06 November 2018

By Maynard Paton

Update on System1 (SYS1).

Event: Interim results for the six months to 30 September 2018 published 02 November 2018.

Summary: A couple of earlier updates had already signalled this lacklustre first-half performance. Indeed, several references to competitive pricing and re-designed products implied the advertising research specialist may no longer be the ‘pioneering’ force it once was. Furthermore, the new Ad Ratings service could be hard pushed to become a real money-spinner and return the group to growth. That said, margins remain good, there is cash in the bank and the P/E might be 9… if you believe some significant development expenditure will eventually pay off. I continue to hold.

Price: 230p

Shares in issue: 12,476,425

Market capitalisation: £28.7m

Click here to read all my SYS1 posts.

Results:

My thoughts:

* A 19% headcount reduction was the first half’s bright spot

This first-half statement was never going to be spectacular.

Management had previously described June’s annual results as “miserable” while subsequent updates — during September and October — owned up to somewhat mixed trading.

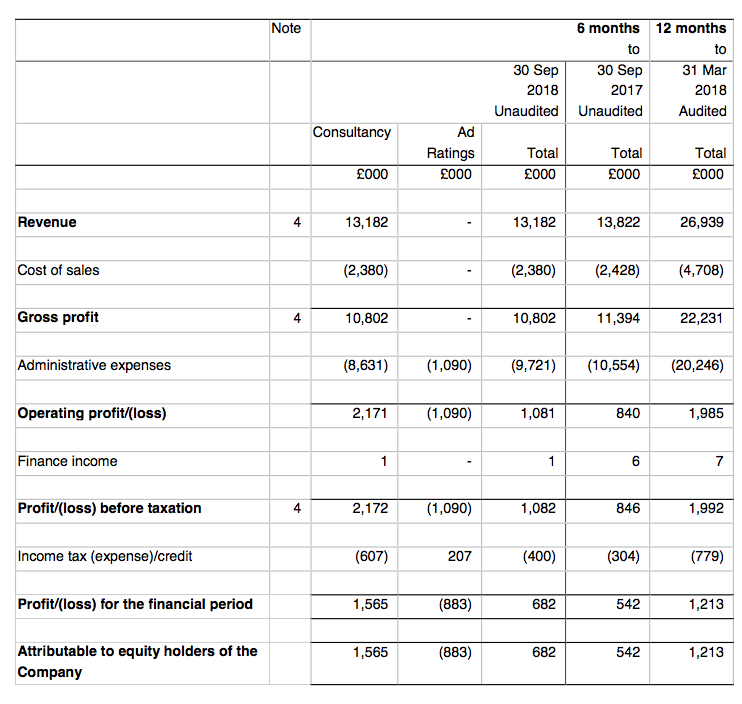

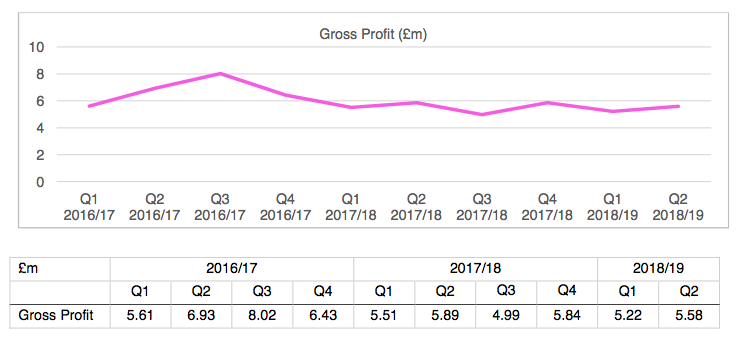

In the event, both revenue and gross profit — SYS1’s “main top-line measure” — dropped 5%.

Reported profit included start-up expenses of £1.1m relating to the new Ad Ratings service (more on that later) and a £251k windfall from the local council (point 8).

Adjust for those items and ‘underlying’ operating profit more than doubled to £1.9m. “Tightly” controlled costs — which reduced the average headcount by a sizeable 19% — caused the ‘underlying’ profit surge:

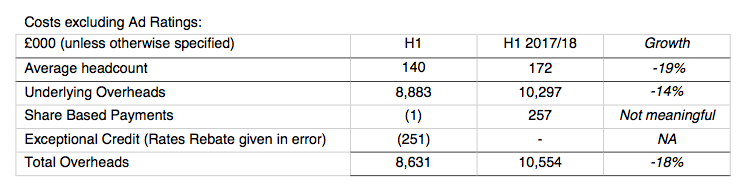

This table from SYS1’s first-half results last year is worth revisiting:

The ‘non-underlying’ severance and re-branding costs of last year were not disclosed this time.

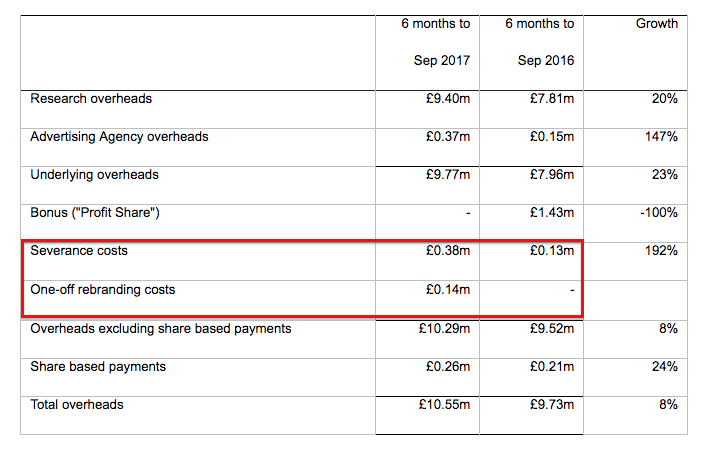

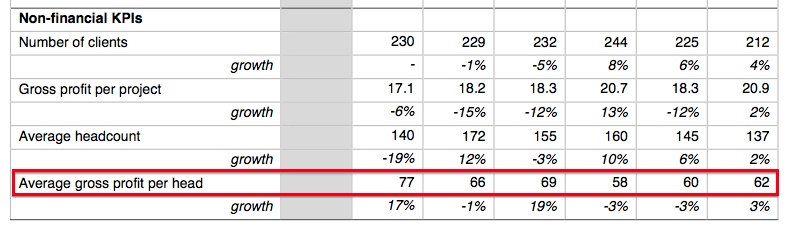

The bright spot among the sea of rather subdued numbers was gross profit per employee, which has now reached its highest first-half level for at least five years:

* The man from Unilever claimed ‘brand and marketing’ spend had actually increased

SYS1’s September and October trading updates had suggested the business was “stabilising” — albeit at a slower rate than had been anticipated.

These results helpfully quantified the gross-profit stabilisation:

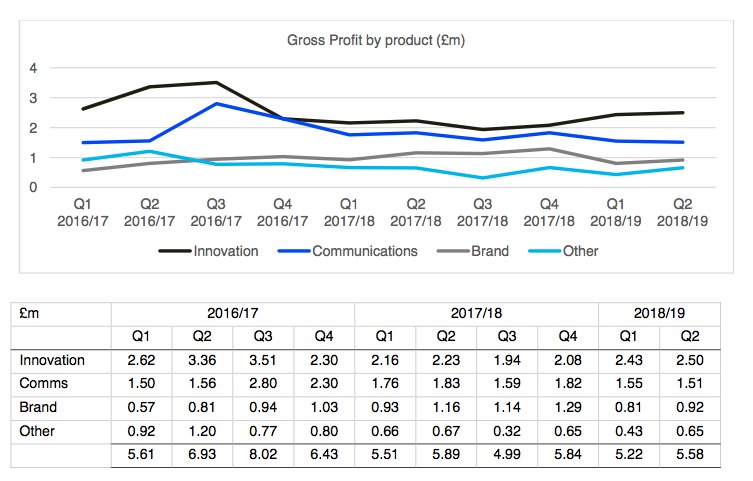

However, the divisional performances varied somewhat:

A product re-design and a new “pricing framework” reinvigorated the Innovation division (which tests new marketing concepts), while similar actions are expected to revive the Communications division (which tests adverts before broadcast).

Meanwhile, the Brand division (which tracks ongoing brand popularity) suffered “isolated client churn”.

All told, it seems SYS1 continues to re-jig its services and lower its prices to combat “cuts in marketing spend by some of [its] largest clients”.

However, the message from clients contradicts SYS1’s talk of cutbacks a little.

For example, according to Marketing Week:

“Speaking on a press call this morning (1 February), Unilever’s CFO Graeme Pitkethly said the company’s ‘brand and marketing’ spend was up slightly in absolute terms in 2017. It invested €250m (£220m) more in media and in-store in 2017 than 2016, offsetting that investment with efficiencies in ad production brought about by zero-based budgeting.”

I suppose “efficiencies in ad production” is the key term from Unilever. An article from Ad Week says:

“Unilever, which has taken repeated steps to combat increasing pressure on the consumer-products space, announced in its 2017 annual report last month that it had saved about 30 percent on agency fees after taking more of its ad work in-house and reducing the roles of its external agencies.”

Similar stories have occurred at Nestle and Procter & Gamble.

So, marketing budgets as a whole appear not to have been slashed. Instead, clients have saved money by becoming more selective with who they work with — and some clients look to have dropped SYS1.

* The director comments at the AGM may have been too fanciful

SYS1 hopes a new Ad Ratings service can return the group to growth.

The Ad Ratings website has all the details, but the general concept is for advertisers to be able to monitor the performance of rival brands by using SYS1’s data and analysis.

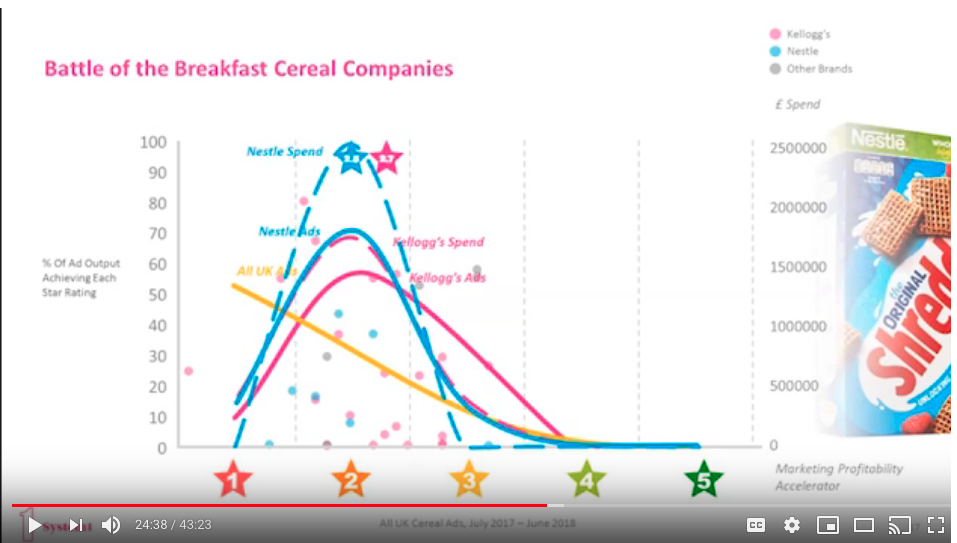

The snapshot below (taken from this video) compares the marketing effectiveness of breakfast cereals for Kellogg’s and Nestle:

I am sure there is more to the service than what my screenshot shows, but essentially marketing directors will now (in theory) be able to see exactly who in their sector is gaining market share through savvy adverts and clever spending.

SYS1 has already rated the 27,000-plus different UK and US adverts broadcast during the last 18 months or so, and continues to evaluate every new UK and US advert, too.

SYS1 has high hopes for Ad Ratings:

“The insights generated from such a large and comprehensive data set will increase our understanding of what makes effective advertising, and so enhance our existing business, as well as opening up the potential for a new and scalable revenue stream.”

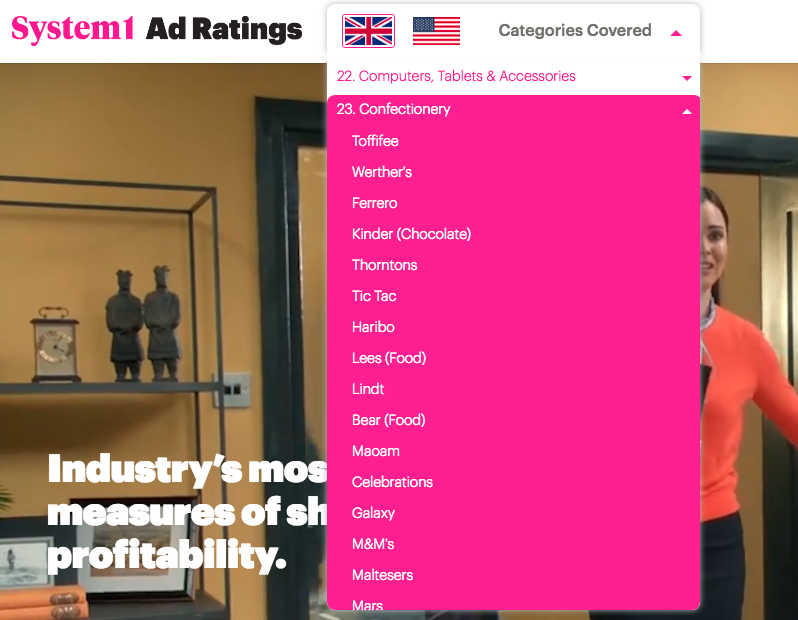

Ad Ratings is a subscription product, which should generate the firm a more predictable income. The cost per advertising category is £1k or $2k per month, and there are 89 different UK categories and 137 different US categories.

These results showed Ad Ratings had absorbed development costs of £1.6m, of which £0.5m was capitalised on the balance sheet. I suspect a similar investment will be required for the second half.

(I should add that SYS1’s annual results had led me to believe that notable Ad Ratings costs would be incurred only if the service’s launch was successful.)

So what is the potential for Ad Ratings?

Back in July I attended the company’s AGM and SYS1 chief exec John Kearon speculated on one day garnering 2,000 Ad Ratings subscribers.

Given the firm served 230 clients during this half year — and that 2,000 subscribers could produce revenue of £20m-plus — I thought at the time Mr Kearon was being rather fanciful.

Still, 2,000 was the figure mooted and according to Mr Kearon, subscribers will be attracted to Ad Ratings due to its low pricing. Comparable services, at least according to Mr Kearon, charge 10 times as much. (Although I am not sure whether Mr Kearon gave a strict like-for-like comparison).

From the Ad Ratings website, I have counted approximately 4,000 different advertisers from the 226 different UK/US categories:

Ambitions therefore to capture 2,000 subscribers may be a very tall order.

Looking though the categories and counting those 4,000 advertisers, two thoughts struck me.

First, numerous categories cover only a handful of advertisers. Potential subscribers may therefore already have a good idea of who is performing well in their sector — and not require SYS1’s data.

Second, certain categories — such as finance and medical — are hamstrung by various advertising regulations.

Such adverts are generally deemed by SYS1 as 1-star money-wasters, which begs the question why anyone would pay to discover how much money everybody else serving the category is (apparently) wasting.

Anyway, assuming 5% of the 4,000 or so UK and US advertisers sign up, I reckon Ad Ratings revenue could be £3.3m. Then assume a chunky 30% margin and we could be looking at an extra £1m profit.

While any extra earnings would be very welcome, the near-term Ad Ratings potential does not appear truly transformational — especially as these interim results showed the main divisions already enjoying a combined £1.9m operating profit.

* The dividend could be reduced to pay for a share buyback

The aforementioned reduction to the headcount ensured SYS1’s margins remain quite respectable.

Excluding the Ad Ratings costs and the £251k windfall, operating profit represented 14.5% of revenue and 17.7% of gross profit (SYS1’s “main top-line measure”).

Furthermore, the balance sheet continues to show cash (£3.6m or 28p per share), no debt and no pension complications. However, cash flow was not great.

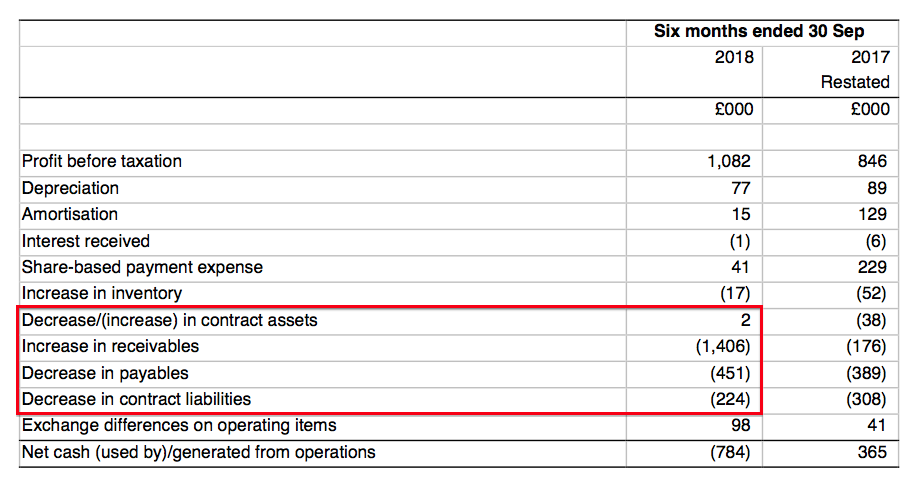

A significant £2m was absorbed into working capital (mostly receivables):

No real explanation was given, save that cash flow was “lower than we would expect” and due “principally to debtor days increasing from 57 days… to 77 days”.

SYS1 has never suffered cash flow problems before, so I trust this working-capital performance is a half-year timing issue rather than anything more sinister.

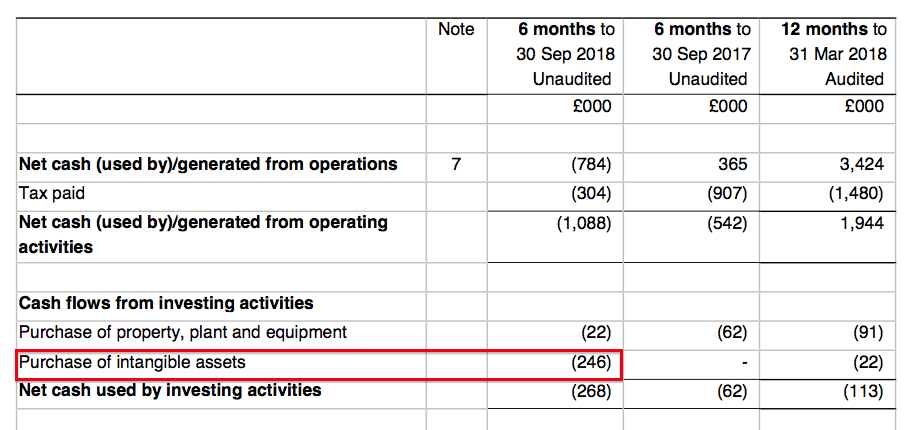

Elsewhere, I noted intangible expenditure of £246k:

I am not sure why this £246k does not match the £498k Ad Ratings expenditure that management said was capitalised on the balance sheet.

Anyway, the Ad Ratings investment and wider cash flow performance prompted SYS1 to admit its final dividend “may be reduced”.

News of a potential dividend cut is never great, but at least SYS1 claimed the savings could be used to “purchase shares at an attractive valuation”.

I have to confess, I do not know what to make of this. I suppose I should be pleased the company wishes to buy back its shares at an attractive valuation. (And some of the senior managers have been buying shares of late anyway).

However, SYS1’s previous buyback (during 2016/17) involved spending more than £3m purchasing shares at almost 400p. The price has since dropped close to 50%.

Valuation

I can see why management might think the shares are attractive.

Doubling up this first-half’s operating profit of £1.9m (before Ad Ratings costs) gives earnings of 22p per share after applying the 28% tax seen within these results.

Then subtracting the 28p per share cash position from the 230p share price gives an enterprise value of 202p per share. Dividing that 202p by my 22p per share earnings guess produces a possible P/E of 9.

I must admit, the ‘core’ business (i.e. excluding the Ad Ratings start-up) does look cheap — especially if you believe Ad Ratings will eventually generate a profit.

However, I have been guilty of excluding certain SYS1’s costs before…only to find they become part and parcel of the ongoing business.

In particular, SYS1 started an advertising agency the other year — the losses for which are also separately disclosed from the ‘core’ business.

Trouble is, this agency still loses money and is now described as a “valuable showcase” for the firm’s main services.

Therefore my valuation sums now include the agency’s losses… and I do wonder whether the Ad Ratings service will also lose money for years… and ultimately become another “valuable showcase”.

To be honest, my main dilemma right now is deciding whether SYS1’s services will actually be that useful to many more clients.

You see, I have read the book, watched the presentations and I am convinced about SYS1’s “pioneering” System1 approach to marketing. However, existing clients keep on quibbling about price while the firm’s products seem to be re-designed every year.

So maybe the people who actually work in advertising — or those who set advertising budgets — have a different experience of using System1 thinking. Maybe the firm’s “pioneering” approach is, well, no longer that pioneering.

While I ponder further, the shares yield 3.3% assuming the 7.5p per share dividend is maintained.

Maynard Paton

PS: You can receive my Blog posts through an occasional e-mail newsletter. Click here for details.

Disclosure: Maynard owns shares in System1.

System1 (SYS1)

Shareholder presentation

The accompanying results powerpoint contained no great revelations. Perhaps the most interesting lines was this:

“Business is pivoting towards digital data products using its core IP: Ad Ratings is first example”

If Ad Ratings takes off then hopefully that can lead to similar ventures.

Maynard

“This month we celebrated the launch of our latest product, Ad Ratings. We now have 50 subscribers who are able to access info about every US / UK TV ad + media spend in over 100 categories, from May 2017 to yesterday!”

https://twitter.com/System1Research/status/1068564812861505536

Doesn’t say whether they are paying subscribers but seems a reasonable start if they are.

Hello GSBMBA99

Thanks for highlighting the Tweet. I have asked SYS1 and sadly the 50 include free trials. The free trial lasts 14 days and so after one month and an even distribution of sign-ups, the max we can expect to be paying could be 25. Assume a (very bold) 50% conversion rate and we get 12-13. Which does not feel great.

Maynard

Great bit of analysis. Thanks.

Thanks Ivan

System1 (SYS1)

Trading update published 15 April 2019

A rather steady update, with cost-cutting helping to shore up profit. No word was given about why gross profit remains subdued and when the (costly) Ad Ratings service is likely to show a return.

Here is the full text:

——————————————————————————————————————

2018/19 saw our Consultancy business, which comprises mainly our market research activities, together with a small advertising agency, stabilising after a difficult 2017/18. Gross Profit, the Company’s main top-line performance measure, was slightly down for the year as a whole at £22m (-1%). Despite continued pricing pressure, Gross Profit in the second half of the year was 4% ahead of that achieved in H2 2017/18.

Operating Costs were tightly controlled and, excluding the Company’s investment in its new Ad Ratings service, were some 9% lower than in 2017/18 as the Consultancy business achieved higher levels of efficiency.

As a result, System 1 has generated underlying Pre-tax profits for the year, excluding Ad Ratings, share based payments and a one-off business rates rebate, of around £3.7m, approximately 80% higher than in 2017/18.

During 2018/19 System1 invested heavily in the development of its new Ad Ratings subscription service. Ad Ratings enables clients to compare the effectiveness of their advertisements with that of competitors, and to correlate advertising effectiveness with media spend. Total investment during 2018/19 has been £3.1m, of which some will be expensed and some capitalised. We continue to refine and enhance the new service, which is being trialled by a number of clients. Looking forward, we plan to continue investing in the product, and to launch at scale during 2019/20.

Despite this high level of investment, System1’s financial position remains strong. At the year end the Company had a cash balance of £4.3m (31 March 2018: £5.7m), and no debt.

——————————————————————————————————————

The numbers indicate SYS1’s second half produced an £11.2m gross profit and a £1.8m pre-tax profit — broadly similar to the first-half effort.

No reason was given for the subdued gross-profit performance — an explanation will be required within the full-year results.

Ad Ratings expenditure was £1.5m for H2 (vs £1.6m for H1) while cash in the bank advanced by £0.75m during H2. Including the H1 dividend paid during H2, underlying H2 net cash generation was close to £0.9m (i.e. Ad Ratings is funded fully from cash flow).

No word was mentioned about the final dividend. SYS1’s H1 statement said the final payout could be cut depending on Ad Ratings investment and opportunities to repurchase shares at an attractive valuation.

SYS1 has not bought back any shares since the H1 statement, and the implied cash generation (of £0.9m) covers a maintained 6.4p per share final payout (c£0.8m). So that is something.

I am not sure what to make of this line:

“Looking forward, we plan to continue investing in the product, and to launch at scale during 2019/20.”

I had assumed the launch last year was the actual launch, not a soft launch. I get the impression the Ad Ratings product has yet to really take off and perhaps is being refined following early customer trials. As an outsider, I find it difficult to understand why clients may not have signed up — all UK/US adverts for at least a year have now been analysed and are available within the service.

The questions remains whether Ad Ratings can eventually become profitable, or ends up becoming a loss-making “valuable showcase” as the loss-making Ad Agency venture became. Perhaps the forthcoming full-year results will shed some light on this matter.

The 2019 pre-tax profit of £3.7m may translate into earnings of approximately 21p per share. Net cash of £4.3m equates to 34p per share.

Similar to my sums in the Blog post above, the shares at 230p appear to trade on a P/E of 9 adjusted for the cash and ignoring the Ad Ratings expense.

Maynard

System1 (SYS1)

Grant of options published 18 April 2019

Here is the full text:

——————————————————————————————

Following consultation with its major shareholders, the Company announces that it has granted awards under an equity incentive plan to Stefan Barden, an advisor to the Board and PDMR, subject to approval by shareholders at the Company’s next Annual General Meeting. In the event the approval is not obtained, the awards will lapse.

The awards comprise zero priced options over 300,000 shares (approximately 2.4% of the Company’s voting share capital), and are split into three equal tranches. They are designed to vest only if a significant step-change in gross profit is achieved; being growth rates of approximately 100%, 200% and 300% for each of the three tranches respectively.

Performance Conditions

100,000 zero-priced stock options (“Tranche One Options”)

· Vest: when the Company’s audited Gross Profit in any financial year exceeds £45m, subject to the Company’s share price exceeding £5.00 per share for a 30 day consecutive period prior to the lapse date;

· Lapse date: 30 July 2024;

100,000 zero-priced stock options (“Tranche Two Options”)

· Vest: when the Company’s audited Gross Profit in any financial year exceeds £68m, subject to the Company’s share price exceeding £7.50 per share for a 30 day consecutive period prior to the lapse date;

· Lapse date: 30 July 2029;

100,000 zero-priced stock options (“Tranche Three Options”)

· Vest: when the Company’s audited Gross Profit in any financial year exceeds £90m, subject to the Company’s share price exceeding £10.00 per share over a 30 day consecutive period prior to the lapse date;

· Lapse date: 30 July 2032.

——————————————————————————————

I am not a fan of nil-priced options, but happy to see them awarded when attached with a challenging share-price target.

The minimum gross profit hurdle of £45m compares with £22m recently confirmed for 2019.

Total gain for Mr Barden could be £0.5m + £0.75m + £1.0m = £2.25m during the next 13 years (I am not sure why these options extend to 13 years rather than the normal 10).

Who is Stefan Barden?

His profile on LinkedIn.

“Stefan Barden is an experienced and entrepreneurial FTSE 250 CEO supporting selected Entrepreneurs and Investment funds build ever more successful companies in the UK, Europe and internationally; with a focus on hyper-growth.

Stefan currently supports a portfolio of 5 businesses which aspire to be at the leading edge of change in their industries. He supports management teams deliver step change value by aiding their setting of clear strategies, creating a positive performance culture that ‘gets work done’, and in helping build strong teams.”

This snippet from Crunchbase may be more relevant for SYS1 and its marketing services:

“At Heinz he famously built the team who revived Heinz Salad Cream, with a campaign that went viral before the web was invented! His team also harmonised Heinz Tomato Ketchup across Europe into one single recipe and introduced the then innovative, now ubiquitous, ‘upside-down’ Ketchup and Salad Cream bottles. His team won over 30 marketing award including ‘UK Advertiser of the Year’ and ‘UK Young Marketer of the Year’.”

He oversaw the introduction of upside-down squeezey Heinz bottles!

Presumably he works full time within SYS1 to be able to win the option grant.

Last year Mr Barden bought shares from boss John Kearon and bought shares from a fund at less than 200p, and currently holds 5.7% of the group. He therefore seems committed to the SYS1 cause.

Maynard