12 October 2018

By Maynard Paton

Update on Bioventix (BVXP).

Event: Preliminary results for the year to 30 June 2018 published 08 October 2018.

Summary: The antibody specialist delivered yet another set of record results, with my number-crunching indicating underlying growth of 20%. However, I was disappointed to discover early sales of the important new troponin product had been below expectations — and may have left the lofty P/E valuation open to debate (at least for now). Still, the business continues to exhibit magnificent accounts while a special dividend for the third consecutive year underpins the board’s confidence. I continue to hold.

Price: 2,700p

Shares in issue: 5,140,674

Market capitalisation: £139m

Click here to read all my BVXP posts.

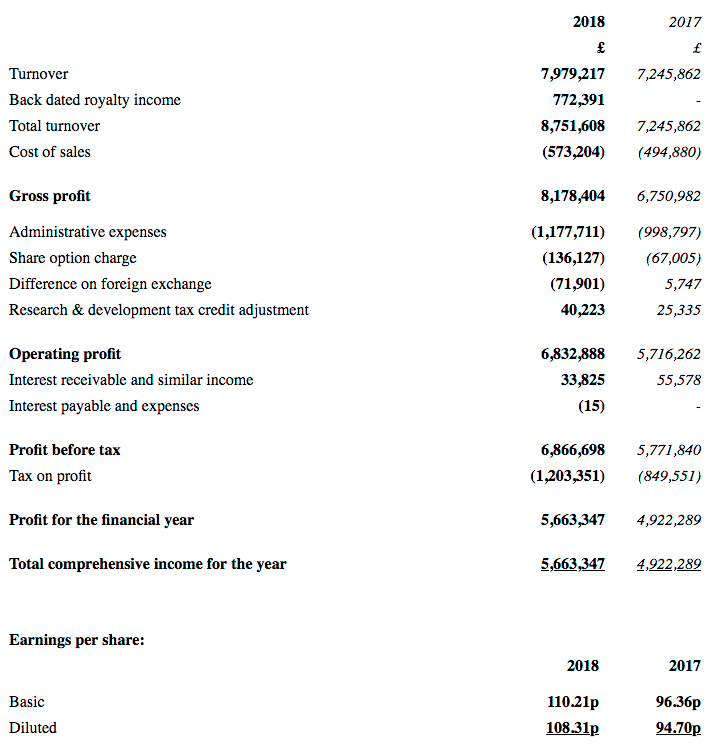

Results:

My thoughts:

* Record 2018 figures influenced by back-dated royalties and loss of certain product income

BVXP reported record annual figures for 2018, while extended the group’s run of substantial growth to eight years. The headline numbers showed revenue up 21% and operating profit up 20%:

| Year to 30 June | 2014 | 2015 | 2016 | 2017 | 2018 |

| Revenue (£k) | 3,535 | 4,333 | 5,517 | 7,246 | 8,752 |

| Operating profit (£k) | 2,372 | 3,098 | 4,205 | 5,716 | 6,833 |

| Other items (£k) | (169) | - | - | - | - |

| Finance income (£k) | 28 | 8 | 14 | 56 | 34 |

| Pre-tax profit (£k) | 2,231 | 3,106 | 4,219 | 5,772 | 6,867 |

| Earnings per share (p) | 36.1 | 50.7 | 69.2 | 96.4 | 110.2 |

| Dividend per share (p) | 24.0 | 32.6 | 42.5 | 51.0 | 61.0 |

| Special dividend per share (p) | - | - | 20.0 | 40.0 | 55.0 |

The reported performance was influenced by two notable events:

1) The first-half receipt of back-dated royalties totalling £772k, and;

2) The loss of a particular product income source, which had generated revenue of £1m during the comparable year, but just £400k during the first half and nothing during the second (this loss of income was not mentioned within the RNS).

Adjust for the back-dated royalties, and full-year revenue and profit would have gained only 10% and 6% respectively:

| H1 2017 | H2 2017 | FY 2017 | H1 2018 | H2 2018 | FY 2018 | ||

| Back-dated royalties (£k) | - | - | - | 772 | - | 772 | |

| Revenue (£k) | 3,110 | 4,136 | 7,246 | 4,295 | 4,457 | 8,752 | |

| Revenue before back-dated royalties (£k) | 3,110 | 4,136 | 7,246 | 3,523 | 4,457 | 7,979 | |

| Operating profit (£k) | 2,472 | 3,244 | 5,716 | 3,372 | 3,461 | 6,833 | |

| Operating profit before back-dated royalties (£k) | 2,461 | 3,244 | 5,716 | 2,599 | 3,461 | 6,060 |

However, also adjust for the terminated product income, and revenue for both halves and the full year gained approximately 20%:

| H1 2017 | H2 2017 | FY 2017 | H1 2018 | H2 2018 | FY 2018 | ||

| Revenue before back-dated royalties (£k) | 3,110 | 4,136 | 7,246 | 3,523 | 4,457 | 7,979 | |

| Loss of product revenue (£k) | (500)* | (500)* | (1,000) | (400) | - | (400) | |

| Revenue before back-dated royalties and loss of product (£k) | 2,610 | 3,636 | 6,246 | 3,123 | 4,457 | 7,579 |

(*estimated)

Alas, the details supplied by BVXP do not allow us to determine the effect on profit from the loss of the terminated income. But I would like to think a 20% revenue advance near enough reflects the group’s underlying progress.

Certainly the 20% annual dividend lift — plus a special dividend for the third consecutive year — underpins my rough sums.

* I am hopeful of a further 23% “modest” increase

The management narrative revealed BVXP’s largest money-spinner — an antibody to detect low levels of vitamin D — experienced 23% sales growth:

“Our most significant revenue stream continues to come from the vitamin D antibody called vitD3.5H10. This antibody is used by a number of small, medium and large diagnostic companies around the world for use in vitamin D deficiency testing. Sales of vitD3.5H10 increased by 23% to £3.4 million during the year. Once again, sales have surpassed our expectations based on customer feedback during the year.”

This time last year, BVXP said the following about vitamin D antibody sales (my bold):

“Our prudent belief is that the vitamin D market will plateau in the near future. Nevertheless, we anticipate a modest further increase in vitamin D antibody sales over the next year as a limited number of smaller customers bring new vitamin D products to the market.”

Well, I will take 23% sales growth as a “modest further increase” any day!

And guess what? Another “modest further increase” is forecast for 2019 (my bold):

“Whilst actual royalties received were once again in excess of expectations, we nevertheless perceive a plateauing of the vitamin D testing market.

Despite this expectation we still have smaller vitamin D customers bringing in new products to the market and we anticipate a modest further increase in vitamin D antibody sales over the next year or so as these smaller customers enjoy success with their new vitamin D products.”

I calculate the vitamin D product represented 45% of group sales during 2018 — excluding the back-dated royalties and the terminated product income.

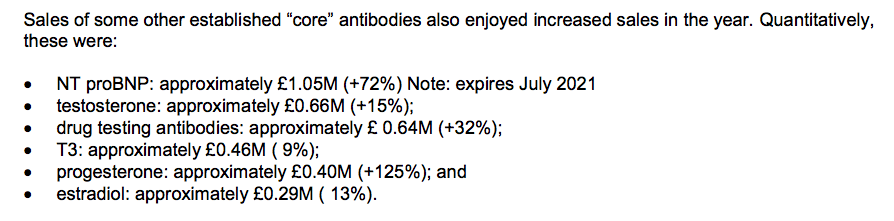

* Other antibodies enjoy a collective 24% revenue gain

BVXP confirmed a selection of other antibodies did well during the year:

My sums suggest these products saw their collective revenue jump 24%, from £2.8m to £3.5m. Excluding the contract product that expires during 2021, revenue from the other antibodies gained a more sedate 11%.

Note that two antibodies saw their revenue fall: T3, down 9% to £460k, and estradiol, down 13% to £290k.

* Early troponin sales come in below expectations

BVXP’s remarks concerning its important troponin product — an antibody that improves the blood-test diagnosis of chest pain — disappointed me. The firm said (my bold):

“We have reported previously on the importance of our troponin project with Siemens Healthineers. Sales during the reporting period were not significant and below our expectation. We have no reason to question our belief that this project will generate significant value into the future and Siemens recent US approval from the FDA should help in this regard.”

Twelve months ago, BVXP reckoned the troponin test would exert a “significant influence” on sales for the year just passed. BVXP now claims the new product will have a “significant influence” on sales during “the next few years”.

It seems BVXP’s level of optimism about the troponin product has fluctuated with every set of results.

For example, BVXP stated back in March 2017 (my bold):

“Significant troponin revenues during the financial year 2017/2018 are expected to offset the loss of revenues of around £800,000 from another product due to the expiry of the relevant agreement.”

Then this time last year, the firm admitted an “education period” would occur before troponin sales could take off:

“Whilst it is clear that a quicker test will be of benefit to patients, clinicians and hospital budget holders, it is also clear that there is likely to be an education period during which clinicians become comfortable with a significant change in diagnostic practices that can result in non MI (i.e. patients not having a heart attack) being released from A&E much earlier.”

Then earlier this year, BVXP became “confident” and “optimistic” about troponin:

“We remain confident that [troponin] sales will build during 2018…

We remain optimistic about our troponin project and the success of Siemens as their product launches around the world and we look forward to further progress in the second half of the year.”

And currently, troponin income (initially at least) is at insignificant levels and below expectations.

Oh well — I can only trust this product does eventually come good. I have read broker research that expects troponin sales to one day surpass £3m.

A possible bonus from the RNS was the revelation that “another Bioventix licensee” had created a separate troponin test to rival the Siemens effort. BVXP expects this alternative product can in time generate the firm “some revenue”.

* First-class financials lead to another special dividend

BVXP’s financials continue to be remarkable.

In particular, the group’s operating margin remains in the stratosphere while the return on average equity ratio still suggests the business runs on thin air:

| Year to 30 June | 2014 | 2015 | 2016 | 2017 | 2018 |

| Operating margin* (%) | 67.1 | 71.5 | 76.2 | 78.5 | 76.0 |

| Return on average equity** (%) | 103.6 | 117.9 | 132.4 | 144.7 | 125.6 |

(*adjusted for back-dated royalties **adjusted for net cash)

I have no concerns with BVXP’s cash flow:

| Year to 30 June | 2014 | 2015 | 2016 | 2017 | 2018 |

| Operating profit* (£k) | 2,372 | 3,098 | 4,205 | 5,691 | 6,060 |

| Depreciation (£k) | 21 | 46 | 42 | 39 | 58 |

| Cash capital expenditure (£k) | (2) | (114) | (21) | (22) | (108) |

| Working-capital movement (£k) | (546) | (279) | (581) | (570) | (539) |

| Net cash (£k) | 3,351 | 4,131 | 5,380 | 6,167 | 6,987 |

(*adjusted for back-dated royalties)

I calculate total capital expenditure has represented a tiny 1.2% of BVXP’s aggregate operating profit during the last five years — and the £108k spent during 2018 was relatively insignificant, too.

Meanwhile, BVXP’s working-capital movements are somewhat larger — although the amounts absorbed have remained stable despite operating profit (before back-dated royalties) climbing from £2.4m to £6.1m throughout the same period.

Most of BVXP’s surplus cash flow — £4.9m or 96p per share — was distributed as dividends during the year. The £0.8m left over lifted the bank balance to £7.0m or 136p per share.

BVXP repeated its view of not needing more than £5m in the bank:

“Our current view is that a cash balance of approximately £5 million is sufficient to facilitate operational and strategic agility with respect to possible corporate or technological opportunities that could arise in the foreseeable future.”

Accordingly, a welcome 55p per share (£2.8m) special dividend was declared.

The balance sheet continues to carry no debt and no pension obligations.

Valuation

Looking ahead, BVXP said (my bold):

“We are delighted to be able to report such positive news for the current year. Looking ahead to the future, we keenly anticipate the roll out of the Siemens troponin project and modest growth from additional vitamin D antibody sales and royalties.”

The company does like to use the word “modest”.

Here is the outlook from last year (my bold):

“For the financial year 2017/18, our challenge will be to make up for the approximately £1 million of lost sales mentioned above with revenues from the newly launched Siemens troponin project and modest growth from additional vitamin D antibody sales and royalties.”

And the year before that (my bold):

“Furthermore, we remain optimistic that further modest growth next year will come from additional vitamin D antibody sales and royalties.”

And the year before that (my bold):

“Furthermore, we remain optimistic that further modest growth in the next two years will come from additional vitamin D antibody sales and royalties.”

Each time the “modest” growth projection turned into a 20%-plus advance.

I just hope BVXP is trying to under-promise and over-deliver once again.

Anyway, BVXP’s £6.1m operating profit (before back-dated royalties) alongside the 17.5% tax rate applied within these results gives earnings of £5.0m or 97p per share.

Then subtracting the 136p per share cash position from the 2,700p share price gives an underlying trailing P/E of 2,564p/97p = 26.

In the past I have pondered BVXP’s lofty valuation in light of the uncertain near-term prospects for troponin, and I dare say the lack of initial troponin sales has indeed left the share-price rating somewhat exposed.

Nonetheless, adjust for the back-dated royalties and the terminated product, and the rest of the business has continued to grow at a very fair pace.

Throw in the favourable attractions of selling antibodies, too…

* Customers generally keep using the same antibody to ensure testing consistency and lower regulatory aggravation, and;

* Blood tests using diagnostic antibodies are performed on a regular basis and their frequency is not really linked to wider economic factors…

…and you can understand why BVXP’s recurring revenue, super-high margin, wonderful return on equity and majestic cash flow have been prized highly by investors during the last few years.

Just how prized BVXP’s future earnings will be is hard to say — although I would like to think the shares will generally trade at a premium to the wider market. In my experience, long-term quality businesses tend to be valued relatively highly.

In the meantime, the 61p per share ordinary dividend supports a 2.3% income — although I would like to think BVXP’s apparent commitment to special dividends can bolster that projected yield to a sustainable 3%-plus.

Maynard Paton

PS: You can receive my Blog posts through an occasional e-mail newsletter. Click here for details.

Disclosure: Maynard owns shares in Bioventix.

Bioventix (BVXP)

FY 2018 Results Presentation Slides

Here is the associated results presentation.

I note the slides say the terminated product produced revenue of c£900k during the comparable year. The previous presentation (dated March 2018 for the six months to December 2017) suggested the terminated product had sales of £1m. So if I had used the £900k figure instead of the £1m within the Blog post above, my sums would have led to a small improvement of my underlying growth rate.

Maynard

FWIW

gnnmatin, your post 897 seems to imply that Roche is a competitor, in the sense that BVXP’s chemical has to compete with other folks, chemicals.

I don’t understand the market like that. As I understand it, the diagnostic equipment in a hospital is used for a whole range of different tests and is very expensive. So, a hospital that has Roche kit will not switch to Siemens kit because of marginal differences in one test – and vice versa.

Iff this is correct then BVXP’s chemical has a fixed market to grow into – i.e. the number of hospitals that has Siemens kit – and no competitors.

Is this correct, or am I missing something?

Thanks for your note,

Bioventix (BVXP)

ShareSoc presentation/PI World video

An informative presentation that explains the main attractions of the business.

At 29m55s, a question is asked that reveals hospitals tend to keep their blood-test machines for about 10 years and that they are not “ripped out and replaced“. Siemens apparently has 10-12% of installed blood machine, so for troponin at least (which has been developed exclusively for Siemens), that is the size of the market and there is no effective competition.

Maynard

Hi Maynard

I too have half term with my 10 year daughter Jasmine at home, but my wife is Singaporean and of course a tiger mum as well, so there’s lots of homework to keep Jasmine occupied.

I have started to look through the shares on your “My shares” list that I’m not familiar with, and Bioventix looked particularly interesting, especially its amazing profitability. In your web site you very kindly take us through the questions you ask before deciding to invest, so I thought I would briefly run through my method, and would welcome any comments.

The first thing I do with a company of interest, is complete my valuation spreadsheet, which is very quick and easy using SharePad. I developed this spreadsheet from the book written by Keith Ashworth-West called “Invest in the Best”, which I’m sure you have read. For the first run through with the spreadsheet, I use the consensus forecasts in SharePad, and then a figure of 15% for growth for the following 7 or 8 years, to make 10 years. I then assume a disposal value based on the PE of the average of the last 3 years, and if I have a rate of return (IRR) of over 20% I will then dig far more deeply into the company. In Bioventix’s case, I had an IRR of 24%.

The next thing I do is read the latest annual report, check FE Investigate for subsequent announcements, check the ADVFN bulletin boards for adverse comments. I’ll then check both the Investors Chronicle and Shares for any useful comments. Next would be a search for any videos, which for Bioventix was easy, because your blog pointed out the October one. For larger companies, I’ll then read any employee comments from the Glassdoor web site.

I then complete a scorecard I’ve developed to try to capture and rank all those factors I am looking for. I will end up with a score out of 100. I also return to the initial valuation spreadsheet, and substitute the initial 15% growth estimate for a more educated guess, and possible modify the 3 year PE figure for another value.

I should then read competitors annual reports as well, but I never seem to get around to that!

I then compare the scorecard value and IRR with those other investments I own, and in most cases take no further action, other than add the company to my FE Investigate alert list, so I can revisit the situation the next time results come out.

In Bioventix’s case, its score put it in the middle of my portfolio, and so now I have to decide what to sell from those companies lower down the list. I currently hold 44 investments, which I know is too many, but as I’ve only been using my scoring system since June last year, I don’t have the evidence to check its validity quite yet. My return from 6th April 2018 to 6th October 2018 was 12% compared to the FSTSE AIM of 4.6%, so something must be working. Of course nearly all of that gain has gone now! Longer term, my intention is to very gradually reduce my investments over time, whilst minimising the amount of churn.

Anyway, over the next few days I will sell something and buy Bioventix. BTW, when I make the purchase, I will use the Level 2 data I get via Sharescope to decide whether I should split my purchase into 2 or even 3 batches, and also the limit price to use. My experience is that the £240 a year is paid for pretty quickly, as its easier to buy within the spread.

I hope you don’t take this message in the wrong way. I work on my own, and would find it extremely useful to receive comments that come from someone that knows what they are talking about. I you would be interested to receive my valuation spreadsheet and score card on Bioventix, I would be very happy to email them to you. (I would need an address).

Best regards

Gerard

PS Lets hope the chancellor doesn’t remove BPR for AIM investments!

Hello Gerard,

Thanks very much for explaining how you evaluate your shares. I must admit I do not extend any forecasts for 10 years. My experience is that very few quoted UK businesses have the wherewithal to grow their earnings smoothly over such a long period of time. There are generally setbacks (major and minor) along the way. I tend to look for above-average companies trading on below-average ratings, but such opportunities have been few and far between during the last few years. When I bought BVXP, I worked out it traded on a P/E of 16-17, which did not look too bad given the firm’s previous growth rate and the decent financials. I did not become bogged down with projections, but that is my preference.

Employing a scorecard and checklist is probably good practice. It can take the emotion out of investing, and perhaps prevent you from placing undue weight on a particular factor. For instance, my Tasty investment is due to management’s past record, but on other measures the share scores poorly. Perhaps a scorecard may have prevented my large loss there.

Ultimately we all invest in different ways, with a certain amount of gut feel and intuition involved as well. You just need to find the approach that works for you, stick to it and not be swayed by others.

Interesting that you say you would “find it extremely useful to receive comments that come from someone that knows what they are talking about.” There are actually very few online sites that cater for sensible investment conversation — Twitter, ADVFN etc are full of noise and little signal. Maybe one day I could find a solution. In the meantime, feel free to comment on this Blog.

Maynard

Hi Maynard, Thank you for your reply. I used to have exactly the same view as you do over 5 or 10 year forecasts; and still do over their accuracy. But please consider this. If such a forecast, with the current share price, and say projected growth of 15%, implied an IRR of 9%, would you invest? Probably not. The point being that this approach can indicate whether a stock is too expensive, given it achieves a reasonable forecast. I must say at the moment more stocks fail to reach my forecast hurdle than they do to meet my scorecard.

Bioventix (BVXP)

Publication of 2018 annual report

A simple text-only report. Just the type I like.

As before, these accounts are unusual as they are presented in the ye olde UK GAAP format, which does not provide as much disclosure as the usual IFRS standard.

AIM Rule 19 allows UK companies without subsidiaries (such as BVXP) to present their accounts using UK GAAP. UK businesses that are formed of a parent company plus one or more subsidiary operations have to present group accounts using IFRS.

Here are the points of interest:

1) Back-dated royalties prompt extra audit check

An extra line has been inserted into the ‘revenue recognition’ risk:

I bet the auditor’s review of “management’s controls surrounding the self-declaration of royalty income and the completeness of this income stream” follows the discovery of the late disclosure of royalties from a customer. I hope the review ensures all customers become timely with their royalty payments.

2) Corporate governance

This is new — BVXP has now adopted a code of corporate governance:

Thankfully the annual report is spared the full details (cf Tristel).

Instead, the full details are here. A quick skim revealed nothing too radical.

3) Employee costs

BVXP’s employee-related ratios remain strong:

The workforce lost one employee to 15 (which differs to the 13 cited with BVXP’s powerpoints), and each bears a total cost of £67.6k to the group — last year the figure was £58.5k. (See director pay below for the likely explanation of this increase)

Still, each employee on average generated a superb £583k of revenue for 2018, up from £453k last year and £165k in 2009. Total employee costs represented 11.6% of revenue, up from 11.1% last year but still lower than the 12% or more from the years before.

I am hopeful BVXP’s already stratospheric operating margin might increase further should the company continue to grow its revenue and keep its employee team so small.

4) Director pay

This is the first time BVXP has disclosed the individual pay of each director:

I can’t begrudge Mr Harrison collecting that bonus, a doubled pension contribution and what seems to be a basic pay rise as well. Five years ago his basic pay was c£70k, since when the dividend has shifted form 14.5p to 61p per share. I note the bonus was calculates using “EPS and share price parameters“. Would be useful to know what the share-price parameter was.

Note 26 reveals the non-exec finance director, who works for a third-party accountancy, collected £17k.

5) Debtors

This is an interesting note:

For most companies, trade debtors is usually the largest figure within the debtors (or receivables) note. But for BVXP, prepayments and accrued income is the largest.

As I understand, BVXP carries a lot of accrued income — which reflects revenue earned during the period but where the customer had not yet been invoiced at the balance-sheet date.

(Trade debtors reflect revenue earned during the period where the customer has been invoiced).

This accrued income relate to the company’s collection of royalties. From this extract of the 2016 results narrative:

“Approximately three quarters of Bioventix sales are generated from customer royalties. These are based on our customers’ global sales which are then factored by a royalty percentage and then sent to Bioventix around 2 months after the end of each half year.”

BVXP’s customers inform BVXP of their global sales after the period end, and BVXP then invoices the customers for the appropriate royalty sum. As such, the revenue to be collected is deemed to be accrued income — i.e. the revenue had not been invoiced at the balance-sheet date.

Anyway, the year-end prepayment and accrued income figure for 2018 is equivalent to 54% of royalty revenue, which compares to between 52% and 54% for 2015, 2016 and 2017. I am pleased the backlog of customer payments is not growing faster than royalty revenue.

I see trade debtors has jumped from £452k to £824k. The 82% increase appears large, but the absolute increase of £372k is relatively minor given total revenue gained £1.5m. And as noted in my Blog post above, cash flow was very adequate anyway.

Maynard