03 April 2024

By Maynard Paton

Happy Wednesday! I trust your shares have enjoyed a positive start to 2024.

A summary of my portfolio’s first quarter:

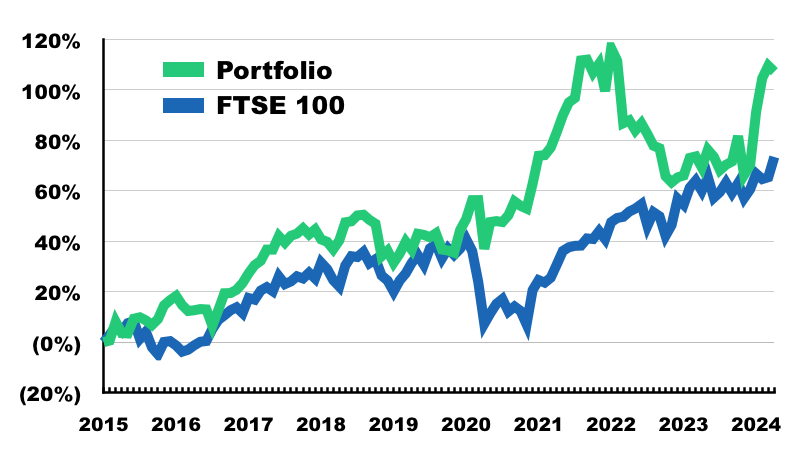

- Q1 return: +8.2%* (FTSE 100: +4.0%**).

- Q1 trades: None.

- Q1 winners/losers: 4 winners vs 6 losers.

(*Performance calculated using quoted bid prices and includes all dealing costs, withholding taxes, account fees, paid dividends and cash interest **Total return)

The year has started with my best Q1 since I commenced this blog at the beginning of 2015.

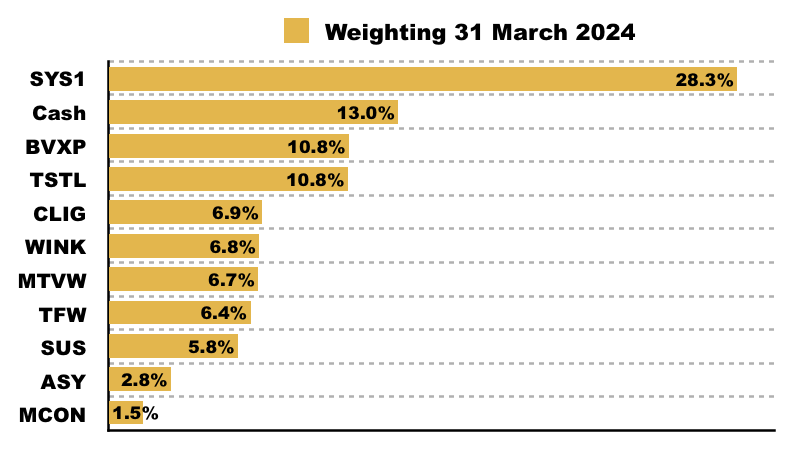

As I predicted within my 2023 review, System1 has dictated proceedings and an upbeat statement from the advert-testing specialist has caused its large weighting to become even larger. My portfolio now requires only a further 5% advance to match its all-time high of December 2021.

Other RNSs from my portfolio were somewhat mixed. Bioventix and Tristel both issued record H1 figures and provided useful increases to their dividends. But S & U warned of lower collections and cut its interim payout, which feels unnerving. I can’t recall the last time a holding of mine reduced its dividend for non-pandemic reasons.

The rest of my shares seem to be marooned, with the stock market generally circumspect about their prospects given their flat-at-best earnings. Small market caps and limited liquidity due to significant director (and ex-director) holdings have not helped matters.

But I remain convinced the owner-orientated managers — backed by respectable competitive positions and asset-rich balance sheets — will eventually reward shareholders for their patience.

I have summarised below what happened to my portfolio during January, February and March. (Please click here to read all of my previous quarterly round-ups). I will then outline some thoughts on corporate cash management and which of my holdings are earning the best and worst interest on shareholders’ money.

Contents

- Q1 share trades

- Q1 portfolio news

- Q1 portfolio charts

- My portfolio’s best and worst corporate cash managers

Disclosure: Maynard owns shares in Andrews Sykes, Bioventix, City of London Investment, Mincon, Mountview Estates, S & U, System1, FW Thorpe, Tristel and M Winkworth. This blog post contains SharePad affiliate links.

Q1 share trades

None.

Q1 portfolio news

As usual I have kept watch on all of my holdings. The Q1 developments are summarised below:

- Board changes and “extremely confident” management at Andrews Sykes.

- Record H1 results showing profit up 15% and the dividend up 10% at Bioventix.

- Further funds under management outflows, a standstill H1 payout and a “strategy of engagement” with George Karpus at City of London Investment.

- FY 2023 profit down 38% but much-needed H2 debt and inventory reductions at Mincon (review coming soon).

- A Q4 profit alert admitting higher loan provisions after collections suddenly deteriorated at S & U.

- Q3 platform revenue up 46% and “materially ahead” projections of a £2m FY 2024 profit at System1.

- Standstill interim progress albeit with the H1 dividend lifted 5% and a “good” start to H2 at FW Thorpe.

- Record H1 results announcing revenue up 20%, profit up 28% and the dividend up 100% at Tristel.

- Confirmation that FY 2023 will show a 6% payout advance but a 16% lower profit at M Winkworth.

- Nothing of significance from Mountview Estates.

Q1 portfolio charts

The chart below compares my portfolio’s monthly progress to that of the FTSE 100 total return index:

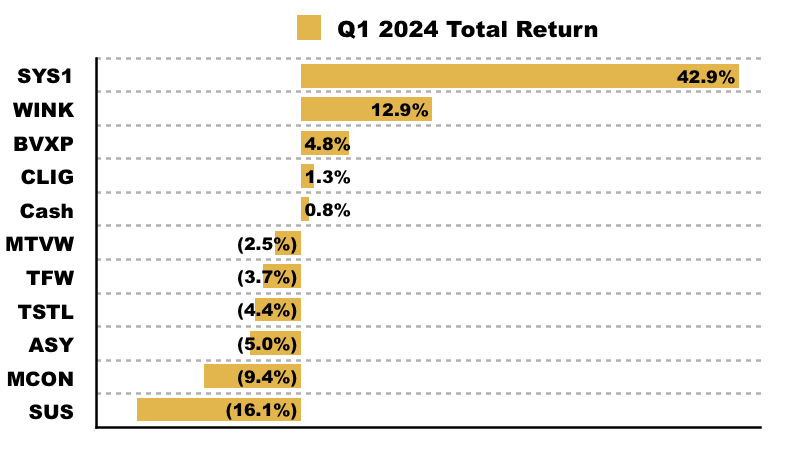

The next chart shows the total return (that is, the capital gain/loss plus dividends received) each holding has produced for me during Q1:

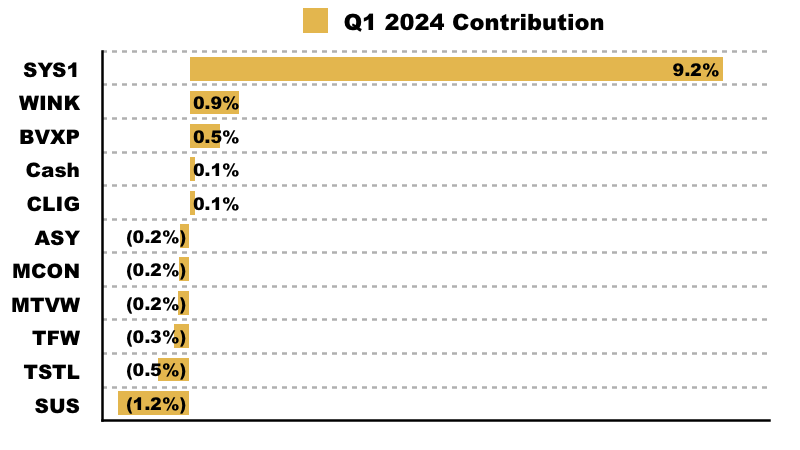

This chart shows each holding’s contribution towards my 8.2% Q1 gain:

And this chart shows my portfolio’s holdings and their weightings at the end of Q1:

My portfolio’s best and worst corporate cash managers

George Karpus may well be right. The largest shareholder of City of London Investment told me a few months ago there were “tremendous opportunities” to properly manage corporate cash balances:

“With interest rates where they are, our cash management should be revived. Professionally managing corporate reserves could be a big opportunity. That’s where I see the company’s growth. I can see growth on the Karpus side and I can see tremendous opportunities in London. But the board does not see that.”

Receiving a respectable rate of interest on a company’s cash deposits ought to be among the more straightforward tasks for a finance director. And yet a check of my own portfolio suggests a wide range of rates being earned on behalf of shareholders. Strategies include enjoying 5%-plus from active cash management and receiving an ‘under-the-mattress’ 0%.

If you, like me, prefer to invest in cash-rich businesses, then maybe your portfolio also contains sleepy FDs who have yet to maximise their company’s cash returns.

Estimating the interest rate

I estimate the rate of interest earned on a company’s cash position by dividing the amount of interest earned during a half-year or full-year by the average cash balance for that same period.

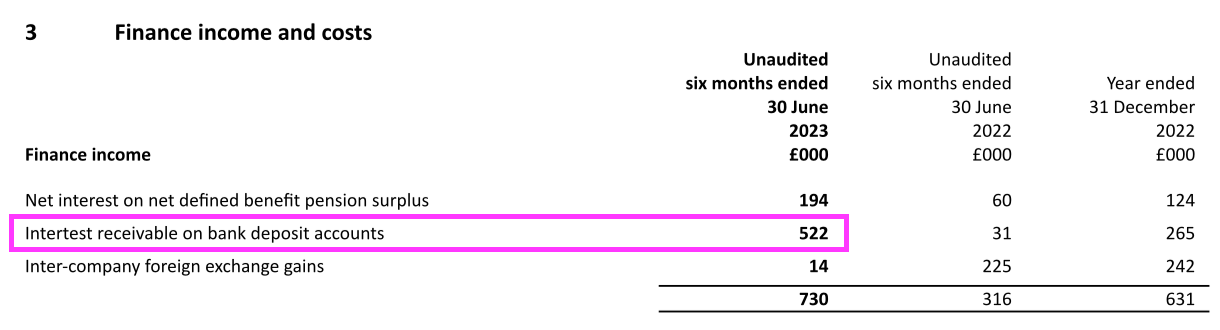

Interest earned can be found in the finance-income footnote, and sometimes can be mixed with dividends received, investment gains and pension movements. For example, the latest (interim) figures from Andrews Sykes showed bank interest of £522k earned during the six months to 30 June 2023:

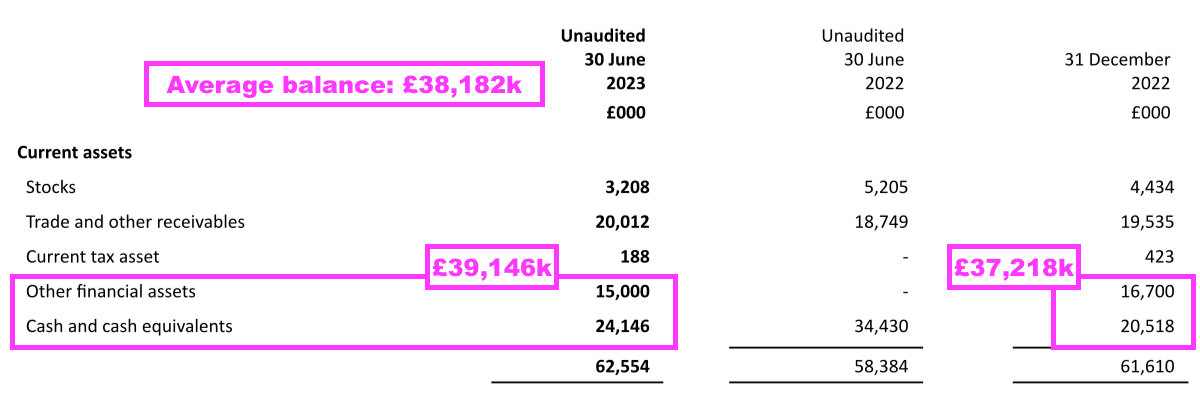

The average cash balance is simply the average of the start and end values of the cash position taken from the balance sheet.

Note that ‘cash and cash equivalents’ represent cash that can be accessed within three months, while any money on deposit with a maturity of more than three months will usually be classified under a separate entry, such as ‘short-term investments’ or ‘other financial assets’.

For example, the same results for Andrews Sykes include both the standard ‘cash and cash equivalents’ alongside cash that can be accessed only after three months:

For the six months, I calculate Andrews Sykes earned interest at an effective 1.37% (£522k/£38,182k), which annualised comes to 2.73%.

Calculating the interest rates achieved by my other nine shares gives the following results:

| Company | 6 months to | Interest (£k) | Average cash (£k) | Rate (%) |

| City of London Inv.* | 31-Dec-23 | 697 | 27,241 | 5.12 |

| Bioventix | 31-Dec-23 | 92 | 5,611 | 3.28 |

| Andrews Sykes | 30-Jun-23 | 522 | 38,182 | 2.73 |

| Tristel | 31-Dec-23 | 125 | 10,156 | 2.46 |

| M Winkworth | 30-Jun-23 | 34 | 4,743 | 1.43 |

| FW Thorpe | 31-Dec-23 | 204 | 33,158 | 1.23 |

| Mincon** | 31-Dec-23 | 71 | 16,578 | 0.86 |

| Mountview Estates | 30-Sep-23 | 0 | 1,342 | 0.00 |

| S & U | 31-Jul-23 | 0 | 1,569 | 0.00 |

| System1 | 30-Sep-23 | 0 | 6,000 | 0.00 |

(*Figures in USD **Figures in EUR)

Top of the table

No surprise to see City of London Investment at the top of the table after its major shareholder lobbied the board to make use of the group’s own cash-management service!

Mr Karpus started managing cash professionally during 1980, and built up his Karpus wealth-management business partly on active cash strategies that employ government bonds, exploit overseas rates and undertake ‘reverse repos’.

The Karpus cash-management division is now part of City of London Investment and, according to Mr Karpus, could have helped the group earn 6% on its deposits:

“[The directors] have been slow to embrace changes to our [cash] reserves that would improve returns and reduce risk… The generous dividend is protected in the near future by substantial after-tax cash reserves that now should be earning 6% annually or about 2.1 million during this fiscal year.”

My estimate of 5% earned by City of London Investment is not quite the 6% hoped for by Mr Karpus, but is good enough versus what the rest of my portfolio has achieved.

Between 2% and 4%

Of my other shares, only Bioventix, Andrews Sykes and Tristel earned more than an annualised 2% on their cash during their last half years. I note both Andrews Sykes and Tristel have disclosed holding cash on deposit for more than three months, which ought to pay a greater rate of interest than their instant-access accounts.

I suspect Bioventix also has cash on deposit for more than three months, but the company’s (unusual) UK GAAP accounting (see AIM rule 19) may not need to differentiate such deposits from ‘standard’ cash.

All three companies have sported significant cash deposits for years and I am hopeful the trio’s future results will show greater sums attracting higher rates.

Between 1% and 2%

Elsewhere in my table, the sub-2% rates effectively earned by FW Thorpe and M Winkworth are the minimum shareholders should expect.

My interest-rate benchmark is supplied by NatWest, which offers an instant-access business account paying between 1.46% and 1.92% AER (variable) with no minimum or maximum balance restrictions. Both FW Thorpe and M Winkworth have carried substantial cash reserves for years, and could easily achieve a higher annualised rate using term deposits.

Less than 1%

Mincon‘s sub-1% rate is poor but not as awful as the 0% earned by Mountview Estates, S & U and System1.

One excuse I guess for Mincon, Mountview Estates and S & U is all three employ notable borrowings, and I dare say their respective treasury departments have been preoccupied with paying greater interest to think about receiving greater interest of late. Mountview Estates and S & U are both asset-backed companies and typically operate with minimal cash anyway.

I can’t see any reason for System1 earning no interest whatsoever, although I understand the next results ought to show interest being received. Mitigating the mattress-based approach to cash reserves is the group’s turnaround and return to positive cash generation.

I can only speculate System1‘s management has been too busy with that recovery to find a bank account that pays interest.

Calculation considerations

My calculations are not perfect and their interpretation should consider the following:

- Demands on company cash can be unpredictable, and keeping cash on hand will limit payment problems but also earn lower interest than term deposits.

- Company cash balances can fluctuate significantly from day to day, and the actual daily-average cash balance may differ substantially to my simple period-start/end average.

- Company cash balances may be held within different geographies with interest rates different to those of the UK.

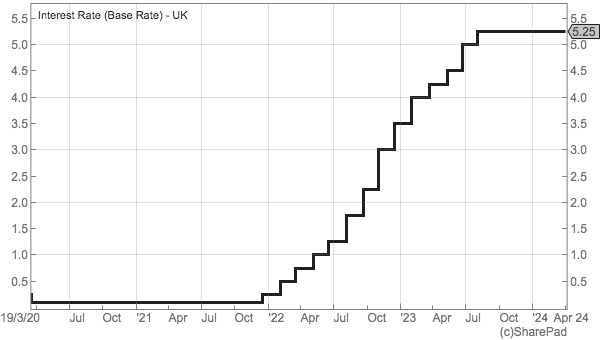

- The UK base rate has sat at 5.25% since August 2023, and interest earned by companies before then may not be as high as interest earned now:

Nonetheless, any business that has reported consistent cash balances but is currently receiving little interest should prompt some questions for the FD. What is the company’s cash-management strategy? Where is the cash held? How does cash flow fluctuate? Are you ‘window dressing‘ the balance sheet?

Summary

I doubt every FD will adopt the extreme cash-management approach of Mr Karpus — he would transfer money to banks in different timezones to ensure he always captured that day’s interest — but company cash in the bank is still shareholders’ cash…

…and shareholders should expect directors to exploit those reserves to generate greater interest to enhance profits or at least counter rising costs. City of London Investment has started to do just that, and I trust my other holdings will soon follow.

Until next time, I wish you safe and healthy investing.

Maynard Paton