07 August 2024

By Maynard Paton

FY 2023 results summary for Andrews Sykes (ASY):

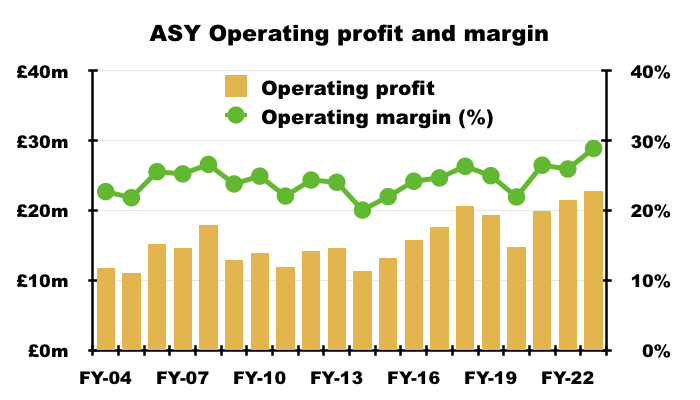

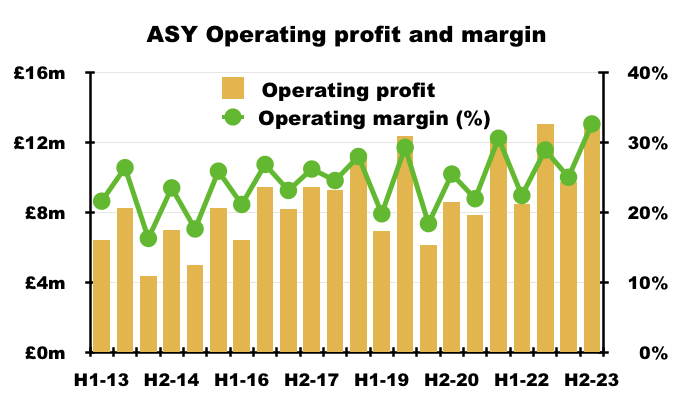

- A “robust” FY performance, which delivered a record £23m profit through “careful cost management” and positive sales momentum within a number of European countries.

- UK air-conditioning revenue declined 14% to £8m following lower summer temperatures, leaving the domestic market’s progress to again be dictated by pump hire — up 2% to register a sixth consecutive FY improvement.

- Closing the French subsidiary, curtailing Middle Eastern losses and reducing the wider workforce by 13% were among the decisive actions that helped the group margin achieve a new 29% high.

- The very respectable accounts showcased net cash at £20m, capex requirements of just £3m, a 34% return on equity and a “fully de-risked” pension scheme.

- A possible 13-14x P/E does not appear outrageous, with the restricted free float, weather-sensitive operations and absence of obvious economies of scale counterbalanced perhaps by bid-target potential. I continue to hold.

Contents

- News link, share data and disclosure

- Why I own ASY

- Results summary

- Revenue, profit and dividend

- UK

- Europe

- Middle East

- Other

- Financials: hire revenue and hire equipment

- Financials: cash flow and working capital

- Financials: margin and return on equity

- Financials: pension scheme and employees

- Valuation

- Potential bid target?

News link, share data and disclosure

- Share price: 560p

- Share count: 41,858,744

- Market capitalisation: £234m

- Disclosure: Maynard owns shares in Andrews Sykes. This blog post contains SharePad affiliate links.

Why I own ASY

- Supplies air conditioners, portable heaters and industrial pumps for hire, with success based on a prompt 24/7/365 service, high-quality rental fleet and commercial-only customer base.

- Straightforward accounts regularly showcase high margins, generous cash flow, net cash and satisfactory returns on equity.

- Chairman and family are 91%/£213m shareholders and their “presence and requirements… has resulted in a strategy with the key aim of creating long–term shareholder value” (point 10a).

Further reading: My ASY Buy report | All my ASY posts | ASY website

Results summary

Revenue, profit and dividend

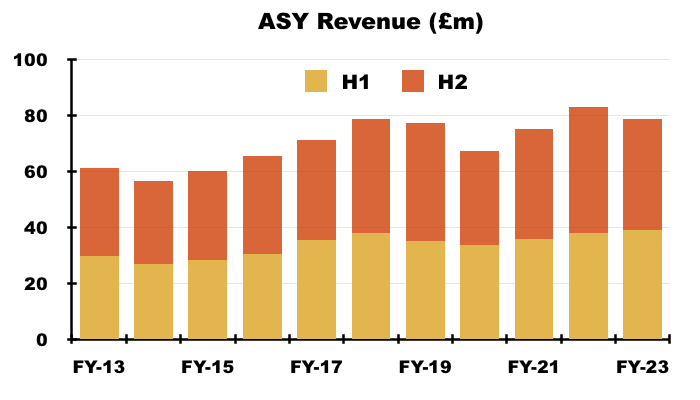

- A record H1 that was accompanied by a mixed H2 outlook…

“Following the Company’s strong first half performance, trading in the second half of the year to date has been more mixed. Whilst extreme summer temperatures in Southern Europe positively impacted demand for the Group’s chillers in Italy, a more subdued summer season in the UK has limited the overall positive impact for the Group. Overall, Management remains confident of delivering full year results in line with the Board’s expectations.”

- …had already hinted this FY may not surpass the revenue and profit highs set during the comparable FY.

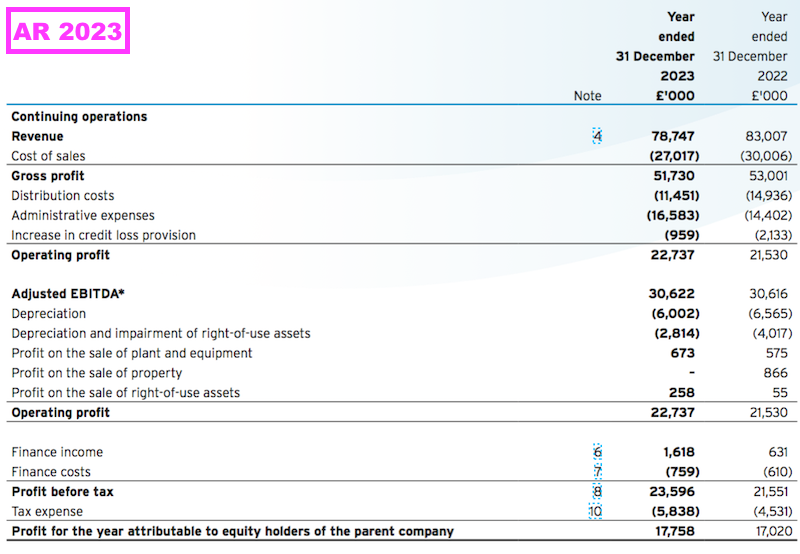

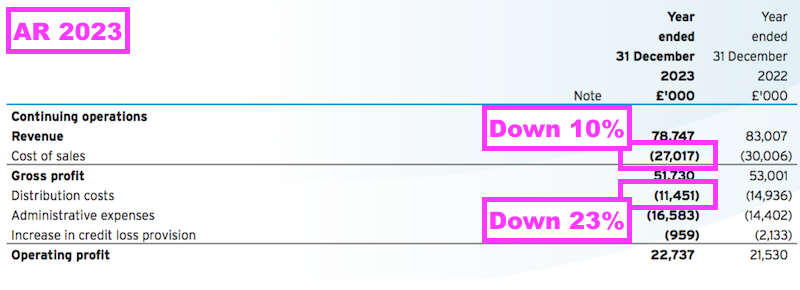

- Although FY revenue fell 5% to £78.7m…

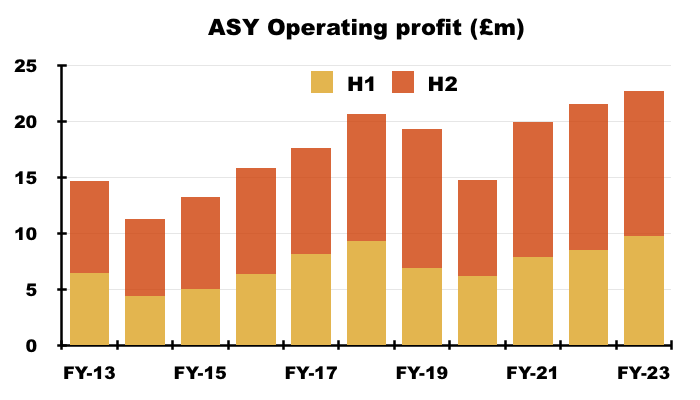

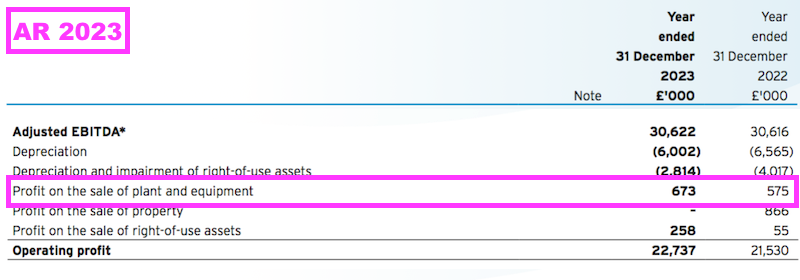

- …FY operating profit commendably advanced 6% to £22.7m:

- ASY described this FY as “robust” and said the performance was supported by “careful cost management“.

- The FY profit improvement was complicated by the comparable FY including:

- A £1.0m impairment (point 20) following the relocation of four UK depots (see UK) and the exit from France (see Europe), and;

- A £0.9m gain following a property disposal (points 16 and 19).

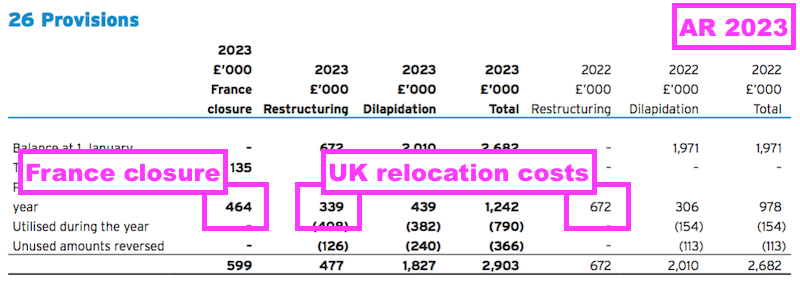

- The profit comparison was complicated further by this FY incurring additional provisions relating to the relocation of another three UK depots and the exit from France (see Financials: margin and return on equity).

- ASY said “key accounts” helped shore up this FY’s profit:

“The group has continued to develop its relationships with key customers throughout the UK and Europe which has underpinned the strong results reported. These key accounts provide a consistent and growing revenue stream. Whilst turnover is down in the second half of the year as compared to the prior year, mainly due to revenue opportunities presented by the record summer temperatures seen last year, the focus on our key accounts means the group has still produced profit growth despite reporting a lower revenue.”

- “Key accounts” are presumably the large, high-spending customers that ASY says support approximately 50% of the business:

“We regard customer relationships as being of the utmost importance and our key account customers, which account for approximately 50% of our business, are visited by a customer relationship manager on a quarterly basis to ensure we are meeting their expectations.”

- FY progress was hampered by the aforementioned exit from France (see Europe) and difficult trading in the UAE (see Middle East).

- Extreme weather — particularly cold snaps, heatwaves and extensive rain — typically prompt sudden demand for the group’s hire equipment (primarily temporary boilers, air conditioners and water pumps).

- Progress from year to year can therefore fluctuate due to different climatic conditions.

- This FY referred to lower UK temperatures and higher European temperatures:

“In 2023, the UK and Northern Europe summer temperatures were more subdued but the group controlled costs and produced a record operating profit”.

“Southern Europe in particular was aided by the record temperatures seen during the summer and has been reflected in increased chiller and air conditioning hire revenues.”

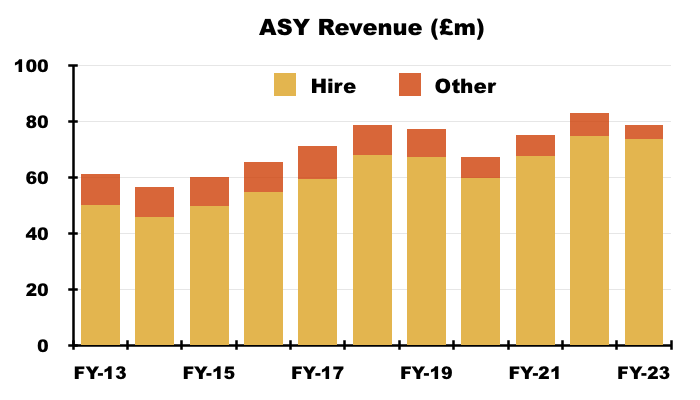

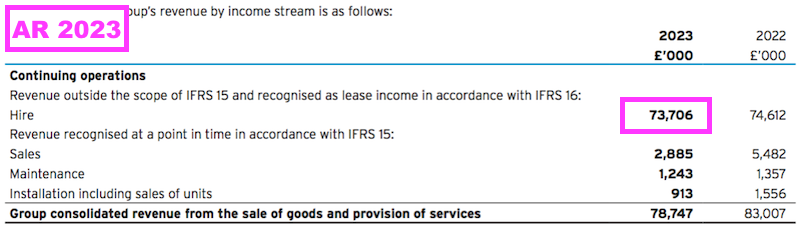

- The temperature fluctuations left FY revenue from ASY’s core hire activities down 1% to £74m:

- FY revenue from ASY’s non-hire operations — essentially equipment sales and installing/maintaining fixed air-conditioning systems — meanwhile dived 40% to just £5m (see Other).

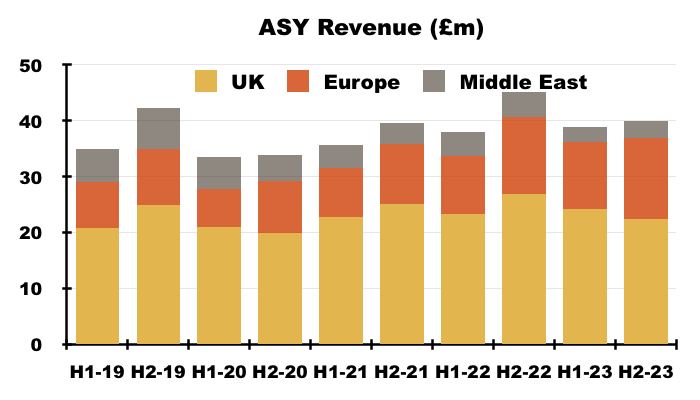

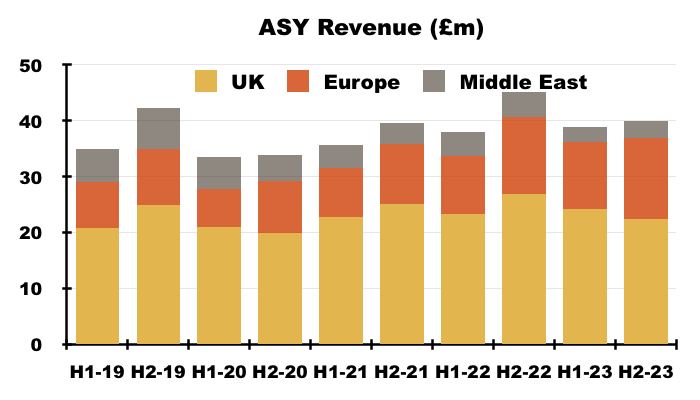

- The “more subdued summer season in the UK” alongside the collapse of non-hire income (see UK) led to total H2 revenue declining 12%.

- But somewhat remarkably, H2 profit remained unchanged at £13.0m.

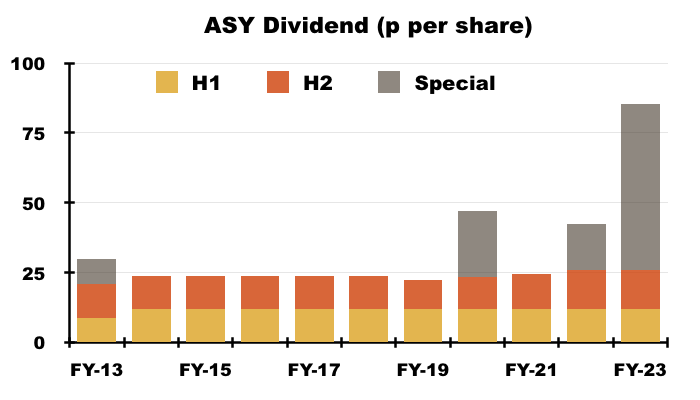

- The final dividend was again set at 14p per share to leave the FY payout static at 25.9p per share:

- The FY dividend highlight was of course the 59.4p per share special payout declared within the preceding H1.

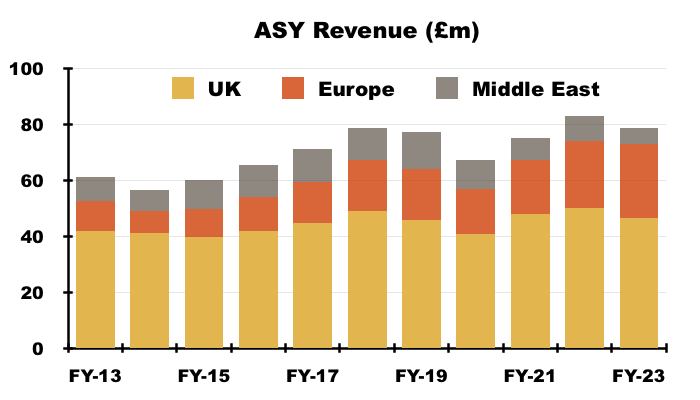

UK

- ASY can trace its UK Sykes history back to the 1850s and its UK Andrews history back to the 1960s:

- The combined group today offers a trade-only nationwide rental service supplying pumping equipment, air conditioners, air purifiers, chillers, heaters, boilers, dehumidifiers and ventilation units:

- ASY’s competitive edge is based upon depots providing first-class customer service…

“By providing a premium level of service 24 hours per day, 365 days per year, we have become the preferred supplier to many major businesses and operations spanning a huge range of industries and geographic locations. Our reputation for providing high levels of training to our staff whilst maintaining a strict health and safety workplace, within an environmentally conscious culture, makes us an employer of choice for our industry.”

- ...and stocking the best and most relevant equipment for different clients:

“Continual investment in new technology ensures that we provide our customers with new solutions to overcome their operational challenges. We constantly review and refresh our fleet of rental equipment to ensure that we set the standards within the rental industry throughout the UK, Europe and the Middle East.”

- This FY repeated the claim from the preceding FY that the tip-top service combined with management experience had helped the depots sidestep a difficult economy:

“The current year has not been without its challenges with the well publicised inflationary pressures and tight labour markets that have been impacting the UK and European economies also impact Andrews Sykes. However, our strong relationships with customers and long standing relationships with key suppliers, coupled with our highly experienced management team have allowed us to once again not only navigate our way through these circumstances, but thrive.”

- UK Hire and Sales remains ASY’s largest division.

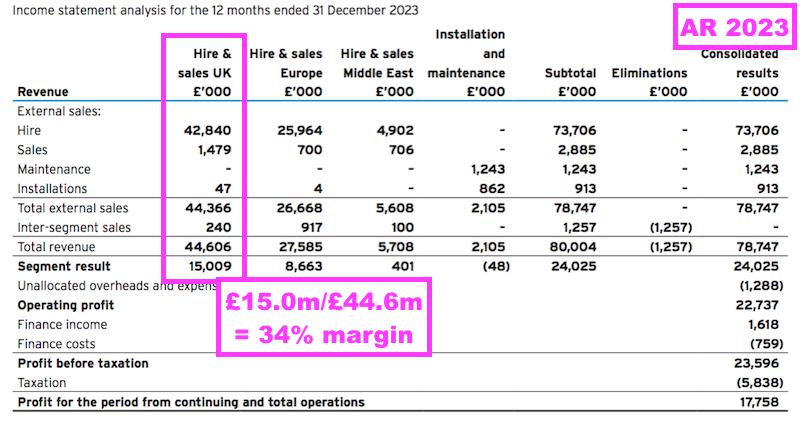

- For this FY, UK Hire and Sales represented 57% of group revenue and 62% of group profit, which led to a super divisional margin of 34%:

- The absence of a long, hot summer left the division’s FY revenue down 6% and FY profit down 9%.

- ASY therefore had to “flex the cost base“:

“This [UK] result, we believe, shows the ability of the business to react to changing customer demands and market circumstances, and to flex the cost base of the business quickly to adapt to customer demand.“

- ASY disclosed the following UK growth rates for its main categories of hire equipment:

“The UK hire business experienced a 6% turnover decrease when compared to last year, driven by negative comparisons for our air conditioning division against an exceptional prior year which was aided by the record temperatures experienced in the UK during 2022… Current year air conditioning hire was down £1.3m or 14.0% on prior year.

Our pump hire business continues to perform strongly with revenues achieving record levels for the sixth year in a row and are 2% higher than 2022.

Chiller and boiler revenues remain under pressure and are 12% down on 2022.”

- For the first time I can recall, ASY disclosed the UK hire revenue generated by a particular category of equipment.

- UK air-conditioning revenue down £1.3m or 14% suggests FY rental income from such equipment declined from £9.3m to £8.0m.

- Air-conditioning revenue of £8.0m therefore supported 19% of UK hire revenue during this FY.

- Note that the comparable FY witnessed UK air-conditioning revenue gain 36% (helped by a 40-degree summer), which suggests this FY’s UK air-conditioning revenue remains 16% ahead of the level recorded for FY 2021 (c£6.9m).

- Chiller and boiler hire in the UK did not perform well for the third consecutive year. The 12% revenue shortfall for this FY follows a 14% reduction during the comparable FY and a 7% reduction during FY 2021.

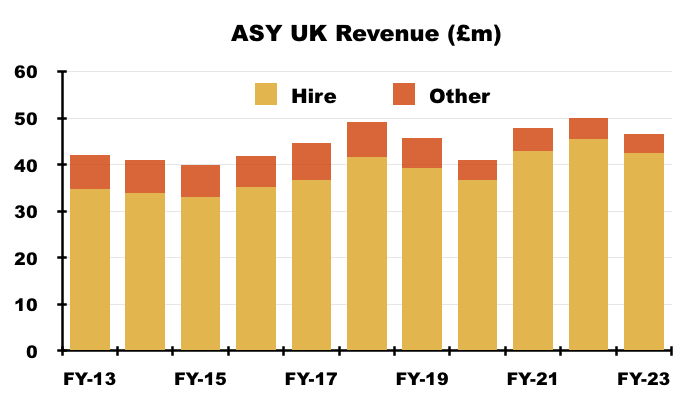

- UK progress therefore seems dictated mostly by pump hire, with such revenue up 2% limiting the UK division’s revenue shortfall to the aforementioned 6%.

- This FY’s 2% pump-hire improvement follows a 4% revenue advance during the comparable FY, a 16% advance during FY 2021 and a 3% advance during FY 2020.

- UK pump-hire revenue has in fact achieved “record levels” for the last six FYs.

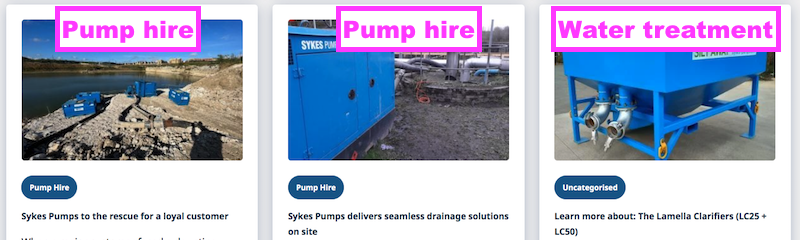

- Reflecting the UK bias towards water pumps, six of the last twelve updates on ASY’s blog (at the time of writing) referred to pump hire:

- Companies House shows ASY’s main UK subsidiary lifting UK Hire revenue from £36m to £45m during the ten years to this FY — equivalent to a very modest 2.0% compound average:

- ASY’s website says the UK operation trades from 32 locations…

- …although this FY oddly repeated the comparable FY and said the main UK subsidiary operates from 22 locations:

“Our main UK trading subsidiary, Andrews Sykes Hire, has 22 locations covering the UK and employing around 300 members of staff.“

- I still don’t understand why ASY declares 22 UK locations when the group’s website lists 32 UK depots.

- Maybe my confusion is caused by ASY’s “continuing property relocation within the UK“:

“Restructuring provision relates to the continuing property relocation within the UK. In the previous year four properties were vacated and merged into one large consolidated site… During the current year, three further property locations are in the process of being vacated and merged into one larger facility.”

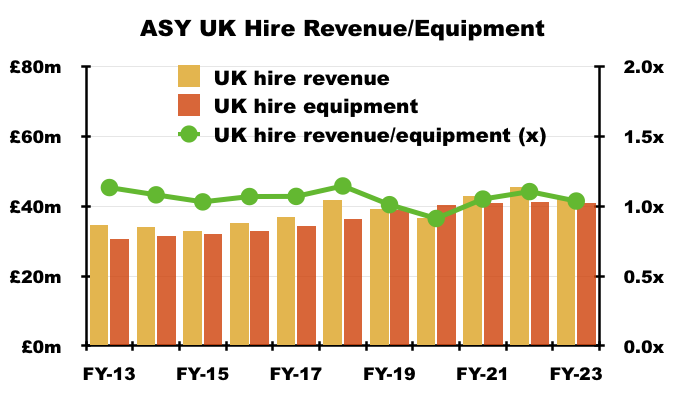

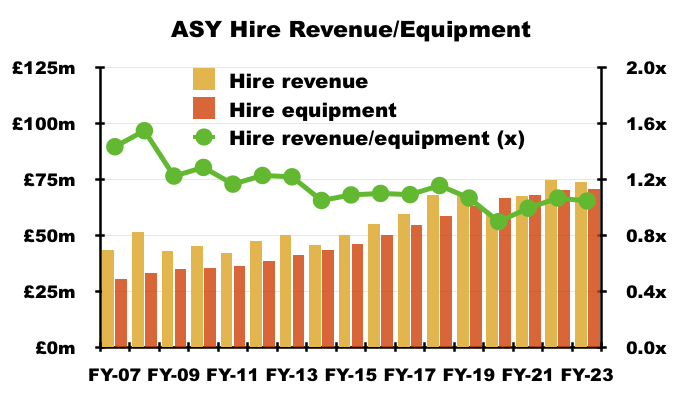

- ASY’s UK property relocations have not yet improved the utilisation of the rental fleet. Hire revenue compared to the original cost of the hire equipment remains at just over 1x (see Financials: hire revenue and hire equipment).

- ASY’s UK operations include installing and maintaining fixed air-conditioning systems, revenue from which has rarely generated a significant profit (see Other).

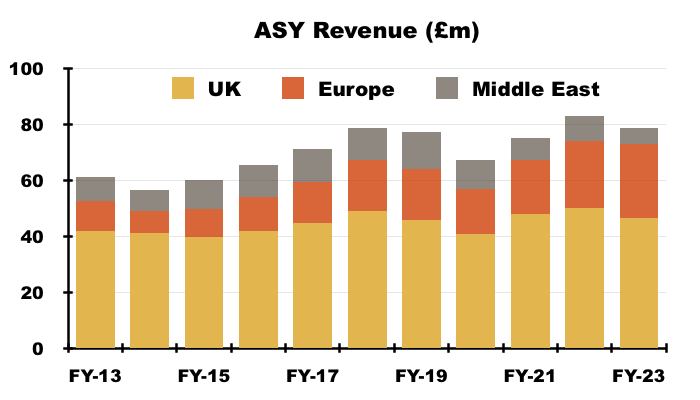

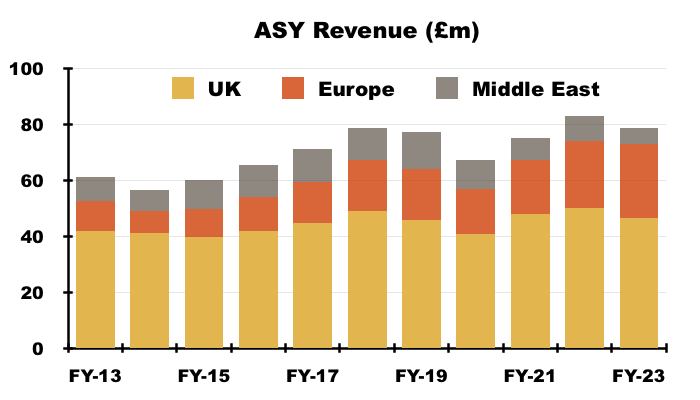

- Total FY UK revenue declined 7% to £46.5m to represent 59% of group revenue — the lowest-ever FY proportion for ASY’s domestic market:

- ASY’s dependence on the UK reduced further during H2. Total H2 UK revenue represented 56% of group H2 revenue:

- The aforementioned UK property relocations led to minor restructuring costs (see Financials: margin and return on equity).

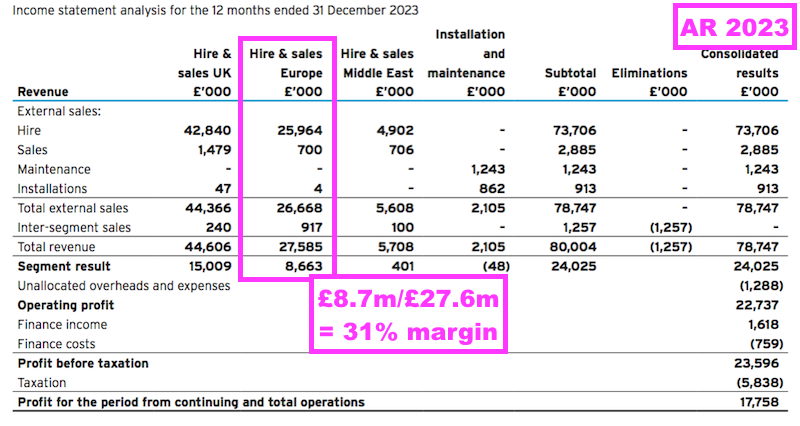

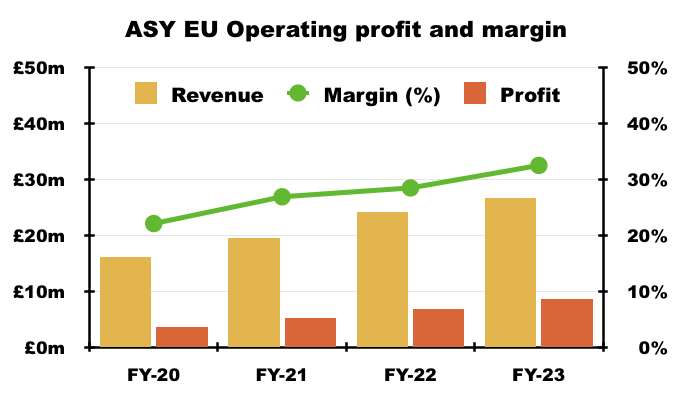

Europe

- Europe remains ASY’s main opportunity for growth.

- Between FYs 2012 and 2022, European revenue expanded from £10.9m to £24.2m to represent 29% of group turnover.

- This FY then witnessed European revenue advance a further 10% to £26.7m to support 34% of group turnover:

- H2 saw European revenue represent 36% of group turnover — a record six-month proportion for the region:

- ASY said the European performance was driven by a “focus on key accounts in Northern Europe and high summer temperatures in Southern Europe”.

- European markets achieving new revenue records included:

- Belgium: up 7%;

- Netherlands: up 10%;

- Luxembourg: up 21%, and;

- Italy: up 25%.

- Swiss revenue meanwhile declined 1%.

- ASY decided to exit France during this FY:

“In France, in the second half the decision was taken to cease trading and start the process to wind up the business. Management made this difficult decision after trying to restructure the business in the prior year and scale the operations back with a view of achieving profitable growth. Ultimately this restructure was unsuccessful and France remained loss making operationally, as it has been throughout its history. The decision was made to cease future trading to eliminate future ongoing losses. As a result turnover decreased 36%.”

- ASY opened its first French depot during FY 2012 and by FY 2020 had increased the number to six.

- Why ASY did not succeed in France has not been made clear. This FY noted the French subsidiary’s consistent losses.

- ASY’s website shows the European operations now consisting of:

- Netherlands:

- Started FY 1971

- 4 depots (Amsterdam, Bleiswijk, Hoogeveen, Oirschot)

- Belgium:

- Started FY 2007

- 3 depots (Antwerp, Brussels, Kortrijk)

- Italy:

- Started FY 2011

- 4 depots (Bologna, Milan, Toscana, Verona)

- Switzerland:

- Started FY 2013

- 2 depots (Geneva, Zurich)

- Luxembourg:

- Started FY 2014

- 1 depot (Luxembourg)

- Germany:

- Started FY 2023

- 1 depot (Frechen)

- Netherlands:

- ASY opened its first German depot during this FY and described the country’s potential as “exciting“:

“At the same time we are pleased to announce the incorporation of our new subsidiary, Klimamieten AS GmbH, in Germany and look forward to the development of this exciting market. We are encouraged by how the business has consistently adapted to overcome market and operational issues and take advantage of new revenue opportunities.”

- The “exciting” German market provided extra perspective about the difficult French market:

“With reference to market research undertaken on the German market, the Board made the decision that the group’s resources would be better employed in generating shareholder returns by entering the German market than persisting with the French operations.”

- The European subsidiaries lifted their collective FY profit by 26% to £8.7m — although the comparable FY did suffer French impairments of approximately £0.7m.

- The £8.7m profit translated into a lovely 31% FY margin:

- That 31% margin may improve further now that the loss-making French operation has been closed. The European margin has been rising every year since it was first disclosed for FY 2020:

- The French exit means European depots have increased from six to only 15 since FY 2011.

- Opening a net nine depots since FY 2011 could mean future European growth will be slow going.

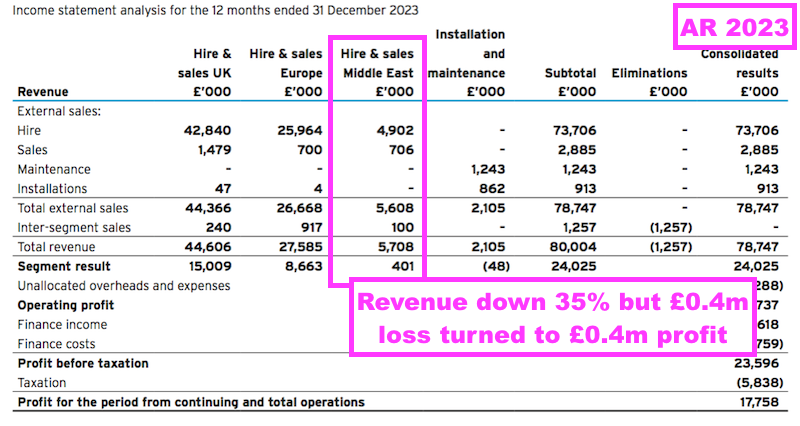

Middle East

- ASY’s Middle Eastern ventures continue to underperform.

- To recap, FY 2021 had revealed Middle Eastern revenue diving 24% and divisional profit — which since FY 2015 had been running at between £2m-£3m a year — collapsing to just £0.3m.

- FY 2021 contained a £1.2m provision for unpaid invoices after certain Middle Eastern customers had not settled their bills.

- The preceding FY then admitted a further £1.9m charge against unpaid Middle Eastern bills, which in turn created a small divisional loss despite revenue gaining 12%.

- This FY then owned up to an ongoing lack of regional projects…

“The operating climate continues to be tough in the Middle East with a lack of significant infrastructure projects still depressing turnover in the pumps division to below what was being generated a few years previously.”

- … which translated into FY revenue down 35%.

- At least the Middle East returned to profit during this FY following a much lower (£0.2m) charge for unpaid bills.

- ASY suggested the worst had now passed for the Middle East after the recruitment of new managers:

“New local management has been installed during the current year and a turnaround of this business is underway. It is pleasing that core hire revenues in the second half of the year are 38.1% up on the first half of the year and in line with that generated in the previous year. Management is confident of a return to increasing profitability in the Middle East.”

- I am hopeful the new managers have tightened customer-credit terms and unpaid bills can now be kept to a minimum.

- FY Middle Eastern revenue of £5.6m represented just 7% of total FY turnover:

- For perspective, Middle Eastern revenue between FYs 2015 and 2020 exceeded £10m and at times represented 17-18% of group turnover.

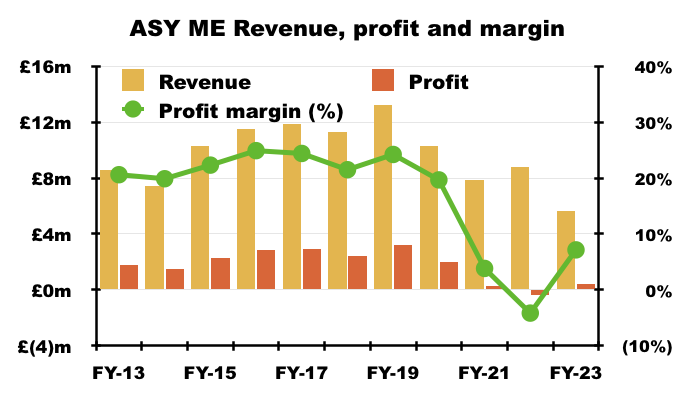

- ASY’s Middle Eastern operations have in the past enjoyed FY profits of £2m-£3m and margins beyond 20%…

- …which presumably explains why ASY is persisting with the region.

Other

- ASY’s Other activities — involving equipment sales and the installation/maintenance of fixed air-conditioning systems — suffered a terrible FY.

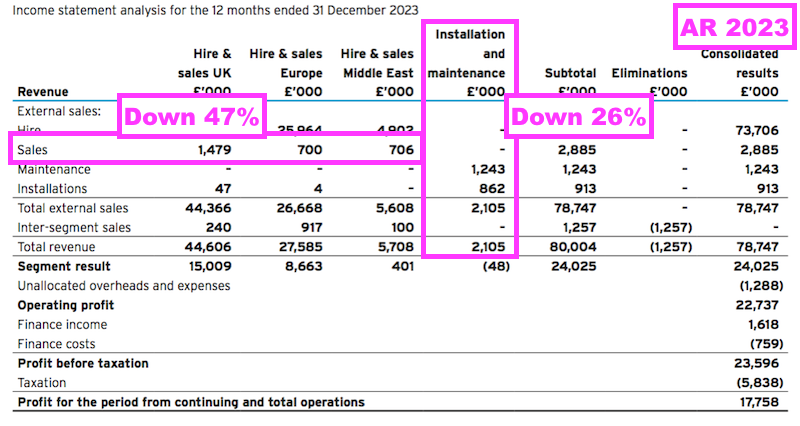

- FY revenue from equipment sales collapsed 47% to less than £2.9m, while FY revenue from installation/maintenance dived 26% to £2.1m:

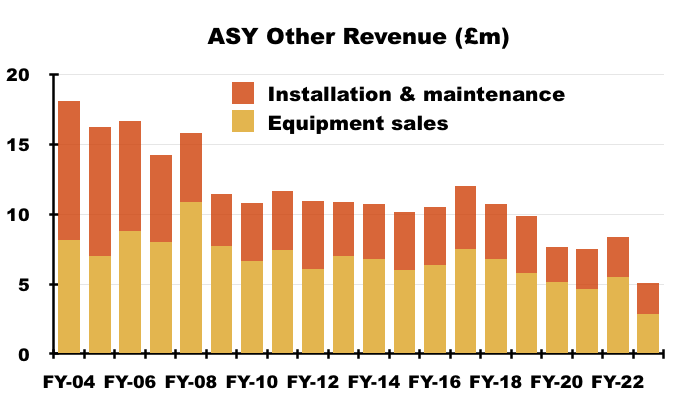

- Revenue from these Other activities appears in terminal decline:

- ASY explained the installation/maintenance revenue shortfall was due to “labour availability“:

“Our fixed installation and maintenance business sector in the UK saw a small decrease in turnover from £2.8m to £2.1m and returned a small operating loss of £0.1 million this year, a decrease of £0.1 million from the small operating profit achieved in 2022. This result was largely driven by labour availability impacting the ability to service contracts which limited revenue opportunities and the operating profit of the business.“

- ASY did not explain why revenue from equipment sales had reduced by so much.

- I have never determined whether equipment sales have ever made ASY any profit.

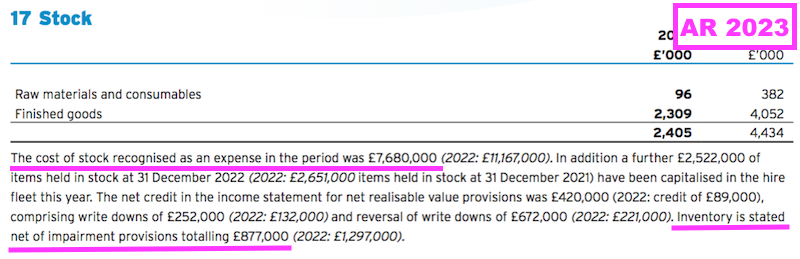

- This FY confirmed stock sold — presumably relating entirely to equipment sales — was £7.7m:

“The cost of stock recognised as an expense in the period was £7,680,000 (2022: £11,167,000).”

- No wonder ASY seems to be winding down its equipment sales when such revenue was £2.9m while the cost of stock sold was £7.7m (see Financials: cash flow and working capital).

Financials: hire revenue and hire equipment

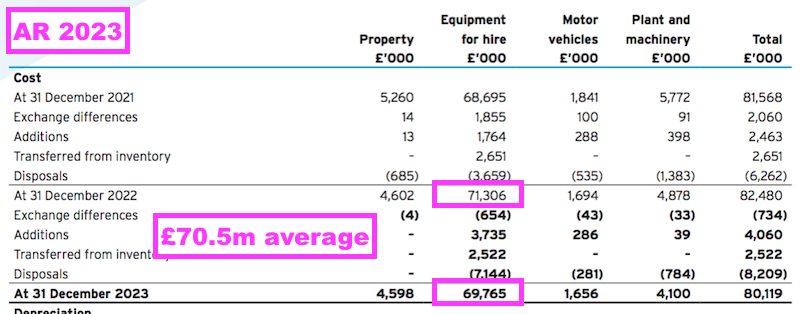

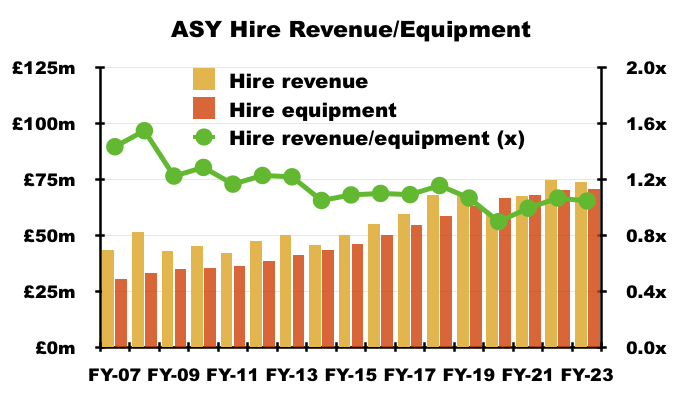

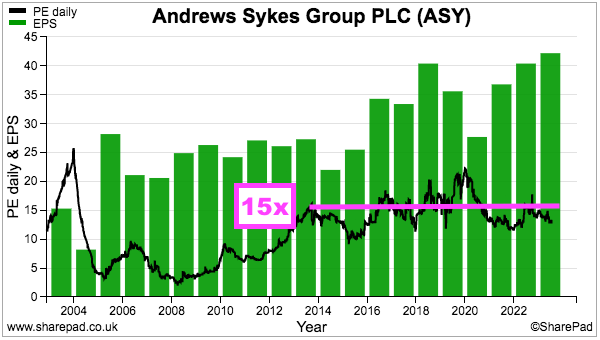

- The productivity of ASY’s hire equipment deteriorated slightly versus the preceding FY but remains within the range witnessed since FY 2014.

- I measure hire-equipment productivity by dividing hire revenue by the historical cost of the hire equipment. Using historical cost rather than book value avoids distortions caused by depreciation rates.

- ASY employed hire equipment that averaged a £70.5m historical cost during this FY:

- Hire revenue was £73.7m:

- Hire revenue of £73.7m divided by hire-equipment cost of £70.5m gives 1.04x:

- Hire-equipment productivity greater than 1x means ASY buys equipment for hire and recoups the cost through hire fees within a year.

- Hire-equipment productivity has bobbed between 0.90x and 1.16x since FY 2014, which suggests ASY has been unable to:

- Dramatically improve utilisation of its equipment, and/or;

- Raise hire fees faster than the cost of new equipment.

- Between FYs 2006 and 2013, hire-equipment productivity ranged between 1.17x and a remarkable 1.57x.

- The much higher rates from 10-15 years ago reflect some very impressive hire-equipment productivity outside the group’s main UK subsidiary.

- However, the impressive hire-equipment productivity outside the main UK subsidiary has since ‘normalised’ towards the UK rate.

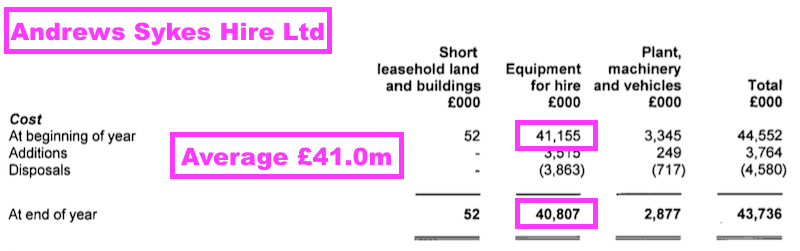

- For perspective, ASY’s main UK subsidiary employed hire equipment that averaged a £41.0m historical cost during this FY…

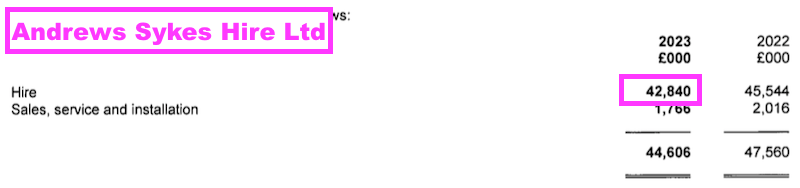

- …while the subsidiary’s hire revenue was £42.5m:

- UK hire revenue of £42.5m divided by UK hire-equipment cost of £41.0m gives 1.04x:

- Outside of the group’s main UK subsidiary, average hire-equipment employed was £29.6m versus hire revenue of £31.2m to give 1.06x for this FY:

- ASY being unable to really improve its group hire-equipment productivity is not ideal, but at least the measure is reasonably consistent.

- What’s more, the high margin earned from hire revenue leads to superior returns on equity (see Financials: margin and return on equity).

Financials: cash flow and working capital

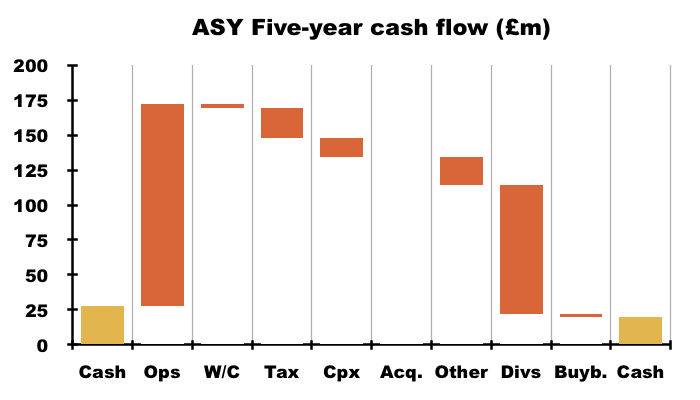

- The aforementioned 59.4p per share special dividend declared during H1 amounted to £25m, and was funded through years of controlled capital expenditure and tight working-capital management:

- Between FYs 2019 and 2023 for example, aggregate cash of £144m was generated through operations but only £3m was subsequently absorbed into working capital and just a further £14m was spent on capex:

- The £144m less £3m less £14m then left £127m to pay tax of £21m, pay leases and debt reductions of £20m and return a mighty £94m to shareholders through dividends.

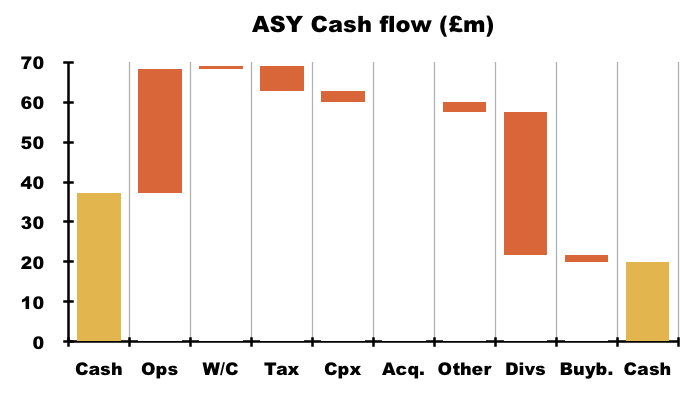

- This FY’s cash generation was impressive, with cash flow from operations of £31m benefitting from a £1m working-capital inflow and funding net capex of only £3m:

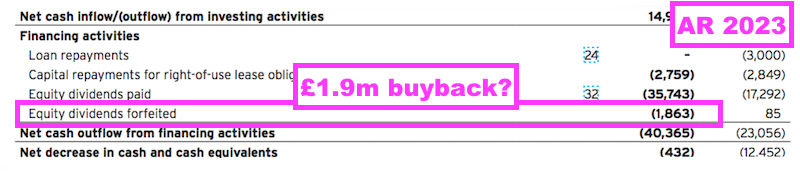

- This FY witnessed ASY’s first share buyback since FY 2018.

- £1.9m was spent repurchasing 0.7% of the share count at approximately 643p per share:

“During the year the company repurchased and cancelled 289,301 ordinary shares at a price between 510p and 665p per share. The total cash spent on share buybacks during the year amounted to £1.9 million.“

- The accounts incorrectly deemed the buyback as “equity dividends forfeited“:

- The £1.9m buyback may be a positive omen; the last time ASY undertook significant buybacks occurred during FYs 2010, 2011 and 2012, when an aggregate £3.1m was spent cancelling shares at a 155p average.

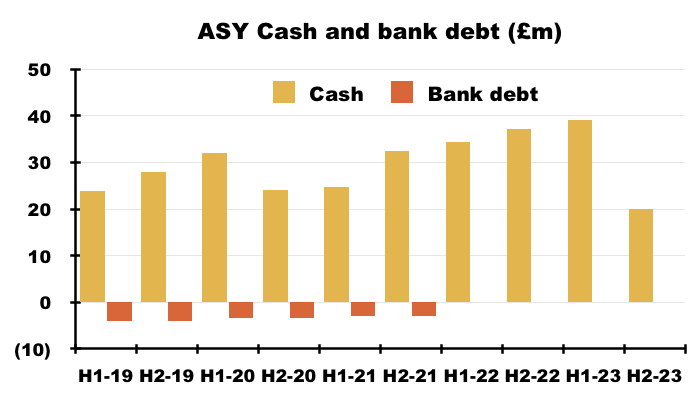

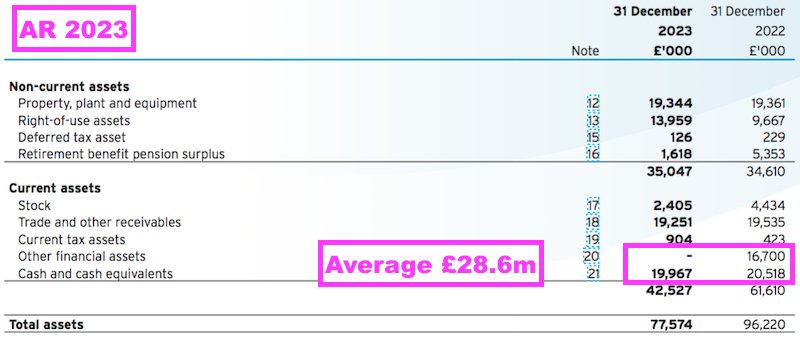

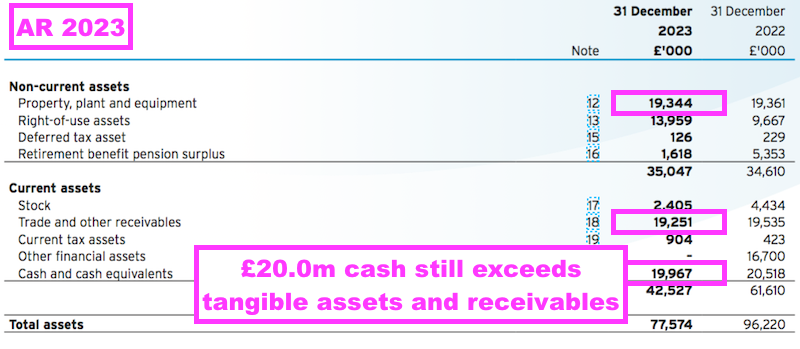

- The £25m special dividend was the main reason why the cash position finished £8m lower at £20m.

- The balance sheet still carries no bank debt.

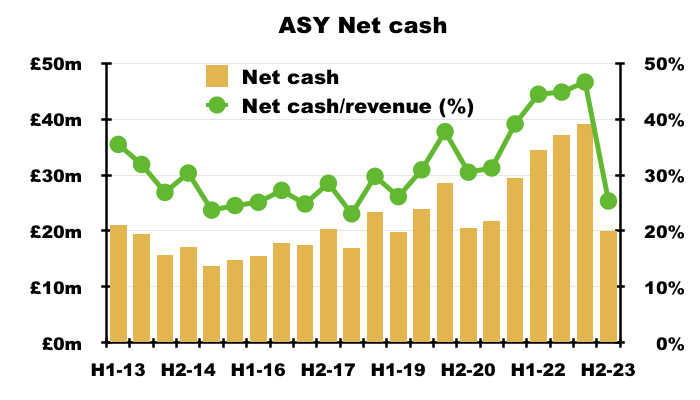

- Net cash at £20m is equivalent to 48p per share and is the lowest level since H1 2019 (£19.8m):

- Net cash of £20m is equivalent to 25% of FY revenue of £78.7m — the lowest proportion since H1 2018 (23.1%):

- Note that net cash as a percentage of revenue always topped 30% between FY 2020 and the preceding H1 — during which three special dividends were declared.

- Net cash rebounding to the equivalent of 30% of revenue may not take too long.

- After all, this FY’s free cash flow was £20m, which if repeated for FY 2024, would take the cash position to £29m assuming ordinary dividends remain at £11m. Net cash of £29m is equivalent to 37% of this FY’s revenue.

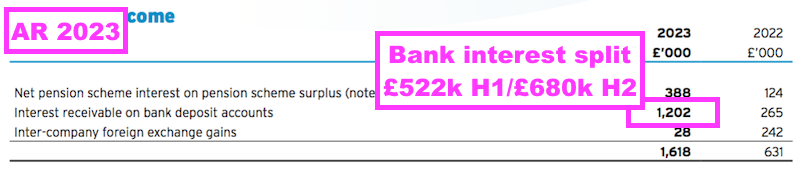

- Bank interest received during this FY was a useful £1.2m:

- Year-end cash averaged £28.6m, giving an effective 4.2% interest rate (£1.2m/£28.6m):

- The 4.2% figure is the best within my portfolio (save for City of London Investment) and just goes to show quoted companies can earn worthwhile sums from surplus cash.

- ASY said interest received was in fact 4.3%:

“Deposit accounts comprise instant access interest-bearing accounts and other short-term bank deposits with a maturity of three months or less on inception. Interest was received at an average floating rate of approximately 4.3% (2022: 1.3%).

- The £680k bank interest earned during H2 equated to 4.6% of H2’s average £29.6m cash balance.

- ASY’s capital expenditure is complicated by the group acquiring equipment for resale but then capitalising a proportion of that stock into the hire fleet:

“In addition a further £2,522,000 of items held in stock at 31 December 2022 (2022: £2,651,000 items held in stock at 31 December 2021) have been capitalised in the hire fleet this year.“.

- Such stock-to-fixed-asset transfers are unusual, but presumably reflect ASY offering equipment for hire that could not be sold direct.

- Between FYs 2019 and 2023, stock with an aggregate £12m value was reclassified into the hire fleet.

- This £12m is arguably capital expenditure rather than working-capital investment, although the net effect on cash flow is zero.

- ASY’s stock footnotes raise two other points:

- First, the cost of stock recognised as an expense of £7.7m exceeded revenue from equipment sales of £2.9m:

“The cost of stock recognised as an expense in the period was £7,680,000 (2022: £11,167,000).”

- Those figures imply ASY sells equipment at a loss (see UK).

- Second, the £2.4m stock position is stated net of impairment provisions of £0.9m:

“Inventory is stated net of impairment provisions totalling £877,000 (2022: £1,297,000).

- A £0.9m inventory provision equates to a very significant 36% of this FY’s stock value and indicates ASY suffers from material levels of inventory obsolesce or damage. The figures imply £9 of every £33 invested in stock is written off entirely.

- Emphasising ASY’s generally conservative accounting, a small profit over the book value of disposed equipment has been recorded every year since at least FY 2005:

Financials: margin and return on equity

- The aforementioned high margins within the UK and European divisions ensured the group converted a record 29% of revenue into profit:

- A 25% H1 margin was followed by a 32.6% H2 margin — the highest for any six-month period since at least H1 2008.

- Supporting margins during this FY was a 10% reduction to cost of sales and a 23% reduction to distribution costs:

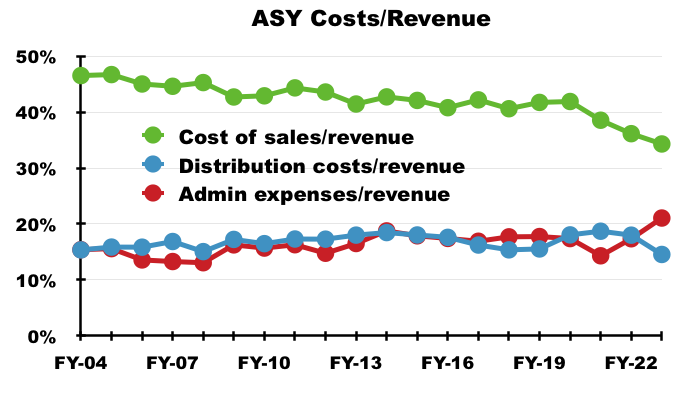

- Cost of sales absorbing 34.3% of revenue was the lowest FY proportion since at least FY 1998, while distribution costs absorbing 14.5% of revenue was the lowest FY proportion since FY 2003 (14.1%):

- Mind you, administration expenses absorbing 21.1% of revenue was the highest FY proportion since at least FY 1998.

- Note that this FY’s margin comparison was complicated by provisions covering:

- Extra French closure costs of £464k, and;

- UK restructuring costs of £1,011k during this FY and the comparable FY.

- A high margin combined with the aforementioned hire-equipment productivity leads to appealing returns on equity (ROE).

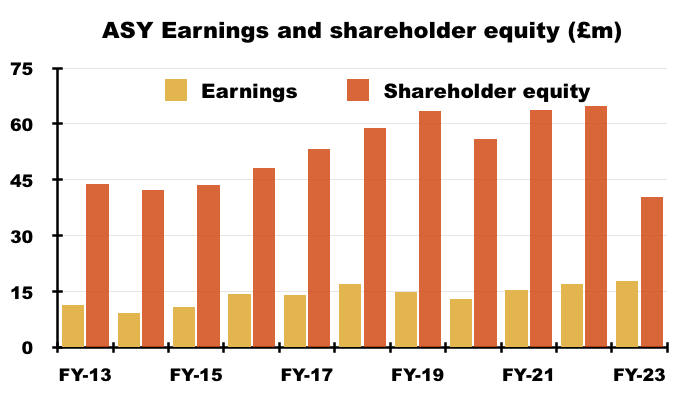

- Reported earnings of £18m versus average shareholder equity employed during this FY of £53m gives a conventional return on equity of 34%:

- Assuming earnings remain steady, ROE ought to improve during the next few years after the aforementioned £25m special dividend reduced shareholder equity by a commensurate amount.

- Despite the £25m special dividend, ASY’s largest balance sheet asset for this FY — and for the eleven FYs before that — was cash:

- While interest on cash has been a useful 4%-plus (see Financials: cash flow and working capital), much greater returns can be generated from ASY’s other assets.

- For perspective, during this FY, shareholder equity excluding cash averaged £24m while earnings excluding interest income was approximately £16m — leading to a remarkable cash-adjusted conventional ROE of 66%.

Financials: pension scheme and employees

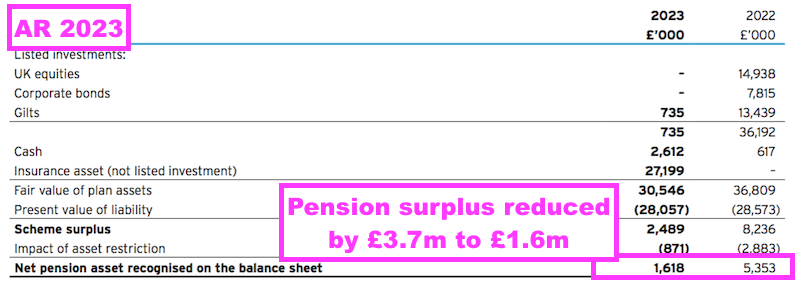

[H1 2023] “Since the period end, the company has worked with the pension scheme Trustees and pension advisors, Hymans Robertson, to successfully de-risk its defined benefit scheme by completing a buy-in deal with Canada Life.

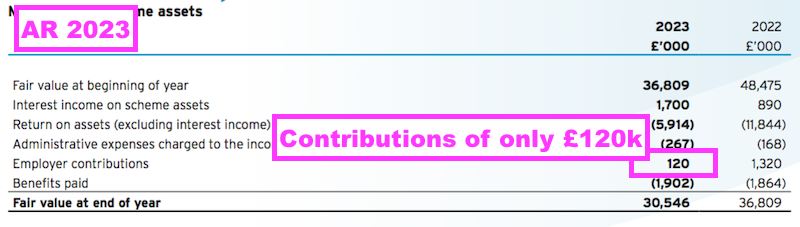

This transaction, whilst significantly reducing the defined benefit pension scheme surplus recorded on the balance sheet, means that future liabilities are fully de-risked and the company will not be required to contribute significant cash payments into the pension scheme to fund adverse liability movements. During 2021 and 2022 the company contributed £2.6m of cash into the defined benefit pension scheme.“

- The buy-in did indeed “significantly [reduce] the defined benefit pension scheme surplus recorded on the balance sheet“:

- Employer contributions of only £120k during this FY confirm ASY did not have to contribute a sizeable sum to the scheme to complete the buy-in:

- The buy-in is represented by a £27m “insurance asset” that effectively shifts responsibility for the scheme’s obligations to Canada Life:

“This transaction, whilst significantly reducing the defined benefit pension scheme surplus recorded on the balance sheet, means that future liabilities are fully de-risked and the company will not be required to contribute significant cash payments into the pension scheme to fund adverse liability movements…

No cash contributions are to be made during 2024.”

- The buy-in should now eliminate significant distortions between ASY’s profit and cash flow.

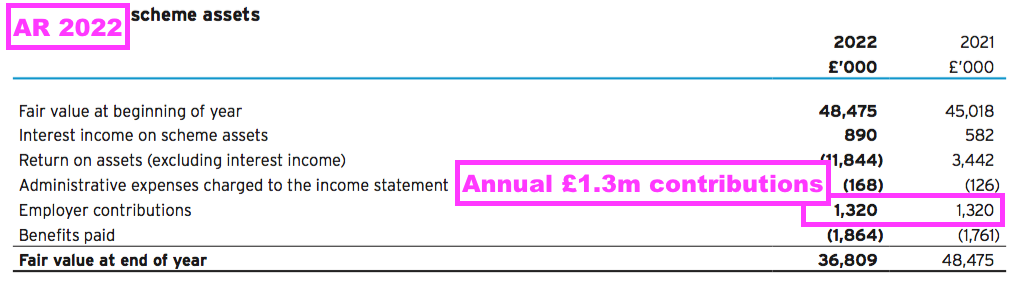

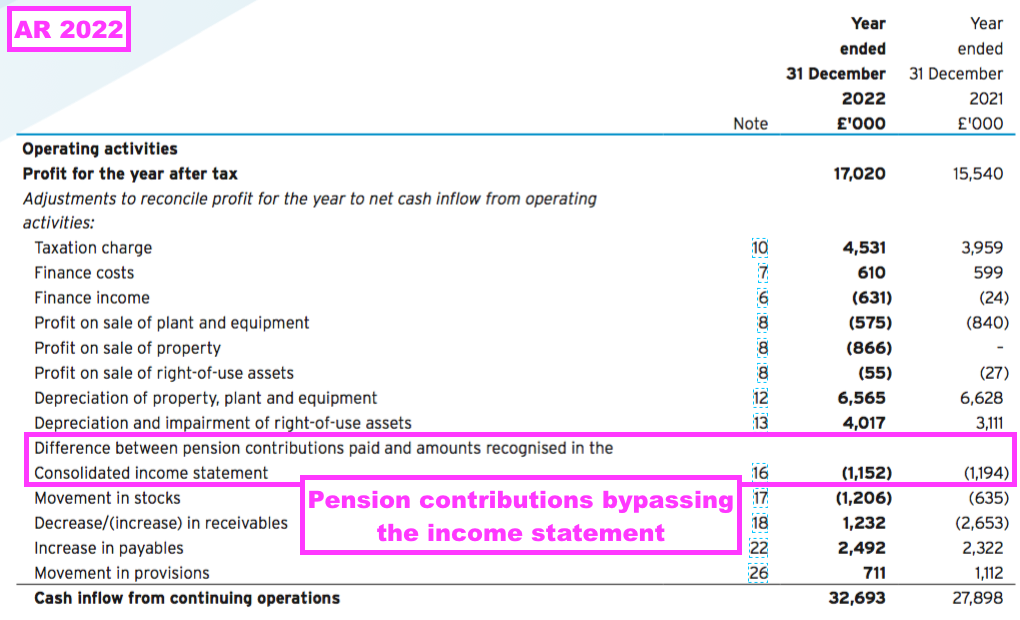

- ASY had been contributing an annual £1.3m into the scheme…

- …most of which bypassed the income statement and was therefore not charged to earnings:

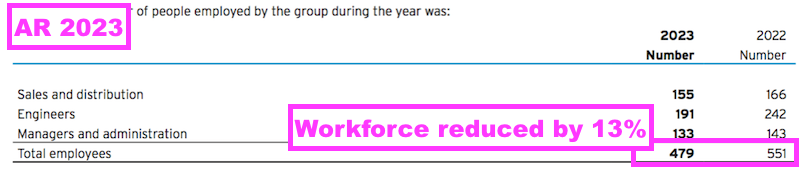

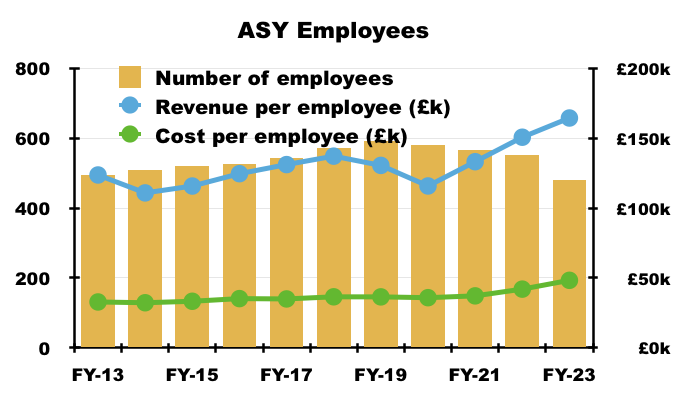

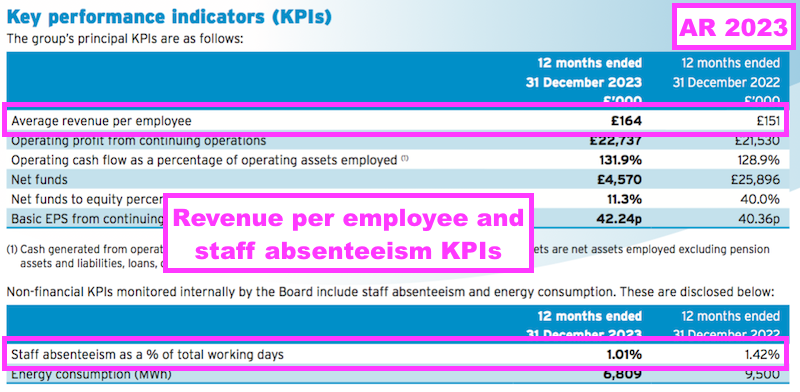

- Perhaps the most remarkable feature of this FY concerned ASY’s employees; the workforce was reduced by 13% to 479:

- 479 is the lowest headcount since FY 2012 (472):

- Revenue per employee rallied to £164k — a new high and some distance beyond the £115k-£137k range witnessed between FYs 2010 and 2022.

- Despite fewer employees, the total staff cost remained at £23.1m, suggesting ASY pruned the less productive workers and gave the more productive a pay rise.

- The average cost per employee during this FY in fact gained £6k to £48k.

- ASY said the lower headcount was “driven by operational efficiencies“.

- Revenue per employee and ‘absenteeism’ are very welcome KPIs:

- Absenteeism is calculated by something called the Bradford Factor:

“The group uses Bradford Factor scoring in the UK, a common means of measuring worker absenteeism. In using this measure to manage absenteeism the group has reduced the staff absenteeism metric during the year. The Board is pleased with this reduction and would seek a similar reduction in 2024.”

- Between FY 2020 and this FY, absenteeism has reduced from 1.67% to 1.54% to 1.42% to 1.01%.

- More quoted companies should publish an absenteeism KPI.

- I speculate the pandemic has helped ASY find more efficient ways of working. Although ASY employs some 113 fewer people versus pre-pandemic FY 2019, FY revenue remains at approximately £78m.

Valuation

- This FY’s terse FY 2024 outlook did not give much away:

“Trading momentum has continued into the current year, with overall performance in the year to date in line with the Board’s expectations. The group is confident in its core markets, its revenues and its profits.”

- Although ASY’s blog has reported plenty of FY 2024 activity…

- “Sykes assist in re-opening of the Channel Tunnel“;

- “The call for warmth from a supermarket in need of a space heater hire“;

- “Empty theatre gets a makeover with the help of our industrial dehumidifier hire and heating“;

- “Andrews Sykes flood packages put to action!“;

- “Sykes Pumps to the rescue: a pipe dream come true“;

- “Drying out damp: Andrews Sykes keeps housing project on track“;

- “Sykes Pumps delivers seamless drainage solutions on site“;

- “Sykes Pumps to the rescue for a loyal customer“, and;

- “We provide temporary marquee heating for outdoor events and parties“.

- …updates have not been published since 30 May.

- Perhaps ASY’s blog writer has become a casualty of a further workforce reduction.

- FY operating profit approaching £23m less 25% standard UK tax gives earnings of £17m or nearly 41p per share.

- The valuation sums could be fine-tuned for:

- The £20m net cash position;

- UK restructure costs;

- The elimination of French losses;

- A revival of Middle Eastern profit, and;

- Annual IFRS 16 lease-financing costs of almost £0.8m.

- But at least the valuation sums do not have to be fine-tuned for the “de-risked” pension scheme.

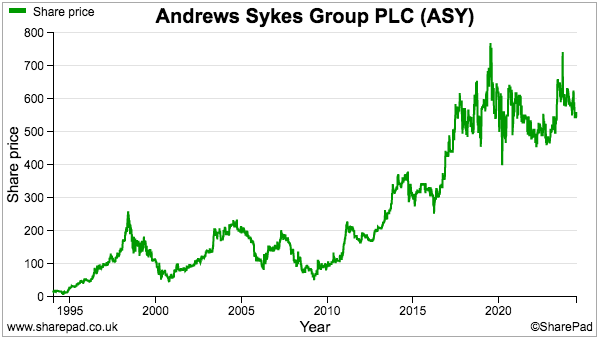

- The 560p shares are valued at 13-14x my 41p per share estimate, which does not appear outrageously expensive for a high-margin, cash-rich and cash-generative business that:

- Has delivered a record profit for this FY;

- Offers further expansion opportunities within Europe, and;

- May possess vague bid hopes should the Murray family want to exit (see Potential bid target?).

- Bear in mind ASY’s P/E has tended to bob around the 15x mark during the last ten years and has rarely climbed to a 20x rating:

- Keeping a lid on the P/E may be:

- The Murray family’s 91% ownership (see Potential bid target?) and limited free float;

- A lack of reinvestment opportunities for growth, underlined by that £25m special dividend, and/or;

- The profit ups and downs due to the weather.

- Plus ASY’s economies of scale may not be fantastic. In particular, previous results have shown a consistent 1.2x limit between revenue generated from the group’s hire equipment and the original cost of that hire equipment:

- A sustained P/E re-rating may therefore require ASY to earn more revenue from its existing hire equipment, rather than through consolidating its UK locations and/or opening more depots within Europe.

- My decision to buy ASY during 2013 was made easier because the shares were then valued on an 8-9x multiple at 233p.

- Following my purchase, my total ASY income has amounted to 370p per share, of which 109p per share has been funded by special payouts.

- For now the 25.9p per share trailing twelve-month ordinary dividend supplies a 4.6% income at 560p.

Potential bid target?

- I continue to speculate ASY may become a bid target.

- Jean-Jacques Murray becoming executive chairman is very intriguing.

- After all:

- ASY has coped well employing just one board executive (ASY’s managing director) since 2011, and;

- The Murray family had previously never undertaken an executive ASY role since taking the aforementioned controlling interest during 1994.

- Jean-Jacques Murray alongside his brother Jean-Pierre Murray control 91% of ASY following the death of their father, Jacques-Gaston Murray, last year.

- My notes from ASY’s 2016 AGM recounted the Murray family were ‘hands off’ shareholders:

[2016 AGM notes] “The controlling family, who are not involved in the operation of the business, like the higher levels of management governance a stock-market listing can provide“

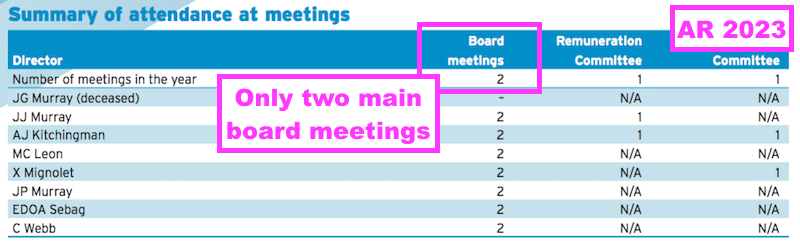

- Holding just two main board meetings a year also indicates a ‘hands off’ approach:

- But now an executive, Jean-Jacques Murray appears very much ‘hands on’… although I doubt he will be managing water pumps and temporary boilers.

- I speculate Jean-Jacques Murray might instead be contemplating corporate activity.

- Wishful thinking perhaps, but that £25m special dividend alongside “de-risking” the pension scheme could be interpreted as optimising the balance sheet for a potential bidder.

- After all, corporate suitors never like to:

- Pay a premium for surplus cash, and;

- Guess whether pension obligations will turn into ‘black holes’.

- Exiting France and reducing the workforce by 13% are other decisive actions that may have been encouraged to ‘tidy up’ the group.

- Selwood manufactures and hires out a wide range of industrial water pumps from 21 UK branches:

- Siltbuster meanwhile claims to operate the UK’s largest rental fleet of water-treatment equipment:

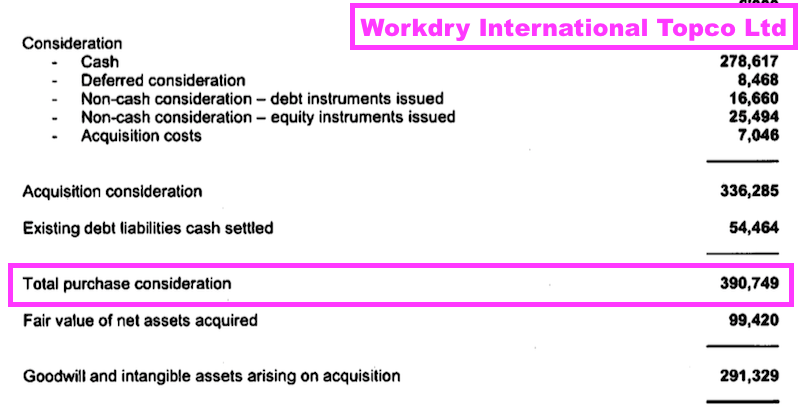

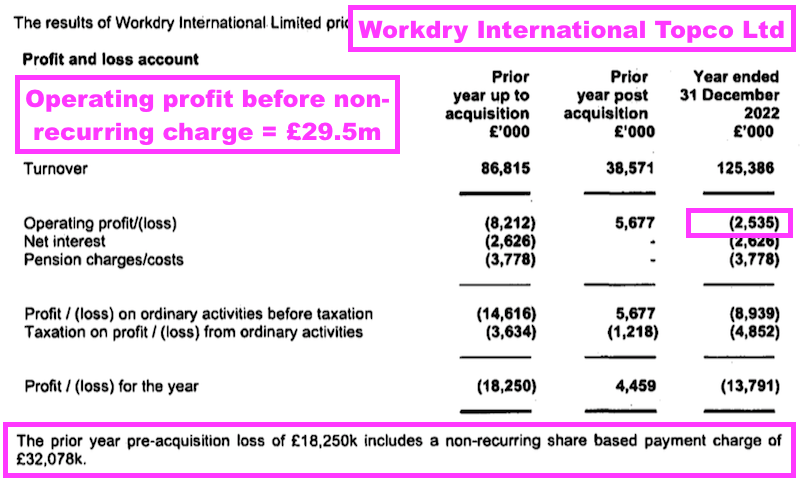

- Arcus paid a £391m enterprise value for Workdry International, the holding company of Selwood and Siltbuster:

- Workdry’s accounts indicate revenue of £125m and an operating profit of £30m for 2022:

- Arcus therefore paid 13x operating profit for Workdry, which if applied to ASY would give a near-£300m market cap or a share price just beyond 700p (excluding any additional value for ASY’s £20m/48p per share net cash).

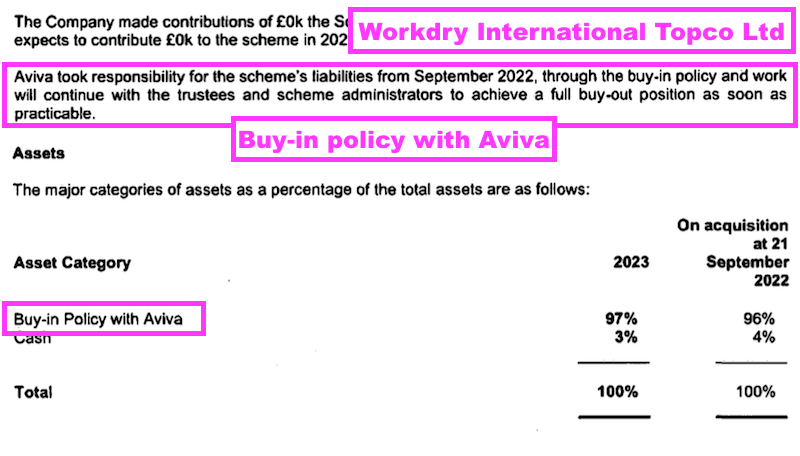

- Perhaps with a view to optimising the balance sheet, Workday undertook a pension-scheme buy-in with Aviva just before the sale to Arcus:

- Coincidentally perhaps, ASY started its own water-treatment service — Siltaway — during April:

- The Murray family were cited by the Sunday Times Rich List 2024 as being worth £2.8b, and maybe the death of Jacques-Gaston Murray will prompt a review of the family’s portfolio.

- The family’s 91% ASY shareholding carries a £213m market value and therefore represents less than 10% of their estimated fortune.

- The Murray family’s other London-quoted investment — a 99% shareholding in London Security (LSC) — has a market value of approximately £478m.

- The Murray’s business empire also includes Miami beach-front hotels, the buying and selling of which might be more appealing to Jean-Jacques Murray than managing water pumps and temporary boilers!

Maynard Paton

Hi Maynard, What an amazing writeup. I had to chuckle at “Perhaps ASY’s blog writer has become a casualty of a further workforce reduction” :D

I assume the Murrays wouldn’t be affected by any change in CGT since they are a corporation so perhaps not much time pressure to do this before the budget on the 30th. If they don’t sell it’s still a very stable cash generative business with some modest growth potential.

Thanks Jan. The Murrays selling is pure speculation on my part, influenced probably by the seemingly high volume of approaches to other shares earlier in the year. Maybe the family will prefer to sit tight and collect the dividends. ASY’s blog continues, but sadly more for generic SEO purposes than for showcasing the group’s services, which is a shame.

Maynard

Andrews Sykes (ASY)

Publication of 2023 annual report

Here are the points of interest beyond those noted in the blog post above:

——————————————————————————————————————

1) PRINCIPAL OBJECTIVES AND STRATEGY

Just a tweak to this text for 2023. Now more than 35 locations and around 500 staff versus more than 40 and around 550 cited for FY 2022:

“Having been originally established in the UK since 1857, we now have over 35 locations and operate with around 500 staff worldwide“.

I presume the reduction reflects the closure of the operations in France. ASY’s website currently shows 34 UK locations and 16 European locations, including oddly one in Paris. I have never been able to correlate ASY’s locations on its website to the number of locations cited in the annual report.

Otherwise this text simply reminds shareholders of the group’s competitive positioning based on equipment sophistication and first-class service:

“The Andrews Sykes Group is one of the market leaders in the rental of specialist hire equipment, offering bespoke solutions to our customers for their temporary or emergency needs.”

“We aim to provide the most modern, technically advanced and environmentally friendly rental equipment in the market.”

“By providing a premium level of service 24 hours per day, 365 days per year, we have become the preferred supplier to many major businesses and operations spanning a huge range of industries and geographic locations. Our reputation for providing high levels of training to our staff whilst maintaining a strict health and safety workplace, within an environmentally conscious culture, makes us an employer of choice for our industry.”

“Continual investment in new technology ensures that we provide our customers with new solutions to overcome their operational challenges. We constantly review and refresh our fleet of rental equipment to ensure that we set the standards within the rental industry throughout the UK, Europe and the Middle East.”

2) FUTURE DEVELOPMENT OF THE BUSINESS

No major text changes for 2023, and a reminder that the group does benefit from — but tries not to be dependent on — extreme weather:

“Although our business benefits from extreme climate conditions and is affected by regional economic influences, we aim to provide acceptable levels of success without relying on advantageous market conditions, whilst optimising favourable conditions when they arise.”

A milder 2023 summer but a higher 2023 profit does not suggest the group’s air conditioners/coolers are the primary earners:

“In 2022 the group capitalised on extreme climate conditions, including the UK experiencing 40 degree temperatures for the first time and temperature records being broken throughout Europe. In 2023, the UK and Northern Europe summer temperatures were more subdued but the group controlled costs and produced a record operating profit.”

3) KEY PERFORMANCE INDICATORS

I love ASY’s KPIs!

More quoted companies should publish employee-related KPIs. After all, for many companies, ’employees are their most important asset’.

Operating cash flow as a percentage of operating assets employed is a worthwhile KPI — a sort of ROE but more usefully applying cash flow and ignoring ‘non-operating’ assets. For 2023, the reduction in stock helped lift the ratio:

“Operating cash flow as a percentage of operating assets continues to demonstrate both strong working capital management and high levels of asset utilisation. The increased percentage is driven by a decreased operating asset base reflecting the tight working capital control of the group largely as a result of the stock reduction seen in the year.”

The EPS effort was described as “exceptional” for the fourth consecutive year:

“Achieving an EPS of 42.24 pence is regarded as an exceptional performance and a record for the group.”

ASY’s KPI commentary on energy usage was once again kept to the following:

“The Board is pleased to see the continued efforts to operate in a more environmentally friendly way, limiting our increase in energy consumption from the previous year.”

The KPIs showed a steep 28% reduction to Mwh usage during 2023.

Revenue per MwH was 11.57 for 2023, up from 7.85, 8.58 and 8.74 during the previous three FYs. So the business is becoming much more energy efficient (see points 5 and 13).

4) CASH FLOW FROM OPERATING ACTIVITIES

How ASY calculates operating cash flow as a percentage of operating assets:

Helpful text that explains the Middle East impact on trade debtors…

“Although still high in UK terms, the debtor day statistic in both years includes our subsidiary in the Middle East, whose debtor days were 113 days (2022: 70 days). During the prior year, management provided against historic debt that was no longer considered recoverable, this has had the impact of significantly reducing the overall debtor days for the country. The group’s average debtor days for current unimpaired debts remained unchanged to last year at 41 days.”

…and the Middle East impact on trade-debtor write-offs:

“Adequate provisions continue to be made for expected credit losses and impairment of trade debtors. In 2023, debts written off against the expected credit loss provision were £348,000 compared with £1,955,000 last year, and there was a net charge of £959,000 (2022: £2,133,000) to the income statement from the expected credit loss provision, which was calculated on a consistent basis each year. Of these figures, £159,000 (2022: £1,769,000) of the debts written off and £201,000 (2022: £1,945,000) of the expected credit loss charge related to external debtors of our subsidiary in the Middle East.”

The fewer Middle East write-offs also influenced the positive profit performance between 2022 and 2023.

5) TASK FOR ON CLIMATE-RELATED FINANCIAL DISCLOSURES

Six new pages of TCFD information for 2023! The text includes various snippets of useful information.

a) Governance

The introduction suggests the headcount reduction witnessed during 2023 is likely to be “reversed in future years“:

“The Companies Act 2006 s414, s414CA and 414CB requires AIM listed companies with more than 500 employees to make disclosures consistent with the recommendations of the TCFD and provide an explanation including details of the steps being taken to ensure future compliance. Although the group’s headcount has dropped below 500 employees in the current year, this is expected to be reversed in future years so the group has decided to voluntarily comply with the TCFD requirements.”

The board appears to be taking the TCFD matter seriously:

“Whenever the Board meets, climate change will be on the agenda. ”

Indeed, bonuses may soon be linked to “climate targets“:

“ The Remuneration Committee – integrates the group’s climate performance metrics into the group’s key personnel variable remuneration where relevant and will ensure that climate targets are embedded into incentive schemes over time.”

A new role of ESG director appears to have been created:

“During the year the group has established a specific ESG Committee, headed by a newly recruited Group ESG Director who reports into the Executive Strategy Team.”

b) Strategy, risks and opportunities

Transitional risks to a ‘lower-carbon economy’ include ASY’s diesel-power equipment becoming redundant:

ASY also cites the risk of low-carbon equipment being more expensive to purchase than existing equipment, meaning margins could suffer unless hire-fees increase (which ASY thinks they will, see below).

An obvious climate ‘opportunity’ for ASY is greater equipment-hire demand to cope with more instances of extreme weather:

“The group’s products are in high demand to respond to the consequences of extreme weather events, such as flooding or record summer temperatures. Climate change and the increased frequency of extreme weather events that it brings about could lead to increasing demand for the group’s products and services.”

Complex/expensive low-carbon equipment could mean customers are more likely to hire than buy:

“In addition, the increasing complexity and cost of keeping pace with the latest regulatory legislation makes it more difficult for customers to maintain compliance. Low-carbon equipment has tended to be more complicated to maintain and has an increased initial capital cost compared to traditional high-carbon equipment. As such, the group believes there will be an increasing demand shift from customers purchasing a new asset to rental of that asset from an industry specialist such as Andrews Sykes, which will provide an additional economic push to move from direct ownership to rental of equipment. The group believes that this, coupled with the environmental benefits for customers of renting rather than owning assets, will contribute to a larger rental market. Given the group’s strong balance sheet and cash reserves, the group is well placed and confident in its ability to be able to capitalise on this increase in demand.”

Any shift to a lower-carbon economy is likely to increase costs…

“In a 2°C or less scenario, the group believes that the risks and opportunities faced will primarily be related to transition risks. In this scenario, as the group and our suppliers and customers look to reduce carbon emissions, the group is likely to face increasing costs whether that be through increased cost of our rental fleet or other operational costs from increased energy costs or property rates increasingly being tied to the efficiency of the property. In order to minimise these costs, we are working with our suppliers and other parties to move to newer, more efficient technologies where possible and find operational savings that energy efficient products offer.”

…although increased hire rates should mitigate those higher costs and maintain the gross margin.

“We expect rental and transportation rates to reflect the increased cost of rental and transportation equipment, enabling us to maintain similar levels of gross margin. As the disposal of old rental fleet is not a significant driver of operating profit for the group, an anticipated reduction in the second-hand value of the group’s older, less environmentally friendly equipment is not anticipated to have a material impact on the group’s results.”

And any shift to a lower-carbon economy won’t immediately require a complete overhaul of existing equipment:

“In the near to medium term, production capacity will likely constrain the availability of new technology. The group expects to have sufficient time to be able to transition our rental fleet to the latest technology gradually under the normal economic replacement cycle of the fleet. The group believes there will be an increasing demand shift from customers purchasing a new asset to rental of that asset from an industry specialist such as Andrews Sykes, which will provide an additional economic push to move from direct ownership to rental.”

c) Metrics and targets

Emissions information now includes all group subsidiaries:

“The group has been disclosing Scopes 1 and 2 emissions for the group’s UK subsidiaries since 2020 in accordance with Streamlined Energy and Carbon Reporting (“SECR”). This gives some trend analysis but does not include all the subsidiaries of the group. In FY23 the group has adopted the Greenhouse Gas (“GHG”) Protocol methodology to calculate the entire group’s GHG emissions. The use of this metric will allow for aggregation and comparison across organisations and jurisdictions. FY23 will be the first year of consolidated group GHG emissions and as such will form a baseline for the assessment of future years.”

The hard part of emissions reporting is always the calculation of Scope 3 — which includes customer usage of the products/services provided:

“The group is working towards an estimate of the group’s Scope 3 emissions and to understand how these will evolve going forward. The most significant components of the group’s Scope 3 emissions relate to the group’s customers’ use of our assets during the rental period. Measuring Scope 3 emissions will involve a significant application of judgement. Accordingly, even when developed, the group’s Scope 3 emissions will always be subject to a significant degree of estimation uncertainty. ”

Scope 3 emissions in this report seemingly excluded customer usage, and was dominated by business travel (see below).

Scope 1 emissions — largely fuel — were reduced as the group’s vehicle fleet introduced more hybrids/EVs:

“During the year the group achieved a 613.30 tonnes of CO2e reduction, or 18.1%, on the prior year. This was largely achieved due to the 710.95 tonnes of CO2e reduction in the Scope 1 emissions. The business is in the process of transitioning its fleet of vehicles away from internal combustion engines to those using hybrid and full electric technology. This shift has primarily driven the decrease in this area, along with the continued monitoring and reporting of vehicle usage.”

Greater rail travel increased the reported Scope 3 emissions by 75%:

“The business continues to promote video conferencing and a reduction in business travel in cars where possible. This reduction in business travel in cars has naturally led to an increase in the use of public transportation, notably rail, which has increased the Scope 3 emissions during the year.”

All told, emissions per revenue declined a useful 14%:

“The group’s tonnes of CO2e per £m turnover has decreased 13.7% in the year, from 40.77 to 35.19.”

A 5% per annum decrease to Scope 1 and 2 emissions has been targeted until 2030:

“The group has set a near-term target to reduce Scope 1 and 2 emissions by 5% per year and to achieve a 35% reduction in the total CO2 from the 2023 baseline level by 2030. We will develop a long-term plan to reach net zero by 2050, in line with the UK commitments. Our road map will focus on Scope 1 and 2 emissions showcasing a full breakdown of all carbon-related activities.”

Could ASY choose TFW to supply vehicle-charging points and LED lighting?

“The group’s pathway to reducing carbon will specifically focus on targets that cover our transport fleet, fuel usage, energy and waste consumption. Currently 30% of our UK fleet is either full electric or hybrid. As our vehicles are largely leased for on average 48–60 months, the group has an up-to-five-year replacement cycle. As such, the group’s aim is that by 2030, 80% of our car fleet is either full electric or hybrid and 30% of our commercial fleet is full electric or hybrid. To support this, we aim to install electric charging points at all of the large hub depots throughout the group. In addition, by 2030 we aim to reduce our internal energy consumption by 30%. The group aims to achieve this electricity usage through the installation of LED lighting throughout our depot network along with various other energy saving initiatives including the installation of AMR meters throughout our depots.“

6) PRINCIPAL RISKS AND UNCERTAINTIES

No text changes versus 2022. Risks remain ‘going concern’, strategic risks, competitive risks, technological risks, climate risks and financial risks (involving interest rate, market, credit and funding/liquidity sub-risks).

The text contains a few useful snippets.

Service standards and pricing are seen as competitive:

“Competition, product innovations and industry changes are regarded as the main strategic risks. These are mitigated by investment in new environmentally friendly, technologically advanced products and equipment, and providing service levels that are recognised as being amongst the best in the industry. Market research and customer satisfaction studies are undertaken to ensure that our products and services continue to meet the needs of our customers. Our pricing is regarded as competitive to the market place.”

The technological risk includes this text:

“The group is currently working through an upgrade of its existing IT systems and this will involve a new group-wide ERP system being fully rolled out over the next year.”

Seems like the ERP roll-out has taken longer than expected, given the exact same text was included within the prior-year report.

ASY’s revealed the ERP roll-out within its 2021 report:

[AR 2021] “The group has recently approved the upgrade of its existing IT systems and a group wide ERP system will be rolled out over the next few years.”

7) DEFINED BENEFIT PENSION SCHEME

a) Pension scheme surplus

Now that the defined-benefit pension scheme has been ‘de-risked’ through the Canada Life buy-in, all this prior-year text was not included for 2023:

[AR 2022] “As set out in note 16 to the consolidated financial statements, as at 31 December 2022, the pension scheme assets were £36.8 million which, after deducting the present value of the pension scheme liabilities of £28.6 million, calculated in accordance with IAS 19, and associated asset restrictions for withholding taxes of £2.9 million results in a surplus of £5.4 million. When assessing the appropriateness of the recognition of this surplus, the directors have considered the guidance in IAS 19 and IFRIC 14 and have concluded that because of the rights upon wind-up it is appropriate to recognise this asset in the financial statements. Management continues to work with the pension scheme trustees to maximise the return from the pension scheme assets and to match that return with the pension scheme liabilities as they crystallise in order to minimise the exposure to the group. The net surplus is sensitive to changes in assumptions, which are at least in part influenced by changes in external market conditions, and therefore, this area continues to be subject to management focus.”

The subsequent buy-in effectively confirmed management did indeed work with the trustees to match the scheme’s returns with its liabilities.

b) Defined contribution pension scheme and auto enrolment

Although the salary-sacrifice arrangement may skew the rates a little, UK employees can receive pension contributions of 8% and up to a very useful 15% of salary:

“During the prior year, the UK introduced a salary sacrifice arrangement for pension contributions meaning the employer now makes all pension contributions instead of the employee and employer making contributions. As such, the employers’ contribution rates vary from 8% to 15%. The current period charge in the income statement amounted to £1,175,000 (2022: £1,017,000).”

8) SHARE BUYBACKS

Confirmation of the year’s buybacks:

“During the year the company repurchased and cancelled 289,301 ordinary shares at a price between 510 pence and 665 pence per share for each of these shares. The company has repurchased its own ordinary shares for cancellation and these purchases enhanced earnings per share and were for the benefit of all shareholders. In the prior year, the company repurchased 26,314 shares at a nominal value of 1 pence per share for cancellation.”

The final buyback occurred during September 2023 at 665p, at which point ASY announced a £25m special dividend. I wonder whether the buybacks will resume given the price now trades at c500p.

The purchased shares represented 0.7% of the share capital, which does not seem a lot, but is more significant in light of the c9% free float. All the shares purchased have been cancelled.

The c91% family owners could take full control of ASY should it exercise the full 12.5% buyback authority:

“At the forthcoming 2023 Annual General Meeting, shareholders will be asked to vote in favour of a resolution to renew the general authority to make market purchases of up to 12.5% of the ordinary share capital in issue. Any purchases will only be made on the London Stock Exchange and they will only be bought back for cancellation provided they enhance earnings per share. If this resolution is passed, it should not be taken to imply that shares will be purchased but the Board believes that it is in the best interests of shareholders if it has this authority in order that market purchases may be made in the right circumstances if the necessary funds are available.”

If cash earns an after-tax return of, say, 4%, buybacks will in theory enhance EPS up to a P/E of 25.

9) DIRECTORS’ DUTIES AND SECTION 172(1) STATEMENT

No major changes for 2023. Text includes a few useful snippets that reiterate the group’s competitive positioning: tip-top customer service, an organic-growth strategy, long-term supplier relations and a working culture that creates employee loyalty:

“We aim to provide dependable high-quality services to our business partners in the UK, Northern Europe and Middle East. We often provide business critical solutions to key businesses and are instrumental in helping our customers achieve their goals.”

“The company is committed to being a responsible employer. Our behaviour is aligned with the expectations of our employees and together we provide a first-class service to our clients, 24 hours per day, all year round.”

“Our business strategy prioritises organic growth. We regard customer relationships as being of the utmost importance and our key account customers, which account for approximately 50% of our business, are visited by a customer relationship manager on a quarterly basis to ensure we are meeting their expectations. The next largest 25% of customers are actively managed by desktop reviews supported by contact by telephone, and the remaining customers’ accounts are subject to periodic internal reviews to ensure no issues are apparent.”

“Externally, the group has strong relationships with a number of key suppliers; many of these relationships have been in place for 10 years or more. Regular meetings are held with these suppliers to ensure that relationships are optimised, with new innovation high on the agenda.”

“The group has a large number of long-serving staff members, many with 30-plus years’ service, which is a testament to our working culture.”

“Our business strategy is to differentiate our services from those of our competitors by providing our customers with a first-class level of service 24 hours per day, all year round.”

“Our reputation is amongst the best in the industry and means we are the employer and service provider of choice for many individuals and businesses alike.”

10) PRINCIPAL DECISIONS TAKEN DURING THE YEAR

An explanation of why the French operation was closed:

“During the year the Board made the decision to close our French subsidiary, Andrews Sykes Climat Location. In making the decision, the Board considered the continuing losses being made despite the recent attempts to downsize and return the subsidiary to profitability and the future pipeline of potential work. Ultimately it was decided that the French business did not warrant further investment of cash and management time and both of these resources could be more efficiently deployed elsewhere to generate improved returns for the shareholders and the decision was taken to close the business. A contributing factor was the Board’s decision to incorporate a new German subsidiary, Klimamieten AS GmbH. With reference to market research undertaken on the German market, the Board made the decision that the group’s resources would be better employed in generating shareholder returns by entering the German market than persisting with the French operations.”

11) DIRECTORS’ INTERESTS

The Murray family’s aggregate shareholding did not change during the year:

EOI Sykes Sarl is a Murray family venture.

The aforementioned buybacks (point 8) lifted the Murray’s collective holding to 90.9%.

Note that the rest of the board — the managing director and four non-execs — do not own any shares. Options were last seen in 2010.

12) BUSINESS ETHICS, MODERN SLAVERY AND HUMAN RIGHTS

A new section for 2023, which seems very standard:

“Senior employees across the group receive regular business ethics training to ensure they are aware of their obligations and responsibilities with regard to the UK Bribery Act. The group’s Anti-Bribery Committee monitors and overseas compliance with the UK Bribery Act. Anti-corruption and bribery policies are maintained and reviewed on a regular basis with relevant guidance incorporated into our employee handbooks and available on our website.

Human rights and modern slavery are important aspects of our business ethics. We have group-wide policies in place covering these areas, all of which protect our employees, our business and our suppliers. These policies are embedded in our everyday business operations. Modern slavery is an abuse of human rights and we have a separate modern slavery policy that commits the group to ensuring there is no modern slavery in our business or our supply chain. Any suspicion that our policy is being breached or at risk of being breached can be reported through our anonymous whistleblowing procedures.”

13) SECR DISCLOSURES

ASY continues to publish its SECR emissions information for its main UK subsidiary:

The UK operation used an astounding c45% less gas, c8% less electricity and c19% less fuel for transport.

The text explains how the savings were achieved through relocations and new vehicles:

“Moving to newer, more efficient depot locations is also enabling the more efficient heating and lighting of our operations and reducing the level of gas and electricity usage.”

“During 2023, the transition of our fleet of vehicles towards hybrids and full electric vehicles has allowed the business to significantly reduce the level of transport fuel used within the business. As vehicles come to the end of their lease period and are renewed with hybrid or full electric vehicles, the business should see a continuing reduction in the fuel consumption into next year and beyond.”

14) CORPORATE GOVERNANCE

ASY follows the QCA’s corp-gov code:

“The group has chosen to apply the Quoted Companies Alliance (QCA) corporate governance code (the “code”) following the change to the AIM Rules for Companies in September 2018, which required AIM companies to comply with a recognised corporate governance code.”

a) Missing three QCA principles

ASY oddly lists only seven of the ten QCA code principles in the annual report. The other three are published on ASY’s website.

The missing three are:

“i) Seek to understand and meet shareholder needs and expectations

The Company has a controlling 86.33% shareholder which has a number of representatives on the Board.

The Company monitors its share register and ensures that dialogue is entered into with other shareholders as appropriate. The Vice Chairman and the Managing Director respond to all enquiries made of them by shareholders and Andrew Kitchingman, the Senior Independent Non-Executive Director, not only provides an independent view of the Group but is also a point of shareholder access which is independent of the executive team or the majority shareholder.

The Board recognises the importance of communication with the Company’s shareholders. The Annual Report and the Half Year Accounts and related announcements are made available promptly on the Company’s web site in accordance with the AIM Rules.

All shareholders are invited to attend the Company’s Annual General Meeting (“AGM”). The AGM includes a question and answer session and Directors make themselves available to meet with shareholders following the meeting.”

I must attend another ASY AGM. The last one I attended was 2016.

“ii)Take into account wider stakeholder and social responsibilities and their implications for long-term success

The Company recognises that long term success is driven by good relations with both internal and external stakeholders. Internally the senior management team communicates with staff at all levels by both formal and informal communication channels, feedback from these channels are often used to drive improvements and provide new initiative for product and service developments.

Externally the Group has strong relationships with a number of key suppliers, many of these relationships have been in place for 10 years or more. Regular meetings are held with these suppliers to ensure that relationships are optimised, with new innovation high on the agenda. We communicate with our customers in many ways and channel feedback via a line management structure which is much flatter than many companies within our sector. Customer communication ranges from social media through to high level contract reviews. Customer feedback is monitored by senior management on a regular basis. Executive and Non-Executive Directors communicate with shareholders directly and make themselves available for such meetings.”

The lack of middle-management may help explain ASY’s good margins.

“iii) Maintain governance structures and processes that are fit for purpose and support good decision-making by the Board

The Board is responsible for creating value for shareholders, determining strategy, investment and acquisition policy, approving significant items of expenditure and for the consideration of significant financing and legal matters. Matters specifically reserved for decision by the full Board, include matters of business strategy, material corporate actions, approval of budgets and approval of financial statements.

The Board meets on at least three occasions each year. Due to the consistent nature and strategy of the Group, this is considered sufficient. Interim meetings or appropriate sub-committees are established when urgent decisions are required on matters specifically reserved for the Board between scheduled Board meetings. In addition, all Directors receive appropriate monthly management information and have the opportunity to discuss this with the Managing Director or any member of the executive team.

All Directors receive a pre-Board meeting briefing pack and post Board meeting minutes and appropriate attachments from the Company Secretary. A number of the Board are based overseas and cannot always attend all meetings in person. Where a Director cannot attend a meeting in person (or by telephone) he / she can give their contributions in advance to an attending Director or the Company Secretary and relay any comments concerning the Board minutes before they are adopted. Should there be any matter that requires further discussion, a supplementary telephone Board meeting is convened.

The roles of Chairman and Managing Director are held by separate directors and there is a clear division of responsibilities between them. The Chairman leads the Board and ensures its effectiveness and approach to corporate governance. He sets the Board agenda and ensures that all Directors make an effective contribution. The Chairman is also responsible for ensuring the Board and broader management framework is established, operates effectively and is compliant with relevant statutory codes and Company policies and for the regular assessment of the effectiveness of the Board and its committees. The Managing Director has responsibility for all operational matters and implementation of the Company’s strategy as approved by the Board. The Non-Executive Directors have particular responsibility in ensuring that the strategies proposed by executive management are fully challenged.

All Directors must offer themselves for re-election at least once every three years and at least one third of the Directors must offer themselves for re-election each year.

The Board maintains two standing committees – the Audit Committee, which is chaired by Andrew Kitchingman, the Independent Non-Executive Director, and the Remuneration Committee which is chaired by Jean-Jacques Murray, the Non-Executive Chairman.

The Audit Committee is responsible for ensuring that the financial performance of the Group is properly monitored, controlled and reported upon. It meets at least three times a year, to review the half year and full year financial results, to meet the Company’s auditors to discuss the audit and to review the internal controls framework of the Group. The audit committee comprises Andrew Kitchingman (Independent Non-Executive Director) and Xavier Mignolet (Non-Executive Director).

The Remunerations Committee meets at least once a year to review the performance of Executive management and set the scale and structure of their remuneration and the basis of their service agreements with due regard to the interests of the shareholders. The Remuneration Committee comprises Jean-Jacques Murray (Non-Executive Chairman), Emmanuel Sebag (Non-Executive Director) and Andrew Kitchingman (Independent Non-Executive. Director). Details of the Directors’ remuneration are set out in the Directors’ Remuneration Report in the Annual Report.

All Board appointments are considered by the Board as a whole and, as such, it has not been considered necessary to establish a Nomination Committee. The removal of any Board member is also a matter for the Board as a whole.

The Board and its Committees are considered to comprise individuals with the necessary experience and strategic and operational skills required to drive the Group forward and to deliver its strategy for the benefit of shareholders over the medium to long term.

The terms of reference for the Audit committee can be found here and the terms of reference for the Remuneration committee can be found here.”

The QCA text says both the board and audit committee meet at least three times a year, but the board met only twice and the audit committee only once during 2023. The directors comprising the remuneration committee have since changed (point 15).

As perhaps is expected with this family-controlled board, the directors are re-elected only every three years. Best practice these days is re-election every year.

The above QCA principle text was published during March 2023 — a few months before the non-exec chairman died. The new chairman has since taken on executive responsibilities, which leads to ASY defying a bevy of further corp-gov best practices!

b) Other seven QCA principles

No text changes among the other seven QCA principles documented within the annual report.

A reminder of the snippets supporting the wider investment case due to the dominant family shareholding:

“Shareholder value in the medium term to long term is intended to be delivered by driving operational excellence across the group and growing within selected markets and geographies. The Board believes that the presence and requirements of a long-standing controlling shareholder helps focus the company’s strategy on long-term shareholder value creation.”

“The presence and requirements of a long-standing majority shareholder has resulted in a strategy with the key aim of creating long–term shareholder value.”

A reminder that there is likely to be just one independent non-exec on the board for some time:

“The company has only one independent non-executive director whereas the code recommends that boards have at least two independent non-executive directors. The Board considers that there is sufficient independence on the Board taking into account the shareholder base of the company. For this reason the Board has no current plans to appoint an additional independent non-executive director but will keep the matter under review“.

The following text on ASY’s website suggests many of the family-linked non-execs may not be truly active board members:

“In order to reduce the administrative burden at Board meetings and to optimise the decision making process, I [the chairman] often act as a conduit for the aggregated views and opinions of many of these non-independent directors.”

Oddly, the text above was signed off by “Jean-Jacques Murray, Chairman” and dated March 2023 — three months before Jean-Jacques Murray actually became chairman!

Given the Murray family owns 91%, 20% of the independent votes equal 1.8%:

“The Board pays particular attention to the votes cast by the shareholders at the AGM. In the event that a significant proportion (>20% including proxies) of independent votes are cast against a resolution at a General Meeting of the company, the Board intends, on a timely basis, to explain any action it has taken or will take as a result of that vote.”

I wonder if this 20% is likely to be breached at an AGM, should upset outside investors ‘act in concert’ with their votes and the happy outside investors do not vote? The largest protest voted at the 2023 AGM was 0.36% of the votes cast.

15) SUMMARY OF ATTENDANCE AT MEETINGS

Just the four meetings for 2023 to match the number for 2022:

At least all the directors turned up to the meetings. This earlier QCA text suggested some directors may not always attend:

“A number of the Board are based overseas and cannot always attend all meetings in person. Where a Director cannot attend a meeting in person (or by telephone) he / she can give their contributions in advance to an attending Director or the Company Secretary and relay any comments concerning the Board minutes before they are adopted.

There’s no remuneration-committee report:

“The Remuneration Committee comprises JJ Murray as Chair and AJ Kitchingman. The Committee reviews the performance of executive directors and sets the basis of their service agreements with due regard to the interest of the shareholders. Details of the directors’ remuneration are set out in note 9. Due to there only being one other executive director apart from the Chairman, the directors consider the disclosures given in note 9 are adequate and a separate Remuneration Committee Report is not included in these financial statements.”

And there’s no audit-committee report:

“The Audit Committee comprises AJ Kitchingman as Chair and X Mignolet. The Audit Committee is responsible for ensuring that the financial performance of the group is properly monitored, controlled and reported on. The Audit Committee considers risk and internal control as a fundamental part of its responsibilities. It meets the auditor to discuss the audit approach and the results of the audit. The Audit Committee considers the need to introduce an internal audit function each year. After taking into consideration the current size and complexity of the group, the Committee believes that it would not be cost effective to have an internal audit function and the Committee feels that sufficient control is obtained through the scope and quality of management’s ongoing monitoring of risks. As such, and given the inclusion of the independent Audit Report on pages 32 to 37, the directors consider no additional Audit Committee Report to be required.”

16) INDEPENDENT AUDITOR’S REPORT

a) Key audit matters

Four key audit matters for 2022 have been reduced to one for 2023.

The three matters that have disappeared are:

i) Application of IFRIC 14 for the defined benefit pension scheme net surplus (Group)

ii) Expected credit losses (Group)

iii) Useful economic lives (Group)

The pension-scheme matter related to an incorrect tax calculation, which presumably was a one-off. The credit-losses matter related to the particularly high Middle Eastern write-offs (point 4), which did not re-occur for 2023.

The useful-lives matter is interesting. The prior-year report reminds me that ASY carries hire equipment at zero but which still generate revenue:

[AR 2022] “There are several points of judgement that management apply when setting the UELs and notably, due to various factors, there are a significant amount of hire assets held on the balance sheet at nil net book value but which are still generating revenue when required. ”

ASY appointed a new auditor for 2022 (Mazars), who I suspect wanted to double check the useful-life policy right from the start. I suppose another check for 2023 was not warranted.