01 February 2023

By Maynard Paton

Results summary for FW Thorpe (TFW):

- A record FY outcome (profit +29%) bolstered by the acquisition of Spanish firm Zemper that supported TFW’s 20th consecutive annual dividend increase.

- Progress at Thorlux was supported by impressive SmartScan sales (+49%), with the innovative lighting system reducing running costs for customers by as much as 62%.

- A positive Dutch performance has led to a reassuring non-exec appointment and an encouraging start within the electric-vehicle charging market.

- Net cash of £39m may arguably be only £9m following the subsequent purchase of TFW’s largest customer plus the eventual earn-out for Zemper.

- A possible 24x P/E seemingly reflects TFW’s healthy order book, savvy acquisition approach, distinguished operating history and growth opportunities beyond the UK and lighting. I continue to hold.

Contents

- News links, share data and disclosure

- Why I own TFW

- Results summary

- Revenue, profit and dividend

- Thorlux

- Netherlands

- Zemper

- Ratio Electric

- Other companies

- SchahlLED

- Financials

- Valuation

News links, share data and disclosure

News: Annual report for the twelve months to 30 June 2022 published 11 October 2022, acquisition published 26 September 2022, directorate change published 24 October 2022 and AGM statement published 17 November 2022

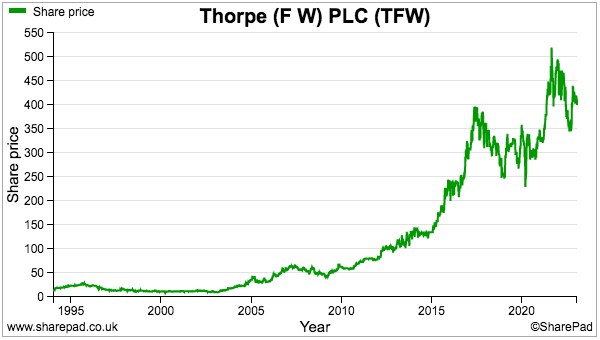

Share price: 400p

Share count: 118,935,590

Market capitalisation: £476m

Disclosure: Maynard owns shares in FW Thorpe. This blog post contains SharePad affiliate links.

Why I own TFW

- Develops professional lighting systems with a long-established reputation for high product quality, leading technical innovation, first-class service and sustainable manufacturing processes.

- Board led by a veteran executive and assisted by family non-execs who steward a 42%-plus/£203m-plus shareholding and favour special payouts.

- Conservative accounts display useful operating margins, substantial cash reserves, consistent working-capital management and illustrious rising dividend.

Further reading: My TFW Buy report | All my TFW posts | TFW website

Results summary

Revenue, profit and dividend

- Record H1 figures that included encouraging remarks for H2…

“Supported by the Group’s healthy order book, I foresee a good second-half revenue performance, provided the component shortages continue to improve. Operating results remain the focus and will improve once the recent headwinds experienced for most businesses subside.”

- …had already suggested a very satisfactory FY 2022 outcome.

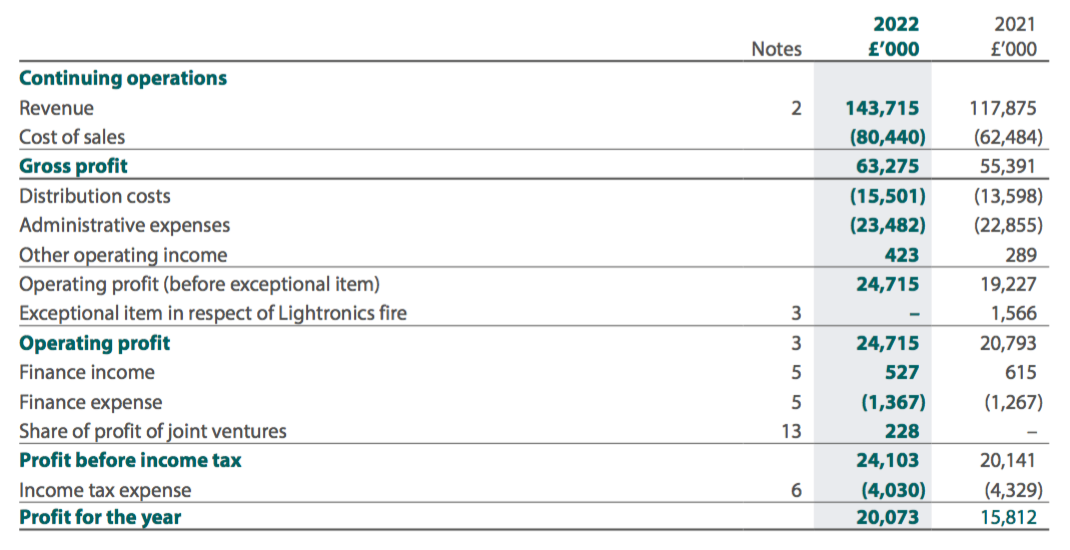

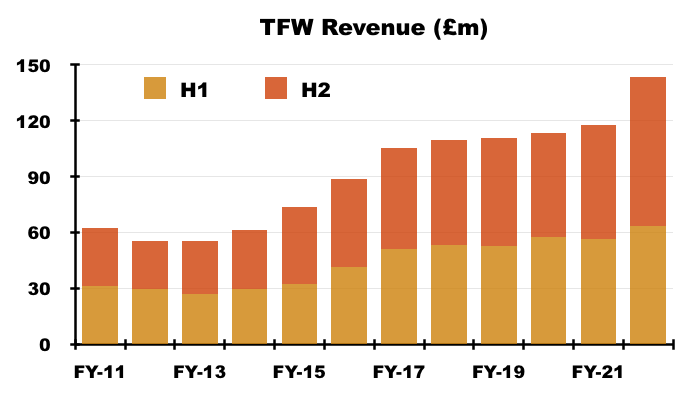

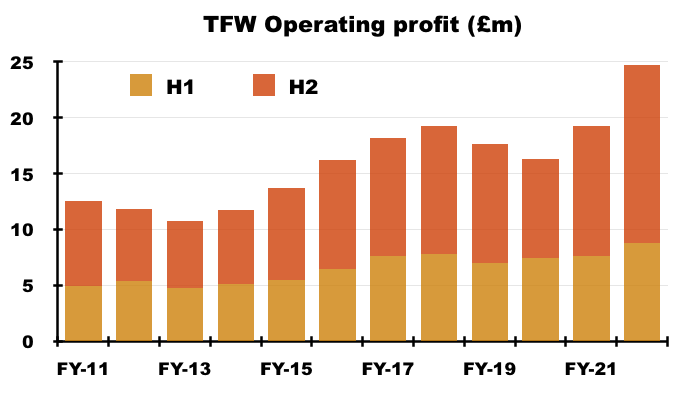

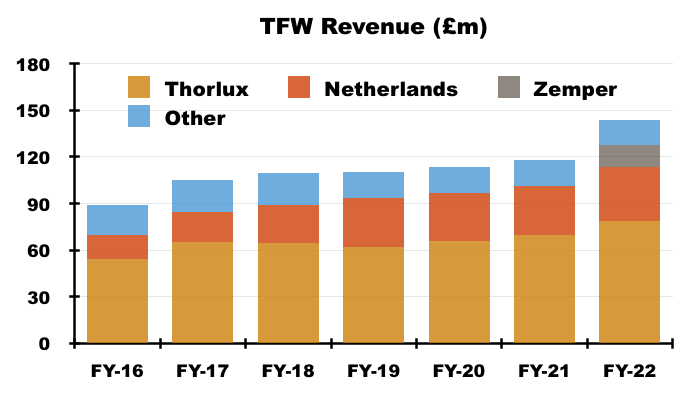

- FY revenue gained 22% to almost £144m while FY operating profit climbed 29% towards £25m:

- The purchase of Zemper during October 2021 helped deliver the new FY revenue and profit highs.

- Without the Spanish acquisition, revenue would have gained 10% and operating profit would have gained 20%.

- H2 was especially strong, with H2 revenue up 15% and H2 operating profit up 27% excluding Zemper.

- Healthy order books underpinned by customers seeking to mitigate higher energy bills…

“The dramatic rising cost of energy is a catalyst for customers to study their lighting energy consumption and look for ways to reduce it… Customers’ energy costs have trebled in some instances, which means investment payback periods could be one third of those a year ago.“

- …as well as price rises to offset greater costs supported the positive progress. The prior-year performance was also dampened by the effects of the pandemic.

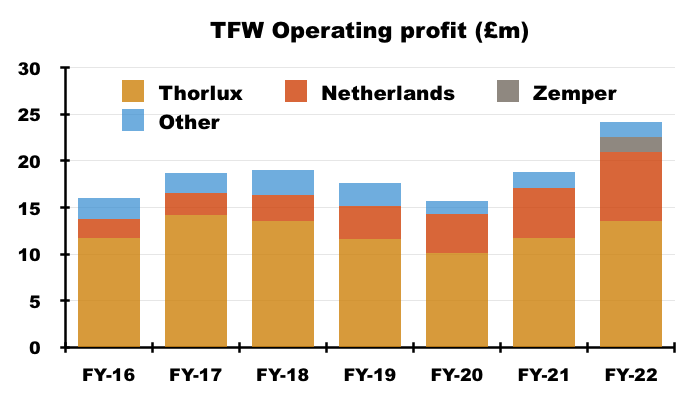

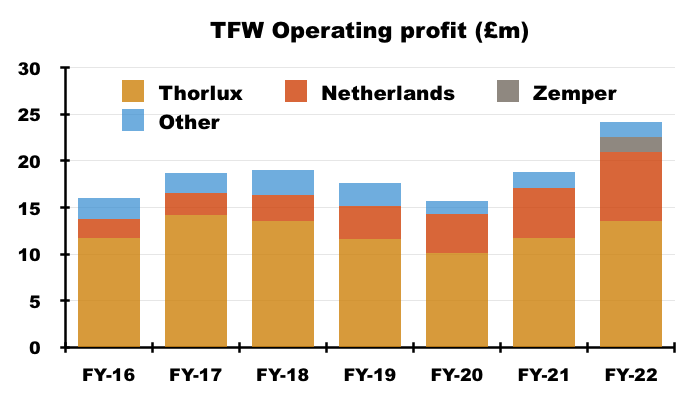

- FY profit was assisted by the absence of earn-out provisions within the Netherlands division, which led to the Dutch subsidiaries representing a third of group profit (see Netherlands):

- Zemper’s reported profit was meanwhile suppressed by an amortisation charge associated with the acquisition (see Zemper).

- The preceding H1 admitted revenue had been held back by supply problems:

“Sales revenues were suppressed across the Group at +4% (excluding the addition of Zemper), because of each company’s difficulty sourcing sufficient components, in particular electronic components and microchips“

- This FY statement reiterated the same difficulties:

“Most companies in the Group suffered severe component shortages throughout the financial year, hampering production output and efficiency, and softening year-end results.”

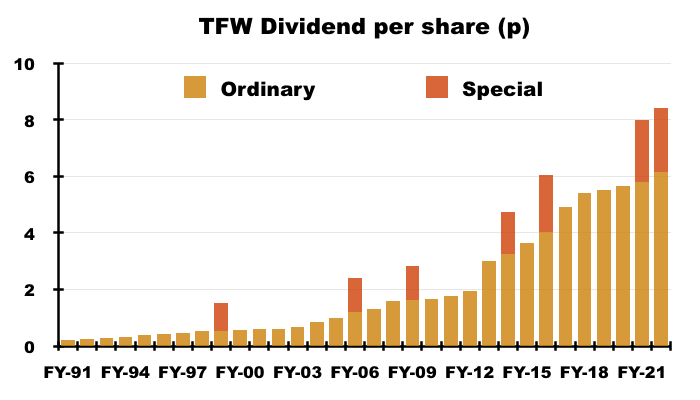

- After the ordinary H1 dividend was lifted 3%, the final dividend was raised 7% to cement TFW’s 20th consecutive annual payout increase:

- The dividend has not been cut since at least 1991, although dividend cover at one point reaching 5x did leave plenty of leeway for payout advances.

- The preceding H1 and FY 2021 statements had both declared special dividends, but these FY results did not complete a bonus-payout hat-trick due to another acquisition (see SchahlLED).

Thorlux

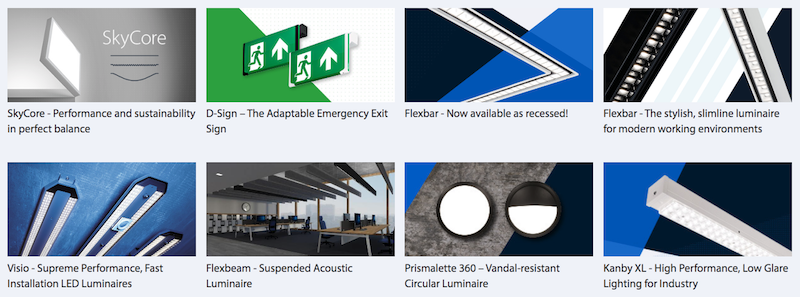

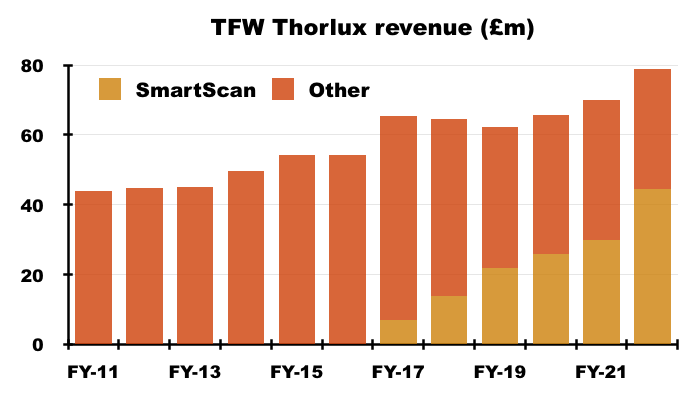

- Thorlux manufactures a wide range of professional lighting equipment and represents approximately 55% of the group:

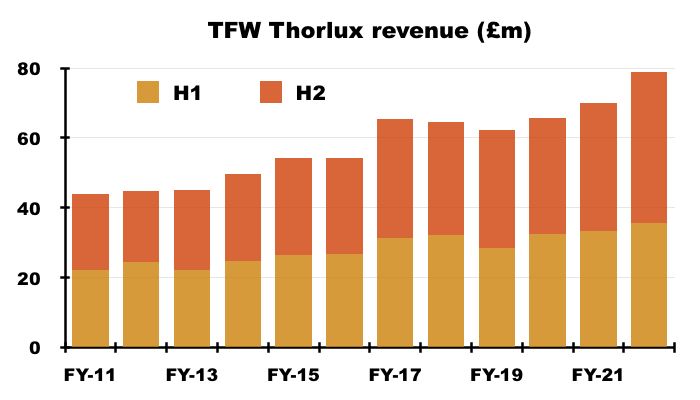

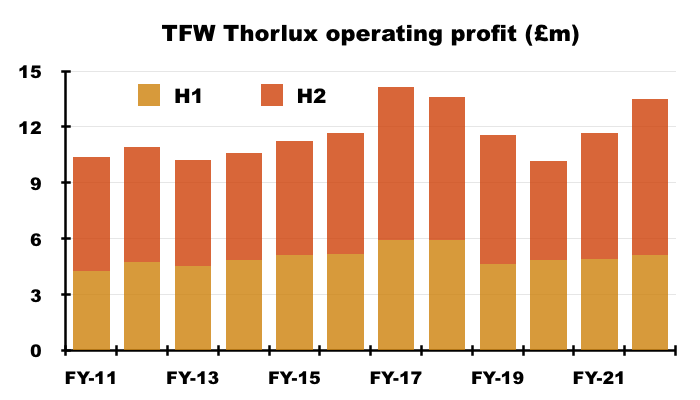

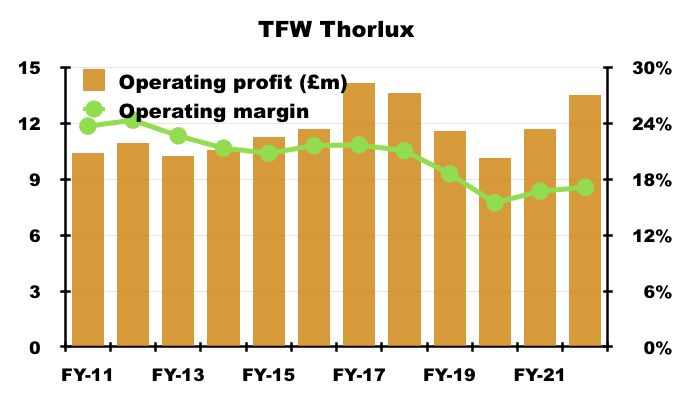

- Thorlux reported FY revenue up 13% and FY profit up 16%:

- H2 was in fact Thorlux’s best-ever six-month performance, with H2 revenue up 19% to £43.3m and H2 operating profit up 24% to £8.4m.

- The record H2 was particularly welcome given Thorlux had been experiencing mixed progress following the LED boom during FYs 2017 and 2018.

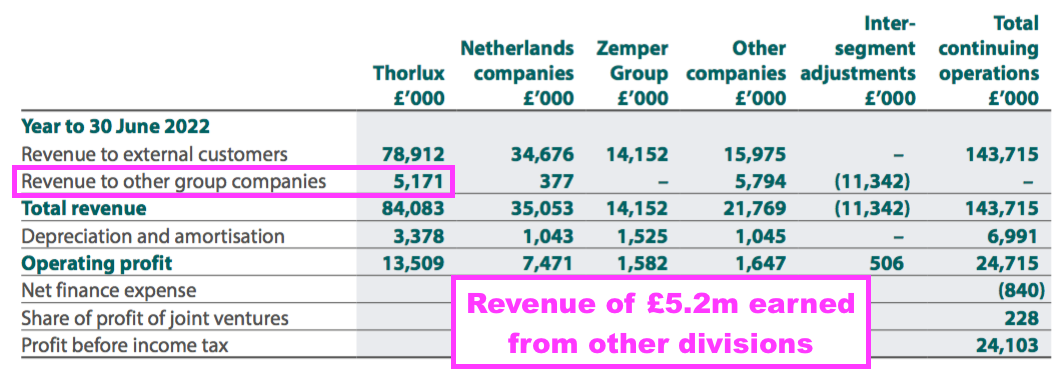

- Note that Thorlux also supplies products to different group subsidiaries, and the profit generated when those products are sold to the final customer may accrue to those different subsidiaries and not to Thorlux.

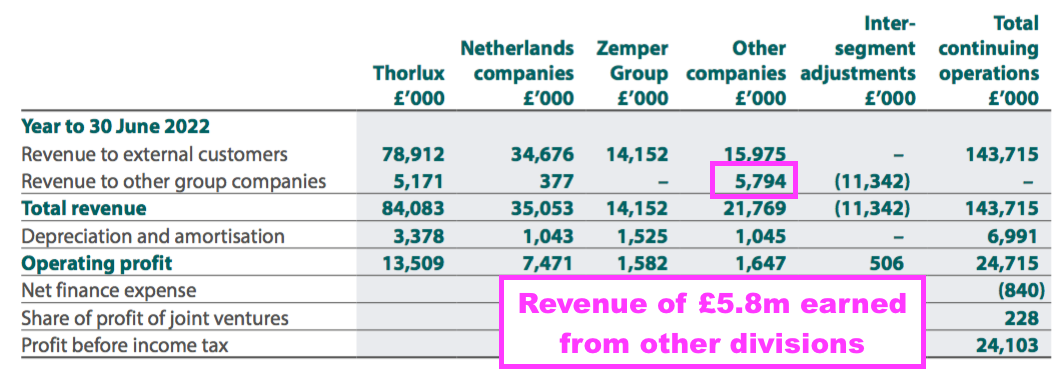

- Products worth £5.2m were sold to other subsidiaries during this FY, and the yearly figure has bobbed between £3m and £4m since FY 2017:

- The SmartScan lighting management service has underpinned recent progress:

- The 2022 annual report suggested SmartScan sales had improved by 49% during this FY:

- TFW last disclosed SmartScan revenue during FY 2020 at £25.9m, and the chart below uses my estimates for FYs 2021 and 2022:

- Other influences on Thorlux’s progress possibly include newly launched lights such as SkyCore, Visio and the recessed Flexbar:

- Emphasising the energy savings available to customers, Thorlux cites a 62% reduction enjoyed by a French exhibition centre now using Visio lighting and SmartScan.

- Leisure centres, offices, universities, schools and showrooms are among other Thorlux clients:

- The greater revenue helped improve Thorlux’s margin:

- 17% of revenue was converted into operating profit for this FY, with 19% converted during H2. The H2 margin was in fact Thorlux’s best since H2 2019 (20%).

- Greater ‘services’ work may have caused Thorlux’s margin to decline during the last few years:

“Services such as surveying and sub-contracted installation and project management works have a dilutive impact on results; however, an improved contribution from installations this year supported a growth in operating profit. Whilst margin is impacted by providing services, Thorlux’s ability to offer a “one stop shop” helps it secure significant projects, contributing to the good order pipeline currently ahead.”

- Re-designing products to combat component shortages may have also reduced margins:

“The engineering and procurement teams have worked tirelessly to resolve these [supply] issues, and the company’s ability to re-engineer and source alternatives has stood it in good stead.“

- Thorlux’s prospects for FY 2023 appear promising although component difficulties persist:

“The order book is currently at a high level, and includes a significant healthcare project to be delivered over the next two financial years…

Whilst Thorlux enters the new financial year with a significant order book, the supply chain challenges are not over.“

Netherlands

- TFW’s Dutch businesses — Lightronics and Famostar — represent almost a third of TFW’s profit.

- Lightronics manufactures mostly street lighting and was acquired during FY 2015 for an initial £8.3m that included a £1.9m debt repayment.

- Famostar manufactures mostly emergency lighting and was acquired during FY 2018 for an initial £6.3m.

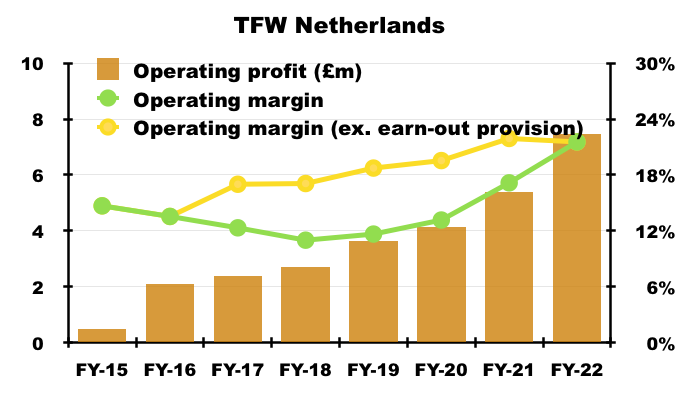

- Both Lightronics and Famostar appear to have flourished under TFW’s ownership:

- Trailing aggregate Lightronics/Famostar revenue has reached £35m versus less than a combined £18m at the time of their purchases.

- Trailing aggregate Lightronics/Famostar operating profit has meanwhile advanced to £7.5m versus a combined £2.3m at the time of their purchases.

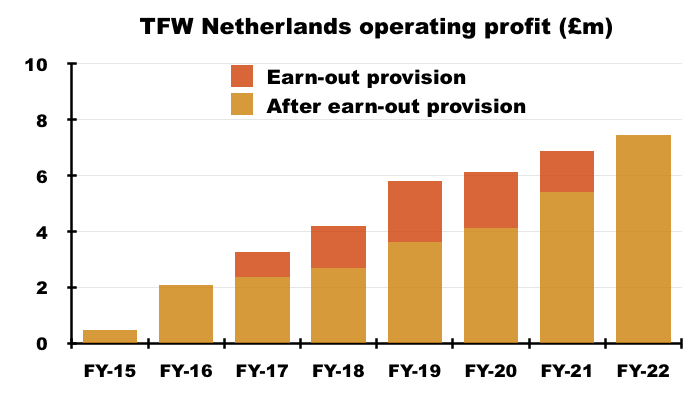

- TFW noted the Dutch profit was “unhampered by accounting adjustments for earn-out provisions”:

“The Netherlands companies made a strong contribution, unhampered by accounting adjustments for earn-out provisions which were settled back in September 2021.”

- The prior ‘hampering’ of Dutch profit was caused by increases to the eventual earn-out payment of the Dutch businesses (i.e. any extra earn-out provision was charged against that year’s profit):

- Without the earn-out complication, the Dutch businesses converted a healthy 22% of revenue into profit:

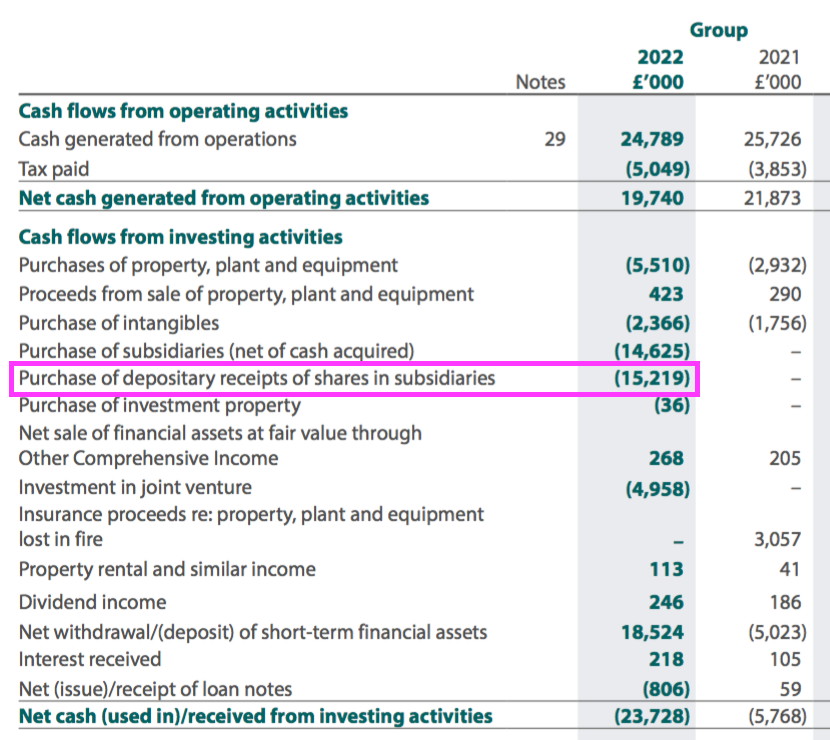

- The cash flow statement showed the £15.2m paid to clear the Dutch earn-out provision:

- The overall amount to acquire Lightronics and Famostar was therefore £8.3m + £6.3m + £15.2m = £29.8m.

- Dutch FY 2022 operating profit of £7.5m less 26% standard Dutch tax gives Dutch earnings of approximately £5.5m.

- Earnings of £5.5m from a total £29.8m Dutch investment give a very satisfactory 19% return.

- That 19% calculation could well understate the true return, given the £15.2m final earn-out would have been funded partly by earlier profits generated by the Dutch businesses.

- The FY 2022 performance of the Netherlands division was acceptable, with revenue up 10% and operating profit (excluding earn-out provisions) up 8%.

- Progress at Lightronics was held back by “employee turnover“, an absence of “major projects” and logistical challenges arising from the factory fire during H1 2021:

- I am hopeful the revamped building alongside a new commercial director could mean Lightronics’ revenue can soon surpass the c£22m recorded during the last few years.

- Famostar’s revenue jumped 20% to £11m and is now 58% higher than at the time of purchase. Progress during FY 2022 was buoyed by SmartScan:

“Targeted customer activity, the continued success of SmartScan and the addition of Thorlux product sales have driven revenues to new heights this year.”

- The subsidiary also experienced a change of leadership:

“Succession was an important topic during the year. We congratulate both Richard Stroo (Managing Director) and Frank Risseeuw (Technical Director and Group Head of Synergy) for their new roles and thank Frans Haafkens for his guiding hand over the last few years.”

- My past TFW write-ups have questioned why the large, healthy and growing Dutch division does not have any main board representation.

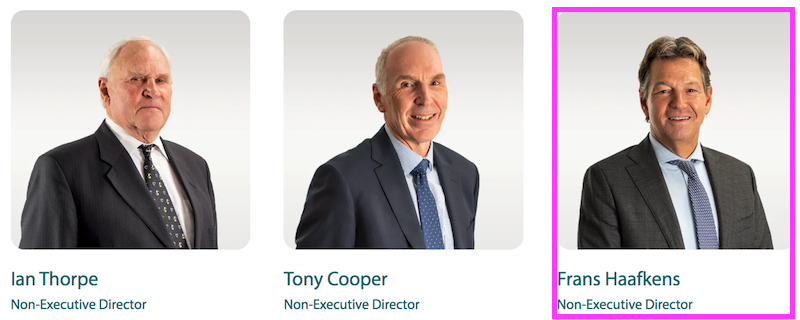

- That question was resolved partly during October with the appointment of Frans Haafkens as a board non-executive:

“Mr Frans Haafkens will join the Board as an independent non-Executive Director, effective immediately.

Frans is Managing Partner at Dutch investment firm i4hi, a company having direct investments in manufacturing and technology businesses. He spent his formative years with McKinsey & Co. as well as working for a short period in the UK lighting industry.

Frans is a Dutch national who has worked with the Group in recent years supporting the continued success of its Dutch entities, Lightronics and Famostar, both as a consultant and an investor. He is also a minority investor in Ratio Electric B.V., the recent joint venture investment by the Group.“

- Mr Haafkens is TFW’s first ever independent non-exec, and has worked with TFW since TFW bought Lightronics from his investment group during FY 2015.

- Mr Haafkens’ investment firm co-purchased Famostar with TFW during FY 2018, and bought a majority stake in Ratio Electric a year before TFW bought a 50% stake during December 2021.

- The presence of Mr Haafkens on TFW’s board implies relations between TFW and Mr Haafkens are reassuringly cordial after the Famostar and Ratio Electric deals.

- The non-exec duties of Mr Haafkens will presumably include seeking out and/or consulting on further acquisitions.

Zemper

- Buoyed perhaps by the success of the Lightronics and Famostar acquisitions, TFW acquired Spanish emergency-lighting group Zemper during October 2021:

- The Zemper deal was significant, with £19.9m spent to acquire a 63% share that included cash of £5.3m.

- For perspective, the initial £19.9m payment exceeded TFW’s entire FY 2021 operating profit of £19.2m.

- This FY statement said Zemper had made a “solid start… despite facing similar issues to other companies“. TFW added:

“[Zemper’s] results were hampered by the similar types of cost increases to those experienced across the Group: materials, labour, logistics and utility costs. Revenues, however, were generally in line with expectations. Zemper expects sales price increases to take effect in the new financial year to help address this situation.”

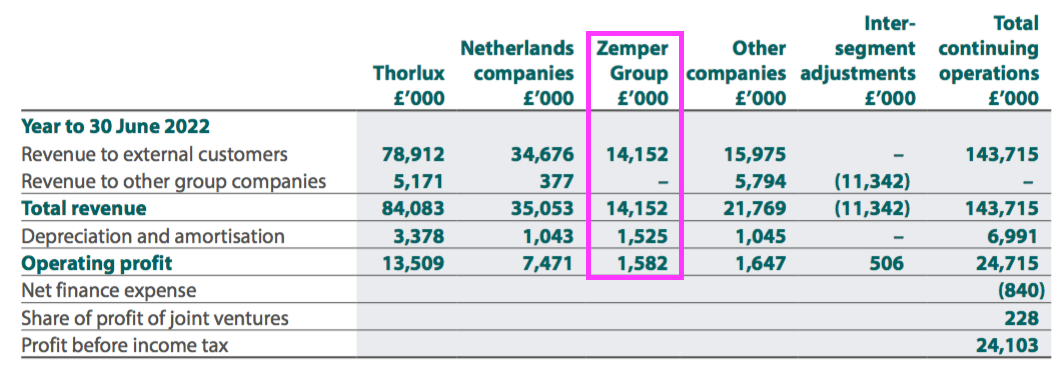

- Zemper recorded revenue of £14.2m and an operating profit of £1.6m:

- TFW noted Zemper’s contribution was “dampened by the required acquisition accounting adjustments“.

- The “required acquisition accounting” relates to the amortisation of the intangibles created through the acquisition.

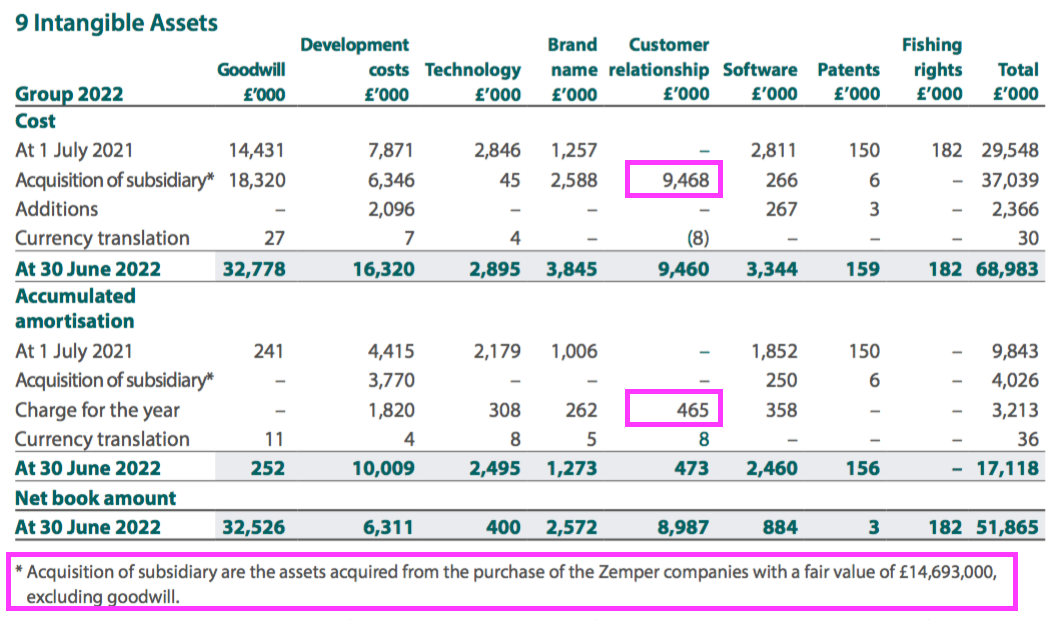

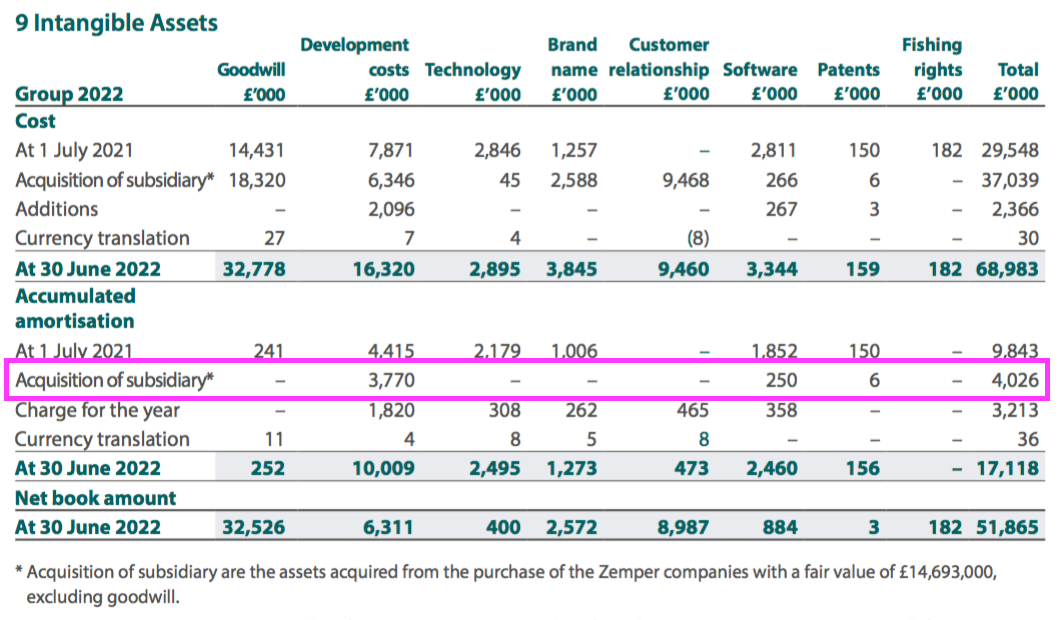

- The accounts show ‘customer relationships’ of £9.5m were created through the Zemper acquisition, of which £465k was subsequently amortised:

- As such, Zemper’s profit before the intangible accounting technicalities was £1.6m plus £465k = £2m.

- Zemper made a nine-month contribution to the FY 2022 performance and the following small-print…

“If the acquisition had occurred on 1 July 2021 the consolidated pro-forma revenue and profit before tax for the year ended 30 June 2022 would have been £148.0m and £24.6m respectively.”

- …implies Zemper’s full twelve-month performance was revenue of £18.5m and a profit (before intangible amortisation) of perhaps £2.5m.

- At the time of purchase, TFW said Zemper’s 2021 results had shown revenue of €20.3m and profit before tax of €3.8m.

- Zemper’s progress during the first nine months of ownership therefore did not witness a huge performance improvement.

- TFW mentioned within the preceding H1 that Zemper’s balance sheet would be subject to a fair-value review:

“A fair value exercise has not yet been performed on the acquired assets and liabilities; this will be undertaken for the current financial year-end. The outcome of this exercise may result in changes to the fair value of the acquired assets and liabilities, as well as associated goodwill.“

- The intangibles note disclosed an interesting amortisation line:

- The numbers read as if the fair-value review reduced the value of the acquired intangibles by £4m, which in turn implies such intangibles are no longer worth what TFW had initially thought they were.

- Another interesting snippet from the 2022 annual report concerns the useful life of the acquired ‘customer relationships’:

Other intangible assets

An intangible asset acquired in a business combination is recognised at fair value to the extent it is probable that the expected future economic benefits attributable to the asset will flow to the Group and that its cost can be measured reliably. Intangible assets principally relate to brand names and technology that were valued discounting estimated future net cash flow from the asset. The cost of intangible assets is amortised through the income statement on a straight-line basis over their estimated economic life. The rates generally applicable are:

Technology 12%-14%

Brand name -10%-20%

Customer Relationships 7%

- A 7% amortisation rate suggests customers may continue transacting with Zemper for up to 14 years!

- Still, what counts with Zemper is the new subsidiary’s future profit — and if Zemper can expand at a pace similar to the Dutch division, then the intricacies of the acquisition accounting will quickly be forgotten.

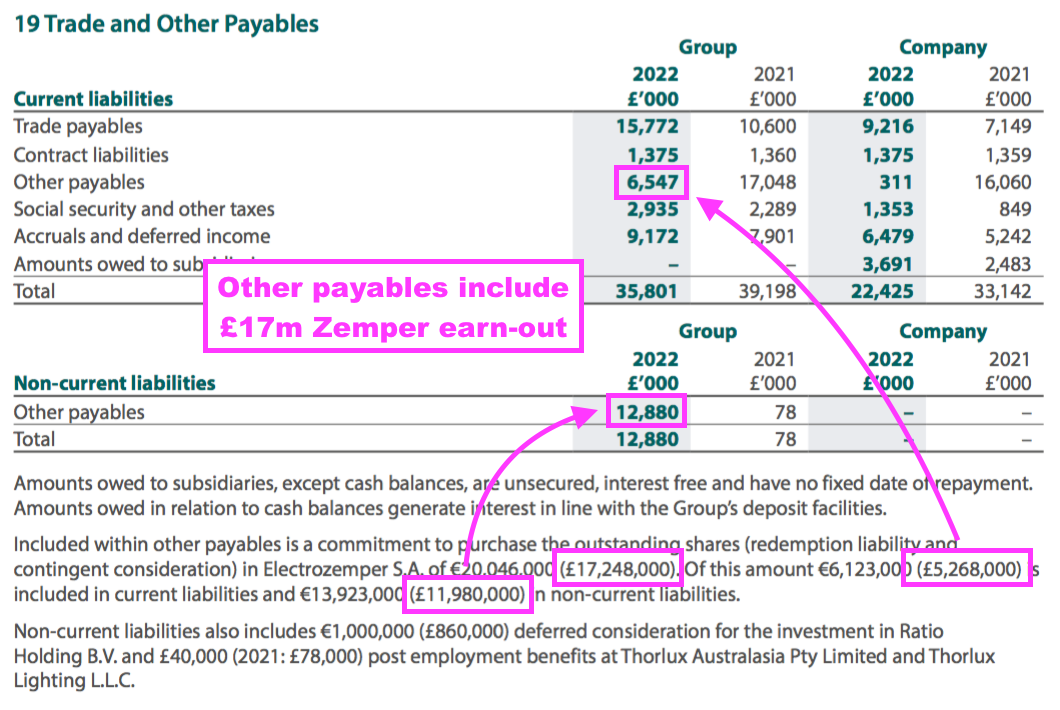

- The accounts show TFW liable to pay a £17m earn-out for the 37% balance of Zemper:

- TFW confirmed £5m of that £17m has already been paid:

“On 12 September 2022, the Group paid the second tranche of payments for the acquisition of Electrozemper S.A. totalling €6.1m (£5.3m).”

- The other £12m will be paid within the next two years.

- TFW suggested operational improvements at Zemper were forthcoming:

“Technical teams from around the Group have embarked on several synergy projects together and some common sustainability and circularity work. I hope this will improve productivity and enhance margins too.“

Ratio Electric

- TFW acquired 50% of Ratio Electric during December 2021 for £4.9m, with an extra loan note issued for £0.9m “to help fund the development of [the] business” and a further £0.9m to be paid during December 2023.

- Ratio is located within the Netherlands and develops electric-vehicle charging systems:

- TFW appeared satisfied with Ratio’s performance:

“Revenue growth, as expected, has been significant , even though Ratio has experienced component shortages like other companies. Profitability has grown only slightly but is in line with expectations due to the investments required to develop the more high technology chargers, especially suited to the UK market and some of the Group’s commercial customers”

- TFW was optimistic about Ratio’s potential:

“Ratio now has a developing UK operation, with five employees, distribution and manufacturing space, and new ranges of cloud-connected chargers which are targeted to be ready in late autumn this year. These are exciting times for all concerned.“

- TFW gave only the following financial information about Ratio at the time of the investment:

“The forecast results to December 2021 expect Ratio to achieve annual revenue of €8.0m with solid returns in keeping with Group operating profit levels.”

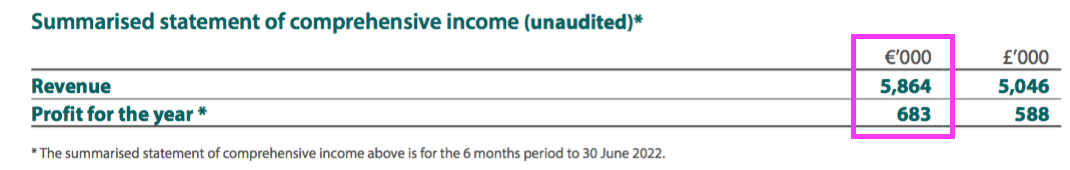

- This FY statement confirmed six-month revenue of €5.9m and a €0.7m profit:

- Ratio’s annualised revenue could now therefore be running at €12m — some 50% higher than that disclosed at the time of the investment.

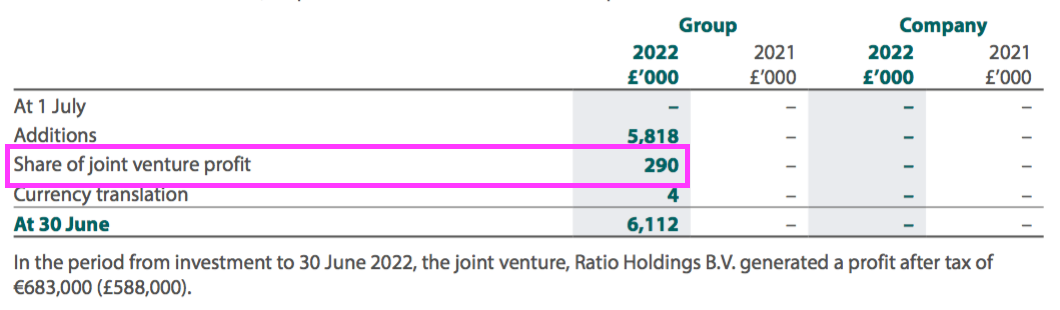

- TFW’s 50% share of Ratio’s earnings came to £290k…

- …although £62k of other costs left the overall six-month contribution at £228k:

“The Group has recognised its 50% share of €342,000 (£290,000) in the Income Statement, less costs in the parent company of £62,000.“

- The £228k six-month result from the initial £4.9m investment gives a 9% annual return, which TFW no doubt hopes has scope for improvement as demand increases for electric-vehicle charging facilities.

- Electric-vehicle charging is a departure from TFW’s core lighting speciality, but the 2022 annual report reiterated the rationale made at the time of the investment:

“This is an exciting opportunity for the Group. FW Thorpe’s know-how in electrical engineering, manufacturing and lighting, combined with Ratio’s experience in electrical vehicle charging will allow the introduction of new products into the UK market as well as supporting growth in Ratio’s existing markets.

We see similarities in technology and engineering skills, giving the Group the opportunity to diversify into new areas of engineering with high growth potential.”

- Ratio’s small profitable contribution during this FY is an encouraging start to the new venture.

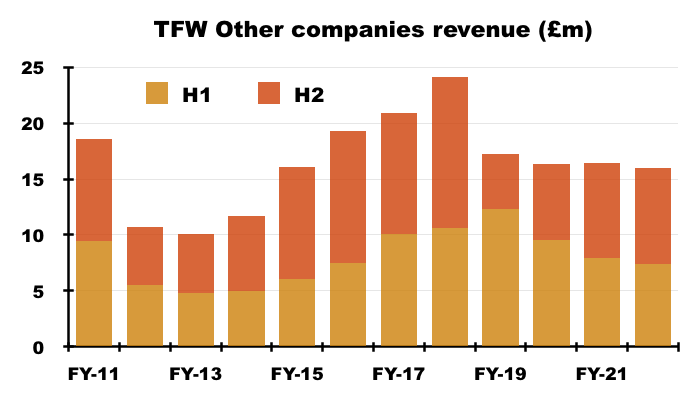

Other companies

- TFW’s Other companies consist of:

- TRT Lighting, which was established during FY 2012 and supplies lighting for roads and tunnels;

- Philip Payne, Solite and Portland, which supply emergency lighting, cleanroom lighting and shop lighting respectively, and;

- A handful of overseas Thorlux offices.

- By far the best long-term performing Other subsidiary is TRT Lighting, which went from nothing to sales beyond £10m during the nine years to FY 2021.

- But TRT’s FY 2022 performance was disappointing. Revenue fell 18% to £8.7m that TFW admitted “led to a poor profit performance only marginally above break-even.”

- TFW added:

“There was a notable downturn at TRT Lighting due to the lack of a sizeable one-off project during the year and some factory efficiency issues. TRT’s order book has now returned to a good level. A new operations director started at TRT in mid-August and is addressing manufacturing performance.“

- TFW described Portland as the “standout performance” of FY 2022 after its revenue rallied £1m higher to £3.8m.

- Portland’s performance was helped by retail and hospitality customers recovering after their pandemic woes. The subsidiary also sells Belisha beacons to local authorities and domestic lighting through Amazon.

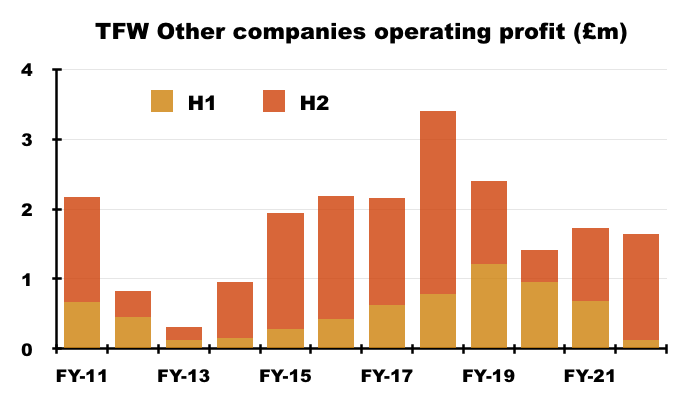

- Total Other profit was £1.6m, with the tiny £120k profit reported for the preceding H1 thankfully recovering to a somewhat remarkable £1.5m during H2:

- Philip Payne, Solite and Portland may be kept on by TFW primarily because they supply products to the group’s larger operations:

SchahlLED

- TFW extended its European expansion even further by announcing the purchase of German lighting installer SchahlLED during September.

- TFW paid an initial £12.8m for 80% of SchahlLED, with the remaining 20% to be acquired “subject to performance conditions” during the next three years.

- This FY statement revealed TFW had not planned the acquisition:

“SchahlLED’s independent majority shareholder approached FW Thorpe to discuss the sale of its shares… Although members of the Board of FW Thorpe had planned for a few years to be quieter on the acquisition front, we approached this situation in both a defensive capacity to protect existing work, but also in an opportunistic way, as we see good growth potential in SchahlLED’s business model of focusing on energy saving payback projects, and think they could be adopted in some other territories.“

- Tweaking TFW’s interest was the fact SchahlLED had become the group’s largest customer during the last three years.

- The purchase announcement said SchahlLED enjoyed revenue of €15.9m and Ebitda of €2.8m during the year ending December 2021.

- TFW presumably will be expecting to improve that Ebitda level by capturing SchahlLED’s gross margin for itself.

- TFW recognised its work with SchahlLED had led to SmartScan enhancements that secured a notable order:

“The new generation SmartScan system was developed in collaboration with Thorlux’s biggest customer and resulted in Thorlux winning the lighting contract for one of the largest factories in Europe, in central Germany.”

- SchahlLED’s vendor was a Dutch private-equity group.

Financials

- TFW’s accounts remain flush with cash despite the payments for Lightronics/Famostar (£15m), Zemper (£15m net of cash acquired) and Ratio Electric (£6m).

- Cash and short-term deposits ended the year at £41m, while ‘financial liabilities’ (bank debt and government loans associated with Zemper) were £2m.

- The 2022 annual report reiterated the reason for the high cash balance:

“The Group’s policy has been to maintain a strong capital basis in order to maintain investor, customer, creditor and market confidence. This sustains future development of the business, safeguarding the Group’s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders.

…

The Group has a long-standing policy not to utilise debt within the business, providing a robust capital structure even within the toughest economic conditions.“

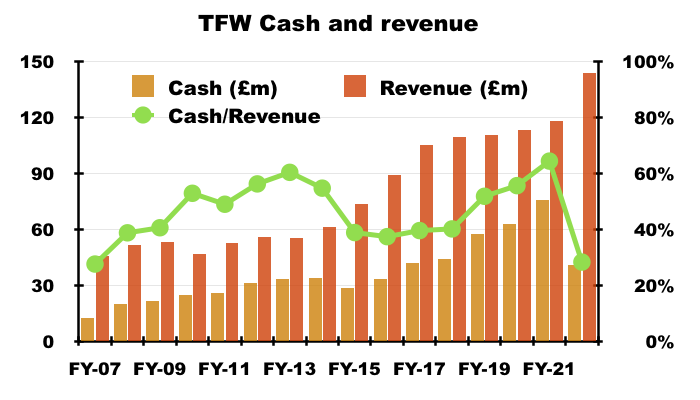

- Mind you, year-end cash as a proportion of revenue was 28.2% — TFW’s lowest level since FY 2007 (27.5%):

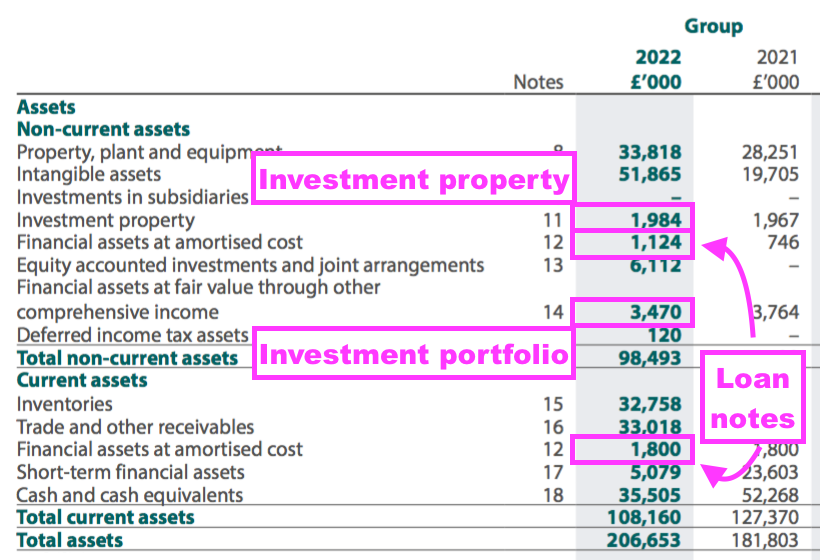

- TFW’s balance sheet also carries investment property of £2m, loan notes of £3m (including £0.9m loaned to Ratio) and an investment portfolio of £4m:

- FY 2022 cash conversion appeared satisfactory:

| Year to 30 June | 2018 | 2019 | 2020 | 2021 | 2022 |

| Operating profit (£k) | 19,466 | 17,649 | 16,332 | 19,227 | 24,715 |

| Depreciation and amortisation (£k) | 4,595 | 5,022 | 5,817 | 5,664 | 6,991 |

| Cash capital expenditure (£k) | (7,819) | (5,473) | (8,495) | (4,398) | (7,453) |

| Working-capital movement (£k) | (241) | 2,234 | 627 | (1,445) | (5,719) |

| Cash (£k) | 43,958 | 57,290 | 63,002 | 75,871 | 40,584 |

- The £8m difference between five-year net capital expenditure of £34m and five-year depreciation and amortisation of £28m can be explained by TFW’s purchases of extra freehold property.

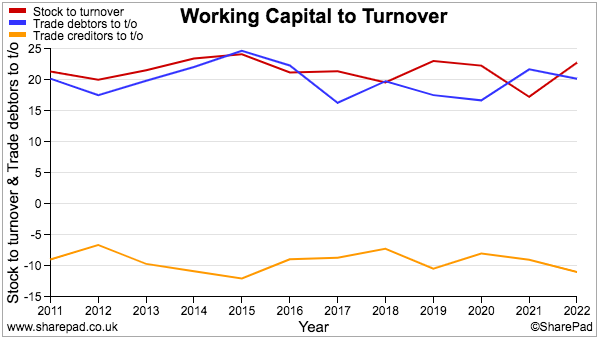

- Working capital absorbed £6m after £9m was invested in extra stock to mitigate supply difficulties and support the healthy order book.

- Year-end stock increased a substantial 61% to £33m, which is equivalent to 23% of revenue and not out of keeping with prior years (red line below):

- TFW noted:

“It is important that this stock is carefully managed to avoid overshoot and obsolescence in coming months“.

- The stock provision increased by 52% — less than the stock increase of 61% — suggesting no immediate obsolescence worries:

“The value of the inventory provision is £4,449,000 (2021: £2,928,000) for the Group and £2,477,000 (2021: £1,475,000) for the Company.”

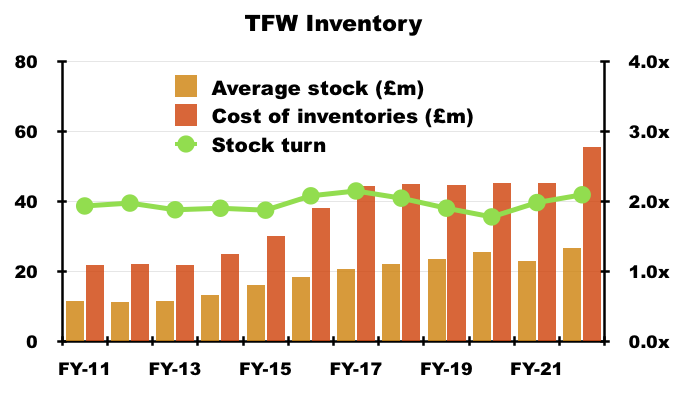

- Cost of inventories for FY 2022 was £56m, which versus average stock held during the year of £27m implied components were kept in the warehouse for almost six months before use.

- Such stock turn of approximately 2x matches TFW’s longer-term pattern:

- FY operating cash flow of £24.8m less tax of £5.0m and less net capex of £7.5m meant reported earnings of £20.0m translated into free cash of £12.2m.

- The £15m Dutch earn-out, the net £15m paid for Zemper, the £6m invested in Ratio Electric (including the loan note) and the £12m spent on dividends then ensured total cash finished the year approximately £35m lighter than at the start.

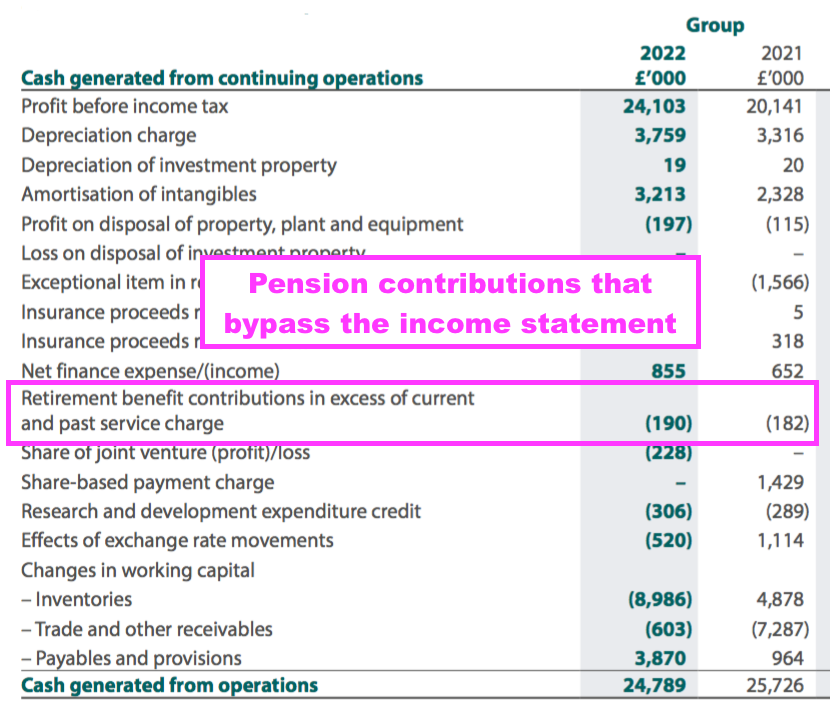

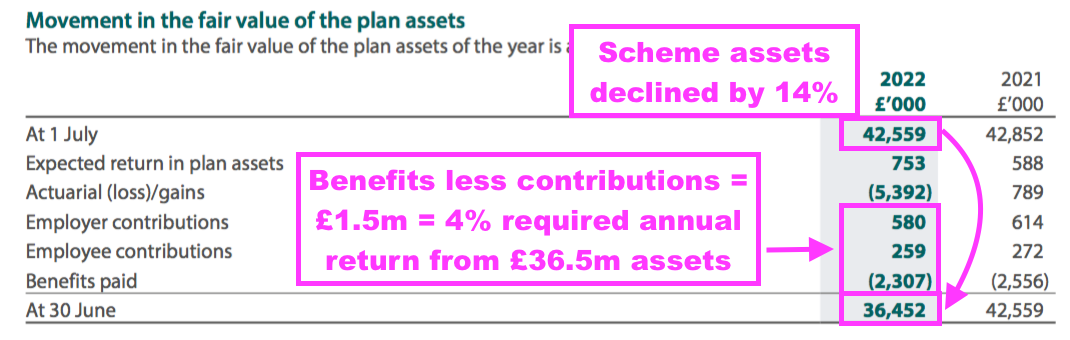

- Cash flow suffered a £190k catch-up pension-scheme contribution:

- Although TFW’s final-salary pension scheme sports a small £3m surplus, contributions of £0.8m may have to be increased to maintain last year’s paid benefits of £2.3m if asset returns continue to be poor:

- The mix of divisional performances led to an improved 16.9% FY group operating margin:

| Year to 30 June | 2018 | 2019 | 2020 | 2021 | 2022 |

| Operating margin (%) | 17.5 | 15.7 | 14.2 | 16.1 | 16.9 |

| Return on average equity (%) | 15.1 | 13.8 | 10.6 | 11.9 | 14.2 |

- The operating margin has deteriorated from the 19%-plus enjoyed between FYs 2008 and 2014, with distribution costs rising from 8% to 11% of revenue appearing to be the primary cause.

- A conventional return on equity calculation shows an increase for FY 2022 to 14%, although such measures are complicated by TFW’s significant cash position and acquisition activity.

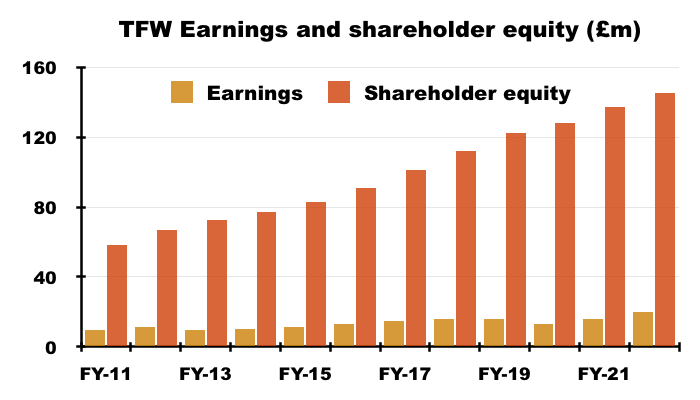

- Looking at equity returns another way, since FY 2017 TFW’s earnings have advanced £5.5m to £20.1m while shareholder equity (i.e. earnings less all dividends paid) has advanced £44.1m to £145.4m:

- Retaining £44.1m to earn an extra £5.5m since FY 2017 gives a 12% return on incremental equity.

- The next year or two ought to see TFW’s returns improve, as recent acquisitions should produce an income greater than would have otherwise been achieved had the cash been left in the bank.

- Following the year end, the £41m cash position has since paid £5m for the first Zemper earn-out and the £13m for 80% of SchahlLED. A further £12m is estimated for the final Zemper earn-out within the next two years.

- Surplus cash could arguably be £41m less £5m less £13m less £12m = £11m, with the aforementioned ‘financial liabilities’ of £2m taking surplus net cash to just £9m.

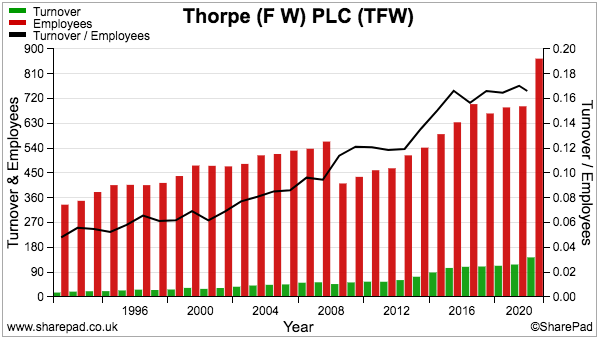

- Staff productivity remained stable at a creditable £164k revenue per employee:

Valuation

- Outlook comments within this FY statement were satisfactory given the mixed economic conditions:

“The whole Group, and especially Thorlux, is focused on designing energy saving products; therefore, I anticipate that orders should be resilient if a recession becomes inevitable.

…

FW Thorpe has a broad portfolio of customers; those in government or blue-chip industries have usually found the capital to invest in their assets when times get more difficult.

…

The Group has started the financial year with a robust order book and some healthy projects on the horizon. The Group sees an improving supply and operations picture and, as such, the Board expects a good first half performance despite ongoing pressures on operating costs.”

- November’s AGM then predicted a “solid half-year result“:

“Since the beginning of the new financial year, orders and revenue for the Group are in line with expectations and overall, ahead of the same period last year. Margin and price pressures continue, offset by reasonable selling price increases where possible.

Manufacturing service levels have improved significantly in recent months and our sales teams have a generally positive outlook. We foresee a solid half-year result, supported by our recent acquisitions.

In light of current economic conditions, the longer-term outlook is more difficult to predict but our diverse market, geographical coverage and low carbon solutions mean we are well placed to continue a trajectory of steady sustainable growth.“

- Trailing revenue and profit including a full-year contribution from Zemper are £148m and £25m respectively.

- Adding on a full-year contribution from SchahlLED would increase revenue to £162m and profit to £26m.

- Applying the forthcoming 25% UK tax rate then gives earnings of near to £20m or almost 17p per share.

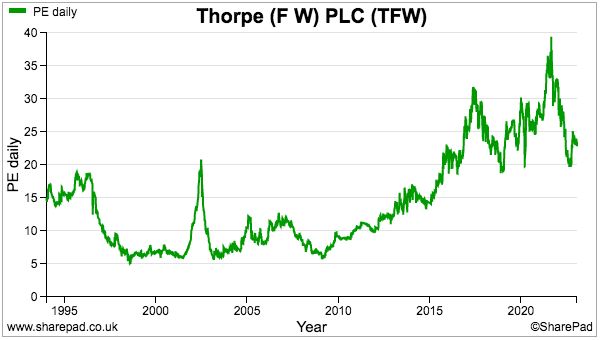

- The calculations could be fine-tuned further for potential margin improvements at TRT Lighting, Zemper and SchahlLED, but the implied 24x rating at 400p is already somewhat distant from obvious bargain status:

- My decision to purchase TFW between 2010 and 2012 was made much easier because the shares were then valued at a more modest P/E multiple:

- Perhaps today’s buyers are willing to pay a premium multiple because of TFW’s:

- Long-time operational resilience as demonstrated by the 20 years of consecutive dividend increases;

- Savvy acquisition approach that has earned TFW 19% returns on its Dutch expenditure;

- Healthy order books supported by ongoing technical innovation and customer concerns about elevated energy costs, and;

- Growth opportunities beyond pure lighting systems (e.g. SmartScan and electric-vehicle charging).

- TFW’s ‘ESG’ angle may be attracting greater City attention. The 2022 annual report devoted 11 pages to ESG matters and claimed such matters could improve profit:

“Efforts continue within the Group to improve companies’ sustainability credentials and move sooner towards Net Zero – which, apart from being the right thing to do, will bring commercial advantages…

Some employees have even been awarded with a ‘Net Zero Hero’ tee shirt for special achievements. Many of the efficiency gains in Group factories and at product level reduce costs, make Group companies more successful at winning orders, and improve the Group’s reputation“

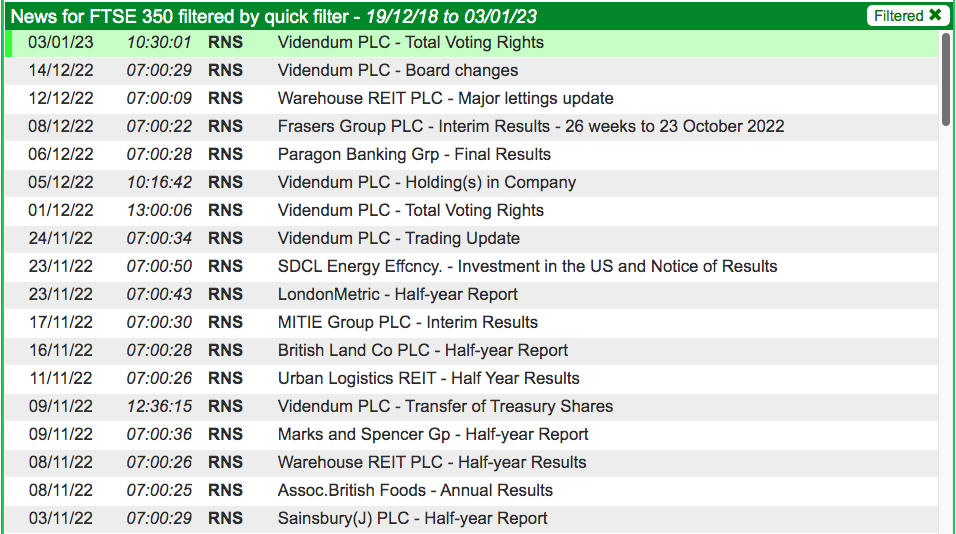

- A SharePad search through the RNS for ‘LED lighting’ shows plenty of FTSE 350 companies that may well be (or become) TFW customers:

- As shareholders await the forthcoming “solid half-year result“, the trailing 6.15p per share ordinary dividend supplies a modest 1.5% income at 400p.

Maynard Paton

Thanks for another in depth review, it’s most appreciated!!

I’m not sure I agree with your suggestion that surplus cash requires downward adjustment of £12m though. Whilst it falls due within the next two years for the Zemper earn out, during that time Zemper is likely to earn at least twice that during the period??

Cheers, Mike

Hi Mike

Glad you liked the review. I calculated Zemper’s annual profit to be £2.5m, so £5m over two years before tax. I think if I were the FD, I would be looking at the cash position less the final earn-out as ‘surplus’ cash. Yes, intervening cash flow may help pay for the earn-out, but I would not want to ignore the final earn-out and so make a hefty acquisition (as TFW have been doing), then have some trading problems arise and find the bank balance a bit short for the final earn-out.

Maynard

FW Thorpe (TFW)

Publication of 2022 annual report

Here are the points of interest beyond those noted in the blog post above:

1) MARKETPLACE

Two brand new questions among the five marketplace questions:

“Q: What is the impact of inflationary cost pressures?

Q: How has the market sector approach evolved in recent times?

The answers sadly did not reveal any great revelations.

A reworded question for 2022 about TFW’s focus:

“Q: Where is the focus for FW Thorpe for 2022/23?

A: Order books across the Group are at the highest levels and compounded with the material availability issues is causing extended lead times for our customers.

Returning to normal levels of service is paramount for our businesses this year but can only be achieved when supply is stabilised. We will need to be agile in the coming year if economic conditions become more challenging.”

The two repeated questions about competitors and geographies from 2021 repeated the answers from 2021.

2) CASE STUDY

A useful case study about SmartScan featuring property landlord CBRE and tenant Ordnance Survey.

CBRE citing TFW’s green credentials as a selling point:

“For CBRE, one of the main advantages of using Thorlux products was the ability to carbon offset the CO2 produced during the manufacture and use of the luminaires. In 2009 Thorlux designed an ambitious carbon offsetting scheme to help compensate for the CO2 released into the atmosphere as an indirect result of factory and selling activities and customers’ use of luminaires. To date the total number of trees planted is 165,687; these trees will sequester over 41,000 tonnes of CO2 over a period of 100 years.

CBRE’s testimonial:

“From initial engagement to project completion Thorlux Lighting was brilliant. The installation was completed with more than 3000 fittings being replaced and the client can now use the SmartScan portal to track and highlight energy usage and lighting patterns throughout the site.”

3) MARKET DRIVERS

A new ‘market driver’ for 2022: “Drive for energy efficiency and carbon reduction”

Interesting that customers are offered “financing options“:

“How we are responding:

* We continue to offer energy saving technology with the SmartScan platform

*Financing options with partners to make solutions more affordable to customers to match the savings achieved

* Offering turnkey packages to customers to enable change

* Investment in electric vehicle charging products with Ratio”

The other market drivers remain International economic conditions and Globalisation. Various refreshed bullet points now refer to interest rates, payback periods, carbon-saving investments, potentially acquiring struggling rivals and security of supply:

“* Certain sectors could slow investment given recent interest rate raises and concerns over future economic growth

* Increased energy costs are resulting in shorter payback periods for energy saving lighting projects

* Renewed focus on carbon saving investments with support from Governments

* Potential to win market share or acquire competitors who struggle in these economic conditions

* Sourcing opportunities – chance to review what is sourced from where. Considering not only price, quality, carbon footprint but the security of supply

LED sales still represent more than 90% of revenue:

“The Group’s shift to LED sales now representing over 90% of total revenue.”

4) BUSINESS MODEL

A repeat of last year’s approach towards product quality, service and longevity:

“Customers come to us for peace of mind. They want the correct technical solution, professional service, sustainability of products/services and the ability to provide support during a product’s warrantable life and beyond.

Our business model is focused on the needs of customers and the marketplace, with a robust capital structure that underpins our ability to deliver sustainable growth, innovative products and excellent customer service.”

5) STRATEGY

A reminder of TFW’s strategy:

“Strategy was designed to build on the values that have been at the core of the company since its inception. FW Thorpe has been built on product innovation – design and product development is fundamental.

The Group is product led.This enables us to maintain competitive advantage with marketing leading products, utilising technology to retain and attract new customers.

Sustainable growth is key to our stakeholders – targeting new customers in existing or new territories, using our product portfolio to drive into new sectors.

Control of the manufacturing processes is of utmost importance – key processes are kept in-house with targeted investment in new machinery as required.

Family principles and how we treat our people is fundamental to our success. The Group prides itself on the development of people from within the organisation providing training and experience as well as maintaining our core values.”

Plus lots of new text about Zemper:

“Established in 1967 by Aurelio Espinosa, father of the current Managing Director Jesús María Espinosa, Zemper was initially involved in the manufacture of transformers and electrical voltage stabilisers. Subsequently, with the aim of increasing its turnover, it began the manufacture of emergency lighting and became Electrozemper S.A. (Zemper) on 25 March 1978.

The company operates from a modern 10,000m2 self-contained factory in Ciudad Real manufacturing hundreds of thousands of luminaires per year.

For over 50 years the company has focused on manufacturing quality products, and this mentality has not been lost over time. Zemper has adapted to changes in the market and in the needs of its customers, who not only demand high quality products but also a greater commitment to environmental sustainability. ”

Zemper is a family business, with the son of the founder its current MD.

And lots of new text about Ratio:

“In December 2021, FW Thorpe Plc announced the acquisition of 50% of the share capital of Ratio Electric B.V. in the Netherlands. Ratio was established in 1960 by its pioneering founder Hans Snaak. The company developed products such as energy distribution systems for data centres and offices, a breakthrough plug and play shore power connection which set a new standard in the maritime world, and innovative charging solutions for electric cars.

Today Ratio Electric continues to supply high quality, functional and affordable products to OEMs, installers and specialised wholesalers, with e-mobility accounting for nearly 60% of the business.

Over 60 years of experience, combined with FW Thorpe skills and expertise, enable Ratio to develop smart solutions for current and upcoming customer needs, such as connected charging stations and market-leading charging pillars. Ratio EV Charging is a collaboration between FW Thorpe Plc and Ratio Electric. Ratio EV Charging designs, and will manufacture, EV charging products at its factory in Redditch, specifically to serve the UK market. ”

And lots of new text about SmartScan:

“Launched in 2016, SmartScan has continued to evolve over the last 6 years. The latest generation offers an extensive range of new customer features that improve user interaction and simplify maintenance of the system.

An increase in wireless network speed enables faster access to information, providing a larger data set and improved analytics. In addition, this faster network allows for a live, secure, truly IOT (internet of things) system that is now online permanently. This allows users to interact with installations from anywhere in the world without any delay, a valuable feature for larger multi-site users.

User control has been improved with the addition of manual dimming and an increase in the number of available scenes on offer. A new selection of battery or mains powered switches complements the range and offers a simplified method for connection of smart phones for app control. The SmartScan website and method of communication with installations has evolved to meet the latest security standards, future proofing the system for years to come. ”

Client demands naturally dictated SmartScan’s development:

“However, the customer also asked for features that were not previously available. Subsequently, the next generation of SmartScan was developed to secure the order.

These additional features include:

* Web based commissioning of luminaires (reducing time and cost by 50%).

* The ability for the customer to re-zone or adjust lighting parameters via the SmartScan website.

* The ability to change luminaire parameters via the interactive site drawing.

* Manual dimming via a push switch.

* Additional scenes and fixed manual dim levels via the new scene plate.

* New battery powered options for the scene plate, to simplify installation.

* New smart phone connection and app.

* New global commands for system override for out of hours or for alarm signals.

* New calendar function that will change system parameters out of hours.

* Faster remote testing and diagnostics.”

6) KEY PERFORMANCE INDICATORS

KPIs as before include two green measures:

7) OPERATIONAL PERFORMANCE

A few extra snippets from the divisions:

a) Thorlux

“Record order and revenue performance from Thorlux surpassed last year’s all-time high. A positive contribution was achieved from different sectors. The order book is currently at a high level, and includes a significant healthcare project to be delivered over the next two financial years.

Whilst Thorlux enters the new financial year with a significant order book, the supply chain challenges are not over. Also, economic storm clouds are gathering, it seems, with the threat of recession and higher interest rates. The targets within Thorlux will be to steady the supply flow and improve productivity to reduce the order backlog and improve the company’s ability to service customers in a more timely manner.

Services such as surveying and sub-contracted installation and project management works have a dilutive impact on results; however, an improved contribution from installations this year supported a growth in operating profit. Whilst margin is impacted by providing services, Thorlux’s ability to offer a “one stop shop” helps it secure significant projects, contributing to the good order pipeline currently ahead.

A number of fleet vehicles were exchanged for either full electric or hybrid cars; this technology now makes up 47% of the Thorlux fleet. ”

b) Philip Payne

“A strong second half performance helped move the business towards pre-pandemic revenue levels. Major projects had been lacking in previous years, and the business has also been impacted by increased costs.

Following the investment in selling resource and marketing activities, revenues have improved to marginally below the peaks of the past few years. The company has some work to do on improving operating profit levels – a clear target for the coming year. ”

c) Solite

“Another solid performance from Solite was driven both by demand for clean-room lighting and by bespoke projects for clients and the Group. This has brought revenues to pre-pandemic levels; however, operating results need to improve. ”

d) Portland

“The standout performance of the year was that of Portland. The growth this year is due to the return of business in Portland’s traditional markets. Focused on the retail and hospitality sectors, Portland has continued to recover from the pandemic lows experienced in recent years, following its strong close to last year. ”

e) TRT Lighting

“TRT’s performance was surprisingly disappointing following the highs of last year’s record figures. Orders started very slowly during the year; combined with the inability to pass on price increases to customers, this led to a poor profit performance only marginally above break-even.

Whilst last year was disappointing, this year starts with renewed optimism with a decent order book from a street lighting perspective as well as solid opportunities for tunnel lighting projects to boost results. Amenity projects will also be targeted this year, and the collaboration with Group companies should yield better results. ”

f) Lightronics

“Results for the business might seem disappointing this year at first glance; however, revenue in euros is consistent with last year’s and, despite margins being impacted by increased costs, Lightronics has delivered a creditable operating profit return in line with Group expectations.

Lightronics battled with rising costs and employee turnover, and following the fire had to continue to manage its operations across two manufacturing sites until the new building was completed in early June of this year.”

g) Famostar

“Famostar delivered yet another year of growth since joining the Group in 2017. Targeted customer activity, the continued success of SmartScan and the addition of Thorlux product sales have driven revenues to new heights this year.”

h) Zemper

“Results were hampered by the similar types of cost increases to those experienced across the Group: materials, labour, logistics and utility costs. Revenues, however, were generally in line with expectations. Zemper expects sales price increases to take effect in the new financial year to help address this situation.

In the next financial year Zemper will, of course, have the benefit of a full trading year, and the Group will start to see some of the benefits of Group collaboration”

8) FINANCIAL PERFORMANCE

Although unlikely to provide material ‘hidden value’, the freeholds remain in the books at cost:

“The directors are of the opinion that the market value of the freehold land and buildings is in excess of their net book value. While it is considered that the market value is significantly greater than the net book value for many of the Group’s properties as a result of being acquired between one and over 20 years ago, management considers that undertaking formal valuation exercises would be costly for limited value and consequently no formal exercise has been undertaken. ”

9) SECTION 172

No text changes here from 2021, though I now note the group hosts company visits:

“Investor meetings and presentations, including company visits.

I remember being given a tour of the HQ facilities when attending the 2010 AGM.

10) SUSTAINABILITY

Various snippets of interesting text, including TFW being confirmed as carbon neutral:

“FW Thorpe now holds the Green Economy Mark, which identifies companies and funds listed on the London Stock Exchange that generate between 50 and 100% of total annual revenues from products and services that contribute to the global green economy.

…

This investment in solar PV will enable the Group to generate 40–50% of its own electricity usage when the project is completed later this financial year.

…

Since 2009, FW Thorpe has been planting trees on its own land in Wales to offset Group emissions each year. To date 165,687 trees have been planted, offsetting 41,000 tonnes of CO2. A further 15,000 trees will be planted by the end of 2023.

…

FW Thorpe has been officially recognised as being carbon neutral, with systems of reduction, measurement and certified offsetting in place, since 2012. ”

TFW is now targeting becoming ‘net zero’:

“FW Thorpe Plc has set out its ambition to be a net zero company as soon as possible. To this end the Group is currently measuring and evaluating its Scope 3 carbon emissions and will set science-based targets, aligned to the Paris Agreement, to further reduce its carbon footprint.”

No surprise given TFW’s environmental focus that greenhouse gases per £1m of revenue fell by 13%

The measure is down by a third since 2020.

11) PRODUCTS

Disclosure of the number of mainline supplies and non=-product suppliers:

“The FW Thorpe Plc supply chain comprises approximately one hundred mainline suppliers. These companies are based throughout the world and vary considerably, both in terms of size and amount spent with them. All the product suppliers are subject to an approvals process before they are permitted to supply products. Many hold international quality standards and accreditations and are regularly audited to ensure ongoing compliance with quality standards and other regulatory requirements. In addition, the Group has approximately five hundred non-product suppliers, who are predominantly based in Europe. These suppliers are subject to the same due diligence processes as the product suppliers.

12) PEOPLE

A nice perk in the current climate: the staff have hotline access to a GP:

“The Group offers a fully funded Employee Assistance Programme (EAP) and 24/7 GP video helpline that make available the support and resources needed to address any personal challenges and/or concerns that may affect well-being and/or work performance. The EAP is confidential and free to all employees as well as their eligible family members.”

12) TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES

TFW has commendably put together a TCFD statement a year ahead of schedule:

“The FCA introduced requirements for premium-listed companies to report against the Task Force on Climate related Disclosures (TCFD) framework on a comply or explain basis for years starting on or after 1 January 2021. TCFD is a reporting framework that consists of a list of recommendations for companies to consider, with the aim to improve and increase the reporting of climate-related financial information.

This does not apply to FW Thorpe until 2023, however, in preparation for its introduction and as the Group transitions on its sustainability journey from carbon neutral to net zero, it is important to understand and assess the climate-related risk to our business. This year we report for the first time on the four thematic areas set out in the TCFD’s recommendations: strategy, governance, risk management, metrics and targets. ”

13) PRINCIPAL RISKS AND UNCERTAINTIES

The same risks as last year, save for the COVID-19 risk has been swapped for the Ukraine conflict:

As well as the Ukraine conflict, risks increasing in the year were adverse economic conditions and price changes:

Three risks are rated as ‘high’ for possible impact on performance: adverse economic conditions, price changes and business continuity, with price changes being increased from ‘medium’ during the previous year.

14) BOARD OF DIRECTORS

Pleased to say the board has changed composition since this 2022 report was published:

As noted in the blog post above, Frans Haafkens was appointed as a non-exec during October.

Then last month, executive David Taylor and non-exec Tony Cooper both retired from the board.

I could never understand why Mr Taylor, MD of tiny subsidiary Philip Payne, remained a board member when the Dutch businesses were much larger and performing much better.

15) CORPORATE GOVERNANCE

TFW continues to not adhere to two of the 10 QCA principals.

“5. Maintain the Board as a well-functioning, balanced team led by the Chair

Total of eight directors, four executive directors and four non-executive directors. The non-executives are not considered fully independent. The Board considers that the non-executive directors are appropriate as they bring significant experience and expertise in the sector. In addition, as the directors retire on a three-year rotation, shareholders have a regular opportunity to ensure that the composition of the Board is in line with their interests. There is a Remuneration Committee but no Audit Committee, with matters that would normally be tabled at an Audit Committee put to the full Board. ”

“7. Evaluate Board performance based on clear and relevant objectives, seeking continuous improvement

There is no formal evaluation process; however, the Chairman is responsible for Board performance and accordingly actively encourages feedback on the content and function of board meetings. The composition and succession of the Board are subject to constant review, considering the ever-changing needs of the Group. In addition, the directors retire by rotation every three years giving shareholders the opportunity to ensure that the Board is aligned with their interests.

Best practice is to have a non-exec chairman, a majority of board members being independent non-execs, all directors retiring for re-election every year and proper nomination and audit committees.

Other explanatory text for the partial compliance says:

“The Company continues to be proprietorial in nature and the directors act as a unitary Board and as a consequence are unable to see the benefits of splitting the Board into sub-committees and in particular of constituting audit and nomination committees as matters that would normally be considered by an audit or nomination committee are addressed by the full Board with the non-executive directors present and the auditors attending as appropriate.”

‘Quirky’ corporate governance often appears at family-run businesses. Outside shareholders really are passengers with these shares and have to generally adopt a take-it-or-leave-it attitude, as such boards never change unless forced to by the authorities. At least with TFW the illustrious dividend record suggests the board set-up works quite well.

16) DIRECTOR REMUNERATION

Quite a skimpy remuneration report for a £400m-plus market-cap business, although AIM rules do not mandate reams of director-pay disclosure.

Executive chairman Mike Allcock enjoyed a 10% basic-pay rise and for the first time since at least 2010, collected a bonus that exceeded his basic salary:

Two other executives collected bonuses that surpassed their associated basic salaries, too.

TFW supplies only the following to explain the bonus calculations:

“Annual bonus: The bonus is made up of two elements. The first element relates to the operating profit of the business unit for which the director has specific performance responsibilities. The second element relates to the operating profit of the Group as a whole.”

The remuneration notes say:

“The directors’ emoluments exclude contributions to the pension scheme.”

Pension payments can be sizeable, with company contributions at up to 17% of basic salary and bonuses:

“The defined benefit section aims to provide a maximum pension of two-thirds of pensionable salary at normal retirement date. M Allcock’s and D Taylor’s pensionable salary includes an average of the previous three years’ profit bonus. Defined contribution members contribute up to 5% of basic salary and the Company contributes up to 17%“.

But the pension payments are in fact ‘compensation’ due to (subsequently ceased) lifetime pension allowances:

“M Allcock, D Taylor and A M Cooper have ceased being active members of the FW Thorpe Retirement Benefits Scheme and C Muncaster has ceased being an active member of his personal pension scheme due to HMRC limits on lifetime allowances and annual contributions. Subsequently the Company has entered into pension compensation arrangements with these four directors and J E Thorpe to compensate them for the loss of these employer pension contributions. During the financial year the Company paid pension compensation to M Allcock of £170,358 (2021: £169,410), C Muncaster £44,439 (2021: £40,790), D Taylor £19,546 (2021: £19,163) and to J E Thorpe £12,016 (2021: £10,500).”

Salary plus pension compensation for Mike Allcock has been £381k, £381k, £382k and £404k for 2019, 2020, 2021 and 2022. So not a huge increase on this combined basis — assuming I have interpreted these figures correctly!

Note also the executive chairman can receive a two-year payoff rather than the standard one-year payment: “M Allcock has a service contract terminable on two years’ notice.”

Director options do not look troublesome at 120,000 with a share count of 119 million. The last options were granted during 2014 and of the five directors to receive options back then, only two (the chairman and FD) have some remaining. Another options batch may therefore be forthcoming.

Two-thirds of the three-person remuneration committee is represented by Thorpe family members, who oversee a c45%-plus family shareholding and ought to possess a sensible view on value-for-money executives.

17) INDEPENDENT AUDITORS’ REPORT

Nothing untoward here.

Full audit coverage now includes TRT:

“An audit was conducted of the complete financial information of the four reporting units: Thorlux Lighting (the Company, located in the UK), TRT Lighting Limited (located in the UK), Lightronics and Famostar (both located in the Netherlands).”

Audit procedures now includes Zemper:

“The audit work performed at these four reporting units (2021: three reporting units), together with specified procedures performed on Electozemper (located in Spain and France) and additional procedures performed on centralised functions at the Group level, including audit procedures over the consolidation, gave us the audit evidence we needed for our opinion on the Group financial statements as a whole.”

Coverage was an adequate 91% of PBT:

“This provided coverage of 91% (2021: 89%) of profit before tax.”

Materiality still at a standard 5% of PBT:

“* Overall group materiality: £1,200,000 (2021: £929,000) based on 5% of profit before tax.

* Overall company materiality: £788,000 (2021: £760,000) based on 5% of profit before tax.

* Performance materiality: £900,000 (2021: £697,000) (group) and £591,000 (2021: £570,000) (company).”

A new key audit matter related to purchasing Zemper:

Other key audit matters remained ‘valuation of warranty provisions’, ‘capitalisation of development costs’ and ‘impairment considerations over inter-company receivables’.

The warranty-audit small-print reveals cover is provided typically for five years:

”The typical warranty provision offered is for a period of five years, although longer periods are offered by Lightronics and Famostar on certain product lines.”

A few extra lines were also included in this year’s audit inspection:

”* Reviewing component teams’ key working papers for all in-scope components with a particular focus on the areas involving judgement and estimates; and

* Incorporating elements of unpredictability into our audit procedures“.

18) ACCOUNTING POLICIES

No major changes overall.

The Going Concern note now talks of a “a severe, but plausible downside scenario” rather than a specific revenue decline (33% decline for 2021):

“The directors confirm they are satisfied that the Group and Company have adequate resources, with £35.5m cash and £5.1m short-term deposits, to continue in business for the foreseeable future, including the affect of increased costs caused by the Ukraine and Russia conflict, where the Group has no sales, and other global events. They have also produced a severe, but plausible downside scenario that demonstrates that the Group could cover its cash commitments over the following year from approving these accounts. For this reason, they continue to adopt the going concern basis in preparing the accounts.”

Some changes to the useful lives applied to acquired intangibles:

“* Technology 12%-14%

* Brand name 10%–20%

* Customer Relationships 7%

Technology was previously just 14% and Brand name was previously 14-20%, which suggest the Zemper intangibles have a shorter useful life than intangibles acquired through earlier purchases.

Customer Relationships is a new intangible type and 7% suggests customers could remain buyers for 14 years. Zemper was established in 1967 so I can only assume TFW has good evidence to verify that assumption.

Lots of new text about recognition of government grants and financial liabilities:

“Government grants relating to costs are deferred and recognised in profit or loss over the period necessary to match them with the costs that they are intended to compensate. Government grants relating to the purchase of property, plant and equipment are included in non-current liabilities as deferred income, and they are credited to profit or loss on a straight-line basis over the expected lives of the related assets…”

“Financial liabilities are initially recognised at fair value, net of transaction costs incurred and subsequently measured at amortised cost. Any difference between the proceeds (net of transaction costs) and the redemption amount is recognised in profit or loss over the period of the financial liability using the effective interest rate method…

This text suggests warranties last between 5 and 10 years:

“The Group provides for expected warranty costs covering both specific known warranty claims and calculating expected future warranty claims in order to estimate the expected costs that will arise in respect of products sold within the remaining warranty periods. The usual warranty period provided is between 5 and 10 years, dependent on market requirements.”

New text about estimating the earn-out for Zemper:

“The Group has the obligation to purchase the remaining shares of the Zemper business in tranches over the next 3 years. To calculate the expected repurchase value the Group has considered the recent and budgeted future performance of the Zemper business analysing forecasted EBITDA, revenue and costs upon which the obligation is based. This analysis is reviewed and updated each year and, if necessary, adjustments are made to ensure that the provision value reflects the best current estimate of settlement with movements recognised as a share-based payment charge. If the forecast EBITDA assumption were to increase by 5%, the resulting deferred consideration would increase by £520,000.”

And some reassuring comments about capital-risk management:

“The Group’s policy has been to maintain a strong capital basis in order to maintain investor, customer, creditor and market confidence. This sustains future development of the business, safeguarding the Group’s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders…”

“The Group has a long-standing policy not to utilise debt within the business, providing a robust capital structure even within the toughest economic conditions. The Group’s significant cash resources allow such a position, but also require close management to ensure that sufficient returns are being generated from these resources. The Group’s policy with regard to the cash resources is to ensure they generate sufficient returns, whether by investment in business activities, such as plant and equipment, or assessing suitable opportunities to grow the business, or the physical investment of these funds to ensure appropriate returns to investors.”

19) GEOGRAPHICAL ANALYSIS

The UK now represents 58% of total revenue — its lowest ever proportion:

The UK proportion has been shrinking as overseas businesses have been acquired, being 63% during 2021, 72% during 2016 and 90% during 2011.

20) OPERATING COSTS

A few things here:

TFW registering a small profit following the disposal of fixed assets suggests the depreciation charge is appropriate.

Share appreciation rights are no longer a notable expense following the completion of the Dutch earn-outs. Not quite sure why 2022 shows a small credit — possibly a small adjustment for the final calculation.

Cost of inventories for 2021 was corrected while government grants were collected after £192k was received during 2020. I guess these grants relate to some type of environmental efforts, but do not know for sure.

21) EMPLOYEES

Nothing untoward here:

Revenue per employee slipped £4k to £165k. After seeing years of growth, revenue per employee reached £165k in 2017 and has stayed around that level since. I suspect acquisitions have influenced the progress. Revenue per head at Zemper prior to acquisition was €169k, so Zemper will have reduced the group’s productivity slightly.

Revenue per employee was £119k in 2012 and £85k in 2007, which is evidence of useful productivity improvements over time.

The average employee cost fell £1k to £47k for 2022, with total employee costs staying at 29% of revenue to match the previous three years.

TFW’s employee ratios have been quite consistent, with employee costs steady at between 27-30% of revenue since 2006.

22) NET FINANCE EXPENSE

All sorts here:

Total of £840k does not tally with the £855k shown in the cash flow statement.

Dividend income from the equity portfolio has reached its highest level since at least 2013.

Net rental income of £113k I can’t reconcile to another note (see point 25)

Loan interest of £114k is rising higher as the bulk of the associated loan accrues interest linked to the BOE base rate (see point 26).

Non-controlling interest refers to the outstanding payment for Zemper, and I guess the £613k reflects a notional interest payment on the estimated earn-out.

I do not know what ‘loan interest’ of £55k relates to. The heading ‘non-current assets’ suggests the £55k is incurred by TFW on a loan deemed to be an asset. A similar charge has been incurred for the last few years.

The £507k fair-value loan adjustment reflects a loan write-down (see point 26)

23) PLANT, PROPERTY AND EQUIPMENT

Spending on plant and equipment last year was only 10% more than the depreciation expensed through the income statement:

Note how freehold assets that cost £25m are in the books for £20m after years of modest depreciation. The market value of TFW’s freeholds is in fact “significantly greater” than £25m (see point 8).

24) INTANGIBLE ASSETS

TFW has never shown any cavalier capitalisation of development costs:

Capitalised costs and the amortisation expensed through the income statement were reasonably close last year. Capitalised development costs have an acceptable three-year useful life.

‘Customer relationship’ assets relate to Zemper (see points 18 and 31).

Fishing rights meanwhile remain one of the stock market’s more unusual intangibles (in this case created years ago through the purchase of a riverside property that is used (as I understand) for customer entertainment purposes).

Various small numerical changes were contained in the small-print below:

The Portland discount rates were 7.6% and 15.4% for 2021, so the increases to 10.06% and 34.4% suggest a lower NPV for the subsidiary.

The Lightronics and Famostar ‘headroom’ of £33m was previously £20m, which suggests the NPV of the Dutch divisions has improved by £13m.

The 6x EBITDA multiple cited refers to the purchase of the Dutch divisions, but Zemper was purchased at 10x and its earn-out will also be 10x.

25) INVESTMENT PROPERTY

Investment properties are in the books for £2m, with net rental income of £94k:

The £94k does not reconcile with the £113k stated within ‘net finance income’ (see point 22).

The fishing area and woods now sport a £1.97m market value, up £0.4m on 2021.

26) FINANCIAL ASSETS AT AMORTISED COST

Essentially a collection of IOUs, the credit-worthiness of which is variable:

The bulk of the £1.8m Mackwell loan has been outstanding since 2018 and 2022 was another year when no interest was paid (although interest was accrued in the income statement (see point 22)),

Note the Mackwell loan will now pay interest at 9.25% (4%+BOE base rate). Default is deemed minimal as Mr N Brangwin I am sure is a connected party to the Estate of CM Brangwin, which is a 6% TFW shareholder with 7.2 million shares.

Luxintec looks a disaster, with a £756k loan advanced in 2021 after earlier problems, and a further £507k write down in 2022 (see point 22). My notes say this Spanish operation suffered a £529k impairment in 2021 and a £407k impairment in 2020.

Ratio is not (yet) paying interest on its £860k loan, although during H2 the joint-venture did report a £588k after-tax profit (see blog post above).

26) FINANCIAL ASSETS AT FAIR VALUE

Essentially a collection of equity investments:

A devaluation of £57k seems a good achievement given the rough market conditions during H2.

27) INVENTORIES

As mentioned in the blog post above, stock increased by 61%:

The £4m stock provision equates to 12-13% of the year-end stock balance and, although that proportion matches 2021 and 2020, does indicate TFW’s products are at some risk of obsolescence while waiting in the warehouse.

28) RECEIVABLES

Nothing obviously amiss here:

Year-end trade receivables represented 20.2% of revenue, down from 21.7% for 2021 but higher than 2017-2020 (16-20%). However, Zemper did not contribute for the full year and so the receivables-to-revenue ratio will be unfavourably skewed, and should be nearer than 2017-2020 range.

Receivables past due but not written down decreased to £2.7m — to represent 9.3% of trade receivables and within the typical 5-10% range witnessed since 2014. The figure for 2021 had risen to an all-time high 13%.

The net bad-debt figure remains minimal:

29) PAYABLES

Nothing obviously amiss here as well:

Trade payables up almost 50% versus revenue up 21% does not account for the lack of a full-year revenue contribution from Zemper.

The ‘Other payables’ are almost entirely estimated earn-outs for Zemper and Ratio.

Text elsewhere in the report confirms the £5.3m current earn-out for Zemper was paid in September:

“On 12 September 2022, the Group paid the second tranche of payments for the acquisition of Electrozemper S.A. totalling €6.1m (£5.3m).”

30) FINANCIAL LIABILITIES

A collector’s item this — TFW carrying debt… well, a mix of overdrafts, bank loans and French government Covid loans following the Zemper purchase:

31) ZEMPER ACQUISTION

Full details of the Zemper deal:

Total consideration (including estimated earn-outs) is £37m.

Note the useful lifetimes stated as 8, 10 and 15 years for acquired intangibles (see point 18):

Minor fair-value adjustments were stated, suggesting no horrors were found in the accounts.

I misinterpreted the intangible movements in my blog post above:

I had written: “The numbers read as if the fair-value review reduced the value of the acquired intangibles by £4m, which in turn implies such intangibles are no longer worth what TFW had initially thought they were.”

But that note also shows development cost additions of £6,346k, so TFW has brought the historical cost of the acquired development intangible onto the books, and the accumulated amortisation as well — so not a fair-value movement! (Argh!)

32) OPTIONS

TFW has nearly 8x as many shares in treasury than options:

The imbalance may be further evidence for scope to grant more options. The shares held in treasury seem purely for option-satisfaction purposes and perhaps ought to be counted as normal shares for valuation sums.

Maynard