15 September 2023

By Maynard Paton

FY 2023 results summary for System1 (SYS1):

- A much stronger H2 versus the unsatisfactory H1, with disgruntled shareholders and proposed board changes prompting management to lift Q4 Data/Data-led revenue by a bumper 81%.

- New partnerships and customer wins support the H1 strategic review, although partnership revenue and customer numbers remain frustratingly inconsistent and unclear.

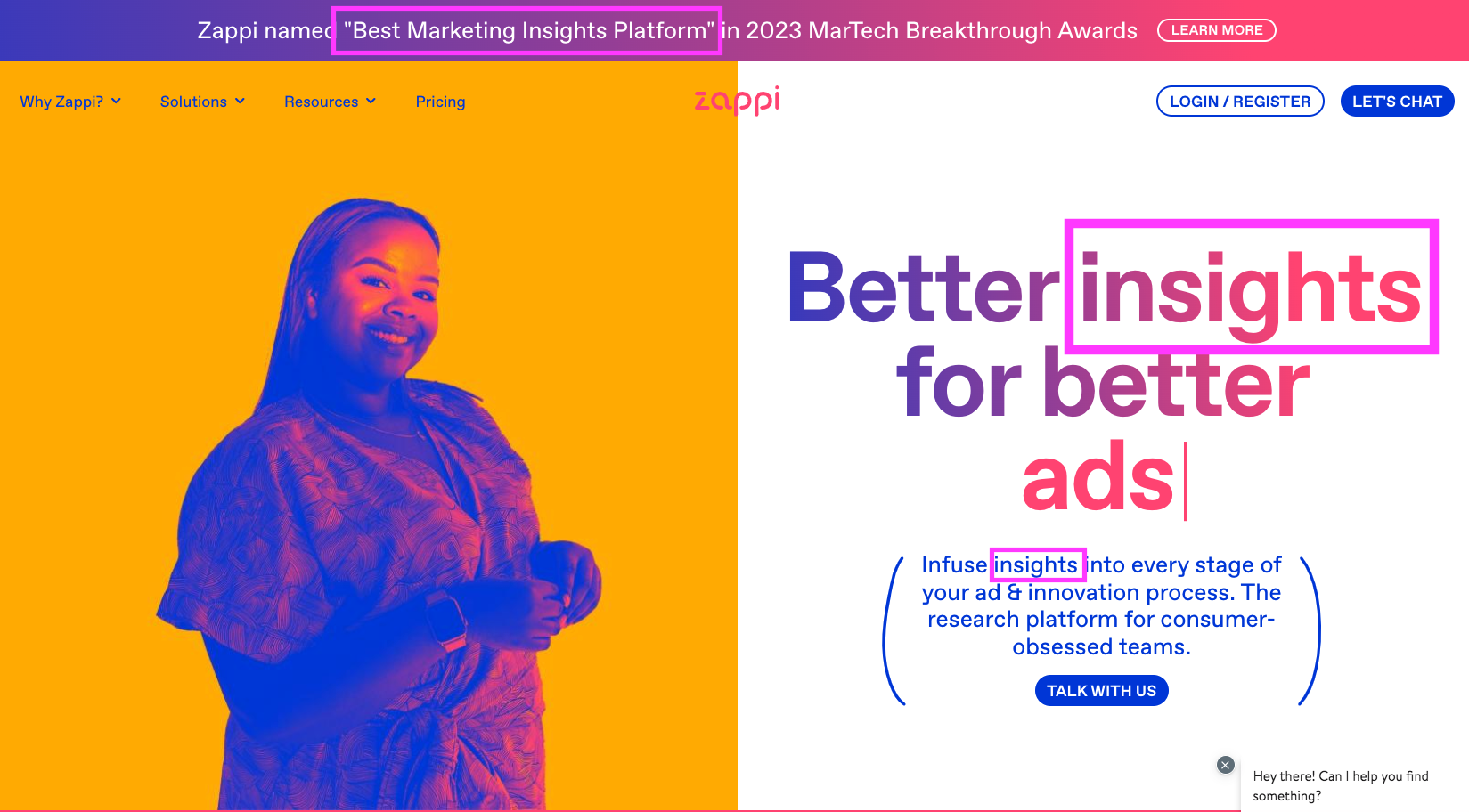

- Progress at Test Your Idea/Brand continues to be slow, with rival Zappi taking market share and an upcoming marketing course raising fresh doubts about management’s Data-platform focus.

- Vague signs of favourable ‘operational gearing’ may now be emerging, although regular adjustments and capitalised IT still complicate reported earnings.

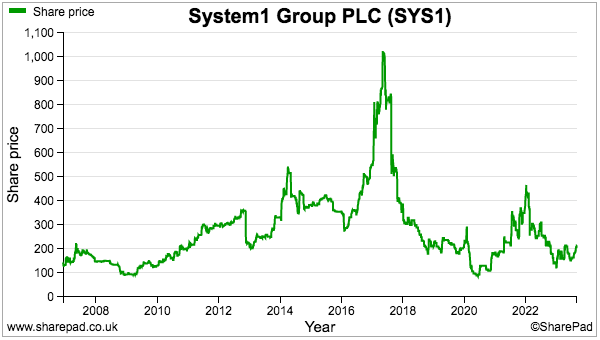

- A deeply divided shareholder base and languishing share price may leave the door open for corporate activity, with global market-research groups hopefully able to recognise significant sales/cost benefits. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own SYS1

- Results summary

- General meeting and deeply divided shareholders

- Revenue and profit

- Strategic review and ‘unmatchable’ predictiveness

- Data versus Consultancy

- Test Your Ad versus Test Your Idea/Brand

- Orlando Wood and Uncensored CMO

- Partnerships

- Clients and customers

- Sales and marketing

- Zappi

- Financials

- Valuation

- What next for larger shareholders?

News links, share data and disclosure

- Annual results, presentation and webinar published/hosted 01-02 August 2023

- My Q&A with management hosted 04 August 2023

- Q1 2024 trading update published 13 July 2023

Share price: 215p

Share count: 12,678,829

Market capitalisation: £27m

Disclosure: Maynard owns shares in System1. This blog post contains SharePad affiliate links.

Why I own SYS1

- Research specialist that forecasts the success of television adverts, with progress resting upon “unmatchable predictiveness” backed by “unique IP” delivered at “market-beating speed and value” through a “world-class product suite“.

- Transition from bespoke consultancy towards ‘scalable’ data services should create a much more valuable business with larger customers attracted at a lower cost.

- A 42% shareholder protest against management may open the door to corporate activity, with a former director having offered to refocus the business and exit through an £8 per share trade sale.

Further reading: My SYS1 Buy report | All my SYS1 posts | SYS1 website

Results summary

General meeting and deeply divided shareholders

- This FY 2023 did not really mention April’s general meeting (GM) and SYS1’s disgruntled shareholders.

- To recap, SYS1 undertook a strategic review during the preceding H1 and presented the details during February’s Capital Markets Day.

- But former SYS1 executives Stefan Barden and James Geddes were unconvinced by the strategic review and requisitioned the GM to implement various board changes:

“The board changes proposed by Stefan Barden and James Geddes are to:

(i) retire Rupert Howell as Chairman and a Non-Executive Director of the Company;

(ii) elect Stefan Barden as Executive Chairman and a Director of the Company;

(iii) retire Philip Machray as a Non-Executive Director of the Company; and

(iv) re-elect John Kearon as a Director of the Company but moving into a Non-Executive capacity.”

- Mr Barden believed SYS1 was not exploiting its full ‘platform’ potential with founder John Kearon maintaining an executive role.

- In particular, Mr Barden felt SYS1’s transition from bespoke consultancy to marketing-data specialist had become hampered by a return to the creative side of advertising. Mr Barden told me earlier this year:

“System1 should be selling marketing predictions. What System1 should not be doing is selling advertising creativity. And this is the fundamental issue, the creativity side has taken over and pushed the platform thinking out...

To maximise shareholder value, System1 should be the definitive decision-making platform that delivers better predictions…

System1 should be talking about its marketing predictions being the best, the cheapest and the quickest. I now believe that the only way for System1 to become a global number-one platform is for there to be a clear shareholder mandate.“

- The proposed board changes were rejected at the April GM by 58% to 42% of the votes cast.

- The GM voting highlighted SYS1’s deeply divided shareholder base, which can be split between:

- Mr Kearon and supportive shareholders (48%);

- Mr Barden and other unhappy shareholders (35%), and;

- Shareholders that did not cast a GM vote (17%).

- Note that Mr Kearon’s 22% shareholding ensured the GM vote went his way, although his endorsement by other shareholders — 26% of the share count — was less than the 35% that voted for the board changes.

- This FY said the shareholder dissatisfaction had been “considered carefully“:

“As a board we are conscious of our fiduciary duty to all stakeholders including customers, employees and shareholders. Over the year we were satisfied with our engagement with customers and colleagues. However, the share price performance in the period and the dissatisfaction expressed by a number of shareholders in the lead up to the AGM and the 21 April 2023 general meeting has been listened to and considered carefully. We will continue to engage with all shareholders, including those who voted in favour of the resolutions, to improve alignment on the Group’s strategy and increase shareholder value.”

- The FY webinar mentioned the GM had prompted extra reporting disclosure:

“And specifically on what we’re doing differently, we’re having more engagement with shareholders including this Investor Meet session. We’re providing greater disclosure on our quarterly trading updates on platform revenue for example, and extra information on cost and cash flow in this presentation.”

- Part of the “more engagement with shareholders” included my own management Q&A session after these FY results.

- The GM voting created a new risk within the 2023 annual report:

“POTENTIAL IMPACT: Shareholder relations: the company’s plans could be opposed by significant shareholders

MITIGATION: The company holds comprehensive investor one-on-one and group meetings in roadshows after the full-year and interim results are announced. In addition, quarterly trading updates provide an opportunity to engage with shareholders who follow the company closely.”

- That mitigation does not feel sufficient to me.

- The very best mitigation to prevent any shareholder opposition is to deliver the full level of revenue and profit the group’s services are capable of.

- Management disclosed during my Q&A the GM had “cost a lot of money“, all of which was expensed during this FY.

- Management also disclosed during my Q&A the requisition “did not do any harm” to the Q4 2023 outcome (see Data versus Consultancy).

- AGM voting later this month will reveal whether this FY’s performance has sweetened or soured the mood among shareholders. Every director is up for re-election.

Revenue and profit

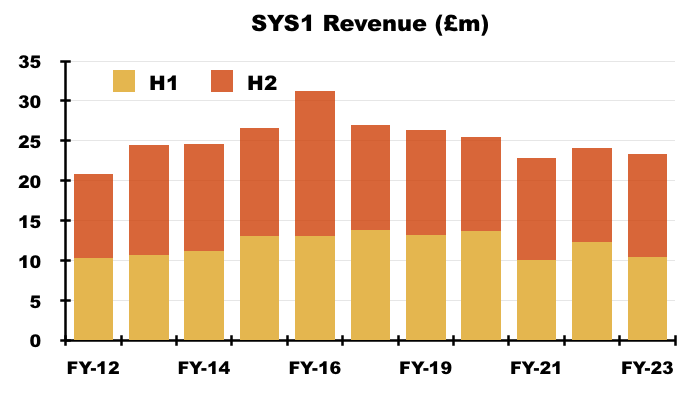

- This FY confirmed the stronger H2 that was anticipated within April’s GM notice…

“For example, in respect of the Predict Your (data) and Improve Your (data-led consultancy) offering only:

…

* H2 FY23 looks likely to deliver over 30% revenue growth vs H2 FY22

* Q4 FY23 is expected to produce double digit % revenue growth vs Q3 FY23, and we expect Q4 FY23 to deliver 50% higher revenue than Q4 FY22

…

We have grown the Predict Your and Improve Your revenue from launch in H2 FY21 to expected revenue of over £16m in FY23. However, this has been more than offset by a decline in the bespoke consultancy business from £25m to circa £6m in the same timeframe. “

“The improved revenue performance in H2 is expected to bring a return to profitability at adjusted and statutory levels for H2and also for the year as a whole, based on the unaudited management accounts, and the Board now anticipates that profit for the year ended 31 March 2023 will slightly exceed its previous expectations. As indicated in the 23 February 2023 trading update, there was a cash inflow during Q4, resulting in year-end net cash of £5.7m.“

- Matters were complicated slightly by SYS1 restating its revenue numbers between April and this FY.

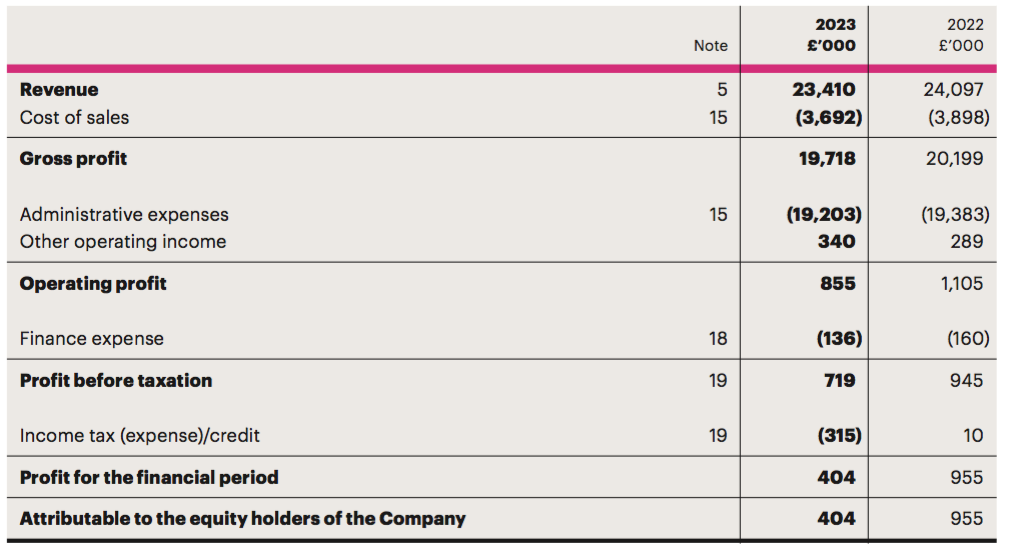

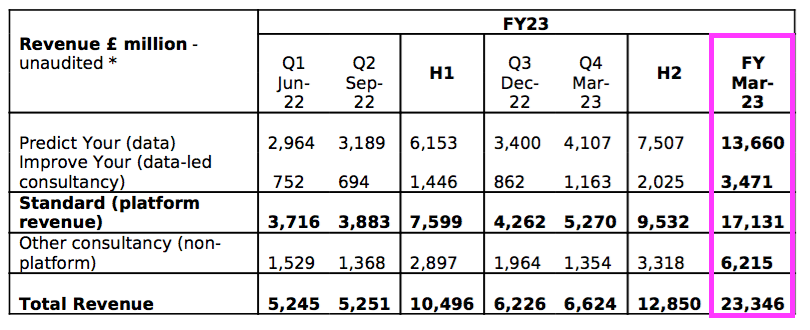

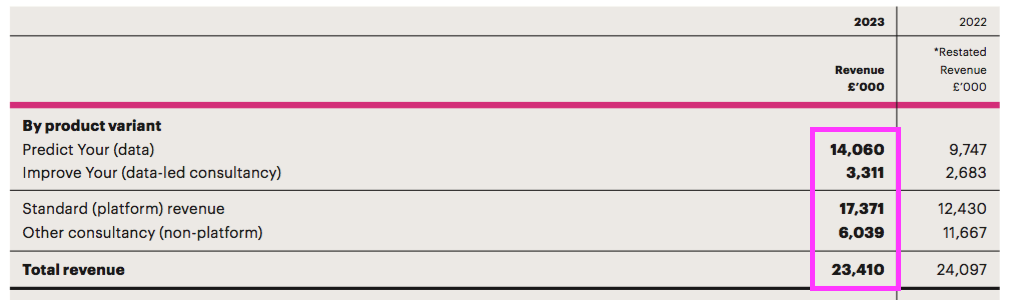

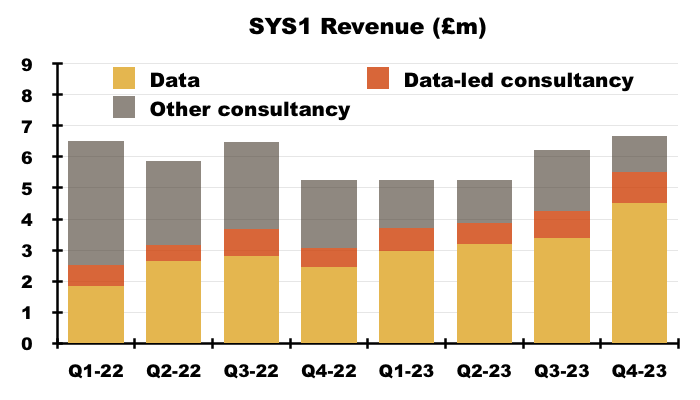

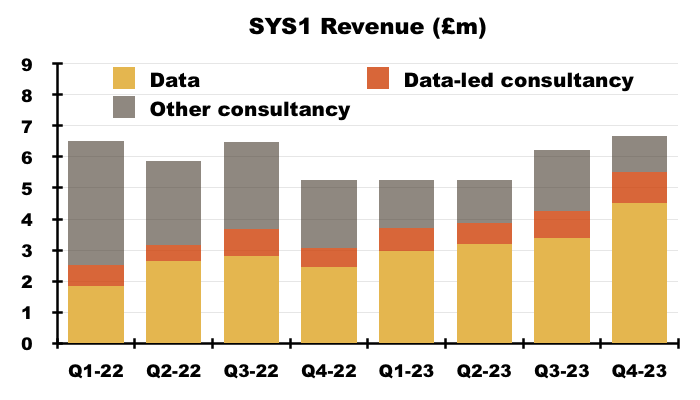

- SYS1 initially claimed FY 2023 showed Data revenue of £13.7m, Data-led consultancy revenue of £3.5m and old bespoke Consultancy revenue of £6.2m:

- But these results declared Data revenue of £14.1m, Data-led consultancy revenue of £3.3m and old bespoke Consultancy revenue of £6.0m:

- Total FY 2023 revenue was therefore £23.4m versus the £23.3m cited during April:

- Taking the restated FY revenue figures, Data/Data-led consultancy gained:

- 81% to £5.5m during Q4 2023;

- 45% to £9.8m during H2 2023, and;

- 40% to £17.4m during FY 2023:

- FY revenue from bespoke Consultancy dived 48% to £6.0m.

- Total FY revenue fell 3%, although total H2 revenue gained 10% to £12.9m to register the best H2 revenue effort since H2 2019 (£13.7m).

- Note that H2 2023 revenue and FY 2023 revenue were lower than the respective levels struck ten years ago (H2 2013: £13.7m, and FY 2013: £24.5m).

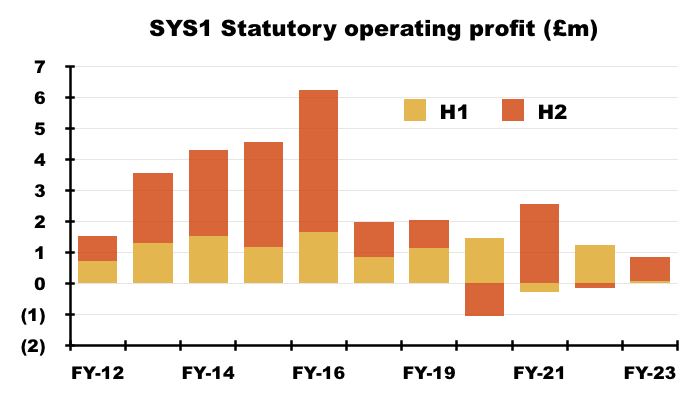

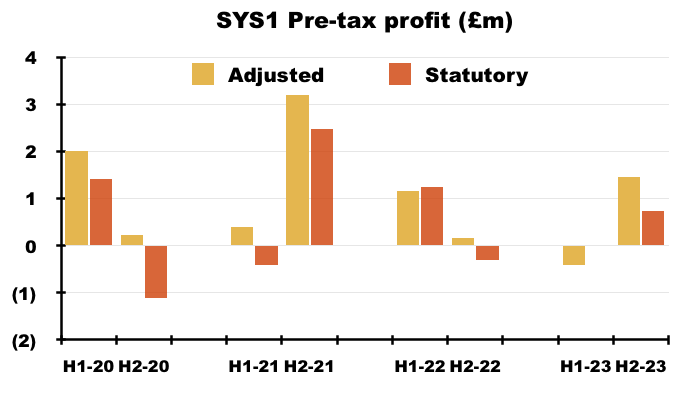

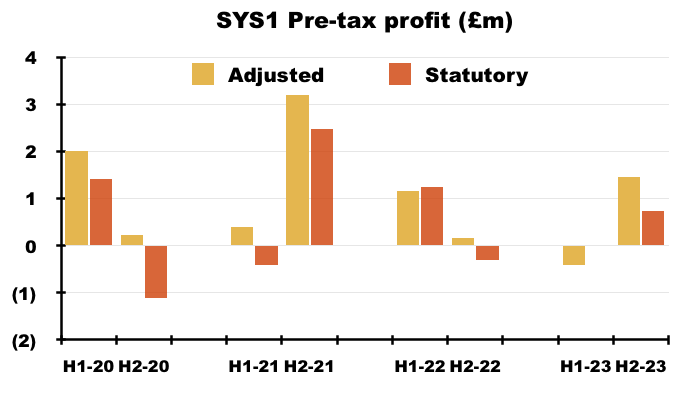

- SYS1 did indeed “bring a return to profitability at adjusted and statutory levels for H2 and also for the year as a whole“:

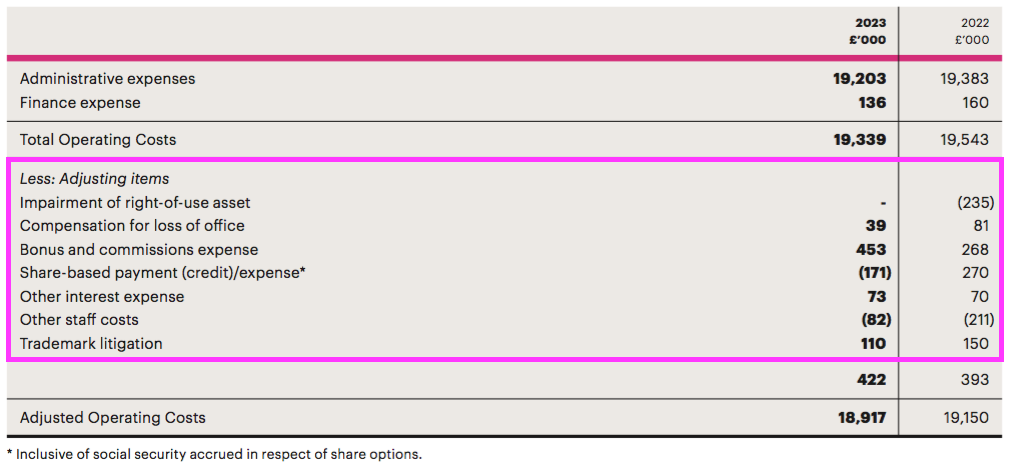

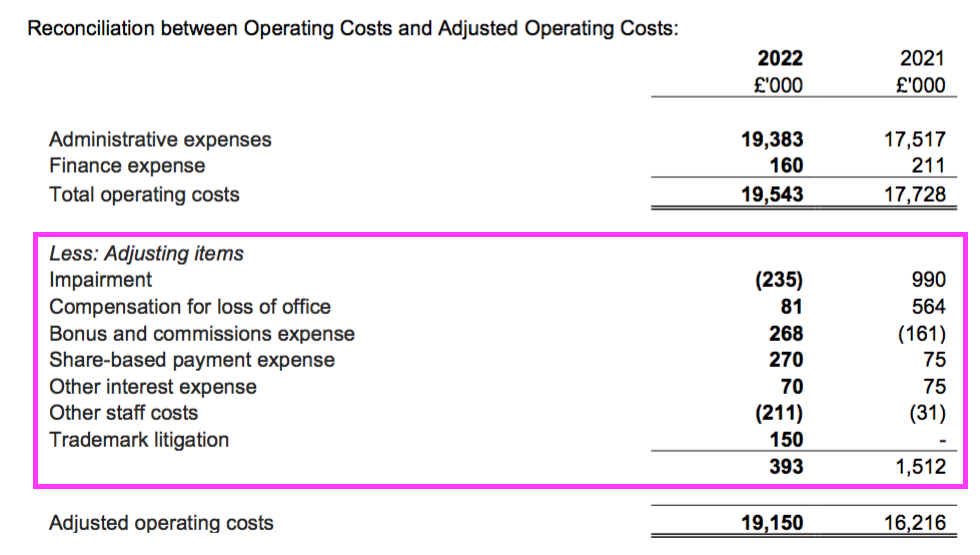

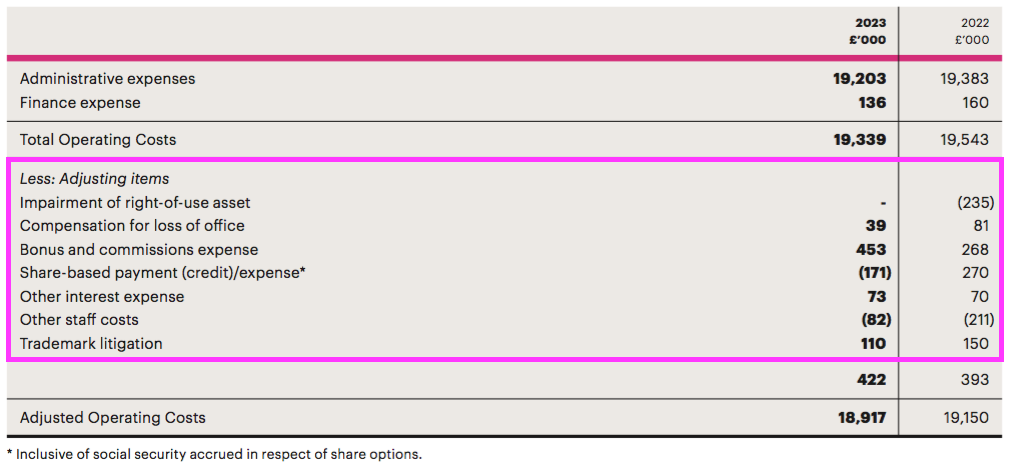

- Mind you, the income statement included SYS1’s usual array of adjustments:

- SYS1 claimed its adjusted figures exclude items that “impede easy understanding of underlying performance” (see Financials).

- SYS1’s results have not offered an “easy understanding of underlying performance” for some time.

- Adjusting items featured during FYs 2021 and 2022…

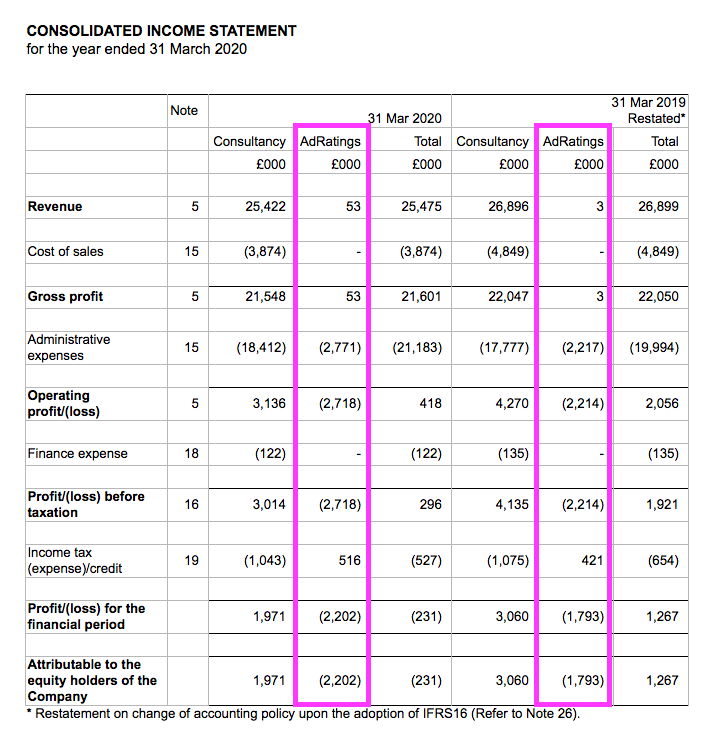

- …while significant AdRatings costs were segmented for FYs 2019 and 2020:

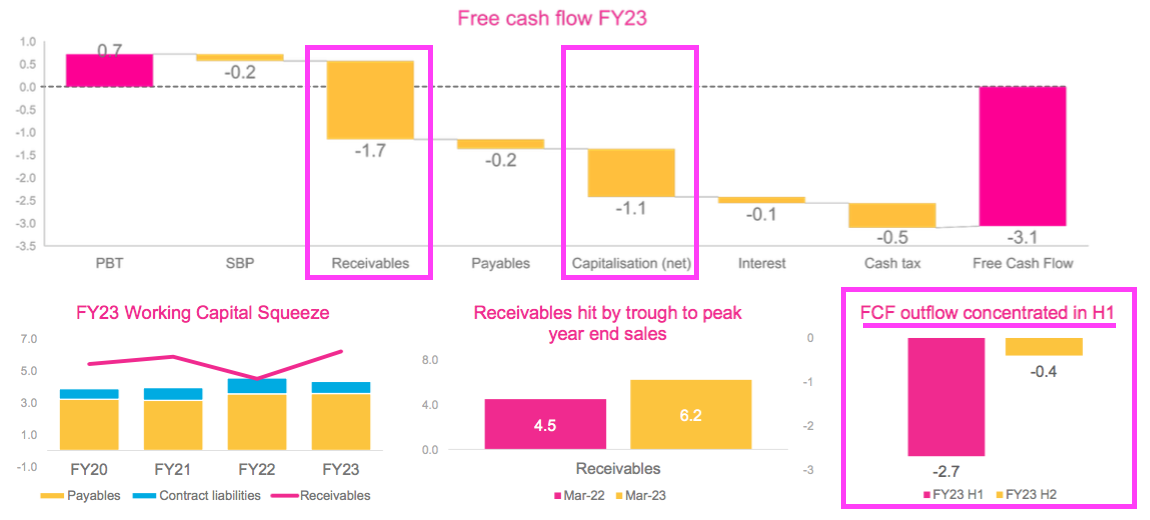

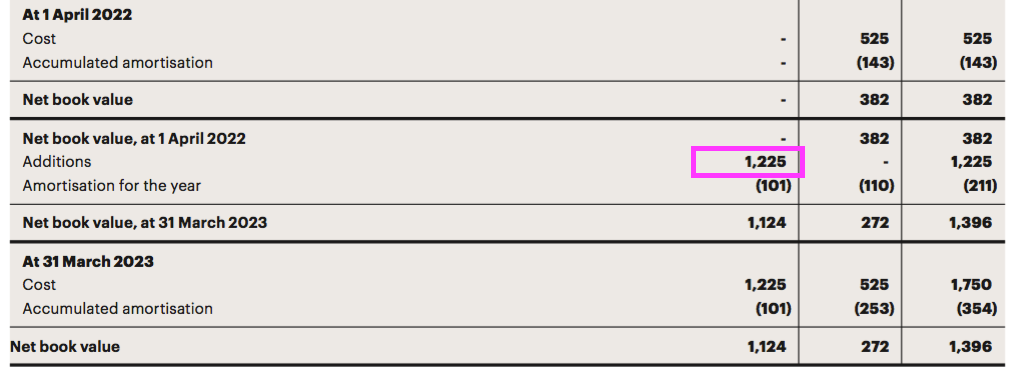

- This FY witnessed SYS1 return to capitalising software development, with a net £1.1m spent on new systems that bypassed the income statement (see Financials).

- SYS1 previously capitalised IT spend of £1.4m for AdRatings during FYs 2019 and 2020, only for it all to be written off following insufficient sales.

- History may therefore suggest SYS1 should expense all software development, and this FY’s £0.8m adjusted pre-tax profit should arguably have been reported as a £0.3m loss.

- My sums indicate H2 delivered an adjusted pre-tax profit of £1.4m…

- …although I calculate that £1.4m was supported almost entirely by H2 adjustments (c£0.7m), capitalised IT expenses (c£0.6m) and other income (c£0.1m), leaving the business seemingly operating at breakeven.

- At least the £5.7m net cash position signalled during April was confirmed within this FY without restatement or adjustment.

Strategic review and ‘unmatchable’ predictiveness

- This FY reiterated the outcome of the H1 strategic review, which concluded SYS1 should devote greater attention to:

- The group’s ‘unique selling proposition of predictiveness’;

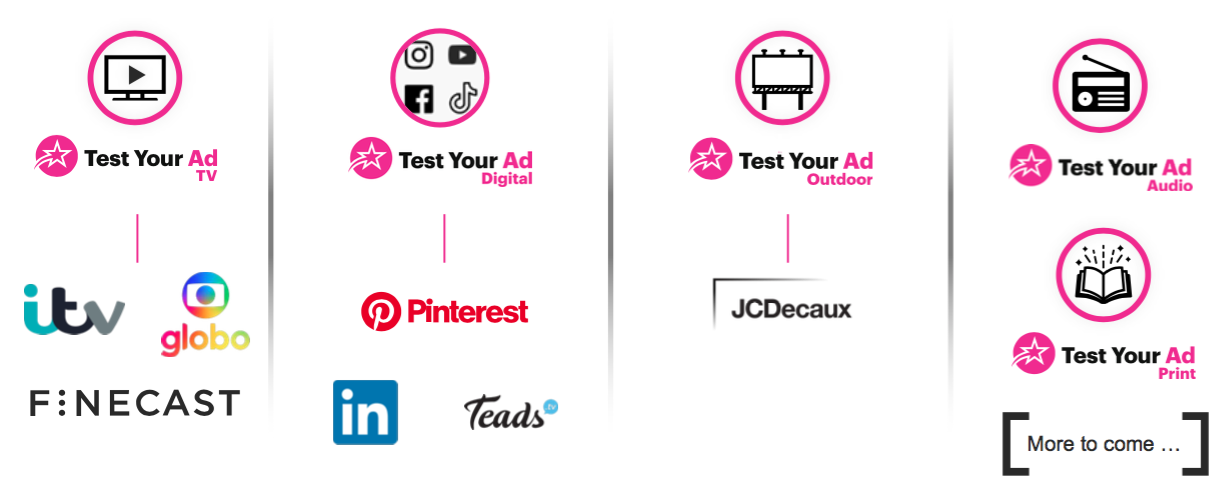

- Digital ads;

- The world’s largest advertisers;

- Partnerships with media groups, such as the existing tie-ups with ITV and LinkedIn;

- Partnerships with industry agencies, such as Omnicom/BBDO, and;

- The United States.

- SYS1 presented its strategic review in more detail during February’s Capital Markets Day.

- On the unique selling proposition, this FY reiterated the group’s competitive position was based upon “unmatchable” ad-testing predictions delivered through a “world-class” IT platform:

“System1 offers unmatchable predictiveness alongside market-beating speed and value…

We have continued to build out our world-class platform and product suite, translating our unique IP into predictions and improvements for our customers…

These predictions are delivered at world-class speed, ready for customers within 24 hours and offered at incredible value pricing. This creates an automated marketing decision-making platform to delight our customers and create competitive advantage, enabling System1 to build out significant market share.“

- The mystery to shareholders — and which essentially led to April’s GM — is why this “unmatchable predictiveness” backed by “unique IP” and “world-class” service has not yet translated into worthwhile earnings.

“Let me finish with a question that I have pondered with System1 for many years:

“If the company’s products and services are so world class — why then has the company performed so poorly?”

I am still looking for answers to this question, but the share price always tells a story. The £2 price is back to where it was more than ten years ago, and the common executive denominator throughout all that time is Mr Kearon.

If the share-price action is telling me anything, it is Mr Kearon should step aside and allow Mr Barden the opportunity to finally maximise the group’s world-class products.”

- This FY did not reveal any huge developments within the areas of focus identified by the strategic review.

- This FY did confirm various new partnerships had expanded SYS1’s coverage within digital, mobile and outdoor advertising:

“Our new partnerships are focussed on increasing global presence in specific channels and each launched with joint thought leadership content to promote the partnership and grow System1’s fame.

• Pinterest (digital advertising in Europe)

• Finecast (addressable TV advertising US, UK,Canada, Australia)

• Teads (mobile advertising US and UK)

• JCDecaux (out-of-home advertising US and UK)

- July’s Q1 update then said the new partnerships were working well:

“The Board is encouraged by the development of these new partnerships and the adoption of System1’s methodology across further advertising formats.”

- I note partnership income was not disclosed for this FY 2023 (see Partnerships).

- This FY repeated the US progress mentioned within April’s Q4 update:

“Excellent progress was made in Q4 where we won new mandates from 3 of the country’s 25 biggest advertising spenders, including the largest.”

- July’s Q1 update then noted at least four new US customers:

“The Company scored a series of new customer wins in the quarter.In the US, these included one of the world’s largest publicly traded international oil and gas companies, a worldwide employment website, a global chocolate manufacturer, and a significant provider of search and advertising services on the internet.“

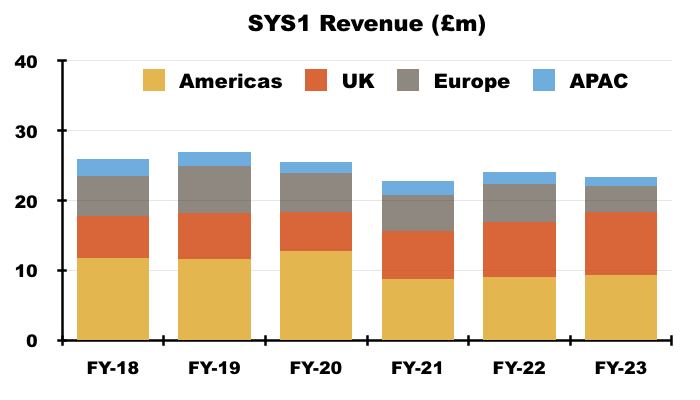

- Revenue from the Americas represented 40% of group revenue during this FY, with the proportion at 42% for H2:

- Management said during my Q&A the United States:

- Represented the “vast majority” of Americas revenue;

- Should become SYS1’s “biggest growth engine and fastest growth engine“, and;

- Now operates with a “solid” team that is “really working well“.

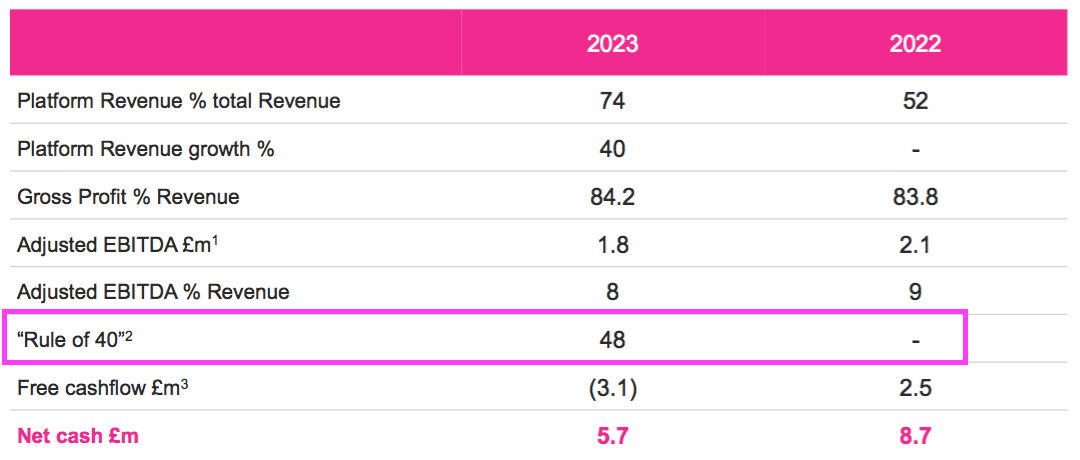

- The ‘Rule of 40’ target introduced by the strategic review was maintained for this FY:

- The Rule of 40 figure is derived by adding Data/Data-led revenue growth to the adjusted total Ebitda margin…

- …although that calculation could be flattered by excluding old bespoke Consultancy revenue but including old bespoke Consultancy Ebitda (see Data versus Consultancy).

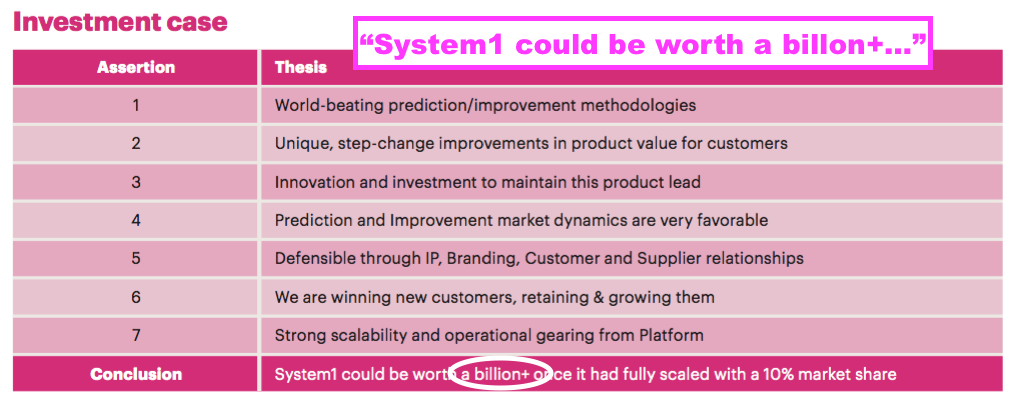

- The £1 billion market-cap ambition first trumpeted within the 2021 annual report and then watered down within the 2022 annual report still enjoyed a mention within the 2023 annual report:

- Management said during my Q&A there was “space in the market [for the company] to become much larger” and the £1 billion market-cap ambition remained a “great aspiration“.

- Management also noted during my Q&A the absence of the £1 billion goal within the FY results narrative and FY powerpoint “did not mean we are less ambitious“.

Data versus Consultancy

- This FY went some way to emphasise the “execution” of SYS1’s strategy:

“FY23 has truly been a year of 2 halves as we have moved from a period of design and transition to one of relentless commercial execution.”

…

“With renewed strategic focus in H2, we delivered £12.9m revenue, up 10% vs the second half of FY22, as we executed a refined go-to-market strategy, with a realigned Executive team and clarity of mission.”

…

“We are dedicated to creating a performance-based culture, relentlessly focussed on execution against our strategy.“

- That strategy was defined during the preceding H1 and validated the shift from supplying bespoke consultancy work to providing automated data services.

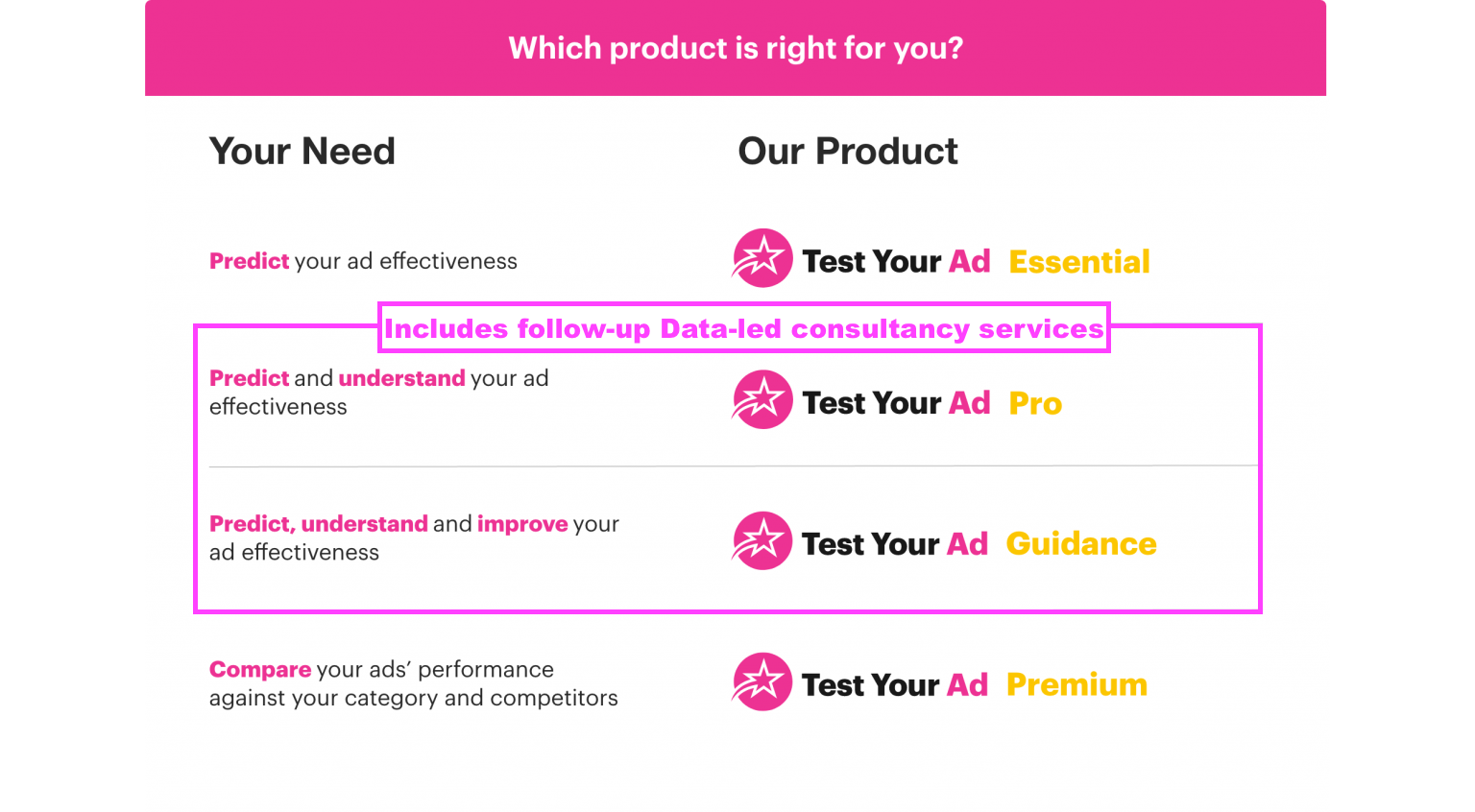

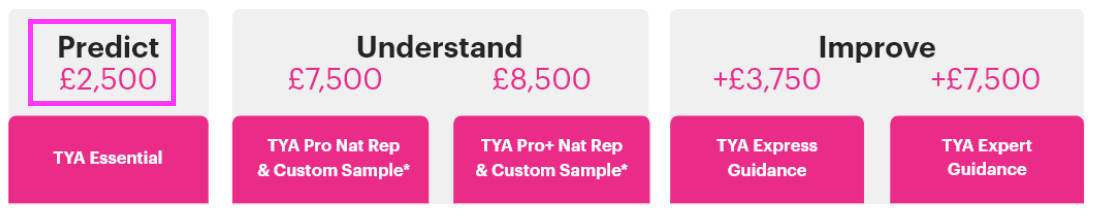

- Data products are led by Test Your Ad…

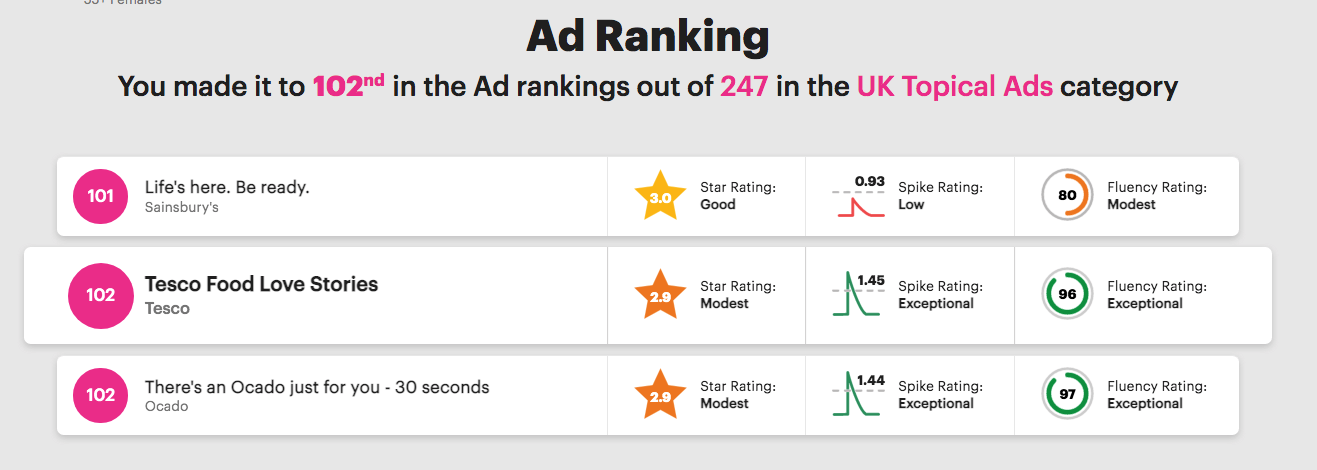

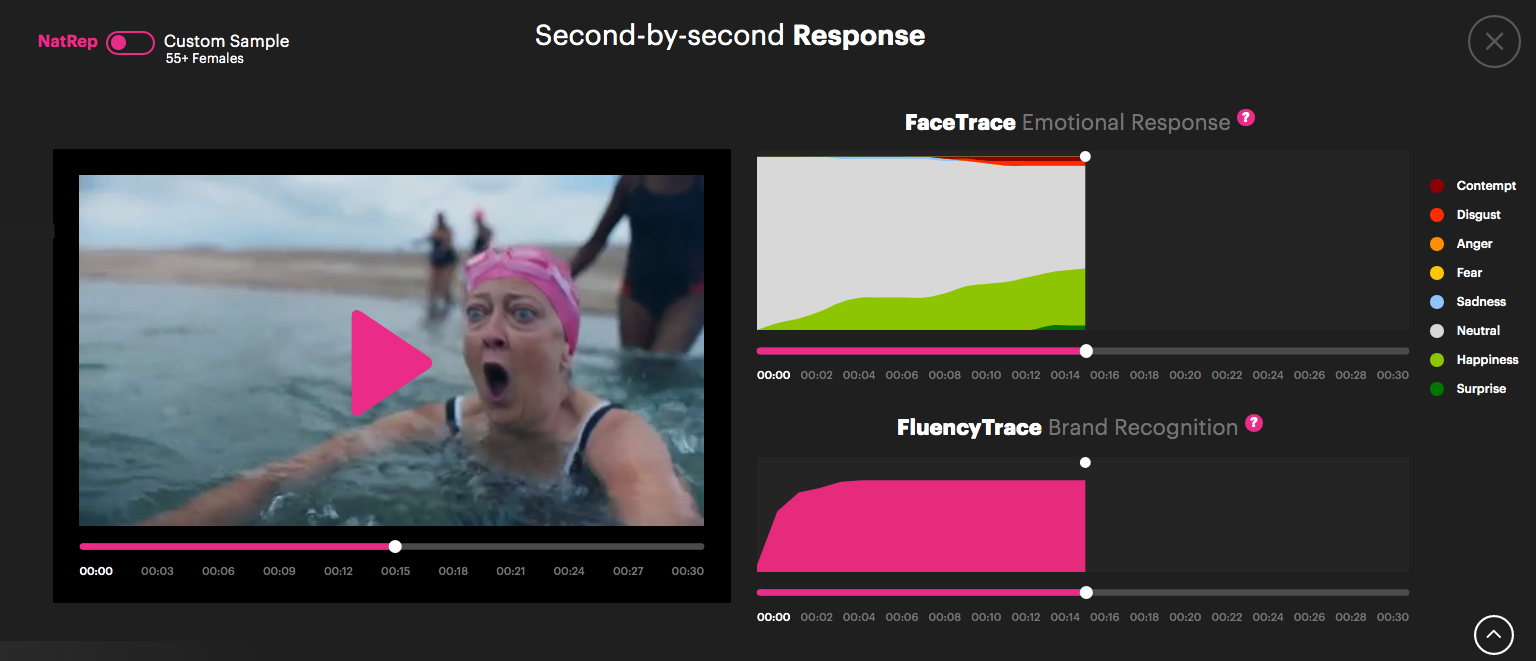

- …which was launched during April 2020 and allows customers to upload proposed adverts to SYS1 and receive a report within 24 hours based upon the verdict of an online panel (example pdf here):

- Data revenue is supported by Test Your Idea and Test Your Brand, which perform the same online-panel function for product ideas and company brands:

- Test Your Brand and Test Your Idea were launched during November 2021 and May 2022 respectively.

- Data revenue is bolstered by Data-led consultancy revenue, which consists of follow-up improvements and guidance from SYS1’s marketing experts:

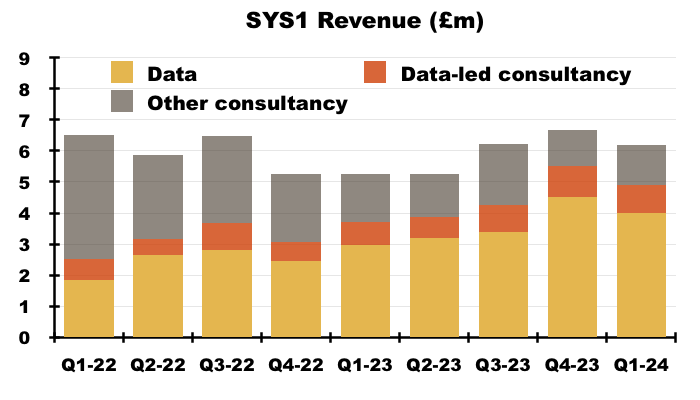

- This FY revealed H2 Data/Data-led revenue up 40% to £17.4m with:

- Q3 Data/Data-led revenue up 16% to £4.3m, and;

- Q4 Data/Data-led revenue up 81% to £5.5m:

- Management said during my Q&A that Q4 was “exceptional” and March was “the best month the company has ever done by a mile“.

- Management claimed during my Q&A that it did not know what happened during March to help generate the bumper Q4 revenue… but acknowledged the GM requisition “did not do any harm“.

- I interpret “did not do any harm” to mean management issued an ‘all hands on deck’ command during Q4 to generate extra sales to impress shareholders ahead of April’s GM.

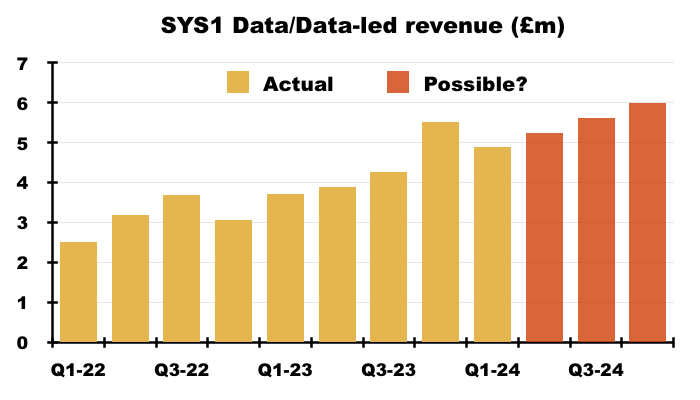

- Management’s command worked and helped prevent an adverse GM vote, although July’s Q1 2024 update showed Data/Data-led revenue at £4.9m — down 11% on the preceding bumper Q4 2023:

- The growth comparisons will naturally become harder during H2 2024 given the strong H2 2023 and bumper Q4.

- For example, 7% sequential quarterly growth from Q1 2024 would deliver H2 2024 Data/Data-led revenue of £11.6m — up 19% on H2 2023…

- …but also deliver Q4 2024 Data/Data-led revenue of £6.0m — up only 9% on Q4 2023.

- My 7% sequential quarterly growth projection gives FY 2024 Data/Data-led revenue of £21.7m — up 25% on this FY.

- SYS1’s response to the GM requisition suggested a minimum 25% Data/Data-led revenue growth rate to meet the aforementioned Rule of 40 ambition:

“We have stated our ambition to become a Rule of 40 company. To do this, we will need to deliver revenue growth of the ‘Predict Your’ and ‘Improve Your’ products, plus EBITDA margin, to total 40. While we are in growth mode, we expect the majority of this to come from revenue, so the Company will need to be growing revenue at a minimum of 25% over the coming years.”

- 25% annual Data/Data-led revenue growth would require an adjusted Ebitda margin of 15% to meet the Rule of 40.

- For perspective, SYS1 reported an 8% adjusted Ebitda margin for this FY.

- SYS1 has never disclosed the profit contributions from the Data/Data-led services versus the old bespoke Consultancy work.

- As such, that 8% adjusted Ebitda margin could have been supported entirely by old bespoke Consultancy work…

- …which would raise clear doubts about calculating the Rule of 40 by adding Data/Data-led revenue growth to the total adjusted Ebidta margin.

- SYS1’s Rule of 40 should be consistent, and add Data/Data-led revenue growth to the Data/Data-led adjusted Ebidta margin.

- The suspicion with the Rule of 40 using total adjusted Ebitda is the Rule would otherwise not be met because the Data/Data-led services lose money.

- SYS1 should make clear whether Ebidta from the old bespoke Consultancy work ensures the Rule of 40 is met, especially as Data/Data-led services now dominate the top line.

- Data/Data-led ‘platform’ revenue represented 74% of total revenue during this FY, with 82% represented during the bumper Q4.

- This FY implied the old bespoke Consultancy work should “level out” at £6m during FY 2024.

Test Your Ad versus Test Your Idea/Brand

- One complaint made by Mr Barden against SYS1 concerns its bias towards Test Your Ad versus Test Your Idea and Test Your Brand. Mr Barden told me earlier this year:

“Apart from mentioning they have Innovation and Brand services, you won’t see anything out there where they are doing anything to sell them. That’s why the sales of those areas have lagged. The advertising part has grown, but everything else has collapsed far faster because there is nobody focusing on them. The net result is flat-to-declining total revenue.“

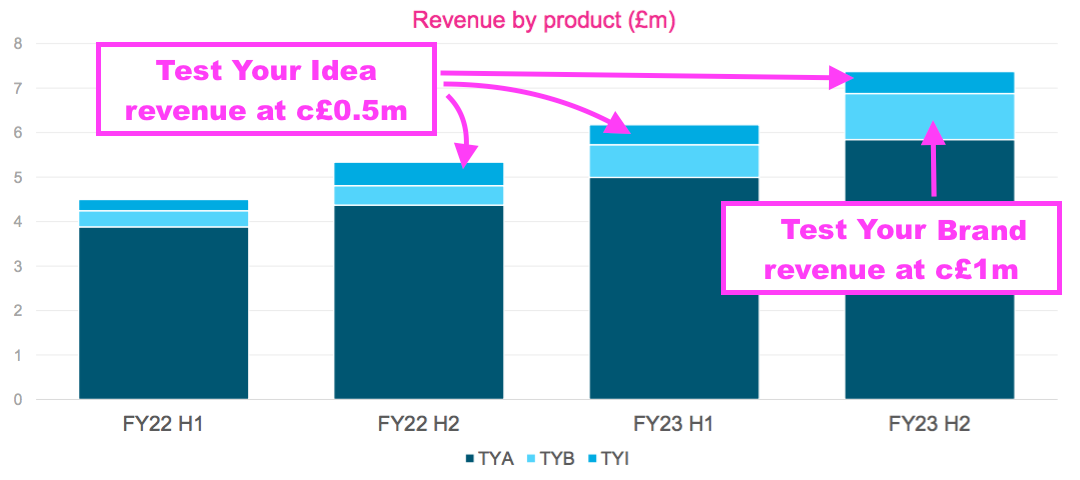

- The FY 2023 presentation showed Test Your Brand growing to c£1m of Data/Data-led revenue during H2:

- Test Your Idea meanwhile remained at c£0.5m of Data/Data-led revenue.

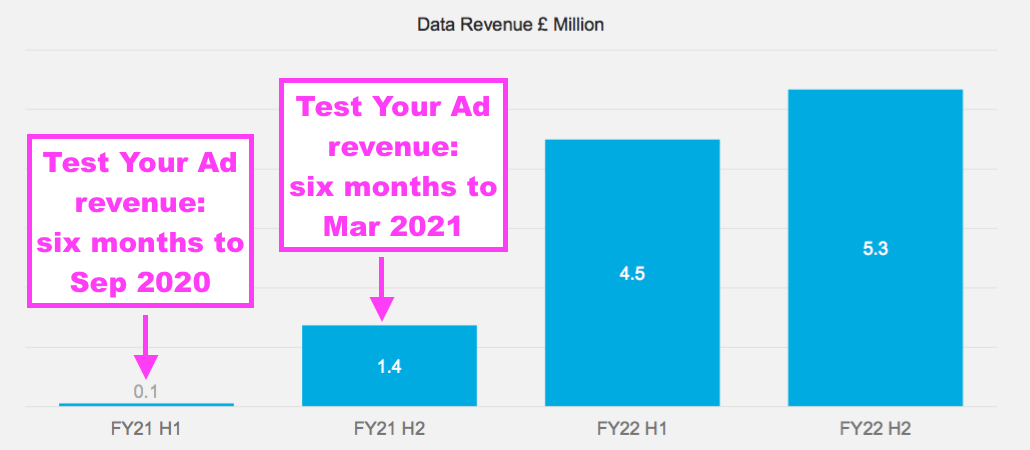

- Note that Test Your Ad quickly managed to generate six-month Data revenue of £1.4m after its launch (during the pandemic!):

- Both Test Your Idea/Brand therefore appear to have experienced much slower starts than Test Your Ad.

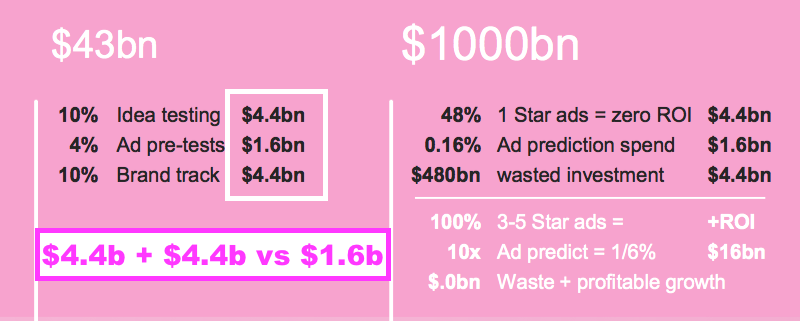

- February’s Capital Markets Day re-emphasised both Test Your Idea/Brand have much larger market sizes than Test Your Ad:

- SYS1 did not repeat that market-size slide for this FY.

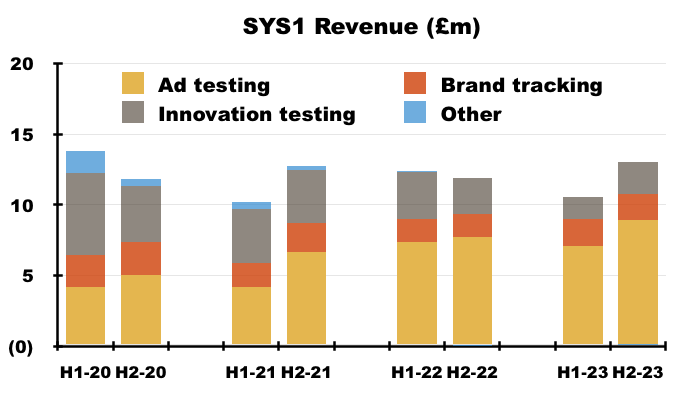

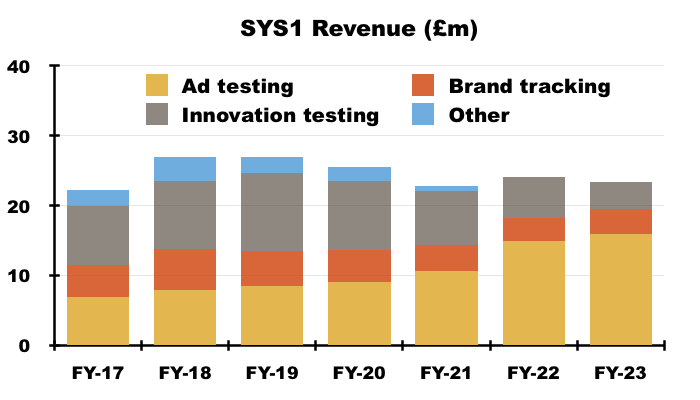

- Innovation revenue (which includes Test Your Idea) dropped 34% during this FY, and declined every six months between H2 2020 and H1 2023:

- Note that Innovation revenue topped £11m during FY 2019 to represent 42% of SYS1’s top line:

- Innovation revenue was less than £4m during this FY to represent 16% of the top line.

- I am sure the Innovation division remains dominated by old bespoke Consultancy revenue, and I get the distinct impression the division’s Test Your Idea plays second fiddle to Test Your Ad within SYS1 (see Orlando Wood and Uncensored CMO).

- Management’s FY webinar described Test Your Idea as an “untapped opportunity… to grow in the future” and confirmed “our ambition is for all three of these [divisions] to provide similar levels of revenue in the future“.

- Management made the following points about Test Your Idea/Brand lagging Test Your Ad during my Q&A:

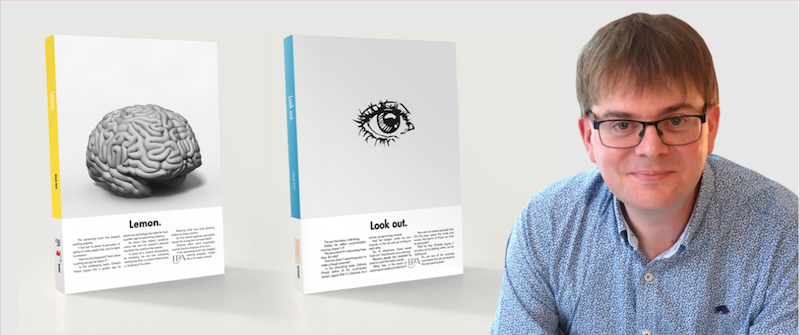

- Test Your Ad enjoys a lot more industry recognition due in part to the “thought leadership” derived from SYS1’s Lemon and Look Out books;

- Test Your Idea/Brand were meanwhile “behind the curve” in terms of the equivalent promotion;

- Conversations are underway to decide how best to promote Test Your Idea;

- SYS1 first had to “double down” on Test Your Ad to “stabilise” the business;

- Because Test Your Ad’s win rate is “so good“, the sales team naturally focuses on that product;

- Due to the greater public visibility of advert spending versus idea testing, SYS1 is more likely to win a customer through Test Your Ad and then cross-sell Test Your Idea, rather than the other way around, and;

- Brand testing tends to involve multi-year contracts, which can be “difficult to win“, “quite commoditised” and “not as profitable” as testing adverts and ideas.

- Those management comments suggest SYS1 requires new books to help promote Test Your Idea, but sadly SYS1’s leading author is busy elsewhere…

Orlando Wood and Uncensored CMO

- Orlando Wood is SYS1’s chief innovation officer and wrote SYS1’s Lemon and Look Out books:

- The 2022 annual report described one book as a “seminal work” and claimed the other received “widespread critical acclaim“:

“We continue to be recognised for thought leadership in the industry. Following on from his earlier seminal work, Lemon, published jointly with the Institute of Practitioners in Advertising (IPA), our Chief Innovation Officer, Orlando Wood, published Look out, to widespread critical acclaim.“

- I have never been convinced about the effectiveness of Mr Wood’s own marketing.

- Three years ago Mr Wood wrote and presented the following SYS1 film:

• Where the Lemons Bloom” opens with the line “Kennst du das Land, wo die Zitronen blühn?” and then recounts the early life of German writer Johann Wolfgang von Goethe and his trip to Italy in 1786.

• Experience the full 21m22s recording, and you too may think you have inadvertently tuned into a BBC4 history documentary.

• Just how this somewhat indulgent and rather dull film that talks of “brain lateralisation” is meant to resonate with modern-day marketing folk is not clear to me.

- Look Out also provided a deep lesson on art history:

- Mr Wood is returning to film making. During this interview on SYS1’s Uncensored CMO podcast, Mr Wood revealed an upcoming marketing course that will include a series of films:

“[The course] is really made for marketing teams, who want to know how to get the most out of their creative and the space they buy.

It is going to look at many of the things in the books but other things, too. We talk about creating advertising in a digital age, we are going to look at the brain… we are going to talk about lessons that I think we have forgotten in some ways about how to stand out. There’s a lot in there that I think you might enjoy and find useful.

The course will be a practical guide and a series of films, each of which will have several important principles.“

- You can register your interest for Mr Wood’s course at orlandoonadvertising.com.

- Quite why SYS1’s chief innovation officer is spending time developing a marketing course when Test Your Idea/Brand are without their own books, “thought leadership” and wider promotion has not been made clear.

- Whatever the reason, SYS1 has reduced its sales opportunity significantly by overlooking Test Your Idea/Brand, which in turn has helped rivals win market share (see Zappi).

- This FY talked of SYS1 being “relentlessly focussed on execution against our strategy”, but Mr Wood’s new course suggests he has escaped/ignored/missed that board instruction.

- All the course work, film making, German literature and art studies do make me wonder whether Mr Wood:

- Has ambitions beyond SYS1 (in film, art, history and/or academia)?

- Sees advertising research more as an intellectual challenge than a business service?;

- Advocates SYS1’s platform strategy?

- Is actually concerned about SYS1’s poor financial history since 2017?, and;

- Is really that suitable to promote SYS1’s services?

- SYS1’s board — having survived the GM vote — really ought to be ordering senior managers to focus on Data/Data-led sales rather than approving distracting side projects with no obvious shareholder benefit.

- No wonder Mr Barden told me earlier this year that SYS1 had lost its “platform thinking“:

“System1 should be selling marketing predictions. What System1 should not be doing is selling advertising creativity. And this is the fundamental issue, the creativity side has taken over and pushed the platform thinking out.”

- I note the podcast with Mr Wood discussed “moto e azione” and 17th century Italian artists…

- …but did not mention anything about SYS1’s “unmatchable” predictiveness or “world-class” platform.

- I asked management during my Q&A whether SYS1’s podcast should contain adverts for the group’s services.

- After all, SYS1 did launch Test Your Ad Audio during this FY.

- Management responded:

“We explicitly decided we did not want to do a sponsored-by-System1 podcast. We are number one in the marketing [podcast] charts, so it is a winning model. We are very happy with the ROI. If you listen to the podcast, System1 is mentioned in a clever way. We think that is more powerful than an intrusive ad half-way through.“

- The irony of course is SYS1 helps its customers intrude radio/podcasts with audio adverts…

- …but believes adverts — even for its own services — on its own show would interfere with the content.

- Management disclosed during my Q&A the Uncensored CMO podcast is “part-funded” by SYS1. I presume the other part is funded by the podcast’s host, SYS1’s chief customer officer Jon Evans.

Partnerships

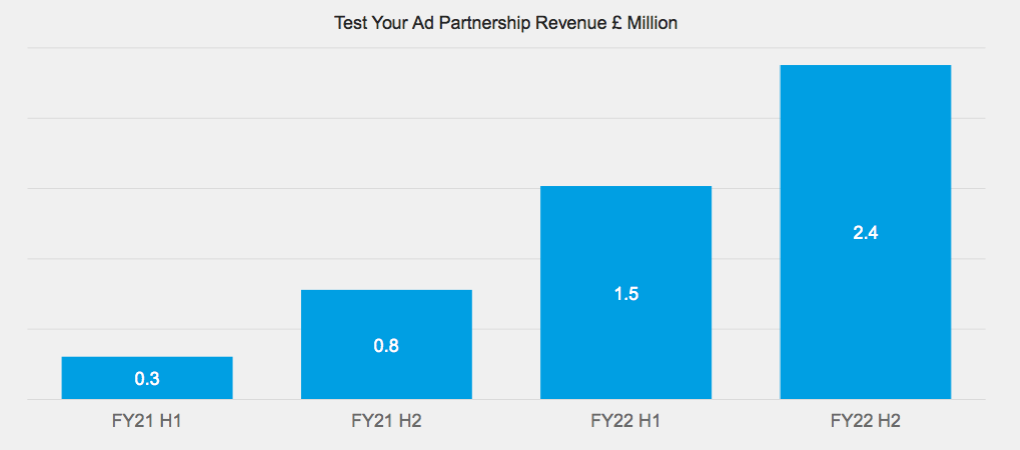

- The comparable FY 2022 revealed the growing influence of partnerships on SYS1’s revenue:

- An updated version of that chart was absent from the FY 2023 presentation…

- …which felt ominous because revenue from partnerships during FY 2022 was “the most significant source of new business”.

- The H1 strategic review gave prominence to forming new partnerships:

“In addition, significantly increase our focus on commercial partnerships with major ad platforms/media owners such as LinkedIn and ITV. These platforms provide the Company with access to multiple advertisers at significantly reduced customer acquisition costs.

Furthermore, we will target advertising & media agency groups, such as Omnicom/BBDO, and professional service firms who provide advertising effectiveness advice to multiple clients, with a view to including our ‘Test Your’ and ‘Improve Your’ products in their suite of service recommendations, again reducing customer acquisition costs.“

- Partnerships with high-profile media groups such as LinkedIn and ITV help verify SYS1’s claim of supplying “unmatchable predictiveness alongside market-beating speed and value”.

- This FY defined partnerships as “formal” and “informal“:

2. Partnerships provide direct or indirect access to a large customer base.

This access can be formal and direct, such as our partnership with LinkedIn, where we are part of the LinkedIn B2B Edge programme, helping LinkedIn grow its advertising revenues by increasing the effectiveness of the advertisers on their platform.

This can also be informal, such as our partnership with ITV, where we jointly host events to promote our thought leadership, directly to the ITV customer base.“

- Management disclosed during my Q&A:

- LinkedIn as a “formal” partner pays SYS1 to test and improve the adverts of some of its top advertisers.

- SYS1 then hopes to persuade those LinkedIn customers to use its services further.

- Partnership revenue declined during this FY because of lower LinkedIn spending, although management could not give a partnership revenue figure due to an “internal reorganisation“.

- ITV as an “informal” partner does not pay for its customers to use SYS1’s services. ITV instead commissions SYS1 research, participates in joint events and pays for its own ad-testing.

- SYS1 does not pay anybody to become a partner or introduce customers.

- This FY reiterated partnerships would help reduce customer acquisition costs:

“WORK WITH COMMERCIAL PLATFORM AND MEDIA PARTNERS TO REDUCE CUSTOMER ACQUISITION COSTS AND PROVIDE SCALE AND FAME

We have a clear business model to ensure that our partnerships with global media platforms, creative agencies, industry partners and professional service firms is successful.”

- The breakeven performance at best for this FY suggests customer acquisition costs have yet to reduce and partnerships are not currently yielding significant income.

- The lower rate of LinkedIn payments puts the spotlight on SYS1’s own sales team to drum up enough new business at an acceptable cost (see Sales and marketing).

Clients and customers

- SYS1’s disclosure of customer numbers remains frustratingly inconsistent.

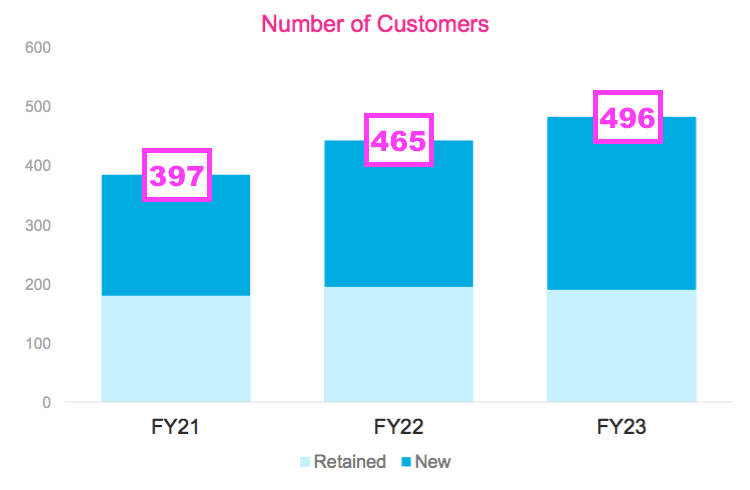

- The comparable FY 2022 disclosed 209 new customers and a total of 465:

“Our Test Your Ad automation, increased industry profile, and Partnerships with ITV, LinkedIn, Globo, enabled us to win 209 new customers in the year, many of which are industry leaders like Lenovo and H&M. Our total customer base rose to 465, an increase of 17%.”

- The preceding H1 then disclosed 240 Data customers:

“We had 240 Data customers in H1, of which 85 were new.”

- And this FY disclosed 149 new platform clients.

“FY23 was a record year for new client acquisition, based on our platform automation and increased fame building, amplified through many global partnerships. We recruited 149 new platform clients in the financial year (previous year: 117).“

- Note the comparable FY 2022 referred originally to 209 new customers, but this FY has restated that 209 to 117 new platform clients.

- Management explained during my Q&A how ‘customers’ and ‘clients’ have different meanings:

- A multinational ‘client’ can provide SYS1 with multiple regional ‘customers’ (e.g. Coca-Cola could be the ‘client’, but ‘customers’ could be Coca-Cola (UK) and Coca-Cola (Brazil)). Contracts are signed with the legal ‘customer’ entity.

- Mix in SYS1’s references to either total, Data or platform for clients and/or customers, and shareholders can be forgiven for mis-interpreting SYS1’s progress.

- I have assumed this slide provides definitive customer numbers:

- That said, the 496 I have derived for this FY follows FY 2022’s 465 customers and then adds a net 31 new clients (not customers!):

“A year of focussed fame building, amplified by new partnerships resulted in strong growth in the number of new platform clients in FY23 (net increase of 31), and new revenue (net increase of £5m, of which £3m was from clients recruited in FY23). “

- Revenue per customer for FYs 2021, 2022 and 2023 was £58k, £52k and £47k respectively (possibly!).

- Declining revenue per total customer is not surprising given customers have shifted towards SYS1’s lower-cost automated Data services where ad-tests start at £2.5k:

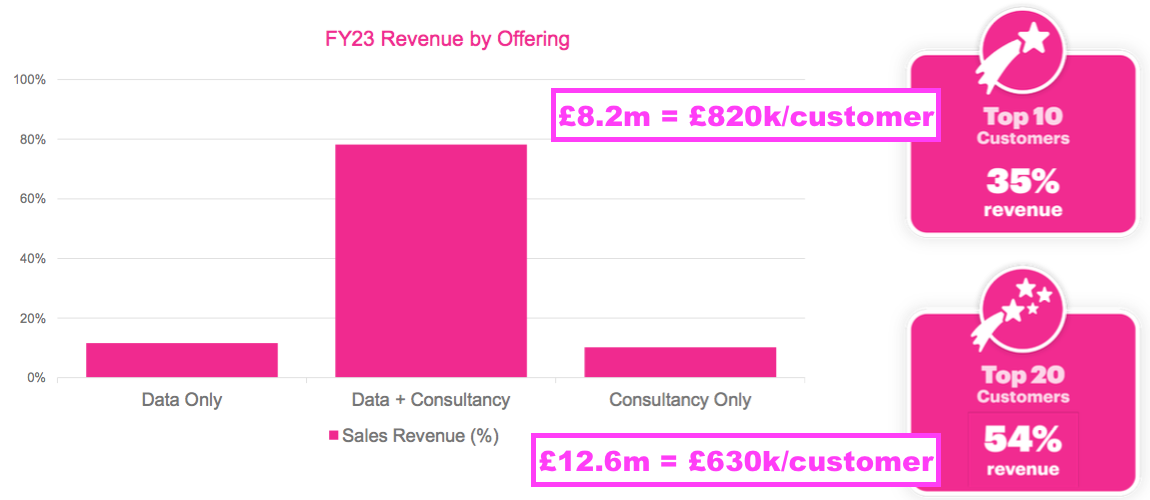

- This FY indicated the top 10 customers on average generated revenue of £820k:

- Customers 11-20 on average generated revenue of £445k.

- Customers 21-496 on average generated revenue of £23k (possibly!).

- Management said during my Q&A that the customer base is skewed by a “long tail” of SMEs spending “something like £2k” a year, which “was not very attractive” for SYS1.

- Bear in mind old bespoke Consultancy income was £6.0m during this FY…

- …and if that £6.0m was attributable entirely to the top 20 customers, then those top 20 customers would have spent £6.6m on Data/Data-led services… or £330k each.

- Exactly how much SYS1’s larger customers are paying for what type of service remains irritatingly unclear.

- SYS1 must provide consistent customer numbers for shareholders to:

- Accurately assess the group’s platform economics, and;

- Determine whether the business is in fact supported by a handful of bespoke Consultancy customers paying several £000k each every year.

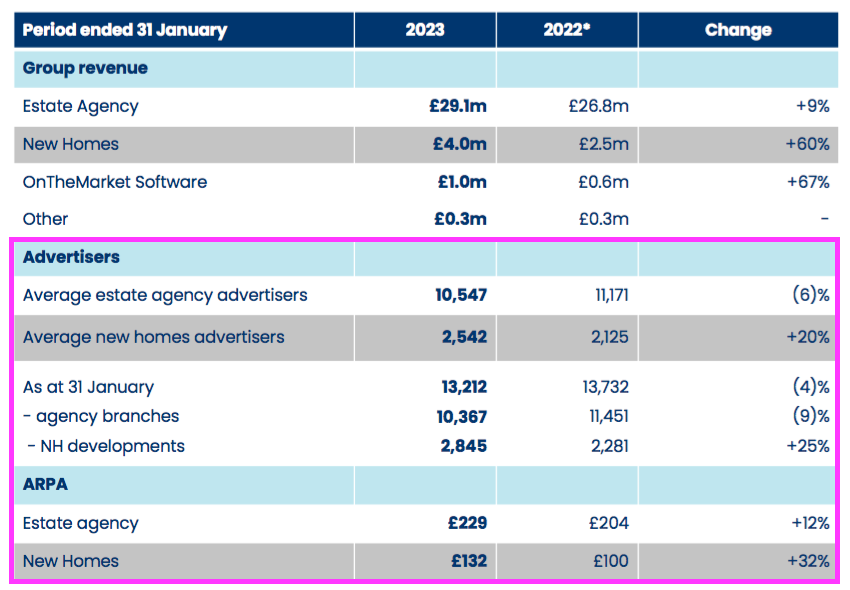

- OnTheMarket (OTMP) provides a useful comparison for investor ‘platform’ disclosure.

- Similar to SYS1, OTMP is a small AIM-traded company with a haphazard financial record and a fledgling platform trying to disrupt much larger incumbents.

- And yet OTMP spotlights its different ARPA (average revenue per property advertiser) measures clearly within its investor presentations:

- Why can’t SYS1 also provide such clear stats about its average revenue per customer?

- I worry SYS1 does not present such vital platform measures because they:

- Would divulge unfavourable trends;

- Are difficult to calculate because the internal data is not clear, and/or;

- Are not uppermost in management’s thinking, which would underline why Mr Barden had “lost confidence with the board understanding the economics of a ‘platform’“.

- Management did however disclose during my Q&A the average customer lifetime value was £80k versus an acquisition cost per customer of less than £20k.

Sales and marketing

- SYS1 revealed £3m of the extra £5m Data/Data-led revenue for this FY was derived from new clients:

“A year of focussed fame building, amplified by new partnerships resulted in strong growth in the number of new platform clients in FY23 (net increase of 31), and new revenue (net increase of £5m, of which £3m was from clients recruited in FY23).“

- £3m from 31 new clients implies £97k each, and perhaps an annualised run-rate of £194k each.

- £194k per new client compares well to the aforementioned £47k customer average, and suggests SYS1 is indeed attracting larger customers…

- …although bear in mind the aforementioned SYS1 distinction between clients and customers!

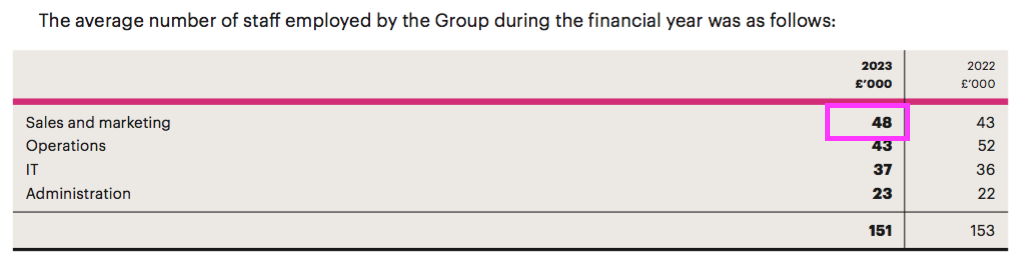

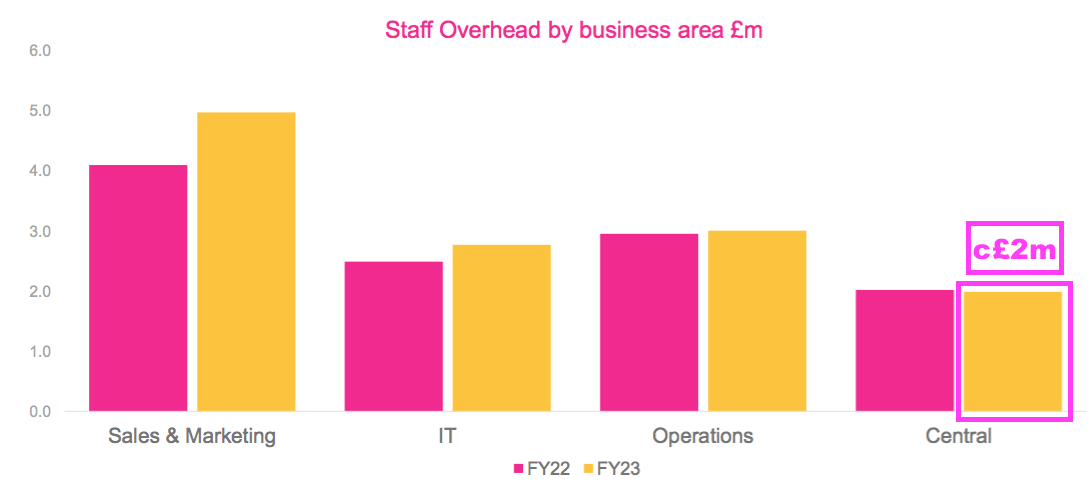

- SYS1 employed 48 people within its sales and marketing department during this FY:

- This FY commendably disclosed a breakdown of staff costs:

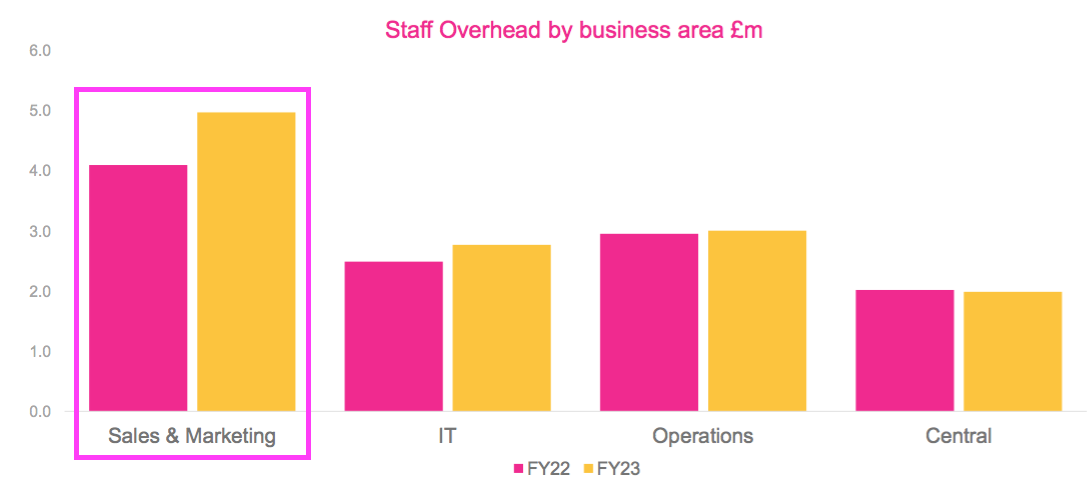

- Sales and marketing staff costs look to have increased by approximately £1m or 25%.

- The average cost per sales and marketing employee therefore appears to have gained approximately £10k to £104k during this FY.

- Management said during my Q&A that 20% of the sales team was dedicated to winning new business, with the other 80% focused on account management (i.e. helping larger customers with purchase decisions).

- Management’s FY webinar signalled sales and marketing costs would not grow as fast as revenue during FY 2024:

“As we grow revenue, admin, IT and operations will require few if any additional heads, and the sales and marketing overhead will grow but at a much slower rate than revenue, so that just emphasises this is a highly operationally geared business that is scalable and so the economics as we go forward and grow should be attractive“

“The big growth in sales and marking was absolutely deliberate and we will likely see some growth in the current year over last year, so that trend will continue probably at a slightly slower rate”

- I am hopeful a mix of greater revenue and a lid kept on costs can soon lead to favourable operational gearing emerging within the accounts (see Valuation).

Zappi

“I point to Zappi.io as a benchmark. Arguably Zappi has a worse product but such clear marketing and sales focus that it has overtaken System1 on both revenue and reputation. In the US ‘MarTech’ press, Zappi is the assumed leader in the marketing-predictions space. System1 needs to acknowledge this issue and address it urgently and head-on. I have made these points for three years now, without being heeded. Hence I unfortunately do not hold out much hope for any change soon.“

- Zappi raised $170m during December through Sumero Equity. Zappi has bold ambitions for its marketing-data platform:

“Zappi has a bold vision for the future: we want to digitise consumer insights for every enterprise,” said Steve Phillips, CEO and co-founder of Zappi.

“Today, only 3% of the market-research industry is digitised. The other 97% is controlled by service-based incumbents that are slow, expensive, analog, and don’t fit the needs of creators. We’re driving innovation in the century-old industry with a platform that acts as a single source of truth for the modern enterprise, where creators have the right insights at their fingertips to inform every decision. Sumeru’s experience in high-growth, innovative SaaS businesses and commitment to people and growth culture made them the perfect partner to help us achieve this ambitious vision.”

- The video below shows how Zappi’s system works:

- This TechCrunch article described Zappi focusing on what SYS1 defines as Innovation testing:

“The core of [Zappi’s] product is that it helps… customers run surveys on ideas as they weigh up what kinds of products to develop as well as early insights into how best to market them. Zappi is mostly used at the pre-product stage…”

- Happy Zappi clients include PepsiCo, Vodafone, McDonald’s and Reckitt Benckiser.

- In contrast, SYS1 dedicates its sales efforts towards chief marketing officers (CMOs):

- Management said during my Q&A that CMOs are targeted because they “control the budgets“.

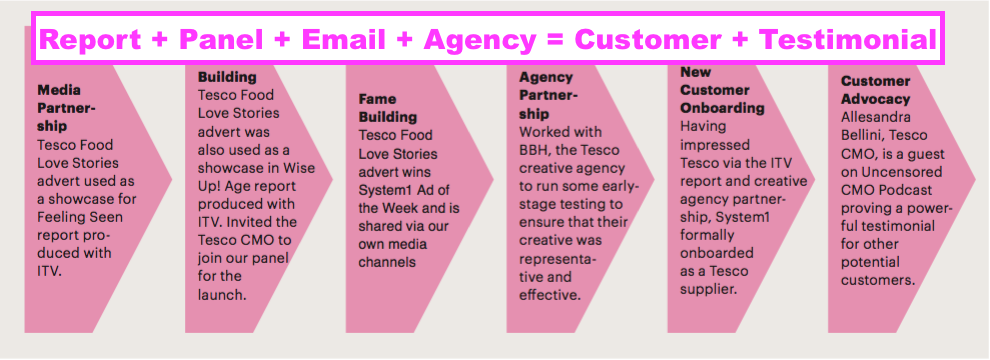

- Persuading CMOs can be a long process. The 2023 annual report highlights how Tesco‘s CMO was won over after SYS1:

- Published a report with ITV featuring the supermarket;

- Hosted a panel event with the supermarket;

- Spotlighted the supermarket in an email, and;

- Worked with the supermarket’s ad agency:

- My notes from the 2019 AGM recall SYS1 struggling to convert marketing ‘insights’ teams:

• [Mr Kearon] said chief marketing officers [CMOs] generally accept the benefits of the System1-style of advertising and are open to experiment. Trouble is, their Insights teams are risk-averse and wish to keep using existing suppliers/methods/data rather than throw away years of work and start again using other supplier/methods/data — even though SYS1’s services are simpler.

• [Mr Kearon] claimed Insights teams typically argue for no change (i.e. an easier life) — which is good news for incumbent ad-services suppliers such as Kantar. SYS1’s chairman mentioned many large organisations suffer from “large inertia” when it comes to marketing change.

• Upshot is SYS1 has to make a “compelling case” to CMOs to get them to change the habits of their Insights teams. SYS1 has previously targeted (change-resistant) Insights teams, but is now talking more directly to CMOs.

- Zappi does not seem to have sales difficulties with marketing-insight managers.

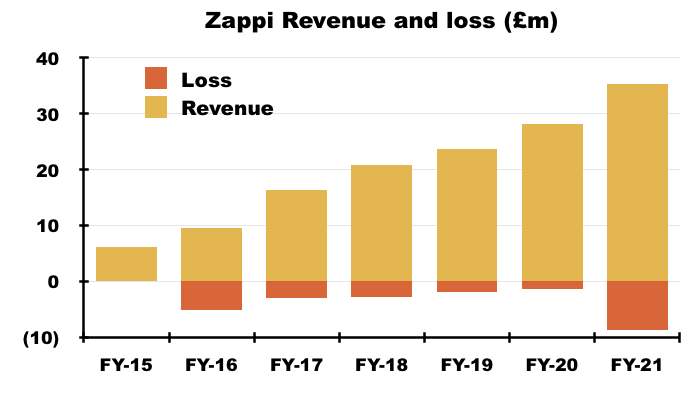

- Zappi was established in 2012 and Companies House shows revenue surging from £6m to £35m between 2015 and 2021:

- Between 2015 and 2021, Zappi’s growth was supported by equity funding of £15m and net new debt of £8m.

- Zappi’s growth may also explain why SYS1’s own Innovation revenue has declined from more than £11m to less than £4m since FY 2019 (see Test Your Ad versus Test Your Idea/Brand).

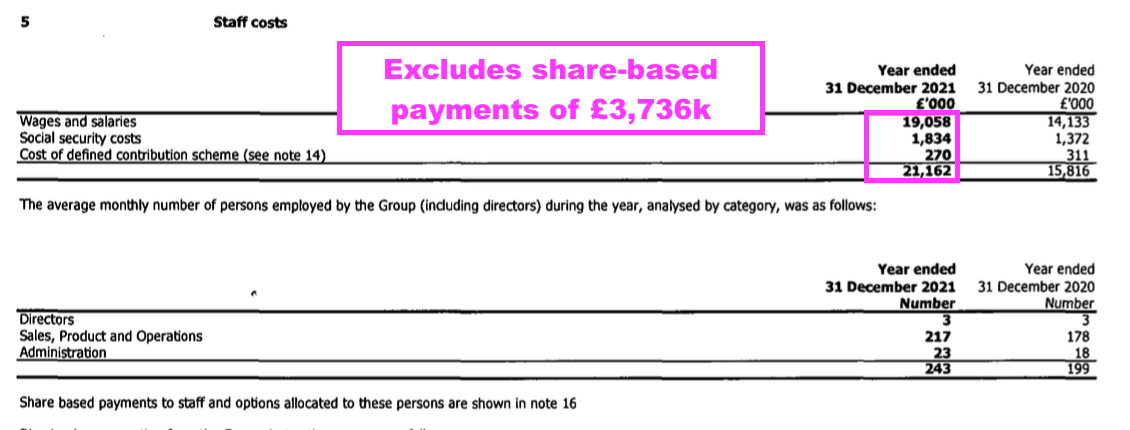

- Zappi’s employees (at least during 2021) appeared to be less productive and more expensive than SYS1’s employees:

- Revenue per Zappi employee during 2021 was £145k versus £155k for SYS1 during this FY.

- The cost per Zappi employee during 2021 (including share-based payments) was £102k versus £86k for SYS1 during this FY.

- Zappi’s gross margin has meanwhile bobbed between 66% and 78% since 2015, while SYS1’s gross margin has consistently topped 80%.

- Despite Zappi’s inferior economics (at least up to 2021), it is Zappi — not SYS1 — that has attracted the $170m investment.

- No doubt that $170m was attracted by Zappi’s much faster sales growth…

- …which may one day translate into very favourable economics should Zappi’s platform emerge as the Rightmove/Autotrader equivalent within the marketing-data sector.

- Zappi’s private-equity funding of $170m is equivalent to more than £10 per SYS1 share.

Financials

- SYS1 helpfully published additional cash flow information for this FY:

- The stronger H2 ensured the H2 free cash outflow at £0.4m was much lower than the very unwelcome £2.7m outflow reported for H1.

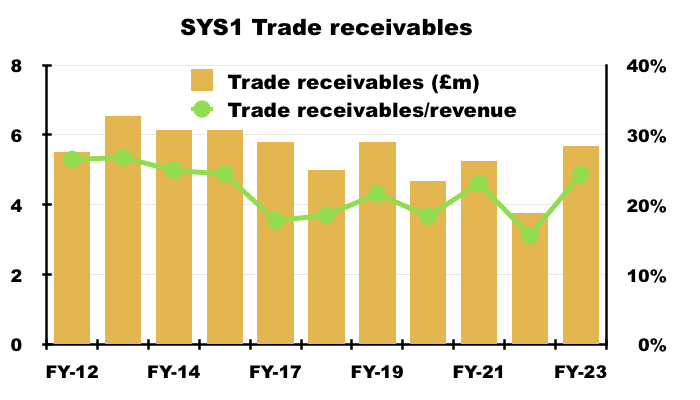

- SYS1 highlighted the extra £1.7m absorbed by greater receivables, although FY trade receivables at £5.7m were equivalent to 24% of revenue and not out of keeping with previous years:

- Software development of £1.2m bypassed the income statement:

- The footnotes suggested capitalised software expenditure may be lower during FY 2024:

“Development costs relate to costs capitalised for the development of the “Test Your” platform (carrying value £865k), which completed during the year ended 31 March 2023, and the Supply Chain Automation platform (carrying value £259k), which is due for completion in the year ended 31 March 2024.”

- SYS1’s capitalised software costs are amortised over three years, with amortisation of £101k expensed for this FY.

- Net cash declined by £3.0m to £5.7m during this FY, with £0.8m of that reduction occurring during the stronger H2.

- Net cash of £5.7m is equivalent to approximately 45p per share and roughly 20% of the £27m market cap.

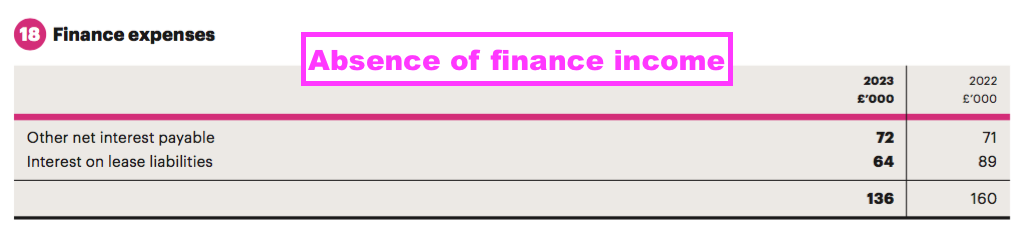

- The lack of FY interest from that £5m-plus cash position was very noticeable now that the base rate exceeds 5%:

- For FY 2024, SYS1 could easily earn income of perhaps £50k-plus from placing some of that £5m within an interest-bearing account.

- SYS1 cleared its £2.5m bank borrowing during H2 to leave the balance sheet free of conventional debt.

- Management’s FY webinar helpfully revealed FY 2024 was likely to be “cash [flow] neutral“:

“Q1 revenue was good and at a level you would expect us to be profitable and we are seeing good or encouraging cash flow trends in the current year. For the current year, you should expect us to be profitable and broadly cash [flow] neutral and by cash neutral I mean plus or minus £0.5m.”

- Complicating SYS1’s accounts are regular adjusting items, the ‘exceptional’ nature of some are debatable:

- ‘Compensation for loss of office’ for example has been reported every year since FY 2012 (total £1.8m).

- At least management said during my Q&A that ‘bonus and commissions expense’ is likely to be restated as a standard cost for FY 2024.

- The aggregate difference between adjusted pre-tax profit and statutory pre-tax profit is a significant £4.2m between FYs 2020 and 2023:

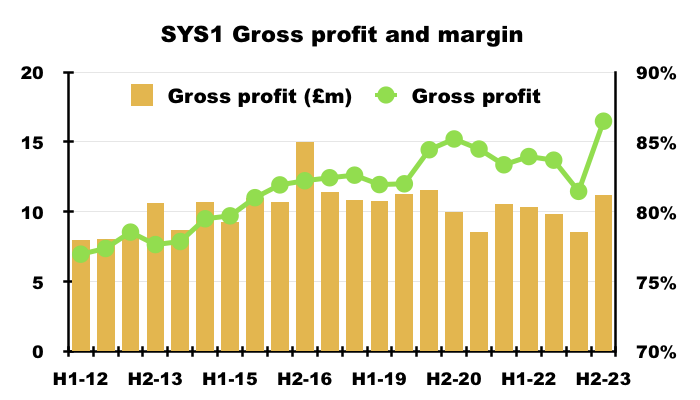

- Perhaps the most promising profit measure during this FY was gross margin, which reached a record 86% during H2:

- An 86% gross margin implies SYS1 can buy online-panel responses for £14 and repackage that data for sale at £100.

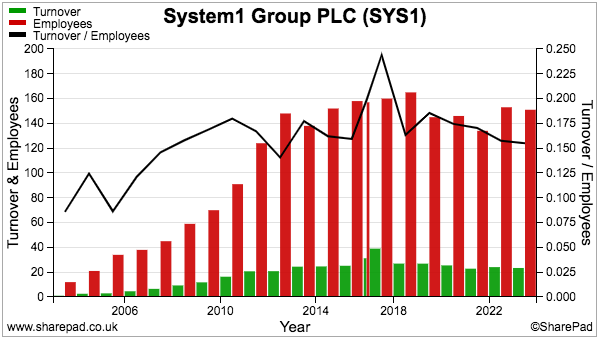

- Revenue per employee at the aforementioned £155k was SYS1’s weakest since FY 2012 (£141k)…

- …although the poor £138k for H1 improved to £171k for H2.

- Wishful thinking perhaps, but could that improvement show SYS1 evolving into a ‘scalable’ platform business?

Valuation

- SYS1’s breakeven performance, bevy of adjustments and negative cash flow does not make assessing the £27m market cap straightforward.

- But referring again to SYS1’s minimum 25% sales growth ambition…

“We have stated our ambition to become a Rule of 40 company. To do this, we will need to deliver revenue growth of the ‘Predict Your’ and ‘Improve Your’ products, plus EBITDA margin, to total 40. While we are in growth mode, we expect the majority of this to come from revenue, so the Company will need to be growing revenue at a minimum of 25% over the coming years.”

- ...let’s (confidently) assume Data/Data-led revenue advances 25% to £21.7m during FY 2024.

- Let’s also assume old bespoke Consultancy income stays at £6m and (confidently) assume the group gross margin is maintained at the record 86% witnessed during H2.

- Adjusted operating costs were £10m during H2, which annualised gives £20m. Let’s add on a further £1m to reflect extra sales people and the reclassification of bonuses as a standard cost.

- All those assumptions turn into a £2.8m operating profit ((£27.7m*0.86) less £21m)…

- …which alongside the net cash of £5.7m would not make the £27m market cap vastly expensive.

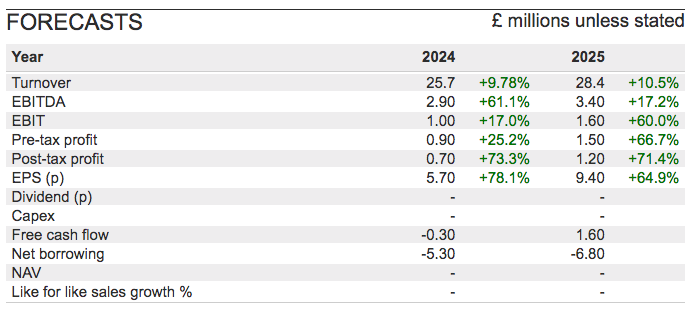

- Note that my calculations are rather optimistic versus the forecasts shown on SharePad:

- Mind you, my sums do get me close to an Ebidta margin of 15%, which is required to meet SYS1’s Rule of 40 with Data/Data-led revenue growth of 25%.

- Furthermore, a £2.8m operating profit may produce management’s anticipated “broadly cash [flow] neutral” position for FY 2024 if:

- Extra receivables absorb another £1m;

- Capitalised IT absorbs another £1m, and;

- Lease-finance costs and yet more adjusting items absorb a good chunk as well.

- I am not sure whether the forecasts shown on SharePad get SYS1 to that Rule of 40.

- Of course, SYS1 needs to deliver 25% Data/Data-led revenue growth for my guesswork to become anywhere close to reality.

- But I do worry such 25% growth will not be achieved because:

- The stronger H2/bumper Q4 was a one-off spurred only by the GM;

- Test Your Idea/Brand will take a long time to flourish (if they ever do), and;

- The chief innovation officer (and others?) are not “relentlessly focussed” on platform revenue…

- …which in turn could leave worthwhile earnings frustratingly elusive despite SYS1’s “unmatchable predictiveness” and “world-class” IT.

- At least smaller shareholders have larger investors to help keep the board in check and ensure SYS1’s “unique IP” is maximised.

What next for larger shareholders?

- Mr Barden and Mr Geddes seem unlikely to call another GM, given Mr Barden made clear the GM was a “now-or-never decision“:

“This vote really is a now-or-never decision. Right now System1 can still compete with Zappi and become the dominant platform in the industry, but that opportunity is getting smaller and smaller and time is running out very quickly.

…

There’s no point shareholders approaching me again a year from now and then asking for these changes, because the opportunity for System1 to become the number one will almost certainly have gone for good.”

- If the GM proposals failed to gain enough support, Mr Barden said he would “hold management to account” while awaiting an exit at 440p:

“If at the GM the board and its supporting shareholders carry the vote against our resolutions and continue to support current management, then I will likely exit at £4.40, the share price at the time I stepped back, such is my lack of confidence in the current board to obtain £8/£10 per share.

…

If I do not become chairman, I’m therefore inclined to wait for the £4.40, and hold management to account accordingly. The ‘global #1 platform’ shareholders will increase board pressure until either the share price rises or ever-growing shareholder frustration will lead to patience eventually running out and board changes.”

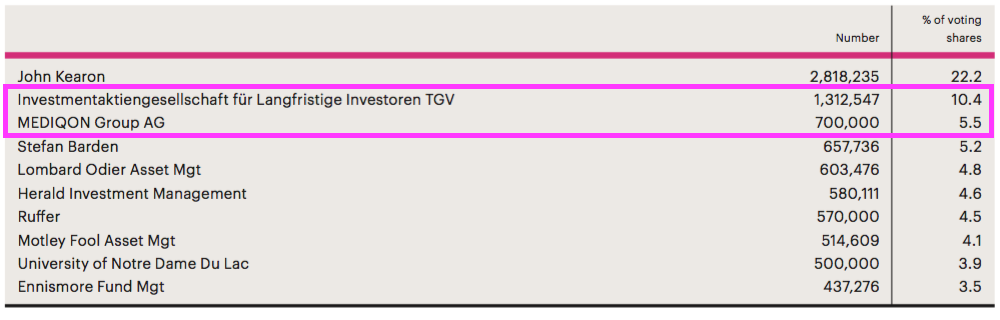

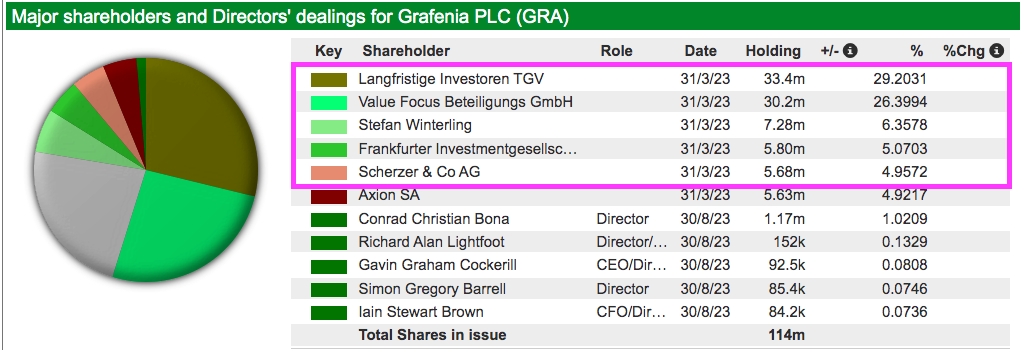

- Further activist activity could be led by SYS1’s German shareholders, who control 16% of the group (although I understand may in fact speak for 23% through various other holdings):

- The German investors called for last year’s strategic review and installed a non-exec to keep tabs on board proceedings. They also (as I understand) voted for the proposed board changes at the GM.

- The German shareholders could requisition their own GM to propose their own board changes, but I see that as unlikely given:

- They would need to find credible management willing to run SYS1, and;

- The adverse outcome of the earlier GM.

- SYS1’s German shareholders may in fact harbour greater ambitions elsewhere. They — alongside other German investors — control Grafenia (GRA):

- SYS1’s German shareholders have restructured GRA into a “serial acquirer of vertical market software businesses“, and this month raised £23m to help fund new acquisitions.

- SYS1’s German shareholders — and other German investors — provided at least £13m of that £23m. For perspective, their collective SYS1 investment is valued at no more than £6m.

- Mr Barden told me earlier this year he planned to refocus SYS1 before selling the group to a trade buyer for at least £8 a share:

“It is Focus, Prove and Sell. System1’s products can be global leaders, but only if sold through an existing global salesforce with existing global sales relationships. It is hubris to think System1 can build this capability organically itself. But global buyers will want proof before they pay a premium. Over the next few years we prove the System1 business really works, and then sell it. Shareholders will get a percentage share of the synergies that the new owners get. The crux is there is a big chunk of synergy there that shareholders would receive. Shareholders would also be able to realise this gain without selling at a discount.“

…

“I think this business is worth £100m at least, £8 a share, if not £125m, £10 a share.”

- Trade buyers are now able to step in and refocus SYS1 themselves at a valuation much less than £8 a share.

- Possible buyers may include smaller rivals such as Zappi/Sumero Equity, which could combine Zappi and SYS1 to form a very attractive marketing-technology platform with the chance of truly disrupting the traditional market-research industry.

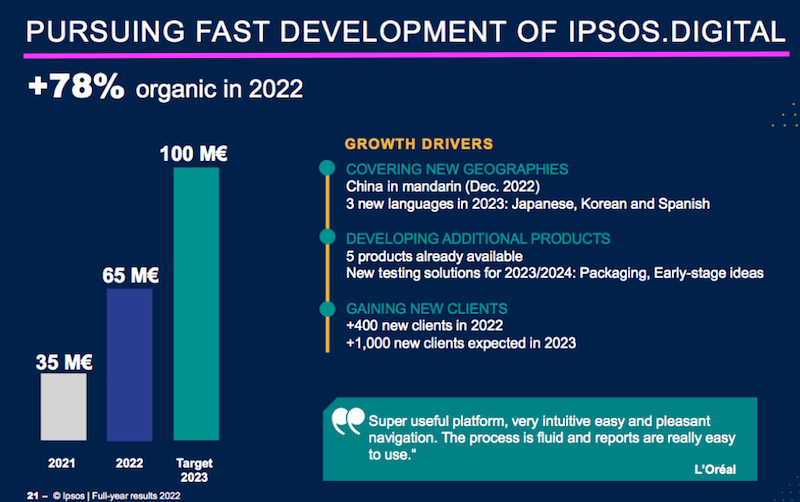

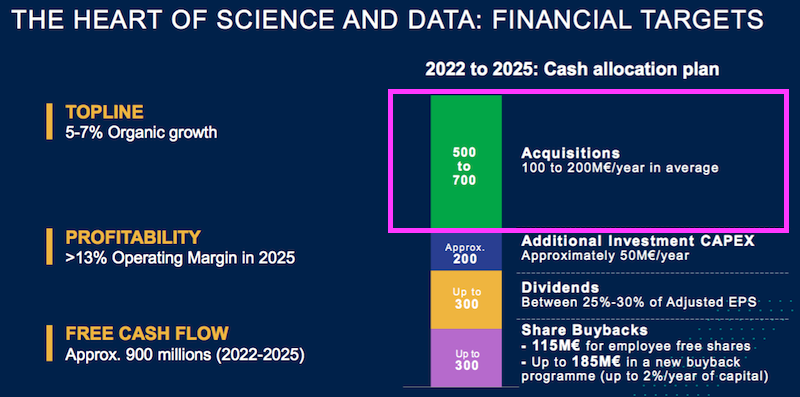

- Ipsos for example offers a range of SYS1-type digital services using “behavioural science principles” to evaluate and optimise product ideas and advertising campaigns.

- Ipsos is targeting “fast development” of its Ipsos.digital division…

- … and the group is set to spend between €100m and €200m a year on acquisitions:

- Kantar Marketplace meanwhile “brings together the best of technology and human expertise in a powerful market-research platform, so you get decision-quality insights in as little as a few hours.”

- Kantar spent almost $1.5b on acquisitions during 2021 and 2022. Purchases included marketing-data/SYS1-like operators such as:

- Advertising ROI optimiser Blackwood Seven;

- Marketing effectiveness tracker MeMo2, and;

- Consumer survey platform Qmee.

- I speculate SYS1’s divided shareholder base has now left the door wide open to corporate activity.

- I dare say the 35% of shareholders who voted against the board at the GM will be very tempted by a suitable premium to the 215p share price…

- …and I suspect some of Mr Kearon’s 36% support will be tempted as well.

- The 215p shares are, after all, at a level first witnessed more than 10 years ago:

- Mr Barden at least is now looking to exit at 440p, which seems as informed a benchmark as any for layman shareholders to judge SYS1’s value to a potential suitor.

- 440p gives a £55m market cap and may well be achieved if a trade buyer can foresee significant cost savings and/or healthy extra sales.

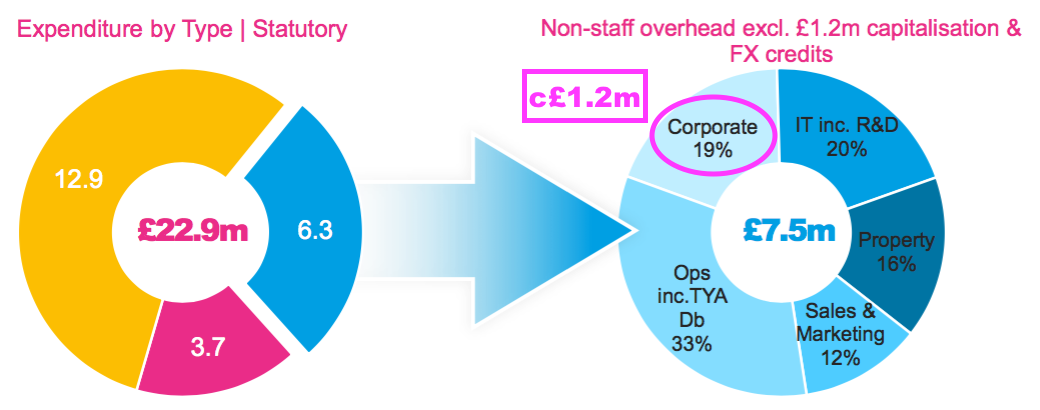

- SYS1’s slides helpfully disclosed central staff costs of £2m…

- …and corporate expenses of approximately £1m…

- …which I suspect could be eliminated quickly in any combination.

- Furthermore, SYS1’s “unmatchable” predictions and “world class” IT ought to be an easy cross-sell to the wider clientele of Ipsos, Kantar or some other global researcher…

- …and therefore that £5m spent on SYS1’s sales and marketing employees could be reduced significantly, too.

- The likes of Ipsos and Kantar would also seem more likely to find further large clients.

- For example, SYS1’s largest ten clients each pay an average £820k a year, and another five of those at an 86% gross margin would lead to an additional £3.5m gross profit that — if ‘platform’ costs remain fixed — would flow to the bottom line.

- I speculate a suitable trade buyer could in time enjoy sales/cost benefits beyond £7m to make Mr Barden’s 440p/£55m very appealing.

- Director comments during the GM claimed the board was “not frightened of a capital event”, which provides hope founder John Kearon is open to good offers for his 22%.

- I supported the proposed GM board changes, and would very much welcome any further action from Mr Barden, the German shareholders and/or interested trade buyers.

Maynard Paton

Thanks for the very thorough review Maynard, very informative. By my reckoning John Kearon is at least 58 (based on him leaving University at 21, Thank you LinkedIn), so whilst not exactly ancient he’s old enough to want to potentially leave the corporate world (and perhaps do more of the dancing that he seems to be more passionate about than anything else!) and maybe that explains why the System1 management seem content to plod along? So maybe a buy out isn’t so far fetched, though it might just be wishful thinking from a frustrated holder.

Thanks Paul. Companies House says Mr Kearon is indeed 58 (this month). The general meeting suggested Mr Kearon was not keen on leaving just yet, although I do think he is better suited in his present sales role than his previous CEO role that required more involvement with practical business matters. Stefan Barden reckoned he could re-focus the business and then sell it, although as you say a buyout now may well be wishful thinking!

Maynard

Pretty decent results announced this morning.

Hitting Canacord’s FY Pbt forecasts in H1 suggests upgrades should be on their way (perhaps accompanying the Interims when some Q3 visibility is apparent). Cash inflow also welcome.

Especially good to see the link between increased revenue and improved pbt which does reinforce the view the business could be nicely profitable if the current revenue trends continue.

Hi Maynard

IMHO – Overall a pretty decent set of interim results today. But the management outlook is still uncertain. I guess that new advertising campaigns are naturally ‘lumpy’ and so their income isn’t much like a real SAAS model. i.e. their ‘platform’ might be excellent, but it does not guarantee any particular level of income.

Given the downside risks, I wouldn’t be surprised if the SP did drop back again but I do feel that the team and especially John Kearon deserve some credit for the success so far.

As always, thank you for all your hard work.

Charles

NB – I am very sad that Charlie Munger died. He was a wonderful man.

Hi Maynard

I thought that the SYS1 H1 InvestorMeet presentation was excellent. It might even be the cause of the subsequent price rise. As you might have seen, I put my question about lumpiness and the reply implied that it was not a big problem and that it would also get less of a problem as they grew. Do you have any thoughts on their answer?

I definitely wish you well with this investment as it is your biggest investment. For me it is just a 1% long term holding but at this rate it could grow quite fast!!! (although I expect that it will be very lumpy).

Thanks as always – especially for all the massive work that you continue to do on analysing this company.

Charles

Hi Charles,

Management referred to the non-platform bespoke lumpiness, and such lumpiness should indeed have less impact if the platform side grows significantly. Mind you, platform revenue can fluctuate between quarters (e.g. Q4 2022->Q1 2023) but management noted platform income from the top 20 customers should be less volatile. I think quarter-to-quarter fluctuations will continue to occur, though, which could cause some anxiety for anyone who does not believe the long-term transition story.

Maynard

Hi Maynard –

Previously Mr Barden seemed to think that a buyout price of £4.40 was a good deal for shareholders. But he also said: “I think this business is worth £100m at least, £8 a share, if not £125m, £10 a share.”

Kearon himself suggested £1bn a while back (i.e. £80 a share)

I know that you normally buy and hold, but this is becoming a huge holding for you and I imagine that you are thinking about the long term value. I’m looking forward to your next update!

Well done.

Charles

PS – I was buying a few more at c£4.20 in February.

Hi Charles

Yes, Mr Barden said he was happy to sell a year ago at 440p when the shares were c200p. He also talked of selling SYS1 to a trade buyer after 3 years at £8-10 a share had he become executive chairman at last year’s EGM.

The £1b value was touted jointly by Mr Kearon, Mr Barden and the FD a few years ago, and was watered down when Mr Barden left the company. The £1b value was cited with SYS1 becoming part of a larger marketing business -> “You can get System1 to a billion if it is owned by a major multinational.” (More here)

Mr Barden said during his EGM statement:

“6) Valuation: As a result, and you might want to pass this to Chris, if successful, how much could System1 be worth in say 2 to 3 years time?

a) If you can’t give a valuation what would the shape of the P&L be? For example, your 25% CAGR sales growth aspiration is a doubling in sales every 3 years. What is the associated cost structure?”

The Capital Markets Day in February provided an illustration of what could happen to profit (or at least Ebitda) if sales did double. If that illustration proves reasonably accurate, then maybe the shares still offer good upside. Steadily clearing my backlog of updates from other portfolio companies (ASY+MTVW) then I will be onto SYS1.

Maynard

System1 (SYS1)

Publication of 2023 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

1) GROUP OVERVIEW

Some changes here for 2023:

a) Who we are

The 2022 report contained encouraging text such as “best in the world“, “scalable players” and “laser focussed:

“We believe we are the best in the world at what we do. The “Test Your…” platform leverages data and production economics, rather than service economics. Data and production economics point to industry value accruing disproportionately to a small number of scalable players. We are laser focussed on becoming one of them.”

But that encouraging text was sadly replaced for 2023 by this more functional introduction:

“System1 is a marketing decision-making platform business. Our target customers are the world’s largest advertisers. These businesses understand that creativity is the most powerful tool for growth within their control. System1 helps them make confident creative decisions that lead to transformational business results.”

b) What we do

A new line for 2023 that reminds shareholders that SYS1’s products measure emotion:

“System1 predicts and improves marketing effectiveness. Our advertising and idea tests measure emotion to give our customers the most accurate predictions of the business impact of creativity. We ‘predict’ (provide research results) and ‘improve’ (provide insight and consultancy on those results) on arguably three of the most critical marketing questions for our customers: advertising effectiveness, innovation effectiveness and brand effectiveness. We aspire to do these three things better than anyone else at a value that makes System1 our customers’ choice.”

c) Our products

The graphic below now includes Bespoke Consultancy that implies such work is done only on an ‘Enterprise’ scale:

KDA stands for Key Drivers Analysis, while DAT stands for Distinctive Assets Testing. I am not quite sure what the ‘Audit’ service is for Test Your Ad and Test Your Innovation. It is not listed on SYS1’s website (TYA and TYI). Although the website does list Distinctive Asset testing for both TYA and TYI, which might be ‘Audit’.

d) The size of the prize

All this text from 2022 was sadly omitted for 2023:

“The size of the prize

‘Predictions’ currently represent less than 10% of the global research market. We estimate that our target markets of predicting and improving advertising, brand and innovation effectiveness represent about $10bn of the $89bn research market. Currently at less than 1% share, we believe that System1 can gain 10% global market share in the next decade—a lower share than the current market leaders. Whether we can achieve that scale is the management challenge. But a necessary, if not sufficient, pre-condition to success is having the vision and a plan.”

e) Investment case

This remains unchanged from 2022:

But the explanatory text accompanying the investment case, such as this below…

“ Unique and step-change improvement in product value for customers

Today many of our Advertising predictions are automated, and we have challenged ourselves to deliver them at 1/20th the cost and 20x faster than traditional methods. We believe we are far ahead of traditional competitors in automated predictions and indeed that some of our competitors’ legacy economics will make it difficult for them to catch up with us. In addition, our pioneering framework for how advertising works at its best also enables our experts to provide the very best improvement advice for increasing our customers’ return on their annual advertising investment.”

…was omitted for 2023. Perhaps the explanatory text had become outdated and/or a little too detailed. The “1/20th the cost and 20x faster” for instance from 2022 was originally “1/100th the cost and 100x faster” within the 2021 report and I mentioned this change at the 2022 AGM. I wonder if that question may have prompted SYS1 to remove all the accompanying text and just leave the ‘big picture’ ambitions.

f) Progress towards our goals

SYS1 commendably kept to its four goals within the CEO’s 2023 review:

“This year, alongside our shift of culture towards relentless execution, we made significant progress towards delivering the four goals we set out 5 years ago, namely: Build defensible assets; Generate fame; Win new customers; and Generate new revenues.”

Within the table below, the stats for TYA (c80,000 ads) and TYI (c60,000 ideas) are oddly the same for 2023 as for 2022:

TYB now has c7,000 brands versus c6,000 the year before.

2) PRINCIPAL RISKS AND UNCERTAINTIES

The 2023 report introduced a new ‘Strategic’ risk about AI and competing ineffectively with the following potential impacts and mitigations:

“Potential impact: Technological advances including artificial intelligence reduce the commercial viability of the group’s methodology:

Mitigation: The group positions itself as “the most predictive” provider of information to support creative and marketing decisions. Currently a combination of real-life panel respondents and System1’s methodology achieves this goal. The group acknowledges that this may change over time and continuously reviews the application of AI and other tools in predictive market research and more generally.”

“Potential impact: Participation. The group does not compete effectively in the largest and faster-growing markets:

Mitigation: The group formally reviews product and geographic markets as part of its annual strategy review. We upweighted our presence in the US to reflect the significant opportunity in that market and launched digital and audio versions of Test Your Ad.”

The Operational risk now includes the potential impact of lower-quality panel data:

“Potential impact: A reduction in panel data quality affects the company’s reputation with key customers:

Mitigation: We conduct both operational and strategic reviews of respondent quality in close collaboration with our approved panel suppliers and can switch provider where required.”

The Environmental and political risk now includes the potential impact of unhappy shareholders:

“Potential impact: Shareholder relations: the company’s plans could be opposed by significant shareholders:

Mitigation: The company holds comprehensive investor one-on-one and group meetings in roadshows after the full-year and interim results are announced. In addition, quarterly trading updates provide an opportunity to engage with shareholders who follow the company closely.”

The other risks remain the same, namely:

* Loss of a significant customer/key personnel/critical supplier/assets, data & IP;

* Litigation

* Operational

* Financial

* Environmental and political

3) SECTION 172 REPORT

SYS1’s ‘cultural pyramid’ remains unchanged:

a) Customers

A text refresh for 2023:

“Customers

Our target customers are the world’s largest advertisers. The board understands the importance of forming and retaining good working relationships with its existing and target customers. These customers understand that creativity is the most powerful tool for growth within their control…

System1 helps these companies make confident creative decisions that lead to transformational business results. Our advertising and idea tests measure emotion to give our customers the most accurate predictions of the business impact of creativity. We also provide expert guidance to our customers to help them improve the effectiveness of their ad or innovation. Enabling our customers to Create with Confidence“.

The case studies of LinkedIn and adidas — used both for 2022 and 2021! — were thankfully replaced by a new example for 2023 (Sam Adams/Boston Beer).

b) Talent

A good sign: drinks with John Kearon cited within the 2022 report…

“There is a comprehensive programme of employee communication and engagement sessions, monthly Town Hall meetings with all staff, to fortnightly senior management forums, through to “birthday cheers” with the CEO.”

…have been curtailed and replaced with monthly workshops:

“We hold follow up discussions with each team across the business, chaired by the team leaders and the HR team to agree improvements, actions and owners. In addition to monthly Town Hall meetings with all staff, we also hold monthly senior management forums and run monthly workshops with managers.”

New text for 2023 about ‘flexible holiday and benefits’ and a November all-company meeting:

In April 2023 we introduced a Flexible Holiday pilot, to build on our Flexible Working approach and additionally launched a Flexible Benefits platform. This provides our employees with increased autonomy when it comes to choosing how they work and rest and we have received very positive feedback on all of these initiatives. We find it very important to regularly bring people together in person, to share updates and build relationships, to complement the time spent working remotely. For example, we run 1derful Wednesday events to encourage employees to socialise together in the office and in November 2023 we plan to gather all staff in the UK for an all-company Strategy update meeting.”

c) Investors

The line “They have no cash bonus scheme” was removed for 2023 as cash bonuses were introduced (see point 7a).

New text for 2023 referred to IMC:

“In the past year we began using InvestorMeetCompany, an investor engagement platform which we use for capital markets days, group meetings of investors and the annual general meeting.”

The general meeting held during April 2023 that considered the board reshuffle was not broadcast on IMC.

d) Suppliers

Some new text for 2023:

“As outlined in the Principal Risks and Uncertainties section on page 20, the loss of a critical supplier could leave the Group unable to meet customer demand, therefore the Board has regard to the importance of fostering good relationships with our suppliers to promote the success of the Group.”

The text below has not changed, but worth reiterating how SYS1 commendably discloses its main suppliers:

“Our key delivery suppliers include:

• MAP Marketing Research provides us with survey programming and project management services

• Toluna, Prodege and NetQuest provide us with market research panel respondents to complete our surveys

• Datawise provides us with bespoke data processing and charting services on our non-standard deliverables

• Intonation provides us with translation services (forward translation of questionnaires and back translation of respondent verbatim)”

e) Community

SYS1 is developing an ESG strategy:

“We are currently in the process of developing a comprehensive ESG Strategy with the support of expert consultants, to create an appropriate plan that includes achievable goals and timelines that are in line with science-based targets. In the meantime, we have outlined below some of the things that we are currently doing under each heading.”

All the emission stats that follow in the 2023 report are in fact copied from the 2022 annual report! However, the 2023 report did add this text:

“This year, we are partnering with ITV on Sustainability initiatives in two ways:

1. We are working together to produce and publish research on Sustainability in Advertising – this will seek to understand the most effective ways to talk about sustainability in advertising with a view to behaviour change. We will launch this at the Festival of Marketing in October

2. We are committing to assist ITV in achieving its emissions reduction targets, in alignment with the Science-Based Targets initiative (“SBTi”) Corporate Net-Zero Standard Framework (sciencebasedtargets.org) and to achieve at least a 5% reduction of Greenhouse Gas Emissions year on year”

Plus lots of new text under the Social sub-heading:

”We launched Look Out volunteering this year. Under this initiative, employees are invited to participate in local events that support the community. So far these have included delivering meals to vulnerable people in Singapore, preparing clothing packages for homeless people in Brazil and working with Breakthrough in the UK, to prepare ex- o enders to re-enter the workplace. In addition, we are supporting the ESOMAR Foundation (esomarfoundation.org) and Women In Research (www.womeninresearch.org/). John Kearon has been President of the Foundation for the last four years. Its purpose is, ‘using Market Research to build a better world’ and it is run on a purely voluntary basis. With a team of System1 volunteers, together with five volunteer research industry Board members, the Foundation provides research training, inspirational case studies, and support, to help charities anywhere in the world in making a difference to the communities they serve. The Foundation raises over £100,000 a year, through annual donations from the research community, to fund these activities. Emma Cooper (Chief People Officer) organises WIRexec (Women in Research) annual summits and System1 is sponsoring the European event this year. WIRe believes in the positive impact of women in business and works to advance the contributions and voice of women in research, both for themselves and for the greater good of the industry. System1 is also putting 10 employees through the WIRe Accelerate program, a multi-module, virtual program delivering professional development concepts.

System1 increases its sphere of influence by partnering on initiatives that impact the community. In addition to the Sustainability example outlined in the previous section, other examples include the Feeling Seen and Wise Up reports we have produced with ITV. These provide guidance on diversity in advertising, and we have conducted events and run panels to help socialise our findings within the industry.”

4) GROUP DIRECTORS’ REPORT

No significant changes to this section for 2023.

a) Credit risk

SYS1 reiterating a lack of bad debts and that HSBC is the bank that does not pay the group interest (see blog post above):

“Since the majority of the Group’s customers are large blue-chip organisations, the Group rarely suffers a bad debt. The Group’s cash balances are held, in the main, at HSBC Bank.

b) Foreign-Exchange risk

SYS1 reiterating its sensible approach to foreign currencies:

“In addition to the United Kingdom, the Group operated in the United States, Rest of Europe, Brazil, Singapore, and Australia during the period and was exposed to currency movements impacting commercial transactions and net investments in those countries. Management endeavours to match the currencies in which revenues are earned with the currencies in which costs are incurred. So, for example, its US operation generates most of its revenue in US dollars and incurs most of its costs in US dollars also. Management does not believe that there would be any long- term benefit in endeavouring to manage currency risk further, and to avoid the cost and complexity does not deal in hedging instruments.”

c) Subsequent events

New text for 2023. I understand the payment is recorded within ‘other income’:

“On 30 June 2023, the Group reached a mutually agreeable resolution of the lawsuit filed by System1 Group PLC against System1 OpCo, LLC in the Southern District of New York for trademark infringement. The parties have signed a global agreement which governs the co-existence of their respective use of the “System1” trademark in connection with their operations. As part of this agreement, the Group will receive a fixed amount, payable in instalments, in the years ending 31 March 2024 and 2025. The parties have agreed to keep further detail of their agreement confidential.”

d) Disclosure of information to auditors

New boilerplate text for 2023:

“The directors are responsible for the maintenance and integrity of the corporate and financial information included on the System1 Group PLC website. Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

In the case of each Director in office at the date the Directors’ report is approved:

• so far as the director is aware, there is no relevant audit information of which the group’s and company’s auditors are unaware; and

• they have taken all the steps that they ought to have taken as a director in order to make themselves aware of any relevant audit information and to establish that the group’s and company’s auditors are aware of that information.”

e) Substantial shareholders

A number of alterations to the major shareholdings since 2022, despite only one TR1 RNS (from Langfristige) during the period between when the shareholdings were taken (1 August 2022 to 1 August 2023):

• Langfristige now owns 10.4% versus 7.7% for 2022.

• Stefan Barden now owns 5.2% versus 6.2% for 2022.

• Lombard Odier now owns 4.8% versus 4.7% for 2022.

• Motley Fool now owns 4.1% versus 4.5% for 2022.

• Ennismore now owns 3.5% versus 4.5% for 2022.

I think any trading by Stefan Barden and Ennismore ought to have been reported through the RNS as their holdings both crossed through a percentage threshold. Shareholding sizes are important given the unhappiness expressed at the April 2023 general meeting. I therefore wonder if the changes actually reflect a double-check for the 2023 shareholdings ahead of the general meeting, which corrected possible shareholding errors reported for 2022. Indeed, I understand the Langfristige change was due to a consolidation of smaller, affiliated shareholdings under one name, rather than actual share buying.

5) CORPORATE GOVERNANCE

a) Introduction and QCA code

A whole new section of introductory text for 2023: