***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

20 October 2022

By Maynard Paton

Difficult market conditions have led to depressed ratings for many asset-flush shares.

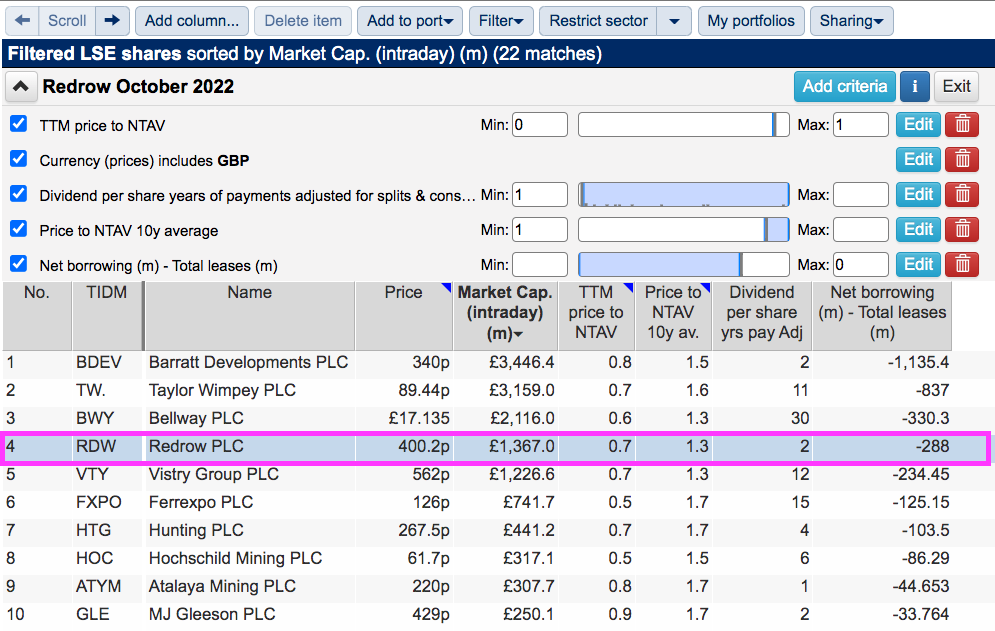

Hence a new screen to pinpoint companies offering cash-rich balance sheets and market caps below their book value. I have attempted to avoid ‘value traps’ by demanding the shares pay a dividend and offer a history of trading above book value.

The exact filter criteria I employed for this search were:

- A price to net tangible assets of no more than 1;

- A dividend being paid during the most recent year;

- A 10-year average price to net tangible assets of at least 1;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A share price denominated in pounds sterling.

I applied the screen the other day and SharePad returned 22 matches:

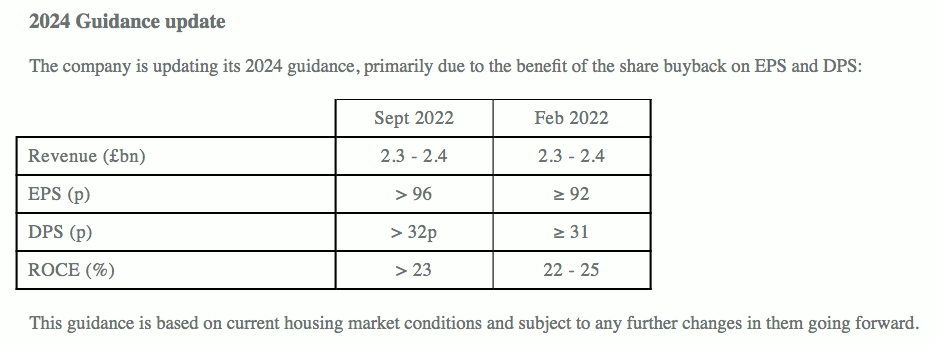

I selected Redrow from the five house builders at the top of the list because the group’s recent results included very clear guidance:

Redrow’s own projections put its 400p shares on a P/E of approximately 4 and a yield of at least 8%

Combined with a net asset value of 554p per share that gives a price to book of 0.72, the FTSE 250 constituent is very much trading at the ‘deep value’ end of the market spectrum.

Let’s take a closer look.

Read my full Redrow article for SharePad.

Maynard Paton

Hi Maynard

Great writeup with compelling data. Few thoughts I had as I have been thinking about the sector recently:

– because we are always preparing for the last war, the big builders have much healthier balance sheets now than the GFC, when most of them actually were guilty of big acquisitions and/or big land buying through the 2000s as the last price crash of the early 90s receded from memory and Brown assured us that the era of boom and bust was over.

– what’s different now I think is squeezed margins and how long they might last. After the GFC, prices were supported by QE. But if interest rates go up and stay up to historic normal levels, there could be pressure on prices for a while at the same time as cost inflation. All the big builders have had stellar margins from a decade of increasing house prices and low inflation which I think makes pricing off recent years tricky.

– If we do head in to that sort of environment, there is then also the question of the political response, as politics is never far from this sector. Could a Labour gov’t – with precious little fiscal room now and desperate to do something – have another go at something like the Community Land Act to effectively raid the builders’ land banks.

– On the plus side, the sector is fundamentally more consolidated and for the big builders with healthy balance sheets, I do not think survivability is a question as in 2008.

– A final question here is one of timing, something as a died in the wool value investor I try not to get into. But the share price declines in 2008 for some of the builders are hard to look at. Having fallen by half over 2007 as gloom set in (which is where I think we are now), they then fell precipitously through 2008. Persimmon for eg announced a slowdown in sales and price decreases in April 2008 and its share price then went down a further 75% through July for a total peak-to-trough decline of 90%- and then they took writedowns later in the year. Redrow was at a 1/3rd of trailing NTAV in july 2008, havig also declined 80-90%. I am hearing the builders are downtooling now and going into cash preservation mode and I think it is inevitable there is more bad news to come – slowing sales, reduced margins and writedowns. I do think the big difference now as with other cyclicals like Somero is no debt so survivability is not the same issue. However, equally I think the risk that a steep decline in the sector’s medium term profitability with no relief from interest rate decreases as in 2008 and uncertainty over inflation could send valuations lower and keep them there.

– In short, long term, the sector is fundamentally sound. But I’d rather take a chance on it getting cheaper to compensate me for me the uncertainty about the trajectory of future profits. At that point, I would probably be buying a basket of the big builders, weeding out any with company-specific issues

Just to add in the interest of political balance that one of Sunak’s campaign pledges the same ‘use-it-or-lose’ taxes proposed by Labour in 2019.

Thanks Jerry. And thanks for the considered points. Can’t argue with your verdict and preferring to take a chance on valuations becoming cheaper and then buying a basket of names. Exactly when to dive in is difficult; certainly the discount to NAVs seem significant at present but comparisons with 2008 could widen those discounts — even though the NAVs seem in better health today (net cash) than during 2008 (net debt). I guess you just have to estimate the level of stock write-offs that could occur using 2008 as a guide and see whether that is already reflected by the share price. This time any housing slump could be a prolonged affair as higher rates etc filter through into the mortgage market. Back in 2008 mortgage financing essentially ceased overnight as the banks teetered on the brink. Famous last words, but I think banks and builders are in better shape now than in 2007.

Maynard