***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

21 February 2026

By Maynard Paton

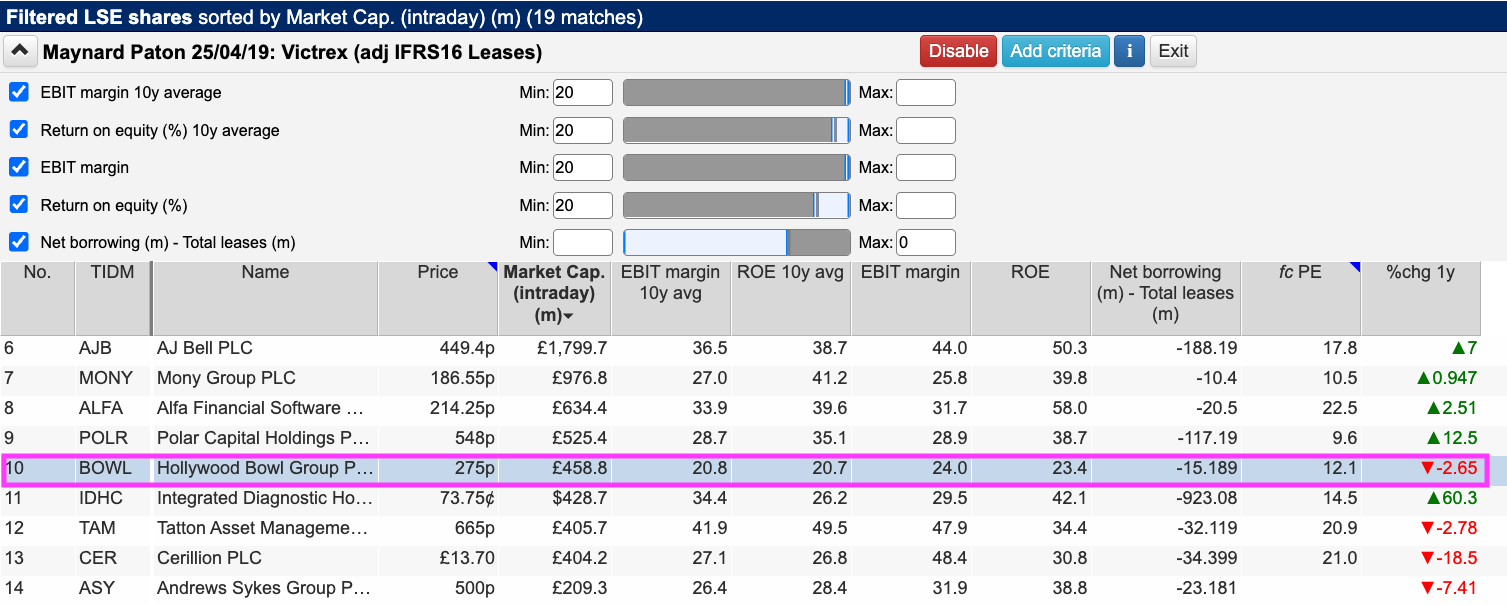

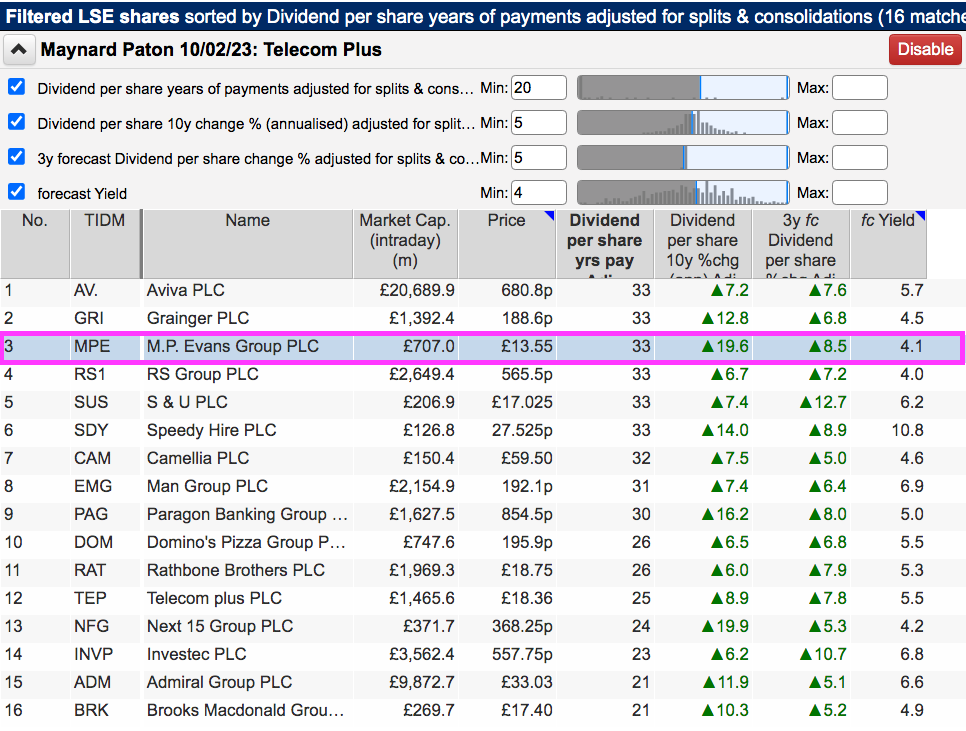

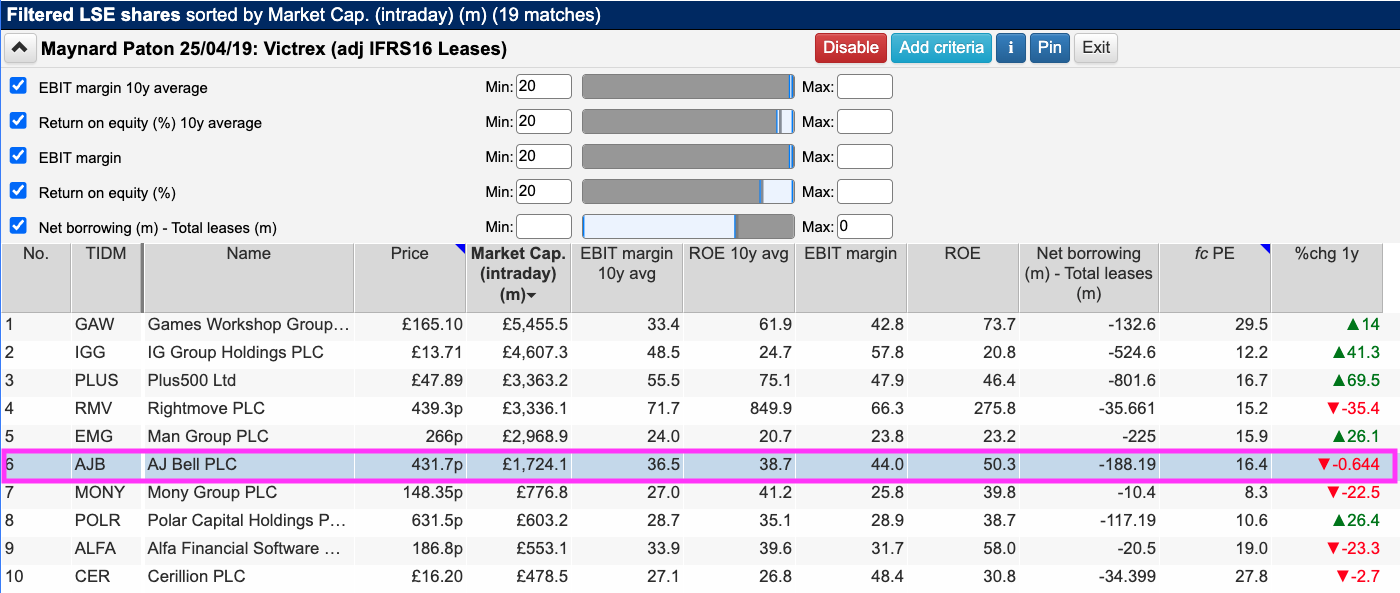

Last month I revisited a ShareScope screen that applied two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

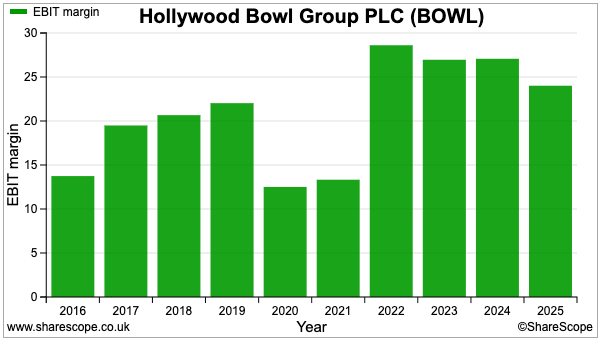

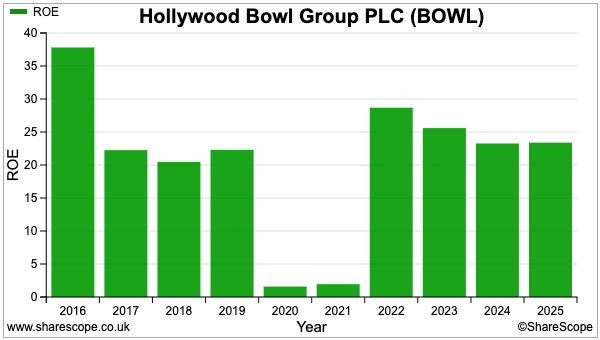

The filtering then returned 19 matches and I opted to study Hollywood Bowl.

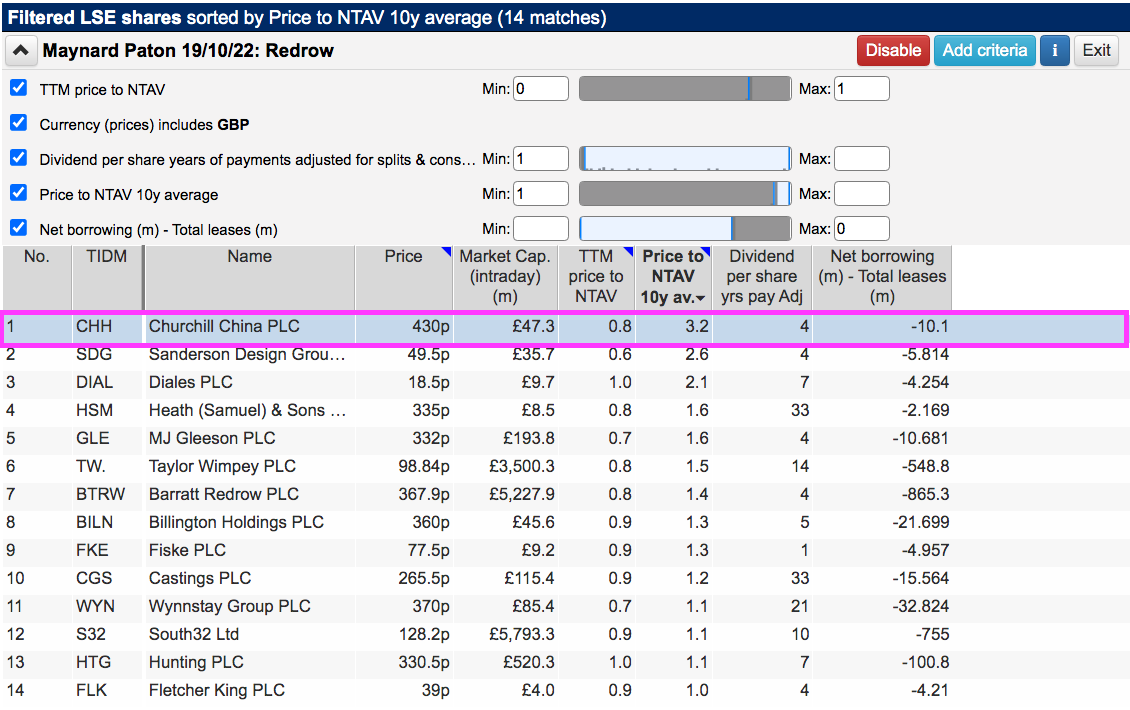

This month I have re-run the same ShareScope screen and once again received 19 matches. As a reminder, the primary criteria of this screen are:

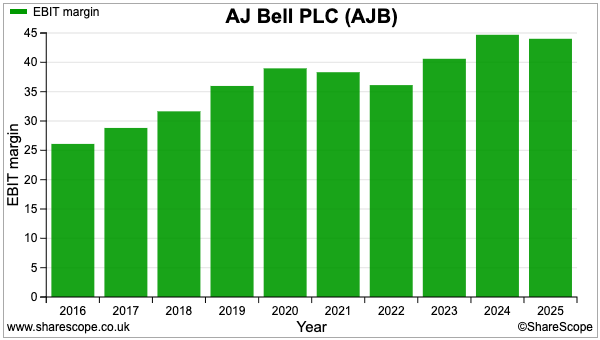

- An operating margin (latest and 10-year average) of 20% or more, and;

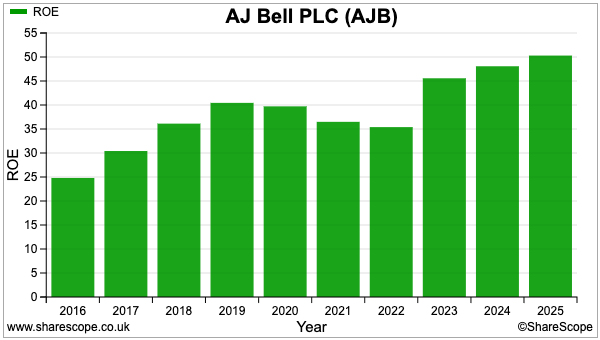

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE of at least 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

This time I selected AJ Bell, primarily because I have been a customer of the investing platform for 25 years. ShareScope also shows AJ Bell registering a wonderful 40%-plus margin and ROE since 2023:

Let’s take a closer look.

Read my full AJ BELL article for ShareScope >>Maynard Paton