17 May 2024

By Maynard Paton

H1 2024 results summary for Mountview Estates (MTVW):

- A satisfactory H1 performance, showing revenue up 5% and profit up 16% buoyed by the gross margin on property sales rebounding to a reassuring 59%.

- Despite a hefty £29m spent acquiring new properties, greater debt, higher interest costs, extra tax and the chunky dividend kept net asset value (NAV) at approximately £101 per share.

- Properties purchased after a 2014 valuation and then sold look to have realised limited gains, and could explain why NAV growth has slowed and the share price has stagnated during recent years.

- The protracted search for a replacement non-exec could spark further tensions between the board and unhappy shareholders, with the chief executive still entrenched through family support albeit with no obvious successor.

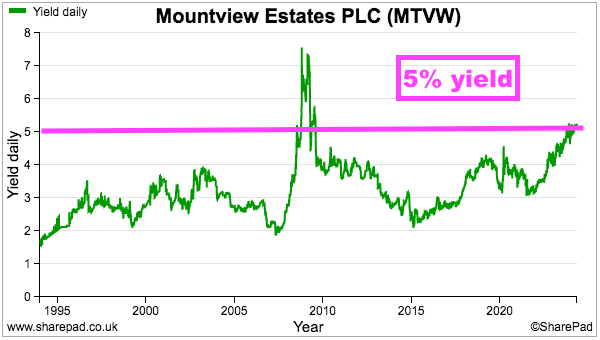

- The £100 shares currently offer a 5% income, the highest for decades aside from the banking crash, and could be worth £189 if all the group’s properties were sold today at their vacant possession value. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own MTVW

- Results summary

- Revenue, profit, dividend and net asset value

- Trading properties: disposals and acquisitions

- Trading properties: gross margin and rental income

- Trading properties: properties valued by Allsop

- Trading properties: properties not valued by Allsop

- Financials

- Protest votes and search for new non-executive

- Sinclair family concert party

- Valuation

News links, share data and disclosure

- Interim results for the six months to 30 September 2023 published 23 November 2023;

- Result of General Meeting published 20 November 2023, and;

- Update on 2023 AGM outcome published 09 February 2024.

- Share price: £100

- Share count: 3,899,014

- Market capitalisation: £390m

- Disclosure: Maynard owns shares in Mountview Estates. This blog post contains SharePad affiliate links.

Why I own MTVW

- Buys, holds and sells regulated-tenancy (and similar) properties and boasts an illustrious, 40-year-plus history of net asset value and dividend advances.

- Board led by veteran family manager who continues to lead an aggregate 50%/£195m concert-party shareholding.

- Properties are carried at cost, and when eventually sold at their ‘reversionary’ values may generate total proceeds significantly in excess of the recent market cap.

Further reading: My MTVW Buy report | All my MTVW posts | MTVW website

Results summary

Revenue, profit, dividend and net asset value

- This H1 seemed quite satisfactory given the preceding FY talked vaguely about an “unpredictable housing market“…

[FY 2023] “Looking forward, whilst it is clear that there is some uncertainty ahead, much driven by the war in Ukraine, most economists are predicting an easing of inflationary and other economic pressures, albeit at a slower rate than once hoped. Coupled with interest rates closer to historic levels and regulatory and legislative developments in the rental sector that are driving many smaller landlords out of the market would normally suggest an unpredictable housing market though for the moment it appears to defy expectations.”

- …and referred to a potential “technical recession“:

[FY 2023] “In the event the UK avoided a technical recession, but the wider outlook remains finely balanced as any one of a number of factors could tip the balance into technical recession. Against this backdrop pretty much all markets have been affected and housing is no exception.”

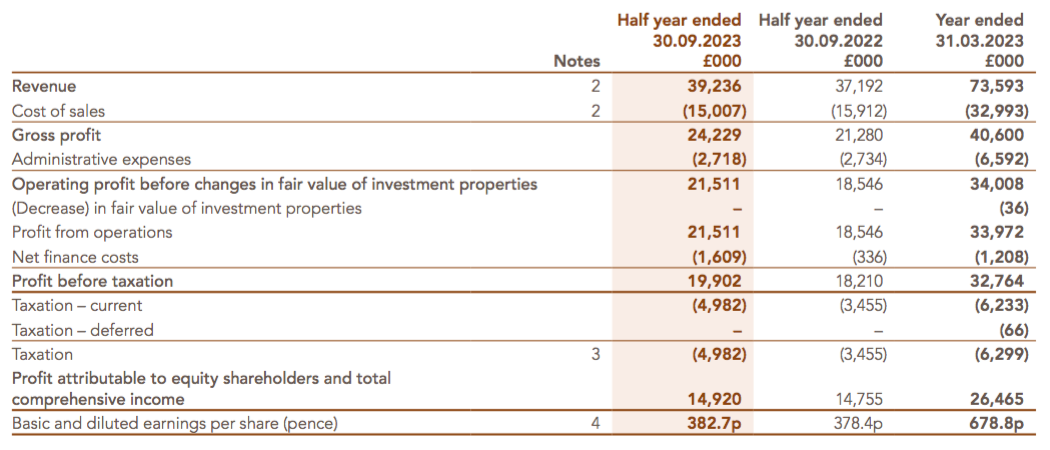

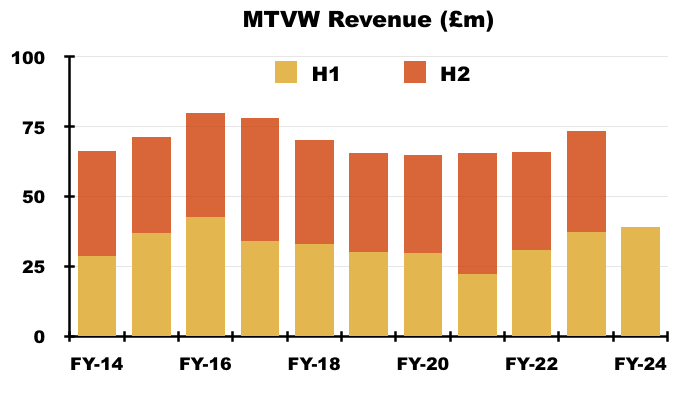

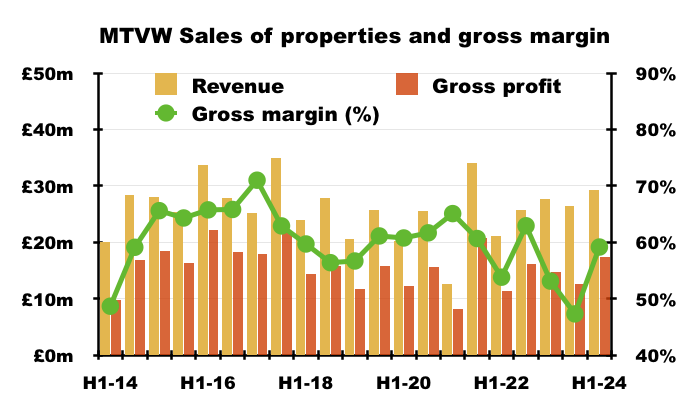

- Revenue gained 5% to £39.2m and was the highest for an H1 since H1 2016 (£42.7m):

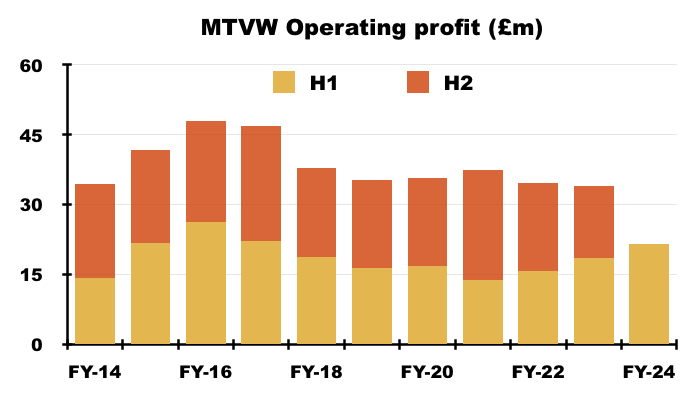

- Operating profit advanced 16% to £21.5m and was the highest for an H1 since H1 2017 (£22.2m):

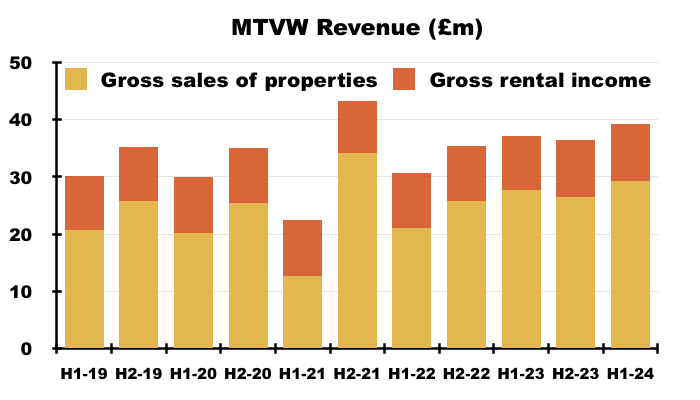

- Revenue was split 75%/25% between property sales and rental income, which broadly matched the preceding ten-year average (73%/27%):

- Note that MTVW typically sells its regulated-tenancy properties when the tenancy ends — which almost always occurs when the tenant dies (point 20).

- The mix of properties becoming available for sale — and the total proceeds and profit MTVW generates — can therefore vary significantly from one set of results to the next (see Trading properties: disposals and acquisitions and Trading properties: gross margin and rental income).

- This H1 did not suggest the economy had suddenly improved…

“We will not abandon our financial prudence, but I am determined that we shall protect our staff from the worst economic misfortunes. Many of our staff have been loyal to the Company for many years and they deserve our loyalty.

…

“We live in difficult times, but I believe that this Company will continue to prosper and can continue to care for its staff and its shareholders.”

- …but the narrative did imply employee costs may (once again) increase significantly (point 24).

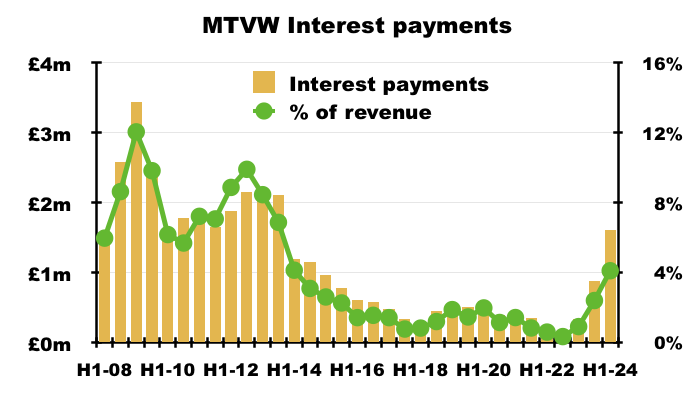

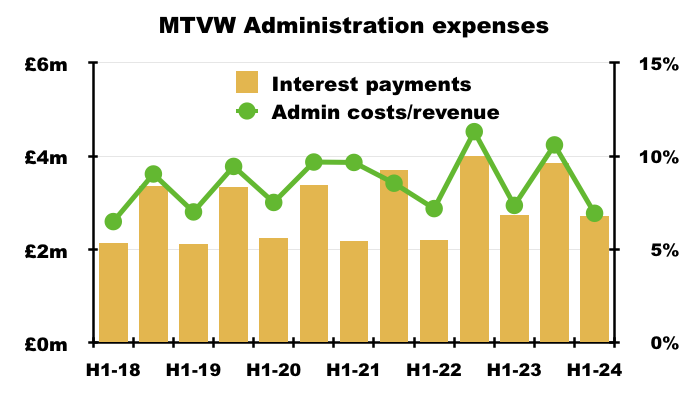

- Interest payments absorbed 4.10% of revenue, the highest proportion since H1 2014 (4.13%):

- Interest payments more than quadrupled to £1.6m due to the higher rate of interest paid on a greater level of debt (see Financials).

- MTVW noted the influence of the higher tax rate on earnings:

“The rise of over 30% in corporation tax from 19% to 25% is the main, if not only, reason that earnings per share have risen only by 1.1%.”

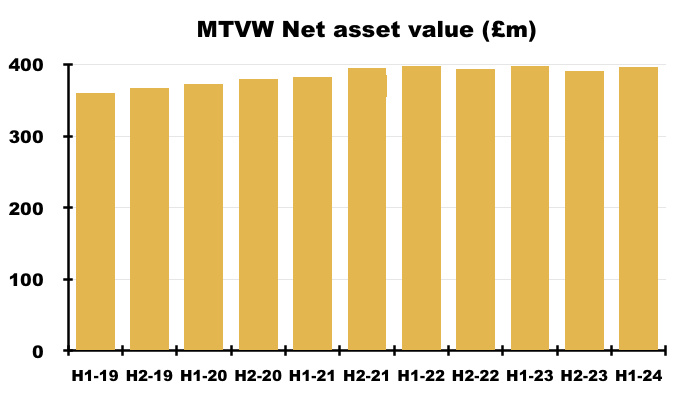

- H1 earnings of £15m less the £10m final dividend from the preceding FY meant net asset value (NAV) increased by just £5m to £396m or £101.53 per share:

- H1 NAV of £396m comprised properties of £468m, debt of £66m and net other liabilities of £6m, and exceeds the £390m market cap (see Valuation).

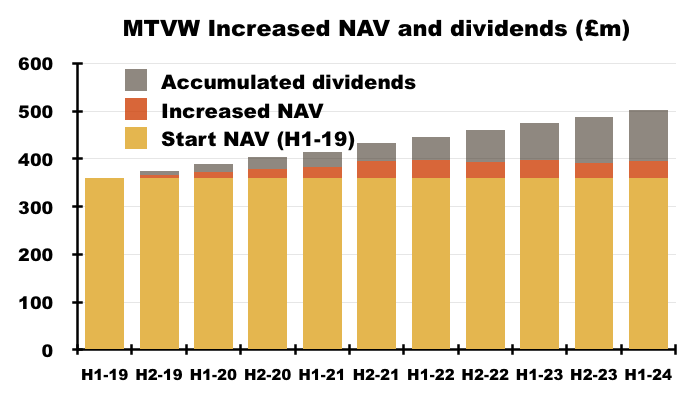

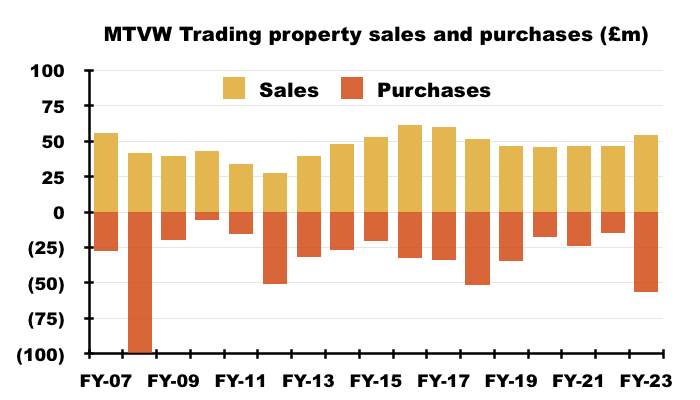

- NAV has increased by approximately £36m or 10% since H1 2019.

- Include dividends paid of £106m, and the combined additional NAV and dividend return comes to £142m or 40% over five years:

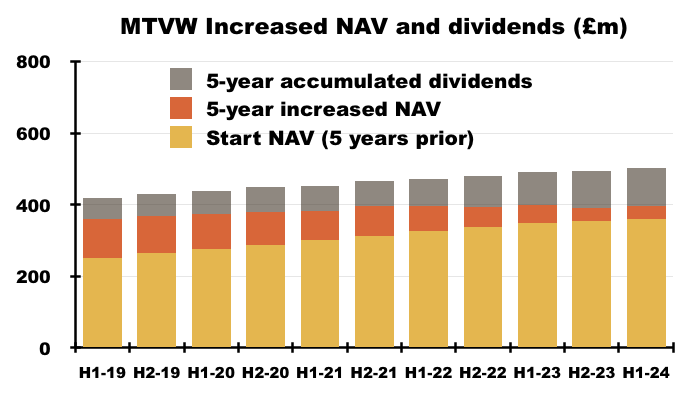

- Five-year shareholder returns through increased NAV and dividends have slowed during recent years.

- For example, increased NAV and accumulated dividends came to £151m during the five years to H1 2021 (a 45% combined NAV and dividend return) — and reached £167m during the five years to H1 2019 (a 67% combined NAV and dividend return):

- The hope is future NAV and dividend growth will improve through savvy property purchases. This H1 suggested such investments have been made:

“Our purchasing activity has remained strong during these six months and our financial strength should enable us to continue to take advantage of good purchasing opportunities.”

- The preceding FY reckoned MTVW’s “lower priced” property portfolio ought to help the group sidestep any housing-market downturn (point 5):

[FY 2023] “We are fortunate that the properties that Mountview brings to auction are typically in high demand as they offer a lower priced entry to the housing market or, if sold to developers, provide opportunity for ‘developer profit’. We are hopeful therefore that Mountview will continue to be well placed to weather any continued down turn in the general housing market, should it occur, through both continuing sales of attractive properties and also with the opportunity to purchase potentially discounted replacement properties both through auction and private tender.”

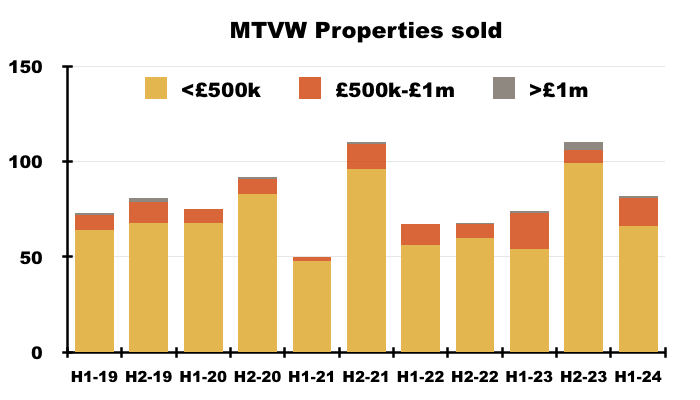

- Most of MTVW’s properties are located within London and south-east England, and 698 (86%) of the 809 properties MTVW sold during the five years to this H1 achieved less than £500k:

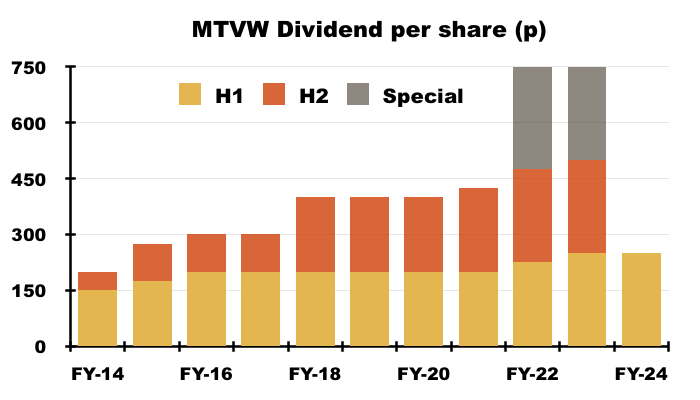

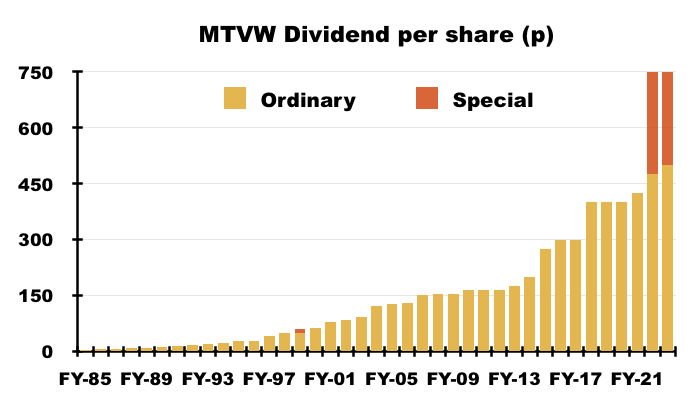

- This H1’s dividend was kept at 250p per share:

- Companies House shows the ordinary dividend has never been cut since at least 1985 — after which the payout has risen 111-fold:

Trading properties: disposals and acquisitions

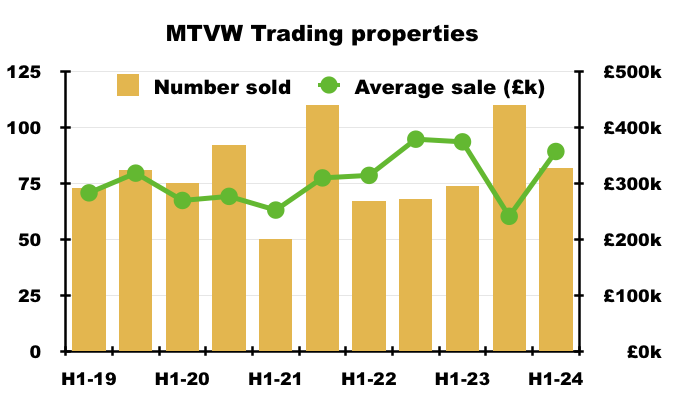

- Revenue of £29m from property sales was generated through the disposal of 82 units, which was the largest number of H1 disposals since H1 2018 (84):

- The average sale price of £357k for this H1 did not seem influenced by numerous sales of ground rents.

- The preceding H2 2023 included the disposal of 50 ground rents for approximately £26k each that reduced the H2 2023 average sale price to £241k.

- Average sales prices can also be skewed by MTVW occasionally collecting £1m-plus from a single transaction. This H1 included one £1m-plus disposal, while the preceding H2 included four.

- Between H1 2019 and this H1, the average sales price has increased by 26%.

- Bear in mind revenue from property sales will be influenced by the unpredictable mix of homes becoming available for sale in any one period (point 20):

[FY 2023] “Regulated tenancies by their nature are not for any specific period of time and in most cases they do not become vacant until the death of the tenant. It is difficult to predict with any certainty the time at which Mountview’s inventory properties might become vacant.”

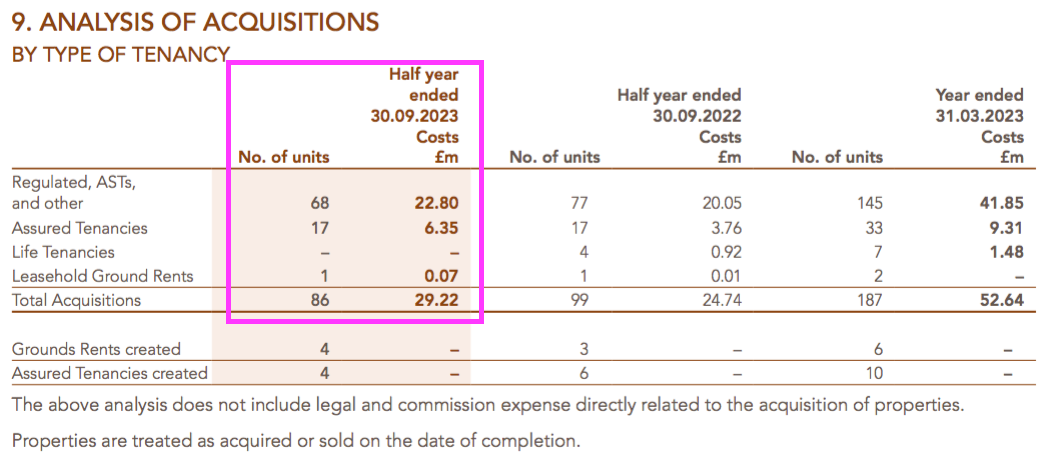

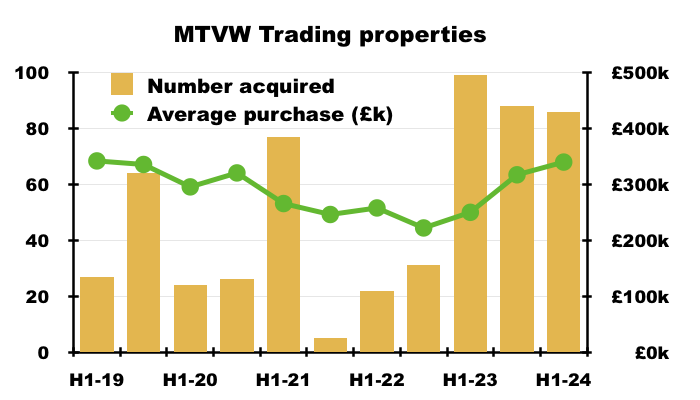

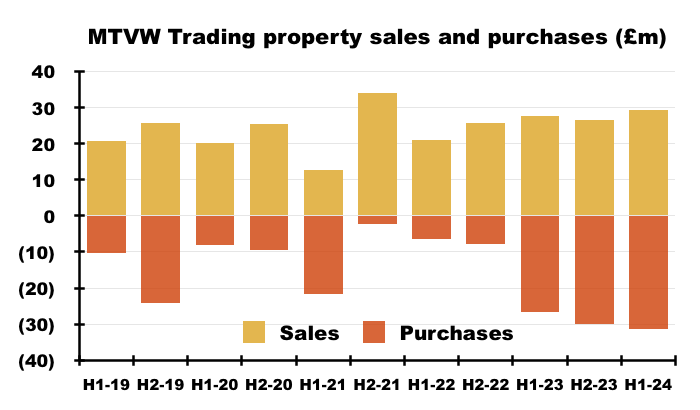

- Some £29m (before purchasing expenses) was used to acquire 86 properties during this H1:

- MTVW has now acquired 80-plus properties during this H1, the preceding H2 and the comparable H1. The previous time more than 80 properties were purchased during a six-month period was H1 2014 (143):

- Including purchasing expenses, the £31m spent on new properties during this H1 was the largest six-month investment since H2 2018 (£43m):

- Including purchasing expenses, the £31m spent on new properties during this H1 and the £30m spent during the preceding H2 2022 was the largest twelve-month investment since FY 2008 (£100m):

- This H1 provided no further insight into the ongoing purchase spree, but the preceding FY did note market and/or regulatory concerns were causing other landlords to sell:

[FY 2023] “There are hypotheses circulating that the growing opportunities for purchasing have arisen due to either general concerns about the property market or more directly, concerns among buyers about acquiring properties with sitting tenants in the face of proposed reforms to the rental market. In either case both play into Mountview’s core values around careful purchasing of primarily regulated tenancies and patience in waiting for vacant possession, with the latter highly aligned with the aims behind the proposed leasehold reform. “

- Management’s 2023 AGM remarks also implied some landlords had become ‘forced sellers’:

[AGM 2023] “Not everyone keeps their gearing at the modest level we do. There are some who are being forced to sell to keep within their borrowing limits, which presents opportunities to us and less competition for properties. The opportunities have been there and the prices have been a little more modest than they were.”

- The ‘forced seller’ theory is supported by the preceding FY implying MTWV was presented with a lot more properties for bulk purchase (point 4):

[FY 2023] “During the year we were offered the opportunity acquire more portfolios than in recent years. While applying our normal due diligence process to the portfolios offered, we were able to secure more than four times by number and value of properties compared with 2022.”

- Bear in mind the preceding FY also talked of “difficult economic circumstances [that] may be with us for some years” — which could mean better buying opportunities still lie ahead.

Trading properties: gross margin and rental income

- MTVW’s margin and profit can fluctuate due to the unpredictable mix of properties becoming available for sale during any particular period.

- The percentage gain on each property sold — reflected by MTVW’s gross margin — is typically correlated to the duration of MTVW’s ownership, which can range from a few years to a few decades.

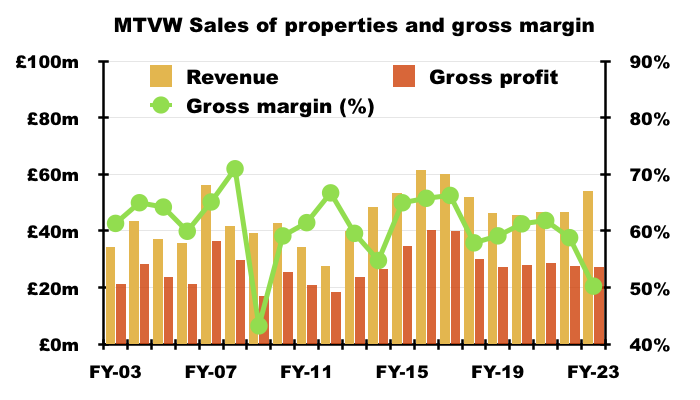

- A 50% gross margin was achieved through property sales during the preceding FY — the lowest since FY 2009 (43%):

- The 50% property-sales gross margin was therefore very unusual, especially as average selling prices (excluding ground rents) during the preceding FY were a record £395k.

- However, the gross margin on property sales for this H1 rebounded to a more reassuring 59%:

- A property-sales gross margin of 59% is equivalent to buying a property for £100k and selling it for £244k.

- The mix of properties sold has tended to even out over time. MTVW’s average property-sales gross margin over five-year periods has been reasonably consistent:

- FYs 2019 to 2023: 58% average;

- FYs 2014 to 2018: 62% average;

- FYs 2009 to 2013: 58% average;

- FYs 2004 to 2008: 65% average, and;

- FYs 1999 to 2003: 59% average.

- Emphasising the gross-margin fluctuations due to the unpredictable mix of properties becoming available for sale, the aforementioned 43% property-sales gross margin for FY 2009 had rebounded to a super 67% by FY 2012.

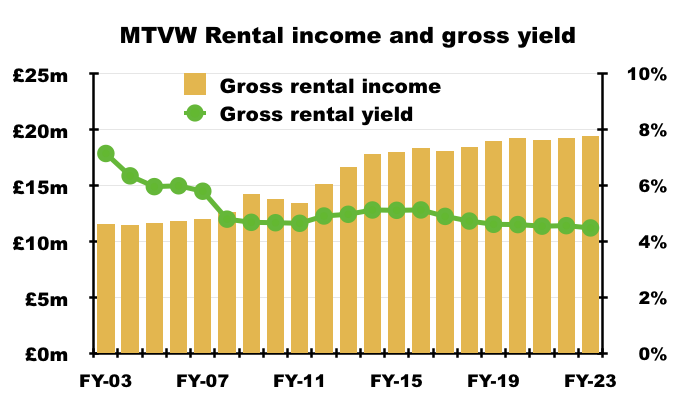

- MTVW’s H1 rental income gained 5% to set a new H1 record at almost £10m:

- The rental-income gross margin remained at a normal 69% after certain maintenance work was deferred during the pandemic.

- Rental income has struggled to advance, gaining only 16% between FYs 2013 and 2023:

- Total rental income from this H1 and the preceding H2 of £20m equates to a 4.4% rental yield from the average £450m carrying value of all properties during the same twelve months.

- That 4.4% rental yield is the lowest since at least FY 1998 and raises questions about the level of rental income from recent purchases given the base rate is 5.25% (see Trading properties: properties not valued by Allsop):

- MTVW’s property estate had a book-value equivalent to a 6% rental yield when interest rates previously approximated 5% prior to FY 2009.

Trading properties: properties valued by Allsop

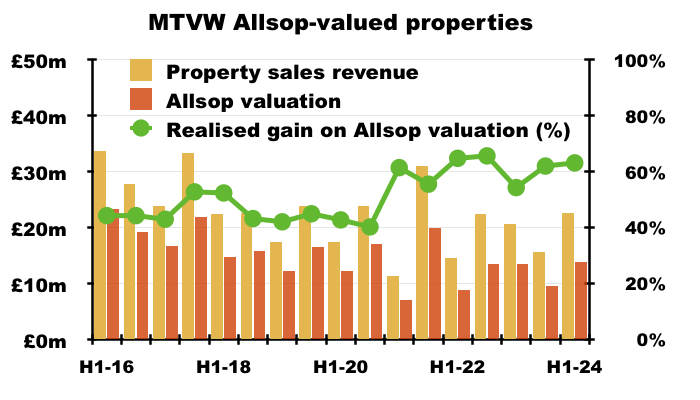

- MTVW continues to dispose of properties at a reasonable premium to a past valuation.

- To recap, MTVW commissioned property agent Allsop during September 2014 to assess the group’s estate.

- Allsop returned a £666m valuation — some 2.1x the £318m book value of the properties owned at the time.

- The Allsop assessment was based on MTVW’s properties remaining in their regulated-tenancy state and therefore excluded any ‘reversionary’ gain (i.e. the value uplift that occurs when a regulated tenancy finishes, the rent reverts to a proper market level and the property can then be sold at a fair market value).

- The Allsop assessment was never applied to the formal accounts. MTVW’s properties instead remain on the balance sheet at their cost price.

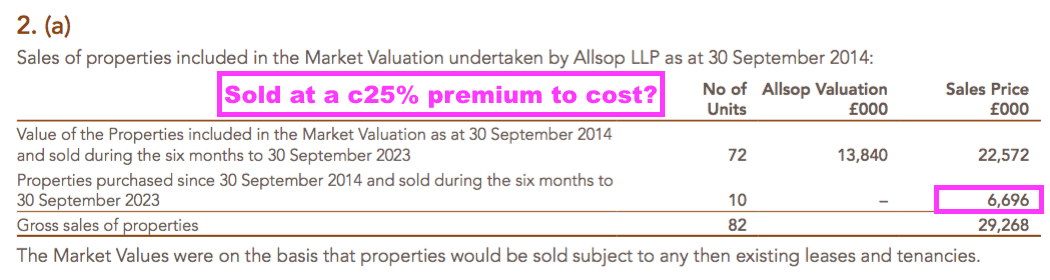

- Following the Allsop assessment, MTVW reveals the proceeds from sold properties versus their Allsop valuation:

- This H1 witnessed MTVW sell properties with a combined £13.8m Allsop valuation for £22.6m — a premium of 63%:

- Prior to the pandemic, premiums of between 43% and 53% on the Allsop valuation were realised on sales proceeds.

- This H1’s 63% premium is the highest save for the 65-66% achieved during FY 2022.

- The realised premium versus the Allsop valuation has implications for estimating MTVW’s potential share price (see Valuation).

- During the nine years following the Allsop assessment, MTVW has raised £410m from selling properties that the agent had valued at £273m.

- Selling properties that Allsop had valued at £273m implies the book value (i.e. the original cost) of the properties sold was £130m (£273m divided by the aforementioned 2.1x multiple).

- Selling Allsop-valued properties with a £130m book value indicates Allsop-valued properties with a £187m book value remain within MTVW’s ownership (i.e. the £318m book value at the September 2014 assessment less the £130m since sold).

- MTVW during this H1 sold Allsop-valued properties with an estimated original book value of approximately £7m (£23m/2.1), which indicates the remaining Allsop-valued properties of £187m could take a further 14 years to sell.

- This H1 showed total trading properties with a £442m book value, implying properties purchased after the Allsop review have a £255m book value (i.e. £442m less the remaining Allsop-valued properties of £187m).

- As more Allsop-valued properties are sold and other properties are purchased, the less relevant the 2014 Allsop valuation becomes to the share price.

- MTVW’s results commentary has never referred to the Allsop valuation since the assessment was undertaken.

- Management’s 2023 AGM remarks reiterated another Allsop-type assessment was not being considered. The same old reasons were once again reeled off:

- The assessment is not used by management;

- The assessment is expensive, and;

- There is no accounting requirement.

- The 2023 annual report repeated the following text from previous years (point 26):

[AR 2023] “The [Allsop] valuation is not a useful tool for running the business because we are always going to await vacant possession, and no perceived uplift in value can justify selling a tenanted property. The nature of our business and the rules and conventions under which we operate place no obligation upon us to value our trading stock at any given time and therefore the valuation has not been updated since.”

- I maintain MTVW could tone down the board’s pay and use the savings to implement regular valuations to provide greater clarity about the inherent value of the group’s property estate.

- In particular, further valuations would help shareholders judge the astuteness of MTVW’s more recent purchases (see Trading properties: properties not valued by Allsop).

- Mind you, MTVW’s long-term dividend and NAV records do not suggest outside shareholders have been too hard done by through a lack of formal valuations.

- September 2024 will mark ten years since the Allsop assessment was undertaken. I doubt the board will commission another revaluation to celebrate the anniversary.

Trading properties: properties not valued by Allsop

- The Allsop assessment and associated disclosures allow shareholders to evaluate the properties not valued by Allsop.

- During this H1, properties bought after the Allsop valuation raised proceeds of £6.7m:

- But what was the original cost of those properties that raised the £6.7m?

- The Allsop-valued properties sold during this H1 had an Allsop valuation of £13.8m, which suggests their book value (i.e. purchase price) was £13.8m/2.1x = £6.6m.

- The total book value of properties sold during this H1 was £12.0m, which implies the book value of the properties bought after the Allsop valuation and sold during this H1 was £12.0m less £6.6m = £5.4m.

- Raising £6.7m from selling properties with an estimated £5.4m purchase price indicates MTVW disposed of the properties at a 25% premium.

- Management’s AGM remarks (during both the 2021 and 2023 events) stressed MTVW purchased regulated tenancies at 75% of their vacant possession value.

- In theory at least, a regulated property purchased one day at 75% of vacant possession value — which then becomes vacant the next day — should enjoy an immediate 33% value uplift.

- During the nine years following the Allsop valuation, I estimate MTVW has raised a total £58m from selling properties not valued by Allsop with an estimated book value (i.e. purchase price) of £54m:

- My estimates do not suggest MTVW has worked miracles buying (and then selling) properties following the Allsop assessment of September 2014.

- My estimates could easily explain why NAV growth has slowed during recent years; properties bought and the sold since September 2014 have seemingly realised limited gains.

- My estimates could also explain why the share price has made little headway during the same time:

- Of course, not every property MTVW has purchased following the Allsop assessment has been sold.

- Those properties not valued by Allsop but still owned by MTVW could be sitting on huge paper gains, while those that have been sold were held for short durations that would always limit their final profit.

- Furthermore, MTVW acquires properties other than regulated tenancies, which may require more than the nine years since the Allsop assessment to maximise their upside.

- Still, buying properties for an estimated £54m and selling for £58m can’t be deemed a rousing success and probably explains the pointed questions from David Pears at last year’s AGM.

- The lack of any further Allsop-type assessment leaves me to assume the properties not valued by Allsop but still carried on the balance sheet may not have a current vacant-possession value vastly in excess of their aforementioned £255m aggregate purchase price.

- Management’s 2023 AGM remarks claimed there was “little difference” between the returns on properties purchased during the 1990s or earlier, and the returns on properties bought since the 2014 Allsop valuation.

Financials

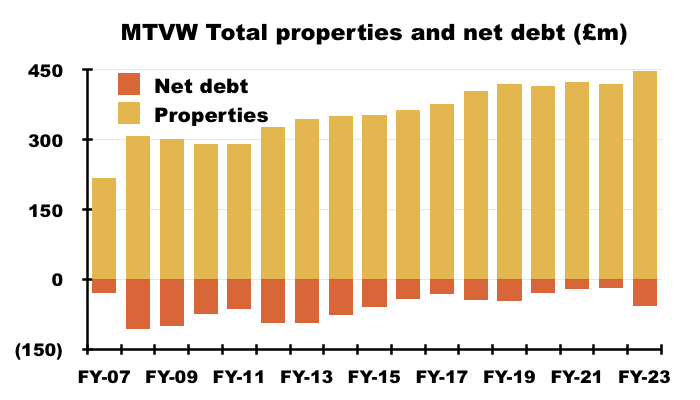

- MTVW’s accounts remain very straightforward, with properties and debt the two prime entries.

- The aforementioned £31m spent on new properties left free cash flow at £1m, with dividends of £10m then taking H1 net debt from £56m to £64m.

- Net debt at £64m is the highest since FY 2014 (£77m) but is equivalent to only 12% of the group’s £468m total property estate:

- For perspective, MTVW operated with net debt equivalent to 25% or more of its property estate during FYs 2008, 2009, 2010, 2012 and 2013:

- Management’s 2023 AGM remarks noted the board would “pay much greater attention to managing debt and cash flow” if gearing reached 25%.

- MTVW’s banking facilities allow borrowings of up to £90m, equivalent to 19% of the total property estate.

- Finance costs of £1.6m for this H1 were more than quadruple the ultra-low £336k for the comparable H1, and implied a 5.2% interest rate on this H1’s £38m average debt.

- My estimated interest cost of 5.2% is the highest since H1 2011 (5.3%).

- The 2023 annual report confirmed (point 29) MTVW’s borrowings are variable rate with a margin of approximately 2% above SONIA:

[AR 2023]

“1. The Group has a short-term borrowing facility of £10 million (2022: £10 million) with Barclays Bank. This is due for review in November 2023 and the rate of interest payable is:

• 1.6% over base rate on overdraft

• Headroom of this facility at 31 March 2023 amounted to £9.94 million (2022: £10 million).

2. The Group has a £60 million (2022: £60 million) long-term revolving loan facility with Barclays Bank with a termination date of March 2027. The rate of interest is 1.9% above SONIA. The loan is secured by a cross guarantee between Mountview Estates P.L.C. and its subsidiaries. The loan is not repayable by instalments. Headroom under this facility at 31 March 2023 amounted to £20 million (2022: £58 million).

3. The Group has re-negotiated a £20 million long-term revolving loan facility with HSBC Bank. The termination date for this facility is March 2028. The rate of interest payable on the loan is 2.1% above SONIA. The loan includes a Negative Pledge. The loan is not repayable by instalments. As at 31 March 2023 headroom under this facility amounted to £3.3 million (2022: £2.8 million).”

- SONIA is currently 5.20%, which means MTVW should now be paying approximately 7.20% on its debt.

- Assuming gross debt stays at £66m and SONIA stays at 5.20%, annual finance costs would advance to £4.8m or 122p per share.

- For perspective, finance costs of £1.2m during the preceding FY were equivalent to 31p per share, although debt averaged £33m during that FY.

- Finance costs of £298k during FY 2022 were equivalent to 8p per share, although debt then was less than £20m.

- Paying an extra £1 per share or so through higher interest is not ideal and will dampen immediate NAV growth…

- …but should (in theory!) enhance longer-term NAV — assuming the properties purchased by the extra borrowings generate eventual returns well in excess of my projected 7.2% annual debt cost.

- This H1’s £5.0m tax charge was MTVW’s first that was derived under the current 25% UK standard rate, and would have been £3.8m under the previous 19% rate.

- The extra tax of £1.2m equates to approximately 31p per share, which annualised indicates a further 62p per share of NAV erosion a year.

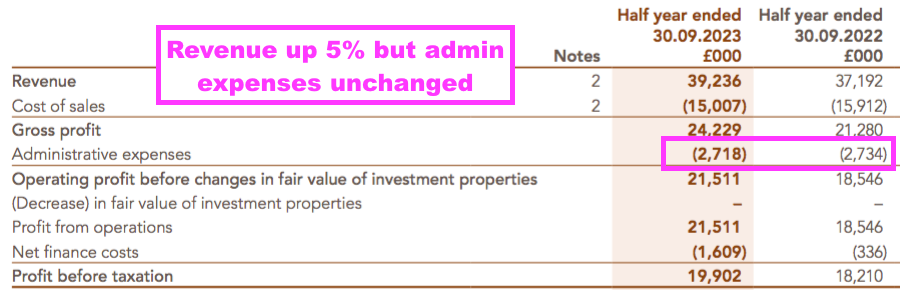

- H1 administration expenses were kept steady despite the greater revenue:

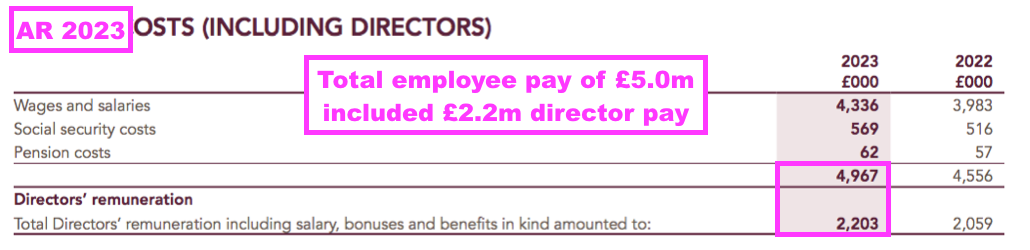

- The majority of administration expenses are employee costs. During the preceding FY, administration expenses of £6.6m comprised employee costs of £5.0m and other costs of £1.6m.

- A significant proportion of employee costs are payments to the directors. During the preceding FY, employee costs consisted of £2.2m paid to the directors and £2.8m paid to other employees:

- Administration expenses absorbed 6.9% of revenue during this H1, the lowest proportion since H1 2018 (6.5%):

- However, administration expenses are weighted towards H2 and the days of yearly administration expenses absorbing less than 6% of revenue seem to have long gone:

- Mind you, administration expenses versus NAV have remained very consistent at less than 2%.

- Lifting the wages of employees — and directors! — may therefore not be entirely out of kilter with the group’s NAV progress.

- MTVW’s chunky salaries may be a by-product of keeping other expenditure to a bare minimum.

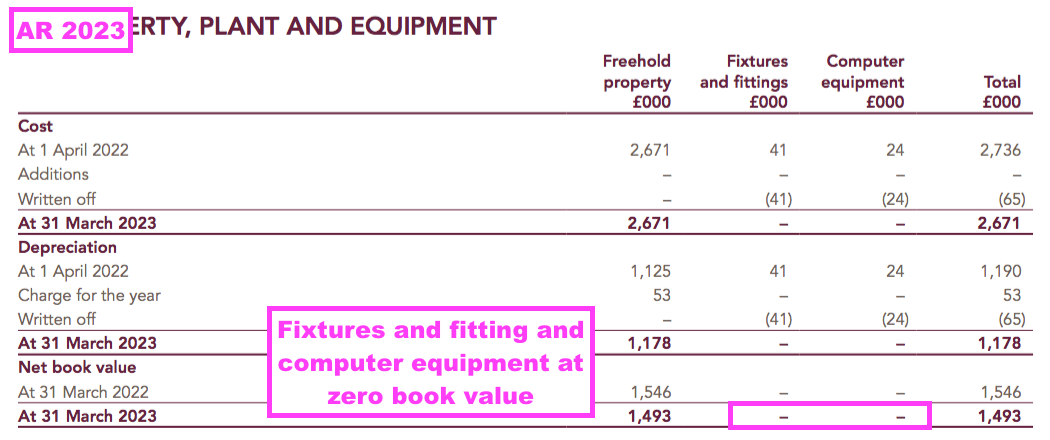

- In particular, the 2023 annual report shows the carrying value of the group’s office fixtures and computers to be zero…

- …with expenditure capitalised on the former last occurring during FY 2018 and expenditure capitalised on the latter last occurring during FY 2020.

- Nothing is certainly spent on investor communications beyond the annual report, the AGM, the occasional terse RNS and the website.

Protest votes and search for new non-executive

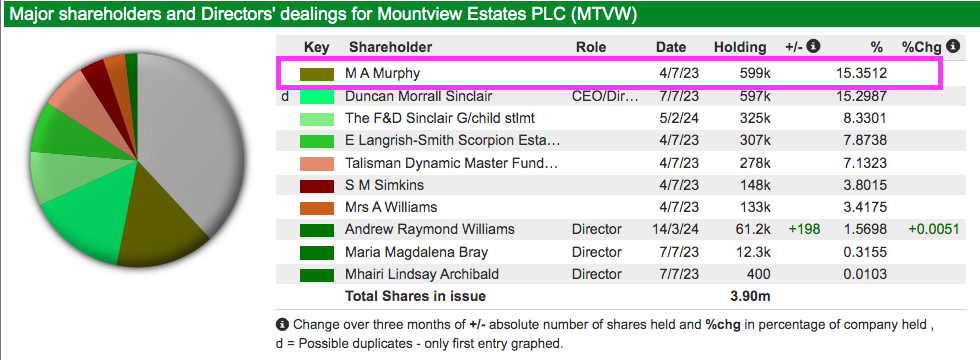

- MTVW’s shareholders fall into three camps:

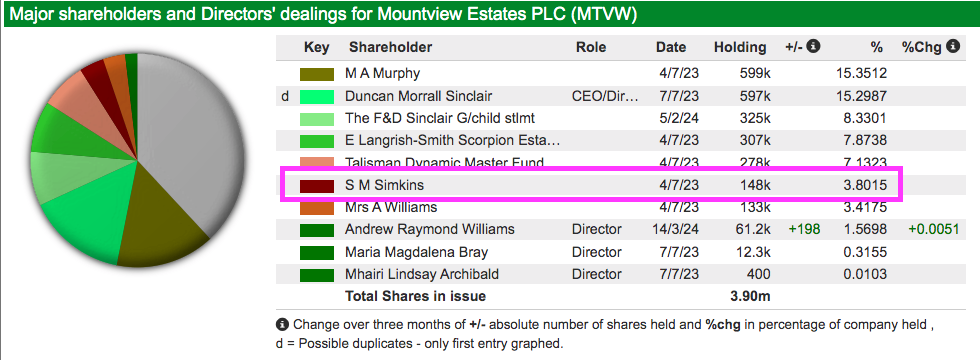

- The Sinclair family concert party, which is led by chief executive Duncan Sinclair and controls 50.4% of the share count (see Sinclair family concert party);

- The Murphy family and connected parties, who claim to own 24% of the share count and whose leading shareholder is Margaret Murphy, the chief executive’s sister, and;

- Everybody else, who own approximately 25% of the share count.

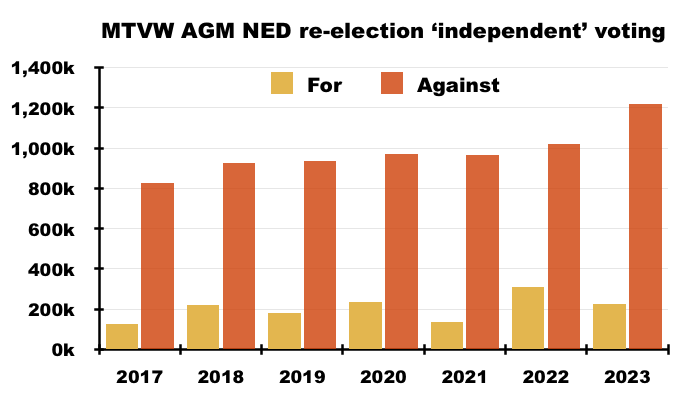

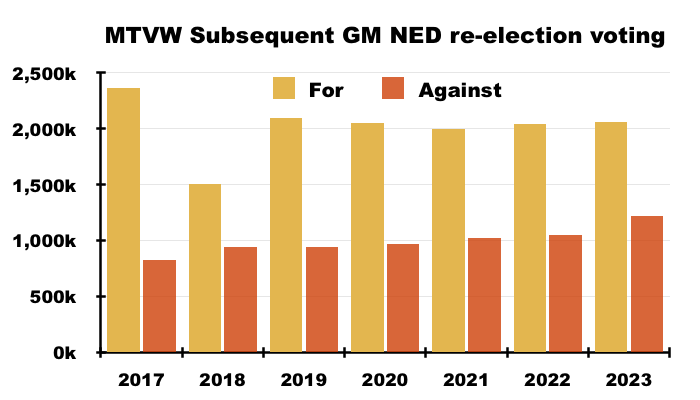

- MTVW’s last seven AGMs have witnessed c30% (or more) protest votes against:

- Re-electing certain non-execs;

- Approving the board’s pay, and;

- Re-appointing the auditors.

- The protest votes have been led by the Murphy family and connected parties.

- From what I can tell, the Murphy family is broadly satisfied with how MTVW’s day-to-day operations are run, but:

- Is aggrieved about the board’s (generous) pay;

- Has lost the trust of the non-execs to act on the views of all shareholders, and;

- Is frustrated about a general lack of influence at board level.

- The Murphy family stated during the 2021 AGM that it was no longer in direct communication with the company and would engage with the directors only through a “public forum“.

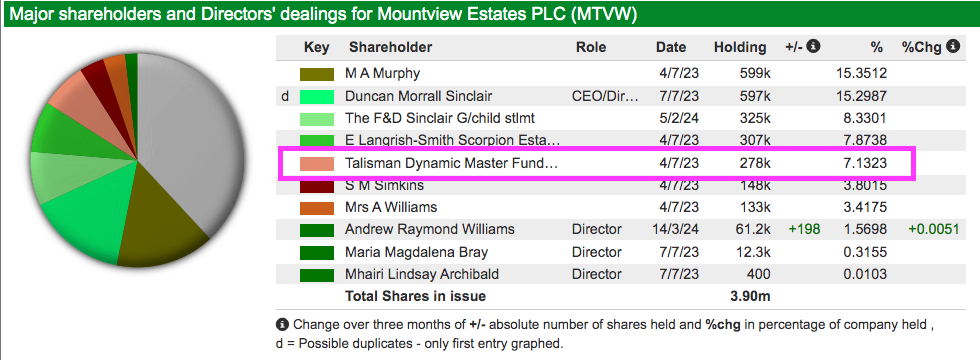

- The 2023 AGM attracted another unhappy shareholder, David Pears, who is a member of the Pears family that owns property group William Pears and controls a 7% stake in MTVW through the family’s Talisman investment fund:

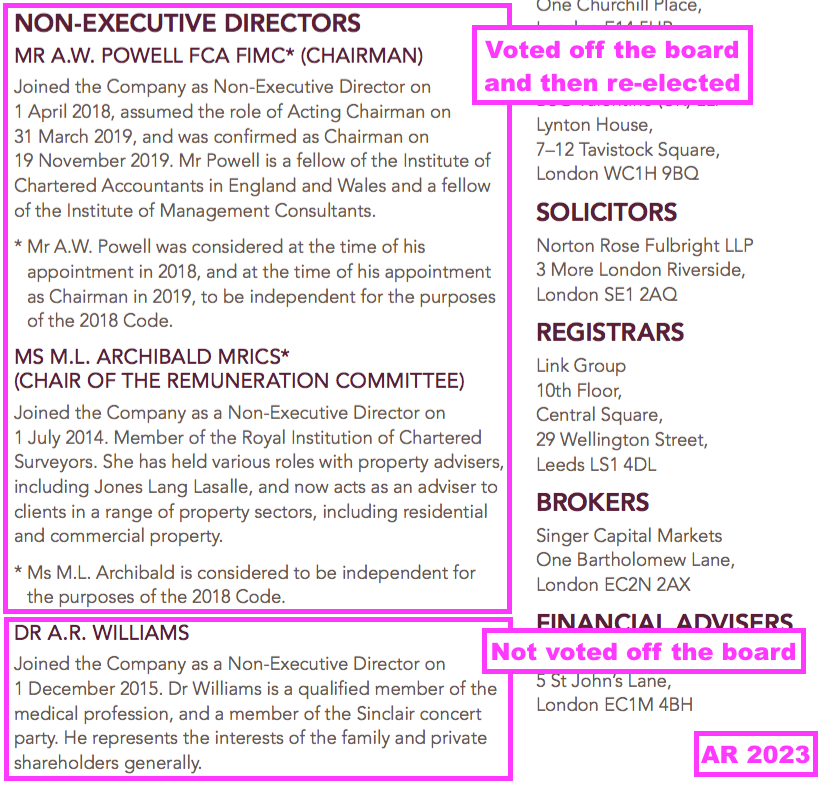

- The Murphy family, (presumably) Talisman and other unhappy shareholders prevented the re-election of certain non-execs at the last AGM — and the six prior AGMs:

- Following each AGM, MTVW is entitled to convene a general meeting (GM) and hold a further vote to re-elect the ousted non-execs.

- The ousted non-execs have (to date) all been re-appointed at the subsequent GMs because the Sinclair family concert party can then vote on the non-exec re-elections (unlike at the AGMs, where the concert party is prohibited from voting on particular ‘independent’ resolutions):

- The number of unhappy shareholders has been increasing. The average AGM /GM votes against the re-election of the contentious non-execs have climbed from c827k to c1,220k since 2017.

- The 2023 AGM also revealed a 9% protest vote against MTVW’s two executives. Near-3% protest votes against the executives were lodged at the 2022 AGM, with immaterial protest votes lodged before 2022.

- Stock-market rules dictate any company incurring a 20%-plus AGM or GM protest vote has to contact the unhappy investors and publish an update to shareholders within six months.

- Six months after the 2023 AGM, during February 2024, MTVW announced:

[RNS Feb 2024] “Following the 2023 AGM, and as it has done previously, the Company identified as far as possible those shareholders who did not support the various resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage, other shareholders raised matters which are under consideration by the Board. The Board is grateful to those shareholders who took part in the engagement process and value the feedback provided. The Company remains committed to shareholder engagement and we will continue to offer to have discussions with shareholders and will take into account their concerns and considerations in the future.”

- Whether any of the matters raised will convert into action remains to be seen.

- But 14 AGM/GM protest votes since 2017 suggest the “engagement process” has no influence on board decisions.

- The ineffective protest votes have not yet persuaded the Murphy family to sell; in particular, Companies House indicates Margaret Murphy has maintained a 500k-plus shareholding since at least 1980:

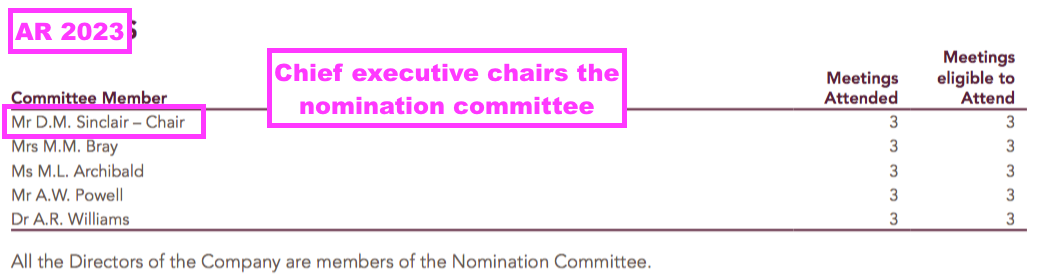

- A flashpoint at the upcoming 2024 AGM could be the appointment (or lack of appointment!) of a replacement non-executive.

- The replacement non-exec will be ‘independent’ of the Sinclair family concert party, and could allow the Murphy family and other unhappy shareholders to enjoy greater influence at board level.

- The 2023 annual report claimed the replacement non-exec would be recruited within “six to nine months” (point 17b):

[AR 2023] “The Nomination Committee has commenced its search for a new, suitably experienced and qualified independent Non- Executive Director and has engaged an external recruitment consultant Stephenson Executive Search Ltd, which has no other connection with the Group. The Nomination Committee is reasonably confident that it will be in a position to complete the recruitment and appointment process within the next six to nine months. It is envisaged that the new independent NED will have a short period of overlap with Ms Archibald to enable a smooth and seamless transition of Ms Archibald’s role and duties as chair of the Remuneration Committee and her other committee membership roles and responsibilities.“

- The 2023 annual report was published on 28 July 2023, and therefore the new appointment ought to have been announced by the end of April 2024.

- The absence of an appointment is not encouraging for the Murphy family and other unhappy shareholders. The worry perhaps is the board’s nomination committee, which is chaired by chief executive Duncan Sinclair, is not pursuing the appointment with suitable urgency:

- Alternatively, the board may have struggled to find a qualified non-exec who meets the appropriate diversity criteria. The 2023 annual report stated (point 17c):

[AR 2023] “The Board is aware that the target in LR 9.8.6 R(9)(a)(ii), having at least one Board member from a minority ethnic background, has not been met and its consideration will form part of its deliberations in building a diverse and inclusive culture on the Board… The Committee keeps the composition of the Board, and its diversity, under close review and in considering and acting upon its succession planning for the refreshment of the Board is ensuring that the current search for a new independent NED is open to people of all backgrounds.”

- Or perhaps the board has struggled to find a new non-exec that wishes to be voted off the board at every AGM and re-elected through a follow-up GM.

- The sole non-exec who is not voted off the board at every AGM is Dr Andrew Williams, who is a grandson of MTVW co-founder Frank Sinclair.

- According to the 2023 annual report, Dr Williams is a member of the Sinclair family concert party (but has not been named as such — see Sinclair family concert party) and “represents the interests of the family and private shareholders generally“:

- I attended MTVW’s 2019, 2021 and 2023 AGMs and Dr Williams did not speak during the formal Q&A sessions at all three events.

Sinclair family concert party

- The Sinclair family concert party is led by MTVW chief executive Duncan Sinclair and seven years of outvoting unhappy shareholders prove the arrangement effectively controls the group.

- MTVW’s 2005 annual report appears to be the first that formally mentioned the concert party, and stated the aggregate party shareholding was then “approximately 53%“.

- The last update on the aggregate shareholding during November 2022 stated a 50.4% ownership.

- MTVW last confirmed the membership of the Sinclair family concert party during January 2020:

- [RNS Jan 2020]

- Anray Limited (associated with Mrs Angela Williams)

- Mrs Elizabeth Langrish-Smith

- Mrs Emma Adjaye

- Mr James Langrish-Smith

- Mr Matthew Langrish-Smith

- Scorpion Estates Limited (associated with Mrs Elizabeth Langrish-Smith)

- Mrs Susan Mary Simkins

- Mr Ronnie Simkins

- Miss Louise Simkins

- Mr Thomas Simkins

- Whitehart Holdings Pty Ltd (associated with Mr Alistair Sinclair)

- Viewthorpe (Old) Limited (associated with Mr Alistair Sinclair)

- Mr Duncan Sinclair

- Sinclair Estates Limited (associated with Mr Duncan Sinclair)

- The Sinclair Charity (associated with Mr Duncan Sinclair)

- Viewthorpe (Subco2) Limited (associated with Mrs Susan Mary Simkins)

- Mrs Angela Williams

- Mr Rupert Williams

- Courtland Capital Limited (associated with Mr Rupert Williams)

- Frank & Daphne Sinclair Grandchildren Settlement

- Old MTVW annual reports identify leading concert-party members Mrs Elizabeth Langrish-Smith, Mrs Angela Williams and Mr Alistair Sinclair to be children of MTVW co-founder Frank Sinclair.

- I have been unable to establish whether Mrs Susan Simkins is the daughter of co-founder Frank Sinclair, daughter of co-founder Irving Sinclair, or is some other Sinclair family member.

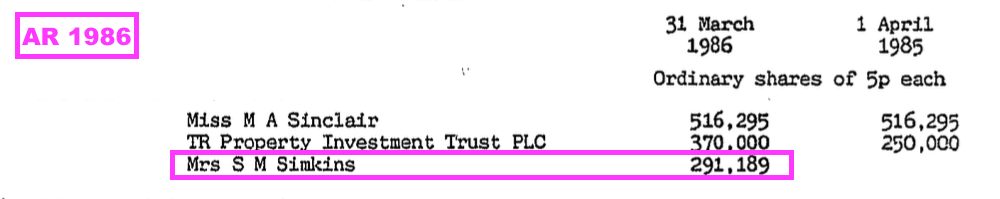

- The 1986 annual report shows Mrs Simkins owning 291k shares while SharePad now shows that holding reduced to 148k:

- Chief executive Duncan Sinclair is the son of MTVW co-founder Irving Sinclair.

- I believe every other concert-party member is a relation of either Mr Alistair Sinclair, Mrs Elizabeth Langrish-Smith, Mrs Angela Williams or Mrs Susan Simkins.

- The question for unhappy shareholders is how long can the Sinclair family concert party remain intact to retain effective control of the group?

- Companies House reveals the leading party members are between 69 and 76 years old:

- Duncan Sinclair (born October 1947);

- Mr Alistair Sinclair (born September 1949);

- Mrs Elisabeth Langrish-Smith (born April 1952);

- Mrs Angela Williams (born April 1952), and;

- Mrs Susan Simkins (born May 1955).

- At some point the collective 50.4% will be controlled entirely by younger members of the Sinclair family, who may have an alternative approach to handling a near-£200m aggregate investment.

- From what I can tell from my AGM visits and messages via my contact page, the concert party has not lined up a family member to one day succeed chief executive Duncan Sinclair.

- The chairman had indicated succession planning was underway during 2014:

[FY 2014] “Duncan Sinclair has been with the Company for 43 years, during which he has occupied the positions of Company Secretary, Director, Executive Chairman and Chief Executive. The Company has grown and developed significantly since Duncan became Chief Executive in 1990. The search to find and establish Duncan’s successor is on going and now intensifying. This is an important phase in the Company’s development.“

- But a year later the chairman had left and Duncan Sinclair said he was staying put:

[FY 2015] “Our management teams continue to evolve and it may become appropriate to appoint one or more of these personnel to the Board. The continuing good results and the sound financial structure of the Company are a testimony to tried and trusted methods and tried and trusted personnel. Whilst we are aware of the need for our management structure to evolve for the future benefit of the Company, our results do not suggest that radical surgery is needed as a matter of urgency.

The default retirement age has been abolished and shareholders will be aware that many companies are being well served by men and women who would once have been regarded as being of advanced years. I may be considered to fall into this category, but I will be happy to step aside when we have in position those of proven ability who are capable of producing results at the level for which I have been responsible for an extended period of years.“

- With Duncan Sinclair still in charge today, that 2015 text suggests MTVW has never found anybody to match his “proven ability”.

- At some point of course, a new chief executive will be needed and, without an obvious family successor, the Sinclair family concert party could be at risk of losing its grip on the boardroom.

- But the wait for a leadership change could be long. Chief executive Duncan Sinclair is 76 and his father, co-founder Irving Sinclair, retired from the board at 86.

- Still, MTVW is a share for extremely patient investors. The group was established during 1937 and floated during 1960, since when the shares have climbed from (an estimated) 11p to £100 with at least another £60 per share of dividends declared along the way.

- Family shareholders (even unhappy ones) have generally kept their shares through thick and thin… attracted presumably by the genuine asset backing, reliable dividend and the prospect one day of a trade sale when family leadership is no longer available.

- One could surmise while MTVW patiently waits for its regulated properties to be vacated to earn a suitable return…

- … unhappy shareholders are patiently waiting for the boardroom to be vacated to earn a suitable return.

Valuation

- MTVW’s shares might be attracting bid interest today were it not for the majority concert-party holding.

- I calculate the shares could be worth £189 were all of the group’s regulated tenancies to end immediately and the properties then sold at a fair market value.

- The following table outlines the sums:

| Property stock Sept 2014 (£k) | 317,651 |

| Less sold Allsop-assessed stock (£k) | (130,372) |

| 187,279 | |

| Allsop-premium-to-book | 2.10x |

| Sold-premium-to-Allsop | 1.63x |

| 639,901 | |

| Stock purchased since Sept 2014 | 254,952 |

| Possible property stock value (£k) | 894,854 |

- I have taken the estate’s September 2014 value of £318m and subtracted the (estimated) £130m book value of Allsop-assessed properties sold since that date.

- I then multiplied the £187m remainder by the 2.1x ‘Allsop-premium-to-book’ multiple and then added the 63% ‘sold-premium-to-Allsop’ gain that was realised during this H1.

- I arrived at a £640m estimate for all of MTVW’s properties that were owned at September 2014 but have yet to be sold.

- Since September 2014, MTVW has acquired additional properties with a £255m book value.

- I have assumed these additional properties will be sold for their £255m book value — based upon my analysis of properties bought and then sold since the Allsop assessment (see Trading properties: properties not valued by Allsop).

- Adding the £640m and the £255m together gives £895m.

- This next table adjusts that £895m for 25% taxation, the £25m conventional property portfolio, net debt and other liabilities to give a possible NAV of £735m or £189 per share:

| Possible property stock value (£k) | 894,854 |

| Less tax at 25% (£k) | (113,156) |

| Plus other investments (£k) | 25,415 |

| Less net debt (£k) | (64,292) |

| Less other liabilities (£k) | (7,473) |

| Possible NAV (£k) | 735,348 |

| Possible NAV per share (£) | 188.60 |

- My estimated NAV sums are not perfect, and the following questions remain unanswered:

- How long will MTVW take to sell all of its properties?

- Will future house-price inflation compensate for being unable to sell all the properties immediately?

- How relevant is the 2014 Allsop assessment today?

- Will properties bought since the 2014 Allsop assessment continue to be sold close to cost price?

- What impact could annual admin costs of £7m have on the calculations? (I have ignored such costs)

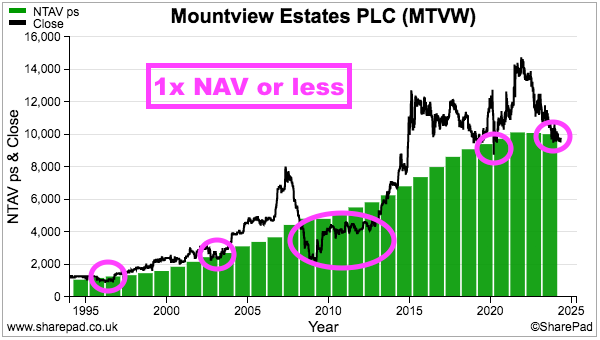

- MTVW’s shares have drifted lower to trade at NAV:

- The best time to buy appears to be when the market cap trades at (or below) NAV, at which point no future gains from any property purchases are priced into the valuation.

- What future gains could lie ahead?

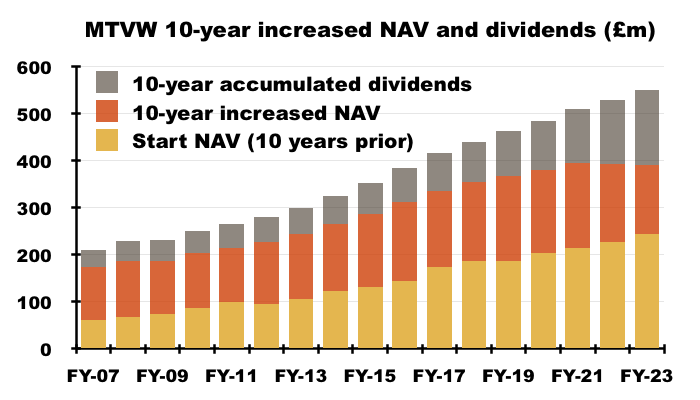

- For perspective, the ten years to this H1 witnessed:

- NAV advance by £146m, from £250m to £396m, and;

- Cumulative dividends paid of £164m:

- Generating an additional £300m (£146m extra NAV plus £164m cumulative dividends) from a starting NAV of £250m over ten years equates to a compound annualised return of 8.4%.

- For further perspective, the ten years to FY 2016 witnessed NAV advance £169m and dividends accumulate to £74m, equating to a 10.4% compound annualised return from a £143m starting NAV…

- …while the ten years to FY 2007 witnessed NAV advance £111m and dividends accumulate to £36m, equating to a 13.0% compound annualised return from a £62m starting NAV:

- The next ten years repeating the aforementioned 8.4% annualised return may not enthuse prospective investors given:

- MTWV’s ten-year returns have been declining over time, and;

- Fixed-term cash alternatives currently yield 5%.

- Perhaps a discount to NAV is now required to generate suitable investment returns.

- For example, my original MTVW purchase occurred during 2011 when the £42 shares traded at 0.75x the then £55 per share NAV.

- Since then:

- The market cap has advanced by £226m, from £164m to £390m, and;

- Cumulative dividends of £181m have been paid…

- …equating to an 10.1% annualised total return over the last 13 years.

- Without the market-cap re-rating from the then 0.75x NAV to today’s 1x NAV, my annualised return from that original £42 purchase would have been 8.5%.

- Could the “difficult economic circumstances [that] may be with us for some years” one day compress the share price towards a 0.75x NAV multiple?

- The shares sank to £21 at the depths of the 2008 banking crash, giving buyers a 0.44x NAV multiple versus the then £48 per share NAV.

- But taking a positive view, the aforementioned 2014 Allsop assessment pushed the shares to £125 during early 2015 as buyers paid 1.69x the then £74 per share NAV:

- Another Allsop assessment divulging further ‘hidden value’ could easily prompt a favourable price-to-NAV re-rating.

- Occasional bouts of wider market optimism can also push the share price well beyond NAV. In particular:

- The £145 peak during 2021 was equivalent to 1.42x the then £102 per share NAV, and;

- The £80 peak during 2007 was equivalent to 1.75x the then £46 per share NAV.

- At least future returns from today should be front-loaded by dividend payments:

- The illustrious ordinary payout supplies a 5.0% income at a £100 share price — the highest yield for at least 30 years excluding the banking crash.

Maynard Paton

Mountview Estates (MTVW)

Update on General Meeting voting outcome published 20 May 2024

Nothing much too see here — MTVW thanks those unhappy shareholders who spoke to the board about their protest votes at November’s general meeting. Here is the full text:

——————————————————————————————————————

“ In accordance with provision 4 of the UK Corporate Governance Code, the Company is providing the following update to the General Meeting voting results announced on 20 November 2023 regarding the significant vote against both resolutions which were put to shareholders at the General Meeting, namely:

Resolution 1: to re-elect Mr. A.W. Powell as a director of the Company; and

Resolution 2: to re-elect Ms. M.L. Archibald as a director of the Company.

At the General Meeting, both Mr. A.W. Powell and Ms. M.L. Archibald were re-elected as directors of the Company.

Following the meeting, the Company identified, as far as possible, those shareholders who did not support the resolutions and attempted to engage with them to seek their views. Some shareholders did not wish to engage, other shareholders raised matters which are under consideration by the Board and its Committees. The Board is grateful to those shareholders who took part in the engagement process and value the feedback provided. The Company re-affirms its commitment to ongoing shareholder engagement and will continue to offer to have discussions with shareholders and will take into account their concerns and considerations in the future.”

——————————————————————————————————————

This time MTVW said the matters raised were are under consideration by the Board “and its Committees” — although whether the addition of “Committees” will mean deeper consideration about the matters raised is not clear. I suspect not!

Maynard

Hi Maynard

Thank you for all your informative comments on various companies, much appreciated. What about MTVW, looking a bit seedy now, is this due to family infighting or just being inept?

Invest or dump and run?

Best wishes, Bertie

Hi Bertie,

Well I invested more a few months ago (here). The lowly share price — now below book value — is perhaps due to MTVW’s property purchases since 2014 realising quite modest gains. I included my calculation within my last MTVW blog post (here) and the topic was discussed at length during the recent AGM. The general vibe from attendees after the formal meeting was MTVW’s stated ambition to acquire regulated tenancies at a 25% discount to vacant possession value was rather optimistic.

Maynard

Any news on the appointment of the new INED. We should have heard month ago?

Please keep up with your excellent analysis

Where did the #300k of shares sold by the director end up. Talisman? They must have been placed as there is no ready market for the shares

Hi Max

No news on the new non-exec. At the AGM the board talked of not finding the right person for a variety of (unspecified) reasons but interviews would be continuing. I think the outgoing non-exec is scheduled to retire in March 2025. The 3,400 shares did look to be placed as they were repurchased within 15 minutes of the sale. Hopefully Talisman did pick up a few as the board did suggest at the AGM it was engaging with David Pears behind the scenes. Will hopefully have my next MTVW write-up — and AGM notes — published before the November interims!

Maynard