14 April 2015

By Maynard Paton

Quick update on M Winkworth (WINK).

Event: Final results published 14 April

Summary: A quite satisfactory set of full-year results, albeit the second half produced flat profits. WINK has become slightly more dependent on the booming London property market, but its estate-agency franchising operation continues to produce super margins and high returns on equity. There are not many shares with such finacials that I have found that presently trade on a P/E of about 10. I continue to hold.

Price: 140p

Shares in issue: 12,676,238

Market capitalisation: £17.7m

Click here to read previous WINK posts.

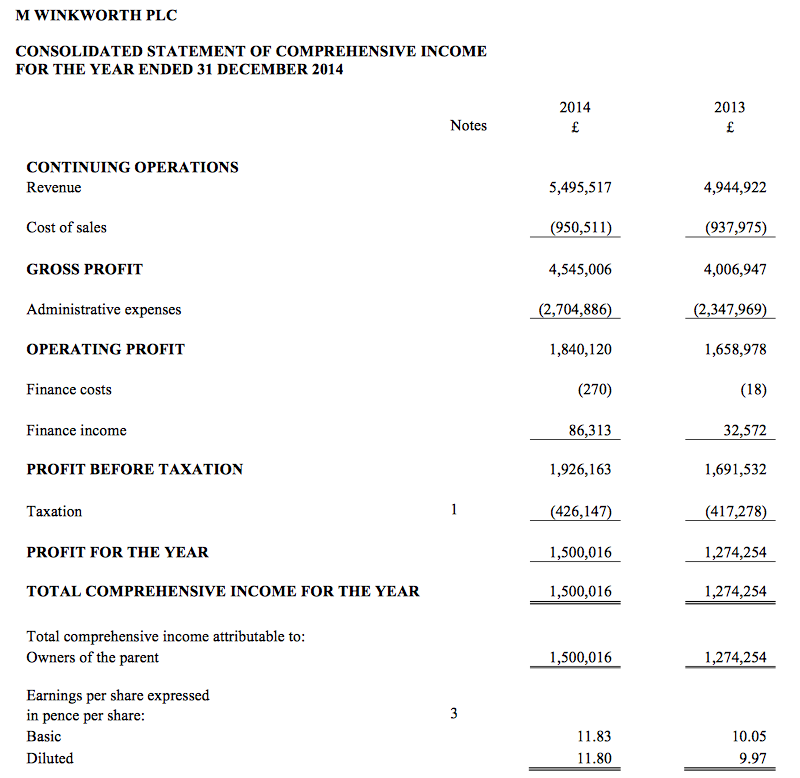

Results:

My thoughts:

* These results seemed satisfactory

I felt these results were quite satisfactory. WINK reported ‘a year of two halves’, with the full-year 11% operating-profit improvement being achieved entirely during the first six months.

The firm claimed uncertainty about the outcome of the forthcoming general election — including mooted policies such as the ‘mansion tax’ — alongside the mortgage market review had stifled progress during the second half:

| H1 2013 | H2 2013 | FY 2013 | H1 2014 | H2 2014 | FY 2014 | ||

| Revenue (£k) | 2,072 | 2,873 | 4,945 | 2,494 | 3,002 | 5,496 | |

| Operating profit (£k) | 576 | 1,083 | 1,659 | 785 | 1,055 | 1,840 |

* WINK remains dependent on a buoyant London property market

Despite WINK’s franchisees outside of London recording sales up 21% and its franchisees inside London reporting transaction activity down 15%, the overall business actually became even more dependent on the capital’s property market.

You see, transaction commissions in London gained 13% due to higher prices and caused the total proportion of WINK’s revenues that come from its London-based franchisees to advance from 80% to 81%.

Meanwhile, the proportion of group revenues derived from lettings remained at 35% and WINK revealed it is now aiming for “nearer 50%”. I’d welcome such an improvement, as regular lettings income ought to be more reliable than commissions from individual housing sales.

(That said, I do hope the “nearer 50%” weighting is achieved by the franchisees winning more lettings business rather than watching their sales commissions dry up!)

* But when will London’s booming property market really come off the boil?

I have long given up predicting the direction of house prices. However, WINK’s board is confident higher prices are on the way:

“Experience shows that it is traditional for the property market to be affected by uncertainty before elections, with activity returning to above normal seasonal levels after the event.

We expect this trend to be borne out in 2015, with the property market remaining below last year’s highly active level until polling day. Assuming a conclusive result, we believe that the market will enjoy a post-election bounce, restoring transactions to 2014 levels. We anticipate that prices will recoup the weakness of the opening months and show modest appreciation for the year as a whole.”

* WINK’s franchise business is still attractive

Operating as a pure estate-agent franchisor continues to produce high margins and high returns on equity:

| Year to 31 December | 2010 | 2011 | 2012 | 2013 | 2014 |

| Operating margin (%) | 34.8 | 29.8 | 31.1 | 33.5 | 33.5 |

| Return on average equity (%) | 56.7 | 34.2 | 23.2 | 35.3 | 34.8 |

WINK’s cut from its franchisees remains stable at about 11%, too:

| Year to 31 December | 2010 | 2011 | 2012 | 2013 | 2014 |

| Gross Franchise Sales & Lettings (£k) | 33,400 | 35,900 | 39,100 | 46,300 | 50,200 |

| Revenue (£k) | 3,708 | 3,979 | 4,292 | 4,945 | 5,496 |

| Revenue/Gross Franchise Sales & Lettings (%) | 11.1 | 11.1 | 11.0 | 10.7 | 10.9 |

* Cash flow continues to support franchisees

I mentioned in my February WINK write-up that I felt WINK’s cash generation had been disappointing.

Something I had not really considered at the time of my share purchases in 2011 was that the business would lend significant sums to its franchisees. These cash handouts are accounted for in working-capital movements, which are compared to operating profits below:

| Year to 31 December | 2010 | 2011 | 2012 | 2013 | 2014 |

| Operating profit (£k) | 1,289 | 1,191 | 1,333 | 1,659 | 1,840 |

| Working-capital movement (£k) | (147) | (246) | (415) | 274 | (878) |

Today’s results revealed a substantial negative movement of working capital and the balance sheet now shows at least £800k currently loaned to franchisees.

True, these franchisee loans last for just three years on average and ought to help develop what are generally fledgling operations. But I had hoped WINK, as a pure franchising business, would be by now producing more free cash that it is.

The loans to franchisees are something I will continue to monitor.

The cash movements — including the 5.9p per share dividend paid during the year — left cash in the bank almost £150k lighter at £2.5m. The business remains free of debt.

Valuation

* Trailing operating profits now stand at £1.8m and, taxed at a standard 20%, would produce earnings of £1.5m or 11.6p per share.

* Subtract the group’s £2.5m net-cash position from the current £17.7m market cap (at 140p), and I get an enterprise value (EV) of £15.2m or 120p per share.

* Then divide that 120p by my 11.6p earnings estimate and I arrive at a P/E of 10.4. That does not look bad value for a business that has just lifted its annual sales, profit and dividend by 10%-plus.

* My P/E goes below 10 if I treat those £800k-plus of franchisee loans as net cash and use an EV of £14.4m or 114p per share.

* I said in my February WINK write-up that “I suspect I won’t hesitate to drop WINK if I pinpoint a mouth-watering buying opportunity elsewhere!”

Well, I still hold WINK and have sold other shares to fund two recent buying opportunities. I have to confess, I have found very few shares that — similar to WINK — trade at about 10x profits and are blessed with super margins, net cash, a rising dividend and family management.

Next events: Q1 dividend announcement mid-May, AGM on 19 May, Q3 dividend announcement mid-August, half-year results in September.

Maynard Paton

Disclosure: Maynard owns shares in M Winkworth.

2014 annual report now published:

http://winkworth.supadu.com/images/ckfinder/2/pdfs/2015/Winkworth_Annual%20Report_2014.pdf

A few points I noted:

1) Staff costs and director pay:

I see staff numbers have increased from 18 to 27 as the business establishes its Client Services and Corporate Relocation departments, and total staff costs are up 26% — ahead of the revenue advance.

I calculate total staff costs represented 23.6% of revenue during 2014 — versus 20.8% for 2013. I can live with that advance given 2009-2012 saw the proportion at between 22.2-23.3%. I await to see whether the new Client Service and Corporate Relocation departments will continue to add costs at a greater pace than revenues. I trust they won’t.

Promising news on the director-pay front. I see the chief exec (DCM Agace) and the finance director (C Neoh) were paid less in 2014 than 2013. It looks as if neither received a bonus. That suggests the board has a firm grip on pay, given WINK’s revenue, profits and dividend were all lifted 10%-plus in the year.

2) Trade receivables:

Here’s where we can see the loans to the franchisees I mentioned in the above post.

The relevant figures I believe are £244,218 and £810,704, which total up to £1,054,922 — which matches the £1m mentioned in the chairman’s statement.

This sum could be a ‘hidden’ asset — that is, the cash is owed to WINK and could be seen as a proxy for cash in the bank (less a discount for possible non-payment of course). My valuation sums have in the past ignored the loans, but I may have to revisit that policy due to their growing size. At least by ignoring the loans in my sums, I should enjoy some upside as and when the loans are repaid and WINK’s cash position increases.

Also within trade receivables I see £243,708 of the £566,733 is past due — or 43.0%. This seems a high proportion, although it is less than the 54.3% for 2013. The figures for 2008 to 2012 were 46.4%, 39.3%, 45.2%, 41.4% and 44.4%… so the 43.0% for 2014 isn’t historically out of the ordinary.

But the trade-receivable situation does suggest to me that WINK’s franchisees are slow payers and what with those franchisee loans as well, apparently aren’t the most robust of operations.

I couldn’t find anything else in the 2014 annual report that warranted any comment.

Maynard

Q1 dividend announced:

http://www.investegate.co.uk/m-winkworth-plc–wink-/rns/dividend-declaration/201505130700249105M/

Up from 1.5p to 1.7p.

Going on past dividend payments, WINK’s 2015 payout is now likely to be at least 1.7+1.7+1.7+1.7 = 6.8p per share. The Q4 payout has sometimes been higher than the preceding Q1, Q2 and Q3 payouts, so the full-year dividend may be 6.9p or even 7.0p per share.

At 162p to buy, the shares yield 4.2% on the 6.8p per share forecast. P/E is 11.7 based on my 11.6p EPS calculations in the above post.

Meanwhile, London’s housing market seems to have sparked into life following the election:

http://www.dailymail.co.uk/news/article-3074523/Housing-market-frenzy-election-results-Millions-pounds-worth-luxury-homes-sold-just-hours-exit-poll-signalled-David-Cameron-s-victory.html

“Estate agents described atmosphere as ‘manic’ as homes were put on sale and snapped up almost immediately”

Plus WINK has had its first election success — renting a property to a new MP:

Maynard