15 August 2023

By Maynard Paton

H1 2023 results summary for FW Thorpe (TFW):

- A record H1 performance bolstered by acquisitions of Zemper and SchahlLED that showed total revenue up 29% and adjusted profit up 34%.

- Thorlux and SchahlLED combined well, with adjusted Thorlux profit up 57% after supply problems eased and the launch of a new SmartScan system.

- Mixed progress was delivered elsewhere, as Dutch profit fell 8% and Zemper not obviously living up to what could be an eventual £37m purchase price.

- Net cash of £18m was the lowest for 16 years and no longer covers the anticipated earn-outs for Zemper (£12m) and SchahlLED (£7m).

- A possible 20x P/E seemingly reflects TFW’s distinguished operating history and the persistent demand for energy-saving lighting rather than any doubts about the hefty acquisition expense and the uncertain wider economy. I continue to hold.

Contents

- News link, share data and disclosure

- Why I own TFW

- Results summary

- Revenue, profit and dividend

- Thorlux and SchahlLED

- Netherlands

- Zemper

- Ratio Electric

- Other companies

- Financials

- Valuation

News link, share data and disclosure

News: Interim results for the six months to 31 December 2022 published 16 March 2023.

Share price: 375p

Share count: 118,935,590

Market capitalisation: £446m

Disclosure: Maynard owns shares in FW Thorpe. This blog post contains SharePad affiliate links.

Why I own TFW

- Develops professional lighting systems with a long-established reputation for high product quality, leading technical innovation, first-class service and sustainable manufacturing processes.

- Board led by a veteran executive and assisted by family non-execs who steward a 45%-plus/£199m-plus shareholding and favour special payouts.

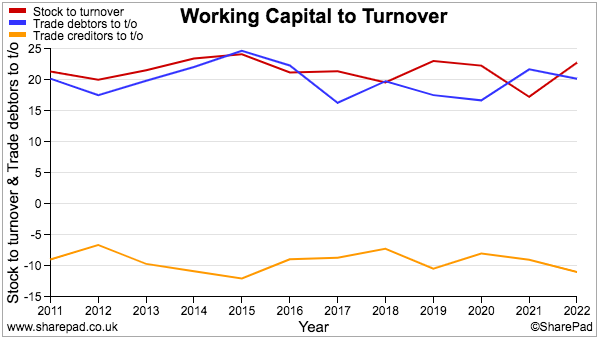

- Conservative accounts typically display useful operating margins, substantial cash reserves, consistent working-capital management and illustrious rising dividend.

Further reading: My TFW Buy report | All my TFW posts | TFW website

Results summary

Revenue, profit and dividend

- A very satisfactory FY 2022 that anticipated a “good” H1…

“The Group has started the financial year with a robust order book and some healthy projects on the horizon. The Group sees an improving supply and operations picture and, as such, the Board expects a good first half performance despite ongoing pressures on operating costs.”

- …followed by an AGM statement that described this H1 as “solid“…

“Since the beginning of the new financial year, orders and revenue for the Group are in line with expectations and overall, ahead of the same period last year. Margin and price pressures continue, offset by reasonable selling price increases where possible.

Manufacturing service levels have improved significantly in recent months and our sales teams have a generally positive outlook. We foresee a solid half-year result, supported by our recent acquisitions.

- …had already suggested an acceptable H1 performance.

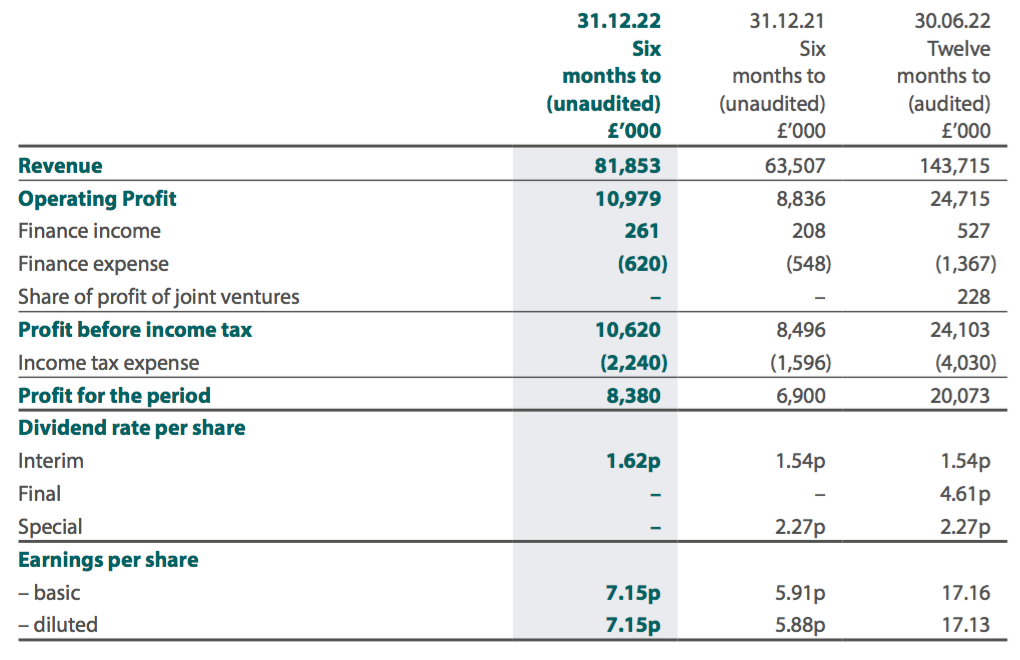

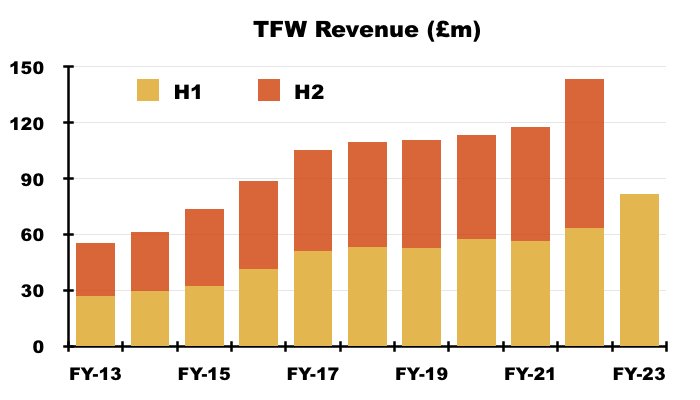

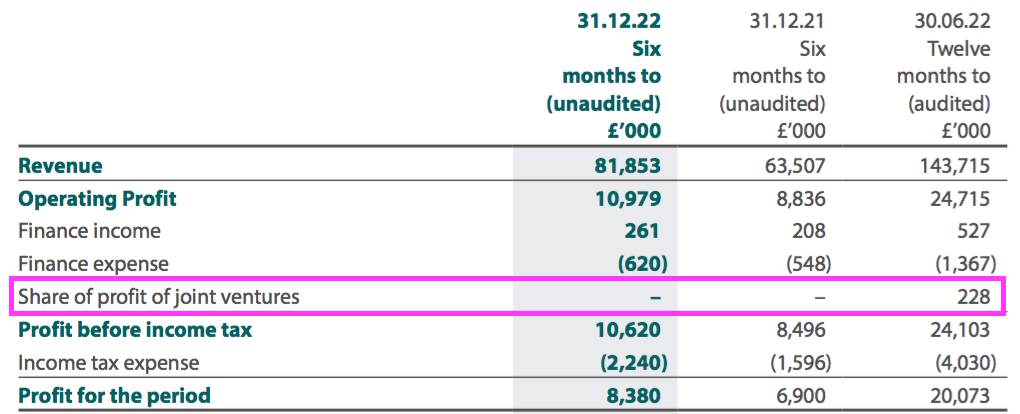

- H1 revenue gained 29% to £82m while H1 operating profit climbed 23% to £11m:

- The purchases of Zemper during October 2021 and SchahlLED during September 2022 helped deliver the record H1 revenue and profit highs.

- TFW claimed the like-for-like revenue performance was +12%:

“On a like-for-like basis, excluding the recent acquisition of SchahlLED, revenue increased 12%“

- SchahlLED brought in revenue of £6.7m…

“Included in the Thorlux segment are additional revenues from SchahlLED of £6,674,000 and operating profit of £367,000.“

- …while six-month revenue of £8.7m from Zemper was 87% higher than the three-month contribution during the comparable H1 (£4.6m).

- Excluding SchahlLED and Zemper, revenue advanced 13% from £58.9m to £66.5m:

- The preceding FY admitted revenue had been held back by supply problems:

“Most companies in the Group suffered severe component shortages throughout the financial year, hampering production output and efficiency, and softening year-end results.”

- But this H1 stated supply problems had been “mostly… resolved“:

“Now that supply shortages have mostly been resolved, the Group is in a healthy stock position and all companies have active plans to reduce stocks to more normal levels in coming months.“

- The supply resolution prompted a catch-up of orders:

“The Group had an excellent operational performance, allowing it to catch up on outstanding deliveries: the order backlog reduced, whilst order input generally slowed during the period.“

- TFW noted profit was hindered by acquisition adjustments:

“Whilst revenue is consolidated from all Group companies, the headline operating profit number is suppressed by IFRS acquisition adjustments in relation to Zemper and SchahlLED.”

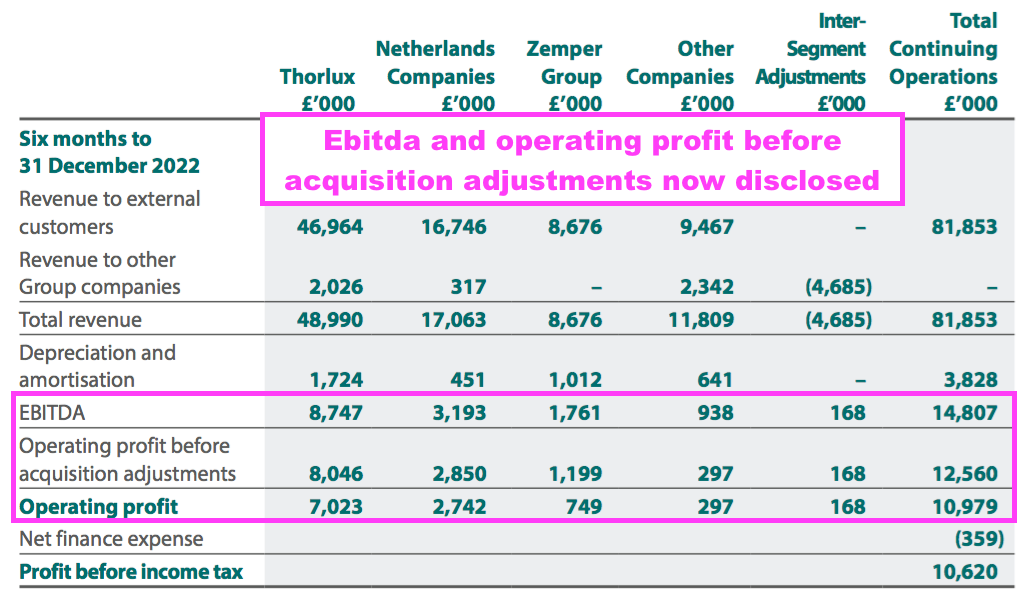

- The adjustments involve the amortisation of acquired intangibles as well as (I believe) changes to earn-out provisions, and TFW has helpfully started to disclose operating profit before and after such adjustments:

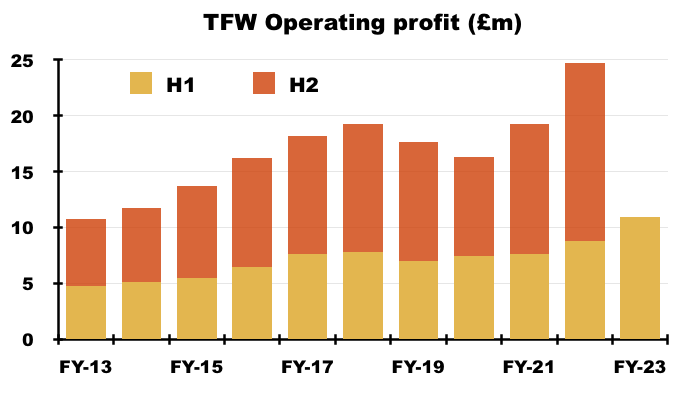

- H1 operating profit before such acquisition adjustments in fact gained 34% from £9.4m to £12.6m.

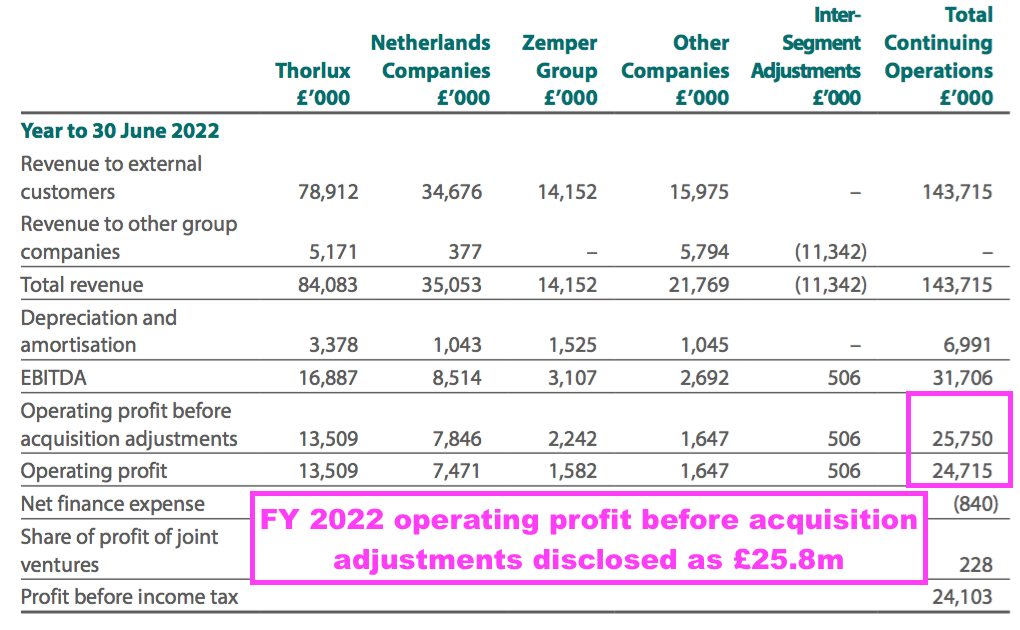

- This H1 revealed the preceding FY 2022 had in fact scored a £25.8m adjusted operating profit — some 4% ahead of the £24.7m operating profit reported at the time:

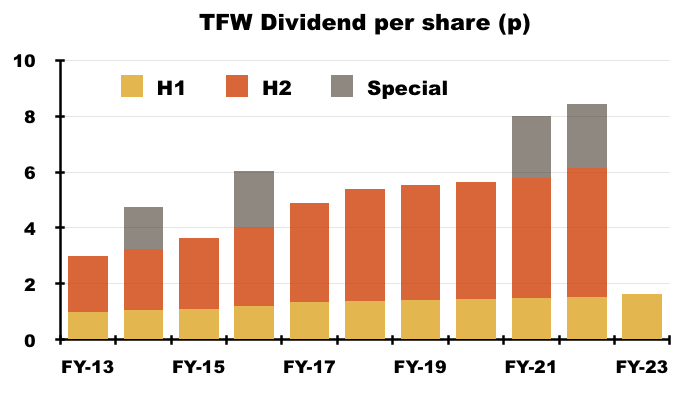

- The H1 dividend was lifted 5% to register the largest H1 payout increase since H1 2017 (+12.5%):

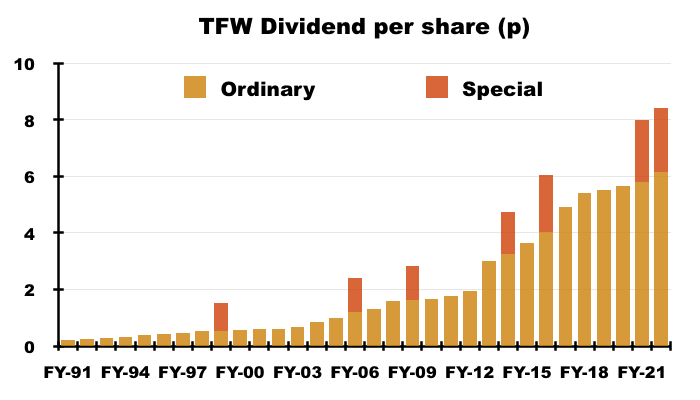

- The ordinary dividend looks on course for its 21st consecutive annual increase and has not been cut since at least 1991:

- The ordinary dividend has grown at a compound average of 7-8% during the last 10 years.

- Special dividends were declared for FY 2021 and H1 2022, but understandably ceased following significant expenditure on SchahlLED, Zemper and joint-venture Ratio Electric (see Financials).

Thorlux and SchahlLED

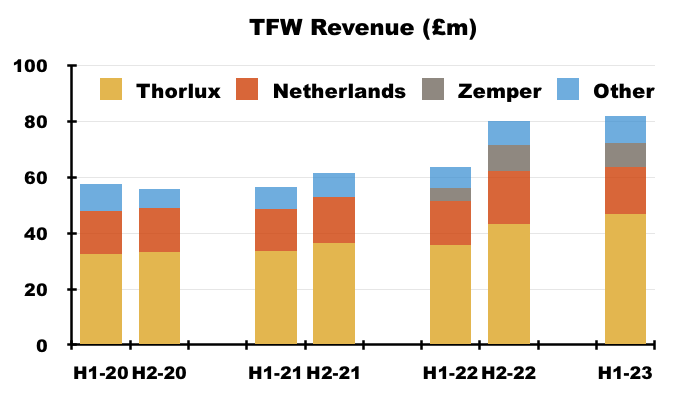

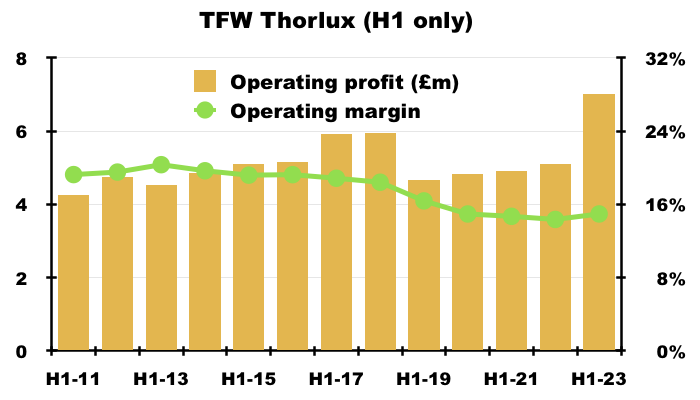

- Thorlux manufactures a wide range of professional lighting equipment — most notably the SmartScan system — and represents approximately 60% of the group:

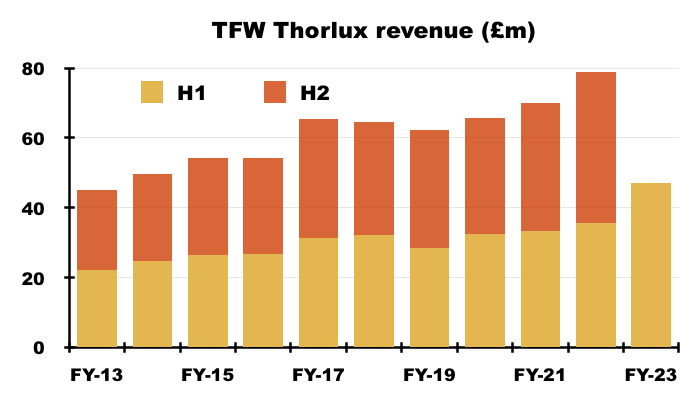

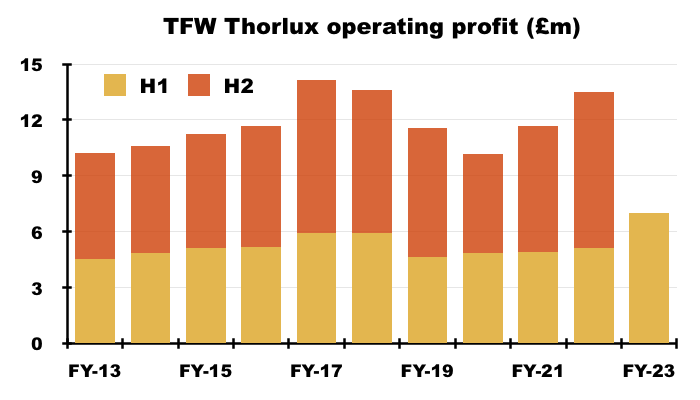

- Thorlux reported a record H1 effort, with H1 revenue up 32% to £46.9m and H1 operating profit up 37% to £7.0m:

- SchahlLED is now part of Thorlux, and H1 Thorlux revenue would have advanced 12% to £40.3m without SchahlLED.

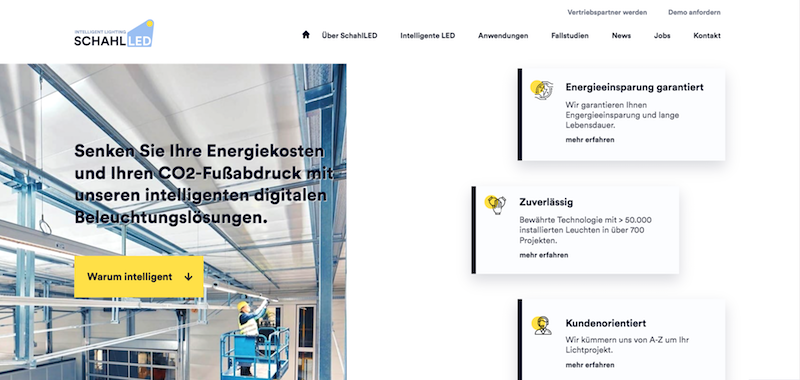

- Thorlux started working with SchahlLED during 2019, after which the German lighting installer quickly became TFW’s largest customer:

- SchahlLED was owned only for three months during this H1, although TFW noted the three-month contribution was “seasonally strong”.

- TFW said SchahlLED produced a £367k profit during its “seasonally strong” October-to-December…

“Included in the Thorlux segment are additional revenues from SchahlLED of £6,674,000 and operating profit of £367,000.”

- …which does not quite chime with the full-year Ebitda of £2.8m stated at the time of purchase:

“During the last financial year ending 31 December 2021, SchahlLED achieved revenues of €15.9m with EBITDA of €2.8m.“

- Thorlux appears to have now captured SchahlLED’s gross margin, and the resultant extra profit was not included within SchahlLED’s stated £367k contribution.

- With H1 Thorlux profit up 37% to £7.0m — or up 57% to £8.0m before acquisition adjustments — clearly something went right for Thorlux/SchahlLED during those “seasonally strong” three months.

- Note also that Thorlux’s H1 margin was 15%, or 17% before the acquisition adjustments.

- Thorlux’s H1 margin has not topped 17% since H1 2018 (18%):

- TFW paid an initial £12.9m for 80% of SchahlLED, with a further £1.1m earn-out paid during H2 2023 and the remaining 20% to be acquired “subject to performance conditions” for an estimated £5.5m within the next three years:

“There is a fixed commitment to acquire the remaining [SchahlLED] shares, based on current best estimates, a further £5.5m (€6.2m) could be payable which is subject to future performance conditions.”

- The return on the eventual £19.5m investment will be impossible to determine for outside shareholders, given SchahlLED’s profit is now amalgamated within Thorlux.

- TFW’s Thorlux commentary was limited to the division’s “notable achievements” and the next version of SmartScan:

“Thorlux’s new SmartScan generation 2 is now in production and in use on several projects, with thousands of luminaires successfully exploiting the new software and improved platform. SmartScan is now also integrated into products manufactured by most Group companies.“

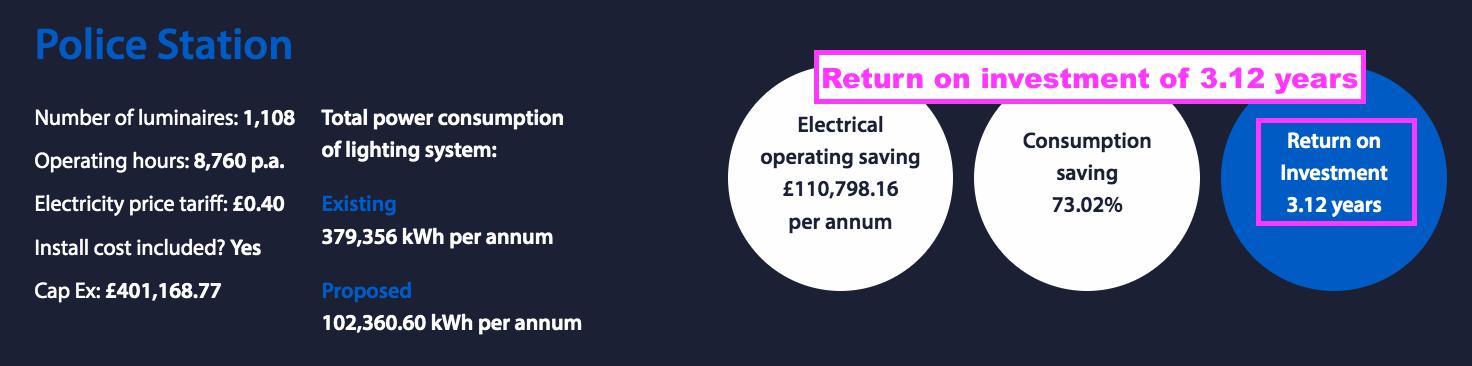

- SmartScan installed with LED lights can apparently generate energy savings of more than 70%:

“Projects combining Thorlux LED luminaires and the SmartScan wireless management system frequently benefit from energy savings exceeding 70% when compared with conventional technology.“

- Payback periods can be less than four years with electricity at 40p/kWh:

- The 2022 annual report small-print (point 3) talked of financing options…

“Financing options with partners to make solutions more affordable to customers to match the savings achieved.”

- …which may help persuade some companies to invest in new Thorlux kit:

- Payments are spread over a number of months with zero upfront cost.

- Annual gross savings aligned to be more than annual gross costs potentially giving net financial saving from day one.

- Savings could pay for the equipment whilst still reducing energy and carbon.

- Organisations recently employing Thorlux include:

- Thorlux’s prospects for H2 2023 appear promising although economic doubts persist:

“Positivity about the short-term order outlook remains, especially at Thorlux (the Group’s largest business), notwithstanding some general concern about the state of the economy as a whole.“

Netherlands

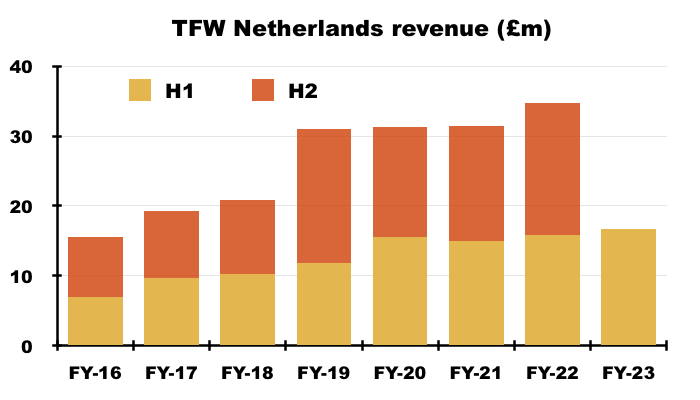

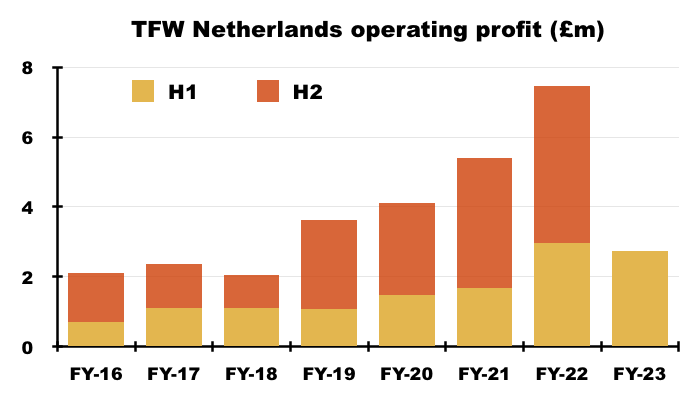

- TFW’s Dutch businesses — Lightronics and Famostar — represent almost a quarter of TFW’s profit.

- Lightronics manufactures mostly street lighting and was acquired during FY 2015 for an initial £8.3m that included a £1.9m debt repayment.

- Famostar manufactures mostly emergency lighting and was acquired during FY 2018 for an initial £6.3m:

- An earn-out payment during FY 2022 took the total Dutch acquisition cost to £30m.

- Both Lightronics and Famostar appear to have flourished under TFW’s ownership.

- Trailing aggregate Lightronics/Famostar revenue has reached £35m versus less than a combined £18m at the time of their purchases.

- Trailing aggregate Lightronics/Famostar operating profit has meanwhile advanced to £7.5m versus a combined £2.3m at the time of their purchases.

- My previous calculations suggest the total £30m Dutch investment is providing TFW a very satisfactory 19% (or probably more) return.

- The Dutch businesses sadly did not deliver a fantastic H1.

- H1 Dutch revenue increased 6% to £16.7m, but H1 Dutch profit fell 8% to £2.7m.

(Famostar acquired during H1 2018 but reported within Netherlands from H1 2020)

- TFW’s H1 statement did not mention the Dutch businesses specifically, but implied they had suffered margin pressure:

“Some other companies struggled to some extent to cope with and react to rising costs, in particular material and wage inflation.“

- The Dutch adjusted margin was still a useful 17% for this H1, albeit lower than the 19% enjoyed during the comparable H1 and the 21% for the preceding FY.

- Recent project wins in the Netherlands include:

- TFW’s commendably widened its boardroom talent last year after appointing Frans Haafkens as a non-executive:

“Frans is a Dutch national who has worked with the Group in recent years supporting the continued success of its Dutch entities, Lightronics and Famostar, both as a consultant and an investor. He is also a minority investor in Ratio Electric B.V., the recent joint venture investment by the Group.“

- Mr Haafkens has worked with TFW since TFW bought Lightronics from his private-equity group during FY 2015.

- Mr Haafkens’ investment firm co-purchased Famostar with TFW during FY 2018, and bought a majority stake in Ratio Electric a year before TFW bought a 50% stake during December 2021.

- The presence of Mr Haafkens on TFW’s board implies relations between TFW and Mr Haafkens are cordial following the Famostar and Ratio Electric deals.

Zemper

- Buoyed perhaps by the success of the Lightronics and Famostar acquisitions, TFW acquired Spanish emergency-lighting group Zemper during October 2021:

- The Zemper deal was significant, with £19.9m spent to acquire a 63% share that included cash of £5.3m.

- Another £5.3m was spent during September 2022 to purchase a further 13.5% of Zemper.

- The combined £25.2m so far paid to acquire 76.5% of Zemper almost exceeds TFW’s entire FY 2022 adjusted operating profit of £25.8m.

- The initial £19.9m payment valued 100% of Zemper at £32m, while the subsequent £5.3m payment valued 100% of Zemper at £39m.

- The 2022 annual report (point 31) states a further £12m could be paid to acquire the remaining 23.5% — valuing 100% of Zemper at £51m:

“Included within other payables is a commitment to purchase the outstanding shares (redemption liability and contingent consideration) in Electrozemper S.A. of €20,046,000 (£17,248,000). Of this amount €6,123,000 (£5,268,000) is included in current liabilities and €13,923,000 (£11,980,000) in non-current liabilities.”

- Similar to the Dutch businesses, Zemper was not mentioned specifically during this H1 and presumably “struggled to some extent to cope with and react to rising costs” as well.

- Zemper recorded a 14% adjusted margin during this H1, versus 15% during the preceding H2 and 17% for the three-month contribution during the comparable H1.

- The 2022 annual report (point 31) revealed Zemper’s acquired ‘customer relationships’ had a 15-year useful life.

- I trust such a lengthy useful life is indicative of loyal Zemper customers rather than optimistic accounting. Zemper was established during 1967, so TFW presumably has good evidence to verify Zemper’s customers have bought Zemper’s lighting for 15 years.

- At the time of purchase, TFW said Zemper’s 2021 results had shown revenue of approximately £17.5m and profit before tax of approximately £3.3m.

- Zemper’s revenue and adjusted operating profit currently run at £18.2m and £2.7m respectively, suggesting no significant trading improvement following the acquisition.

- I must confess, Zemper profit running at approximately £3m does not seem great when the total Zemper purchase looks set to cost £37m.

- The 2022 annual report (point 24) reveals the Zemper earn-out is priced at 10x Ebitda versus 6x Ebitda paid for the Dutch businesses:

“A multiple based on a six times EBITDA, that we consider a reasonable multiple for the sector, is used in these computations, except for Zemper where an EBITDA multiple of ten has been used in accordance with the agreement upon which the contingent consideration is based.”

- The higher 10x multiple may reflect Zemper’s superior prospects, but could also reflect TFW’s weakened discipline with acquisition pricing.

Ratio Electric

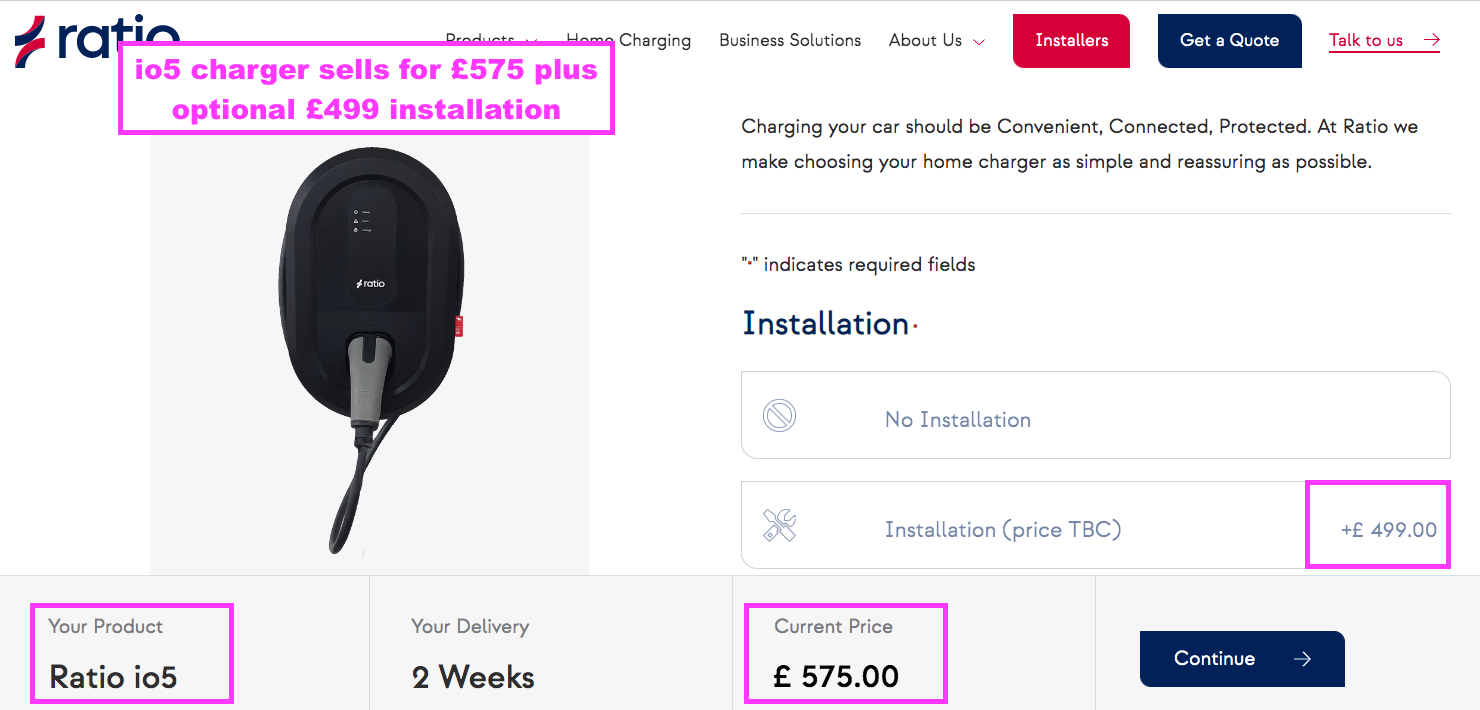

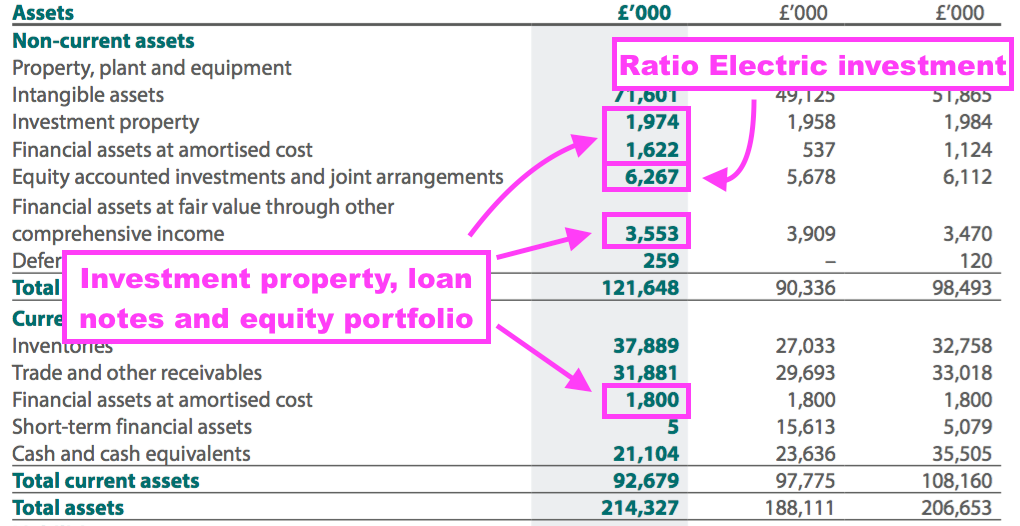

- TFW acquired 50% of Ratio Electric during December 2021 for £5.8m, with an extra loan note issued for £0.9m “to help fund the development of [the] business”.

- Ratio is located within the Netherlands and develops electric-vehicle charging systems:

- TFW did not mention Ratio during this H1.

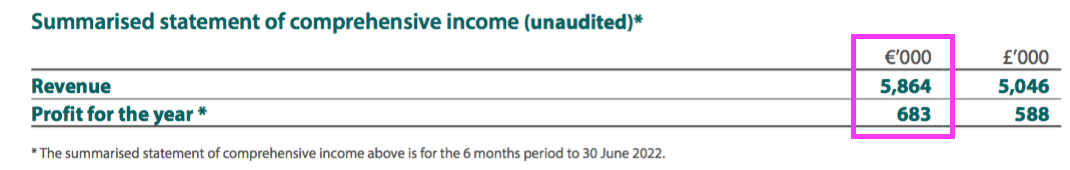

- The preceding FY 2022 showed the joint-venture contributing a £228k profit, but the venture contributed nothing during this H1:

- Ratio’s UK operation currently sells its io5 home-charging unit for £575 plus an indicative £499 for installation:

- The preceding FY 2022 disclosed H2 Ratio revenue of €5.9m and H2 Ratio profit of €0.7m:

- I am therefore hopeful Ratio’s annualised revenue is running close to €12m — some 50% higher than the €8m disclosed at the time of the investment — although current profitability still looks insignificant at present.

- Electric-vehicle charging is a departure from TFW’s core lighting speciality, but the 2022 annual report reiterated the rationale made at the time of the investment:

“This is an exciting opportunity for the Group. FW Thorpe’s know-how in electrical engineering, manufacturing and lighting, combined with Ratio’s experience in electrical vehicle charging will allow the introduction of new products into the UK market as well as supporting growth in Ratio’s existing markets.

We see similarities in technology and engineering skills, giving the Group the opportunity to diversify into new areas of engineering with high growth potential.”

- The Ratio investment is carried presently at £6.3m, up £0.2m during this H1 due I presume to currency movements.

- The 2022 annual report implied interest on the Ratio loan note was 2.4% and was not being paid by the joint venture:

“Pursuant to the investment in Ratio Holding B.V. in December 2021, the Group has issued loan notes of €1,000,000 (£860,000) to help fund the development of this business. With accrued interest, the balance at 30 June 2022 is €1,012,000 (£872,000) (2021: nil (£nil)).“

Other companies

- TFW’s Other companies consist of:

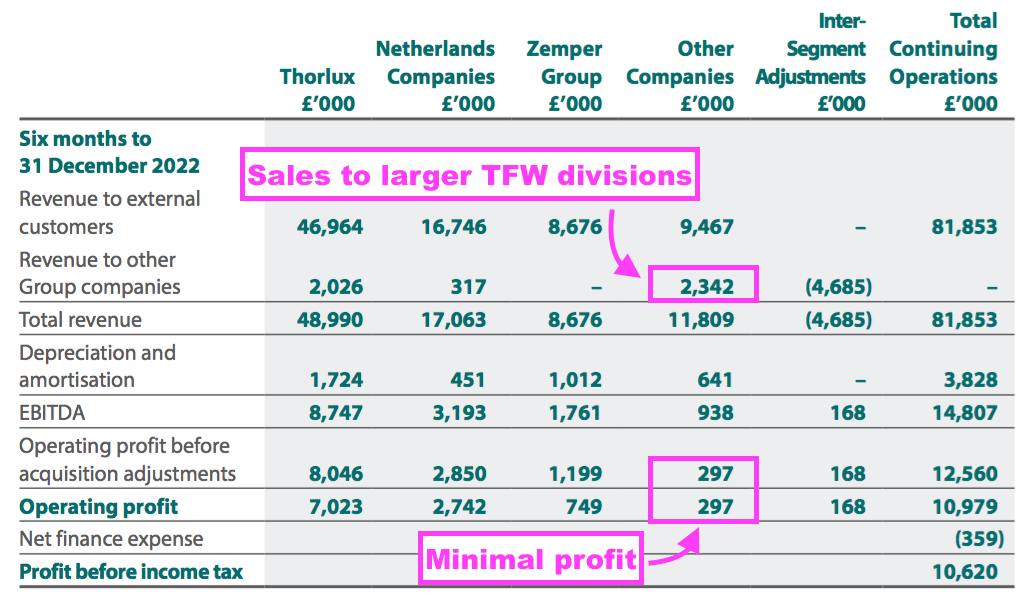

- TRT Lighting, which supplies lighting for roads and tunnels, and earns revenue of almost £9m;

- Philip Payne, Solite and Portland, which between them supply emergency lighting, cleanroom lighting and shop lighting to earn combined revenue of approximately £11m, and;

- A handful of overseas Thorlux offices.

- These Other companies have not registered great progress during recent years. Since FY 2017, their total gross revenue has bobbed around the £19m mark.

- Two of the Other companies enjoyed an improved H1:

“There were notable achievements at Thorlux Lighting and continued improvements at the UK companies Philip Payne and Solite, whilst some other companies struggled to some extent to cope with and react to rising costs, in particular material and wage inflation.“

- Profit at the Other companies remains minimal and I speculate they are kept on by TFW mostly because they supply products to the group’s larger divisions:

Financials

- TFW’s accounts remain cash rich despite the purchase of SchahlLED (£13m) during this H1 and substantial outlays for Lightronics/Famostar (£15m), Zemper (£15m net of cash acquired) and Ratio Electric (£6m) during FY 2022.

- Cash and short-term deposits ended the half at £21m, while ‘financial liabilities’ (bank debt and government loans associated with Zemper) were £3m.

- The 2022 annual report (point 18) reiterated why TFW keeps a net cash position:

“The Group’s policy has been to maintain a strong capital basis in order to maintain investor, customer, creditor and market confidence. This sustains future development of the business, safeguarding the Group’s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders.

…

The Group has a long-standing policy not to utilise debt within the business, providing a robust capital structure even within the toughest economic conditions.“

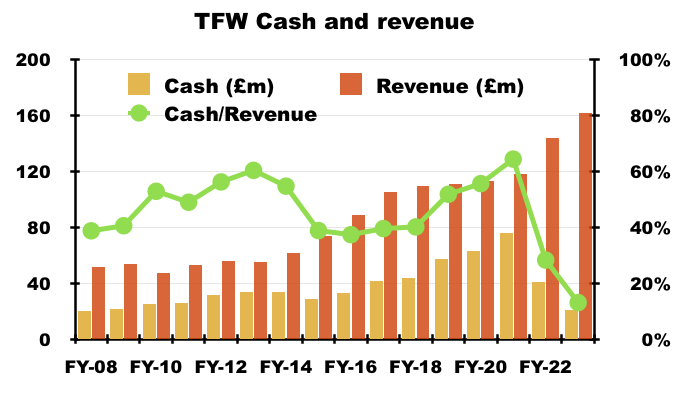

- Mind you, net cash at £18m was the lowest since FY 2007 (£13m) and was equivalent to 13% of trailing twelve-month revenue — the lowest proportion since FY 2001 (7%):

- Net cash of £18m does not look enough to cover the aforementioned estimated earn-outs for Zemper (£12m) and SchahlLED (£7m).

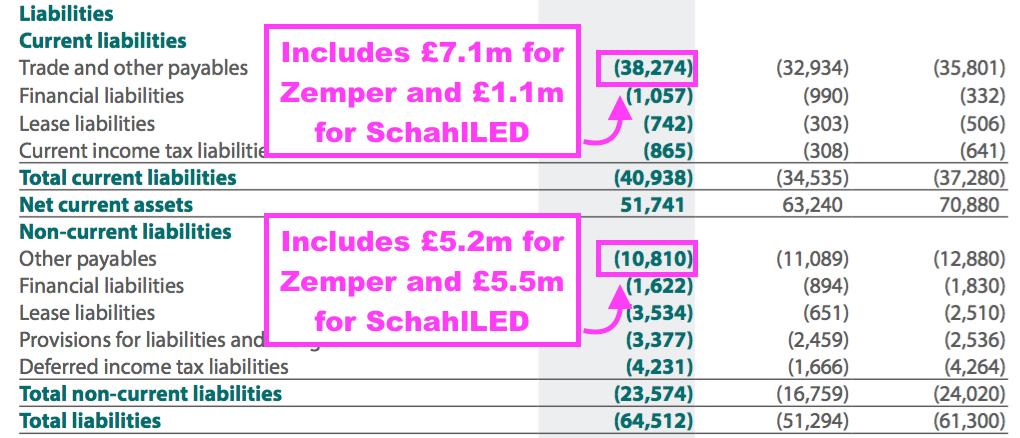

- TFW helpfully confirmed to me where the outstanding earn-outs are carried on the balance sheet:

- I trust TFW’s operational cash flows during the next year or two will help fund the earn-outs and keep TFW net cash positive.

- The balance sheet also carries investment property of £2m, loan notes (of varying quality (point 26)) of £3m and an equity portfolio of £4m:

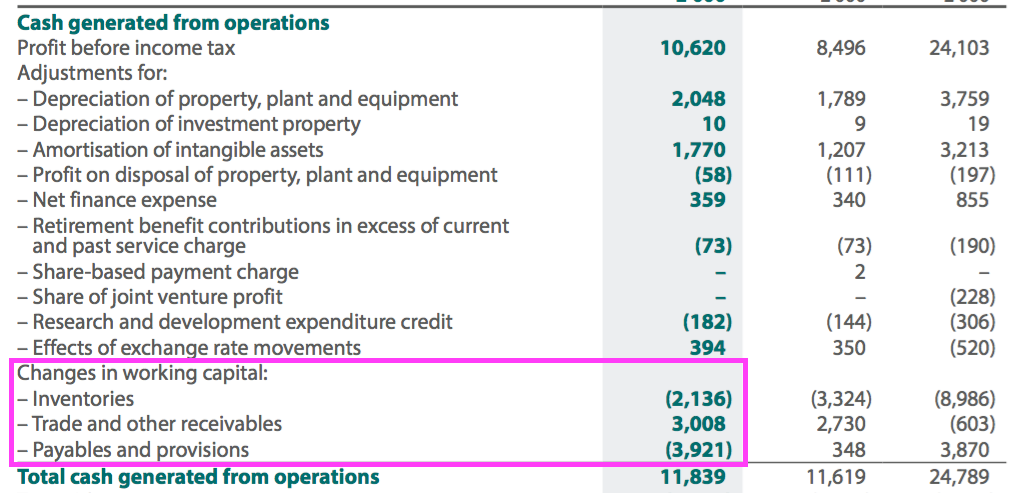

- Cash conversion was adequate. H1 operating cash flow of £11.8m less tax of £2.0m less capex of £5.1m plus net finance income of £0.2m meant reported earnings of £8.4m translated into free cash of £4.9m.

- The bulk of the £3.5m difference between earnings and free cash flow was caused by a £3m investment into extra working capital:

- Stock ended this H1 at £38m, TFW’s highest ever level — and equivalent to a not insignificant 23% of trailing twelve-month revenue.

- Stock at 23% of revenue is not out of keeping with previous FYs (red line below):

- A full-year contribution from Zemper and SchahlLED plus company action to reduce stock levels…

“Now that supply shortages have mostly been resolved, the Group is in a healthy stock position and all companies have active plans to reduce stocks to more normal levels in coming months.“

- …ought to mean that 23% proportion reduces within the forthcoming FY 2023 accounts.

- The £12.9m spent purchasing SchahlLED, the further £5.3m Zemper payment and the £5.4m spent on dividends then ensured total cash finished the half approximately £20m lighter than the preceding year-end.

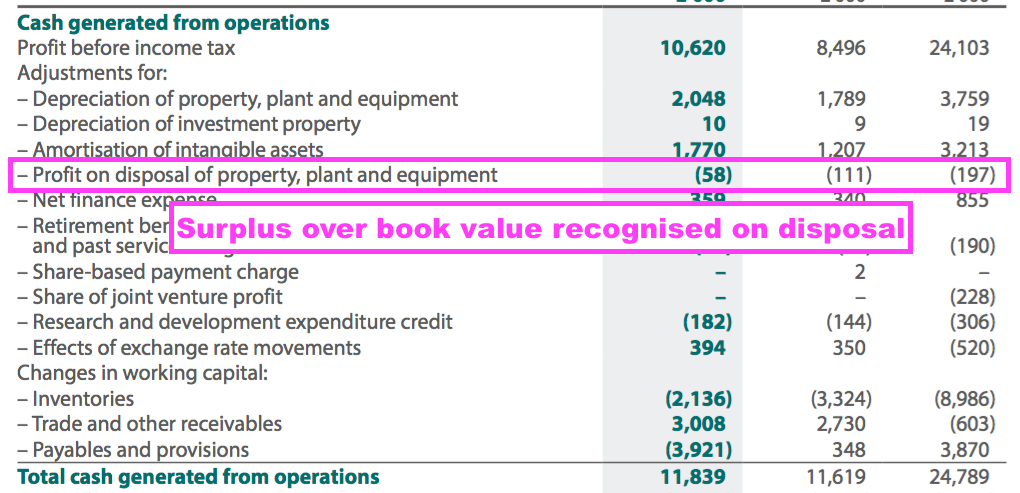

- TFW’s cash flow statement includes consistent ‘profit on disposal of property, plant and equipment’ entries:

- These entries suggest a conservative depreciation policy, whereby equipment is written down on the balance sheet to valuations below the eventual disposal proceeds.

- The mix of divisional performances led to an acceptable 15.3% group adjusted operating margin, versus 14.7% for the comparable H1 and 17.9% for the preceding FY 2022.

Valuation

- Outlook comments within this H1 statement were satisfactory given the mixed economic conditions:

“High energy costs and the imminent ban on the sale of fluorescent lamps in the UK and EU are both stimulating activity in the Group’s key market sectors. The outlook for the second half remains quite positive, although the revenue growth percentage is unlikely to be maintained at such a high level due to the good performance in the second half of last year.”

- Trailing twelve-month revenue and operating profit before acquisition adjustments are £162m and £29m respectively.

- I suspect a full-year contribution from SchahlLED might take operating profit before acquisition adjustments beyond £30m.

- Applying the 25% UK tax rate to that possible £30m gives earnings of £22.5m or approximately 19p per share.

- My calculations could be fine-tuned further for the:

- Net cash (£18m);

- Estimated earn-outs (£19m);

- The Ratio Electric investment (£6m), and;

- The loan notes, investment property and equity portfolio (£9m)…

- …but such adjustments will not make a significant difference to the £446m market cap that my guesswork says is supported by a 20x multiple.

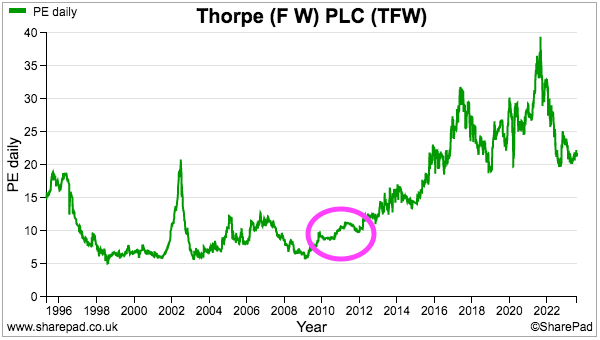

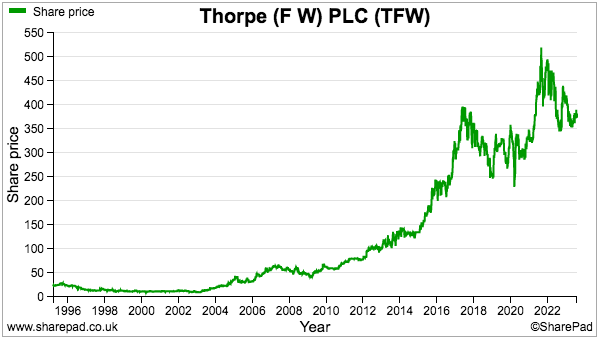

- My decision to purchase TFW between 2010 and 2012 was made much easier because the shares were then valued at a more modest c10x P/E multiple:

- Despite trailing earnings advancing 50% between FYs 2016 and 2022, the shares at 375p have traded sideways for six years:

- Perhaps today’s buyers are (still) willing to pay a healthy 20x multiple because of TFW’s:

- Long-time operational resilience as demonstrated by 20 years of consecutive dividend increases;

- Savvy acquisition approach that is earning TFW (an estimated) 19% return on its Dutch expenditure;

- Growth opportunities beyond pure lighting systems (e.g. SmartScan and electric-vehicle charging);

- First-class environmental credentials, including the London Stock Exchange’s Green Economy mark awarded to only 112 companies and funds, and;

- Growing order books supported by ongoing technical innovation and customer concerns about elevated energy costs.

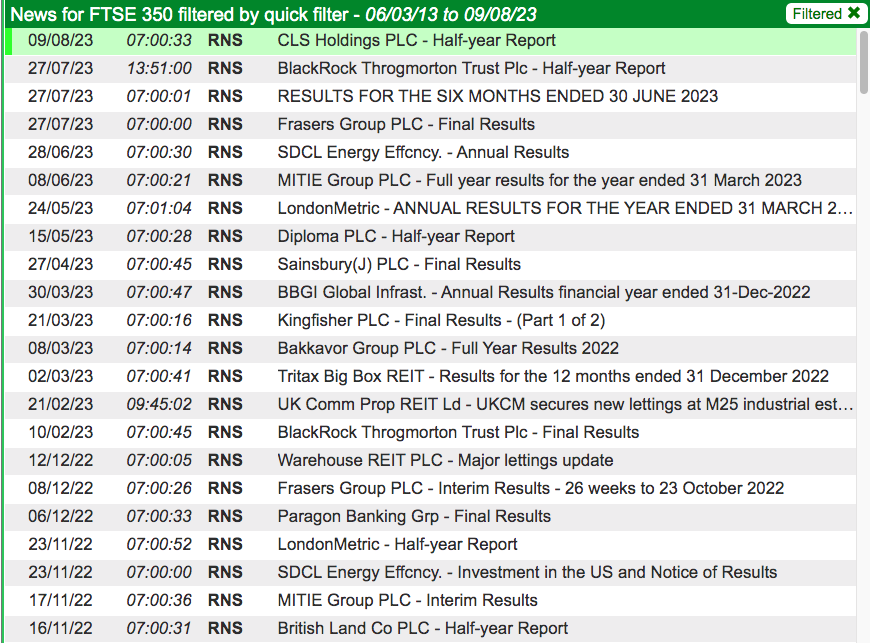

- On that last point, a SharePad search through the RNS for ‘LED lighting’ continues to show plenty of FTSE 350 companies that may well be (or become) TFW customers:

- The downside risks include:

- Zemper, SchahlLED and Ratio Electric not performing as expected following significant acquisition expenditure;

- The boardroom becoming tested by overseas operations now representing more than 40% of revenue;

- TFW exhausting its net cash position just as a difficult economy hits trading, and/or;

- An ongoing share-price de-rating as growth moderates to match the 10-year dividend CAGR of 7-8% per annum.

- Of those risks, I do wonder whether Zemper has performed as management initially envisaged. I also trust future cash flows will prevent the net cash position from becoming exhausted completely.

- While shareholders await the forthcoming “quite positive” H2, the trailing 6.23p per share ordinary dividend supplies a modest 1.7% income at 375p.

Maynard Paton