***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

23 September 2022

By Maynard Paton

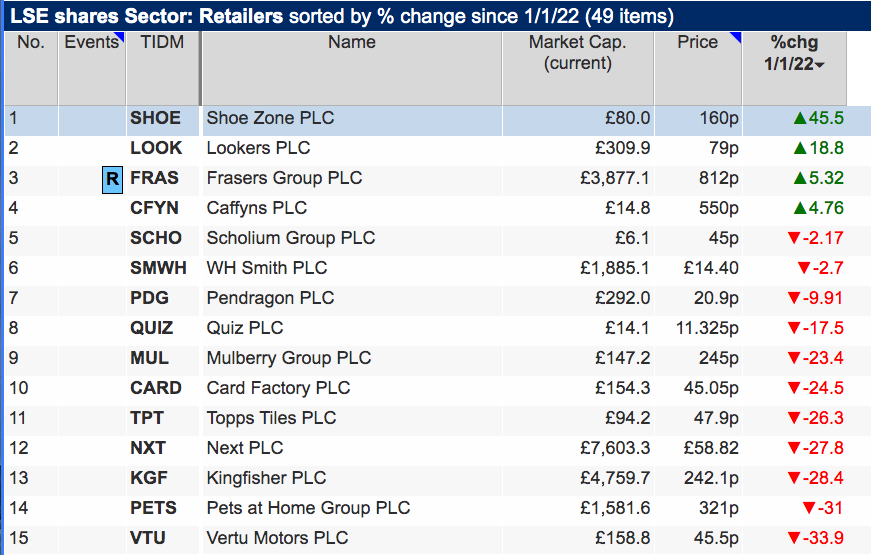

Top of the shops among this year’s market carnage has been Shoe Zone.

The discount shoe retailer has enjoyed an amazing 46% share-price gain so far this year in a sector blighted by rising costs and recessionary fears:

A trio of upbeat trading statements caught the market’s attention this summer.

The first occurred during June and referred to “strong margin improvements“:

“29 June: Shoe Zone is pleased to announce that since the publication of its interim results in May, the business has been trading well and has also seen strong margin improvements and cost savings, in particular as a result of rent reductions and good supply chain management, which are expected to continue into Q4 of the Company’s financial year for the 52 weeks to 2 October 2022″.

The second update followed in July, and revealed “stronger than expected” trading:

“26 July: Shoe Zone is pleased to announce that since the publication of its trading update on 29 June 2022, trading has been stronger than expected due to higher than expected demand for summer products, particularly in the last two weeks. The Company has also continued to experience margin improvements as a result of good supply chain and cost management.”

And the third update occurred last month, and confirmed trading had “continued to exceed expectations“:

“31 August: Shoe Zone is pleased to announce that since the publication of its trading update on 26 July 2022, trading has continued to exceed expectations due to continued strong demand for summer and back-to-school products throughout August. The Company also continues to benefit from the margin improvements as outlined in recent trading updates.”

The remarkable run of RNSs also revealed the group lifting its current-year profit expectations from “not less than £8.5 million” to “not less than £10.5 million“.

The profit upgrades and share-price surge will of course be welcomed by shareholders, although the company’s longer-term performance could mean the positive summer may not be a persistent phenomenon.

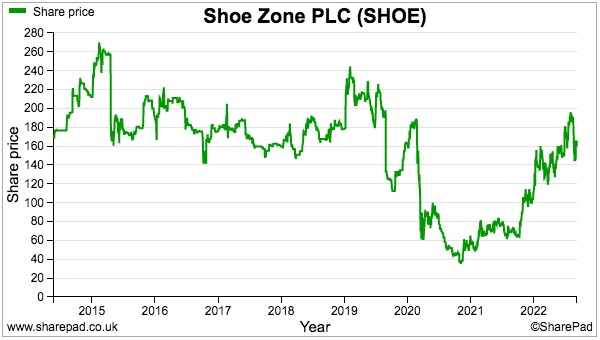

The shares joined AIM at 160p during 2014 and, eight years later, the price stands at… 160p:

Let’s take a closer look.

Read my full Shoe Zone article for SharePad.

Maynard Paton