***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

16 December 2023

By Maynard Paton

I love ‘owner managers’ — company bosses with significant shareholdings who want to build wealth for the long haul.

Such leaders do seem to act differently to standard chief executives. A hefty investment complemented by substantial dividends should certainly focus the mind on long-term operational matters…

…versus more typical executive considerations such as bonuses, expense accounts, awaydays and career progression.

I have attempted to identify promising ‘owner managers’ by screening for companies with the following criteria:

- At least ten years of annual dividend increases, and;

- A minimum 10% total director shareholding.

SharePad returned only eight companies, including James Halstead, Judges Scientific and Craneware:

I selected Lok’nStore as it offered the highest forecast dividend growth among the shares I had not previously evaluated for SharePad.

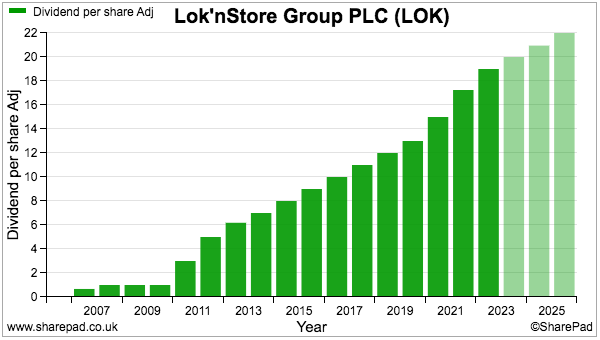

Lok’nStore’s history of annual dividend increases runs to 13 years, with another three years of payout advances predicted:

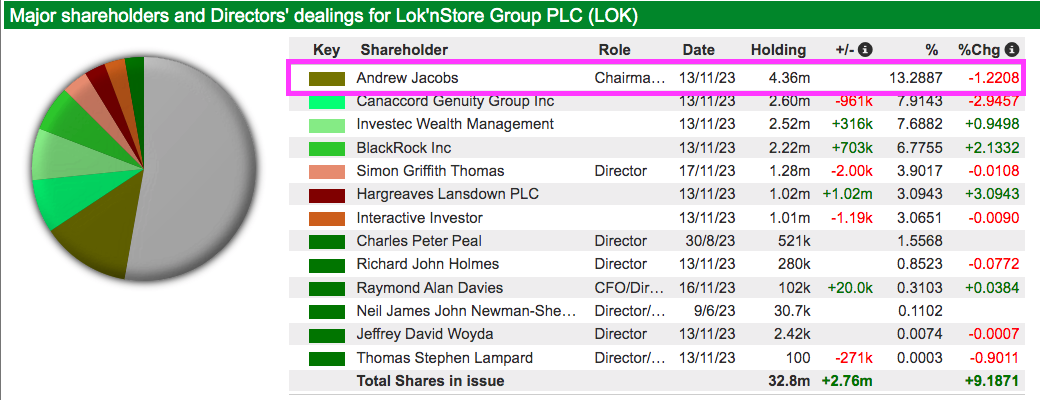

SharePad reveals Lok’nStore’s ‘owner manager’ to be executive chairman Andrew Jacobs, who controls 13% of the business:

Let’s take a closer look.

Read my full LOK’NSTORE article for SharePad >>Maynard Paton