02 March 2015

By Maynard Paton

Today I’m continuing my hunt for Watch List shares with a look at Shoe Zone (SHOE).

Here are the initial attractions that prompted this research:

Simple business: It’s a retailer of cheap shoes

Cash-rich: Latest balance sheet showed cash of £9m and no debt

Owner-aligned bosses: Family management boasts 55%/£69m shareholding

As usual, I’m applying a question-and-answer template to help me pinpoint companies that match the criteria set out in How I Invest. I’m looking for as many Yes answers as possible.

Activity: Discount shoe retailer with 500-plus UK stores

Website: www.shoezoneplc.com

Share price: 250p

Shares in issue: 50,000,000

Market capitalisation: £125m

Does the business boast a respectable track record?

Possibly not.

SHOE was formed back in 1980 but came to the stock market only last year. As such, detailed financial information is limited to the Admission prospectus and the subsequent 2014 annual report.

Those documents showcase a mixed performance:

| 52 weeks to | 1 Jan 2011 | 1 Oct 2011* | 29 Sep 2012 | 5 Oct 2013** | 4 Oct 2014 |

| Sales (£k) | 239,071 | 155,995 | 221,114 | 193,882 | 172,861 |

| Operating profit (£k) | 9,363 | (8,657) | 4,566 | 5,307 | 11,505 |

| Exceptional and other items (£k) | - | - | - | - | (936) |

| Finance income (£k) | (338) | 1,445 | (1,041) | (249) | (70) |

| Pre-tax profit (£k) | 9,025 | (7,212) | 3,525 | 5,058 | 10,499 |

| Earnings per share (p) | - | - | - | - | 16.1 |

| Dividend per share (p) | - | - | - | - | 3.6 |

(*39 weeks **53 weeks)

The downward sales performance has been caused by shop closures — the store estate was reduced by 158 during 2013 and by a further 25 during 2014. In fact, the chain operated more than 700 outlets a few years ago and at the last count the number was down to 545. The fact SHOE has had so many “underperforming” locations to close is somewhat disappointing.

Still, profits have risen during recent years through higher margins — in part due to SHOE either negotiating lower-cost rents or relocating stores to cheaper landlords.

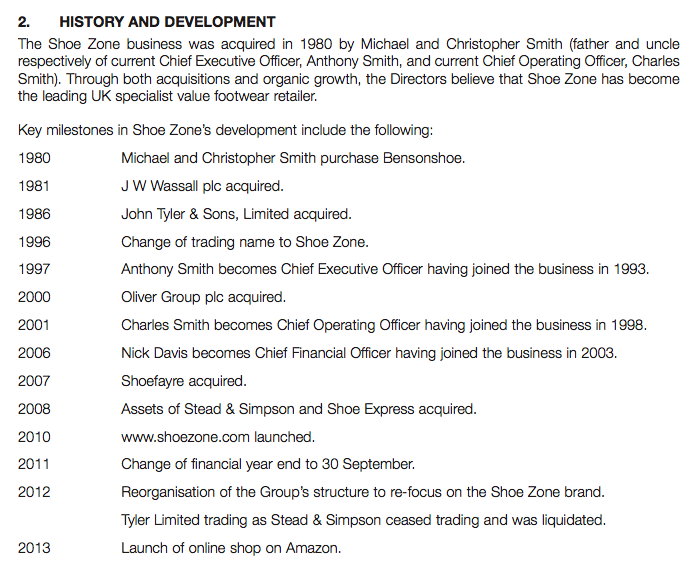

Has the business grown mostly without acquisition?

No.

Here’s a potted history from the Admission prospectus:

The prospectus describes three of the acquisitions as “major”. For what it is worth, the latest balance sheet shows no goodwill.

Has the business mostly self-funded its growth?

Possibly.

The latest balance sheet displays net assets of £32m, of which £29m has been funded by retained earnings. The group carries no debt.

Does the business possess an asset-strong balance sheet?

Yes.

The latest balance sheet shows cash of £9m, no debt and freeholds of £10m.

Something to note: SHOE’s cash position is flattered by significant trade and other payables — that is, money SHOE owes to suppliers and other creditors. At the last count, such sums came to £30m — versus just £8m effectively owed to SHOE by its customers and suppliers.

The accounts also contain two defined-benefit pension schemes. However, the latest combined deficit of these schemes came to £5m, which looks a manageable liability to me given recent profit levels. Plus, SHOE’s pension contribution for the current year is not that substantial at £300k.

I always find it worth evaluating leasehold liabilities when looking at retailers. That’s because being locked into high-cost, long-term leases can become very troublesome should sales start to falter.

SHOE’s leasehold liabilities do not appear problematic:

| 52 weeks to | 1 Jan 2011 | 1 Oct 2011* | 29 Sep 2012 | 5 Oct 2013** | 4 Oct 2014 |

| Property lease expense (£k) | 38,665 | 28,017 | 34,176 | 29,171 | 25,153 |

| Minimum lease payments due: | |||||

| Within one year (£k) | 34,785 | 34,512 | 33,586 | 25,130 | 22,866 |

| Between one and five years (£k) | 110,680 | 107,006 | 97,059 | 70,314 | 59,867 |

| After five years (£k) | 67,845 | 68,880 | 54,927 | 30,258 | 19,516 |

| Total (£k) | 213,310 | 210,398 | 185,572 | 125,702 | 102,249 |

(*39 weeks **53 weeks)

I’m pleased the bulk of future lease commitments last for less than five years, as it should allow SHOE greater room for manoeuvre with any further underperforming stores.

Dividing the total future lease commitment (£102m) by the lease payment for 2014 (£25m) suggests the average lease has 4.1 years left to run.

Does the business convert profits into cash?

Yes, or at least it has during the last few years.

| 52 weeks to | 1 Jan 2011 | 1 Oct 2011* | 29 Sep 2012 | 5 Oct 2013** | 4 Oct 2014 |

| Operating profit (£k) | 9,363 | (8,657) | 4,566 | 5,307 | 11,505 |

| Depreciation (£k) | 6,053 | 5,544 | 8,755 | 6,497 | 4,527 |

| Cash capital expenditure (£k) | (10,918) | (6,081) | (2,034) | (2,827) | (2,008) |

| Working-capital movement (£k) | (673) | 1,234 | 2,558 | (3,398) | 922 |

| Net cash (£k) | (1,501) | (10,423) | 4,752 | 4,864 | 9,114 |

(*39 weeks **53 weeks)

I see the aggregate depreciation charged against earnings has been well ahead of actual cash capital expenditure, and the Admission prospectus partly explains why:

“Low cost store refit programme: Shoe Zone intends to continue to implement its low cost store refit programme at an average rate of 50 store refits per annum between 2014 and 2017. The Directors expect that the £2.5 million annual capital expenditure refit programme will be approximately half of the £5.0 million depreciation charge anticipated for the 2014 financial year”.

There are no problems with aggregated working-capital movements either.

Does the business enjoy a competitive advantage?

Not really.

Everything boils down to management — as it always does with retailers. I suppose the board’s long-standing relationships with various Chinese manufacturers may be helpful.

A 6.7% operating margin for 2014 seem impressive for a discount retailer, and suggests the group employs a welcome, low-cost mindset. That, too, may keep SHOE ahead of its rivals.

Does the business produce a respectable return on equity?

Yes, or at least it did during 2014.

Return on average equity for 2014 was £8m/£32m = 25%, and even adjusting the denominator for the pension deficit still gives more than 20%.

A lack of working capital tied up in the business — stock of £29m is counterbalanced entirely by the aforementioned £30m of trade creditors — is the main reason for the impressive percentage.

Prior to 2014, SHOE’s return on equity was a so-so 12% or less.

Does the business employ capable executives?

This depends on your view of SHOE’s track record.

The group is led by brothers Anthony and Charles Smith. Anthony has been chief executive since 1997 and Charles has been a board executive since 2001. Both Smiths are in there 40s and, backed by their major shareholdings (see below), could be heading this business for some time to come.

Does the business employ good-value-for money executives?

I think so.

Anthony Smith collected a £225k basic salary last year and is on £250k for this year. Meanwhile, his brother Charles collected £188k last year and is now on £200k. Those pay packets do not look outrageous to me at an £11m-profit business. I see last year neither Smith received any pension payments nor any bonus — suggesting some restraint pay-wise.

Does the business employ owner-orientated executives?

Yes.

The Smiths sold 45% of this business during last year’s flotation and presently retain a 55% stake with a current £69m market value.

I like the fact SHOE’s maiden 3.6p per share dividend gave the Smiths an aggregate dividend (of £1m) that was well ahead of their combined basic pay.

I also like the lack of an option scheme.

Does the business enjoy reasonable growth prospects?

I’m not sure.

Anthony Smith last reported:

“Despite the well publicised warm start to the Autumn/Winter season we believe that 2015 will be a year of continued growth for the Group.

We have continued to optimise our store portfolio and so far we have opened six stores (two relocations, four new) and have agreed terms on 10 stores (seven relocations, three new).

Our successful multi-channel offering continues to grow ahead of forecast. The falling oil price is already having a positive impact on the cost of logistics and should also impact the price of raw materials.

The Board continues to see significant opportunities ahead and remains confident that the business will perform in line with market expectations.”

As far as I can tell, opening four stores and agreeing terms on another three is not going to make a great impact on a 500-plus outlet estate. Indeed, SHOE’s Admission prospectus stated just five new stores a year could be opened until 2017.

It seems future gains are more likely to emerge via re-locating smaller stores into larger stores. According to the Admission document, keen lease negotiations and other economies of scale following a re-location can double a shop’s margin.

The Admission prospectus claims such relocations and other management actions “will assist to improve the average cash contribution per store from approximately £54,000 currently to approximately £70,000 by 2017.”

A 30% profit uplift between 2014 and 2017 certainly sounds impressive. I am awaiting clarification from SHOE about the definition of “cash contribution per store” — I presume it represents gross profit.

I am also awaiting clarification as to whether the directors still expect a £70,000 ‘cash contribution’ per store by 2017. This projection was not mentioned within SHOE’s recent results or City presentations — which makes me wonder whether it has been quietly dropped.

Does the share price stand a good chance of becoming a bargain?

Possibly.

Operating profits for the 52 weeks to 4 October 2014 were £11.5m. Less standard 20% tax gives earnings of £9.2m or 18.4p per share.

I do not deem SHOE’s cash pile to be ‘surplus to requirements’, so on a straightforward P/E basis the rating is 250/18.4p = 13.6.

Not an obvious bargain, especially given the modest potential for extra stores.

However, assume all 545 current stores do indeed improve their ‘cash contribution‘ to £70,000 by 2017, then gross profits could be £38m. Less administration and distribution costs of, say, £20m (currently £17m), and tax at 20%, then earnings could rally to £14.5m or 29p per share.

Apply a middling P/E of 12 on that 29p per share estimate and the share price comes to 349p. That equates to 40% potential upside over three years from 250p, which with dividends could reach 45% or more. Such possible returns do not look that bad to me.

Something to consider: I’ve seen many specialist retailers stumble in the past… and it is not uncommon for such shares to significantly de-rate to single-digit P/Es as the market frets about relentless competition. I can’t see Shoe Zone being immune to a depressed rating if trouble emerges.

Is it worth watching Shoe Zone?

Probably.

The real attraction here is the long-standing family managers. They presumably know the industry inside out and look to be the owner-orientated types with £69m still riding on the share price. The tone of their annual-report commentary is reassuringly clear-cut as well.

But SHOE does have drawbacks. In particular, I’m surprised such veteran bosses allowed themselves to reach a point where 100-plus underperforming shops had to closed. What’s more, I suspect re-locating stores to improve profits will never attract the same investor enthusiasm — and possible premium P/E rating — as growing profits by rolling-out new stores.

My gut feel on SHOE is to bide my time and perhaps see if a cheaper buying opportunity occurs. I also want some clarification from SHOE about the £70,000 per store ‘cash contribution’. Similar to purchasing a pair of the group’s shoes perhaps, I feel a good investment result here will be dependent mostly on bagging a cheap price.

Maynard Paton

Disclosure: Maynard does not own shares in Shoe Zone.

Hi Maynard

Good article as always. I’ve had Shoezone on my watchlist for a while, and am kicking myself as I remember looking at it last May when it IPO’d at around 160p. What’s your target entry price?

I did remember seeing a small drop in the SP last week to around the 225-230 level, but wasn’t quick enough to buy any stock, and since then its risen back to normal levels.

Best wishes,

Imran.

Hello Imran

I am not disclosing target entry prices here as i) I don’t want anybody to act on anything I write here; ii) I don’t want anybody asking ‘have you bought?’ when the price hits that level, and; iii) I may change my mind in the meantime and I don’t want to keep updating the Blog.

I too looked at SHOE at the flotation and thought it was interesting and really should have bought — but I never got round to looking at the firm in any detail until now. Oh well, I will bide my time and await an opportunity here or elsewhere.

Mayn

Good article, thanks for sharing Mayn

David

Maynard,

Thanks for some great reviews. I hold SHOE as I have a penchant for boring companies, and I feel that SHOE fits the bill. One thing I may have missed in your analysis was the potential for online sales. It appears that SHOE are investing a lot in this channel and with some success that should be a cause of growth in the coming years. I see SHOE as having the potential for being the Primark of the shoe world, and as such I have a small holding.

Hello Danyou,

Thanks for the comment. The 2014 annual report said online sales represented only 3% of group sales, so I did not think it worth mentioning. I did look at SHOE’s amazon.co.uk reviews a while back and they were generally positive, which is quite reassuring. Becoming the Primark of the show world is a good target!

Maynard

Oh dear. Profit warning:

http://www.investegate.co.uk/shoe-zone-plc–shoe-/rns/trading-update/201504210700447833K/

SHOE’s preliminary results on 14 January declared:

SHOE already had 3.5 months of H1 trading in the bag when it made that statement, so clearly the company over-estimated its trading for the following 2.5 months of the half. A ‘dividend adjustment’ suggests the profit impact is significant, which surprises me and just goes to show the dependence SHOE has perhaps on certain product lines (e.g. pricier winter boots).

Anyway, there were some positives from today’s statement, including: i) sales volumes increased; ii) margins have “remained robust” and iii) nine new stores opened and terms agreed for a further ten.

Looking back at my original Blog post above…

I wrote:

Well, I never did receive a reply from SHOE and I suspect today’s news means I can now forget about that £70k projection.

Trouble is now emerging and I suspect this share will not be immune from a single-digit P/E. Today’s warning was a surprise and I wonder if the market will now take a depressed view of the management here. My gut feel is to await the interim results in June and take a view of the business then. Today’s warning sounds temporary, but it has underlined the sensitive nature of this discount retailer and how any sales setback can have a substantial effect on its profits.

That remains the case!

Maynard

Just dug out this old Fool article:

http://news.fool.co.uk//qualiport/2002/qualiport020708.htm

Shows how some specialist retailers can trade on P/Es of 7 or less if the market becomes very despondent after a warning.

I am sure PIZ went on to trade at 300p.

Maynard