15 February 2018

By Maynard Paton

Today I’m re-starting my hunt for Watch List shares with a look at James Latham (LTHM).

Here are the initial attractions that prompted this research:

* Owner-friendly management: The Latham family has £75m-plus riding on the share price and appear to run the business in a sensible (and LTIP-free) manner.

* Respectable track record: Recent decades of the group’s 261-year history have witnessed average dividend growth of approximately 10% a year.

* Asset-rich accounts: The books boast a sizeable cash position, freehold assets and a share count that has not changed since at least 1994.

As usual, I’m applying a question-and-answer template to help me pinpoint companies that match the criteria set out in How I Invest. I’m looking for as many Yes answers as possible.

Activity: Importer and distributor of timber and wood-based panel products

Website: www.lathamtimber.co.uk

Share price: 757p

Shares in issue: 19,690,800

Market capitalisation: £149m

Does the business boast a respectable track record?

Yes.

LTHM was established during 1757 when James Latham began to import and trade exotic hardwood in Liverpool.

The business now claims to be the UK’s largest independent distributor of timber and panel products.

LTHM operates from only ten warehouse depots, which alongside some port storage facilities are apparently enough to provide national coverage. The depots sell close to 1,000 tonnes of wood every working day for approximately £800 a tonne. Customers are predominantly joiners, builders’ merchants, shop fitters and kitchen manufacturers.

The Latham family has always run the business and still own more than half of the shares. Five members of the ninth Latham generation are current LTHM employees.

LTHM went public during 1965 and although exact financial details from back then have long since disappeared, the firm’s website does carry annual reports from 2006. In addition, Companies House stores all annual reports going back to 1995… as well as the 1983 edition.

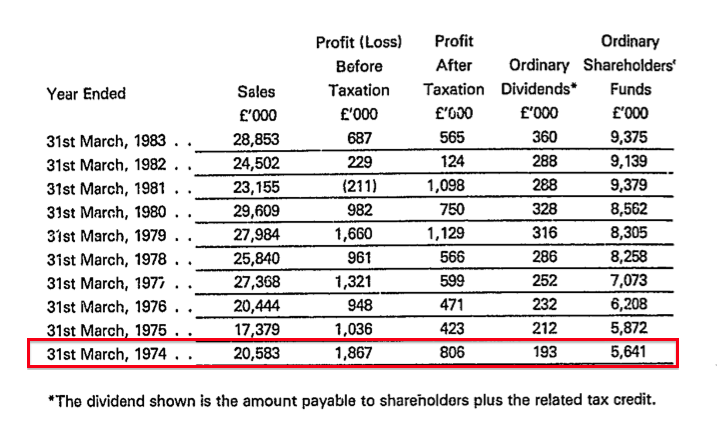

The 1983 report reveals revenue was £20.6m and pre-tax profit was £1.8m during 1974:

By 2017, revenue had surged to £199m and had lifted pre-tax profit to £13.8m. The rate of expansion during the last two decades has been quite acceptable:

| 2012 to 2017 | 2007 to 2017 | 2002 to 2017 | 1997 to 2017 | |

| Revenue CAGR | 6.7% | 14.8% | 5.7% | 4.5% |

| Operating profit CAGR | 12.9% | 22.5% | 12.6% | 8.9% |

| Dividend CAGR | 9.5% | 15.7% | 9.4% | 10.9% |

LTHM’s history has sadly not been without setback.

Reported annual profit has declined during seven of the last twenty years, including 40%-plus slumps witnessed during 2003 and 2009. The banking crash forced a 27% dividend cut, while the early 90s recession saw the business deliver losses for three consecutive years.

LTHM’s ups and downs — alongside its building/construction customer base — lead me to believe the business is quite sensitive to the wider economy.

Mind you, the last few years have shown very welcome progress:

| Year to 31 March | 2013 | 2014 | 2015 | 2016 | 2017 |

| Revenue (£k) | 143,069 | 163,117 | 174,855 | 185,929 | 198,808 |

| Operating profit (£k) | 7,369 | 9,478 | 10,564 | 13,241 | 14,179 |

| Other items (£k) | 257 | 1,797 | - | - | - |

| Finance income (£k) | (657) | (796) | (457) | (365) | (352) |

| Pre-tax profit (£k) | 6,969 | 10,479 | 10,107 | 12,876 | 13,827 |

| Earnings per share (p) | 28.7 | 44.3 | 40.3 | 53.7 | 56.0 |

| Dividend per share (p) | 10.2 | 11.4 | 12.5 | 14.3 | 15.4 |

I am impressed the archives reveal no exceptional or one-off costs — a sign that management has not been tempted to window-dress the accounts.

Instead, I see one-off gains totalling £23m were enjoyed following various subsidiary and property disposals during the mid-Noughties. The proceeds helped fund three special dividends.

Has the business grown mostly without acquisition?

Yes.

The 2017 balance sheet carries no goodwill and the last acquisition entry occurred within the 1999 figures.

Has the business mostly self-funded its growth?

Yes.

The 2017 balance sheet displays share capital of £5m versus earnings retained by the business of £68m.

I note LTHM’s issued share count has remained unchanged since at least 1994 and the amount raised by share options has been trivial.

Does the business possess an asset-strong balance sheet?

Yes, although there is a defined-benefit pension scheme to consider.

LTHM’s 2017 balance sheet carried cash of £17m (86p per share) and freehold property with a £20m (104p per share) book value. In comparison, bank debt was only £1m.

Although LTHM’s pension-fund obligations appear large, the group’s contributions and the value of the plan’s investments do not indicate the scheme requires extra support.

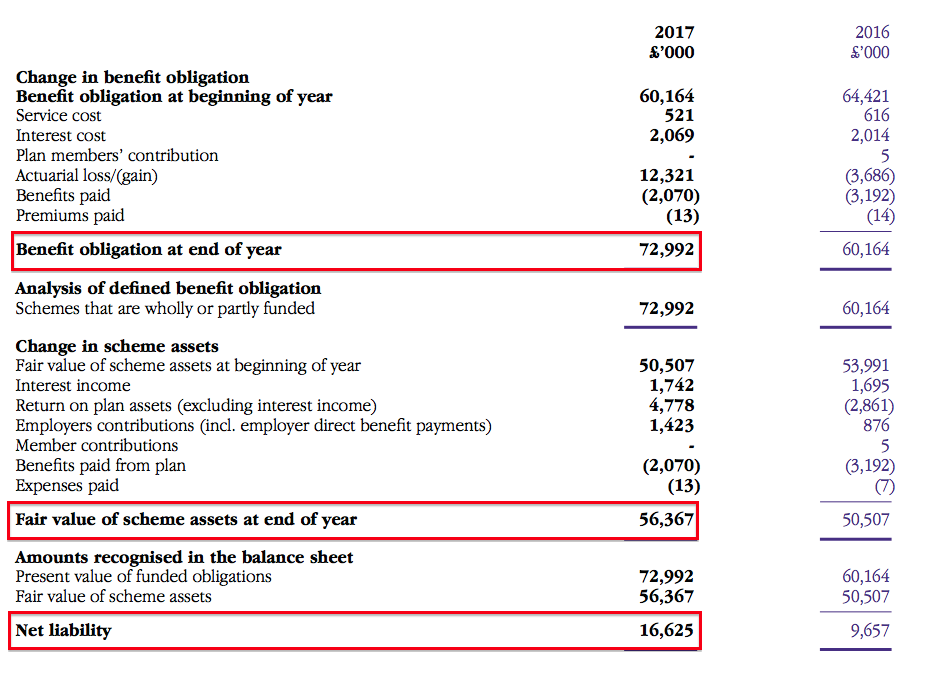

The 2017 accounts show pension obligations of £73.0m, scheme assets of £56.4m and a resultant net deficit of £16.6m:

I do not pay too much attention to defined-benefit pension obligations. Calculated using all sorts of long-term projections — mortality rates, inflation, and so on — such figures are simply ‘best guesses’ from actuaries and can fluctuate significantly over time.

I do not pay too much attention to defined-benefit pension obligations. Calculated using all sorts of long-term projections — mortality rates, inflation, and so on — such figures are simply ‘best guesses’ from actuaries and can fluctuate significantly over time.

Instead I concentrate on the pension scheme’s assets, the contributions being made and the benefits being paid.

That way I can determine whether the scheme owns enough assets and receives enough contributions to cover its present liabilitied.

I like to think this approach is simpler and more likely to identify under-resourced schemes that may cause shareholder trouble.

Anyway, the excerpt above shows LTHM’s scheme’s receiving contributions of £1.4m, paying benefits of £2.1m and ending the year with assets of £56.4m.

To cover benefits of £2.1m, LTHM’s assets would need to return £0.7m a year to add to the contributions of £1.4m.

I would say earning £0.7m from assets of £56.4m — equivalent to an annual 1.2% return — should be quite achievable.

During the last ten years, LTHM’s pension fund has received aggregate contributions of £13.8m, earned total returns of £23.0m and paid benefits of £18.2m.

On the face of it, the scheme’s benefits have been covered amply by contributions and investment returns. However, the reported net deficit has widened from £3m to £16.6m over the same time — due in part to adverse actuarial changes of £21.8m.

While LTHM’s pension contributions look very adequate, complex accounting rules mean they are not charged entirely to reported profit.

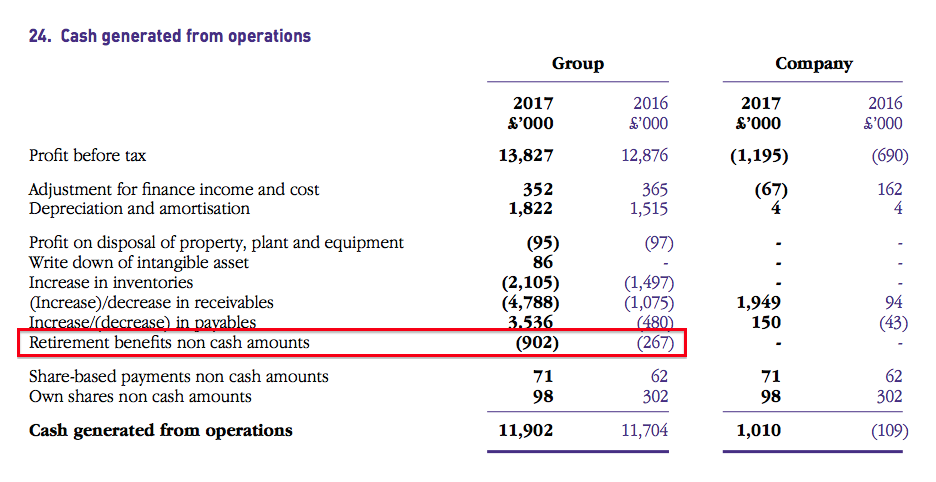

The following note within the 2017 report highlights this bookkeeping feature:

Some £902k was injected into the scheme during 2017 but also avoided the income statement.

Notably, the last ten years have seen a total £9.1m pumped into the scheme and not charged against profit.

What’s more, the management narrative within the 2017 report states (my bold):

“Under the recovery plan agreed following the triennial valuation at 31 March 2014 there will be no deficit recovery payments made in the year to 31 March 2018. The triennial valuation for 31 March 2017 will be concluded during the course of the next financial year and in anticipation of this needing deficit recovery payments to restart in the year to 31 March 2019, the board agreed to pay £1m in this year, with a further £1m to follow in the year to 31 March 2018 as a special contribution.”

I would argue reported profit needs to be reduced by £1m to arrive at a realistic pension-adjusted level.

Does the business convert profit into free cash?

Sort of.

| Year to 31 March | 2013 | 2014 | 2015 | 2016 | 2017 |

| Operating profit (£k) | 7,369 | 9,478 | 10,564 | 13,241 | 14,179 |

| Depreciation and amortisation (£k) | 1,208 | 1,503 | 1,435 | 1,515 | 1,822 |

| Net capital expenditure (£k) | (1,517) | (1,181) | (383) | (2,056) | (6,045) |

| Working-capital movement (£k) | (1,800) | (2,109) | (4,693) | (3,052) | (3,357) |

| Net cash (£k) | 5,718 | 9,106 | 10,607 | 15,845 | 16,259 |

During the last five years, working-capital movements have absorbed a hefty £15m from an aggregate operating profit of £55m.

The 2017 annual report admits:

“The timber importing and distribution business requires considerable working capital investment in stock and debtors.”

During 2017 for example, stock levels and trade debtors both averaged £34m — which are significant amounts when revenue was £199m.

At least LTHM’s stock and debtor numbers have not outpaced the expansion of the wider business.

Between 2013 and 2017, timber in the depots has represented a steady 21% of cost of sales, while outstanding invoices have been trimmed from nearly 19% down to 17% of revenue.

I think I can live with LTHM’s substantial working-capital demands assuming these ratios remain stable.

Elsewhere, the discrepancy between cash capital expenditure and the depreciation charged against earnings is due to LTHM occasionally purchasing freehold property. Such expenditure is usually an ‘expansionary’ investment and ought to hold its value.

All the movements have meant surplus cash totalling a useful £22m has been generated during the last five years, of which £10m was added to the bank balance and the other £12m distributed as dividends.

Does the business enjoy a competitive advantage?

I am not too sure.

LTHM’s 2017 annual report says:

“The directors recognise that the strength of the group is as a distributor of fit-for-purpose, high quality timber and associated products purchased using the TTF RPP from legal and sustainable sources of supply to existing and new customer bases.”

That does not suggest LTHM enjoys obvious economic ‘moat’.

Other report snippets provide further competitive clues:

“The company is well respected in its industry and amongst its customers and suppliers for its principled trading policies and its integrity.”

“Having stock of product in the right place at the right time is important to provide this service.”

“While the business is organised to give as much local autonomy as possible and staff are targeted at depot level, groups of senior staff meet regularly to coordinate purchasing and sales strategy. Group product champions look after key product ranges backed by product champions at each depot.”

“A key focus of the board throughout this year has been managing margins to enable us to remain competitive in commodity products but grow margins in our focus products in which we can provide a value added service.”

I get the impression LTHM’s advantage relies mostly on motivated staff delivering tip-top service at an affordable price.

At 18%, the group’s gross margin indicates plenty of sector rivals. However, this margin has been on a slight upward trend over the years and perhaps signifies LTHM as a capable operator in a competitive industry.

The operating margin has advanced from 5% to 7% during the last ten years, as administrative costs have not expanded as much as revenue.

Does the business produce a respectable return on equity?

I am not sure.

Return on average equity for 2017 was £11m/£72m = 15%. Not bad, but the figure has generally fluctuated between 10% and 16% since 2011 and before that often flirted with single digits.

Adjustments for the cash pile and the pension deficit provide similar results, so I can only conclude the aforementioned freehold property and hefty working-capital requirements do not equate to exceptional earnings returns.

Does the business employ capable executives?

Yes.

Nick Latham is LTHM’s current executive chairman. He took the top role last year after serving on the board since 2007 and working within the business since the early 1990s.

Aged 49, Mr Latham would appear ready to lead LTHM for some years to come. His predecessor, Peter Latham, was in charge for a decade or so and retired last year in his 60s.

Mr Latham is assisted by a managing director with 12 years of board service and a finance director with 17 years of board service.

The boardroom is complemented by Piers Latham, who has served as an executive since 2014 and has been a LTHM employee for 24 years.

Does the business employ good-value-for-money executives?

Yes.

Nick Latham took home a £165k salary and £41k bonus during 2017, which does not strike me as outrageous when the year saw operating profit improve 7% to £14m.

Another positive sign is the remuneration committee keeping wage inflation in check with shareholders’ returns.

For example, Peter Latham’s decade or so in charge saw his basic pay advance by 48% while the ordinary dividend gained 69%.

Does the business employ owner-orientated executives?

Yes.

I suppose it is no coincidence that the Latham family has delivered that very acceptable long-term dividend record while owning more than half of the shares — a collective £75m stake.

A run of special dividends during the mid-Noughties underlines the family’s straightforward view of handling surplus funds.

I am hopeful current boss Nick Latham will maintain the sensible approach, given he enjoys a personal 3%/£5m shareholding. Fellow director Piers Latham boasts a similar investment.

One striking feature of LTHM’s annual reports is the absence of the dreaded LTIP acronym. In fact, the 2017 report reveals the board owned only 31,000 options. Meanwhile the entire workforce owns almost 300,000, representing 1.5% of the wider share count.

Does the business enjoy reasonable growth prospects?

Maybe.

Current trading does not appear too bad. Half-year results published during November declared:

“The second half of 2017/18 has started well with growing revenues at slightly higher margins. Trading conditions continue to be mixed, but despite the uncertainties in the economy, we and our customers remain busy. We are confident in the long term prospects of our key product drivers, and this underpins our plan to continue to invest in our business to further improve the offering to our customers.”

The same statement also revealed first-half revenue up 7% but profit down 11%, due in part to suppliers increasing their prices.

Perhaps not surprisingly for a 261-year-old business, the board does think about the longer term.

Here is an extract from 2017 annual report (my bold):

“Last year the Directors carried out a detailed strategic review of how the company should progress over the next 10 years and I am confident that an excellent team is in place at all levels in the business to carry this out.”

Of course a lot can happen during ten years, and I suspect the main cause of any future setback will be adverse economic conditions rather than management mishaps.

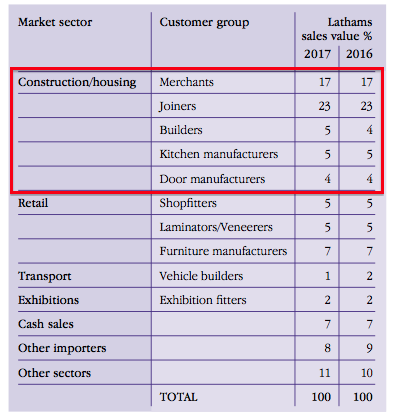

The table below from the 2017 annual report confirms 54% of revenue relates to the construction and housing sector:

I dare say difficulties within the property market could lead to a reversal of LTHM’s impressive progress seen during the last few years.

At least importing and wholesaling timber do not seem obvious activities for online disruption.

Does the share price stand a good chance of becoming a bargain?

Maybe.

At 757p, the share price is equivalent to 14 times the 52.6p per share earnings reported for the twelve months to November 2017. Adjust for the cash position and the multiple reduces to 13.

However, I would argue a further adjustment for the pension scheme is required.

So, subtracting the £1m annual additional pension contribution from the £13m trailing operating profit, I arrive at earnings of 50.6p per share assuming a standard 19% tax rate. Those sums lead me back to a multiple of 14.

I would say 14 is an understandable rating given LTHM’s rate of expansion during recent years. For some perspective, the shares traded at 100p and approximately 5 times trailing earnings during the depths of the banking crash.

Is it worth watching James Latham?

I think so.

There is a lot to like about LTHM, not least its significant family ownership, respectable dividend progress, asset-rich accounts and LTIP-free board.

That said, many of LTHM’s accounting ratios do not look that special. I can only conclude selling timber is a very competitive activity and the family management has worked hard over the years to deliver the respectable history.

I would not rank LTHM as highly as the following four shares in my portfolio — FW Thorpe, Andrews Sykes, Mincon or M Winkworth. The economics of those businesses lead to much higher margins and returns on shareholders’ capital, plus you enjoy similar family backing, too.

Nonetheless, LTHM ought to be one of those investments where you could easily back the management and balance sheet to emerge safely from any sector downturn.

The group’s sizeable exposure to the vagaries of the housing and construction markets could mean better buying opportunities may lay ahead.

Maynard Paton

PS: You can now receive my Blog posts through an occasional e-mail newsletter. Click here for details.

Disclosure: Maynard owns shares in FW Thorpe, Andrews Sykes, Mincon and M Winkworth, and does not own shares in James Latham.

I remember when you tipped LTHM as a “square share” on the Fool, and a very good tip it was too. I think it was yielding 6% on a P/E of 6 at the time.

I was a customer of LTHM for a while and can add the following:

1. They never cut their price just to get an order

2. A lot of what they sell, particularly in the Advanced Technical Panels division, is hard to get elsewhere at exactly the same quality

3. They were one of the first importers to take certification seriously. You can get the certification stamps on all sorts of dodgy stuff these days, but if a customer really wants to be sure they are not buying illegal timber Lathams is one of the few suppliers you can trust

4. The staff are very high quality, from the order desks to the warehouses to the delivery drivers.

I just called up the long-term chart. The shares held up well in 2008-09, there was a good safety net under them. But how they ever got to 950 last year baffles me. The reason to hold them is that the company will probably never go bust and it pays a dividend, but the spread is frightful. Hargreaves Lansdown are quoting 655/700 this afternoon so that’s a 6.4% spread! Does that help explain recent volatility between ~640 ~700?

I’ll buy the shares at 550 with a spread of ~2% But >6% spread? No way.

Hello Michael

Thanks for the Comment. That sort of customer insight is really helpful, and backs up the notion the business is managed well. The spread sadly is the result of i) the family’s sizeable holding and ii) the business attracting other longer term investors, who do not trade in and out. Share-trading liquidity is therefore limited. Sometimes a normal online broker can present opportunities to trade within the quoted spread. You have to think long term when you buy with a large spread.

Maynard