27 February 2024

By Maynard Paton

FY 2023 results summary for Bioventix (BVXP):

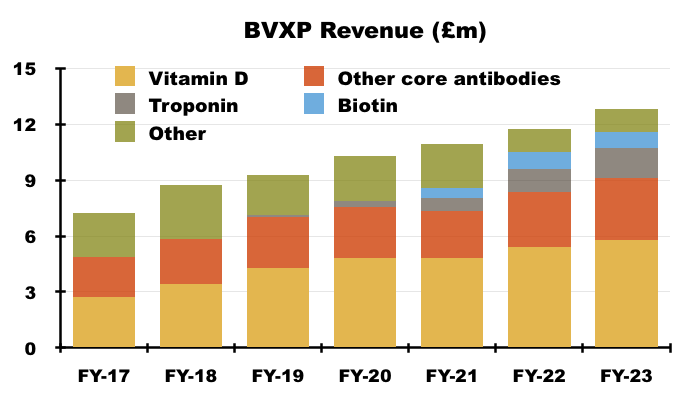

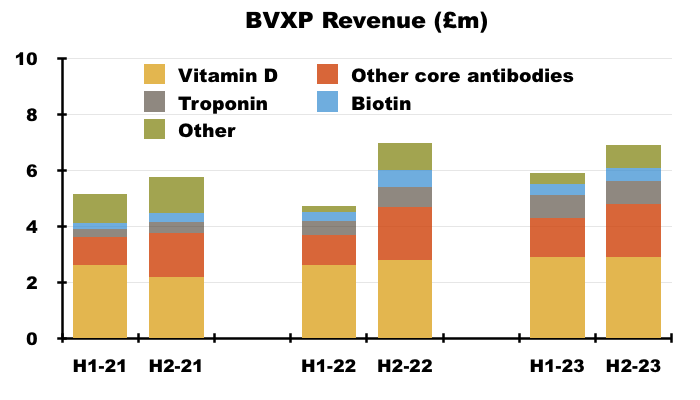

- A record FY, with revenue up 9% and profit up 8% albeit split between a post-pandemic H1 rebound followed by a standstill H2.

- Sales efforts were supported by best-seller vitamin D (+7%) and second-best-seller troponin (+30%), although the latter may not be too far away from reaching ‘peak’ revenue.

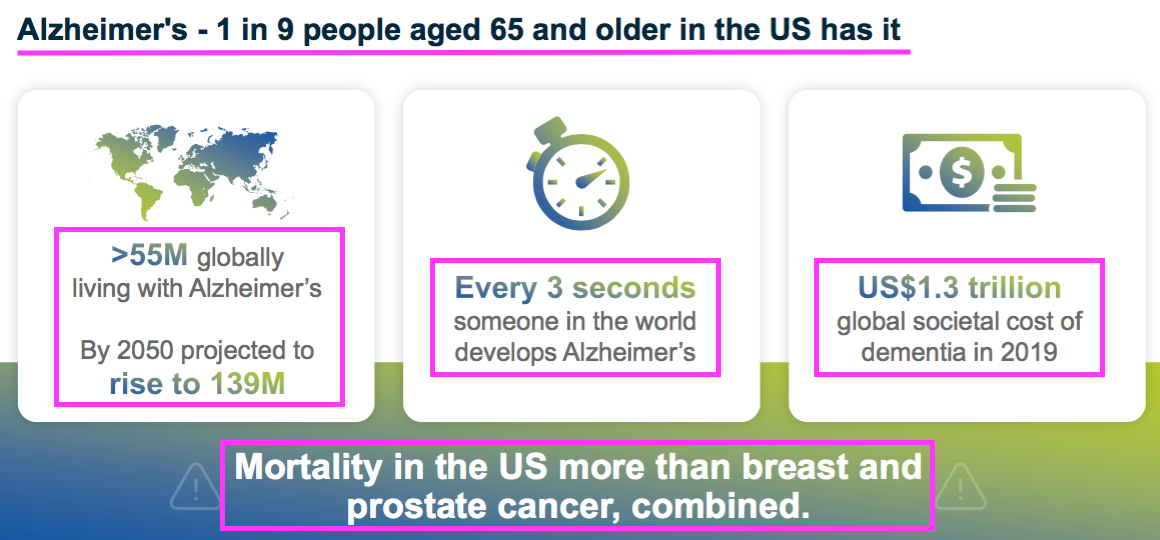

- Significant long-term progress continues to rest upon R&D success with the University of Gothenburg, which has published encouraging lab results using BVXP’s antibodies to identify early-stage Alzheimer’s through p-tau217.

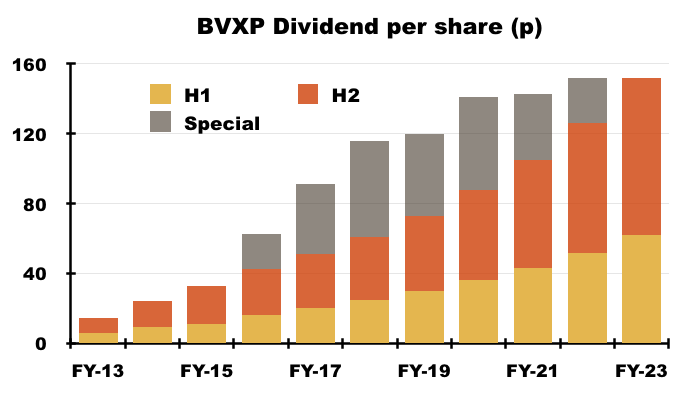

- While revenue per employee at a super £801k and minuscule £11k capex continue to underpin amazing cash generation, the total dividend was unchanged at 152p per share, dividend cover has reduced to almost 1x and the seven-year run of special payouts has now ended.

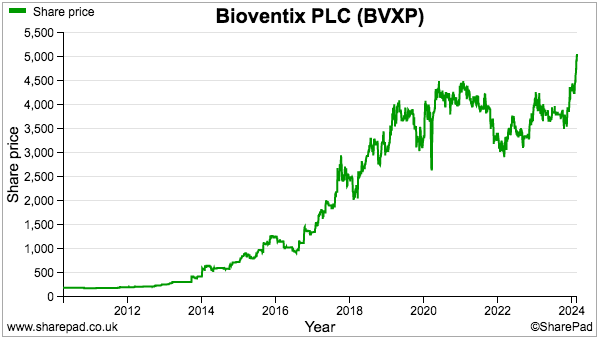

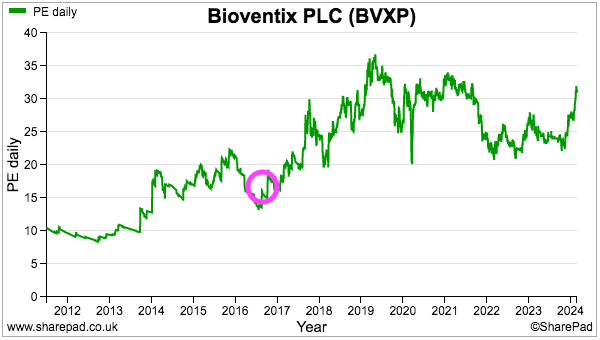

- The £50 shares trade at a premium 31x P/E and reflect understandable Alzheimer’s optimism alongside the general revenue longevity and terrific economics of successful antibodies. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own BVXP

- Results summary

- Revenue, profit and dividend

- Product revenue and royalty income

- Vitamin D

- Troponin

- Other antibodies

- Pipeline developments: tau

- Pipeline developments: biomonitoring

- Pipeline developments: CardiNor and Pre-Diagnostics

- Financials

- Valuation

News links, share data and disclosure

- Annual results and presentation for the twelve months to 30 June 2023 published 30 October 2023.

- Share price: £50

- Share count: 5,219,656

- Market capitalisation: £261m

- Disclosure: Maynard owns shares in Bioventix. This blog post contains SharePad affiliate links.

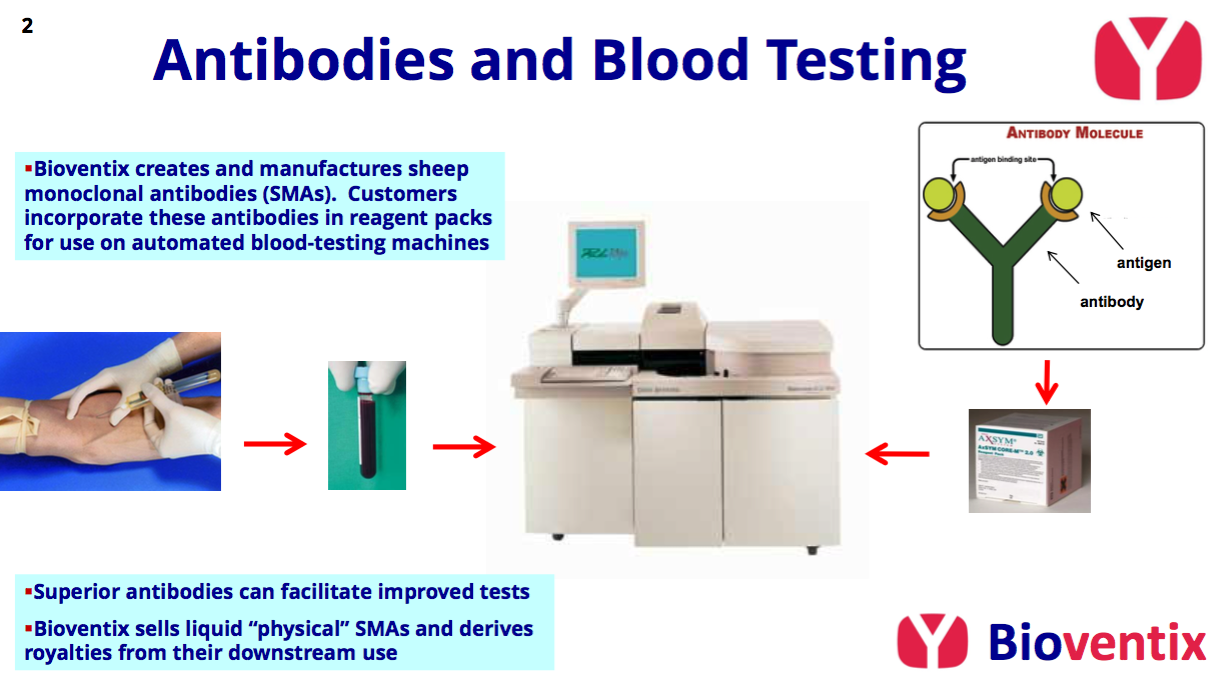

Why I own BVXP

- Develops diagnostic blood-test antibodies, direct competition for which is limited due to the necessary scientific innovation, protracted regulatory testing, onerous switching procedures and ‘captive’ hospital end-customers.

- Boasts founder/entrepreneurial chief exec who has overseen an attractive growth record, retains a 6%/£15m shareholding and has declared seven special dividends.

- Employs ‘scalable’ royalty/licensing model that requires few employees and leads to terrific margins, generous cash flow and immense returns on retained profits.

Further reading: My BVXP Buy report | All my BVXP posts | BVXP website

Results summary

Revenue, profit and dividend

- A record H1 that suggested a “solid performance” for H2…

“In conclusion, after the difficulties experienced during the pandemic, we are pleased to see a solid performance of our core business and look forward to this continuing over the remainder of the year. We remain optimistic about our troponin revenues and the success of these high sensitivity troponin products around the world and we look forward to reporting further progress in the second half of the year.“

- …had already implied this FY would report satisfactory progress.

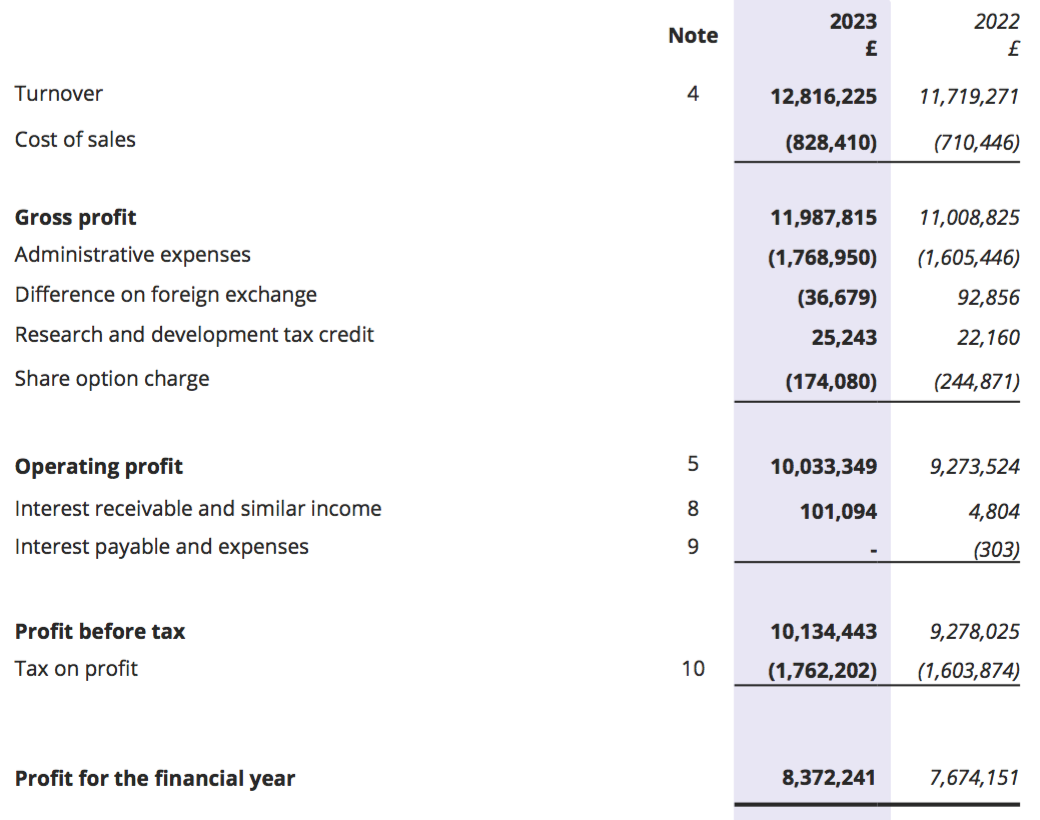

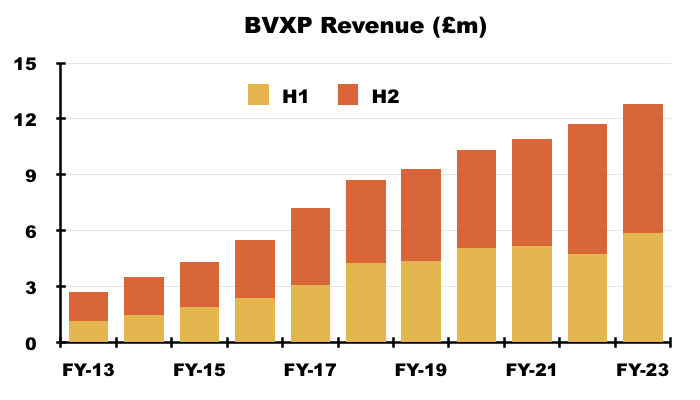

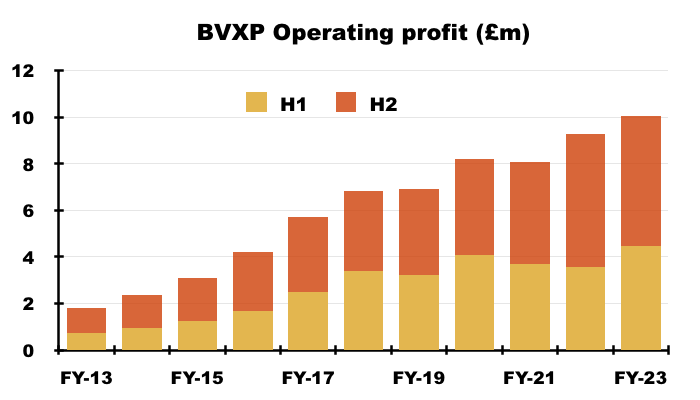

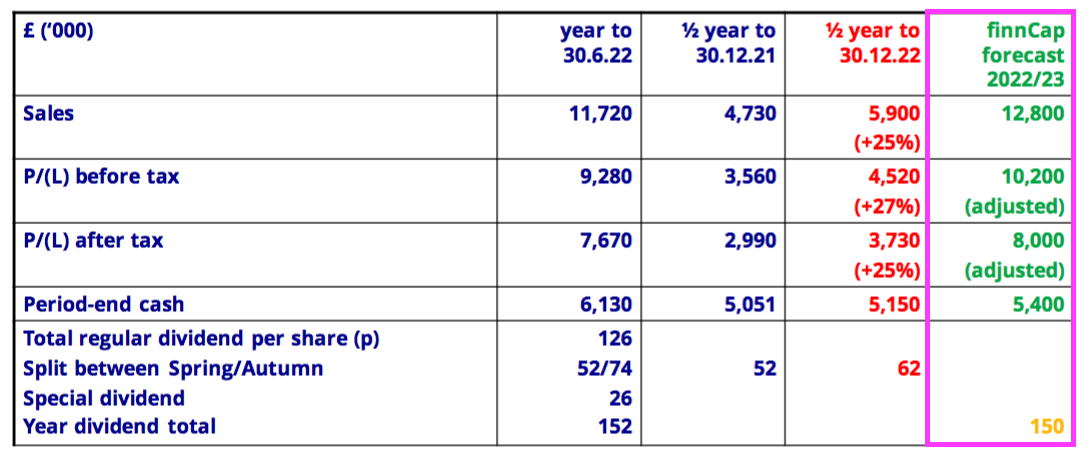

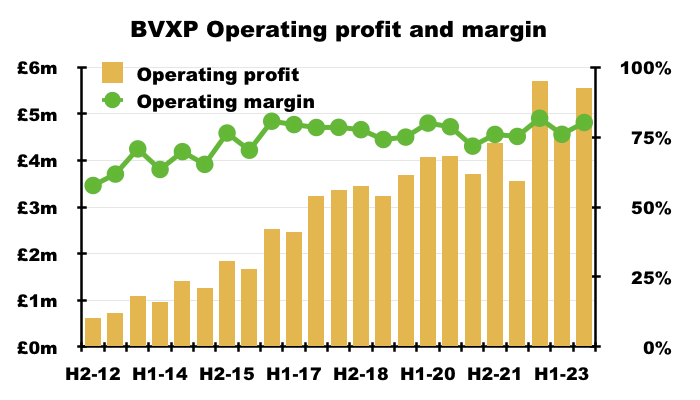

- FY revenue advanced 9% and FY operating profit advanced 8% to set new annual records:

- This FY broadly met the broker forecasts highlighted at the preceding H1; revenue was in line, pre-tax profit was £0.1m behind, post-tax profit was £0.4m ahead and cash in the bank was £0.3m ahead:

- FY progress was supported entirely by the strong H1 performance, which witnessed both H1 revenue and H1 profit advance approximately 25% following a post-pandemic rebound.

- In contrast, H2 revenue dipped 1% to £6.9m while H2 profit fell 3% to £5.6m.

- The FY performance — but not the standstill H2 — matched the “sustainable” 8-10% growth rate cited during the comparable FY:

“[FY 2022]: The growth in our underlying business over the year is in the range 8-10% which we believe is sustainable for the immediate future as our sales mix continues to change.”

- This FY reiterated the bulk of revenue is effectively earned in USD:

“We estimate that between 50% and 60% of our total revenue is either directly linked to US Dollars via physical product pricing in Dollars or indirectly linked to US Dollars via royalties based on downstream Dollar sales. The remainder of the currency split is dominated by Euros and important Asian currencies. In the past year, exchange rates have been relatively stable compared to the previous 12 months.”

- Currency movements did not seem to cause the standstill H2.

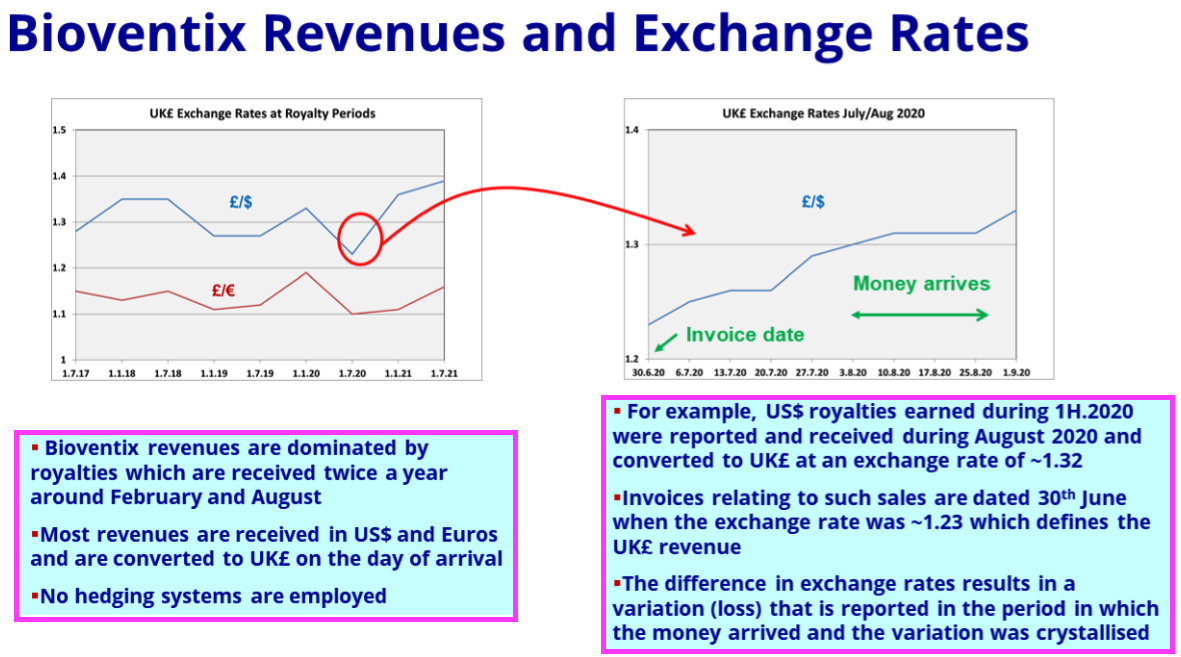

- FY 2021 explained how exchange rates influence revenue:

- Royalty invoices for H2 were dated 30 June 2023, at which point GBP:USD was 1.270

- Royalty invoices for the comparable H2 were dated 30 June 2022, at which point GBP:USD was 1.216.

- As such, USD-invoiced H2 revenue was translated into GBP at only a 4% lower rate.

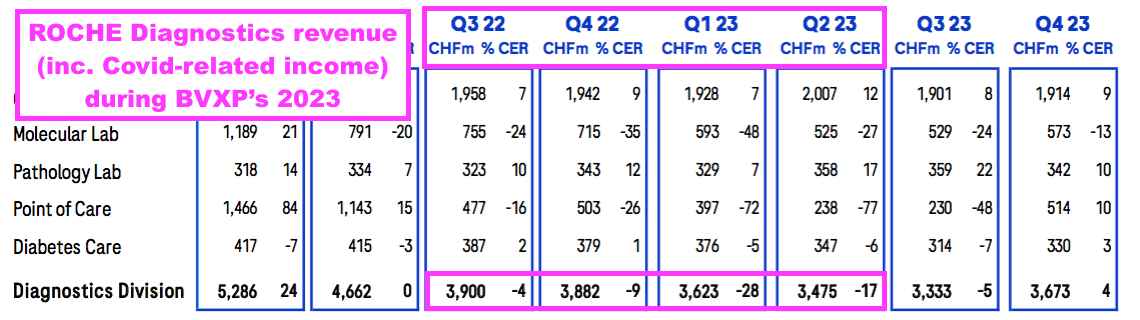

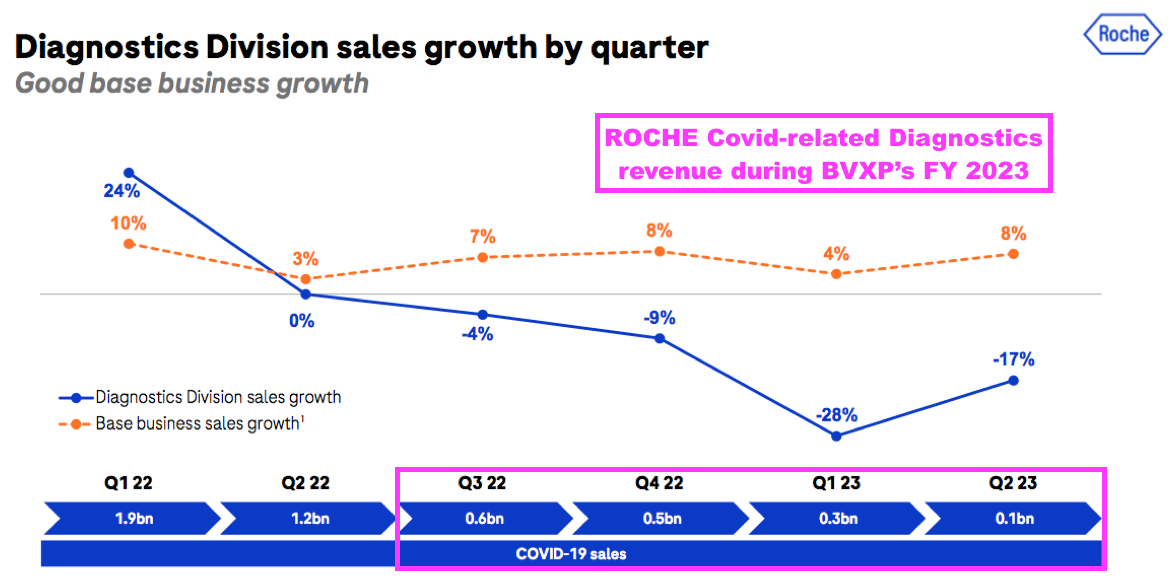

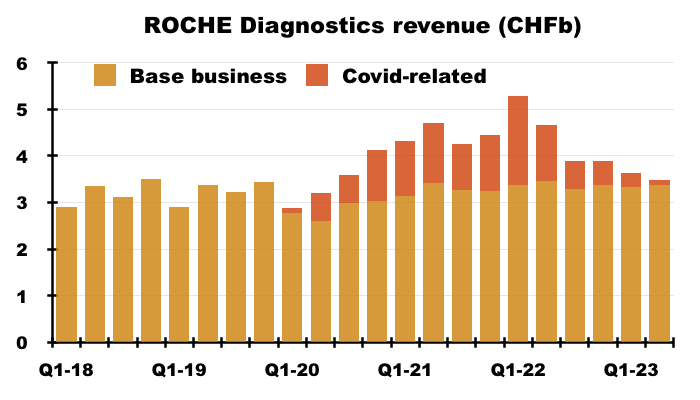

- BVXP’s FY revenue progress looks to have exceeded that of Roche, the world’s largest in vitro diagnostic (IVD) company.

- Roche supplies a vast range of healthcare diagnostic services and seems as good a benchmark as any to judge demand for the type of blood-test antibodies BVXP develops.

- The comparable twelve months at Roche saw quarterly diagnostic revenue (excluding Covid-related income) remain flat (at CHF13.4b) versus 9% revenue growth at BVXP:

- BVXP appears to have outperformed Roche during the pandemic.

- I estimate Roche’s routine-diagnostic sales expanded 4% (CHF12.9b to CHF13.4b) between July-June 2019 and July-June 2023:

- BVXP’s revenue meanwhile advanced 38% (£9.3m to £12.8m) during the same four years (FY 2019 to FY 2023).

- My H1 review speculated BVXP, were it to repeat the 19% H1 dividend advance for the H2 payout, could declare a 13p per share special dividend within this FY.

- BVXP instead lifted the H2 dividend by 22% to 90p per share and did not declare a special dividend.

- The absence of a special divided ceased a run of seven years with an extra payout:

- The 152p per share FY dividend matched the total ordinary/special 152p per share dividend declared for the comparable FY.

- Reported FY earnings of 160p per share covered the FY dividend by just 8p per share.

- The absence of substantial dividend cover suggests special payouts will not return in the immediate future.

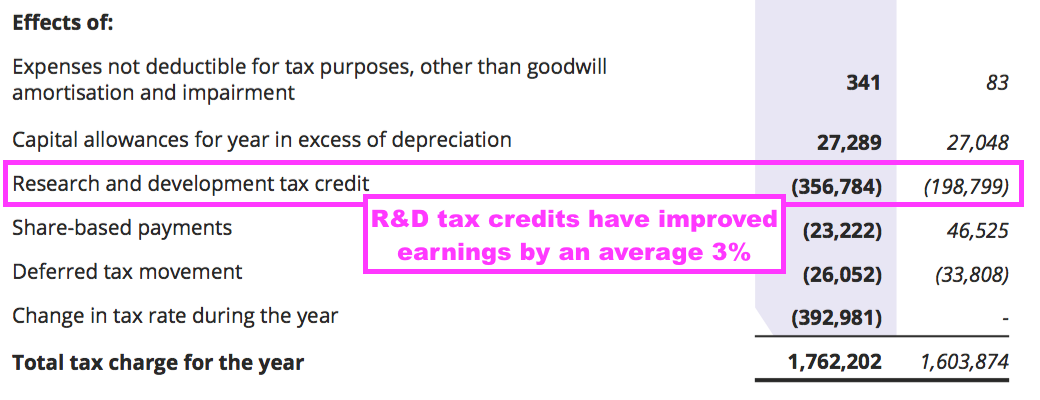

- Earnings would have exceeded the 152p per share dividend by just 1p per share had the 25% standard UK tax rate been in force for the entire FY (see Financials).

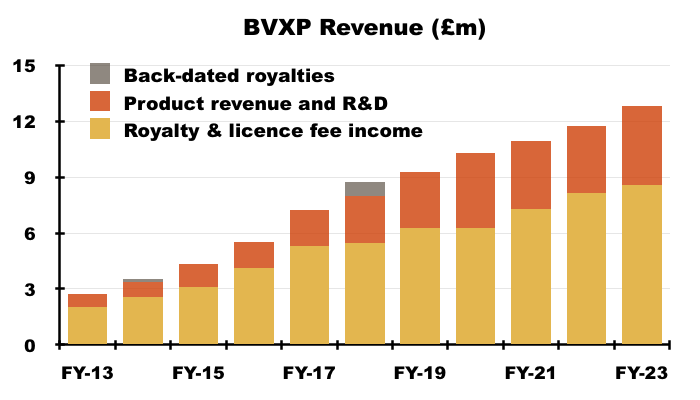

Product revenue and royalty income

- Royalties and licence fees continue to represent the bulk of BVXP’s revenue:

- Management explained during the 2022 AGM that customers can:

- Buy BVXP’s antibodies in physical form, and/or;

- Manufacture BVXP’s antibodies under licence and pay a royalty for their subsequent usage.

- Whether payments are made through physical sales or royalties/licence fees is determined mostly by the volume of antibodies required for a particular blood test. Some tests require 100s or 1000s more antibodies than others:

- Antibodies used in large volumes tend to be sold physically and collect only small royalties, whereas antibodies used in small volumes tend to have small physical sales but collect larger royalties.

- Royalty rates are typically around 2% of the price the end user (e.g. a hospital) pays BVXP’s customer (e.g. a blood-test machine manufacturer) for the blood-test reagent packs.

- Royalties and licence fees gained 6% during this FY to £8.6m, while product revenue (physical sales) alongside contract R&D (subcontracting income) gained 18% to £4.2m.

- Product revenue and contract R&D has gained 70% during the last five years versus 56% for royalties and licence fees.

- Physical sales during this FY were helped by greater Chinese demand:

“Our shipments of physical antibody to China continued to increase. Some sales are made directly but the majority are made through five appointed distributors. Regulatory approvals for domestic Chinese customers have considerable lead times but we continue to see modest increases in royalty payments owing from these customers.”

- But greater Chinese demand may lead to greater Chinese risks:

The prospects for further growth in China are good although we detect pressure on downstream final assay prices that has resulted from aggressive purchasing on the part of centralised procurement organisations. This could exert pressure on Bioventix as we supply relatively high-cost reagents. We also recognise that continued antibody technology development in China and elsewhere constitutes a longer-term threat.“

- This FY revealed China accounted for approximately half of all physical sales:

“Sales to China remain strong accounting for ~50% of total physical sales. Chinese downstream assay price pressure has increased through aggressive central health authority procurement mechanisms”

- This FY reiterated the tiny volume of physical antibodies sold:

“We currently sell a total of 15–20 grams of purified physical antibody per year“

- 20 grams of physical antibodies generating product revenue of up to £4.2m during this FY implies antibodies may sell for up to £210k a gram.

- For perspective, gold sells for approximately $2,000 an ounce, which is equivalent to £56 a gram.

Vitamin D

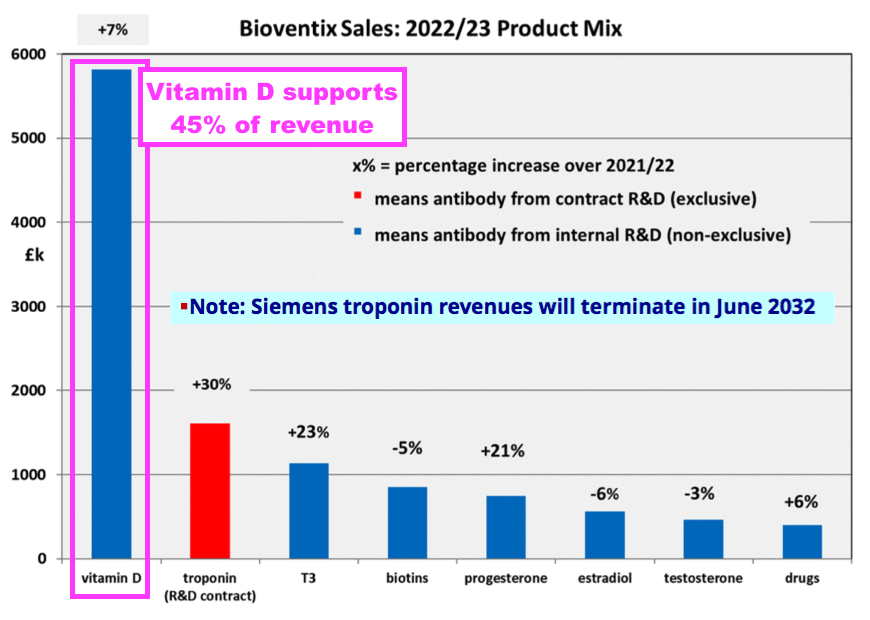

- BVXP’s vitamin D antibody remains by far the company’s best seller and increased its FY revenue by 7%:

“Our most significant revenue stream continues to come from the vitamin D antibody called vitD3.5H10. This antibody is used by a number of small, medium and large diagnostic companies around the world for use in vitamin D deficiency testing. Sales of vitD3.5H10 increased by 7% to £5.8 million which reflects analysts’ expectation for a relatively mature global IVD market.”

- The FY powerpoint implied the analysts’ expectation was between 5% and 10%:

“Vitamin D and core antibody sales were in line with an expectation of 5-10% annual growth“

- Vitamin D represented 45% of total revenue:

- Vitamin D has represented between 38% of revenue (FY 2017) and 47% of revenue (FY 2020) since FY 2016:

- This FY and the preceding H1 provided minimal commentary on vitamin D.

- BVXP has claimed since FY 2017 that vitamin D sales would “plateau” and the other year the company talked of “price erosion in downstream markets“:

[H1 2022]: “As reported previously, the growth rates for our vitamin D antibody sales were not expected to match those seen in recent financial years and a plateau in the downstream global vitamin D assay market had been anticipated. Sales associated with assay formats using larger quantities of antibody per test suffered more as price erosion in downstream markets puts pressure on costly “antibody-hungry” products“.

- So far at least, vitamin D revenue continues to advance although the growth rate may indeed ‘plateau’.

- Using broker ‘estimates’, vitamin D revenue was £5.9m during both H1 and H2:

- The same broker ‘estimates’ imply H2 vitamin D revenue was up only 4%.

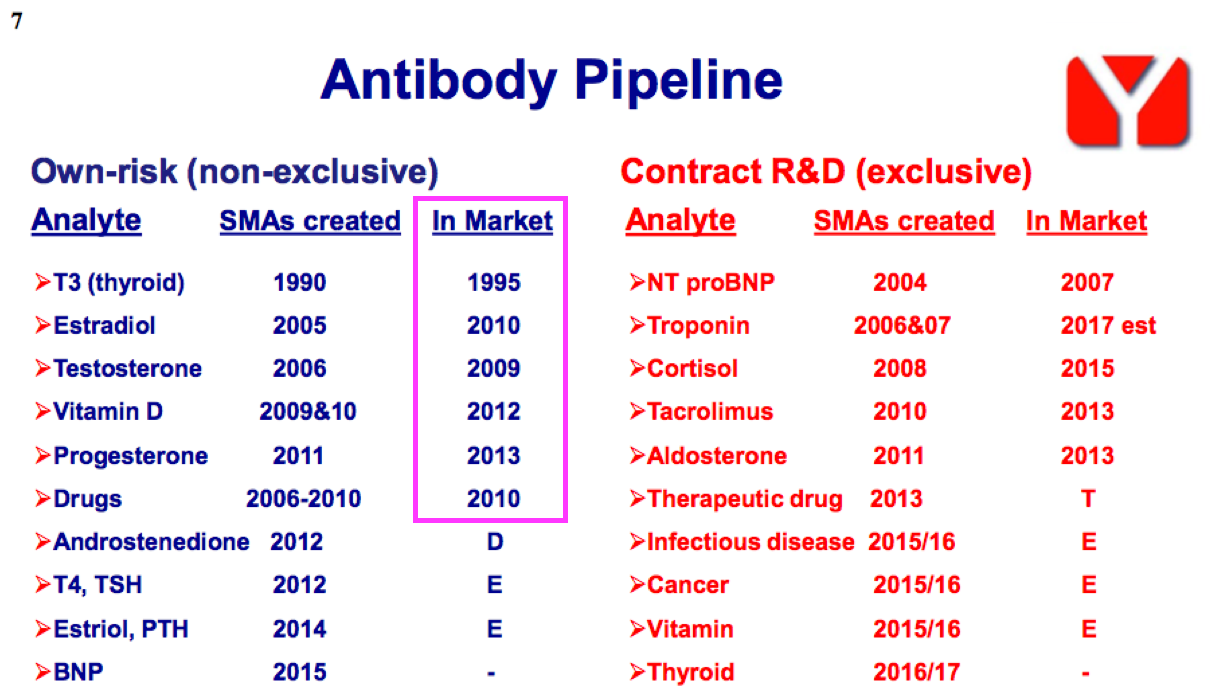

- Development on vitamin D started during 2008 and revenue was first earned during 2011.

- Going from zero revenue to almost £6m within 13 years may give some idea as to the potential of BVXP’s future antibodies.

Troponin

- This FY reiterated BVXP’s near-term prospects are still dependent mostly on the company’s troponin antibody:

“Over the next few years, the continued commercial development of the new troponin assays and their roll-out by our customers will have the most significant influence on Bioventix sales.”

- Development work on troponin — an element used to detect potential heart attacks — commenced during 2006 and sales were first reported during FY 2019.

- This FY revealed troponin revenue gained 30%:

“Troponin is the preferred biomarker to help diagnose heart attacks. Under an antibody creation contract previously undertaken with a company subsequently acquired by Siemens, SMAs were created that facilitated an improved troponin test that was launched by Siemens in 2017. Total troponin antibody sales from Siemens Healthineers and another separate technology sub-license increased by 30% during the year to £1.61 million (2021/22: £1.23 million).”

- The FY 2018 statement explained the “separate technology sub-licence” for troponin:

[FY 2018]: “One of Siemens competitors, Beckman Coulter also offers a new high sensitivity troponin assay. It is known through access to FDA data that this new assay also features a sheep monoclonal antibody. In accordance with our historic exclusivity agreement with Siemens (which we negotiated with Dade Behring, a company later acquired by Siemens) we have played no part in the development of this antibody. Nevertheless, the means by which the antibody was created by another Bioventix licensee does leave us in a position whereby this product will generate some revenue for the company in the future. It would be reasonable to assume that, as with the new Siemens product, it will take a while before this Beckman product gains commercial momentum.”

- This FY referred to analysts’ forecasts for troponin’s potential:

“Whilst the [30%] percentage growth is less than last year, we have no reason to doubt that prospective troponin sales in 2024 and beyond will increase in line with analysts’ forecast until June 2032 when contractual payments from our contract with Siemens will cease.“

- The broker note accompanying this FY stated:

“Given the lower than forecast revenues in FY 2023 and H1, we have reduced our FY 2024 revenue forecast by £0.4m to £2.1m and introduced c.£2.8m in FY 2025E.

Peak revenues of troponin are still estimated to be in the £3-3.5m range.“

- The broker reducing its troponin forecast by 16% to £2.1m for FY 2024 does not feel great.

- While the broker then expects troponin revenue to climb 33% to £2.8m for FY 2025, “peak” troponin revenue of “£3-£3.5m” suggests annual advances thereafter of only c3% until contractual payments cease during 2032.

- This FY was the first RNS to confirm troponin revenue would cease during 2032. Management had previously divulged the 2032 cut-off during a 2020 webinar:

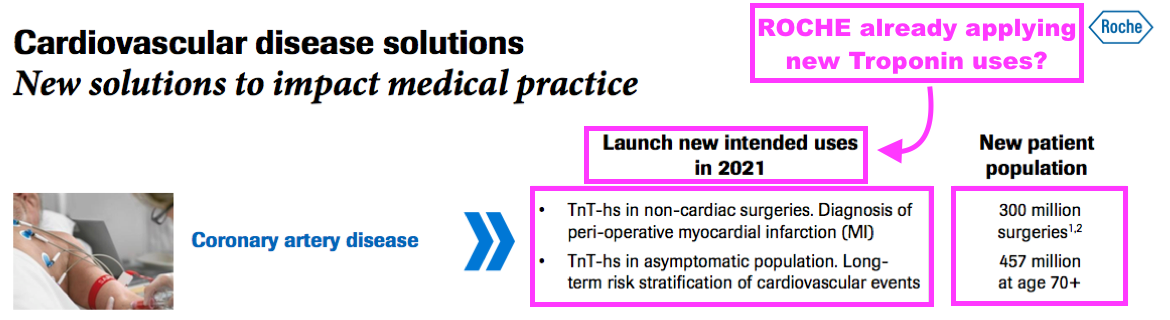

- The broker hinted troponin may enjoy opportunities beyond its current usage:

“As we have indicated in the past, the prospect of this [troponin] revenue level being exceeded could be driven by using troponin beyond its current use as a rule-in test for myocardial infarction (heart attack), to predict potentially higher-risk patients and allow for earlier invasive strategies, for example:

* Diagnosis of peri-operative myocardial infarction (heart attack) and mortality in non-cardiac surgeries. This is evidenced by studies conducted by Roche that show that non-cardiac surgery cases with high pre-operative troponin levels (>14ng/L) are associated with increased mortality over time, with 80%-plus of myocardial injuries after non-cardiac surgery being clinically asymptomatic. According to Roche, there are c.300m people undergoing non-cardiac surgeries who could benefit from this approach.

* Long-term risk stratification of cardiovascular events in asymptomatic patients. This is particularly relevant in the elderly. According to Roche, there are c.457m people over 70 years old who could benefit from this.“

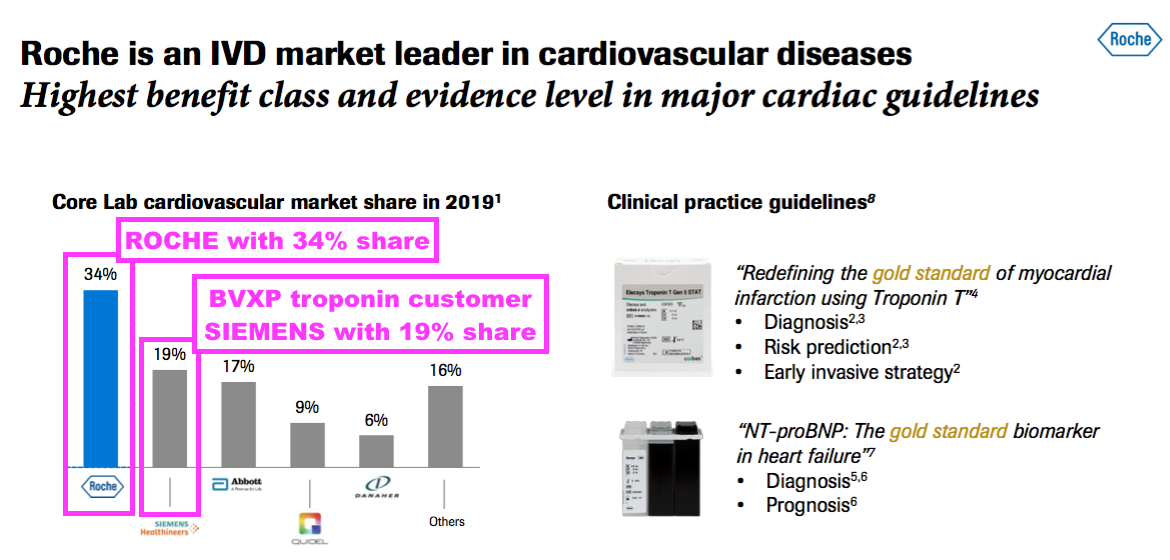

- A Roche presentation from 2021 is the source of the ‘troponin-plus’ speculation:

- Roche naturally has its own high-sensitivity troponin test, which helped support a 34% share of the wider cardiovascular-diagnostic market during 2019:

- BVXP troponin customer Siemens Healthineers enjoyed a 19% share of the wider cardiovascular-diagnostic market during 2019.

- The broker did not make clear whether Siemens Healthineers and sub-licensee Beckman Coulter are actively following Roche down the same ‘troponin-plus’ path.

- BVXP is aware of the additional uses for troponin. The following management comments were made during the aforementioned 2020 webinar:

[Webinar October 2020]: “There is a clear new application for troponin testing, which is in addition to the current application, which is chest pain in accident and emergency clinics. This [new application] relates to people who have had some form of cardiac event but are regular visitors to their cardiologist for routine follow-ups.”

“Troponin levels when measured on those people [who have experienced a cardiac event] enable cardiologists to stratify the risk of those patients into low, medium and high of a secondary event, which enables the cardiologist to better allocate their time and resource to the people who need it and also consider in more detail the therapy of people who are at risk of an impending secondary event.”

- Troponin represented 13% of this FY’s revenue.

Other antibodies

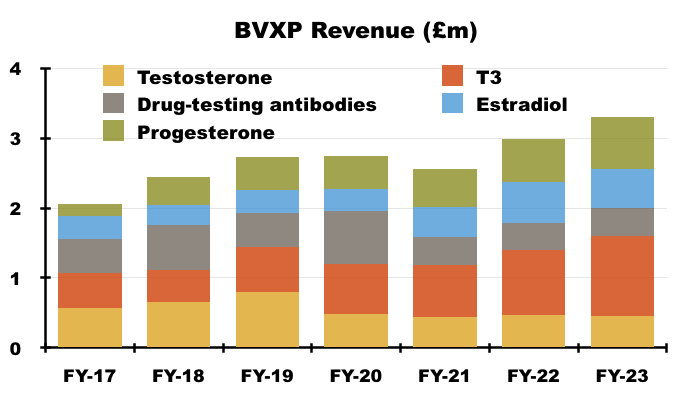

- FY revenue from BVXP’s collection of “core historic” antibodies gained 7% to £4.2m:

- T3 (tri-iodothyronine): £1.14 million (+23%)

- Biotins and biotin blockers: £0.85 million (-5%)

- Progesterone: £0.75 million (+21%)

- Estradiol: £0.56 million (-6%)

- Testosterone: £0.46 million (-3%)

- Drug-testing antibodies: £0.40 million (+6%)

- Income from biotins and biotin blockers was divulged for the first time within the comparable FY, when such sales surged 67%.

- Management comments at the 2022 AGM suggested the biotin antibody — through “good fortune” — was now used as a replacement for streptavidin.

- But management could not offer any explanation for the end customers suddenly buying the streptavidin-like antibody.

- This biotin/streptavidin admission raises a notable downside for shareholders; BVXP seemingly has little knowledge about who or what is exactly driving demand for certain antibodies.

- Despite BVXP apparently not knowing why customers are buying, longer-term progress from the core antibodies has been positive albeit with mixed individual performances:

- Since FY 2017 for example, total revenue from testosterone, T3, estradiol, progesterone and various drug-testing antibodies have climbed 60% to £3.3m, with progesterone income up 322% and testosterone income down 20%.

- For this FY, biotin supported 7% of revenue while testosterone, T3, estradiol, progesterone and various drug-testing antibodies supported a combined 26%.

- Once developed, BVXP’s antibodies typically earn revenue for some time. The FY 2016 presentation suggested the “core historic” antibodies have generated revenue for more than ten years:

- Commercial longevity is due mainly to the healthcare industry’s reluctance to replace a proven blood-test antibody, unless the new upgraded version offers significant diagnostic improvements over the incumbent.

Pipeline developments: tau

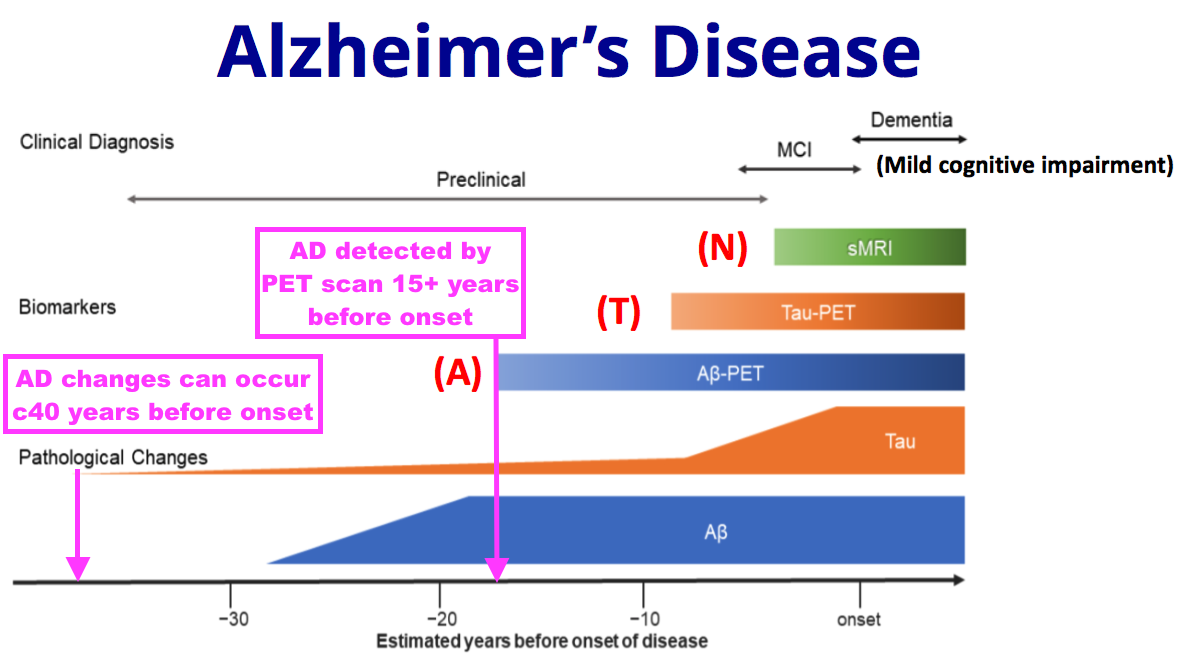

- This FY provided extensive commentary about developing antibodies to diagnose Alzheimer’s disease (AD) through collaboration with the University of Gothenburg (UGOT).

- The commentary introduced the “ATN framework” to shareholders:

“Over the last few years, a considerable amount of lab resource has been allocated to the tau project and Alzheimer’s disease (AD) diagnostics. AD is a complex disease that manifests itself differently across the patient population. At a cellular level, nerve cells (neurons) become associated with amyloid (A)plaques that build up outside the neurons. This is followed by the build-up of tau (T) tangles inside the neurons. These pathological processes then result in neuronal cell death and the symptoms of neurodegeneration (N) that accompany this. This “ATN” framework is used by neurologists to define the disease pathway that progresses many years before patient symptoms become more obvious.

- The recent emergence of treatments to slow AD has triggered a greater need to identify patients suitable for such treatments:

“Recent clinical trials of AD therapeutics have produced remarkable results and there are now two therapeutic agents (Lecanemab from EISAI Pharma and Donenamab from Eli Lilly) that whilst not a cure, have been demonstrated to slow the disease process. Patients presenting early in the ATN pathway appear to benefit most from therapy and ATN assessments can therefore be used to screen for patients suitable for therapy and also for monitoring patients whilst on therapy.”

- AD patients are currently identified and/or monitored through brain scans and lumbar punctures, but the ‘holy grail’ is identification and/or monitoring through simple/fast/cheap blood tests:

“The ATN status of patients can be defined with the use of PET scans using appropriate amyloid and/or tau contrast agents together with other assays for biomarkers in cerebral spinal fluid. It would be desirable if such diagnostic procedures could be replaced or augmented with cheaper convenient blood tests.

- This FY suggested AD could be detected by a brain scan — and hopefully a blood test — more than 15 years before the onset of the condition:

- BVXP explained its involvement with both early-stage identification (‘A’) and later-stage monitoring (‘N’) of AD patients under the aforementioned ‘ATN framework’:

- Tests that identify the early stages of disease (A) could be valuable in identifying patients suitable for therapeutic intervention

- Tests that identify tau tangle formation (T) and the rate of neurodegeneration (N) could help monitor patients receiving therapy

- Bioventix is supplying SMAs to the University of Gothenburg where prototype tests for A and N are being developed“

- BVXP had previously cited only developments with the later-stage AD test.

- This FY spotlighted the success of a BVXP antibody identifying the p-tau217 protein associated with early-stage AD:

“A leading blood biomarker for “A” is a phosphorylated form of tau called pTau217. A prototype assay from Gothenburg using an SMA has now been established which has performed well with frozen patient samples from a number of different cohorts. The “effect size” (AD patients relative to controls) has been x2-4 which is similar to other leading groups and likely to be clinically useful. The percentage of false positives and false negatives is also relatively modest confirming potential clinical utility.”

- Shareholders were directed to this UGOT academic paper: “A novel ultrasensitive assay for plasma p-tau217: performance in individuals with subjective cognitive decline and early Alzheimer’s disease”, Fernando Gonzalez-Ortiz, Journal of the Alzheimer’s Association, accepted for publication October 2023.

- My layman reading of the research paper led to three highlights:

- p-tau217 is generally recognised as being the “most promising… p-tau biomarker” for identifying the likely onset of AD:

“The diagnostic accuracy and sensitivity of plasma p-tau217 have been demonstrated consistently across different publications by various research groups, outperforming other blood-based biomarkers.Although further studies in other cohorts are needed, the current evidence suggests that p-tau217 is the most promising of the plasma p-tau biomarkers presently available.”

- Unlike other p-tau217 studies, BVXP/UGOT’s p-tau217 efforts have helped identify “cognitively unimpaired” patients likely to develop AD:

“Although previous studies have shown good biomarker accuracies for plasma p-tau217,performance among CU [cognitively unimpaired] participants in population-based cohorts has been scanty and in the few available reports the results have been less consistent. This can be attributed mainly to the weak analytical performance (e.g., lack of quantifiable signals, poor precision) of first-generation p-tau217 assays in individuals with very low concentrations including CU participants and those in early symptomatic stages.However, detection of incipient Aβ pathology in the early stages of the AD continuum is crucial not only for early disease identification but also to determine eligibility for recently approved anti-amyloid therapies. The high performance of the UGOT p-tau217 corroborates the results from previous studies. The diagnostic performance of UGOT p-tau217 in early AD makes it a suitable candidate as a first-in-line diagnostic test for patients with suspected AD pathology, regardless of cognitive status.”

- Unlike other p-tau217 assays, the BVXP/UGOT p-tau217 assay comes with no commercial restrictions:

“Even though plasma p-tau217 assays on different platforms from some biotechnology/pharmaceutical companies are expected to become commercially available in the next few months, having an assay developed completely from an academic source removes restrictions such as the need to have the results cleared by the company in question before data can be published. Moreover, the companies tend to select cohorts with clinical and biomarker characterisation that align with their commercial interests, thereby limiting access to these assays. Getting rid of these limitations by providing access to a plasma p-tau217 assay with pure academic interests opens the possibility for assay testing an optimisation in real-life scenarios. The UGOT p-tau217 assay presents an opportunity to fill the gap between academic research and clinical applications by ensuring that the new assay is available to academic partners for research and easily accessible for clinical settings.”

- I hope such unrestricted usage could make BVXP/UGOT’s p-tau217 the preferred assay for other researchers, which may in turn spur wider industry development and perhaps place BVXP in a better commercial position — if or when the test is approved for public use.

- This FY also outlined the later-stage AD work:

“A novel blood-based prototype assay for neurodegeneration (N) using another Tau SMA has also been developed in Gothenburg. This work clearly supports the potential utility of this blood test and further work is on-going in Gothenburg with further publications planned.”

- Shareholders were directed to the following UGOT papers:

- “Brain-derived tau: a novel blood-based biomarker for Alzheimer’s disease-type neurodegeneration”, Fernando Gonzalez-Ortiz, BRAIN 2022: 00, and:

- “Levels of plasma brain-derived tau and p-tau181 in Alzheimer’s disease and rapidly progressive dementias”, Fernando Gonzalez-Ortiz, Journal of the Alzheimer’s Association, accepted for publication October 2023“.

- My layman reading of those research papers derived the following conclusions:

- Blood-based brain-derived tau seems able to replicate the established AD-identification qualities of spinal-fluid brain-derived tau, and;

- A combination of brain-derived tau and p-tau181 seems able to distinguish “unusual presentations” of AD from other cases of “rapidly progressive dementias”.

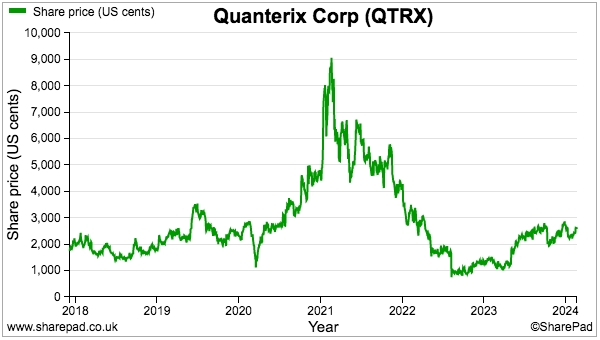

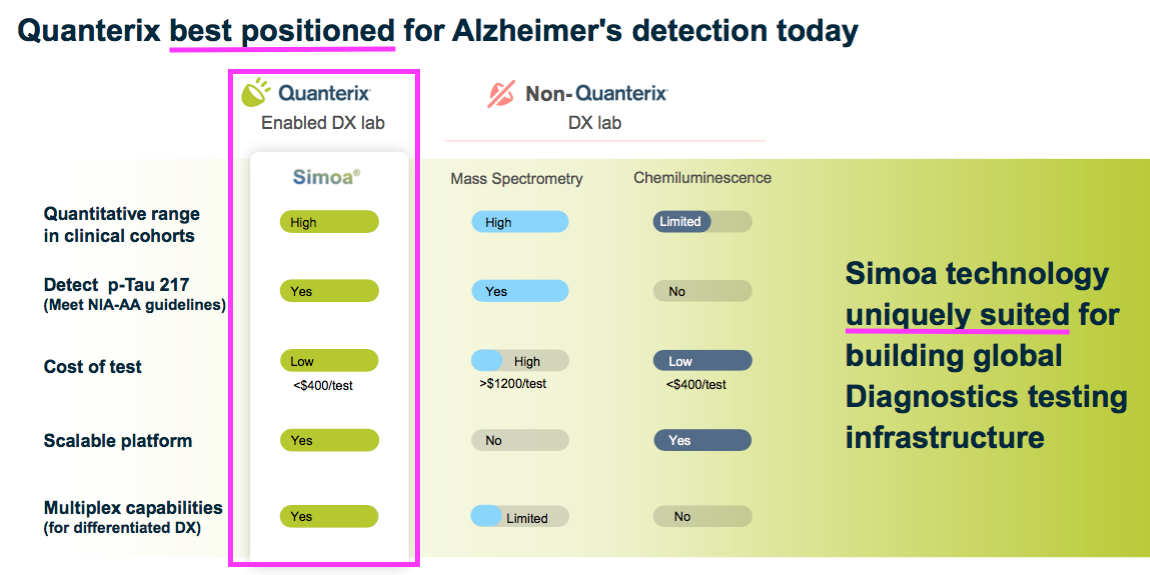

- This FY mentioned Quanterix (QTRX):

“Expert neurology centres are likely to adopt “research use only” tests in advance of the availability of other tests through hospital-orientated IVD companies. The prototype Gothenburg tests are run on Quanterix (Billerica, MA) machines and so a partnership with Quanterix would be desirable in this research use field.”

- QTRX is a $1b Nasdaq-quoted manufacturer of “ultrasensitive” immunoassay analysers, which are apparently “up to 1000x” more powerful than conventional analysers:

- QTRX reckons its machines are the equipment of choice for AD research:

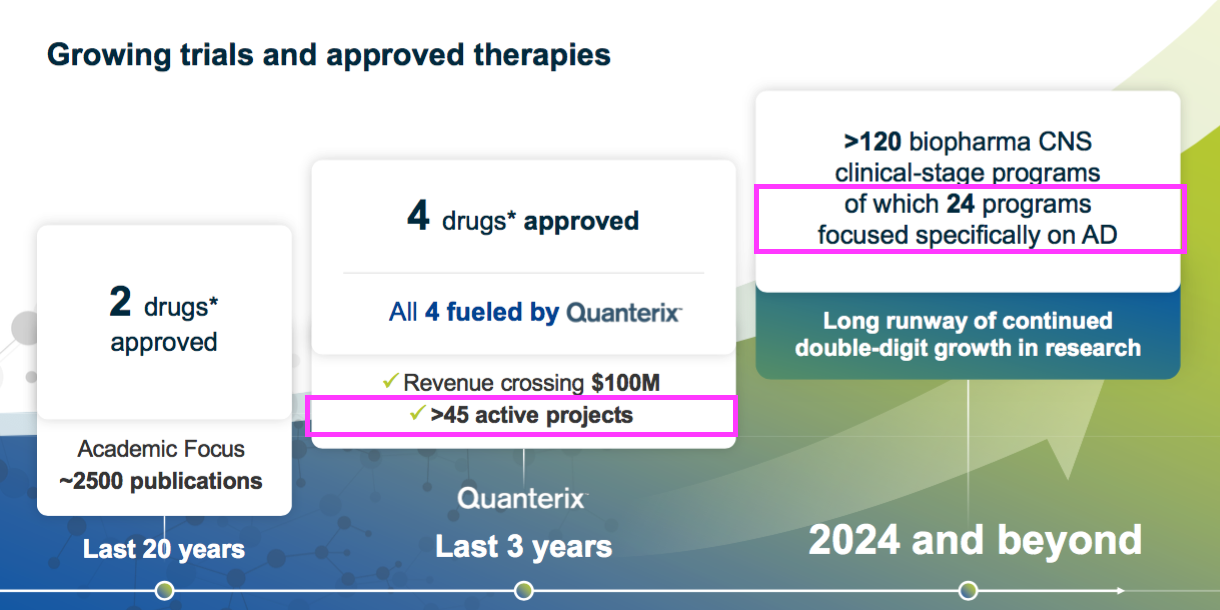

- More than 45 neurological research projects apparently employ QRTX equipment:

- QTRX implies BVXP/UGOT are not alone developing AD assays, with 24 industry programmes “focused specifically on AD“.

- This FY provided a vague hint that the “later 2020s” may be the very earliest to expect the AD research to convert into AD revenue:

“The emergence and adoption of Alzheimer’s therapies during the later 2020s and 2030s will require associated screening and monitoring diagnostic tools”

- The same timescale was suggested by this FY comment:

“By the same dynamics, the current research work active at our laboratories now is more likely to generate sales in the period 2028–2038.“

- Lab work translating into revenue may now be taking longer than expected. The comparable FY talked of 2026-2036:

“By the same dynamics, the current research work active at our laboratories now is more likely to influence sales in the period 2026 to 2036.”

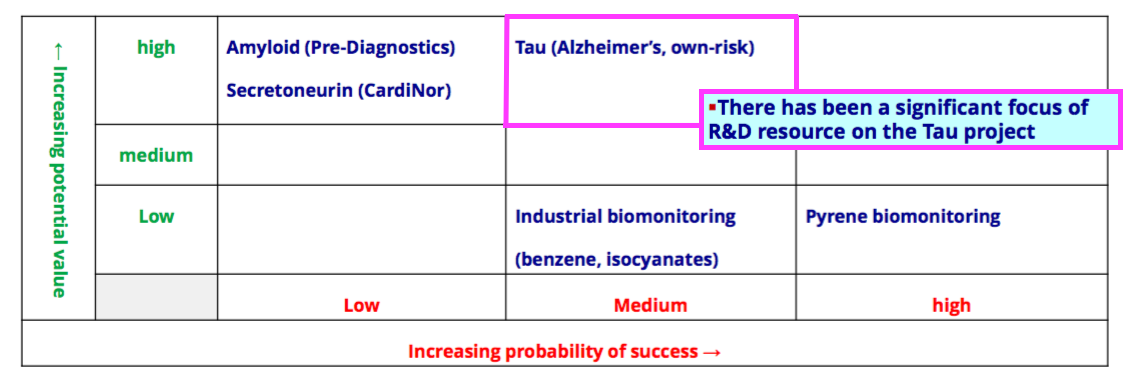

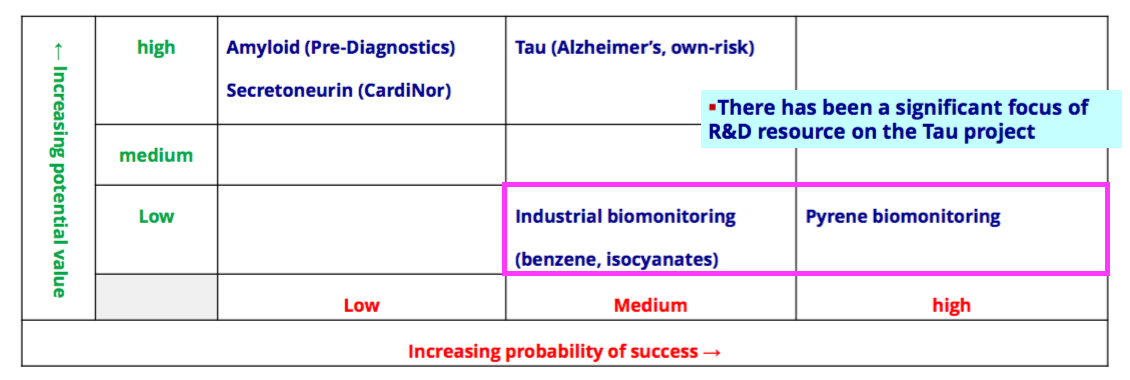

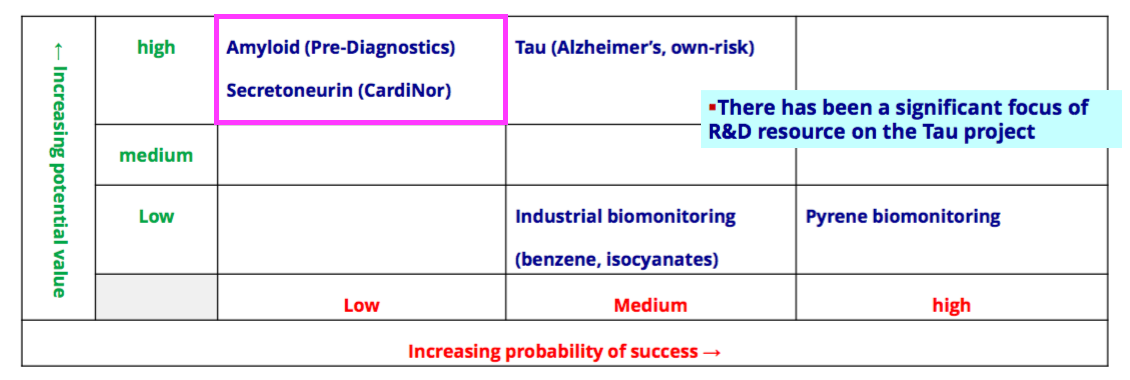

- The comparable FY had upgraded the tau R&D from Low to Medium probability of success, and this FY showed the probability still at Medium:

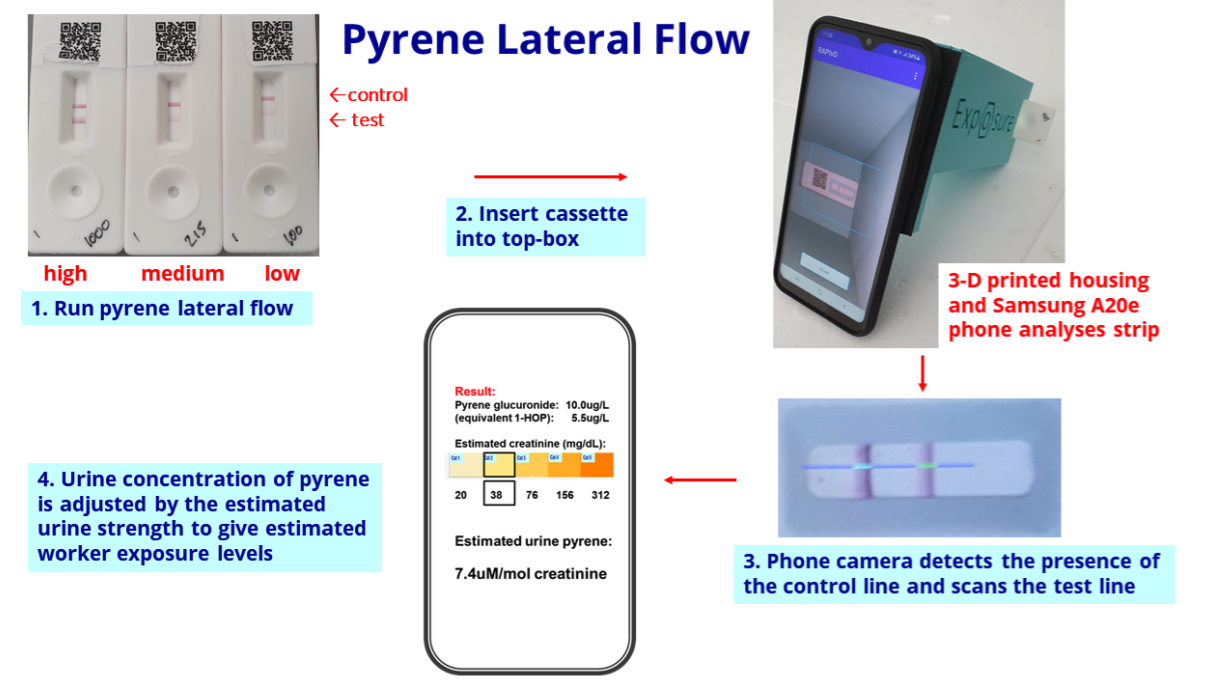

Pipeline developments: biomonitoring

- BVXP’s pipeline grid continues to rate the group’s two biomonitoring projects as Low potential value:

- Conventional industrial-pollution tests involve sending all samples to central laboratories that employ expensive high-performance liquid chromatography for analysis.

- BVXP’s biomonitoring tests in contrast can ‘pre screen’ samples through low-cost kits that deliver results within an hour. Only those samples showing adverse results are then sent away for further analysis.

- Trials of the pyrene test will continue during 2024:

“Our pyrene lateral flow system for industrial pollution biomonitoring completed a second field trial at a UK industrial site during quarter 2 of 2023. This went well and we plan to conduct additional site studies during 2024.

- Work on additional biomonitoring tests will extend into 2025:

“The progress of the pyrene project has encouraged us to develop additional assays for benzene and isocyanates, also in the field of industrial health and safety. Benzene exposure is of relevance to the petroleum industry and isocyanates are hazardous chemicals used in the manufacture of polyurethane paints and plastics. This work will continue into 2024 and 2025.“

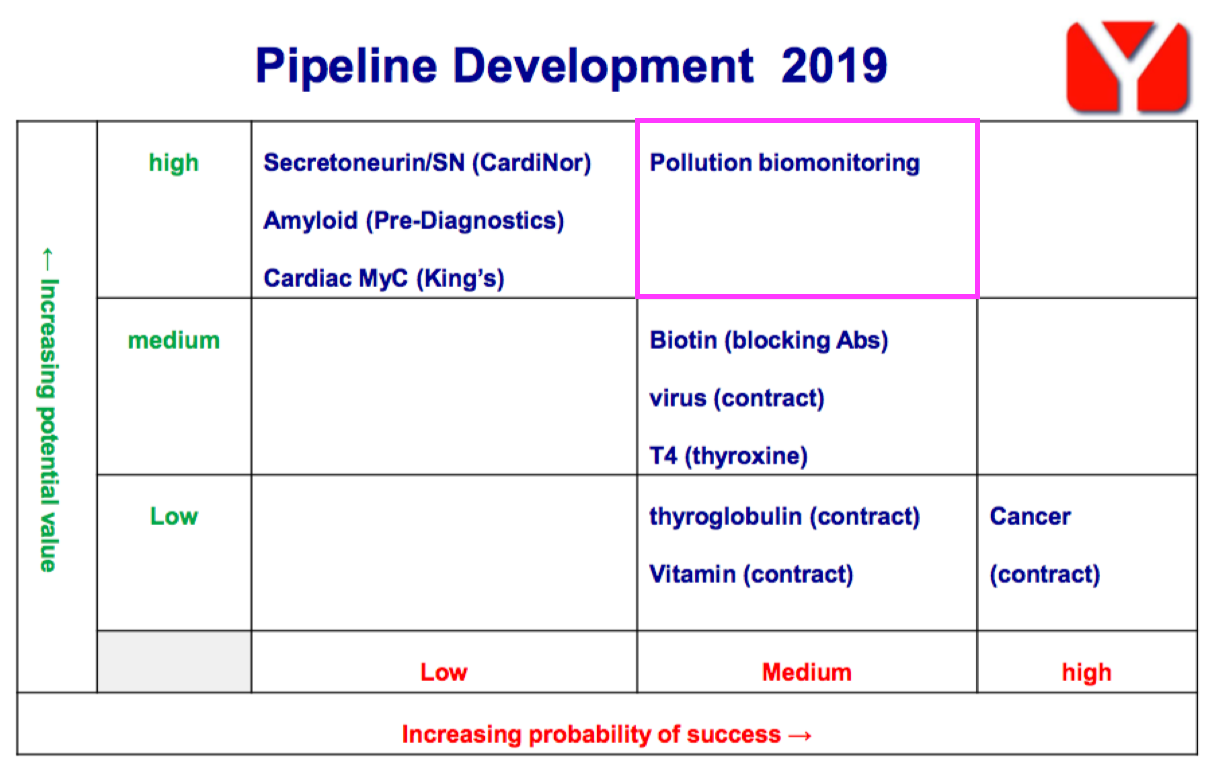

- BVXP’s expectations for biomonitoring have reduced over time. The project was blessed initially with High potential value within the FY 2019 pipeline grid:

Pipeline developments: CardiNor and Pre-Diagnostics

- Collaborations with Norwegian research houses CardiNor and Pre-Diagnostics remain stuck with a Low probability of success:

- BVXP invested an aggregate £610k into CardiNor and Pre-Diagnostics between FYs 2016 and 2020.

- The preceding H1 suggested the two Norwegian projects might issue news during 2023:

“We continue to await news and critical data from both of our partners in Oslo; on our secretoneurin project with CardiNor for enhancing cardiac diagnostics and on our amyloid beta project with Pre-Diagnostics in Alzheimer’s diagnostics. We hope to have more news on these two projects during 2023.“

- This FY did not disclose much Norwegian progress:

“Pre-Diagnostics (in Oslo) and their clinical collaborators have two amyloid beta assays based on Bioventix antibodies available for research use. A current focus for Pre-Diagnostics is ARIA (amyloid related imaging abnormality) which is an important side-effect of new anti-amyloid drugs for Alzheimer’s. Pre-Diagnostics assays relate to amyloid metabolism and could help screen for ARIA vulnerable patients, before or during treatment.”

Our partners at CardiNor (also in Oslo) have continued with their work to try and identify the possible utility of secretoneurin in heart failure patients and in particular those patients who might be candidates for implantable cardiac devices (ICDs)”

- CardiNor’s secretoneurin project tests for a particular type of heart failure, with development work starting during 2015.

- CardiNor’s progress seems not to have met expectations. A new chief executive was recruited during December, and the appointment apparently brought “crucial competence“:

“Bjørn Fuglaas, Chairman of the board, states; I am very pleased that Thomas [Grünfeld, the new chief executive] is strengthening the team, and he brings with him crucial competence at this stage of CardiNor’s development.“

- The new boss coincides with extra funding.

“Investment of £122,000 in ordinary shares, held at £58,000 fair value, for which last investment round is deemed the most appropriate basis of measurement.”

- IIG had always valued its original £125k/1.8% CardiNor investment at cost. The £125k cost compares to a present book value of £58k.

- BVXP’s forthcoming H1 2024 will reveal whether or not the company participated in CardiNor’s latest funding.

- This 2018 document from CardiNor’s website indicates BVXP was then a 21.5% Cardinor shareholder.

- Pre-Diagnostics appears to have changed tack over time following its 2013 formation.

- When BVXP first invested during FY 2016, Pre-Diagnostics was working on an early-stage AD test based on amyloid-beta peptides.

- But the aforementioned BVXP/UGOT research papers now suggest p-tau217 has become the pre-eminent predictor of likely AD.

- Pre-Diagnostics today appears focused on projects to indicate the likelihood of:

- Suffering side effects from new AD treatments, and;

- Developing Parkinson’s Disease.

- Pre-Diagnostics appears more commercially viable than CardiNor. Snippets from this August 2023 Pre-Diagnostics investment summary included remarks about a “licensing agreement by 2025, which also could create a basis for stock-listing or trade sale of shares“.

- This 25-page Pre-Diagnostics investor presentation supplies further information, but the absence of any monetary values within the document is notable.

- This 2020 Pre-Diagnostics document indicates BVXP was at the time a 7.5% Pre-Diagnostics shareholder.

Financials

- Royalties earned from regular worldwide blood tests using antibodies developed within a small laboratory continue to translate into some wonderful accounts.

- This FY enjoyed a majestic 78% operating margin, with 80% reported during H2:

- BVXP’s margin has topped 70% since H2 2015.

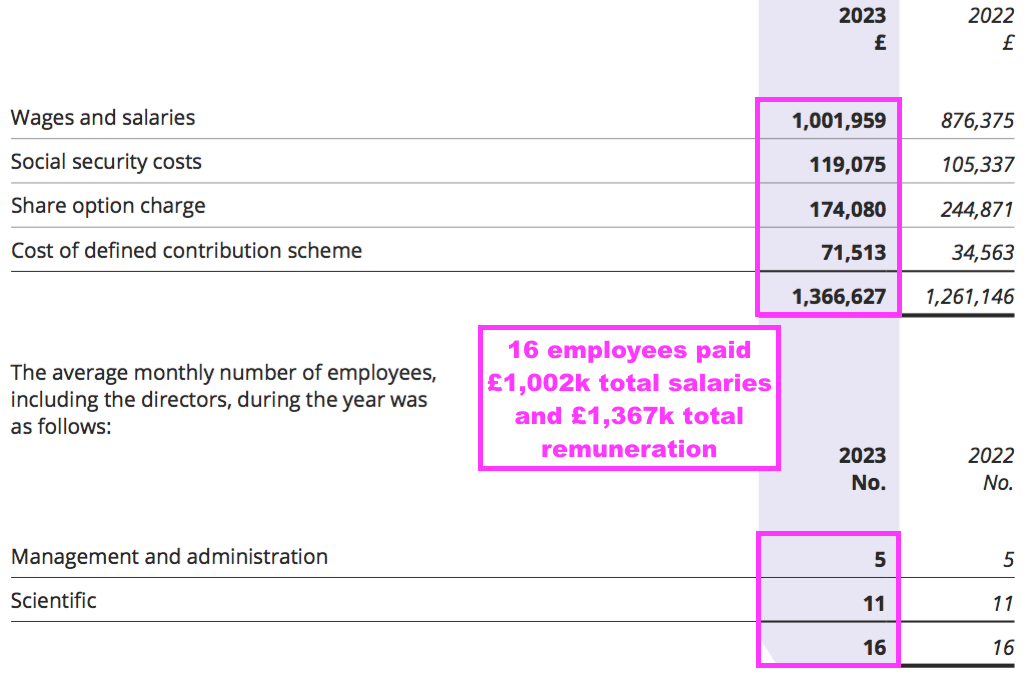

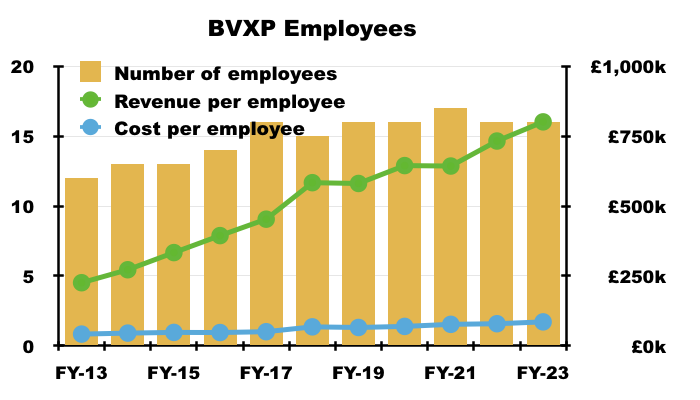

- This FY showed 16 employees being paid total salaries of £1,002k or £63k each:

- Note that that 16 employees might actually be 8 full-time and 8 half-time:

“The composition of the Bioventix team of 12 full-time equivalents has remained stable over the year, facilitating excellent performance and know-how retention”

- Total employee costs as a percentage of revenue remained at the 11% witnessed since FY 2017:

- Revenue per employee meanwhile rallied to a super £801k.

- Employee costs typically represent approximately 50% of all BVXP’s expenses, and the £700k-plus gap between revenue per employee and cost per employee underpins BVXP’s majestic operating margin.

- I continue to wonder whether the workforce will ever demand much greater salaries to reflect the significant economic value they have created for shareholders.

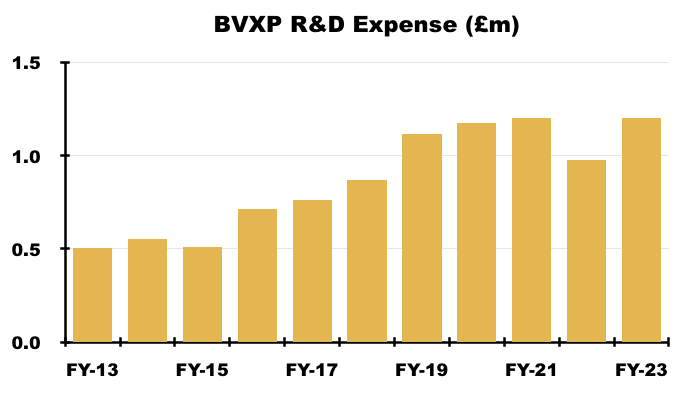

- A significant proportion of employee costs are classified as R&D, which is (commendably) all expensed as incurred and (presumably) generates no revenue.

- R&D for this FY rebounded 23% to £1.2m, a level witnessed during FYs 2020 and 2021:

- As well as employing only 16 people, BVXP’s capex during this FY amounted to just £11k — all of which occurred during H1.

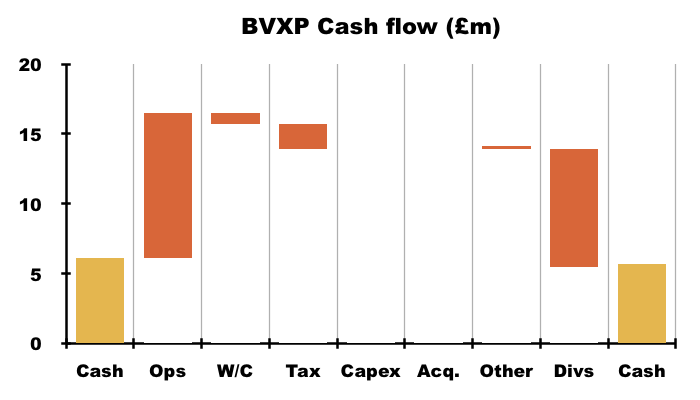

- The tiny capex ensured cash flow could pay a hefty £8.4m through dividends:

- Cash ended this FY only £0.4m lower at £5.7m after cash from operations of £10.3m invested only £0.8m into working capital, paid tax of £1.8m, funded that capex of £11k to allow that hefty £8.4m to be paid as dividends.

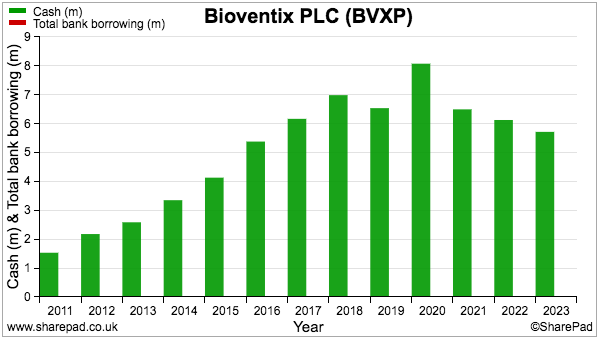

- The £5.7m cash position is not troubled by significant liabilities; the balance sheet carries no bank debt and no pension complications.

- This FY reiterated management’s conservative approach to financing:

“Our view continues to be that maintaining a cash balance of approximately £5 million is sufficient to facilitate operational and strategic agility both with respect to possible corporate or technological opportunities that might arise in the foreseeable future.”

- BVXP has in fact operated with cash and no debt since its flotation:

- Bank interest amounted to £102k or 1.7% on this FY’s average £5.9m cash position. However, £67k was earned during H2 at an effective 2.5% rate on an H2 average cash balance of £5.4m.

- Companies blessed with significant ‘surplus’ cash should now be earning notable interest. As a minimum, NatWest for example offers an instant-access business account paying between 1.46% and 1.92% AER (variable). BVXP’s 2.5% for H2 therefore seems reasonable.

- This FY’s cash generation extended BVXP’s superb record of converting reported earnings into dividends.

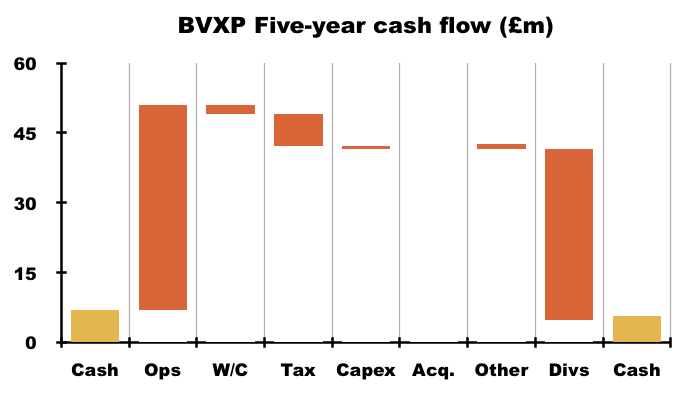

- For example, during the five years to this FY, cash declined just £1.3m to £5.7m after cash from operations of £44.1m invested only £2.1m into working capital, paid tax of £6.7m, funded net capex of £0.7m that allowed £36.7m to be distributed as dividends:

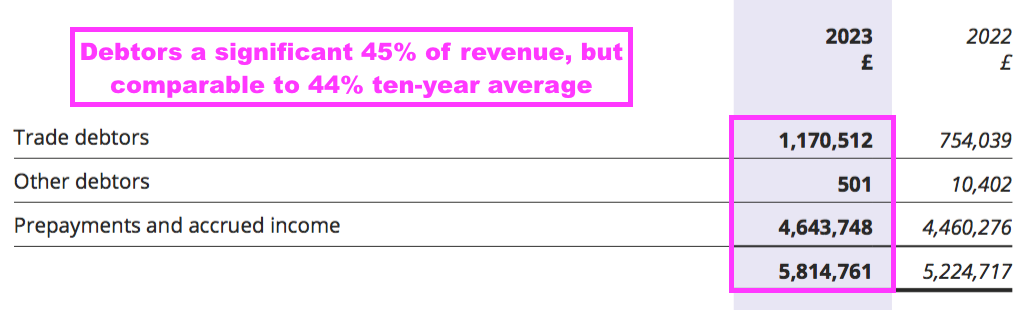

- Within working capital, total debtors of £5.8m do seem alarming versus revenue of £12.8m:

- Debtors mostly reflect ‘accrued income’, which are royalties recognised as revenue but have not been invoiced to the customer at the balance sheet date. By the time BVXP publishes its accounts, the royalties have been paid and the accrued income has therefore already been converted to cash in the bank.

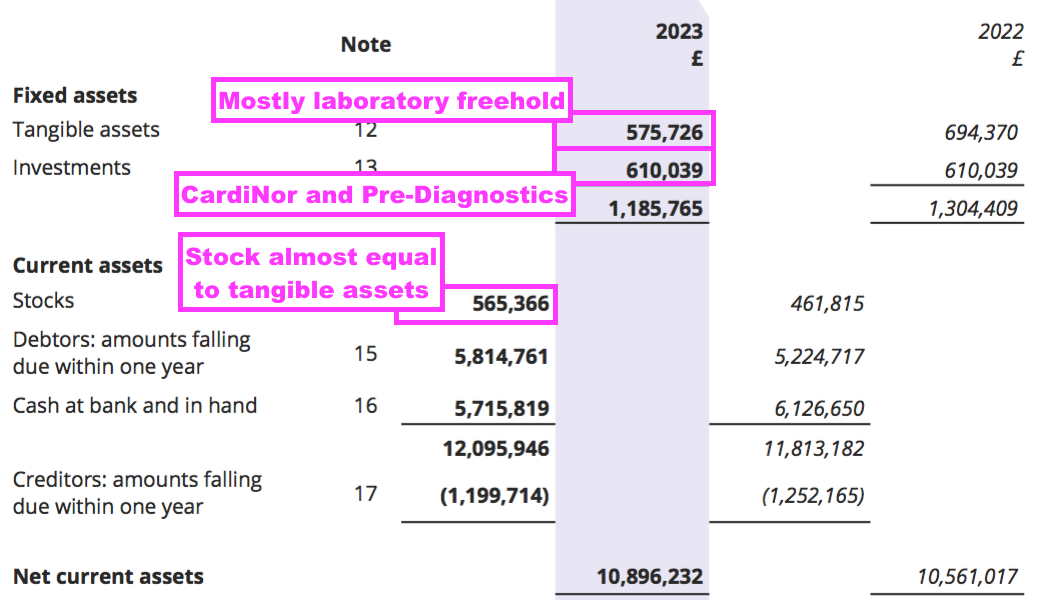

- Other balance sheet items remain minor compared to this FY’s £10m profit. In particular, tangible fixed assets — mostly the laboratory freehold — are carried at just £10k greater than the stock of antibodies held in the laboratory freezer:

- The rising revenue/earnings/dividend record alongside the absence of significant assets does emphasise how BVXP can seemingly grow on ‘thin air’.

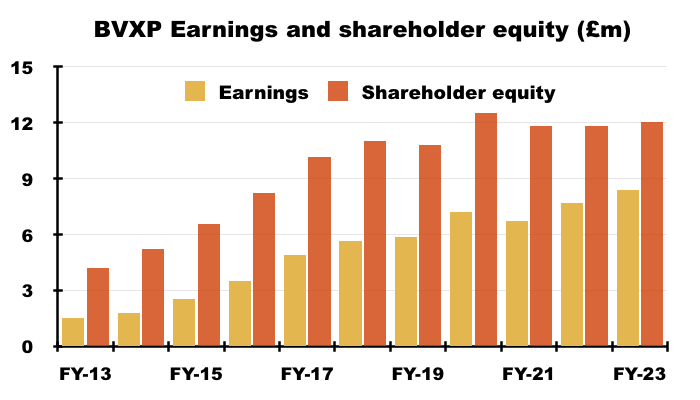

- For example, since FY 2018 BVXP’s earnings have advanced £2.7m to £8.4m while shareholder equity (i.e. cumulative earnings less all dividends paid) has advanced £1.2m to £12.1m:

- Retaining £1.2m to enhance earnings by £2.7m over five years underlines the very attractive economics of commercial antibodies.

- R&D tax credits have assisted BVXP over time, with an aggregate £1.3m awarded during the last five FYs that has boosted reported earnings by 3%:

- BVXP commendably revealed the impact of the higher rate of UK tax:

“Factors that may affect future tax chargesThe rate of corporation tax increased from 19% to 25% on 1 April 2023. This change will increase the tax charge in future years such that, had the change been effective throughout the current year, [the tax charge] would have increased by £392,980, from £1,762,202 to £2,155,182.“

- A repeat of this FY for FY 2024 but with that extra £393k tax would lead to earnings of 153p per share — just 1p per share greater than this FY’s annual dividend.

Valuation

- BVXP’s outlook referred to the “later 2020s and 2030s”:

“We are pleased with our financial results for the year which we believe reflect steady growth in the use of our established products and the continued roll-out of the high sensitivity troponin assays.

Excellent technical progress has been made with our research projects and we anticipate that our pipeline of opportunities will create additional shareholder value in the later 2020s and 2030s and we look forward to further progress in the years ahead. “

- No mention was made of the aforementioned “sustainable” 8-10% growth rate cited during the comparable FY.

- The implication perhaps is near-term growth may be relatively subdued.

- Bear in mind troponin revenue will cease during 2032 and the associated profit should not therefore be valued on a simple multiple.

- Assuming troponin revenue:

- Averages (a possibly optimistic) £3.5m for the next 8.5 years before expiry, and;

- Has no associated costs…

- …gives a value of £22m after 25% standard UK tax but before any time-value discounting.

- The table below derives possible FY 2023 earnings from BVXP’s vitamin D and other commercial antibodies by:

- Subtracting troponin revenue from FY 2023 revenue;

- Then subtracting all cost of sales and administration expenses;

- Then adding back R&D costs, and;

- Then applying tax at the 25% standard UK rate:

| Estimated FY 2023 for vitamin D and other antibodies | (£k) |

| Revenue | 12,816 |

| Less troponin revenue | (1,610) |

| Less cost of sales | (828) |

| Less admin expenses | (1,954) |

| Add back R&D expense | 1,201 |

| Operating profit | 9,625 |

| Less tax at 25% | (2,406) |

| Earnings | 7,219 |

- Assuming vitamin D and the other commercial antibodies are a source of predictable income that could grow at 5% per annum, maybe their estimated earnings of £7.2m translate into a £160m ‘fair’ valuation if buyers were satisfied with an initial 4.5% cash yield.

- BVXP’s present £261m market cap less the £22m troponin estimate less the £160m vitamin D/other estimate leaves the pipeline valued at £79m.

- Valuing the pipeline at £79m seems optimistic given:

- The pipeline effectively rests entirely on tau/AD;

- Tau/AD commercialisation is not expected until the “late 2020s” at the very earliest, and;

- Significant tau/AD revenue may then take several years to emerge.

- True, these valuation sums could be fine-tuned to:

- Calculate a more realistic net present value for troponin;

- Include R&D tax credits and other tax adjustments;

- Allocate cost of sales to the appropriate antibody, and;

- Apply different multiples to that £7.2m vitamin D/other earnings estimate…

- …but right now signs of a compelling valuation are not truly obvious.

- Mind you, BVXP’s tau/AD progress does seem positive and the UGOT research papers do suggest the company’s antibodies may well be in the mix as and when tau/AD blood tests reach the market.

- QTRX in particular is bullish on why the eventual AD-diagnosis market should become a money-spinner:

- The tau/AD prospects probably explain why BVXP’s shares have accelerated to a new £50 high:

- £50 equates to 31x this FY’s earnings, and such a premium rating is understandable.

- As well as the tau/AD potential, core shareholder attractions include:

- The reliable and ongoing income from antibodies (pandemics aside) for ten years or more, due in part to the cost/time/upheaval/risk of replacing proven blood-test assays with upgraded versions;

- A competitive ‘moat’, helped in part by protracted development/regulatory timescales and ‘captive’ end-customers (e.g. hospitals) restricted to particular blood-test machines (and therefore particular diagnostic antibodies), and;

- The amazing margins and minimal reinvestment requirements, which underline the terrific economics of antibodies if they become commercial.

- My decision to purchase BVXP during 2016 was made much easier because the shares were then valued at a more modest c17x P/E multiple:

- For now, longer-term upside seems almost entirely dependent on the success of the tau/AD research to generate a step-change to future earnings.

- While further tau/AD developments are awaited, the 152p per share ordinary dividend supplies a 3.0% income from the £50 shares.

Maynard Paton

What a review Maynard. Thank you. I don’t know you do it.

I also hold, since October 2024 and while I see no reason to sell, it has now reached 13.2% of my portfolio, I will almost certainly be reducing to around 10% soon.

Regards

Michael

Thanks Michael. Glad you found the review useful.

Maynard

Hi Maynard

Agreeing with the earlier comment, thank you for another great write up so generously shared.

Regards

Deb

Thanks Deb. Glad you liked the review.

Maynard

Bioventix (BVXP)

Publication of 2023 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

0) INTRODUCTION AND TECHNOLOGY

Includes some extra text this year about the background to the company’s testosterone test:

“The blood test for testosterone is an example of where a Bioventix SMA has facilitated an improved test. In 2003, it became clear that testosterone tests performed on automated IVD platforms were deficient. Whilst the higher levels of testosterone in healthy adult males were accurately reported, the lower levels of testosterone in pre-pubescent boys and women were inaccurately reported. In 2005, Bioventix created an antibody called testo3.6A3 which was evaluated by customers during 2006. Evaluations were successful and following the necessary regulatory approvals, the first testosterone assays based on testo3.6A3 were launched in 2009. A number of IVD companies now use this antibody for revised tests that more accurately measure lower levels of testosterone.”

The text reiterates 20 antibodies have been developed and tiny physical sales:

“Over the past 18 years, we have created and supplied approximately 20 different SMAs that are used by IVD companies around the world. We currently sell a total of 15–20 grams of purified physical antibody per year…”

The only text change of significant is the timescale for R&D converting into sales. The prior year’s report said 2026-2036 and this year’s report now says 2028-2038:

“Another consequence of the lengthy approval process is that the revenue for the current accounting period is derived from antibodies created many years ago. Indeed, revenue growth over the next few years from, for example the troponin antibodies, will come from research work already carried out more than ten years ago. By the same dynamics, the current research work active at our laboratories now is more likely to generate sales in the period 2028–2038.”

1) THE BIOVENTIX TEAM AND FACILITY

Confirmation the business continues to employ just 12 full-time equivalents:

“The composition of the Bioventix team of 12 full-time equivalents has remained stable over the year, facilitating excellent performance and know-how retention.”

The prior year’s text said BVXP planned to use its “diesel generator and reserve fuel supplies to minimise any disruption caused to the lab by any… power outages.”

The generator and fuel were not required (see below). This year the text instead referred to rising prices to supplies of plastics and chemical reagents, which has added “further incentive to increase the productivity of our manufacturing processes“.

2) PRINCIPAL RISKS AND UNCERTAINTIES

No changes here. The main risks remain:

* Dependence on key employees

* Technology (R&D failure, product obsolescence, IP litigation)

* Regulatory environment

* Distribution risk (adverse restrictions on sheep-derived products)

* Market (M&A between customers)

* Competition

3) FINANCIAL RISK MANAGEMENT

No changes here, with pretty standard text about currencies, tax, trade debtors, interest rates, liquidity, Covid and Brexit.

The ‘price’ risk remains the same, reiterating antibody royalty prices are set at the start of the agreement…

“The key income stream is that of royalties and these prices are set at the start of the royalty agreement, thus limiting the exposure to sales price risk. The key cost to the Company is that of its staff and this is a manageable cost price risk.”

…although I am not sure whether ‘prices’ mean the actual sum BVXP receives or the royalty percentage BVXP accrues from each blood test that employs its antibodies. My AGM visit strongly indicated BVXP has limited visibility on end-customer pricing and the only definitive information within BVXP’s commercial arrangements is the royalty percentage.

4) FINANCIAL INSTRUMENTS

The text is as per last year, and includes confirmation the useful interest received on the cash position is derived from high street banks:

“In respect of bank balances, the liquidity risks are managed conservatively by maintaining deposits of short to medium duration in High Street Banks, thereby reducing the risk of financial default.”

5) KEY PERFORMANCE INDICATORS

The financial KPIs continue to be revenue, profit before tax and the cash balance — which are important of course, but a result of workforce efforts that also need to be monitored.

The text also says:

“The future growth of the Company relies on its research and development activities creating and being able to manufacture unique antibodies, that are required by our customers.”

KPIs should involve R&D — e.g. how the R&D is progressing, the likelihood of success and whether the R&D was actually worth it. Sadly the latter will only be known after the event.

My AGM visit indicated BVXP’s Alzheimer’s research for example will continue until a solution is found — either by BVXP (good!) or somebody else (probably bad!). I am therefore hopeful the Alzheimer’s R&D will prove valuable to shareholders, and also trust the board will recognise if/when the fight has been lost and divert R&D to other areas.

6) SUSTAINABILITY

a) Introduction

A fair amount of new/revised ESG text for 2023. The intro now trumpets the positive role BVXP’s antibodies play within society:

“The use of our products in IVD tests allows clinicians to accurately and economically diagnose and then appropriately treat life-changing diseases and conditions, thereby improving outcomes and the lives of populations across the world.”

b) Environmental

Extra text this year on energy usage:

“Measuring and then improving the efficiency of our energy usage and reducing the energy we consume matters to us. In 2023/24 we have started to collate greater detail on the energy we use, when we use it and how we use it. This information will allow us to identify further areas of improvement and to set some meaningful targets to reduce energy consumption at our laboratory in Farnham.

We adhere strictly to the specified maintenance schedules for laboratory and other equipment and continue to ensure that any replacement equipment we require is selected not just on cost or operational performance but also takes into account our commitment to improve our water usage and energy efficiency. At our laboratory in Farnham the energy we use is sourced from our electricity supplier.”

Monitoring energy usage within two small industrial units (floorspace c600 square metres) should not be too difficult. And no need for the generator this year:

“We maintain a UPS backup diesel generator which provides for, and mitigates the risk of, any power outages and which, apart from our regular testing, was not used in 2022/23.”

The prior year’s text mentioned productivity improvements:

“We also promote the effective and efficient use of equipment, facilities, services and supplies and have implemented genetic engineering techniques to deliver a four-fold increase in the yield in the production of one of our antibodies.”

But no mention of such improvements this year. My AGM visit indicated the improvements did not really resonate with customers, as any updated antibody would have to be re-tested before general use.

This year’s text revealed the CEO had travelled to see customers:

“The travel restrictions in place during the COVID-19 pandemic led to the greater adoption of technology to facilitate meeting business partners based around the world. However, we consider that face-to-face interaction with customers and physical presence at industry conferences and events has significant benefits that cannot be replicated by technology. During the year our CEO therefore conducted a limited amount of business travel both in the UK and internationally including, in July, attending the Association for Diagnostics and Laboratory Medicine conference in Anaheim, California. This trip also combined visits with some of our largest customers elsewhere in the USA. There is little option other than air travel between cities to manage such a schedule; however, all our CEO’s car hire requirements were covered by electric vehicles.”

My AGM visit indicated these customer chats are very important, as BVXP can obtain a sense of future opportunities within blood-test diagnostics.

c) Social

New text this year about “mental health first aid training“:

“A safe and clean work environment is fundamental to our creation and manufacture of SMAs. By promoting a culture of safe operations, we aim to secure the wellbeing and efficiency of our team and establish a supportive and inclusive environment. During 2022/23, two members of our team underwent mental health first aid training, following which we created our Mental Health and Wellbeing policy, which was approved and introduced in May 2023.”

I can’t believe two people out of 12 full-time equivalents are really needed for mental-health training.

This new text is more interesting. BVXP must be one of few employers that pays women more than men:

“Women represent 53% of the total Bioventix workforce. We have twice as many women as men in our scientist and support teams at Bioventix and hourly pay rates for female employees in these teams are 101% of those of male employees. This reflects the longevity of the team of female scientists who on average have circa two years more service than our male scientists.”

A new chart shows 8 females and 4 males within the scientists and operations department.

The additional diversity text above follows AGM protest votes during 2022 about the lack of women on the board.

And responding to the protest votes, new text this year confirming the appointment of a female board member and commentary giving a wider definition of “diversity“:

“The Board of Bioventix plc now has one female director, 20% of our Board. Jo Pisani joined our Board in July 2023 bringing wide and different experience of developing strategy and managing change in life science and biotech businesses.

Diversity recognises similarities and differences, it is defined more broadly than race, religion, gender and ethnicity and, as a small operation, we also address it through a diversity of thinking, background, skill set and age. Our processes and communications are open and all-inclusive and we positively encourage all of our team to bring new ideas, critically challenge and add their knowledge and experience to improving the operation and performance of our business.”

New text this year implying the employees are loyal and happy:

“We recently celebrated the 20th birthday of Bioventix plc and several of our team have been with the business throughout its life. Across the Company the average length of service at 30 September 2023 was 10 years 11 months, an increase of 5 months since 30 September 2022; our scientists have all been with the business for more than 5 years and our overall retention rate has been unchanged at 100% in each of the last 2 years.”

Oh dear, this new text is not ideal:

“During 2023 the team considered, reviewed and selected a cloud-based solution to automate the recording, management and communication of quality, production, research and development and operational processes replacing previously manual and spreadsheet-based documentation.”

Always worrying when companies admit to manual processes — gives the impression of outdated management and scope for errors. How many manual processes remain is unclear.

7) DIRECTORS

New text for new non-exec Jo Pisani, who seems a relevant appointment. Her background is partly in pharma and biotech, she has a keen interest in dementia and she has consulted on M&A:

“Jo was appointed as a Non- Executive Director of Bioventix in May 2023. She is a Chartered Engineer with a distinguished background in the Pharmaceutical, Life Sciences and Biotech sectors. She held roles for both GSK and BP in strategy, commercial and operational functions before working in strategic consultancy, latterly leading PwC’s UK Pharmaceutical and Life Sciences practice assisting clients with developing strategy, designing and implementing transformational change and completing M&A transactions.

Jo is a passionate supporter of critical public health issues, such as tackling dementia, rare diseases and anti-microbial resistance. She focuses on supporting charities, universities and business start-ups. She is chair of Birmingham’s Precision Health Technology Accelerator and chairs the Advisory Board for London’s MedCity. Jo also serves on the boards of the UK Dementia Research Institute, LifeArc, The RSA Group, London and Partners and Beacon. She is also a Non-Executive Director and strategic advisor to biotech companies in the UK, Finland and Spain. Jo is Chair of the Bioventix plc Audit Committee, and she is also a member of both the Remuneration and Nomination Committees.”

A little extra text this year to confirm no more options for the non-execs:

“During the year the share options issued to Ian Nicholson and Nick McCooke in 2017 were exercised in full, and currently it is not the Board’s intention to make further share option awards to the Non- Executive Directors.”

Options for the non-execs is against best corp-gov practice.

8) CORPORATE GOVERNANCE

No changes at all to how BVXP complied with the 10 principles of the QCA code. The text did confirm the board meets on at least four occasions and this year every director attended every meeting with no absences.

New non-exec Jo Pisani has become the chairwoman of the audit committee, which is useful from a corp-gov perspective as the group’s chairman previously held the role (a corp-gov no-no)

The chairman has served in the role for more than nine years, which is against corp-gov best practice, but BVXP says he remains ‘independent’:

“The Company has three Non-Executive Directors, each considered to be independent by the Board. Ian Nicholson, who was appointed as Non-Executive Chairman of the Company in 2007, is considered by the Board to remain independent of the management and free to exercise independence of judgement. The other Non-Executive Directors are Nick McCooke, who was appointed in 2014, and Jo Pisani, who was appointed in 2023.“.

The other long-time non-exec has served for 10 years and he too ought to be replaced… assuming strict corp-gov best practice. But I would like to think shareholders are pragmatic enough not to demand radical board changes given BVXP’s long-term progress.

9) AUDIT COMMITTEE REPORT

Nothing untoward here. Met twice with the usual agenda. Only change versus the prior year was the prior-year text included how the committee selected and appointed a new auditor.

10) REMUNERATION COMMITTEE REPORT

a) Bonus

As per the prior year, not everyone received a bonus:

“A cash bonus award for performance during the financial year 2021/22 was made to the Chief Executive and most staff in November 2021; bonuses in respect of performance in 2022/23 are forecast to be made in November 2023. ”

The finance director was among those not to receive a bonus (see below).

The bonus calculation remains very vague:

“Bonus criteria for the Executive Directors are based on performance criteria that are designed to align with shareholder interests and comprise factors relating to shareholder return, earnings per share and performance against agreed long-term corporate and operational milestones.”

b) Benefits

As well as not receiving a bonus, the finance director did not receive a pension contribution. But he will do during FY 2024:

“Benefits provided to the Chief Executive during the year comprised pension contributions; since the year end pension contributions have also been made for the benefit of the Chief Financial Officer.”

c) Remuneration table

Pay rises all round for 2023:

The chief exec’s salary climbed 6%, the finance director’s salary gained a mighty 19% while the non-exec fees advanced 7%. But the higher amounts do not appear excessive given BVXP’s long-term progress.

Mind you, the figures contradicted the text, which said remuneration was “unchanged“:

“In light of the ongoing COVID-19 pandemic and the ensuing uncertainty, remuneration remained unchanged for 2022/23. During the year the Remuneration Committee conducted a comprehensive review of remuneration, following which adjustments were made to the remuneration of the Chief Executive Officer and Chief Financial Officer effective from 1 July 2023. ”

Ah, a bit more on the bonus calculation:

“The Chief Executive’s bonus above is determined by the Remuneration Committee according to performance criteria designed to be consistent with companies of a similar profile and relating to EPS and share price parameters, together with a smaller R&D element. ”

The chief exec’s bonus was £4k less than his bonus for the prior year. But his pension contribution has almost tripled and was equivalent to a hefty 19% of his salary.

The chief exec and chairman remain the notable shareholders on the board:

Option grants are far from excessive, and the recent £40 share price is unlikely to lead to many exercises of the £38 options:

The chief exec and finance director were awarded 10,740 and 4,427 new options respectively during the year. The non-execs meanwhile exercised a combined 5,990 options at £13.50

11) NOMINATIONS COMMITTEE REPORT

Met twice to recruit the new non-exec. “Race and gender” were considered during the process to appease some shareholders (given the aforementioned AGM protest votes):

“The Committee met twice during the year to consider the composition of the Board and to undertake the process of recruiting a candidate for recommendation to the Board as an additional Independent Non-Executive Director to the Board. As well as seeking candidates with relevant industry experience, the selection of suitable candidates included seeking diversity of skills, background knowledge and international experience. Race and gender, amongst many other personal and professional qualities, were also taken into consideration in appointing a new director to the Board. Following meetings and discussions with a number of suitable candidates, the Committee was delighted when Jo Pisani accepted our invitation for her to join the Bioventix Board. As can be seen from Jo’s biography elsewhere in this report, she brings a diverse range of knowledge and skill as well as considerable strategic experience which will all add to the expertise on the Board.”

12) AUDITOR’S REPORT

No text changes for 2023 and all straightforward.

Key audit matters remain ‘revenue recognition’, ‘valuation of investments’ and ‘management override’.

Materiality remains 5% of pre-tax profit and scope is still 100% (as BVXP is just one company entity).

13) ACCOUNTING POLICIES

Confirmation that BVXP uses ye olde UK GAAP (FRS 102) to prepare its accounts:

“The financial statements have been prepared under the historical cost convention unless otherwise specified within these accounting policies and in accordance with Financial Reporting Standard 102, the Financial Reporting Standard applicable in the UK and the Republic of Ireland and the Companies Act 2006.”

BVXP has been able to avoid “UK-adopted international accounting standards” (IFRS) because AIM Rule 19 allows companies without subsidiaries (i.e. all operations are accounted for within a single entity) to adopt either IFRS or their local accounting standards:

“An AIM company incorporated in the UK or an EEA country must prepare and present these accounts in accordance with International Accounting Standards. Where, at the end of the relevant financial period, such company is not a parent company, it may prepare and present such accounts either in accordance with International Accounting Standards or in accordance with the accounting and company legislation and regulations that are applicable to that company due to its country of incorporation. ”

The only text change this year is extra text within the “Judgements in applying accounting policies and key sources of estimation uncertainty” section and relates to share-based payments:

“Valuation of share-based payments

The Company operates two share option schemes: an Approved EMI Share Option Scheme and an Unapproved Share Option Scheme. In calculating the charge to profit or loss in respect of options granted to employees under these schemes, the Company has applied the requirements of FRS 102 which includes making estimates for both the expected volatility of the Company’s shares and the risk-free interest rate the details of which are shown in Note 21 to the accounts.”

14) OPERATING EXPENSES

A £25k fee to the auditor was £3k higher than the prior year but absorbed only 0.2% of revenue (£12.8m), which is a very low proportion.

R&D costs were £1.2m, up from £975k, but matching the c£1.2m spent during FYs 2021 and 2020. R&D of £1.2m was equivalent to 9.4% of revenue, versus 10%-13% between FYs 2015 and 2021. If the company continues to grow and keep R&D steady, margins may be able to improve even further from this year’s 78%.

15) EMPLOYEES

As per the blog post above, the average wage increased from £55k to £63k:

Bear in mind many of BVXP’s employee work part time, and the greater wages may reflect greater working hours from the part-timers (say from 3 to 4 days) rather than pure pay rises.

The greater pension cost was due almost entirely to the extra pension contribution to the chief exec. His £37k pension contribution (up more than £25k!) now represents more than half of the company’s entire pension contribution! My rough sums suggest the workforce (excluding the chief exec!) enjoy pension contributions at approximately 4% of their salary.

16) TANGIBLE FIXED ASSETS

The blog post above mentioned BVXP’s laboratory freehold, which is in the books at £318k:

The original cost was £475k, and I would like to think the £318k is a very conservative valuation.

All the other tangible assets are depreciated by 25% a year on a straight-line basis, which seems conservative as well. I would imagine laboratory equipment lasts longer than four years.

Following the (relatively sizeable) lab fit-out costs of FY 2021, capex for this 2023 was just £11k.

17) STOCKS

Average stock held during the year was £514k.

Versus cost of sales of £828k suggests stock stays in the lab freezer for 7-8 months before being sold. I suspect cost of sales includes other items beyond stock, so stock turn may be longer. Prior to FY 2022, stock turn was 3-5 months, so stock levels remain relatively high. But I am sure BVXP’s stock of antibodies does not become obsolete overnight while the £565k year-end entry is only 4.4% of revenue.

18) DEBTORS

Year-end trade debtors jumped a significant 55% versus revenue up only 9%:

I presume trade debtors relate almost entirely to product and R&D contract revenue, which gained 18% during the year. Year-end trade debtors were equivalent to 27% of such revenue, and proportions have ranged between 16% and 42% since 2014. I speculate the timing of the products sold/R&D undertaken (e.g. close to the year end) can influence the level of reported trade debtors substantially.

I note the combined trade debtors and prepayments/accrued income are equivalent to 45% of total revenue, which is within the 42%-50% range witnessed during 9 of the previous 10 years.

19) CREDITORS

Nothing too amiss here:

Total creditors are equivalent to 9% of revenue, and the proportion has bobbed between 3% and 15% during the last decade. Creditors are mostly tax, accrued expenses and deferred income (advance customer payments), with trade creditors very small this year at £78k suggesting BVXP paid its non-staff costs (c£1.4m) very promptly.

20) OPTIONS

Total options of 77,280 are equivalent to 1.5% of the year-end share count:

With almost 40k new options granted during the year, seems like the entire workforce now holds options:

“The number of staff and officers holding share options at 30 June 2023 was 16 (2022: 13). The share options have been issued to underpin staff service conditions.”

Maynard