21 July 2023

By Maynard Paton

FY 2022 results summary for M Winkworth (WINK):

- An acceptable FY performance that revealed ordinary dividends up 18% and remarkably took FY franchisee income close to the £64.8m exceptional level of FY 2021.

- A subsequent trading update rather overshadowed the figures by admitting a “more challenging” housing market had “delayed” agreed sales and in turn caused current-year profit to run below expectations.

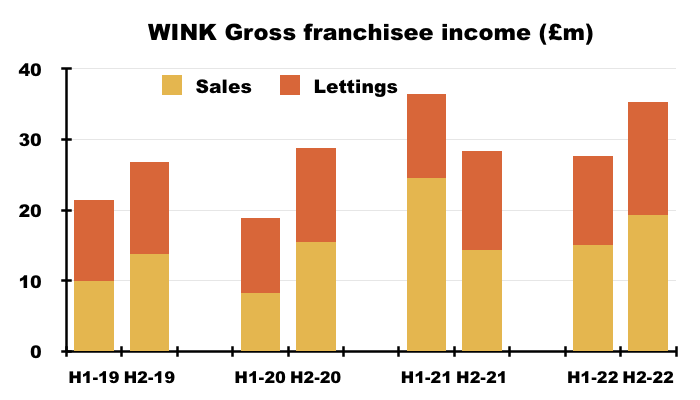

- The “uncertain economic outlook“‘ had already reduced the proportion of franchisee commissions converted into revenue to 10% — WINK’s lowest percentage since at least 2009.

- Healthy rental commissions, favourable competitor comparisons, resilient company-owned branches and cash-flush accounts suggest WINK should be well prepared for any house-price downturn.

- Possible earnings around 12p per share may limit advances to the 11.4p per share trailing dividend, although net cash of £5m plus owner-directors who “prioritise” income should sustain the 7.6% yield. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own WINK

- Results summary

- Revenue, profit and dividend

- Franchisee sales and lettings income

- Winkworth versus Foxtons

- Corporate-owned offices

- Financials

- Valuation

News links, share data and disclosure

News: Annual results, presentation and webinar for the twelve months to 31 December 2022 published/hosted 19-20 April 2023 and dividend announcement and trading update published 12 July 2023.

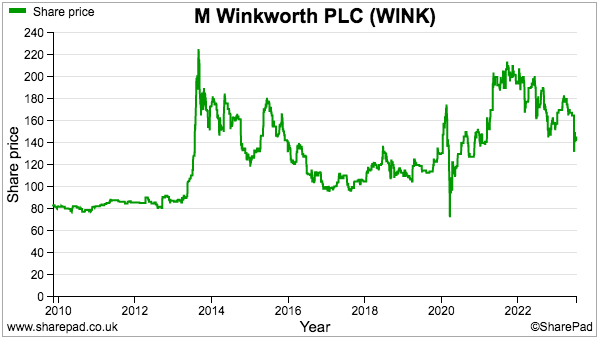

Share price: 150p

Share count: 12,908,792

Market capitalisation: £19.4m

Disclosure: Maynard owns shares in M Winkworth. This blog post contains SharePad affiliate links.

Why I own WINK

- Operates a London estate-agency franchising business, with progress buoyed by motivated franchisee owners developing their own local agencies and capturing greater market share.

- Franchisor set-up leads to high margins, low capital requirements and a cash-rich balance sheet able to fund attractive franchisee investments.

- Seasoned family management boasts a £9m/47% shareholding and rewards investors through durable quarterly dividends and occasional special payouts.

Further reading: My WINK Buy report | All my WINK posts | WINK website

Results summary

Revenue, profit and dividend

- An acceptable H1 followed by a profit upgrade during November…

“As a result of this buoyant level of activity in the second half of 2022, Winkworth’s full year revenues are expected to exceed management forecasts and our full year pre-tax profits to be ahead of the current market forecast of £2.1m.”

“Winkworth’s full year pre-tax profits, subject to the audit, are expected to be modestly ahead of the current market forecast of £2.3m…“

- …had already signalled this FY 2022 would reveal another acceptable performance.

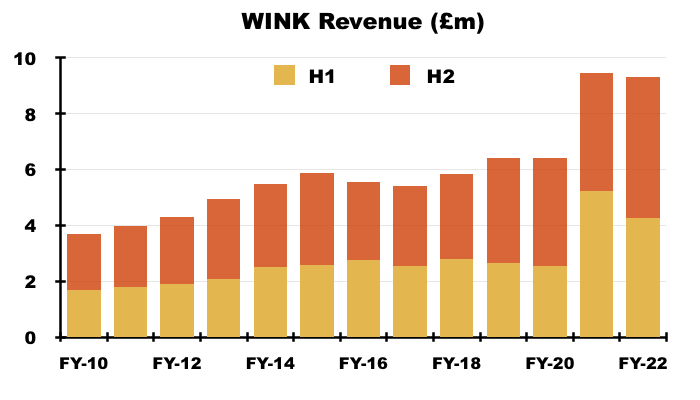

- Pre-tax profit was indeed ahead of the then market forecast of £2.3m at nearly £2.5m.

- WINK described FY 2022 as “very satisfactory“, although the figures were never going to match the outstanding FY 2021 that was bolstered by “pandemic-induced buyers” and stamp-duty holidays.

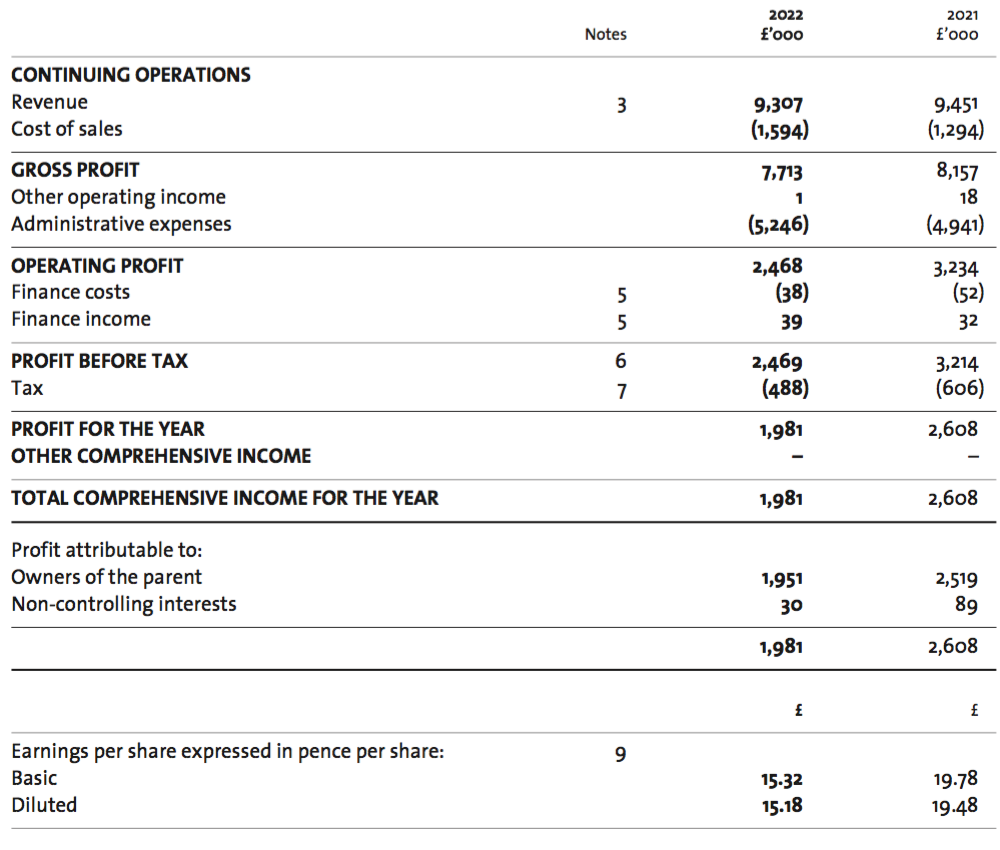

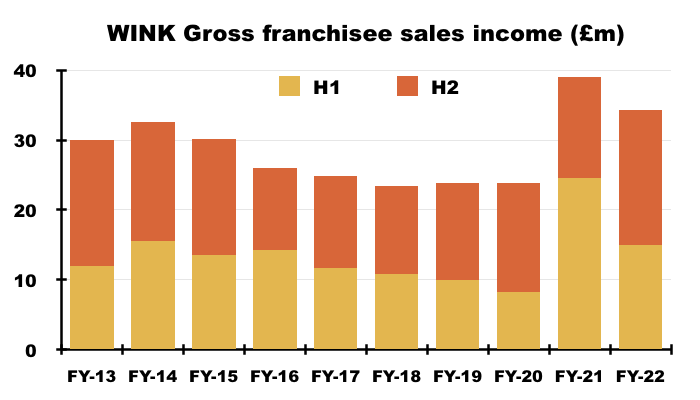

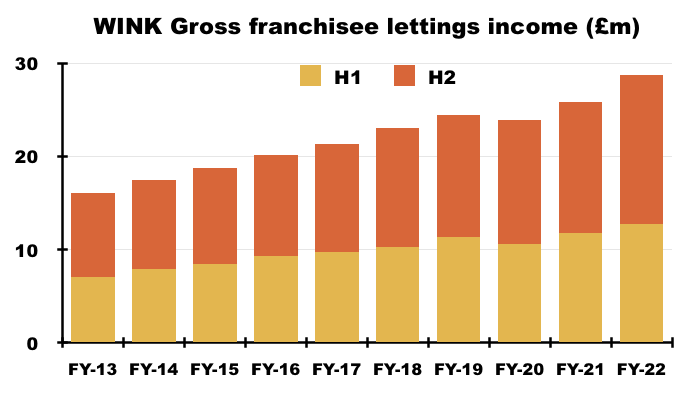

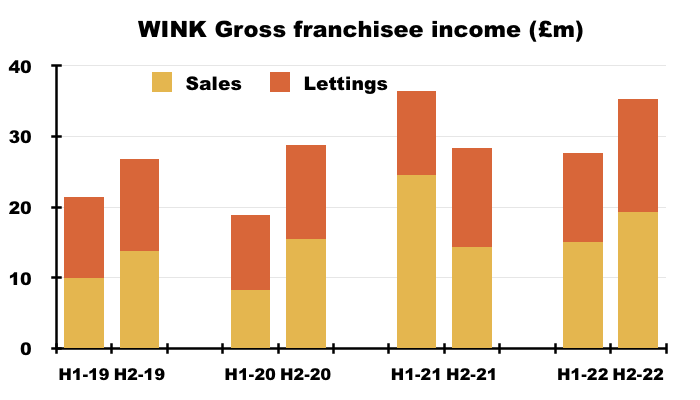

- During the year, franchisee sales income fell 12% to £34.3m while franchisee lettings income gained 11% to £12.7m:

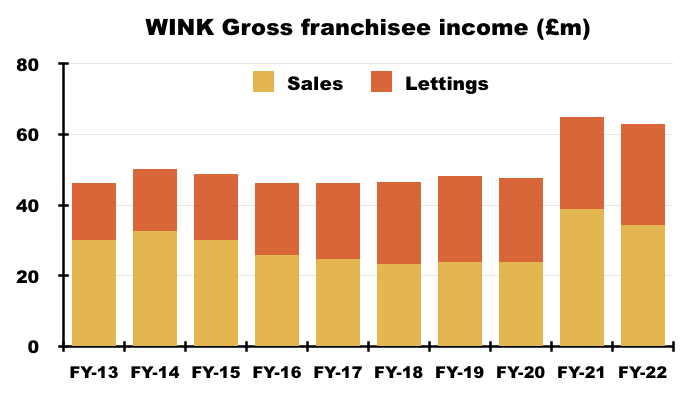

- H2 was much stronger than H1, and remarkably took total FY franchisee income to £63.1m — just shy of the bumper £64.8m reported for the exceptional FY 2021.

- Indeed, H2 franchisee sales income surged 34% to £19.3m while H2 franchisee lettings income rallied 14% to £16.0m:

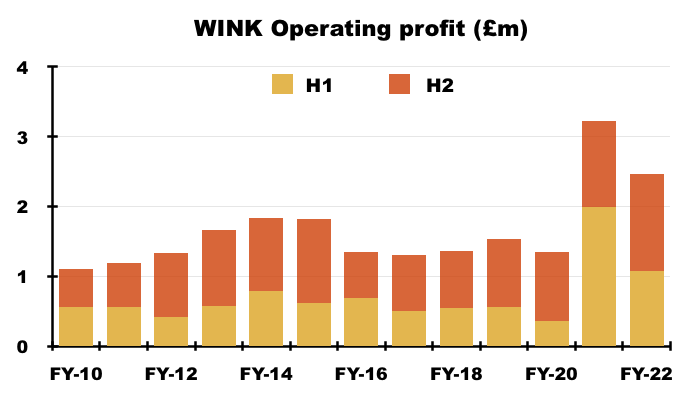

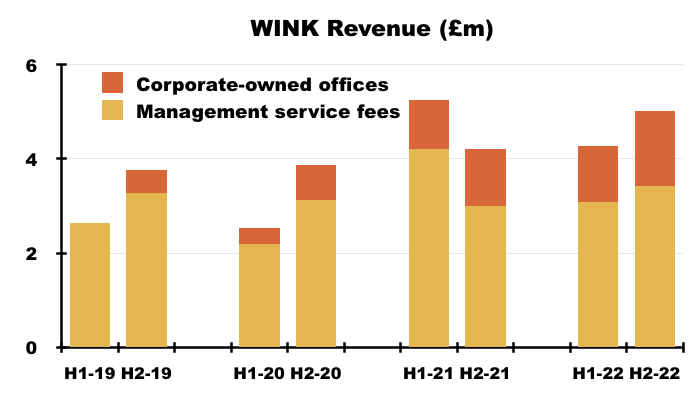

- The stronger H2 witnessed revenue climb 20% to £5.0m and reported operating profit increase 13% to £1.4m:

- But combined with the weaker H1, FY revenue slipped 2% and FY reported operating profit dived 23%.

- WINK suggested shareholders overlook the pandemic distortions and instead compare this FY to the pre-pandemic FY 2019:

“It is worth noting that in 2022 our revenues, profit before tax and net cash position were all some 50% higher than the pre-pandemic levels achieved in 2019.“

- Progress was not complicated by adjustments, with non-trading charges limited only to a £30k investment write-down.

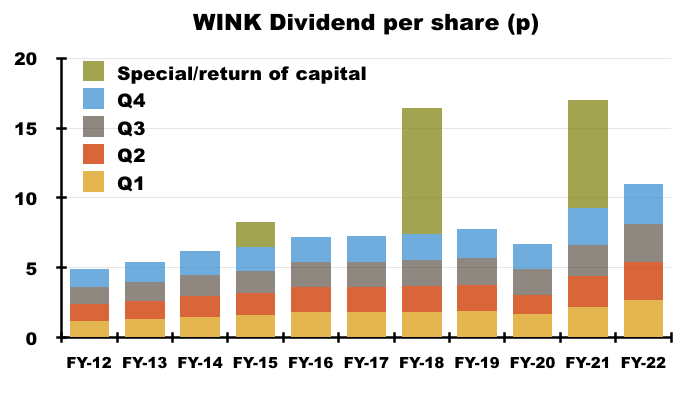

- The preceding H1 plus October’s Q3 2022 update and January’s Q4 2022 update had already heralded ordinary quarterly dividends up 18% to total 11p per share for this FY:

- April’s Q1 2023 update and this month’s Q2 2023 update subsequently revealed quarterly payouts of 2.9p per share, which means the FY 2023 payout should be at least 11.6p per share.

- Following three special payouts for FY 2021, no specials were declared for this FY.

Franchisee sales and lettings income

- WINK’s franchisee network consists of 102 estate-agency branches located throughout London and south-east England.

- Franchisees pay WINK a straight 8% of all of their sales and letting income, plus variable sums towards IT, training, landlord/tenant referrals and other services.

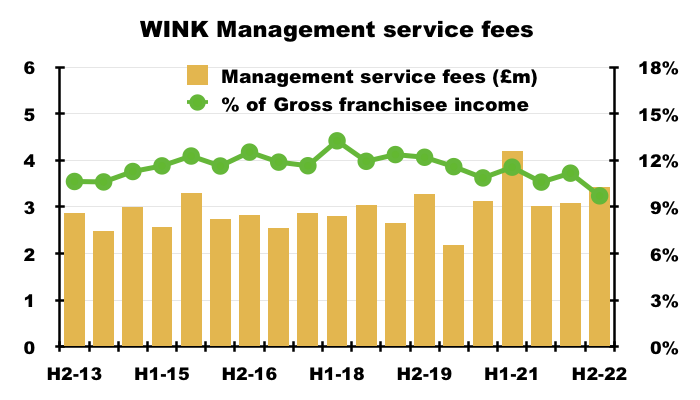

- During this FY, 10.3% of the £63.1m earned by the franchisees was taken by WINK as revenue:

- The 10.3% proportion was the lowest since at least the 2009 flotation, with the H2 proportion at 9.7%.

- I had previously speculated the declining proportion had been due to buoyant trading conditions, and franchisees no longer requiring commensurate expenditure on WINK’s extra services.

- But the annual report small-print disclosed a less optimistic explanation:

“…but the more uncertain economic outlook impacted some of our ancillary services, whose revenue were lower by comparison to their very strong performance in 2021.“

- WINK revealed its London-based franchisees fared better than their counterparts outside of the capital:

“The ongoing reversal of the Covid-induced race for space, with a reversion to office working and city life returning to business as usual, translated into gross revenues of the franchised network in London being down by only 1% year-on-year, compared to a fall of 9% in the country markets. As expected, Central London benefitted from the return of international travel, with income 11% ahead of 2021.“

- Albeit with fewer pandemic-prompted transactions and no stamp-duty holidays, the number of FY sales completions was described as “exceptionally high“:

“Completed sales instructions hit an exceptionally high level which, allowing for normal withdrawals due to outside issues, is remarkable.”

- Market forces meanwhile kept franchisee rental income “incredibly strong“:

“The rental market remained incredibly strong across all regions, with price increases of over 10% in many areas due to a shortage of supply following the sell-off of many buy-to-let properties by landlords facing the higher tax and regulatory changes that have reduced the viability of this activity in recent years.”

- Franchisee rental income has now almost doubled between FYs 2012 and 2022:

- The sales-rental split was a consistent 54%:46% throughout H1 and H2:

- The sales-rental split is set to change dramatically during FY 2023.

- This month’s update talked of lower mortgage approvals and agreed sales being “delayed to the second half of the year“.

- This month’s update therefore admitted:

“Preliminary gross network income figures for H1 2023 indicate an overall fall of 6%, with lettings revenue approximately 11% higher and sales revenues down by 20% compared with H1 2022.“

- The latest update implies H1 2023 has witnessed franchisee sales income of £12.0m and franchisee lettings income of £14.1m.

- Lettings income during H1 2023 might therefore represent 54% of total franchisee income — which would be WINK’s largest-ever weighting towards lettings.

- Doubling up my estimated H1 2023 total franchisee income of £26.1m gives £52.2m — less than the £60m-plus enjoyed during FYs 2021 and 2022, but more than the £48m registered for FYs 2018 and 2019.

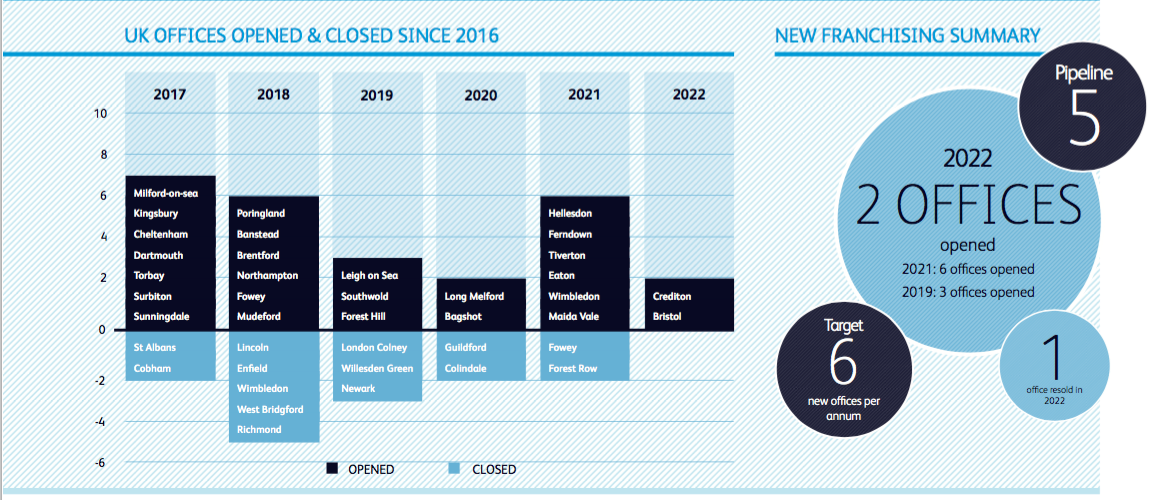

- WINK’s presentation did not include any changes to the ‘franchising outlook’ slide from the preceding H1:

- The target number of new offices remains six per annum and the number of pipeline offices remains at five.

- Prompted by “disturbed” market conditions during H2, only two new offices were opened during this FY:

“Two new offices were opened in 2022, extending the reach of the successful franchises in Exeter and Bath. One office was resold to new management. Further new openings for the second half of the year were delayed due to the disturbed conditions following the October mini budget. The pipeline remains healthy.“

- Management’s webinar commentary confessed several new openings “fell through” — rather than were “delayed” — due to the mini budget.

- Some 28 offices have been opened and 17 have been closed since FY 2016.

- Some new offices have not worked out; Fowey for example was opened and then closed a few years later.

- But closed offices can re-open; Wimbledon for example was shut and then re-opened a few years later.

- Expanding the franchisee network has been slow going. The 102 franchised branches operating during this FY compare to 86 quoted within the 2009 flotation document.

- But revenue growth may not be entirely correlated to opening new offices. WINK said:

“Winkworth is not trying to be the highest volume agent for property listings, but instead aims to achieve a high level of complete transactions at the best price for the client”.

- Management’s webinar commentary reiterated how growth can be achieved despite the total office count remaining unchanged: older franchisees who are “on the road to the golf course” can sell their branches to “energetic new blood“, who in turn can revive sales.

- One office was resold during this FY:

“We successfully resold our leading office in Shepherds Bush to a new generation franchisee to take it on to the next level.“

Winkworth versus Foxtons

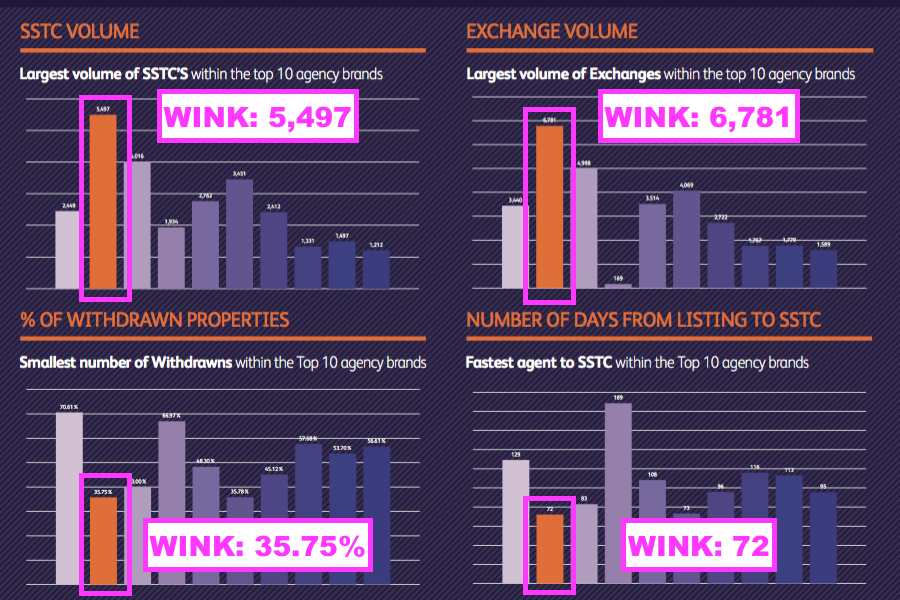

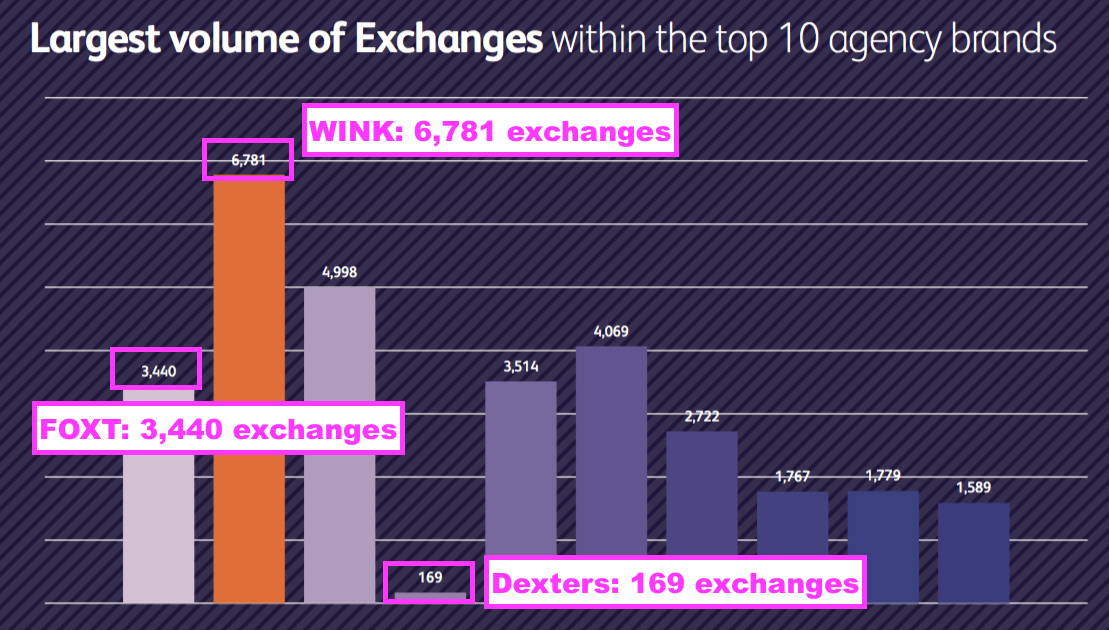

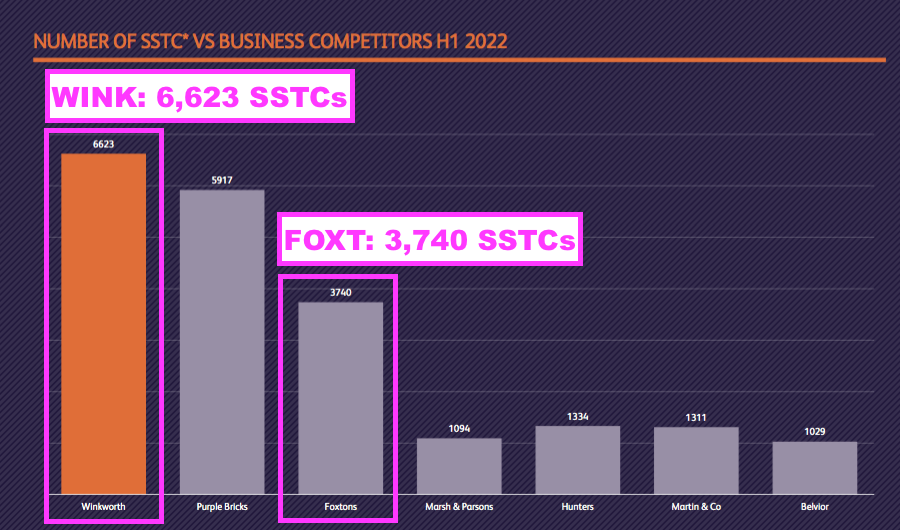

- The FY presentation included encouraging statistics about SSTCs (sold-subject-to-contracts), exchanges, withdrawals and listing-to-SSTC timescales:

- WINK commendably revealed 6,781 properties were exchanged within its “addressable area“.

- But I am not sure the comparable exchange statistics are entirely accurate.

- For example, WINK’s slide implied London competitor Foxtons (FOXT) exchanged 3,440 properties during the year…

- … although FOXT’s 2022 annual report said transactions numbered 3,215:

“Sales revenue increased by 1% to £43.2 million (2021: £42.7 million), reflecting a 2% decrease in average revenue per transaction (2022: £13,431; 2021: £13,668), offset by a 3% increase in transaction volumes (2022: 3,215; 2021: 3,122)“

- The 169 exchanges for Dexters does not look right either.

- Despite WINK franchisees (apparently) conducting approximately twice the number of exchanges as FOXT, WINK’s gross franchisee sales income of £34.4m was 20% less than FOXT’s sales revenue of £43m.

- The divergence is due to the level of fees charged. I calculate WINK’s franchisees charge an average £5k (or so) per exchange, while FOXT says it charges £13k.

- Versus the SSTCs reported at the preceding H1…

- …WINK’s SSTCs have since fallen 17% to 5,497 while FOXT’s SSTCs have since fallen 35% to 2,449.

- I must admit I remain unsure as to how changes to SSTCs should correlate to future levels of exchanges.

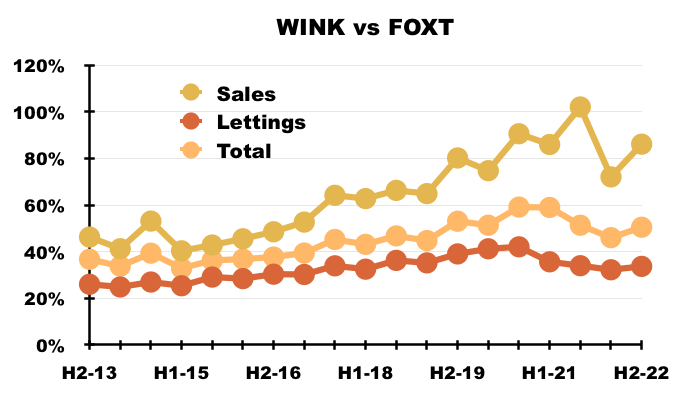

- The chart below expresses the sales, lettings and total franchisee income of WINK as percentages of the comparable FOXT revenue:

- The rising trends until FY 2021 indicate WINK’s self-employed franchisees handled London’s property market during Brexit and the pandemic far better than FOXT’s conventional employees…

- …although this FY did witness FOXT improve its performance markedly versus WINK.

- FOXT’s improvement is probably linked to last year’s appointment of a fresh chief executive.

- FOXT’s new boss has identified his company’s shortcomings…

- …and how to fix them:

- He also aims to increase FOXT’s adjusted operating profit from the £14m for FY 2022 to between £25m and £30m “over the medium term“.

- Note that comparing WINK with FOXT is not strictly like-for-like. FOXT generates almost all of its revenue from branches within London while WINK’s franchisees last year generated 76% from the capital.

- Further distortions are caused by FOXT and WINK acquiring and/or selling businesses.

- Nonetheless, FOXT’s revitalised leadership could leave WINK facing stiffer competition from its rival in what could be a difficult time for the housing market generally (see Valuation).

Corporate-owned offices

- WINK’s two controlled branches — Tooting and Crystal Palace in London — continue to perform well versus the wider franchisee network.

- To recap, WINK acquired:

- The 2020 annual report (point 15) said the two offices would lead to greater “front-end” insight:

“As with the acquisition of Tooting Estates Limited as a subsidiary, Crystal Palace Estates Limited will keep Winkworth in touch with and learning from front-end experiences and industry trends, It will also provide a live platform to test and develop future digital initiative and evolve our centralised CRM systems, which be of benefit to all our franchisees.”

- But management’s webinar commentary suggested taking control of branches was driven more by improving lacklustre performances:

“We use industry data… to look at where we are not performing to our potential, and when we have the right person, we are prepared to buy the business… and just changing the person can make a dramatic difference“.

- WINK looks to have found the “right person” for both Tooting and Crystal Palace.

- Tooting revenue for example was £871k during FY 2019, £979k (+12%) during FY 2020, £1,679k (+72%) during FY 2021 and £1,743k (+4%) during FY 2022.

- Management’s webinar commentary claimed Tooting revenue was in fact only £250k before the new manager was appointed.

- WINK also reported its controlled Crystal Palace branch increased its FY sales by 30%:

“Tooting retained its position as number one for ‘Sold Subject to Contract’ in its area and Crystal Palace continued to grow its revenue and improve its market share, rising from 7th to 4th in its area and growing its revenue by 30% over 2021.“

- Complementing the two majority-owned branches is WINK’s Development and Commercial Investment agency, which provides advice about converting business premises into residential accommodation.

- WINK said DCI revenue had “more than doubled” during this FY.

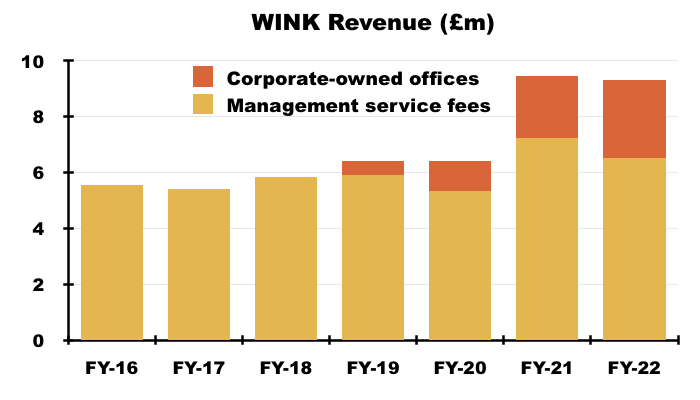

- Total revenue from the corporate-owned offices gained an impressive 25% to £2.8m:

- Revenue from the corporate-owned offices represented 30% of total revenue during this FY, and 32% during H2, versus 24% for FY 2021:

- Profit from the corporate-owned offices may not have tracked revenue higher.

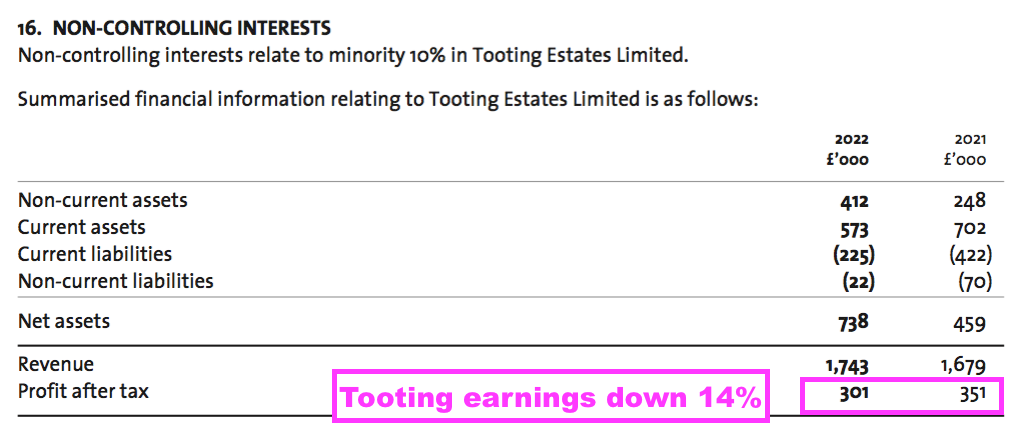

- Earnings from the Tooting branch fell 14% to £301k:

- But Tooting remains an exceptional investment.

- WINK paid £137k during FY 2021 to increase its ownership of Tooting Estates from 55% to 90%.

- Paying £137k for 35% valued the entire Tooting operation at £391k.

- Tooting earnings of £301k during this FY therefore gave a remarkable 77% return on the implied £391k valuation.

- WINK’s 90%/£271k share from Tooting during this FY represented 14% of the total £1,951k earnings attributable to the group, with the proportion for H2 at 16% (£181k/£1,154k).

- The proportion for FY 2021 was only 10%.

- Relying on the Tooting office for approximately 16% of group earnings is not ideal, although that dependence was caused by that “right person” generating that effective 77% return.

- WINK’s optimistic remarks on Tooting, Crystal Palace and DCI do not suggest the subsidiaries will underperform the typical franchisee:

“We will seek to grow the revenues and profitability of our partnered businesses and plan to launch a new homes operation within our DCI venture as part of its evolution.”

Financials

- WINK’s accounts remain in good shape.

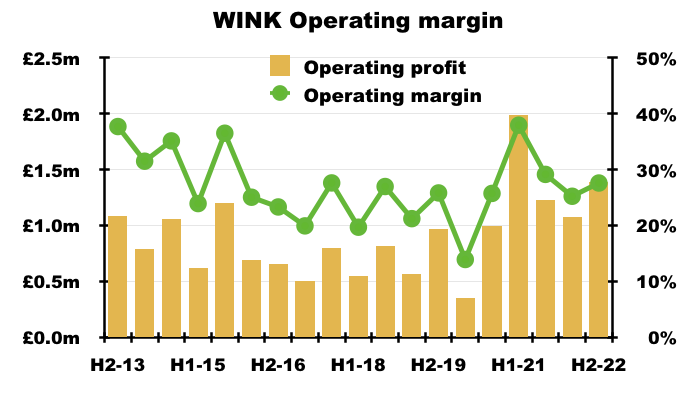

- Although not as high as the super 34% witnessed during the comparable FY 2021, the 27% operating margin during this FY exceeded the levels achieved between FYs 2016 and 2020:

- The much lower margin versus the comparable FY 2021 coincides with lower sales transactions, and implies sales commissions attract much higher profit than lettings income.

- Property sales are of course less predictable than monthly lettings payments.

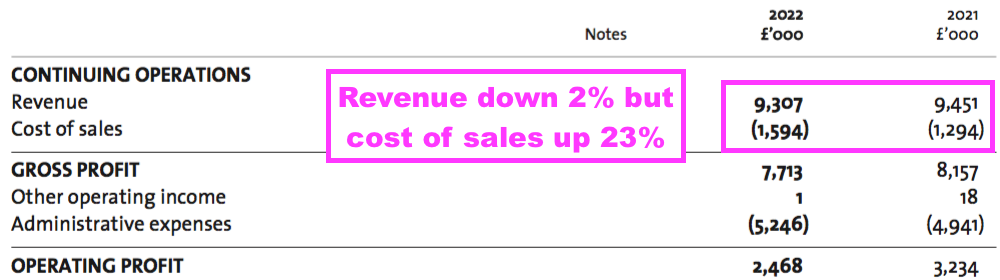

- Management’s webinar commentary helpfully explained why cost of sales advanced 23% as revenue dropped 2%:

- Reasons given included:

- Higher revenue at the company-owned branches (which presumably incur greater direct costs than the franchising division);

- Larger legal fees due to 19 franchisee renewals, and;

- Generally rising expenses for external IT and marketing services.

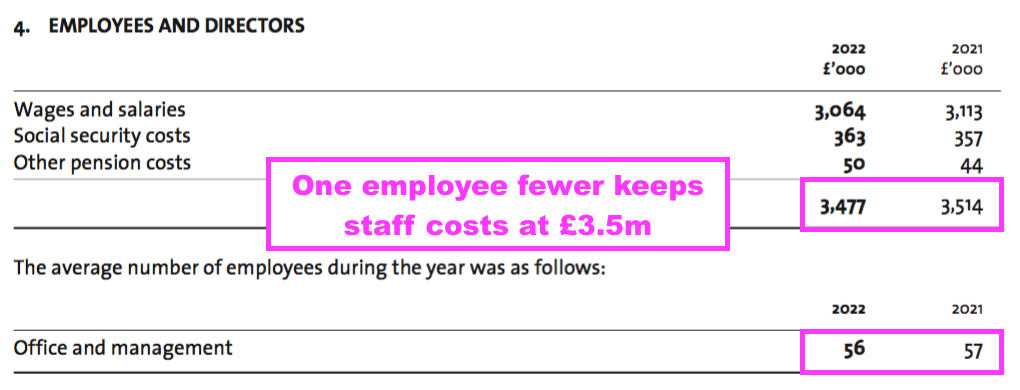

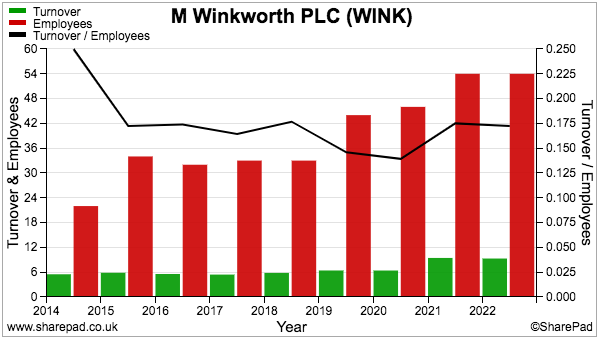

- I note a lid was commendably kept on employee costs:

- Revenue per employee meanwhile held steady around the adequate £170k mark:

- Cash generated from operations during this FY was a useful £3.3m, with £2.3m produced during H2.

- Cash flow was helped by favourable working-capital movements:

| Year to 31 December | 2018 | 2019 | 2020 | 2021 | 2022 |

| Operating profit (£k) | 1,369 | 1,535 | 1,348 | 3,216 | 2,467 |

| Depreciation and amortisation (£k) | 270 | 288* | 308* | 265* | 285* |

| Net capital expenditure (£k) | (189) | (277) | (241) | (276) | (458) |

| Working-capital movement (£k) | (56) | 157 | 773 | (786) | 304 |

| Net cash and investments (£k) | 2,988 | 3,614 | 4,732 | 5,090 | 5,292 |

(*excludes IFRS 16 depreciation)

- WINK’s working-capital cash requirements fluctuate from year to year but have evened out over time.

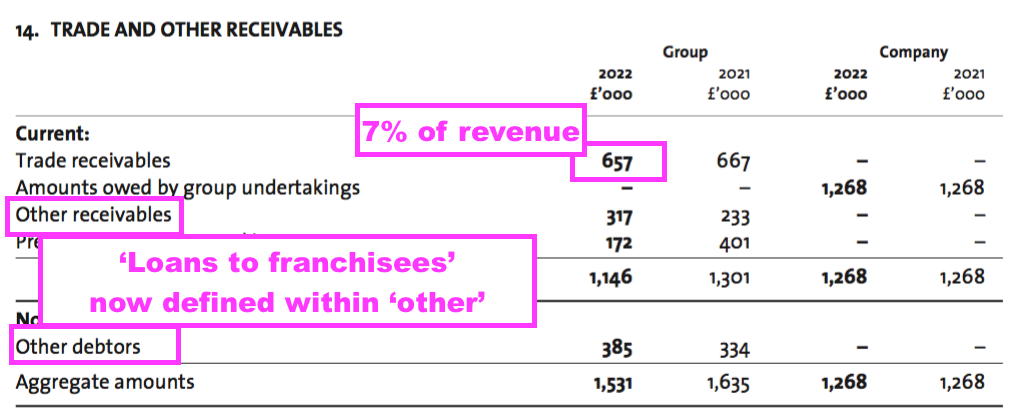

- Trade receivables remain equivalent to just 7% of revenue, and indicate franchisees are timely payers:

Note that WINK’s receivables include loans to franchisees, which for this FY were irritatingly not disclosed separately as per previous years.

Loans to franchisees were £529k for FY 2021 and I estimate they were approximately £660k for FY 2022.

- EDIT 30 MARCH 2024: Loans to franchisees were £529k for FY 2021 and the Financial Instruments note (point 20) states they were £664k for FY 2022.

- Loans to franchisees can sometimes create notable cash flow movements when loans are issued and repaid.

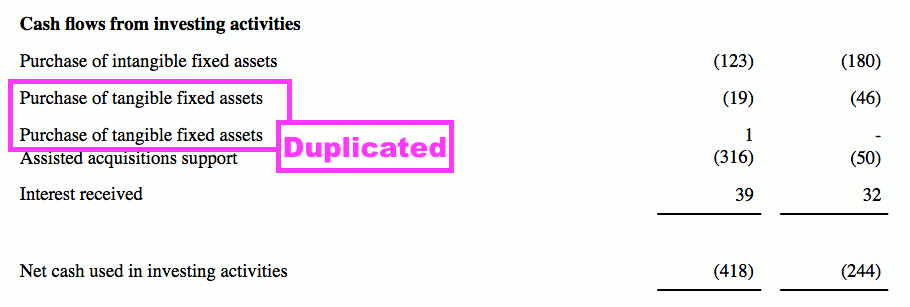

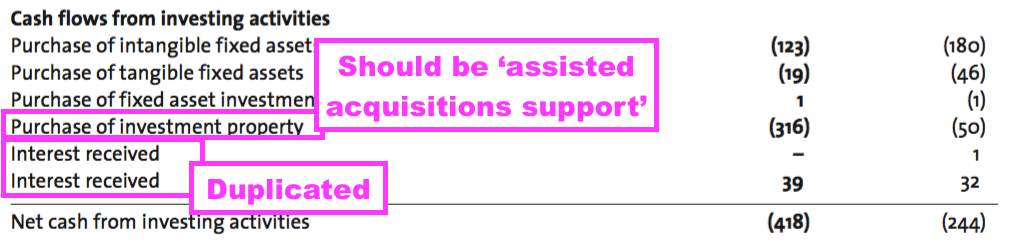

- WINK’s cash flow statement was confusing.

- The results RNS duplicated ‘purchase of tangible fixed assets’…

- …while the subsequent annual report duplicated ‘interest received’ and mistakenly replaced ‘assisted acquisitions support’ with ‘purchase of investment property’:

- Management’s webinar commentary clarified ‘assisted acquisitions support’, which occurs when a franchisee identifies a lettings portfolio to purchase.

- WINK can help franchisees fund such purchases through its ‘assisted acquisitions support’, whereby WINK gives the franchisee an amount equivalent to three times 8% of the revenue of the target lettings portfolio.

- Given WINK will in turn collect 8% of the additional lettings income through the basic franchising arrangement, the ‘assisted acquisitions support’ should be repaid after three years.

- After those three years, WINK should then enjoy the additional 8% rental commission at a net investment cost of zero.

- WINK paid a notable £316k as ‘assisted acquisitions support’ during this FY, which took total payments to £496k since FY 2018.

- Management’s webinar commentary suggested ‘assisted acquisitions support’ helped fund only purchases of lettings portfolios.

- Mind you, my notes from FY 2021 recall webinar commentary claiming WINK would pay four years’ worth of 8% commission to a suitable independent agent to convert into a WINK franchisee.

- I am not sure if WINK now only purchases lettings portfolios rather than agencies with both sales and lettings income.

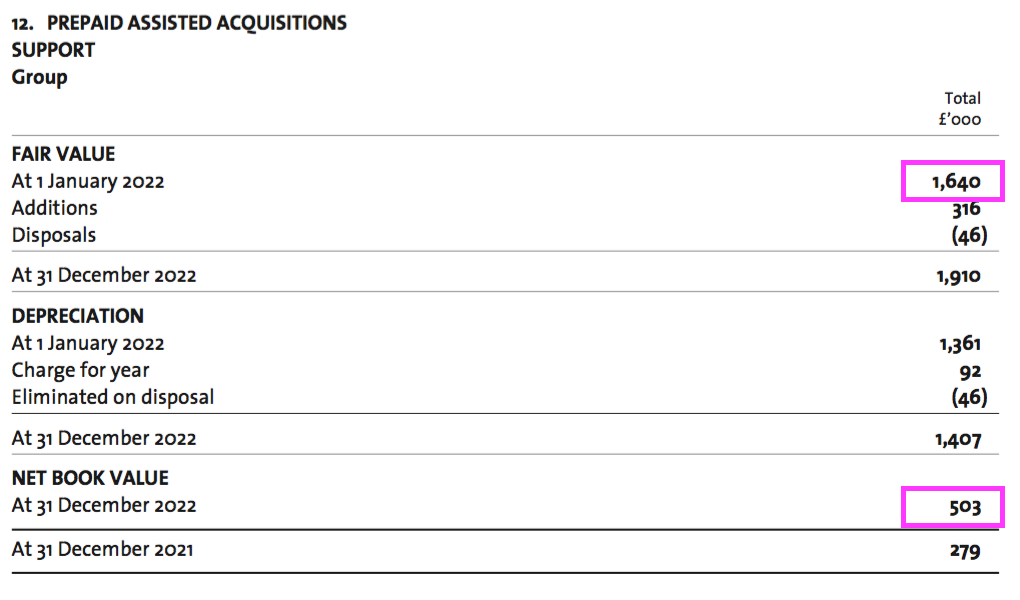

- ‘Prepaid assisted acquisitions’ are carried in the books at a net £503k, with a historic cost of £1.6m:

- I am sure that £1.6m cost reflects purchases of both sales agencies and lettings portfolios.

- Assuming only lettings portfolios were purchased, £1.6m of ‘assisted acquisitions support’ equates to franchisees buying letting portfolios with total revenue in excess of £6m.

- Combining the carrying values of:

- Prepaid assisted support (£0.5m);

- ‘Customer lists’ acquired with Tooting and Crystal Palace (£0.5m), and;

- Capitalised website costs (£0.4m)…

- …gives costs of £1.4m that have yet to be expensed through the income statement.

- FY cash conversion was favourable after earnings of £2.0m translated into free cash flow of £2.4m, which in turn funded the aforementioned ‘assisted acquisitions support’ of £0.3m alongside dividends of £1.9m to leave cash £0.2m higher at £5.3m.

- Bank debt and defined-benefit pension obligations remain at zero.

- An investment portfolio that declined £20k to £51k during the preceding H1 declined by a further £10k during H2.

- Net cash, (estimated) loans to franchisees plus investments finished this FY at almost £6m or 47p per share.

- Finance income from that near-£6m was a very low £39k, although H2 enjoyed £28k versus £11k during H1.

- Cash, loans and investments of almost £6m really ought to earning well over £100k a year now that the base rate is 5%.

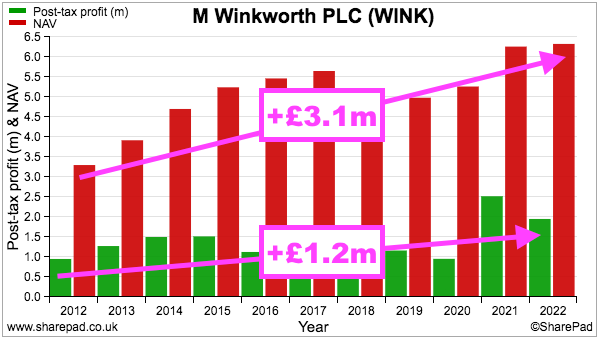

- Although cash of £5m-plus (and still earning next to nothing) remains by far the largest item on the balance sheet, return on average equity was still an appealing 31% (£2.0m/£6.5m):

| Year to 31 December | 2018 | 2019 | 2020 | 2021 | 2022 |

| Return on average equity (%) | 22.6 | 26.8 | 23.8 | 44.4 | 31.0 |

- During the last ten years, net asset value has advanced by £3.1m to deliver additional earnings of £1.2m — an incremental return of 38%:

- WINK remains a very capital-light business. Net asset value for FY 2022 excluding cash (£5.3m) and acquired ‘customer lists’ (£0.5m) was only £683k.

- Emphasising the absence of hefty reinvestment requirements, between FYs 2018 and 2022 WINK reported aggregate earnings of 64p per share of which 50p per share (79%) were declared as ordinary or special dividends.

Valuation

- This FY supplied an optimistic outlook on the property market:

“After a positive start to the year, we expect the property market to perform towards the higher end of expectations, albeit at transaction levels more closely aligned to historic averages than the boom levels of the last two years, with the increased cost of financing leading to prices drifting down by 5%“

“With mortgage rates having fallen from the peak levels seen after the mini budget and now settling at more historic norms of around 4%, we see a rebased market emerging, with transactions reverting to the long-term average of around 1 million per annum“.

- Events have since moved on, with this month’s update confessing:

“After a first quarter that was in line with management expectations, the sales market proved to be more challenging in the second quarter of 2023 as interest rates rose higher and faster than anticipated.“

“Mortgage approvals, which in Q1 recovered from the low levels seen in Q4 2022, were reported below the levels seen in the first half of last year. Property prices have held up reasonably well but transactions have slowed, leading to a high number of agreed sales being delayed to the second half of the year.“

…

“Preliminary gross network income figures for H1 2023 indicate an overall fall of 6%, with lettings revenue approximately 11% higher and sales revenues down by 20% compared with H1 2022.“

- FY 2023 profit will therefore come in below forecast:

“While the Directors believe that confidence will return once buyers can access a broader choice of mortgage finance, the outlook for sales in the second half of the year remains uncertain and the shortfall in H1 2023 means that full year pre-tax profits are likely to fall below market expectations.“

- My aforementioned estimate for total franchisee income of £52m compares to £48m for FY 2019, during which reported operating profit was £1.5m.

- Assuming total franchisee income of £48m could still generate a £1.5m operating profit, I guess total franchisee income of £52m might take reported operating profit towards £1.7m.

- Contributions from Tooting, Crystal Palace and DCI might then take reported operating profit towards £2m.

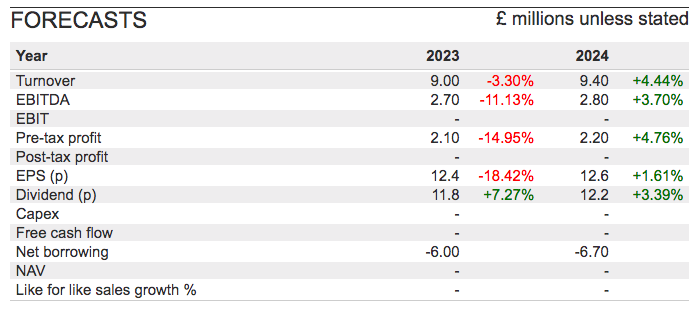

- £2m after standard 25% UK tax gives earnings of £1.5m or 11.6p per share.

- SharePad is showing projected earnings of 12.4p per share:

- Earnings of 11.6p (or perhaps 12.4p) per share will not leave much room for dividend advances when the trailing twelve-month payout is 11.4p per share and the FY 2023 payout is heading for at least 11.6p per share.

- But WINK did reiterate a “progressive dividend” policy:

“We also committed to maintain a strong balance sheet in order to develop the Company without debt. This policy has enabled us not only to grow the business, but also to pay progressive dividends to shareholders under all but the most extreme market conditions.“

- Indeed, the tone of WINK’s commentary suggested further franchisee/branch investments may play second fiddle to dividend payments:

“With uncertain times ahead, where economically viable we will continue to prioritise dividend payments, while retaining sufficient cash to be able to expand.“

- Dividing the 150p offer price by my 11.6p per share earnings guess gives a P/E of 13x.

- Assume the £5.3m/41p per share cash position is not required for the business to operate successfully, and a cash-adjusted P/E could be (109p/11.6p) = 9x.

- But keeping cash at significant levels may be fundamental to operating this business, and the aforementioned text commendably shows WINK still determined to “develop the Company without debt”.

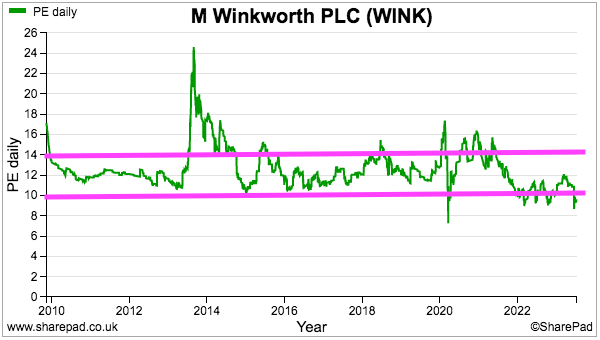

- A multiple of 9x or 13x or somewhere in between appears modest, but is not out of keeping with WINK’s typical trailing P/E of 10x-14x:

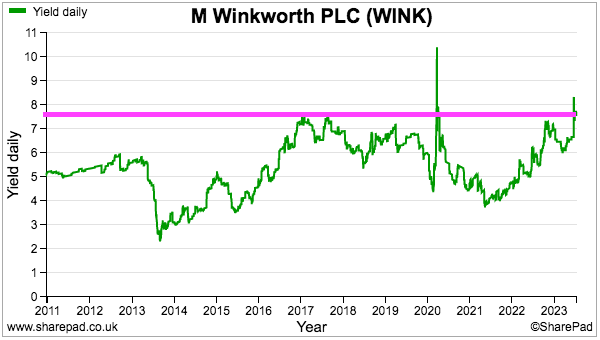

- The trailing 11.4p per share dividend meanwhile supports a 7.6% income — WINK’s highest yield save for the 8%-plus offered during the 2020 pandemic crash:

- WINK’s current rating no doubt reflects the recent profit warning and the possibility of further upsets within the housing market.

- The headlines from Property Industry Eye are gloomy:

- “Estate agents selling fewer homes as prices fall and completions delayed“

- “House prices could plunge by up to 25%, warns thinktank“

- “Buyers and sellers must accept ‘era of historically low interest rates is over’“

- “Lenders report biggest increase in mortgage defaults since 2009“

- “Fresh data underlines ‘the pain that rising interest rates are causing’“

- “Rising mortgage rates will cause ‘financial stress’, MPs told“

- “Property auctioneers reveal ‘challenges’ obtaining payment from buyers“

- “Property transactions fall sharply despite hike in new listings“

- “Bank of England could be forced to hike interest rates to 7%, economists warn“

- “Property sales fall-throughs remain high amid growing concerns for agents“

- On the plus side, difficult market conditions may provide more terrific Tooting-type opportunities for the cash position.

- I first bought WINK during 2011 at 90p and the shares have since delivered a very generous income. Total payouts (ordinary and special) throughout the last twelve years have totalled 107p per share to recoup my entire initial investment.

- Capital gains during the same twelve years have in contrast been somewhat modest:

- The risk for long-term shareholders is the “progressive” dividend that has dominated past returns eventually becomes untenable as:

- A challenging housing market becomes even more challenging;

- Lower profit becomes even lower, and;

- The thin dividend cover becomes even thinner.

- Long-term shareholders include the chairman, who owns 42%/£8m, the chief executive (and chairman’s son), who owns a further 6%/£1.1m, and a non-exec, who owns another 3%/£0.6m.

- The board therefore has good reason to ensure the dividend is sustained during difficult times.

- The chairman’s 42% shareholding may provide greater intrigue during the years to come.

- The chairman bought WINK outright during 1974 and turned 80 years old last year. Will his 42% stake one day be handed to other family members, or could WINK be sold outright?

Maynard Paton

M Winkworth (WINK)

Publication of 2022 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

1) CHAIRMAN’S STATEMENT

WINK’s chairman bought WINK during 1974 and used his annual statement to recount some of his 50-plus years of experience:

“I enjoy my non-executive role but, of course, I was an estate agent on the ‘shop floor’ for over 50 years through some of the most interesting times in the property market and, in more recent years, I have influenced the business to maintain our personal touch and the quality of the business.”

The chairman is very much an old-school estate agent, who views ‘people skills’ as vital for “background information” and subsequent agency success:

“We believe that our customers should have freedom of access to our agents and directors or partners and we welcome discussion and casual calls on any subject related to property. In this way, franchisees are able not only to gather useful background information but also to exercise their expertise and judgement on the market at all times.”

“While we have continued to upgrade our digital, online and other systems, as we consistently invest to support the needs of our franchisees and customers, Winkworth’s greatest asset is its people. Our technology is there to enable them to use their skills to create better outcomes for clients, not to reduce headcount to the detriment of client care.”

The ‘background information’ then leads to greater local-market insight:

“We are well-placed to interpret the large number of often disparate judgements being made on the property market and to establish why certain reports on trends may be more accurate than others. For instance, a report on site registrations of properties for sale, in a changing market where some agents may still be pitching over-optimistic prices, can distort the real picture. Equally misleading can be analysis based on land registry prices which, as it takes six months for the data to be published, are always out of date. Likewise, building societies using their own data may only be lending to a section of the market.”

And greater local-market insight can then lead to a more efficient agent, who recruits only vendors with “realistic pricing“:

“Local knowledge is vital for estimating realistic pricing, whereas blatant over-pricing is a danger to the client and subsequently lowers the agent’s percentage of sales completed from instructions. This, not the largest number of properties to sell, is the best gauge of success. Winkworth is not trying to be the highest volume agent for property listings but instead aims to achieve a high level of completed transactions at the best price for the client.”

The self-employed franchisee is apparently more likely to attract lettings landlords, too:

“In lettings and management, we continue to build the number of landlords and tenants with whom the Company has a close relationship. We have always found that proprietor-led management and lettings brings tenants and landlords closer to decision-taking and guidance on their property. Our experience is that landlords like to connect with a local individual rather than a centralised, often remote team, so our relationship between landlords and the manager of the office is, in our opinion, a long-term win.

Perhaps in response to comparisons with other quoted estate agents, the chairman noted WINK’s lack of financial-service income:

“We do not have our own legal offering or financial services business, but we encourage our franchisees to use their market connections to help our clients with their transaction requirements.”

The chairman owns 42% of the shares and, in a straight choice, would appear to prefer dividends to expansion expenditure:

“We also committed to maintain a strong balance sheet in order to develop the Company without debt. This policy has enabled us not only to grow the business, but also to pay progressive dividends to shareholders under all but the most extreme market conditions. With uncertain times ahead, where economically viable we will continue to prioritise dividend payments, while retaining sufficient cash to be able to expand.”

2) GROUP STRATEGIC REPORT

a) Cost of sales

Cost of sales for the core franchising operation relate to external services such as IT and legal, of which payments for the latter correlate to the volume of new/changed owners of franchised offices:

“Cost of sales rose year on year as a result of full year contributions from the owned offices, administrative costs around the renewal of certain franchises, and some additional recharge expenses.”

b) Administrative expenses

The advantage of a pure franchise operation for shareholders is the franchisee takes on responsibility for their employees and their pay. With company-owned branches, WINK now suffers greater exposure to salary inflation with perhaps no reciprocal benefit to revenue:

“Higher administrative expensed were driven largely by the increased salary and on costs of the new Corporate owned offices that as well as the general inflationary impact of the higher cost of living.”

3) PRINCIPAL RISKS AND UNCERTAINTIES

Some changes here for 2022.

a) Geopolitical developments

A reworded risk that refers to higher interest rates and the “likely… negative impact” on the property market:

“Inflationary pressures resulting from higher energy prices and supply imbalances post-Covid have led to rising interest rates worldwide. In the UK, the higher cost of finance for both new buyers and existing owners needing to refinance their mortgages is likely to have a negative impact on prices and the number of transactions in the housing market.”

b) Competition

This line about private sales from 2021 was removed for 2022:

“In the future, increased private sales activity is another factor that could affect the group’s revenues.”

But the text about ensuring “quality and value” remains:

“Management action: We monitor the market and our competitors’ activities closely and are constantly working to ensure that quality and value remains at the heart of our service offering. We invest consistently in our digital offering to ensure that it meets the high standards required by our franchisees and their customers.”

c) Sales and Lettings markets

WINK now talks of aiming to “uphold fees” in a slower sales market:

“Risk: In a low volume market, pressure on commission margins can increase, which may lead to lower revenues on a smaller number of transactions. In particular, Winkworth is exposed to fluctuations in the London market, with the majority of revenues generated by franchisees concentrated in this area.

Management action: We have strong local market knowledge and expertise, both in London and in the country markets, and aim to uphold our fees by providing the highest level of service to satisfy the requirements of our customers. We seek to build confidence and trust with our customers and win repeat business.”

The line “Winkworth is exposed to material fluctuations in the housing market” from 2021 was removed for 2022.

An all-new lettings-market risk for 2022:

“Risk: The cost of complying with increasing regulation and the threat of the introduction of rent controls has discouraged some landlords from entering or remaining in the buy to let business, which may further reduce the supply of available properties. With demand at a high level, this has already led to a sharp increase in rental prices.

Management action: We look to grow our book of rental properties by offering landlords the highest standards of service and by attempting to balance both their needs and those of tenants fairly.”

d) Reputational risk

This text was beefed up for 2022:

“Management action: Winkworth has a rigorous vetting procedure for new franchisees and only a small number of applicants are successful in joining the group. Once accepted, franchisees are closely monitored to make sure that they achieve the service levels set down for them and remain compliant with the law by providing regular training through the Winkworth Academy and internal auditing.”

e) Other risks

There were no notable changes to the text recapping the recruitment of franchisees and the building of franchises risk, the legal and regulatory environment risk and the digital infrastructure and IT risk.

4) SECTION 172

I like how WINK continues to list shareholders ahead of franchisees and employees:

“The directors preside over the Group for the benefit of all stakeholders. In making decisions, the directors take into account both their potential short- and long-term implications. The basic goal is the long-term sustainable growth of the business which will see returns to shareholders increasing, enable franchisees and employees to realise their ambitions, and help customers of the Winkworth network achieve their goals.”

The s172 commentary included a few tweaks for 2022:

a) Shareholders

This text referring to “dynamic performance” from 2021…

“We seek to build long term investor loyalty through dynamic performance and regular updates on the market and our positioning”

…was unfortunately replaced by this less ‘dynamic’ ambition:

“We recognise the importance of our relationship with shareholders and seek to build long term investor loyalty through regular updates on the market, our positioning and our returns”

2022 also now refers to the IMC platform:

“Online presentations and Q&A using the services provided by Investor Meet Company”

b) Franchisees

No change here, but a reminder that the company-owned branches are not a “departure from our traditional franchising approach“:

“Franchisees: Meetings are held with representative groups of franchisees to share their input on key strategic and operational issues. The ownership of Tooting Estates Limited and Crystal Palace Estates Limited, whilst not representing a departure from our traditional franchising approach, will improve our own awareness of day-to-day market issues and their impact on customers, suppliers and other stakeholders.”

c) Community and environment

WINK’s environmental commentary was limited to the following:

“Winkworth is a carbon neutral company. Our Corporate Carbon Footprint (CCF) has been independently calculated and we are continuously reducing our carbon emissions while offsetting unavoidable ones through carbon offset projects.

Community and environment: The Company is mindful of the impact of its operations on both the community and the environment, and expects both its employees and its suppliers to meet exacting standards in their everyday business conduct.”

The two paragraphs make you wonder about quoted-company obligations for ESG reporting, and how/why other companies seem obliged to publish pages of emissions statistics. Details of the CCF noted above were not published in this report.

d) Customers

The text reiterated WINK’s approach to brand quality and the “highest standards of conduct“:

“Customers: In a highly competitive environment, winning and retaining customers is a key objective. Winkworth takes great store in the quality of its brand and maintains it by applying the highest standards of conduct and business practice in its everyday dealings. By developing and enhancing its digital presence, the Company is ensuring that it more than meets the evolving needs of its franchisees and their customers.”

5) REPORT OF THE DIRECTORS

A very short director report, which on the one hand is saving time and money, but on the other gives very little away to outside shareholders. As long as the business performs satisfactorily, I hope the directors continue to save time and money.

a) Committee reports

The only major change for 2022 was the absence of any additional rem-com commentary. This was 2021’s rem-com text:

“The Remuneration Committee looks to ensure that the pay of directors and other senior Winkworth staff is set at a level that is competitive and will help retain senior talent. Remuneration is reviewed annually against internal and external measures to ensure that levels are appropriate. In addition, the Committee will sound out major shareholders before finalising their decisions.

As well as considering wage inflation and other economic considerations in the UK, the Committee review executive director fixed and variable remuneration levels against a peer group of quoted estate agency companies to ensure that the different elements are not out of line. The level of bonuses paid in 2021 reflect the group’s exceptionally strong performance in the year and the significantly increased returns that shareholders enjoyed in the period. ”

The committee reports are very short:

”Remuneration Committee The Committee, chaired by Lawrence Alkin and with John Nicol in attendance met in December to discuss and approve certain bonuses in respect of 2022 and the 2023 remuneration of the Executive Directors and key senior managers in the group.“

“Audit Committee The Committee, chaired by John Nicol, and with Lawrence Alkin in attendance met three times in 2022. In March the Committee met with Crowe to discuss and approve the 2021 Accounts and to review the Audit. In September, the Committee met to discuss and approve the 2022 Interim results and Announcement. In December, the Committee met to discuss Risk and approve the Accounting Policies.”

At least the rem-com met once while the audit-com met thrice, so less talking about pay and more talking about the accounts.

There is no nominations committee, although see point 5b below.

Among the other text, the non-execs are still expected to devote 15 days a year to their roles. And only non-exec Lawrence Alkin missed any board meetings (8 out 10 main board meetings attended).

b) Compliance with the QCA code

I never like companies referring to their websites for QCA matters. They should put the QCA commentary in their annual reports, which will allow shareholders to look back for any changes made from year to year:

“As mentioned in the Chairman’s Statement on Corporate Governance, Winkworth adheres to the QCA Code on Corporate Governance. Full details of how the ten principles have been applied are shown on our website http://www.winkworthplc.com.”

Here is the QCA link.

A few snippets:

Re-emphasising the board’s cautious approach:

“Winkworth looks to grow its franchise network and add like-minded entrepreneurial franchisees and offices to the network. Not, however, through growth at any cost, as new franchisees need to adhere to the Winkworth brand values. We also have a conservative approach to financing expansion.”

Last time I went to WINK’s AGM, one of the non-execs was not pleased with my questions. I trust attitudes to ordinary shareholders turning up to the meeting have since changed:

“The Board recognises the AGM as an important opportunity to meet private shareholders. The Directors are available to listen to the views of shareholders informally immediately following the AGM.”

The website says the QCA details were last updated during January 2024, but reference is made to a new executive appointed during February 2024:

“Tara Tan is a lawyer with considerable franchise experience.”

WINK does not employ a formal nominations committee, although the text below reads as if the Agace family (chairman and CEO) is effectively that committee:

“The chairman and CEO consider the balance of skills, knowledge and experience on the board and make appropriate recommendations for consideration by the whole board.”

Best practice these days is the directors seek re-election every year:

“All continuing Directors stand for re-election every three years”

Talk of WINK being a premium agency brand with high-quality service:

“With our people-based ethos and as a premium, customer-focussed business dependent on its reputation, we understand that our success depends on everyone working under the Winkworth brand doing so with respect, loyalty and pride. All our offices need to ensure we exceed our customers’ expectations by delivering the highest quality service at all times so that our customers not only return, but also share their experience with other potential customers.”

6) REPORT OF THE INDEPENDENT AUDITORS

No major changes here for 2022.

a) Materiality and scope

Materiality still at 5% of three-year average pre-tax profit:

“Based on our professional judgement, we determined overall materiality for the Group financial statements as a whole to be £120,000 (2021: £105,000) based, as in 2021, on 5% of the average profit before tax over the 3 financial years to the reporting date, a benchmark chosen to normalise the effects of the Covid-19 pandemic on the group.”

A full-scope audit is undertaken on the main franchising subsidiary, while Tooting is audited by another (unaffiliated) firm (point 10):

“The parent company and Winkworth Franchising were subject to full scope audit by ourselves, Tooting Estates was audited by a component auditor.”

b) Key audit matter

Remains revenue recognition and “completion“, the latter referring to the possibility some franchisees may not declare all of their commissions to WINK:

“There is a risk that revenue is earned but not recorded, especially due to under reporting of revenue on the part of franchisees. Therefore there is a potential risk in terms of the completeness of revenue being recognised.”

Payments by customers to franchisees for property sales are handled by WINK’s IT system, so any under-reporting of commissions will either i) involve payments for property sales accepted through different methods, or ii) payments by customers for lettings income.

7) ACCOUNTING POLICIES

a) Revenue

A reminder that WINK earns a flat 8% of franchisee sales and lettings commissions:

“The group earns a straight 8% by value on all sales and lettings income generated by the franchisees.”

New text for 2022 confirming revenue recognition for the company-owned branches:

“In Tooting Estates Limited and Crystal Palace Estates Limited, revenue in respect of commissions due on house sales is recognised on completion. Revenue in respect of commissions due on lettings and property management is recognised over the life of the rental agreement.”

b) Intangible assets

Website costs are now amortised over 6 years rather than 3-6 years:

“The website development costs are amortised over their useful life which is deemed to be 6 years. Customer lists are amortised over 15 years on a straight line basis.”

I generally view website costs as just another ongoing cost that should be expensed as incurred.

Customer lists — essentially an intangible to reflect the acquired value of existing custom at Tooting — are still amortised over 15 years. I presume this timescale reflects the longevity of landlords serviced by Tooting (and other branches). But see point 11.

The value of WINK’s intangible assets are relatively small, and general intangible cash expenditure has not been huge versus the associated amortisation, so the lengthy useful lives are not significant quibbles. And see point 7e.

c) Prepaid assisted acquisitions support

A reminder that prepaid assisted acquisitions support is essentially ‘goodwill’ paid to franchisees to start/acquire/expand their business:

“Prepaid assisted acquisitions support represents amounts paid to franchisees on the incorporation of their business into the Winkworth brand. The amounts paid to franchisees are contributions towards their growth plans, which in turn will grow the Winkworth brand.

Amounts paid to franchisees are amortised over the initial 10 year franchise agreement on a straight-line basis as a reduction in revenue. They are tested for impairment at each reporting date by reference to the financial performance of the relevant franchise.”

d) Property, plant and equipment

A change to the depreciation rate of fixtures and fittings:

“Fixtures and fitting – 15% – 33% straight line,“.

The rate was previously 25%. Fixtures and fittings have a minimal £73k book value (point 12).

e) Critical accounting estimates and judgements

Unchanged from 2021, various percentages that explain the valuation for intangible customer lists (see point 7b):

“The valuation of customer lists was based on industry multiples of 150% of the historic lettings revenue and 100% of the sales revenue, discounted by 30% for lettings and 70% for sales revenues, to reflect the future prospects and inherent goodwill relating to the staff of the business. An assumption has been made that cash flows from the lettings business will fall by 7% per annum.”

Assuming lettings cash flow will fall by 7% a year seems quite conservative.

8) EMPLOYEES AND DIRECTORS

a) Employees

Should say that the 57 employees declared for the comparable 2021 were reported originally as 54:

Average cost per employee was £62k, matching 2021 and the highest since 2012 (£63k). Revenue per employee back in 2012 was £286k versus £166k for 2022, which underlines how staff ‘productivity’ is diluted by owning branches. 37% of revenue was expensed as staff costs during 2022 versus 22% for 2012.

b) Directors

Executive pay was mixed:

The chief exec enjoyed a 10% advance to his salary and bonus, while the finance director suffered a 6% decline to his salary and bonus. Bonuses are amalgamated with salaries in the table, which is irritating but I guess expected given the bare-bones approach to corporate-governance reporting (point 5).

The chief exec’s £249k total pay is not trivial versus a 2022 operating profit of £2.5m.

The chief exec’s pay and bonus total has climbed 35% since 2017, while the ordinary dividend has gained 52%. So shareholders have enjoyed a greater income, too.

The two execs at the time owned 489k options, which represented 87% of the then total 562k options.

Once again WINK has not calculated an options charge against profit; options then represented 4.4% of the share count and their IFRS 2 cost I am sure would have been greater than zero (point 19).

9) NET FINANCE INCOME

Year-end cash averaged more than £5m during 2022 and interest was only £39k = less than 1% interest:

Interest should include interest from franchisee loans as well (point 15). I have guessed in the blog post above that franchisee loans were £660k, so maybe that £39k reflects a 6% rate on franchisee loans and nothing from the bank.

Either way, with rates moving higher following this 2022 report, I expect the 2023 accounts to show interest of much more than £39k.

10) PROFIT BEFORE TAX

Audit fees at £69k = 0.7% of revenue, which is not a low percentage going by my ad-hoc audit comparison.

Maybe the auditors spend a lot of time with the self-employed franchisees checking they have not under-reported their commissions (point 6a).

Not quite sure why the unaffiliated component auditor enjoys larger non-audit fees than audit fees for checking the books of the Tooting branch. Non-audit fees are typically tax related, and good practice is to keep non-audit fees low to ensure there is no auditor ‘influence’.

11) INTANGIBLE ASSETS

Details of the acquired customer lists and capitalised website costs (point 7b):

For the customer lists, amortisation of £45k = 7% of the original £643k cost and underlines the c15-year amortisation timescale.

For the website costs, the difference between amortisation of £97k versus cash expense of £123k is not huge given the operating profit of £2.5m. A book value of £385k will take 4-5 more years to clear assuming no further additions.

12) PROPERTY, PLANT AND EQUIPMENT

Details of the (very low-value) tangible assets (point 7d):

A book value of £83k for computers and office equipment compares to a £2.5m operating profit — WINK is not a business that requires hefty capex to grow (point 7d)!

13) PREPAID ASSISTED ACQUISITIONS SUPPORT

Details of the prepaid assisted acquisitions support (point 7c):

Amortisation of £92k was exceeded by actual cash expenditure of £316k. But this assisted support fluctuates from year to year and over the last 5 and 10 years, aggregate amortisation has exceeded the aggregate cash expense. Indeed, the assisted-support book value was £1m for 2012 but was £503k for 2022. I therefore get the impression fewer franchisees need assisted support :-)

14) INVESTMENTS

A £71k quoted investment lost 44% of its value during 2022:

Worth keeping an eye on the operational subsidiaries listed in the report.

In particular, WINK’s development and commercial subsidiary reported sales of £500k and a £75k operating profit for 2022 (Companies House).

Progress at Crystal Palace was not quite so positive, with retained losses increasing from £90k to £198k for 2022 (Companies House).

For Tooting Estates, see point 16.

15) TRADE AND OTHER RECEIVABLES

Year-end trade receivables at 7.1% of revenue matches the 7.1% for the previous three FYs, so commendable consistency collecting franchisee payments:

This line suggests WINK does not give up on late payers until the very end:

“Impaired receivables are only written off following the conclusion of administration proceedings.”

The provision for doubtful unpaid invoices came to just £79k.

16) NON-CONTROLLING INTERESTS

As per the blog post above, a lower profit at 90%-controlled Tooting:

Companies House reports director changes at Tooting.

This social-media message confirms the original director drafted in by WINK left during 2023:

“Today is my last official day at Winkworth Tooting. What a journey. Having taken the office from a poor performing office just over 5 years ago to no1 in sales (according to Rightmove) has been a hell of an achievement. I look forward to updating you all in the coming weeks of my next chapter. Seriously exciting times ahead. Thank you Winkworth and keep in touch.”

He seems to have started his own agency.

Why has he not started his own WINK franchise?

Not sure what the director changes means for WINK Tooting now.

17) TRADE AND OTHER PAYABLES

Nothing of concern here:

18) RELATED PARTY DISCLOSURES

Yet another irritating feature of WINK’s accounts — shareholdings of the directors and outside investors above the disclosable 3% threshold are not reported!

Shareholders are instead informed of aggregate director dividend payments, which is not very helpful:

“During the year total dividends of £935,523 (2021 – £539,917) were paid to directors.”

Website is no help either for the smaller director holdings.

Quite poor disclosure actually.

19) SHARE-BASED PAYMENT TRANSACTIONS

562k options represented 4.4% of the share count (point 8b):

176k options had a June 2023 expiry date and sure enough, 176k options were exercised during June 2023:

Share count is now 12,908,792 and option count is now 387k giving dilution of 3.0% (the options are conditional only on the holders remaining WINK employees for two years).

20) POST BALANCE SHEET EVENTS

WINK has owned up to sloppy accounts administration:

“After the reporting date the Directors became aware that aggregate dividends totalling £713,000 paid in the period and shortly after the end of the period had been made otherwise than in accordance with the Companies Act 2006 as unaudited interim accounts had not been filed at Companies House prior to the dividend payment. A resolution has been proposed at the General Meeting to be held on 6 June 2023 to authorise the appropriation of distributable profits to the payment of the relevant dividends and waive the entitlement of the Company to pursue shareholders and Directors for repayment. This will constitute a related party transaction under IAS24 ‘Related party disclosures’, the effect of which will be to return all parties, so far as possible, to the position they would have been in had the relevant dividends been made in full compliance with the Companies Act 2006.”

WINK is not the first company to have overlooked the proper filing of Companies House documents before paying dividends. Among my other shares, CLIG has been a recent offender.

21) FINANCIAL INSTRUMENTS

Arggh! Contrary to my original blog post above, WINK continues to disclose loans to franchisees — but just in the Financial Instruments note! I tend not to look at this note as generally it recaps entries elsewhere in the accounts. But not so this time with WINK! Anyway, my original £660k guess for loans to franchisees was just £4k out:

Maynard