09 December 2020

By Maynard Paton

Results summary for Tasty (TAST):

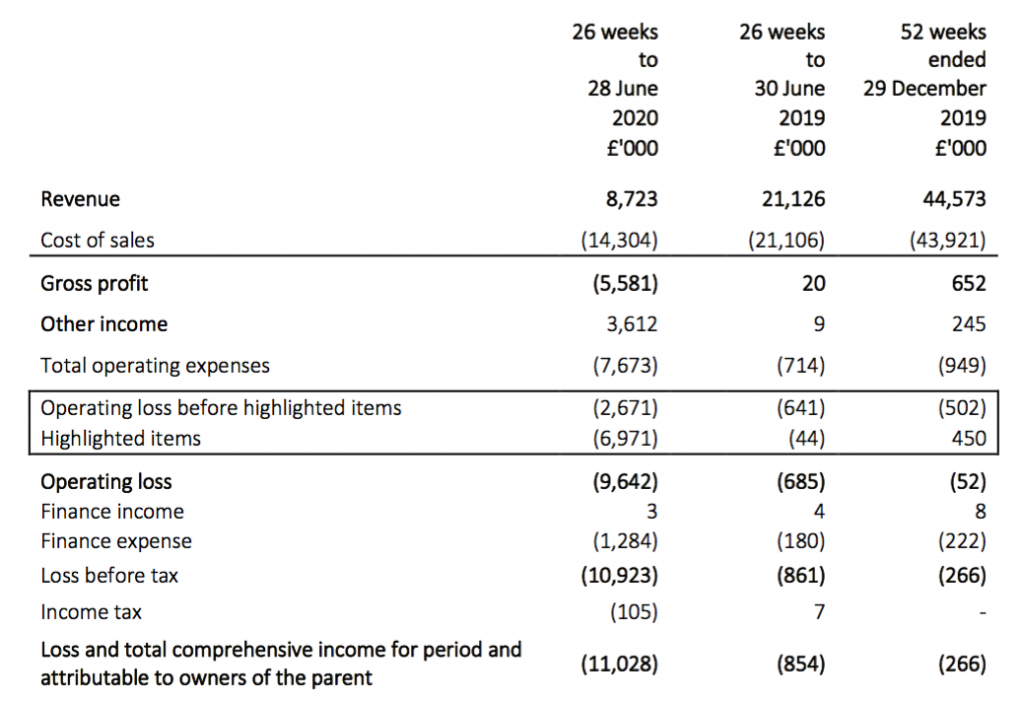

- Revenue down 59% led to a £10m operating loss after the pandemic guaranteed an awful performance.

- Cash of £3.2m and six-month cash burn of £1.6m implies TAST will run out of money by June 2021.

- Immediate survival hopes seem dependent on landlord negotiations, CVA hints, a loan from Barclays, UK vaccinations and Christmas burgers delivered to your door.

- One pandemic positive: management has been forced/allowed to instigate much-needed changes to an underperforming restaurant estate.

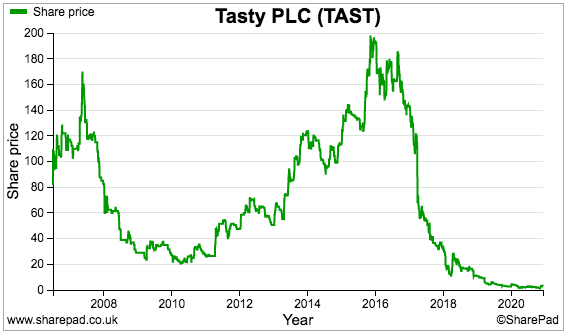

- The £4m market cap could be a bargain, assuming government restrictions are lifted, rents are reset, competition is reduced and a recovery one day takes place. I continue to hold.

Contents

- Event link, share data and disclosure

- Why I own TAST

- Results summary

- Coping with Covid-19

- Disrupted recovery?

- Revenue and losses

- Cash and debt

- Write-up and lease obligations

- Second-half prospects

- Valuation

Event link, share data and disclosure

Event: Interim results for the 26 weeks to 28 June 2020 published 30 October 2020

Price: 3p

Shares in issue: 141,089,758

Market capitalisation: £4.2m

Disclosure: Maynard owns shares in Tasty. This blog post contains SharePad affiliate links.

Why I own TAST

- Experienced family management (c.f. ASK Central and Prezzo) may possess enough industry connections and resources to muddle through the pandemic.

- Bombed-out share price may provide substantial upside potential… assuming the business does not run out of cash during any further lockdowns.

- Just too late to sell. TAST represents just 1% of my portfolio, with the investment already losing more than 80% of its value.

Further reading: My TAST Buy report | All my TAST posts | TAST website

Results summary:

Coping with Covid-19

- The closure of TAST’s restaurants due to the pandemic in March guaranteed a terrible financial performance.

- TAST used terms such as “extremely difficult”, “extraordinary challenges” and “unprecedented impact” to describe the six months.

- Earlier RNSs had already flagged the major Covid developments.

- In particular, an update during July confirmed 32% of the workforce had been made redundant.

- An October update then announced new banking facilities, the commencement of “consensual” negotiations with landlords and the possibility of a company voluntary arrangement (CVA).

- Negotiations with landlords about outstanding rents were expected to complete by the end of November.

- TAST has yet to issue an update on the landlord negotiations. But this H1 statement did claim:

“[O]n the whole there seems to be a willingness to assist”.

- As a message to landlords perhaps, TAST reiterated the possibility of a CVA within these results:

“[W]ith creditor assistance, a more formal procedure such as a Company Voluntary Arrangement, may be avoided.”

“Whilst no decision has yet been made regarding a restructuring or potential Company Voluntary Arrangement (CVA), the Board is continuing to work with its advisers, KPMG, to assess the potential impact of Covid-19 on the business and the various strategic options available to the Group.”

- The ‘going concern’ commentary was unsurprisingly amended.

- Published a week or so before the March lockdown, the FY 2019 statement had said:

“The Group is currently monitoring the COVID-19 situation and more information can be found in the Principal Risks and Uncertainties section above. The Board regularly reviews cashflow and sensitivity forecasts and they have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. Thus, the going concern basis of accounting is adopted in preparing the annual financial statements.”

- But this H1 statement was more circumspect:

“At the time of approving the interims, the Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. In reaching this conclusion the Directors have considered the financial position of the Group, together with its forecasts for the next 12 months and taking into account possible changes in trading performance. The going concern basis of accounting has, therefore, been adopted in preparing the interim financial report. However, the Directors note that there may be material uncertainty in relation to going concern due to the effects of Covid-19 and the impact of ongoing losses.”

- The greater caution within the going-concern text may of course be another message to landlords.

- A CVA may be exactly the radical action TAST needs to reshape the group entirely.

- After all, this business had been struggling for three years with unprofitable restaurants — and the pandemic has (finally!) forced/allowed management to instigate far-reaching changes.

- This H1 revealed six of the group’s 55 restaurants “were at risk of permanent closure”.

- Bolstering the finances during this H1 were government Covid subsidies of £3.5m.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Disrupted recovery?

- The arrival of the pandemic disrupted a possible TAST turnaround.

- Results for FYs 2017, 2018 and 2019 had delivered woeful performances due in part to greater competition…

- …and this time last year TAST looked dependent on bumper Christmas bookings to avert a terminal cash trauma.

- The FY 2019 results thankfully indicated an encouraging second-half performance, and possibly signalled TAST was at long last embarking on a recovery:

“H2 sales per site of £823k was the best six-month performance since £851k was registered during H2 2016.

The simple idea of serving turkey at Christmas worked well.”

- The H2 2019 momentum continued into 2020. This H1 said:

“In the period leading up to the closure, revenue had been ahead of management expectations.”

- Maybe the improving pre-pandemic performance led to the bold use of “stability” within this H1 statement:

“There are opportunities to build on the stability in the Group and the lower operating cost base which will allow us to take advantage of reduced competition.”

- “Stability” has not been a term I have ever associated with TAST.

Revenue and losses

- During this 26-week H1, TAST’s restaurants were open for twelve weeks and then shut for ten weeks. Some sites were then re-opened for takeaways and deliveries for the remaining four weeks.

- H1 revenue dropped 59% to £8.7m.

- The only listed sector comparison that has reported for the same 26 weeks is Restaurant Group (RTN), which declared revenue down 56% to £227m.

- TAST’s revenue shortfall was amplified by reducing its estate from 60 sites to 56 between the start of 2019 and the start of 2020.

- Using the twelve weeks of pre-lockdown trade as the denominator, TAST’s weekly sales during this H1 were £727k — 11% lower than the £812k witnessed throughout the 26 weeks of H1 2019 .

- A fall of 11% does not seem too awful given the fewer sites and this H1 missing the busier months of April, May and June.

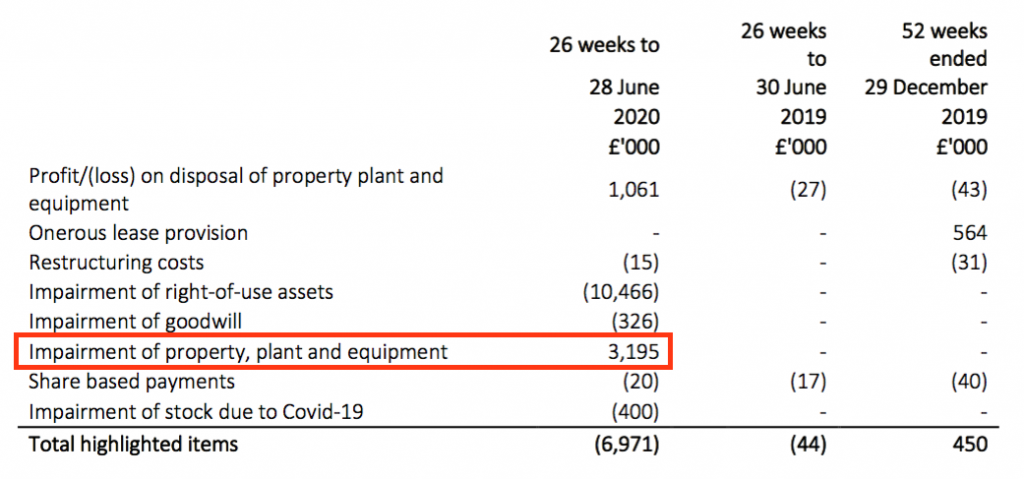

- The results predictably carried a bevy of ‘highlighted’ items:

- The highlighted items included an unusual ‘write-up’ of £3.2m (see Write-up and lease obligations below).

- The £3.2m write-up, the aforementioned £3.5m government subsidy and a £1.1m gain following a £2.0m restaurant disposal limited the total operating loss to £9.6m.

- The operating loss including the government subsidy but excluding the highlighted items was £2.7m.

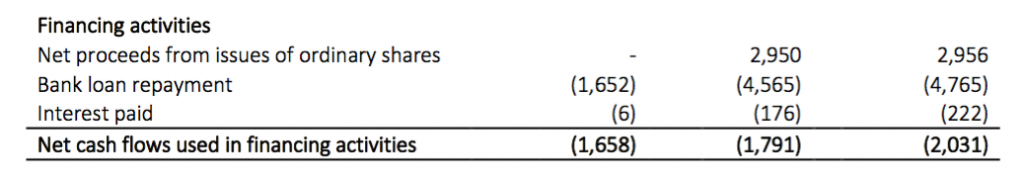

Cash and debt

- The £2.0m restaurant disposal at the start of 2020 ensured TAST entered the pandemic in a debt-free position.

- During the half, cash reduced by £1.4m to £3.2m while bank debt was reduced by £1.7m to zero.

- TAST admitted it had enjoyed the “fortunate position to have [had] no banking covenant pressure during the shutdown of the estate”.

- This H1 statement confirmed TAST had secured a £1.25m four-year loan from Barclays to “strengthen the balance sheet”.

- However, the Barclays arrangement is dependent upon suitable “restaurant closures and creditor arrangements”.

- Barclays lending money to TAST (albeit with pre-conditions) is encouraging. TAST had mooted an equity raise during the summer.

- Adjusting for the property disposal proceeds, TAST absorbed cash of £1.6m during this H1.

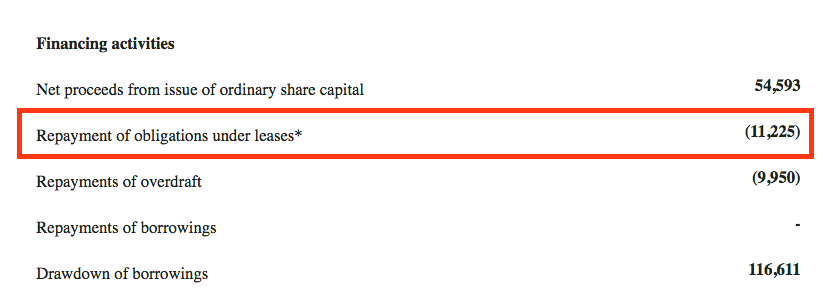

- The ‘financing activities’ part of the cash flow statement did not refer to lease payments:

- As a comparison, RTN recorded an £11m cash lease expense during its H1:

- TAST therefore appears to have withheld all lease payments during the half…

- …which is not surprising given the circumstances. TAST confessed:

“Cash preservation became a key priority in order to maximise the chances of the Group surviving the unprecedented impact caused by the pandemic.”

- And let’s not forget those “consensual” negotiations with landlords were about “outstanding rents”.

- Landlords include TAST executive Sam Kaye through his various family ventures.

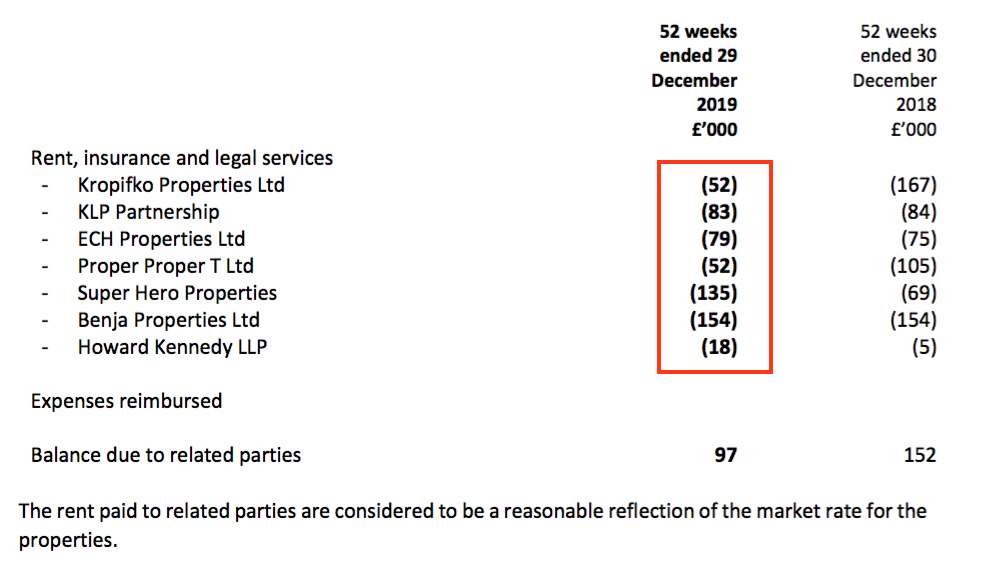

- Payments to the Kaye family (presumably mostly rent) came to £573k last year:

Write-up and lease obligations

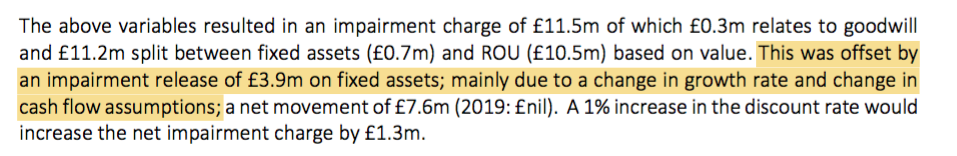

- The aforementioned £3.2m write-up was an unexpected item within these H1 accounts.

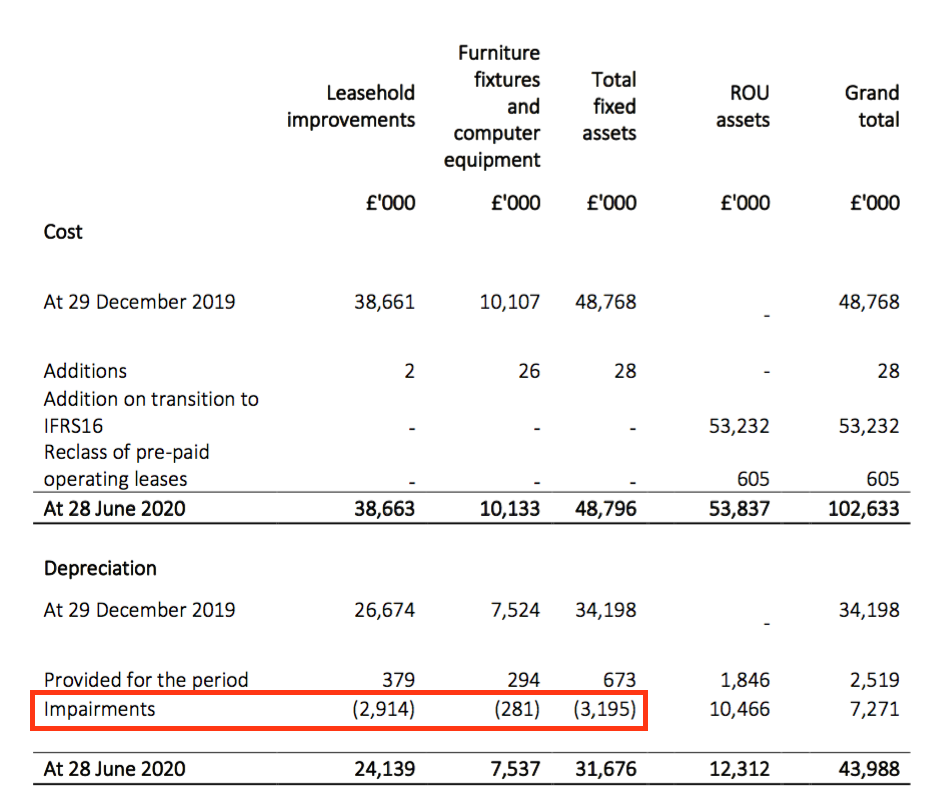

- This write-up reversed previous impairments on TAST’s leasehold improvements and its fixtures and fittings:

- This H1 statement briefly explained the reversal:

- The reversal effectively increased the book value of some of TAST’s restaurants, which is hard to comprehend given the pandemic disruption.

- But maybe the write-up followed a generous rent reduction or lease alteration that was not forecast at the time of the write-down.

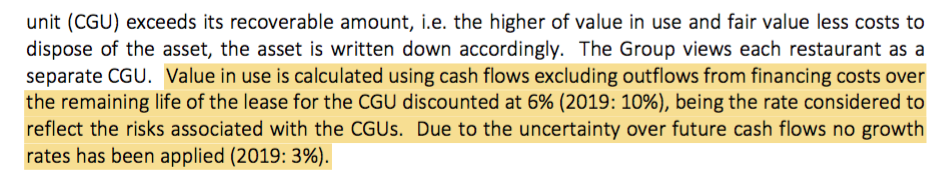

- TAST mentioned the following assumption changes:

- Changing a discount rate from 10% to 6% increases the net present value of future cash flows, and supports a higher asset valuation.

- Some of TAST’s asset assumptions have always felt optimistic. The 2019 annual report (point 7) implied restaurant fixtures had a 10-year life and computers had a 20-year life.

- The implementation of IFRS 16 brought TAST’s lease obligations onto the balance sheet.

- Total lease obligations were £56.1m on a net present value basis.

- The accompanying right-of-use asset was £41.5m, which arguably suggests TAST would pay £14.6m (£56.1m minus £41.5m) less to rent its properties were it to commence the same leases today.

- The surrender of a lease at no cost after the half-year was a welcome development and will reduce the total lease obligation.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Second-half prospects

- TAST expressed hope of surviving the second half:

“Whilst the trading environment continues to be extremely challenging and ever-changing, with the additional bank facility and support from our creditors and landlords, we are hopeful that we will be able to navigate our way through these difficult times due to our agility and restructured operational base.”

- A phased re-opening occurred during July, while August enjoyed the government’s Eat Out To Help Out (EOTHO) scheme that TAST confirmed had “helped trade”.

- However, stricter government measures including a 10pm dining-out curfew were imposed during September.

- Then all restaurants were limited to takeaways and deliveries during most of November for a second lockdown.

- TAST confirmed it would again “be relying on Government support for employees’ pay and VAT and business rate holidays.”

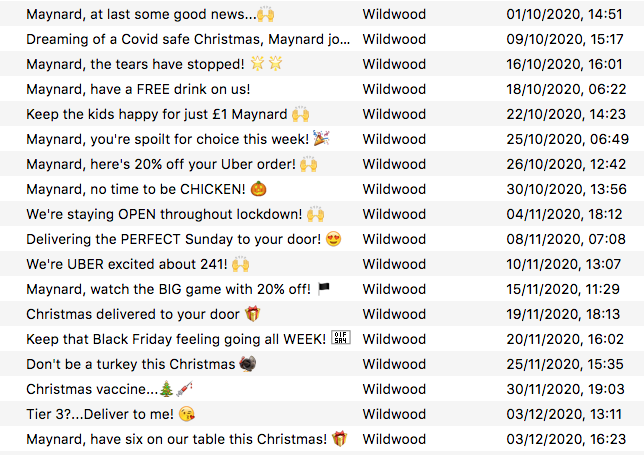

- Wishful thinking perhaps, but TAST’s own EOTHO scheme — offering 50% off food and soft drinks on Mondays, Tuesdays and Wednesdays during September and October — may have salvaged something out of H2:

- After all, TAST would not run a September EOTHO and then an October EOTHO unless the August EOTHO was a success.

- A decent December could now make the difference between a very bad H2 and just a bad H2.

- Christmas will happen, but will be very different. The sector this year will sadly not host as many money-spinning office parties and family gatherings.

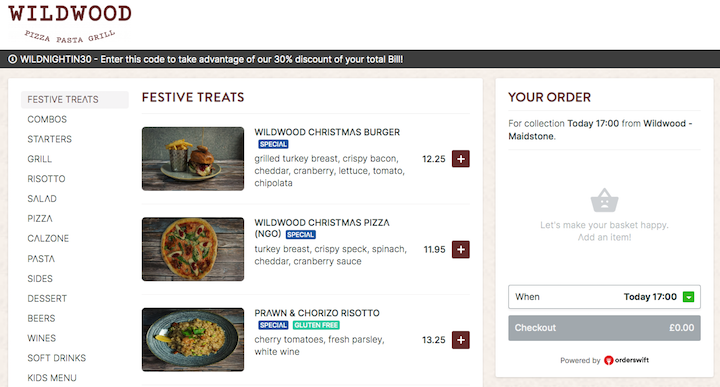

- The alternative to the works do is perhaps ordering TAST’s Christmas burger or Christmas pizza to your door:

- At least TAST’s email campaigns have not let up, with 18 emails sent since 01 October (four more emails than last year):

- Of the group’s 55 restaurants:

- 32 are presently open;

- 10 are presently open for takeaway/delivery only, and;

- 13 are presently closed.

- More restaurants fully open than operating takeaway/delivery-only suggests a wholesale shift to takeaway/delivery-only may not be viable.

Valuation

- The 3p share price supports a £4.2m market cap.

- TAST’s estate is therefore valued at £4.2m / 55 restaurants = £84k per site.

- A return to 2019 revenue (£45m) that delivers a small profit would make that £4.2m market cap extremely cheap.

- The question of course is whether TAST goes broke before the pandemic subsides, industry restrictions are lifted and things ‘get back to normal’.

- Cash of £3.2m and cash burn (excluding disposals but including subsidies) of £1.6m during this H1 implies TAST has until June 2021 before the money runs out.

- Receiving that £1.25m loan from Barclays would therefore be very helpful.

- Not paying owed rent to landlords would be very helpful, too.

- The start of UK vaccinations is extremely positive.

- But newly vaccinated pensioners/NHS staff will on their own not rescue Christmas for TAST this year.

- Government subsidies will continue until 31 March 2021. Receiving subsidies during the usually quiet January could in fact be very beneficial to the restaurant sector.

- For now TAST’s survival seems dependent on:

- Enough vaccine progress occurring during the next few months to negate the need for ongoing restaurant restrictions;

- Enough landlords agreeing to suitable lease changes/deferred payments, and;

- Enough diners returning to the group’s restaurants.

- I have worried about impending bankruptcy at TAST for almost three years now, but I doubt I will be worrying about it for another three years.

- Instead, I get the impression the pandemic will force a definitive ‘yes/no’ bankruptcy answer within the next twelve months.

- And a definitive ‘yes’ answer could arrive sooner if TAST’s restaurants are again ordered to close, landlords become difficult and the Barclays loan disappears.

- But you never know. TAST might actually survive and one day even prosper if rents are reset and competition is reduced. The potential upside from 3p would then be significant — which is what I keep telling myself after losing 80%-plus of my investment.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Maynard

Great update as usual, very well considered. I continue to hold also!

Fingers crossed

Best

David

Thanks David. Fingers crossed also.

Maynard

Tasty (TAST)

Trading Statement published 15 December 2020

TAST admitting landlord negotiations are taking longer than expected. Here is the full text.

——————————————————————————————————————

Further to the Company’s most recent Trading Update on 6 November 2020 detailing the closure of all of its restaurants for in-store dining due to the second UK COVID-19 lockdown, the Company confirms that it had re-opened 38 restaurants with an additional 5 units providing takeaway and delivery services only, due to the Government restrictions. It is expected that a further 9 units will move to providing takeaway and delivery services only with the additional tier 3 restrictions being introduced in London and Essex on 16 December 2020.

Certain restaurants within the Company’s estate have remained closed due to poor trading conditions in their locality. The Company continues to monitor developments affecting both the open and closed restaurants in line with the continually changing UK tier restrictions. The Company intends to continue to offer takeaway and delivery services across the 43 open units, until such time as the Government announces that it is prohibited from doing so or it is not viable to continue those services.

Trading across the business continues to be challenging with Christmas parties cancelled and the differing levels of restrictions significantly reducing the number of customers eating out and related restaurant capacity restrictions.

The Company has now been successful in achieving rent reductions and lease concessions on more than half of the estate. The Company is continuing consensual negotiations with landlords and other creditors in respect of outstanding rents and anticipates that this process will now be completed in January 2021. The Company will again be relying on Government support for employees’ pay and VAT, and business rate holidays and grants, where available.

——————————————————————————————————————

Landlord discussions were expected to complete by the end of November. Some landlords are therefore clearly unhappy with their rent remaining unpaid, which could increase the possibility of a CVA — something TAST implied was an option.

Perhaps the landlords are hoping for good vaccine progress and lockdown restrictions having alleviated by, say, Easter, and TAST eventually having the money to pay their owed rents. The risk of course is the landlords get nothing if they hold out for too long and TAST simply goes under.

Maynard

Tasty (TAST)

Board Changes and Growth Share Scheme published 23 December 2020

The Kaye family has relinquished executive duties and left the co-chief exec to become the sole chief exec and given him a new option scheme for his extra responsibilities. The new scheme perhaps implies TAST is not going bust or about to delist just yet.

Here is the full text of the board change:

——————————————————————————————————————

Tasty (AIM: TAST), the owner and operator of restaurants in the casual dining sector, announces that Sam Kaye, joint Chief Executive Officer, has become a non-executive director of the Company and Jonny Plant, joint Chief Executive Officer has become sole Chief Executive Officer with immediate effect. This will allow Sam Kaye to devote more time to his other interests in these challenging times.

Keith Lassman, Non-executive Chairman, commented: “Sam has committed himself to the Company for almost two decades and the Board looks forward to continuing to benefit from Sam’s input and experience in his new role.”

Following these changes, the Board will commence the search for an additional independent non-executive director as soon as practicable. Further announcements will be made in due course.”

——————————————————————————————————————

No major surprise to see Sam Kaye step down. The Kaye family has extensive commercial property interests that no doubt require greater attention at present.

I was never quite sure whether Sam Kaye was a ‘property man or a restaurant man’, and when I asked him once he said (I paraphrase) ‘to operate a good restaurant chain you need good properties in good locations’. I think this announcement confirms he was always more of a property man, or at least that is where is priorities now lie.

That leaves TAST with just one chief exec, who might even be able to make the radical changes this business needs with the Kayes now sidelined as non-execs.

The chief exec receives a new option scheme for sticking around and taking charge. Extracts below:

——————————————————————————————————————

As announced on 15 September 2020 and 23 December 2020, the composition of the Board of Directors has changed with Adam Kaye stepping down from the Board, Sam Kaye changing his role from Joint Chief Executive Officer to Non-executive Director and Jonny Plant becoming sole Chief Executive Officer. As part of these changes, Jonny Plant’s role and responsibility has increased significantly and it was therefore deemed appropriate, given his current lack of equity incentive, aside from his interest in Ordinary Shares, to incentivise him in the form of the Growth Shares Scheme to which Jonny Plant will be invited to join as the first participant.

…

The 90 day VWAP of an Ordinary Share as at the Last Practicable Date was 2.30 pence. The level of participation that the B Ordinary Shares are entitled to, and the maximum number of Ordinary Shares into which the B Ordinary Shares can convert is referenced to the following share price performance targets of the Company being met:

· if, at any time, within 12 months, the 90 day VWAP of the Ordinary Shares is 6 pence or more, up to 3.33%;

· if, at any time, within 24 months, the 90 day VWAP of the Ordinary Shares is 8 pence or more, up to 6.67%;

· if, at any time, within 48 months, the 90 day VWAP of the Ordinary Shares is 16 pence or more, up to 10%;

The maximum percentage that the new Ordinary Shares will represent, as a result of the conversion of B Ordinary Shares, will be no more than 10% of the Existing Ordinary Shares.

——————————————————————————————————————

Mr Plant already owns 5% of TAST and through this new scheme could receive shares equivalent to 10% of the current (141.1 million) share count.

I do prefer simple option plans based on share-price gains (c.f. Tristel and System1) and TAST’s new scheme looks good to me. The basic message to Mr Plant: quintuple the share price from today’s 3p in four years and you get shares worth £2.2m at 16p.

Of course TAST’s shares could soar due to a sudden lifting of Covid restrictions rather than any miracles worked by Mr Plant. But I doubt shareholders will care exactly why the shares recovered (if they ever do). What counts is that this scheme would be less likely to have been worked on and proposed if bankruptcy or a delisting were imminent.

Maynard

Tasty (TAST)

Trading Update and Bank Facility published 15 January 2021 and Director Shareholding published 19 January 2021

Talks with some landlords about unpaid rents continue to drag on. But receipt of a bank loan and some director buying may suggest the business will survive the current lockdown.

Here is the full text of the Trading Update and Bank Facility:

———————————————————————————————————–

Since the Company’s Trading Update announced on 15 December 2020 (and as further updated on 23 December 2020), the UK has been subject to unexpected increased restrictions as a result of the third COVID-19 lockdown, leading to the closure of all in-dining at the Company’s restaurants. As a result, the Company currently has open approximately 38 units providing takeaway and delivery services only. The Company continues to monitor developments affecting its restaurants in line with the continually changing UK restrictions.

As previously announced, the Company has now been successful in achieving rent reductions and lease concessions on more than half of the estate. The Company is continuing consensual negotiations with landlords and other creditors in respect of outstanding rents and, given the current third lockdown, now anticipates that this process will continue into at least March 2021. The Company will again be relying on Government support for employees’ pay and VAT, and business rate holidays and grants, where available.

The bank facility secured in order to strengthen the Company’s balance sheet and provide additional working capital support as detailed in the announcement dated 30 September 2020, has now been drawn down by the Company.

———————————————————————————————————–

TAST said initially the landlord negotiations would be complete by November. Discussions were then extended to the end of January and they will now continue into March and probably beyond. Some landlords clearly want their full rent paid. TAST has previously mooted a CVA if discussions become fruitless.

The bank-facility news feels promising in the circumstances. The original facility announcement said:

“The Facility is available to be drawn down until 7 February 2021, however, draw down is restricted until the future of the Company is assured through restaurant closures and creditor arrangements”

Receipt of the loan implies Barclays now thinks TAST’s future is “assured” following management’s actions. The facility is a four-year, £1.25m loan.

Perhaps the stubborn landlords are hoping TAST will use the £1.25m loan to pay its rents. Or perhaps the stubborn landlords are hopeful the pandemic will soon subside, and TAST then trades normally, following the vaccination programme.

Here is the full text of the Director Shareholding:

———————————————————————————————————–

Tasty (AIM: TAST), the owner and operator of restaurants in the casual dining sector, announces that on 19 January 2021, Keith Lassman, Chairman, acquired 615,384 ordinary shares of 0.1 pence each in the Company (“Ordinary Shares”) through the market at a price of 3.25 pence per Ordinary Share.

Following this purchase, Mr Lassman now holds 1,421,983 Ordinary Shares representing approximately 1.01% of the Company’s issued share capital.

———————————————————————————————————–

The significance here is not so much the ‘token’ £20k involved — but the fact directors should not deal if the board is in possession of insider information.

We can therefore deduce TAST is not presently contemplating an equity raise — which makes sense given the receipt of the bank loan. So maybe this director trade is an informal market ‘signal’ of TAST not needing any more cash just yet.

Maynard

Any idea what is driving the recent uptick in share price?

Hi Eric

People buying :-)

Recent newsflow suggests bankruptcy/delisting is not imminent (see earlier comments above).

Option grant just before Xmas would have been odd if a delisting was being planned. Grant also suggests a possibility of a 6p-16p share price in the years to come. Director buying last month also suggests nothing material was being planned at the time.

Banking facility is the key development. The loan from Barclays has been received, which was dependent on the bank believing the future of the company was “assured“. So it seems , at least to Barclays, TAST’s future is “assured“.

Maynard

Thanks Maynard, the momentum seems to be continuing today and long may it continue! I’d lost hope on this one but might not end up being too much of a disaster after all…

Eric