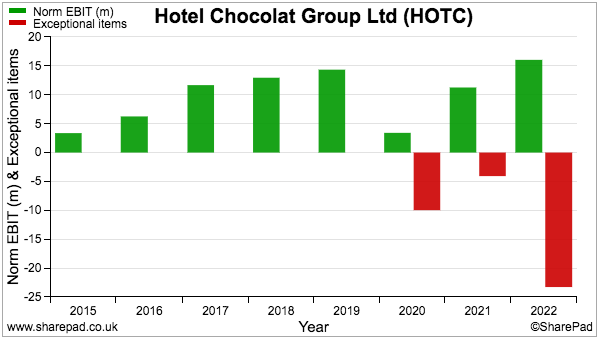

A few weeks later Hotel admitted its Japanese venture had effectively entered insolvency proceedings. Extensive Japanese write-offs followed, which SharePad shows matching adjusted profit throughout 2021 and 2020:

Mr Thirlwell seemed to blame the pandemic for the Japanese outcome.

“As can be imagined we have asked ourselves many questions as to how we could have done this differently. The size of the prize in Japan certainly sustained our risk appetite through the three increasingly difficult years of COVID, alongside the loyal enthusiasm of our Japanese fans for all things Hotel Chocolat.”

“Whilst recognising the above, it is clear that shortcomings in downside risk evaluation, and the challenges of assessing the JV’s management capability to execute their plan during the two-year period when visits to Japan were prohibited did contribute to the outcome.”

Mr Thirlwell did not explain why Hotel allowed the Japanese venture to increase its estate from 8 to 22 stores during Covid. But he did mention “shortcomings in downside risk evaluation“.

Could other board members have warned the co-founders of international trouble ahead?

Dominating boardroom proceedings

A downside to backing owner-operators is they may dominate boardroom proceedings and not listen to opposing views.

Hotel’s board when the Japanese venture started comprised the two executive co-founders, the finance director, the operations director, the non-exec chairman and two other non-execs.

The chairman at the time was not deemed independent due to his involvement in another Hotel joint venture, while one of the other non-execs offered “considerable experience of growth through…international retail“.

Neither may have been quite the right appointments to cast doubt on overseas growth plans. Which would have left one non-exec — an ex-City analyst — to raise any concerns.

Maybe the finance director could have kicked up a fuss about the growing Japanese risk. But the sub-standard reporting from the FD — and perhaps the hint of sub-standard financial discipline — emerged too late for shareholders.

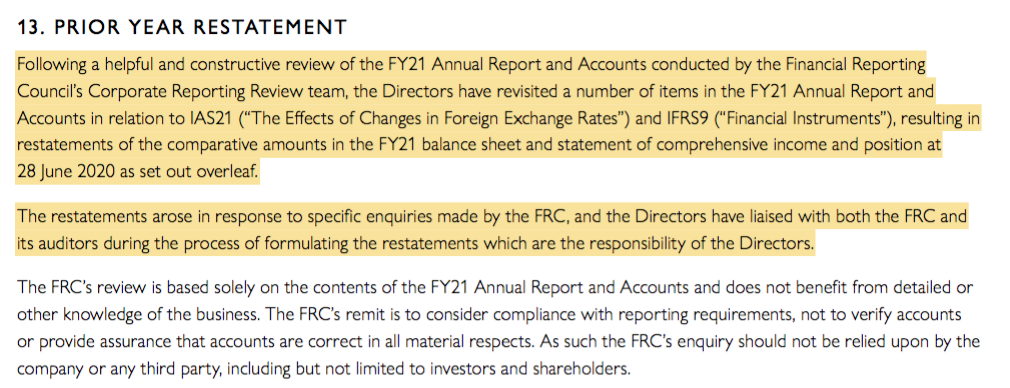

The 2022 annual report admitted the Japanese write-offs were in part triggered by the Financial Reporting Council (FRC) making “specific enquiries” and asking for revisions to the Japanese bookkeeping:

The 2022 report also contained uncomfortable text from the auditor:

“[We challenged] growth assumptions utilised within the impairment models, leading management to complete an exercise to re-forecast the future cash flows and revise downwards their value in use assessments”.

Sadly for shareholders, the earlier accounts did not show obvious signs of sub-standard reporting. Accounting oddities were limited only to revised cash positions.

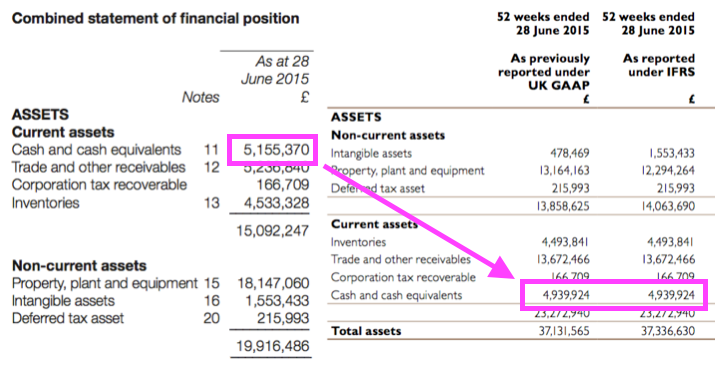

The 2015 cash position declared within the flotation document was slightly more than the 2015 cash position(s) subsequently declared within the 2016 annual report:

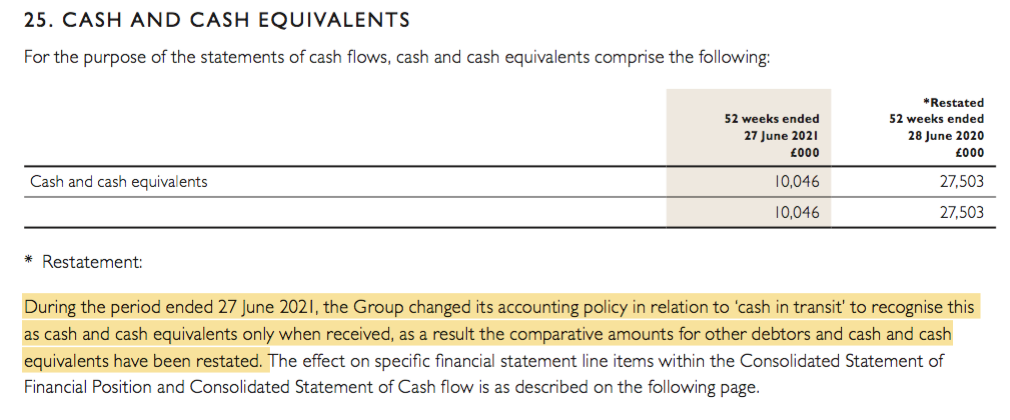

The 2020 cash position was meanwhile restated within the 2021 report by £1 million:

Although both cash restatements were relatively small, cash in the bank should have been the simplest item on the balance sheet for the FD to have calculated.

New directors and UK growth plans

Shareholders must now trust the recent appointments of a new chairman and the new FD will prevent further mishaps.

Following the FRC’s “specific enquiries“, I would argue the non-exec who chairs the audit committee ought to be replaced as well.

Now the overseas ambitions have been curtailed — they are now limited to a “capex-light, risk-contained global wholesale model” — growth attention has turned back to the UK.

Interim results during March announced a further 50 UK shops would open during the next three-to-five years (12-13 new shops per annum)…

…which does seem ambitious given Hotel took 19 years to get to 123 UK outlets (6-7 new shops per annum).

Early progress on the UK expansion has not been promising.

An April statement warned of sales slightly below expectations and trading running at breakeven…

…while an update last month warned 2024 sales and profit would be behind budget due to “ongoing weakness in consumer sentiment and continuing inflationary pressures“.

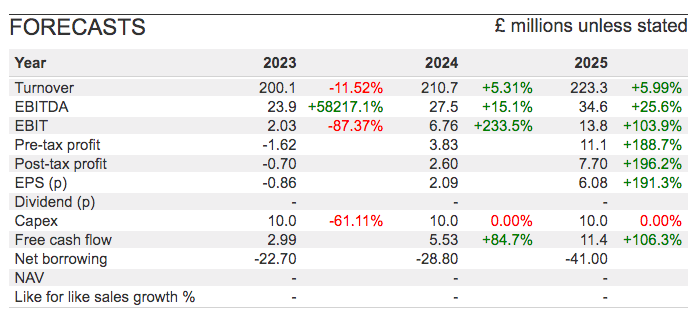

A full return to Ebitda margins of 20% or more is now not expected until 2026, with forecast profits in the meantime looking slim versus the £165 million market cap:

Whether the plan for 50 new UK shops remains on course following the slower 2023/2024 sales remains to be seen.

Let’s hope the fresh board members will reappraise the UK expansion to prevent further “shortcomings in downside risk evaluation”.

A further board shuffle required?

Owner managers can deliver wonders for investors with their innovative ideas and unrelenting drive. But sometimes they can become too ambitious, too optimistic, too stubborn, too absorbed or simply too busy to realise problems are looming.

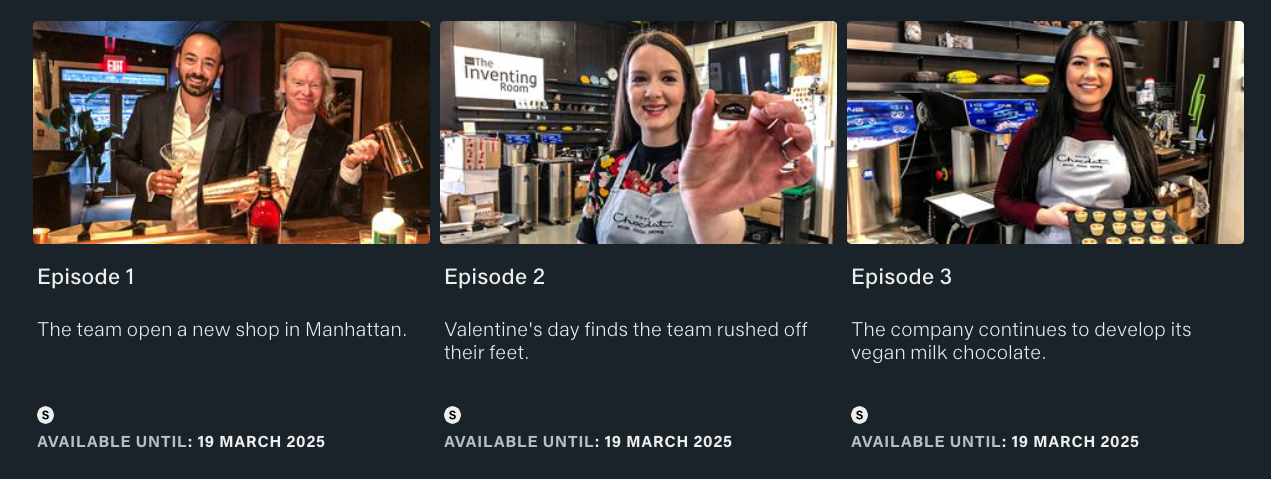

Co-founder Mr Thirlwell is Hotel’s chief executive and appears involved in every aspect of the business. This Channel 5 documentary followed him opening new UK shops, organising the New York store, supervising the St Lucia cocoa plantation, conducting regular tasting sessions and double-checking the chimes on the chocmobile:

From what I can recall, the TV series never showed any:

- Discussions about capital allocation;

- Visits to Japan, and;

- Engagement with shareholders.

Given Hotel’s recent woes, I would venture:

- Mr Thirlwell’s undoubted passion towards high-quality chocolates is exploited as full-time chief marketing officer, and;

- Somebody else — perhaps co-founder Mr Harris — is employed as chief executive to undertake all the City activities and capital-allocation decisions.

You never know, further reshuffling of the board may even give the directors more time to speak to ordinary shareholders.

An investor friend of mine attended Hotel’s AGM on three occasions before the pandemic. He tells me the first two meetings offered “exemplary-informative presentations“, but the third meeting saw the directors leave after the formal business with no opportunity for questions.

(My friend recounted the third AGM “was the start of [his] disaffection” with the company, “which ended in spring 2020 when [he] sold out completely after a deeply discounted placing excluded retail investors.”)

Interactions with retail shareholders have not improved. Hotel’s last AGM was held on 29 December at 10 am and the board effectively told investors not to turn up:

“We anticipate that many shareholders may find it more convenient to attend the remote shareholder presentation in the new year rather than the AGM, which will be reserved for the formal business described in the notice below.”

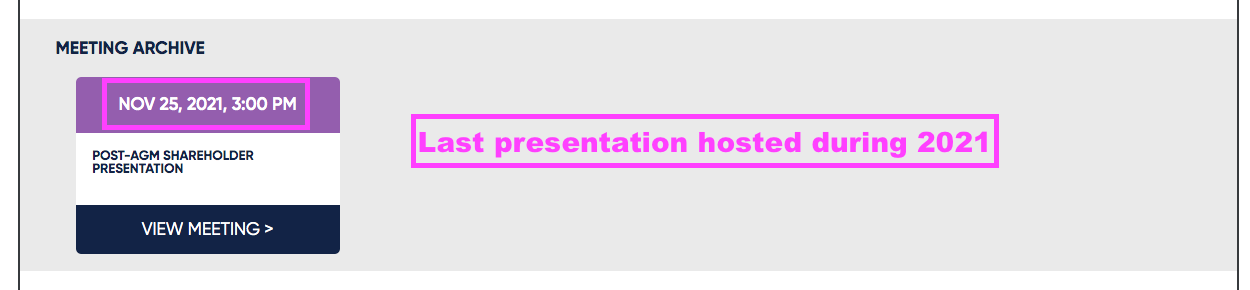

The “remote shareholder presentation” was scheduled to take place during January on the Investor Meet Company website, but seems not to have occurred:

Messrs Thirlwell and Harris are certainly owner-managers with significant shareholdings who live and breathe their business and everything it stands for.

They have also built their wealth by growing Hotel as a private company, but will they now build your wealth in a quoted firm?

Certainly, with the group now suffering weaker UK sales and earnings becoming quite uncertain, I would become more convinced if the co-founders:

- Toned down the growth rhetoric;

- Considered whether their undoubted skills match their board roles;

- Ensured tip-top financial reporting and discipline, and;

- Returned to taking questions at the AGM.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Investor’s Roundtable Podcast with Roland Head, Mark Simpson and Bruce Packard. Maynard does not own shares in Hotel Chocolat.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.