11 September 2020

By Maynard Paton

Results summary for M Winkworth (WINK):

- A very acceptable lockdown performance, with underlying half-year revenue down 17% and profit down 20%.

- Temporary stamp-duty changes have supported a “significant uplift in activity” and ought to herald a much stronger second half.

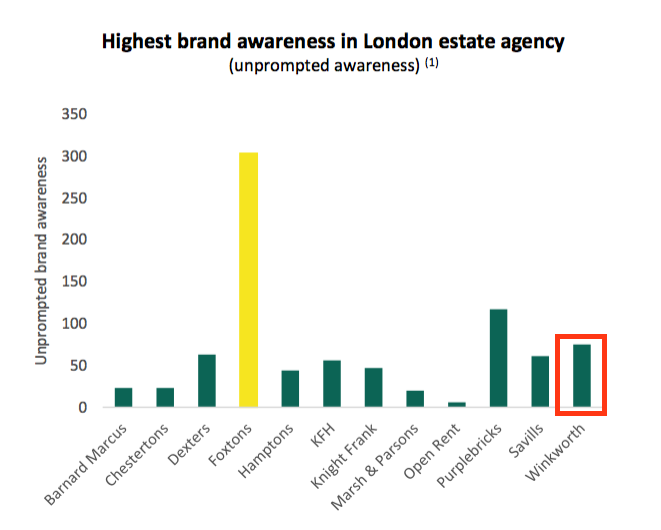

- Extremely impressive market-share gains continue to be won from London rival Foxtons.

- Despite a number of accounting re-jigs, the books remain in good shape with respectable margins and net cash.

- A possible P/E of 11-14 and potential income of at least 4% may offer upside should earnings one day regain their momentum. I continue to hold.

Contents

- Event link, share data and disclosure

- Why I own WINK

- Results summary

- Covid-19, Q2 dividend and housing-market rebound

- Revenue and profit

- Network sales/lettings and commission

- Foxtons comparison

- Tooting investment

- Financials

- Valuation

Event link, share data and disclosure

Event: Interim results for the six months to 30 June 2020 published 09 September 2020.

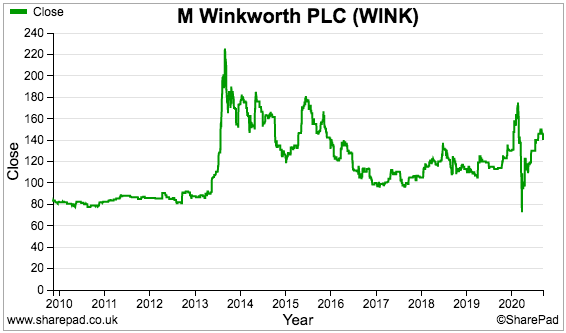

Price: 130p

Shares in issue: 12,733,238

Market capitalisation: £16.6m

Disclosure: Maynard owns shares in M Winkworth. This blog post contains SharePad affiliate links.

Why I own WINK

- Operates a London estate-agency franchising business, with progress buoyed by motivated franchisee owners capturing market share from conventional rivals.

- Franchising set-up leads to high margins, low capital requirements and a cash-rich ‘pandemic-proof’ balance sheet.

- Seasoned family management boasts £8m/50% shareholding and rewards investors through durable quarterly dividends.

Further reading: My WINK Buy report | All my WINK posts | WINK website

Results summary

Covid-19, Q2 dividend and housing-market rebound

- Resilient results commentary published during April followed by the declaration of a Q1 dividend had already suggested WINK would survive the pandemic lockdown.

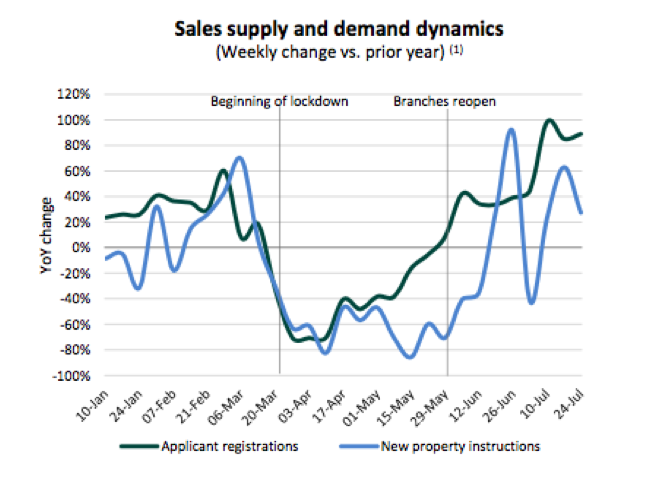

- News of a Q2 dividend alongside remarks of “the busiest July in at least the past five years” then implied WINK might recover sooner rather than later.

- This H1 statement extended the optimism.

- In particular, WINK claimed stamp-duty changes should sustain a property-market rebound for the rest of 2020:

“Since the ending of lockdown, we have seen a significant uplift in activity in the sales market, with pent-up demand being combined with new movers entering the market, looking for a change in their living environment following enforced time at home.

This has been further fuelled by the raising of the stamp duty threshold, and since the start of the second half we have seen the highest weekly number of applicants in five years registering, viewing and agreeing sales. With the stamp duty cut remaining in place until March 2021, we anticipate that this surge in demand will be maintained through H2 2020.”

- Until 31 March 2021, stamp duty is no longer payable on purchases of residential properties up to £500k.

- However, WINK did say the market revival would not entirely recoup the lockdown profit shortfall:

“We have seen a spike in activity in the first two months of the second half and, if this carries through to the rest of the year, we hope to make up much of the ground lost in the second quarter.”

- WINK’s confirmation of no staff redundancies underlined the business having enjoyed a relatively satisfactory lockdown.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Revenue and profit

- The aforementioned Q1 and Q2 dividends were, respectively, 12% and 24% lower than the 1.9p per share quarterly payouts declared during 2019.

- Matching the dividend reductions, these half-year results unsurprisingly revealed lower revenue and profit.

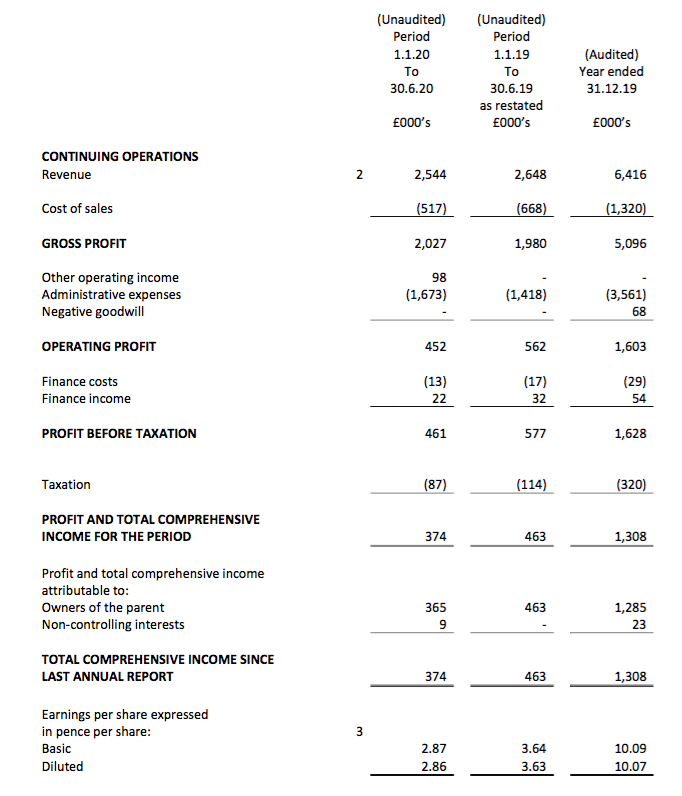

- In the event, WINK reported revenue down 4% and operating profit down 20%:

| H1 2018* | H2 2018* | H1 2019* | H2 2019* | H1 2020 | |||

| Revenue (£k) | 2,798 | 3,181 | 2,727 | 3,689 | 2,544 | ||

| Operating profit (£k) | 551 | 818 | 576 | 959 | 452 |

(*unadjusted for subsequent restatements)

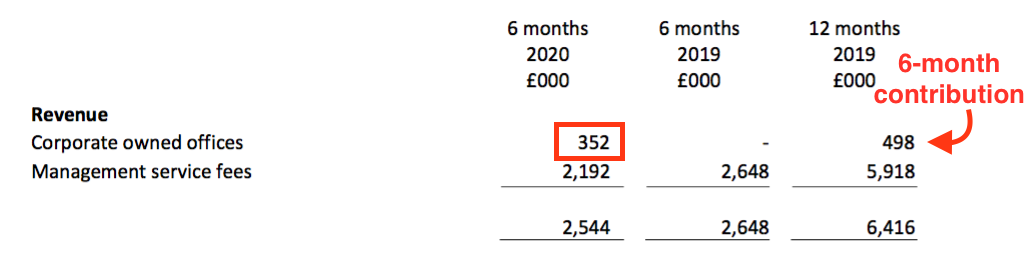

- Similar to the 2019 full-year numbers, these H1 figures were affected by:

- An unusual restatement of intangible assets and revenue;

- Yet another (!) revised implementation of IFRS 16 accounting, and;

- Last year’s 55% purchase of a group franchisee.

- The accounting re-jigs were explained within my 2019 results write-up and, for this H1, were relatively trivial given the wider Covid-19 issues.

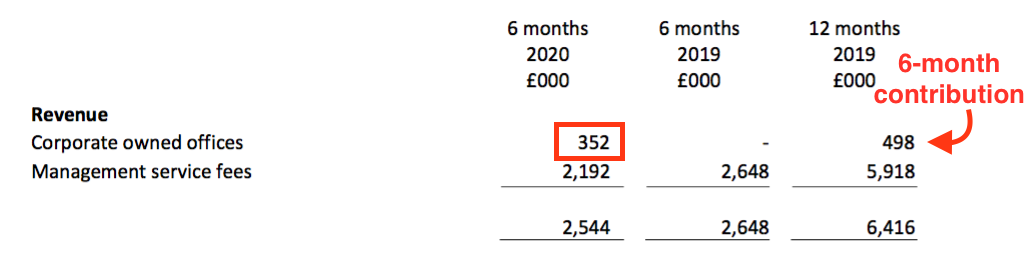

- The 55% purchase of the franchisee was more significant. Without the acquisition, revenue would have dropped 17% to £2.2m:

- WINK has long been sceptical of hybrid and online agencies (“digital experiments”), and stressed the importance of its conventional branches post-lockdown:

“From our experience of reopening our offices, we remain convinced that our high street presence is still the driver of our business. The return of our clients and buyers to our shops shows they value the proximity of Winkworth’s local expertise and knowledge, together with the relationships built up over the years of local trading.”

- Mind you, WINK did admit website enhancements from last year had helped the business cope during the pandemic:

“The early signs for the new website platform are extremely encouraging as we drive record leads to our offices.”

Network sales/lettings and commission

- Some 78% of WINK’s income is dependent on franchisees operating within London.

- However, Brexit and taxation changes have kept a lid on the capital’s property market since 2016.

- As such, total network revenue — that is, the gross revenue earned by WINK’s franchisees through property sales and lettings — has been stuck just below £50m for the last few years:

| Year to 31 December | 2016* | 2017* | 2018* | 2019 | H1 2020 |

| Gross Franchisee Sales & Lettings (£k) | 46,120 | 46,200 | 46,500 | 48,300 | 18,900 |

| Revenue (£k) | 5,566 | 5,423 | 5,979 | 5,918 | 2,192 |

| Revenue/Gross Franchisee Sales & Lettings (%) | 12.1 | 11.7 | 12.9 | 12.3 | 11.6 |

(*unadjusted for subsequent restatements)

- Franchisees pay WINK 8% of all commissions/letting income received alongside variable contributions towards advertising and IT. Franchisees also pay WINK for introductions to new landlords and tenants.

- During this H1. WINK’s network of franchisees witnessed gross revenue drop 11% to £18.9m, of which 11.6% (adjusted for the 55% purchase of a group franchisee) went to WINK.

- Franchisee sales income fell 17% while lettings income dropped 7%:

| Gross Franchisee Revenue | H1 2018 | H2 2018 | H1 2019 | H2 2019 | H1 2020 | ||

| Sales (£m) | 10.8 | 12.6 | 10.0 | 13.8 | 8.2 | ||

| Lettings (£m) | 10.3 | 12.8 | 11.4 | 13.0 | 10.6 | ||

| Total (£m) | 21.1 | 25.4 | 21.4 | 26.8 | 18.9 |

- The network split between sales and lettings income was 45%-55% during the half.

- Lettings income at 55% is the highest proportion ever for WINK.

- The aforementioned “significant uplift in activity in the sales market” could mean the 55% proportion reduces during the second half.

Foxtons comparison

- WINK continues to outperform Foxtons (FOXT), which claims to be “London’s leading agent”:

- During 2016, WINK’s gross network revenue represented 37.3% of FOXT’s property sales and lettings revenue:

| Year to 31 December | 2016 | 2017 | 2018 | 2019 | H1 2020 |

| Winkworth | |||||

| Gross Franchisee Sales Revenue (£m) | 26.0 | 24.8 | 23.4 | 23.8 | 8.2 |

| Gross Franchisee Lettings Revenue (£m) | 20.1 | 21.3 | 23.1 | 24.4 | 10.6 |

| Total Gross Franchisee Revenue (£m) | 46.1 | 46.2 | 46.5 | 48.3 | 18.9 |

| Foxtons | |||||

| Sales Revenue (£m) | 55.5 | 42.6 | 36.2 | 32.6 | 11.1 |

| Lettings Revenue (£m) | 68.3 | 66.3 | 67.0 | 65.7 | 25.7 |

| Total Sales & Lettings Revenue (£m) | 123.8 | 108.9 | 103.2 | 98.3 | 36.8 |

| Winkworth / Foxtons | |||||

| Sales Revenue (%) | 46.8 | 58.2 | 64.6 | 73.0 | 73.9 |

| Lettings Revenue (%) | 29.4 | 32.1 | 34.5 | 37.1 | 41.2 |

| Total Revenue (%) | 37.3 | 42.3 | 45.1 | 49.1 | 51.4 |

- By 2019, the proportion had increased to 49.1%.

- During this H1, the proportion increased further to 51.4%.

- WINK has particularly outclassed FOXT on property sales.

- WINK’s network revenue from property sales was £8.2m during this H1, and represented 73.9% of FOXT’s £11.1m equivalent.

- For perspective, the proportion was 45.5% for H1 2016 (£14.3m of £31.4m).

- The 73.9% calculation does not look like a fluke. The same calculation for H2 2019 gave 80.2%.

- These 73.9% and 80.2% numbers imply WINK performed really well and/or FOXT performed really badly during the twelve months to June this year.

- The FOXT comparison is not strictly like-for-like, as FOXT generates almost all of its revenue from branches within London while WINK generates 78%.

- Nevertheless, WINK’s self-employed franchisees appear to have handled London’s standstill/lockdown property market far better than FOXT’s conventional employees.

- Published during July, FOXT’s H1 results did not read that well.

- FXOT reported a small (adjusted) loss after revenue fell 22%.

- FOXT raised £22m earlier this year to shore up its balance sheet, while the dividend has not been seen for more than two years.

- The chart below from FOXT’s H1 results presentation shows how the firm’s buyer registrations and seller instructions fluctuated during the half:

- FOXT’s presentation included this next chart, which claims WINK is the third-most recognised estate-agency brand in London after FOXT and Purplebricks:

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Tooting investment

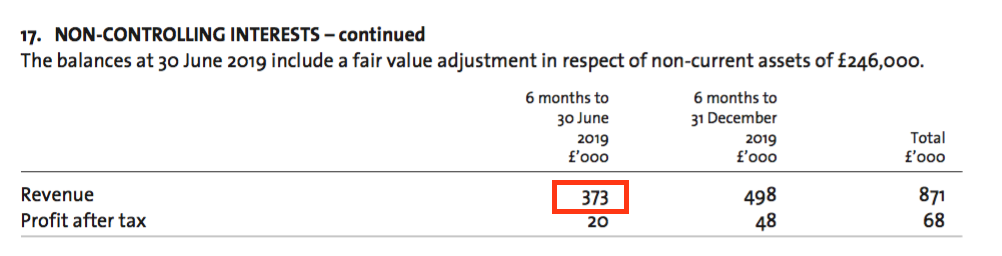

- WINK purchased 55% of Tooting Estates for £23k and a £92k loan at the start of the second half of last year.

- Tooting Estates operates the WINK franchise in Tooting, London, and the deal heralded WINK’s return to controlling agency branches.

- The 2019 results claimed the purchase was to garner ‘front line’ insight:

“The acquisition of Tooting Estates… will keep Winkworth in touch with and learning from front end experiences and industry trends. It will also provide a live platform to test and develop future digital initiative and evolve our centralised CRM systems, which will be of benefit to all our franchisees.”

- The 2019 results also hinted further deals could follow:

“We backed one new franchisee through equity participation… looking to increase our financial return to above the 8% that we receive as part of our regular franchise agreement, and we remain open to repeating this approach where we find the right local market and the right operator.”

- The strategy may have some drawbacks.

- A top attraction to WINK’s franchisor status is the business remaining lean and efficient, while the self-employed franchisees do all the hard work operating branches and dealing with property vendors and landlords.

- Further investments in agency branches could therefore dilute WINK’s historically attractive margins and returns on equity.

- This H1 statement said:

“We are very pleased that, against the trend, the Winkworth Tooting office maintained its revenue in H1 2020 year-on-year.”

- The 2019 annual report small-print said Tooting’s H1 2019 revenue was £373k:

- Tooting revenue during this H1 was £352k, indicating an acceptable-in-the-circumstances reduction of 6%:

- The non-controlling interest shown within the income statement represents the earnings associated with the 45% of the Tooting office that WINK does not own:

- The £9k non-controlling interest implies WINK’s 55% share was £11k.

- Doubling up £11k would mean WINK’s annual Tooting earnings run at £22k — or 19% of the total £115k Tooting investment.

- A 19% return on investment during a pandemic seems pretty good to me.

- No wonder WINK is keen to find more Tooting-like opportunities:

“We have identified further individuals with the potential to take on their own Winkworth businesses in H2 2020 and 2021 and we look forward to updating shareholders on our progress in due course.”

- The H1 small-print disclosed a potential Tooting-like deal:

“On 20 July 2020 the group acquired the trade and assets of Stilum Properties Limited through a subsidiary undertaking, Crystal Palace Estates Limited. The trade and assets were acquired for £Nil consideration. Crystal Palace Estates Limited commenced trading on 27 July 2020.”

- Companies House reveals Stilum had a £41k net asset value and other searches unearth a vague connection with the Tooting branch.

Financials

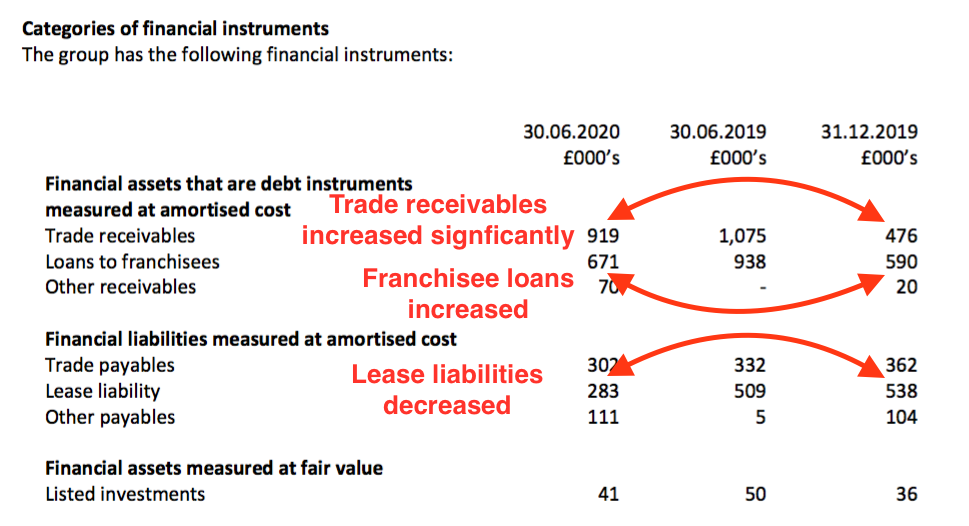

- WINK’s balance sheet remains very acceptable given the Covid-19 uncertainties.

- Cash finished the half at £3.3m, while conventional debt and pension obligations remain at zero.

- Enhancing the cash position are investments of £49k and start-up loans to franchisees of £671k.

- Net cash and investments are therefore £4.0m, or 31p per share.

- WINK’s finance income includes the interest collected from the start-up loans and, at £22k, represented a helpful 5% of H1 pre-tax profit.

- Cash conversion was not the best.

- H1 earnings of £365k translated into cash of £176k before dividends.

- A combination of greater unpaid invoices and extra start-up loans to franchisees seemed to account for the bulk of the cash absorption:

- The 2019 annual report (point 17) reiterated WINK’s franchisees can be slow payers.

- Lease liabilities enjoyed a welcome decrease following a lockdown HQ rent renewal.

- The second half typically sees cash conversion improve on the first.

- An 18% operating margin during this H1 was very reasonable in the circumstances.

Valuation

- WINK’s aforementioned comments on recent trading suggested a better second half.

- However, earnings for this year — and perhaps those for 2021 as well — remain rather unpredictable.

- As a guide, operating profit for 2019 (including IFRS 16 lease/interest costs) was £1.5m, which after standard 19% tax gave earnings of £1.2m or 9.3p per share.

- The current £16.6m market cap less cash/franchisee loans of £4.0m gives an enterprise value of £12.6m, or 99p per share.

- Dividing the 99p per share enterprise value by the 9.3p per share earnings guess leads to a possible multiple of 11.

- Assume the cash and franchisee loans are inherently required for the business to operate successfully, and the P/E comes to 14.

- Neither the 11x nor 14x rating seem outrageous.

- However, the multiples assume earnings for 2021 can match those of 2019.

- Further pandemic-related disruption to London’s housing market could defer the earnings recovery to 2022 or later.

- Remember, too, that operating profit for 2016, 2017, 2018 and 2019 was at least 15% below that reported for the ‘boom’ years of 2014 and 2015.

- Still, WINK could prosper at the expense of rival agents.

- Further market-share gains against FOXT (and others) might prompt a return to growth even if London’s property market stumbles further.

- A final resolution to Brexit — which WINK has often cited for its 2016-2019 stagnant performance — may also spur greater housing activity in the capital.

- WINK’s dividend is likely to foretell the short-term earnings trend.

- The group confirmed:

- “[T]he Board remains committed to paying a quarterly dividend.:

- Committing to a dividend is often the case when directors boast a significant shareholding. The 2019 annual report (point 3) stated:

“As a number of significant shareholders sit on the Board, the discussions on the quarterly dividend payments ensure that the wishes of shareholders are aligned with those of the company over both the short and longer term.”

- WINK should declare a Q3 dividend during October.

- Last year’s quarterly payments were 1.9p per share, and the Q3 2020 payout should at least match the Q2 2020 payout of 1.4p per share.

- Anything greater than 1.4p per share may well confirm the start of an earnings recovery.

- For now, annualising the 1.4p per share Q2 dividend supports a possible 4.3% full-year yield.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Thanks for that, good analysis, as always. FWIW, their website is very slick

I stayed in student accommodation in Tooting Bec when I first travelled to the UK many years ago (20) , so a nice bit of nostalgia.

I see that director’s wages were 372K (2019), total divas paid were ~980, not necessarily a red flag but leaves somewhat of a bad taste, though I note that the wages themselves don’t seem egregious.

I don’t really have a sense of the “vibe” in the UK, over here in Oz it seems mixed to me, again, ultra low interest rates and government stimulus make things a bit murky. What does it cost to set up a franchise ?

I will stick WINK onto my watch list, it doesn’t seem expensive.

Hi Christian,

Thanks for the comment. With very smaller companies, director pay could well be close to the size of the dividend. What I look at is director dividends versus their pay, and which income source the directors are more dependent on. I prefer directors earning more through dividends than salaries, as that bias ought to put them in the same boat as outside investors. The Agace family own half the shares, so a dividend income of close to £500k, which exceeds their combined board salaries.

‘Cold start’ franchise cost is £125k or more: https://www.winkworth.co.uk/estate-agent-franchise/faqs

No wonder WINK issues start-up loans to franchisees. Agreed, the website is good.

Maynard

M Winkworth (WINK)

Dividend Declaration published 14 October 2020

Promising news. Here is the full text:

—–

The Directors of M Winkworth Plc (“Winkworth” or the “Company”) are pleased to announce that the Company will pay a dividend of 1.8p per ordinary share for the third quarter of 2020 to shareholders. The timetable is as follows:

Ex-Dividend Date * 22/10/20

Record Date ** 23/10/20

Expected Payment Date 19/11/20

* Shares bought on or after the ex-dividend date will not qualify for the dividend

** Shareholders must be on the Winkworth share register on this date to receive this dividend.

—–

WINK’s remarks of an H2 rebound within September’s interim results have been underpinned by this Q3 dividend of 1.8p per share, which is greater than the 1.68p and 1.4p per share payouts declared for Q1 and Q2 respectively.

True, WINK’s payouts have not yet reached the 1.9p per share level of 2019, but the signs are encouraging in the circumstances. Industry newsflow continues to be positive, too. For example: https://propertyindustryeye.com/residential-properties-are-flying-off-the-shelf/

Maynard

M Winkworth (WINK)

Trading Update published 13 January 2021

An encouraging update given the circumstances, although the positive trading may be short-lived as the government’s stamp-duty subsidy comes to an end.

Here is the full text interspersed with my comments:

——————————————————————————————————————

M Winkworth plc (“Winkworth” or the “Company”), the leading franchisor of real estate agencies, is pleased to announce the following trading update for the financial year ending 31 December 2020.

Despite the stop/start market conditions brought about by government mandates to control the spread of coronavirus, 2020 was marked by the underlying strength of demand in the sales market. After a brisk start to the year following Boris Johnson’s election, putting an end to the political uncertainty which overshadowed the residential market in 2019, the first lockdown in early Spring created new challenges to which we responded rapidly and effectively. We were, therefore, well placed for the ensuing post lockdown boom, fuelled by the stamp duty holiday incentive. The second half of the year remained strong, not only as a result of catch-up but also supported by a new category of buyers and sellers looking to change their lifestyles. Once again, Winkworth increased its market share of Sales Subject to Contract, most notably in London where we ranked second with a market share of 4.6% in 2020 up from 4.2%¹ in 2019.

——————————————————————————————————————

This commentary underlines the encouraging remarks made within the H1 statement. The “stamp-duty holiday incentive” ends on 31 March and — not surprisingly — the industry is calling for an extension. For now, the housing market from April onwards may be more subdued.

The market share stats more importantly confirm my own reading of WINK gaining market share (at least against Foxtons). The same SSTC share reported within this update was 3.6% for 2018.

——————————————————————————————————————

Lettings and management revenues suffered far less in the first lockdown, due to the renewal of contracts and property management services, so trading for the year showed greater consistency. Business was driven by a catch-up following the pause rather than an increase in demand and, until international interest recovers, we see reduced rental prices in London limiting growth.

The rate of new office openings was, unsurprisingly, subdued in 2020, but nonetheless we opened two new offices and transferred one office, Crystal Palace, to our ownership. We have four new offices at advanced stages of negotiation at the start of 2021, with promising early discussions on a further four. Over the course of 2020, we avoided making significant cost cuts to our infrastructure and teams to ensure that we were well placed to support our franchisees and help them to grow market share once conditions improved.

Despite the market upheaval, Winkworth’s total revenues were broadly flat on 2019. Profits before tax are expected to be lower than those achieved in 2019 and as a result, the total dividend pay-out for the year has been reduced by some 15%. The Company expects to announce its final results for the year ended 31 December 2020 on or around 8 April 2021. ——————————————————————————————————————

Nothing too surprising there. Reported H1 profit was down 20% and the Q1/Q2 dividends combined were down 19%. The Q3 dividend was 1.8p and the Q4 will be 1.8p, so H2 dividends will be 3.6p versus 4p for 2019 — down 10%. If the dividend movement continues to correlate to profit movement, then H2 profit down 10% to c£860k does not seem too bad. An H2 £860k profit exceeds that recorded for H2s 2016, 2017 and 2018.

——————————————————————————————————————

We are relieved that estate agencies are to remain open for business during the current lockdown and with our Q4 2020 sales applications up 44% and lettings applications up 12% year-on-year, and with a record pipeline of sales still to feed through to trading in Q1 2021, we have entered the current year with considerable momentum.

——————————————————————————————————————

“Considerable momentum” sounds promising but may be short-lived due to the ending of the stamp-duty holiday.

——————————————————————————————————————

The directors of Winkworth are pleased to announce that the Company will pay a dividend of 1.8p (2019: 2.1p) per share for the fourth quarter of 2020, bringing total dividend payments declared for the year to 6.68p (2019: 7.8p).

The timetable is as follows:

Ex-Dividend Date: 21/01/21

Record Date: 22/01/21

Expected Payment Date: 18/02/21

¹ Source: TwentyCI

Dominic Agace, Chief Executive Officer of Winkworth, commented:

“Last year will be remembered primarily for the Covid crisis. Our thanks go to our franchisees and employees for working so hard to adapt to changing demands, and to our customers for their patience and loyalty. We are pleased to have once again increased our market share and, notwithstanding the latest lockdown, look forward to our company’s future with great confidence.”

——————————————————————————————————————

I do like timely quarterly dividends.

Maynard