17 July 2020

By Maynard Paton

Results summary for System1 (SYS1):

- Somewhat academic annual figures that showed pre-AdRatings profit down 27% due to weak trading prior to Covid-19.

- The pandemic has since caused demand for SYS1’s services to drop 38% and created pre-tax losses.

- AdRatings continues to generate minimal revenue at significant cost, although the tie-up with ITV suggests the fledgling service has some inherent value.

- SYS1 bizarrely remains very poor at marketing its own services. A flagship company film commences with references to 18th century German literature.

- A £3.9m cash buffer ought to keep SYS1 afloat as it moves towards more reliable revenue sources. Valuation in the meantime remains anyone’s guess. I continue to hold.

Contents

- Event links, share data and disclosure

- Why I own SYS1

- Results summary

- Coping with Covid-19

- Revenue, profit and dividend

- Consulting divisions

- AdRatings

- Lemon and Orlando

- Financials

- Valuation

Event links, share data and disclosure

Event: Final results and annual report for the twelve months to 31 March 2020 published 30 June 2020

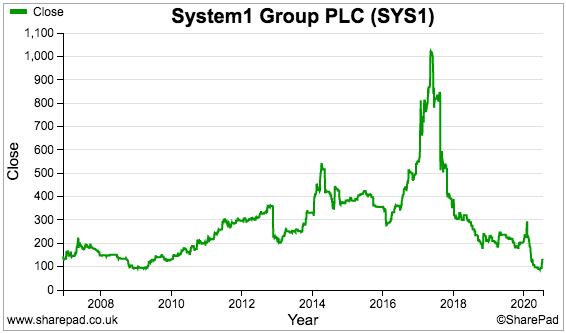

Price: 125p

Shares in issue: 12,599,785

Market capitalisation: £15.8m

Disclosure: Maynard owns shares in System1. This blog post contains SharePad affiliate links.

Why I own SYS1

- Market-research agency that predicts the long-term effectiveness of television adverts, with progress resting upon a “difficult-to-replicate” database of advert assessments created over 20 years.

- Boasts founder/entrepreneurial/owner-friendly chief exec who has overseen acquisition-free growth, declared five special dividends and retains a 23%/£4m shareholding.

- Ongoing shift from ad-hoc to recurring income alongside a growing business relationship with ITV offers turnaround hopes following pandemic-related losses.

Further reading: My SYS1 Buy report | All my SYS1 posts | SYS1 website

Results summary

Coping with Covid-19

- SYS1’s 2020 results are now somewhat academic due to Covid-19 and an ongoing operational shift within the business.

- SYS1 is a market-research agency that evaluates television adverts, monitors brand recognition and tests product ideas through an online panel.

- The pandemic brought a sudden to halt to marketing expenditure and therefore demand for SYS1’s services.

- A report from the Institute of Practitioners in Advertising (IPA) — “Coronavirus outbreak drives record decline in UK marketing budgets” — claimed market-research spend dropped 42% during April, May and June.

- These 2020 results admitted gross profit (SYS1’s “main top-line performance indicator”) plunged 38% during April and May, the first two months of the group’s current 2021 financial year.

- April and May also witnessed a small pre-tax loss and a net cash outflow.

- Not surprisingly, a final dividend was not proposed.

- Not surprisingly, some employees have been laid off while some have been furloughed:

“We have taken mitigating actions including deferring employment costs, reducing the number of hours paid for where the volume of work has fallen, reducing discretionary expenditure, laying off a small number of colleagues, and taking advantage of government-backed business support and furloughing schemes.”

- These 2020 results are therefore unlikely to bear much resemblance to the pandemic-affected 2021 figures.

- In the mix as well is SYS1’s start-up AdRatings service, which continues to generate negligible revenue at substantial cost.

- The 2020 statement confirmed SYS1’s commitment to AdRatings and the “significant systems and process improvements that the business is engaged with as it transforms its product offering.”

- The transformation involves SYS1 becoming “a more automated digital business” and less dependent on bespoke consultancy work.

- This transformation also means SYS1’s past accounts will offer less relevance to future progress.

Revenue, profit and dividend

- SYS1’s 2020 progress had already exhibited weakness before the pandemic struck.

- Unremarkable first-half results published during November were followed by a profit warning in February:

“[T]rading in Q4 to date has been disappointing, due in the main to the ongoing transition of sales talent, and subsequent disruption and decline in adhoc revenue from smaller clients.”

- I think “transition of sales talent” means an organisational restructure.

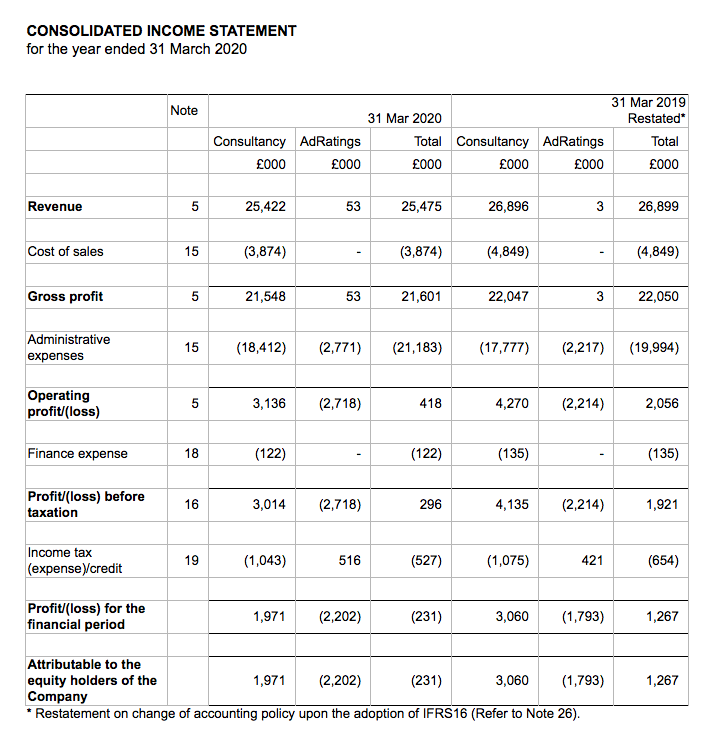

- In the event, full-year gross profit fell 2% while reported operating profit before AdRatings expenditure dropped 27%.

- Bookkeeping factors complicating SYS1’s figures included:

- A £251k exceptional gain recorded during the prior year and accounted for within operating profit;

- The introduction of IFRS 16, whereby operating lease costs are now recognised as a mix of depreciation and finance expense;

- Share-based payments, which were credits during this year and last;

- A £921k AdRatings write-off during this year, and;

- The reclassification of certain central costs and divisional income.

| Year to 31 March | 2016 | 2017 | 2018 | 2019 | 2020 |

| Revenue (£k) | 25,917 | 32,801 | 26,939 | 26,899 | 25,475 |

| Gross profit (£k) | 20,989 | 26,984 | 22,231 | 22,050 | 21,601 |

| Operating profit (£k) | 5,052 | 6,308 | 1,985 | 2,056 | 418 |

| Other items (£k) | - | - | - | - | - |

| Finance income (£k) | (21) | (29) | 7 | (135) | (122) |

| Pre-tax profit (£k) | 5,031 | 6,279 | 1,992 | 1,921 | 296 |

| Earnings per share (p) | 26.7 | 32.7 | 9.9 | 10.1 | (1.8) |

| Dividend per share (p) | 4.5 | 7.5 | 7.5 | 7.5 | 1.1 |

| Special dividend per share (p) | - | 38.1 | - | - | - |

- SYS1 described the year as “eventful”. Other adjectives could have been more appropriate.

- For a longer-term perspective, full-year revenue and gross profit were approximately 5% above those witnessed during 2015.

- Operating profit from the three main Consulting divisions was markedly lower during the second half:

| Consulting | H1 2019 | H2 2019 | FY 2019 | H1 2020 | H2 2020 | FY 2020 | |

| Revenue (£k) | 13,182 | 13,714 | 26,896 | 13,704 | 11,718 | 25,422 | |

| Gross profit (£k) | 10,802 | 11,245 | 22,047 | 11,568 | 9,980 | 21,548 | |

| Operating profit* (£k) | 1,669 | 2,350 | 4,019 | 2,545 | 591 | 3,136 |

(*excludes £251k exceptional H1 2019 gain)

- AdRatings meanwhile recorded trivial revenue and further losses.

| AdRatings | H1 2019 | H2 2019 | FY 2019 | H1 2020 | H2 2020 | FY 2020 | |

| Revenue (£k) | - | 3 | 3 | 21 | 32 | 53 | |

| Gross profit (£k) | - | 3 | 3 | 21 | 32 | 53 | |

| Impairment (£k) | - | - | - | - | (921) | (921) | |

| Operating profit (£k) | (1,090) | (1,124) | (2,214) | (1,081) | (1,637) | (2,718) |

- The aforementioned dividend cancellation contrasts with special payouts totalling 62p per share declared between 2013 and 2017.

Consulting divisions

- SYS1 operates three market-research Consulting divisions.

- SYS1 has claimed previously that the group’s “main competitive strength” lies within its Communications division, which evaluates televisions adverts and has “developed market research techniques [that]… are better able to predict the long-term effectiveness of advertising than anyone else’s.”

- The Brand division tracks ongoing client-brand popularity, while the Innovation division tests new marketing concepts.

- The Communications division should offer the best growth prospects and the widest ‘moat’ to shareholders. Brand is apparently the more reliable of the three income sources, while Innovation caters for ad-hoc work and is the most unpredictable.

- The table below summarises the gross-profit contributions from each department:

| Year to 31 March | 2016 | 2017 | 2018 | 2019 | 2020 |

| Communications (£k) | 4,623 | 8,151 | 6,994 | 7,372 | 7,992 |

| Brand (£k) | 1,481 | 3,349 | 4,511 | 3,699 | 3,423 |

| Innovation (£k) | 9,682 | 11,789 | 8,404 | 9,608 | 8,555 |

| Other (£k) | 5,203 | 3,695 | 2,322 | 1,368 | 1,578 |

| AdRatings (£k) | - | - | - | 3 | 53 |

| Total (£k) | 20,989 | 26,984 | 22,231 | 22,050 | 21,601 |

- This next table shows the percentage gross-profit contribution from each department:

| Year to 31 March | 2016 | 2017 | 2018 | 2019 | 2020 |

| Communications (%) | 22 | 30 | 31 | 33 | 37 |

| Brand (%) | 7 | 12 | 20 | 17 | 16 |

| Innovation (%) | 46 | 44 | 38 | 44 | 40 |

| Other (%) | 25 | 14 | 10 | 6 | 7 |

| AdRatings (%) | - | - | - | - | - |

| Total (%) | 100 | 100 | 100 | 100 | 100 |

- The more appealing Communications and Brand divisions have advanced from 29% to generate a combined 53% of total gross profit since 2016.

- SYS1 has therefore moved towards becoming a more predictable business during recent years.

- In turn, the group’s headline progress has arguably been clouded by the ‘legacy’ Innovation and Other divisions losing business alongside ‘transformation’ costs hitting profits.

- For the time being, the Innovation and Other divisions remain significant to SYS1’s financials and can’t be abandoned completely.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

AdRatings

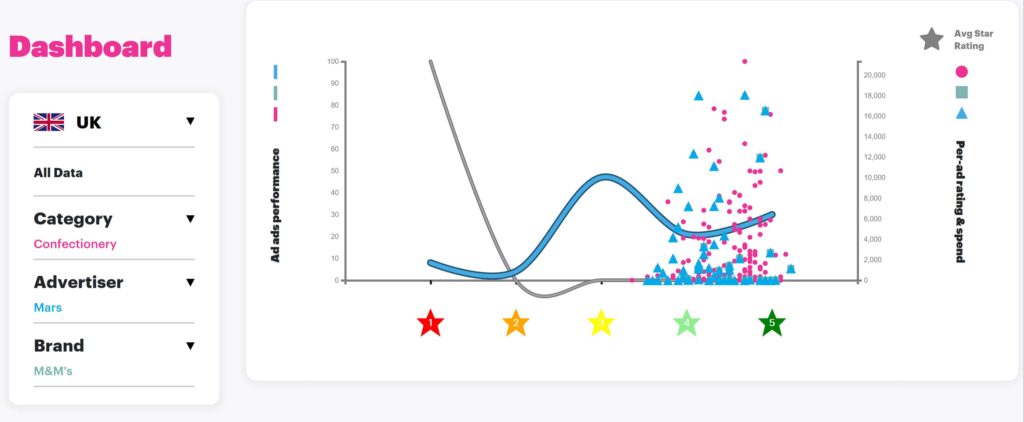

- SYS1 reminded shareholders what AdRatings offers:

“AdRatings is a large database showing ‘ratings’ or ‘scores’, of adverts in the market as a whole. It allows clients to assess the effectiveness of their historical advertising and benchmark it against peer companies, competitor categories and the industry as a whole. ”

- The previous results RNS described AdRatings as “the world’s largest, and most predictive and validated database of short and long-term advertising effectiveness”.

- This results RNS changed the emphasis slightly, with SYS1 now having a “goal of becoming the world leader in predicting advertising effectiveness”.

- Somewhat confusingly, the AdRatings website has been rebranded TestYourAd and now offers a cheap way for clients, to, er, test their ads:

“In the last quarter of the year we launched Test Your Ad, to increase access to our testing and generate additional revenues from AdRatings. Users can upload and pre-test any ad and get next-day or even same-day predictions for a fraction of current costs. They see the likely performance of their ad and can compare it with all other ads in their category.

- I am not sure how TestYourAd differs to the advert testing undertaken by the aforementioned Communications division.

- SYS1 also claimed:

“It’s early days, but the initial reaction [to TestYourAd] has been extremely positive and ITV are promoting the service to all their advertisers. Test Your Ad is our online offering and AdRatings remains the name for our advert database.”

- The cross-promotion with ITV provides some hope that AdRatings/TestYourAd possesses some intrinsic value to the wider marketing industry.

- Indeed, ITV was keen to use SYS1’s services this summer for the (now-postponed) Euro 2020 football tournament.

- Whether ITV is in fact paying SYS1 for AdRatings/TestYourAd is not clear.

- The AdRatings financials suggest the ITV deal is a free trial:

| AdRatings | H1 2019 | H2 2019 | FY 2019 | H1 2020 | H2 2020 | FY 2020 | |

| Revenue (£k) | - | 3 | 3 | 21 | 32 | 53 | |

| Gross profit (£k) | - | 3 | 3 | 21 | 32 | 53 | |

| Impairment (£k) | - | - | - | - | (921) | (921) | |

| Operating profit (£k) | (1,090) | (1,124) | (2,214) | (1,081) | (1,637) | (2,718) |

- To date almost £5m has been spent developing AdRatings for total revenue of £56k.

- The results RNS contained mixed messages about AdRatings.

- The chief exec looked on the bright side (my bold):

“Although the number of annual subscribers to AdRatings is still low, it’s proving a very effective way to sell System1’s ad testing consultancy and a high proportion of our new ad testing clients are also choosing to subscribe.”

- But the (new) finance director was not so sure (my bold):

“AdRatings generates significant interest and enquiries from clients but it has proved difficult to attribute subsequent consulting revenue streams from those clients to the database.

- The FD also confirmed:

“The Board has decided that capitalising the database is no longer appropriate and will expense future costs as they are incurred. We have therefore impaired the carrying value of the remaining asset (£0.9m)”

- I am not surprised by the write-off.

- Development costs can only be recognised as an intangible if, among other conditions, a company can demonstrate “how the intangible asset will generate probable future economic benefits”.

- The “probable future economic benefits” of AdRatings are not clear at present.

- Within my previous SYS1 review I wrote:

“Management comments at the AGM indicated AdRatings was becoming an integral part of the business —rather than a standalone operation that could (in theory) be scrapped.

The AdRatings costs should therefore not be ignored for valuation purposes.”

- Sure enough, this results RNS confirmed AdRatings will be amalgamated into the main Consulting divisions and the start-up’s figures will no longer be disclosed.

- At least we now know not to ‘adjust for AdRatings’ with our valuations sums.

- But we also won’t know just how bad the AdRatings numbers are.

- A subscription to AdRatings costs $4k/£2k a month. Revenue of £53k last year implies only two or three paying subscribers.

- Why are SYS1’s other 230-odd clients not interested?

- Remarks at last year’s AGM revealed:

- Interested clients require “validation” — they want to see market-share changes in their particular advertising category correlate to changes to SYS1’s star ratings for the relevant adverts. SYS1 only has correlation evidence in certain advertising categories. Work is underway to ensure all categories have such validation.

- The low subscription cost of AdRatings meant the service has not reached the attention of chief marketing officers — who can’t justify their time evaluating a £24k a year service.

- I am convinced another factor is responsible for the woeful AdRatings performance — SYS1 is ironically very poor at marketing its own products.

- Meet Orlando Wood, SYS1’s chief innovation officer…

Lemon and Orlando

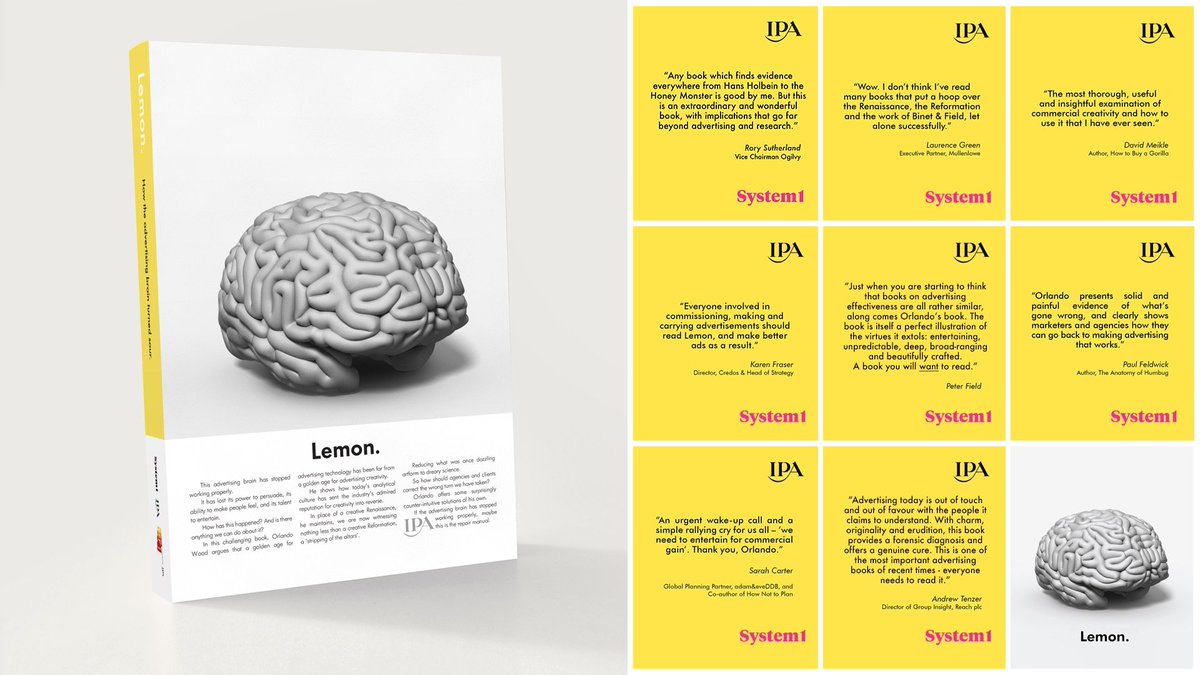

- Last year Mr Wood wrote a book called Lemon:

“Last year, the [AdRatings] database proved invaluable to an effectiveness evaluation project with the IPA, which culminated in the publication of Lemon – authored by our Chief Innovation Officer, Orlando Wood.

The publication has been critically acclaimed by such industry luminaries as Rory Sutherland, Vice Chairman of Ogilvy and Peter Field, co-author of the seminal Long and The Short of It, who said of Lemon, “Just when you are starting to think that books on advertising effectiveness are all rather similar, along comes Orlando’s book. The book itself is itself a perfect illustration of the virtues it extols: entertaining, unpredictable, deep, broad-ranging and beautifully crafted. A book you will want to read.”

- The book was published by the IPA and costs £53 (or £28 for IPA members):

- I continue to wonder whether the critical acclaim for Lemon helped book sales exceed the income from AdRatings.

- A free PDF summary of Lemon is available here. The gist is that adverting has become “flat, abstract, dislocated and devitalised” and ought to become more creative and produce greater emotional reactions.

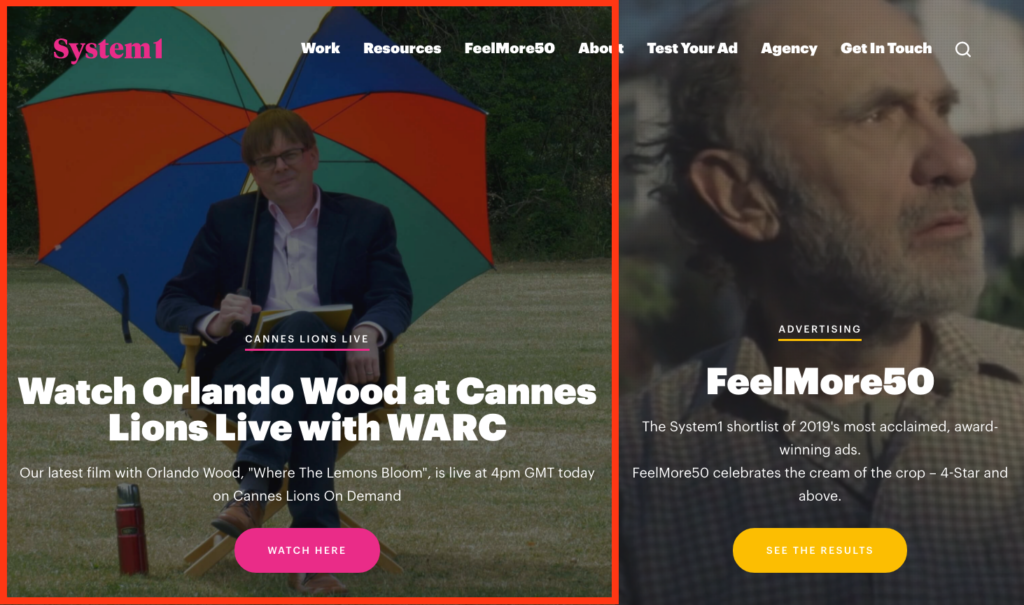

- I have not read Lemon, and I am glad not to have paid £53 if the book is as bad as Mr Wood’s latest film:

- “Where the Lemons Bloom” was written and presented by Mr Wood.

- Underlining the importance of “Where the Lemons Bloom” to SYS1, two-thirds of the group’s website home-page is devoted to the film:

- “Where the Lemons Bloom” opens with the line “Kennst du das Land, wo die Zitronen blühn?” and then recounts the early life of German writer Johann Wolfgang von Goethe and his trip to Italy in 1786.

- Experience the full 21m22s recording, and you too may think you have inadvertently tuned into a BBC4 history documentary.

- Just how this somewhat indulgent and rather dull film that talks of “brain lateralisation” is meant to resonate with modern-day marketing folk is not clear to me.

- The problem stems from the film’s System 2-type presentation.

- To recap:

- System 1 thinking is automatic, quick, intuitive, emotional and reactive, and;

- System 2 thinking is conscious, effortful, logical, and deliberate.

- Mr Wood wants his audience to engage their System 2 brains, concentrate on what he says and think rationally about how they should enhance their marketing creativity.

- Trouble is, his audience are likely to have their System 1 brains engaged and become quickly fed up with 18th century German literature.

- The film only engages the System 1 brain briefly when four memorable old adverts are shown:

- The great irony of course — SYS1 tells its clients that television viewers always have their System1 brains engaged and adverts should be created accordingly.

- My challenge to SYS1 then — test “Where the Lemons Bloom” with your online panel and see what ‘star rating’ is produced.

- Mr Wood’s essays are also written for System 2 thinkers. (See for yourself)

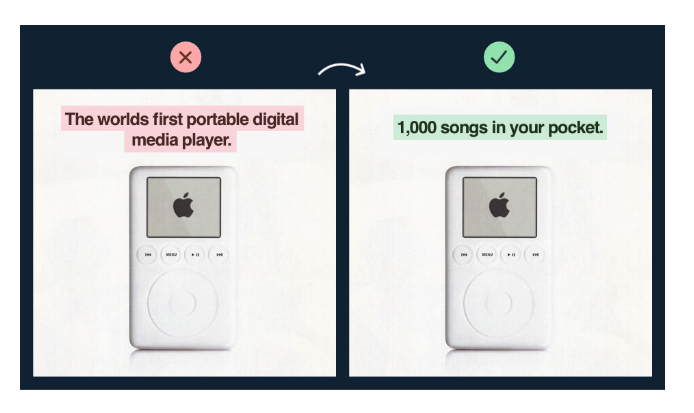

- Perhaps Mr Wood can improve his marketing by keeping the essays simple. In particular, readers might be more likely to appreciate images such as this…

(Source: Marketingexamples.com)

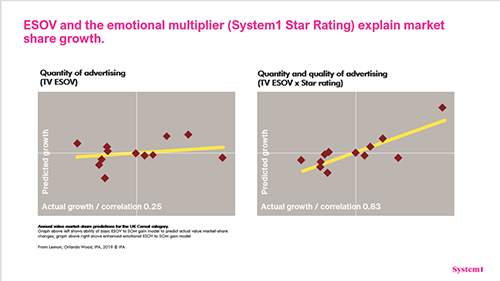

- …rather than charts such as this:

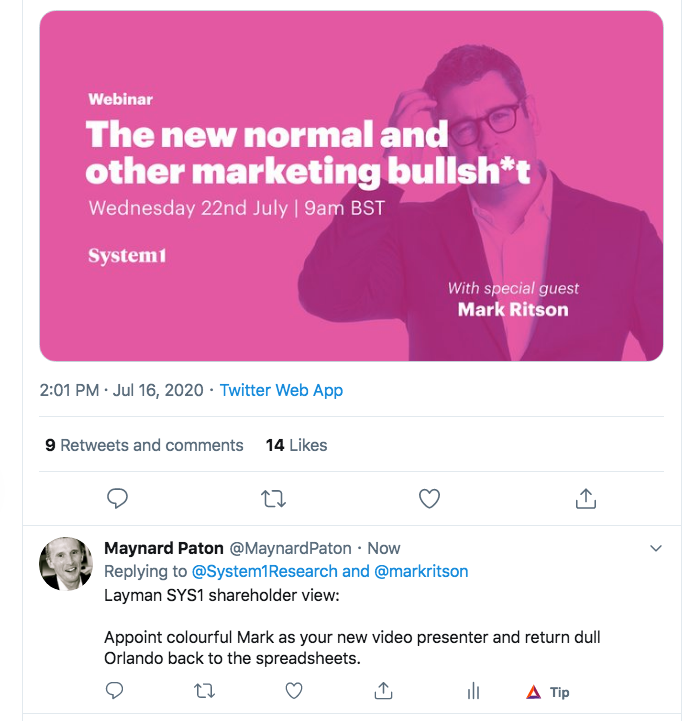

- I would recommend Mr Wood keeps to the spreadsheets and German literature. SYS1’s chief marketing officer should step up — or appoint someone else — to do the much-needed System 1 promotional work instead.

- Mark Ritson would be ideal:

- EDIT 19 July 2020:

- SYS1’s chief marketing office has responded to my Tweet above.

- More details in this comment.

Reader offer: Claim one month of free SharePad data. Learn more. #ad

Financials

- For the first time since 2006, the year-end balance sheet carried bank debt.

- SYS1 took on borrowings of £2.5m during March 2020.

- Cash ended the year at £6.7m, giving a net cash position of £4.2m.

- The £4.2m provides a useful buffer for pandemic- and/or AdRatings-induced losses.

- This results RNS said:

“Over [April and May] the business as a whole incurred a Pre-Tax loss of some £0.7m as we pursued our short-term objectives of continuing to develop our new automated product set, while conserving cash by shrinking the cost base to offset lower sales. Cash net of debt facilities ended May at £3.9m compared with £4.1m at 31 March”

- I am not sure how the two-month pre-tax loss of £0.7m correlates with the two-month cash outflow of £0.2m.

- Either the pre-tax loss included non-cash charges, or certain expenses have yet to be paid.

- Taking the £0.45m mid-point between the £0.7m loss and the £0.2m cash outflow, SYS1 could be losing £225k a month.

- A £225k monthly loss would give SYS1 approximately 18 months of breathing space until the last reported £3.9m net cash position ran dry.

- I would like to think SYS1 can become cash generative between now and December 2021.

- Until then, SYS1’s net cash position is certainly not ‘surplus to requirements’.

- Last year’s cash conversion appeared good. I calculate pre-write-off earnings of £690k converted into free cash of £740k.

- Within the cash flow statement, a favourable working-capital movement helped offset the capitalised AdRatings costs that bypassed the income statement:

| Year to 31st | Dec 2015 | Mar 2017* | Mar 2018 | Mar 2019 | Mar 2020 |

| Operating profit (£k) | 4,546 | 7,260 | 1,985 | 2,056 | 418 |

| Depreciation and amortisation (£k) | 459 | 556 | 374 | 286** | 494** |

| Net capital expenditure (£k) | (322) | (290) | (113) | (1,030) | (916) |

| Working-capital movement (£k) | (1,053) | 767 | 832 | (864) | 211 |

| Net cash (£k) | 6,365 | 8,266 | 5,784 | 4,315 | 4,150 |

(*15 months **excludes IFRS 16 depreciation)

- The AdRatings expenditure has depressed margins and returns on equity:

| Year to 31st | Dec 2015 | Mar 2017* | Mar 2018 | Mar 2019 | Mar 2020 |

| Operating margin (%)** | 22.4 | 22.6 | 8.9 | 9.3 | 1.9 |

| Return on average equity (%) | 35.8 | 47.9 | 14.9 | 14.4 | (2.4) |

(*15 months **operating profit as a proportion of gross profit)

- I do not expect a recovery to the ratios of yesteryear any time soon.

Valuation

- Assessing SYS1’s valuation requires a view on:

- The prospect of recovery following the pandemic, and;

- The potential profitability of AdRatings.

- On both counts your guess is as good as mine.

- For context, 2020 pre-write-off earnings of £690k support a 23x multiple with the market cap at £15.8m.

- Without AdRatings, earnings would have been £2.0m and the trailing P/E would be 8.

- As mentioned earlier, AdRatings expenditure can no longer be ignored.

- As mentioned earlier, the cash position shouldn’t really be used in any valuation sums.

- As mentioned earlier, the dividend has been stopped.

- All that leaves other less obvious measures to consider.

- At the last count AdRatings carried the testing results for 42,382 adverts.

- The £15.8m market cap therefore implies each AdRatings analysis is worth £372 — assuming the rest of the business is worth zero.

- I assume a client pays more than £372 to have an advert tested by AdRatings.

- On that basis, perhaps buying SYS1/AdRatings outright for £372 per test is cheap.

- Mind you, who wants to purchase all the AdRatings test results… especially those from long-forgotten adverts produced by brands that have since disappeared?

- Judging by the subscriber take-up of AdRatings… nobody.

- All told, I just wonder whether SYS1 would be more suited to becoming part of ITV.

- The broadcaster is clearly interested in the AdRatings database, and sees an opportunity to benefit its network by improving the effectiveness of advertising generally.

- However, ITV is suffering its own pandemic issues.

- The broadcaster’s advert income fell 42% in April, staff have been furloughed and its dividend has been scrapped. No doubt strategic deals are off the agenda for the time being.

- I last bought SYS1 shares in January and February this year at 251p on the assumption the net present value of AdRatings was zero based on ITV’s involvement.

- Six months on, and that AdRatings assumption now feels optimistic.

- I can only hope ITV keeps the AdRatings faith during the pandemic and beyond.

- In the meantime SYS1 can help matters by ensuring its marketing is actually devised for System 1-type thinking.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

System1 (SYS1)

Publication of 2020 annual report

Some interesting snippets, most of which were not mentioned in the blog post above:

1) Covid-19 and going concern

The Risk section not surprisingly mentions Covid-19 this year:

This next snippet in interesting. The ‘going concern’ note claims “trading continues to be above the levels anticipated in the Group’s Covid-19 scenario planning”:

That sounds encouraging.

2) Director pay

Perhaps the most interesting snippet within the whole report:

The former CFO was paid £220k for losing his job.

Seems to me Mr Geddes was pushed out to make way for the ex-Bradford & Bingley man. I had assumed Mr Geddes had left of his own accord, perhaps because he foresaw major trouble ahead with the pandemic/AdRatings etc. After all, you don’t leave a job of 17 years on a whim.

The new CFO was announced at the same time as the departure of Mr Geddes, so yes, the succession was lined up. The new CFO has a blotted CV, which now makes this planned succession slightly peculiar.

The execs do not seem vastly overpaid and are taking a 20% Covid-19 pay cut:

3) Employees

The CFO pay-off leads onto more loss-of-office compensation:

£521k is significant given the reported pre-write-off profit was £1.2m.

Mind you, SYS1 has recorded such compensation costs every year since 2012, so I am wary of treating the £521k as ‘exceptional’ and trying to find ‘hidden value’ in the shares.

Note that the £521k includes the £220k for the ex-CFO:

Even though the ex-CFO left after the year-end, the £220k was charged in the 2020 year.

4) Options

No problems here. The LTIP scheme and the Stefan Barden scheme both require significant share-price improvements to cause any dilution:

Earlier share-based payment charges for the schemes were reversed this year and last, with credits:

Stock options that have already vested represent 2.5% of the share count:

5) Corporate governance

Good to see every board meeting was attended in full:

Improvements to succession planning were identified during the previous year:

Not sure whether the improvements were implemented for the new CFO appointment. I get the impression certain senior appointments have in the past been based mostly on the chief exec’s personal recommendation.

A new Whistleblowing hotline has commenced:

A nice succinct Section 172 note that contrasts with the more verbose ones I have read:

6) Audit

RSM replaced Grant Thornton (of Patisserie Holdings fame) as auditor:

All change for key audit matters for 2020.

‘Going concern’ replaces ‘revenue recognition’ as a key matter:

Covid-19 also enhances a general ‘accounting estimates’ audit matter:

Management had to prepare an “impairment paper” for the AdRatings write-off:

Materiality at £145k represents 12% of pre-tax, pre-write-off profit of £1.2m, while the standard is 5%. Not a great start for a new auditor:

At least scope is 100%.

7) Agency and other reclassifications

A few years ago SYS1 launched an advertising agency business to help stir up sales. The venture never took off and has now been amalgamated into Other:

The more appealing Communications and Brand divisions were not involved with any reclassifications.

8) Borrowings

The rate on the new £2.5m loan is 2.5% above LIBOR, which does not seem excessive:

9) IFRS 16

The IFRS 16 note has more on possible debt rates:

The note implies additional borrowings could be attained at 4.3%. Does not sound too onerous, but the rate was estimated on 31 March 2020 — and maybe a bank could have a different view now.

10) AdRatings

Confirmation that AdRatings absorbed cash of £2m last year:

Such expenditure for 2021 will be written off entirely.

11) Intangibles

Not sure about this. AdRatings costs are from next year to be expensed as incurred, but expenditure on a new finance IT system is to be capitalised:

Seems ridiculous to me to capitalise finance-system costs. Surely they are a day-to-day expense of maintaining a business.

12) Largest client

The largest client generated revenue of £2.6m for SYS1, up 73% on 2019 but matching that of 2018:

13) Non-Financial KPIs

Credit for SYS1 for continuing to disclose its client numbers:

14) Tax

Not quite sure whether research into advertising merits a tax break, but a £0.5m refund would come in handy to help mitigate ongoing pandemic losses:

15) Trade receivables

No concerns here:

Trade receivables represent 18% of revenue, in line with the 18%-22% seen since 2016.

Any receivables owed more than 3 months are now more likely to be written off:

16) Trade payables

No concerns here:

17) Related-party transactions

A family member of the ex-CFO is still on for that £40k office commission:

Maynard

System1 (SYS1)

CMO social media comment

The chief marketing officer of SYS1 has responded to my Tweet about the presentations given by Orlando Wood:

I cited another example:

Here is the link: https://www.youtube.com/watch?v=XUXYRf5O5T

Two minutes into that Youtube video the subject turns to the late Roman empire.

The CMO claims: “For advertising researchers and planners Orlando’s presentation has been captivating”

He adds: “Advertising researchers and planners” are a “different audience” to the casual viewer such as you and me.

What seems to happen is Mr Wood gives an academic, System2-type presentation to the researchers and planners, who then (hopefully) apply their System2-type logic to adopt SYS1’s services…

…which actually emphasise the System1-type thinking among the wider public.

I don’t know whether this works or not. Perhaps “advertising researchers and planners” can suspend their System1 instincts when attending the presentations and absorb the history lessons. The CMO reckons Mr Wood’s research is starting to generate new business. We’ll only know through SYS1’s future results.

Maynard

System1 (SYS1)

ITV H1 2020 results presentation published 06 August 2020

Not major news, but encouraging that ITV is starting to refer to its involvement with SYS1 (sort of) within its investor presentations:

Maynard

System1 (SYS1)

Trading Update published 14 October 2020

Here is the full text:

—————

System1, the marketing services group, issues the following update on trading for the six months to end-September 2020. The Company will announce its interim results on 17 November 2020.

Overall, the first half of the current year (H1) saw a marked reduction in sales compared to the prior year, due partly to the impact of Covid-19 on the business of many of our clients. The downturn was particularly pronounced in the US, against a very strong H1 2019/20, while the UK and Asia Pacific produced double-digit revenue growth. Both Turnover and Gross Profit for the half year are expected to be some 25% below the comparable 2019/20 period.

The Company is reviewing its office footprint for lease impairment in view of the ongoing Covid-19 pandemic and new ways of working. This review may give rise to an impairment charge, but any such adjustment will be a non-cash charge and will be confirmed at the release of Interim Results.

Operating Costs were managed down as part of System1’s Covid-19 response, and the business took advantage of some government support schemes, notably in the US and the UK. System1 continued to invest in support of future growth in H1, particularly in product innovation and automation. H1 Operating Costs excluding any impairment charges were some 22% lower than in H1 2019/20.

Group Pre-tax Profits (excluding any impairment charges) are expected to be some £0.6m in H1, approximately £0.8m lower than in the comparable period.

System1’s financial position remains strong. Despite lower profits, period end net cash was £5.1m, compared with £4.1m at end-March 2020. Approximately half of the improvement in H1 was due to receipt of an R&D tax credit related to FY 2018-19, and a similar claim for FY 2019-20 is being prepared.

Given continued uncertainty over the medium- and longer-term impact of Covid-19, we are continuing to suspend financial guidance for the time being. No 2020/21 interim dividend will be paid (prior year 1.1p).

—————

Annual results published in June had already signalled a very poor H1, with a £0.7m pre-tax loss indicated for April and May.

So news of a £0.6m pre-tax profit for this H1 appears very significant — and suggests June, July, August and September recorded a somewhat remarkable £1.3m pre-tax profit.

The £0.6m H1 result broadly reconciles with the statement’s other stats:

Gross profit down 25% = £11.6m*0.75 = £8.7m.

Operating costs down 22% = £10.2m*0.78 = £8.0m.

Profit therefore = £8.7m less £8.0m = £0.7m.

As always, the devil will be in the detail and pre-tax profit may have been bolstered by reverse share-based payments or other such accounting oddities.

Cash can’t be fudged as much and a £1m improvement is promising, although half of that improvement is due to tax credits. Arguably free cash generation is running at an annualised £1m, which is reassuring to the extent that the company won’t go broke just yet. The market cap at 120p is £15m, which is starting to become interesting assuming £1m of free cash flow is sustainable alongside the £5m cash position. Extrapolating the four-month £1.3m pre-tax profit would make the £15m market cap very cheap, but let’s see the finer details first.

Just how AdRatings (or TestYourAd) is doing is anyone’s guess right now. Any sales improvement there would be encouraging in the circumstances. AdRatings remains the great hope for investors, as success there would bring in recurring revenue to counterbalance the haphazard project/consulting income.

I note Orlando’s new video has a great title and even included Bugs Bunny within the first few minutes: https://system1group.com/achtung

A bit of (dull) art history then follows, then mainly lots of stats for marketing data geeks. So not quite the literary borefest of the earlier Lemon video referred to in the blog post above.

Maynard