28 October 2023

By Maynard Paton

FY 2023 results summary for Mountview Estates (MTVW):

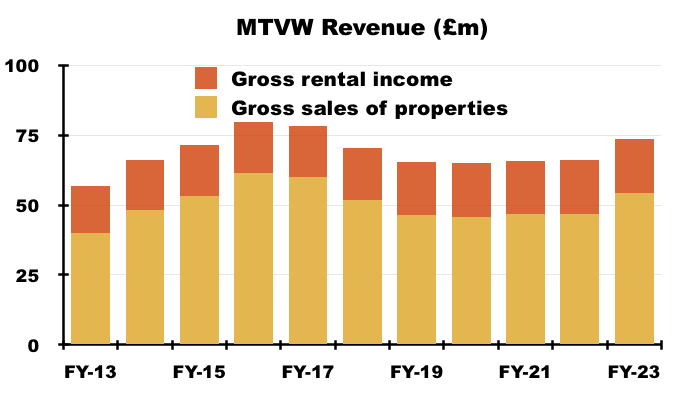

- A lacklustre FY performance, with profit down 2% to the lowest level for ten years despite average property sales (excluding ground rents) rising 14% to a record £395k.

- Property sales achieving a 50% gross margin, the worst for 14 years, suggest properties purchased following a 2014 valuation have realised very limited premiums on disposal.

- Debt remains under control at 12% of the property estate, although £56m was spent on new properties — the largest amount since FY 2008 — despite management talk of ongoing “difficult economic circumstances“.

- Protest votes against the board’s composition and remuneration continue to increase, with property investor David Pears among the unhappy shareholders asking questions at the latest AGM.

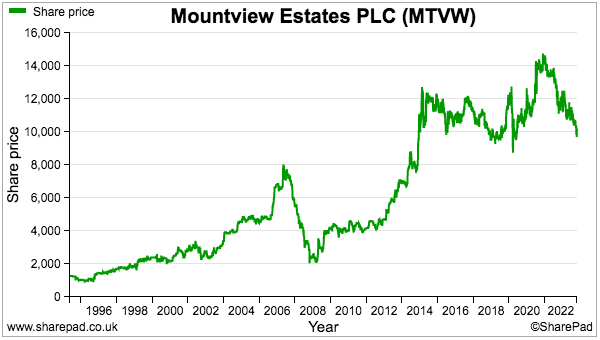

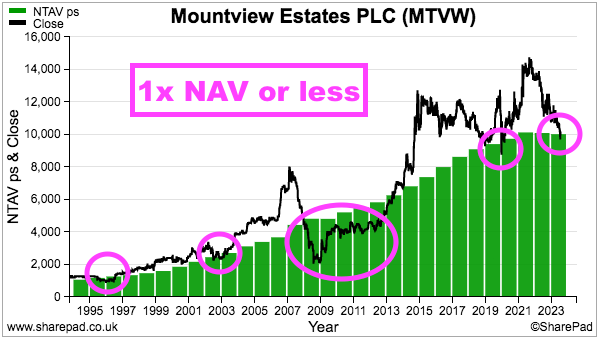

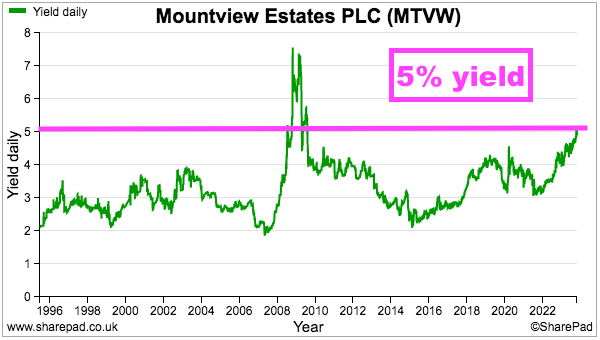

- The £100 shares trade at net asset value (NAV), which in theory prices in no future property gains, and offers a 5% income, the highest for decades aside from the banking crash. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own MTVW

- Results summary

- Revenue, profit, dividend and net asset value

- Trading properties: disposals and acquisitions

- Trading properties: gross margin and rental income

- Trading properties: properties valued by Allsop

- Trading properties: properties not valued by Allsop

- Financials

- Protest votes, David Pears and executive pay

- Valuation

News links, share data and disclosure

- Annual results for the twelve months to 31 March 2023 published 15 June 2023

- AGM attendance 09 August 2023

Share price: £100

Share count: 3,899,014

Market capitalisation: £390m

Disclosure: Maynard owns shares in Mountview Estates. This blog post contains SharePad affiliate links.

Why I own MTVW

- Buys, holds and sells regulated-tenancy (and similar) properties and boasts an illustrious, 40-year-plus history of net asset value and dividend advances.

- Board led by veteran family management that continues to boast an aggregate 50%/£195m shareholding.

- Properties are carried at cost, and when eventually sold at their ‘reversionary’ values may generate total proceeds significantly in excess of the recent market cap.

Further reading: My MTVW Buy report | All my MTVW posts | MTVW website

Results summary

Revenue, profit, dividend and net asset value

- After the preceding H1 expressed caution about “economic storms“…

“We are all aware that difficult times lie ahead but the financial strength of this Company should enable us to weather the economic storms that lie ahead better than most.”

…

“We all know that times are going to be tough, but I believe that this Company is better placed than most to survive the difficulties and indeed prosper. “

- …this FY was perhaps never going to show a wonderful H2.

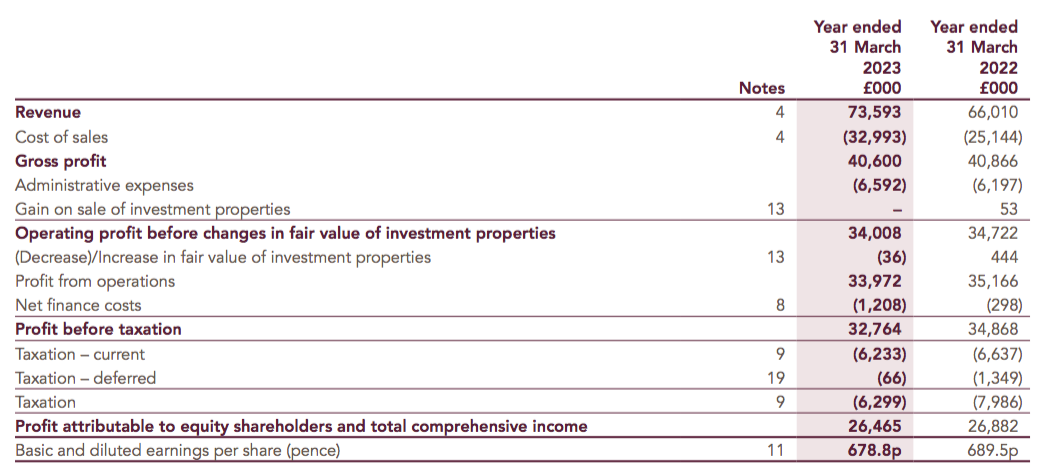

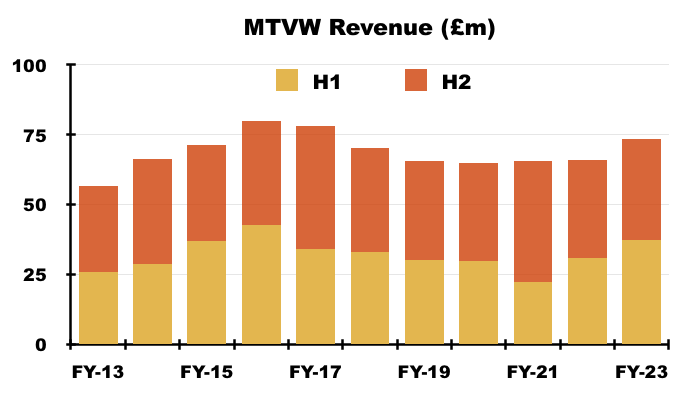

- Although H2 revenue gained 3% to £36.4m…

- …H2 operating profit dived 22% to £15.5m, the lowest H2 profit since H2 2012 (£12.0m):

- The H2 performance meant FY 2023 revenue advanced 11% to £73.6m, the highest since FY 2017 (£78.2m)…

- …but FY 2023 operating profit slipped 2% to £34.0m, the lowest since FY 2013 (£30.0m).

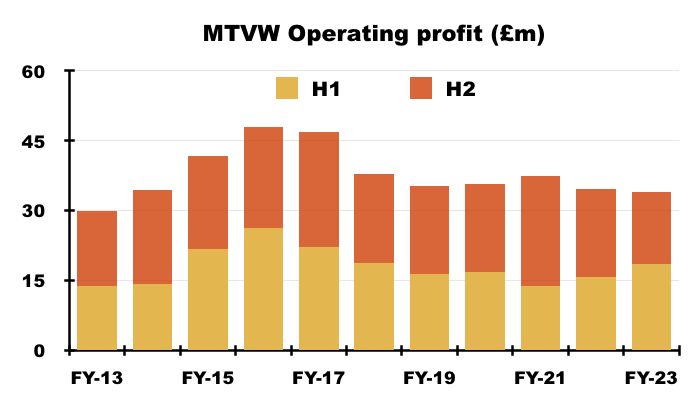

- Revenue was split 74%/26% between property sales and rental income, which matched the preceding ten-year average (73%/27%):

- Note that MTVW typically sells its regulated-tenancy properties when the tenancy ends — which almost always occurs when the tenant dies.

- The mix of properties becoming available for sale — and the total proceeds and profit MTVW generates — can therefore vary significantly from one set of results to the next (see Trading properties: disposals and acquisitions and Trading properties: gross margin and rental income).

- MTVW claimed “difficult economic circumstances” would continue for some time…

“Difficult economic circumstances may be with us for some years but I am confident that Mountview will remain profitable and that the Company will remain a sound investment for all its stakeholders.”

- …and even suggested shareholders ought to be grateful for the business staying afloat:

“We are now living in the circumstances of double digit inflation and rising interest rates which give us very different problems to those experienced before and indeed during the Covid pandemic. At a time when companies are failing to pay dividends and even ceasing to trade, mere survival must be considered to be a success.“

- MTVW hoped its “lower priced” property portfolio may not be too damaged by any downward housing market:

“We are fortunate that the properties that Mountview brings to auction are typically in high demand as they offer a lower priced entry to the housing market or, if sold to developers, provide opportunity for ‘developer profit’.

We are hopeful therefore that Mountview will continue to be well placed to weather any continued down turn in the general housing market, should it occur, through both continuing sales of attractive properties and also with the opportunity to purchase potentially discounted replacement properties both through auction and private tender.”

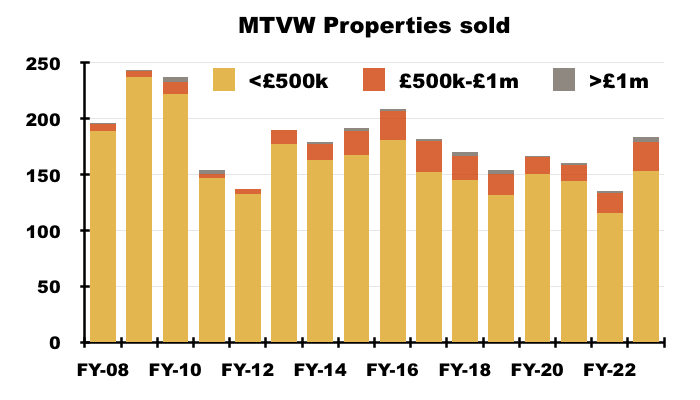

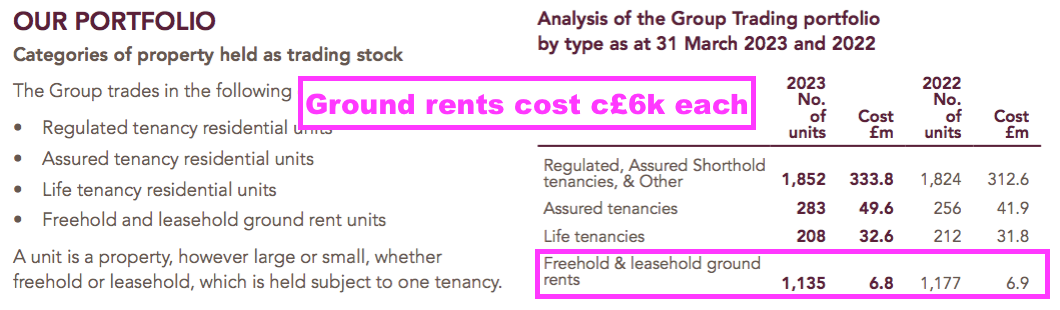

- Most of MTVW’s properties are located within London and south-east England, and 696 (87%) of the 800 properties MTVW sold between FYs 2019 and 2023 achieved less than £500k:

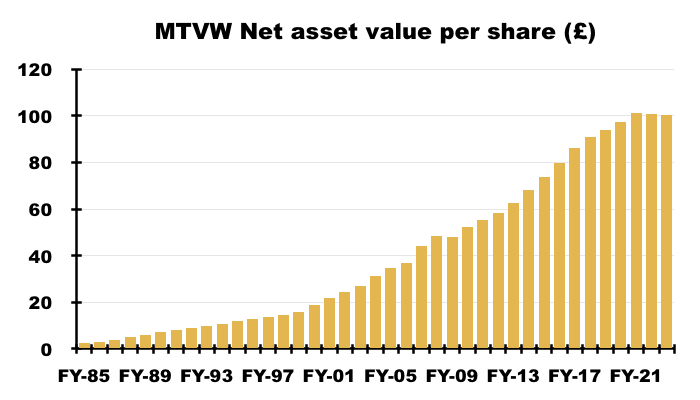

- The payment of the 250p per share special dividend announced within the preceding H1 caused net asset value (NAV) per share to decline for the second consecutive FY:

- NAV ended this FY at £391m, or £100.21 per share, versus £393m, or £100.92 per share, one year earlier and £395m, or £101.27 per share, two years earlier.

- The 250p per share H1 special dividend cost almost £10m, and were it not paid would have lifted NAV to £400m or £102.71 per share.

- Were the 275p per share H1 special dividend of FY 2022 also not paid, NAV would be £411m or £105.46 per share.

- MTVW’s NAV per share growth has slowed over time.

- NAV per share has compounded at:

- 2% during the five years to FY 2023;

- 5% during the ten years to FY 2023;

- 5% during the 15 years to FY 2023, and;

- 7% during the 20 years to FY 2023.

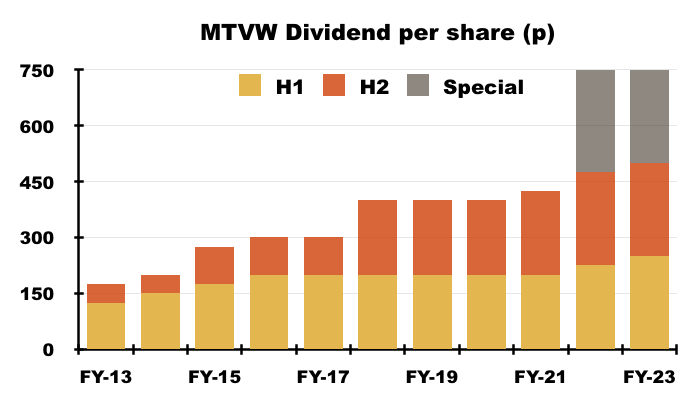

- The final dividend was kept at 250p per share to leave the full-year ordinary payout 25p higher at 500p per share:

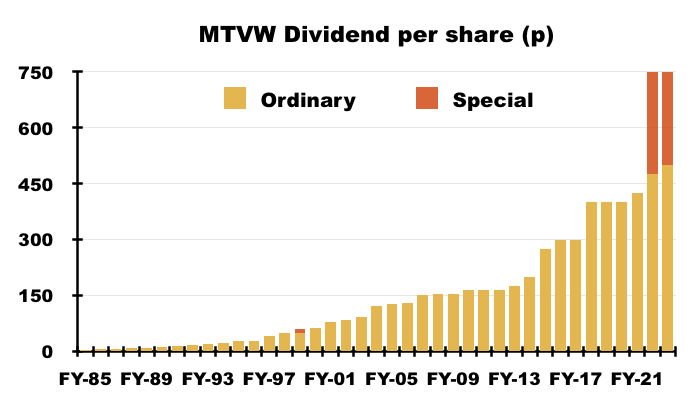

- Companies House shows the ordinary dividend has never been cut since at least 1985 — after which the payout has risen 111-fold:

Trading properties: disposals and acquisitions

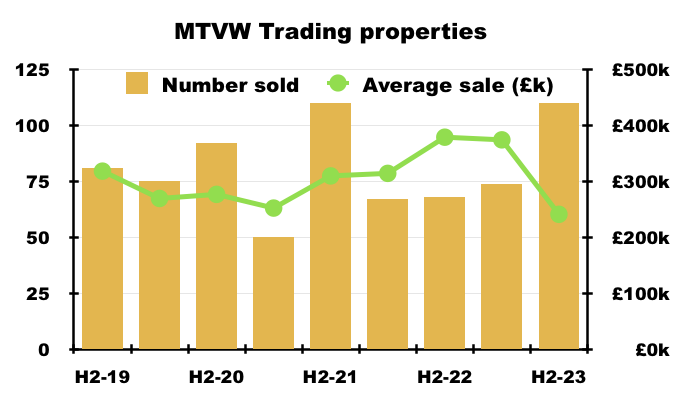

- The 184 properties sold during this FY compared to 135 during the comparable FY, with 74 sold during H1 and 110 sold during H2:

- The 184 sold was the largest number of disposals since FY 2016 (209):

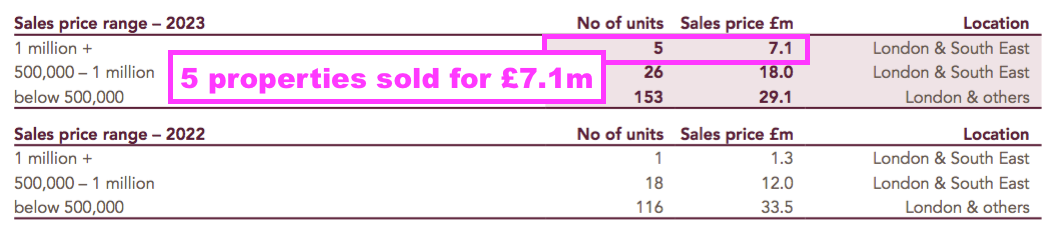

- The average sale price of £295k for this FY was skewed by the disposal of 50 ground rents:

“During the financial year we achieved sales of £54.2 million (2022: £46.8 million), demonstrating the liquidity of the Portfolio. The average sales price achieved, excluding sales of ground rent, was £395k (2022: £347k).”

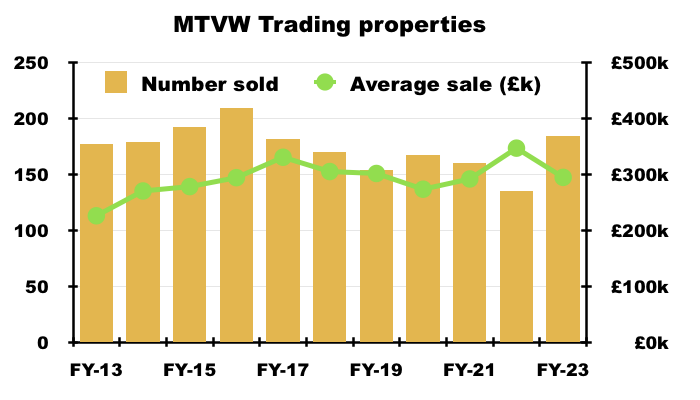

- Ground rents tend to be low-value investments. The 2023 annual report indicates MTVW’s ground rents are carried at an average cost of £6k each:

- The 50 ground rents were sold for approximately £1.3m, or £26k each.

- Management’s AGM remarks noted the Leasehold Reform Act had prompted the ground-rent disposals and admitted other ground rents would be analysed for potential sale, too.

- MTVW claimed the average sale price excluding ground rents was £395k, up a useful 14% on the comparable FY’s £347k.

- The £395k figure may have itself been skewed by MTVW selling five properties for an average £1.4m:

- MTVW has never before sold five properties for more than £1m each during an FY since first disclosing such statistics during FY 2008.

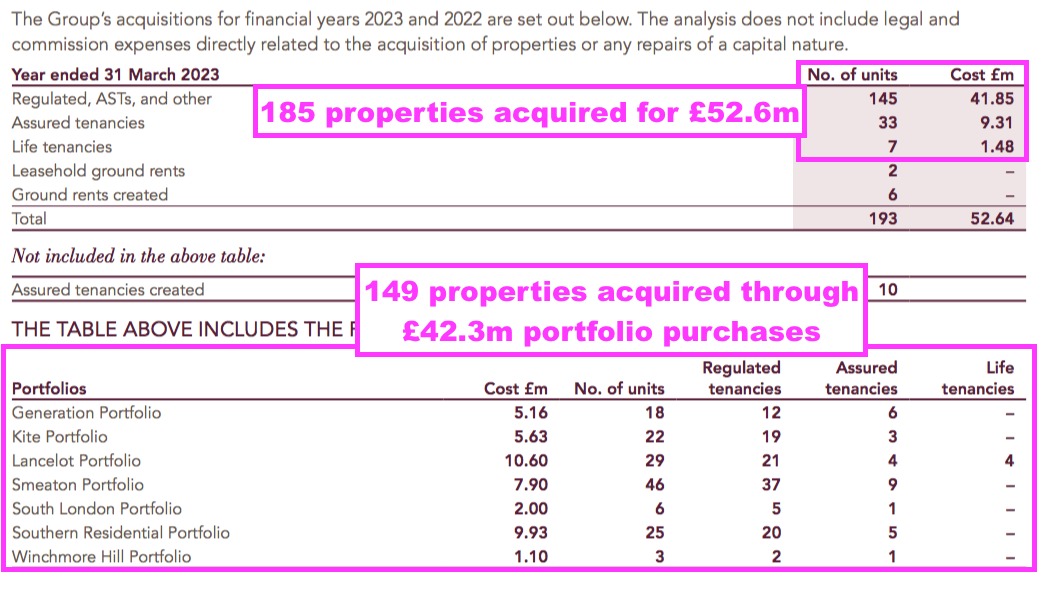

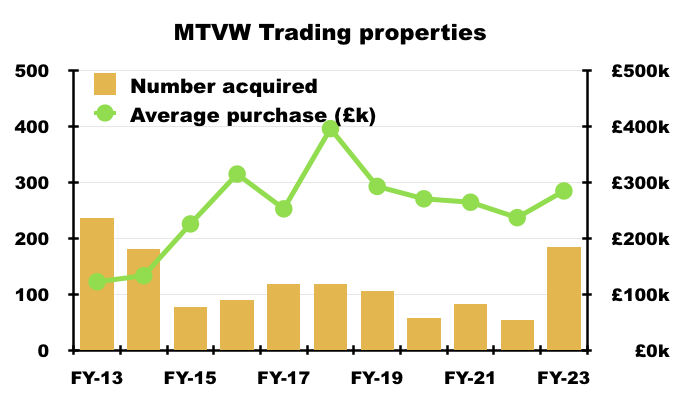

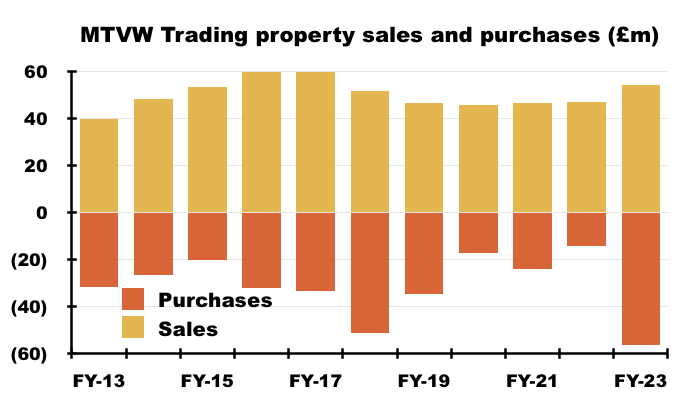

- Some £53m (before purchasing expenses) was used to acquire 185 properties during this FY:

- The 185 properties acquired was the highest since FY 2013 (236):

- Including purchasing expenses, the £56m spent on new properties was the largest sum since FY 2008 (£100m) and exceeded the aggregate expenditure witnessed during FYs 2020, 2021 and 2022 (£55m):

- MTVW suggested the purchase spree was prompted by market and/or regulatory concerns causing other landlords to sell:

“There are hypotheses circulating that the growing opportunities for purchasing have arisen due to either general concerns about the property market or more directly, concerns among buyers about acquiring properties with sitting tenants in the face of proposed reforms to the rental market.

In either case both play into Mountview’s core values around careful purchasing of primarily regulated tenancies and patience in waiting for vacant possession, with the latter highly aligned with the aims behind the proposed leasehold reform. “

- How the largest purchase spend since FY 2008 marries up with the aforementioned comments of “difficult economic circumstances may be with us for some years” was not explained.

- However, management’s AGM remarks implied some landlords had become forced sellers:

“Not everyone keeps their gearing at the modest level we do. There are some who are being forced to sell to keep within their borrowing limits, which presents opportunities to us and less competition for properties. The opportunities have been there and the prices have been a little more modest than they were“.

- Management’s AGM remarks also reiterated MTVW acquired regulated properties at up to 75% of their vacant possession value (see Trading properties: properties not valued by Allsop).

Trading properties: gross margin and rental income

- MTVW’s margin and profit can fluctuate due to the unpredictable mix of properties becoming available for sale during any particular period.

- The percentage gain on each property sold — reflected by MTVW’s gross margin — is typically correlated to the duration of MTVW’s ownership, which can range from a few years to a few decades.

- MTVW noted:

“While sales were well ahead of 2022, once again the cost factors related to timing and location of purchase led to flat gross profit…“

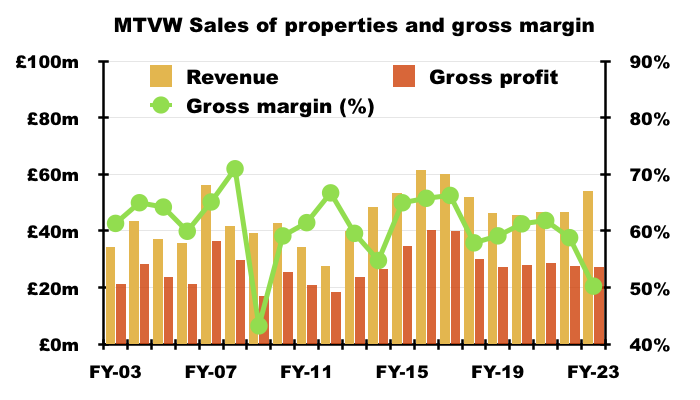

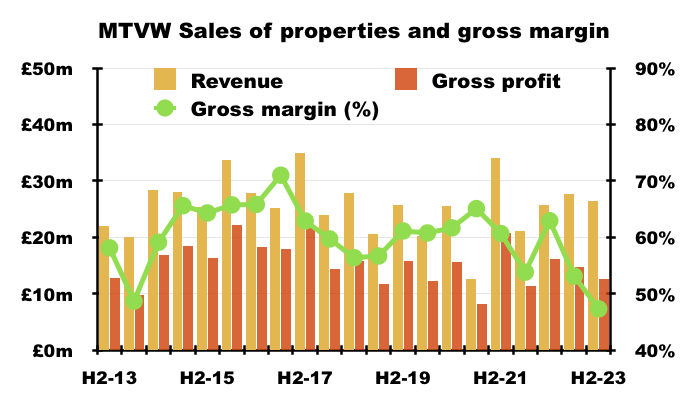

- A 50% gross margin was achieved through property sales during this FY:

- The 50% property-sales gross margin was the lowest since FY 2009 (43%).

- A 47% property-sales gross margin was achieved during H2, the lowest since H2 2009 (46%):

- A 47% property-sales gross margin is therefore very unusual, especially as average selling prices (excluding ground rents) during this FY were a record £395k.

- A property-sales gross margin of 47% is equivalent to buying a property for £100k and selling it for £189k.

- Management’s AGM remarks suggested the low gross margin may have been due to a greater proportion of more recently purchased properties being sold during the last few years.

- The mix of properties sold tends to even out over time. MTVW’s average property-sales gross margin over five-year periods has been reasonably consistent:

- FYs 2019 to 2023: 58%

- FYs 2014 to 2018: 62%

- FYs 2009 to 2013: 58%

- FYs 2004 to 2008: 65%

- FYs 1999 to 2003: 59%

- Emphasising the gross-margin fluctuations due to the unpredictable mix of properties becoming available for sale, the aforementioned 43% property-sales gross margin for FY 2009 had rebounded to a super 67% property-sales gross margin by FY 2012.

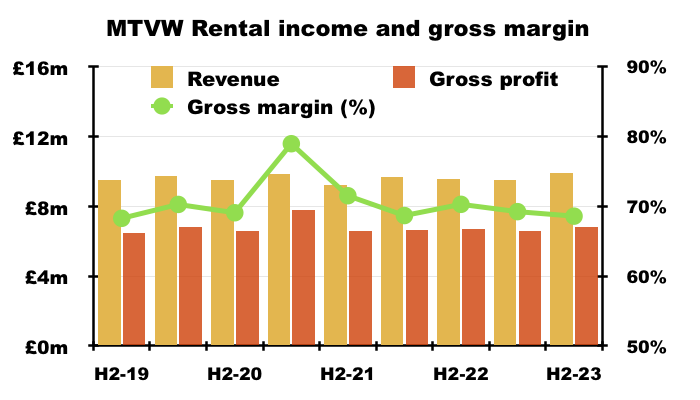

- MTVW’s rental-income gross margin remained at a normal 69% after certain maintenance work was deferred during the pandemic:

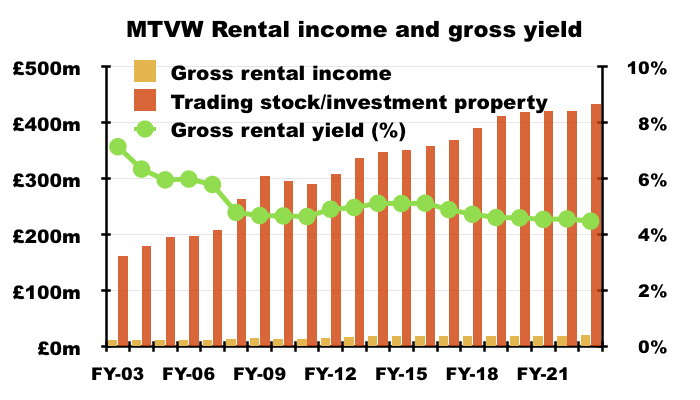

- FY rental income of £19m gave a 4.5% rental yield from the carrying value of all properties:

- That 4.5% rental yield is the lowest since at least FY 1998 and may raise questions about the level of rental income from recent purchases given interest rates are now 5.25% (see Trading properties: properties not valued by Allsop).

- MTVW’s property estate had a book-value equivalent to a 6% rental yield when interest rates previously approximated 5% prior to FY 2009.

Trading properties: properties valued by Allsop

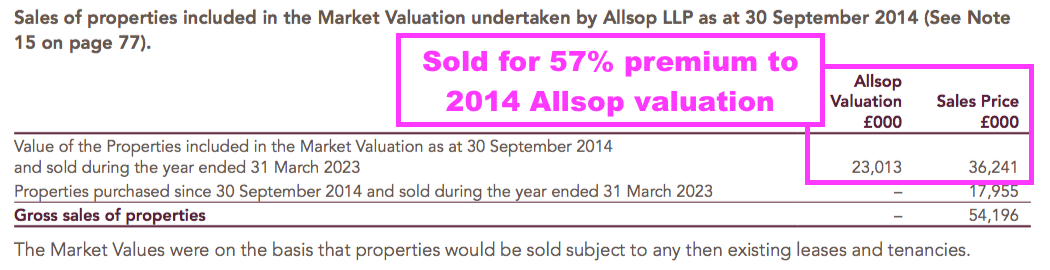

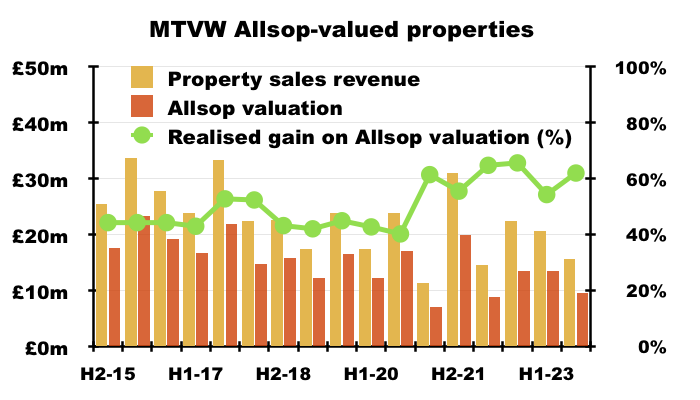

- An encouraging development during this FY concerned the proceeds from sold properties compared to a past valuation.

- To recap, MTVW commissioned property agent Allsop during September 2014 to assess the group’s estate.

- Allsop returned a £666m valuation — some 2.1x the £318m book value of the properties owned at the time.

- The Allsop assessment was based on MTVW’s properties remaining in their regulated-tenancy state and therefore excluded any ‘reversionary’ gain (i.e. the value uplift that occurs when a regulated tenancy finishes, the rent reverts to a proper market level and the property can then be sold at a fair market value).

- The Allsop assessment was never applied to the audited accounts. MTVW’s properties instead remain on the balance sheet at their cost price.

- Following the Allsop assessment, MTVW reveals the proceeds from sold properties versus their Allsop valuation:

- This FY witnessed MTVW sell properties with a combined £23.0m Allsop valuation for £36.2m — a premium of 57%.

- This FY’s 57% premium was split 54% during H1 and 62% during H2:

- Prior to the pandemic, premiums of between 43% and 53% on the Allsop valuation were realised on sales proceeds.

- H2’s 62% premium is the highest except for the 65-66% achieved during the comparable FY.

- The realised premium versus the Allsop valuation has implications for estimating MTVW’s potential share price (see Valuation).

- During the 8.5 years following the Allsop assessment, MTVW has raised £388m from selling properties that the agent had valued at £259m.

- Selling properties that Allsop had valued at £259m implies the book value (i.e. the original cost) of the properties sold was £124m (£259m divided by the aforementioned 2.1x multiple).

- Selling Allsop-valued properties with a £124m book value indicates Allsop-valued properties with a £194m book value remain within MTVW’s ownership today (i.e. the £318m book value at the September 2014 assessment less the £124m since sold).

- MTVW during this FY sold Allsop-valued properties with an estimated book value of approximately £11m (£23m/2.1), which indicates the remaining Allsop-valued properties of £194m could take a further 18 years to sell.

- This FY showed total trading properties with a £423m book value, implying properties purchased after the Allsop review have a £229m book value (i.e. £423m less the remaining Allsop-valued properties of £194m).

- As more Allsop-valued properties are sold and other properties are purchased, the less relevant the 2014 Allsop valuation becomes to the share price.

- MTVW’s results commentary has never referred to the Allsop valuation since the assessment was undertaken.

- Management’s AGM remarks reiterated another Allsop-type assessment was not being considered. The same old reasons were once again reeled off:

- The assessment is not used by management;

- The assessment is expensive, and;

- There is no accounting requirement.

- The 2023 annual report repeated the following text from previous years:

“The [Allsop] valuation is not a useful tool for running the business because we are always going to await vacant possession, and no perceived uplift in value can justify selling a tenanted property. The nature of our business and the rules and conventions under which we operate place no obligation upon us to value our trading stock at any given time and therefore the valuation has not been updated since.”

- I maintain MTVW ought to implement regular valuations to provide greater clarity as to the inherent value of the group’s property estate.

- In particular, further valuations would help shareholders judge the astuteness of MTVW’s more recent purchases (see Trading properties: properties not valued by Allsop) and perhaps the appropriateness of the board’s pay (see Protest votes, David Pears and executive pay).

- Mind you, MTVW’s long-term dividend and NAV records do not suggest outside shareholders have been too hard done by through a lack of formal valuations.

- September 2024 will mark ten years since the Allsop assessment was undertaken.

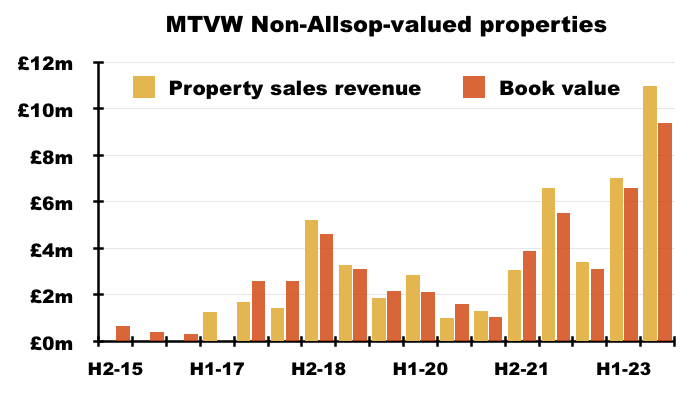

Trading properties: properties not valued by Allsop

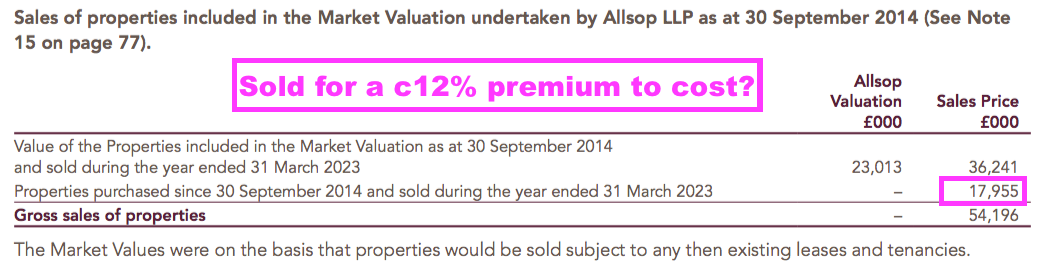

- The Allsop assessment and associated disclosures allow shareholders to evaluate the properties not valued by Allsop.

- During this FY, properties bought after the Allsop valuation raised proceeds of £18m:

- But what was the original cost of those properties that raised the £18m?

- The Allsop-valued properties sold during this FY had an Allsop valuation of £23m, which suggests their book value (i.e. purchase price) was £23m/2.1x = £11.0m.

- The total book value of properties sold during this FY was £27.0m, which implies the book value of the properties bought after the Allsop valuation and sold during this FY was £27.0m less £11.0m = £16.0m.

- Raising £18.0m from selling properties with an estimated £16.0m purchase price does not seem exceptional…

- …especially when management’s AGM remarks (both during the 2021 and 2023 events) stressed MTVW purchased regulated tenancies at 75% of their vacant possession value.

- In theory at least, a regulated property purchased one day at 75% of vacant possession value — which then becomes vacant the next day — should enjoy an immediate 33% value uplift.

- During the 8.5 years following the Allsop valuation, MTVW has raised a total £51m from selling properties not valued by Allsop with an estimated book value (i.e. purchase price) of £49m:

- My estimates do not suggest MTVW has worked miracles buying (and then selling) properties following the Allsop assessment of September 2014.

- These estimates could easily explain why NAV growth has slowed during recent years; properties bought and the sold since September 2014 have seemingly reported limited gains.

- These estimates could also explain why my evaluation of MTVW’s property estate has not really improved during recent years. My previous calculations were:

- £210 per share for FY 2022;

- £214 per share for FY 2021;

- £202 per share for FY 2020;

- £204 per share for FY 2019;

- £213 per share for FY 2018;

- £206 per share for FY 2017, and;

- £200 per share for FY 2016.

- Buying and then selling properties for limited gains since 2014 may also explain why the share price has made little headway during the same time:

- Of course, not every property MTVW has purchased following the Allsop assessment has been sold.

- Those properties not valued by Allsop but still owned by MTVW could be sitting on huge paper gains, while those that have been sold were held for short durations that would always limit their final profit.

- Furthermore, MTVW acquires properties other than regulated tenancies, which may require more than the 8.5 years since the Allsop assessment to maximise their upside.

- Still, buying properties for an estimated £49m and selling for £51m can’t be deemed a rousing success and probably explains the pointed questions from David Pears at this year’s AGM (see Protest votes, David Pears and executive pay).

- The lack of any further Allsop-type assessment leaves me to assume the properties not valued by Allsop but still carried on the balance sheet may not be worth much more than their aforementioned £229m aggregate purchase price.

- Management’s AGM remarks claimed there was “little difference” between the returns on properties purchased during the 1990s or earlier, and the return on properties bought since the 2014 Allsop valuation.

Financials

- MTVW’s accounts remain very straightforward, with properties and debt the two prime entries.

- The aforementioned £56m spent on new properties left free cash flow at minus £8m, with extra debt of £38m and dividends of £29m leaving FY net debt at £56m.

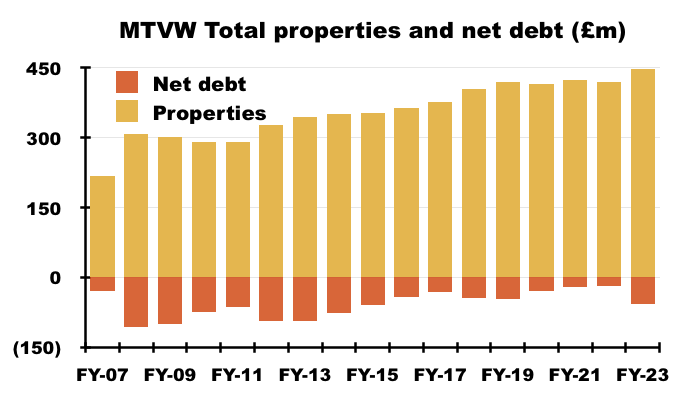

- Net debt at £56m is the highest since FY 2015 (£60m) but is equivalent to only 12% of the group’s £448m total property estate — historically low versus the 25%-plus levels witnessed during FYs 2008, 2009, 2010, 2012 and 2013:

- Management’s AGM remarks noted the board would “pay much greater attention to managing debt and cash flow” if gearing reached 25%.

- MTVW’s current banking facilities allow borrowings of up to £90m, equivalent to 20% of the total property estate.

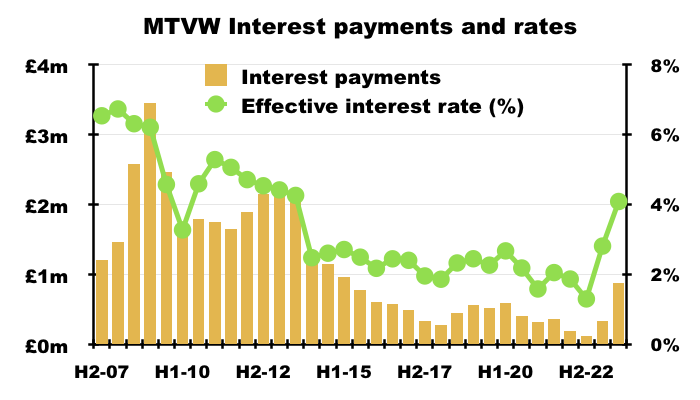

- Finance costs of £1.2m for this FY exceeded the ultra-low £298k for the comparable FY, and implied a manageable 3.2% interest rate on this FY’s £38m average debt.

- Note that H2 finance costs were £876k — more than double H1’s £336k — due to greater debt and rising debt costs.

- Average debt during H2 was £43m, implying a 4.1% interest rate:

- Interest cost at 4.1% is the highest since H2 2013 (4.3%). H2 debt costs of £876k were the highest six-month charge since H2 2014 (£1.2m).

- The 2023 annual report confirms MTVW’s borrowings are variable rate with a margin of approximately 2% above SONIA:

1. The Group has a short-term borrowing facility of £10 million (2022: £10 million) with Barclays Bank. This is due for review in November 2023 and the rate of interest payable is:

• 1.6% over base rate on overdraft

• Headroom of this facility at 31 March 2023 amounted to £9.94 million (2022: £10 million).

2. The Group has a £60 million (2022: £60 million) long-term revolving loan facility with Barclays Bank with a termination date of March 2027. The rate of interest is 1.9% above SONIA. The loan is secured by a cross guarantee between Mountview Estates P.L.C. and its subsidiaries. The loan is not repayable by instalments. Headroom under this facility at 31 March 2023 amounted to £20 million (2022: £58 million).

3. The Group has re-negotiated a £20 million long-term revolving loan facility with HSBC Bank. The termination date for this facility is March 2028. The rate of interest payable on the loan is 2.1% above SONIA. The loan includes a Negative Pledge. The loan is not repayable by instalments. As at 31 March 2023 headroom under this facility amounted to £3.3 million (2022: £2.8 million).”

- SONIA is currently 5.19%, which means MTVW should now be paying approximately 7.19% on its debt.

- Assuming gross debt stays at £57m and SONIA stays at 5.19%, finance costs would advance from £1.2m to £4.1m for FY 2024.

- Extra finance costs of £3m equate to approximately 77p per share, and the higher rates will dampen future NAV growth.

- This FY’s £6.3m tax charge would have been £8.2m under the new 25% UK tax rate.

- Extra tax of £1.9m equates to approximately 49p per share, and the higher rate will also dampen future NAV growth.

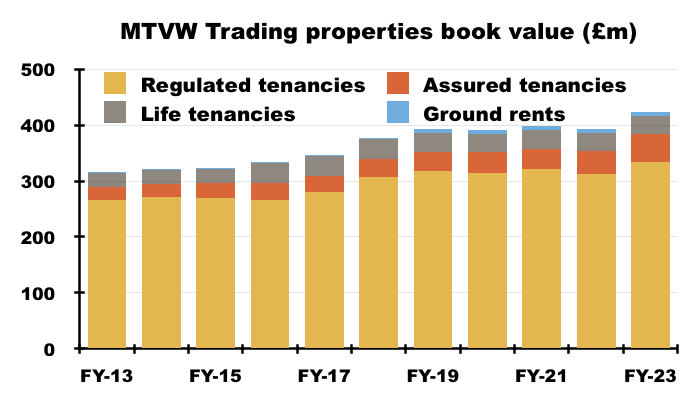

- MTVW’s trading-property estate has a £423m book value, of which regulated tenancies represent £334m or 79%:

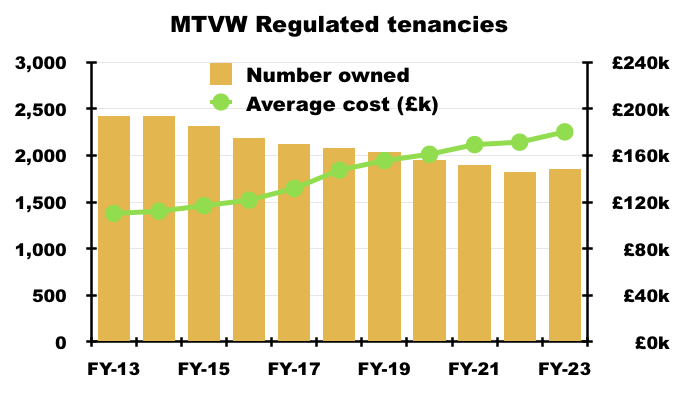

- The market for MTVW’s regulated tenancies will continue to shrink. Such tenancies have not been created since 1989 and Allsop estimates fewer than 75,000 now exist.

- The number of regulated tenancies owned by MTVW topped 3,000 20 years ago, topped 2,400 ten years ago but today stands at less than 1,900:

- MTVW’s conventional investment properties remain in the books at £25m or £6.52 a share.

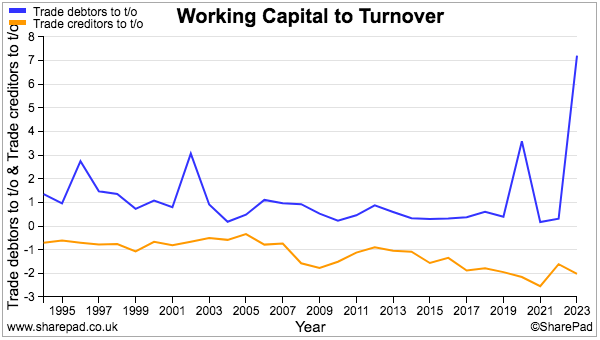

- An outstanding £4.4m due from three property sales — paid just after the year end — meant trade debtors were uncharacteristically well beyond the typically tiny 1% of revenue:

- MTVW’s accounts remain free of defined-benefit pension obligations.

Protest votes, David Pears and executive pay

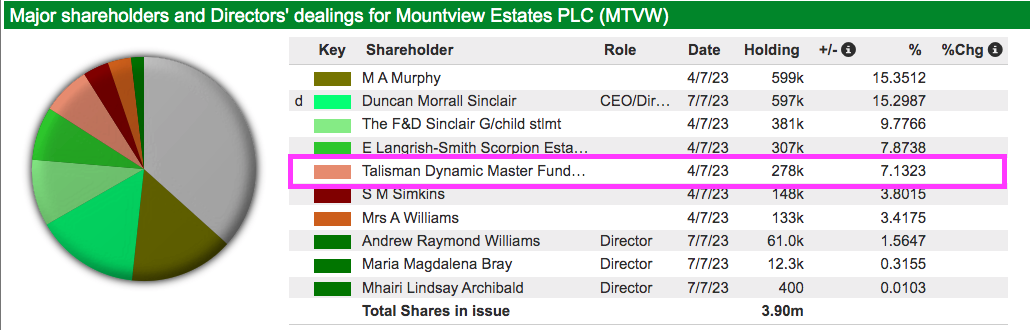

- MTVW’s shareholders fall into three camps:

- The Sinclair family concert party, which is led by chief executive Duncan Sinclair and controls 50.4% of the share count;

- The Murphy family and connected parties, who claim to own 24% of the share count and whose leading shareholder is Margaret Murphy, the chief executive’s sister, and;

- Everybody else, who own approximately 25% of the share count.

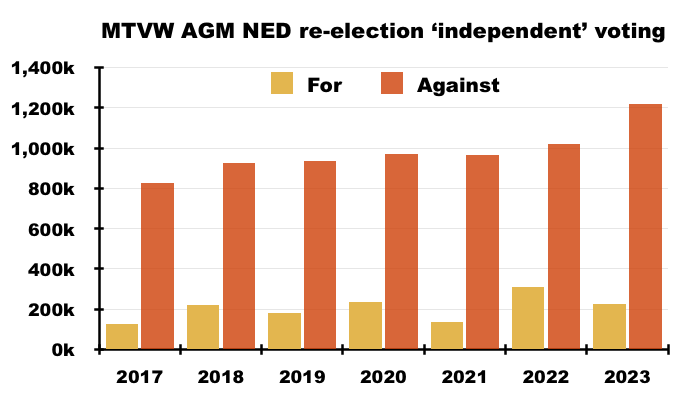

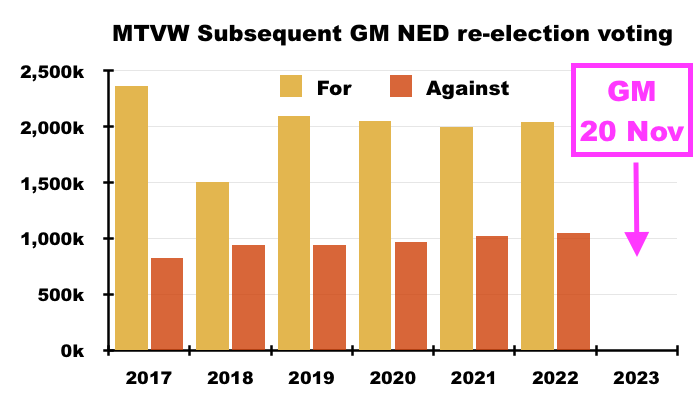

- MTVW’s last seven AGMs have witnessed c30% (or more) protest votes against:

- Re-electing independent non-execs;

- Approving the board’s pay, and;

- Re-appointing the auditors.

- The protest votes have been led by the Murphy family and connected parties.

- From what I can tell, the Murphy family is broadly satisfied with how MTVW’s day-to-day operations are run, but:

- Is aggrieved about the board’s pay;

- Has lost the trust of the non-execs to act on the views of all shareholders, and;

- Is frustrated about a general lack of influence at board level.

- The Murphy family stated during the 2021 AGM that it was no longer in direct communication with the company and would engage with the directors only through a “public forum“.

- The 2023 AGM attracted another unhappy shareholder: David Pears.

- David Pears is part of the Pears family that controls property group William Pears.

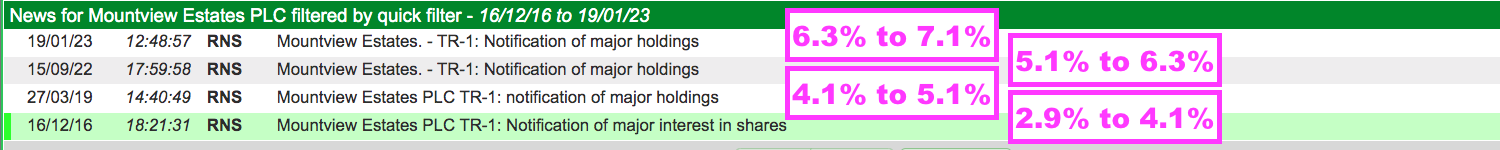

- William Pears controls Talisman, an investment fund established to manage the Pears family’s wealth. Talisman owns 7% of MTVW:

- During the AGM Mr Pears asked:

“Interest rates have gone from zero to 5%, but you are still paying 75% of vacant possession. At zero you are paying 75% and at 5% you are paying 75%?!

…

“Can you disclose IRRs on the properties sold? Your results could be flattered because properties that may have been brought in 1990. I am concerned with your approach, spending £50m with interest rates rising, and EPC costs. What sort of return are you really going to get from today and from the last few years as well?”

…

“You have talked about succession plans for [non-executive] Ms Archibald. What are the succession plans for the senior management?“

- I sat directly in front of Mr Pears during the AGM and let’s just say during the post-meeting chit-chat he did not appear impressed by the board’s responses to his questions.

- Talisman’s shareholding has increased from less than 3% to more than 7% since 2016:

- I don’t know why Talisman has increased its shareholding given Mr Pears seems unhappy with the board.

- The Murphy family, (presumably) Talisman and other unhappy shareholders prevented the re-election of certain non-execs at the last AGM — and the six prior AGMs:

- Following each AGM, MTVW is entitled to convene a general meeting (GM) and hold a further vote to re-elect the ousted non-execs.

- The ousted non-execs have (to date) all been re-appointed at the subsequent GMs because the Sinclair concert party can then vote on the non-exec re-elections (unlike at the AGMs, where the concert party is prohibited from voting on particular ‘independent’ resolutions):

- The GM to re-appoint the non-execs voted off the board at the 2023 AGM will be held on 20 November.

- The number of unhappy shareholders has been increasing. The average AGM votes against the re-election of the contentious non-execs have climbed from 827k to 1,220k since 2017.

- The 2023 AGM also revealed a 9% protest vote against MTVW’s two executives.

- I speculate that 9% was led by Talisman. Near-3% protest votes against the executives were lodged at the 2022 AGM, with immaterial protest votes lodged before 2022.

- Stock-market rules dictate any company incurring a 20%-plus AGM or GM protest vote has to contact the unhappy investors and publish an update to shareholders within six months.

- Six months after the 2022 general meeting, during May 2023, MTVW announced:

“Following the meeting, the Company identified, as far as possible, those shareholders who did not support the resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage, other shareholders raised matters which are under consideration by the Board.

The Board is grateful to those shareholders who took part in the engagement process and value the feedback provided. The Company re-affirms its commitment to ongoing shareholder engagement and will continue to offer to have discussions with shareholders and will take into account their concerns and considerations in the future.”

- MTVW has never before expressed its gratitude to shareholders providing feedback.

- But whether any of the matters raised will convert into action remains to be seen.

- No less than 13 AGM/GM protest votes since 2017 suggest the “engagement process” has no influence on board decisions.

- The ineffective protest votes have not yet persuaded the Murphy family to sell; in particular, Companies House indicates Margaret Murphy has maintained a 500k-plus shareholding since at least 1980.

- My feedback to a non-exec after the AGM was MTVW would receive far less grief if the executives toned down their pay and redeploy the savings into an occasional estate valuation.

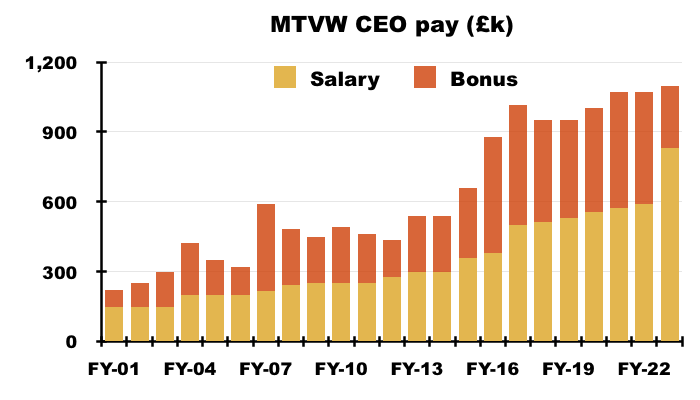

- Chief exec Duncan Sinclair has received a bonus every year since at least FY 2001…

- …which does raise the question as to whether board bonuses are effectively guaranteed.

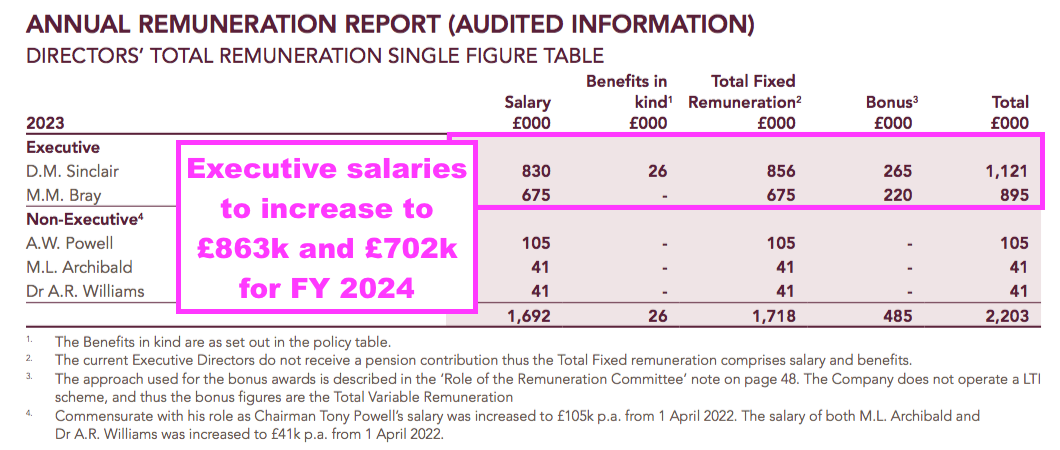

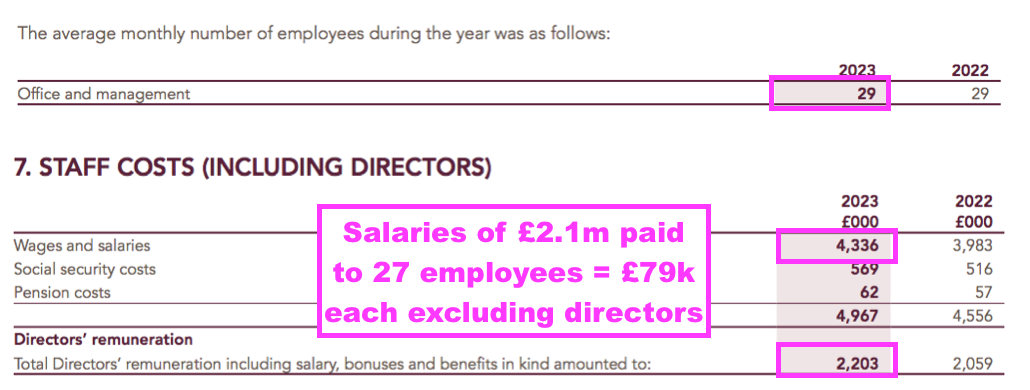

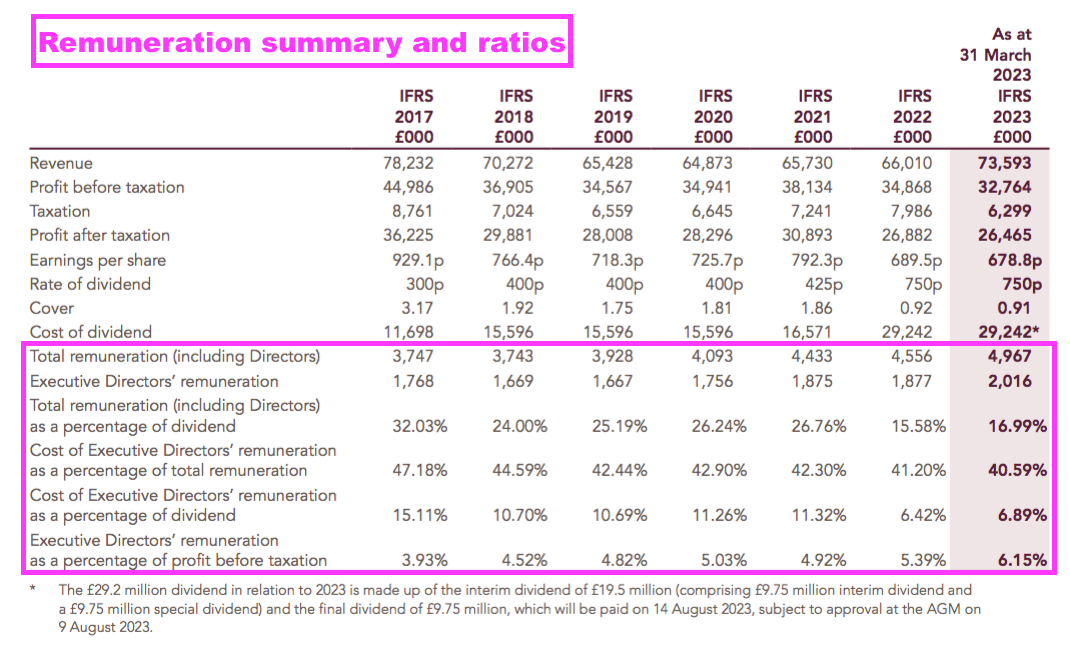

- The two executives shared £2m between them last year…

- … while the wider workforce averaged a useful £79k:

- The feeling among attendees during the post-AGM chit-chat was the board is very well paid for essentially:

- Putting vacant properties into auction;

- Collecting rent, and;

- Buying properties during recent years that may not have earned worthwhile gains on disposal.

- MTVW is the only company I know that includes remuneration ratios within its annual-report summary table:

- MTVW should add ratios that compare remuneration to NAV.

- For this FY, executive pay of £2m reduced NAV by 0.5% and total pay of £4m reduced NAV by 1%. Such percentage reductions have occurred consistently throughout the last 20 years.

- Employee pay reducing NAV by 1% per annum has become more notable after NAV declined during this FY and the previous FY.

- At least MTVW does not operate a share-option scheme, and in fact has never issued any new shares since at least 1979.

Valuation

- I now calculate MTVW’s shares could be worth £186 were all of the group’s regulated tenancies to end immediately and the properties then sold at a fair market value.

- The following table outlines the sums:

| Property stock Sept 2014 (£k) | 317,651 |

| Less sold Allsop-assessed stock (£k) | (123,770) |

| 193,881 | |

| Allsop-premium-to-book | 2.10x |

| Sold-premium-to-Allsop | 1.57x |

| 640,029 | |

| Stock purchased since Sept 2014 | 228,861 |

| Possible property stock value (£k) | 868,889 |

- I have taken the estate’s September 2014 value of £318m and subtracted the (estimated) £124m book value of Allsop-assessed properties sold since that date.

- I then multiplied the £194m remainder by the 2.1x ‘Allsop-premium-to-book’ multiple and then added the 57% ‘sold-premium-to-Allsop’ gain that was realised during this FY.

- I arrived at a £640m estimate for all of MTVW’s properties that were owned at September 2014 but have yet to be sold.

- Since September 2014, MTVW has acquired additional properties with a £229m book value.

- I have assumed these additional properties will be sold for their £229m book value — based upon my analysis of properties bought and then sold since the Allsop assessment (see Trading properties: properties not valued by Allsop).

- Adding the £640m and the £229m together gives £869m.

- This next table adjusts that £869m for 25% taxation, the £25m conventional property portfolio, net debt and other liabilities to give a possible book value of £725m or £186 per share:

| Possible property stock value (£k) | 868,889 |

| Less tax at 25% (£k) | (111,537) |

| Plus other investments (£k) | 25,415 |

| Less net debt (£k) | (55,984) |

| Less other liabilities (£k) | (1,465) |

| Possible NAV (£k) | 725,319 |

| Possible NAV per share (£) | 186.03 |

- My estimated NAV sums are not perfect, and the following questions remain unanswered:

- How long will MTVW take to sell all of its properties?

- Will potential house-price inflation compensate for being unable to sell all the properties immediately?

- How relevant is the 2014 Allsop assessment today?

- Will properties bought since the 2014 Allsop assessment continue to be seemingly sold at cost price?

- What impact could annual admin costs of £7m have on the calculations? (I have ignored such costs)

- MTVW’s shares have drifted lower to trade at NAV:

- The best time to buy appears to be when the market cap trades at (or below) NAV, at which point no future gains from any property purchases are priced into the valuation.

- What future gains could lie ahead?

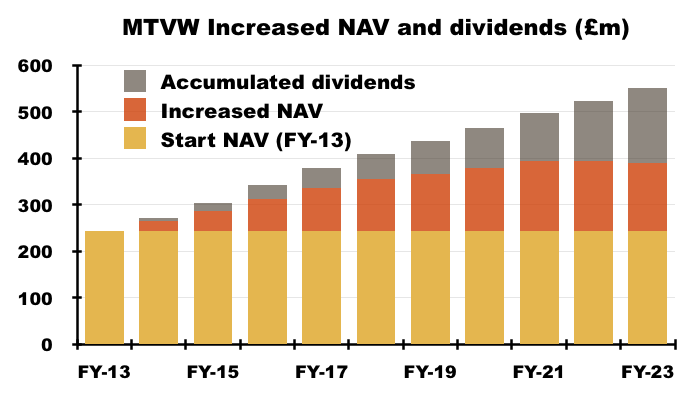

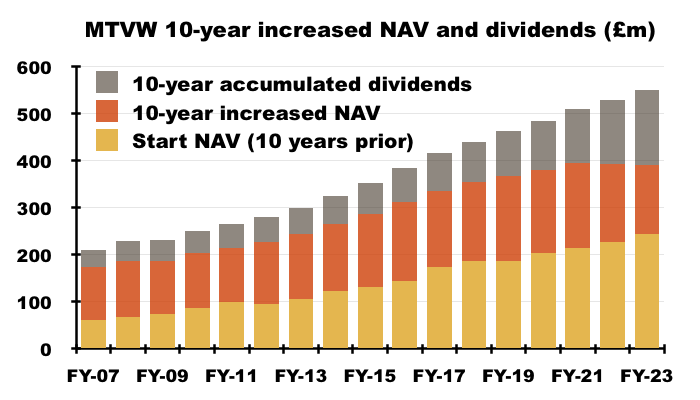

- For perspective, the ten years to this FY witnessed:

- NAV advance by £147m, from £244m to £391m, and;

- Cumulative dividends paid of £159m:

- Generating an additional £306m (£147m extra NAV plus £159m cumulative dividends) from a starting NAV of £244m over ten years equates to a compound annualised return of 8.5%.

- For further perspective, the ten years to FY 2015 witnessed NAV advance £155m and dividends accumulate to £64m, equating to a 10.3% compound annualised return from the £132m starting NAV…

- …while the ten years to FY 2007 witnessed NAV advance £111m and dividends accumulate to £36m, equating to a 13.0% compound annualised return from the £62m starting NAV:

- The next ten years repeating the aforementioned 8.5% annualised return may not enthuse prospective investors given:

- MTWV’s ten-year returns have been declining over time, and;

- Fixed-term cash alternatives now yield 5%-plus.

- Perhaps a discount to NAV is now required to generate suitable investment returns.

- For example, my original MTVW purchase occurred during 2011 when the £42 shares traded at 0.75x the then £55 per share NAV.

- Since then:

- The market cap has advanced by £230m, from £160m to £390m, and;

- Cumulative dividends of £172m have been paid…

- …equating to an 11.0% annualised total return since FY 2011.

- Without the market-cap re-rating from the then 0.75x NAV to today’s 1x NAV, my annualised return from that original £42 purchase would have been 8.3%.

- Could the “difficult economic circumstances [that] may be with us for some years” alongside an increasingly despondent stock market once again push the share price towards a 0.75x NAV multiple?

- The shares sank to £21 at the depths of the 2008 banking crash, giving buyers a 0.44x NAV multiple versus the then £48 per share NAV.

- At least future returns from today are front-loaded by near-term dividend payments:

- The illustrious ordinary payout supplies a 5.0% income at a £100 share price — the highest yield for at least 30 years excluding the banking crash.

Maynard Paton

Mountview Estates (MTVW)

AGM attendance 09 August 2023

Below are my notes from MTVW’s AGM. All five directors were present, alongside 30+ attendees. Questions were asked by Craig Murphy, David Pears (of William Pears/Talisman), myself and a number of other investors.

The meeting was once again recorded on audio — certain major shareholders do not get on and disagree about the group’s corporate governance, board membership and other matters. A tape recording could therefore be useful as to who said what. My notes are paraphrased/summarised.

Good to see David Pears attend and ask some questions. I sat directly in front of Mr Pears and, during the post-meeting chit-chat, he was clearly not happy with the board’s responses during the meeting.

Quite a frustrating meeting overall. Chairman seems to delight in referring questioners to the random mix of properties that become available for sale in any given year; that way, points raised about low margins, low profits etc, can be brushed aside with a shrug of the shoulders. Despite being an accountant, the chairman never gives any factual or financial information about the business at these meeting either. I can fully understand the protest votes against him.

(CM: Craig Murphy; DP: David Pears; DS: Duncan Sinclair (chief executive); MP: Maynard Paton; Q: Another questioner; MTVW: Chairman).

——————

Q: Since DS joined the company in 1977, there has been a massive increase in life expectancy. Has that altered the length of tenancies?

DS: Has been an increase in life expectancy, but does not alter the method of the business. Slightly greater amount of patience required but not altered the nature of the business.

MP: November’s interims talked of “economic storms that lie ahead”, and the company bought properties of £50m last year, which was a lot more than in previous years. Can you talk about the decision making behind that purchase of £50m given economic storms may lie ahead. Perhaps property will be cheaper in years to come?

DS: Mountview has always done well when the going is tough. Not everyone keeps gearing at the modest level we do. Some are being forced to sell to keep within borrowing limits, which presents opportunities and less competition for properties. The opportunities have been there and the prices have been a little more modest than they were.

MP: What level of discount to vacant possession value do you look for?

DS: We reckon to buy at 75% of vacant possession.

MP: Has that level changed over time?

DS: Property price inflation also looks after us, so we are rarely embarrassed by that figure. We know others are prepared to pay more, but not at present, so we can acquire properties at 75% of vacant possession or less.

We are very strict with the condition of the property. Not always possible to inspect the property and determine how much to spend to get the property in a saleable condition.

Q: About 4-5 years ago you bought a leasehold property in the west end for several million. How did that work out?

DS: We still own the property. Confident we will make a significant profit when it become vacant.

CM: What is number of shares held by the concert party and are there non-family members in the concert party?

MTVW: As per the annual report, the concert party owns over 50%. Membership is just family members.

CM: Marie Bray was a past member of the concert party. Is she currently a member?

MB: No.

DP: What is your expected IRR from the £50m of purchases last year and what are your current debt costs?

MTVW: Annual report explains how purchases were funded through operations and debt. Debt now lower because of the cash flows since the year end.

IRR assumes you know the sale date. But we don’t know sale dates. So we do not actually use or look at IRR. We look primarily at the discount, possibly offset a bit by the current rental.

DP: Interest rates have gone from zero to 5%, but you are still paying 75% of vacant possession. At zero you are paying 75% and at 5% you are paying 75%?

MTVW: Got to look at the properties that are available for purchase, and how we choose to fund them. The figure that we look at is gearing, which is still relatively low at, 12.5% compared to 4.5% for the year before.

DP: You have talked about succession plans for Ms Archibald. What are the succession plans for the senior management?

MTVW: Succession planning covers executives and non-executives. Nomination committee meetings discuss succession plans. Last time committee asked, the executives were happy to continue for a good few years yet.

Q: Can you explain the considerable increase in the cost price relative to the sales price?

MTVW: Can’t control which properties are going to become vacant, which causes fluctuations in the cost of sales versus the sales price and therefore hits the gross margin.

Q: Have you sold properties that were not vacant?

DS: Sold one property that was not vacant since year end. Can occasionally sell to the tenant or a relative at vacant possession value. Any discount they get will only reflect us saving agent costs. But always sold at vacant possession value.

Q: Can you explain the huge difference with cost prices for this year versus last year?

MTVW: Due to costs following revenue, and revenue arises when we get vacant possession, which is outside of the directors’ control.

Q: Seems very surprising the cost price is so huge this year and should rise so sharply.

MTVW: Probably due to age profile of property. May have been a non-representative proportion of newer properties being sold in the last two years. Plan to do an analysis.

CM: Has been the case for two years, and you have not got round to looking into it? What else have you been doing?

MTVW: Had to wait for two years for data points to emerge and prompt analysis. Rest of time spent chairing meetings, prepping annual report and meeting shareholders.

Q: Cost of the property sold in the year was 49.7% of sales proceeds, way higher than normal. Is there significant expenditure on improving the properties before sale that would explain the increase?

MTVW: Tend not to improve properties prior to sale. Allows buyers or developers to add their own value. Exception is higher-end properties, where there is greater potential to add value for a relatively small refurb cost.

Q: Figure would be helpful to separate cost of improving property and cost of purchasing property.

MTVW: Comment is noted:

Q: Sale of 50 ground rents, seems a significant number.

MB: Due to the Leasehold Reform Act. Analysed our ground rents and decided to put them up for auction. Sold them because they were not going to gain further value. Going to be a future trend of analysing and selling the freehold ground rents.

Q: The Building and Safety Act of 2022 has come into effect. How are you coping with that?

MB: Have a department who deals with regulation and new regulations. We are very well prepared. Still have blocks of flats with regulated tenants, but not going to sell them. Fully observant of regulations especially fire risk. Have put together a pack for tenants.

DS: 7-10% of our properties become vacant each year. One year is never typical of the company. Look at our accounts over 3-5 years would be more reasonable.

MP: What is your estimated EPC cost?

MTVW: Legislation on second reading and light on detail, so difficult to make reliable predictions. Common figure is a cap of £10,000 per property, but too many uncertainties to give a reliable figure.

MP:Rough estimate of the number of properties affected by EPC?

MTVW: We know the current EPC ratings of our properties. Choose your own expenditure cap and multiply that by a proportion of our property portfolio. Won’t say what that proportion is. We do know the proportion, but don’t have it to hand. Would be very unfair and unreasonable to start making a guess on that question. All we have is the figure which is presented in the annual report of the number of properties that meet EPC or have an exemption.

CM:Given the dramatic deterioration in the relations between the non-executive directors and the independent shareholders, is one of the criteria the board is looking for in the successor to Ms Archibald is somebody who can command the confidence of the independent shareholders?

MTVW: That’s an assertion about the independent shareholders as a whole which is not supported from the conversations I have. Nomination committee report outlines process we would follow and develop job specification. Advisers are identifying candidates and send us through CVs.

DP:Possible to disclose IRR on properties sold?Your results could be flattered because properties may have been brought in 1990. Concerned with your approach, spending £50m with interest rates rising, and EPC costs. What sort of return are you really going to get from today and from the last few years as well?

MTVW: Do look specifically at possible EPC needs and is reflected by the purchase price we are willing to pay. On IRRs, have analysed the data and there is little difference between the returns on properties purchased in the 90s or earlier, and the return on properties bought since the 2014 valuation.

DS: Have been times when you could buy properties at 50% of vacant possession, which became 60% which became 66%. Have been times recently where 75% did not win the day. Figure will fluctuate. Said 75%, but not everything is costing 75%.

MP: What’s the maximum you will borrow?

MTVW: No formal gearing limit, but we have said at 25% we would pay much greater attention on managing debt and cash flow.

MP: Best guess as to the lifespan of the regulated property sector?

MTVW: Don’t know. 20 years ago answer could have been 10 years. Sector still has life in it. Allsop report from 2019 or 2020 suggested 75,000 regulated tenancies. This year shows tenancies can still be purchased. Occupiers are younger than DS.

Q: Lots of properties unsold due to legal issues, Why can’t legal issues be resolved before vacancy occurs?

MB: Legal issues mostly life tenancies. Tenant dies and family demand right to property, but don’t realise the tenancy. Matter has to be referred to solicitors.

Q:Does the board contemplate revaluing the estate at any point?

MTVW: Question has cropped up regularly, short answer is not in the foreseeable future.

Q: Lack of a revaluation leaves outside shareholders in a degree of ignorance and is not acceptable given this is a public company. Made the complaint before, and the complaint remains.

MTVW: Comment is noted. Valuation crops up in board meetings once a year. Do not use the valuation as a management tool. No accounting requirement to revalue the trading properties. Quite a large expense.

——————

Maynard

Having been a shareholder for a number of years, it seems to me that the management is both cosy and complacent. The share price has been drooping for for sometime, down about a third in the last year or so. I think the estimate for EPC upgrading at 10k per property is way out from my experience.

The only thing that works is the NAV.

Perhaps the low price might encourage somebody like Talisman to buy enough to change the attitude.

Best wishes

Bertie

Thanks Bertie. MTVW did say it had welcomed shareholder feedback earlier this year, and I speculate that feedback came from Talisman. Aside from Talisman, the other major shareholders are concert-party members, who I assume are happy with the board, and the Murphy family (and related parties), and Craig Murphy said the other year the Murphy family would only engage with the board in a public forum. What was a bit strange during the post-AGM chit-chat was David Pears saying he was ‘trapped’ in the shares, yet Talisman had been buying earlier this year. Mr Pears carries sector gravitas and Talisman buying suggests all is not lost for ordinary investors. Hopefully Talisman will buy some more. Margaret Murphy has never sold any shares for decades (if at all), despite being the largest dissident shareholder.

Maynard

Mountview Estates (MTVW)

Publication of 2023 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

1) OUR PURPOSE AND HOW WE OPERATE

No major text changes for 2023.

This section of the annual report provides a useful reminder of the group’s “values” and “culture“:

“Mountview’s core purpose is to acquire and maintain regulated tenancy residential property providing below market rent accommodation for our tenants until we get vacant possession when we sell such properties. In meeting this purpose, the Group has a long established strategy, business model and set of operating procedures. All these have been developed and refined by marrying the values of the founders and the knowledge and experience of our executives and staff with the evolving environment that we operate in.”

This year the “family” values were replaced by “our founders’” values:

“Our key strengths that underpin our culture and support our continuing success are:

• Our team’s experience and knowledge of their sector and the communities we operate in

• A long-term view, underpinned by our founders’ values

• A conservative approach to financing, and management of our cost base

• Investing responsibly to maintain our existing assets and acquire new assets

• Operating responsibly in the communities we serve”

MTVW was founded by Frank and Irving Sinclair in 1937, and the current chief exec is the son of Irving Sinclair.

Given the regular AGM protest votes, MTVW acknowledged not everyone is happy with how the business operates:

“The strategy and business model are reviewed annually and discussed with major shareholders, the majority of whom have confirmed their support for the Company to continue to operate unchanged.”

This line now refers to worries that have superseded the pandemic:

“Uncertainty remains a factor as the continuing fallout from Brexit, the war in Ukraine and the rising cost of living present serious challenges to the wider economy and as a result to our different stakeholder groups who often have conflicting needs, some familiar though some prompting a re-think of how we currently work.”

2) SALES

A reminder that MTVW buys life tenancy properties as well as regulated tenancy properties:

“At Mountview, we have a relatively straightforward yet proven way of working: we buy tenanted residential properties and sell them when they become vacant. We buy both regulated tenancy and life tenancy properties.

Regulated tenancies are characterised by rental returns below market value, are decreasing in total number as, since the Housing Act 1988 no new regulated tenancies have been created. Nonetheless, as described below under Purchases, opportunities to acquire regulated tenancies continue to be available to allow us to refresh the portfolio by replacing sold stock with further tenancies.

Life tenancy stock has nominal rental income, is bought at a greater discount to vacant possession value and has a higher margin on sale. A key attraction of this sector to Mountview is the fact that property maintenance is usually the responsibility of the life tenant and this leads to lower ongoing costs to the Group. We carry out regular checks to ensure that all properties are maintained in good condition.”

Life tenants have all the rights of a homeowner, stay in their property for life and pay no (or very low) rent to MTVW (until the property becomes vacant and MTVW can then sell). This annual report showed 208 life tenancy properties with a £33m cost value = purchased at an average £157k:

3) PURCHASES

A reminder that MTVW can refurbish properties to enhance their sale value:

“The majority of our residential properties that are subject to a regulated tenancy are concentrated in London and the South East. Returns from the regulated portfolios are derived from a combination of below market rental income and trading profits on the sale of property, when the property becomes vacant and the reversionary gain is crystallised.

Most properties acquired are unimproved and therefore of low average value. One of the core Mountview capabilities is to actively manage these properties: we identify opportunities to add value by carrying out refurbishments prior to their sale. The greatest gains are available at the upper end of the market and this is where we concentrate our refurbishment activities. These properties are predominantly sold by private treaty.”

4) ANALYSIS OF ACQUISITIONS

A new line for 2023, suggesting vendors approached MTVW to buy their property portfolios:

“During the year we were offered the opportunity acquire more portfolios than in recent years. While applying our normal due diligence process to the portfolios offered, we were able to secure more than four times by number and value of properties compared with 2022.”

MTVW spent £42m on 7 portfolios containing 149 properties:

I am not a property expert, but I suspect these 7 portfolio deals of up to £10.6m were undertaken in private rather than through public auctions that typically handle individual unit sales.

Being approached by vendors may correspond to the chief exec’s AGM comments of ‘forced sellers’ (see comment above):

“Not everyone keeps gearing at the modest level we do. Some are being forced to sell to keep within borrowing limits, which presents opportunities and less competition for properties. The opportunities have been there and the prices have been a little more modest than they were.”

5) SUMMARY PROSPECTS FOR THE GROUP

MTVW was not exactly upbeat about the immediate future:

“In the event the UK avoided a technical recession, but the wider outlook remains finely balanced as any one of a number of factors could tip the balance into technical recession. Against this backdrop pretty much all markets have been affected and housing is no exception.”

But the group claims its modest properties ought to help limit problems during any downturn:

“We are fortunate that the properties that Mountview brings to auction are typically in high demand as they offer a lower priced entry to the housing market or, if sold to developers, provide opportunity for ‘developer profit’. We are hopeful therefore that Mountview will continue to be well placed to weather any continued down turn in the general housing market, should it occur, through both continuing sales of attractive properties and also with the opportunity to purchase potentially discounted replacement properties both through auction and private tender.”

This text was repeated from 2022 and may well be repeated from years earlier:

“Our strength is based on a tight focus on our core business of regulated tenancies together with a prudent operational approach…. Given our financial strength, we believe that we are in a strong position to take advantage of any prime purchasing opportunities which may arise in the future.”

6) NON FINANCIAL METRICS

No text changes for 2023.

The chairman loves to reiterate this feature of MTVW’s business at the AGM:

“The Group’s drivers of their main source of revenues and profit arising in the current year – sales on vacant possession – are beyond the control of the Group as they are in turn driven by factors that are outside the Group’s control: the timing of vacant possession, the location and thus market price of properties disposed of, the original purchase date and price of the properties sold and the current market appetite for the properties that are sold.”

Any difficult question on performance is typically rebuffed at the AGM (see comment above) with ‘the random mix of properties that come up for sale in any given year’ spiel!

Confirmation MTVW uses only financial indicators:

“Consequently, in view of this and the stable and long standing nature of the Group’s business model and operating procedures, and the very close involvement of the Executive Directors in the day to day operations of the business, the Group has not developed and does not use non-financial indicators as the Directors believe that they would not add to the Group’s ability to manage the business day to day.”

But the board does employ non-financial indicators to help award the executive bonuses (point 19b)!

7) RISK MANAGEMENT APPROACH

This year MTVW’s revamped text made greater references to the group’s “Risk Matrix“:

“Making effective decisions to realise our strategic and operational aims is underpinned by our risk management processes that embrace monitoring of currently identified risks, scanning for emerging risks and then once identified assessing those risks and our response to them within our context and the challenges placed on us by the external environment. The Audit and Risk Committee maintains our risk matrix which classifies risks broadly between those for active and regular monitoring and those for reporting on by exception and reports on them to the Board (Risk Matrix). The Risk Matrix also includes risks where the impact would be high, but probability is deemed low and it is these risks in particular that we consider when assessing longer term resilience and viability. In particular in the recent years, and as described in our annual reports from 2020 to 2022, the risk management processes were tested by Covid-19. This year, following a Board discussion, we have taken the view that we can move Covid-19 risks from the active monitoring status to one of being ready to react in the event of a recurrence of a new strain of Covid or other pandemic. Accordingly in this annual report the notes describing our operational response to Covid-19, and many other references to Covid-19 have been removed – though remain accessible from our earlier annual reports.”

The major business risks remain:

1) Trading stock — regulated tenancies

2) Market

3) Financial

4) Dividends

5) People

6) Regulatory

7) Operations and property maintenance

8) Climate

There were no major text changes for 2023. But MTVW did replace “creditably” with “exceptional” and “good” with “substantial“:

“The Group has developed clear criteria that are applied when considering asset purchases. Using these, the Group has performed excellently in a difficult market replacing this class of assets in the year ended 31 March 2023, with substantial purchasing during the year.”

The text repeated this line from 2022 about employee loyalty:

“The Company has a good record of long-term service, a great number of our employees have worked for the group for over 10 years.”

And the text included a new paragraph acknowledging the emerging risk from (at the time) upcoming EPC rules:

“Where the likelihood of a risk materialising becomes high and imminent, we factor accommodating the risk, into our operational plans to be activated once the impact is clear. This is the case with the Climate Transition risk related to tightening EPC requirements where our teams are monitoring progress of the legislation.”

The upcoming EPC changes have now been scrapped (see point 9).

8) SECTION 172

No great changes for 2023.

But a lot of the introductory text was reworded and/or revised slightly with a seemingly standard corporate narrative. Here is the new text.

“Responses to issues arising, particularly new issues and those affecting multiple stakeholder groups, present the opportunity for creativity in reaching effective solutions and for our teams to learn and, where appropriate, update our standard operating procedures.

Communication is the watchword in handling matters arising and assists in ensuring that stakeholder needs are properly understood and taken into account when making operational or strategic decisions. As noted in our commentary on Our purpose and how we operate on page 5 there were occasions where the needs of different groups conflicted and a decision was needed that would not fully satisfy all parties. In taking these decisions the overall wellbeing of the groups affected is a primary consideration in reaching our eventual course of action.

As described elsewhere the Board gets regular updates from the heads of department both through the Executive Directors and in writing. In rare cases, for example if the needs of different stakeholder groups, including environmental considerations, are not aligned and time is not a critical factor, these decisions may be referred to the Executive Directors or the Board for consideration or endorsement of proposed action.

The Board keeps our stakeholder framework under regular review and updates as we identify new groups or changes to the nature, scope or extent of engagement with existing groups. The list below shows the key stakeholders identified and outlines the nature of our engagement with each of them; there were no changes in our key stakeholders during the year.”

Within the reams of the follow-on text, I quite like how SHAREHOLDERS continue to be named as the first of the ten stakeholder groups. The second stakeholders are EMPLOYEES. The other eight — contractors, funders (banks), customers (tenants/buyers), corporate regulators, operational regulators, local government, advisers and local communities — remain the same and in the same order as 2022.

On the shareholder front, this unchanged text suggests MTVW is still open to shareholder contact…

“In addition to reporting formal financial results twice a year, the AGM presentation and discussion and regulatory announcements throughout the year, the Chairman and other members of the Board hold ad hoc meetings or calls on request with shareholders. This includes annual discussions with the major shareholders to gather their views on the Company strategy and business model. Shareholders of all sizes contact us throughout the year by letter, phone or e-mail. We respond to questions on an individual basis or by regulatory announcements depending on the nature of questions asked. A summary of the matters covered in all contact with shareholders, whether by face to face or electronic means, is given to the Board at the next available meeting after the discussion or contact.”

…although whether the board acts upon shareholder suggestions is open to debate (judging by the AGM questioning (see comment above)!)

9) TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES (TFCD) SUMMARY

MTVW’s TFCD section runs to 9 pages for 2023 versus only 3 for 2022. Therefore plenty of new text, although how relevant it all is to the wider investment case is open to debate. MTVW is, after all, a residential property landlord.

The main climate ‘worry’ as such is tighter EPC rules, although proposals to lift the minimum EPC for a rental property from band E to band C were scrapped during September 2023 (i.e. after this 2023 annual report was published) (more here). Anyway, the 2023 annual report still provided a few snippets of ‘climate’ interest.

This year reiterated the group’s Climate Working Group:

“Mountview’s Board oversees climate-related matters and reviews reports from the Audit and Risk Committee and Climate Working Group (CWG). Ultimate responsibility for climate-related matters lies with Mountview’s Board and accountability for implementation rests with the CEO and the Executive Directors. The CWG was specifically created in Q1 2022 to consider and review climate-related risks and opportunities…Mountview’s CWG includes the Chair, Head of Property Management, Head of IT, deputy CFO and a Non-Executive Director as an independent observer to scrutinise recommendations…”

Climate matters appeared to be discussed at least five times a year at board level:

“The CWG progresses and leads on climate-related matters feeding in on an ongoing basis climate-related risks to Mountview’s Risk Matrix… The Audit and Risk Committee considers and reviews the Risk Matrix at every meeting (held at least five times per year). The Risk Matrix is reviewed at each Board meeting (held at least five times per year)“.

The text suggested climate-change knowledge was becoming more important at senior-management levels:

“New Board appointments now include consideration of ESG skills competency and experience. Existing Board members’ competency are reviewed during the annual review by the Nomination Committee. The CWG undertakes annual ESG training including on climate-related matters. Mountview is considering implementing over the coming year a structured approach to climate training.”

No surprise that MTVW’s property-trading activities did not lead to any radical climate-related discussions:

“Examples of climate-related risks and opportunities arising during 2022 for Mountview include:

• Exposure to and contingency plans arising from the 2022 wildfires (no Mountview properties were affected in 2022) and any extremes in temperatures (e.g. requirements for heating/cooling infrastructure);

• Review of climate-related risks covering both physical risks (e.g. flooding) and transition risks (e.g. taking account of Environmental Performance Certificate (EPC) ratings during the 22/23 acquisition programme); and

• Consideration of further steps to reduce Mountview’s carbon footprint in alignment with Mountview’s net zero aims.“.

MTVW provided this table outlining the risks:

The EPC risk seemed the most obvious to have an impact on MTVW’s financials. Before the regulatory proposal was scrapped, rental properties were going to need a minimum ‘C’ EPC rating by the end of 2028, the cost of upgrades for which could have been several £k per property.

MTVW confirmed EPC legislation is/was the main climate-related risk:

“Monitoring the progress of EPC legislation and its requirements and the proposed modification financial cap per property is a key aspect for the Board, the property management team and the CWG. The property management team constantly monitor the portfolio and will use this knowledge to establish an EPC implementation plan (as undertaken during the previous iteration of EPC legislation) once the requirements are known.”

Prior to the minimum EPC C proposals being scrapped, MTVW confirmed extra EPC costs would have been incurred over the next 10 years:

”The potential impacts on Mountview’s financial position and financial performance include:

• Increased costs related to energy procurement and compliance with regulation;

• Reduction in property values following damage arising from extreme weather events; and

• Requirement to re-locate tenants due to physical climate risks or any potential non-compliance due to tighter EPC regulations.

Mountview’s medium-term financial planning anticipates estimates of the costs required to improve properties (e.g. to comply with EPC regulations or any upward trend in damage arising from physical climate risks). The timeline for this is up to ten years to align with the Company’s medium-term horizon noted above.”

An interesting snippet: MTVW “self-insures“:

“Mountview self-insures and undertakes and finances repairs as they become necessary and to supplement this, maintains a reserve which is reviewed on an annual basis and maintained as a precautionary measure. The treatment of financial accounting for climate related works is kept under review.”

MTVW continues to monitor the EPC ratings across its estate:

All MTVW’s properties are either rated E, exempt from the EPC rules, undergoing work or cannot be accessed.

MTVW reiterated becoming net zero by 2050:

“Mountview has committed to achieving net zero carbon for Scope 1 and Scope 2 and required Scope 3 GHG emissions by 2050 to align with the Paris Agreement objective of 1.5 degrees.”

10) NOTIFIABLE INTERESTS IN SHARE CAPITAL

Some minor changes to shareholdings during the year:

The trustees of the Frank and Daphne Sinclair Grandchildren Settlement trimmed their holding from 10.08% to 9.78%, while Mrs A Williams increased her holding from 3.34% to 3.42% and Talisman increased its holding from 5.69% to 7.13%.

The Settlement trustees, Elizabeth Langrish-Smith, Angela Williams and Susan Simkins are all members of the Sinclair content party, and changes to their holdings may simply reflect re-arranging their family’s shareholdings rather than deliberate buying and selling. Likewise, any changes to the shareholding of lead dissident shareholder Margaret Murphy (see blog post above) may be just a reshuffle among her family members.

Talisman (see blog post above) is the sole major outside investor and its purchases ought to encourage hopes of some engagement with the board!

11) STREAMLINED ENERGY AND CARBON REPORTING DISCLOSURES

Largest Scope 1 emitter is company vehicles, which recorded a total 77,500 miles last year:

This line…

“Emissions from company vehicles have decreased by 7.2%. This is due to the change of one diesel vehicle to plug-in hybrid vehicle.”

…suggests MTVW runs a fleet of a dozen or so diesels inspecting the property estate.

Electricity use is mostly communal areas. The annual charge per flat has increased from £37 to £47 as the standard rate increased from 18.3p to 25.2p/kwH:

“The Company pays an average £47 electricity charge per managed flat towards communal areas. The Company covers communal area charges for 27 (managed blocks of flats). The average electricity standard rate is 25.2p/kWh.“

Other emission stats are heading in the right direction:

12) SUSTAINABILITY AND CLIMATE CHANGE

MTVW has not updated these stats from the previous AR:

“We have obtained an Energy Performance Certificate (E.P.C.), or have valid exemptions for 91.4% of properties in our portfolio with 6.6% awaiting re-test and 2.0% yet to review due to access issues. Following these reviews, we have undertaken, where necessary, loft insulation, cavity wall insulation, provision for storage heaters and dual plate power meters.

13) EMPLOYEES

The only new line here concerned training on “climate matters“:

“We are currently identifying providers for training, tailored to roles on climate matters for the Board, the CWG and all our teams.”

Otherwise the text reiterated the group’s “family roots“:

“Notwithstanding that the Group’s strategy, business model and operations are long established with well developed underlying processes that reflect our business drivers, the performance of the business could not be sustained without a strong, skilled and knowledgeable workforce who enjoy their work at Mountview. This is manifested in one statistic in particular which is the average time in role of our staff – which currently stands at over 13 years. The Group has family roots and it is our belief that a similar feel remains today within what is a small and highly skilled workforce of 24 staff plus the Directors. This is an environment in which every member of staff meets and talks with one or both of the Executive Directors, if not on a daily basis then on a weekly basis, either face-to-face or using electronic means.”

14) SIGNIFICANT AGREEMENTS

Good to know if this particular (unlikely) event occurs:

“Certain banking agreements to which the Group is a party (described in Note 18 to the Consolidated Financial Statements) alter or terminate upon a change of control of the Group following a takeover bid. There are no other significant agreements to which the Group is a party that take effect, alter or terminate upon a change of control of the Group following a takeover bid.”

15) CONCERT PARTY, RELATIONSHIP AGREEMENT AND GENERAL MEETING

No text changes for 2023.

MTVW continues to claim the Sinclair concert party owns “over 50%” of the shares:

“Mountview Estates PLC is a family controlled company. There is a concert party in existence whose net aggregate shareholdings amount to over 50% of the issued share capital of the Company.

But the 2019 AR said the holding was “approximately 51%” and I am pretty sure “over 50%” really means “just over 50%“.

The concert party is bound by “independence provisions” dictated by the Listing Rules (here):

“In accordance with the FCA’s Listing Rules (the Listing Rules), the Company has entered into an agreement with the Sinclair family concert party, which, as it controls more than 30% of the Group’s total issued share capital, is deemed a controlling shareholder. The relationship agreement is intended to ensure the controlling shareholder complies with the independence provisions in Listing Rule 9.2.2AR. Under the terms of the relationship agreement, the Principal Concert Party Shareholder, Mr D.M. Sinclair (a member of the Sinclair family concert party), has agreed to procure the compliance of other individual members of the Sinclair family concert party who are treated as controlling shareholders with independence obligations contained in the relationship agreement.

The Board confirms that, since the entry into the relationship agreement as at 4 July 2023, being the latest practicable date prior to the publication of this annual report and accounts:

• the Company has complied with the independence provisions included in the relationship agreement;

• so far as the Company is aware, the independence provisions included in the relationship agreement have been complied with by the Sinclair family concert party and their associates; and

• so far as the Company is aware, the procurement obligation included in the relationship agreement has been complied with by the Principal Concert Party Shareholder.”

As the AGM Q&A can attest, these “independence provisions” do not mean the board must always act upon the wishes of unhappy shareholders (see comment above)!

As per corp-gov rules (here), 20%-plus protest votes must prompt engagement with shareholders and confirmation of such engagement must be published within the annual report. The ousting of two non-execs at the 2022 AGM led to this update:

“At the AGM held on 10 August 2022, the resolutions concerning the re-election of both Mr A.W. Powell and Ms M. L. Archibald as Directors of the Company did not receive support of a majority of the independent shareholders who voted, which is a requirement of the Listing Rules where the Company has a controlling shareholder, and therefore Mr Powell and Ms Archibald stood for re-election at a general meeting held on 21 November 2022 (General Meeting). Both Mr Powell and Ms Archibald were re-elected at the General Meeting. Between the 2022 AGM and the General Meeting certain Board members contacted a number of major shareholders. All shareholders (including the Sinclair family concert party members) were entitled to vote on the resolutions to re-elect Mr Powell and Ms Archibald at the General Meeting. As reported through the regulatory announcement to the market, following the 2022 AGM the Company identified as far as possible those shareholders who did not support the various resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage. The Company remains committed to shareholder engagement and we will continue to offer to meet with shareholders to take into account their concerns and considerations in the future.”

16) CORPORATE GOVERNANCE

a) Introduction

A new line or two emphasising the importance of “effective governance“:

“We noted last year that Covid-19 has strengthened our processes by testing them under ‘stress’ and also by opening up new ways of working that might otherwise not have been considered, and while impact of Covid-19 on those processes is receding, as we describe in our discussion of summary prospects for the Group on page 9 in this report we face new uncertainties that will bring their own challenges to all processes – both operational and governance. The last financial year has been another successful one for the Group and we view effective governance, together with our Purpose and values as essential ingredients for this long-term success and the generation of sustainable value for all our stakeholders.”

The text below is unchanged from 2022, and perhaps the board may wish to ponder why shareholder contact absorbs a “considerable amount of Board time“:

“In addition, effective engagement with our stakeholders, as described in our Section 172 statement on page 14 has underpinned our work during the year using both traditional and electronic means. Contact with stakeholders, is key to understanding their views and receiving their feedback. As a result a considerable amount of Board time has been taken up with reporting back on contact with shareholders and other stakeholders and discussing and responding to points that they have raised.”

b) Compliance

MTVW continues to claim it operates within the “spirit” of the corp-gov principles:

“We are of the view that throughout we are operating within the spirit behind the principles of good corporate governance – in a manner that is appropriate to our business, our size and our economic footprint. In particular, as a small Board, we recognise that there are matters concerning the size and composition of the Board that fall into this category. The Board and also shareholders, when consulted, are at one with their view that new Board positions should be created only when there is a clear need and when the appointee will add capacity or skills that are needed by the business in order for it to continue to pursue its strategy.”

Contraventions of the corp-gov principles remain:

* Not enough independent non-execs.

* No senior independent non-exec.

* Limited composition of committees.

* No formal evaluation process and diversity policy.

* Concurrent chairman roles — board chair is also audit-comm chair.

* No internal audit function .

* Chairman’s fees set by the executives and not the rem-comm.

c) Board leadership and group purpose

No major changes for 2023. The directors apparently “constantly seek feedback“, although the AGM Q&A sessions (see comment here) may not suggest that is actually the case (especially about revaluing the property estate)!

“Group strategy is proposed by the Executive Directors and that strategy is rigorously discussed, debated and agreed by the Board. The NEDs work with the Executive Directors to deliver on the agreed strategy. The Directors constantly seek feedback from any source or stakeholder on how well the current operations are working to meet the strategy as the working environment evolves.”

An interesting snippet: board meetings are mostly held online:

“All Directors are expected to attend all meetings of the Board, and any committees they are members of, and devote sufficient time to the Company’s affairs to fulfil their duties as Directors. During the year most Board and committee meetings were held by remote electronic means.”

I think board meetings should be face to face, because such meetings are almost always more interactive and effective for all involved. I wonder if the directors and staff mostly work from home? Would be quite sad if they did.

At least every director logged on for every meeting:

MTVW historically held 2-3 remuneration meetings a year, which was bumped up to 6 for 2021 and 2022. At 5 meetings for 2023, the board still does a lot talking about the generous executive pay and bonuses. The two executives even showed up for two of the rem-comm meetings (point 19a)!