28 August 2023

By Maynard Paton

H1 2023 results and FDA approval summary for Tristel (TSTL):

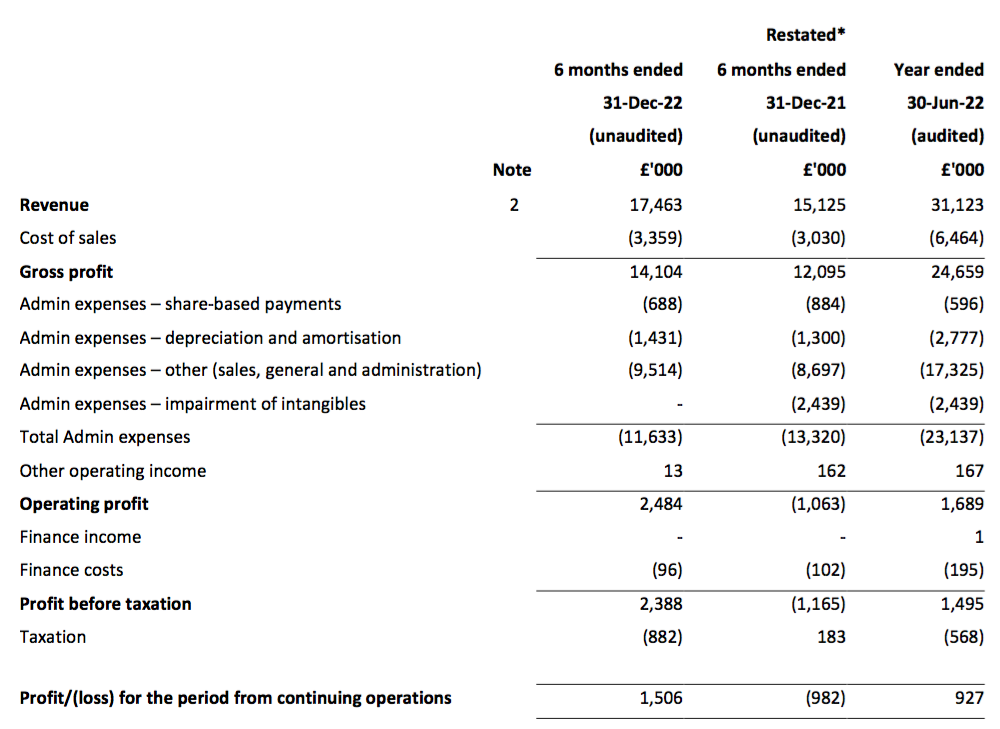

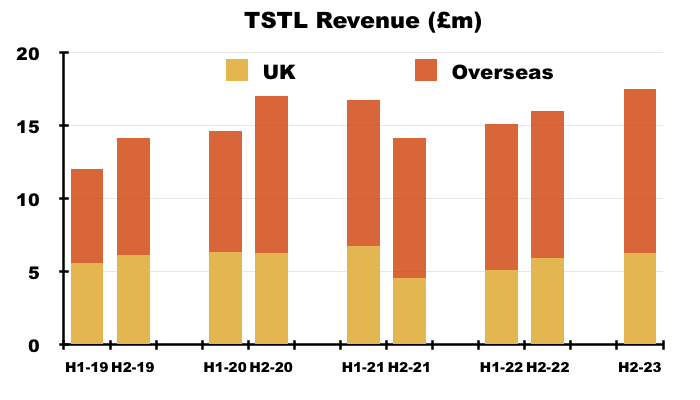

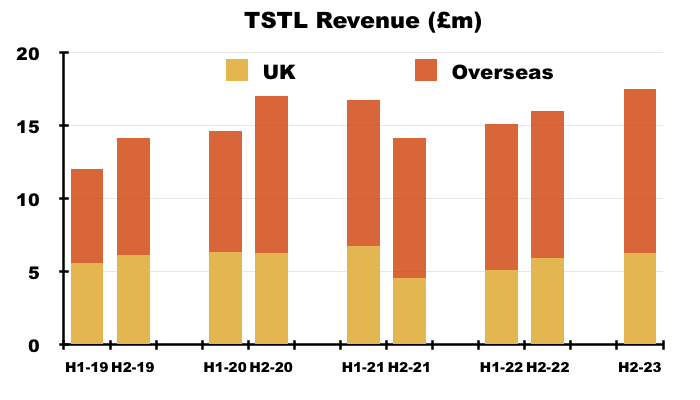

- A positive pandemic-recovery performance, with H1 revenue up 16% to a record £17.5m and H1 profit rebounding up to 33% albeit after a bevy of adjustments.

- A record 81% gross margin helped offset greater H1 staff costs, with useful cash conversion keeping net cash above £8m — which oddly earns no interest.

- The H1 effort was perhaps eclipsed by the subsequent FDA product approval, which creates the opportunity to capture 43 million US disinfection procedures and collect a revised 24% US royalty.

- An informative open-day webinar revealed dividend cover was under review, option grants had been paused, H2 revenue per disinfection procedure had surged plus an ambition to “double revenue over the medium term“.

- An estimated 23x P/E for FY 2026 is not an obvious bargain, but a premium rating could be justified by lucrative US income and management proposals to raise the group’s three-year targets. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own TSTL

- Results summary

- Revenue, profit and dividend

- Revenue classification

- Procedures and pricing

- UK

- Overseas

- United States: H1 commentary and FDA approval

- United States: update on royalties and costs

- United States: potential

- Patents

- Share options

- Financials: margins and costs

- Financials: cash and cash flow

- Valuation

News links, share data and disclosure

- Interim results, presentation and webinar for the six months to 31 December 2022 published/hosted 20 February 2023

- FDA De Novo approval, presentation and webinar published/hosted 05 June 2023

- Open-day trading statement, presentation and webinar published/hosted 25 July 2023

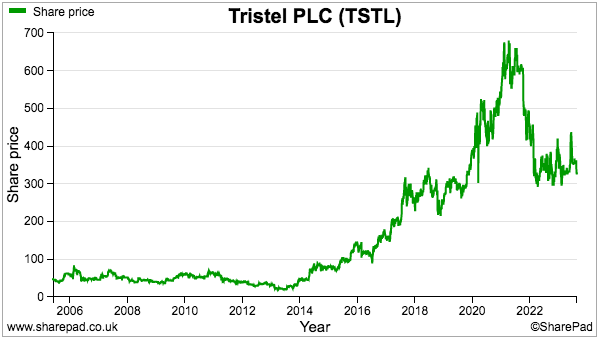

Share price: 325p

Share count: 47,310,993

Market capitalisation: £154m

Disclosure: Maynard owns shares in Tristel. This blog post contains SharePad affiliate links.

Why I own TSTL

- Develops medical-device disinfectants that face limited direct competition due to proprietary chemistry, instrument-manufacturer approvals, scientific testimonies and regulatory hurdles.

- Enjoys a sizeable and resilient UK market position alongside worthwhile expansion opportunities abroad — most notably within the United States.

- Boasts financials that, pandemic-disruption aside, showcase high margins, low capital requirements, decent cash conversion and no debt.

Further reading: My TSTL Buy report | All my TSTL posts | TSTL website

Results summary

Revenue, profit and dividend

- An upbeat outlook from the preceding FY 2022…

“The new financial year has started strongly with first quarter sales up 20% on the prior year — a sales run rate of £34m. We look to the future with confidence as Tristel continues to grow and expand its geographical reach.“

- …followed by further progress reported at December’s AGM…

“The Company is returning to its pre-pandemic growth trajectory, with first half revenue expected to exceed £17m, compared to £15m in the first half of last year. Revenue growth is consistent across all our geographical markets. Gross margin is in line with expectations.

…

The Company is making good progress. With no debt and cash of approximately £10m we face the prevailing economic environment with confidence.”

- ...had already signalled a positive H1 2023 performance.

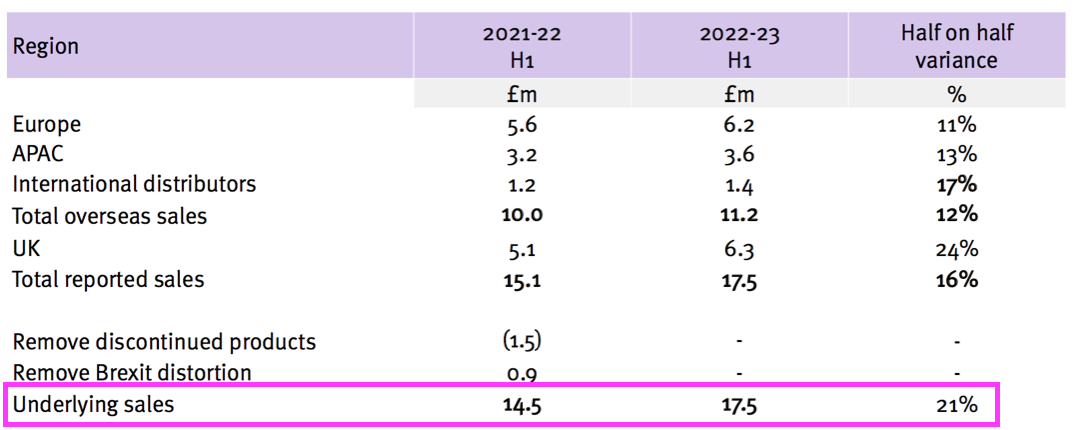

- H1 revenue was £17.5m and did indeed exceed £17m to support a sales run-rate of £34m.

- Cash was indeed approximately £10m at the time of the December AGM, having finished the December half-year at £8.4m after funding the £1.9m final dividend approved at the meeting.

- TSTL’s top-line efforts were complicated by:

- Brexit stock-piling, which generated extra revenue of £0.9m during H1 2021 that would have otherwise been earned during the comparable H1 2022, and;

- The “discontinuation of several low-growth product lines“, which TSTL said contributed revenue of £1.5m during the comparable H1 2022 but which contributed zero for this H1.

- TSTL said underlying revenue growth was 21%:

- Revenue without adjustments for Brexit stock-piling and discontinued products gained 16%.

- Both the 16% and 21% advances exceeded the 10-15% target growth rate confirmed within the preceding FY 2022:

“i) sales growth in the range of 10% to 15% per annum as an annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding share-based payment charge) of at least 25%.”

- TSTL develops wipes and foams that decontaminate diagnostic medical instruments such as nasendoscopes, ultrasound probes and tonometers, and the number of procedures involving such instruments reduced during FYs 2021 and 2022 as hospitals became overwhelmed by Covid-19 matters.

- The pandemic disruption now appears to have passed as this H1 declared “all parts of the group performed well“.

- TSTL commendably split revenue growth between volume and pricing:

“We have increased our prices to hospitals in response to global inflation. Of the increase in revenue of £2.4m, £1.8m relates to additional volume and £0.6m to pricing, which reflects a 4% global price rise. “

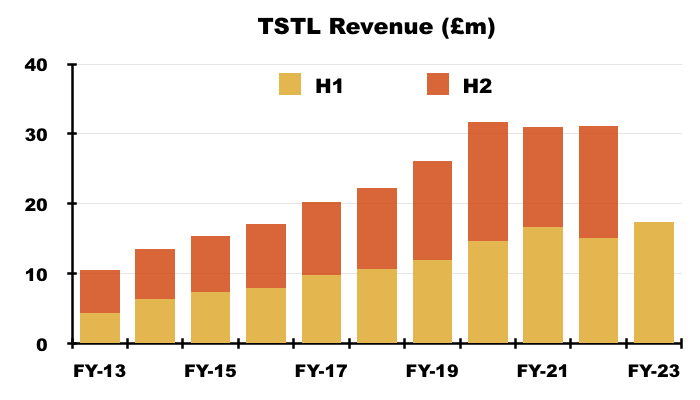

- The £17.5m revenue achieved during this H1 was TSTL’s best ever six-month sales performance:

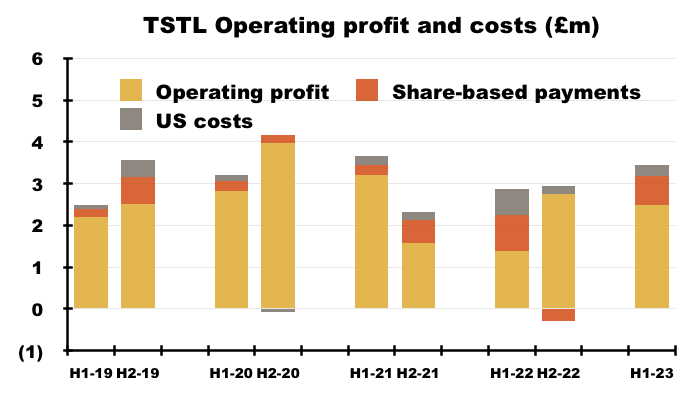

- TSTL’s profit progress remains difficult to analyse.

- As well as the Brexit stock-piling and discontinued products, reported H1 profit was complicated by TSTL’s usual:

- Share-based payments (see Share options), and;

- Costs associated with the US regulatory programme (see United States: H1 commentary and FDA approval).

- Discontinued-product write-offs totalling £2.4m and other operating income of £162k (relating to chemical-data fees and formulation transfers) during the comparable H1 2022 also influenced the comparison.

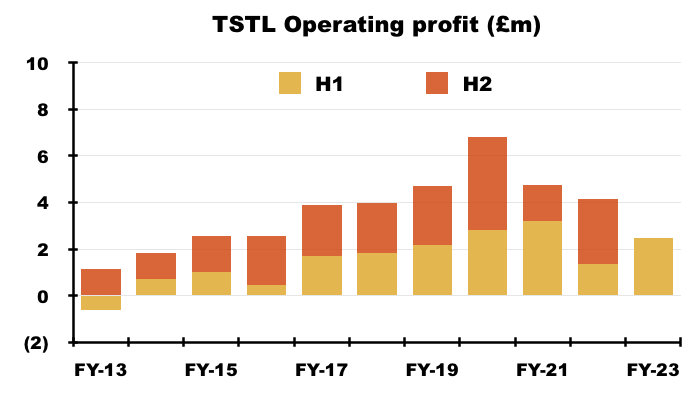

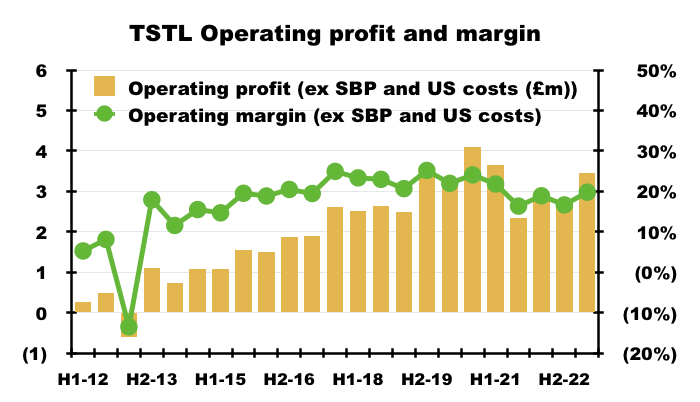

- Including every operating credit and charge, the comparable H1 operating loss of £1.1m was transformed into an H1 £2.5m operating profit.

- Excluding the discontinued-product write-offs, H1 operating profit went from £1.4m to £2.5m:

- Excluding the discontinued-product write-offs, share-based payments, US costs and other operating income, H1 operating profit improved 33% from £2.7m to £3.4m:

- Mind you, adjust for the Brexit stock-piling as well (extra revenue of £0.9m and, say, extra gross profit of £0.7m), and the comparable H1 operating profit may have been equal to this H1’s £3.4m.

- Although the adjustments and guesswork with these H1 2023 figures suggest an ‘underlying’ profit improvement versus H1 2022, ‘underlying’ profit looks to have come in below H2 2019 (£3.6m), H2 2020 (£4.1m) and H1 2021 (£3.7m).

- Given this H1’s record six-month £17.5m revenue, extra costs do seem to be creeping into the business (see Financials: margins and costs).

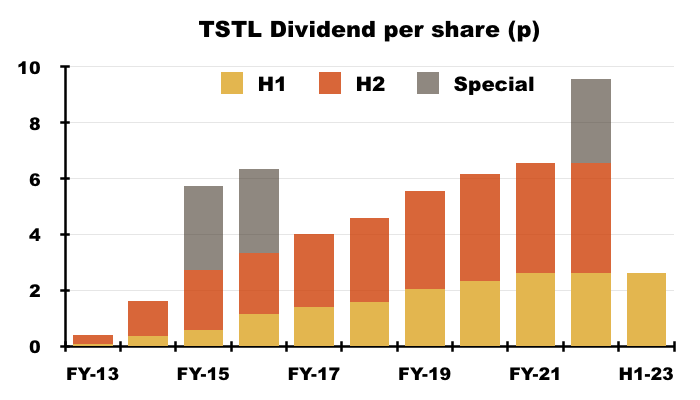

- The dividend was the sole headline measure not subject to interpretation, and was set at 2.62p per share for the third consecutive H1:

- TSTL reiterated its plan to rebuild dividend cover to 2x before contemplating a dividend increase:

“The dividend pay-out will be held at its current level of 2.62 pence interim and 3.93 pence final, until the Group’s stated dividend policy of two times EPS cover can be reinstated without a reduction in dividend per share.”

- Dividend cover of 2x requires annual earnings of 13.1p per share. TSTL’s trailing twelve-month adjusted earnings were 8.1p per share.

- Management’s H1 webinar hinted at a lower dividend-cover policy:

“But we will have a review of that dividend policy with an eye as to whether or not we should reduce that cover number, because you may recall in August (2022) we made a special dividend payment and we would much rather have a steady and stable standard dividend policy than find ourselves in a situation where we are making special dividends“.

- Management’s open-day commentary then said the dividend policy was now under review:

“The board is currently considering increasing our dividend payout ratio and that is something that we will report back to you when a decision has been made“.

Revenue classification

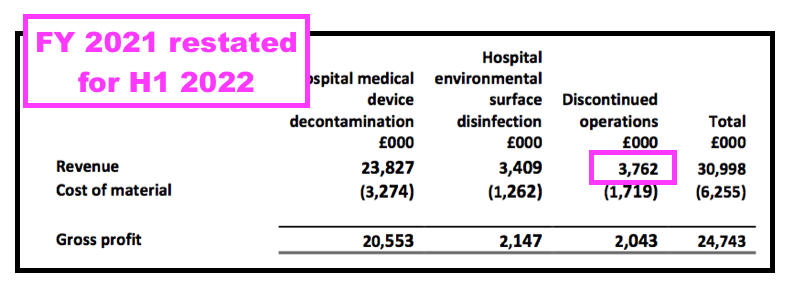

- The comparable H1 announced a welcome culling of legacy products that suffered unfavourable economics:

“During the period the Company refocused the business to accelerate top-line growth and increase profitability as it exits the pandemic. This focus is on Tristel’s proprietary chlorine dioxide technology and the hospital market. These represent “Continuing operations”.

“The Company has discontinued the manufacture and sale of most products in its Anistel and Crystel product ranges and these represent “Discontinued operations”. The Discontinued operations command substantially lower margins, and the Board considers that they will not contribute to future revenue growth without significant investment.“

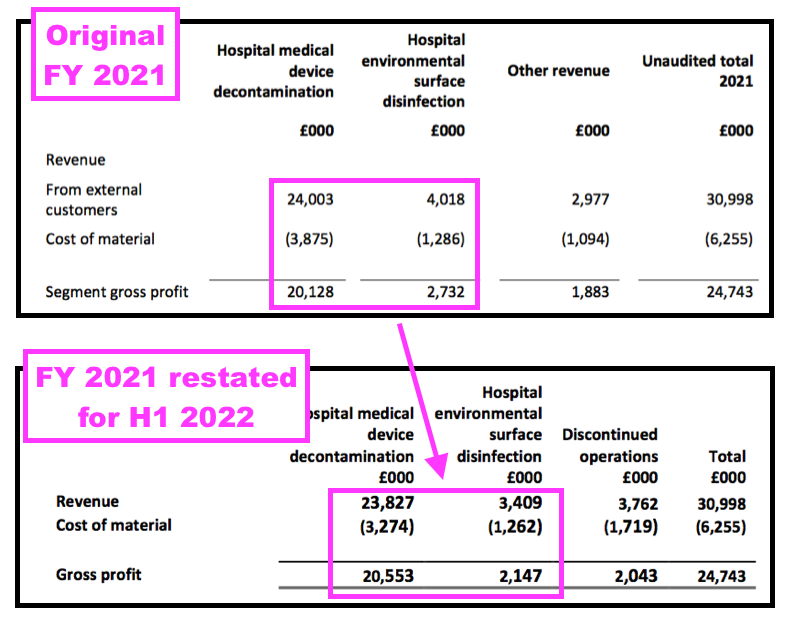

- The product rationalisation was accompanied by an accounting change that divided the group’s revenue and profit into ‘Continuing’ and ‘Discontinued’.

- That H1 2022 accounting change revealed the surface-disinfectant division to be less lucrative than shareholders had previously thought:

- TSTL reverted to its previous accounting policy for FY 2022 after the auditor disagreed with TSTL’s ‘Continuing’ and ‘Discontinued’ interpretation.

- Reverting to the previous accounting policy at least gives shareholders reporting consistency for the different revenue classifications.

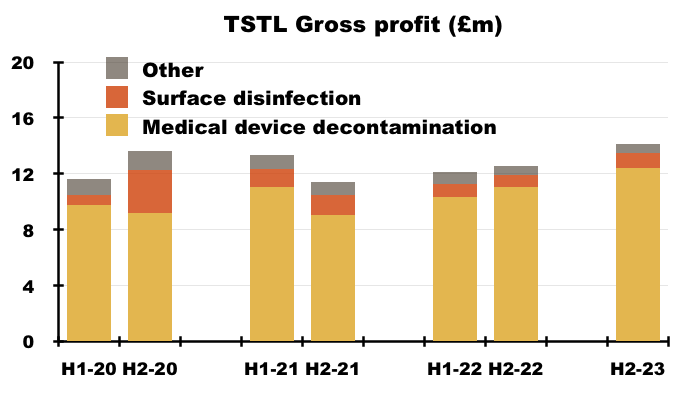

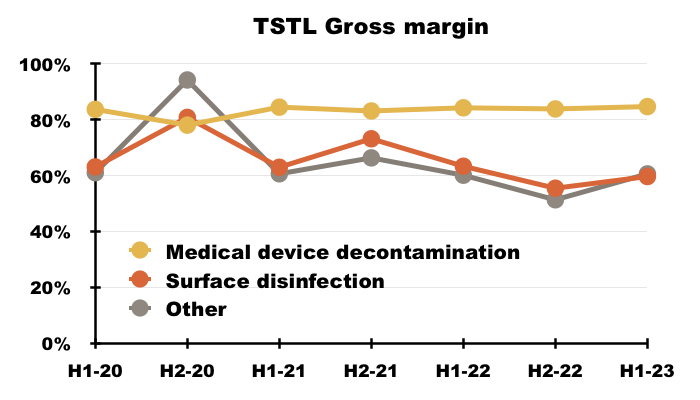

- More than 80% of TSTL’s revenue and gross profit continues to be generated from the wipes and foams that decontaminate medical devices:

- TSTL’s surface-disinfectant products meanwhile contribute approximately 10% of revenue and 8% of gross profit.

- Approximately 5% of TSTL’s business is derived from Other revenue, which TSTL redefined for this H1 as:

“Other:

This revenue derives from carriage, and products which are complementary to the Company’s key strategic focus on infection prevention, some involving third-party collaborations.”

- ‘Carriage’ is income earned from charging customers for delivery.

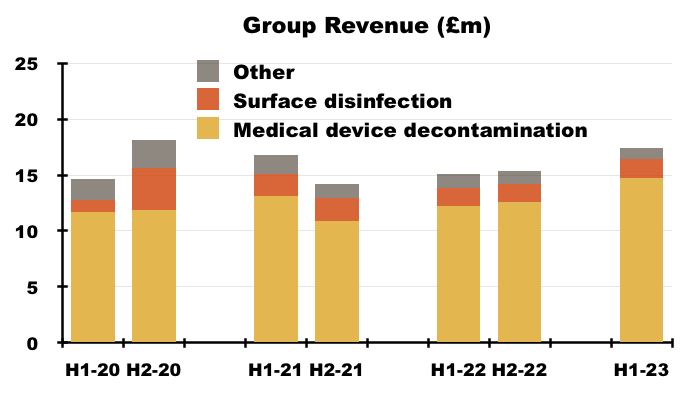

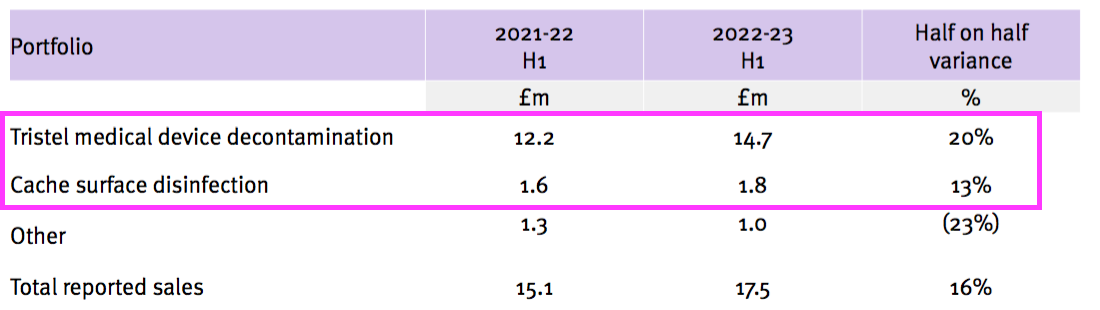

- H1 revenue from the medical-device wipes and foams improved 20% while H1 revenue from the surface disinfectants advanced 13% — although both increases do not adjust for the Brexit stock-piling and the discontinued products:

- Perhaps the best barometer of progress is this H1’s updated Pandemic Impact slide:

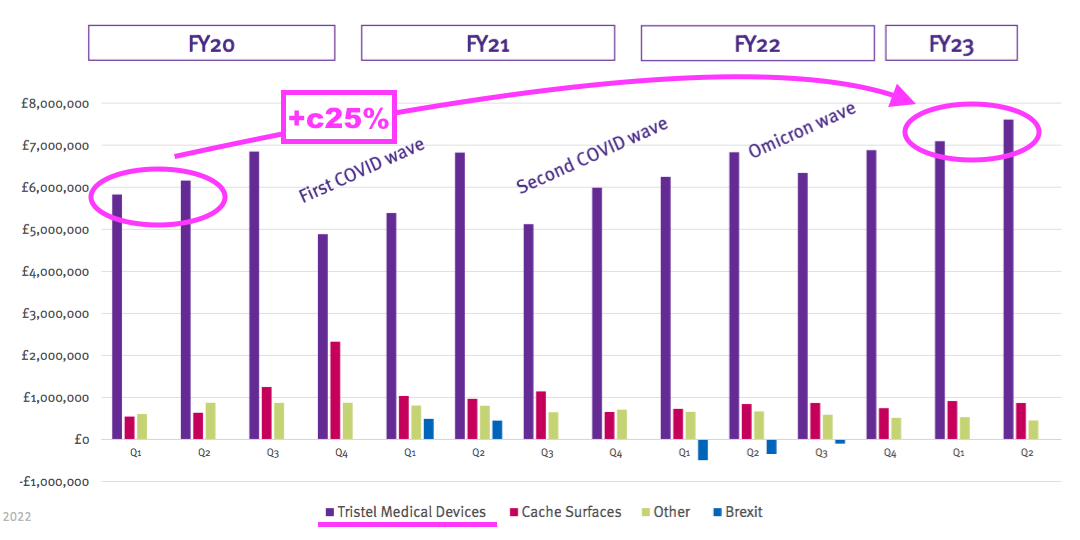

- Revenue for the medical-device wipes and foams during (pre-pandemic) H1 2020 was approximately £12m and has since grown 25% — or a CAGR of 7% — to this H1’s £14.6m.

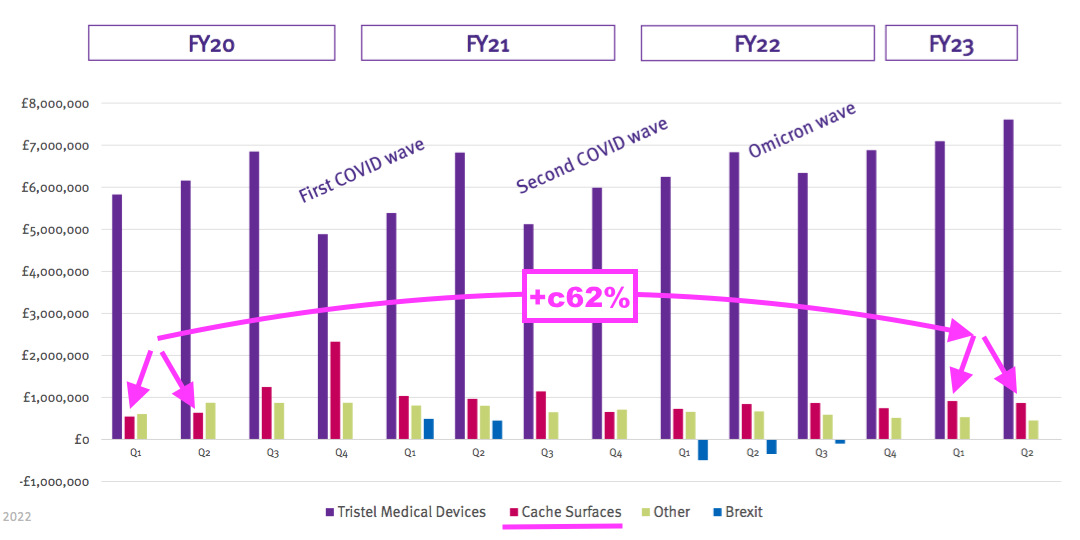

- Surface-product revenue has meanwhile gained approximately £700k, or 62%, since (pre-pandemic) H1 2020:

- The H1 2024 results (due February 2024) will be the first without distorted comparisons from Brexit stock-piling, discontinued products and the pandemic.

Procedures and pricing

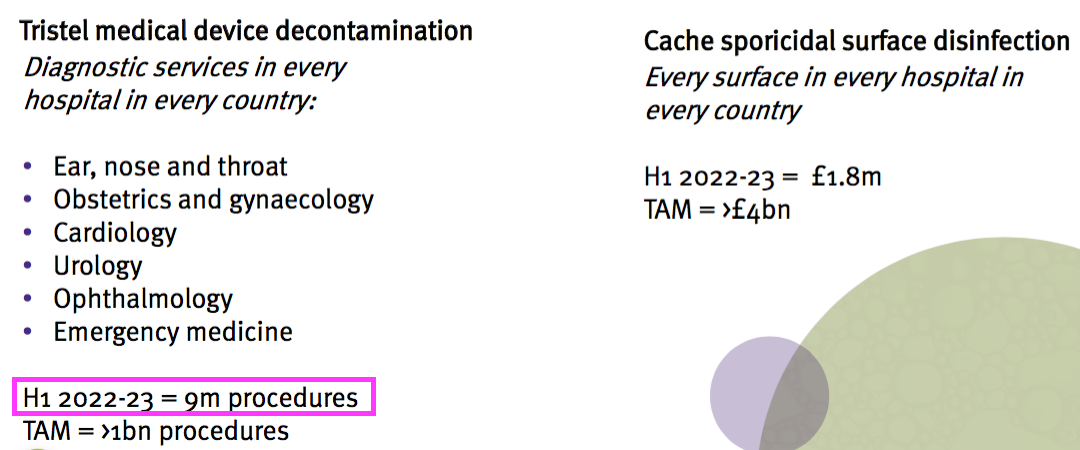

- The H1 presentation included a medical-device disinfection “procedures” statistic:

- Revenue from medical-device wipes and foams was £14.7m during this H1, which implies revenue per procedure was £1.63.

- For comparison, 15.7 million “disinfection events” used a TSTL wipe or foam during FY 2022:

“During the year 15.7 million disinfection events took place with a Tristel medical device disinfectant, which is 31% higher than in the year ended 30 June 2019, before the pandemic struck.“

- Revenue per disinfection event for FY 2022 was £1.62 (£25.4m from 15.7 million events) and for FY 2019 was £1.73 (£20.8m from 12 million events).

- This H1’s £1.63 per disinfection event versus £1.62 for FY 2022 seems disappointing after TSTL claimed to have lifted prices by 4% during the half.

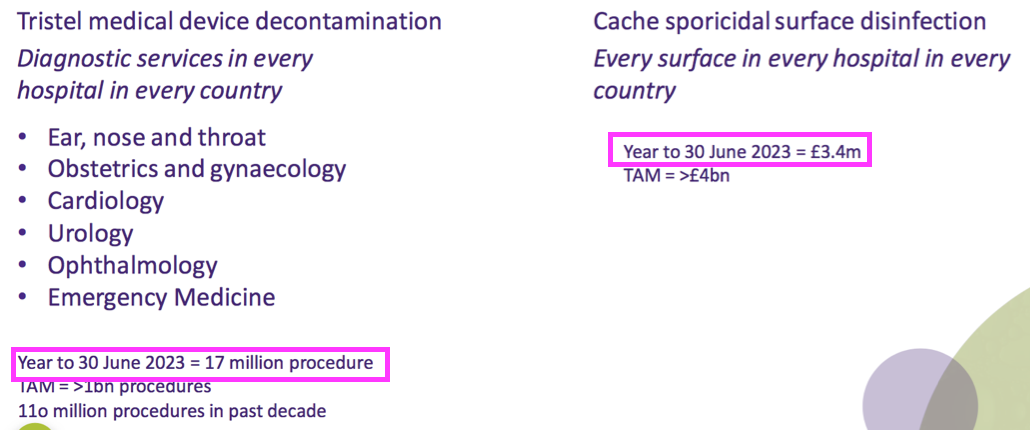

- Last month TSTL said the number of disinfection procedures for FY 2023 was 17 million and disclosed FY 2023 surface-product revenue to be £3.4m:

- The number of disinfection procedures during H2 2023 was therefore 8 million versus 9 million for this H1.

- Fewer disinfection procedures during H2 than H1 does not feel promising, although the procedure numbers may be skewed by seasonal influences and/or rounded calculations.

- Given the open-day RNS confirmed FY 2023 revenue of £36m…

“As a result, revenues for the year were up 16% to £36.0m (FY 2022: £31.1m), ahead of consensus forecasts and above the Company’s long-term target for revenue growth.“

- …surface-product revenue of £3.4m for FY 2023 implies FY 2023 revenue from medical-device wipes and foams was a maximum £31.6m, with H2 2023 revenue from medical-device wipes and foams being a maximum £16.9m.

- H2 revenue from medical-device wipes and foams of £16.9m and 8 million H2 disinfection procedures indicates revenue per procedure surged from £1.63 during H1 to £2.11 during H2.

- That 48p advance to £2.11 during H2 looks very optimistic given TSTL lifted prices by only 4% during this H1, although explanations for the advance may include:

- Much higher price increases during H2;

- Greater (higher-price) sales through direct operations rather than through (lower-price) wholesale distributors;

- Currency fluctuations, and;

- Changes to the product mix (wipes have a higher price point than foams).

- On that last point, an online search shows the Trio Wipes System available to buy for £435 and the Duo ULT foam available to buy for £112.

- The Trio Wipes System gives 50 wipes and therefore costs the purchaser £8.70 per disinfection (£435/50). The Duo ULT foam gives 310 doses and therefore costs the purchaser £0.36 per dose (£112/310).

- TSTL’s income will be less than £8.70 per disinfection and £0.36 per dose because of the gross margin enjoyed by the retailer.

- October’s FY 2023 results may clarify my revenue per procedure calculations and whether the ratio is actually useful for shareholders.

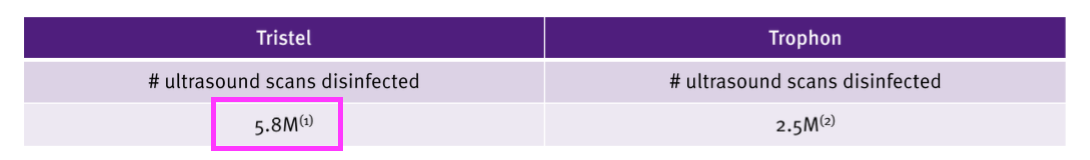

- The ultrasound market appears to be TSTL’s primary money-spinner.

- June’s FDA-approval RNS said:

“Approximately half of Tristel’s global revenue is generated from the ultrasound market.“

- The FDA-approval presentation disclosed 5.8 million ultrasound scans employ TSTL’s wipes and foams:

- “Approximately half of TSTL’s global revenue” could equate to ultrasound revenue of £18m and £3.10 per ultrasound scan (£18m/5.8m).

- The ultrasound numbers given this year differ to those presented previously. TSTL once said its disinfectants handled 8 million ultrasound procedures a year:

“Duo ULT is widely used throughout Europe, the Middle East, Asia, and Australasia and during the Company’s current financial year the product will have been used in over 8 million disinfection procedures of ultrasound probes worldwide.“

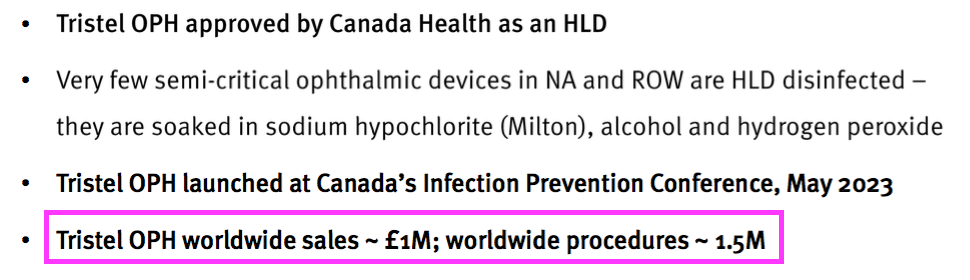

- TSTL’s FDA-approval presentation implied the group’s ophthalmology foam generated revenue of £0.66 per procedure:

- This H1 did not mention anything of consequence about TSTL’s disinfectants used for cleaning hospital surfaces such as floors, mattresses and bedside tables.

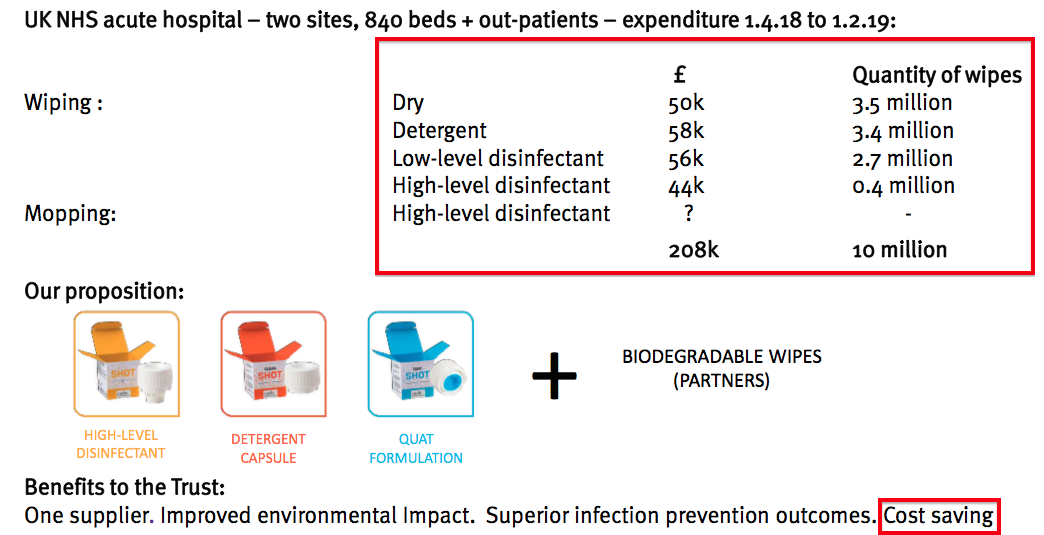

- The last time the division was given prominence in a shareholder powerpoint was H1 2019:

- My notes from FY 2022 reported a revamped surface product called Tank had yet to be launched.

- Management’s open-day commentary admitted the Tank product was still on the sidelines:

“These product ideas take many years to evolve. We started the product development process from the germ of an idea from the Cache concept three, four, five years ago, and the product development process takes a long time, and the regulatory hurdles that we have to jump over can take even longer.”

“We today can’t go full pelt at the Cache product range because we have not got regulatory approval. There is a real sort of malaise in the whole regulatory world. There are not enough auditors. The BSI is our auditing body, and it is difficult for them to find time to review our technical submissions. We are in something of a hiatus at the moment with respect to Cache. But we will get there in the end.”

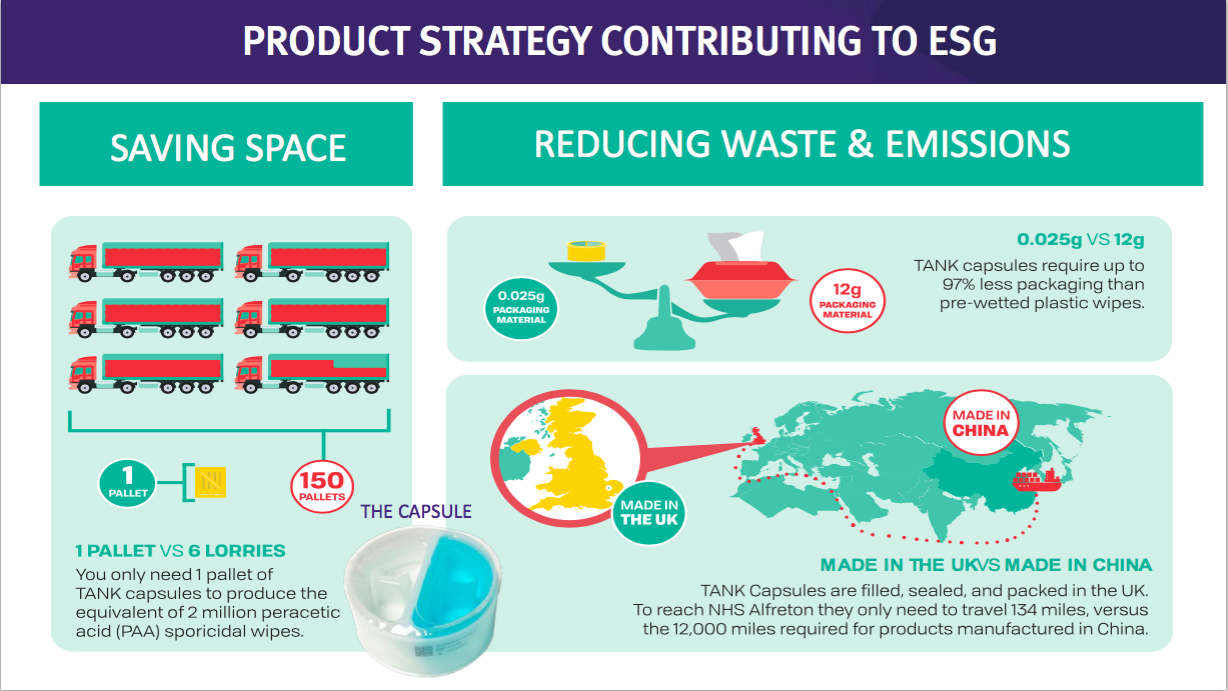

- This TSTL website showcases the surface disinfectants and their environmental credentials versus pre-wetted plastic wipes:

- The drawback to surface disinfectants may be their significantly lower price point compared to the medical-device wipes and foams.

- Management’s presentation comments from FY 2018 suggested the NHS was purchasing low-grade surface wipes at 2p a pop.

- Assuming TSTL price-matches that 2p, enormous volumes will be needed for surface disinfectants to ever represent a notable proportion of TSTL’s business.

- In theory at least, a much more effective surface cleaner that is cheaper than pre-wetted plastic wipes — as well as being much more environmentally friendly — ought to have a big future:

- Mind you, TSTL promoting the environmental benefits of its surface disinfectants against pre-wetted wipes…

- …does raise the question about the environmental impact from its own Trio Wipes System.

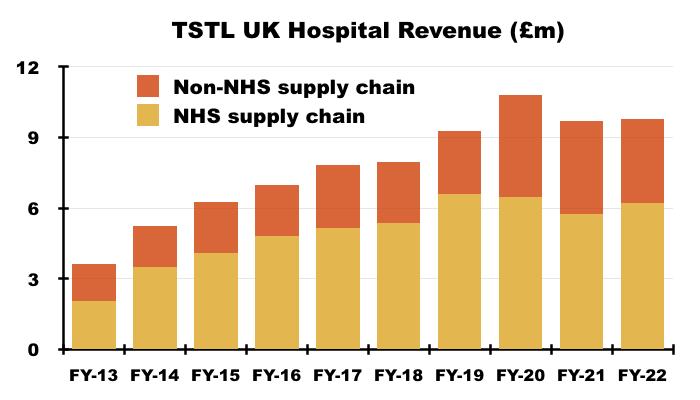

UK

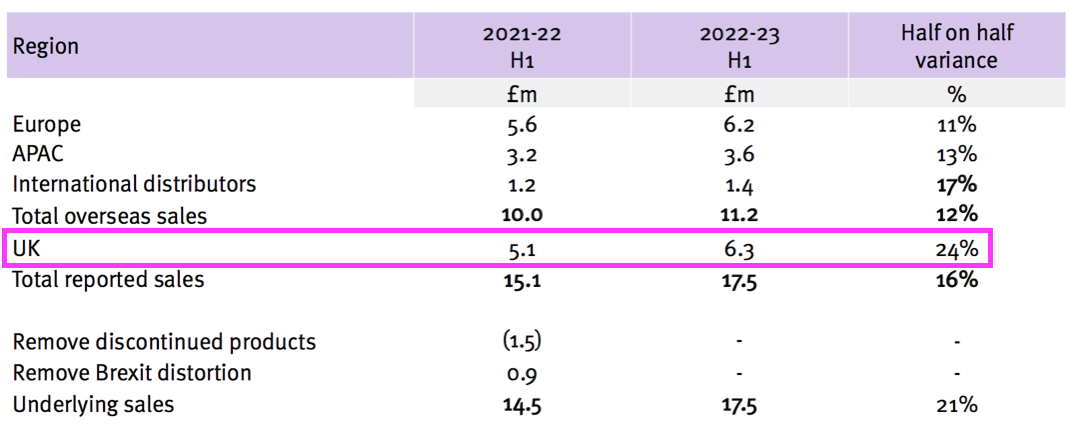

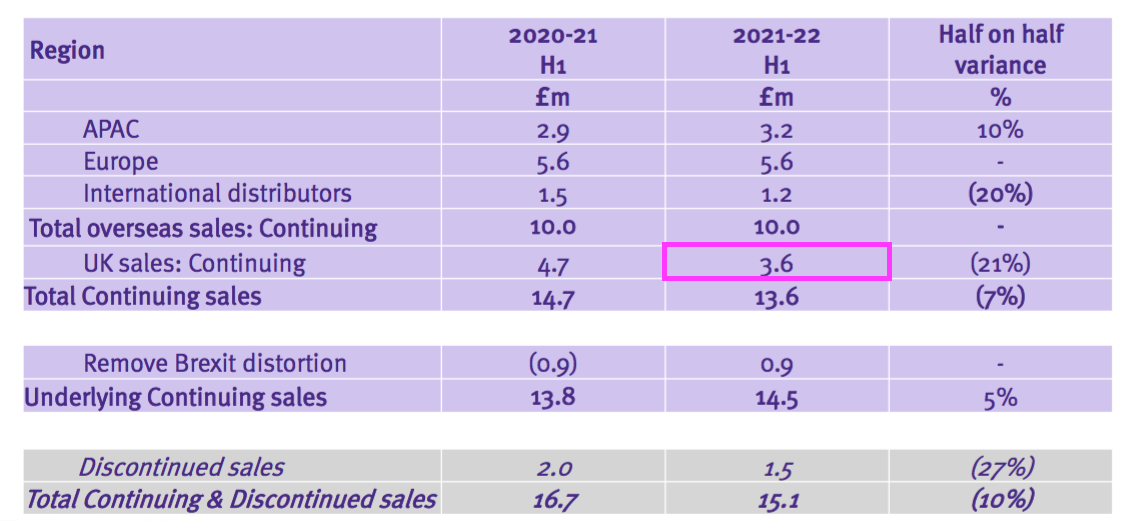

- The Brexit stock-piling and discontinued products distorted the H1 revenue progress within the UK, which remains TSTL’s largest individual country market.

- TSTL’s H1 presentation showed UK sales gaining 24% from £5.1m to £6.3m:

- But the comparable £5.1m included £1.5m of discontinued-product revenue, because the comparable H1 presentation showed continuing UK sales to be £3.6m:

- Add back the Brexit stock-pile revenue of £0.9m to that £3.6m, and the ‘underlying’ comparable H1 2022 UK revenue is £4.5m…

- …which implies ‘underlying’ UK revenue rebounded a superb 40% during this H1 (£6.3m/£4.5m).

- Management’s H1 webinar referred to ‘underlying’ UK revenue growth in fact being 29%.

- Management’s H1 webinar stated UK growth was due to higher pricing and greater volumes, in part through new customers:

“We are winning new customers. Through the pandemic, we just did not sit still and do nothing. In the UK we were able to contact customers and we were able to talk to them and demonstrate and persuade them. We can now see that increased level of custom coming through in the numbers.“

- Management’s H1 webinar suggested the UK market would continue to grow:

“The UK is certainly not ex-growth. I don’t think the UK will or ever has gone sideways and will go flat”.

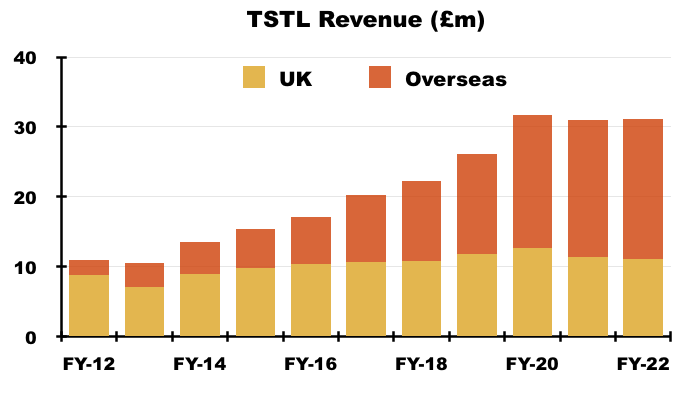

- UK revenue represented 36% of total revenue during this H1:

- UK revenue has progressively become a smaller part of TSTL as the group expanded overseas through deft purchases of international distributors (see Overseas):

- UK revenue has bobbed around the £10m-£12m level since FY 2016, although that ‘stagnation’ is influenced by past sales of discontinued products that contributed zero during this H1.

- For some perspective, discontinued-product sales were £3.8m during FY 2021 — the bulk of which I am sure were derived within the UK:

- UK revenue includes sales to the NHS Supply Chain, which has always dominated UK hospital-disinfection income and provided sometimes unpredictable orders:

- Given:

- The UK is by far TSTL’s most mature market;

- The culling of legacy products, and;

- The bulk of group revenue is derived from the core wipes and foams…

- ..annualised UK revenue of £12.6m now provides a good benchmark for the sales potential of other countries.

- TSTL talked of the product rationalisation “sharpening” its focus:

“The product rationalisation which took place in the corresponding period last year has achieved the key objective of sharpening our focus on our core hospital market. The benefits have been the elimination of products that were in sales decline and releasing operational and corporate resources to activities with high growth potential.”

- I am hopeful TSTL’s extra “operational and corporate resources” will continue to help UK revenue accelerate.

Overseas

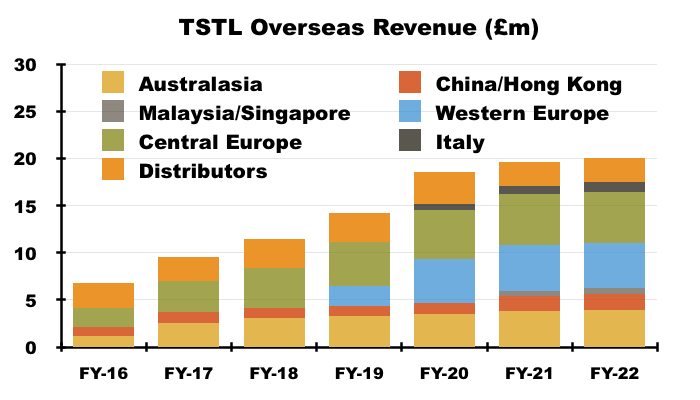

- Overseas revenue climbed 12% to £11.2m during this H1:

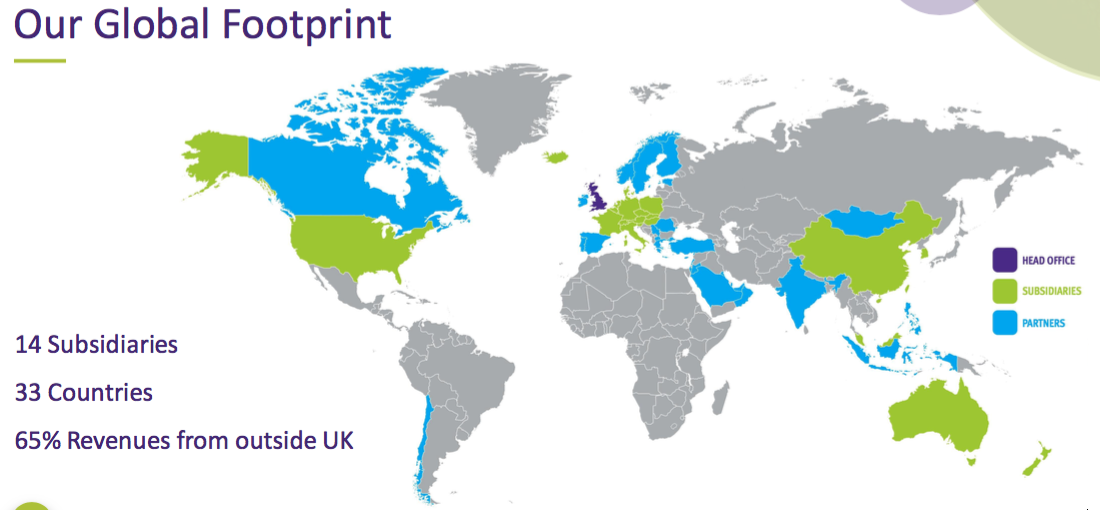

- Overseas revenue is derived from a mix of direct operations and independent distributors that combine to sell in more than 40 countries:

- Management’s H1 webinar implied every country save for China experienced “double-digit growth” during this H1.

- TSTL acquired:

- Its Australian distributor for £1.1m during FY 2017;

- Its Belgian/Dutch/French distributor for £6.4m during FY 2018, and;

- The outstanding 80% of its Italian distributor for £0.6m during FY 2020.

- My FY 2022 sums showed:

- Australasian sales (i.e. Australia and New Zealand) have since climbed 87% from approximately AU$3.9m to approximately AU$7.3m (six-year CAGR: 11%);

- Western Europe sales (i.e. Belgium, Netherlands and France) have since climbed approximately 86% from €3.1m to approximately €5.7m (four-year CAGR: 17%), and;

- Italian sales have since climbed 70% from €700k to approximately €1.2m (three-year CAGR: 19%).

- The 2022 annual report (point 15) disclosed the following revenue growth rates used by TSTL to test the value of the associated goodwill acquired:

- Australasia: 5%;

- Belgium and the Netherlands: 7%;

- France: 10%, and;

- Italy: 18%.

- Those assumed growth rates should indicate which overseas markets have the greater sales potential.

- Management’s H1 webinar noted possible further opportunities and/or potential in the Philippines, Indonesia, India, the Middle East, North Africa and Scandinavia.

- Management’s FDA-approval webinar then added Central and South America as further opportunities.

- The big overseas hope of course is the United States…

United States: H1 commentary and FDA approval

- The preceding FY 2022 indicated the FDA would decide before the end of June as to whether a TSTL ultrasound disinfectant could be sold within the United States.

- This H1 expressed confidence about the impact an FDA approval would have on the group:

“We remain optimistic for the Company’s future, and if our FDA submission is approved this will add a new dimension to the Company’s future ambitions – a challenge that we are ready to meet.”

- TSTL announced the FDA’s approval during June after receiving this letter:

“Tristel plc (AIM: TSTL), the manufacturer of infection prevention products utilising proprietary chlorine dioxide technology, announces that the USA Food and Drug Administration (“FDA”) has completed its review of the Company’s De Novo request for classification (Class II) of Tristel ULT as a high level disinfectant, and has granted its approval for immediate sale.”

- Let’s just say eight years of FDA back-and-forth has thankfully concluded with a positive outcome.

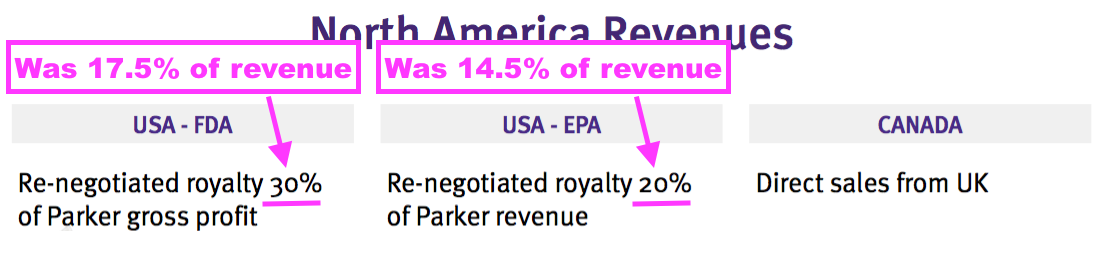

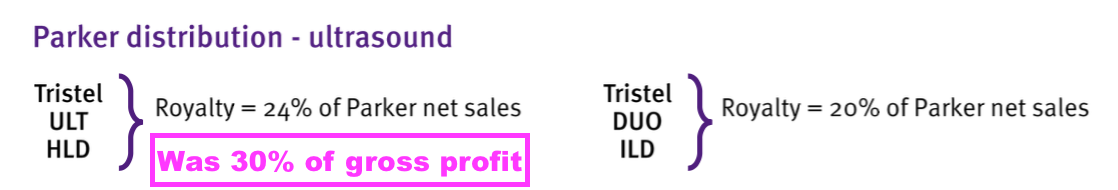

- The H1 presentation revealed enhanced US royalty agreements with US partner Parker Laboratories:

- Management’s H1 webinar admitted greater-than-expected US costs had prompted the revised royalties:

“We had invested more than we thought we would to get to this point, being on the cusp of getting FDA approval. And it is probably going to require more resources from us here in the UK and from our organisation around the world, to make a great success of the US. So we felt the commercial balance of the relationship [with Parker] was not quite as it should be.“

- Management’s H1 webinar claimed US product gross margins would be (an amazing) 95%:

“Discussions culminated in a fresh renegotiation and recasting the royalty rate that we will earn from the ultrasound activity in the US, in conjunction with Parker. Previously we had from the FDA-approved product a 17.5% royalty of revenue, and it is now 30% of gross profit. But the gross margin will be about 95%. And with the EPA-approved product, rather than the 14.5% royalty on revenue, it goes up to 20%.“

- Management’s H1 webinar follow-up explained how the 95% gross margin would be achieved versus this H1’s 81% gross margin:

“The 95% gross margin is calculated from componentry only – and the Company has defined this in the agreement. Tristel’s medical-device gross margin contains additional costs that are not applicable to Parker, and includes a wider set of products than DUO, where margins are lower.”

- Management’s H1 webinar implied the Parker royalty renegotiation was straightforward:

“We [TSTL and Parker] both needed to feel comfortable to build the business together. We got there amicably and it was an easy journey to be honest“

- Management’s H1 webinar follow-up said H1 regulatory US costs were £285k:

“The USA costs were £285k in the first half and will likely be the same again or less in the second half. The resources needed in the US going forward will principally be travel of the Company’s staff into the country to help launch the product. Tristel doesn’t anticipate anything more substantial at this time.”

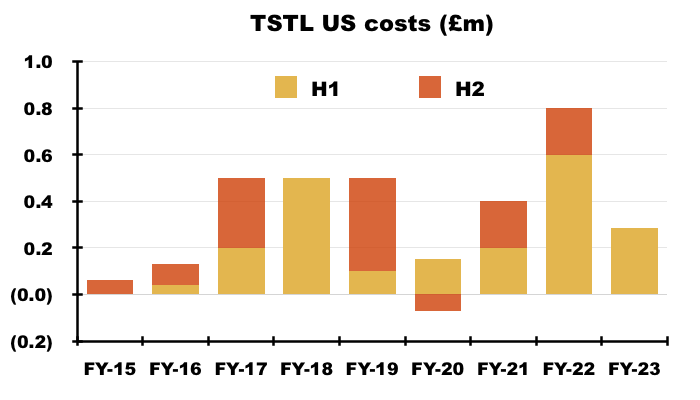

- Total US regulatory costs expensed since FY 2015 are now £3.3m:

- Adjusting TSTL’s reported profit for US costs allows shareholders to better judge the group’s underlying profitability. US costs up to this H1 have of course been accompanied by no US revenue.

- Management’s H1 webinar hinted of ongoing US costs being greater than previously anticipated:

“The original business relationship was founded on us not having to invest SG&A overhead establishing an operation to support Parker in the US.

What we are contemplating is a bigger prize… and we have committed more in terms of upfront investment in the regulatory process on which we need to get our return. We are more prepared than we were, say two years ago, to invest in resources in the US to support Parker’s efforts.

It will not be around establishing a sales force, because Parker already has a sales force. It would be more around the educational side of things, helping shape the hospital market’s understanding of chlorine dioxide and acceptance of it.“

- Management’s H1 webinar added that part of the US promotional push would involve giving away product worth $250k at retail prices.

United States: update on royalties and costs

- TSTL’s FDA-approval webinar during June updated shareholders about the US.

- The FDA-approval presentation noted the FDA-product royalty rate was now 24% of net sales:

- 24% of net sales compares to 30% of gross profit with a 95% gross margin as declared within the H1 presentation (which equates to 28.5% (30%*95%) of revenue).

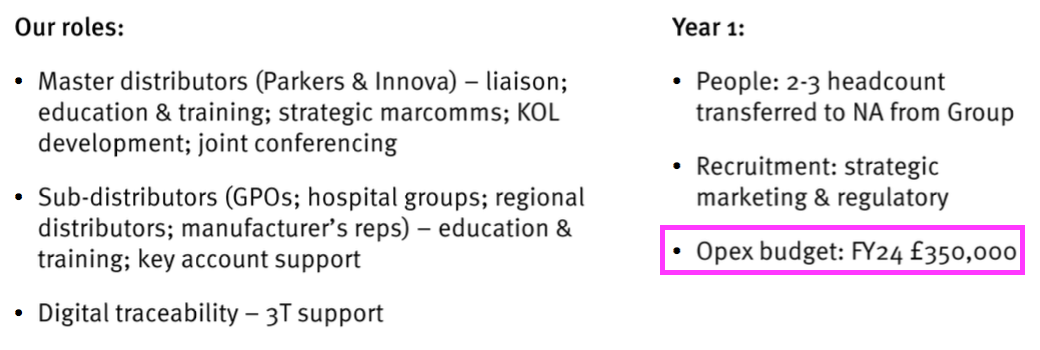

- The FDA-approval presentation revealed a US operational-expense budget of £350k:

- Management’s FDA-approval webinar suggested total US costs would go beyond that £350k:

“What that [£350k] represents is incremental spend directly linked to having a presence in the US and Canada market, but of course there is a very significant part of the corporate opex budget that is being devoted to this [North American] business plan.“

United States: potential

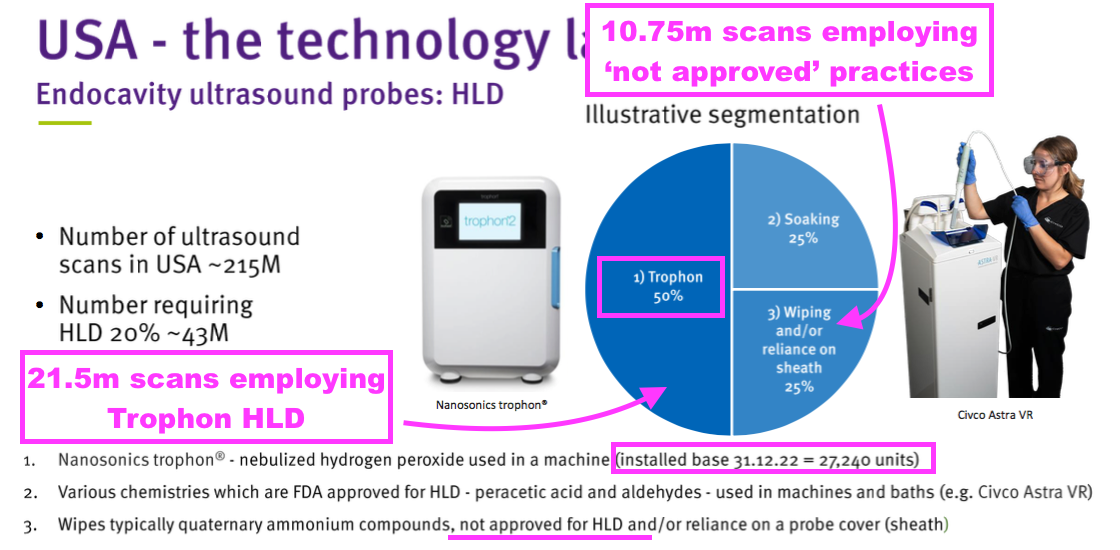

- TSTL’s FDA-approved product is limited to cleaning ultrasound probes only, and the FDA-approval presentation said that particular US market handled 43 million ‘high-level’ disinfections a year:

- Management’s FDA-approval webinar claimed 25% of all high-level ultrasound disinfections within the US were undertaken using “unauthorised and non-compliant” practices that were “not acceptable” to regulators.

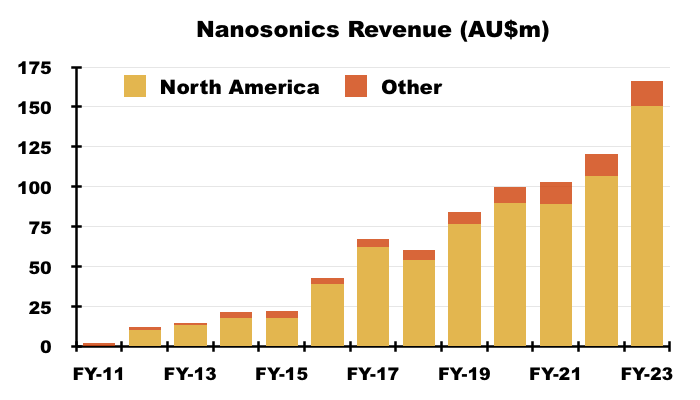

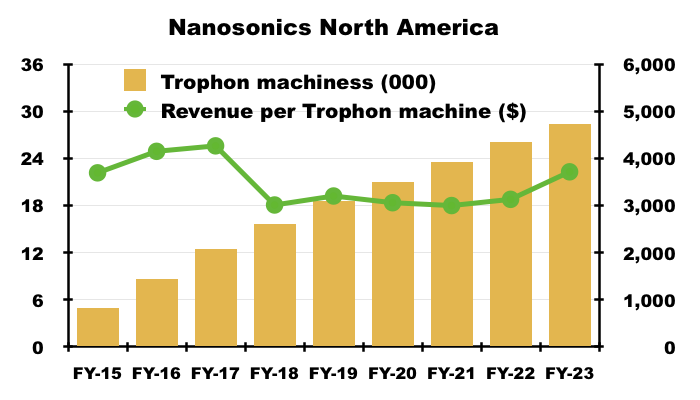

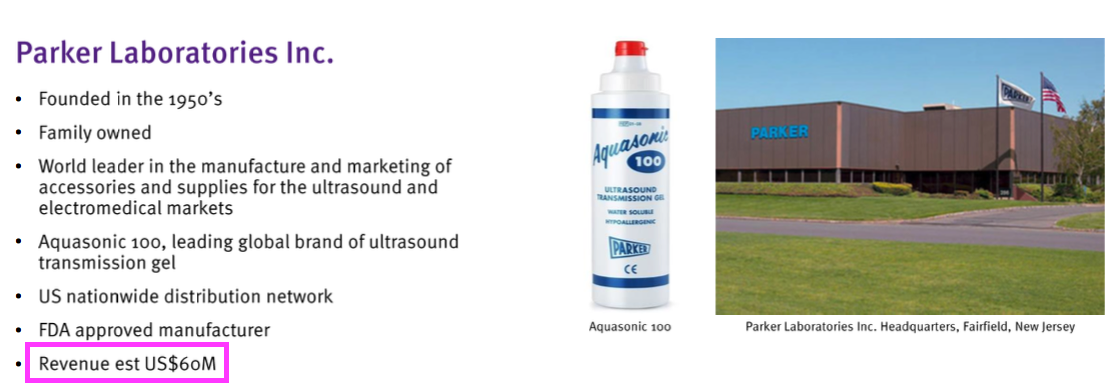

- The US benchmark is set by Nanasonics (NAN), the quoted Australian group that manufactures the Trophon machine. Trophon machines are limited to disinfecting ultrasound probes only:

- TSTL’s FDA-approval presentation showed the 27,240 Trophon machines in North America undertake 21.5 million ultrasound-probe disinfections every year.

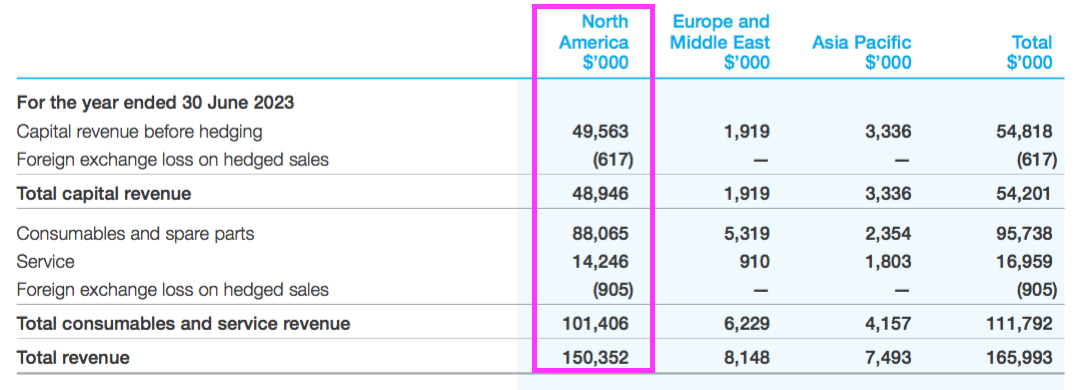

- NAN’s FY 2023 results showed revenue of AU$166m, of which AU$150m ($101m) was earned within North America:

- That AU$150m was split AU$49m from the sale of machines, AU$88m from consumables and spare parts, and AU$14m from servicing:

- The AU$88m from consumables and spare parts is probably the best direct comparable to potential US hospital spend on TSTL’s newly approved ultrasound foam.

- AU$88m versus 21.5 million Trophon procedures every year gives AU$4.10 — or $2.76 or £2.30 — per ultrasound disinfection.

- During the 2022 open day, management more than once referred to NAN’s North American “consumable revenue of £30m“.

- £30m from 21.5 million Trophon procedures every year gives £1.40 per ultrasound disinfection.

- £2.30 and £1.40 compare to the £3.10 revenue-per-ultrasound-disinfection currently enjoyed by TSTL (see Procedures and pricing).

- TSTL’s ultrasound revenue comprises both wipes and foams, with the wipes selling at much higher price points than the foams.

- TSTL’s FDA-approved product is a foam, and I would venture revenue-per-ultrasound-disinfection within the States is likely to be closer to £1.40 than £2.30 and £3.10.

- That said, this informative interview with the boss of Parker provided further insight:

“We estimate the cost of using competitive products at roughly $7 per application. By contrast, we expect the cost of using Tristel ULT will be between $2.50 and $3 per application.

On top of that, using Tristel ULT will eliminate the disruptive effects of dealing with capital equipment used for high-level disinfection—purchase costs, calibration, maintenance, and the time required to transport and retrieve transducers between uses. So we’re excited about the product positioning for Tristel ULT.“

- I translate “competitive products” to be NAN’s Trophon machine, although I can’t correlate a $7 per application with NAN’s total North American revenue of $101m and its mooted 21.5 million disinfection procedures.

- Still, taking Parker’s $2.75 per procedure mid-point and assuming TSTL converts the entire 25% of US hospitals currently employing “unauthorised” ultrasound decontamination methods…

- … total annual US sales attributable to Parker would be $29.6m ($2.75*10.75m).

- TSTL’s 24% royalty would then equate to income of $7.1m or £5.5m.

- TSTL has not divulged a target for US market share, with the FDA-approval RNS stating only the group “expects to gain significant market share in the world’s largest ultrasound market“.

- For what it is worth, the Q&A during TSTL’s open day revealed TSTL’s broker forecasting a 40% US market share by 2030.

- Parker’s boss said TSTL’s newly approved foam would go on sale during October:

“FDA granted its clearance in the first couple of days of June. We plan to make the product available on October 1, so it’s not on the US market yet“.

- NAN reckons North America could support 60,000 of its Trophon machines. Revenue per Trophon machine last year was approximately $3,700:

- NAN’s theoretical market size for US high-level ultrasound disinfection is therefore $222m (60,000*$3.7k).

- Parker itself earns annual revenue of $60m from selling the ultrasound gel used to enhance the diagnostic imaging of ultrasound probes:

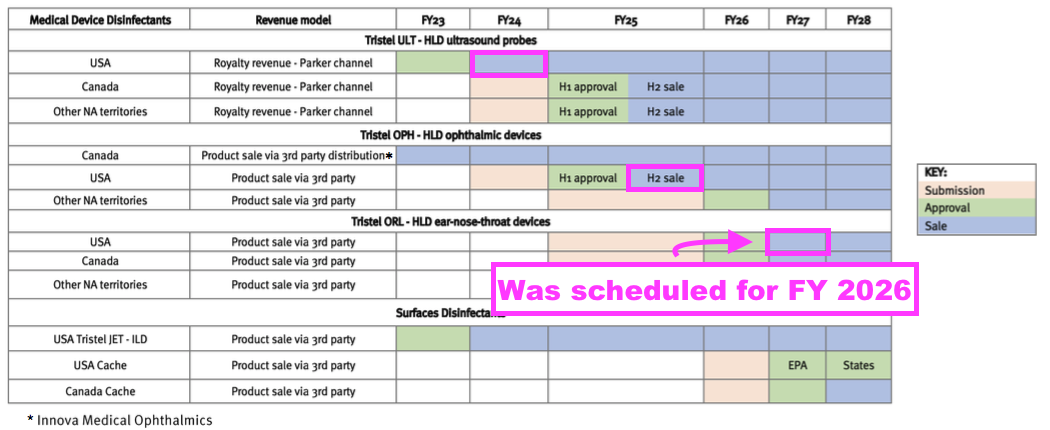

- TSTL plans to earn additional US revenue from other products, an updated schedule for which was provided within the FDA-approval presentation:

- US sales of foams for cleaning ophthalmic devices (Duo OPH) are still expected during FY 2025, while US sales of foams for cleaning ear, nose and throat devices (Duo ORL) are now expected during FY 2027.

Patents

- TSTL has regularly cited patents as part of its competitive advantage (point 3b):

“On 30 June 2022, we held 137 patents granted in 33 countries providing legal protection for our products.

In its broadest sense, our intellectual property relates to:

1. Patents, trademarks and registered designs;

2. The scientific validation of our chemistry and our products that have entered the public domain, via a number of peer‐reviewed and published papers, and;

3. The certification by medical device manufacturers that our chemistry is compatible with their products. We enjoy official compatibility with the instrumentation of 56 medical device manufacturer, with respect to 1,449 of their individual models.”

- Serving more than 40 different countries but having patents granted in 33 could mean some countries do not require patent protection for TSTL to generate good sales.

- Some of TSTL’s patents are due to expire within the next few years.

- Google Patents shows the expiry dates of TSTL’s wipe patents to be:

- UK: 7 May 2024 (GB 240 4337)

- EU: 26 July 2024 (EP 174 2672)

- US: 7 September 2024 (US 808 0216)

- Google Patents shows the expiry dates of TSTL’s foam patents to be:

- UK: 27 January 2026 (GB 242 2545)

- EU: 27 January 2026 (EP 184 3795)

- US: 11 September 2030 (US 884 0847)

- The Q&A during TSTL’s open-day touched upon the importance of patents.

- Management talked of further protection for “anything up to another 30 years“:

“We have a whole array of protections that you would describe as intellectual property protections, and patents are an important part of that. The key patents that we have that were filed many years ago expire in 2026 and 2030 in the US, so they are coming towards the ends of their lives.

During the course of the past 15 years we have made applications that have gone to grant in multiple countries of something like 225 other patents. We have replaced the few patents that we started our business with, with a broad portfolio of legal IP protection and they will last for, depending upon when the original filing was, for anything up to another 30 years.“

- Management also outlined the importance of approvals from device manufacturers at the open day:

“But it is not just about patents that provide us with the competitive moat that keeps out competitors from our space. An important element has been that over the years we have worked very closely with the device manufactures, companies like GE Healthcare, Siemens, Olympus… to get compatibility proven with their instruments and our disinfectants.

When they try to sell an endoscope or an ultrasound system to a hospital, the first question their sales team will be asked is ‘What disinfectant product would you recommend, and is it compatible?’ or ‘Can you assure me that it is not going to damage our instrumentation?‘, which is very expensive typically.“

- TSTL described gaining device-manufacturer approvals as a laborious task:

“We have invested heavily over the years in working with the device manufactures to prove our compatibility. A lot of work that goes on across the road in our science block is to do exactly that, repetitive immersions, or repetitive wiping processes, to prove that after a 1,000 wipes, our foam has not damaged the surface or the components of an ultrasound probe.

We then get listed on the equipment manufacturers’ care cards or the information they provide to their users, and just the sheer investment and time and effort and resource means that very few companies have got the same number of device compatibility statements as we do, and very unlikely I think to be able to accomplish what we have over time. That’s an important part of our defensive moat.”

- I would like to think TSTL’s customers would not want to suddenly clean their sophisticated/expensive/important medical devices with cheap/generic/unapproved disinfectants.

- I would also like to think US partner Parker would not have become involved with TSTL if TSTL’s expiring patents would soon allow generic alternative wipes and foams to disrupt the US market.

- Other hurdles for rivals cited during the open day included being written into healthcare guidelines and appearing within scientific reviews.

- Management concluded:

“Patents are quite important, but not at the top of the list of the protections we enjoy that help us with our competitive position.“

- My discussion with Bruce Green, the chemist who devised TSTL’s disinfectant chemistry, at the 2022 open day revealed competitors were also kept at bay through secret chemical ingredients and secret manufacturing processes.

Share options

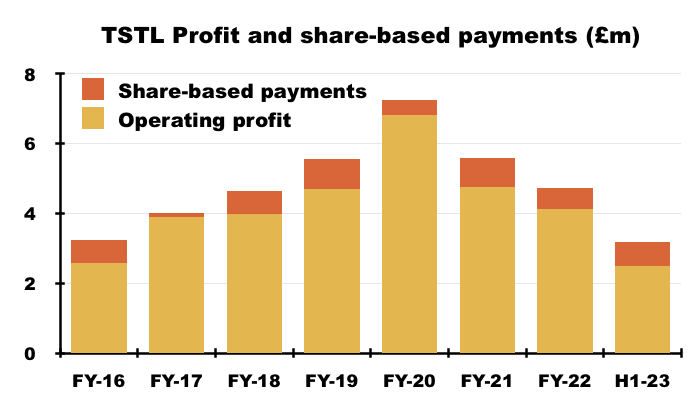

- Significant share-based payments have featured regularly within TSTL’s accounts.

- Between FY 2016 and FY 2022, share-based payments reduced the aggregate pre-exceptional operating profit by £4.2m, or 12%:

- This H1 witnessed share-based payments reduce operating profit by £688k, or 22%.

- TSTL explained why share-based payments are excluded from adjusted profit:

“The value of share-based payments is significantly influenced by the volatility of the Company’s share price, a factor that is out of the Board’s control. As a consequence, profit and earnings are reported on both an adjusted basis, adding back share-based payments, alongside unadjusted, so that the underlying profitability of the Company can be understood.”

- This H1 also revealed the Executive Management LTIP incurred a £0.2m cost:

“The share-based payment charge of £0.7m is derived from the Group’s All-Staff share option scheme (£0.5m) and the Executive Management LTIP scheme (£0.2m).”

- Another reason for overlooking share-based payments is such charges can occur despite the options likely to become worthless.

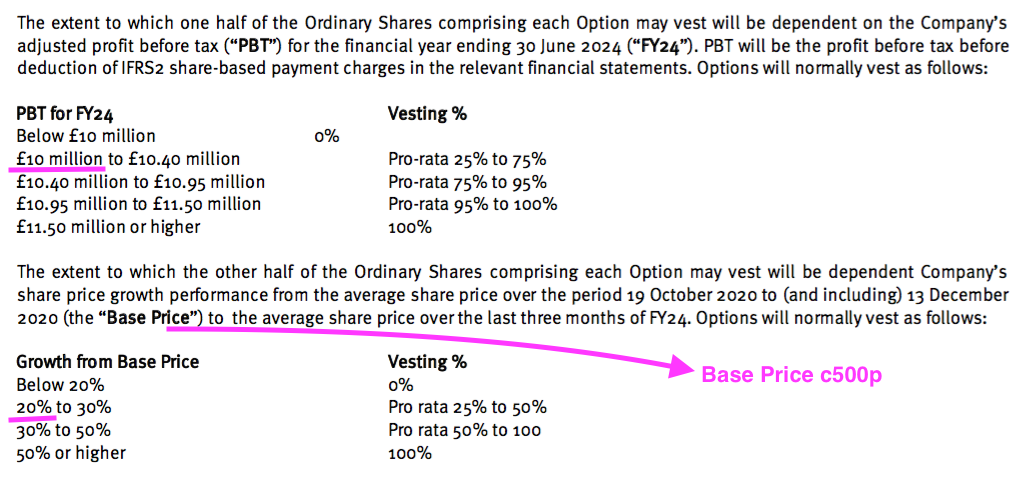

- For example, the £0.2m charged for the Executive Management LTIP relates to 800k options that pay out if profit reaches £10m during FY 2024 (versus £4.7m for FY 2022) or the share price trades at a c600p average during Q4 2024:

- Neither a £10m profit nor a 600p share price seem likely by FY 2024, yet a £0.2m charge was still expensed.

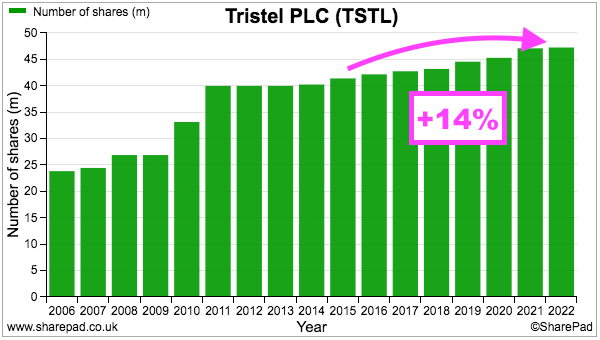

- The true cost of options to ordinary shareholders is through permanent dilution and not accounting charges.

- TSTL’s share count has advanced 14% since the start of FY 2016, with 12% due to options and 2% due to the purchase of the Belgian/Dutch/French distributor:

- During the same period, the share price has increased from 101p to 325p while the dividend has increased from 2.72p to 6.55p per share. Outside shareholders have therefore still been rewarded despite the dilution.

- Management’s open-day commentary disclosed a fascinating option revelation: option grants have been paused due to excessive past grants:

“Everybody within the company would qualify for the issue of share options over the course of their long service. As a board, we had to revisit that because the number of shares under option was exceeding the ABI [Association of British Insurers] rules. It has caused us to have a pause on the scheme and in fact it is a subject for our board discussions over the course of the next three or four months because we all recognise what an incentive it is.

Although we can see that [the option scheme] creates dilution to our shareholder base, it is a key employment benefit for our employees and indeed has created some fantastic of incidents of payouts. Everyone from our forklift drivers to our factory cleaners up to our executive directors at a local level have benefitted from being able to participate in the growth of the business that they themselves are working towards. I very much hope we can find a way to putting another scheme in place. It is incredibly important.”

- I believe best practice with options is to limit awards to 10% of the share count over ten years.

- Now I understand why the following text from the 2021 annual report…

“All permanent staff no matter their pay scale or job, are awarded share option grants at set intervals which accumulate to 40,000 share options after 10 completed years of employment.“

- … was absent from the 2022 annual report (point 5).

- The 2022 annual report (point 21) and this RNS point to 2,022k options outstanding, a 47.3m share count and a maximum further dilution of 4.3%.

Financials: margins and costs

- The aforementioned management talk of a possible 95% US gross margin underlined TSTL’s high profitability:

“Gross margins have remained steady at 81% (2021: 80%), in line with expectations.“

- The gross margin increasing slightly to 81% was particularly impressive given TSTL faced sharp increases to various direct costs:

“Other cost increases include packaging (50%), plastics (24%) and chemicals (128%).“

- An 81% gross margin is equivalent to buying stock for £19 and selling it for £100, and underlines buyers are willing to pay handsomely for TSTL’s chemistry.

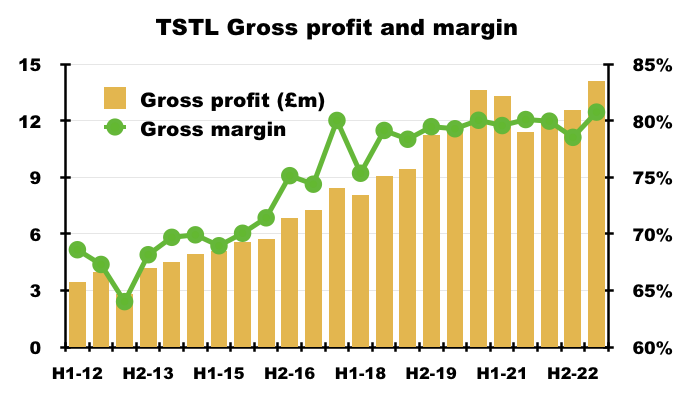

- This H1’s 81% gross margin was TSTL’s best-ever for any six-month period:

- The medical-device wipes and foams sported an 85% gross margin during this H1:

- The 81% gross margin helped TSTL meet its Ebitda target, which the preceding FY 2022 set to least 25%:

“i) sales growth in the range of 10% to 15% per annum as an annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding share-based payment charge) of at least 25%.”

- This H1’s Ebitda margin was 26%.

- The H1 operating margin excluding share-based payments and US costs was a useful 20%:

- Mind you, the same margin calculation was 21% or more between H2 2017 and H1 2021.

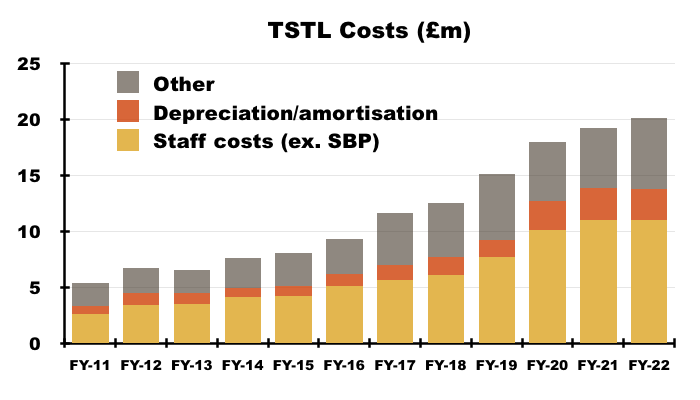

- TSTL has shouldered greater staff costs during recent years, and this H1 showed that trend continuing:

“Sales, general and administrative expenses of £9.5m (2021: £8.7m) have increased by 9%, reflecting the general inflationary environment and the recruitment of an additional 18 staff to accelerate our product development, sales, and marketing activities. Consequently, personnel costs have increased by 13%.“

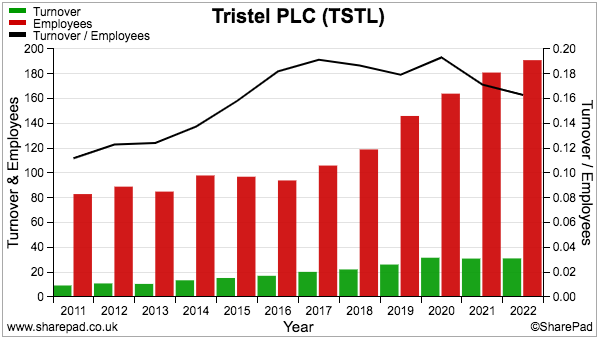

- Staff costs are TSTL’s largest expense, representing 35% of revenue during FY 2022 versus 30% or less between FYs 2015 and 2019:

- Higher staff costs when revenue per employee has flat-lined is not ideal:

- Recruiting employees for the US programme (total cost since FY 2015: £3.3m) may be one reason why staff costs now absorb greater revenue.

- Another reason could be R&D expenditure that has yet to create material revenue.

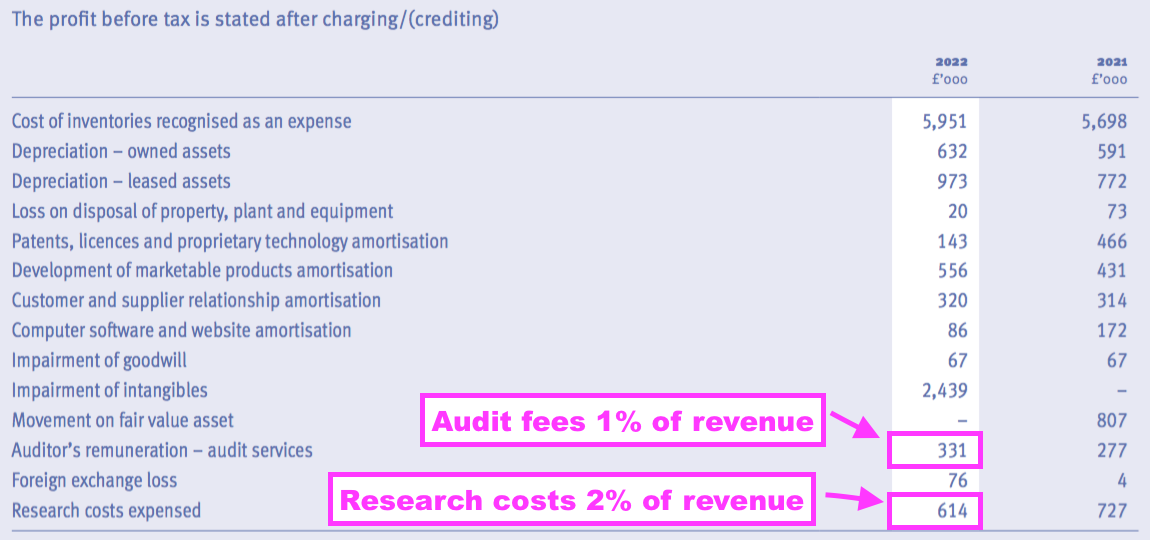

- Expensed R&D totalled £4.2m between FYs 2017 and 2022, equivalent to 2.6% of revenue during the same period:

- I suppose (conventional) staff costs could increase further if employees are compensated for the loss of their option scheme.

- Other costs represented a notable 20% of revenue during FY 2022, and that proportion may advance given travel and marketing expenses were subdued during the pandemic (point 4a).

- TSTL’s FY 2022 audit bill of £331k was very steep at 1% of revenue.

- By comparison, the nine other companies in my portfolio have audit fees at an average 0.3% of revenue with the highest at 0.74%.

Financials: cash and cash flow

- The aforementioned H1 £8.4m cash position remains TSTL’s largest balance-sheet item.

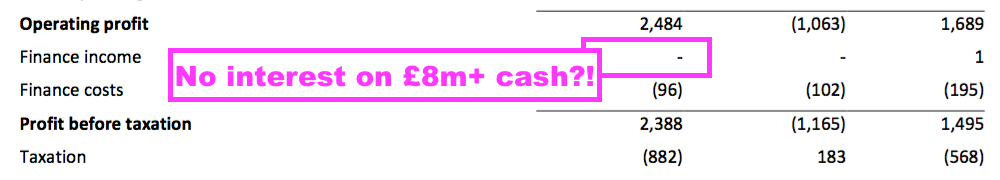

- The lack of H1 interest from that cash position was very noticeable now that the base rate exceeds 5%:

- The 2022 annual report cited a cash interest rate of 0.1% (point 22):

“The Group’s financial assets include cash at bank and short-term investments. At 30 June 2022, the average interest rate earned on the temporary closing balances was 0.1% (2021: 0.1%).”

- Interest earned during FY 2022 when cash topped £8m was a pitiful £1k.

- For FY 2024, TSTL would be almost negligent to overlook easy income of perhaps £100k-plus from not placing some of that £8.4m within an interest-bearing account.

- Cash flow was very respectable during this H1, with adjusted earnings of £2.2m translating favourably into free cash of £2.8m.

- Cash capex of only £0.4m compared well against depreciation and amortisation of £0.8m charged to the income statement. Working capital meanwhile required only a £0.3m H1 investment.

- July’s open-day RNS said cash had increased to £9.5m during H2 2023, implying H2 free cash generation of £2.3m (following this H1’s £1.2m dividend payment).

- Management’s H1 webinar confirmed the company would not need outside funds to expand:

“We could treble the size of the business and I think it would be self-funded“

- The following text from the 2021 annual report…

“The Board is risk averse when investing any surplus cash funds. It considers that a minimum cash balance of £4 million is appropriate – providing adequate protection against unexpected events – for the current size of the business and seeks to adhere to this wherever possible and practicable. Cash exceeding this level, which cannot be used for earnings enhancing investment purposes, may be returned to shareholders in the form of a special dividend.”

- …was absent from the 2022 annual report (point 6j). I trust the board remains “risk averse” with its cash position.

- TSTL carries no bank debt and no final-salary pension obligations.

Valuation

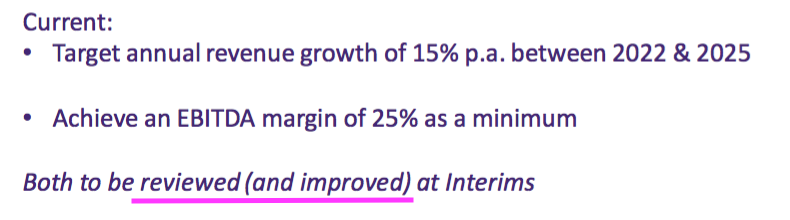

- The open-day presentation revealed TSTL’s three-year financial targets will be “reviewed (and improved)“:

- Management’s open-day commentary confirmed the review was prompted by the FDA approval:

“These goals were set before we attained the FDA approval, and so we will revisit those [goals] and we anticipate that they will be improved and we will publish those to you at the time of our interims in February next year.”

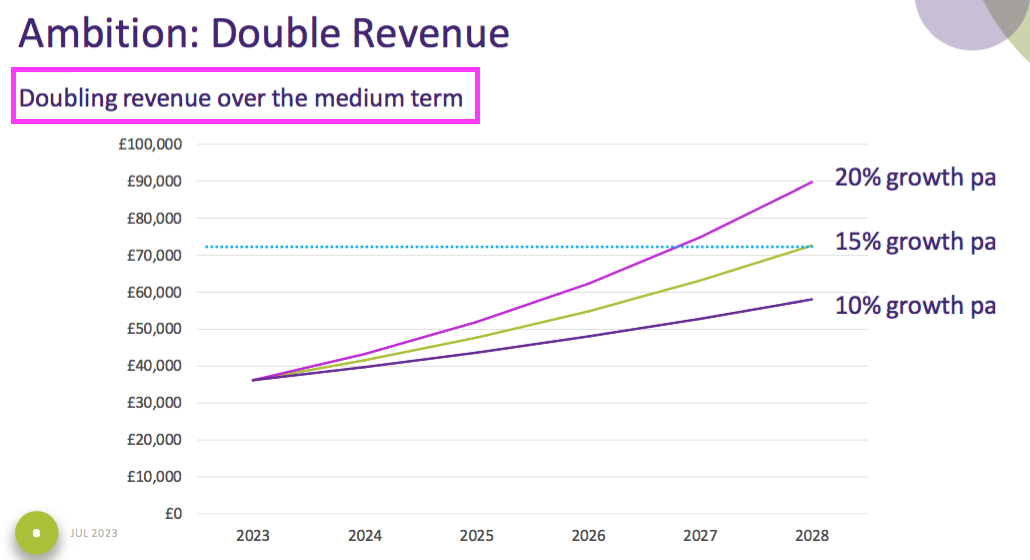

- The open-day powerpoint disclosed TSTL’s ambition to double revenue:

- A tantalising chart was included to suggest revenue may double (to £72m) “over the medium term“:

- For now the official financial targets remain:

i) sales growth in the range of 10% to 15% per annum as an annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding share-based payment charge) ofat least 25%.”

- I note management’s open-day commentary referred to targeted sales growth “of at least 15%“, which seems bullish given the actual target (at the moment) is “in the range of 10% to 15%“.

- 15% revenue growth for FYs 2024, 2025 and 2026 would deliver FY 2026 revenue of £54.8m.

- Then meeting the minimum 25% Ebitda margin (before share-based payments) would give FY 2026 Ebitda of £13.7m.

- Depreciation and amortisation staying at 9% of revenue would then leave a pre-tax profit of £8.8m.

- My £8.8m pre-tax projection for FY 2026 compares to the open-day RNS disclosing FY 2023 pre-tax profit will be “slightly ahead” of £6m.

- Applying standard 25% UK tax to my £8.8m projection leaves earnings of £6.6m or 13.9p per share.

- My valuation sums could be fine-tuned for margin improvements, lease costs, the cash position, option dilution and tax intricacies, but the 325p share price at 23 times my 13.9p per share estimate — for FY 2026! — does not indicate an obvious bargain.

- That said, my sums do not anticipate TSTL hitting the big time within the US and becoming what the open-day RNS described as a “leading global player in the infection prevention industry“:

“Looking forward to the years ahead, I am confident that Tristel will truly become a leading global player in the infection prevention industry. We now have access to the world’s largest ultrasound market for our high-level medical device decontamination products and we have an exciting pipeline of new product innovations supported by a strong balance sheet. We are very excited about the prospects for further growth and the outlook is positive.”

- Wishful thinking of course, but my aforementioned US royalty guess of £5.5m placed on a 20x multiple would value the US operation at £110m or 232p per share.

- The 325p shares are valued at a racy 40x trailing twelve-month earnings, the basis for which include TSTL enjoying:

- Very lucrative US progress;

- Further meaningful growth from established products within established markets;

- A long-term competitive advantage through patents, manufacturer agreements, regulatory approvals and secret chemistry;

- Higher margins following the re-focus on hospital disinfectants, and;

- Attractive returns from that £4m-plus R&D spend.

- My decision to purchase TSTL during 2013 and 2014 was made much easier because the 46p shares were then valued at a more modest c12x P/E multiple.

- While shareholders await early US progress and the revised three-year targets, the trailing 6.55p per share ordinary dividend supports a modest 2.0% income.

Maynard Paton