***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

27 July 2024

By Maynard Paton

An illustrious dividend history and a worthwhile yield have brought RWS to my attention. The language-translation group presently offers:

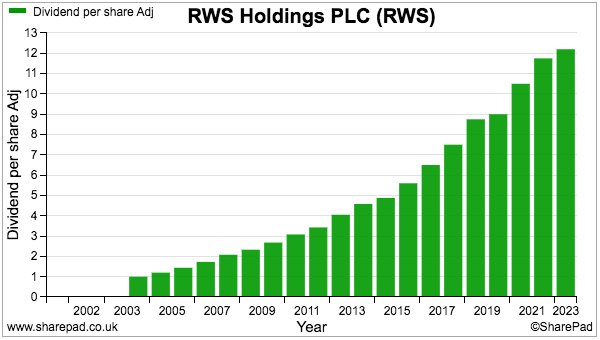

- An unbroken record of dividend increases since its 2003 flotation;

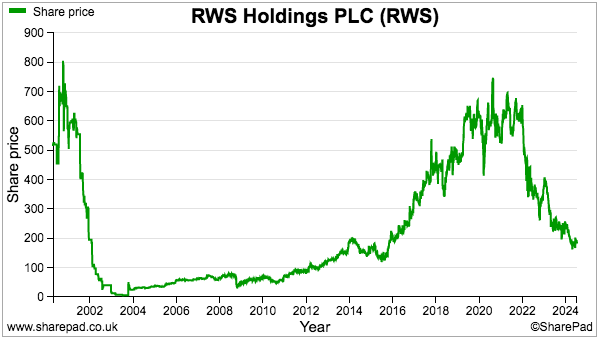

- A despondent share price that provides a 6.5% yield;

- Forecasts for further growth, albeit tempered by significant profit adjustments and unnerving management changes, and;

- A long-time board member with a £170 million investment who has never sold a share.

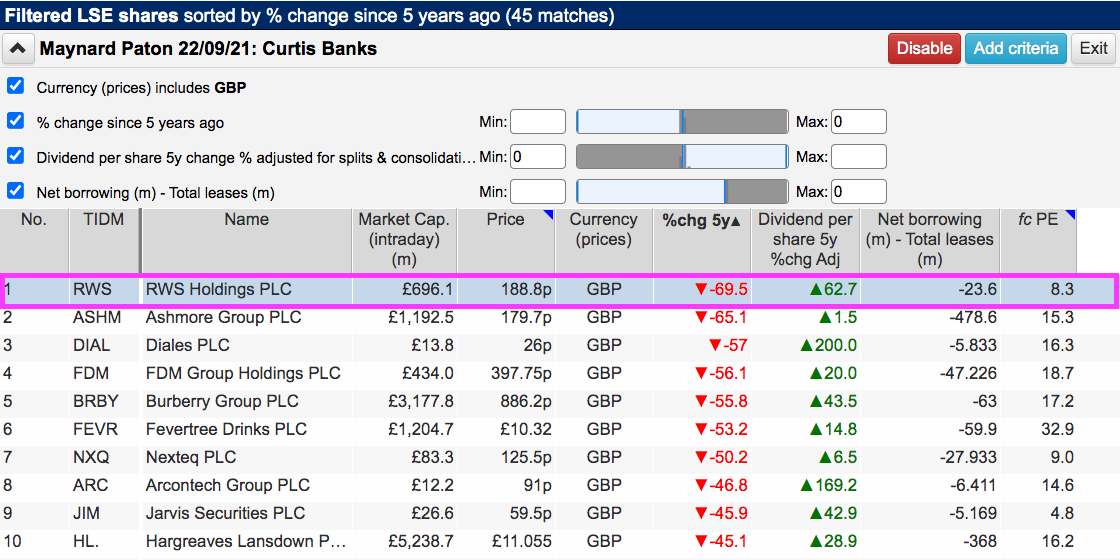

I pinpointed RWS after revisiting a SharePad filter that shortlisted companies where the last five years had shown their dividends going up but their share prices going down:

I selected RWS because its shares had fallen the furthest among the shortlist. I also noted the group’s forecast P/E was a modest 8x.

Not only has RWS’s dividend increased during the last five years, the payout has been lifted every year for a remarkable 19 years!

But the rising dividend has not stopped the shares plummeting to 189p, which supports a £696 million market cap:

Let’s take closer look.

Read my full RWS article for SharePad >>Maynard Paton