07 April 2023

By Maynard Paton

Notice of general meeting summary for System1 (SYS1):

- Confirmation of a vote on 21 April to i) appoint former director Stefan Barden as executive chairman; ii) demote founder John Kearon from executive to non-executive, and; iii) retire two non-executives.

- Data and Data-led revenue advancing 33% during FY 2023 and 50%-plus during Q4 2023 suggests SYS1’s mooted 25% growth target is achievable.

- My conversation with Mr Barden revealed his data-platform sales focus, plans for a £100m-plus exit and the reasoning behind SYS1’s $1 billion market-cap ambition.

- SYS1’s proposed new US advisory team emphasised Mr Kearon’s advert-creative sales approach, which I now believe explains the group’s lowly revenue and lack of profit.

- Shareholders have, according to Mr Barden, a “now or never” decision to support SYS1 becoming the “definitive” marketing-data platform with a potential 5-bagger outcome. I still support the proposed board changes and continue to hold.

UPDATE 17 April 2023: Following the publication of this blog post, Stefan Barden/James Geddes and SYS1 have referred to its contents within this RNS announcement issued on 13 April 2023. Mr Barden has since provided a further statement that is now published at the end of this blog post.

Contents

- News link, share data and disclosure

- Why I own SYS1

- Notice of requisitioned general meeting

- Q4 and FY 2023 revenue update

- Stefan Barden: SYS1 introduction, platform focus and creativity distraction

- Stefan Barden: target customers and trade-sale exit plan

- Stefan Barden: potential £100m-plus valuation and $1 billion ambition

- Stefan Barden: management, employees, losses and now-or-never vote

- New US advisory team and contrasting sales approaches

- Potential conflict of interest, director pay, staff motivation and corporate governance

- Verdict on Stefan Barden conversation and SYS1’s statement

- UPDATE 17 April 2023: Further statement from Stefan Barden NEW

- UPDATE 21 April 2023: Stefan Barden statement at the General Meeting NEW

- UPDATE 21 April 2023: My statement at the General Meeting NEW

News link, share data and disclosure

News: Notice of requisitioned general meeting published 24 March 2023

Share price: 160p

Share count: 12,678,829

Market capitalisation: £20m

Disclosure: Maynard owns shares in System1. This blog post contains SharePad affiliate links.

Why I own SYS1

- Advertising research specialist that predicts the success of television adverts, with progress resting upon “the most accurate, cheapest and quickest” data and follow-up guidance that is “the best in the industry”.

- Partnerships with ITV and LinkedIn support welcome transition from bespoke consultancy towards ‘scalable’ data services and should attract greater customers at lower cost.

- Proposed board changes could finally exploit the group’s “superb, proven suite of products” and rescue shareholders from very unsatisfactory financial performances.

Further reading: My SYS1 Buy report | All my SYS1 posts | SYS1 website

Notice of requisitioned general meeting

- An earlier statement during March had already revealed two former SYS1 directors were seeking to requisition a general meeting:

“System1 announces that it has received an email dated 3 March 2023 from Stefan Barden (former System1 chief executive officer and Board adviser) and James Geddes (former System1 chief financial officer) seeking to requisition a general meeting of the Company (the “Requisition”) unless certain board changes were agreed to by the Company’s board of directors (the “Board”), as set out below.

- The two former directors had proposed the following board changes:

“The board changes proposed by Stefan Barden and James Geddes are to:

(i) retire Rupert Howell as Chairman and a Non-Executive Director of the Company;

(ii) elect Stefan Barden as Executive Chairman and a Director of the Company;

(iii) retire Philip Machray as a Non-Executive Director of the Company; and

(iv) re-elect John Kearon as a Director of the Company but moving into a Non-Executive capacity.”

- This latest statement confirmed the proposed board changes, set the meeting date for 21 April and carried SYS1’s arguments for voting AGAINST the resolutions.

- The statement also included details of SYS1’s Q4 performance alongside extra revenue statistics for FYs 2022 and 2023. Potential future sales growth was indicated as well.

- My broker says online votes for the general meeting must be submitted by 18 April:

Q4 and FY 2023 revenue update

- SYS1 reported H2 2023 had been “strong” and disclosed some healthy percentage revenue gains:

“We are starting to deliver ambitious growth plans. While previous years’ revenue growth has not met management or shareholder aspirations, under revived new leadership the business is delivering a strong FY23, with high levels of H2 revenue growth, delivered through the combined data and data-led consultancy offer.

For example, in respect of the Predict Your (data) and Improve Your (data-led consultancy) offering only:

* H1 FY23 saw over 30% revenue growth vs H1 FY22, despite the entire US sales team being exited or resigning from the Company during the first half of calendar 2022 and having to be rebuilt during H1 FY23

* H2 FY23 looks likely to deliver over 30% revenue growth vs H2 FY22

* Q4 FY23 is expected to produce double digit % revenue growth vs Q3 FY23, and we expect Q4 FY23 to deliver 50% higher revenue than Q4 FY22“

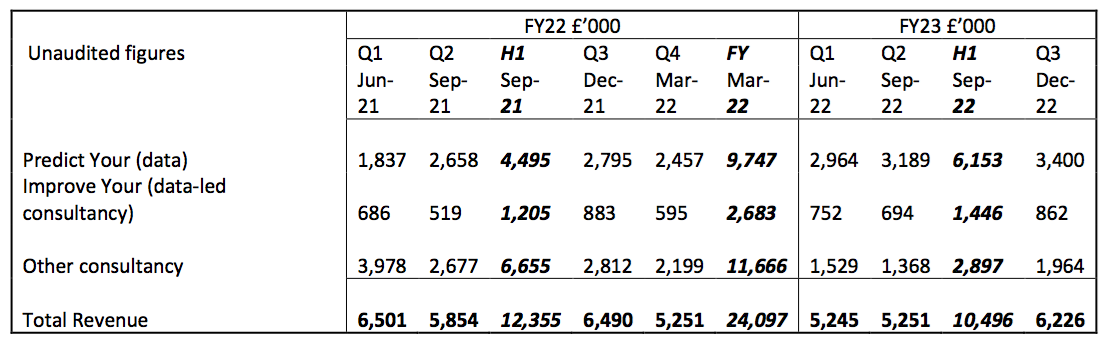

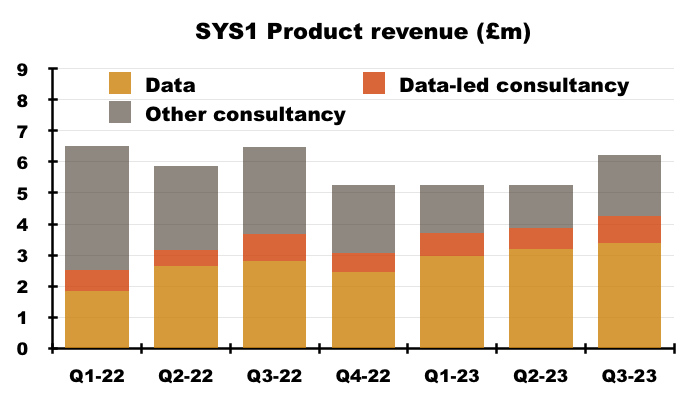

- SYS1 helpfully included revenue statistics that clarified the income from the new-style Data services, the new-style Data-led consulting work and the old-style bespoke consulting activities:

- To recap, SYS1 is transitioning away from bespoke Consultancy work towards automated Data services in order to create a “fully integrated platform” that delivers attractive economics based on “strong scalability and operational gearing“:

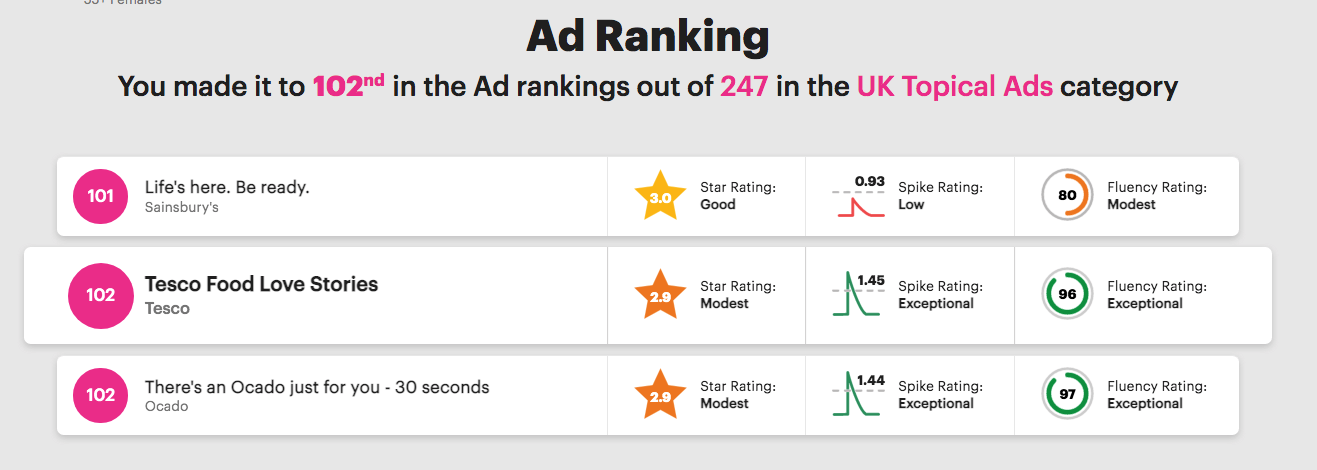

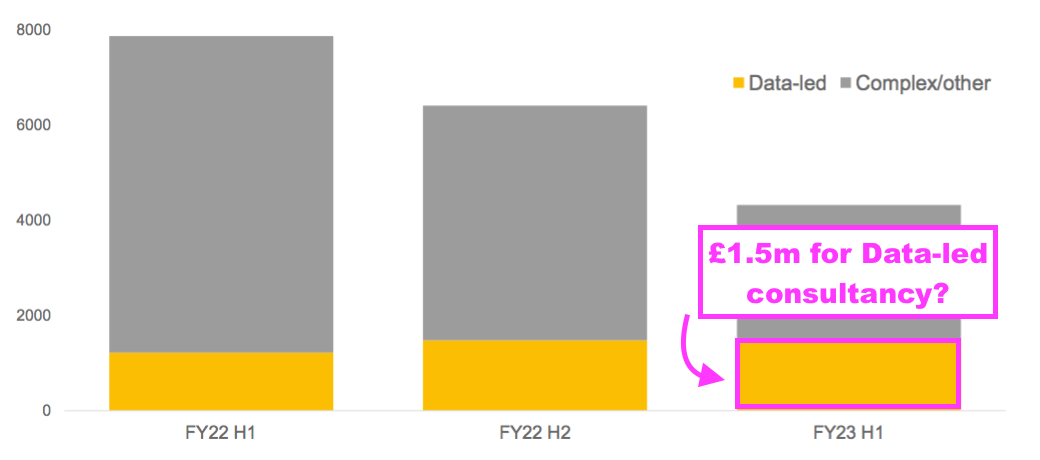

- SYS1 had previously reported the new-style Data-led consultancy within its wider Consultancy segment, which left shareholders interpreting charts such as this…

- …to determine the level of new-style Data-led revenue.

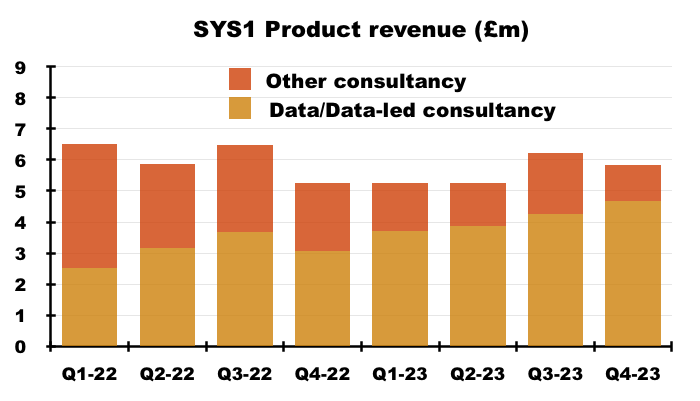

- Shareholders were told Data and Data-led revenue represented 52% of total revenue during FY 2022, 72% of total revenue during H1 2023 and 68% of total revenue during Q3 2023:

- SYS1’s statement also implied Q4 2023 Data and Data-led revenue would be £4.7m, versus £3.7m, £3.9m and £4.3m for Q1, Q2 and Q3 respectively.

- SYS1 suggested old-style consultancy revenue had reduced to £6m during FY 2023…

“We have grown the Predict Your and Improve Your revenue from launch in H2 FY21 to expected revenue of over £16m in FY23. However, this has been more than offset by a decline in the bespoke consultancy business from £25m to circa £6m in the same timeframe.“

- …which in turn implied Q4 old-style consultancy revenue was just £1.1m:

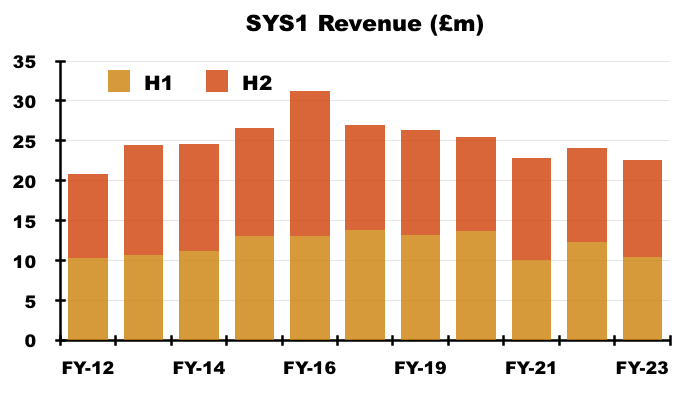

- That £1.1m estimate indicated total Q4 revenue would be £5.8m and total FY 2023 revenue would be £22.6m — down 6% on FY 2022 and the lowest level of annual revenue since FY 2012:

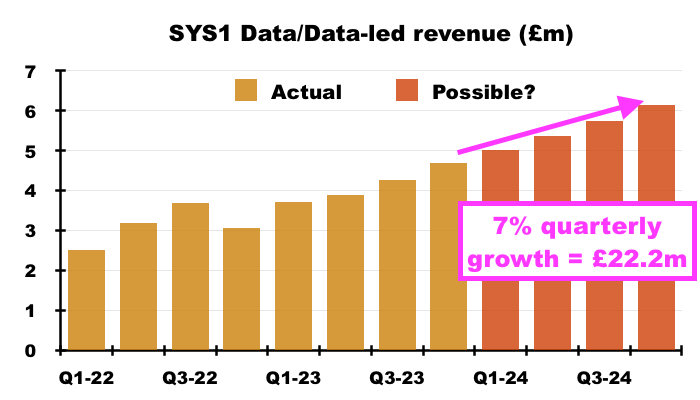

- My calculations mean total Data and Data-led revenue increased by £4.1m, or 33%, to £16.6m during FY 2023.

- Data and Data-led revenue advancing another £4.1m during FY 2024 — with bespoke consultancy work remaining at £6m — would lead to total FY 2024 revenue rising 18% to £26.7m.

- SYS1 hinted at a 25% revenue growth target:

“We have stated our ambition to become a Rule of 40 company. To do this, we will need to deliver revenue growth of the ‘Predict Your’ and ‘Improve Your’ products, plus EBITDA margin, to total 40. While we are in growth mode, we expect the majority of this to come from revenue, so the Company will need to be growing revenue at a minimum of 25% over the coming years.”

- Assuming bespoke consultancy revenue remains at £6m, total FY 2024 revenue advancing 25% would require Data and Data-led revenue to gain £5.6m, or 34%, to £22.2m.

- Could Data and Data-led revenue gain 34% to £22.2m during FY 2024?

- If SYS1 achieves 7% consecutive quarterly growth for Data and Data-led revenue during FY 2024, total Data and Data-led revenue should reach £22.2m to support the mooted 25% growth target:

- My chart above suggests 7% consecutive quarterly growth for Data and Data-led revenue is achievable given the growth trend witnessed during FY 2023.

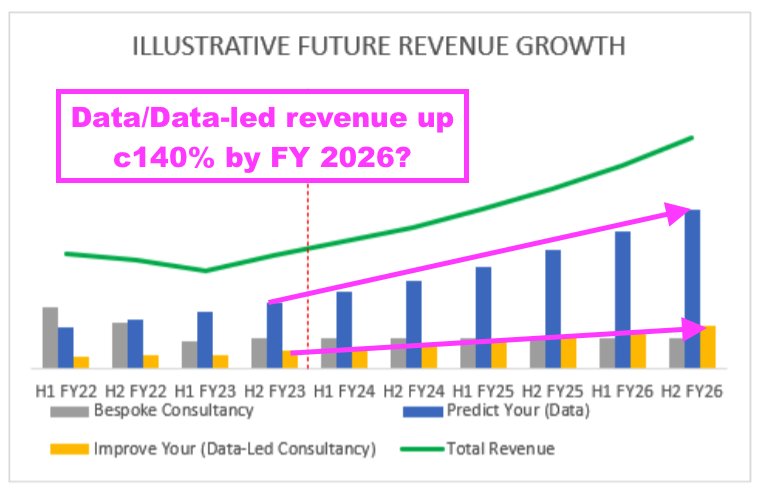

- SYS1’s own chart below implied Data and Data-led revenue could advance by approximately 140% by FY 2026:

- SYS1 cautioned its chart above was “provided for illustrative purposes only” and was “not intended… to represent or constitute a forecast of profits“.

- Advancing revenue by 140% over three years equates to a compound annual growth rate of approximately 34% — matching the 34% growth I estimate is required to support 25% total revenue growth for FY 2024.

Stefan Barden: SYS1 introduction, platform focus and creativity distraction

- SYS1 said:

“Members of the Board have spoken to Mr. Barden and Mr. Geddes on multiple occasions to understand the intention behind the requisition. The Board has received no proposals, either written or verbal that set out any change of strategy to deliver an increase in shareholder value.”

- Mr Barden and Mr Geddes not disclosing their intentions publicly does leave outside shareholders in the dark.

- I therefore contacted Mr Barden to clarify his plans and we spoke for approximately an hour.

- Mr Barden explained what initially prompted the requisition notice:

“Shareholders with around a quarter of the total votes approached me for my view on System1’s performance and what could be done to improve it. With their support, James Geddes and I contacted several other large shareholders to get their views, too.“

“All of them thought change was required, and they unanimously encouraged or supported James and I to push for these board changes, agreed with other shareholders, if the Capital Markets Day did not deliver.”

- Mr Barden then recounted how he was introduced to SYS1:

“My working life has always involved utilising technology to create step-change value in businesses. They come in waves. About ten years ago the latest wave of Data emerged, and the commercial opportunity was to answer the question ‘How do you take a service and wrap it in data, to either to create new, repeatable, and have for the first time ever, scalable, products or new services?’ “

“And from that I was introduced to John Kearon, System1’s founder. John was looking to turn BrainJuicer into a £1 billion company, like YouGov, which was created at the same time System1 was (as BrainJuicer).”

- Mr Barden was already familiar with SYS1 because he had employed the group’s services throughout his career. He investigated further and became positive:

“What I liked about System1 was the simplicity, because you are just capturing people’s emotions. At a fundamental level, that meant it was a) scalable and b) really low cost. So if somebody else came up with another methodology, they would be unlikely to do so at a lower cost because there really are very few steps with System1’s process. Getting the economics right is crucial. I agreed to help.”

- SYS1 had already changed its name from BrainJuicer during 2017 and Mr Barden was invited to help establish the group’s new plan:

“John, I, the board and team, then did a lot of work on the proposition, which had to be very clear, and convey what System1 did, which was help marketers make better decisions by providing them with more accurate marketing predictions… very quickly and very cheaply, or ‘Test, don’t guess’.“

“We would sell to everyone and be creative- or innovation-methodology agnostic. We would simply provide more accurate predictions, far more cheaply and quicker than any competitor.“

- Mr Barden said that was the proposition he invested behind.

- Mr Barden then spent 2018-2022 at SYS1, initially as a board adviser, then becoming chief information officer, chief operating officer and chief executive, all part-time, as he “quickly backfilled” the group’s senior-management gaps. He re-emphasised his SYS1 stint was only ever on an “interim” basis as per the June 2020 announcement.

- Thinking his job was done at the end of 2021, Mr Barden stepped back from SYS1…

- …however, SYS1’s transition from bespoke consultancy work to marketing-data ‘platform’ became hampered by a shift back towards the creative side of advertising during 2022. Mr Barden said:

“System1 should be selling marketing predictions. What System1 should not be doing is selling advertising creativity. And this is the fundamental issue, the creativity side has taken over and pushed the platform thinking out.“

“To maximise shareholder value, System1 should be the definitive decision-making platform that delivers better predictions. If you believe that, you would then get that message really clear to customers, rather than publishing books such as Look Out and other ideas on advertising creativity, because a global number-one platform business sells to all agencies and should be agnostic of any one methodology.”

“System1 should be talking about its marketing predictions being the best, the cheapest and the quickest. I now believe that the only way for System1 to become a global number-one platform is for there to be a clear shareholder mandate.“

- Mr Barden disclosed SYS1 enjoyed a healthy sales pipeline before his departure:

“Management are three years into their sales approach and it is not working fast enough. When I stepped back there was a sales pipeline that should have increased sales substantially. Instead, System1 is flat. Something has clearly gone wrong.”

- Mr Barden noted the shift towards advertising creativity was underlined by the absence of promotion towards SYS1’s non-advertising activities:

“Apart from mentioning they have Innovation and Brand services, you won’t see anything out there where they are doing anything to sell them. That’s why the sales of those areas have lagged. The advertising part has grown, but everything else has collapsed far faster because there is nobody focusing on them. The net result is flat-to-declining total revenue.“

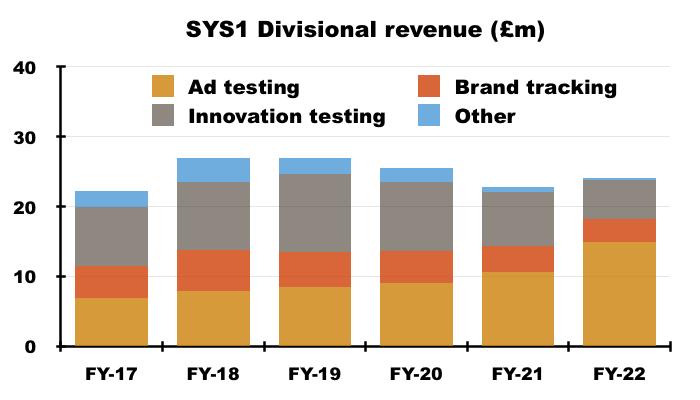

- Revenue from SYS1’s ad-testing activities has grown by £8.0m, or 114%, to £15.0m between FYs 2017 and 2022:

- Revenue from SYS1’s innovation-testing and brand-tracking activities has meanwhile reduced by £4.0m, or 31%, to £8.9m between FYs 2017 and 2022.

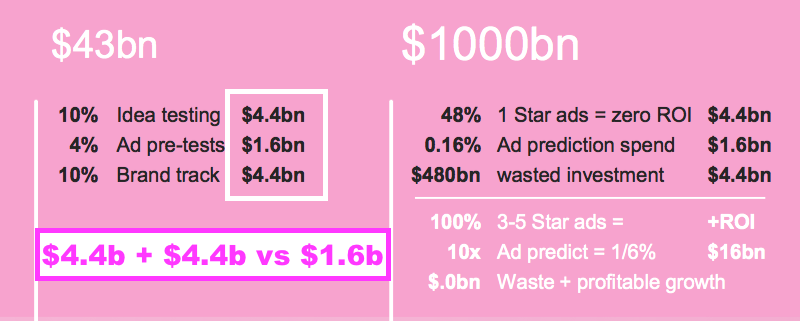

- If the vote goes his way, Mr Barden would redirect sales attention towards the innovation-testing and brand-tracking services in addition to adverts. He referred to SYS1’s recent presentation, which disclosed the market size of advert testing being much smaller than the market sizes for both innovation testing and brand tracking:

Stefan Barden: target customers and trade-sale exit plan

- SYS1’s February webinar emphasised the group was targeting the world’s biggest advertisers…

- …and SYS1 reiterated that approach within this latest statement:

“The Board has recognised the value to our customers of retaining a bespoke consultancy proposition. Retaining this capability has meant we have onboarded some of the world’s largest advertisers, who have purchased the full range of propositions from us on condition that we provide their specific requirement for bespoke research consultancy.”

- Mr Barden believed SYS1 could broaden its sales efforts to include smaller companies, “national champions” and fast-growing start-ups, as well as the the very largest businesses:

“There’s a pyramid of customers and System1 is starting at the top, which they do need to get to, because they need to get to every single level. At the very top are really competent global players, such as Unilever, P&G, Nestle… where the top people have a lot of experience and it’s really difficult for you to get in there and change their minds”

“Imagine a three-by-three matrix. Columns are headed by product; Advert, Innovation, and Brand. The Rows are the key channels. Let’s start with just three; Global brand, National brand and Fast growing start-up.“

“System1 should sell its platform equally to all. But today the board seems to focus only on the top left: Advert testing for global brands. Not only that, it seems to sell creative advertising support, methodologies and insight, rather than the best-in-class prediction platform, which is more accurate, cheaper and quicker than anyone else.”

“Filling out the matrix, adding extra channels and focusing on also becoming viral rather than just purely selling relationship by relationship is the key to success. I would argue that such an approach is just not in the psyche of the current board as they have an advertising-agency background and see the platform only through an agency lens. The proposed extra hires will only exacerbate this”.

- Mr Barden claimed if SYS1 captured all markets, the business would then become more attractive to much larger groups:

“If System1 becomes the definitive platform for all sizes of companies… showing they have absolutely won at every level, potential acquirers will believe they can convert slowly over time some, or all, of their major customers over time. That is a big £££ synergy!”

“An acquirer would buy our products, they would buy the databases, they would buy the talent, and they would put all that into their own business, and hopefully leverage the large customer relationships that they already have. And they could get a very quick return.“

- Mr Barden called the process “Focus, Prove and Sell”:

“It is Focus, Prove and Sell. System1’s products can be global leaders, but only if sold through an existing global salesforce with existing global sales relationships. It is hubris to think System1 can build this capability organically itself. But global buyers will want proof before they pay a premium. Over the next few years we prove the System1 business really works, and then sell it. Shareholders will get a percentage share of the synergies that the new owners get. The crux is there is a big chunk of synergy there that shareholders would receive. Shareholders would also be able to realise this gain without selling at a discount.“

- And Mr Barden signalled a relatively short timescale for a potential trade-sale exit:

“I believe it should take up to three years to prove the value. And if it is not sold, it would still be more valuable than the current ‘creative agency’ approach.”

Stefan Barden: potential £100m-plus valuation and $1 billion ambition

- What could SYS1 be worth to a potential acquirer? Mr Barden suggested potential 5-bagger upside from SYS1’s recent £20m market cap:

“I think this business is worth £100m at least, £8 a share, if not £125m, £10 a share.“

- Is £100m-plus realistic? Mr Barden cited Zappi, a SYS1 competitor, as an example of the marketing-technology sector attracting keen investor interest.

- Zappi raised $170m during December and this TechCrunch article recapped Zappi’s AI-based service, which drew distinct parallels with SYS1’s products:

“Typically, market research of this kind could cost these large FMCG companies as much as $20,000 and take between four to six weeks to complete, with lengthy surveys of panels of users and then a lot of data crunching to turn that into something that can be used.”

“Zappi’s pitch is that for $2,000, it uses a mix of human surveys — it integrates with other companies that build those networks of respondents and might get as many as 300 or 400 people per campaign — plus a lot of other data, including its own consumer database that it says is made up of 1.2 billion data points — to get the same research done in four to six hours.”

“That research comes complete with reports that can be used by Zappi’s clients in their wider in-house analytics, too.“

- The article cited Zappi earning revenue of more than $50m, so at least twice as much as my estimated £22.6m that SYS1 generated for FY 2023.

- Note the $170m raised by Zappi represents an unspecified percentage of that business. The whole of Zappi could therefore be worth a lot more than $170m for group revenue of more than $50m. This, Mr Barden reckons, is arguably the “platform upside“.

- SYS1 growing its FY 2023 Data and Data-led revenue from my estimated £17m to £25m-£30m — and then attracting a Zappi-type sales multiple — would get close to Mr Barden’s £100m-plus valuation.

- The TechCrunch article said Zappi focused on what SYS1 defines as innovation testing:

“Zappi is mostly used at the pre-product stage…The core of its product is that it helps these customers run surveys on ideas as they weigh up what kinds of products to develop.”

- No wonder Mr Barden wants SYS1 to reinvigorate its own innovation-testing service.

- Zappi’s website also claims basic advert testing and a separate product for digital ads:

- Why are investors happy to apply a seemingly elevated valuation to Zappi? Mr Barden explained:

“Every industry will have a platform and I, and many others, believe the platform in this industry will be worth at least a billion.“

- Mr Barden believes the marketing-technology sector is a winner-takes-all opportunity, with SYS1, Zappi or another competitor one day emerging as the dominant marketing-data supplier.

- I suppose a trade-buyer could also imagine SYS1 (or Zappi or another competitor) becoming the Rightmove or Autotrader of the marketing-technology industry… and pay handsomely for that potential.

- But Mr Barden clarified SYS1 would not become the dominant platform and enjoy a $1 billion market cap as an independent:

“You can get System1 to a billion if it is owned by a major multinational.”

- Mr Barden outlined his sums for a $1 billion:

“Having something that takes a 10% share of the market, which System1 now says is $8.5 billion, then 80-85% gross margins, 30% Ebitda, and then put a multiple on the profit, and you get to one or two billion”.

- Mr Barden added:

“It’s not $10b and it’s not $100m. And whatever the valuation, it is many times what an agency is worth.“

- Mr Barden’s $1 billion potential mirrors that highlighted (occasionally) by SYS1… and he confirmed he co-ordinated the $1 billion ambition with Mr Kearon, the board and the executive team. Mr Barden recounted:

“Our fundamental thesis on that one billion, which we put into the annual report a couple of years ago, was to make sure everyone was behind it… You nail your flag to the mast and get everybody behind it. That’s part of the cultural change, and everyone in the business knows this is our giant shareholder commitment.”

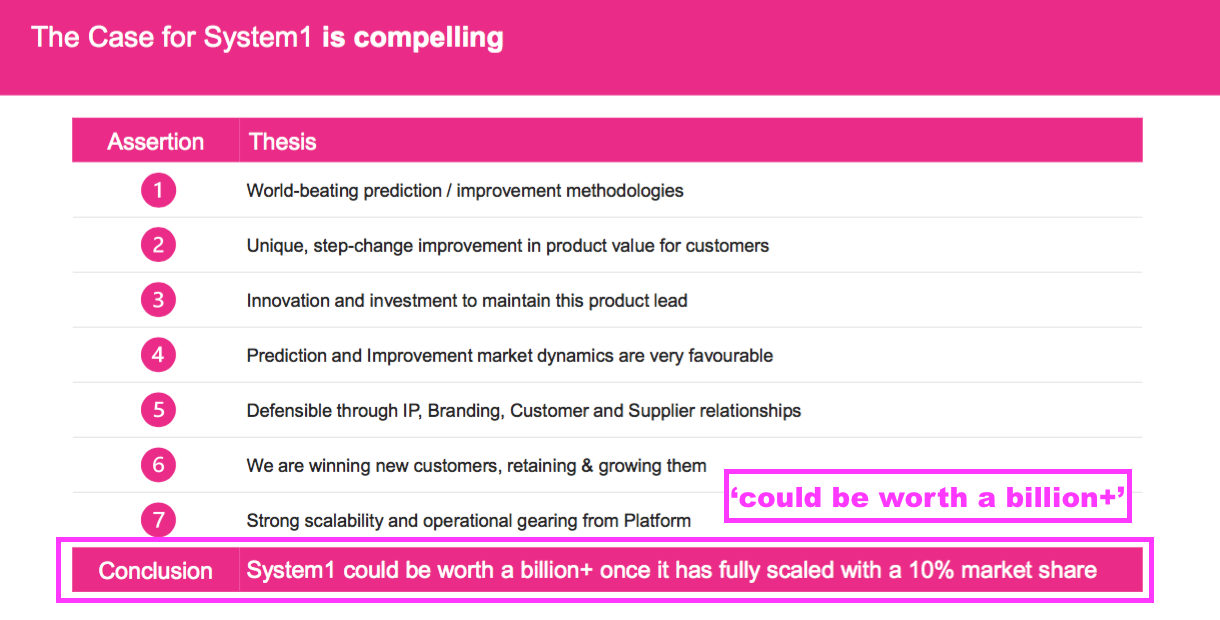

- SYS1’s statement in contrast did not repeat the “System1 could be worth a billion+ once it has fully scaled with a 10% market share” ambition that was highlighted during February’s webinar:

- Prompted perhaps by the progress made by Zappi, Mr Barden injected a sense of urgency into proceedings:

“I believe there will be a $1 billion platform in the market. I really believe that. It could be System1, but for any chance of System1 becoming number one, change has to happen now. If System1 is not the platform, it is going to be stuck at around a $25m or $50m valuation at best.”

“I also believe the board are retaining the target platform valuation, but implementing a creative-agency approach that is worth much less. They should straighten out this thinking.

“Agencies are by definition talent-heavy and difficult to scale. They have diminishing scale economics and are often captured by their talent, which walks out of the door every evening. I think we are seeing this captured in the current financial statements. Agencies are not worth much at all. Say 6 times Ebitda?“

- And Mr Barden noted M&A transactions had held up well despite stock-market valuations sliding last year:

“Private Equity own several of the large multinational research companies and they are looking to add quality companies. If you look at the M&A market for this type of business, it remains active, dynamic and competitive.“

Stefan Barden: management, employees, losses and now-or-never vote

- SYS1’s statement argued against appointing Mr Barden (see Potential conflict of interest, director pay, staff motivation and corporate governance), but Mr Barden would not be drawn into commenting upon SYS1’s current management. He said:

“This vote is not about personalities because a good business is greater than any individual.”

“All I would say is the board is not shareholder focused, whereas I would go in and ask how do we create a step-change improvement in value? There is going to be a winner in this industry, so how do we change the business proposition to capture it? System1 was well placed to win. Albeit less so as every week passes.“

- SYS1 claimed Mr Barden becoming executive chairman would herald employee departures:

“The Board and the executive leadership team are ensuring that the distraction of the GM does not impact business performance. However, the Board is very concerned that many of the executive leadership and senior management team would leave the Company if the proposed resolutions were approved“

- I would venture Mr Barden expects to recruit some new staff. After all, SYS1 remarked last year that Mr Barden had “reinforced our Executive Team with key hires to add to our own home-grown talent, including the appointment of a chief operating officer” during his board tenure.

- Mr Barden did not dispute having to hire new people if he took charge. He recounted previously having to recruit a new sales team, as well as appointing James Gregory, Chris Willford and Mark Beard:

“The sales team that I brought in, who were fantastic and professional, they transformed everything. They set up a sales support team, always shared best practice and were getting better and better. But after I left, the company changed its sales approach towards the creativity side. They all left because of that change of direction.“

“I have a good track record of building strong teams. I brought in many of the current senior team. I am not looking to exit anyone. I do however know that many in the current team are excited by a renewed platform focus, but if anyone is not excited by the platform opportunity then they should leave.“

“I regularly meet talent in the research industry and would appoint an Advisory board of platform sales talent very quickly. Between us and the current team that remained, I am confident that we could quickly hire a better version of anyone who decided to leave.”

“It is disappointing that the board try to create issues that don’t exist, and are easily solvable if they do, rather than focus on improving their business model and results.”

- Mr Barden was concerned about SYS1’s lack of profit:

“The company should not be losing money. I don’t believe System1 should be losing cash and how to get to at least breakeven will be one of the first questions I pose to James [Gregory] and Chris [Willford].“

- And what if his resolutions are defeated at the general meeting on 21 April? Mr Barden stressed the vote was a “now-or-never decision” for shareholders:

“We have proposed these resolutions not because anyone wants to run the company, but because performance is poor and shareholders are losing confidence in any improvement.“

“I would talk to other shareholders to work out what to do, but this vote really is a now-or-never decision. Right now System1 can still compete with Zappi and become the dominant platform in the industry, but that opportunity is getting smaller and smaller and time is running out very quickly.”

“Think of it this way — what if our platform approach fails? The company can always go back to management’s current business model. But that won’t work the other way. There’s no point shareholders approaching me again a year from now and then asking for these changes, because the opportunity for System1 to become the number one will almost certainly have gone for good.“

New US advisory team and contrasting sales approaches

- Underlining the need for improved revenue and a return to profit, SYS1’s statement noted many actions to bolster its sales efforts.

- SYS1 reiterated founder John Kearon’s move to the States to find new customers:

“John has recently been working in the US, using his unique position as the Company’s founder to develop new business opportunities and partnerships. This activity is already bearing fruit with several recent customer wins.“

- Non-exec chairman Rupert Howell is becoming involved, too, introducing SYS1 to potential customers…

“The Board, the executive leadership team and wider business are delighted to have Rupert Howell as Non-Executive Chair. He has already delivered unique value to the business with introductions to one of the world’s largest social media platforms, one of the largest global creative agencies and notable talent in the US.“

- …and introducing SYS1 to other introducers of potential customers:

“The US is key to success – a distinguished and tech-savvy US advisory team, assembled by Rupert Howell, is ready to start work after the GM

Subject to defeating the resolutions at the GM, we are forming a new US advisory team that will focus on providing significant introductions to the business, as well as local market advice. The role of the advisory team will be to help the Company grow revenue quickly in the US. The team members will be remunerated on a payment-by-results basis.”

- Proposed introducers include Jon Bond and Noah Brier:

“Subject to agreeing contractual terms, the team will be led by Jon Bond, founder of legendary New York agency Kirshenbaum & Bond and now active in the MarTech space. Noah Brier, a famous New York digital leader, will also be on the team. He is the founder of BrXnd.ai, co-founder of Variance and Percolate and one of the leading talents in the US MarTech space.”

- Mr Howell, Mr Bond and Mr Brier all have creative/consultancy advertising backgrounds:

- Mr Howell co-founded HHCL, the agency famous for Ronseal’s ‘It does exactly what it says on the tin’;

- Mr Bond co-founded KBP, the agency that apparently pioneered ‘viral’ marketing, and;

- Mr Brier founded BrXnd.ai, an AI-driven brand-collaboration service.

- The creative/consultancy backgrounds of the US advisory team emphasise the different sales approaches of Mr Kearon and Mr Barden.

- From what I can tell:

- Mr Kearon wishes to sell SYS1’s creative-advertising services to marketing people who develop/commission adverts, while;

- Mr Barden wishes to sell SYS1’s platform-prediction services to marketing and ‘insights’ people, as well as innovation and creative agencies. Everyone in fact.

- Which is the best strategy? The evidence to date is not clear.

- My notes from the 2019 AGM recall SYS1 struggling to convert customer ‘insights’ teams:

“[Mr Kearon] said chief marketing officers [CMOs] generally accept the benefits of the System1-style of advertising and are open to experiment. Trouble is, their Insights teams are risk-averse and wish to keep using existing suppliers/methods/data rather than throw away years of work and start again using other supplier/methods/data — even though SYS1’s services are simpler.

[Mr Kearon] claimed Insights teams typically argue for no change (i.e. an easier life) — which is good news for incumbent ad-services suppliers such as Kantar. SYS1’s chairman mentioned many large organisations suffer from “large inertia” when it comes to marketing change.

Upshot is SYS1 has to make a “compelling case” to CMOs to get them to change the habits of their Insights teams. SYS1 has previously targeted (change-resistant) Insights teams, but is now talking more directly to CMOs.“

- Maybe Mr Barden will struggle to change the habits of insights teams, too.

- But Mr Barden does have a very different sales proposition:

“We should be talking about our predictions being the best, the cheapest and the quickest, supporting all client creative and innovation processes agnostically.”

- And maybe insights teams could always employ SYS1’s services alongside their existing suppliers of marketing predictions — to double-check SYS1’s predictions are indeed the best.

- All told, SYS1’s financial performance of late suggests Mr Kearon’s sales approach has not been optimal, while Mr Barden’s short executive stint means his sales approach remains somewhat unproven.

Potential conflict of interest, director pay, staff motivation and corporate governance

- SYS1’s statement made several references to Mr Barden that did not appear justified.

- The group noted Mr Barden’s non-exec involvement with Behaviorally.

“The Company wishes to highlight Mr. Barden’s potential conflict of interest arising from his current role as Non-Executive Chair of Behaviorally, an unlisted market research platform business, that would prevent him from operating both roles concurrently in a transparently independent way.“

- But SYS1 did not seem concerned with the very same “potential conflict of interest” when Mr Barden was a SYS1 executive.

- Mr Barden became a SYS1 board executive during June 2020, was appointed chairman of Behaviourally during January 2021 and stepped down from the SYS1 board during January 2022.

- SYS1 raised the matter of Mr Barden’s pay:

“Whilst Mr. Barden has not set out his remuneration requirements for the role, the Board expects, based on his previous tenure, that these will likely be significantly higher than the existing Non-Executive Chair’s remuneration (currently a fee of £42,000 per annum with no equity participation).“

- But SYS1 overlooked the savings that would be made if founder John Kearon was demoted to a non-executive role.

- If the proposed board changes were implemented, Mr Barden could collect Mr Kearon’s £265k salary, Mr Kearon could then collect the outgoing chairman’s £42k non-exec fee (if Mr Kearon stayed on as a non-exec) while the outgoing chairman would of course collect nothing. Total board pay would therefore not change.

- Bear in mind Mr Kearon’s basic salary:

- Increased 14% during FY 2022 despite Mr Kearon having relinquished his chief executive duties to Mr Barden at the start of that year (point 5d), and;

- Increased 16% during FY 2021 despite SYS1 receiving government furlough payments and scrapping the dividend.

- Maybe Mr Kearon’s pay increases were prompted by his dividend income reducing to zero.

- Had the pre-pandemic 7.5p per share dividend been maintained, Mr Kearon’s 22% shareholding would now be paying him an extra £211k a year.

- I note Mr Kearon will seek compensation should he be voted out of his executive role:

“The Board does not understand how any additional shareholder value will be added by this requisition; indeed, they believe it can only damage shareholder value, in particular through the additional cost of terminating John Kearon’s service agreement.“

- The 2022 annual report highlights a six-month notice period, which would lead to a £132.5k pay-off based on Mr Kearon’s FY 2022 salary.

- SYS1’s statement included this somewhat unseemly remark about 53% staff-motivation levels:

“The Company measures staff motivation in a quarterly anonymous survey. Under Mr. Barden’s tenure as CEO, average staff motivation levels measured 53%. Following his departure, the average increased to 61% with John Kearon returning as CEO. Since the launch of the new strategy and James Gregory stepping into the role of CEO, staff motivation has further increased to 71%.“

- But when Mr Barden stepped down from the board, Mr Kearon gave Mr Barden this glowing testimonial:

” I would like to express the whole Company’s gratitude to Stefan for his immeasurable executive contribution over the past 18 months. Including playing a leading role implementing the new strategy centred around our Marketing Predictions platform, rebuilding our ‘back-office’ from first principles to support it, and reinforcing our Executive Team with key hires to add to our own home-grown talent, including the appointment of a chief operating officer. I’m very pleased Stefan will continue with us in his original advisory role. Thank you, Stefan.”

- Mr Barden said he did not want to “stoop to the level of these personal attacks“. But he felt he had to clarify the motivation survey, which had been “ad-hoc” before he introduced the company’s “mandatory quarterly rhythm“.

- Mr Barden disclosed the survey under his areas of responsibility had “above-average levels of satisfaction”, with “the real issue” arising “in the sales team that John Kearon controlled”, in which the newly recruited platform sales team “did not feel properly supported“.

- SYS1 cited corporate-governance guidelines as another reason to reject Mr Barden:

“The Board notes that the proposed role of Executive-Chair would breach the UK Corporate Governance Code which stipulates that a Chair should be independent on appointment, and explicitly not a former CEO of the Company. Neither the Board nor the executive leadership team see value in the hybrid role he proposes. We have a plan and a full-time CEO focused on execution and do not need an executive chair.“

- Two counter-points here:

- SYS1’s adherence to the corporate-governance code has not exactly delivered wonderful long-term returns to shareholders, and;

- Many companies that contravene corporate-governance standards can perform well, not least because their boards are led by management-owners who do not wish to fritter money away on non-essential non-execs. Examples of corp-gov contraveners in my portfolio include Andrews Sykes, FW Thorpe, Mountview Estates and S & U.

- SYS1 reckoned it could do without Mr Barden’s skillset:

“The Company is now in its next phase of commercialising the platform and has recruited a team that will make this a success. The Board does not need Mr. Barden’s operational and technology skillset for this phase of the business’s development.“

- My layman-shareholder perspective begs to differ. As I noted within my H1 2023 review, Mr Barden’s skillset quickly returned SYS1 to profit during FY 2021 following his appointment to an executive role:

“When Mr Barden was first appointed as a board executive, quarterly losses were running at £0.5m… which remarkably transformed into a £0.9m profit by the next quarter and eventually led to a £2m-plus H2 2021 profit and a better-than-expected FY 2021.

This may be very simplistic, but a pattern seems to have emerged:

* Mr Barden takes on executive board duties, and SYS1 turns from loss to profit, and;

* Mr Barden relinquishes executive board duties, and SYS1 turns from profit to loss.

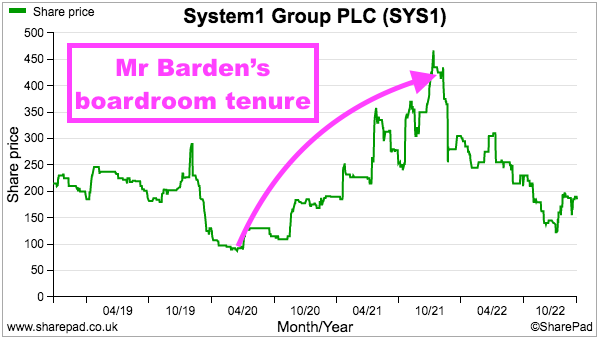

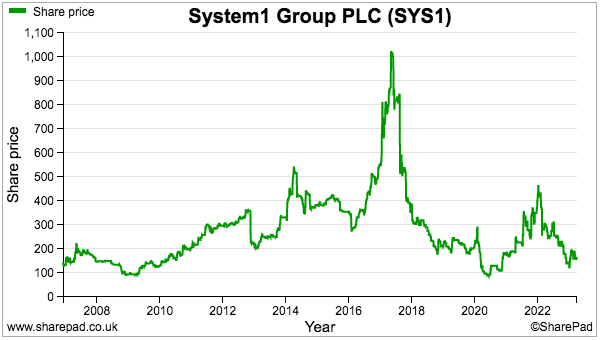

- The return to profit during Mr Barden’s boardroom tenure prompted the share price to increase from approximately 100p to more than 400p:

- SYS1’s H1 2023 results showed a £2m cash outflow and Mr Barden’s skillset looks to be required once again to stem the losses and return the group to profit (see Stefan Barden: management, employees, losses and now-or-never vote).

- Somewhat ominously I feel, SYS1’s latest statement did not mention any near-term plans to become profitable and February’s webinar provided only this response on the subject:

“We will become profitable when we move out of the current revenue range given that we’re marginally profitable today… it’s that simple.“

Verdict on Stefan Barden conversation and SYS1’s statement

- My conversation with Stefan Barden provided some missing pieces to the frustrating SYS1 investment puzzle.

- Within my H1 2023 write-up I had pondered:

* Maybe SYS1’s products are actually nothing special?

* Or maybe the products are great, but the marketing is poor? (Remember the indulgent Where the Lemons Bloom?)

- SYS1’s products and potential seem good enough .

- After all, Mr Barden bought a 6% shareholding during his time at SYS1…

- …and I doubt he would also requisition a general meeting to reshuffle the board if SYS1 had become a complete no-hoper.

- But what about SYS1’s marketing? I now believe the group’s marketing is the problem.

- Take a SYS1 email just this week, highlighting a webinar concerning what makes a great Christmas advert:

- Look through that email and there is nothing about the high accuracy, fast speed and great value of the group’s Data services.

- Even the launch of the new Test Your Ad Audio service covered the “best practices for brand building“…

- …and not how SYS1’s audio-ad predictions will be better, cheaper and faster than those of the group’s competitors.

- There has been, as Mr Barden claims, a lack of promoting SYS1 as a marketing-data supplier and too much promoting SYS1 as a service to help advert creativity…

- …which goes a long way to explain why the purported “strong scalability and operational gearing” of the Data platform have never emerged within the financials.

- Following Mr Barden’s mention, SYS1’s lack of promotion for the innovation-testing and brand-tracking operations is striking.

- I now feel I understand why SYS1 has become unprofitable:

- Too much spent on the wrong type of promotions, and;

- Too little earned from Test Your Idea and Test Your Brand.

- I welcome SYS1’s confirmation that Data revenue continues to grow while the mooted ambition of 25% annualised sales growth sounds encouraging… and may even be achievable during FY 2024 and/or FY 2025.

- But SYS1’s arguments surprisingly overlooked the outcome of the strategic review — including the greater focus on digital adverts and desire to create further partnership channels — that could have expanded upon its sales ambition.

- Nor did SYS1 talk about the prospect of near-term profitability, which feels like an obvious oversight given the recent H1 loss.

- I was disappointed many of SYS1’s arguments against Mr Barden — notably his Behaviorally chairmanship, potential pay and that 53% staff rating — did not really stand up to scrutiny.

- My H1 2023 write-up recounted a bevy of reporting niggles, a number of overlooked webinar questions and a general sense of frustration…

- …as to why SYS1 has failed to thrive long term despite offering the marketing industry “superior predictiveness… at market-beating speed and price”.

- Mr Barden did give a clear business vision:

“System1 should be the definitive decision-making platform that delivers better predictions than anyone else!”

- But I must confess his vision translating into a £100m-plus trade-sale feels very bold from where SYS1 sits now.

- Mind you, SYS1’s mooted 25% sales growth may also seem fanciful given the group’s FY 2023 revenue (an estimated £22.6m) was the lowest recorded since FY 2012.

- I believe the choice for outside shareholders boils down to this quote from Mr Barden:

“Think of it this way — what if our platform approach fails? The company can always go back to management’s current business model. But that won’t work the other way. There’s no point shareholders approaching me again a year from now and then asking for these changes, because the opportunity for System1 to become the number one will almost certainly have gone for good.“

- Stick with founder John Kearon and his advert-creativity approach, and shareholders should already understand what they can expect…

- …and Mr Barden’s platform plan most likely disappears for good.

- But support Mr Barden, and there’s an eagerness for a trade-sale at a £100m-plus within a few years…

- …plus the option of returning to the advert-creativity approach if his vision flops.

- To me at least, Mr Barden’s platform plan offers little strategic downside while his trade-sale ambition — albeit with a seemingly optimistic 5-bagger outcome — offers long-suffering shareholders hope they will eventually realise a suitable return.

- I will therefore vote FOR the proposed board changes ahead of the general meeting on 21 April.

Maynard Paton

UPDATE 17 April 2023: Further statement from Stefan Barden NEW

- Stefan Barden has provided the following statement for publication on this blog.

Stefan Barden: Response to System1 RNS issued 13 April 2023

Thank you for the opportunity to communicate with System1’s retail investors.

Our shareholder RNS seems to have became a company RNS. I do not intend to rebut the company’s points in a tit-for-tat manner, however tempting, but think it in the interests of shareholders, particularly retail investors, to have a response that keeps the debate at a constructive strategic level. My points cover:

A) A reminder about the purpose of our resolutions.

B) A summary of the key strategic choices facing System1 today.

C) A revisit of our recommendations.

D) And lastly, in an appendix, my corrections to some of the major inaccuracies/innuendo in the board’s edits/additions to our RNS.

A) What is the point of these resolutions?

We, a core group of around a third of shareholders by vote, remain focused on the result that we would like: A return on our investment (via an increased share price because the business has improved) and liquidity to take that return.

We have subsequently contacted other major shareholders, taking our total to some 55% of the votes. After discussions all were unanimously supportive and suggested/agreed that the four resolutions be put to the board in an EGM; though some might now think the board responses are adequate to no longer support these changes.

1) We understand that it is one thing to demand a share-price increase, and another to take responsibility for it. To that end, the core one-third of shareholder votes, who bought in off the back of the ‘platform’ strategy that I helped espouse, have asked me to be public with what I believe I could deliver if I led the board:

a) When I was at System1 I said we should aspire to deliver £8 to £10 per share over 2-3 years. We would do this by proving the sales potential of a new System1 and then selling to a company with a global customer network to further capitalise on this success, ensuring that some of those future synergies are shared early with today’s shareholders in the sale price (‘Focus, Prove and Sell’, the highly successful Private Equity approach to value creation).

b) We understand that some existing and new shareholders still believe in my ability to deliver this so much, that they are prepared to buy shares in the market if our resolutions are successful.

2) The board’s response has been two-fold: ‘We have the right strategy, Q4 shows this’, and ‘We need more time, all will be good’:

a) This tactical response does seem to resonate with some institutional shareholders, who may now support the board. Let’s see at the EGM.

b) My issues are more strategic. I have lost confidence with the board understanding the economics of a ‘platform’ and a ‘focus, prove and sell’ strategy. I am concerned that the board was just nodding when I promoted this 2-3 years ago and led the building of the products and back office.

c) And in any case, whether the board does or does not understand ‘platform’, the actions it is taking are returning System1 to the very BrainJuicer agency John Kearon wanted to move away from, and there seems to be zero attempt to get the business ready for a sale. Both are major valuations reducers.

3) So if at the EGM the board and its supporting shareholders carry the vote against our resolutions and continue to support current management, then I will likely exit at £4.40, the share price at the time I stepped back, such is my lack of confidence in the current board to obtain £8/£10 per share:

a) When I stepped back in December 2021, only 15 months ago, the share price was £4.40, a market cap of some £55 million.

b) Shareholders could ask why I do not sell at today’s price of circa £2.00. Well: i) even at around £2.00, there seems to be little/no liquidity for my 8% stake, and; ii) I feel that I am being artificially squeezed.

The board manages the business poorly enough to depress the share price, but not so badly that a few shareholders can still decide to add their shares to John Kearon’s 23% stake to block board changes.

c) Today, if I do not become chairman, I’m therefore inclined to wait for the £4.40, and hold management to account accordingly. The ‘global #1 platform’ shareholders will increase board pressure until either the share price rises or ever-growing shareholder frustration will lead to patience eventually running out and board changes. The board can’t offer a target share price less than our £8/£10 and not even deliver £4.40 again and expect to be left alone.

B) Clarifying the two Strategic choices

Platform business model

1) A platform business model could well deliver a £100 million market capitalisation (£8/share), £150 million market capitalisation (£12/share) or £200 million market capitalisation (£16/share).

2) These valuations are predicated on building a business that can credibly be worth £1-2 billion to a research or similar company with global customer reach. System1 must be a good, solid and scalable business. It will be subjected to very robust due diligence during any purchase. We would need to prove at least 4 points:

a) That the products are best in class for predictions, speed and lowest cost. This point is complete and I believe is a large part of my legacy from my time at System1; acknowledging of course Mark Beard, the CIO I hired from Wiggle and his excellent team for all the heavy tech lifting, and John Kearon and team for the IP and front-end design.

b) That the products are unique and good enough, and have a large enough reputation (brand) to drive demand from all market segments, so that a competent sales team can then convert. This branding should become part of the company’s ‘defensive moat’ as well as being the major source of sales leads.

c) That the products require minimal company support during usage, so that scaling is not held back by having to hire people, costs are kept to a minimum and gross margins remain in the mid-to-high 80%s. Of course there will always be support available, but this should be charged to customers incrementally as used, and focused on training them to be self-serve which should be the best, quickest and cheapest product experience.

d) That there are minimal overheads, with highly scalable cloud computing and account management increasing far less quickly as sales ramp up. A target EBITDA of over 30% and very high cash generation is quite normal.

3) This was the model I thought I had left behind when I stood back in December 2021.

Agency business model

4) Agency business models are defined by their talent (also called Professional Service business models). The value of such companies is in customer relationships and solving ad-hoc problems. This is what System1 was when it was called BrainJuicer. It is why, when John Kearon first asked me to help him create a £1 billion business (to rival YouGov), I declined, saying that culturally it would be impossible for his ‘lifestyle’ team to do.

Eventually John leaned into the issues and convinced me otherwise, enough even for me to invest both my money and my time. However, since I have stepped down I believe that the business has regressed. What has changed? Taking the points above:

5) Happily the products are mainly complete and the sub-products (Test Your Ad Audio, and so on) are all solid. However, the products must remain standard and must not be adjusted to have tailored client versions, i.e. a Coke version or a P&G version. These are demands that will be made if they are not already.

6) It is on branding and ‘creating demand’ that System1 is beginning to regress to the Agency model. Despite protestations to the contrary, the facts are that the current System1 focus is almost exclusively on advertising (the smallest market) and multinational clients (the hardest channel to crack). And the sales pitch focuses on creativity rather than platform prediction accuracy, speed and cost:

a) There are many things to improve here, and it is easy to get lost in the detail. So I point to Zappi.io as a benchmark. Arguably Zappi has a worse product but such clear marketing and sales focus that it has overtaken System1 on both revenue and reputation. In the US ‘MarTech’ press, Zappi is the assumed leader in the marketing-predictions space. System1 needs to acknowledge this issue and address it urgently and head-on. I have made these points for 3 years now, without being heeded. Hence I unfortunately do not hold out much hope for any change soon.

b) I also point to the sales focus on creativity rather than the platform per se. System1 should be selling to every agency and brand no matter what creative process(es) they like to use. The company should be creative-process agnostic rather than hanging its hat on its own unique view. The current marketing approach is, in our view, too obtuse to gain widespread traction and is also limiting in audience.

7) Built for self-service, we now understand that a full service is provided to many (all?) clients for free. (To make an analogy, having built Ryanair, System1 recruits former British Airways talent and continues to run the new business as BA). This negatively impacts scalability and profitability, and is hence a massive valuation drag.

8) And lastly, the board tells us that sales are only now made through relationships and that the most important sales tool is a Rolodex. This again underlines the lack of a strong brand or marketing of the proposition, my points above, but economically it creates a significant overhead to the business as the talent extracts its own economic rent from shareholders. This again is a large valuation drag on any exit and reduces the universe of potential buyers.

C) So what can shareholders do?

Firstly the Board has to come clean: which operating model is it following? Platform or Agency? Not in words, but by communicating its target P&L and what the scalability economics are.

1) It is disingenuous to say that the board is sticking to the platform, global #1 model and target P&L that I created, yet add in lots of extra costs and still claim that the £1 billion valuation target remains intact.

2) The business should already have a clear view of its exit Information Memorandum (IM) and be clear with shareholders and prospective purchasers today what its target P&L will look like. Incremental costs need to be clearly identified in the P&L, supported by the narrative. System1 today is clearly far more of an agency than when I left. This is not surprising due to the influx of agency personnel.

3) If the current board is clear about its financial model, then hopefully it will have a target above £4.40. Shareholders can either buy into the board’s model by buying more shares, or signal disbelief by selling (or holding). Alternatively, if the board cannot be clear then it should step back and let someone who can deliver this value do so (by for example, supporting our 4 resolutions). The board can’t have it both ways.

4) If the board is not clear then we should fear the worst. Each shareholder has to then create their own valuation model using the current P&L as a base. If shareholders are unpersuaded today about board change, this modelling might make the case.

Then shareholders choose.

5) We suggest that the decision criteria are: a) what value can be created, AND; b) how easy will it be to access. Unless the board resolves the liquidity issues (high today even for an AIM company), any upside will remain difficult to realise.

6) The choice is then in essence one of 3:

a) Shareholders support the current team, believing the strategic issues I raise are in fact minor and that the Q4 results presented last week represent a fundamental turnaround in fortune — such that Zappi will be overtaken and the global #1 platform crown will soon rest on System1’s head.

b) Shareholders support the resolutions and the minor board changes enable me to have a crack once more at the, I believe, very credible £8/£10 per share target. This will be in parallel with:

i) chairing Behaviorally LLC doing something similar and making good progress;

ii) having the experience from building the current System1 products and back office;

iii) having a good commercial track record of such transformations, and;

iv) having a reputation of building strong iconoclastic teams.

c) The middle road: Shareholders vote to support the board now, to give it the time requested, thinking that if things don’t work out then they can back me a few months from now, say at the AGM. Well, this choice may or may not work. It does however carry a lot of risk:

i) Firstly, I am retired, my personal circumstances might change and I might not be able to become chairman even if I am still interested in doing so.

ii) Secondly, Zappi is not to be underestimated. Zappi is a class act and sits on a large new cash pile. I know Zappi is hiring talent and is very active in the USA, a region which is a blind spot to System1. With Zappi under Sumeru Equity Partners, a highly competent tech-focused Private Equity fund, System1’s global #1 aspirations have a limited shelf life. Even I might balk at the #1 aspiration by September.

iii) Lastly, if I am not chairman, then I will exit as soon as I find someone able to buy my shares for a reasonable sum. Today I think that price is £4.40, but I reserve the right to change my mind depending on what other investment opportunities are available to me. Without an investment I will not be interested in System1. It is quite small after all.

7) My obligations: I understand that a substantial minority of shareholders have bought off the back of the #1 platform strategy and £100 million to £125 million valuation that the board espoused when I was part of it. And I believe that I have done the decent thing by offering to deliver this upside with these resolutions.

However, we are a democracy and if the majority* of shareholders prefer to back the current board then I have fulfilled all of my obligations. (*This includes John’s 23%. So, as pointed out to me, in fact a minority of other shareholders could maintain the status quo – but that is for other shareholders to worry about, I will have done what I could).

8) I await the vote with interest. I am at the service of the shareholders, as chairman if it is their will, or as a free man otherwise.

END

D) APPENDIX: Response to some of the company’s RNS points

Though tempting I do not intend to rebut errors made by the board in the RNS issued on 13 April 2023. But I must set the record straight on a few general points:

Firstly, some shareholders have talked about the messiness and personalisation of the process. We agree, but it is the board that determines the process and its tone.

1) The board has made it very difficult/impossible to talk to retail investors without censorship:

a) The board told us we were allowed one RNS, which could only go through the company.

b) When James Geddes and I did give the company a few paragraphs (linking to Maynard’s blog), our text was topped and tailed substantially.

c) In our view we think this was unprofessional. I personally had to read the RNS twice to find our few paragraphs.

d) It would have been more professional for the board to send out a separate RNS of its own, but so be it.

Secondly, the board’s responses to Maynard’s blog contain a significant number of inaccuracies and innuendo. I correct a few below.

2) The board implies that I was working actively with System1 since mid 2017 until March 2020. In fact my active participation was from late 2018, when I bought shares and joined the board as an observer. I stepped back in December 2021. During this time:

a) I oversaw the building of the product platform, stepping in at short notice when the internal team failed to deliver an important externally announced launch. I hired Mark Beard and was interim (and part-time) CIO while Mark worked his 6-month notice period. For the remaining period I facilitated the business/tech interface as the agency learnt to work with tech (i.e. things can’t be constantly changed on a whim and what is built is built, so needs thinking through and documenting before coding).

b) With Mark in place I took over as interim (and part-time) COO and joined the board proper in April 2020 as Covid hit, and steered the business through this period. The company states that it takes time to impact a P&L, but this is not true when controlling costs. We went from loss making to profitability immediately due to my leadership; again taking nothing away from the Executive team that did the hard work.

c) With the back office in a good place, I then took over as interim (and part-time) CEO, but still leaving the front-end marketing and sales to John Kearon, so creating the space to hire a CEO designate into the COO role; James Gregory.

d) I stepped back very amicably and happily in December 2021, genuinely thinking my job had been done and that the business would continue to grow steadily in value. I was wrong. I believe that the move to Agency, well documented above, and lack of engaging in marketing the business for sale, are now major valuation drags for shareholders.

e) For the record, during 2017, I had a number of paid but ad-hoc consultancy conversations with John Kearon explaining why, after some analysis, I believed that his desire to get to £1 billion valuation would be near impossible for the ‘lifestyle’ agency that he ran and, also that as far as I could see, the £10 share price he then enjoyed was not supported by published fundamentals.

The £10 share price should have been, at least in my view, closer to £2. I warned John Kearon that he would likely have very disgruntled shareholders when the share price discovered economic gravity once again. It is disingenuous that the board implies I was responsible for the £10 share price when I was warning of its unsustainability and my predicted valuation became true.

3) The board quibbles about whether System1 is a platform or an agency. I hope I have put that to bed above. The board says platform (keeping my words and even charts from 2-3 years ago) but acts agency. Key for the board is to publish its target P&L and explain the impact of scale on it as we move from today to that target. The board should also acknowledge the value of being the global #1 platform vs #2, #3 or lower. The board would publish its target P&L today if it was serious about an exit in 1-3 years. The target P&L is vital valuation information. If credible, then it should also quickly improve today’s share price, relieving pressure on the board. So win-win I believe. Why is this not happening?

4) The board agrees that this issue is not about personalities, then talks about our proposal being to change 3 people for 1. Just so there is no confusion, we propose to change 2 for 2:

a) We propose changing the chairman (1 for 1).

b) We propose moving John Kearon to non-exec director to allow new talent to join the business (no change in number).

c) We propose asking a UK-based non-exec director to step down to be replaced by a USA-based non-exec director (1 for 1).

d) No Executives are changed, and control is not taken of the board. All Takeover Panel rules are observed. This is not a concert party.

5) The board talks about percentage sales gains on many products, implying that everything is going well. We welcome the progress; we just note that System1 continues to fall behind competitors on a relative basis. A strategic issue is once again responded to at a tactical level in a rhetorical sleight of hand:

a) The attentive reader will note that the board states: “The winner-takes-all hypothesis may or may not be right“. We, the shareholders supporting the ‘global #1’ strategy, are deeply concerned that the board: i) is walking away from the global #1 position and; ii) lacks the understanding of a true, global #1, valuation (as we assume the board would not want to walk away from this valuation if it did understand).

b) Then, even if accepted at a tactical level, it is important to understand what these gains are in monetary values and customer numbers. Many of these gains are very, very small in absolute terms, so percentages are disingenuous.

c) And lastly within the monetary values, the board needs to clarify the impact of price rises (we understand there have been 50% price increases), favourable foreign-exchange movements and favourable accounting changes.

6) While the board talks up the disruption of the board changes on the executive team, I maintain I have good relationships with everyone that I have hired and indeed mentored in the business. I have no plans to exit anyone. If I become chairman we will course-correct back to the valuable platform that global research players would like to buy. Team composition, within the cash constraints available, will be decisions for James [Gregory] and Chris [Willford] to decide.

APPENDIX END

UPDATE 21 April 2023: Stefan Barden statement at the General Meeting

- Stefan Barden attended the General Meeting on 21 April 2023 and made the following statement:

Stefan Barden Statement and Questions for Rupert Howell, Chairman

Thank you for arranging this Extraordinary General Meeting and allowing shareholders to express their views on performance over the last year.

I’m sure many, if not all, shareholders also welcome the uptick in Quarter 4 performance, shared in the last fortnight, and we note Management’s assertion that this is a turning point to continued steady growth. We also note the 25% annual growth aspiration, albeit the caution that this is not a forecast.

We understand that these results, and the board’s request to shareholders for a pause on any board changes for a quarter or two until a trend can be discerned, has gained the board some time, and our resolutions will not pass today.

We want to acknowledge the positive change since we began speaking with you over the last six to nine months, a good start. But there does remain much work for the board to do.

We remind the board that when we first approached them about today’s resolutions I had been encouraged to become involved by around one third of the shareholders. And after further conversations subsequently had the unanimous backing from further major investors, indeed everyone that we contacted, taking support in total to over 55% of shares. This represents widespread dissatisfaction.

The dissatisfaction is because, having built what we all believe are world-beating products, they are not being commercialised to achieve this potential. In addition the board has continued to ignore the issue of the illiquidity in System1 shares, illiquid even for an AIM-traded company. These fundamental issues — growth and liquidity — still need resolving by the board. Post today, please do not relax and ignore them.

It is also important that the board further clarifies its position on certain economic fundamentals to improve shareholder transparency about the basic economics of the business, which will result in better shareholder financial modelling, and ultimately impact the share price: With all this potential, there should be large upsides.

In order to be constructive and help the board clarify its position on some of these points, I would like Rupert, as chairman, to comment on the following assertions which underpinned the $1bn aspiration that we espoused when I was on the board. If you disagree on any Rupert then I ask you to explain to shareholders how the $1bn valuation has changed and what it has become instead.

I will outline the valuation thesis first then ask the specific questions.

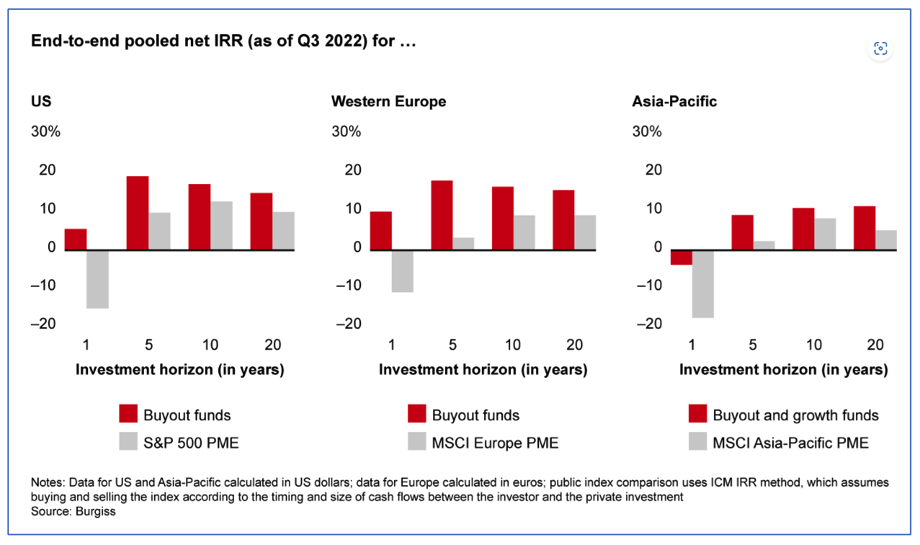

1) The asset class that continually gives shareholders the best returns, over every time period and in every geography is Private Equity.* Private Equity delivers average returns some 5% more than listed markets. Consistently. This is an enormous out-performance and is rarely available to retail investors or indeed the AIM market.

2) This Private Equity outperformance is driven in large part by it’s focus on 5 year projects (+/- 2 years) which focus value creation by:

a) Externally and publicly valuing performance at the end of each project, and hence providing laser focus on whatever plan the owners have announced between these valuations.

b) Thereby allowing resources, talent and financial ownership to be adjusted and optimised for each of these 5 year projects (+/- 2 years).

c) Incentives for all stakeholders are aligned by equitably sharing project gains at these valuation points between management and colleagues, customers, shareholders, and indeed all stakeholders:

i) Management gain reputationally but also in their Long Term Incentive Plans;

ii) Customers gain with best-in-class products and services, constantly challenging the industry status-quo for their benefit, and;

iii) Shareholders, albeit the last to gain, they receive a outsize return on their invested risk capital, on average +5% over investing in capital markets.

3) Today, a common and successful Private Equity strategy is to create and build Platforms. Driven by technology and other societal changes, there are tens, if not hundreds, of Platforms emerging in every industry. Those companies developing these platforms will be tomorrow’s winners. Indeed there are so many opportunities that there are large, multi-billion, Private Equity funds that only invest behind Platforms.

4) The Market Research industry is a laggard in Platform development. It remains highly ad-hoc, relationship and agency/talent focused, for a variety of well understood reasons. But the first Platforms are emerging. For example, I chair Behaviorally LLC, a non-competing, USA-based research firm, where I support the team led by Alex Hunt who is creating much value by leaning into this Platform opportunity. As Behaviorally is owned by a single Private Investor, I suspect its progress will become public at some time in the future, and if so then at that time it will become a good comparison for System1. I also work with investment advisors and, being a good pupil, believe that I understand today’s Market Research industry layout relatively well. By the way, System1 Group plc is on nobody’s industry chart! Not yet at least. (System1 LLC is of course there). I look to the System1 board and ask it not to take this as personal criticism but as a valuation and liquidity opportunity.

System1 Group plc, could and should become the global #1 platform for making best-in-class advertising, innovation and brand-tracking predictions: More predictable, and quicker, and cheaper than any other competitor. This is what John Kearon explained he wanted to happen when he persuaded me to invest my time and money in his company. Other investors have put money into System1 Group plc behind this vision, too.

5) The market-leading products are created, but the issue does remain the marketing, sales conversion, and indeed the overall proposition. Today the company needs to do better in attacking this global #1 opportunity and deter other competitors from taking it. The Q4 results are perhaps the proverbial ‘swallow’. Let’s hope that we see a ‘spring’ with 25% annual growth over the next quarters!

6) For example Zappi can reasonably claim the crown to this prediction platform leadership role. Zappi is growing fast and has recently raised $170m to fund growth. Arguably Zappi has an inferior product, but a laser focussed commercial team and board, are now under Private Equity ownership. If the board is not careful Zappi’s small lead today will quickly grow.

7) To this end, shareholders need to know whether the System1 board is focusing the company fully on this global #1 platform opportunity head-on or not. There is no middle way. Future valuations diverge enormously depending on the answer.

So my specific questions are as follows. I will share them all first Rupert, then feel free to answer as you see fit.

Rupert:

1) Private Equity: Do you agree that one of the most valuable economic plays today is creating valuable Platforms: An upside opportunity rarely available to AIM investors, making System1 a unique investment opportunity for them.

2) Platform: Do you accept that the Platform winners in the Market Research industry are yet to be decided, albeit the contenders are now visible.

3) System1 aspiration: Can you confirm that under this board, System1 is 100% committed to being one of these platform contenders and still aspires to be the global #1 platform for advertising, innovation and brand-tracking predictions?

4) Competition: Who do you see as System1’s main competitor? If it is not Zappi why not?

5) Zappi: In the USA at least, Zappi seems to be touted as the emerging marketing prediction platform winner. How is System1 going to react?

6) Valuation: As a result, and you might want to pass this to Chris, if successful, how much could System1 be worth in say 2 to 3 years time?

a) If you can’t give a valuation what would the shape of the P&L be? For example, your 25% CAGR sales growth aspiration is a doubling in sales every 3 years. What is the associated cost structure?

*Appendix:

Assertion 1: Private Equity beats stock-market returns (hence is best performing asset class in world). See chart below. Source: Bain consulting/Burgiss

UPDATE 21 April 2023: My statement at the General Meeting

- I attended the General Meeting on 21 April 2023 and made the following statement:

Maynard Paton (shareholder)

Thank you Chairman for allowing this statement.

There has been lots of comment about the pros and cons of these resolutions, but I have always believed actions speak louder than words when investing — and voting.

I am a retail shareholder and have held System1 shares for seven years. I have voted FOR all the resolutions and make the following points to explain why:

1) The Circular said the company is now “starting to deliver ambitious growth plans” following a “thorough Strategic Review“.

I would venture the review — and subsequent improvement in trading — has emerged only following the engagement of frustrated shareholders.

I fear that without the actions of Mr Barden and other shareholders holding the board to account, shareholders generally would be in an even worse position than they are in right now.

Rather than simply hope Mr Barden and other shareholders continue to hold the board to account to ensure the company performs, it makes sense for me to just vote for Mr Barden to take charge, and let him get on with running the company his way.

2) It was Mr Kearon who approached and recruited Mr Barden to implement his vision of transforming the old BrainJuicer into the ‘YouGov of marketing data’.

By appointing Mr Barden as chief executive, Mr Kearon effectively admitted he could not lead the transformation himself. After Mr Barden left System1, the company’s performance has been poor.

Clearly Mr Kearon has struggled to continue the transformation, and it seems obvious to me Mr Kearon should just let Mr Barden finish the transformation he was asked to start in the first place.

3) I am sure these resolutions have caused friction between the board and shareholders. And I very much doubt Mr Barden has gone to all the trouble of requesting this meeting just for fun.

So Mr Barden proposing these resolutions must mean — at least to me — that System1’s potential is very significant. Otherwise, why would he go to all the trouble of requesting this meeting and proposing these resolutions?

We can all talk about the different business strategies. But actions do speak louder than words, and the actions of Mr Barden proposing these changes — after having acquired a 6% shareholding — are talking loud and clear to me.

4) On the subject of shareholdings, the Circular said: “the executive leadership team is unambiguous in their support for the Company’s strategy“.

That unambiguous support is not however reflected by the leadership team’s financial conviction to the company.

Beyond Mr Kearon, the board’s shareholdings are pitiful and even as a retail investor I own more shares than the chairman, more than the chief executive, more than the finance director and more than the three other non-executives.

Contrast the board’s small share-buying actions to that of Mr Barden, who acquired a 6% stake — and he even acquired some shares from Mr Kearon.

Simply put, Mr Barden has shown much greater financial conviction to this business — and him ‘putting his money where his mouth is’ — gets my support.

5) I note Mr Barden has put on record his ambition to sell System1 within 3 years at a valuation of £100 million or more.

In response, the board said last week it “shares Mr Barden’s view of the potential future value of the Company.”

Go back to the Circular though, and there is no mention of the potential future value of the company, nor of likely M&A, nor even of the 1 billion market cap ambition the company has touted — on and off — for the last few years.

In retrospect, the Circular was a golden opportunity for the board to expand on its claim that: “System1 could be worth a billion-plus once it has fully scaled with a 10% market share“.

The board’s lack of action to explain this billion-plus valuation suggests this ambition is for marketing purposes only.

While I recognise Mr Barden’s exit plan is not guaranteed, his apparent eagerness for a sale at a healthy premium looks very attractive to outside shareholders in comparison to the board’s vague action.

6) I have wondered whether the board’s actions on pay are in keeping with the mood of outside shareholders.

I note Mr Kearon’s basic pay was increased by 33% during the two years ending March 2022.