24 March 2024

By Maynard Paton

H1 2024 results summary for S & U (SUS):

- A record H1, during which larger loan sizes and lower-than-normal bad debts offset higher interest costs and pushed net asset value (NAV) to a fresh £18.86 per share high.

- This H1 was then overshadowed by February’s trading update, which revealed H2 motor-loan collections alarmingly reduced from 94% to 90%, extra Q4 write-offs of approximately £5m and the second-interim dividend cut by 8%.

- Greater FCA regulation, including the new Consumer Duty regime, is prompting SUS to revise its motor-finance lending and seems likely to lead to inherently lower margins, reduced transactions and higher regulatory-admin expenses.

- Net finance costs absorbed a significant 12% of H1 revenue, with post-H1 debt increasing to £224m — equivalent possibly to 100% gearing — and borrowing rates perhaps now at 8%.

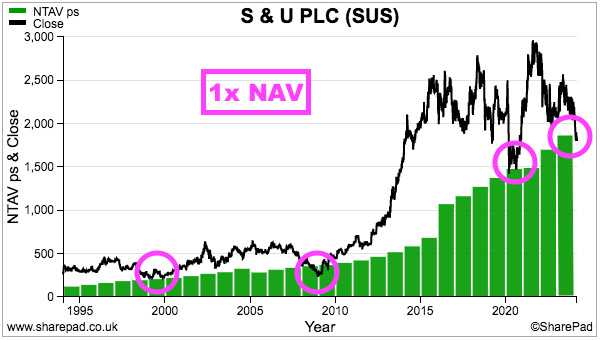

- Tighter regulation, greater debt expense plus various economic “headwinds” leave the £18 shares at 2014 levels and below 1x NAV, a valuation that has occurred only occasionally during the last 30 years. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own SUS

- Results summary

- Revenue, profit, net asset value and dividend

- Advantage Finance: loan sizes and rates

- Advantage Finance: loan volumes and first payments

- Advantage Finance: collections and cash flow

- Advantage Finance: overdue accounts and payment holidays

- Advantage Finance: provisions

- Aspen Bridging

- Management

- Financials

- Regulation: Borrowers in Financial Difficulty

- Regulation: Consumer Duty

- Regulation: Skilled Person

- Regulation: discretionary commission arrangements

- February trading update

- Valuation

News links, share data and disclosure

- Interim results, presentation and webinar for the six months to 31 July 2023 published/hosted 03 October 2023;

- Trading update published 12 December 2023, and;

- Trading update published 09 February 2024.

- Share price: 1,800p

- Share count: 12,150,760

- Market capitalisation: £219m

- Disclosure: Maynard owns shares in S & U. This blog post contains SharePad affiliate links.

Why I own SUS

- Provides ‘non-prime’ credit to used-car buyers and property developers, where disciplined lending, conservative financing and reliable service have supported an illustrious NAV and dividend record.

- Boasts veteran family management with a 40-year-plus tenure, 44%-plus/£97m-plus shareholding and a “steady, sustainable” and organic approach to long-term expansion.

- Various economic “headwinds“, tighter regulation plus higher debt costs have left the shares trading close to NAV, which history suggests can be an attractive buying opportunity.

Further reading: My SUS Buy report | All my SUS posts | SUS website

Results summary

Revenue, profit, net asset value and dividend

- A promising AGM update during May…

“S&U is pleased to report another strong trading performance in the first quarter of this financial year. Group profit, turnover, debt quality and collections are ahead of last year. In addition, S&U continues to strengthen its financial, regulatory and branding foundations which will enable it to grasp significant opportunities for growth, anticipated at its full year results in March.”

- …followed by more circumspect commentary during August…

“The group continues to trade well. It does so carefully due to the current economic headwinds impacting consumer confidence, disposable incomes, taxation and interest rates. Although the past two months have seen an uptick in transactions and the new customer pipeline, current economic policies in the UK reduce consumer confidence and create barriers to our usual rate of sustainable growth.“

- …had already suggested a mixed H1 2024.

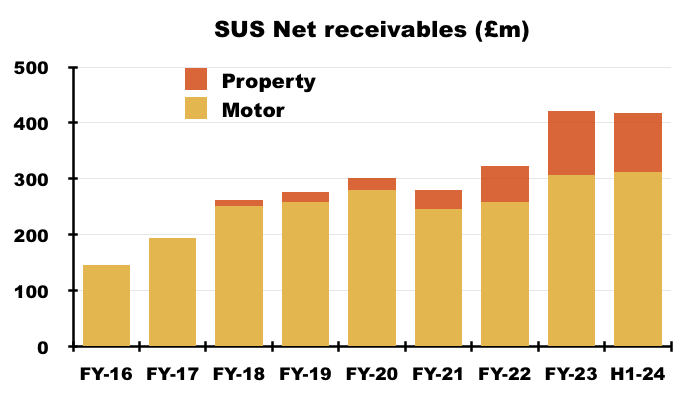

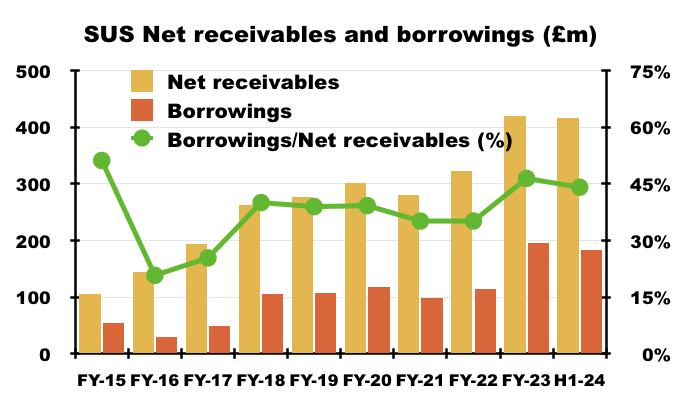

- As heralded within August’s statement, this H1 did indeed show the net loan book at £417m and net debt at £184m.

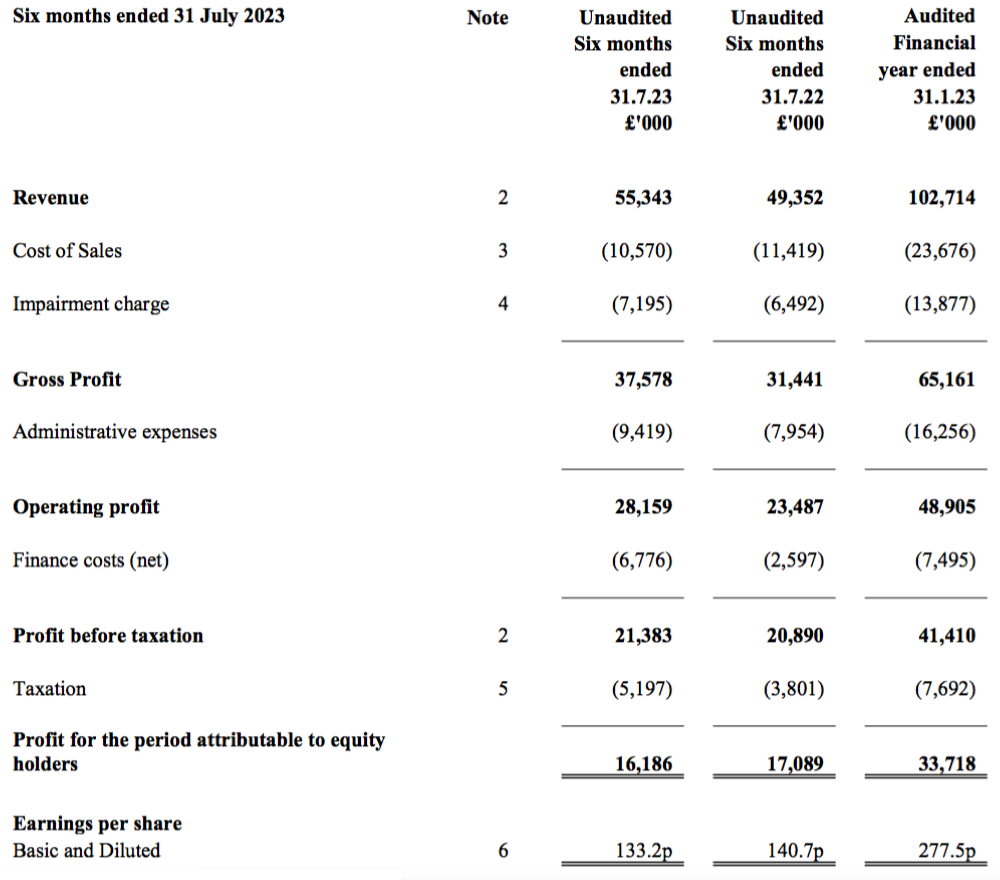

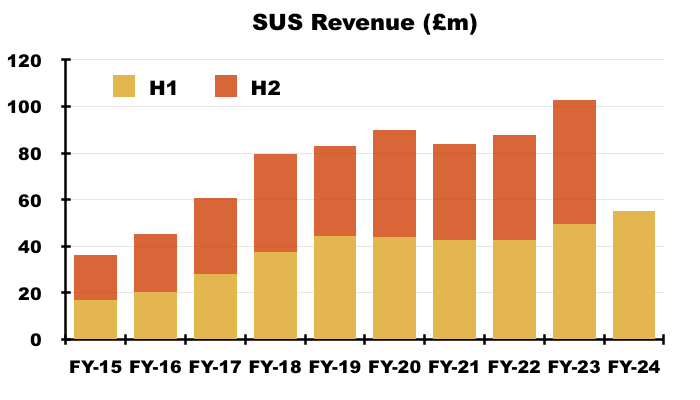

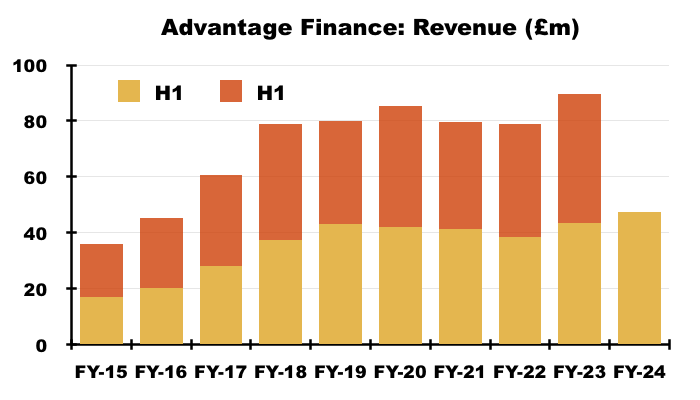

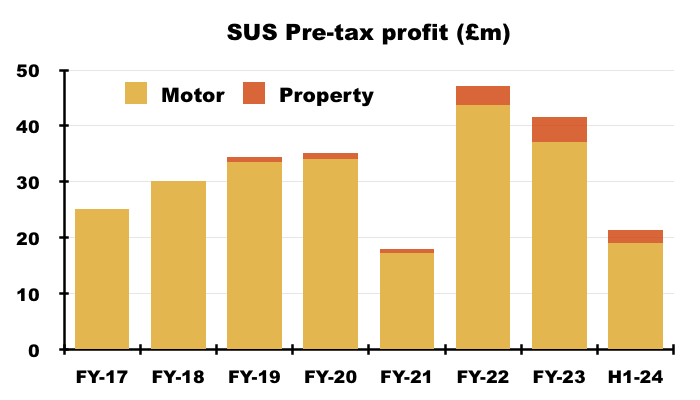

- Revenue improved 12% to £55.3m to set a new record for any H1 or H2:

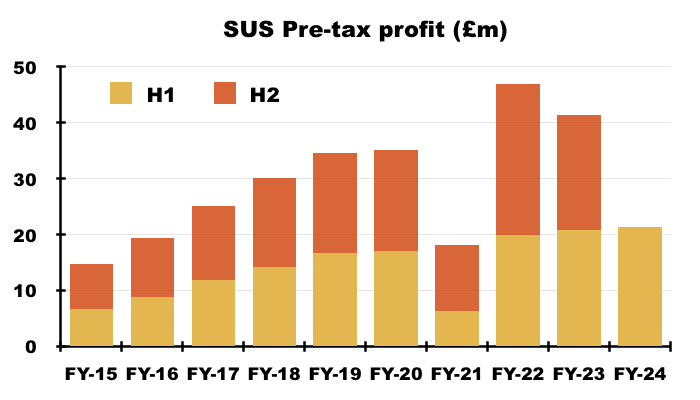

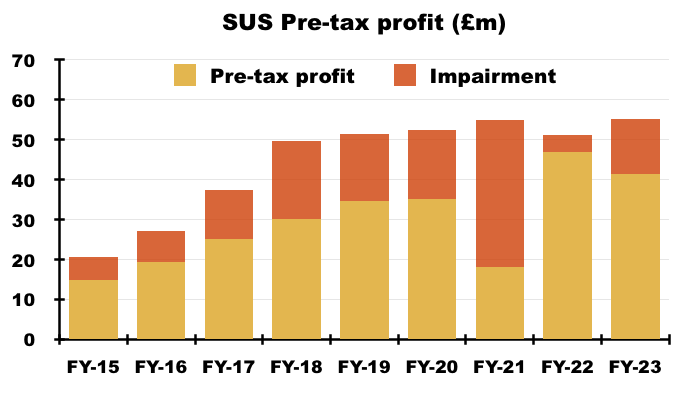

- Pre-tax profit meanwhile gained only 2% to £21.4m to set a new H1 record:

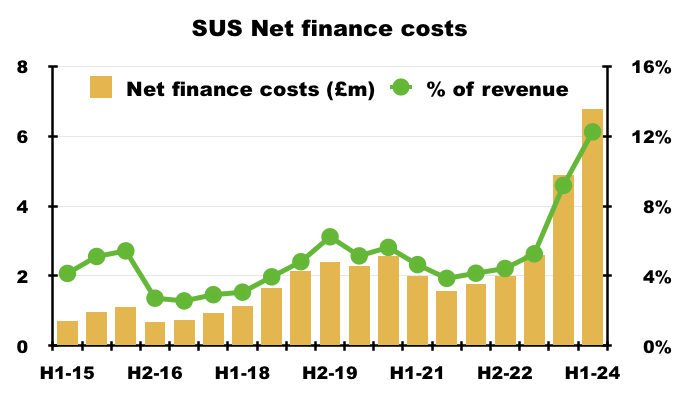

- The profit advance was restricted by net finance costs increasing by £4.2m to £6.8m:

- Net finance costs — which alongside debt interest include (small) preference dividends and (even smaller) IFRS 16 lease expenses (point 16) — absorbed 12% of revenue, the highest proportion since at least H1 2015 (see Financials).

- This H1 and the comparable H1 2023 were thankfully not disturbed by the pandemic.

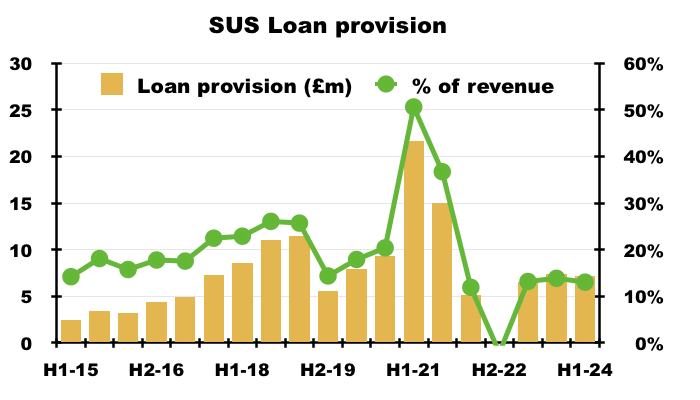

- To recap, FY 2021 suffered an additional Covid-related bad-debt provision of £20m, while FY 2022’s entire bad-debt provision was only £4m after better-than-anticipated collections prompted a significant reversal of that extra £20m:

- In fact, the £7.2m bad-debt provision for this H1 was equivalent to 13% of revenue — the lowest proportion since at least H1 2015 barring the significant pandemic reversal of FY 2022:

- SUS has for some time described its bad-debt provision as “lower than normal“:

[FY 2022]: “Advantage results driven by excellent collections and lower than normal bad debt attrition and full year impairment charge”

[H1 2023]: “Advantage impairment charge of £6.1m (H1 2021: £4.9m) still lower than normal as increase in stage 1 and macroeconomic overlays is more than offset by excellent collections and lower than anticipated realised bad debts in H1″

[FY 2023]: “Impairment charge of £12.9m (2022: £3.8m; 2021: £36.0m) still lower than normal as increase in stage 1 and macroeconomic overlays for forecast future inflation and car prices, more than offset by excellent collections and lower than anticipated realised bad debts“

- This H1 described the bad-debt provision as “still lower than normal“:

“Impairment charge of £6.8m (H1 2022: £6.1m) still lower than normal as an increase in receivables mitigated by good collections and lower than anticipated realised bad debts and voluntary terminations.“

- The FD during management’s H1 webinar did not believe the ongoing “lower than normal” level of bad debts had become “the new normal”:

“I think [the impairments] are lower than normal. I would hope we could continue that lower than normal [level], and therefore I would not at the moment subscribe to this being the new normal, rather that it is both of the businesses are doing pretty well.“

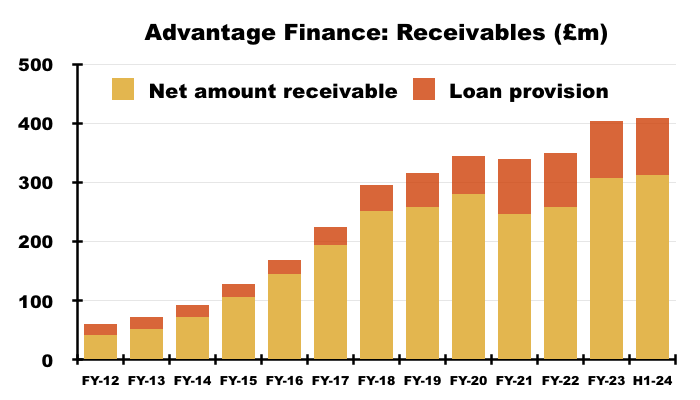

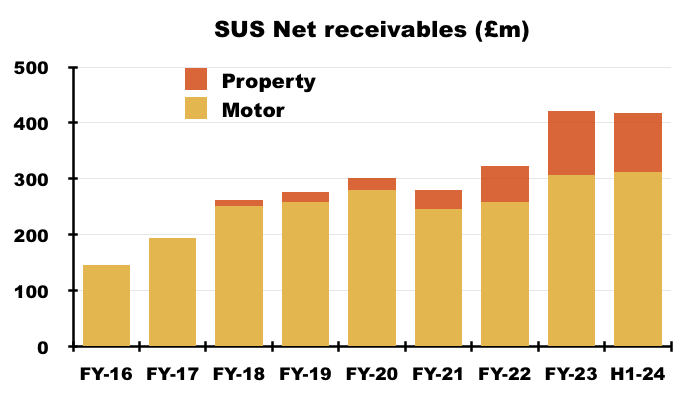

- The accounts continue to be dominated by SUS’s motor-finance division, Advantage Finance, although SUS’s property-loan division, Aspen Bridging, is becoming a greater part of the group’s net loan book:

- The group’s net loan book declined by 1% or £3m to £417m during this H1, with a 2% advance to the size of the motor-finance book (see Advantage Finance: loan sizes and rates) negated by an 8% reduction to the property-loan book (see Aspen Bridging).

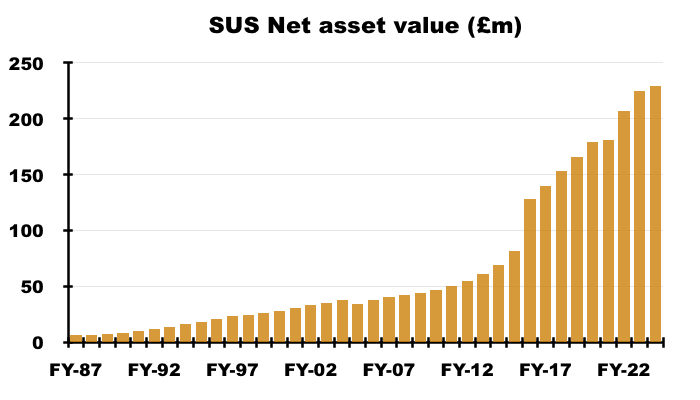

- Debt was reduced by £11m, which offset the 1% loan-book decline and helped net asset value (NAV) advance by £4m to £229m — equivalent to £18.86 per share and a fresh NAV record:

- NAV now exceeds the £219m market cap (see Valuation).

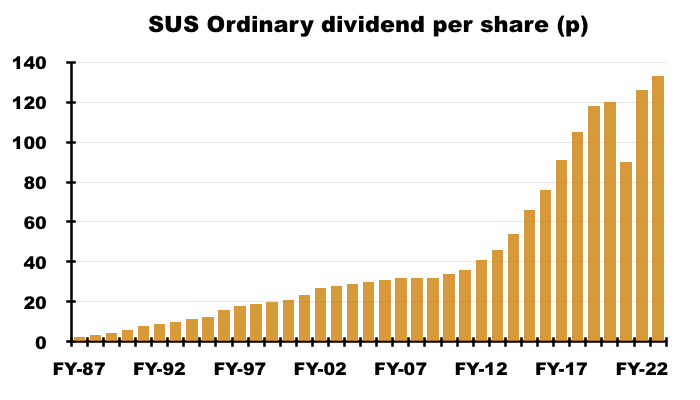

- The higher 25% standard UK tax rate trimmed earnings by 5% to 133p per share, which prompted management’s H1 webinar to claim keeping the interim dividend at 35p per share was the “prudential thing to do“.

- Companies House shows the payout expanding 53-fold since 1987, with the sole reduction occurring during pandemic-blighted FY 2021:

- This H1 was rather overshadowed by February’s trading update, which carried a Q4 profit warning and admitted the group’s second interim payout would be reduced by 3p, or 8%, to 35p per share (see February trading update).

- Unless the final dividend is lifted by 3p to 63p per share, the combination of “weak consumer confidence, cost of living pressures, funding costs and regulatory activity” look set to create an annual dividend reduction for FY 2024.

Advantage Finance: loan sizes and rates

- SUS describes Advantage Finance customers as ‘non-prime’ and the 2023 annual report (point 2a) outlines their typical circumstances:

“This long experience has enabled Advantage to gain a significant understanding of the kind of simple hire purchase motor finance suitable for customers in lower and middle-income groups. Although decent, hardworking and well intentioned, some of these customers may have impaired credit records, which have seen them in the past unable to access rigid and inflexible “mainstream” finance products.”

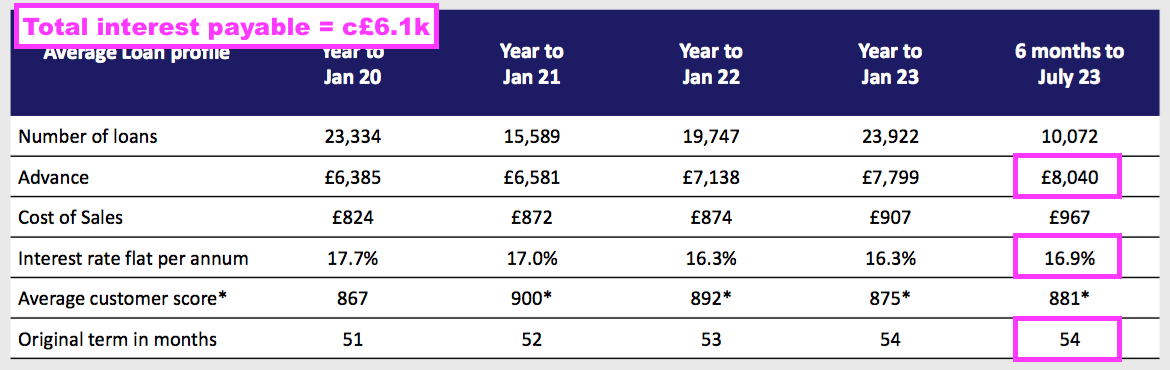

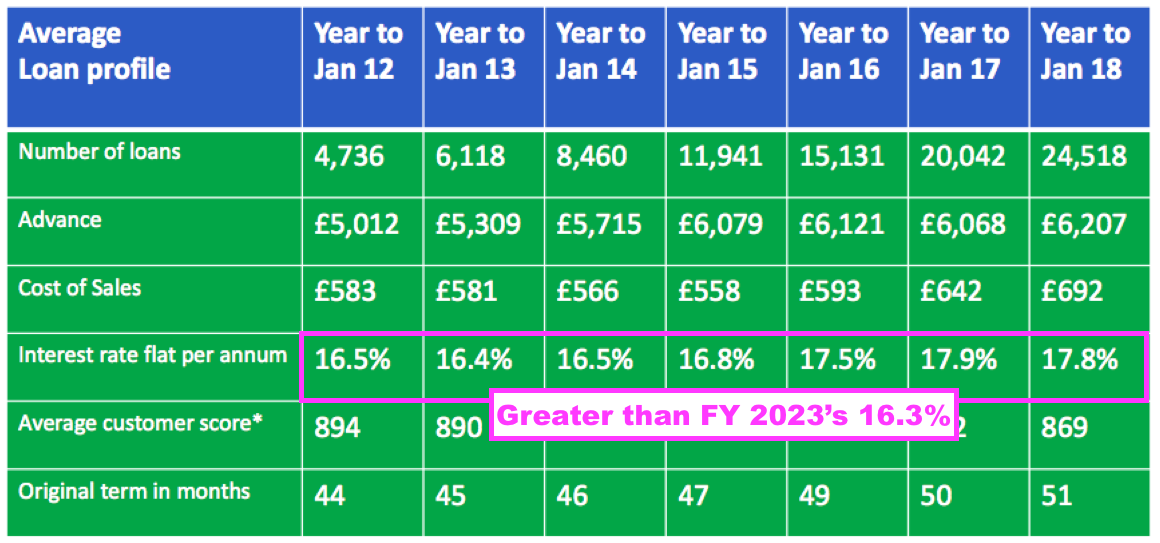

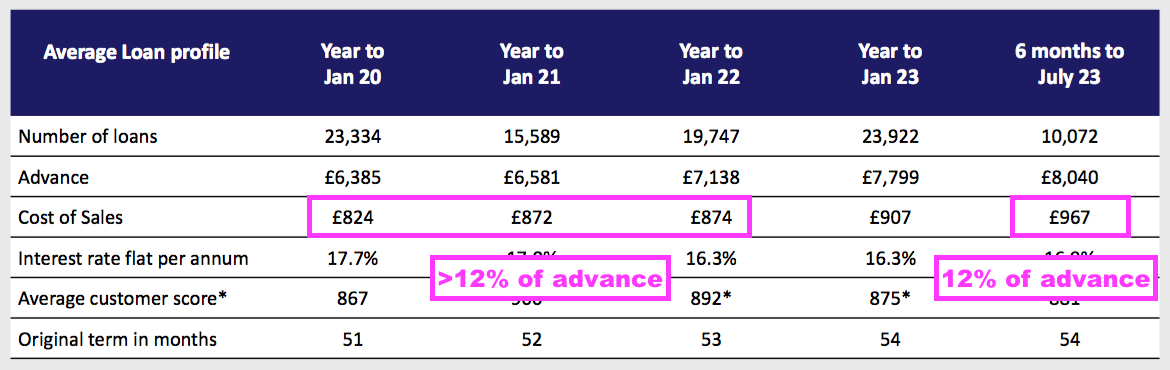

- Loan sizes have increased over time. The average amount borrowed by Advantage’s customers to buy a used car surpassed £5k during FY 2012, £6k during FY 2015, £7k during FY 2022 and £8k during this H1:

- The preceding FY claimed the wider used-car market had seen average prices almost double to £17.6k between 2011 and 2022, and was still experiencing 3% annual advances.

- Rising used-car prices should be positive for Advantage. Customers ought then to borrow more money, pay more interest and (in theory) provide SUS (and shareholders) with more profit.

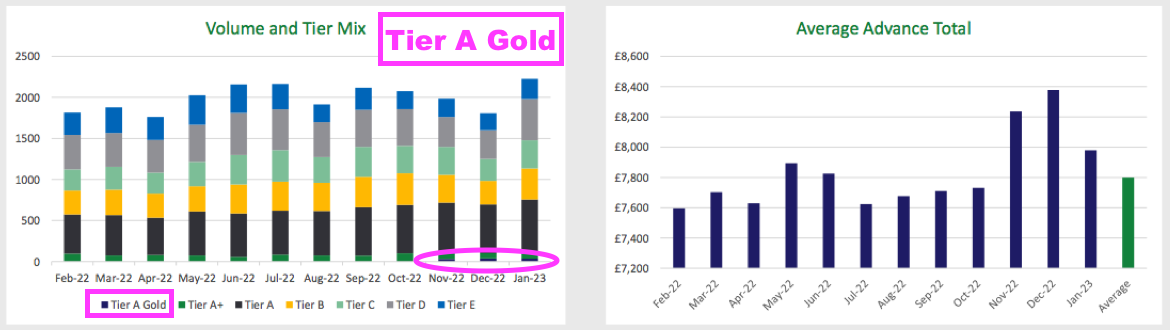

- The preceding FY also introduced a new “A Gold” tier to reflect the group’s very best credit-scoring customers:

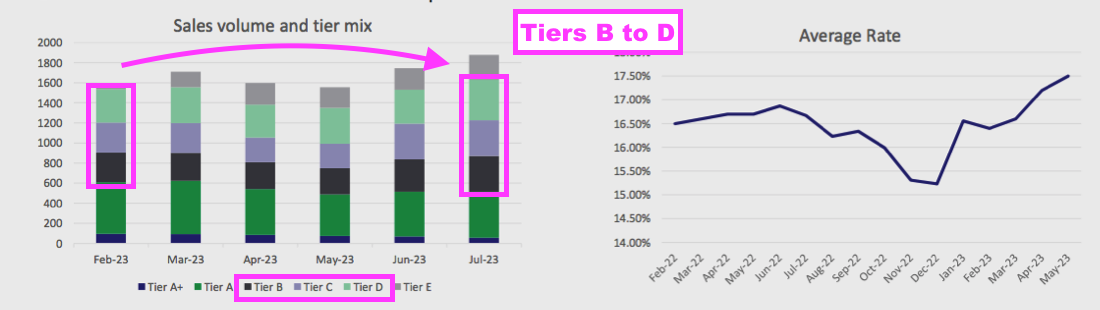

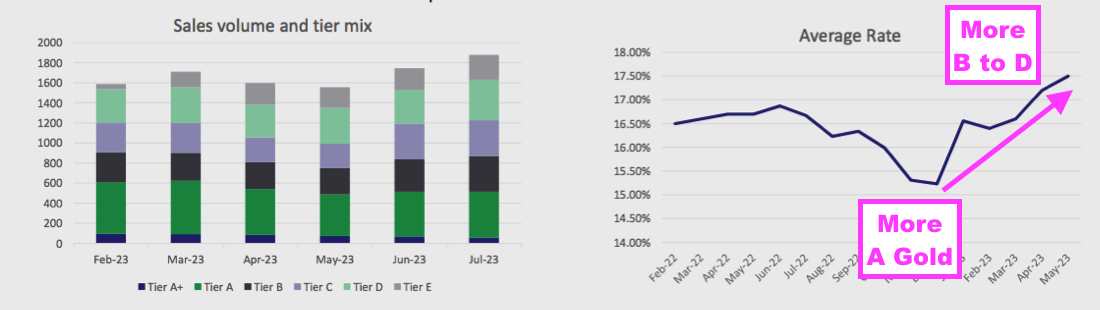

- This H1 dropped the ‘A Gold’ tier as SUS concentrated on “growth of mid-quality customers to protect margin“:

- Management’s H1 webinar added:

“The tier mix is very stable. The average… credit score is very stable as well. And we have been spending this year making small increases and improvements in terms of the mid-quality customers, the B to D categories that give us a higher margin, which has helped us to manage our overall interest rate margin moving forward.

On the chart on the right hand side, in terms of average rate, we see there was a dip in the final quarter of last year as we tested the market for lower-margin but higher-quality business, which was actually in terms of volume very successful and has a knock-on effect on collections…

Since the increase in interest rates at the turn of the year, we have moved both our interest rate and tier mix to help protect some of our margins moving forward. We are doing our best in terms of those interest rate headwinds to manage the overall margin in the business.“

- Testing the market for “lower-margin but higher-quality business” seemingly attracted the ‘A Gold’ borrowers at interest rates of less than 16%…

- …but the shift towards tiers B to D had pushed the rate to 17.5% by the end of this H1.

- The average (flat per annum) rate paid during this H1 was 16.9%. For perspective, the average rate paid between FYs 2016 and FY 2021 was at least 17%, while the 16.3% charged during FYs 2022 and 2023 was the lowest since at least FY 2012:

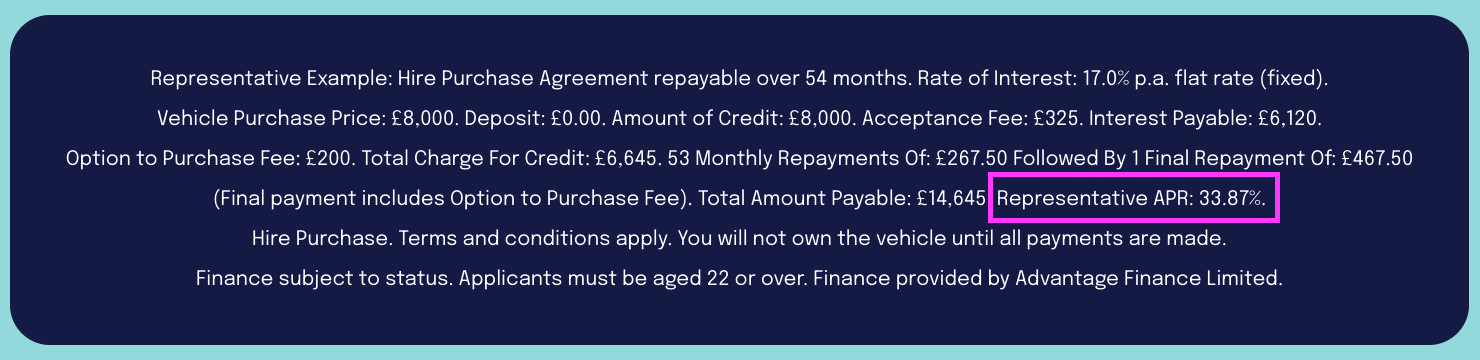

- The duration of the typical loan remains longer than historical norms. The 54 months for this H1 compares to 50 for FY 2017 and 44 for FY 2012.

- I speculate the lengthier repayment duration reflects the aforementioned higher cost of used cars and customer budgets generally reaching a c£275 per month repayment ceiling.

- Advantage’s website cites a representative APR of 33.87%:

- Borrowing £8.0k at a flat 17% a year over 54 months leads to interest of £6.1k and a total repayable of £14.6k including a £325 acceptance fee and a £200 vehicle-purchase fee.

Advantage Finance: loan volumes and first payments

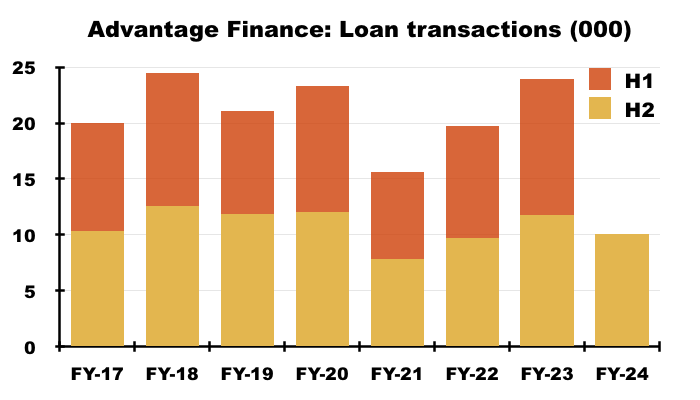

- Pandemic aside, the 10,072 new motor loans issued during this H1 was the lowest for an H1 since at least H1 2017:

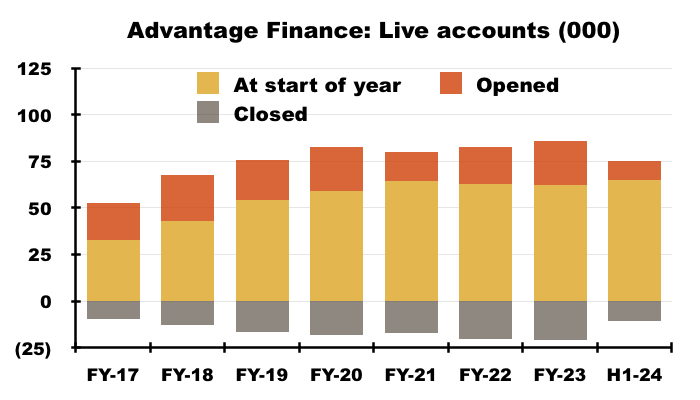

- The 10,072 new loans issued were offset by 10,675 accounts closed due to completed repayments, voluntary terminations or the commencement of legal proceedings:

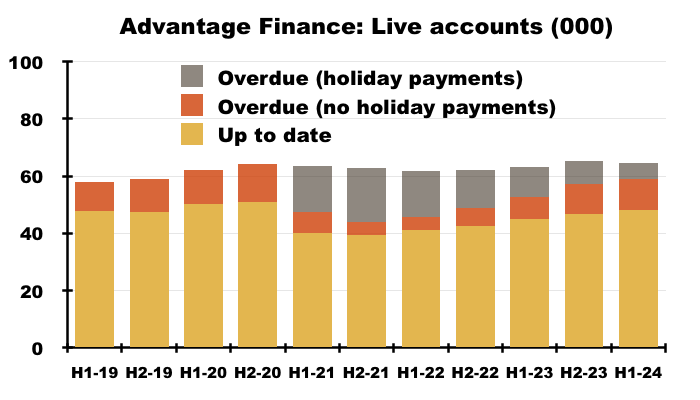

- The account openings and closures left total ‘live’ accounts 603 lower at 64,620:

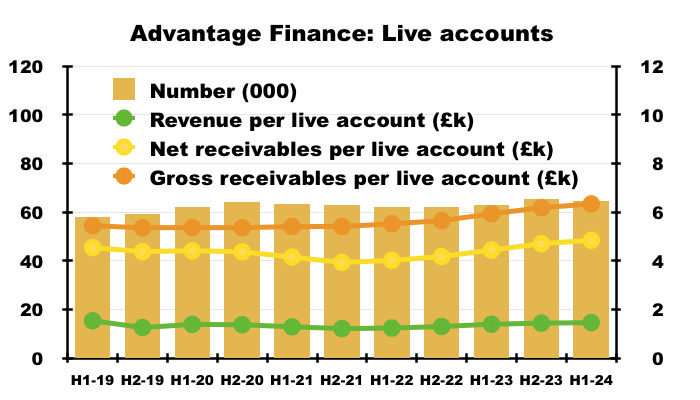

- The higher 16.9% average (flat per annum) rate with account numbers remaining around 65,000 helped push Advantage’s H1 revenue to a record six-month £47m:

- Emphasising how rapid Advantage has grown, H1 revenue of £47m exceeded the division’s FY 2016 revenue of £45m.

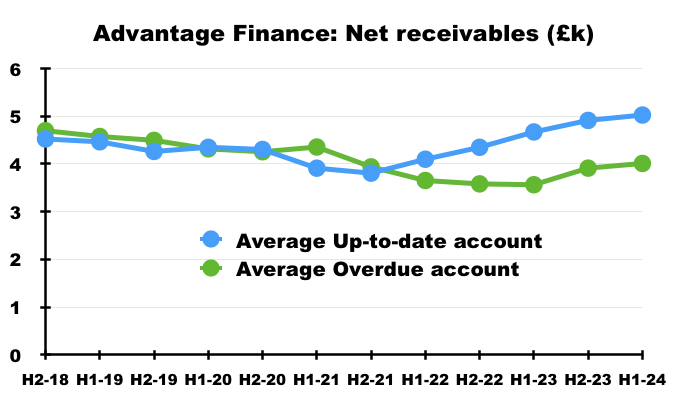

- The aforementioned higher loan sizes translated into revenue per account increasing to nearly £1.5k (the highest since H1 2019), with the average amount outstanding (before provisions) now at a new £6.3k high and the average amount outstanding (after provisions) at a new £4.8k high.

- SUS confirmed no shortage of car-loan applications:

“Demand for Advantage’s products remains high. 1.20m applications for finance were received in the six months (H1 2022: 1.27m). An acceptance rate of just 31% helps demonstrate the rigour of Advantage’s underwriting and affordability checks which are designed to ensure that our valued customers can maintain their average monthly repayments of £250 over a 4.5-year average term.“

- Approving 31% of 1.20 million applications suggests £372k applications were successful, although only 10,072 of those £372k applications went on to accept the loan.

- Management’s H1 webinar explained how “digital tyre kickers” limited the conversion of successful applications into actual loans:

“[The acceptance rate] is fairly consistent, between 30% and 35%, so that [31%] is fairly standard for us. It is a source of personal frustration for us that we can’t penetrate those numbers of approved cases more than we currently do. I would say though that the market intelligence tells us… at least half of those accounts that we approve are for people that we call ‘digital tyre kickers’, where they are actually testing whether they can get access to money.

But by the time they get an acceptance, they may not find the car, [or] may decide the monthly payment is something they can’t currently afford just now, so they step back even though we have approved it.”

- Management’s H1 webinar admitted the “competitive nature of the marketplace” also restricted the conversion of successful applications into actual loans:

“But we are still in a position where we have got 160-170k applicants that are still in the marketplace and we are writing between 20-25k of those, and that shows the competitive nature of the marketplace. We would like to do more of those [160-170k applicants], but at the same time we would like to achieve the margins we have currently got… I think we have got the right balance.”

- 90% of loans continue to be sourced through brokers. Cost of sales per loan (largely commissions to brokers) at £967 equated to 12.0% of the £8.0k average loan and remains below the proportion witnessed during FYs 2020, 2021 and 2022:

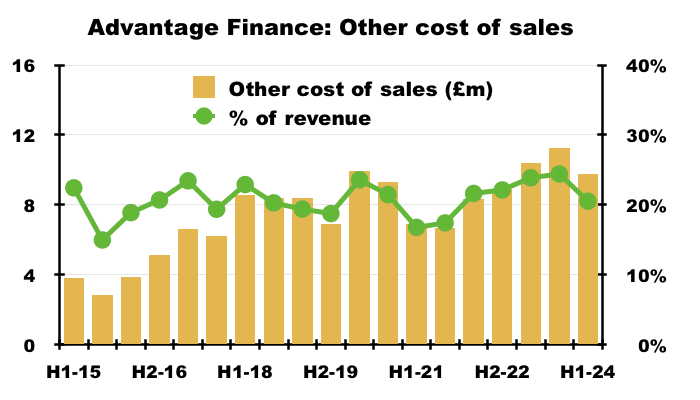

- Perhaps reflecting the aforementioned shift to higher margin B-to-D-tier customers, cost of sales absorbed 20% of motor-finance revenue during this H1 — the lowest for more than two years:

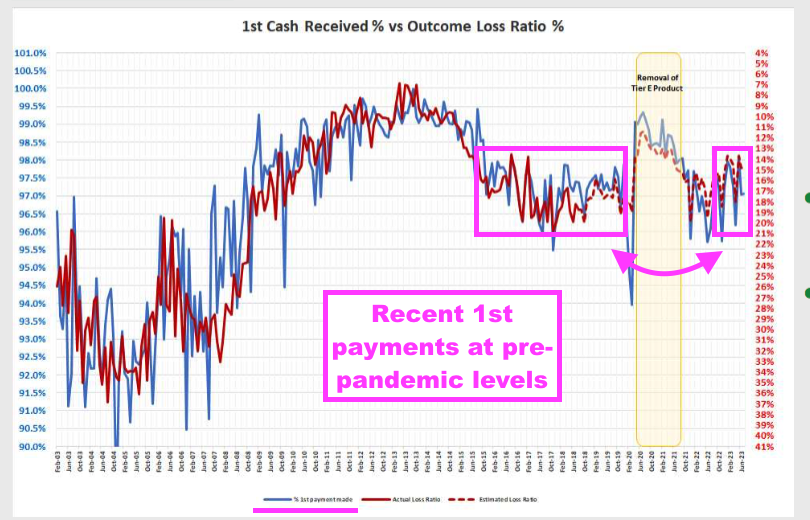

- Advantage’s first-payment statistics remain within levels witnessed before the pandemic:

- The blue line (left axis) reflects the percentage of new customers making their first payment on time.

- The proportion at between 96% and 98% during this H1 was experienced between (pre-pandemic) October 2015 and October 2019.

- The 98%-plus first-time payments achieved during 2020 and 2021 were due to the stringent lending applied as Covid-19 struck.

- The proportion of borrowers making their first payment on time has shown to correlate inversely to the proportion of loans that ultimately suffer losses.

Advantage Finance: collections and cash flow

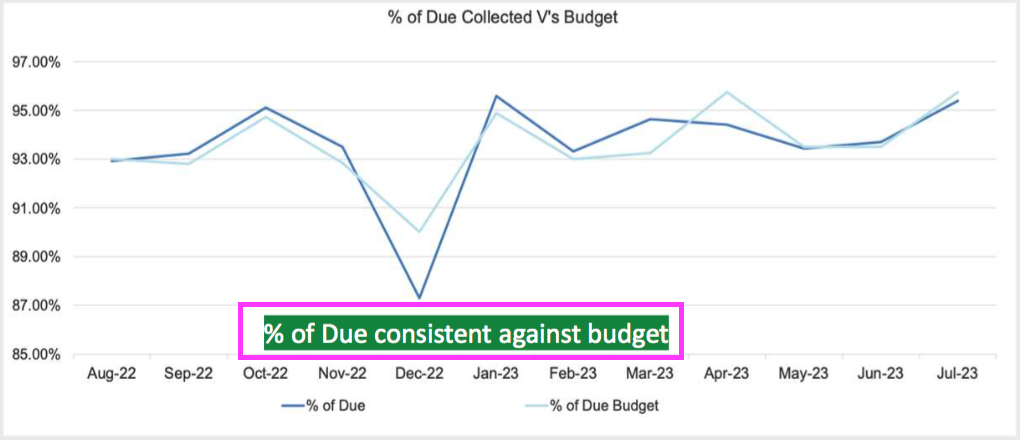

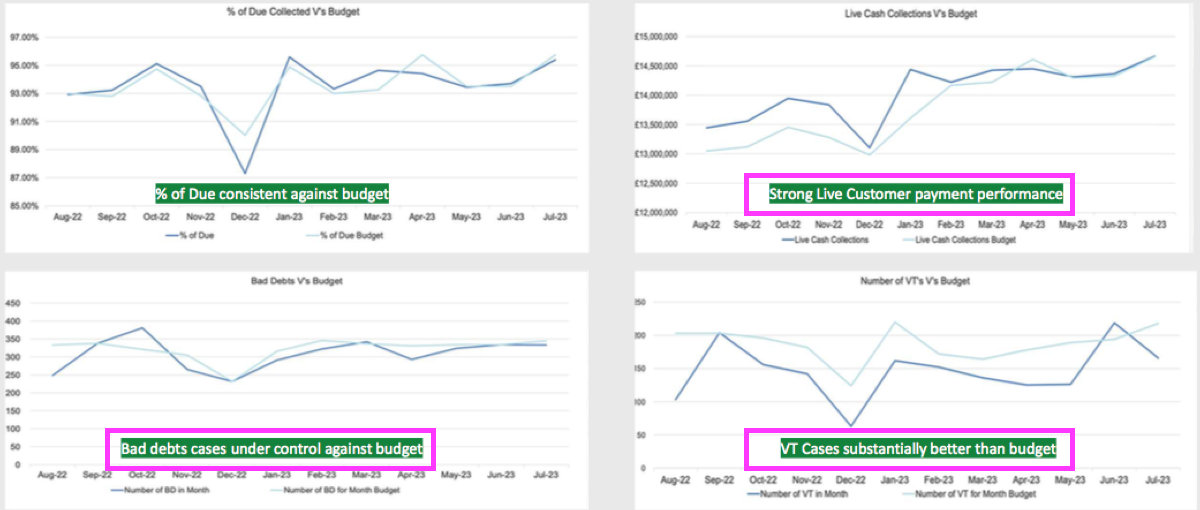

- SUS described Advantage’s collections during this H1 as “good” at 94.1%:

“Average customer credit scores have risen over the past half year and affordability calculations adjusted so that overall collection rates of 94.1% of due are almost identical to a year ago.”

- Collections at 94.1% of due compares well to the 93.6% for FY 2023, 93.2% for FY 2022, 83.3% for FY 2021 and 93.5% for (pre-pandemic) FY 2020.

- February’s trading update admitted Advantage’s collections had since reduced to 90% of due (see February trading update).

- Similar to the collection-of-due performance, the amount of cash collected, the number of bad debts incurred and the number of voluntary terminations handled for this H1 all matched SUS’s budget:

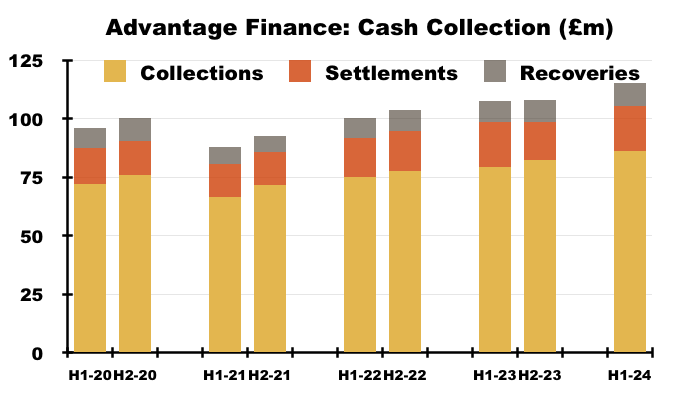

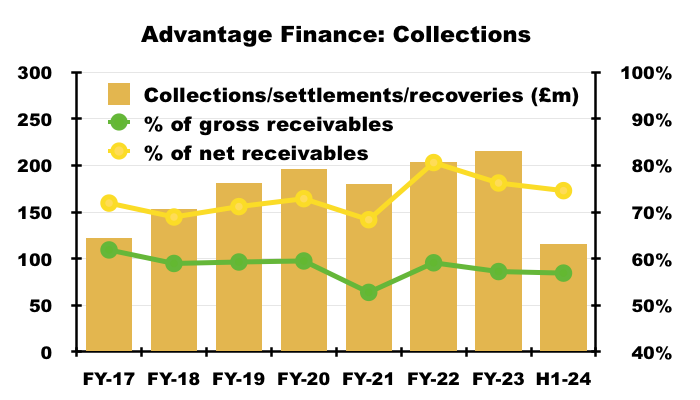

- Advantage’s collections, settlements and recoveries for this H1 amounted to £116m, up 7% on the comparable H1:

- Collections, settlements and recoveries as a proportion of gross receivables (i.e. loans before provisions) and net receivables (i.e. loans after provisions) were 57% and 75% respectively, and broadly matched pre-pandemic norms:

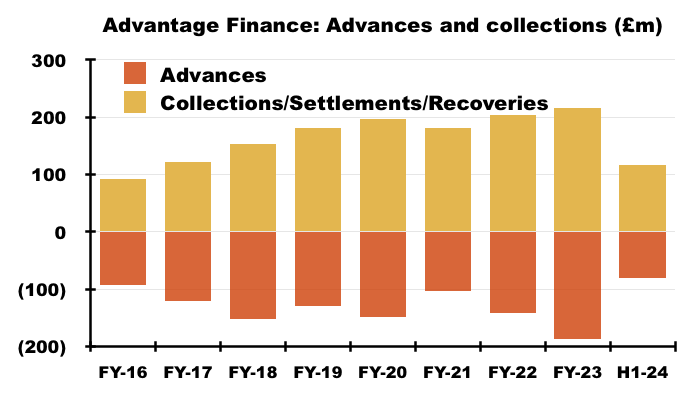

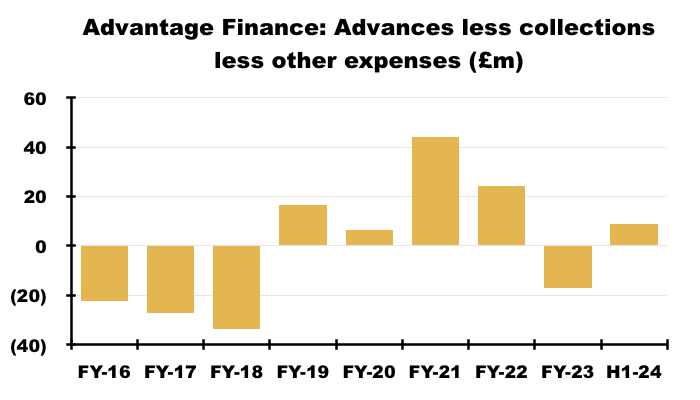

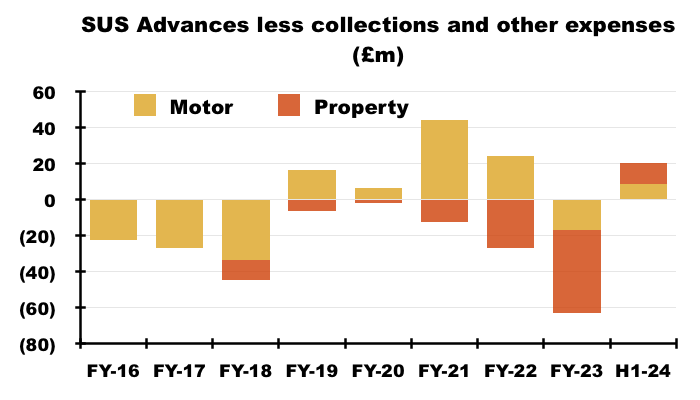

- Collections, settlements and recoveries continue to surpass the amounts used to fund new motor loans:

- Minus overheads, inter-group debt costs and tax, Advantage produced a £9m free cash surplus (see Financials):

Advantage Finance: overdue accounts and payment holidays

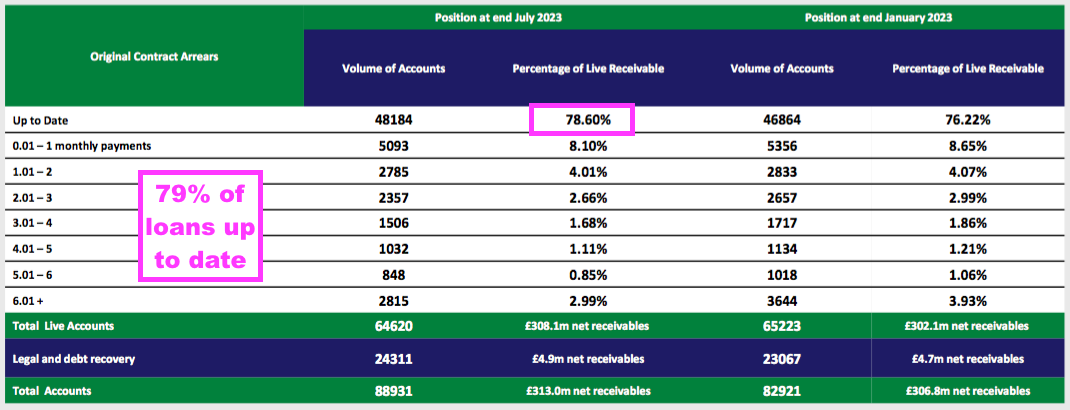

- 79% of Advantage’s loans boasted up-to-date repayments at the end of this H1:

- The up-to-date 79% continues to exclude customers that enjoyed an FCA-authorised payment holiday during the pandemic.

- Payment holidays lasted up to six months and all payment holidays ended on 31 July 2021.

- SUS deems customers that took a payment holiday as ‘overdue’, even if they have repaid as normal following their payment holiday.

- The 79% improves on the 77% for H1 2023, the 69% for H1 2022 and the 61% for H1 2021:

- But the up-to-date proportion did top 80% for FYs 2017 and 2018, and reached a super 91% for FY 2016:

- 5,558 payment-holiday customers were still active at the end of this H1, versus a peak of 18,768 at the end of FY 2021:

- 2,285 payment-holiday customers closed their accounts (one way or another) during this H1. Payment-holiday customers may therefore have all vanished from the loan book within 18 months.

- SUS no longer discloses detailed payment-holiday statistics, and such customers were last reported to be paying a healthy 95% of due during the comparable H1.

- The average loan outstanding at up-to-date accounts continues to be approximately £1k greater than the average loan outstanding at overdue accounts:

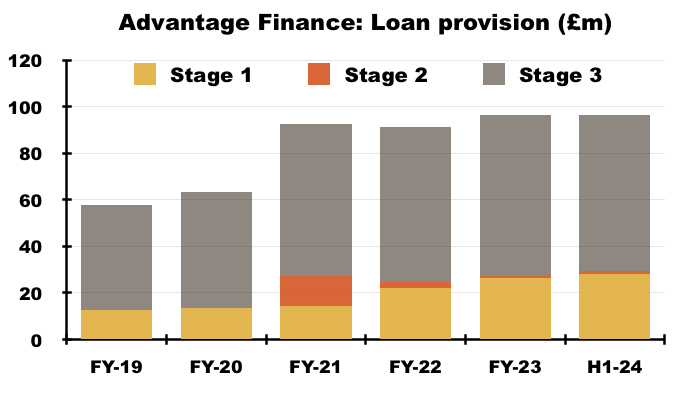

Advantage Finance: provisions

- SUS’s loan provisions are classified as:

- Stage 1, which reflects expected write-offs from up-to-date customers;

- Stage 2, which reflects expected write-offs from customers not in arrears but who are deemed “vulnerable” by factors such as “health, life events, resilience or capability” that create a greater credit risk (point 12b), and;

- Stage 3, which reflects expected write-offs from customers one month or more in arrears.

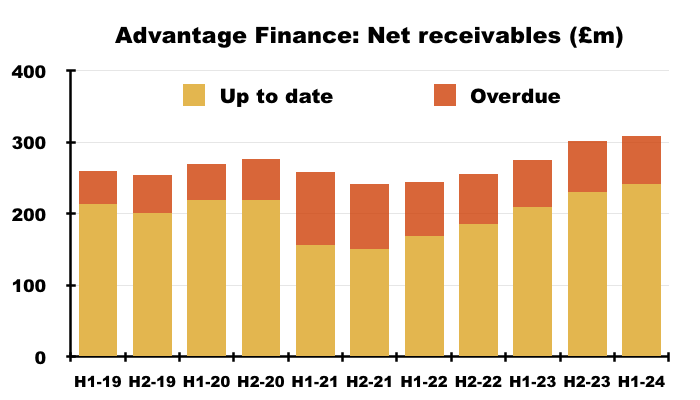

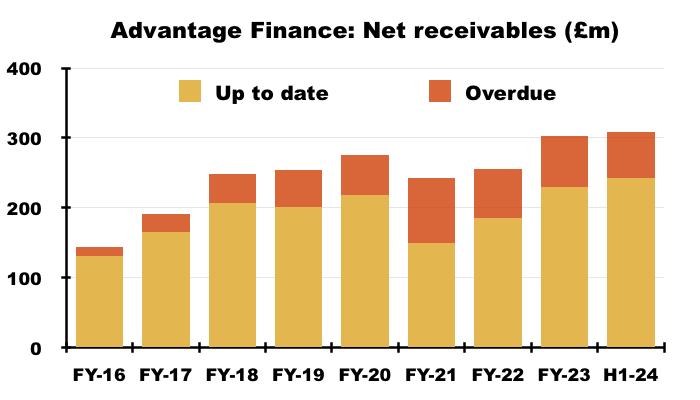

- Advantage’s total bad-debt provision remained at £96m for this H1:

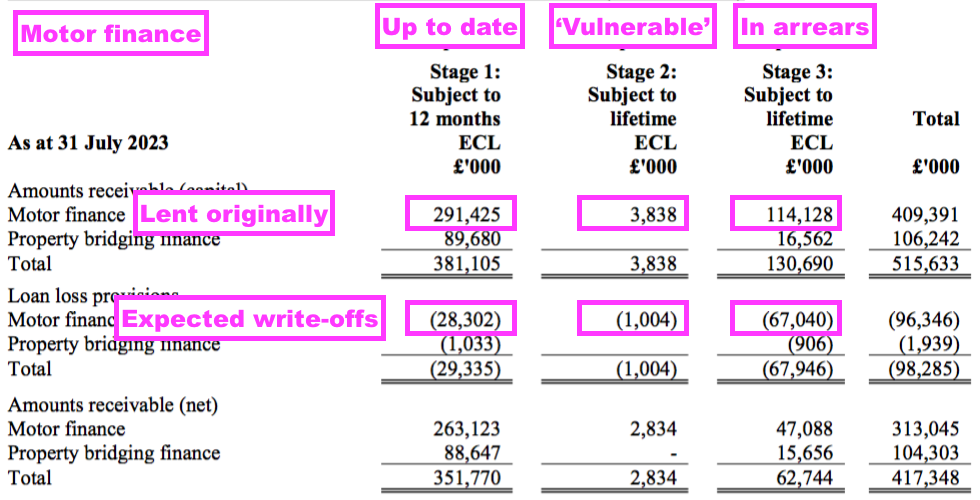

- This H1 was the first to disclose the value of customer loans — as well as bad-debt provisions — categorised in Stages 1, 2 and 3:

- Of the £291m lent to up-to-date Stage 1 borrowers, SUS reckons £28m or 10% will not be repaid.

- Of the £114m lent to in arrears Stage 3 borrowers, SUS reckons £67m or 59% will not be repaid.

- The 10% and 59% match the proportions reported at the preceding FY.

- The total £96m bad-debt provision was equivalent to 24% of the overall £409m lent originally and still outstanding:

- The proportions for FYs 2021 and 2022 were 27% and 26% respectively.

- For pre-pandemic FYs 2019 and 2020, though, Advantage’s provisions ran at 18% of total money lent. But Advantage’s provisions did touch 30% during FY 2012.

- Lending £409m and providing for £96m means Advantage expects to receive 76p of capital for every £1 currently loaned.

- Charging the aforementioned 33.87% APR is therefore required to recoup the 24p of capital not repaid and earn an adequate return on the overall £1 lent.

- The 2023 annual report (point 12c) disclosed revised “macroeconomic overlays”, which refer to IFRS 9 calculations that estimate expected losses:

“As required under IFRS9 the expected impact of movements in the macroeconomy is also reflected in the expected loss model calculations.

For motor finance, assessments are made to identify the correlation of the level of impairment provision with forward looking external data regarding forecast future levels of employment, inflation, interest rates and used car values which may affect the customers’ future propensity to repay their loan.

The macroeconomic overlay assessments for 31 January 2023 reflect that further to considering such external macroeconomic forecast data, management have judged that there is currently a more heightened risk of an adverse economic environment for our customers and the value of our motor finance security.

To factor in such uncertainties, management has included an overlay for certain groups of assets to reflect this macroeconomic outlook, based on estimated unemployment, inflation and used vehicle price levels in future periods.”

- The overlay revisions reflected a “more heightened risk of an adverse economic environment for our customers and the value of our motor finance security” and included a £65m “trade value” estimate of vehicles that at the preceding FY were in Stage 3 arrears:

“Motor finance – except for loans valued at £4.658m (2022: £4.103m), where we are aware the security is no longer present, security is held on a used vehicle for each hire purchase motor finance agreement. As stated in note 1.1.13 above, valuing these used vehicles secured under our hire purchase agreements is uncertain as the condition and mileage of the used vehicle are unknown. We estimate the trade value of collateral held at 31.1.23 for motor finance loans currently in stage 3 was £64.5m (2022: £59.0m) – these estimated values are stated before taking into account recovery and disposal costs.”

- Net receivable Stage 3 loans were less than that £65m “trade value” at £47m, suggesting SUS could (if need be) repossess the Stage 3 vehicles (for £65m) and easily recoup the their Stage 3 loan-book value (of £47m).

Aspen Bridging

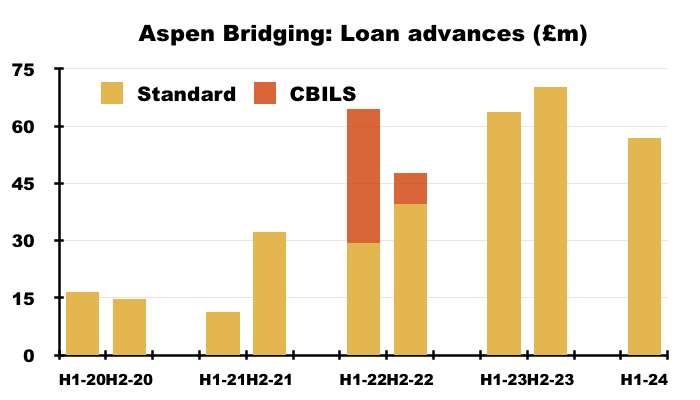

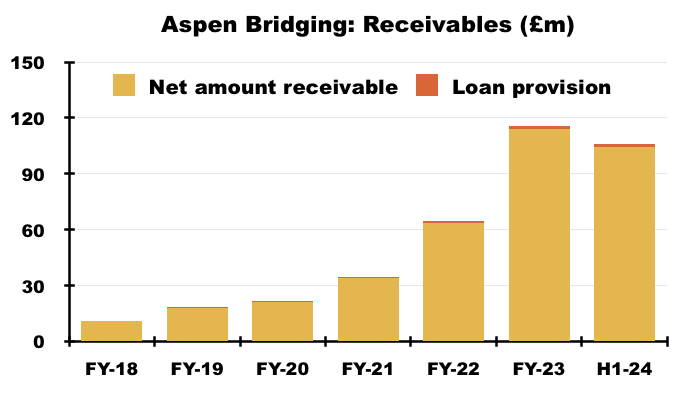

- Established at the start of FY 2018, Aspen offers property-bridging loans for small/individual property developers with awkward financial circumstances.

- The 2023 annual report (point 2c) outlined the division’s attractions to customers:

““Mainstream” banks, including the newer “challengers”, continue to lack the speed, flexibility and appetite to furnish the smaller, short-term loans in which Aspen specialises. Recent consolidation and instability in the challenger banking sector is evidence of this and again shows that, technology, speed and a quality bespoke service – as well as price – are what give smaller entrants like Aspen their competitive edge.”.“

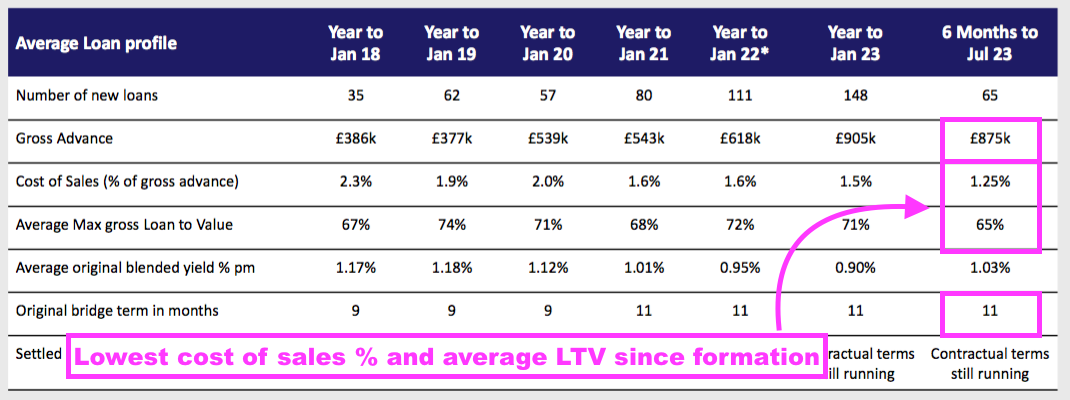

- This H1 talked of housing-market “uncertainty” and reiterated the targeting of “higher quality, more experienced” borrowers:

“At a time of considerable uncertainty in the housing market, Aspen has tightened its lending criteria so that average gross loan to values is now 65% (2022: 72%) and increased its average potential yield on an annual basis by 2% points in a still competitive market. These changes were reflected in a lower first-quarter transactions rate, targeted at higher quality, more experienced borrowers.”

- The tightening of lending criteria seems to have occurred during the preceding H2 2023 rather than this H1. The average 65% gross loan-to-value for this H1 compared to 66% at the end of the preceding FY.

- As per my FY 2023 review, Aspen’s rate card still says developers borrowing against residential properties pay a flat monthly interest rate of 0.95% on a 75% loan-to-value arrangement.

- My H1 2023 review in contrast highlighted 0.84% on a 75% loan-to-value arrangement, while my FY 2022 review highlighted 0.69% on a 70% loan-to-value arrangement.

- These case studies give a flavour of the transactions involved:

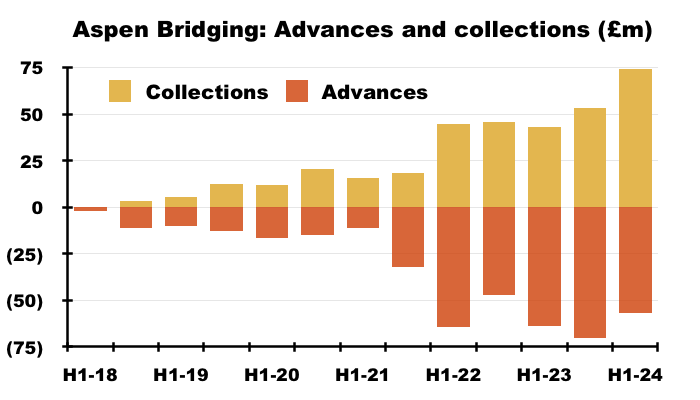

- 65 customers were advanced an average £875k for 11 months during this H1:

- The £875k average reflects the “more experienced” borrower and remains much higher than the average £618k or less advances (excluding CBILS) issued up to FY 2022.

- 65 clients receiving an average £875k loan gave a total £57m advance:

- Cost of sales (mostly broker fees) at 1.25% of the average advance for this H1 was the lowest since Aspen’s formation.

- This H1 said Aspen had been “developing [its] broker relationships with key initiatives such as co-hosting events for foreign investors and four broker events“, and possibly such improved broker relationships (as well as perhaps the “more experienced” borrowers) in turn triggered lower broker fees.

- Total Aspen cost of sales were £827k, or 11% of revenue versus 14-17% between FYs 2020 and 2023.

- This H1 witnessed Aspen’s net loan book shrink by 8% to £104m from the preceding FY’s £114m:

- The 8% loan-book reduction reflected the lower rate of advances. Collections of £74m more than offset the total £57m advance:

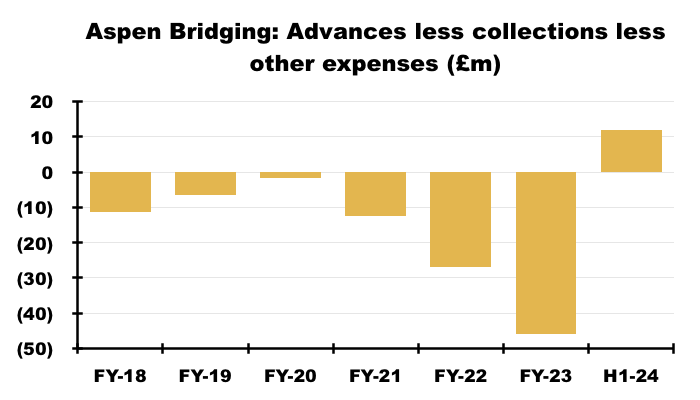

- Minus overheads, inter-group debt costs and tax, Aspen produced a £12m free cash surplus (see Financials):

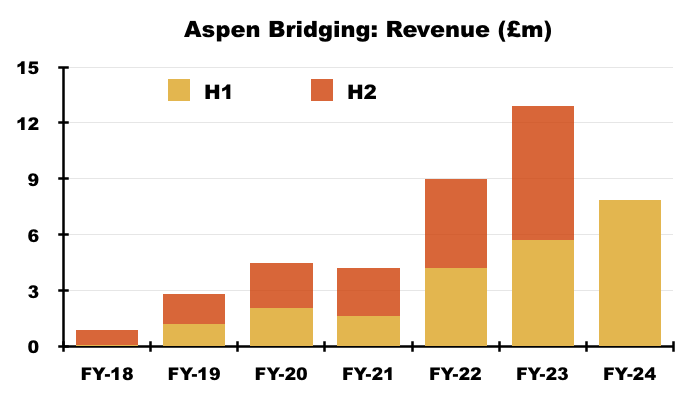

- Despite the reduced loan book, Aspen’s H1 revenue of £7.9m still set a new six-month record:

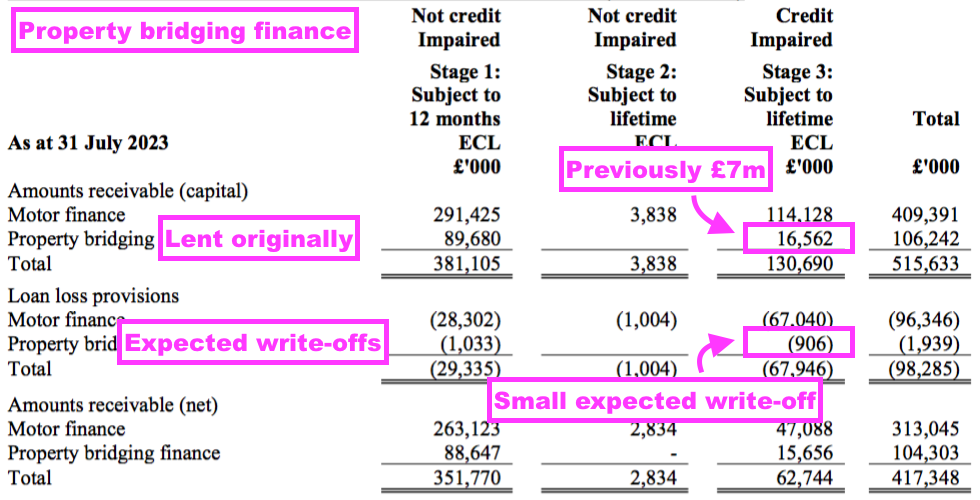

- Aspen’s bad-debt provision increased by 24% during the six months to £2m, but remains tiny versus the £106m gross loan book.

- Of the 582 loans advanced since Aspen’s formation, 452 have been repaid and only 15 of the remaining 130 are in “technical default“.

- SUS anticipated the 15 would be “profitably recovered“, although the number of defaulters has increased from 12 since the preceding FY.

- The 15 defaulters are categorised as Stage 3 borrowers, and the £17m Stage 3 property loans is more than double the £7m carried at the preceding FY:

- Management’s H1 webinar indicated late Aspen payers were charged extra:

“Default is not always a bad thing. If you have got a low loan to value, you can charge rates that were not expected initially“.

- SUS implied Aspen’s bad debts are limited due to physical property inspections:

“This [H1] performance springs from a sensitive and bespoke approach to every customer. The customer journey is continually reviewed and refined. Each property is visited by an Aspen employee for underwriting and in cases of ongoing works often throughout the course of the loan.“

- Whether inspecting every property (possibly more than once) will eventually hamper Aspen’s growth rate and lending scale remains to be seen.

- This H1 revealed more than half of Aspen’s loan book was located within London:

“Re-finance exits, which have slowed over the past six months, are constantly monitored and potential buy-to-let exits are stress tested. Overall 58% of the loan book is in central and outer London where rental demand remains historically very strong.“

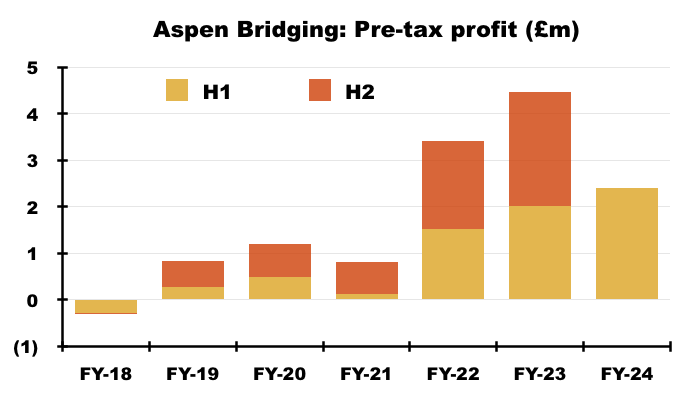

- The low cost of sales and low impairments allowed Aspen’s H1 profit to reach £2.4m:

- Although Aspen’s loan book represented 24% of SUS’s entire lending (after provisions)…

- …Aspen’s profit represented 11% of SUS’s entire profit:

- The implication therefore is Aspen currently generates a much lower return on capital than Advantage.

- Aspen’s £2.4m six-month profit from a loan book of £104m (after provisions) arguably indicates an approximate 5% annualised return on capital, and compares to Advantage’s £19m six-month profit from a loan book of £313m (after provisions) for an approximate 12% annualised return on capital.

- Management’s H1 webinar commented positively upon Aspen’s return on capital employed (ROCE):

“We are very confident and very pleased with Aspen’s ROCE, which is improving and which we anticipate will continue to improve.“

“ROCE is moving in the right direction… It has been a smoother ride in the last four years versus the first two years so we are hopeful to deliver a good ROCE for shareholders over the next few years from the Aspen business.”

“We want a ROCE over 10%, and that is the objective and that’s where really we are heading for.“

- The H1 commentary suggested Aspen’s future was bright:

“Although firm predictions in the current markets are unwise, I am confident that Aspen’s bespoke and speedy service to its customers and broker partners, its analytical attention to detail and its firm financial base will lead to a strong performance for the year as a whole.”

Management

- This H1 revealed the retirement of Advantage boss Graham Wheeler and the appointment of his successor, Karl Werner:

“Graham [Wheeler] has indicated his wish to retire at the beginning of the next financial year. However, I am pleased to announce that he has agreed to continue to serve the S&U Group in a non-executive capacity, thus giving us the benefit of his over 40 years’ experience in the industry.

I am equally pleased to report that following an exhaustive and rigorous selection process, Graham’s successor will be Karl Werner, formerly Managing Director of Motor, Aldermore Bank and before that Deputy CEO of MotoNovo Finance. I am confident that, supported by the uniquely able and experienced Advantage team, Karl will take Advantage from strength to strength, and continue its journey to become a dominant force within the specialist motor finance market.”

- With the benefit of hindsight, Mr Wheeler’s retirement was well timed (see February trading update).

- The incoming Mr Werner now has to oversee the FCA’s new Consumer Duty regime at Advantage (see Regulation: Consumer Duty).

- Both Mr Wheeler and Mr Werner were external appointments for the top job at Advantage.

- Management’s H1’s webinar addressed the apparent lack of succession planning within Advantage:

“We recognise that internal promotions are very important. We have been doing this for many years, and indeed three or four applicants for Graham’s post were internal.

But we do feel it is important we have the best person, the best fit for the job, and Karl Werner, who has got an excellent record within the motor-finance industry and indeed the wider financial-services industry, came out as the outstanding candidate.

That is no reflection at all on the internal or indeed other candidates, and we are in fact looking at the moment at succession planning within the various specialities in [Advantage], and we are certain we have a number of very talented medium level and medium-higher level executives, who will fit those roles.”

- Mr Werner’s former employer, MotoNovo Finance, is part of Aldermore Bank, which is part of FirstRand Group. MotoNovo appears to be a much larger operation than SUS. MotoNovo’s last accounts showed customer lending of more than £4b.

- SUS is run by the Coombs family, and lead executives Anthony and Graham Coombs are grandsons of founder Clifford Coombs and have worked at the business since the mid-1970s:

- The Coombs family controls at least 44% of the shares (point 8c) and it’s this owner-managed boardroom that has delivered that aforementioned 53-fold dividend increase since 1987 (points 2c and 9b).

- Various appointments do suggest the Coombs family prefers Aspen to Advantage.

- Jack Coombs for instance is a main SUS board executive and an Aspen director. Age 36, Jack Coombs may well become the lead SUS/Coombs director when his 71-year-old cousins Anthony and Graham decide to retire.

- Richard Coombs — the son of Graham Coombs — joined Aspen last year.

- I do wonder if the Coombs family favours Aspen as the ‘internal’ SUS subsidiary and views Advantage more like an ‘external’ investment that requires ‘hired hands’ for leadership.

- SUS’s head office and Aspen are both located in Solihull while Advantage is based in Grimsby.

- I note that, in contrast to Advantage and that division’s greater volume of FCA regulation (see Regulation: Borrowers in Financial Difficulty), Aspen does not offer regulated loans and is therefore not regulated by the FCA.

Financials

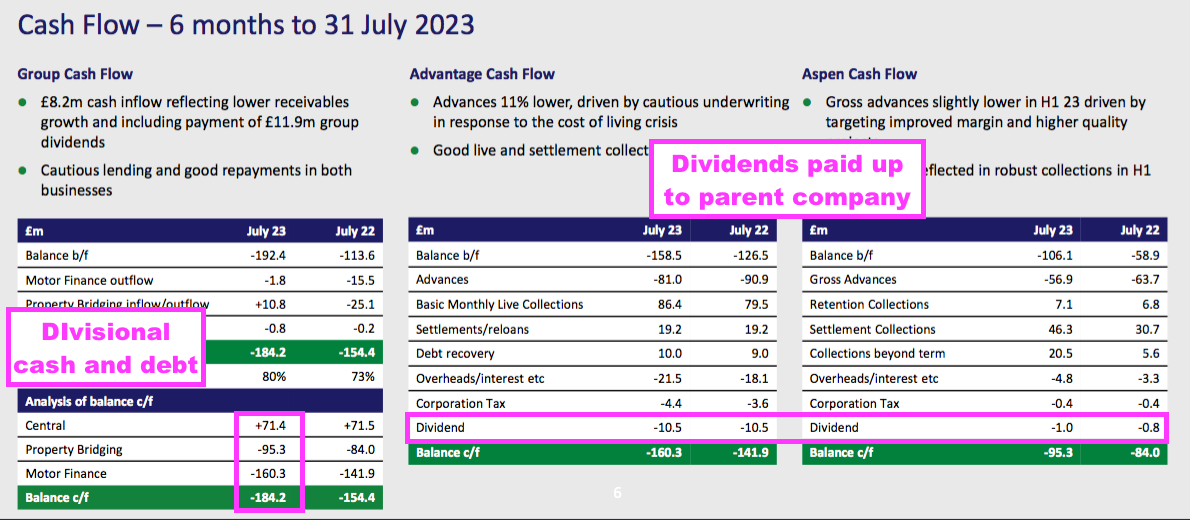

- This H1 confirmed net debt at £184m, which effectively comprised borrowings of £160m at Advantage, borrowings of £95m at Aspen and by cash held by the parent company of £71m:

- Following Advantage’s aforementioned H1 £9m free cash generation, the division paid a £10.5m dividend to the parent company.

- Following Aspen’s aforementioned H1 £12m free cash generation, the division paid a £1m dividend to the parent company.

- Divisional dividends paid up to the parent company can then either be:

- Redeployed within the other division;

- Used to repay borrowings, and/or;

- Used to pay group dividends.

- This H1 was only the third six-month period during which both Advantage and Aspen produced positive cash surpluses before divisional dividends (the others being H2 2020 and H1 2021):

- Net finance costs paid during this H1 of £6.8m implies SUS’s average H1 £190m borrowings incurred interest at approximately 7.1%.

- 7.1% compares to my estimated 3.4% incurred during the comparable H1 2023 and my estimated 5.4% during the preceding H2 2023.

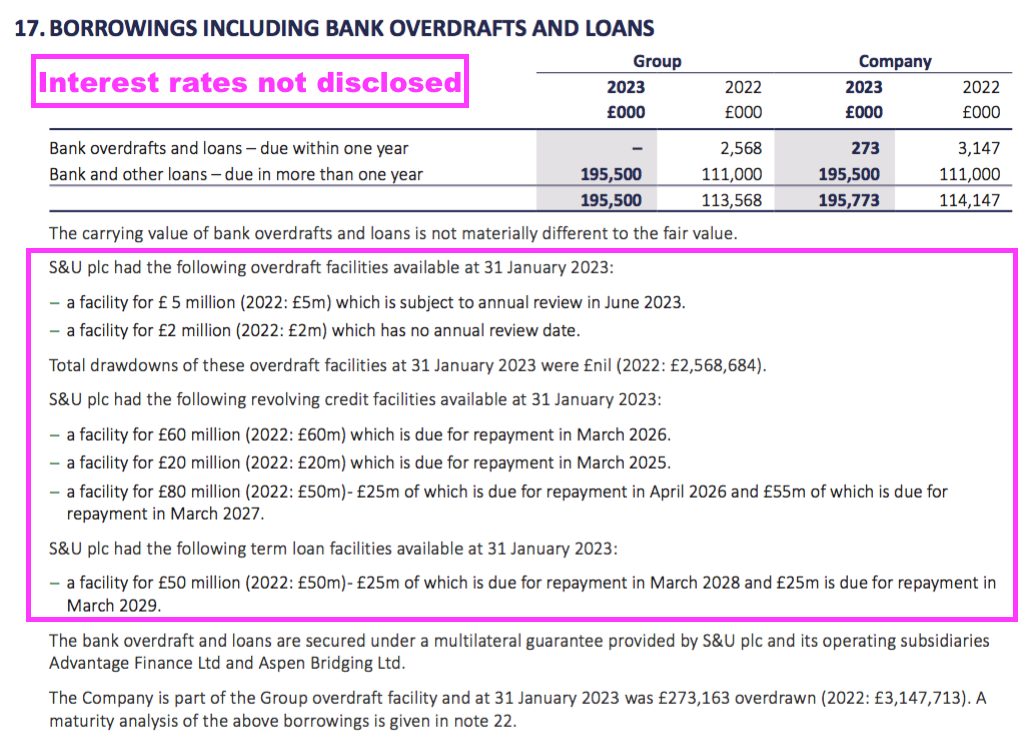

- SUS does not disclose the exact rates payable on its debt facilities, which is poor form for a main-market company:

- However, management’s FY 2023 webinar disclosed debt costs were “just less than 3%” above SONIA, and therefore shareholders “could assume” S&U was at the time paying “about 7% on the borrowings”.

- SONIA is currently 5.19%, which means SUS could now be paying 8% on its debt.

- 8% on gross debt of £184m equates to annual bank interest of £15m — more than double the preceding FY’s £7m.

- Management’s FY 2023 webinar also confirmed 100% of debt was variable-rate.

- This H1 declared the balance sheet was “more solidly founded than ever” and the £184m debt was “well within budget“.

- Total borrowing facilities during this H1 were lifted by £70m to £280m, which now comprise:

- Two £25m term loan facilities maturing in 2028 and 2029, and;

- A £230m revolving credit facility with an initial maturity during 2026 followed by two one-year extension options if all parties agree.

- Debt at £184m remains more than twice covered by the £417m lent to customers (after provisions):

- H1 gearing — calculated by dividing debt by shareholder equity — was 80% (£184m/£229m).

- Management’s H1 webinar implied SUS was not immediately heading for its present 120% gearing limit:

“Overall, we have always been very conservative in terms of our gearing for a finance company. We have an idea that 100% is quite an ambitious level of gearing. We have always had a great deal of equity in our business and that general approach will continue…

We have always said the exact gearing level would relate to the underlying asset opportunity. At the moment we have got two good businesses with an asset opportunity in each and we therefore may well get up to 100%. With our banking facilities at the moment, we have a limit of 120%.”

- However, borrowings during H2 have reached £224m — equivalent possibly to 100% gearing (see February trading update).

- The aforementioned shift towards higher margin B-to-D-tier customers at Advantage will help offset the group’s greater borrowing costs.

- Nevertheless, higher interest rates will diminish the returns earned on the money SUS has already lent, particularly at Advantage, where loan terms last typically for 54 months.

- Interest payable by all customers at both Advantage and Aspen is fixed throughout their initial agreements.

Regulation: Borrowers in Financial Difficulty

- This H1 noted SUS’s ongoing dialogue wth the FCA and the increased industry regulation that includes a Borrowers in Financial Difficulty project and the new Consumer Duty regime:

“Discussions on this with the industry regulator, the Financial Conduct Authority, have become more regular and are generally constructive.

A review of affordability took place earlier in the year and Advantage consistently makes adjustments to its underwriting calculations to account for today’s cost of living pressures.

Focus has recently shifted to the FCA’s Forbearance Review, a continuation of its Borrowers in Financial Difficulty project encompassing the finance industry as a whole.

The introduction of the new Consumer Duty from 31 July and its interaction with older CONC rules and with Consumer Credit legislation has brought forward a review of Advantage’s collecting processes, procedures and policies, particularly as they affect vulnerable customers.”

- From what I can tell, the FCA’s Borrowers in Financial Difficulty project assessed whether lenders were meeting the regulator’s Tailored Support Guidance, which addressed how lenders should handle borrowers with payment difficulties caused by the pandemic.

- An FCA follow-up to the Borrowers in Financial Difficulty project proposed various “forbearance” changes to the Consumer Credit sourcebook (CONC).

- Current CONC forbearance rules refer only to customers who are “in arrears” or are “particularly vulnerable“. The proposed changes refer to customers who are “in or approaching arrears” or are just “vulnerable“.

- Essentially the FCA wants lenders to provide a range of “forbearance options” that allows a greater number of customers to adjust their repayments should their financial circumstances deteriorate. Such options may include:

• suspending, reducing, waiving or cancelling any further interest and charges

• allowing deferment of payment of arrears

• accepting no payments, reduced payments or token payments for a reasonable period of time

• agreeing a sustainable repayment arrangement with the customer that allows the customer a reasonable period of time to repay the debt

- The FCA summarised the benefits of its proposals for customers:

“Our proposals will lead to benefits to customers who find themselves in payment difficulty. These benefits include:

• Lower overall costs from interest, fees, and charges (including consumer credit fees, for which cost savings are quantified)

• Lower time costs, as we would expect customers to need to speak to firms less if debt problems are resolved quickly in sustainable and appropriate ways

• Reduced impact on credit files which could affect customers’ ability to get new (and cheaper) credit products once they are out of financial difficulty

In the longer term, customers resolving their debt problems faster and more sustainably will be able to access credit again at better terms.”

- The FCA’s proposals do not list any benefits for lenders.

- The general implication for Advantage (and similar lenders) is more customers with difficulties may now be able to pay less through penalties than they would have done previously.

- Recent results from specialist lender Secure Bank Trust (STB) acknowledged extra motor-loan costs stemming from the FCA’s proposals:

“[STB] recognised charges for exceptional items of £6.5 million during the year (2022: £nil). Costs of £1.8 million were incurred in relation to non-recurring corporate activity that took place during H1 2023. Following the FCA’s review of Borrowers in Financial Difficulty (‘BiFD’) across the industry, and in response to the specific feedback we received on our own collection activities, costs of £4.7 million (comprising £2.7 million costs and £2.0 million potential redress/goodwill) have been incurred, or provided for, relating to processes, procedures and policies in our Vehicle Finance collections operations. We have engaged external support to assist us with this work and, where necessary, are taking the necessary actions to enhance our approach.“

- This H1 politely noted:

“Reconciling these regulatory requirements with Advantage’s traditional commercial and ethical aims to keep customers on track with their repayments as inflation rages, is a challenge which I am confident Advantage will overcome.”

- I translate that as:

“Reconciling these regulatory requirements with Advantage trying to earn a profit to keep customers on track with their repayments…‘‘

Regulation: Consumer Duty

- Overlaying the forbearance proposals is the FCA’s Consumer Duty regime, which requires lenders to deliver “good outcomes” for retail customers.

- The FCA does not exactly define a “good outcome“, but one aspect that has seen financial-services groups act is ensuring their products offer “fair value“.

- This FCA bulletin noted:

“Retail customers experience harm where they don’t get value for their money. A lack of fair value is unlikely to be consistent with customers realising their financial objectives and firms cannot act in good faith if they are knowingly manufacturing or distributing poor value products or services.

Good practice:

We have seen firms:

Examine whether the total cost to consumers of their products and services – including fees, charges and other costs – provides fair value relative to their benefits. Firms have made changes to improve their value proposition by reducing costs for consumers by:

• Updating pricing models for products and services. For example, reducing the rate of interest paid on certain credit products and/or for certain types of customers

• Reducing or removing charges for certain products or ongoing services where these were deemed too high relative to the benefits provided

• Putting controls in place for certain groups or customers, for whom charges over a certain amount do not offer fair value, to improve value and remove these charges“

- St James Place (STJ) has been a notable Consumer Duty casualty. A statement last year from the wealth manager admitted lower charges for customers would impact its results “over the next few years“:

[STJ] “In addition to benefiting from improved simplicity and therefore comparability, clients will see enhanced value from the changes we are making, with reduced overall ongoing charges for existing client investments across our core product wrappers. Our continued focus on value and outcomes for clients is consistent with the ongoing expectations of Consumer Duty and we are confident that our changes will work well for clients.

For shareholders, these changes and the associated implementation costs will affect the shape of the Cash result in the future. The changes will reduce the Underlying Cash result over the next few years before growth accelerates over the medium term and beyond, aligned with the development of total Group funds under management.”

- The main worry for SUS is the FCA may not believe motor-finance products charging Advantage’s typical 33.87% APR are providing “fair value“.

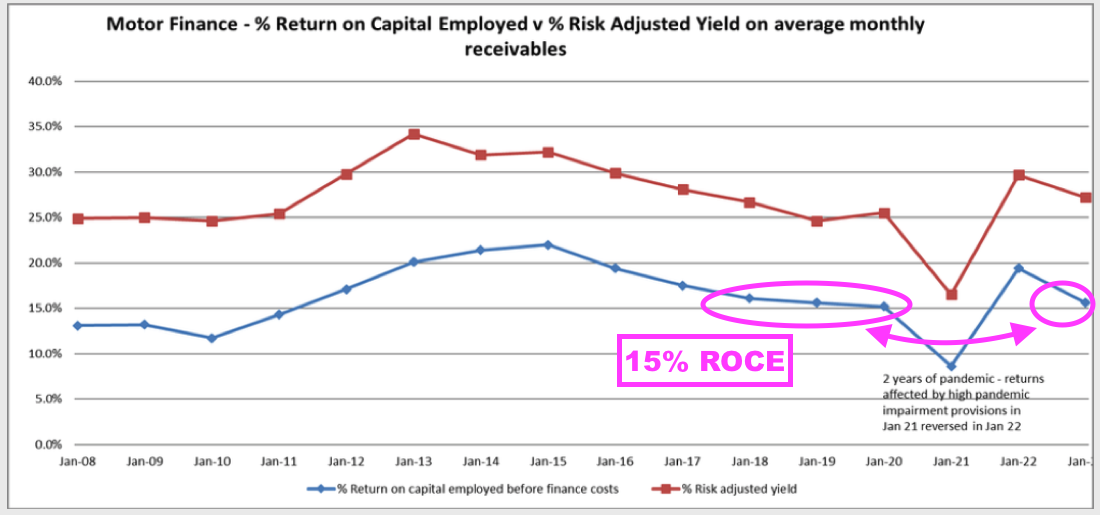

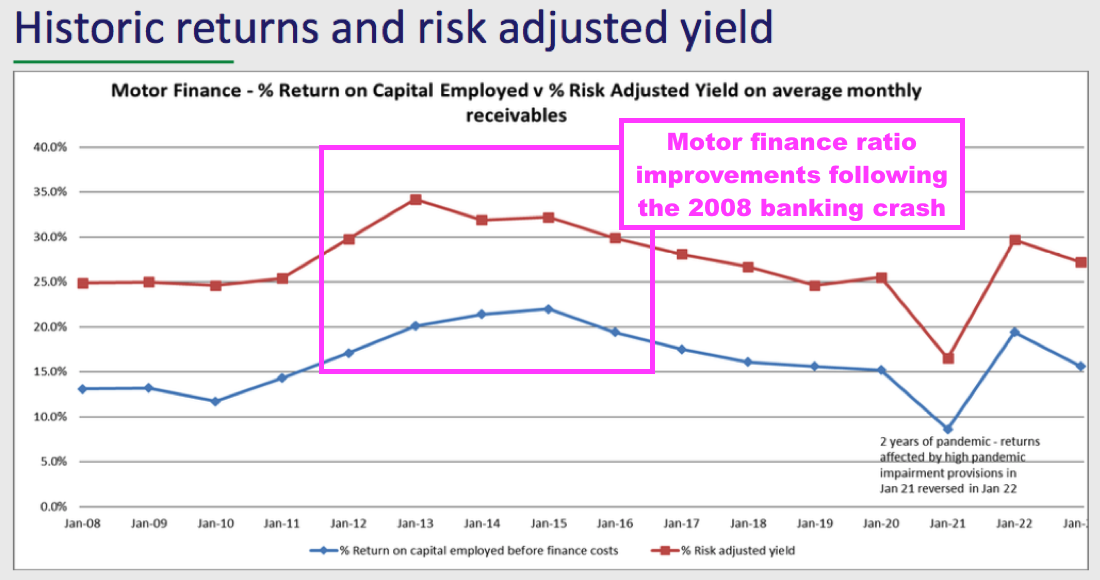

- The preceding FY suggested Advantage was earning a 15% return on capital employed:

- But Advantage earns much a higher ROCE from customers who repay their loans in full and on time.

- Charging a flat 16.9% annual interest on a £8.0k car loan over 54 months less cost of sales of £967 generates approximately £5.1k in return.

- Earning £5.1k from a £8.0k investment over 54 months equates to a 64% return or approximately 14% a year.

- Note that Advantage customers repay a mix of loan capital and interest during the terms of their loans.

- That c14% return could therefore be approximately 28% assuming the loan capital is repaid equally throughout the term.

- SUS could well have to make its case to the FCA that the seemingly healthy returns from Advantages’s perfect customers do indeed represent “fair value“, given the need to cover the lower (and negative) returns from the less-perfect customers.

- Another Consumer Duty concern is that the regulatory desire for consistent product “fair value” may restrict the ability for lenders to satisfactorily recoup losses from non-paying customers. This FCA letter stated:

“Products need to continue to offer fair value when a customer falls behind with their payments, so in considering the fair value of their products firms must consider all interest, fees and charges a consumer may incur, including late payment/arrears charges. This is especially important if the target market includes consumers with poor credit rating.”

- I worry Consumer Duty could open the door for a greater number of borrowers to delay repayment and not suffer any financial penalty.

- Either way, Consumer Duty requires all motor-loan providers to undertake a lot more administration. The same FCA letter stated:

“Firms of all sizes in the sector should be prepared to discuss the Consumer Duty with us and to provide us with information on the reviews and assessments they have conducted as part of the embedding process.“

- SUS’s 2023 annual report (points 1b and 2a) claimed Consumer Duty would (eventually) benefit the group:

“Although some may argue that the new Consumer Duty attempts to lay on lenders’ responsibilities for future events inevitably beyond their control, and which, to an extent, replicates existing statutory duties of care to customers, S&U endorses the Duty for ethical and competitive reasons.”

“This is also why Advantage sees the Consumer Duty giving a significant competitive advantage to businesses which maintain the very high standards of which they have been so rightly proud over the past 25 years.”

“However, Advantage will responsibly embrace the new Consumer Duty. First, because it is right to do so and second, since it will give well organised companies like Advantage a commercial advantage over those who are not.”

Regulation: Skilled Person

- Perhaps not surprisingly, the December update published after this H1 recapped the regulatory situation:

“This [Consumer] Duty forms part of a regulatory regime, encompassing forbearance, affordability and customer vulnerability, which for S&U stretches back over 50 years to our obligations under the Consumer Credit Act.

More recently, these have been supplemented by a significant influx of consumer regulation from the Financial Conduct Authority as set out in its Principles for Business, Consumer Credit Source Book, its “Dear CEO” letters, the Borrowers in Financial Difficulty review, its Tailored Support Guidance……….and now by the Consumer Duty.

As a consequence, attempting to reconcile and interpret the policy, process and operational requirements of these dictates has now become a major, often subjective and expensive process.”

- The Consumer Credit sourcebook alone runs to 444 pages, so no wonder a “Skilled Person” has been recruited to assist with interpreting the deluge of FCA edicts:

“Following the FCA’s special focus on Borrowers in Financial Difficulty (BiFD) in non-prime motor finance, the “review of Advantage’s, collecting processes, procedures and policies” we noted at half year, has developed into a more formal interaction with the FCA.

Along with many other lenders in our market segment, Advantage has appointed a Skilled Person. They are tasked, where necessary, to advise and guide Advantage in delivering, these regulatory requirements. This may be a lengthy and costly process, but it should prove valuable in providing assurance on our longstanding methods of serving our customers, and ensuring, that our products continue to meet their differing needs.

These methods have been validated by Advantage’s excellent record with the Financial Ombudsman Service which at an uphold rate of just 15% is, by some margin, the best in the motor finance industry.“

- SUS did not make clear whether the group appointed the Skilled Person for its own benefit or whether the FCA commissioned a Skilled Person through an s166 investigative request.

- Management’s H1 webinar seemed to imply SUS was not seeking Skilled Person assistance before December’s update:

“We do know from our contacts at the Finance & Leasing Association that the FCA seems to be using the s166 mechanism far more widely than it ever did before in order to investigate practices within the financial-services industry. And it is impossible to say whether [the FCA] would apply [an s166] in our particular case.

What I would say, however, is that [the s166] is widespread, it is a means of investigation, and we are proud of the way we service our customers and provide service to them. We would be very relaxed if a s166 application came our way, although obviously we do not necessarily welcome it or anticipate it“

- February’s trading update implied the Skilled Person was mandated by the FCA as part of a wider sector investigation (see February trading update).

- The 2023 annual report (point 1b) claimed relations with the FCA were “cordial“:

“As a consequence, Advantage has always maintained regular and cordial relations with the FCA“.

- If SUS’s relations with the FCA were indeed “cordial“, I trust any s166 instruction issued to SUS would be among a number of s166 instructions issued to numerous other motor-finance specialists.

- The H1 webinar gave management the opportunity to explain its regulation frustration:

“The frustration is very simple… We believe the free market works very well… There does seem to be a recent trend over the last 15-20 years that the market itself cannot be trusted to deliver the very best outcomes for customers, and that seems to have embedded itself in certain parts of government.

We, however, believe that the free-enterprise system does work very well. It obviously has to be regulated, but it is the degree of that regulation with the whole plethora of the consumer credit act, the consumer duty, CONC rules, etc. There is a continuing questioning of the way in which the industry works, and that has a bad effect.

Firstly, it means we spend less time improving our business for the benefit of our customers, because we have to deal with all of these regulatory enquiries. And secondly, over-regulation does inhibit innovation. People put new products, new processes that might benefit customers very considerably, on hold, and we do not think that is good for customers in the long term”.

Regulation: discretionary commission arrangements

- One regulatory issue not impacting SUS directly concerns motor-finance discretionary commission arrangements (DCAs).

- Banned by the FCA during 2021, DCAs had allowed motor-finance dealers/brokers to receive greater commissions from lenders by increasing the interest rate a customer paid for their car loan.

- The Financial Ombudsman Service recently upheld two complaints for DCA compensation (here and here), which appears to have opened the floodgates to other complaints and compensation demands.

- The FCA is now “urgently assessing whether the historic use of DCAs means a significant number of individuals could be due redress (compensation) from motor finance firms because they paid too much for their car loans.”

- Advantage has never offered DCAs. The division’s website says:

“IMPORTANT NOTICE: DISCRETIONARY COMMISSIONS

Advantage Finance can confirm that as a firm we have never used any form of Discretionary Commission Arrangement and has never allowed the broker to influence the interest rate for any potential customer. Therefore, this action being taken by the FCA does not apply to Advantage Finance and any of its past business.”

- But never having offered DCAs may not exempt SUS from financial trouble.

- Vanquis Banking (VANQ) for example owns motor-finance specialist Moneybarn, which has not been involved with DCAs either:

“FCA’s ban on discretionary commission

Moneybarn have always disclosed to customers prior to entering a Conditional Sale agreement that a commission would be paid to the broker. We have never had discretionary commission agreements in place with any of our brokers, and therefore the interest that the customer pays on a loan has never been affected.“

- And yet VANQ revealed the other week how costs dealing with complaint submissions would “materially impact” its profit:

“[VANQ] is not a subject of the FCA’s review of historical motor finance commission arrangements and sales.

Nevertheless, the Group has been experiencing significant levels of third-party complaint submissions. Reviewing them is causing an increase in administration costs. While the vast majority of these complaints are not upheld, the associated costs are likely to materially impact the Group’s profitability in 2024. The Group is exploring proactive legal steps to address this situation.”

- Only time will tell whether SUS will experience similar “third-party complaint submissions” and elevated administration costs.

- The former employer of Advantage’s new boss appears subject to the FCA’s DCA investigation.

- Management’s H1 webinar reckoned the DCA issue may one day benefit SUS:

“We are in the lucky position that we never offered the type of commission that has been outlawed by the regulator. We offer a flat-fee commission to our brokers, so that means the three legal cases we have processed, we have won them all against claims management companies. And we have had about 24 or 25 individual decisions come back from the Financial Ombudsman Service, a 100% of which have been found in our favour. So we are pretty sure that issue is not going to affect Advantage.

But actually in the long run, it might benefit Advantage because as the prime lenders focus their businesses on possibly re-addressing some customers, they may take their eye off the ball in terms of lending to new customers, which might actually create a bit of an opportunity for us moving forward.“

- Following the H1 webinar, the Financial Ombudsman Service has upheld a (non-DCA) complaint against Advantage.

- The Financial Ombudsman Service website lists all the complaints against Advantage, of which the majority concern alleged “irresponsible lending” or similar.

- Many complainants really ought to take greater responsibility for their financial decisions, rather than blame lenders for providing loans the complainants actually requested but afterwards claim they could not afford.

February trading update

- February’s trading update published after this H1 cited regulatory factors among wider economic “headwinds” that were “unsurprisingly” experienced during H2:

“Since S&U’s last trading statement two months ago, the headwinds I reported then of poor consumer confidence, continuing high interest rates, cost of living pressures and regulation have, unsurprisingly, impacted the Group’s progress and profitability. The intemperate economic climate in Britain surrounding these unfortunately persists. Whilst we continue to invest in the receivables which drive our future profits, we do so with caution.

Thus, loan advances in the period for Advantage, our motor finance lender were 7% lower than last year. Although finance applications remain buoyant at Advantage, and their customer profile is good, the debilitating effects on some customers of continuing cost of living pressures and our obligations under the Customer Duty, make such prudence essential.”

- The headwinds alarmingly combined to reduce H2 motor-loan collections to 90% from 94% during this H1:

“Inevitably, these headwinds affect collections. Thus, live monthly repayments at Advantage for the second half of the year were 90% of due (H1 23: 94%).”

- The February update noted the adverse motor-loan trends had been confined largely to the last quarter:

“Although these trends, particularly at Advantage, have largely been confined to the last quarter, a prudent approach to their likely effect on collections will have a temporary impact on profitability.”

- If motor-loan collections were 90% during H2 and the headwinds confined mostly to Q4, then presumably motor-loan collections during Q4 were much lower than H2’s 90%.

- The lower rate of collections has triggered additional bad-debt impairments that will reduce FY 2024 pre-tax profit by close to £5m to approximately £33m:

“In particular, the reduction in the rate of collections has necessitated increased provisioning under the IFRS9 accounting standard. Thus, our group profit before tax for the year ended 31 January 2024 is likely to finish between 10% and 15% below consensus expectations of c£38m. Nonetheless, we expect a solid rebound; hence our continued funding investment in both businesses of £15m during the period.“

- FY 2024 pre-tax profit of approximately £33m implies H2 pre-tax profit of approximately £12m versus £21m for this H1 and the preceding H2 2023.

- The February update suggested the Skilled Person was appointed by the FCA as part of a wider sector investigation:

“During this period, the interaction with the FCA, through our Skilled Advisor appointed as part of their industry wide investigation into customer forbearance and affordability, has deepened.”

- “Interaction with the FCA…has deepened” also indicates greater costs.

- Reflecting the FCA’s new guidance, Advantage has revised its collection procedures…

“In response to this, Advantage has made precautionary changes to its collection and repossession processes with a particular focus on those customers in payment arrears, or who are identified as vulnerable. Given the evolving demands of the regulatory landscape, operating within them will require a proportionate and constructive dialogue between Advantage and the regulator.”

- …and revised its selection criteria for new customers:

“More certain is that the new collecting environment requires adjustment to both pricing and risk profile at Advantage. This year, has seen Advantage shift towards slightly larger and longer-term products aimed at a more resilient customer base. Whilst we retain our “traditional” customer “tiers” they constitute a smaller proportion of the total. It is this shift, rather than an increase in transactions, which has driven a healthy rise in receivables this year. Customer numbers are just over 66,500.“

- The reduction to collections is expected only to “partly recover” during the next few months:

“In the meantime, the decline in collections referred to above is reflected in a percentage of due 4% lower than Advantage’s habitual 94%. This may be partly seasonal and is expected to partly recover in the coming months. The actual levels of bad debts and voluntary terminations remain within budget.”

- Unlike December’s update, which revealed the group’s loan book stood at £446m after provisions, February’s update did not specify the level of the group’s loan book.

- I therefore speculate SUS at the time had doubts as to final/audited value of Advantage’s loan book. Additional impairments for motor-loan bad debts may in fact be greater than the £5m implied by the lower profit.

- February’s update about Aspen was more encouraging:

“Aspen Bridging continues to make steady progress despite a UK housing market which remains subdued and relatively inactive…

Thus again, the watchwords for Aspen are ambition tempered by caution. Net receivables now stand at just over £130m (2023: £114m) as the business achieved its budgeted annual gross lending target of £144m, and has also just achieved an impressive historical milestone of £500m of gross lending.”

- A £130m property loan book (after provisions) compares to £104m for this H1.

- Aspen’s £144m lending target compares to £134m advanced during FY 2023.

- The £144m advanced less the £57m advanced during this H1 implies £87m was advanced during H2, the largest for Aspen during any six-month period.

- Note that Aspen’s collections were “slower” during Q4:

“Collections have been slower in the period, as refinancing and sale processes take longer. This followed an excellent performance for the year as a whole, when repayments (excluding retentions) at £126m were more than 50% up on 2022/23. Hence loan book quality remains good. Of 167 loans, the number of loans beyond term is 15 (December 23: 16).“

- The February update confirmed year-end borrowings at £224m and annual interest costs at £15m:

“Group borrowing now stands at £224m against £192m last year. Group funding facilities of £280m provide comfortable headroom for the sustainable growth path expected over the next two years. However, these funds come at an increased and not readily transferable cost, and the past year has seen interest payable by the Group rise to £15.1m from £7.5m last year.“

- Borrowings of £224m would incur annual interest of £18m if SUS is indeed paying interest at the aforementioned 8%.

- Under the guise of “partially protect[ing] returns to shareholders“, the various headwinds prompted SUS to reduce its second interim dividend by 3p, or 8%, to 35p per share:

“The past seven years has seen dividends to our loyal shareholders rise from 91p to 133p per share, an increase of 46% whilst profit before tax has risen by 64%. It is therefore right that at a time when the cost of living, funding and regulatory challenges have had an impact on profits, we partially protect returns to shareholders as we also did during the pandemic. Hence this year we propose that S&U’s second interim dividend should be 35p (2023: 38p), payable on 8th March to shareholders on the register on 16th February.“

- Funnily enough, management’s H1 webinar responded to a question about reducing the dividend and reinvesting into more promising sectors:

“[The question] basically suggests we reduce dividends and put the money into adjacent businesses which could mitigate what he sees as weaknesses in our current markets…

“We do not think it is sensible to reduce dividends for two reasons. First, we want to stick to our last(?). We don’t want to go into adjacent businesses, particularly in times of economic uncertainty, about which we may not have the expertise that we do at the moment. Obviously we will look at any good business opportunity, but it will have to be a very good one if we are going to move away from our areas of expertise.

And the second reason why we would not do this is because we do not need to. We have very significant headroom in terms of our available finance through our normal financing mechanisms and I would not want to add unnecessarily to that headroom by depriving shareholders and the owners of the company of their due return.”

- That commentary (made just four months before February’s dividend cut) — alongside SUS’s illustrious payout record — suggests the Coombs family would not easily decide to lower the dividend.

- As such, the payout reduction does raise questions as to whether the impact of the wider economic issues and the fresh regulation:

- Has been significantly underestimated by management, and/or;

- Will permanently dilute the profitability of used-car finance.

Valuation

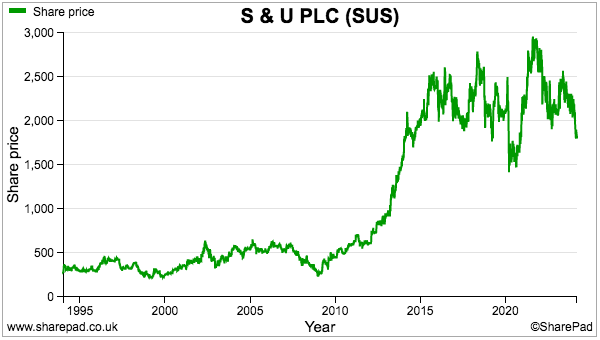

- The £18 share price suggests the profitability of used-car finance — and perhaps property-bridging finance as well — has been permanently diluted.

- This H1 showed net assets at £229m or £18.86 per share.

- December’s update reported the net loan book was £446m, debt was £209m and therefore implied net asset value (NAV) was £237m or £19.50 per share.

- The stock market therefore values SUS at just below NAV, which has happened only occasionally during the last 30 years:

- Buying at NAV should (in theory) deliver returns equivalent to lending direct to SUS’s customers — with NAV effectively protected by the right to repossess the secured vehicles/properties if the loans default.

- My 1x NAV rating therefore implies the market is very worried that economic trouble and — in particular — regulatory changes will lead to reduced collections, greater write offs and limited NAV progress.

- After all, if Consumer Duty now limits the ability for lenders to apply financial penalties to discourage late payments, then maybe the sector will soon be awash with later payers.

- Lenders may then in turn reject more loan applications, which could leave lower-credit-scoring customers unable to obtain any hire-purchase finance.

- The shares fell to £14.75 during the August 2020 pandemic lockdowns, at which point the last declared NAV was £14.81 per share.

- SUS then navigated through FCA-authorised payment holidays, Covid upheavals and so on, and, with hindsight, over-estimated pandemic-related write-offs by £15m.

- I am hopeful SUS is again taking a prudent view of expected write-offs after February’s update, but the absence of a loan-book value within that update is not encouraging.

- For extra perspective on past valuations, the shares dropped to 250p at the end of 2008 when NAV at the time was £43m or 366p per share.

- Mind you, SUS was predominantly a home-credit business during 2008 and may have attracted much greater worries to justify a 0.7x NAV valuation during the banking crash.

- However, the banking crash did reduce competition, and various measures of Advantage’s profitability improved until rivals re-emerged from 2015 onwards:

- Perhaps wider economic issues, Consumer Duty and DCA compensation will combine to inhibit motor-finance competition and eventually bolster Advantage’s profitability and performance.

- In the meantime, the forthcoming FY 2024 results will reveal whether reduced collections, greater bad debts and higher debt costs will continue to dampen earnings, NAV and the dividend.

- Assuming the final payout is held, the trailing dividend is 130p per share and provides a generous 7.2% yield at £18.

- This share has typically offered a useful income. My initial purchase during Q1 2017 at £21 supplied a trailing 4.1% yield, while a top-up during Q2 2019 at £19 supplied a trailing 6.2% yield and a further top-up during Q4 2020 at £17 supplied an (at the time) estimated 5.3% yield.

- Right now, dividends are the primary investor comfort given the £18 shares are back to a level first achieved during 2014:

- To conclude, the aforementioned Coombs family managers have successfully navigated many previous downturns (not least the pandemic), and the 2023 annual report (point 2c) reminded shareholders of the long-term benefit of employing such leadership:

“Our over-arching factor in the success of our business over 80 years and through three family generations of management is our business philosophy. The identity of interest between management and shareholders has fused our ambition for growth with a conservative approach to both credit quality and funding.”

- I trust the board’s “conservative approach to both credit quality and funding” will (once again) prove its worth to shareholders.

Maynard Paton

Hi Maynard

I wonder if you have considered the ultra low returns on the Aspen bridging loan business?

Y/e Jan24 >> Profit £4.8 m (2023: £4.5m) Net receivables £130.4 m (2023: £113.9m)

Isn’t that a return of a 4.2% on capital employed? (Motor finance was 11.9% in y/e Jan23.)

I cannot see how they will ever get returns up to much more than 5% on property, and that seems ever so low considering the ‘black swan’ risks. There is also the problem that leverage will limit the growth of this part of business.

What are your thoughts? Perhaps my concerns are misplaced?

Hi Charles

Yes, I have asked about Aspen’s ROCE during the IMC webinars and management, from what I recall, has more than once stated its confidence of Aspen reaching double-digit levels.

I would argue ROCE ought to take an average of the net receivables employed during the year (i.e. c£122m), although the end calculation may not be too different.

But if you look at slide 8 of the FY 2024 results presentation, Aspen carries debt of £120m — which is significant versus the £130m net receivables. Aspen operates with much higher debt than Advantage relative to their respective loan books, because repayments at Aspen are generally more likely. So on an ROE basis, the sums would look more favourable than ROCE. Lenders of all types use the same approach — borrow cheaply to then lend out at (hopefully much) higher rates.

Maynard

Maynard, Charles,

Chipping in here because it also something I asked a little while ago. I think they could be clearer on this!

The profit figures they mention for Aspen are actually quoted after the absorption of finance costs. One can tie that up with the accounts of Aspen shown on Companies House. This is to say: S&U Plc charges its subsidiaries, both Aspen and Advantage, for the use of the parent company’s capital (some of which they themselves borrow at group level).

I would hence say it is unfair to compare the post-interest profit to the total book of receivables, because it means you are effectively taking the profit which is only attributable to the equity and comparing it to the total book of assets which generates profits which are split both between the debt and the equity.

If you do a return on equity figure – which is more standard – Aspen made £3.6m last year on £9.4m of net assets, so 38%. This is an overstated figure because the business is able to leverage more than it would otherwise because S&U is willing to finance this business almost entirely with debt.

Instead, I tend to look at the return on capital for this business by comparing average receivables to operating profit pre-finance charges. That figure was about 10% last year.

The comparable figure for Advantage was around 12%, though historically it has been 15-20%, and I would hope we can get back in that direction when current issues are resolved.

Hi Lewis

Yes, all that makes sense and I should have remembered ROCE is calculated using profit before interest!

Maynard

Thank you Maynard and Lewis.

1. It seems clear to me that overall returns from bridging loans are inherently less than used to be the case for car loans. Supposedly the property loans are less risky but IMHO they are vulnerable to “black swan” events.

2. Furthermore, any business that relies on a lot of debt is inherently risky.

FWIW I have invested in S&U over the past 10 or more years and used to be a big fan. Nowadays I believe that the risks outweigh the rewards.

Charles