27 August 2019

By Maynard Paton

Results summary for Mincon (MCON):

- Mixed progress, with little underlying revenue growth and profit down 14% due to a “softening market”.

- Earnings were bolstered by the remarkable €8m disposal of a subsidiary purchased 15 months earlier for effectively €1m.

- New ‘challenger’ plan of selling direct to customers appears to have started well with two new contracts won.

- Financials could be improved after accounts show modest margins, notable write-offs and significant working-capital investment.

- The underlying P/E of 20 is not a bargain. I continue to hold.

Contents

- Event link and share data

- Why I own MCON

- Results summary

- Revenue, profit and dividend

- Challenger brand

- Exceptional costs and working capital

- Capital expenditure, cash and debt

- Valuation

Event link and share data

Event: Interim results for the six months to 30 June 2019 published 12 August 2019

Price: 105p

Shares in issue: 210,973,102

Market capitalisation: £222m

Why I own MCON

- Designs and manufactures industrial drill bits, with sales supported by established reputation, quality engineering, product patents and technical services

- Boasts veteran family management with 42-year tenure, 57%/£126m shareholding and long-term perspective

- Pursuing new ‘challenger’ approach that could generate notable contracts, enhance margins and extend the company’s competitive advantage

Further reading: My MCON Buy report | All my MCON posts | MCON website

Results summary:

Revenue, profit and dividend

- Both the 2018 statement published in March and April’s first-quarter update had already suggested MCON would report subdued progress.

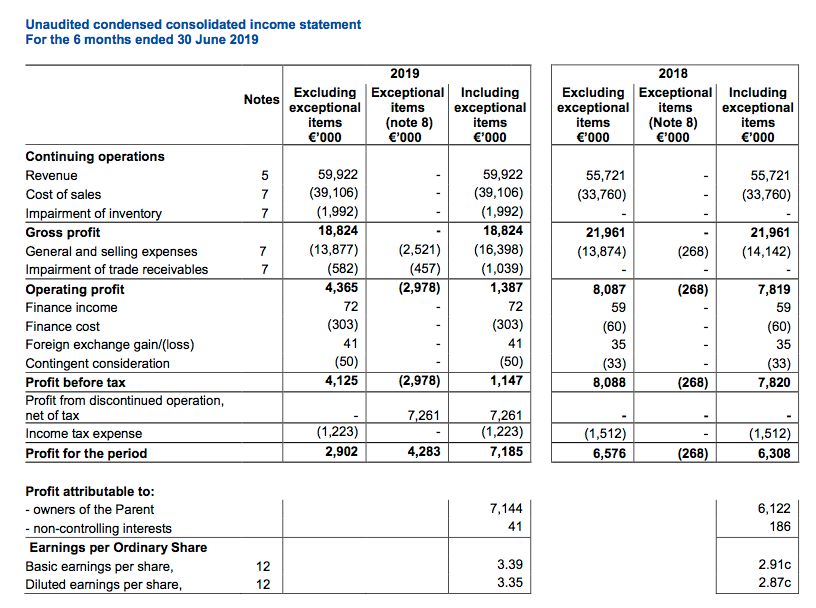

- In the event, total revenue gained 8% while operating profit before exceptional items slid 14%.

- The purchase of Driconeq — a Swedish drill-pipe specialist — during the first half of 2018 made MCON’s underlying growth harder to determine.

- At the time of the Driconeq acquisition, MCON suggested Driconeq would improve group revenue to a run rate of €120m.

- Doubling up the €60m revenue witnessed during this first half gives a run rate of €120m — suggesting the group has not experienced significant underlying sales growth during the last 15 or so months.

- A “backdrop of a softening market” due in part to “competitor [pricing] behaviour” was cited for the mixed performance. MCON had admitted in March that trading was “fitful and flat”.

- Total first-half earnings were bolstered by the somewhat remarkable disposal of a Swedish heat-treatment subsidiary.

- The subsidiary was originally part of Driconeq, which was acquired for a total of €8m last year.

- And yet this Driconeq heat-treatment subsidiary has been sold for €8m to bank an accounting profit of €7m.

- From what I can tell, MCON effectively acquired the bulk of Driconeq — with perhaps sales of close to €20m — for next to nothing.

- The half-year dividend was maintained at €0.0105 per share.

Challenger brand

- March’s annual results were the first to mention MCON’s “challenger brand” strategy of supplying drills and bits directly to end customers.

- This RNS contained more strategic details. MCON explained:

“One of the benefits of the acquisition of Driconeq is that we are now in a position to give mines a full consumables offering. As a result of this range improvement and the offering of a full customer service, we are being considered for inclusion among those suppliers who have the resources to handle larger contracts, dealing directly with mines.”

- The early signs appear promising:

“This [challenger] approach is winning us business… We have recently won, and have started billing, two multi-million-dollar contracts, where we have replaced the market leaders”.

- I suspect the challenger brand strategy commenced well before March’s results mentioned the plan. These results said (my bold):

“The lead time is substantial for these [new] contracts due to the tendering processes that accompany them, the transition period required by a change in suppliers, and the need for delivery assurance by the end customer.”

- A “substantial” lead time suggests the contract tenders commenced at least a year ago.

- These results also said (my bold):

“We are also finding that large contracts can create a substantial cash requirement to support them. This can arise through the provision of cash collateralised performance guarantees, the requirements of inventory reservoirs proximate to the customer, the capital equipment to support service delivery…”

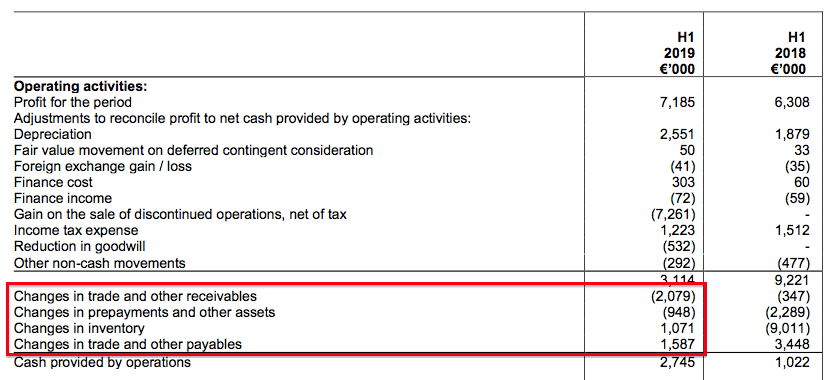

- Ah ha — a “substantial cash requirement” may well explain last year’s sizeable working-capital investment.

- MCON claims the required investment to deliver the new contracts should create a competitive advantage (my bold):

“The ability of the Group to support these multi-million-dollar trading relationships, provide these performance guarantees, and deliver the required working capital investment enables us to overcome what, for other companies, is a very substantial barrier to entry to this business segment.”

- I can only hope the early new contracts can justify the working-capital investment. Stock levels for instance remain at €50m — equivalent to a huge 40% or so of revenue.

- At least selling direct to the end customer ought to improve MCON’s margins — the group should soon start to capture some of the income and profit enjoyed by the intermediary distributors.

- Another advantage of selling direct should be a greater understanding of customer requirements and determining what products the end users actually want.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Exceptional costs and working capital

- The adoption of the challenger strategy necessitated various reorganisation costs and write-offs that totalled €5.5m during this H1.

- 10% of the workforce has been made redundant, which should assist margins during the second half. The first-half operating margin (before the various one-off items) was a modest 12%.

- Write-offs included trade receivables of €1m. I have previously felt MCON could do with asking its customers to pay a little quicker (point 14). Some customers were clearly not going to pay at all.

- Write-offs also included stock of €2m. The results narrative suggested further stock write-offs could occur (my bold):

“A team of experienced senior executives has been charged with working through the inventories in order to simplify the product range to concentrate on fewer variations of our products. This team will also consider write-offs, the disposal of excess product and work-in-progress and review our ranges and markets to make sure we allocate the production to where we have the best manufacturing advantage. Part of this ongoing process will be to identify the markets where we can make the best, sustainable, margins.”

- As mentioned above, stock levels remain huge at €50m.

- MCON had suggested in March that stock levels could be reduced by €10m during 2019:

“In the coming year we intend to realise all of the €2.3 million tied up in rigs, to reduce raw material inventory by approximately €4 million, and depending on the sales level, reduce the work in progress and finished goods inventory by, perhaps €4 million. We will review this plan through the year as we unwind the working capital.”

- The company has now decided to drop the €10m projected reduction, and instead has defined releasing cash from stock as a “particular objective”:

“The nadir in cash has been passed, cash generation is well in hand for the rest of the year, with a particular objective of releasing cash from inventory.”

- The cash flow statement still showed an aggregate working-capital outflow — albeit the €0.4m invested was the lowest first-half amount absorbed by working capital since 2013:

Capital expenditure, cash and debt

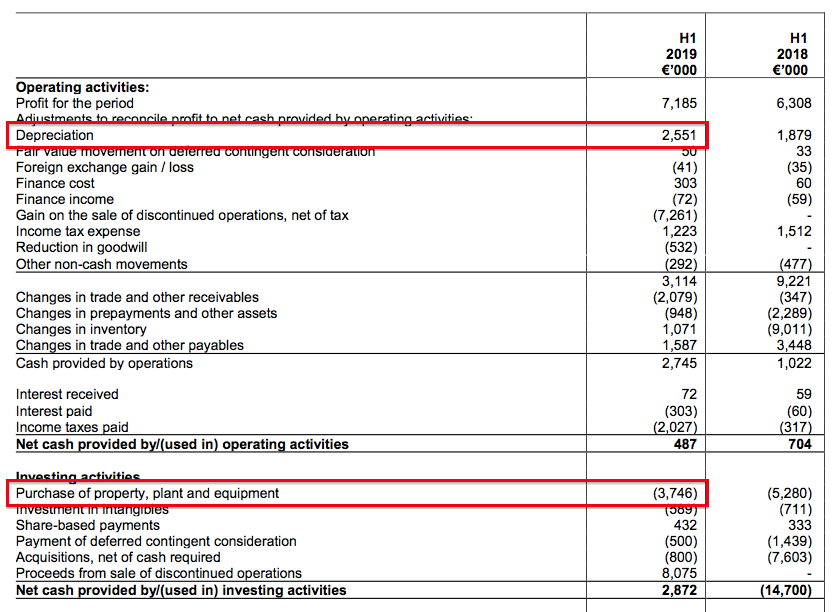

- I did not really understand this paragraph (my bold):

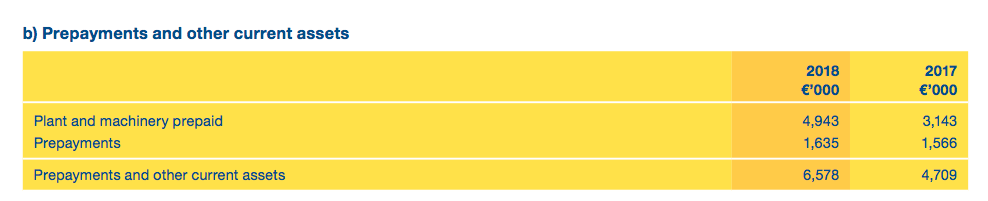

“We have absorbed €3.75 million in capital expenditure in the first half, for commitments made in previous periods, and depreciation in the period was €2.6 million, an increase over the prior year of €0.7m. Capital expenditure is held in prepayments as it is incurred, and prior to the plant and facilities being commissioned, so while the capital expenditure for the year will be significantly above depreciation, little of this will be actual cash outflow in the period.”

- I am not clear why capex “held in prepayments” apparently does not affect the “actual cash outflow”. Surely capex money spent is always cash out of the door, irrespective of whether the payment is then accounted for as a prepayment rather than as actual property, plant or equipment.

- The cash flow statement simply indicates depreciation of €2.6m and capex of €3.75m:

- The 2018 annual report revealed capex prepayments of €5m:

- A further €0.6m was spent developing the ‘Greenhammer’ project — a “hydraulic hammer system designed to deliver a substantial commercial advantage to customers facing hard rock and high-altitude conditions”.

- March’s full-year results had suggested Greenhammer’s key attraction related more to fuel savings than geological or altitude issues:

“[Greenhammer] is a disruptive technology, offering tremendous savings in fuel… and there is growing interest from other potential customers with the problems that this technology can address, such as hard rock, and high-altitude drilling.”

- Total Greenhammer expenditure now totals €4m — of which every cent has been capitalised on the balance sheet and nothing expensed against profit.

- The product is now “in the final stage of commercial development”.

- The capex, the Greenhammer expense, the redundancy/write-off costs, some catch-up tax payments and a small acquisition left cash flow at a negative €5m. The 2018 final dividend cost a further €2m.

- Balancing the books was the aforementioned €8m disposal, which left net cash €1m higher at €2m.

- Account for the €6m earmarked for possible acquisition earn-outs, and arguably MCON operates with net debt of €4m.

- Finance costs surged from €60k to €303k during the half as:

- debt increased by €5m to €12m;

- the new loans were denominated in overseas currencies at higher rates, and;

- lease costs are now classified within finance expenses.

- The greater finance costs can no longer be ignored for valuation purposes. After interest received, net finance costs are running close to €0.5m.

- MCON carries no final-salary pension obligations.

Valuation

- MCON did not suggest trading would improve markedly this year. The most optimistic comment was:

“We aim to return to growth as the new contracts come on stream through the second half.”

- Further contracts may not be forthcoming in the very near term (my bold):

“We are tendering for more substantial multi-million-dollar contracts. However, we have to win these from the market leaders, not our former peer group, so it will take time and investment to build that portfolio.”

- The shares retain a premium rating despite the mixed growth progress, the change of strategy and the significant investments that continue to restrict cash flow.

- Excluding restructuring and write-offs, MCON’s produced a €15.2m operating profit for the twelve months to June 2019.

- After finance costs of €0.5m and tax applied at MCON’s predicted 19%, earnings come to £11.3m or 5.4p per share with £1 buying €1.09.

- The 105p offer price values the business at almost 20x my earnings estimate.

- I can only presume the prospect of MCON winning higher-margin, long-term supply contracts — helped no doubt by the group’s apparent product leadership — has kept the share price so elevated.

- I am hopeful MCON can succeed. The new challenger approach appears sensible and remarks within the annual report reveal a healthy level of development ‘paranoia’ (point 1):

“If we do not work to make our current range of products redundant by developing new, better products, we can rely on our competitors to do this.”

- The trailing €0.021 per share dividend equates to 1.79p per share and supplies a 1.8% yield (before Irish withholding taxes for UK-resident investors).

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Disclosure: Maynard owns shares in Mincon.

Mincon (MCON)

Interim trading update published 31st October 2019

This update was not great for two reasons — i) the remarks implied a weak Q3, and; ii) the text was not concise. Instead, the text was verbose, not clear, contained the odd ominous remark without explanation and sometimes contradictory. MCON’s commentary could really do with an editor.

Here is the full text interspersed with my comments:

————————————————————————————————————————

Mincon Group plc (ESM:MIO AIM:MCON), the Irish engineering group specialising in the design, manufacture, sale and servicing of rock drilling tools and associated products, today provides an interim trading update for the period from 1st January, 2019 to date, incorporating the first nine months of trading to 30th September, 2019.

This was the weakest quarter of the year, and a considerable step down from the same record quarter last year when we cleared the final backlog in orders. While this was a disappointment, the stance we took in reducing overheads in H1, fed through into Q3, and we believe we are beginning to see the recovery in profits and cash.

Key elements (comparison of the first nine months of 2019 to 2018):

Revenue flat for the first nine months

* Mincon product sales decreased by 3%, of which;

* HardTekno disposal accounted for c. 1%

* Premier disposal accounted for c. 3%

* The acquisition of Pacific Bit of Canada added 1% to Mincon product sales

* Third party product sales, excluding rig sales was up 5%

Excluding write-off’s and exceptional items reported at H1 2019;

* Gross margin down 3% to 35%

* Operating profit down 3% to 11%

* Profit before tax down 2% to 11%

Including write-off’s and exceptional items reported at H1 2019, profit before tax was down 0.5%.

————————————————————————————————————————

MCON’s actual Q3 numbers can’t be derived from the bullet points above.

One sign of a weak Q3 was revenue being flat for the first nine months of the year. The H1 results reviewed in the blog post above said H1 revenue had gained 8%.

MCON’s profit updates -— e.g. “Operating profit down 3% to 11%” — confusingly refer to margins.

Operating margin declining from 14% to 11% on flat revenue implies operating profit dropped 21%. H1 operating profit (before exceptionals) fell 14% according to my sums in the blog post above.

“Including write-off’s and exceptional items reported at H1 2019, profit before tax was down 0.5%” —- reads as if profit before tax was down 0.5%, but does that 0.5% refer to margin as per the other bullet points? It might mean actual profit down 0.5% after including a €7m exceptional gain from H1.

And write-offs does not need an apostrophe.

————————————————————————————————————————

This has been a challenging year to date and we have had many issues to address;

* Inability to supply consistent quality due to continued use of out-sourced heat treatment suppliers

* some regional weakness and poor regulatory behaviours in Africa

* some increased competition, and distributor weakness

and some costs incurred as we opened new markets like Russia, or new product release delays as older inventory is run-off.

————————————————————————————————————————

On heat treatment, the 2018 results had said:

“The heat treatment plants, exceeding some €5 million in total investment were commissioned over the year end period and they should facilitate the delivery of consistent quality in our products across our key factories…”

So the consistent quality has yet to emerge. MCON sold a heat-treatment business during H1.

“Poor regulatory behaviours” sounds ominous.

————————————————————————————————————————

From early in 2019, we have been unwinding our historical sales and distribution structure in favour of a regional, high-service structure that we have seen is now winning contracts. This process is now substantially complete, and we have appointed a good team to lead these regions. We have returned to positive cash generation as working capital stabilises, depreciation is half capital expenditure, and profitability drops through.

Our advantage is to be faster moving, flexible, and responsive, with better engineering delivered by a higher level of support service to customers. Promoting this approach, with better engineering solutions, has won us several large contracts in recent months, and we should see revenues from these recently won contracts flow through in the final quarter of 2019 and beyond.

————————————————————————————————————————

Good to see the new structure winning contracts and the return of positive cash generation as working capital stabilises. Working-capital movements have been significant in the past, particularly with very substantial stock build ups.

“depreciation is half capital expenditure” —- this line contradicts subsequent remarks (see below).

————————————————————————————————————————

Along with the flat sales, we had ramped up costs to support sales levels that have, as yet, not delivered. We decided to reduce overheads at the same time as the change in business model, and while this has been expensive and time consuming, it was necessary and has been implemented. We also cut back the direct labour in the factories as the new revenue level stabilised at or around the level of last year.

The capital expenditure approved in the last year has been at about €2 million, about half the rate of depreciation, and outside of requirements in GeoTech, should we decide to take production in-house, may run at that level for the coming periods. ————————————————————————————————————————

“about half the rate of depreciation” —- I think this is correct, and not depreciation is half capex.

————————————————————————————————————————

Revenue

Revenue is flat on last year at this period, at just over €86 million, with the small acquisitions being compensated for by the small disposals. Profitability is at or around the same levels as 2018, with some reduction in the quality of those profits due to the amount of corporate reorganization and activity. This is disappointing, and since we are geared for higher turnover, when this does not materialize it has a significant effect on our margins, which were softer than at the end of H1.

————————————————————————————————————————

Ah —- revenue of €86m implies Q3 revenue of €26m. Quarterly revenue during H1 averaged €30m and during the preceding H2 averaged €31m. So, yes, a weak Q3.

“Profitability is at or around the same levels as 2018” is correct if the exceptional €7m gain from the H1 heat-treatment disposal is included.

————————————————————————————————————————

By the same token, when sales grow, the improvement in margins should also be significant. It should be recalled that the 2018 revenue contained millions of euro of backlogged revenue, while 2019 has a normal four week manufacturing cycle. 2018 was a cycle of forcing revenue through the factories, while 2019 and beyond will be about efficiency at these current levels.

As a Group, we stepped up our fixed costs base for higher anticipated revenue levels and when these sales were not achieved, we moved to reduce the overheads. The disequilibrium occurred in the last two quarters, with Q3 being notably weak, but we managed significant cost cuts while absorbing the disruption and costs.

We have now completed the cost reduction programme and paid for any significant cost cutting, and we look forward to improved margins in Q4 and beyond, while noting that this is directly a function of the sales volumes achieved. We will of course, continue to redeploy the investment and overheads of the Group where they can deliver better value and reward, but that is part of the ongoing costs programmes.

————————————————————————————————————————

A rather long-winded way of saying costs have been cut and margins may now improve if sales improve.

————————————————————————————————————————

We restructured the organisation of the Group as a core element of the refocus. We have divided the Group into the four regions, Americas, Australia Pacific, Europe/Middle East and Africa, and internally appointed new managers to the latter two regions. Africa had fallen back considerably and has required reinvigoration and relaunch. This is well in hand, as is the development of our Black Empowerment planning in the South African market. We believe this is key to success in Africa, equitable treatment of staff, honest behaviour with the state and regulatory authorities, and a long-term view of our commitments in the region.

Europe remains successful and continues to develop. The revenue from the Americas has grown significantly with new contract wins, and Australia is a key region both for the Greenhammer launch in the coming months, and the commissioning of its heat treatment investment to support regional supply.

————————————————————————————————————————

Seems ok to me.

————————————————————————————————————————

The hydraulic hammer range

We have recently completed extended testing over a fifteen day period and drilled sustained meters over several shifts as part of that programme. We set out to test different variations of the hammer system to determine the best combination of parts to ensure drilling speed and reliability. Of the different systems tested, incorporating the drill strings, hydraulic management systems and bits, one particular configuration performed very well, beyond any engineered or forecast level which bodes well for the future of this product.

This latter set up and model has become the selected hammer product at the core of the system and, all other elements remaining equal, will form the launch model. This launch is expected in the coming months, perhaps commencing to invoice in the last quarter of 2019, but certainly in Q1, 2020. The designs and the delivery system appear robust after the recent testing, and the new designs of bits have also functioned well within specification.

————————————————————————————————————————

I am hopeful the new hammer will sell well after seven years in development/testing and €4m capitalised onto the balance sheet.

————————————————————————————————————————

Margins

The gross margin continues to run at about three per cent lower than last year, with approximately half of this due to product mix changes, and with the balance due to loss of contracts we could not supply, and some softness in the mid-range hammer and bit sizes arising from that. This has tracked through to the operating margin line in Q3.

With the exceptional gains and write-offs this is not immediately visible in the financial statements, nor will it be at the year-end, due to, inter alia, to the requirements of the accounting standards, so we intend to expand our comment accordingly at that time, as we did at the half year.

We expect the distortions caused by the reorganization activity to fall away in Q4, and with the lower cost base, the gross and operating margins should begin to normalise again.

Driconeq has been a very successful addition to the Group, though with large turnover and relatively small margins thereby contributing to the downward change on margins, as has the disposal of HardTekno, a small but higher margin company that did not fit with our wider group strategy. The margins on the core products appear intact, in the face of increased competition by competent Indian and Chinese suppliers, particularly in Africa where price sensitivity is higher and quality expectations of products are lower. African markets are currently in rapid evolution and we are taking proactive steps to adapt our strategy there. ————————————————————————————————————————

I look forward to the expanded commentary at the full-year stage to help interpret the results.

————————————————————————————————————————

Balance sheet

As expected, the Group has returned to positive cash generation in the quarter, and this is expected to continue in the coming trading periods. We have reduced overheads, completed the factory extensions a year ago, and as the new heat treatment plant is commissioned in Australia, the last set of historic capital expenditure decisions has now been concluded. The quality of what is being produced in the new furnaces across the Group is improving to the new standards required, and now represents our brand consistently.

This will leave the Group in a strong production shape overall, and the exceptional gains we have made on non-core disposals have accommodated write-offs and provisioning so that assets in the balance sheet are of good quality, current, and realisable over time. We are now able to work on switching production around the factories for comparative manufacturing advantage.

For us, this does not necessarily mean that we will be the lowest cost producer necessarily, but we can provide customers with production and service from a location that best assists their operations. In some cases, the cost of production might be higher where we choose to make product, but the cost of transport is lower, and the speed to market and flexibility of design modification is higher.

We have worked hard over recent years to minimize the volatility of our foreign exchange exposure, and where we have acquired machinery, we have leased much of it in the region in which the manufacturing is occurring, and where the local profitability supports the lending. That means our free cash will reside at Group for acquisitions should we see valuable opportunity, for dividends, and for other investment. Cash flow is positive and is expected to remain that way for the foreseeable future.

————————————————————————————————————————

“Cash flow is positive and is expected to remain that way for the foreseeable future” is an important line. MCON’s cash flow has been very haphazard in recent years due mostly to huge working-capital movements. I look forward to seeing an improvement.

————————————————————————————————————————

Market comment and position

The Regional leadership structure has been put in place with experienced well-qualified managers, and we are winning significant contracts, for mining, mining services, and in the GeoTech space, which we have entered in the last two years. We continue to build out our capability in that GeoTech sub-sector with the intention of driving growth and profitability. Our experience is that the profitability there should, when we have established our market position, support the same margins as we have seen in the mining sector. Much of our GeoTech sales are being manufactured outside the Group, but we can manufacture ourselves over time, and we are considering our options in that regard.

At present we manufacture most of what we sell in the mining consumables space, hammers, bits, pipes, subs and so on, and in GeoTech much of what we buy-in, fits inside our capability today, with the added advantage that we do most of our own heat treatment for items at the upper end of value add. Capital expenditure at present, after some years of build out, has fallen to half the depreciation rate, and is likely to remain there for a couple of years outside of decisions and opportunities in the GeoTech side.

Our factories are well equipped with modern kit and overall throughput is running at about 80% of the capacity we installed. As the larger contracts spool up to their full potential and exiting supplier inventory is run-off, we expect to be able to absorb the increased throughput efficiently. We are also now geared up for increased sales and revenue from the new hammer and bit ranges for 2020.

The response of every competitor in the mining consumables sector has been to increase production in response to market growth, and this has led on to price competition with any market set-back , or where routes to market are blocked, such as the ongoing issues between the USA and China, and supply is redirected. We offer a value proposition, better production for cost expended, and to work through this model to take market share means we aim to constantly improve our offering. Fuel efficiency has been a direction of the Group for years, and the next generation hammers and systems have this at the core.

————————————————————————————————————————

“we are winning significant contracts” — sounds promising.

“Capital expenditure at present, after some years of build out, has fallen to half the depreciation rate,” — so yes, capex is half of depreciation.

————————————————————————————————————————

Concluding comment

With zero net debt, free cash balances, positive cash flow, new ranges of hammers and a management group that is playing as a team, we continue to see contract wins and success in the sectors we address. The core products remain sound, well positioned and represent value for money in the eyes of our customers. The GeoTech and mining consumables and services wins in Chile, Indonesia, Chesapeake, USA, and Europe give us an indication that the way we are deploying our investments in time and resource will continue to develop and pay off for the Group. The next generation products coming through in down the hole mining, and in piling, give us a great platform for the coming years.

————————————————————————————————————————

Sounds upbeat, but the implied financials for Q3, taken alongside the preceding H1, are not great.

Fingers crossed revenue — and therefore profit — can improve as MCON becomes a more comprehensive manufacturer/supplier of parts and services to miners.

Maynard