09 October 2020

By Maynard Paton

Results summary for S & U (SUS):

- Extra write-offs totalling £13.8m did not seem too awful in the circumstances and should reflect the bulk of the pandemic disruption.

- The interim dividend was reduced by 35% and management hoped for a full-year payout of between 80p and 100p per share.

- Payment ‘holidays’ have left some 37% of accounts overdue, but monthly collections have rebounded to a respectable £12m after the half-year.

- Net debt of £108m remains significant, although cash flow covered interest payments a very reasonable 10x.

- The shares trade relatively close to book value and could offer double-digit annual returns assuming a full recovery. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own SUS

- Results summary

- Coping with Covid-19

- Revenue and profit

- Advantage Finance

- Payment holidays

- New customer loans

- Aspen Bridging

- Financials

- Valuation

Event links, share data and disclosure

Event: Interim results and presentation for the six months to 31 July 2020 published 30 September 2020 and results webinar hosted 02 October 2020 (email registration required).

Price: 1,700p

Shares in issue: 12,133,760

Market capitalisation: £206m

Disclosure: Maynard owns shares in S & U. This blog post contains SharePad affiliate links.

Why I own SUS

- Provides ‘non-prime’ credit to car buyers and property developers, where disciplined lending and reliable service have supported an enviable track record.

- Boasts veteran family management with 40-year-plus tenure, 50%-plus/£100m-plus shareholding and a “steady, sustainable” and organic approach to long-term growth.

- Offers a likely Covid-19 recovery given respectable collection levels and potential for market-share gains and higher-quality lending.

Further reading: My SUS Buy report | All my SUS posts | SUS website

Results summary

Coping with Covid-19

- How S&U has so far coped with the Covid-19 pandemic was by far the most pressing matter within these results.

- The company provides loans to used-car buyers and property developers with patchy-but-improving credit histories.

- The economic disruption created by the pandemic could mean S&U suffers significant defaults and becomes nervous about its own borrowings.

- Full-year figures published during early April provided hope of a resilient lockdown performance.

- That annual statement carried confident director talk and revealed only a 2% reduction to the final dividend.

- Updates issued during June and August also carried promising remarks about a recovery but precious little financial information.

- Covering the six month to 31 July, this H1 statement was therefore the first to reveal the pandemic’s financial impact.

- SUS disclosed extra write-offs of £13.8m to reflect the greater number of loans now unlikely to be repaid in full.

- The extra £13.8m write-offs related entirely to car loans and did not seem too awful in the circumstances.

- Management confirmed during the webinar that the extra write-offs were “forward looking” due to IFRS 9 and therefore mostly a “one-off charge”.

- As such, any adjustments to the £13.8m will be charged/credited to future earnings as and when the (non-)repayment of the doubtful loans becomes clear.

- Assuming no further deterioration to the general economy, the £13.8m ought to reflect the bulk of the pandemic disruption.

- The extra £13.8m write-offs compare to annual pre-Covid bad-loan provisions of £17m.

- The extra £13.8m write-offs are equivalent to 5% of the £282m of outstanding car loans seen at the end of January 2020.

- The latest balance sheet showed outstanding car loans of £263m, outstanding property loans of £18m and net debt of £108m.

- The financial effect of the pandemic on SUS’s fledgling property division was immaterial to the group.

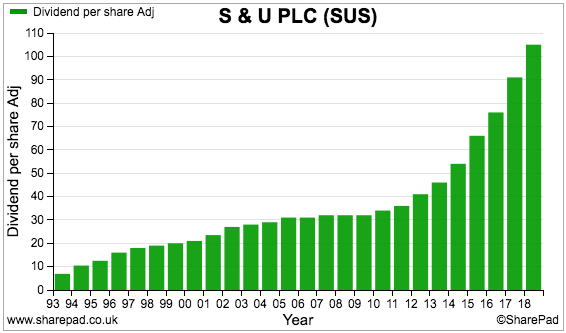

- The interim dividend was reduced by 35%. Management said the reduction was a “sensible balance between prudence in uncertain times and our fundamental confidence in the business.”

- Management revealed during the webinar that the group would like to declare a full-year dividend of between 80p and 100p per share.

- An 80p per share full-year dividend would equate to two-thirds of the previous year’s 120p per share payout.

- The dividend reduction will be the first for SUS since at least 1987:

Revenue and profit

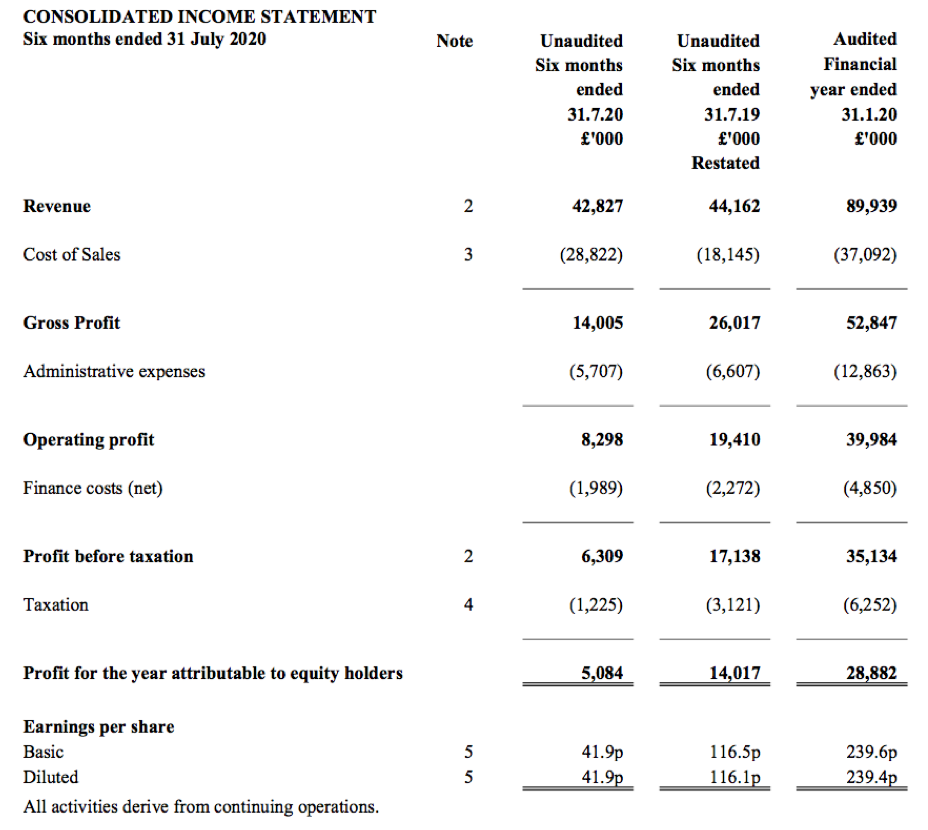

- Group revenue fell 3% while operating profit — after the extra write-offs — plunged 57%.

- The comparative H1 2020 revenue and impairment figures were restated to reflect a new accounting policy adopted within the FY 2020 results:

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Revenue (£k) | 44,460* | 44,755* | 44,162 | 45,777 | 42,827 | ||

| Operating profit (£k) | 18,813 | 20,288 | 19,410 | 20,574 | 8,298 |

(*not restated)

- The pandemic disruption made the restatement rather academic. The restatement did not affect the comparative H1 profit, balance sheet or cash flow.

- SUS’s performance continues to be dominated by Advantage Finance, the group’s motor-loan business.

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Motor | |||||||

| Revenue (£k) | 43,270* | 43,102* | 42,089 | 43,376 | 41,187 | ||

| Pre-tax profit (£k) | 16,306 | 17,334 | 16,622 | 17,405 | 6,139 | ||

| Property | |||||||

| Revenue (£k) | 1,190* | 1,653* | 2,073 | 2,401 | 1,640 | ||

| Pre-tax profit (£k) | 279 | 559 | 502 | 703 | 118 |

(*not restated)

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Advantage Finance

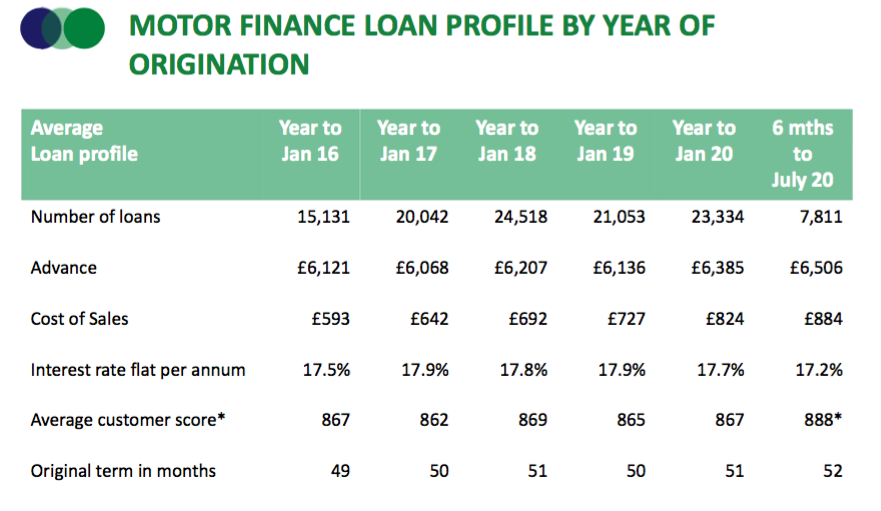

- The typical Advantage Finance customer has a patchy-but-improving credit history and borrows £6.6k to buy a five-year-old car.

- The customer then pays back £11.7k over 52 months — equivalent to a flat c17% interest rate:

- Customers are described by management as ‘non-prime’ — “borrowers that have had a problem in the past but are on an upward trend” (point 3).

- The aforementioned extra £13.8m write-offs gave a total loan provision for Advantage of £21.4m:

| H1 2020 | H2 2020 | H1 2021 | ||

| Motor | ||||

| Loan provision (£k) | 7,578 | 8,929 | 21,369 | |

| Revenue (£k) | 42,089 | 43,376 | 41,187 | |

| Average customer loans (£k) | 266,291 | 277,264 | 272,105 | |

| Loan provision/Revenue (%) | 18.0 | 20.6 | 51.9 | |

| Loan provision/Average customer loans (%) | 5.7 | 6.4 | 15.7 | |

| Revenue/Average customer loans (%) | 31.6 | 31.3 | 30.3 | |

| 'Risk-adjusted yield' (%) | 25.9 | 24.8 | 14.6 |

- Without the pandemic write-offs, Advantage’s loan provision would have equalled the £7.6m reported for H1 2020.

- The extra £13.8m write-offs meant the total loan provision represented more than half of revenue. The proportion for FY 2020 was approximately 19%.

- Other loan-provision ratios, including the ‘risk-adjusted yield’ were similarly impacted.

Risk-adjusted yield is a ‘profit margin’ KPI used by SUS and is calculated as:(revenue – impairment provision) / average outstanding customer loans

- Advantage’s revenue did not suffer too badly.

- Revenue represents the interest paid by customers, and equated to approximately 30% of the average customer loan during the six months.

- The small difference between 30% and 32% suggests many customers kept paying interest during the lockdown — despite payment “holidays”.

Payment holidays

- Previous SUS updates had already expressed unhappiness with the FCA’s decision to allow payment holidays.

- These H1 results stated:

“Many of our customers will be now leaving the Government’s Furlough Scheme and even more are returning to payment from the payment “holidays” which were somewhat precipitately mandated by the FCA at the outset of lockdown and have now been extended to October. “

- SUS confirmed the number of holiday-takers represented 26% of Advantage’s total customers:

“Around 16,500 of the 64,000 Advantage customers took original payment holidays of mainly three months in H1 and currently under 6,500 customers are still on original or extended payment holiday.”

- 16,500 customers taking a payment holiday alongside the extra £13.8m pandemic write-offs perhaps implies each holiday customer will no longer pay back an additional £836.

- Management claimed during the webinar that 40% of customers that had enjoyed a payment holiday were not financially affected by the pandemic.

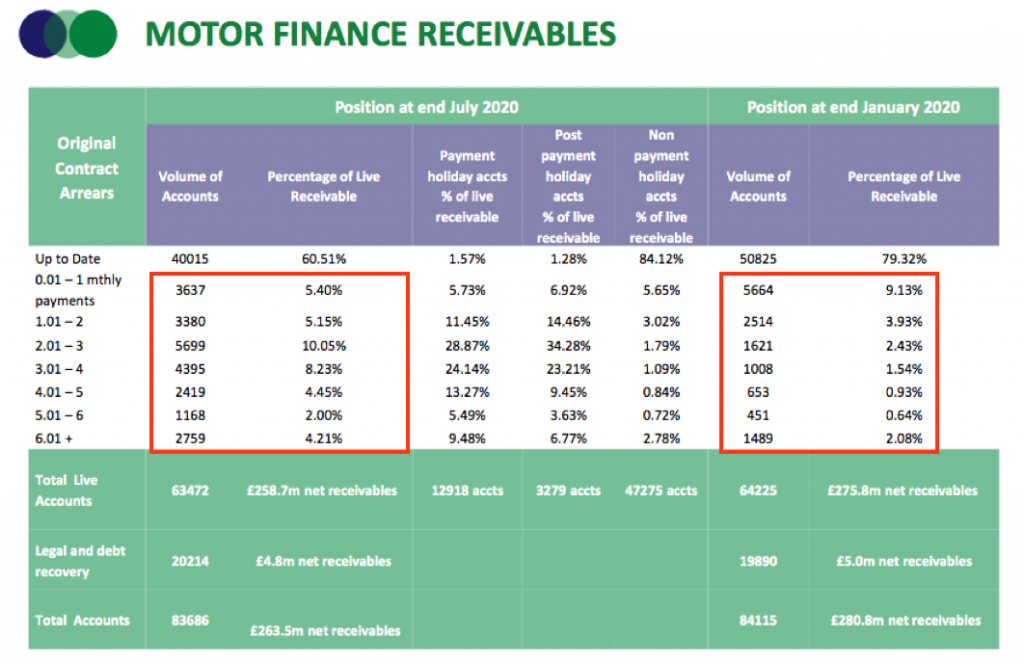

- At the end of January 2020, 13,400 overdue accounts owed car loans totalling £57m, or £4.3k each.

- At the end of July 2020, 23,457 overdue accounts (including holiday-payment accounts) owed car loans totalling £102m, or £4.4k each:

- SUS did not say how much was owed by the 6,500 Advantage customers still enjoying payment holidays. The amount could be 6,500 * £4.4k = £28m.

- Overdue accounts (including holiday-payment accounts) now represent 37% of total accounts. The overdue proportion was 21% for FY 2020 and 10% for FY 2016:

| 2016 | 2017 | 2018 | 2019 | 2020 | H1 2021 | |

| Motor | ||||||

| Up to date accounts | 29,460 | 37,447 | 45,668 | 47,307 | 50,825 | 40,015 |

| Overdue accounts | 3,144 | 5,620 | 8,811 | 11,802 | 13,400 | 23,457 |

| Total accounts | 32,604 | 43,067 | 54,479 | 59,109 | 64,225 | 63,472 |

| Up to date/Total (%) | 90.4 | 87.0 | 83.8 | 80.0 | 79.1 | 63.0 |

| Overdue/Total (%) | 9.6 | 13.0 | 16.2 | 20.0 | 20.9 | 37.0 |

- SUS said 86.4% of customers who had taken a payment holiday were now making their contracted repayments.

- The 86.4% proportion compares to the 95.8% of non-payment-holiday customers who are making payments as due.

- Management comments during the webinar referred to new — and “welcome” — FCA guidance on payment holidays.

- This paragraph from the guidance no doubt pleased SUS:

“Where consumers require further support from firms, either at the end of payment deferrals under the guidance, or where they need support for the first time, this will be reflected on credit files in accordance with normal reporting processes. This will help ensure lenders have an accurate picture of consumers’ financial circumstances and reduce the risk of unaffordable lending. Firms should be clear about the credit file implications of any forms of support offered to consumers.”

- Management comments during the webinar implied a frustration at payment holidays not having affected credit scores up to now.

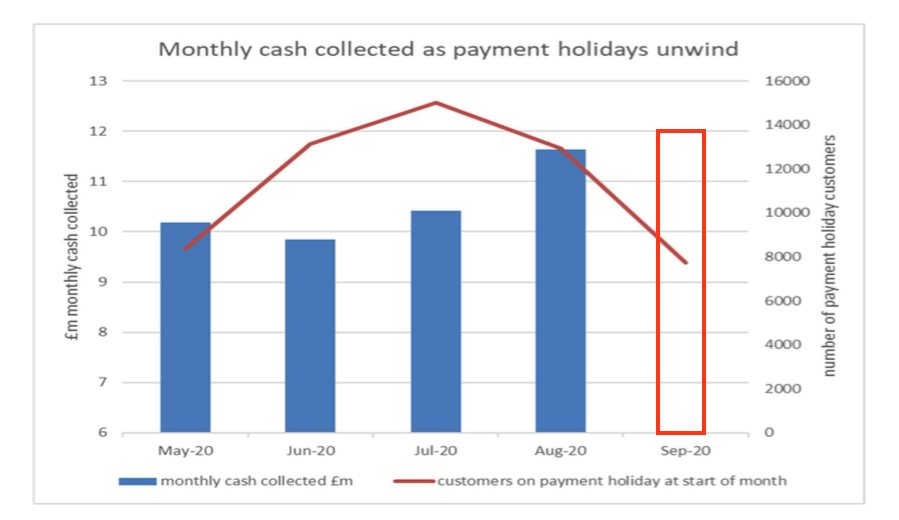

- An important snippet during the webinar concerned monthly collections.

- Management confirmed collections for September had topped £12m:

- Monthly collections during FY 2020 averaged £12.3m, so repayments seem to have returned to respectable levels.

New customer loans

- The number of new loans issued by Advantage during the six months dropped 35% to 7,811:

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Motor | |||||||

| New agreements | 11,822 | 9,231 | 12,065 | 11,269 | 7,811 | ||

| Active customers | 58,008 | 59,109 | 62,032 | 64,225 | 63,472 | ||

| Net customer increase | 3,529 | 1,101 | 2,923 | 2,193 | (753) | ||

| Customer loans (£k) | 263,455 | 258,810 | 273,771 | 280,757 | 263,452 | ||

| Change to customer loans (£k) | 12,240 | (4,645) | 14,961 | 6,986 | (17,305) |

- SUS said 4,463 new loans were written during May, June and July, implying 3,348 new loans were written during February, March and April.

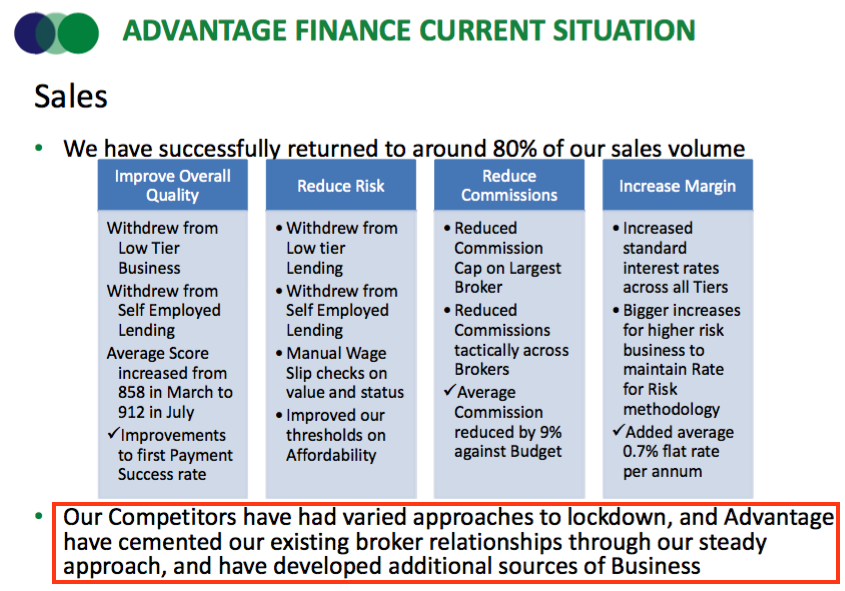

- SUS admitted loan numbers had plunged to 15% “of budget” at the start of the lockdown, but were currently at 80%.

- Tightened underwriting — and in particular, rejecting self-employed applicants — has improved credit quality.

- SUS said:

“Higher proportions of our new customers appear in our top credit tier… Of the 4,463 new loans written in the second quarter, 98.8% made their first due payment; pre Covid-19 that figure was 97.3%.”

- With a higher quality of customer, perhaps profit can recover to pre-Covid levels without the number of new loans issued recovering to pre-Covid levels.

- SUS hinted at further opportunities to recruit ‘near-prime’ borrowers:

“What we can predict is that, echoing the financial crisis of a decade ago, new business opportunities will emerge to attract near prime customers who have been refused credit by credit systems within the mainstream banks.”

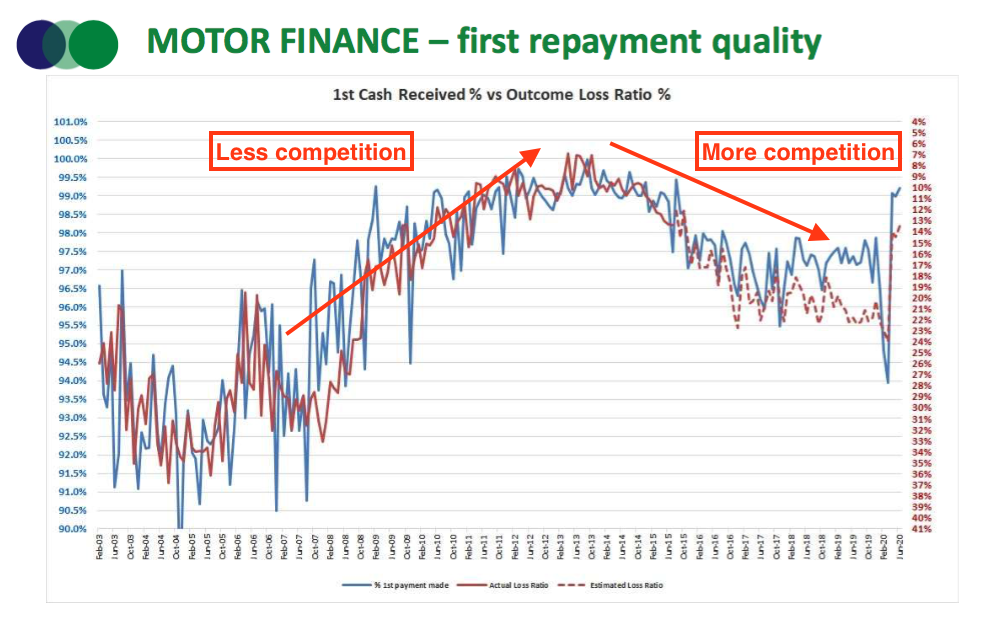

- Management highlighted the following slide within the webinar:

- The blue line (left axis) reflects the percentage of customers making their first payment on time.

- Management mentioned during the webinar that the improvement from 2007 to 2012 was due to the banking crash causing rivals to withdraw from the sector.

- During that time SUS therefore faced less competition for its target ‘near-prime’ customer.

- Competition then returned, and the credit quality (blue line) had softened until much tighter underwriting was implemented a few months ago.

- The slide below prompted an industry anecdote during the webinar:

- SUS’s largest competitor apparently stopped lending entirely during March. Although this rival has resumed lending, it has “lost credibility with brokers”.

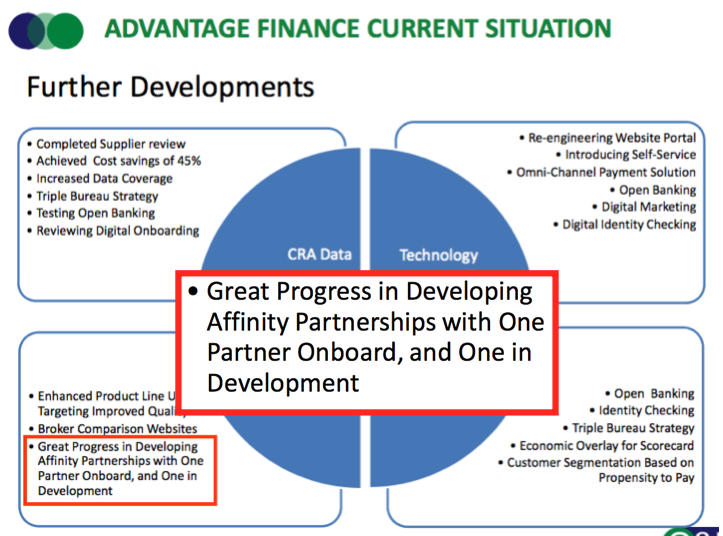

- This next slide also prompted a useful webinar insight:

- The affinity partnerships involve ‘prime’ lenders that will forward on their rejected applicants for SUS to evaluate.

- Management was “very excited” about the partnerships, not least because the leads would bring “higher quality business at a lower cost of acquisition”.

- The results statement described the partnerships as “very significant opportunities”:

“In the longer term, we see very significant opportunities, using our digital expertise, to attract new customers through new partner channels and to increase market share.”

- The implication — perhaps — is that the affinity deals will help that blue line in the earlier chart recover in a manner similar to that witnessed between 2007 and 2012.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Aspen Bridging

- Established three years ago, Aspen offers property bridging loans aimed at small/individual property developers with awkward financial circumstances.

- The average bridging loan to date has been c£450k with a monthly interest rate of approximately 1% and a typical term of 11 months. These case studies give a flavour of the borrowers involved.

- Despite the lockdown, Aspen managed to lend £11.3m through 25 new loans during this H1. The comparable half saw £16.6m lent through 42 new loans.

- The financial impact of the pandemic on Aspen contrasted to the impact on Advantage.

- While revenue dropped slightly and provisions increased significantly at Advantage, revenue dropped significantly (20%) while provisions actually reduced by £11k (to £307k) at Aspen:

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Property | |||||||

| Loan provision (£k) | 98 | 108 | 318 | 295 | 307 | ||

| Revenue (£k) | 1,190 | 1,653 | 2,073 | 2,401 | 1,640 | ||

| Average customer loans (£k) | 13,584 | 17,290 | 21,472 | 22,842 | 19,724 | ||

| Loan provision/Revenue (%) | 8.2 | 6.5 | 15.3 | 16.5 | 18.7 | ||

| Loan provision/Average customer loans (%) | 1.4 | 1.2 | 3.0 | 3.5 | 3.1 | ||

| Revenue/Average customer loans (%) | 17.5 | 19.1 | 19.3 | 21.0 | 16.6 | ||

| 'Risk-adjusted yield' (%) | 16.1 | 17.9 | 16.3 | 17.6 | 13.5 |

- A combination of fewer loans issued, a short loan duration and loans backed by property (and not used cars) presumably led to Aspen’s different outcome.

- However, the final profit outcome was not so different to that of Advantage. Aspen’s H1 profit dived 76%:

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Revenue (£k) | 1,190 | 1,653 | 2,073 | 2,401 | 1,640 | ||

| Pre-tax profit (£k) | 279 | 559 | 502 | 703 | 118 |

- At the July half year, Aspen carried 41 outstanding loans that totalled £18.5m with an average size of £451k.

- Aspen’s loan book may well have increased following a bumper August.

- Management revealed August had been a “record month for both new loans and repayments” as the subsidiary benefited from a revived property market following stamp-duty changes.

Financials

“The current year should also witness positive working-capital movements that lead to favourable cash generation, given few new loans are being issued but collections continue to come in.

Net debt should therefore reduce.”

- Sure enough, cash generation was indeed favourable and net debt did indeed reduce.

- Operating cash flow for the six months was a sizeable £21m:

| H1 2019 | H2 2019 | H1 2020 | H2 2020 | H1 2021 | |||

| Operating profit (£k) | 18,813 | 20,288 | 19,410 | 20,574 | 8,298 | ||

| Working-capital movement (£k) | (21,056) | 2,015 | (20,717) | (3,350) | 18,804 | ||

| Other cash-flow movements (£k) | (4,649) | (4,881) | (5,234) | (5,737) | (6,183) | ||

| Operating cash flow (£k) | (6,892) | 17,422 | (6,541) | 11,487 | 20,919 |

- This £21m funded dividends of £10m and reduced borrowings by another £10m.

- Net debt at the half year was £108m, which compared to a total loan book of £282m.

- Interest charged during the six months was £2m, implying SUS’s own borrowings incur interest at less than 4%.

- The H1 interest payments were covered a very reasonable 10x by operating cash flow.

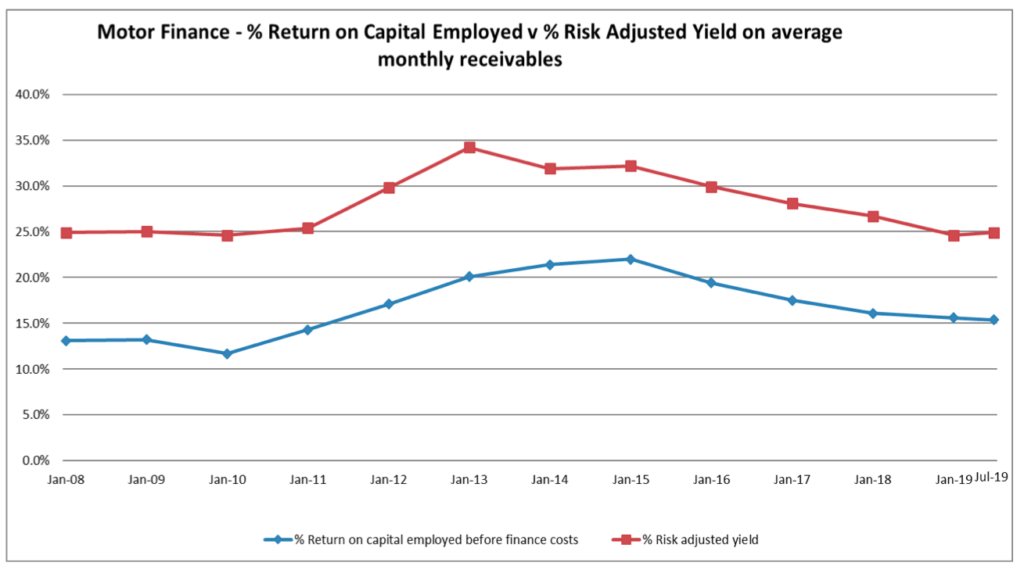

- Notable omissions from this H1 statement were references to return on capital employed (ROCE) and risk-adjusted yield.

- This time last year SUS’s results powerpoint contained this slide:

- No such slide was presented this time.

- No mention of ROCE or risk-adjusted yield were included in the results RNS either. I suppose the levels of both ratios are not too relevant at present.

- However, how the ratios perform from here will be very relevant to shareholders. Improvements ought to lead to healthier earnings and perhaps a higher share price.

- Management was very cagey about the prospects for ROCE during the webinar.

- Management said ROCE for Advantage ought to return to the pre-Covid 15%-plus level “over the longer term”.

- The webinar caution suggests further pandemic-related write-offs and/or issues may still emerge.

- Returning to pre-Covid levels of profitability could therefore take some time.

Valuation

- Management’s webinar remarks about a full-year dividend of between 80p and 100p per share may give some indication of near-term earnings.

- Past results indicate the group has aimed for dividend cover of 2x.

- Assuming no further Covid write-offs and/or wider loan-book troubles, perhaps earnings of 80p * 2 = 160p could be achieved during the next year or so.

- A £17 share price could therefore be valued on an 11x multiple.

- Add the net debt of £108m to the £206m market cap, and the £26 per share enterprise value equates to 16 times the 160p per share earnings guess.

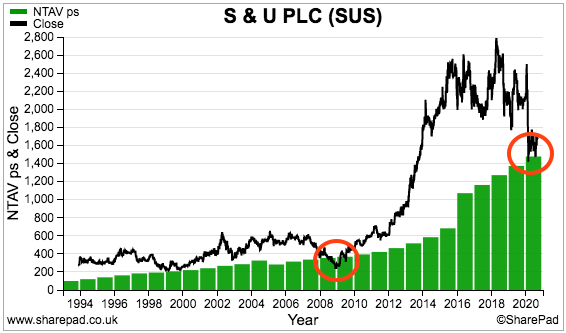

- The latest balance sheet carried net assets of £174m or £14 per share.

- Up until the pandemic, the shares had not traded so close to book value since the banking crash:

- In contrast, the shares traded at £26 — equivalent then to more than 2x book value — for brief periods during 2016 and 2018.

- A return to pre-Covid levels of profitability, ROCE and growth may well see the shares return to £26.

- The £17 share price will compound annually at a useful 15% if £26 is reached within three years.

- Assume management does indeed declare a dividend of between 80p and 100p this year, and maintains such a payment…

- … the three-year compound growth return would rise to almost 19% if £26 is re-attained.

- Assume the recovery to £26 takes four years, and the prospective rate of return (with possible dividends) reduces to 14% per annum.

- Assume five years, and the prospective rate of return (with possible dividends) reduces to 12% per annum.

- Supporting the £26 optimism is the potential to repeat the growth that occurred following the banking crash.

- Both market share and lending quality could once again improve as the competition falters during the current downturn.

- Crucially, recent collection levels seem respectable and go some way to support the prospects of a revival.

- Aspen may become a more significant part of SUS during the next few years, too.

- Perhaps most importantly, management and its connected parties control at least 50% of the company and therefore have up to £100m to lose if the business hits real trouble.

- The 2020 annual report (point 7) reminded shareholders of the long-term benefit of these owner-managers:

“Our over-arching factor in the success of our business over 80 years and through three family generations of management is our business philosophy. The identity of interest between management and shareholders has fused our ambition for growth with a conservative approach to both credit quality and funding.”

- On the downside, nobody knows how long the pandemic will last and how bad the economic disruption will become.

- The extra £13.8m write-offs could be just the beginning, and a return to £26 may well be a pipedream.

- In the meantime, management’s predicted 80p to 100p per share dividend supports a minimum yield of 4.7% at £17 a share.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

S&U (SUS)

Portfolio trading

I should disclose that after these results, I increased my SUS holding by 20% at £17.20 including all costs.

Maynard

S & U (SUS)

Q3 Trading Statement published 09 December 2020

A satisfactory update in the circumstances. Here is the full text interspersed with my comments:

——————————————————————————————————————

S&U, the specialist motor finance and property bridging lender, announces its trading update for the period from the 1st August 2020 to the 8th December 2020. This period has seen a rebound in Group trading and profitability, despite a slowdown in November resulting from the renewed Covid-19 lockdown and uncertainties relating to its planned aftermath. We have continued to focus on quality at both Advantage and Aspen and demand for motor and bridging loans over the period has been healthy.

The business is resilient and financially strong and, notwithstanding constantly changing Government guidance on Covid-19 restrictions, we are confident of a resumption of our usual rates of growth in the first half of next year.

MOTOR FINANCE

The demand for good quality used cars and their auction values has recovered well during the period. Overall used car transactions rose by 4.4% in the UK in the third quarter, at 2,160,000 vehicles. Indeed, recent FLA figures showed the strongest used car price growth in a decade. At Advantage, our motor finance subsidiary, this was reflected in an improved rate of transactions in the period. However, Advantage’s temporary withdrawal from the self-employed and lower tier sectors of the market, means that despite the recent market improvement, current net receivables are at £253 million (£280 million: 2019) and current live customer numbers are at 63,000, slightly less than last year’s 63,500.

Undoubtedly the Covid-19 epidemic is prompting an unease about public transport and a general desire for the security and convenience of a wholly-owned (and unshared) vehicle. Further, considerations of value in uncertain times favour the smaller used car sector in which Advantage specialises.

These trends have been reflected in Advantage’s robust receivables quality. Despite imposition by the Financial Conduct Authority of further and extended customer repayment “holidays” in the period, monthly collections remain within 7% of last year’s and are improving as customers return to normal payment. Thus, the third quarter saw collection rates at 87.5% of due (2019: 94%) against 74.1% in the second quarter. Whilst 12,900 customers were still on payment “holiday” at the end of July, this has fallen to below 5,000 currently. New customer quality and early repayments are performing very well.

Advantage are using the Covid-19 hiatus to prepare for recovery and to embed long term operational improvements. Current examples include developing affinity partnerships, still closer systems integration with our introducer partners to improve transaction rates, and further customer service and affordability analysis which will drive Advantage’s already excellent Trustpilot customer satisfaction ratings even higher.

——————————————————————————————————————

For comparison, the interim results said collections were 85% at the end of July, (now 87.5%), ‘holiday’ customers were less than 6,500 at the end of September (now <5,000), net receivables were £264m at the end of July (now £253m) and live accounts were 63,472 at the end of July (now 63,000).

The collections rate increasing slightly and ‘holiday’ customers decreasing slightly is positive news — ensuring loans are repaid is vital for SUS at the moment. But the numbers are far from signalling a complete rebound.

No surprise to learn net receivables and live accounts both reducing slightly, as S&U refrains from lending as much to the self-employed.

The operational improvements mentioned are welcome. The affinity partnerships in particular should provide more application leads, as the partners pass on prospects that did not match their prime-lending standards. These prospects may be better repayment bets in the current economy.

——————————————————————————————————————

Aspen Bridging Finance

Aspen Bridging has in the period achieved the landmark £100 million of lending since it was founded. Whilst prudently viewing the residential market with their customary caution, Aspen has seen transactions improve considerably over the period. Hence current net receivables stand at £29.6 million against just £18.5 million at half-year.

Loan quality has strengthened too. A sustained focus on overdue and extended customers has seen their number successfully reduce in the period, meaning that in the current live book only two accounts are just past due with no defaults remaining. This improvement in quality has seen an improvement in profitability and provides a firm base for future growth.

Funding

Significant cash generation at Advantage, offset by net investment in Aspen of £10.6 million since half year and payment to shareholders of our first interim dividend, means current Group borrowings are at £103 million against just £108 million in July. With Group facilities at over £130 million and gearing at only 58%, this gives S&U its habitually firm base for the accelerated growth we anticipate may be appropriate next year.

Outlook

Commenting on the Group’s performance and outlook, Anthony Coombs, S&U chairman, said:

“Despite the persistent drag anchor that is Covid-19 and the possibly inevitable zigzagging in Government policy to deal with it, S&U is in fine fettle. Aside from our traditional strengths – experience, conservative financial policies and sustainable growth – most of all I pay tribute to the dedication and sensible ambition of our people. To paraphrase Liverpool FC’s Jurgen Klopp, whatever Covid-19 brings “we deal with it, recover, prepare and go again”. Hence our great confidence in the future.”

——————————————————————————————————————

The line “for the accelerated growth we anticipate may be appropriate next year” is probably about as certain as management can be at present.

Much depends on future lockdowns and general employment prospects to ensure the collection rate continues to improve.

The FCA says payment holidays must end on 31 July 2021. I will be pleased if collections are back to ‘normal’ levels after that deadline.

Maynard

S & U (SUS)

Trading statement published 11 February 2021

The normally conservative chairman included some very promising adjectives within this update. For example:

“We are planning for a significant rebound…”

and

“…tremendous opportunity for growth…”

The commentary all points to a recovery sooner rather than later.

Here is the full text interspersed with my comments:

———————————————————————————————————–

S&U plc, the specialist motor finance and property bridging lender, today issues a trading update for the period f rom its trading statement of 9 December 2020 to the Group’s year end on 31 January 2021. The Group’s full year results will be announced on 30 March 2021.

The Group’s trading remains robust and profitable, despite the current lockdown and the induced coma into which the Government has needed to place the wider UK economy. Demand by customers in both divisions remains strong and collections quality continues to be good.

We are planning for a significant rebound to pre-Covid motor finance transaction levels as lockdown restrictions ease this year, and a substantial increase in business at Aspen our property bridging business.

Motor Finance

Transaction numbers at Advantage have held up well over the period and, despite the closure of a number of car showrooms, continue to improve. In the past 2 months new deal transactions have reached nearly 80% of the comparable period last year and rising. Record application numbers continue , although Advantage’s prudently responsible underwriting and affordability requirements have seen new deal transactions for the year as a whole total around 15,600 with customer numbers at year end of just under 63,000 and net receivables of around £247m.

———————————————————————————————————–

New deal transactions of 15,600 compares with 7,811 for H1, so a similar 7,789 during H2.

For context, new loans during 2020 were 23,334 with 11,269 during H2 2020. Therefore new loans for H2 2021 represented 69% of loans issued during H2 2020. As such, SUS stating the last two months (December 2020 and January 2021) witnessing new loans run at 80% of H2 2020 does indeed signal an improving trend.

Net receivables at £247m have slipped from £263m at the preceding H1 — i.e. £16m less. No mention of extra Covid write-offs, which hopefully is because no extra write-offs have been required. Such confirmation would have been useful.

63,000 customers owing £247m is £3,921 per customer at the 2021 year-end, versus £4,151 at the preceding H1 and £4,371 at the 2020 year-end. Again, difficult to read too much into this as a reduced average loan balance is to be expected if customers are repaying their loans and fewer new loans are being issued.

Talk of “record application numbers” is encouraging, showing demand for second-hand car finance has not dried up just yet.

———————————————————————————————————–

Advantage’s industry leading customer analysis and an evolving product range present tremendous opportunity for growth throughout the non-prime finance spectrum, despite the more competitive environment.

Repayment quality remains good; Advantage’s collections department ha s always been proud of the sustainable relationships it develops with customers. Thus, the number of customers remaining on payment holiday has reduced from 15,000 at the peak to below 4,000. These relationships are also reflected in their payment performance, and in January monthly collections improved to 90% of contractual terms due.

More important, despite an increase in Covid cases in the first half of the period under review Advantage is keeping staff safe. Moreover, our continuous drive for improvement has seen the launch of initiatives on affiliate introducers, product development and customer service – the latter reflected in Advantage’s latest Trustpilot consumer ratings of 4.8 out of 5.0.

———————————————————————————————————–

December’s update said the Q3 collection rate was 87.5% and an improvement to 90% for January is encouraging. SUS’s H1 results implied 94% was the normal collection target, and given the payment holidays, 90% feels promising.

FCA guidance reiterated in January said borrowers have up to 31 March 2021 to apply for a payment holiday and all payment holidays will end on 31 July 2021.

———————————————————————————————————–

Aspen Bridging

Aspen continues to make great progress both in terms of growth and quality. In a resilient residential housing market, (Zoopla’s UK house price index recently reported year on year growth of 5.9%), Aspen has seen net receivables rise from £29.6m to around £34m in the period. During this time, new transactions have consistently beaten budget, and Aspen’s deal pipeline has more than doubled.

Experience, market credibility and sensible underwriting have seen credit quality at its best ever, with only three of over sixty customers slightly beyond term at year end. These promising trends have justified a further £4m investment in Aspen over the past two months, and the recruitment of experienced new staff in business development and underwriting.

———————————————————————————————————–

All very positive, especially “credit quality at its best ever”.

———————————————————————————————————–

Funding

S&U’s financial position has been strengthened still further as borrowings have fallen to £99 m from £103m. Gearing now stands at approximately 55% from 58%. This reflects continued and seasonal cash generation at Advantage, offset by additional investment in Aspen. £130m of Group facilities provide significant headroom for growth.

Dividend

Despite the inevitable effect of Covid-19 on S&U’s profitability, our confidence in future trading, our financial strength and consistent commitment to shareholder reward justify a second interim dividend this year of 25p per ordinary share (2020: 36p). This will be paid on 12th March 2021 to those shareholders on the register on the 19th February 2021.

Commenting on the Group’s performance and outlook, Anthony Coombs, S&U Chairman, said :

“Although the return to economic and general health in the UK will be uneven, the outlook is undoubtedly brightening. The proven strength and experience of S&U, exemplified by our loyal and dedicated staff, make me confident that we can grasp the tremendous opportunities economic revival will bring.”

———————————————————————————————————–

The preceding H1 dividend was reduced by 35% from 34p to 22p, and this second interim payment has been reduced by 31% from 36p to 25p. Management has been hopeful of an 80p-100p dividend for the full year, which would now suggest a final payment of between 33p and 53p.

The 2020 final payment was 50p, and a 30% reduction would give 35p, so giving a 22p+25p+35p = 82p annual payout.

All told, a favourable statement given the circumstances. While the forthcoming results ought to shed light on any further Covid write-offs and the latest collection rate, management’s optimistic tone indicates the company is now looking beyond the pandemic.

Maynard