19 October 2021

By Maynard Paton

Results summary for S & U (SUS):

- A record H1 profit performance supported by a “lower than normal” bad-debt provision and the dividend rebounding 50% to pre-Covid levels.

- The main car-loan division has recovered well from the pandemic, with collection rates (94%) and on-time first payments (98%) now standing at multi-year highs.

- The fledgling property-loan operation enjoyed a bumper six months following the government CBILS scheme.

- Interest charges at 3%, increased borrowing facilities and headroom of £65m indicate no obvious funding concerns.

- The £28 shares are close to an all-time high and may already reflect management’s webinar talk of car-loan volumes increasing 25% to 25,000 a year. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own SUS

- Results summary

- Revenue, profit and dividend

- Advantage Finance: Loan provisions

- Advantage Finance: Credit quality and payment holidays

- Advantage Finance: New loans

- Aspen Bridging

- Financials

- Valuation

Event links, share data and disclosure

Event: Interim results and presentation for the six months to 31 July 2021 published 28 September 2021 and results webinar hosted 30 September 2021

Price: 2,800p

Shares in issue: 12,145,260

Market capitalisation: £340m

Disclosure: Maynard owns shares in S&U. This blog post contains SharePad affiliate links.

Why I own SUS

- Provides ‘non-prime’ credit to used-car buyers and property developers, where disciplined lending and reliable service have supported an enviable dividend record.

- Boasts veteran family management with 40-year-plus tenure, 50%-plus/£170m-plus shareholding and a “steady, sustainable” and organic approach to long-term growth.

- Offers the prospect of improved progress post-pandemic based on enhanced credit scoring, extended marketing partnerships and promising diversification into property loans.

Further reading: My SUS Buy report | All my SUS posts | SUS website

Results summary

Revenue, profit and dividend

- Upbeat statements during May…

“Profitability for the period in our Advantage motor finance business and in Aspen, our property bridging arm, was ahead of group projections.“

- …and August…

“S&U continues to trade well, ahead of expectations in terms of profitability, collections and book debt quality.”

- …had already signalled these H1 2022 figures would reveal a welcome improvement on the pandemic-disrupted H1 2021.

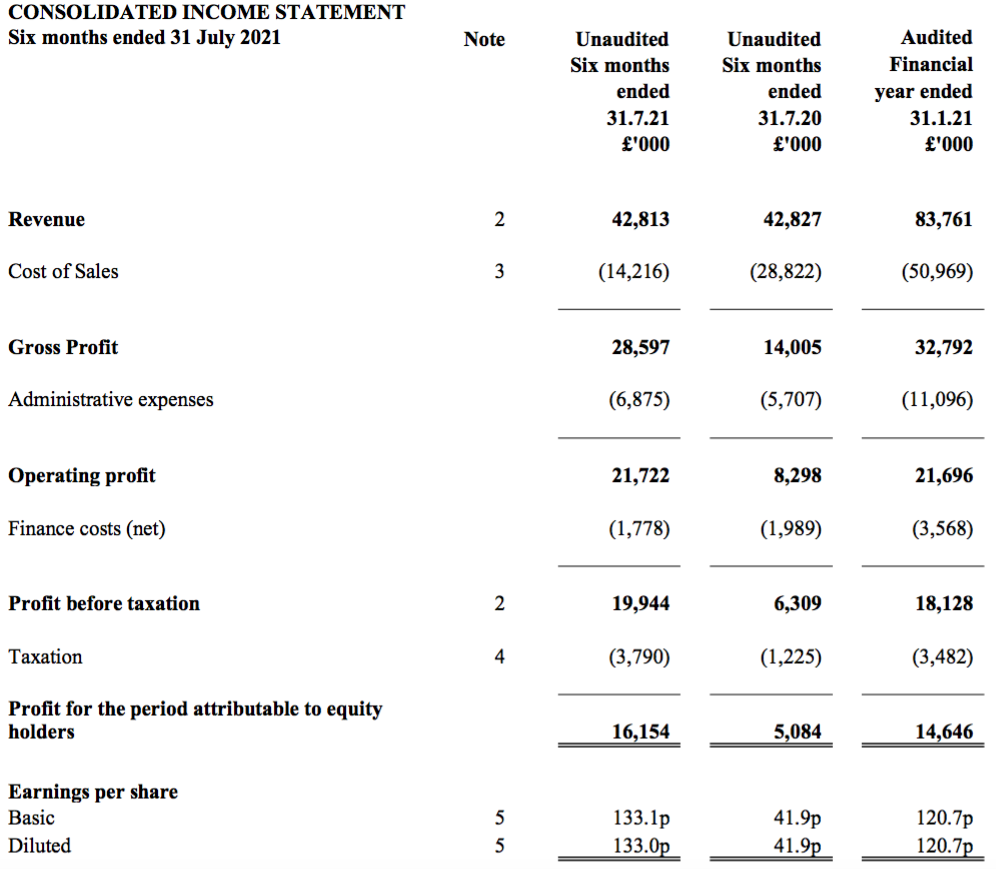

- Revenue remained unchanged at £43m but pre-tax profit tripled to £20m to set a new H1 record:

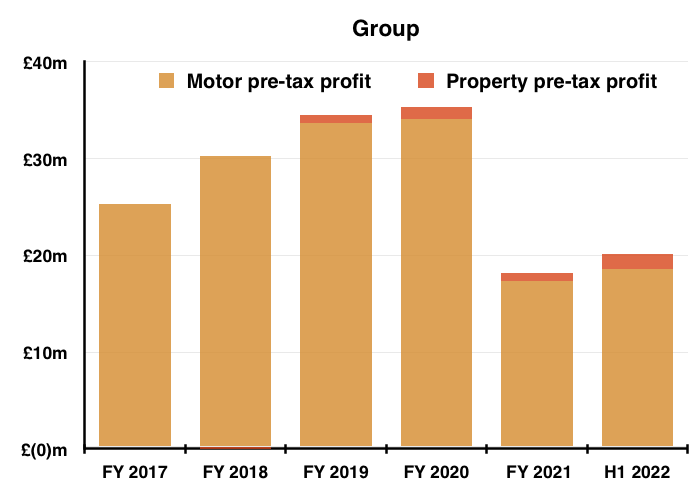

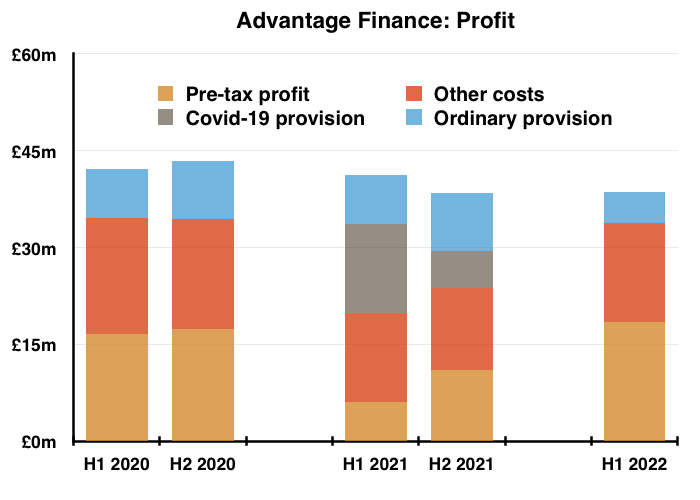

- The profit rebound followed a “lower than normal” provision for potential bad loans and returned SUS to the (pre-pandemic) profit run-rate enjoyed during FY 2020.

- The comparable H1 2021 included an additional Covid-related loan provision of £14m, while this H1’s total provision was only £5m following “an excellent collections performance [that] proved the effect of the pandemic less severe than anticipated.“

- The provision fluctuation related entirely to Advantage Finance, the group’s car-loan subsidiary (see Advantage Finance: Loan provisions below).

- SUS’s property-loan division, Aspen Bridging, meanwhile enjoyed a bumper profit following its involvement in the Coronavirus Business Interruption Loan Scheme (CBILS) (see Aspen Bridging below).

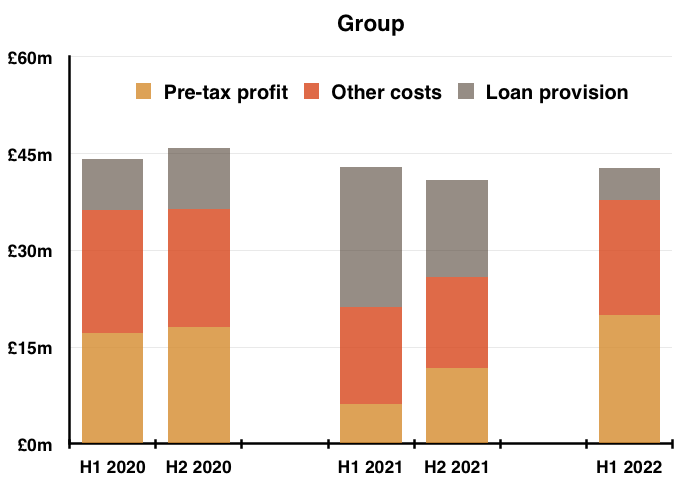

- Group profit continues to be dominated by Advantage Finance:

- The finance director said during the results webinar that the “lower than normal” car-loan provisioning should extend into H2 but then “normalise” thereafter.

- As such, some of SUS’s financial ratios from this H1 may temporarily flatter the group’s performance.

- The 33p per share interim dividend compared to:

- 32p per share for the pre-pandemic H1 2019;

- 34p per share for the pre-pandemic H1 2020, and;

- 22p per share for the pandemic-hit H1 2021.

- The 50% rebound to a 30p-plus per share H1 payout therefore implied the business having passed the worst of the pandemic.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Advantage Finance: Loan provisions

- Management describes Advantage Finance customers as ‘non-prime’ — “borrowers that have had a problem in the past but are on an upward trend” (point 3).

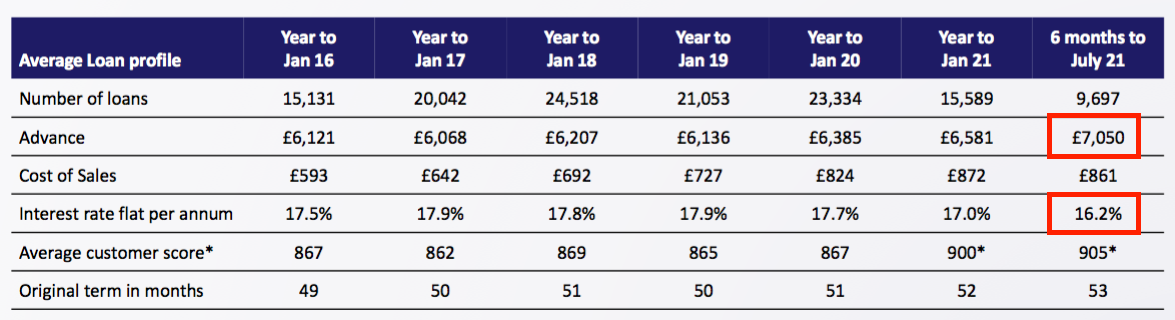

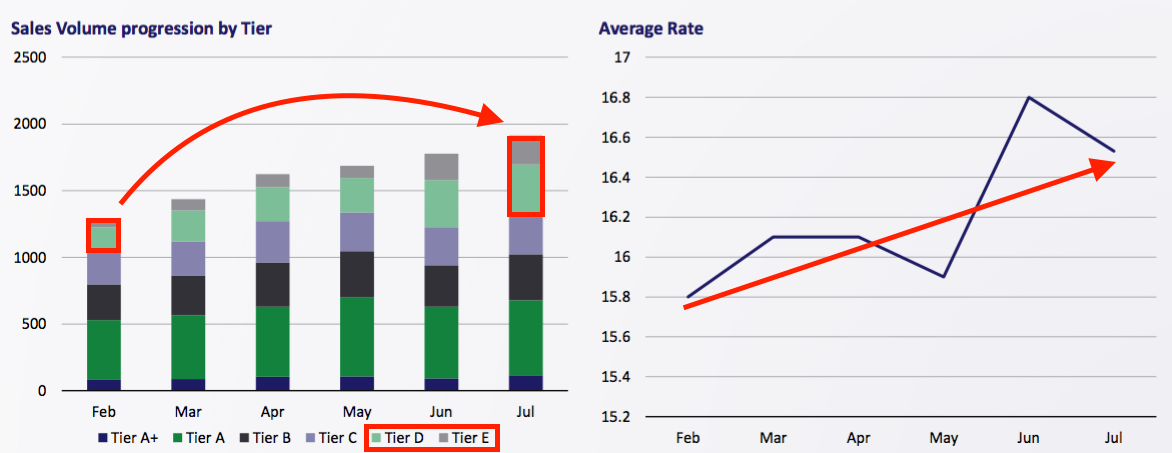

- Advantage borrowers traditionally took on car loans of approximately £6.5k, but rising used-car prices post-lockdown have increased the average loan to £7k:

- The flat interest rate charged by Advantage has meanwhile dropped below 17% for the first time since FY 2015.

- The lower interest rate was due to a smaller proportion of higher-risk Tier D and Tier E customers at the start of the year:

- Borrowing £7k at a flat 16.2% a year over 53 months leads to interest of £5k and a total repayable figure of £12k before administration and other fees.

- Before the pandemic, the average Advantage borrower would have repaid almost £10k of that £12k. But I estimate the repayment would have been less than £9k during the pandemic.

- The tone of management’s commentary for this H1 suggested repayments have returned to £10k.

- The chart below shows the impact of the extra £19.5m Covid-19 bad-debt provision (grey boxes) on Advantage’s profit during FY 2021:

- The ordinary provision (blue boxes) represented 13% of revenue for this H1 versus 19% for (pre-pandemic) FY 2020.

- Management said during the results webinar that its best guess of a “normal” bad-debt rate for Advantage would be a return to that 19% proportion of revenue.

- A “normal” 19% impairment rate for this H1 would have increased the loan provision by £2m to £7m and reduced group pre-tax profit from £18m to £16m.

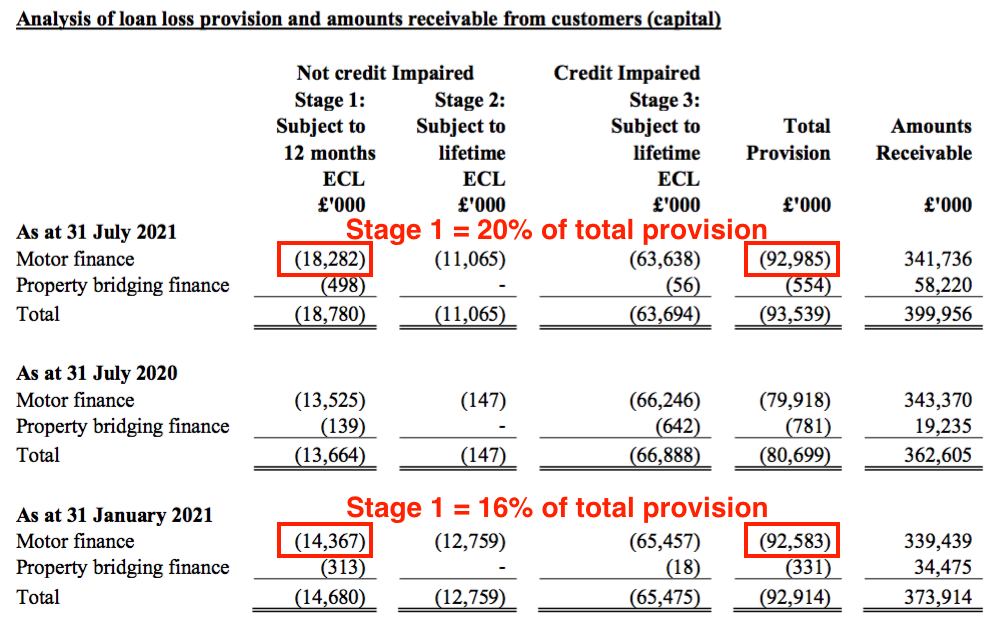

- The additional Covid-related provisions from FY 2021 still sit on the balance sheet.

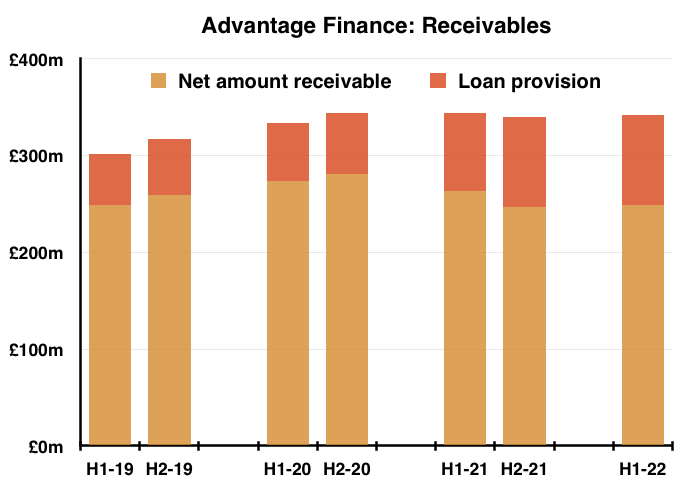

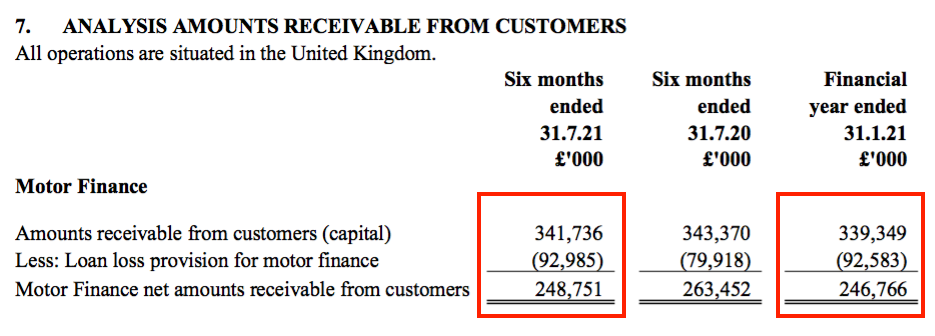

- At year-end FY 2020 (i.e. just before the pandemic), Advantage had lent £344m to customers of which £63m, or 18%, was provided for as a bad debt to leave the net amount receivable at £281m:

- For FY 2021 and this H1 2022 (i.e. following the pandemic disruption), a bad-debt provision of £93m represented 27% of the total approximate £340m loaned:

- That 27% proportion ought to reduce towards 18% as the effects of the pandemic subside over time.

- A higher proportion of the £93m bad-debt provision is now classified as Stage 1 versus Stages 2 and 3:

- Greater Stage 1 provisions ought to mean a lower rate of future defaults because:

- Stage 1 provisions reflect expected write-offs from newly opened accounts (i.e. without any history of arrears), while;

- Stage 2 provisions reflect expected write-offs from accounts that enjoyed an FCA-mandated payment holiday (i.e. technically in arrears), and;

- Stage 3 provisions reflect expected write-offs from accounts actually in arrears.

- The FY 2021 annual report (points 7 and 8) explains the three provision Stages in more detail.

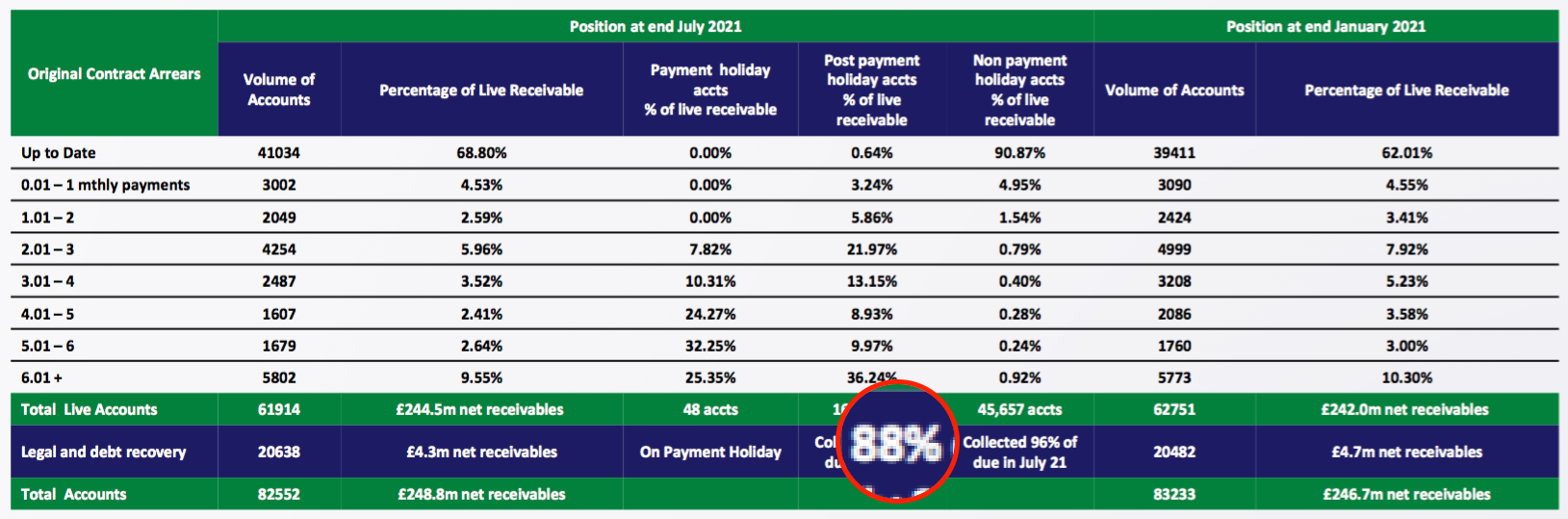

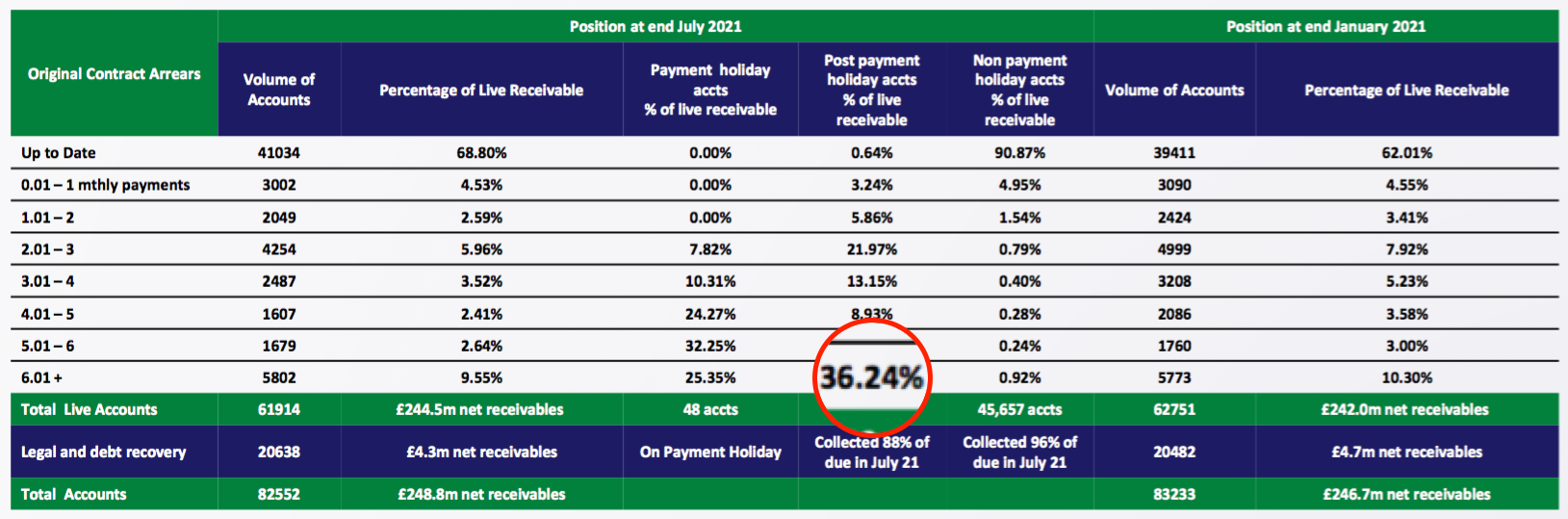

Advantage Finance: Credit quality and payment holidays

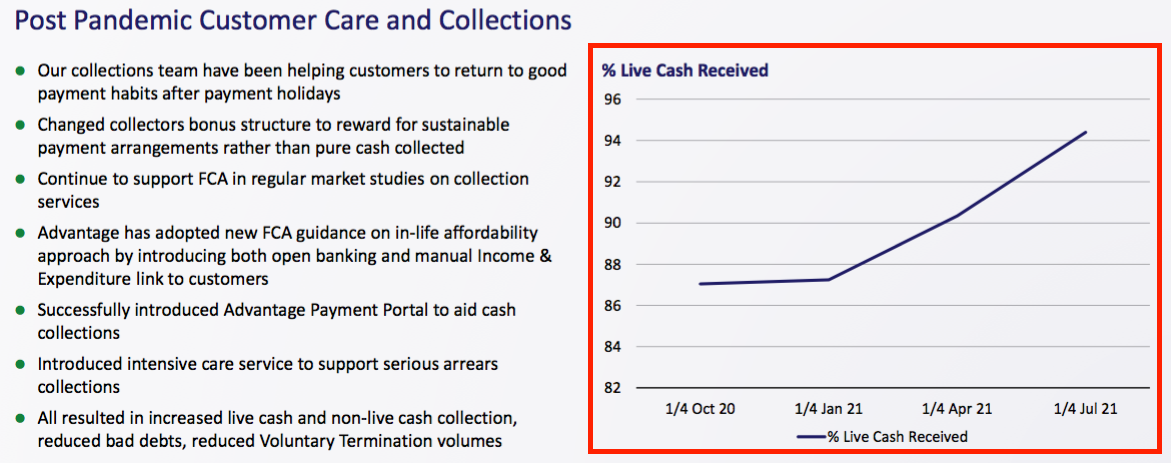

- SUS’s collection rate should be its most important KPI, as customer repayments ultimately determine the extent of bad loans and the associated provisioning.

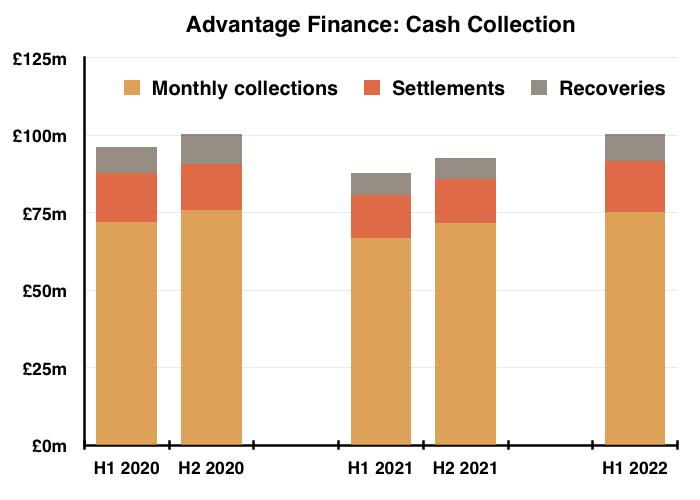

- SUS described its collections performance for this H1 as “superb” and said the collection rate, at 94.4% of due, was the highest since October 2017:

- Total collections, recoveries and settlements amounted to £100m for this H1 to match the pre-pandemic collection performance of H2 2020:

- SUS said the collection improvement was due to a mix of “responsible” underwriting, a new repayment portal and re-jigging collection-staff bonuses.

- Helping matters also were customers that enjoyed payment holidays now repaying at a greater rate.

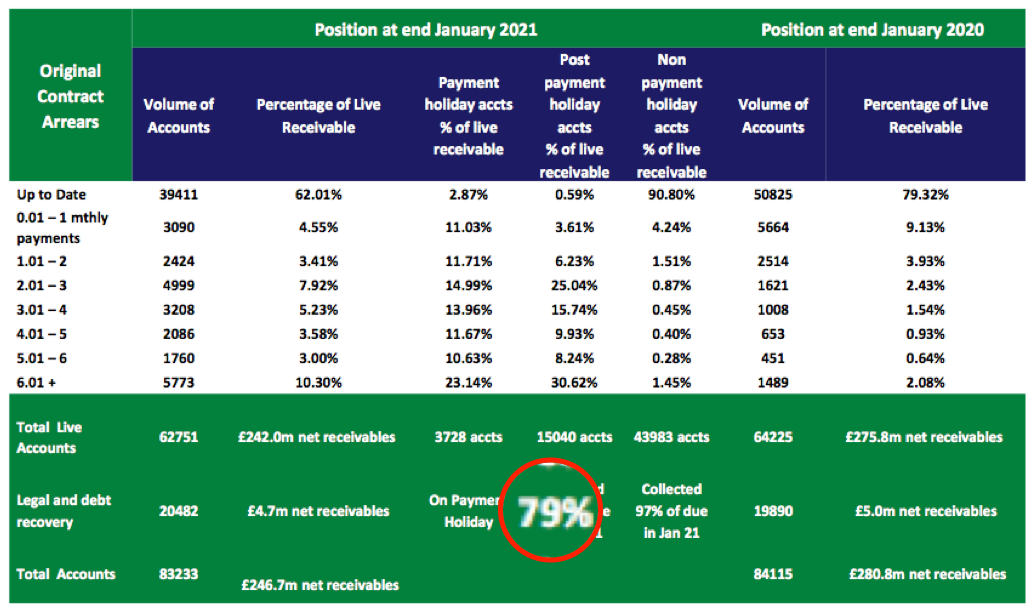

- The pandemic prompted the FCA to allow borrowers to apply for payment holidays lasting up to six months. All payment holidays ended on 31 July 2021.

- During January 2021, customers exiting their payment holidays were paying 79% of due…

- …but by July 2021 they were paying 88% of due:

- Management said on the results webinar that the 16,257 payment-holiday accounts represented 20% — or £50m — of outstanding customer loans.

- Assuming an even split of loan size between payment-holiday accounts and non-payment-holiday accounts, payment-holiday customers may have borrowed £90m but will not repay £40m:

| Payment holiday accounts | Non-payment holiday accounts | Total |

|

| Number | 16,257 | 45,768 | 61,914 |

| Gross amount receivable (£m) | 90 | 252 | 342 |

| Provision (£m) | (40) | (53) | (93) |

| Net amount receivable (£m) | 50 | 199 | 249 |

- That earlier slide showed 36.24% of payment-holiday accounts were more than six months behind with their payments:

- With payment holidays lasting no more than six months, this 36.24% cohort appears not to have recommenced payments.

- Mind you, 90.87% of non-payment-holiday accounts were up to date — a very welcome proportion given the corresponding level for all accounts for pre-pandemic FYs 2019 and 2020 was approximately 80%.

Quality UK investment discussion at Quidisq. Visit forum.

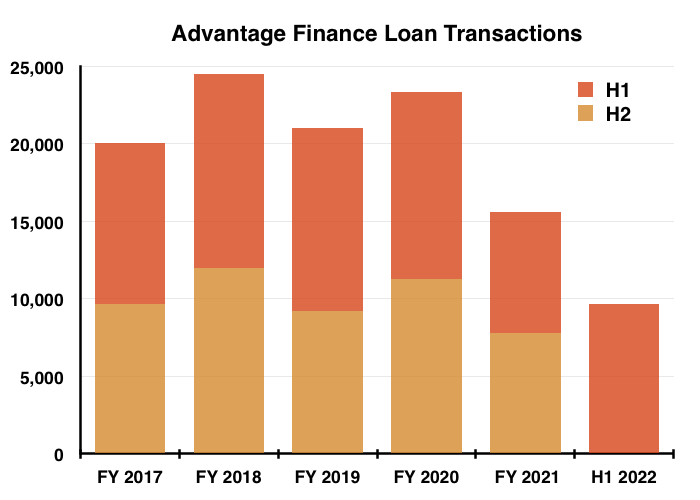

Advantage Finance: New loans

- The 9,697 motor loans issued during this H1 exceeded the number agreed during H1 and H2 2021:

- But SUS did admit industry supply problems had left used-car numbers at “extremely low” levels and in turn were limiting transaction volumes.

- Management nonetheless claimed during the results webinar that Advantage was “planning for an increase in volumes up towards 25,000 units” for FY 2023.

- 25,000 new loans a year would represent a 25% or so increase on the near-20,000 current run-rate.

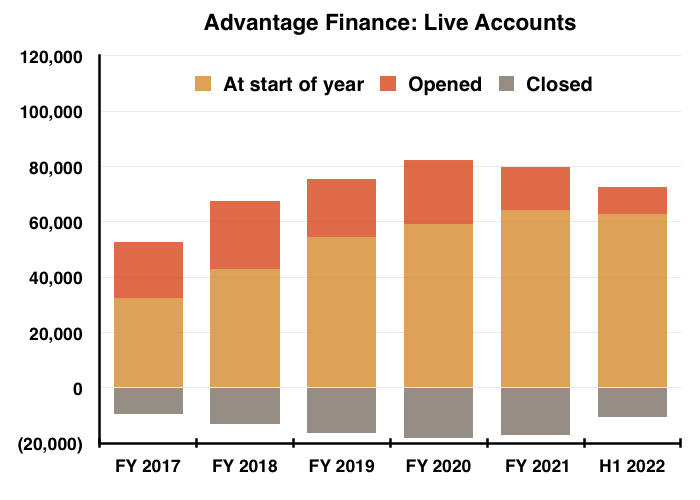

- The 9,697 new loans issued during this H1 were offset by 10,534 accounts being closed due to finished repayments, voluntary terminations or commencement of legal proceedings:

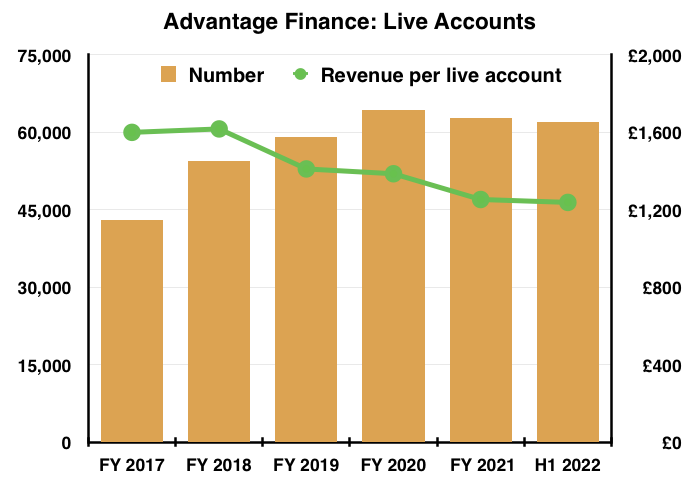

- The account openings and closures meant total ‘live’ accounts remained around 61,000:

- Revenue per account continues to trend lower, with the latest reduction perhaps due to the aforementioned smaller proportion of higher-rate Tier D and E borrowers.

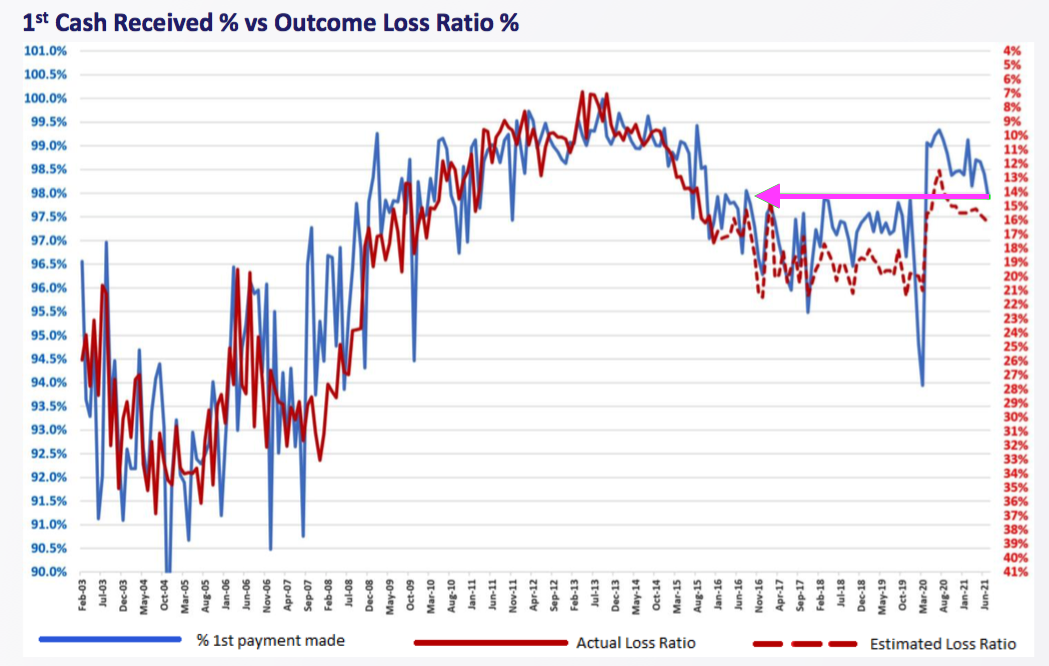

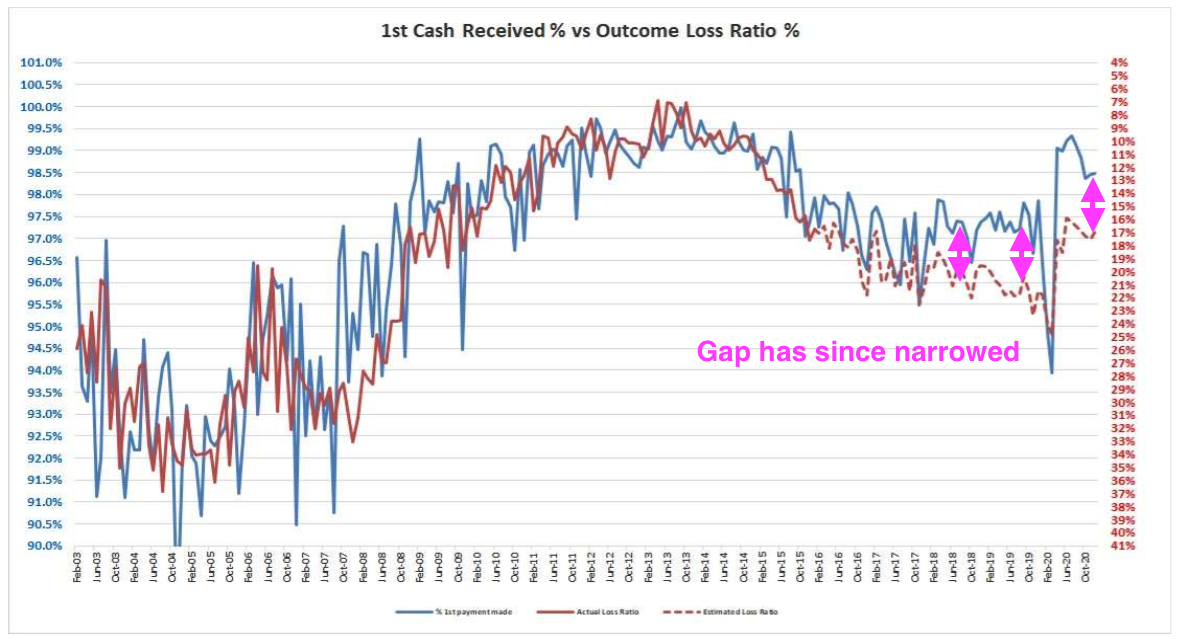

- Advantage’s first-payment statistics remain encouraging:

- The blue line (left axis) reflects the percentage of customers making their first payment on time.

- At 98%, the proportion is back to levels last seen on a regular basis five years ago.

- The unbroken red line (right axis) shows the actual ‘outcome loss ratio’, which correlates strongly to the first payment percentage.

- The dotted red line (right axis) shows the predicted ‘outcome loss ratio’, which has diverged slightly from the blue line to reflect the greater uncertainty of repayments following the pandemic.

- The gap between the blue line and the dotted red line is much closer than the same gap within the preceding FY 2021 presentation below…

- …and implies improved repayment levels ahead.

Aspen Bridging

- Established at the start of FY 2018, Aspen offers property bridging loans aimed at small/individual property developers with awkward financial circumstances.

- Aspen’s rate card says customers borrowing against residential properties will pay a flat monthly interest rate of 0.69% on a 75% loan-to-value arrangement. These case studies give a flavour of the transactions involved:

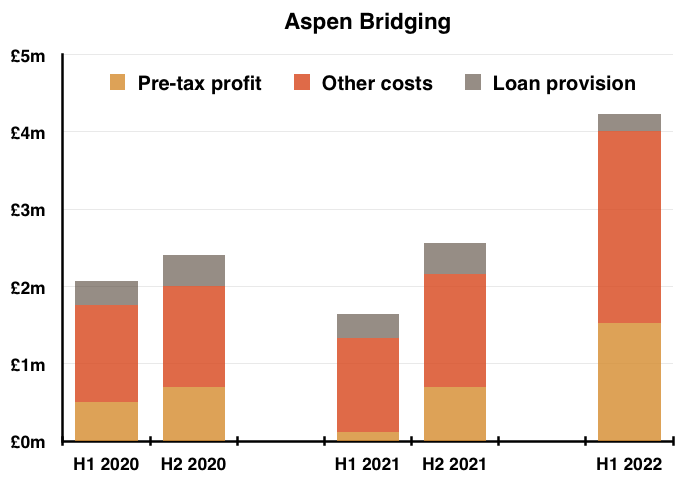

- Aspen’s participation in the government’s CBILS scheme bolstered the division’s progress during this H1.

- Aspen agreed 22 CBILS loans totalling £35m (£1.6m average) alongside 44 standard loans totalling £29m (£668k average).

- Profit for this H1 was double that of the preceding 12 months at £1.5m:

- Aspen’s credit quality remains very good. Expected write-offs from the £58m loan book amount to just £554k.

- Mind you, SUS did admit Aspen’s previously default-free loan book now carried one account in default.

- Aspen’s enlarged loan book currently represents 19% of SUS’s entire lending.

- The cessation of CBILS is likely to mean Aspen’s H2 performance does not repeat this bumper H1.

- But management did claim Aspen has “great opportunities for growth” and that the half-year pipeline of future business was “about 15% above budget“.

- The size of Aspen’s agreements are increasing. Excluding CBILS, the average £668k loan agreed during this H1 compares to less than £600k during the preceding four years.

- Management comments on the results webinar sadly did not repeat the optimistic talk of the preceding FY 2021 webinar, which cited a £5m Aspen profit within 2-3 years.

- Management revealed during the results webinar that Aspen’s deputy chief executive, Jack Coombs, figured in the group’s succession planning.

- SUS’s lead executives — Anthony and Graham Coombs — are presently both 68 years old while their cousin Jack is 34.

- The Coombs family control more than 50% of SUS, with Anthony and Graham Coombs together owning 24% (£80m) and Jack Coombs holding a further 14% (£46m).

- Jack Coombs is already a board executive, and one day becoming the lead Coombs executive hints at Aspen becoming of greater importance to the group.

Financials

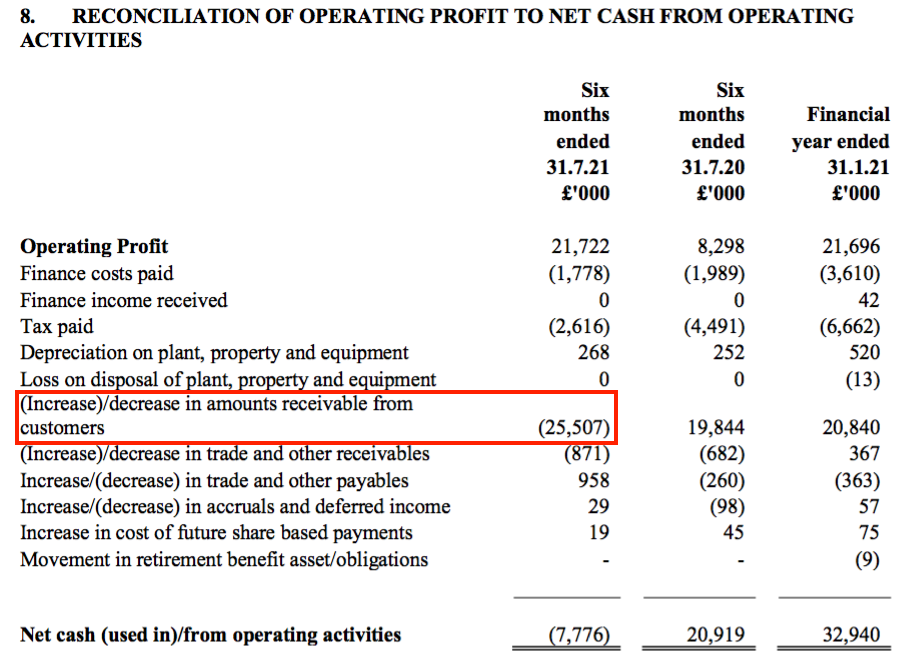

- Aspen’s increased lending was reflected by the £26m net cash movement of customer receivables:

- The additional lending of £26m as well as a £7m dividend required extra debt of £16m and left net debt at £115m.

- Bank interest during the six months was £1.8m, implying SUS’s borrowings incur interest at a reasonable 3.3%.

- The FY 2021 annual report (point 11) claimed SUS borrows money from banks at 4% to then lend out at 27%.

- The wide, 23% net interest margin is required to cover debt impairments and operating costs, and in turn earn a respectable return on the capital employed (pandemics aside).

- The H1 interest payment was covered a satisfactory 12x by operating profit.

- Net debt of £115m compares to the group’s £306m net loan book.

- SUS’s lenders do not seem too worried about the group’s borrowings. This H1 statement confirmed banking facilities had increased by £15m to £180m to give headroom of £65m, with maturity dates meanwhile ranging from 2024 to 2029.

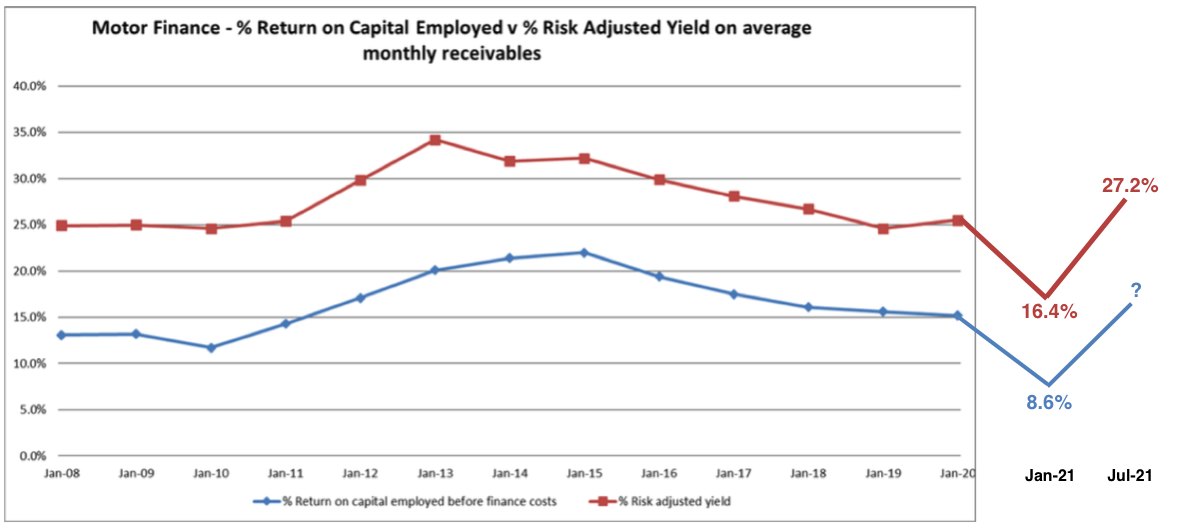

- The presentation did not include the slide showing Advantage’s risk-adjusted yield and return on capital employed, so I have amended the last one (from FY 2020) the best I can:

- The aforementioned “lower than normal” impairment for Advantage has lifted the division’s risk-adjusted yield and ROCE, although this H1 statement did not allow the latter to be calculated properly.

- I am hopeful Advantage’s risk-adjusted yield and ROCE will eventually be sustained at pre-pandemic levels and the missing slide can then return.

- SUS maintains a tiny defined-benefit pension scheme that last carried a surplus (point 13).

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Valuation

- Management gave a positive outlook:

“The Covid induced tribulations of the past year have seen S&U emerge more profitable, more competitive and more attuned to our customers ‘ needs. Add to that the buoyant markets in which we operate, our strongest ever financial base and our loyal and committed workforce, and prospects for the future are bright indeed.“

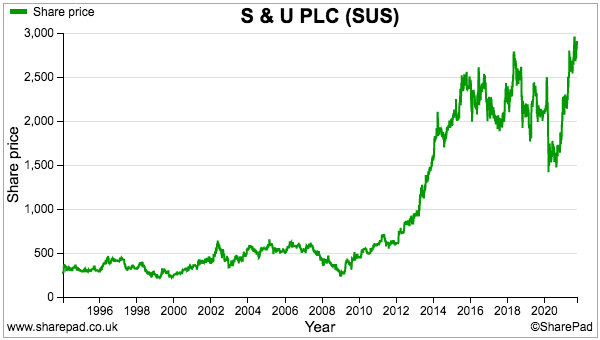

- The shares presently trade very close to an all-time high:

- Doubling up this H1’s performance but also:

- Applying management’s best guess of a ‘normal’ 19% car-loan impairment rate;

- Guessing Aspen’s ex-CBILS annual profit to be £1.5m, and;

- Applying tax at 19%…

- …leads to an operating profit of £34m and earnings of £27m or 224p per share.

- SUS’s enterprise value is £455m (£340m market cap plus £115m net debt), which is 17x my earnings guess.

- The present rating is not low by historical standards, but perhaps the market has warmed to management’s car-loan webinar comments of “planning for an increase in volumes up towards 25,000 units.”

- Arranging 25,000 car loans a year would lift the number of live Advantage accounts beyond 80,000 by 2025 assuming account closures remain at approximately 20,000 a year.

- 80,000 accounts delivering the present £1,238 annual revenue per account would produce total revenue of £99m.

- Then assuming:

- Car-loan impairments run at management’s best guess of a ‘normal’ 19%;

- Other car-loan costs rise in line with revenue;

- Property profit does indeed meet management’s webinar talk of £5m, and;

- Tax is 25%…

- …gives possible FY 2025 earnings of £35m or 285p per share.

- SUS’s current enterprise value is equivalent to 13x that £35m projection.

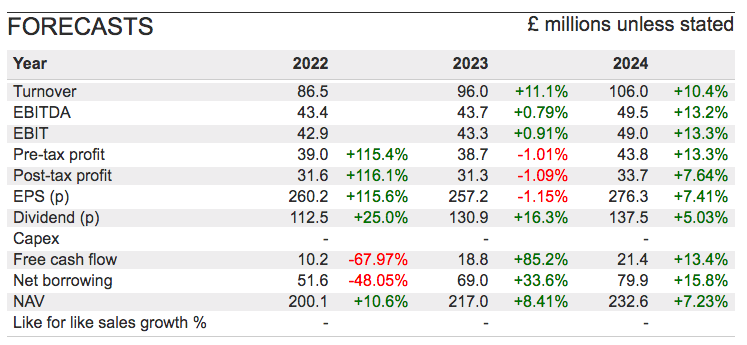

- For what they are worth, the forecasts displayed within SharePad predict a significant profit rebound:

- The 33p per share H1 dividend may herald a full-year payout of between 110p-120p per share if the 32p/34p per share payments of H1s 2019 and 2020 are anything to go by.

- The £28 shares could therefore yield 4.1%.

- Assessing the potential upside of the shares was easier this time last year when the price was £17 and a full pandemic recovery offered potential double-digit returns.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

S & U (SUS)

Trading Update published 09 December 2021

A reassuring update. Here is the full text interspersed with my comments:

——————————————————————————————————————

S&U, the specialist motor finance and property bridging lender, today announces its trading update for the period from 1st August 2021 to 8th December 2021.

The Group continues its growth rebound and is trading strongly, as the economy tentatively returns to normal despite the continuing uncertainty over the course of the Covid pandemic. Growth is accelerating in both businesses, despite a relative lack of used car supply and a quieter housing transaction market over the past quarter.

Credit quality has returned to pre-pandemic highs and remains under close scrutiny. As a result, S&U has laid the trading and financial foundations for a return to its historical levels of significant, sustainable and profitable growth.

——————————————————————————————————————

The terms “trading strongly” and “growth is accelerating” sound encouraging. Even more important is credit quality returning to “pre-pandemic highs“.

I get the impression a return to FY 2020’s profit high should occur sooner rather than later.

——————————————————————————————————————

MOTOR FINANCE

Advantage Finance (“Advantage”), our motor finance subsidiary, is rebounding vigorously both in profitability and in new business transactions. After the record basic live collections in the second quarter of £38.3m, Advantage collections improved further in the third quarter to £39.1m. This superb collections performance, along with continued associated lower than expected impairment provisions, are the main drivers of improved profitability so far this year.

New business transactions have also grown, increasing by over 30% in the period versus the same period last year. This increase is despite a dearth of supply in the used car market this year, which, according to SMMT figures, has seen a fall in used car sales of 6.2% in the latest quarter and a market still 2% short of pre-pandemic sales levels. In contrast, Advantage currently anticipates making increased net loan advances totalling over £140m in our financial year to 31st January 2022 (year to 31st January 2021: £102.6m).

Collection rates are better than ever, as the result of our tightened underwriting over the Covid period and industry-leading customer relations, which are reflected in Advantage’s Trust Pilot rating of 4.7 out of 5. This means that customers are repaying at record levels. Those who never took a Covid related payment “holiday” are at 97% of due, whilst even those who did are now back to nearly 94% of due.

Opportunities abound. As Advantage gears up for further growth, work intensifies on customer service and underwriting refinements and a significant investment in digital marketing. New automated payments, open banking and a self-service customer portal help make the customer’s journey ever more simple and smooth. Brand and website improvements, multi-channel API and new affinity partnerships are attracting more customers to make their finance journey with us.

As a result, with the foundations of over 22 years of excellent profits and operational efficiency, Advantage is positioned for the great opportunities a fast-changing motor finance market presents.

——————————————————————————————————————

The H1 results in the blog post above were bolstered by lower-than-normal motor-loan provisions as collections were better than SUS had expected.

As such, the text “This superb collections performance, along with continued associated lower than expected impairment provisions” confirms the lower-than-normal provisions will stretch into H2 as the finance director previously suggested…

…but also may well extend into H1 of FY 2023 (i.e. from 1 February 2022). Note: this latest statement was issued with less than two months of FY 2022 to run.

Net motor-loan advances of at least £140m for FY 2022, which after £68m for H1, implies H2 advances of £72m and close to the £76m/£72m H1/H2 splits for the record FY 2020.

Payment ‘holiday’ accounts now repaying at nearly 94% is an improvement on the 88% stated at the half year, and is very reassuring.

——————————————————————————————————————

Aspen Bridging Finance

Less than five years after its founding, Aspen continues its development as a dynamic and substantial property bridging business. Its receivables book has now reached over £60m, more than double last year, and transaction numbers to date are 38% up on a year ago. Maintaining margins in a competitive market, alongside robust quality control has resulted in an excellent Aspen profit increase in the period versus the same period last year, building on the excellent Aspen profit increase in H1 21.

Reflecting and underpinning this growth, Aspen’s current paid pipeline of deals has doubled over the period to a record level, and a new Bridge to Let product has been introduced. Aspen’s strong credit quality is reflected in continued low levels of default and most Aspen customers settling within or just beyond the normal term of the loan.

Aspen’s market reputation and credible partnerships with its introducer brokers are demonstrated by the volume of business now being introduced, and by a significantly improved transaction to approval ratio. This augurs well for the significant expansion planned over the next three years.

——————————————————————————————————————

A loan book of £60m+ compares to £58m at the half year, so the CBILS-backed growth of H1 has clearly subsided. No surprise that H2 will see an “excellent” profit increase versus last year, but the FY 2023 performance may not be as spectacular once the CBILS loans wash through.

——————————————————————————————————————

Funding

As usual, S&U’s strong underwriting and collections record has produced current borrowings of £113m against £103m last year and £115m at 31st July 2021. We have appropriate and ample headroom within our banking facilities for the accelerated growth we anticipate next year.

——————————————————————————————————————

So borrowings have reduced a fraction, which does not suggest too much expansion to the overall loan book and feels commensurate with the loan advance comments for Advantage and Aspen.

——————————————————————————————————————

Outlook

Commenting on the Group’s performance and outlook, Anthony Coombs, S&U Chairman, said:

“S&U is in very fine form. Credit for this goes to our great people who have not only maintained an excellent service to customers, whatever the personal depredations or uncertainties of Covid, but are also continuously monitoring, planning and adapting within rapidly evolving finance markets. Much of this effort focusses on marketing and product development to attract new customers to enjoy our traditional offer of finance with a human face. That makes for an exciting and profitable future.”

——————————————————————————————————————

The chairman remains optimistic, and notably refers to marketing efforts that aim to attract customers beyond SUS’s normal finance-broker channels.

Maynard

S & U (SUS)

Trading update published 10 February 2022

A bullish update. Here is the full text interspersed with my comments:

——————————————————————————————————————

S&U plc, the specialist motor finance and property bridging lender, today issues its trading update for the period from its trading statement of 9 December 2021 to the Group’s year end on 31 January 2022. S&U’s full year results will be announced on 29 March 2022.

Founded on an excellent collections and debt quality performance and the expected rebound in sales as the Covid pandemic gradually abates, S&U’s profit before tax for the year is now set to exceed current consensus expectations. Whilst both political and economic uncertainty still clouds the horizon for the UK consumer, and supply shortages still inhibit the used car market, we confidently expect 2022 to gradually see a full rebound to normal motor sales conditions.

Meanwhile, the plans and foundations are in place for continued, accelerated and sustainable growth both at Advantage, our motor finance lender, and at Aspen, our property bridging business.——————————————————————————————————————

All very good. Profit exceeding expectations, a full rebound to normal motor sales conditions and “accelerated” growth all sound promising.

——————————————————————————————————————

Motor Finance

As the economy recovers and consumer confidence gradually returns, Advantage’s focus on good customer relations, responsible underwriting and sensible cost control is reaping its reward, as well as providing a firm base for further growth this year.

Annualised live collection rates were 93% of due – themselves above budget and 9% ahead of last year – including an excellent live collection rate of 98% in January 2022.

Lower bad debts and voluntary terminations than anticipated mean we expect a much lower than normal impairment charge this year. This will see profit before tax more than double last year’s £17.2m, when the Covid-related impairment charge was much higher than normal (prior year impairment charges: £36.0m for year ended 31 January 2021 and £16.5m for year ended 31 January 2020).

This means that Advantage’s profit over the past two years of the pandemic is anticipated to be only slightly below our excellent pre-Covid level – a remarkable achievement.

——————————————————————————————————————

January collections at 98% compare with 97% for non-payment-holiday accounts (or 94% for payment-holiday accounts) seen during Aug-Nov as reported in December. Q2 collections were running at 94%. So the trend appears favourable.

Doubling pre-tax profit of £17.2m gives £34.4m, which less the £18.5m scored during H1 gives at least £15.9m for H2. I trust the upbeat commentary means H2 profit at least equals H1.

I don’t quite follow “Advantage’s profit over the past two years of the pandemic is anticipated to be only slightly below our excellent pre-Covid level“. Profit for FY 2021 was £17.2m, profit for FY 2022 will be £34.4m-plus while profit for pre-pandemic FY 2020 was £34.0m.

——————————————————————————————————————

Whilst supply constraints in the used car market remain, driven by new car production which is 20-25% down on last year, the consequent constraint on sales is expected to gradually reverse from the second quarter of 2022. Even so, as anticipated, Advantage has achieved net loan advances totalling over £140m in our financial year to 31 January 2022 (2021: £102.6m), a trend which is expected to see a return to normal transaction levels and growth over the next two years.

Advantage is already implementing many of the customer and sales initiatives announced in our last trading statement. The self-service portal for customers is driving both higher collections and levels of customer satisfaction. Our investment in Digital Marketing and brand development has been underpinned by the appointment of a new Head of Marketing. Projects with our specialist technology partners will both streamline and strengthen underwriting and open up new fields of opportunity with consolidators and dealer groups.

Further, Advantage is developing a carbon neutral footprint. It has extended its product range and begun to finance electric vehicles for the first time.

As a result, Advantage is poised for a profitable new era of expansion, firmly rooted in an admirable record during the pandemic, excellent debt quality and imaginatively expanded routes to market.

——————————————————————————————————————

Net loan advances of at least £140m had been signalled within December’s update.

I view this line — “…which is expected to see a return to normal transaction levels and growth over the next two years” — as supplying a timescale for a full pandemic recovery.

Good to see the ‘self-service portal’ doing well and the various sales/marketing projects still simmering away.

Electric vehicle finance was mentioned in the 2021 annual report (point 1)

——————————————————————————————————————

Property Bridging

Aspen Bridging is benefiting from both a thriving UK property market and from the growing expertise and experience of its people. House prices in December 2021 rose 7.4% according to Zoopla, followed by a reported 11% increase in January 2022. Equally important, residential transaction levels have recovered strongly in January 2022, being the highest since 2007. This has been reflected in Aspen achieving 28 deals totalling over £20m of gross lending in the two month period.

Credit quality remains strong with continued low levels of default and most customers settling within or just beyond the normal term of the loan.

Aspen is building on this success by selective recruitment, the introduction of a new Bridge to Let product and by refining its product range. As a result, its current net receivables loan book of c£64m is the highest ever and its record profitability this year has greatly exceeded expectations. We anticipate further record results in the year to come.

——————————————————————————————————————

The receivables loan book exceeded £60m within December’s update, so receivables of £64m means the £20m of gross lending during December and January was counterbalanced by £16m or so of repayments.

H1 Aspen profit was £1.5m on a loan book that averaged £46m ((£34m+£58m))/2), so we should expect at least another £1.5m for H2. I’m guessing a £3m+ profit for Aspen for FY 2022 could mean the division represents 5% of total group profit. I recall management webinar talk of Aspen delivering a £5m profit by FY 2024.

——————————————————————————————————————

Funding

Reflecting S&U’s historically strong treasury position and the excellent collections performances mentioned above, Group borrowing at year end is £114m (2021: £99m). This makes Group gearing an estimated 55%, the same as last year, and with Group facilities standing at £180m, gives ample room for the growth we anticipate in both businesses this year.

Dividend

Both current trading and our positive view of S&U’s prospects for sustainable growth, leads the Board to recommend a second interim dividend this year of 36p per ordinary share (2021: 25p). This will be paid on 11 March 2022 to those shareholders on the register on 18 February 2022.

Commenting on the Group’s performance and outlook, Anthony Coombs, S&U Chairman, said:

“Although exceptional factors have benefited the Group’s profitability this year, in the years to come the ongoing quality of our customer lending, the strength of our finances and our investment in the growth of our routes to market will underpin S&U’s return to the levels and rates of profit growth experienced before the pandemic. I therefore remain very confident in our future prospects.”.——————————————————————————————————————

Borrowings of £114m are £1m higher than the level cited in December and £1m lower than at the end of H1. So the business appears happy to broadly match repayments with new lending at present. Facilities of £180m have been in place for about a year now.

The 36p per share dividend means the trailing payout is 36p+33p+43p = 112p per share. I would like to think the final payout can be lifted from 43p to 51p to return the full-year payout to the pre-pandemic 120p.

The normally cautious chairman being “very confident in our future prospects” feels very encouraging.

Maynard