30 April 2021

By Maynard Paton

Results summary for M Winkworth (WINK):

- A revitalised property market led to a much stronger H2, with management optimism underlined by a record dividend for Q1 2021.

- Impressive market-share gains continue to be won from London rival Foxtons.

- Early contributions from in-house branches are encouraging, with implied returns on investment of 38%.

- The accounts remain in good order with net cash, respectable margins, positive cash flow and satisfactory returns on equity.

- A possible P/E of 11-14 and a potential 5% income may offer upside should buoyant trading convert into much higher earnings. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own WINK

- Results summary

- Revenue, profit and dividend

- Franchisee sales and lettings income

- Winkworth versus Foxtons

- Corporate-owned offices

- Financials

- Valuation

Event links, share data and disclosure

Events: Final results and annual report for the twelve months to 31 December 2020 published 08 April 2021, and Q1/special dividend announced 14 April 2021

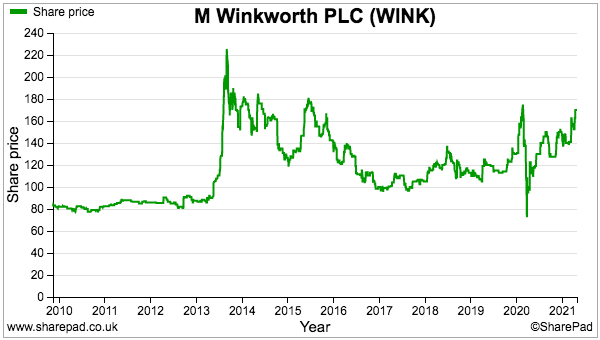

Price: 170p

Shares in issue: 12,733,238

Market capitalisation: £21.6m

Disclosure: Maynard owns shares in M Winkworth. This blog post contains SharePad affiliate links.

Why I own WINK

- Operates a London estate-agency franchising business, with progress buoyed by motivated franchisee owners capturing market share from conventional rivals.

- Franchisor set-up leads to high margins, low capital requirements and a cash-rich balance sheet able to fund attractive franchisee investments.

- Seasoned family management boasts £10m/47% shareholding and rewards investors through durable quarterly dividends.

Further reading: My WINK Buy report | All my WINK posts | WINK website

Results summary

Revenue, profit and dividend

- The following commentary within September’s interim results…

“Since the ending of lockdown, we have seen a significant uplift in activity in the sales market, with pent-up demand being combined with new movers entering the market, looking for a change in their living environment following enforced time at home.

This has been further fuelled by the raising of the stamp duty threshold, and since the start of the second half we have seen the highest weekly number of applicants in five years registering, viewing and agreeing sales. With the stamp duty cut remaining in place until March 2021, we anticipate that this surge in demand will be maintained through H2 2020.”

- …had already heralded a much stronger finish to the year following the lockdown-disrupted first half.

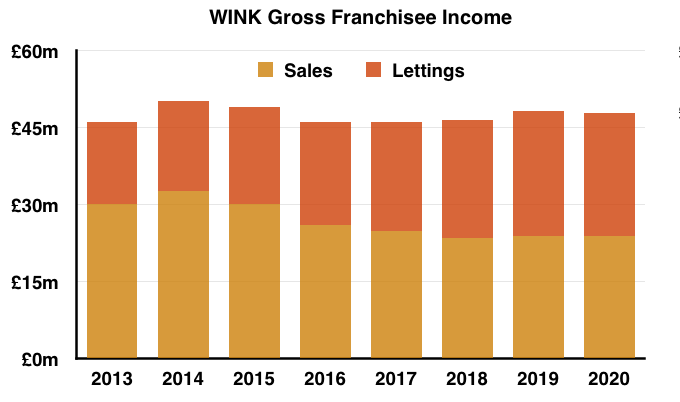

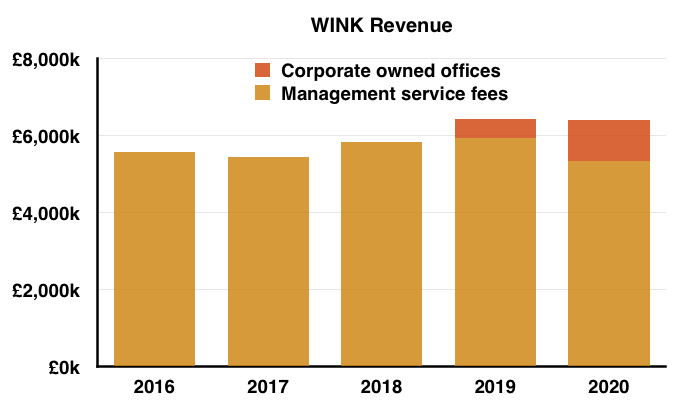

- For the full year, revenue remained flat at £6.4m while operating profit fell 12% to £1.3m:

| Year to 31 December | 2016* | 2017* | 2018* | 2019 | 2020 |

| Gross Franchisee Income (£k) | 46,120 | 46,200 | 46,500 | 48,300 | 47,700 |

| Revenue (£k) | 5,566 | 5,423 | 5,979 | 6,416 | 6,406 |

| Operating profit (£k) | 1,346 | 1,302 | 1,369 | 1,535 | 1,348 |

| Net finance income (£k) | 71 | 74 | 83 | 25 | 17 |

| Other items (£k) | - | - | - | 68 | 167 |

| Pre-tax profit (£k) | 1,417 | 1,376 | 1,452 | 1,628 | 1,532 |

| Earnings per share (p) | 8.84 | 8.66 | 9.14 | 10.09 | 9.18 |

| Dividend per share (p) | 7.20 | 7.25 | 7.45 | 7.80 | 6.68 |

| Return of capital per share (p) | - | - | 9.00 | - | - |

(*unadjusted for intangible restatement)

- But the H2 performance was on a par with H2 2019:

| H1 2019 | H2 2019 | FY 2019 | H1 2020 | H2 2020 | FY 2020 | ||

| Revenue | |||||||

| Management service fees (£k) | 2,648 | 3,270 | 5,918 | 2,192 | 3,131 | 5,323 | |

| Corporate-owned offices (£k) | - | 498 | 498 | 352 | 731 | 1,083 | |

| 2,648 | 3,689 | 6,416 | 2,544 | 3,862 | 6,406 | ||

| Operating profit (£k) | 562 | 973 | 1,535 | 354 | 994 | 1,348 |

- H2 revenue of close to £3.9m was in fact WINK’s best-ever top-line performance for any H1 or H2.

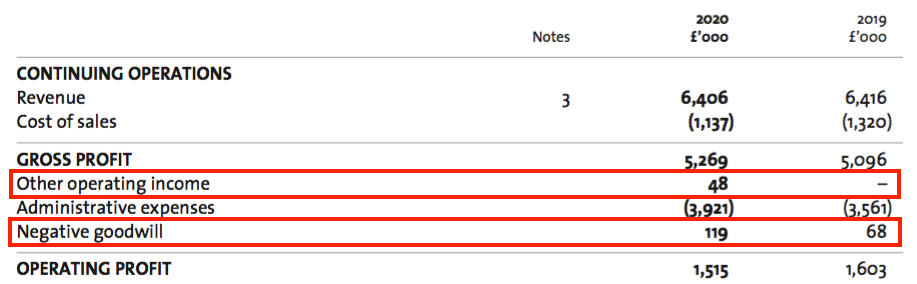

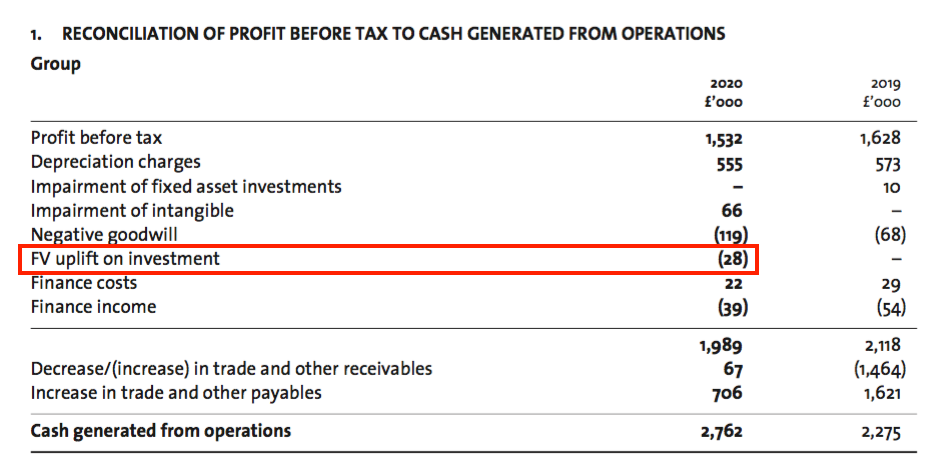

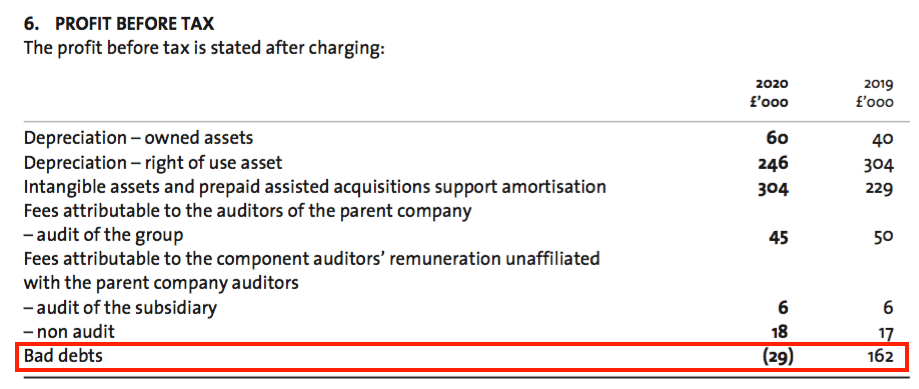

- A number of minor matters influenced the reported progress:

- A full twelve-month contribution from a group franchisee purchased during FY 2019 (see Corporate-owned offices);

- Government furlough benefits of £48k (all since repaid);

- Fair-value investment gains of £28k (see Financials), and;

- Bad-debt reversals of £29k (see Financials).

- According to WINK, the pandemic did not prompt property vendors and landlords to suddenly desert conventional estate agents for online-only rivals.

- On the contrary, management claimed the group’s “high street presence” assisted the H2 recovery:

“During both the first and second lockdowns, the benefit of our outlets being in key locations was once again proven. Our local experience meant that we were able to perform valuations remotely and it was noticeable that, on the lifting of lockdown, our clients were delighted to meet us in a controlled environment. We believe that this relationship helped to power our recovery, which confirms our confidence in Winkworth’s high street presence.”

- WINK has long been sceptical of online agencies (“digital experiments”), and this annual statement confirmed the group would not develop “remote working“.

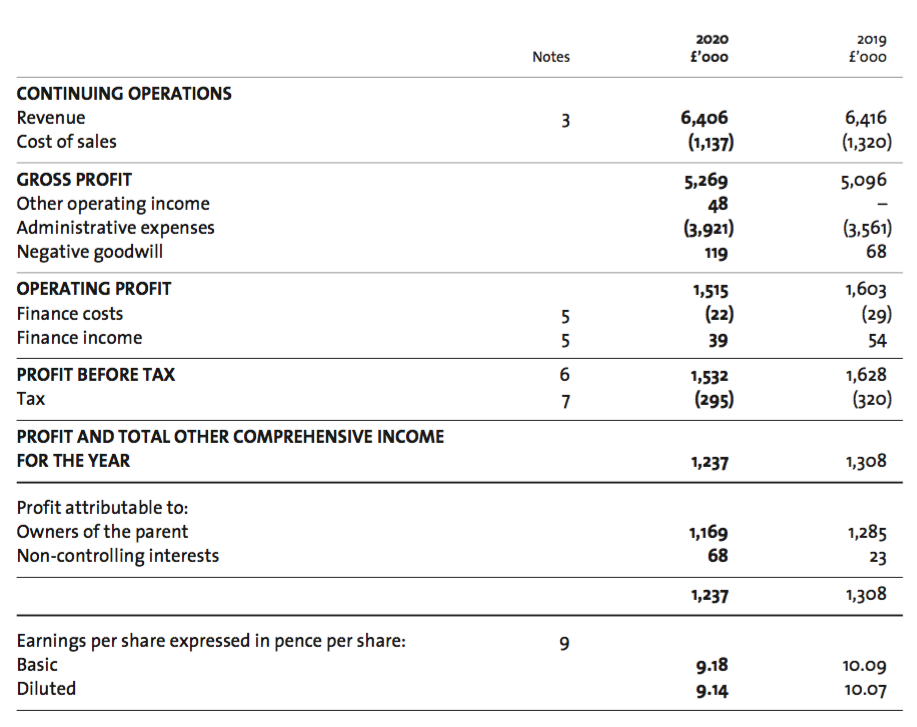

- WINK’s dividend declarations during October and January had already signalled a 6.68p per share payout for FY 2020 — down 14% on FY 2019 and the first dividend cut following the group’s 2009 flotation:

- But a week after these FY 2020 results, WINK declared a record 2.2p per share payout for Q1 2021 — alongside a 1.3p per share special dividend.

- These latest dividend declarations plus upbeat management remarks on current trading bode very well for FY 2021 (see Valuation).

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Franchisee sales and lettings income

- WINK’s franchisee network consists of approximately 100 estate-agency branches located in London or south-east England.

- Franchisees pay WINK a straight 8% of all their sales and letting commissions, plus variable sums towards advertising, IT, landlord/tenant introductions and other services.

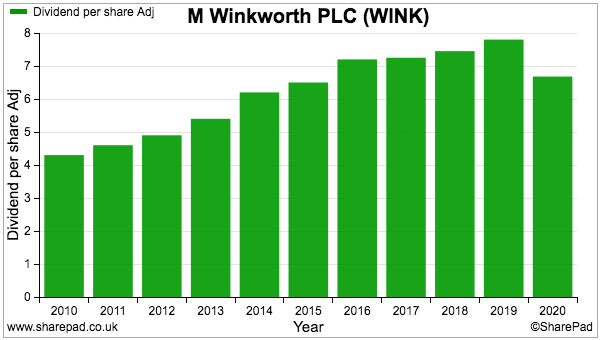

- WINK has generally taken a total cut of between 11% and 12% of aggregate franchisee income:

- The proportion for FY 2020 was 11.3% — the lowest since 2014 — after WINK made a (commendable) “conscious decision to reduce certain fees to franchisees during lockdown“.

- Approximately 80% of WINK’s income is dependent on franchisees operating within London.

- Brexit and certain taxation changes have kept a lid on the capital’s property market since 2016.

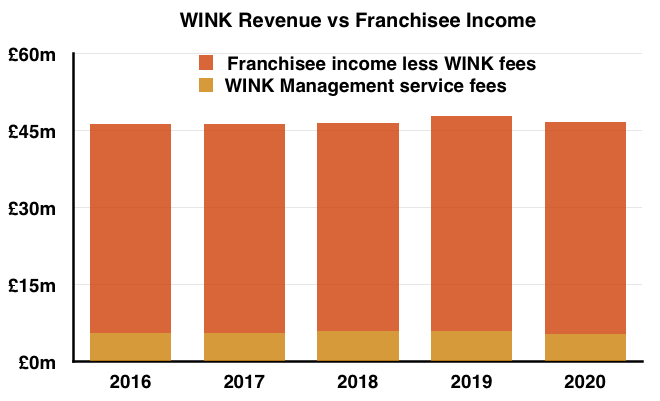

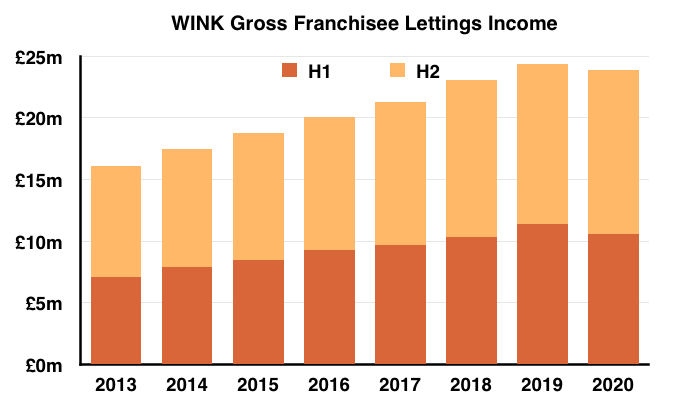

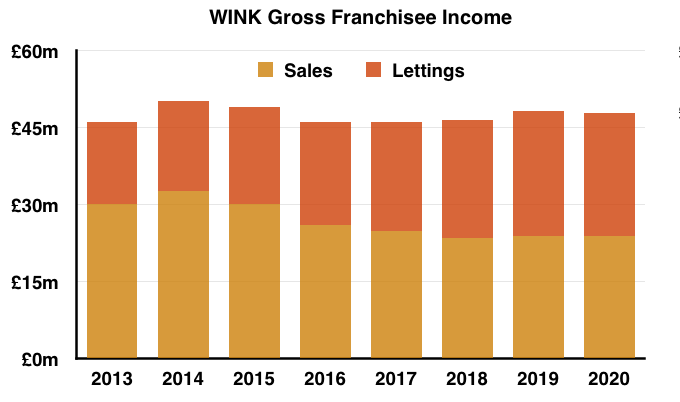

- As such, total gross income earned by WINK’s franchisees has been stuck just below £50m for the last few years:

- Income from franchisee lettings has advanced over time, and presently matches the income generated from selling properties.

- Income from franchisee lettings dipped a fraction during FY 2020 due to fewer travellers and students renting in London:

- However, income from franchisee property sales for the year was bolstered by the best H2 property-sales performance since 2015:

Winkworth versus Foxtons

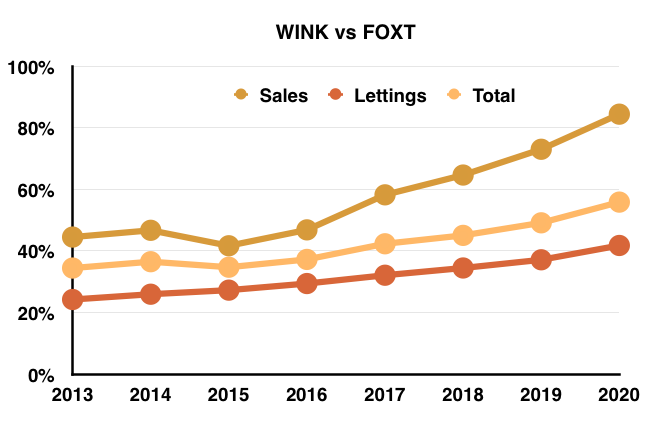

- WINK continues to gain market share:

“We further improved our strong position in the marketplace and ranked 2nd in London with a market share of 4.53%, having increased our share of SSTC properties in 2020 by 0.35% [Source: TwentyCI]”.

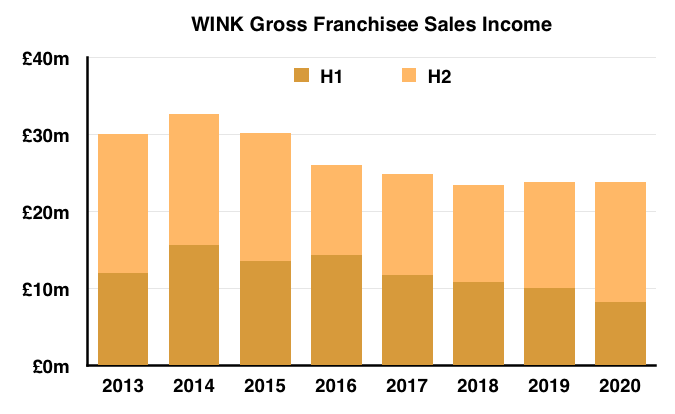

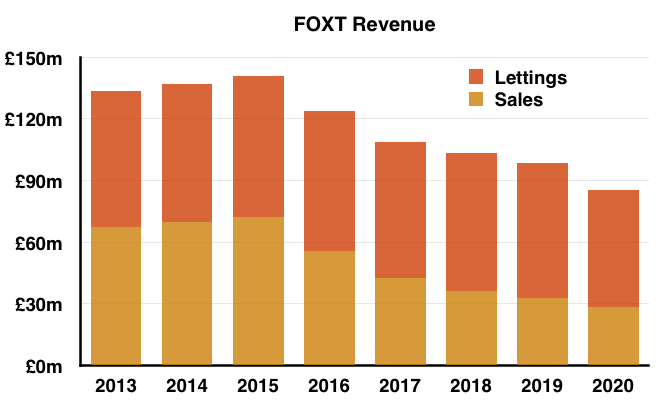

- A comparison with Foxtons (FOXT) shows WINK consistently outperforming this London rival during the last few years.

- While WINK’s total franchisee income has remained broadly flat…

- …aggregate sales and lettings revenue at FOXT has slumped 40% since 2015:

- Between 2013 and 2016, WINK’s total franchisee income represented approximately 36% of FOXT’s sales and lettings revenue (middle line below):

- That 36% proportion has since increased to 56%.

- WINK’s gross franchisee income from property sales has surged from 45% to 84% of FOXT’s sales revenue.

- WINK’s gross franchisee income from lettings has climbed from 24% to 42% of FOXT’s lettings revenue.

- Importantly, H2 2020 witnessed a significant relative improvement for property sales versus FOXT. WINK’s franchisee income from property sales of £15.6m during H2 represented an astonishing 91% of FOXT’s £17.1m equivalent.

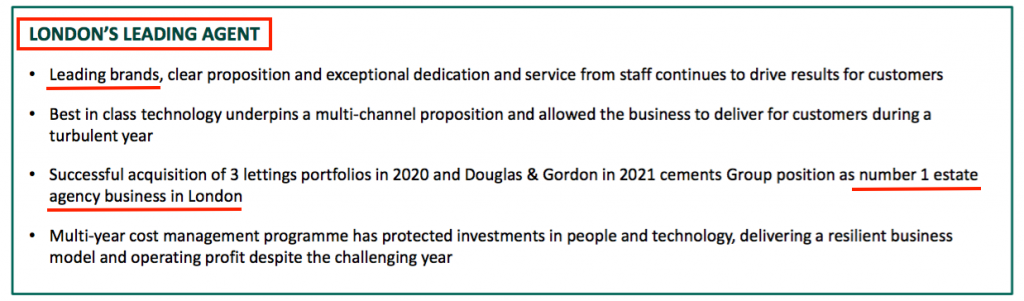

- FOXT claims to be “London’s leading agent”…

- But if WINK continues to gain market share, FOXT may lose its leadership.

- Note that the FOXT comparison is not strictly like-for-like, as FOXT generates almost all of its revenue from branches within London while WINK generates approximately 80%.

- Nevertheless, WINK’s self-employed franchisees appear to have handled London’s standstill/lockdown/rebounding property market far better than FOXT’s conventional employees.

- Note also that FOXT might be heading for a shake-up and could one day recapture its lost market share.

- FOXT’s poor progress has attracted activist attention from property veteran Robin Paterson, who runs Catalist Partners.

- Articles from Property Industry Eye and Estate Agent Today explain Mr Paterson’s frustration with FOXT.

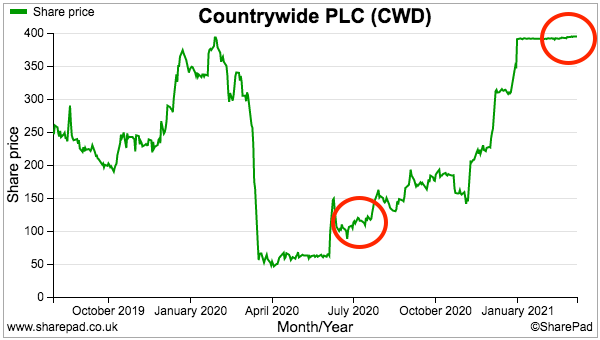

- Mr Paterson has good form with estate-agency shares.

- His Catalist vehicle bought 10% of Countrywide (first buy, last buy) during July 2020 at approximately 100p.

- A cash takeover then gave Mr Paterson a near four-fold return within ten months:

Quality UK investment discussion at Quidisq. Visit forum.

Corporate-owned offices

- WINK purchased 55% of Tooting Estates for £23k and a £92k loan during FY 2019.

- Tooting Estates operates the WINK franchise in Tooting, London, and the purchase heralded WINK’s return to controlling agency branches.

- The FY 2019 results said the transaction would lead to greater ‘front line’ insight:

“The acquisition of Tooting Estates… will keep Winkworth in touch with and learning from front-end experiences and industry trends. It will also provide a live platform to test and develop future digital initiative and evolve our centralised CRM systems, which will be of benefit to all our franchisees.”

- This FY 2020 statement confirmed WINK had taken control of its Crystal Palace office in London after the franchisee declined to renew the franchise agreement.

- No payment was made to take control of the Crystal Palace office.

- The Tooting and Crystal Palace transactions suggest WINK is embarking on some sort of hybrid franchisor-owner strategy. WINK said:

“As we pursue the strategy of backing talented operators, and where appropriate taking an equity position to deliver more than the 8% franchise return, in 2020 we took a second step by investing in the Crystal Palace office.

Having mapped target markets and identified individuals who we believe can make a significant contribution to our business, we have further developments in the pipeline. We will incentivise these individuals with the prospect of earning equity in the office or offices that they manage.“

- I have always considered the main attraction to WINK’s franchising business to be the relative simplicity of collecting the 8% commissions, while leaving the franchisees to do all the hard work with property vendors, landlords, and so on.

- But perhaps co-owning branches may attract talented agents who are not yet ready to become full-on franchisees.

- The early contributions from the Tooting and Crystal Palace offices are certainly encouraging.

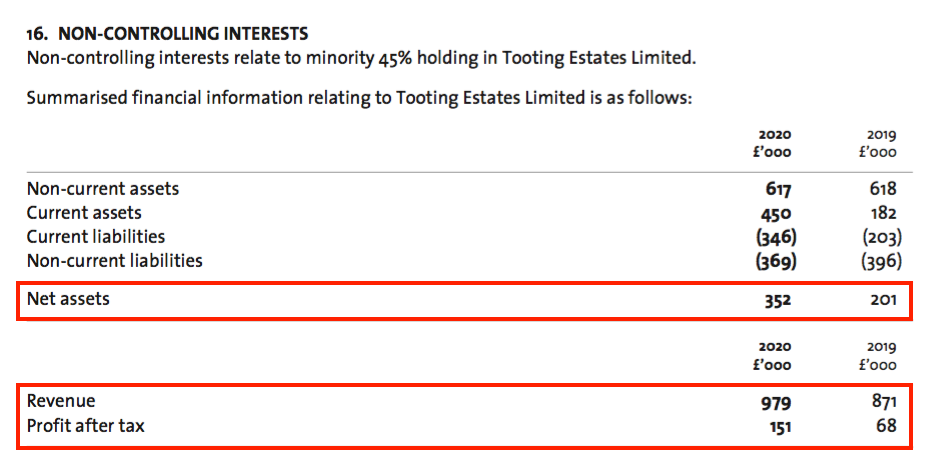

- The 2020 annual report shows Tooting delivering a £151k profit:

- WINK’s 55% share of £151k comes to £83k.

- Yearly earnings of £83k from an initial £23k investment and £92k loan seems very impressive.

- Tooting’s £151k profit was produced from net assets of £352k, equivalent to a super 43% return on equity.

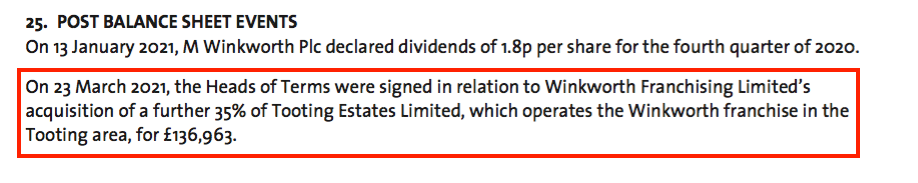

- The 2020 annual report revealed WINK plans to purchase a further 35% of Tooting for £137k:

- 35% of £151k is £53k, and would give an attractive 38% return on the £137k investment should Tooting sustain its profitability.

- Tooting generated total sales of £979k during FY 2020, which as a franchise would have earned WINK revenue of up to approximately £120k.

- Tooting’s £151k profit therefore suggests more money could be earned owning this branch than through collecting the franchising commissions.

- The Tooting sums would be even better if the branch’s H2 performance was annualised.

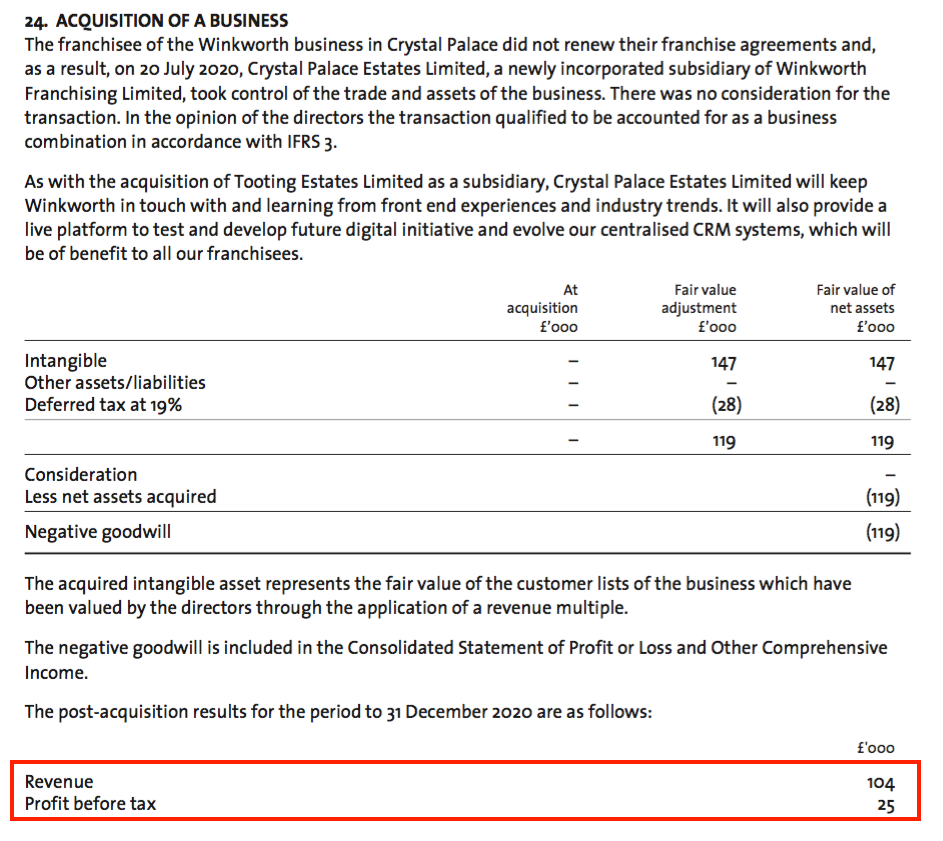

- The 2020 annual report showed the Crystal Palace office contributing revenue of £104k and profit of £25k:

- As a franchise, Crystal Palace would have earned WINK revenue of up to approximately £12k from branch income of £104k.

- The decision to take control of Crystal Palace and instead earn the £25k profit does therefore seem the better outcome — at least for FY 2020.

- Corporate-owned offices represented 17% of WINK’s total revenue for FY 2020:

- Tooting’s £151k profit would have represented 12% of reported FY 2020 earnings had WINK owned 100% of the branch.

- Longer term, WINK must ensure its corporate-owned offices do not underperform their franchisee counterparts.

- Events at FOXT show how employee estate agents may not be as productive as self-employed competitors during tougher market conditions.

- The risk of lower productivity is mitigated somewhat by lowly valuations. The forthcoming £137k Tooting investment was agreed at an effective P/E of less than 3.

Financials

- WINK’s balance sheet should have no difficulties funding further Tooting-type investments.

- Year-end cash of £4.7m was supported by much improved cash generation during H2 versus H1.

- For the full year, earnings of £1.2m plus a favourable £0.8m working-capital movement funded dividends of £0.9m and added £1.1m to the cash position:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Operating profit (£k) | 1,346 | 1,302 | 1,369 | 1,535 | 1,348 |

| Depreciation and amortisation (£k) | 368 | 246 | 270 | 288* | 308* |

| Net capital expenditure (£k) | (250) | (247) | (189) | (277) | (241) |

| Working-capital movement (£k) | (145) | 567 | (56) | 157 | 773 |

| Net cash and investments (£k) | 2,979 | 3,586 | 2,988 | 3,614 | 4,732 |

(*excludes IFRS 16 depreciation)

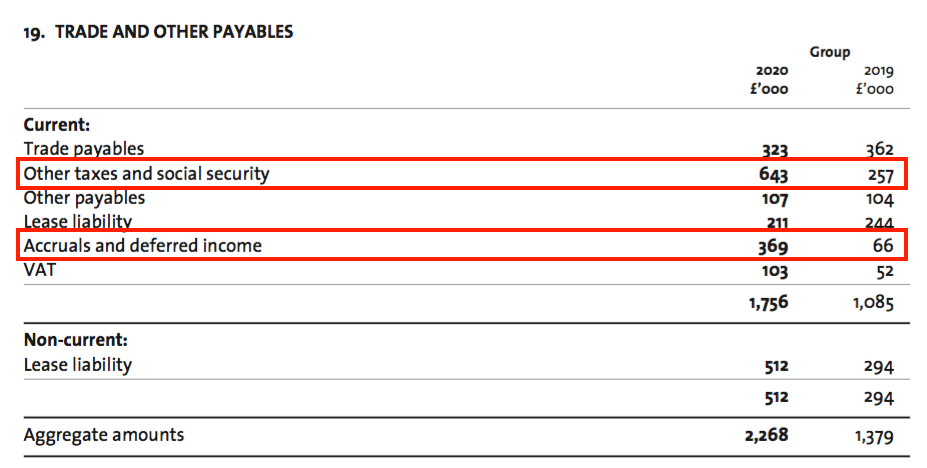

- The positive FY 2020 working-capital movement related mostly to owing an extra £0.7m of tax and expenses:

- The £4.7m cash position may therefore be flattered a little by these deferred payments.

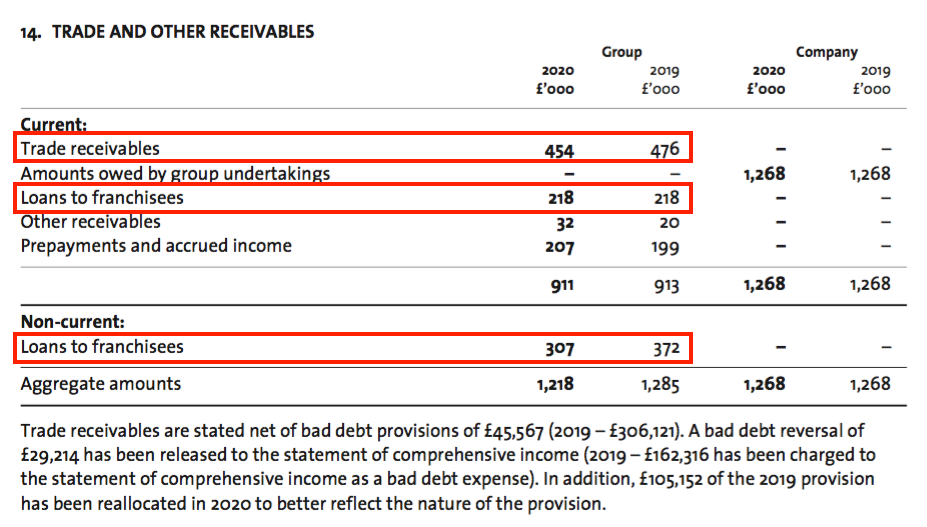

- Trade receivables of £454k continue to represent a modest 7% of revenue and suggest the franchisees are generally quite timely when settling invoices:

- Mind you, FY 2019 included a significant £162k bad-debt expense — so not all franchisees pay all of their invoices.

- Receivables include start-up loans to franchisees of £525k. The books also carry quoted investments valued at £71k.

- Conventional bank debt and pension obligations remain at zero.

- Net cash and investments are therefore £5.3m or 41p per share.

- Expenditure on tangible assets and capitalised website costs remain covered by the combined depreciation and amortisation charged against earnings.

- The accounts contained various entries that bolstered reported profit:

- Other operating income consisted of government furlough payments, while negative goodwill was derived from WINK recognising new intangible assets following the Crystal Palace transaction.

- Investment gains of £28k were lumped into operating profit:

- A bad-debt reversal of £29k also supported operating profit:

- These four entries can all be excluded to derive a more accurate underlying profit performance.

- WINK’s operating margin and return on equity remain at healthy levels, albeit lower than those recorded for FY 2019:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | 2020 |

| Operating margin (%) | 24.2 | 24.0 | 22.9 | 23.9 | 21.0 |

| Return on average equity (%) | 21.0 | 19.8 | 22.6 | 26.8 | 23.8 |

- Staff costs up 18% following a full year of controlling the Tooting branch goes some way to explain the lower group margin:

| Year to 31 December | 2016* | 2017* | 2018* | 2019 | 2020 |

| Revenue (£k) | 5,666 | 5,423 | 5,979 | 6,416 | 6,406 |

| Employee costs (£k) | 1,492 | 1,600 | 1,784 | 2,208 | 2,600 |

| Employees | 32 | 33 | 33 | 44 | 46 |

| Employee costs/Revenue (%) | 26.8 | 29.5 | 29.8 | 34.4 | 40.6 |

| Revenue/Employee (£k) | 174 | 164 | 177 | 146 | 139 |

(*unadjusted for intangible restatement)

- Note also the lower level of revenue per employee following the Tooting and Crystal Palace transactions.

- The H2 operating margin was 24% versus 14% for H1. A higher margin during the bumper H2 implies WINK enjoys ‘operational gearing’, whereby greater revenue can translate into much greater profit.

Which is best for stock-screening: Stockopedia or SharePad? See my verdict.

Valuation

- WINK issued an optimistic assessment for FY 2021:

“Sparked by the stamp duty holiday on purchases up to £500,000, demand has remained strong throughout the recent lockdown and there is a considerable backlog of transactions to be cleared.”

With a successful vaccination campaign making great progress, and as travel and nonessential shops and hospitality open again, we expect the residential sales market to continue to show healthy momentum.

In the first quarter we have seen a strong uptick in sales agreed and a very encouraging increase in applications for both sales and rentals. We anticipate an increase in transactions this year and Winkworth is set to benefit from this, as a more active market encourages agents to set up and manage their own agency.”

- WINK backed up the assessment by declaring a 2.2p per share Q1 dividend and 1.3p per share special dividend one week after the results.

- 2.2p per share is a record quarterly payout, and is 16% greater than the pre-pandemic 1.9p per share payments. The 1.3p per share special payout signals management confidence, too.

- Recent headlines from Property Industry Eye indicate a buoyant housing market:

- London property: ‘It has been the most active market we have seen since 2006’

- Red hot market: One in every 50 homes sold so far this year

- People camped overnight outside estate agents for new homes

- The stamp duty holiday has ‘turbocharged the property market’

- Given the fast pace the market is moving, ‘there will be no houses left to sell’

- High demand is ‘creating a frenzy around properties as soon as they hit the market’

- ‘The biggest lack of stock we’ve seen on the market for at least the past 20 years’, says agent

- Surge in activity for London’s prime housing market

- Asking prices surge to record high – Rightmove

- Housing stock shortage ‘is the worst I’ve seen in thirty years’, says agent

- For how long the positive trading conditions can be sustained is difficult to judge.

- Supporting the market has been a combination of government initiatives, including stamp-duty holidays and a 95% mortgage scheme, alongside wider social/commuting changes prompted by the pandemic.

- The stamp-duty boost could fizzle out from July. Buying a £500k property will incur stamp duty of:

- Zero up to 30 June 2021;

- Then £12.5k between 01 July 2021 and 30 September 2021, and;

- The standard £15k from 01 October 2021.

- WINK has unsurprisingly called for stamp duty to be “permanently reformed“ (i.e. permanently cut).

- The 95% mortgage scheme may support the housing market beyond the stamp-duty holiday.

- The wider social/commuting changes prompted by the pandemic may underpin the housing market well beyond any government initiative.

- Doubling the bumper H2 2020 performance gives a £1.9m operating profit which after standard 19% UK tax leaves earnings of £1.5m or 11.8p per share.

- Dividing the 170p share price by my 11.8p per share earnings guess gives a P/E of 14-15x.

- Assume the cash and investments of 41p per share are not inherently required for the business to operate successfully, and a cash-adjusted P/E could be (129p/11.8p) = 11x.

- Neither an 11x or 14-15x multiple seems completely outrageous.

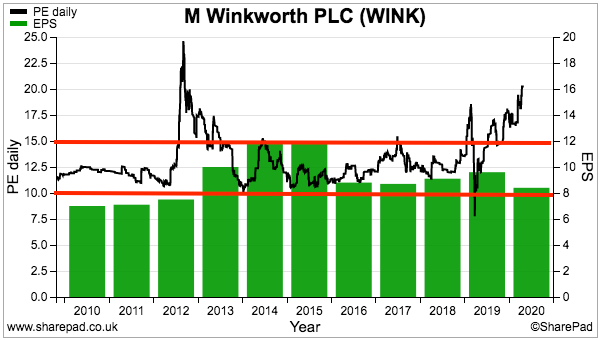

- But the present rating is not out of keeping with WINK’s typical trailing P/E of 10x-15x:

- WINK’s typical rating has reflected the group’s largely stagnant earnings as a public company.

- Arguments for a return to earnings growth and a positive share-price re-rating include:

- A medium-term revitalisation of the London housing market following the pandemic and Brexit;

- Further market-share gains from FOXT and others;

- The possible benefits of operational gearing as revenue grows, and;

- Additional Tooting-type deals that can deliver a 38% return on investment.

- Annualising the 2.2p per share Q1 2021 dividend supports a possible 5.2% full-year income.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

M Winkworth (WINK)

Dividend Announcement and Special Dividend published 14 April 2021

The full text of the record quarterly dividend:

———————————————————————————————————–

The Directors of M Winkworth Plc (“Winkworth” or the “Company”) are pleased to announce that the Company will pay a dividend of 2.2p per ordinary share for the first quarter of 2021 to shareholders.

In the trading updated released on 13 January 2021, the directors of Winkworth announced that the Company would pay a dividend of 1.8p (2019: 2.1p) per share for the fourth quarter of 2020, bringing total dividend payments declared for the financial year ending 31 December 2020 to 6.68p (2019: 7.8p). The reduction in quarterly payments on the previous year reflected caution in the face of the unpredictable fluctuations in trading due to lockdowns.

The trading update also referenced the strong momentum experienced going into the first quarter of 2021. Having repaid the furlough money received from the government for franchisor staff, the directors believe that it is now appropriate to pay a special dividend to shareholders of 1.3p.

The board recognises the importance of dividend payments to shareholders and remains committed to paying a quarterly dividend, with the intention of resuming a progressive payment if trading conditions permit.

The timetable for the combined dividend is as follows:

Ex-Dividend Date: 22/04/21

Record Date: 23/04/21

Expected Payment Date: 20/05/21

———————————————————————————————————–

Maynard

M Winkworth (WINK)

Results of Annual General Meeting published 11 May 2021

A very encouraging statement, with hints that favourable trading may continue beyond the stamp-duty holiday. Here is the full text:

———————————————————————————————————–

Directors of M Winkworth Plc (“Winkworth” or the “Company”) are pleased to announce that all the resolutions proposed at the Company’s annual general meeting held earlier today were approved by shareholders.

At the AGM, Dominic Agace, CEO of Winkworth, made the following comment:

“We have had an exceptionally strong first quarter of the year in sales, with revenues almost doubling on Q1 2020 due to a combination of completions being carried over from the fourth quarter of 2020 and a resurgence of activity in 2021. This momentum has carried over into the second quarter and, while the ending of stamp duty relief in September may temper the number of transactions in the second half, we are well placed to benefit from the revival in interest. Our rentals business, meanwhile, is showing a gentle rise and will again be an important contributor to our results this year.”

———————————————————————————————————–

A near-doubling of income relating to property sales and a modest increase to lettings income suggests overall Q1 2021 revenue gained close to 50% (sales and lettings income was broadly split 50/50 at the start of Q1 2020).

For comparison, Foxtons said Q1 sales income gained 60%. So it seems WINK continues to outperform FOXT, and least with property sales.

WINK did invite questions ahead of the AGM and I submitted the following:

———————————————————————————————————–

1) The annual report says the Tooting/Crystal Palace transactions “will keep Winkworth in touch with and learning from front-end experiences and industry trends. It will also provide a live platform to test and develop future digital initiatives and evolve our centralised CRM systems, which will be of benefit to all our franchisees.”

Tooting has now been owned for more than 18 months, so what has been learnt and what tangible benefits have to date been passed on to the franchisees?

2) The 2020 results said:

“As we pursue the strategy of backing talented operators, and where appropriate taking an equity position to deliver more than the 8% franchise return, in 2020 we took a second step by investing in the Crystal Palace office.”

The Tooting and Crystal Palace transactions do seem to be a departure from the group’s traditional franchising approach — although text elsewhere in the annual report claims otherwise.

The Tooting office reported a £151k profit for 2020 — equivalent to 12% of total group earnings had the office been 100% owned by Winkworth.

If further Tooting-type deals take place, what is the likelihood of group earnings becoming dependent on a handful of corporate-owned offices instead of a spread of franchisee offices?

3) The 2020 annual report says a further £137k will be spent acquiring an extra 35% of Tooting.

Can the board describe its ambition as to the aggregate sums likely to be involved in future Tooting-type transactions? The balance sheet has for some years carried c£3m or more of cash and no debt — will future acquisitions potentially lead to a significantly different cash/debt structure?

———————————————————————————————————–

The AGM Q&A has yet to be published on WINK’s website.Update 22 May 2021: WINK has published its answers to the submitted AGM questions:

——————————————————————————————————————

We received a number of questions prior to the 2020 AGM and the answers to those to which we can reply are set out below. We would like to thank our shareholders for the interest that they expressed in our company.

Our business strategy is to attract the right people into the network and, in circumstances where we have the best-placed person but that person perhaps lacks sufficient funds, incentivise them appropriately.

We are open to taking an equity position to facilitate bringing that person on board, and to offer them with a route to equity ownership. In return, we expect to generate a return over and above the 8% that we typically achieve through an independent franchise.

Franchising, however, remains our main focus and will continue to shape the business and its profits going forward.

When reviewing applications for franchises we use a highly selective process to minimise office closures through failure. We ensure that the business plan and funding are appropriate to launch a new franchise, giving new franchisees the greatest chance of success. As a result, we have a very limited number of closures.

Amongst other things, equity ownership has enhanced our practical understanding of prop tech initiatives and, in turn, its successful implementation has helped support neighbouring offices through referrals and reputation.

The company has no current intention to change its strategy of retaining a healthy level of cash for use should opportunities arise, thus avoiding reliance on debt.

——————————————————————————————————————

Nothing too revealing or disturbing.

I should add that following the 2020 results, I increased my WINK shareholding by 10% at 178p including all costs.

Maynard

M Winkworth (WINK)

Publication of 2020 annual report

Here are the points of interest:

1) Furlough

Confirmation WINK has commendably repaid the furlough benefits:

2) Risks

The ending of the stamp-duty holiday has become a formal risk:

WINK also now refers to its IT systems as helping to mitigate Covid disruption.

3) Section 172

A revamped Section 172. Useful talk of long-term investor “loyalty” and long employee tenures…

… as well as “discerning” customers:

The “customers” stakeholder is all new for FY 2020. Previously WINK had considered its customers to be the franchisees.

More revised text for FY 2020:

Good to see the executives have started to meet investors. And more new text on customers:

4) Corporate governance

Non-execs still work 15 days a year. Good to see the board likes to talk more about audit matters than remuneration matters:

5) Auditor

Materiality a standard 5% of pre-tax profit:

A full-scope audit was undertaken for the main franchising subsidiary, but not for Tooting Estates.

Perhaps not a major issue, but WINK now has two company-owned branches which could in time support a not insignificant proportion of earnings. These operations are not exactly located miles from head office either. I can’t see why the branches should be not be subject to full-scope audits in the future.

Just the one key audit matter this year:

The new auditor (Crowe) no longer considers ‘business combination — valuation of intangible‘ to be a key audit matter. See points 8 and 15 below.

6) Going concern

Similar text to that of FY 2019. WINK continues to claim income would need to “fall substantially…beyond six months” before cash problems arise:

7) Revenue

Confirmation of the 8% commission cut from franchisees that WINK collects:

8) Customer list intangible

WINK claims its customer lists have a useful life of 15 years:

15 years is a long time. The lists represent both sales customers and rental customers (i.e. landlords). I can understand landlords using WINK’s property-management services for lengthy periods. But normal house buyers using WINK’s services for many years? I guess the lists must include regular property investors.

What is surprising is the intangible-valuation assumption of lettings income declining by 7% per annum. Save for Imperial Brands, I can’t recall any other company that based its intangible sums on cash flows reducing:

The customer lists are carried in the books at £585k and relate to the purchases of the Tooting and Crystal Palace branches (see point 15 below):

Arguably this customer-list amortisation is entirely academic, as different accountants could treat the same intangibles as acquired goodwill and not amortise them at all. The cash of course has already been spent on the purchase.

Still, anything that has a lengthy useful life is ways worth considering, just in case the directors are over-optimistic about other matters. Unlike the previous auditor, the new auditor did not treat this intangible as a key audit matter. See point 5 above.

9) Employees

Productivity ratios unsurprisingly did not improve during FY 2020 given revenue

was flat and two extra employees were taken on:

Revenue per employee was £139k, down from £146k for FY 2019 and £200k+ for FY 2014. WINK has seen its revenue per employee ratio drop by 51% since FY 2011 — the worst decline for this ratio in my portfolio. WINK has moved into owning agency branches of late, so that has probably diluted the calculation. But it does seem the days of less than 20 staff delivering revenue of £4m-£5m have now gone for good.

Staff costs represented 41% of revenue for FY 2020, WINK’s highest since at least 2006. The proportion was 34% for FY 2019 and between 20% and 30% during FYs 2008-2017. Average staff cost was £57k, versus £59k for FY 2019.

10) Director pay

No major issues here:

The chief exec received an extra £5k, while the FD received an extra £11k. Not great that the directors enjoy a pay rise during a year where shareholders suffered a pay cut (via dividends), but the pandemic disruption undoubtedly created extra workload. The same director-pay-up-but-dividend-down scenario occurred at S&U.

11) Prepaid assisted acquisition support

This support represents contributions made to new franchisees to help kick-start their businesses. The investment is amortised over ten years, the length of the franchise term:

Additions for FY 2020 (£17k) and FY 2019 (£98k) were covered amply by the associated amortisation charges (£154k and £160k). If future prepaid support remains low, then the associated amortisation could be seen as depressing WINK’s true profitability a little.

12) Investments

WINK’s small portfolio of quoted shares gained a handsome 65% during the year:

13 Trade and other receivables

Trade receivables equate to 7.1% of revenue, a welcome low level (many companies see 15%+) and the lowest level for WINK since FY 2010:

But bear in mind WINK incurred a bad-debt charge of £162k during FY 2019 — i.e. £162k was written off over and above the normal bad-debt provision. So a low level of trade receivables may not be that encouraging if customers are not actually paying their invoices.

I confess I can’t understand why or how £105k of the FY 2019 provision has been “reallocated” to FY 2020. The accounting note has not been restated.

Past-due invoices now total £165k versus £549k for FY 2019:

£165k is in fact the lowest past-due figure since FY 2011, which I trust means WINK’s invoice-collection procedures have improved. Note, too, that the loss rate for 60+ days has reduced from 77% to 44%.

I recall management at the 2016 AGM said WINK collects its 8% commission cut before the franchisees receive their money (WINK runs the IT payment system), so outstanding invoices should only really concern ad-hoc services.

14) Options

Outstanding options represent 4.4% of the present share count:

15) Negative goodwill

How to bolster profit by £119k through ‘negative goodwill’ — pay nothing for an acquisition and claim it has intangible ‘customer lists’:

See points 5 and 8 above.

Maynard

M Winkworth (WINK)

New podcast

WINK has launched a new monthly podcast. WINK’s chief exec and Tooting manager both seem positive about current market conditions.

Useful WINK vs FOXT scuttlebutt in the Property Industry Eye article comments:

“Foxtons current sales inventory acc. is 53 of which just 8 are showing SSTC or Under offer (15/16%) and 8 listed 12 months or longer. Average asking price £568k and average time on market 41 weeks.

Winkworths an impressive inventory of 140 with 73 SSTC or U/O over 50% with just the 4 listed 12 months+.

Average asking price £674k and just 18 weeks listing time”

Seems to back up my theory that WINK is trouncing FOXT in London.

Maynard

M Winkworth (WINK)

Dividend Announcement and Special Dividend published 14 July 2021

A positive update with another special dividend. Here is the full text.

——————————————————————————————————————

The Directors of M Winkworth Plc (“Winkworth” or the “Company”) are pleased to announce that the Company will pay a dividend of 2.2p per ordinary share for the second quarter of 2021 to shareholders.

Following an exceptionally strong performance in the sales division by the network in the first half of 2021, with preliminary figures indicating that network sales revenues exceeded those achieved for the whole of 2020, the Directors will also pay a special dividend of 2.6p per ordinary share at the same time as the second quarter dividend and in accordance with the timetable below.

Added to the 2.2p ordinary dividend and the 1.3p special dividend paid for the first quarter, this brings total dividends declared for the first half of 2021 to 8.3p per ordinary share (2020: 3.08p).

While the Directors anticipate a slowing of activity in sales in the second half of the year following the progressive withdrawal of stamp duty relief, revenues from rentals are running at a similar level to 2019 and ahead of 2020 and the Company is confident that its results for the year as a whole will exceed market expectations.

——————————————————————————————————————

Network sales revenue was £8.2m/£15.6m for H1/H2 2020, so H1 2021 will see at least £23.8m. Assuming a reasonable H2, network sales revenue for the year may even surpass the record £32.6m from 2014.

Network rental income was £24.4m for 2019 and £23.9m for 2020, so for 2021 should be at least £24.0m.

Difficult to judge WINK’s valuation further until trading settles back into a more normal pattern. H2 2021 may suffer a hangover following the exceptional H1 2021, so we may not get any accurate indication of post-pandemic earnings until mid-2022. For now I am happy with my sums from the blog post above, which are based on a doubling of H2 2020.

The Q2 special dividend of 2.3p gives a total of 3.9p for H1 2021, which provides some indication of the ‘excess’ earnings generated from the stamp-duty holiday. For perspective, 3.9p compares to reported earnings of 9p for 2020 and nearly 12p for my valuation sums.

The normal dividend meanwhile looks on course for 8.8p for 2021 to support a 4.5% income at 192p.

For what they are worth, forecasts in SharePad are below:

I assume these forecasts were made before the trading statement, but I could be wrong.

Maynard