27 April 2016

By Maynard Paton

Quick update on World Careers Network (WOR).

Event: Interim results for the six months to 31 January 2016 published 26 April

Summary: These figures were not as bad as I had feared, given WOR’s previous results had confessed to higher costs and lower profit. The outcome for the current year looks set to be better than I had anticipated, too. Notably, revenue moved higher despite one of the software group’s largest customers significantly reducing its payments. Meanwhile, the accounts remain cash-rich and the underlying P/E is less than 7. I continue to hold.

Price: 195p

Shares in issue: 7,549,938

Market capitalisation: £14.7m

Click here for all my previous WOR posts

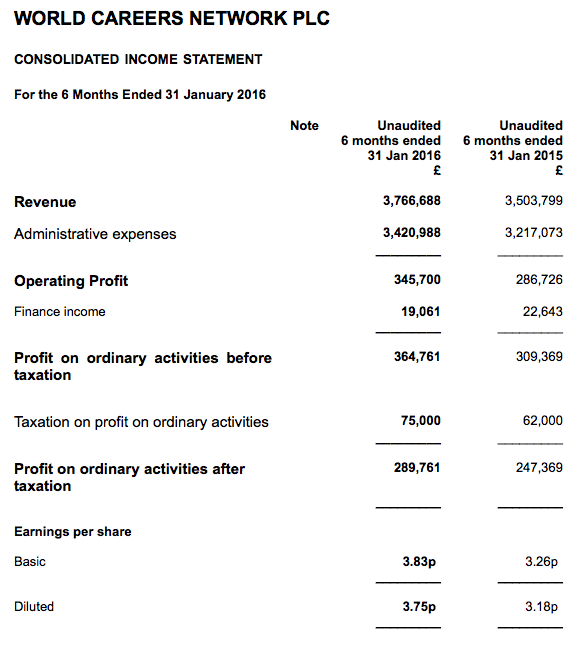

Results:

My thoughts:

* These results were not as bad I had feared

I was not anticipating too much progress within this statement after November’s annual results had warned of “a continued and significant reduction in profitability” for the current financial year.

In the event, revenue actually gained 8% to help operating profit climb 21%. WOR claimed that support fees from the software it had sold in the preceding second half had bolstered its performance.

Although I am pleased WOR could register a decent profit improvement, the £365k scored during the half compares to £1m reported during the first halves of 2012, 2013 and 2014. So there is some way to go before earnings have recovered fully.

* HMRC cutting back

The H1 revenue achievement was not too bad given one of WOR’s largest customers — HMRC — had demanded a much lower charge when its contract came up for renewal in early 2014. Indeed, I calculate the regular monthly payment from HMRC was cut by 66%.

(Here are the full details of the revised HMRC contract.)

From what I can tell, HMRC contributed revenue of £431k (11%) towards the group’s top line during H1 — and the run-rate is currently a third down on 2015.

I note some of WOR’s past HMRC income has related to one-off jobs, which now appear to be reducing substantially in number and value.

* Higher costs, but taking longer to implement than expected

The preceding annual results had warned of the cost base expanding as WOR looked to recruit additional sales and support staff. However, WOR’s H1 costs came in at £3.4m to match those reported during H2 of 2015.

In an unusual admission for a quoted company, WOR confessed that “certain of our investment plans took longer to implement than expected”. Very often, it is the other way around — with additional costs occurring much sooner than expected!

The upshot of the delay is that the current year should see a profit “broadly in line” with that recorded last year. I had previously expected lower earnings.

Still, WOR did say that the second half would incur a “significantly higher level of costs” and that “the cumulative impact of the additional costs we are incurring in this year will, inevitably, be felt in our next financial year.”

* Guessing revenue for the second half and full year

Just how large WOR’s cost base will become in H2 is difficult to judge.

But if I assume it grows from £3.4m from H1 to £3.7m in H2 — and given WOR reckons its current-year profit can broadly match that of last year — I can then make a rough estimate of possible H2 revenue.

My sums suggest H2 revenue coming in at £4.5m to give full-year revenue of £8.3m:

| H1 2015 | H2 2015 | FY 2015 | H1 2016 | H2 2016(e) | FY 2016(e) | ||

| Revenue (£k) | 3,504 | 4,352 | 7,856 | 3,767 | 4,509 | 8,276 | |

| Costs (£k) | (3,217) | (3,484) | (6,701) | (3,421) | (3,700) | (7,121) | |

| Operating profit (£k) | 287 | 868 | 1,155 | 346 | 809 | 1,155 |

* Cash flow and balance sheet

I am pleased WOR’s accounts showed the cash pile increasing by almost £1m to £9.2m during the first half. The advance appears to have been supported by HMRC clearing some outstanding invoices as well as upfront fees being received from other clients.

Roughly adjusting for upfront fees, I reckon WOR’s underlying cash pile could be £8.7m, or 115p per share.

Valuation

Assuming WOR repeats its 2015 operating profit of £1.1m for 2016, earnings could be £923k, or 12.2p per share, after 20% tax.

With the 195p offer price giving a market cap of £14.7m, I reckon WOR’s enterprise value (EV) is 80p per share, or £6.0m. The P/E on my EV and EPS calculations is therefore 6.5.

That multiple appears cheap, and should WOR recover to its 2014 performance — when earnings reached 25p per share — I reckon the share price could improve significantly.

Indeed, WOR has invested heavily in product development at the expense of short-term profit before, and the subsequent pay-off was very handsome. I am hoping the same can happen again.

Maynard Paton

Disclosure: Maynard owns shares in World Careers Network.

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here http://maynardpaton.com/2015/11/04/world-careers-network-cash-now-represents-half-the-market-cap/#comment-9344 that HMRC had paid WOR £707,192.76 (inc VAT) so far for the year ending July 2016.

HMRC’s data now extends to March 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-march-2016

I make the total cash payment to be £790,021.56 (inc VAT) for the year to July 2016 after WOR received a further £56,016 as the monthly service charge and a further £26,812.80 for supplying a management-information download during March.

On an accrued/accounting revenue basis, I make the total for the first eight months of the financial year (July 2016) to date to be £677,989.56, or about £565k ex-VAT.

That compares to £1,287k of revenue from HRMC during the year to July 2015. So I believe the run-rate of HMRC revenue is still about a third lower than last year.

Maynard

World Careers Network (WOR)

New staff and chief exec comments:

https://www.recruitment-international.co.uk/blog/2016/05/wcn-makes-senior-appointments

This recruitment software firm has recruited two senior sales people and a finance director.

The interesting quote comes from WOR’s chief exec. He said (my bold):

“We are delighted to welcome Adam, Julian and Peter to WCN’s senior management team. The breadth of experience they bring will be crucial in driving the business forward, helping us meet our ambitious global growth plans.”

Sounds promising. Certainly there seems to be a sales push in the United States at present.

Maynard

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here http://maynardpaton.com/2016/04/27/world-careers-network-better-than-expected-results-give-cash-adjusted-pe-of-less-than-7/#comment-9496 that HMRC had paid WOR £790,021.56 (inc VAT) so far for the year ending July 2016.

HMRC’s data now extends to April 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-april-2016

I now make the total cash payment to be £846,037.56 (inc VAT) for the year to July 2016 after WOR received a further £56,016 as the monthly service charge.

On an accrued/accounting revenue basis, I make the total for the first nine months of the financial year (July 2016) to date to be £734,005.56, or about £587k ex-VAT.

That compares to £1,287k of revenue from HRMC during the year to July 2015. So I believe the run-rate of HMRC revenue is now running about 40% lower than last year (up to now it had been running at about 33% lower).

Maynard

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here that HMRC had paid WOR £846,038 (inc VAT) so far for the year ending July 2016.

HMRC’s data now extends to May 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-may-2016

I now make the total cash payment to be £958,069.56 (inc VAT) for the year to July 2016 after WOR received two further payments of £56,016 as monthly service charges.

On an accrued/accounting revenue basis, I make the total for the first ten months of the financial year (July 2016) to date to be £846,037.56, or about £705k ex-VAT.

That compares to £1,287k of revenue from HRMC during the year to July 2015. So I believe the run-rate of HMRC revenue is now back to running about 33% lower than last year.

Maynard

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here that HMRC had paid WOR £958,070 (inc VAT) so far for the year ending July 2016.

HMRC’s data now extends to June 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-june-2016

I now make the total cash payment to be £1,014,085.56 (inc VAT) for the year to July 2016 after WOR received one further payments of £56,016 as a monthly service charge.

On an accrued/accounting revenue basis, I make the total for the first eleven months of the financial year (July 2016) to date to be £902,053.56, or about £752k ex-VAT.

That compares to £1,287k of revenue from HRMC during the year to July 2015. So I believe the run-rate of HMRC revenue is now about 36% lower than last year.

Maynard

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here that HMRC had paid WOR £1,014,085.56 (inc VAT) so far for the year ending July 2016.

HMRC’s data now extends to July 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-july-2016

I now make the total cash payment to be £1,049,935.56 (inc VAT) for the year to July 2016 after WOR received £36,850 for the supply of online tests. The firm ought to receive a £56,016 monthly service charge payment in August for July, too.

On an accrued/accounting revenue basis, I make the total for the financial year (July 2016) to be £937,903.56, or £993,919.56 including the owed £56,016 July service charge. The latter figure equates to about £828k ex-VAT.

That £828k compares to £1,287k of revenue from HRMC received during the year to July 2015. So I believe HMRC revenue for the financial year to July 2016 was about 36% lower than 2015.

Maynard

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

I mentioned in the Comment here that WOR had earned from HMRC, on an accrued/accounting revenue basis, for the financial year to July 2016 £937,903.56, or £993,919.56 including the owed £56,016 July service charge.

HMRC’s data now extends to August 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-august-2016

Sure enough, HMRC paid the £56,016 July monthly service charge payment in August.

The £993,919.56 figure equates to about £828k ex-VAT and compares to £1,287k of revenue from HRMC received during the year to July 2015. So I believe HMRC revenue for the financial year to July 2016 was 36% lower than 2015.

Maynard

World Careers Network (WOR)

Social media post

Sales must be doing well if the team are hiring Humvee Limos in the States…

World Careers Network (WOR)

HMRC payments update:

I continue to monitor the monthly expenditure updates from HMRC (what was (and maybe still is) WOR’s largest customer).

HMRC’s data now extends to September 2016:

https://www.gov.uk/government/publications/hmrc-spending-over-25000-september-2016

For the current financial year (to 31 July 2017), HMRC has paid £168,048k cash to WOR inc VAT.

On an accrued revenue basis, the total so far is £112,032 (£56,016 for both August and September 2016).

The payments made to date match those from this time last year.

Maynard