20 April 2018

By Maynard Paton

Update on Record (REC).

Event: Trading update for the three months to 31 March 2018 published 20 April 2018

Summary: REC has struggled to make any decisive progress for several years now. The firm’s currency-trading strategies have floundered, clients have regularly jumped ship, while those clients that have stayed have demanded lower fees. Now comes the alarming news that REC’s bog-standard currency-hedging service will cut its fees by 10% to keep clients happy. To add insult to injury, greater costs will be required to cater for this product “enhancement”. I have been frustrated with REC for quite some time, and have belatedly decided enough is enough. I have sold my entire holding.

Price: 41p

Shares in issue: 199,054,325

Market capitalisation: £82m

Click here to read all my REC posts

My thoughts:

* Alarming Passive Hedging development as management remarks seem like guff to me

Record’s Q4 update contained the now-standard frustrating news on client money.

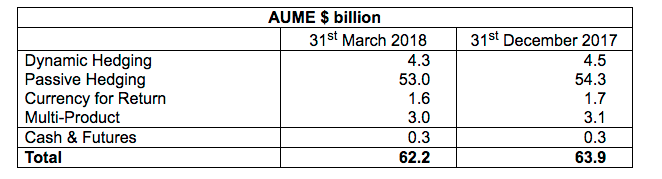

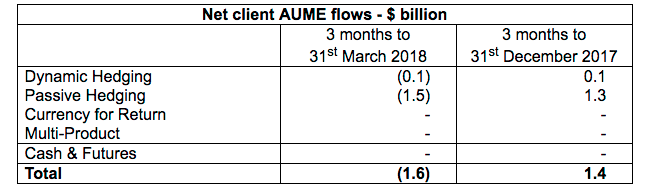

Total effective client assets under management (AUMe) fell by $1.7 billion, due mostly to clients withdrawing $1.6bn:

However, the update also carried this alarming news (my bold):

“During the year to 31st March 2018, we have continued to innovate and enhance all our services to meet clients’ developing needs. This is particularly true in Passive Hedging, where changes in FX market structure have allowed Record to enhance Passive Hedging programmes so as to minimise costs and to add value for clients.

We have been working with our clients to identify and recognise this added-value, and as a result some Passive Hedging clients have changed from a management fee only to a lower management fee with a performance-related fee. This change creates the opportunity for Record to earn performance fees which over time are expected to match or exceed the foregone management fees.

The revenue effect from this change for the year ended 31st March 2018 is not expected to be material. For the year ending 31st March 2019, this change is expected to reduce total Passive Hedging management fee revenues by approximately 10% compared to the level that would otherwise have been expected to be earned, everything else being equal. The first performance fees capable of being earned under these changes would be earned in the year ending 31st March 2019, and if earned will be disclosed in quarterly Trading Updates in the ordinary course.

The continued innovation and enhancement of Passive Hedging services has also required a continuation of the investment in additional resources, as highlighted in the Group’s results to 30th September 2017.”

This development with Passive Hedging concerned me for a number of reasons:

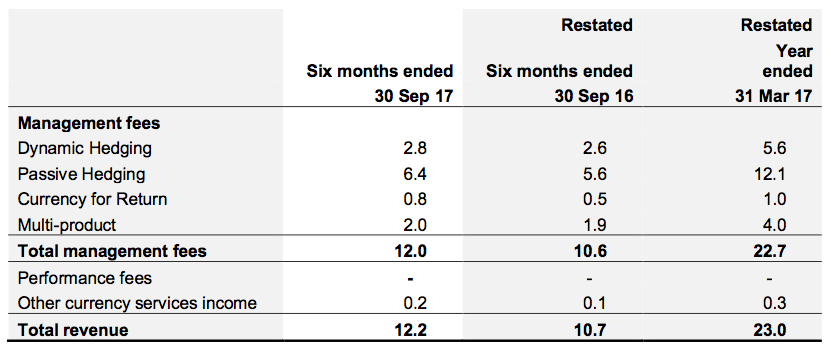

1) Passive Hedging is REC’s largest division. The last results showed Passive Hedging fees representing 52% of total revenue:

As such, the 10% fee reduction will be significant.

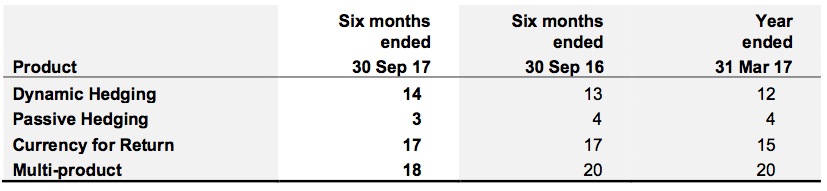

2) Passive Hedging already operates with a fee-rate much lower than that charged by REC’s other divisions:

(Fee rates shown in basis points)

And yet the division’s clients have been able to squeeze their fee-rate lower.

3) Passive Hedging has sustained REC’s revenue during the last few years:

| Year to 31 March | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Passive Hedging AUMe ($bn) | 15.7 | 18.9 | 22.1 | 37.9 | 41.2 | 43.4 | 48.2 |

| Other AUMe ($bn) | 15.7 | 12.0 | 12.7 | 14.0 | 14.2 | 9.5 | 10.0 |

| Total AUMe ($bn) | 31.4 | 30.9 | 34.8 | 51.9 | 55.4 | 52.9 | 58.2 |

| Passive Hedging fees (£k) | 2,718 | 2,989 | 4,093 | 5,728 | 8,105 | 9,438 | 12,130 |

| All other fees (£k) | 25,478 | 17,546 | 14,459 | 14,194 | 12,952 | 11,696 | 11,798 |

| Revenue (£k) | 28,196 | 20,535 | 18,552 | 19,922 | 21,057 | 21,134 | 23,928 |

With REC having experienced great difficulty attracting clients to its other, higher-margin, strategies, I am now very uncertain as to how the group can progress from here.

4) According to REC, the “continued innovation and enhancement of Passive Hedging” requires “investment in additional resources”.

Two points here.

i) “Innovation and enhancement” usually equates to developing a better product that clients could be willing to pay more for — not 10% less.

ii) I find it hard to understand how a business can happily increase its cost base* after agreeing to reduce client fees.

What seems to have actually happened is that the clients have demanded lower fees, and REC has had to adapt quickly — and incur greater costs — to prevent the loss of mandates.

(*REC’s rising cost base is nothing new. Indeed, despite previously reporting stagnant financial performances, the company still issued a 10% company-wide pay rise during 2015. I have since suspected this business has been run for the benefit of the staff rather than for ordinary shareholders. Just look at this picture:)

5) REC’s ability to earn performance fees from its other divisions has been laughable.

Since 2010, the group has collected aggregate performance fees of just £1m — compared to aggregate revenue of £188m.

As such, I just don’t believe the board when it claims:

“We expect that these [Passive Hedging] performance fees will more than offset the reduction in management fees over the longer-term”

Given reason 4) as well, I would say the entire wording of this Passive Hedging news seems like utter management guff.

Valuation

Using my own fee-rate sums from November, I now arrive at the following calculations after applying the latest AUMe numbers, a 10% Passive Hedging fee reduction and a £1:$1.43 exchange rate:

| Year to 31 March 2019 (est) | AUMe ($m) | Fee rate (bps) | Management fee (£k) |

| Currency for Return | 1,600 | 15.8 | 1,768 |

| Dynamic Hedging | 4,300 | 13.4 | 4,029 |

| Passive Hedging | 53,000 | 3.0 | 11,008 |

| Multi-product | 3,000 | 18.1 | 3,797 |

| Cash and other | 300 | 0.0 | 0 |

| TOTAL | 20,602 |

Overheads of £13m (which may now be increased) and the 30% employee profit share leave a possible operating profit of £5.3m:

| Year to 31 March 2019 (est) | |

| Management fees (£k) | 20,602 |

| Less expected staff costs (£k) | (8,000) |

| Less expected other costs (£k) | (5,000) |

| Less 30% profit share (£k) | (2,281) |

| Operating and pre-tax profit (£k) | 5,321 |

After standard 19% tax, my new sums suggest earnings could be £4.3m or 2.17p per share. Back in November I was projecting earnings of 3.03p per share.

The P/E at 41p could therefore be 19. Adjust for what could be £12.7m of ‘surplus’ balance-sheet cash, and the rating drops to 16. Neither multiple strikes me as an obvious bargain for a business where earnings have generally stagnated and are now very likely to fall.

The highlight of this stock had been the dividend, which November’s interim results suggested would be 2.3p per share for the current year to support a 5%-ish income.

However, the combination of lower AUMe, reduced Passive Hedging fees and adverse exchange-rate movements could now mean — assuming my sums prove accurate — the payout is no longer covered by earnings.

Summary

Looking back through my REC archives, I really should have sold this share some time ago.

I had become frustrated at the lack of new client mandates and the extra costs that crept steadily into the business. I also tired of RNSs that regularly mentioned lost clients, lower fee rates, additional resources… and “engagement with prospective clients” that never led to anything.

Perhaps it was not surprising that Neil Record, the group’s founder, concocted a £10m tender offer last year to reduce his shareholding.

Keeping me in the stock, though, were some every attractive financials. The operating margin was consistently in excess of 30%, returns on equity were often close to 50%, while cash flow was majestic and sustained a substantial bank balance without debt.

The board’s aim to pay chunky dividends also appealed.

Nonetheless, the attractive books and sizeable dividends are delivered ultimately by the underlying business — and the lower-fee/rising-cost trend does not appear favourable. In fact, the actions of REC’s clients suggest the firm’s services are just not very good.

My sums do not indicate an obviously cheap valuation and, given the news today, I have sold my entire holding at 41.9p per share.

I bought REC between December 2010 and July 2015 at an average of 19.8p, and sold between October 2012 and April 2018 at an average of 31.4p. I collected dividends of 3.1p per share along the way, making a total gain of 75%.

REC has not been the very best investment I have ever made, but at least I have emerged with a reasonable return.

Maynard Paton

PS: You can now receive my Blog posts through an occasional e-mail newsletter. Click here for details.

I have to agree with this. I have looked at it for our 2018/2019 portfolio after reading an IC article by Simon Thompson. However, when I looked at my historical review of this share, it concerned me due to its operating methods.

Thanks Roy.