15 November 2018

By Maynard Paton

Update on Castings (CGS).

Event: Interim results for the six months to 30 September 2018 published 13 November 2018.

Summary: CGS’s results were acceptable but contained several irritating drawbacks. In particular, a recovery at the engineer’s troubled machining division has been seemingly postponed for two years. Furthermore, management has now downgraded customer demand from “strong” to “steady”. Oh, and a depreciation review inflated group profit by 10%. CGS does have strengths — not least its cash pile and dividend history — but I suspect the firm’s stalled earnings will keep the shares marooned for now. I continue to hold.

Price: 400p

Shares in issue: 43,632,068

Market capitalisation: £174m

Click here to read all my CGS posts.

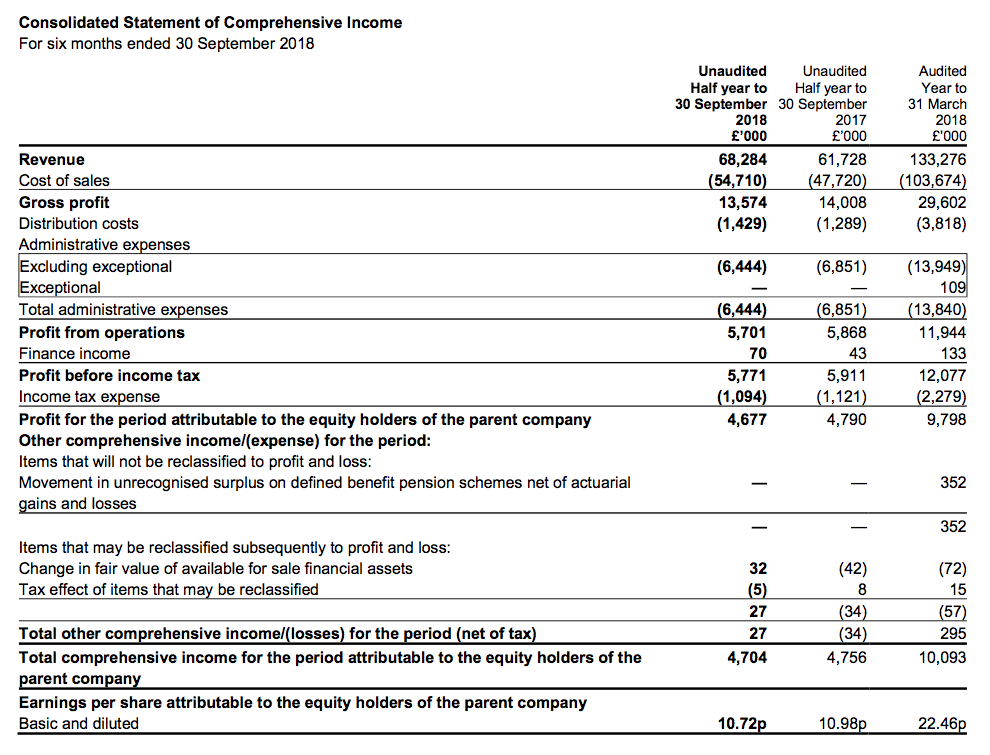

Results:

My thoughts:

* Customer demand has shifted from “strong” to “steady”

This statement was another that conveyed CGS’s acceptable-but-sadly-not-exciting progress.

Total revenue climbed 11% to set a new first-half record, but ongoing problems within the machining subsidiary meant group operating profit fell 3% to the lowest H1 level since 2011.

CGS said customer demand at its main foundry division had remained “steady” during the six months.

The word “steady” was notable — both June’s annual results and August’s AGM update had referred to “strong” demand from the group’s customers.

I wonder whether the change of adjective may be signalling a slight weakening of sales.

Anyway, the foundry division did indeed report a steady performance:

| Foundry | H1 2017 | H2 2017 | H1 2018 | H2 2018 | H1 2019 | ||

| Output (tonnes) | 23,600 | 23,600 | 23,500 | 25,700 | 23,900 | ||

| Revenue (£k) | 54,187 | 57,651 | 58,454 | 68,553 | 64,988 | ||

| Operating profit (£k) | 6,212 | 8,294 | 6,867 | 9,184 | 6,476 |

Similar to this time last year, CGS claimed higher foundry revenue was due to “the continued shift to more machined parts” and blamed the lower foundry profit on “the time lag in passing on raw material and other price increases”.

I calculate revenue and profit per tonne of castings produced now run at £2,692 and £316 respectively, which match the figures of £2,697 and £322 for the preceding twelve months.

* Machining recovery postponed for a further two years

CGS’s troubled machining division continues to lose money:

| Machining | H1 2017 | H2 2017 | H1 2018 | H2 2018 | H1 2019 | ||

| Revenue (£k) | 3,676 | 3,308 | 3,274 | 2,995 | 3,296 | ||

| Operating profit (£k) | 798 | 721 | (999) | (2,951) | (775) |

The management narrative referred to “a back-drop of competitive prices”, a “period of considerable change” and “some time before all the necessary processes have been reviewed and production efficiencies realised.”

Alas, CGS has scrapped its earlier hopes of the machining division returning to profit during the current year. The text below reads as if a further two years are required:

“The intention is to begin a programme of automation investment during 2019/20 which will enable the [machining] business to achieve additional productivity gains over a number of years.”

Meanwhile, this text dashed any hopes of closing the division:

“The [machining] business continues to provide vital support to the foundries in satisfying the product requirements of the group’s core customer base.”

The machining division earned inter-segmental revenue of £9m from the foundry operation during the half.

I have to say, the collapse of the machining division has really surprised me. When I bought my CGS shares three years ago, the division regularly produced a £4m or so profit. These days the division’s annual losses run at £1.5m.

* Depreciation review inflates profit by 10%

The following paragraph is not something you read every day within a chairman’s statement:

“Consequently the management of [the machining division] has reviewed the useful economic lives of the recently acquired items of plant and machinery and has determined that a life of 15 years is more appropriate than the 10 years previously used. This life is within the range recorded in the group accounting policies and the change has resulted in a reduction of the depreciation charge for the period of £0.5 million.”

I have no reason to doubt the board and the reasons behind this depreciation review.

Indeed, such accounting changes are usually hidden away in the annual report small-print — and not declared within the chairman’s statement.

I should add that CGS accounts have, over time, shown cash spent on capital items (excluding property) generally matching the depreciation sum charged against earnings. The company therefore has a reassuring history of decent accounting.

That said…

…extending the useful life of certain machinery — and boosting reported profit — does seem a tad cavalier.

I mean, CGS has regularly invested in new machines — and I dare say that pace of change will not decrease, and so equipment becoming outdated will always be a risk. You might recall June’s annual results carried a £1m write-off relating to obsolete tools.

Note, too, that the 15-year ‘useful life’ chosen is the maximum stated within the group’s accounting policies.

Right now, the only clear feature of this depreciation review is its significance. The accounting change has effectively inflated this H1 operating profit by 10%.

* The arrangement helps “optimise the return on assets held by the pension scheme”

The highlight of CGS’s books remains the conservative balance sheet.

This H1 statement revealed cash of £19.6m, or 45p per share, and no debt.

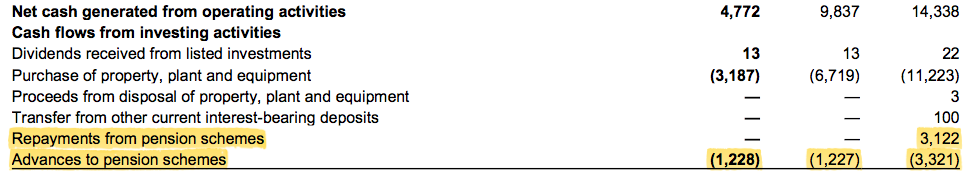

However, cash generation was not the best during the six months.

The bank balance dropped by £4.5m as more than £3m was used for additional working capital, £1m was advanced to the pension scheme and nearly £5m funded the 2018 final dividend.

The working-capital movement was due mostly to “returning finished foundry stocks to satisfactory operational levels” — which I am hopeful is a one-off event.

Meanwhile, the pension advance is nothing sinister.

I will not bore you with the full details (you can read point 6 if you wish), but essentially CGS lends money to its pension scheme and is paid back a year or two later. This arrangement apparently helps “optimise the return on assets held by the pension scheme”.

At the last count, the pension scheme showed a £22m accounting surplus.

Elsewhere in the accounts, the main foundry division reported a 10% operating margin — not a great performance and the lowest H1 percentage for eight years.

Valuation

Looking ahead, CGS claimed:

“Demand from our commercial vehicle customer base remains steady and every effort is being made to ensure further productivity gains are achieved within the foundry businesses to enhance the return.”

Needless to say, I expect the next results will once again report acceptable-but-sadly-not-exciting progress.

Taking the trailing twelve-month operating profit of £15.0m and deducting 19% standard UK tax, I arrive at earnings of £12.1m or 27.8p per share.

Then subtracting the aforementioned 45p per share net cash position from the 400p share price, my estimate of CGS’s enterprise value (EV) comes to 355p per share or £155m.

Dividing that 355p per share by my 27.8p EPS guess gives a multiple of 13. That rating does not look to be an obvious bargain given foundry profits have stalled and the prospect of a machining-division recovery has been delayed by a couple of years.

Oh well. My CGS investment has largely sat in the doldrums ever since my 2015 purchase and, given these so-so results and the present valuation, I dare say the shares will remain marooned for some time to come.

In fact, this RNS is further evidence of CGS not really performing as I had originally expected.

True, I could look to replace this share from my portfolio. And perhaps one day I will, should a great opportunity appear elsewhere.

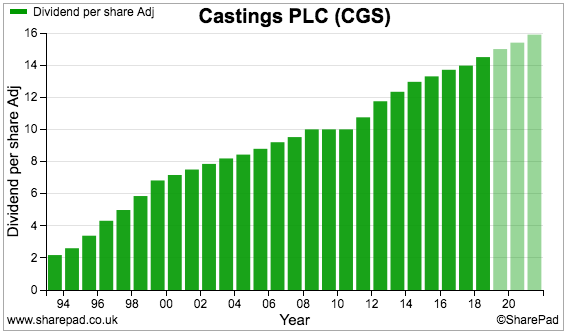

But for now, there is a lot to be said for the group’s hefty cash position, a management team that does not require options (point 2), and the lovely dividend chart below:

Just based on the cash, options and dividend alone, CGS ought to come good one day.

Anyway, the trailing 14.5p per share payout delivers a 3.6% income as I wait patiently for some relatively exciting progress.

Maynard Paton

PS: You can receive my Blog posts through an occasional e-mail newsletter. Click here for details.

Disclosure: Maynard owns shares in Castings.

Informative blog! Thanks for sharing it.

Thanks Nagesh

Castings (CGS)

Pre-Close Trading Update

This statement left me with mixed feelings. I am pleased the company appears to be performing relatively well. However, I sold my entire stake a few weeks before the positive news. Here is the full text:

————————————————————————————————————————————

Castings PLC announces a trading update in respect of the year ended 31 March 2019 ahead of releasing its final results for the year on 12 June 2019.

Following strong demand during the second half of the financial year, which included some customer stock building, the company expects to report final results for the year ended 31 March 2019 ahead of market expectations.

The foundries have seen improved margins during the second half with enhanced productivity and a reversal in the time lag in passing on raw material price increases. The management initiatives implemented in the machining business have started to positively impact results, particularly in the final quarter of the year, although it will still take time for these to be fully realised.

————————————————————————————————————————————

I dare say the stock-building relates to Brexit. Good to see the machining division make some much needed progress.

Oh well.

I sold CGS as I wanted to concentrate on my higher-conviction positions.

True, CGS offers a long dividend history and cash-flush accounts. But so do many other shares in my portfolio, and those alternatives boast long-haul family managers, too.

Also, CGS remains dependent on three large customers, has re-jigged its depreciation charge to improve profit and has suffered machining-division problems that may require another few years to properly recover.

I will review this sale in my Q2 portfolio round-up and try to publish a dedicated write-up.

Maynard