03 October 2024

By Maynard Paton

Happy Thursday! I trust your shares have been keeping up with this year’s rising FTSE.

A summary of my portfolio’s progress:

- Q3 return: +7.9%*

- Q3 trades: None.

- YTD return: +29.4%*

- YTD winners/losers: 3 winners vs. 7 losers.

(*Performance calculated using quoted bid prices and includes all dealing costs, withholding taxes, broker-account fees, paid dividends and cash interest)

Famous last words, but my portfolio seems on course for its best annual performance since I commenced this blog at the beginning of 2015.

As I predicted within my 2023 review, System1 has dominated my returns and what was a very large weighting has become even larger. July’s positive results from the ad-testing specialist helped push my portfolio to a record high and the question now is how far do I run this winner?

Away from System1, my portfolio’s Q3 newsflow was not perfect and some profit setbacks have started to influence my dividends.

In particular, Mincon published a terrible H1 that could not even confess its payout had been paused. As I noted in my last write-up, I can only hope the group’s family directors quickly take decisive action to revive the drill manufacturer now their €2.5m annual dividend income has ceased.

Elsewhere, S & U has admitted to further bad loans following new FCA ‘forbearance’ rules. I suspect the lender’s 17% final-dividend cut earlier this year will be followed by a similar reduction within its forthcoming H1.

Other shares not improving my income during 2024 are Andrews Sykes and City of London Investment, both of which held their latest payouts following unchanged earnings. I have also enjoyed 5%-or-less dividend increases from Mountview Estates, FW Thorpe and M Winkworth.

Only Bioventix (+10%), Tristel (+100%) and System1 (payout reintroduced) have supplied very positive dividend news during the first nine months of the year. My end-of-year returns could therefore reveal a disappointing total income.

I have summarised below what happened to my portfolio during July, August and September. (Please click here to read all of my previous quarterly round-ups). I will then discuss running multi-baggers to 40% (or more!) of your portfolio.

Contents

- Q3 share trades

- Q3 portfolio news

- Q3 portfolio returns

- Running multi-baggers to 40% (or more!) of your portfolio

Disclosure: Maynard owns shares in Andrews Sykes, Bioventix, City of London Investment, Mincon, Mountview Estates, S & U, System1, FW Thorpe, Tristel and M Winkworth.

Q3 share trades

None.

Q3 portfolio news

As usual I have kept watch on all of my holdings. The Q3 developments are summarised below:

- Andrews Sykes: “Milder winter temperatures” keeping revenue, profit and the dividend all flat during H1 2024.

- Bioventix: Nothing of significance.

- City of London Investment: FY 2024 results showing Q4 net client withdrawals of $250m and a dividend covered just 1.02x by adjusted earnings.

- Mincon: A terrible H1 2024 admitting to increased construction-project competition, profit collapsing to breakeven and a suspended dividend.

- Mountview Estates: Protest votes at what was a lively AGM.

- S & U: Greater impairments due to the “imposition” of an FCA industry “inquiry” that will push H1 2025 pre-tax profit down 40%.

- System1: FY 2024 results showing platform revenue up 43%, adjusted Ebitda up 175% plus a 5p per share dividend, followed by Q1 platform revenue gaining 74%.

- FW Thorpe: Nothing of significance.

- Tristel: An update predicting FY 2024 sales up 16% and an annual profit of at least £8m, followed by a second US-regulatory submission.

- M Winkworth: H1 2024 numbers showing revenue up 20%, profit up 24% and a “confident” H2 outlook.

Q3 portfolio returns

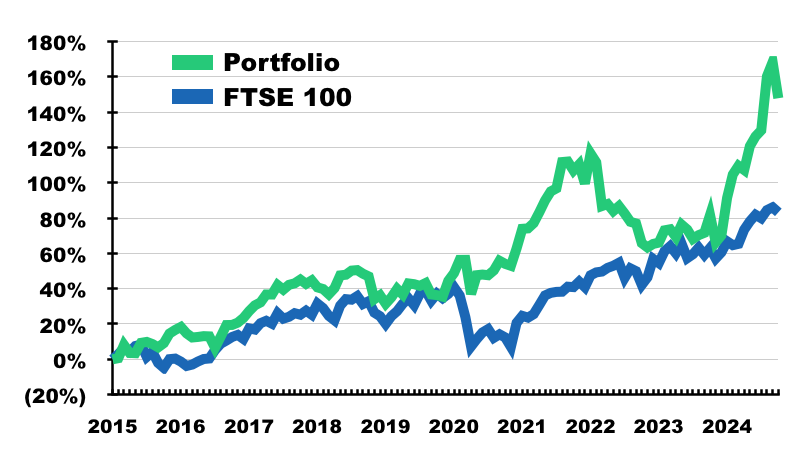

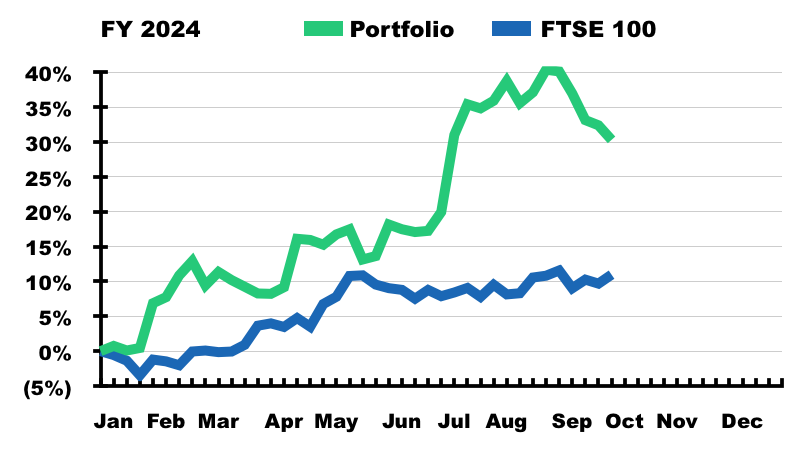

The chart below compares my portfolio’s monthly progress to that of the FTSE 100 total return index:

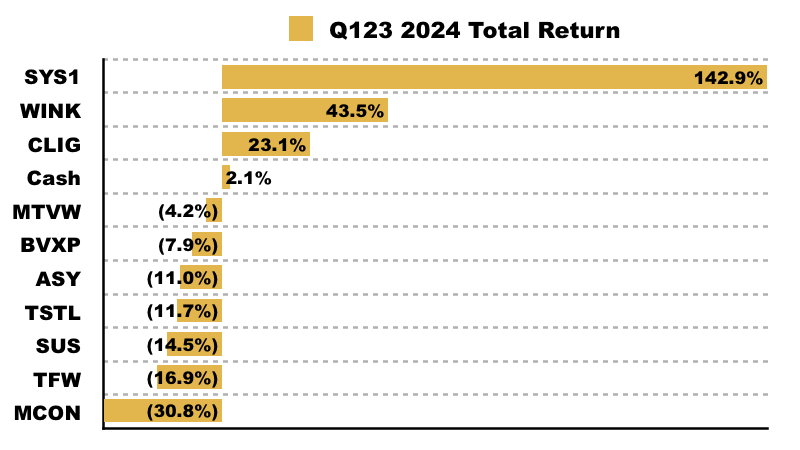

The next chart shows the total return (that is, the capital gain/loss plus dividends received) each holding has produced for me so far this year:

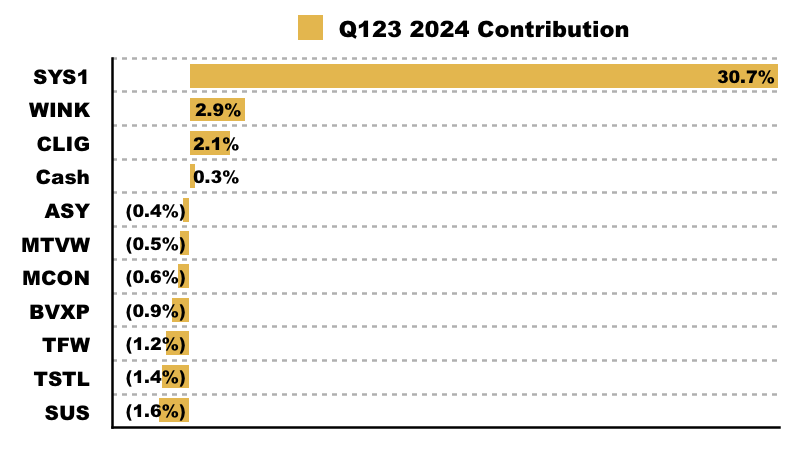

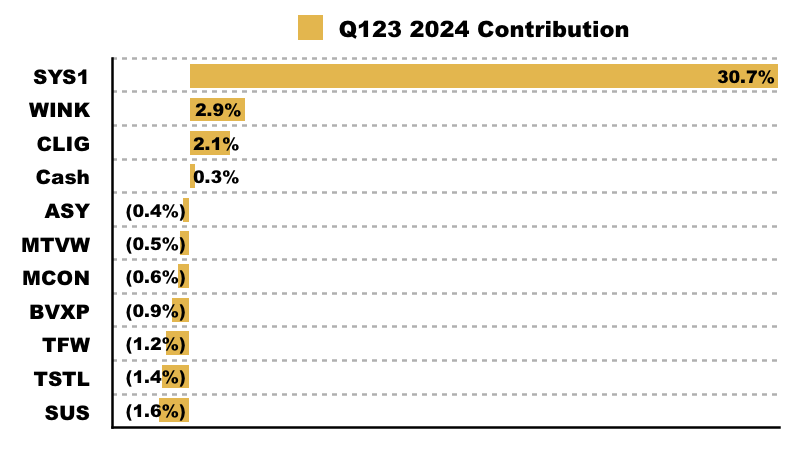

This chart shows each holding’s contribution towards my 29.4% YTD gain:

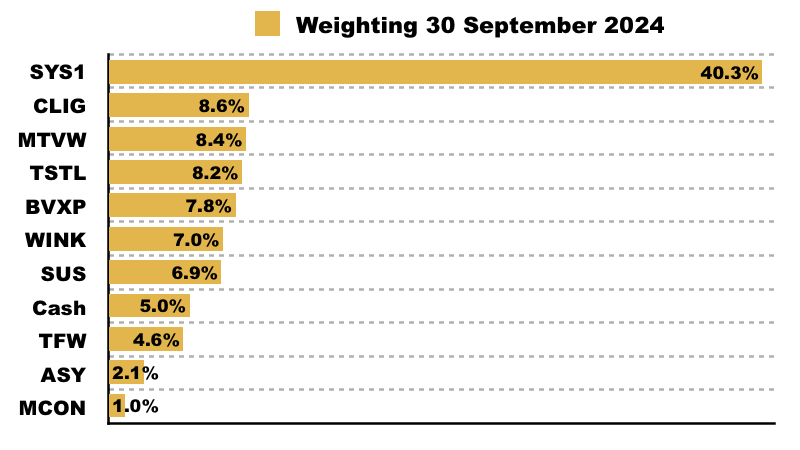

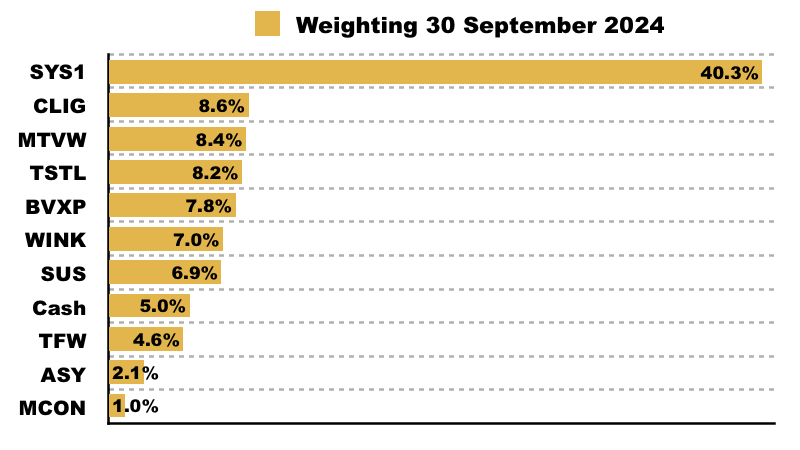

And this chart confirms my portfolio’s holdings and their weightings at the end of Q3:

Running multi-baggers to 40% (or more!) of your portfolio

Oh dear — I am once again tempting fate with my blog.

I have invested for 30 years, and my portfolio always seems to fall apart whenever I mention I own a spectacular performer.

My comeuppance is probably due to investment success quickly leading to overconfidence, complacency and bad decisions. Or perhaps the market gods just dislike investors showing off.

I now trust I will not upset the market gods by mentioning my portfolio’s big 2024 winner. System1 is up 143% so far this year and currently represents a mighty 40% of my portfolio — a proportion that deserves further discussion.

Conviction

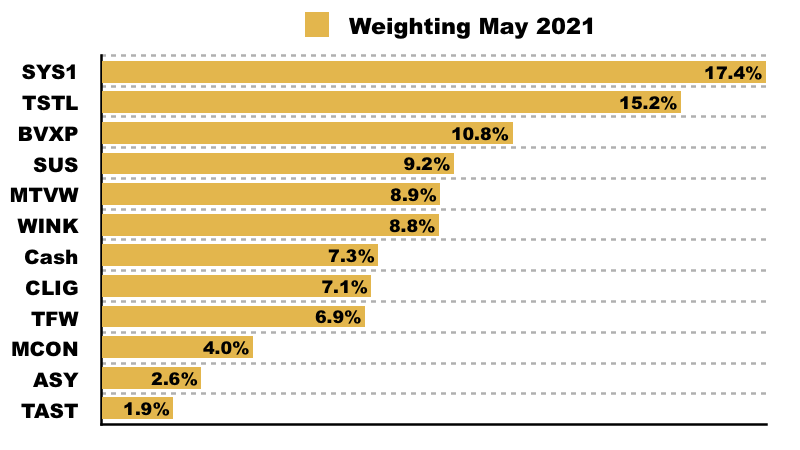

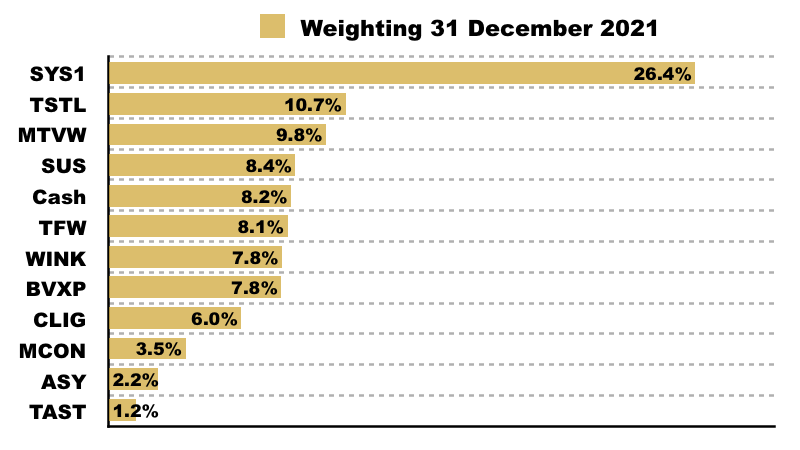

I last topped up System1 during May 2021 and, such was my conviction at the time, the position then represented 17% of my portfolio:

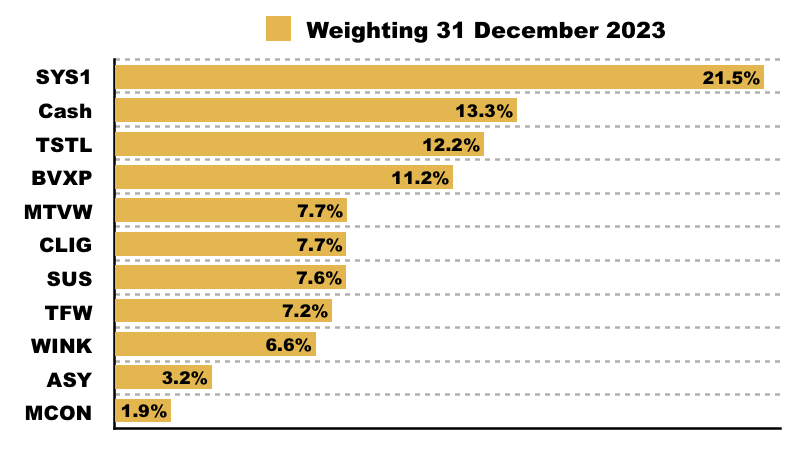

By the end of last year, System1 was by some distance my largest holding at 22% of my portfolio:

And with the shares surging higher, I am well ahead of the market this year…

…and System1 is now more than four times larger than my second-largest holding:

The investment theory is therefore quite simple: build a large holding + wait for a super share price = enjoy an outperforming portfolio.

How far should you run your multi-baggers?

If you build a large position and the share price then starts to motor, how far should you ‘run your winner’?

You will only know for certain with hindsight. But if you are anything like me, then you should probably run it further than you might imagine. In fact, running a big winner to a System1-like 40% may just be the start of an incredible portfolio journey.

I now look back at ‘what could have been’ because I have sadly trimmed large holdings with super share prices far too early.

Tristel

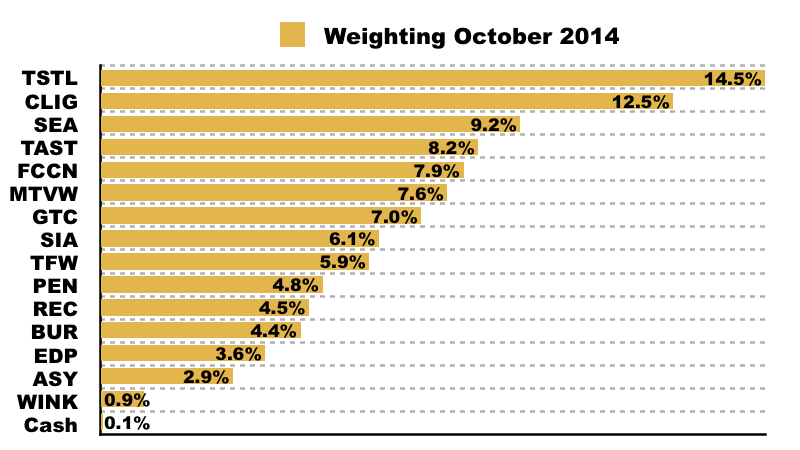

Take Tristel for example. I last bought these shares during April 2014 and six months later the position had reached almost 15% of my portfolio:

Back then I preferred a more diversified approach and I therefore decided to trim my holding. I had bought Tristel at a 46p average and had started selling at only 79p.

Today Tristel shares are 400p having traded as high as 680p. I could have easily run Tristel to well beyond 15% of my portfolio and probably well beyond 40% before cutting back. Instead I sold more at 100p, 123p and 289p during 2015, 2016 and 2017.

Record

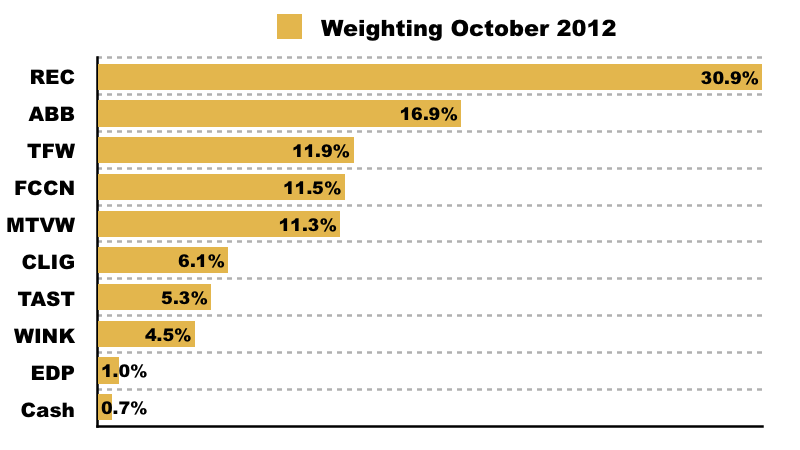

Then there’s Record, which I started buying during 2010 at 36p and stopped buying during April 2012 at 10p when the position became 21% of my portfolio. By October 2012, Record supported 31% of my portfolio after rebounding to 18p:

I decided to sell 75% of my Record shares during the remainder of 2012 at prices between 18p and 31p. That selling reduced my position down to approximately 10% and I exited completely during 2018.

Today Record trades at 60p having reached as high as 100p. With hindsight I should have run Record to well beyond 31% (and 40%) of my portfolio.

London Stock Exchange

Revisiting Tristel and Record is frustrating, but my worst ‘what could have been’ is London Stock Exchange. I started purchasing these shares during 2002 and, by October 2004, was still buying at approximately 320p when the position reached 29% of my portfolio.

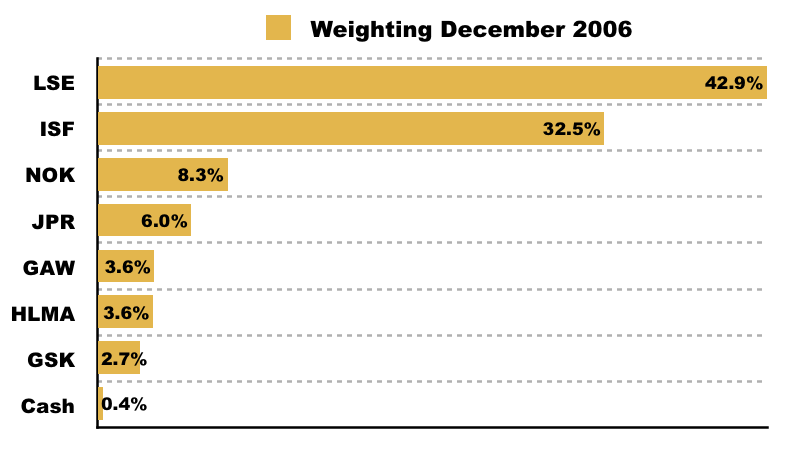

By December 2006 the LSE’s shares had rallied to £13 to represent 43% of my portfolio:

I then started selling, and exited the position completely at £17 during 2007.

Had I decided to stay invested through the 2008 crash and kept all my LSE shares, I would be writing this blog from Monte Carlo. LSE currently trades above £100 and with hindsight I should have just put 100% into the share in 2004 at 320p and then taken up another career.

[Note: Eagle-eyed readers will see I also owned Games Workshop (up 25x since) and Halma (up 13x since) back in December 2006. I sold both of those, too :-(]

Survivorship bias

Blog posts such as this can make investing sound easy. Just invest a lot in a great multi-bagger and then watch your portfolio trounce the market.

But an inherent problem with investing is survivorship bias; we all tend to focus on the market’s best shares and best stock-pickers. So, a few points to consider before you let an investment run to 40% or more of your portfolio.

1) Exceptional winners:

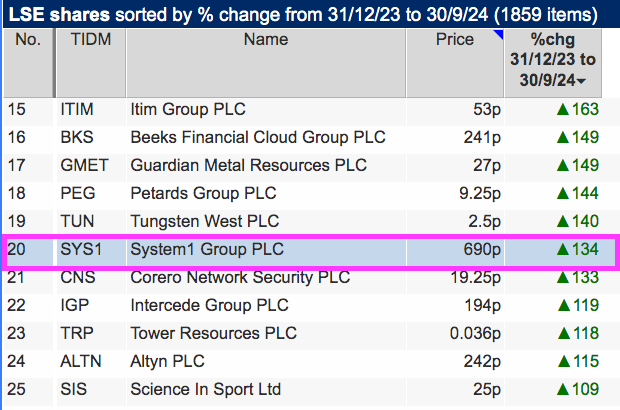

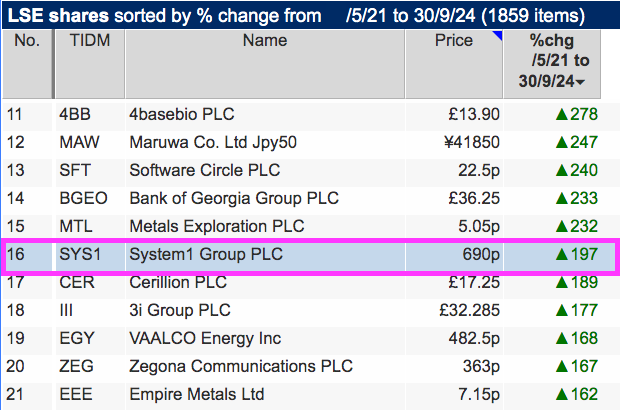

System1’s 2024 performance is not normal. SharePad shows the share to be the 20th best performer this year among 1,859 London-traded equities:

SharePad also shows System1 to be the 16th best performer since my last purchase during May 2021:

Shares generally do not go up so far and so fast as System1.

2) Investment flukes:

My portfolio has always been stuffed with investments that flat-line or eventually sink without trace.

That earlier portfolio chart for this year…

…shows my portfolio would be down 1% YTD without System1. So let’s just say major multi-baggers are very unusual for me.

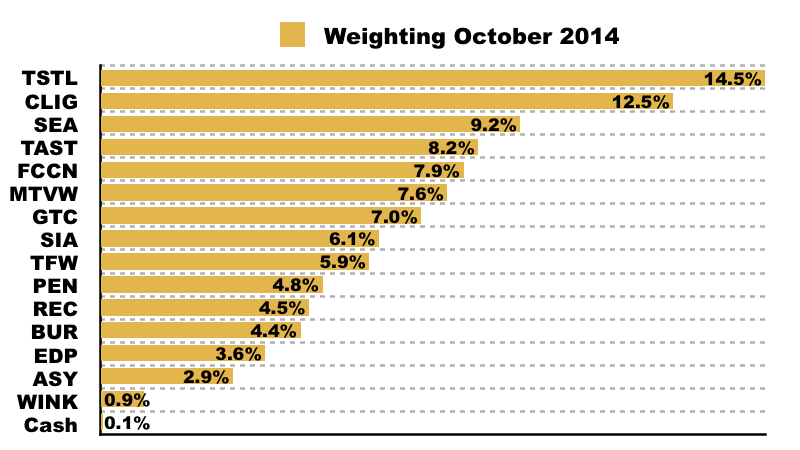

Indeed, go back to October 2014 and Tristel reaching 15% of my portfolio…

…and future disasters I then owned included SeaEnergy, Tasty, French Connection, Getech and Soco International that represented a combined 38% of my portfolio. I must have believed those five names all possessed great potential… before each lost 90%-plus of their value.

Even during my ‘quality investing’ days of 2006, future disasters such as Johnston Press and Nokia sat like time-bombs in my portfolio.

Perhaps owning System1 (and Tristel, Record and LSE) was due mostly to luck.

3) Huge drawdowns:

Writing “Had I decided to stay invested through the 2008 crash and kept all my LSE shares” is all very well…

…until you realise the LSE’s shares started 2008 at £18 and finished 2008 at less than £5. Holding onto a share that represents 40% or more of your portfolio — but then loses 70% of its value! — will test even the most hardiest of long-haul multi-bagger stock-pickers.

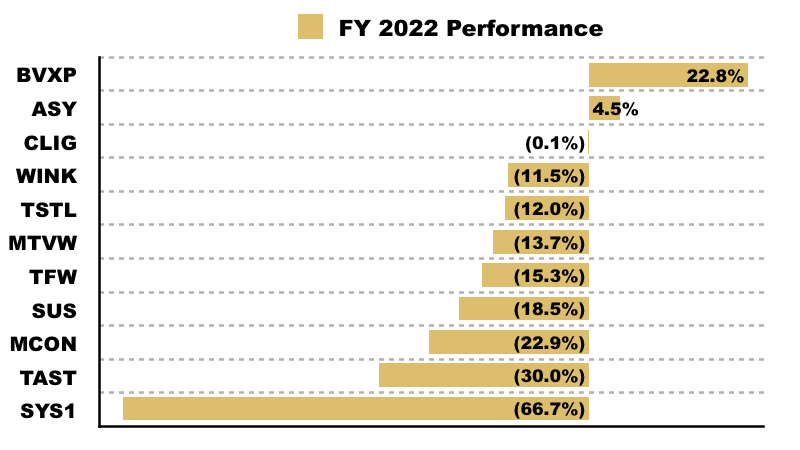

So far I have held my nerve with System1, not least during 2022 when the share started that year supporting a significant 26% of my portfolio…

…but then went on to drop 67%:

I would like to think I could cope with any further large System1 drawdowns. But I can’t rule out top-slicing when if/when I do lose my nerve.

Summary

Sticking with a major multi-bagger can transform a portfolio. And had I kept all my Tristel, Record and/or London Stock Exchange, my investment performance would almost certainly have been far better than it has been — albeit with much greater volatility and even more sickening drawdowns.

Only time will tell whether System1 will eventually transform my portfolio. For now at least, I have my fingers crossed the company can maintain its growth momentum and perhaps meet its own ambitious illustrative projection. If it can, then maybe this winner has much further to run… and can grow far beyond its 40% weighting.

Until next time, I wish you safe and healthy investing.

Maynard Paton

PS: Let’s just hope this blog post does not upset the market gods.

That’s an awesome, highly reflective post! I appreciate you writing honestly about how difficult this business is.

I had to laugh so much at some places, like this:

“Had I decided to stay invested through the 2008 crash and kept all my LSE shares, I would be writing this blog from Monte Carlo. LSE currently trades above £100 and with hindsight I should have just put 100% into the share in 2004 at 320p and then taken up another career.”

Thanks Simon. Glad you enjoyed it!

Maynard

Hi Maynard,

You’re made of far sturdier stuff than I am.

Back in the late 2000s, I ran a super-concentrated portfolio of 10 deep value stocks, which worked out financially but not emotionally. So I diversified to about 30 quality/dividend holdings, and after 15 years of that I’ve decided to go back down to about 20 fairly equally-weighted holdings, which I think is the right balance for me between concentration and diversity.

Will be interesting to see if the market gods punish you for your 40% position, or if they reward you with further outsize gains in 2025.

Good luck!

Thanks John. I suspect I will be punished in the short term but but rewarded (I hope!) in the long term. Let’s see.

Maynard

Thanks for another fascinating post Maynard. Your concentrated portfolio approach is obviously not for everyone – but the resultant volatility is part of how you “earn” your outperformance the long term, along with superior stock selection and knowledge.

I always wondered why you never returned to LSEG after the 08 crash.

Thanks Andrew. I sold LSE due to ‘life events’ and spent 2007-2011 out of the market.

Maynard