19 December 2023

By Maynard Paton

AGM summary for City of London Investment (CLIG):

- CLIG’s largest shareholder George Karpus voted against the group’s non-execs at the AGM and declared “this board should be replaced with a seasoned group of directors that understand the enormous potential of CLIG“.

- My subsequent conversation with Mr Karpus revealed a somewhat alarming lack of board action following reduced funds under management, dwindling fee rates and a dividend he believes may become “questionable“.

- “They are not client driven” was how Mr Karpus summarised the absence of significant new mandates. Greater cross-selling between group divisions CLIM and KIM was still required, too.

- Mr Karpus explained how a corporate cash-management service could lead to “tremendous opportunities” that might add an extra £1b-plus to CLIG’s funds under management during the next five years.

- Mr Karpus also expressed frank views about the group’s approach to corporate governance, its use of consultants, the over-exposure to Russian shares and employees still working from home.

Contents

- News links, share data and disclosure

- Why I own CLIG

- George Karpus

- AGM statement from George Karpus

- AGM voting

- Reduced profit, dividend question and business plans

- Misdirection and consultants

- Cash management

- Client focus, risk controls and sales efforts

- Shareholders and employees

- Verdict on George Karpus conversation

News links, share data and disclosure

- AGM hosted 23 October 2023, and;

- Conversation with George Karpus on 14 November 2023.

- Share price: 320p

- Shares count: 50,679,095

- Market capitalisation: £162m

- Disclosure: Maynard owns shares in City of London Investment. This blog post contains SharePad affiliate links.

Why I own CLIG

- Fund manager that employs a “risk-averse” strategy of buying investment trusts at attractive discounts through a team-based approach (point 1).

- Accounts showcase a high 39% margin, significant net cash and ability to distribute majority of earnings via dividends.

- Yield of 10% offers meaningful income potential with capital-gains upside linked to a wider market recovery — or winning extremely elusive new clients!

Further reading: My CLIG Buy report | All my CLIG posts | CLIG website

George Karpus

- George Karpus founded Karpus Investment Management (KIM) during 1986 and thereafter led the business until he agreed to merge KIM with CLIG during 2020:

- The merger left Mr Karpus as CLIG’s largest shareholder with a 31.5% (£51m) stake. Alongside various close associates, Mr Karpus heads what CLIG defines as a “controlling shareholder group” with a 36.2% (£59m) stake.

- The merger agreement limits the voting power of the ‘controlling shareholder group’ to no more than 24.99%.

- When the merger completed, Mr Karpus retired from KIM and became a CLIG non-executive. He retired from CLIG’s board at the end of July.

- CLIG said at the time Mr Karpus would be retained as a “strategic advisor“:

“The Board looks forward to continued engagement with George in his role as strategic advisor to the Board and as a significant shareholder in the Company.“

- Mr Karpus said at the time:

“I have enjoyed my time on the Board of CLIG and look forward to supporting the Company in the future as the management works to add value for clients, shareholders and employees.“

- I noted in my review of CLIG’s H1 2023 results:

“I do hope outside shareholders can rely on Mr Karpus — in his new role as “strategic advisor” — to provide frank views to the board on employee productivity.”

- I was therefore pleased to learn Mr Karpus had delivered a frank statement to the board at the AGM.

AGM statement from George Karpus

- A representative of Mr Karpus read out the following statement at the AGM:

CLIG Board Meeting

October 23, 2023

“About four years ago Barry Olliff, founder of City of London Investment and I, George Karpus, founder of Karpus Investment Management, became serious about the merger of our two companies, hoping the merger would then make us the biggest and the best worldwide with respect to using closed-end funds in achieving excellent absolute and relative performance for a select group of institutional as well as individual investors.

In June 2020 we announced the merger that closed October 1, 2020. Our shared belief was that strong absolute and relative performance for a select group of individual and corporate clients could be enhanced by combining our two firms that would create greater depth and backup that would continue this unique investment style beyond our years. Furthermore, shareholders would be rewarded through synergies and cost savings associated with doubling the companies in cash flow (accounting, compliance, listing costs, systems, and auditing).

I am more confident today than I was three years ago that Tom Griffith and Carlos Yuste can lead this company in achieving excellent performance for clients, a wonderful place to work for employees and growth with dividends for shareholders.

Blame the Covid lockdown for the lack of in-person meetings that allowed the double weighting in Russian securities prior to the invasion of Ukraine that caused the underperformance that wiped out seven years of outperformance in the largest investment mandates within CLIM. Also, the rise in interest rates in the last three years has caused the worst bond market in history and widening closed-end bond fund discounts have caused poor short-term relative performance at KIM.

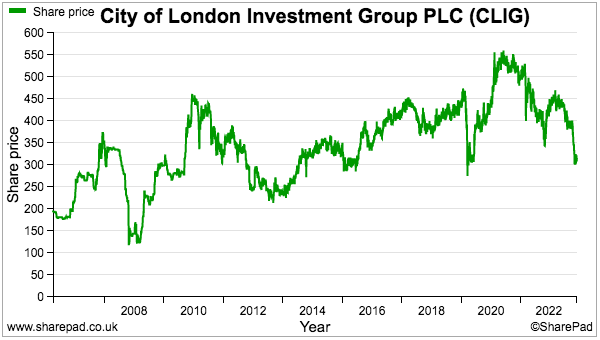

Discount widening occurs when an asset class goes from in favour to out of favour and is a normal but painful part of the investment process and has been present for a good part of the last couple of years causing outflows, lower revenues and profits, and CLIG shareholder pain. For most of 2021 the stock was trading over 500 pence and is now down to 334 pence, painfully reflecting the lower revenue during this part of the investment cycle.

However, I believe CLIG is well positioned to perform well in the future and has most of the staff in place to make that happen. I can see the firm doubling in five years and tripling in ten years.

The generous dividend is protected in the near future by substantial after-tax cash reserves that now should be earning 6% annually or about 2.1 million during this fiscal year.

I am optimistic for the future of CLIG given the right advice and direction.

Having been on the Board of Directors for nearly three years, I have found that most of the board members do not understand the business and do not appreciate the excellent money management that has taken place over the years at CLIG.

Attesting to this is the fact that not even one director has opened a personal account at CLIM or KIM. Not only have they not done business on a personal basis with CLIM or KIM, but they have also not referred any business in the last three years. Their stock ownership is small, and they have not provided good direction for the integration of CLIM and KIM.

They have been slow to embrace changes to our reserves (cash management) that would improve returns and reduce risk. They have directed the management team into pursuing non-synergistic fits for the company.

They discriminate in their selection of future board members and spend a lot of money on consultants instead of putting together a team of board members that can properly guide CLIG into doubling over the next several years.

I believe the future board should consist of individuals with different skill sets that believe in the great future of CLIG. The board members should trust the investment experience with their own monies as well as their friends’ monies. They should have a combination of experience and skills, so they do not have to rely on outside consultants and advisors. They should also be willing to align their interests with shareholders by agreeing to take the minimum of 50% of their board compensation in CLIG stock that cannot be sold for two years. This is why I voted against the current board.

I believe this board should be replaced with a seasoned group of directors that understand the enormous potential of CLIG and that can guide the management in profitably growing the company.”

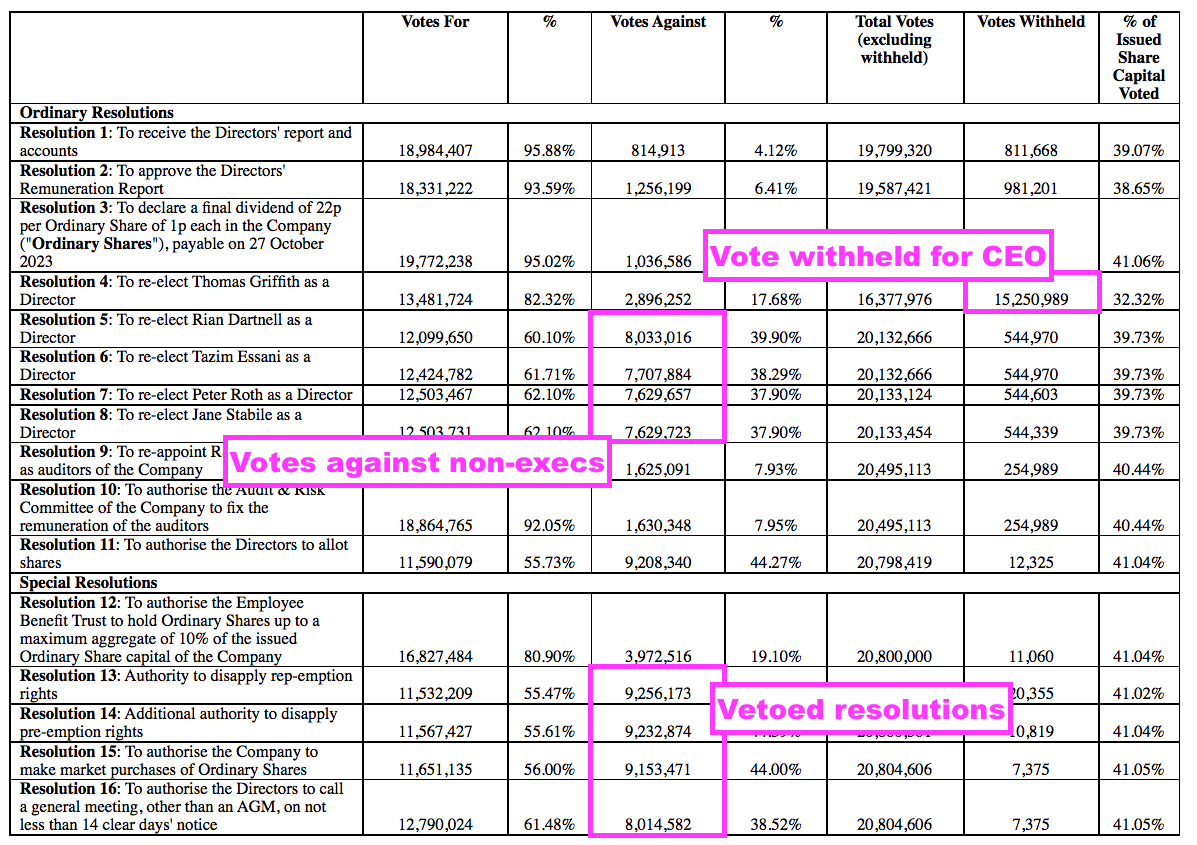

AGM voting

- The AGM voting confirmed Mr Karpus voted against CLIG’s four non-executives (including the chairman) and withheld his vote for CLIG’s chief executive:

- The ordinary resolutions to re-elect the non-execs required 50%-plus approval to pass, and the non-execs remained on the board after garnering 60%-plus.

- The Listing Rules also require the re-election of ‘independent’ directors to be approved by all shareholders excluding ‘controlling shareholders’ such as Mr Karpus.

- The votes against the non-execs excluding Mr Karpus were not significant:

- Mr Karpus helped ensure four special resolutions, which require approval from 75% of votes cast, were not passed. The vetoed special resolutions included the authorisation for CLIG to buy back its shares.

- I calculate three of the special resolutions would have failed even without Mr Karpus voting.

- CLIG said a “further consultation” would now be undertaken with Mr Karpus:

“The Board notes with disappointment the opposition to a number of the resolutions tabled at the AGM primarily from a single shareholder and commits to further consultation, therefore, with a view to providing an update within six months, as required by the UK Corporate Governance Code.”

- Shareholders should be provided with an update by 23 April 2024.

- Mr Karpus did not vote against the directors during the 2020, 2021 and 2022 AGMs, and his statement contained some robust remarks, not least:

“I believe this board should be replaced with a seasoned group of directors that understand the enormous potential of CLIG and that can guide the management in profitably growing the company.“

- I therefore contacted Mr Karpus to learn more about his thoughts on CLIG and we spoke for approximately an hour.

Reduced profit, dividend question and business plans

- The AGM statement from Mr Karpus had already confirmed his support for CLIG’s executives:

“I am more confident today that I was three years ago that Tom Griffith and Carlos Yuste can lead this company in achieving excellent performance for clients, a wonderful place to work for employees and growth with dividends for shareholders.”

- He re-emphasised that support during our conversation:

“I think [chief executive] Tom Griffith is capable of doing a pretty good job of putting CLIM and KIM together, if he puts the right people in the right places.

…

There are a lot of good things going on. I think the people at KIM and CLIM are a cultural fit, but they have got to exploit the closed-end fund business worldwide. I think there is a lot of things that can be done, but with the right direction and right management.”

- But Mr Karpus was clearly unimpressed with the non-execs, and explained to me why he had now decided to vote against them:

“My last board meeting was in July and the annual report was published the week before. Assets under management were down, fee realisation was down and new business had been very elusive. I watched the board to see how they were going to react. And they did not react.

The board did not seem too concerned about fees going down, assets going down and not bringing in new business. That was what really turned me against the board. I did not see what they were adding to the direction of the company.”

- Mr Karpus lamented a lack of action to shore up margins. He also seemed worried that lower earnings could eventually lead to pressure on the dividend:

“Right now I think they must cut costs, and I said in my last board meeting about cutting costs. You have got to look at the areas that are not profitable and get rid of them. The dividend is probably reasonably protected in this current year, but after that it is questionable.“

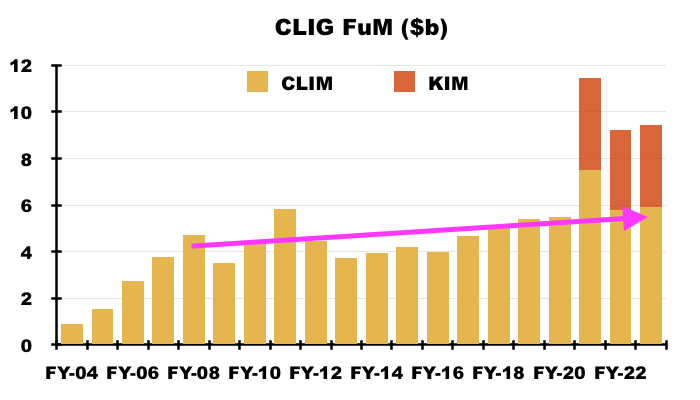

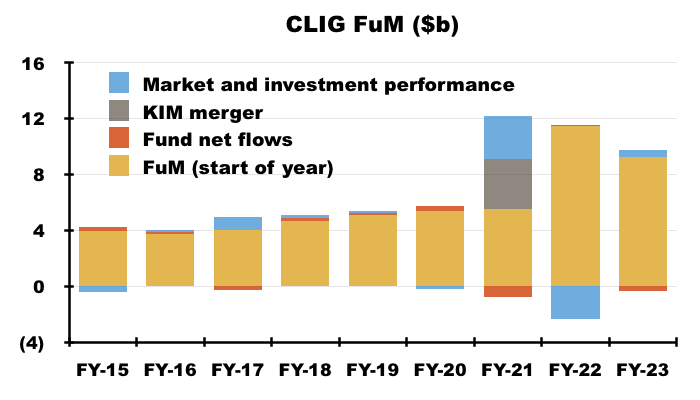

- The combination of lower funds under management (FuM) and lower fee rates caused underlying operating profit to decline 29% (in USD) during FY 2023.

- My calculations indicate current-year earnings of perhaps 34p per share will just about sustain the ongoing 33p per share payout.

- Beyond the current year, the dividend could easily become “questionable” should FuM and/or fee rates continue to dwindle, and leave the payout uncovered by earnings.

- Mr Karpus cited CLIG’s fledgling REIT strategies as examples of board complacency.

- According to the 2023 annual report:

- The REIT strategies were seed funded with £3.9m during 2019 and were worth £3.8m by FY 2023, and;

- Clients own 80% of one REIT fund and 0% of the other.

- Those REIT details imply REIT fees are immaterial versus last year’s revenue of $69m earned from other client FuM of approximately $9 billion.

- Mr Karpus referred to the negative impact of the pandemic on the commercial-property sector and the prolonged absence of clients for the REIT strategies. Mr Karpus reckoned the time had come to close the strategies:

“I suspect they spend £0.5m a year on these [REIT] strategies and they have not produced a dollar of revenue for five years. I asked, ‘when are you going to pull the plug on them?‘“

- Somewhat alarming for shareholders, Mr Karpus disclosed he had never seen a REIT business plan while serving on the board:

“Where was the business plan for these [REIT] strategies? I did not see one.“

Misdirection and consultants

- The AGM statement from Mr Karpus mentioned management pursuing “non-synergistic fits“:

“They have directed the management team into pursuing non-synergistic fits for the company.”

- Mr Karpus elaborated on that subject during our conversation:

“They are looking to acquire other companies, and they found one. But it was a wealth manager and not a money manager. I asked ‘How are we going to make any money if the principals wanted to leave?’ There would be no money to be made.“

“A lot of time was spent travelling and meeting people. I think [executive directors] Tom [Griffith] and Carlos [Yuste] have been a little bit misdirected, and I think it’s the board more than anything.“

- I note CLIG’s talk of acquisitions from FY 2022…

“We will also continue to be selective in identifying potential acquisitions, which we believe will inevitably appear given the difficult market conditions of the past year.“

- …was not repeated for FY 2023.

- Mr Karpus said CLIG employed an adviser to help with the acquisition search, and his AGM statement noted the group “spent a lot of money on consultants“:

“They… spend a lot of money on consultants instead of putting together a team of board members that can properly guide CLIG into doubling over the next several years.”

- The liking for consultancy among the non-execs is not surprising given three of the four non-execs mention “consulting” in their annual-report bios:

“Peter [Roth] currently serves as Managing Partner of Rothpoint Group LLC, a New York based consulting firm focusing on the financial services industry.”

“Jane Stabile is the president and founder of IMP Partners LLC, a FinTech consulting firm founded in 2004 that counts four of the top ten global asset managers amongst their clients.“

“[Tazim Essani] Contributes to the Board: extensive knowledge of financial services industry; leadership; strategic consulting; and strong entrepreneurial skills.”

- I note the latest annual report confirmed the appointment of an environmental consultant:

“During the year, the Group engaged with a third-party environmental consultant – ECO3 Partnership Limited (ECO3) to review and enhance our reporting on environmental risks and opportunities. In collaboration with ECO3, the group produced a 2022 TCFD Supplemental Report which was published in August 2023. ECO3 has also helped the Group to produce a detailed Scope 1-3 GHG assessment and SECR summary, which is available on our website.”

- I get the impression the environmental consultant provided a full bells-and-whistles analysis for CLIG’s climate-related disclosures, which ran to nine pages in the annual report and two further website documents (2022 TCFD and 2023 SECR):

- In contrast, fellow portfolio member S&U (SUS) limited its climate-related disclosures to less than three pages within its latest annual report:

- Both CLIG and SUS are quoted on the main market and abide by the same Listing Rules and climate-related disclosure requirements.

- The key difference perhaps between SUS and CLIG is at least 40% of SUS is owned by its board, while only 1% of CLIG is owned by its board.

- One set of directors may therefore keep a closer eye on consultancy costs than the other.

- I note the word “consultant” appears only once within SUS’s latest annual report versus 11 times within CLIG’s.

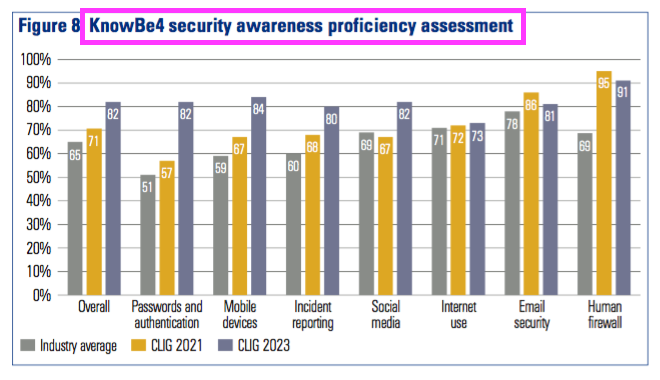

- Outside expertise has also been utilised by CLIG for cybersecurity purposes.

- CLIG is the only small-cap I know that has presented the results of an employee “security awareness proficiency assessment” within its annual report:

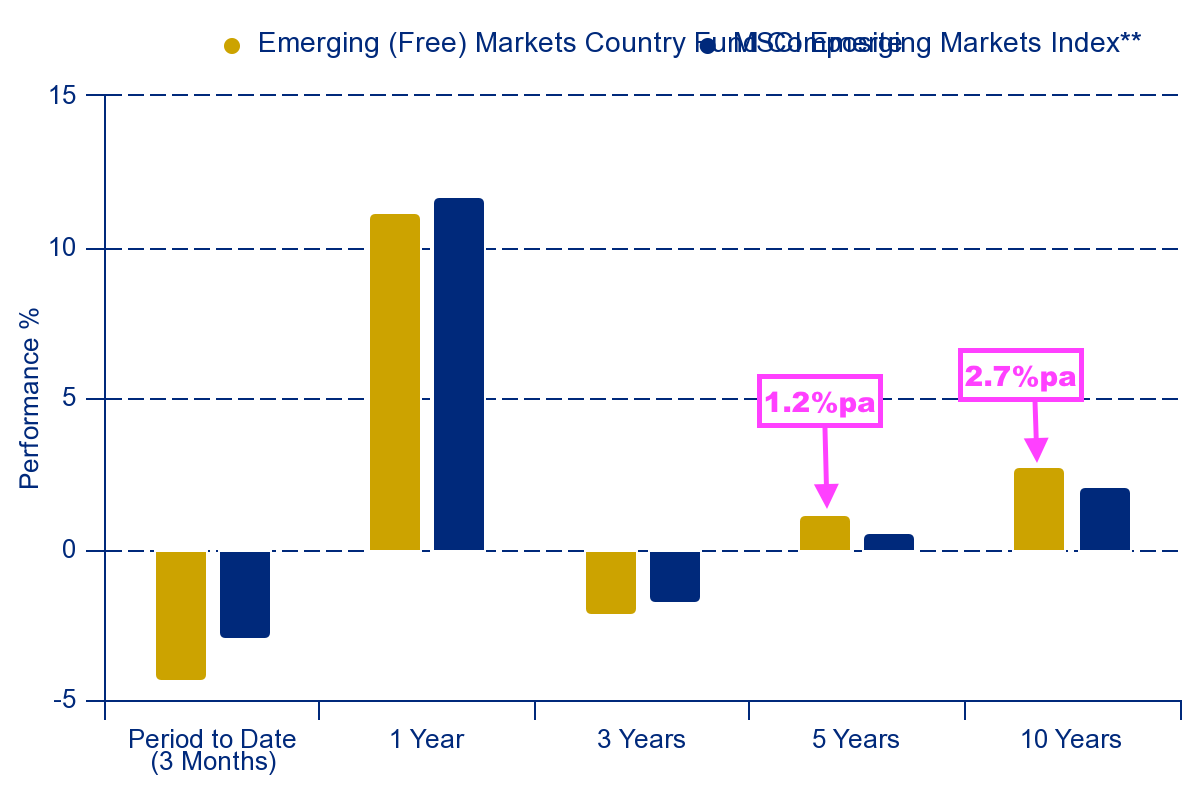

- I just wonder if the same level of ‘proficiency assessment’ should be undertaken on the workforce’s ‘investing awareness’. After all, certain CLIG strategies have delivered compound annual returns of just 1% during the last five years.

- The AGM statement from Mr Karpus claimed the non-execs “discriminate in their selection of future board members“, and my conversation with Mr Karpus gave the distinct impression boardroom diversity within CLIG had become more important than boardroom ability.

- “Diversity” for example is mentioned 46 times within CLIG’s latest annual report, including:

“Efforts to enhance social awareness in the workplace continued this year and all employees received two training sessions focusing on diversity, equity and inclusion. Subjects addressed in these sessions were “disrupting our unconscious bias” and “your words matter about disabilities” and similar initiatives will remain an important factor in the Group’s commitment to encourage community participation by employees.“

- By contrast, “diversity” is mentioned only eight times with the latest SUS annual report, which confirms board appointments are made “purely on the basis of ability and temperament“:

“Whilst the Board notes the Code’s focus on diversity, both Board and executive appointments are made purely on the basis of ability and temperament, irrespective of race, gender or sexual orientation.”

- When appointing board members, CLIG on the other hand…

“[considers] all aspects of diversity when reviewing the composition of, and succession planning for, the Board and its Committees and executive management recruitment;

[ensures] that all searches conducted in relation to Board appointments, whether by the Company or external search firms, identify and present an appropriately diverse range of candidates for the vacancy;”

Cash management

- The AGM statement from Mr Karpus claimed CLIG’s cash position ($29m at the last count) was not being exploited to its full potential:

“They have been slow to embrace changes to our reserves (cash management) that would improve returns and reduce risk... The generous dividend is protected in the near future by substantial after-tax cash reserves that now should be earning 6% annually or about 2.1 million during this fiscal year.”

- Mr Karpus explained during our conversation that he started managing short-term cash professionally during 1980 for what is now part of HSBC.

- He viewed CLIG’s cash-management approach — simple fixed-term deposits at mainstream banks with limited insurance protection — as dating from “1975“.

- He recounted how persuading CLIG to employ other cash-management approaches — such as using government bonds and money-market funds — took almost 18 months.

- Mr Karpus emphasised that KIM undertakes both short- and long-term fixed-income management, and was in the top 1% of such managers in the US over “any 10- or 20-year period“…

- …and yet CLIG “was not using the expertise within the firm” to manage its own short-term cash.

- But cash-management improvements may have occurred. I calculate CLIG earned approximately 3.8% interest on its cash position during H2 2023 versus 1.7% during H1 2023. I presume the target now is to reach the 6% cited by Mr Karpus within his AGM statement.

- Mr Karpus reckoned corporate cash-management services — complete with formal investment guidelines about credit quality and diversification — could lead to “tremendous opportunities” for CLIG:

“With interest rates where they are, our cash management should be revived. Professionally managing corporate reserves could be a big opportunity. That’s where I see the company’s growth. I can see growth on the KIM side and I can see tremendous opportunities in London. But the board does not see that.”

- Anecdotal evidence within my own portfolio suggests there could indeed be “tremendous opportunities” for a cash-management service for UK businesses. Examples of companies with woeful cash-deposit returns include System1 and Tristel.

- Mr Karpus reckoned a corporate cash-management service could grow to handle “$1 billion to $2 billion over the next five to ten years“.

- He believed today’s interest rates “were here to stay” and corporate cash-management clients should therefore be “very easy” to attract.

- Mr Karpus emphasised there was “an appetite for cash” at present, and cited customers at Blackrock having recently sold long-term funds valued at $13 billion and invested $15 billion into cash-management services and money-market funds.

- According to Mr Karpus, fees on cash management for CLIG could start at 100 basis points and reduce to 50 basis points depending on the account size. CLIG currently earns an average 70 basis points across all of its FuM.

- Mr Karpus explained a corporate cash-management service could deliver returns superior to mainstream deposit accounts by:

- Moving money back and forth between the UK and US to exploit different rates;

- Obtaining favourable ‘wholesale’ rates unavailable to individual clients;

- Employing techniques such as ‘riding the yield curve‘;

- Undertaking transactions such as ‘reverse repos‘, and/or;

- Holding certain SPACs.

- Mr Karpus reckoned a corporate cash-management service would “take pressure off CFOs, who are accountants and not skilled in moving money“.

- Mr Karpus even explained how cash returns could be enhanced by simply moving money to always collect a day’s interest:

“It’s about moving the money. Every day you do not get interest on the money, you are losing 1.5 basis points a day when short Fed funds in the United States are 5.5%.“

- He recounted how in the past he worked on the east coast of the US but used a bank on the west coast:

“I could wire the money to them late in the day and earn that day’s interest.”

- All those extra 1.5 basis points would then add up for clients.

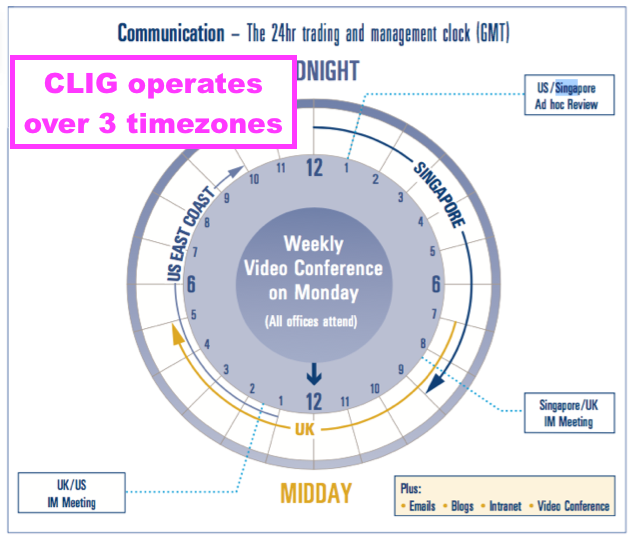

- Mr Karpus observed CLIG had offices in three distinct timezones that led to a “tremendous capability” for money transfers supporting a cash-management service:

“One thing CLIG can do is move money from Singapore to London to the United States on the same day, which is a tremendous capability that should be explored.”

- CLIG’s 24/5 trading ability could also be employed for other approaches. Mr Karpus suggested “international arbitrage“, a strategy he ran for six years at KIM that exploited different equity pricing within different markets and delivered “double the return of the US market without market risk“.

Client focus, risk controls and sales efforts

- My CLIG reviews have regularly bemoaned a lack of new clients that would help elevate FuM and earnings.

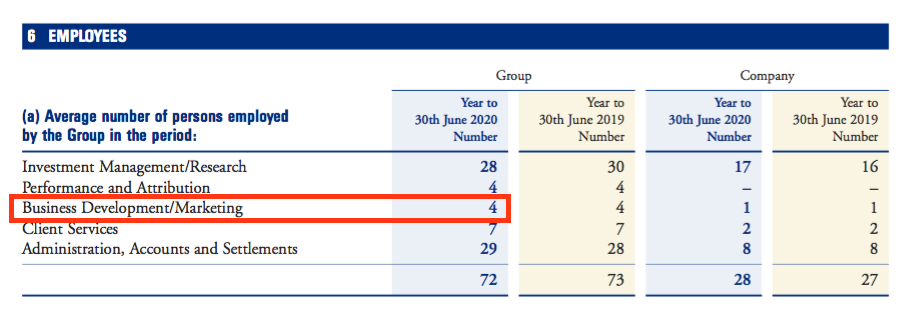

- CLIG took its marketing in-house during FY 2009, after which FuM at the original CLIM subsidiary has improved only 20% on the level witnessed at FY 2008:

- Prior to the KIM merger, CLIG operated with only four of its then 72 employees working in a business development or marketing capacity:

- Mr Karpus gave a blunt assessment of why new mandates had proven to be particularly elusive:

“They are not client driven. They are not offering things that the clients are buying. What are the clients looking for? You have to be driven by what the market wants to buy, regardless of what you think they should buy. I have not seen that from the board and I have not seen that from a lot of people in the company.“

- With the (very thin) red bars on the chart below showing minimal new client money since FY 2015…

- …I would venture clients are simply not interested in CLIG approaches that have returned less than 3% a year over the last decade:

- Some of CLIG’s lacklustre returns were due to ‘double-weighting’ Russia. As Mr Karpus said in his AGM statement:

“Blame the Covid lockdown for the lack of in-person meetings that allowed the double weighting in Russian securities prior the invasion of Ukraine that caused the underperformance that wiped out seven years of outperformance in the largest investment mandates within CLIM.”

- Mr Karpus told me the Russian decision showed CLIM “did not have good risk controls”, and such ‘double-weighting’ would never have occurred at KIM.

- I was also told the employees responsible for the Russian decision have now left CLIG, and I note CLIG’s chief investment officer recently announced his retirement from the group.

- Mr Karpus stressed greater cross-selling integration was still needed between CLIM and KIM:

“It is all one firm now. KIM clients should be able to invest in CLIM’s emerging-market fund, and vice versa with CLIM clients and the fixed-income services at KIM. That has not happened in three years.”

- KIM has struggled to attract new money during recent years, which Mr Karpus confirmed was due to a number of KIM sales people retiring around the same time as the merger.

- He added KIM’s recruitment process had suffered “a lot of false starts” but was now “starting to move in the right direction” with one or two promising sales appointments.

- Mr Karpus revealed he had grown KIM at “20% a year for 20 years“, and I was surprised to be told the board had “never asked him how [he] did it”.

- Mr Karpus disclosed KIM suffers outflows of approximately $100m a year due to clients with an aggregate $2b withdrawing 5% annually for living expenses.

Shareholders and employees

- Although the AGM statement from Mr Karpus said “this board should be replaced with a seasoned group of directors”, he did not suggest during our conversation that a formal move to oust the directors was imminent.

- Mr Karpus told me:

“There are a lot of positives going on and very good employee morale. I want to stay positive with the board and I want to work with them and I want to work with the management.”

- No doubt CLIG’s aforementioned “further consultation” with Mr Karpus will reveal more by 23 April 2024.

- Mind you, I did get the impression Mr Karpus would not wait forever before adopting a more hardline approach.

- Summing up, Mr Karpus felt the balance between clients, shareholders and employees at CLIG had diverged towards the employees over time:

“They must take better care of the clients, and focus more on the shareholders. I think they veer too much on the side of the employees, particularly in the last few years. And that has to change.”

- I note the staff’s profit share for FY 2023 increased from 23.9% to 26.5% (in GBP), which combined with lower FuM and lower fee rates, left underlying profit (in GBP) to decline by more than 20%.

- Perhaps CLIG going back to traditional office working may help improve client returns, which may then help attract more clients and perhaps eventually propel fees and earnings higher.

- Mr Karpus did not support employees ‘working from home’:

“A work week where people could decide not to come into the office on Mondays and Fridays? You can’t manage money that way.”

“You have to manage money in one room. It’s all about the collaboration and team approach. When you have a work week with people working from home, you do not get that collaboration and you are not going to do as well.“

- CLIG’s latest annual report revealed employees have now returned to working four days a week in the office:

“For the next financial year, effective 1st October 2023, we have increased our in-person days in the office to four per week, while providing more flexibility via a bank of optional WFH days for employees.“

- Four days in the office would not appease Mr Karpus, who told me:

“I would say you have to come into the office and work. You can work from home on Saturdays and Sundays, but when the market’s open you have got to be there.“

- Remarks such as that from Mr Karpus tell me CLIG’s board still has work to do to placate its largest shareholder.

Verdict on George Karpus conversation

- George Karpus was as frank with me as he was with his AGM statement.

- I was relieved he did not suggest radical business changes were required. Indeed, cross-selling KIM/CLIM services, promoting a corporate cash-management offer and getting employees in the office full time to help improve performance all appear straightforward enough…

- …and I am not surprised Mr Karpus lodged his protest votes given such simple recommendations have yet to be implemented.

- Whether the board and senior management are capable and/or willing to act upon the suggestions of Mr Karpus remains to be seen.

- While Mr Karpus would be happy to replace the non-execs, I would venture the executive managers must shoulder some responsibility for CLIG’s lacklustre performance over time.

- After all, long-term client returns in low single digits, in-house marketing that fails to bring in significant new money and the lack of a REIT business plan do imply faults lay throughout the business.

- As I mentioned in my FY 2023 write-up, the 320p shares are currently at a level first seen during 2007…

- …and the lack of long-term capital appreciation does suggest CLIG’s operating economics, business strategy and/or management talent are not quite what they should be.

- After speaking to Mr Karpus, I suspect part of the problem is the non-execs prefer to spend time ensuring the corporate governance is first class…

- …rather than spend time challenging the executives to ensure the underlying business performance is first class.

- Another boardroom drawback is the lack of ‘owner managers’. The directors control only 1% of the business and, from what I heard from Mr Karpus, have a very different view about acceptable expenses to him.

- I do wonder whether CLIG changing its stock-market listing to AIM could help Mr Karpus revamp the board to his liking.

- CLIG initially floated on AIM during 2006, and re-joining the lighter-regulated junior market from the main market could ease some of the corporate-governance requirements (and costs!) that appear to frustrate Mr Karpus.

- I must confess I was not convinced about everything Mr Karpus declared within his AGM statement.

- In particular, “the firm doubling in five years and tripling in ten years” looks a very tall order — at least in FuM terms — even if the cash-management service comes good and the KIM/CLIM cross-selling takes off.

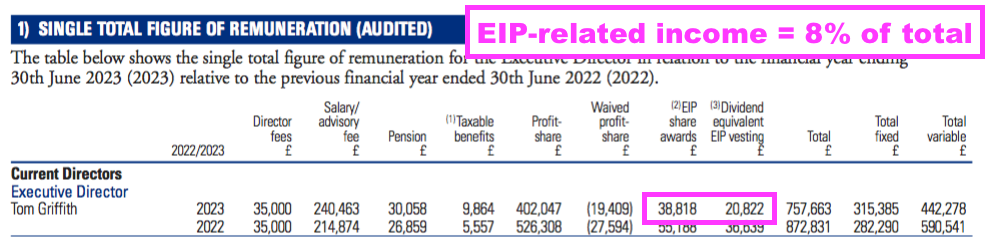

- I am not sure either about expecting the non-execs to take 50% of their fees as shares when incentive-plan shares represented just 8% of the chief exec’s total FY 2023 pay:

- Nonetheless, the AGM statement from Mr Karpus was more than enough to persuade me to increase my CLIG holding by 20% at 320p including all costs.

- While the 33p per share dividend and resultant 10%-plus yield are by no means guaranteed, outside shareholders are now supported by the group’s largest investor who seems very keen to see the group actually deliver on what he describes as “enormous” post-merger potential.

- The possible total return from 320p could be very meaningful if indeed that “enormous” post-merger potential — coupled perhaps with favourable markets! — is realised.

- For now at least, I can only trust CLIG’s board reacts quickly and appropriately to the AGM statement from Mr Karpus.

Maynard Paton

Thanks for the write-up Maynard – very interesting. I’ve held CLIG for a decade or so. They have always struggled without Barry Olliff. He tried to leave before and came back to sort things out and now we have the same problem with the KIM founder, George Karpus. The business itself is sound enough and their investment record is good. From my perspective they struggle in 2 areas: transition from a founder led business and poor sales traction. The latter is particularly important – their lack of new mandates is very poor. They don’t lose many which shows they are good investors, but they need a much better sales team. The problem with the board is a reflection of UK corporate governance – no skin in the game except for director fees!

Thanks Simon. Thinking back, the elusive new-client issue has been apparent for some time. I went to the 2016(?) AGM when Barry O was still an executive and raised questions then about marketing efforts (and also the (im)balance between shareholders and employees). So the problems may be more fundamental, e.g. perhaps the addressable market for CLIG’s investing style is inherently limited and the ceiling was reached years ago. Or maybe the business became somewhat comfortable as shareholders simply sat back for the income. Let’s see whether Mr Karpus will now shake things up.

Maynard

Hello Maynard,

many thanks for the write-up and for sharing your insights from sitting down with Mr. Karpus. I’ve recently seen the dividend yield on a screener and wanted to find out more about the company, and accidentally I’ve got to your blog, which has given me the best up-to-date and in-depth information I could find so far.

Best regards,

Simon

Thanks Simon. Glad you found the blog useful!

Maynard

Hello Maynard.

It is now over 6 months since the CLIG AGM, but the only update we have had as to the concerns raised by Mr Karpus and the votes he cast against various AGM resolutions is the short paragraph when the Interims came out in February, referring to ongoing constructive meetings and discussions – plus the announced Board changes. Nothing further was added on this score when the positive Trading Update came out at the beginning of this week. Apart from your blog, shareholders generally would not be aware of the substance of Mr Karpus’ concerns and we do not know what specifically what has been done to address them -which is what the UK Governance Code requires.

I suppose that the discussions might be taking longer to reach full resolution than 6 months, but I still think that shareholders should have been updated this week – the “comply or explain” principle. Will we have to wait until the Annual Report comes out? I wonder what Mr Karpus makes of all this.

Hi Andrew

Well remembered! There is a new Code being introduced for 2025, but for now we have the 2018 edition, which says:

“When 20 per cent or more of votes have been cast against the board recommendation for a resolution, the company should explain, when announcing voting results, what actions it intends to take to consult shareholders in order to understand the reasons behind the result. An update on the views received from shareholders and actions taken should be published no later than six months after the shareholder meeting. The board should then provide a final summary in the annual report and, if applicable, in the explanatory notes to resolutions at the next shareholder meeting, on what impact the feedback has had on the decisions the board has taken and any actions or resolutions now proposed“.

CLIG’s interims said:

“Since our Annual General Meeting on 23rd October 2023, we have pursued a strategy of engagement with our largest shareholder and have had a series of constructive meetings. Discussions on strategy for CLIG’s businesses have been ongoing. We are making progress on a series of shared priorities, including an enhanced focus on the management of our cash balances as well as maintaining our commitment to expense management. We have also been engaging with our other shareholders and, as always, plan to maintain transparency in our ongoing dialogue.”

…which I suppose recaps “the views received from shareholders and actions taken” as per the Code.

CLIG’s forthcoming annual report should supply more information — or a ‘final summary’ as the Code suggests. For now one can surmise the board changes and $2.5m cost savings were prompted by Mr Karpus but that might be awkward for the company to admit.

Despite the Code, protest-vote commentary tends not to be extensive — I guess to save the public blushes of the boards.

For instance, Mountview Estates has incurred protest votes at its AGM for some years now and its latest 6-month update was limited to:

“Following the 2023 AGM, and as it has done previously, the Company identified as far as possible those shareholders who did not support the various resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage, other shareholders raised matters which are under consideration by the Board. The Board is grateful to those shareholders who took part in the engagement process and value the feedback provided. The Company remains committed to shareholder engagement and we will continue to offer to have discussions with shareholders and will take into account their concerns and considerations in the future“.

And from System1 after a general meeting was called to re-jig the board:

“The Board acknowledges that whilst all resolutions were rejected, on average 41.77% of votes were cast in favour of the resolutions. The QCA Corporate Governance Code requires that where 20% or more of votes have been cast against a Board voting recommendation, a company should include an explanation of what actions it intends to take to understand the reasons behind that vote result, and, where appropriate, any different action it has taken, or will take, as a result of the vote. Accordingly, the Board will continue to engage with shareholders to improve alignment on the strategy, objectives and most importantly its delivery and will explain any different action it will take as a result of the vote with its full year results.”

System1 did not mention anything in its full-year results as it did not take any different action!

Mr Karpus said he believed CLIG’s board “should be replaced with a seasoned group of directors” and I dare say if matters are not resolved to his liking, then his 30%+ shareholding allows him to call a general meeting and he could in theory table his own directors to replace the incumbents.

Maynard

Hi Andrew,

“but I still think that shareholders should have been updated this week – the “comply or explain” principle. Will we have to wait until the Annual Report comes out? I wonder what Mr Karpus makes of all this.”

Ah-ha — the 6-month update was published on CLIG’s website but not announced through the RNS. Bad form!

Here is the full text:

——————————————————————————————————

“Update on 2023 Annual General Meeting resolution votes

In accordance with the requirement of Provision 4 of the UK Corporate Governance Code (2024), City of London Investment Group PLC is providing this update following significant votes (defined as above 20%) against a number of resolutions at its Annual General Meeting (“AGM”) held on 23 October 2023. There were 16 resolutions proposed to shareholders at the AGM, with resolutions 1 to 11 proposed as ordinary resolutions, and resolutions 12 to 16 proposed as special resolutions.

Resolutions 1 to 12 were passed, and resolutions 13 to 16 were not passed. In the Company’s announcement dated 23 October 2023, the Board noted that, in relation to Resolutions 5 to 8, 11 and 13 to 16, the Company received less than 80% approval.

As reported in our Half Year Report for the six-months ended 31 December 2023, since our Annual General Meeting on 23 October 2023, we have pursued a strategy of engagement with the controlling shareholder group which arose following the Company’s merger with Karpus Management, Inc on 1 October 2020 and have had a series of constructive meetings.

Discussions on strategy for the Company’s affiliated businesses have been ongoing. We are making progress on a series of shared priorities, including an enhanced focus on the management of our cash balances as well as maintaining our commitment to expense management. We have also been engaging with our other shareholders and, as always, plan to maintain transparency in our ongoing dialogue.

A further update on this matter will be provided in the 2024 Annual Report & Accounts.”

——————————————————————————————————

Maynard