23 September 2019

By Maynard Paton

Results summary for M Winkworth (WINK):

- A standstill London property market left first-half revenue down 3% and profit unchanged.

- Subdued trading conditions have persisted since the Brexit vote and are likely to continue until the “political and economic uncertainty” clears.

- Further market-share gains have been won from London rival Foxtons, while the online competition continues to struggle.

- The accounts remain simple, high-margin and cash-flush.

- A possible P/E of 10 and yield of 6.6% do not appear expensive should earnings ever resume their momentum. I continue to hold.

Contents

- Event link and share data

- Why I own WINK

- Results summary

- Revenue, profit and dividend

- Franchisee income from sales and lettings

- Foxtons comparison

- Online competition

- Financials

- Valuation

Event link and share data

Event: Interim results for the six months to 30 June 2019 published 11 September 2019

Price: 115p

Shares in issue: 12,733,328

Market capitalisation: £14.6m

Why I own WINK

- Runs a London estate-agency franchising business, where progress is dependent on experienced and motivated franchisee owner-operators.

- Franchising set-up leads to high margins, attractive equity returns, low capital requirements and generous cash flow.

- Seasoned family management boasts £7m/50% shareholding and rewards shareholders through resilient quarterly dividends and the occasional special handout.

Further reading: My WINK Buy report |All my WINK posts | WINK website

Results summary

Revenue, profit and dividend

- The mixed outlook comments contained within the 2018 annual statement had already indicated these first-half figures would not deliver spectacular progress.

- WINK earns approximately 80% of its income from London-based franchisees, and the capital’s property market apparently remains hamstrung by “Brexit uncertainty”.

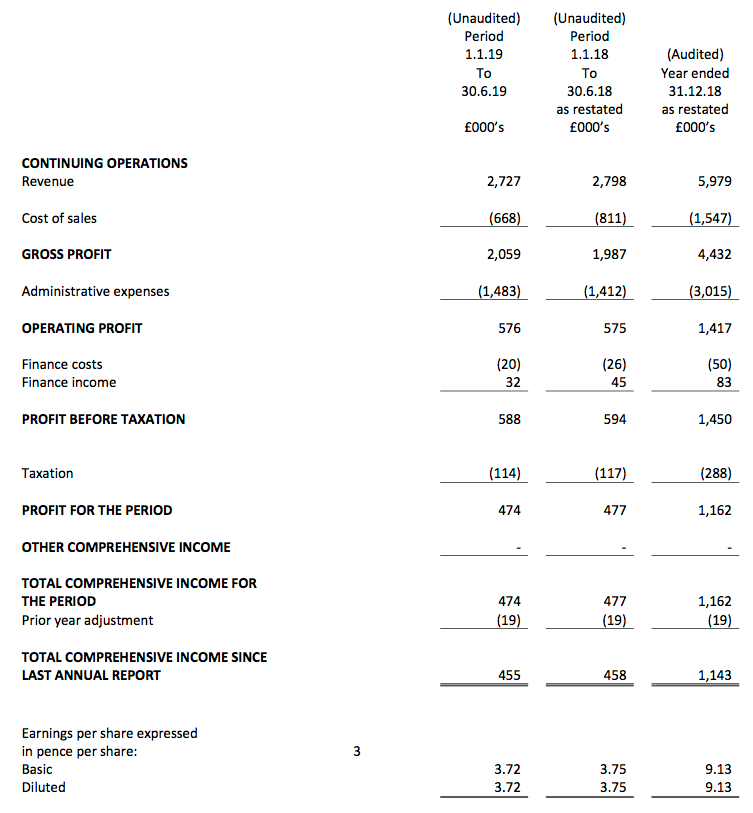

- WINK reported revenue down 3% and an unchanged operating profit:

| H1 2017 | H2 2017 | H1 2018 | H2 2018 | H1 2019 | |||

| Revenue (£k) | 2,544 | 2,879 | 2,798 | 3,181 | 2,727 | ||

| Operating profit (£k) | 507* | 795* | 575** | 842** | 576 |

(*unadjusted for IFRS 16 **restated for IFRS 16)

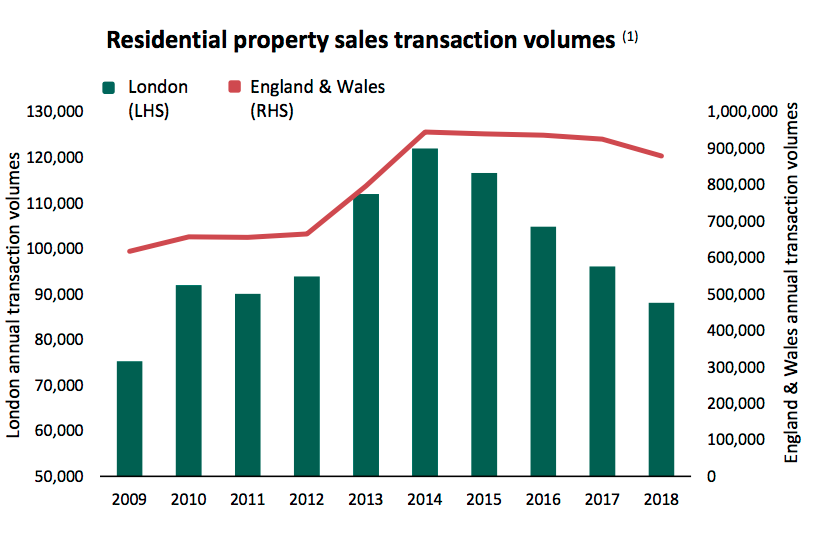

- Reported profit was affected slightly by the implementation of the new IFRS 16 Leases accounting standard.

- Under IFRS 16, the cost of a lease is now accounted for as a mix of depreciation and interest.

- WINK outlined the effect on its earlier accounts:

- For 2018, head-office rent of £286k has now been restated as additional depreciation of £238k and additional interest of £50k.

- IFRS 16 does not affect cash flow.

- However, this new accounting standard will create numerous analysis issues, including:

- Valuations based on operating profit will no longer include the full rent expense;

- Depreciation will now include some rent expense, and therefore will no longer be directly comparable to cash capital expenditure on new tangible assets, and;

- Interest costs will now include some rent expense and may suggest bank debt has become more expensive.

- Subtracting the interest expense (entirely related to IFRS 16 in WINK’s case) from the reported operating profit gives £556k for this first half and £549k for H1 2018.

- The Q2 2019 payout declaration of 1.9p per share indicates the current-year dividend should advance from 7.45p to 7.6p per share.

Enjoy my blog posts through an occasional email newsletter. Click here for details.

Franchisee income from sales and lettings

- Franchisees pay WINK 8% of all sales commissions/letting income received as well as contribute variable amounts towards advertising and IT services.

- Franchisees also pay fees to WINK for introductions to landlords and tenants.

- WINK continues to take a worthwhile 12%-plus of total franchisee income as revenue for itself:

| Year to 31 December | 2015 | 2016 | 2017 | 2018 | H1 2019 |

| Gross Franchisee Sales & Lettings (£k) | 49,010 | 46,120 | 46,200 | 46,500 | 21,400 |

| Revenue (£k) | 5,865 | 5,566 | 5,423 | 5,979 | 2,727 |

| Revenue/Gross Franchisee Sales & Lettings (%) | 12.0 | 12.1 | 11.7 | 12.9 | 12.7 |

- Franchisee income from lettings during the half gained 11% while franchisee income from property sales fell 7%:

| Gross Franchisee Revenue | H1 2017 | H2 2017 | H1 2018 | H2 2018 | H1 2019 | ||

| Sales (£m) | 11.7 | 13.1 | 10.8 | 12.6 | 10.0 | ||

| Lettings (£m) | 9.7 | 11.6 | 10.3 | 12.8 | 11.4 | ||

| Total (£m) | 21.4 | 24.7 | 21.1 | 25.4 | 21.4 |

- After surpassing property-sales commissions for the first time during the preceding second half, lettings income now represents 53% of total franchisee revenue.

- That 53% proportion seems likely to advance during 2019. WINK’s latest statement referred to a “shortage of sellers” in London and “rising rents over the course of the year”.

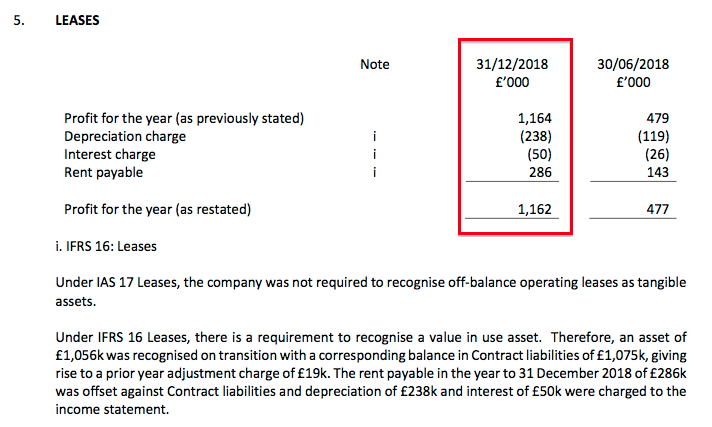

- That said, rival agent Foxtons (FOXT) claims London rental prices have bounced around the £450-a-week level for three years now:

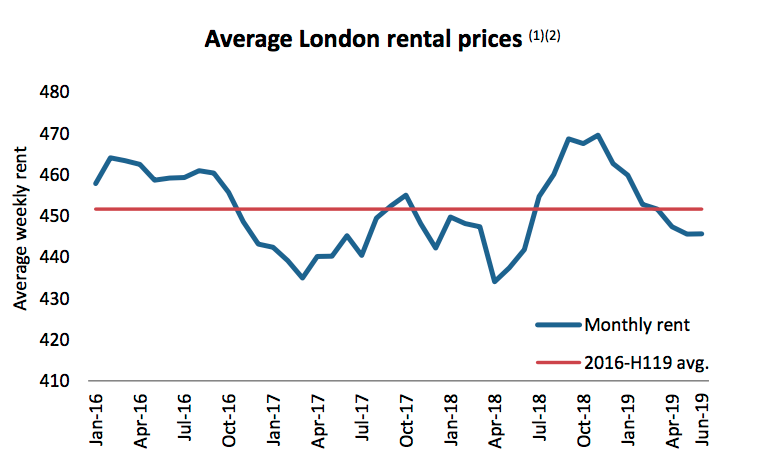

- FOXT also reckons London property transactions are approximately 25% below the number witnessed during 2014:

Foxtons comparison

- WINK continues to outperform FOXT, which claims to enjoy the “most recognised estate agency brand in London with number 1 position in listings across sales and lettings”:

| Year to 31 December | 2015 | 2016 | 2017 | 2018 | H1 2019 |

| Winkworth | |||||

| Gross Franchisee Sales Revenue (£m) | 30.1 | 26.0 | 24.8 | 23.4 | 10.0 |

| Gross Franchisee Lettings Revenue (£m) | 18.8 | 20.1 | 21.3 | 23.1 | 11.4 |

| Total Gross Franchisee Revenue (£m) | 49.0 | 46.1 | 46.2 | 46.5 | 21.4 |

| Foxtons | |||||

| Sales Revenue (£m) | 72.5 | 55.5 | 42.6 | 36.2 | 15.4 |

| Lettings Revenue (£m) | 69.0 | 68.3 | 66.3 | 67.0 | 31.7 |

| Total Sales & Lettings Revenue (£m) | 141.5 | 123.8 | 108.9 | 103.2 | 47.1 |

| Winkworth / Foxtons | |||||

| Sales Revenue (%) | 41.5 | 46.8 | 58.2 | 64.6 | 64.9 |

| Lettings Revenue (%) | 27.2 | 29.4 | 32.1 | 34.5 | 36.0 |

| Total Revenue (%) | 34.6 | 37.3 | 42.3 | 45.1 | 45.4 |

- During 2015, WINK’s total franchisee revenue represented 34.6% of FOXT’s property sales and lettings income.

- During this first half, the proportion had increased to 45.4% — just ahead of the 45.1% witnessed during 2018.

- The FOXT comparison is not strictly like-for-like, as FOXT generates almost all of its revenue from branches within London while WINK generates approximately 80%.

- Still, WINK’s self-employed franchisees appear to be handling London’s standstill property market better than FOXT’s conventional employees.

Online competition

- WINK defied popular industry wisdom by never starting an online/hybrid agent service.

- WINK reiterated in these results that the “individual skills” of its franchisees were “paramount to concluding transactions”.

- Recent headlines surrounding Purplebricks (PURP) — by far the country’s largest online agent — have not been glowing.

- The informative Property Industry Eye website has published the following articles:

- Purplebricks rejects claims that customers are paid to post reviews

- Purplebricks reveals it is in discussion with HMRC over anti-money laundering

- Purplebricks warns investors of possible risk of litigation after months of turbulence

- Some Purplebricks agents in Australia ‘literally went hungry’ as they tried to make it work

- Purplebricks hints at introducing No Sale, No Fee, as it looks to ‘evolve’ its pricing

- Despite all of the publicity and investment, online agents apparently capture just 4% of new sales instructions.

- I remain doubtful as to whether the online/hybrid agent approach employed by Purplebricks (and others) will ever work.

Financials

- WINK’s accounts remain in acceptable shape.

- The operating margin for this first half was a decent 21%.

- WINK continues to spend little on capital expenditure. Just £73k was spent acquiring extra tangible and intangible assets during the period.

- In comparison, the combined deprecation and amortisation (including the IFRS16 rent cost) charged against earnings was £252k.

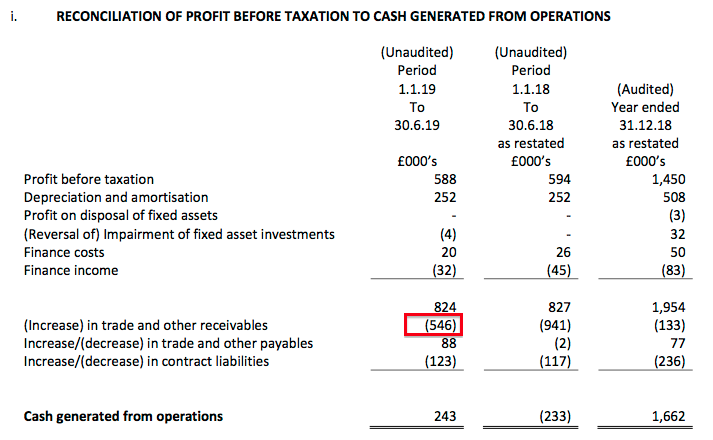

- Cash flow was hindered by a £546k increase to trade and other receivables:

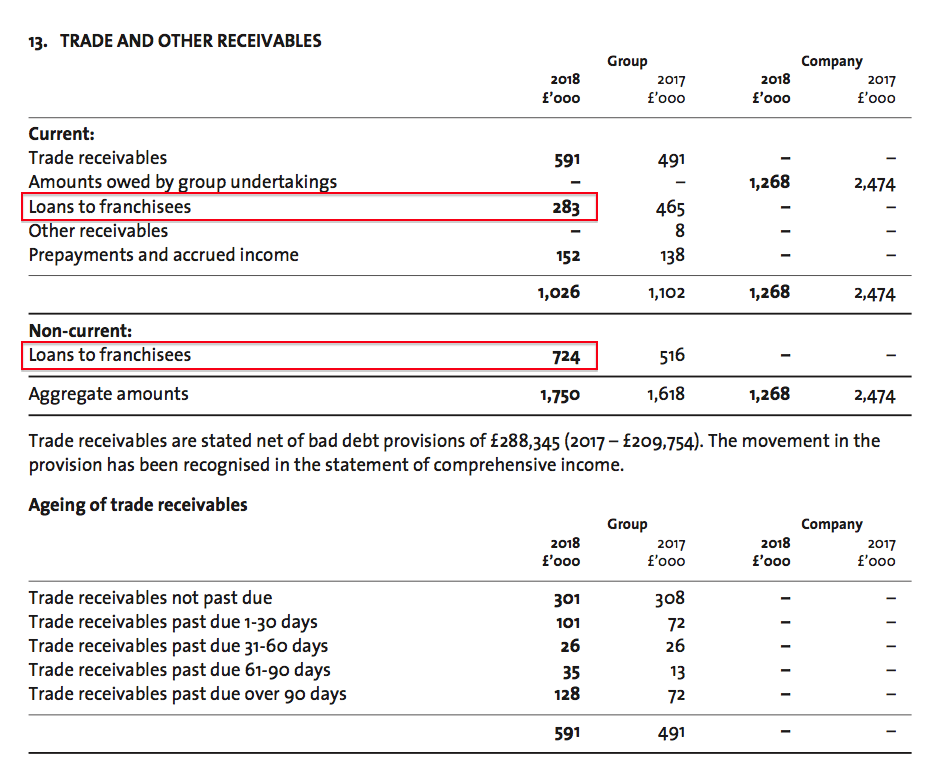

- WINK’s trade and other receivables include loans to franchisees, which the 2018 annual report (point 8) revealed to be £1,007k:

- I am hopeful the £546k change to trade and other receivables is due to extra money being loaned to franchisees rather than franchisees becoming even later with their payments.

- The 2018 annual report (point 8) suggested franchisees were late paying 49% of their invoices to WINK.

- The following post-balance sheet event revealed WINK may earn 5% interest on its franchisee loans (my bold):

“On 1 July 2019, Winkworth Franchising Limited acquired 55% of Tooting Estates Limited, which operates the Winkworth franchise in the Tooting area, for £22,500. The consideration of £22,500, was paid in cash. In addition, Winkworth Franchising Limited advanced a further £92,500 of loans to Tooting Estates Limited repayable over 5 years at a rate of 5%.”

- Finance income — which includes the interest received from the franchisee loans — came to £32k during the six months and represented a not-insignificant 5% of pre-tax profit.

- The £546k change to trade and other receivables alongside dividend payments of £484k meant cash in the bank dropped by £422k to £2,935k.

- Include £1,007k of franchisee loans (at the end of 2018) and £57k of quoted investments, and WINK’s cash and investments come to £4.0m or 31p per share.

- WINK carries no debt and no pension complications.

- WINK said it was “confident that we will be able to continue to distribute dividends at the current level”.

- Quarterly 1.9p per share dividends will cost £968k this year.

- Free cash flow during the twelve months to June 2019 was £1,519k.

- WINK also said it was “hopeful that even a modest upturn in the marketplace will lead to positive news on [the dividend] front”.

- I translate that to mean the quarterly payouts will be held at 1.9p per share until revenue and earnings start to improve.

Valuation

- WINK claimed it had “enjoyed a pickup in sales activity” following the March Brexit postponement, and anticipates taking advantage of “any upturn once Brexit uncertainty clears”.

- I suspect the clearing of Brexit uncertainty may take some time.

- At least the ban of tenant fees should have a “limited impact”.

- Operating profit currently runs at £1.4m, which less IFRS 16 lease/interest costs and standard 19% tax gives earnings of £1.1m or 8.7p per share.

- A market cap of £14.6m less cash/investments/franchisee loans of £4.0m gives an enterprise value of £10.6m, or 84p per share.

- Dividing the 84p per share enterprise value by the 8.7p per share earnings guess leads to an underlying multiple of 10.

- The 10x rating does not look expensive, but earnings for 2016, 2017, 2018 and probably 2019 remain 25% below those reported for 2014 and 2015.

- Profit retained by the business since 2015 has therefore not created any obvious value to date.

- However, WINK has reinvested at high rates in the past.

- During the five years to 2015 for example, earnings improved by £0.7m after £3.3m was added to shareholder equity. The resultant incremental return on equity was £0.7m / £3.3m = 22%.

- Were WINK to ever repeat such reinvestment returns, the present P/E offers scope for a favourable re-rating.

- In the meantime, the prospective 7.6p per share dividend is covered 1.14x by my earnings guess and offers a 6.6% yield.

Maynard Paton

PS: You can receive my blog posts through an occasional email newsletter. Click here for details.

Disclosure: Maynard owns shares in M Winkworth.

M Winkworth (WINK)

Trading Update and Dividend Declaration announced 15 January 2020

A positive update, with a welcome lift to the Q4 dividend. Here is the full text:

—————————————————————————————–

M Winkworth plc (“Winkworth” or the “Company”), the leading franchisor of real estate agencies, is pleased to announce the following trading update for the financial year ending 31 December 2019.

In an uncertain and difficult year that was dominated by political developments, we continued to drive the business forward and increase our market share. This was particularly the case in London, where Winkworth ranked second in Sales Subject to Contract with a market share of 4.2%, up from 3.6% in 2018, and new listings held steady in fifth place, with an increased share of just over 3%¹.

Prices remained broadly flat, having bottomed in 2018, some 20% below their 2014 peak in prime central London and 10-15% in outer London, with low supply underpinning prices. While our activity in the London market remained subdued, we recorded an upturn in transactions outside of London as buyers decided to get on with their lives after years of watching and waiting.

Despite the tenant fee ban, initiatives in the lettings and management sector continued to bear fruit, with revenue growth once again increasing year-on-year.

New franchise openings were held back by caution over the political backdrop but, nonetheless, we opened three new offices over the course of last year. In addition, we continued to see significant growth in revenue from our portfolio management initiatives, where a new generation of franchisees is re-invigorating key offices. In 2019, a further three offices were resold to new operators.

Total network revenues were slightly up on 2018 figures while, subject to audit, consolidated group turnover and profits before tax are expected to be modestly ahead of market expectations. The Company plans to announce its final results for the year ended 31 December 2019 on or around 2 April 2020.

Winkworth ended the year with a strong net cash position and the directors are pleased to announce that the Company will pay an increased dividend of 2.1p (2018: 1.9p) per share for the fourth quarter of 2019, bringing total dividend payments declared for the year to 7.8p (2018: 7.45p).

The dividend timetable is as follows:

Ex-Dividend Date* 23/01/20

Record Date ** 24/01/20

Expected Payment Date 20/02/20

* Shares bought on or after the ex-dividend date will not qualify for the dividend

** Shareholders must be on the Winkworth share register on this date to receive this dividend

¹ Source: TwentyCI

Dominic Agace, Chief Executive Officer of Winkworth, commented:

“We are very pleased with the progress made against a difficult market in 2019 and, once again, to be in a position to raise our dividend payment. Our professional network and robust model have led to further gains in market share and we look forward to welcoming new operators. At the start of 2020, new applications for both sales and lettings have risen sharply and, with borrowing rates remaining low and a more visible political agenda, we anticipate that these will translate into increased activity in coming months.”

—————————————————————————————–

Looks like the end of the Brexit deadlock and a “more visible political agenda” has indeed revived activity within London’s property market.

Revenue and profit being “modestly ahead of expectations” is welcome, but the important point is that the momentum could/should build through 2020. The chief exec says “new applications for both sales and lettings have risen sharply“, so upgrades for this year ought to follow.

Underpinning WINK’s confidence is the Q4 dividend lift — up 10% to 2.1p per share. That increase was higher than I expected, and the highest Q4 dividend lift since 2014. The trailing payout now comes to 7.8p per share. I would not extrapolate 2.1p per share for every quarter for 2020, but could the quarterly payout rise from 1.9p to 2.0p per share?

Maynard